BANK OF IRLAND - ANALYSEN, RATINGS, NEWS, RT-CHARTS - 500 Beiträge pro Seite

eröffnet am 02.01.11 10:10:16 von

neuester Beitrag 22.01.14 10:40:53 von

neuester Beitrag 22.01.14 10:40:53 von

Beiträge: 51

ID: 1.162.409

ID: 1.162.409

Aufrufe heute: 0

Gesamt: 71.018

Gesamt: 71.018

Aktive User: 0

ISIN: IE00BD1RP616 · WKN: A2DR6L · Symbol: BIRG

10,345

EUR

+0,34 %

+0,035 EUR

Letzter Kurs 26.04.24 Tradegate

Neuigkeiten

26.02.24 · wallstreetONLINE Redaktion |

24.02.24 · BörsenNEWS.de |

23.02.24 · BörsenNEWS.de |

26.06.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9000 | +20,00 | |

| 2,1875 | +19,37 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 | |

| 0,5700 | +14,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3500 | -10,60 | |

| 7,16 | -12,04 | |

| 10,799 | -12,20 | |

| 12,90 | -20,07 | |

| 1,5000 | -40,00 |

Um einen vernünftigen Informationsfluss zu gewährleisten, möchte ich, d. in d. Thread nur FUNDAMENTALES eingestellt wird !

Bitte Diskussionen im Hauptthread !!!

Betrachtet dies als NEUBEGINN...userer BOI in 2011 !!!

Vielen Dank

titan

Bitte Diskussionen im Hauptthread !!!

Betrachtet dies als NEUBEGINN...userer BOI in 2011 !!!

Vielen Dank

titan

Antwort auf Beitrag Nr.: 40.785.889 von Aktientitan am 02.01.11 10:10:16LINK.

RT- Kurse/ NASDAQ

http://www.nasdaq.com/aspx/nasdaqlastsale.aspx?symbol=IRE&se…

RT- Kurse/ NASDAQ

http://www.nasdaq.com/aspx/nasdaqlastsale.aspx?symbol=IRE&se…

Antwort auf Beitrag Nr.: 40.785.896 von Aktientitan am 02.01.11 10:13:16LEVEL2-Orderbuch:

Ihr müßt nur die vorgegeben Kürzel austauschen (z.B. BAC) in IRE/ Symbol bei GET STOCK

eingeben...und ...GO !!!

Bei den Chart genauso !!!

http://www.level2stockquotes.com/level-ii-quotes.html

Ihr müßt nur die vorgegeben Kürzel austauschen (z.B. BAC) in IRE/ Symbol bei GET STOCK

eingeben...und ...GO !!!

Bei den Chart genauso !!!

http://www.level2stockquotes.com/level-ii-quotes.html

Antwort auf Beitrag Nr.: 40.785.905 von Aktientitan am 02.01.11 10:17:16Hier der ARCA-BOOK/ Link:

http://datasvr.tradearca.com/arcadataserver/ArcaBookData.php…

http://datasvr.tradearca.com/arcadataserver/ArcaBookData.php…

Antwort auf Beitrag Nr.: 40.785.907 von Aktientitan am 02.01.11 10:18:57Informationen könnt ihr abrufen unter:

FINANZNACHRICHTEN:

http://www.finanznachrichten.de/nachrichten-aktien/bank-of-i…

FINANZNACHRICHTEN:

http://www.finanznachrichten.de/nachrichten-aktien/bank-of-i…

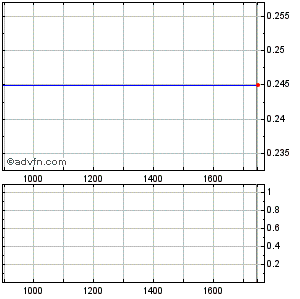

Antwort auf Beitrag Nr.: 40.785.909 von Aktientitan am 02.01.11 10:20:40RT-CHART/ London:

RT-CHART/ DUBLIN:

RT-CHART/ DUBLIN:

Antwort auf Beitrag Nr.: 40.785.917 von Aktientitan am 02.01.11 10:24:05Informationen aus Irland:

Irishtimes-Link:

http://www.irishtimes.com/search/index.html?rm=listresults&f…

Daily Irish Independent-Link:

http://www.independent.ie/search/?q=boi

Irishtimes-Link:

http://www.irishtimes.com/search/index.html?rm=listresults&f…

Daily Irish Independent-Link:

http://www.independent.ie/search/?q=boi

Antwort auf Beitrag Nr.: 40.785.922 von Aktientitan am 02.01.11 10:28:21Link zum US-Forum:

http://messages.finance.yahoo.com/mb/IRE

http://messages.finance.yahoo.com/mb/IRE

Antwort auf Beitrag Nr.: 40.785.922 von Aktientitan am 02.01.11 10:28:21bloomberg

short-interest

http://www.bloomberg.com/news/2010-12-27/new-york-stock-exch…

shortsqueeze

http://shortsqueeze.com/?symbol=ire&submit=Short+Quote%E2%84…

short-interest

http://www.bloomberg.com/news/2010-12-27/new-york-stock-exch…

shortsqueeze

http://shortsqueeze.com/?symbol=ire&submit=Short+Quote%E2%84…

Antwort auf Beitrag Nr.: 40.785.932 von Aktientitan am 02.01.11 10:33:12Tradegate-Link:

http://tradegate.de/orderbuch.php?isin=IE0030606259

http://tradegate.de/orderbuch.php?isin=IE0030606259

After-Hour - Pre-Hour

http://www.google.com/finance?q=NYse%3AIRE

http://www.google.com/finance?q=NYse%3AIRE

Antwort auf Beitrag Nr.: 40.787.369 von winwinsagt am 03.01.11 07:23:13Financial Stocks Mostly Higher (SNV, NLY, FBC, Bank of Ireland)

Written by Kevin Stamos

Sunday, 02 January 2011 07:51

http://www.wallstreetbay.com/201101022998/Financial-Stocks-M…

Written by Kevin Stamos

Sunday, 02 January 2011 07:51

http://www.wallstreetbay.com/201101022998/Financial-Stocks-M…

Antwort auf Beitrag Nr.: 40.787.369 von winwinsagt am 03.01.11 07:23:13The triumphs and disasters that are waiting to meet us in 2011

Takeovers and sell-offs will dominate while our property and job markets splutter back to life in the coming year

Sunday January 02 2011

What will 2011 bring for some of the biggest and best known names in business? Will there be further carnage and teeth gnashing or will the green shoots of recovery start to take root.

We predicted carnage for McInerney, Boundary and Barry O'Callaghan's EMPG 12 months ago, along with nailing property prices and the nuclear winter for banks and developers. How will we do in 2011? Nick Webb looks into the crystal ball to see what could be in store for some of the top players in business for 2011.

ARYZTA TO SELL OFF STAKE IN ORIGIN

Owen Killian's, below, debt-fuelled splurge to buy new businesses for Aryzta will probably continue for some time. But non-core assets such as the croissant company's 71.4 per cent stake in €420m valued fertiliser and animal feed business Origin Enterprises are at risk. The stake harks back to the good old days of IAWS, when the company was run by people in flat caps who knew one end of a pig from another, rather than the slick corporate types now in the boardroom. The disposal will net Aryzta a cool €300m before costs.

Banks to keep blowing up

The regulators and Central Bankers believe that we don't really need to get too excited about the possibilities of defaulting mortgages blasting a big hole in the crippled banks. Pull the other one.

With unemployment stuck at 13.5 per cent, forecasts that the banks will take a modest five per cent hit on their mortgage book is straight out of loo-la land. And that's before credit cards. And personal and car loans. And we haven't even gone into corporate loans, especially ones to the small business sector, which has seen the rise in company failures jump 17 per cent in 2010.

AIB needed to raise €5.2bn to satisfy new regulatory requirements. There was no chance of that happening, so it had to be nationalised. Bank of Ireland's €2.2bn hurdle is also looking far too steep, so the State will own most of that too. Efforts to offload the banks will focus on slimming loan books and selling off parcels of debt. Will John Bruton's, bottom left, recent trade mission to the Gulf have smoked out any oil rich sovereign wealth funds willing to risk a few bob on Ireland? Wilbur Ross and the Cardinal Group will get their hands on EBS with the rump of Anglo and Irish Nationwide plonked into a new entity.

Sovereign debt crisis to roll on

Portugal will tap up the IMF/EU bailout fund... and get a better deal than us. Speculators will zone in on Spain, Italy and Belgium with bond yields rising sharply. But when France comes into the frame, things will really pick up speed. Germany's reluctance to finance its spendthrift European partners will become even more vocal.

However, some form of eurozone bond will be unveiled with a device to force bondholders to share some pain. Ireland's existing bondholders won't be burnt but future lenders to the country will charge through the nose. And we're complaining about a near six per cent interest rate now! The sovereign debt crisis will also spread east with German banks getting increasingly worried about the accession states. A German lender will have to be bailed out by the state.

mixed fortunes for commodities boom

There's no doubt that gold is looking like a big fat bubble. It will pop. But will it be in 2011 or is there a bit more in the bull run. Copper is looking very toppy and silver surges in 2010 may lead to some sell off. If growth continues, then we could see oil prices head back towards the $100 levels. But if the banking sector explodes over huge exposures to the overheating property sector then oil could take a battering.

Grafton to buy UK player

Michael Chadwick may be getting worried. He probably should have taken Grafton private in 2007 as the share price tanked. The DIY and builders supply firm is in rude health again after facing the demons of the recession. But there's precious little in the way of organic growth on the cards here. The market will shrink if anything, as consumer confidence struggles and successive budgets destroy spending power. Chadwick is bound to be looking at further expansion in the UK. There are probably plenty of boring little bolt-on deals but there's a feeling that he might do something big. Could he look at buying debt-laden Focus?

C&C to be bought out

SAB Miller or Canadian outfit Moulson Coors are considered to be potential predators if C&C comes into play.

Government to sell Aer Lingus stake

In 2007, when Ryanair launched its first bid for Aer Lingus, the Government's stake was worth more than €350m. Now it's worth closer to €150m. But expect the stake to be offloaded. ABR -- Anyone But Ryanair. Some form of a tie up with Lufthansa's BMI looks like a good bet at this stage but KLM-Air France, BA or even a private equity player could also be in the shake out. The windfall might even pay to fund about four days of the Government deficit.

sex scandal in boardroom Ireland

It's been a long time since anything naughty happened in Ireland's boardrooms but 2011 will see explosive allegations made against one of the country's top executives. There'll be a high profile resignation and talk of a massive lawsuit... which will of course be settled out of court.

Abbey to be taken private

The Gallagher family own more than 41 per cent of home building group Abbey. The company had about €45m sitting around in cash. The whole company is valued at just €120m. This screams take private. Charlie Gallagher has got to be looking at pressing the button on a deal. But will the banks fund any deal? If they don't, private equity outfits might just step in. Oaktree Capital saw enough of a potential return in bombed out homebuilder McInerney to offer to write a big fat cheque.

property gets a slight heartbeat again

The vulture funds are here. David Bonderman's Texas Pacific Group has hooked up with Stephen Vernon's Green Property with a plan to spend €900m on cheap property assets in Ireland and the UK.

A €120m deal to buy retail property in Dublin was mothballed with the IMF arrival. This may be reheated in coming months. Vast private equity group Carlyle -- also in the running for the EBS -- is also thought to be looking around.

Nama will come under increasing pressure to start offloading some of its €80bn in property loans over the next year. However, while there may be smaller transactions in Ireland, it is more likely to see major asset disposals in the UK and US.

Treasury Holdings' Battersea Power Station project is likely to hit the headlines again, with Derek Quinlan, above, selling some big, big trophy assets. The residential property market will remain dead.

Tullow takeover

Former accountant Aidan Heavey may be able to buy as many Lamborghinis as he wants in 2011. He could have a new one every day if his €13bn oil company Tullow gets bought out. While Korean player KNOC bought Dana Petroleum recently, Tullow's suitors are more likely to be Italy's Eni, Total or one of the major Chinese oil firms .

The economy splutters

A good time to be a multinational as costs continue to fall. But a pretty awful time for everyone else. The FG-led Government will try to renegotiate the bailout and after several weeks of huffing and puffing, we'll all be about two cents better off. The grand plans to reform the public sector will be derailed before being deferred. Unemployment won't budge and emigration will continue to rise. On the plus side, Dublin Airport authority won't look like such berks for building the white elephant at T2, above.

The government growth figures contained in the four-year plan will look quite silly by the end of the year with spin doctors complaining that a misprint meant a decimal point was in the wrong place. Instead of a forecast of 2.75 per cent...we obviously meant 0.275 per cent. But growth is growth, so we can't complain. Otherwise there could be an election. Another one after the one that will see Fianna Fail obliterated in the Spring.

Michael Fingleton not to give back his e1m bonus

The former Irish Nationwide boss probably won't be giving back the €1m bonus as he continues to fight court cases over a Cavan property deal that went bad with major debts.

But Mr Fingleton, above, won't be alone. Former Financial Regulator Patrick Neary probably won't be offering to return his €630,000 golden handshake or the €143,000 public sector pension. Former B of I boss Brian Goggin may not be queueing up outside the Department of Finance offering to give up his €650,000 per year pension, with Eugene Sheehy equally unlikely to show such largesse.

Quelle:

Sunday Independent

Takeovers and sell-offs will dominate while our property and job markets splutter back to life in the coming year

Sunday January 02 2011

What will 2011 bring for some of the biggest and best known names in business? Will there be further carnage and teeth gnashing or will the green shoots of recovery start to take root.

We predicted carnage for McInerney, Boundary and Barry O'Callaghan's EMPG 12 months ago, along with nailing property prices and the nuclear winter for banks and developers. How will we do in 2011? Nick Webb looks into the crystal ball to see what could be in store for some of the top players in business for 2011.

ARYZTA TO SELL OFF STAKE IN ORIGIN

Owen Killian's, below, debt-fuelled splurge to buy new businesses for Aryzta will probably continue for some time. But non-core assets such as the croissant company's 71.4 per cent stake in €420m valued fertiliser and animal feed business Origin Enterprises are at risk. The stake harks back to the good old days of IAWS, when the company was run by people in flat caps who knew one end of a pig from another, rather than the slick corporate types now in the boardroom. The disposal will net Aryzta a cool €300m before costs.

Banks to keep blowing up

The regulators and Central Bankers believe that we don't really need to get too excited about the possibilities of defaulting mortgages blasting a big hole in the crippled banks. Pull the other one.

With unemployment stuck at 13.5 per cent, forecasts that the banks will take a modest five per cent hit on their mortgage book is straight out of loo-la land. And that's before credit cards. And personal and car loans. And we haven't even gone into corporate loans, especially ones to the small business sector, which has seen the rise in company failures jump 17 per cent in 2010.

AIB needed to raise €5.2bn to satisfy new regulatory requirements. There was no chance of that happening, so it had to be nationalised. Bank of Ireland's €2.2bn hurdle is also looking far too steep, so the State will own most of that too. Efforts to offload the banks will focus on slimming loan books and selling off parcels of debt. Will John Bruton's, bottom left, recent trade mission to the Gulf have smoked out any oil rich sovereign wealth funds willing to risk a few bob on Ireland? Wilbur Ross and the Cardinal Group will get their hands on EBS with the rump of Anglo and Irish Nationwide plonked into a new entity.

Sovereign debt crisis to roll on

Portugal will tap up the IMF/EU bailout fund... and get a better deal than us. Speculators will zone in on Spain, Italy and Belgium with bond yields rising sharply. But when France comes into the frame, things will really pick up speed. Germany's reluctance to finance its spendthrift European partners will become even more vocal.

However, some form of eurozone bond will be unveiled with a device to force bondholders to share some pain. Ireland's existing bondholders won't be burnt but future lenders to the country will charge through the nose. And we're complaining about a near six per cent interest rate now! The sovereign debt crisis will also spread east with German banks getting increasingly worried about the accession states. A German lender will have to be bailed out by the state.

mixed fortunes for commodities boom

There's no doubt that gold is looking like a big fat bubble. It will pop. But will it be in 2011 or is there a bit more in the bull run. Copper is looking very toppy and silver surges in 2010 may lead to some sell off. If growth continues, then we could see oil prices head back towards the $100 levels. But if the banking sector explodes over huge exposures to the overheating property sector then oil could take a battering.

Grafton to buy UK player

Michael Chadwick may be getting worried. He probably should have taken Grafton private in 2007 as the share price tanked. The DIY and builders supply firm is in rude health again after facing the demons of the recession. But there's precious little in the way of organic growth on the cards here. The market will shrink if anything, as consumer confidence struggles and successive budgets destroy spending power. Chadwick is bound to be looking at further expansion in the UK. There are probably plenty of boring little bolt-on deals but there's a feeling that he might do something big. Could he look at buying debt-laden Focus?

C&C to be bought out

SAB Miller or Canadian outfit Moulson Coors are considered to be potential predators if C&C comes into play.

Government to sell Aer Lingus stake

In 2007, when Ryanair launched its first bid for Aer Lingus, the Government's stake was worth more than €350m. Now it's worth closer to €150m. But expect the stake to be offloaded. ABR -- Anyone But Ryanair. Some form of a tie up with Lufthansa's BMI looks like a good bet at this stage but KLM-Air France, BA or even a private equity player could also be in the shake out. The windfall might even pay to fund about four days of the Government deficit.

sex scandal in boardroom Ireland

It's been a long time since anything naughty happened in Ireland's boardrooms but 2011 will see explosive allegations made against one of the country's top executives. There'll be a high profile resignation and talk of a massive lawsuit... which will of course be settled out of court.

Abbey to be taken private

The Gallagher family own more than 41 per cent of home building group Abbey. The company had about €45m sitting around in cash. The whole company is valued at just €120m. This screams take private. Charlie Gallagher has got to be looking at pressing the button on a deal. But will the banks fund any deal? If they don't, private equity outfits might just step in. Oaktree Capital saw enough of a potential return in bombed out homebuilder McInerney to offer to write a big fat cheque.

property gets a slight heartbeat again

The vulture funds are here. David Bonderman's Texas Pacific Group has hooked up with Stephen Vernon's Green Property with a plan to spend €900m on cheap property assets in Ireland and the UK.

A €120m deal to buy retail property in Dublin was mothballed with the IMF arrival. This may be reheated in coming months. Vast private equity group Carlyle -- also in the running for the EBS -- is also thought to be looking around.

Nama will come under increasing pressure to start offloading some of its €80bn in property loans over the next year. However, while there may be smaller transactions in Ireland, it is more likely to see major asset disposals in the UK and US.

Treasury Holdings' Battersea Power Station project is likely to hit the headlines again, with Derek Quinlan, above, selling some big, big trophy assets. The residential property market will remain dead.

Tullow takeover

Former accountant Aidan Heavey may be able to buy as many Lamborghinis as he wants in 2011. He could have a new one every day if his €13bn oil company Tullow gets bought out. While Korean player KNOC bought Dana Petroleum recently, Tullow's suitors are more likely to be Italy's Eni, Total or one of the major Chinese oil firms .

The economy splutters

A good time to be a multinational as costs continue to fall. But a pretty awful time for everyone else. The FG-led Government will try to renegotiate the bailout and after several weeks of huffing and puffing, we'll all be about two cents better off. The grand plans to reform the public sector will be derailed before being deferred. Unemployment won't budge and emigration will continue to rise. On the plus side, Dublin Airport authority won't look like such berks for building the white elephant at T2, above.

The government growth figures contained in the four-year plan will look quite silly by the end of the year with spin doctors complaining that a misprint meant a decimal point was in the wrong place. Instead of a forecast of 2.75 per cent...we obviously meant 0.275 per cent. But growth is growth, so we can't complain. Otherwise there could be an election. Another one after the one that will see Fianna Fail obliterated in the Spring.

Michael Fingleton not to give back his e1m bonus

The former Irish Nationwide boss probably won't be giving back the €1m bonus as he continues to fight court cases over a Cavan property deal that went bad with major debts.

But Mr Fingleton, above, won't be alone. Former Financial Regulator Patrick Neary probably won't be offering to return his €630,000 golden handshake or the €143,000 public sector pension. Former B of I boss Brian Goggin may not be queueing up outside the Department of Finance offering to give up his €650,000 per year pension, with Eugene Sheehy equally unlikely to show such largesse.

Quelle:

Sunday Independent

03.01.2011 06:47

FEIERTAGSHINWEIS/Kein Handel in London, Moskau und Tokio

DJ FEIERTAGSHINWEIS/Kein Handel in London, Moskau und Tokio

FRANKFURT (Dow Jones)--Aufgrund von Feiertagen bleiben die Börsen in London, Moskau und Tokio am Montag geschlossen.

FEIERTAGSHINWEIS/Kein Handel in London, Moskau und Tokio

DJ FEIERTAGSHINWEIS/Kein Handel in London, Moskau und Tokio

FRANKFURT (Dow Jones)--Aufgrund von Feiertagen bleiben die Börsen in London, Moskau und Tokio am Montag geschlossen.

STAMMDATEN

WKN 853701

ISIN IE 0030606259

Symbol BIR

Wertpapierart Auslandsaktie

Bezeichnung BANK OF IRELAND (THE GOV. &CO.)Reg. Capital Stock EO 0 ,10 Indexzugehörigkeit Handelssegment -

Währung EURO

Branche Kreditinstitute

Anzahl der Aktien 5.299.413.620

Marktkapitalisierung 2 ,11 Mrd.

WKN 853701

ISIN IE 0030606259

Symbol BIR

Wertpapierart Auslandsaktie

Bezeichnung BANK OF IRELAND (THE GOV. &CO.)Reg. Capital Stock EO 0 ,10 Indexzugehörigkeit Handelssegment -

Währung EURO

Branche Kreditinstitute

Anzahl der Aktien 5.299.413.620

Marktkapitalisierung 2 ,11 Mrd.

INSTITUTIONAL Holdings

Total Number of Holders: 52

% of Shares Outstanding: 0.57%

Total Shares Held: 7,544,837

Total Value of Holdings: $19,842,921

Net Activity: 3,377,911

http://www.nasdaq.com/asp/holdings.asp?symbol=IRE&selected=I…

Total Number of Holders: 52

% of Shares Outstanding: 0.57%

Total Shares Held: 7,544,837

Total Value of Holdings: $19,842,921

Net Activity: 3,377,911

http://www.nasdaq.com/asp/holdings.asp?symbol=IRE&selected=I…

http://www.irishtimes.com/newspaper/finance/2011/0107/122428…

Wir bekommen mehr Zeit die Loan-deposit ratios anzupassen.

mehr Zeit in der Anpassung kann nicht schaden.

Wir bekommen mehr Zeit die Loan-deposit ratios anzupassen.

mehr Zeit in der Anpassung kann nicht schaden.

!

Dieser Beitrag wurde moderiert. Grund: Spammposting

BoI opposes continuation of company's court protection

By Tim Healy

Saturday February 05 2011

BANK of Ireland is opposing the continuation of court protection for a company involved in the door-to-door selling of credit on a wide range of goods to 26,000 people across the country.

Murray Nolan Ltd, with registered offices at Clonee, Co Meath, employs 55 people directly while 65 self-employed commission-based sales agents handle door-to-door sales of goods including clothing and homeware.

The company, whose directors are Michael Murray, of Moynalvey Manor, Summerhill, Co Meath; and Tom Nolan, of Tankards Garden, Newbridge, Co Kildare; issues a catalogue of products twice yearly featuring products sourced from a variety of suppliers but mostly from Littlewoods/Shop Direct.

The company has debts of some €5.6m. If wound up, it claims it would have a deficit of some €4.4m but would have a deficit of some €735,283 on a going concern basis.

Among the causes of its difficulties were falling sales, a reduction in the collection rate of outstanding debtors and problems with its Christmas hamper business, it said. An independent accountant believed the company could survive provided certain conditions were met, the court heard.

It had disposed of the hamper and savings club aspects of the business last December and was engaged in cutting staff numbers and overheads.

Bank of Ireland, its largest creditor with debts of some €1.9m, is opposing examinership because it does not believe the company has a reasonable prospect of survival.

While the company had identified a potential investor who might provide around €500,000, the bank said three times that sum was required and described as "optimistic and incomplete" its cash flow projections for the examinership period.

The bank noted directors' remuneration up to December 2009 was €333,334 when the company had a trading loss of €130,855 that year. In 2008, the loss was €374,516 and €708,790 for the 15 months to end December 2007. The examiner's costs and remuneration of €250,000 would also prejudice the bank, it said.

Accountant Simon Coyle of Mazars was appointed interim examiner last month and the matter was before Mr Justice Peter Kelly yesterday to consider whether to confirm Mr Coyle as examiner. In a report, Mr Coyle said he believed the company could survive if Littlewoods agreed to continue to provide supplies to it.

The court heard Littlewoods wanted payment of some £35,000 (€41,450) due to it but had not given a commitment to continue supplying the company. Mr Justice Kelly adjourned the case to next Wednesday.

- Tim Healy

Irish Independent

By Tim Healy

Saturday February 05 2011

BANK of Ireland is opposing the continuation of court protection for a company involved in the door-to-door selling of credit on a wide range of goods to 26,000 people across the country.

Murray Nolan Ltd, with registered offices at Clonee, Co Meath, employs 55 people directly while 65 self-employed commission-based sales agents handle door-to-door sales of goods including clothing and homeware.

The company, whose directors are Michael Murray, of Moynalvey Manor, Summerhill, Co Meath; and Tom Nolan, of Tankards Garden, Newbridge, Co Kildare; issues a catalogue of products twice yearly featuring products sourced from a variety of suppliers but mostly from Littlewoods/Shop Direct.

The company has debts of some €5.6m. If wound up, it claims it would have a deficit of some €4.4m but would have a deficit of some €735,283 on a going concern basis.

Among the causes of its difficulties were falling sales, a reduction in the collection rate of outstanding debtors and problems with its Christmas hamper business, it said. An independent accountant believed the company could survive provided certain conditions were met, the court heard.

It had disposed of the hamper and savings club aspects of the business last December and was engaged in cutting staff numbers and overheads.

Bank of Ireland, its largest creditor with debts of some €1.9m, is opposing examinership because it does not believe the company has a reasonable prospect of survival.

While the company had identified a potential investor who might provide around €500,000, the bank said three times that sum was required and described as "optimistic and incomplete" its cash flow projections for the examinership period.

The bank noted directors' remuneration up to December 2009 was €333,334 when the company had a trading loss of €130,855 that year. In 2008, the loss was €374,516 and €708,790 for the 15 months to end December 2007. The examiner's costs and remuneration of €250,000 would also prejudice the bank, it said.

Accountant Simon Coyle of Mazars was appointed interim examiner last month and the matter was before Mr Justice Peter Kelly yesterday to consider whether to confirm Mr Coyle as examiner. In a report, Mr Coyle said he believed the company could survive if Littlewoods agreed to continue to provide supplies to it.

The court heard Littlewoods wanted payment of some £35,000 (€41,450) due to it but had not given a commitment to continue supplying the company. Mr Justice Kelly adjourned the case to next Wednesday.

- Tim Healy

Irish Independent

06.02.2011

3,6-Milliarden-Hilfe

Euro-Retter überweisen ersten Kredit nach Dublin

Irland kann sich über eine milliardenschwere Finanzspritze freuen: Der Euro-Rettungsfonds hat die erste Tranche seiner Hilfskredite an den hoch verschuldeten Inselstaat überwiesen - die Regierung in Dublin erhielt sogar deutlich mehr Geld als geplant.

Brüssel - Das erste Geld aus dem Euro-Rettungsfonds ist nach Irland geflossen: Wie mehrere Nachrichtenagenturen übereinstimmend berichten, hat der Euro-Rettungsfonds rund 3,6 Milliarden Euro an die Regierung in Dublin überwiesen. Die Zinsen für den Kredit werden auf 5,9 Prozent beziffert.

Das Geld kommt von einer Anleihe, mit der der Fonds Ende Januar fünf Milliarden Euro an den Kapitalmärkten eingesammelt hatte. "Dank der erfolgreichen Emission ist die an Irland überwiesene Summe höher als die vereinbarten 3,3 Milliarden Euro", sagte ein Vertreter des EFSF.

Dublin bekommt aber nicht die kompletten fünf Milliarden überwiesen, da der Fonds Barreserven halten muss, um an den Kapitalmärkten die Bestnote der Rating-Agenturen ("AAA") zu behalten. Dank der guten Bewertung kann sich der Fonds zu vergleichsweise günstigen Konditionen Geld leihen.

Die Euro-Staaten und der Internationale Währungsfonds hatten Ende vergangenen Jahres ein Hilfspaket für Irland von insgesamt 85 Milliarden Euro beschlossen. Die Turbulenzen auf der grünen Insel wurden von einem maroden Bankensystem ausgelöst.

Die Euro-Finanzminister arbeiten derzeit an einer Stärkung des Euro-Rettungsfonds. Sie versuchen, die Ausleihkapazität, die de facto rund 250 Milliarden Euro beträgt, auszuweiten. Dazu müssen die Euro-Länder, darunter auch Deutschland, ihre milliardenschweren Garantien erhöhen. Derzeit stehen die 17 Länder mit der Einheitswährung gemeinsam mit bis zu 440 Milliarden für den Krisenfonds gerade.

Der Rettungsfonds soll noch im ersten Halbjahr die nächste Anleihe in Höhe von drei bis fünf Milliarden Euro zu zehn Jahren Laufzeit aufnehmen.

ssu/dpa/Reuters

3,6-Milliarden-Hilfe

Euro-Retter überweisen ersten Kredit nach Dublin

Irland kann sich über eine milliardenschwere Finanzspritze freuen: Der Euro-Rettungsfonds hat die erste Tranche seiner Hilfskredite an den hoch verschuldeten Inselstaat überwiesen - die Regierung in Dublin erhielt sogar deutlich mehr Geld als geplant.

Brüssel - Das erste Geld aus dem Euro-Rettungsfonds ist nach Irland geflossen: Wie mehrere Nachrichtenagenturen übereinstimmend berichten, hat der Euro-Rettungsfonds rund 3,6 Milliarden Euro an die Regierung in Dublin überwiesen. Die Zinsen für den Kredit werden auf 5,9 Prozent beziffert.

Das Geld kommt von einer Anleihe, mit der der Fonds Ende Januar fünf Milliarden Euro an den Kapitalmärkten eingesammelt hatte. "Dank der erfolgreichen Emission ist die an Irland überwiesene Summe höher als die vereinbarten 3,3 Milliarden Euro", sagte ein Vertreter des EFSF.

Dublin bekommt aber nicht die kompletten fünf Milliarden überwiesen, da der Fonds Barreserven halten muss, um an den Kapitalmärkten die Bestnote der Rating-Agenturen ("AAA") zu behalten. Dank der guten Bewertung kann sich der Fonds zu vergleichsweise günstigen Konditionen Geld leihen.

Die Euro-Staaten und der Internationale Währungsfonds hatten Ende vergangenen Jahres ein Hilfspaket für Irland von insgesamt 85 Milliarden Euro beschlossen. Die Turbulenzen auf der grünen Insel wurden von einem maroden Bankensystem ausgelöst.

Die Euro-Finanzminister arbeiten derzeit an einer Stärkung des Euro-Rettungsfonds. Sie versuchen, die Ausleihkapazität, die de facto rund 250 Milliarden Euro beträgt, auszuweiten. Dazu müssen die Euro-Länder, darunter auch Deutschland, ihre milliardenschweren Garantien erhöhen. Derzeit stehen die 17 Länder mit der Einheitswährung gemeinsam mit bis zu 440 Milliarden für den Krisenfonds gerade.

Der Rettungsfonds soll noch im ersten Halbjahr die nächste Anleihe in Höhe von drei bis fünf Milliarden Euro zu zehn Jahren Laufzeit aufnehmen.

ssu/dpa/Reuters

Antwort auf Beitrag Nr.: 40.992.251 von Aktientitan am 07.02.11 08:36:35Freitag, 18. Februar 2011

Mit viel Anlauf über die Hürde?Bank of Ireland kämpft

Für die Bank of Ireland, einst zusammen mit vier weiteren Geldhäusern der Stolz eines aufstrebenden Finanzstandorts, wird es ernst: Die Bank versucht, das Eigenkapitalpolster aufzustocken. Mit aller Kraft wehrt sich das Haus gegen weitere Staatshilfen.

Fililale in Belfast: Wenn der Markt nicht mitzieht, muss die irische Staatskasse erneut herhalten.

Die Bank of Ireland kämpft mit allen Mitteln um ihre Eigenständigkeit. Das angeschlagene Institut will der Regierung nach eigenen Angaben noch diesen Monat knapp 215 Mio. Euro an Dividenden zahlen. Damit will die Bank ihre Zahlungsfähigkeit untermauern und verhindern, dass der Staatsanteil von derzeit 36 Prozent weiter erhöht wird. Die größte irische Bank ist eins von zwei Instituten des Landes, das noch nicht vom Staat kontrolliert wird.

Um strengere Kapitalregeln erfüllen zu können, muss die Bank ihr Eigenkapital um 1,4 Mrd. Euro aufstocken. Analysten sind jedoch skeptisch, ob das Geld bei Privatinvestoren eingesammelt werden kann. Gelingt dies nicht, könnte der Staatsanteil auf rund 70 Prozent steigen.

Um Investoren von der Zahlungsfähigkeit zu überzeugen, teilte die Bank mit, die Spareinlagen der Kunden seien seit Ende November weitgehend stabil geblieben. Die Quote des harten Kernkapitals (Core Tier 1), die Ende Juni 10,2 Prozent betrug, ging allerdings zurück. Sie liege aber immer noch über den Vorgaben, beteuerte die Bank.

Die Finanzkrise hat Irlands Banken besonders hart getroffen. Die Summe der Bürgschaften und Kapitalspritzen, die die irische Regierung zur Stützung des Bankensektors vorsieht, übersteigt die Wirtschaftsleistung des Landes deutlich.

http://www.n-tv.de/wirtschaft/Bank-of-Ireland-kaempft-articl…

Mit viel Anlauf über die Hürde?Bank of Ireland kämpft

Für die Bank of Ireland, einst zusammen mit vier weiteren Geldhäusern der Stolz eines aufstrebenden Finanzstandorts, wird es ernst: Die Bank versucht, das Eigenkapitalpolster aufzustocken. Mit aller Kraft wehrt sich das Haus gegen weitere Staatshilfen.

Fililale in Belfast: Wenn der Markt nicht mitzieht, muss die irische Staatskasse erneut herhalten.

Die Bank of Ireland kämpft mit allen Mitteln um ihre Eigenständigkeit. Das angeschlagene Institut will der Regierung nach eigenen Angaben noch diesen Monat knapp 215 Mio. Euro an Dividenden zahlen. Damit will die Bank ihre Zahlungsfähigkeit untermauern und verhindern, dass der Staatsanteil von derzeit 36 Prozent weiter erhöht wird. Die größte irische Bank ist eins von zwei Instituten des Landes, das noch nicht vom Staat kontrolliert wird.

Um strengere Kapitalregeln erfüllen zu können, muss die Bank ihr Eigenkapital um 1,4 Mrd. Euro aufstocken. Analysten sind jedoch skeptisch, ob das Geld bei Privatinvestoren eingesammelt werden kann. Gelingt dies nicht, könnte der Staatsanteil auf rund 70 Prozent steigen.

Um Investoren von der Zahlungsfähigkeit zu überzeugen, teilte die Bank mit, die Spareinlagen der Kunden seien seit Ende November weitgehend stabil geblieben. Die Quote des harten Kernkapitals (Core Tier 1), die Ende Juni 10,2 Prozent betrug, ging allerdings zurück. Sie liege aber immer noch über den Vorgaben, beteuerte die Bank.

Die Finanzkrise hat Irlands Banken besonders hart getroffen. Die Summe der Bürgschaften und Kapitalspritzen, die die irische Regierung zur Stützung des Bankensektors vorsieht, übersteigt die Wirtschaftsleistung des Landes deutlich.

http://www.n-tv.de/wirtschaft/Bank-of-Ireland-kaempft-articl…

Antwort auf Beitrag Nr.: 41.096.696 von Aktientitan am 24.02.11 08:24:27Jetzt mal eine nicht unwichtige Einschätzung die hier noch nicht steht.

Wenn dann doch bitte lückenlos und nicht wie man es braucht oder gerne sehen würde.

http://www.handelsblatt.com/finanzen/boerse-maerkte/anleihen…

Wenn dann doch bitte lückenlos und nicht wie man es braucht oder gerne sehen würde.

http://www.handelsblatt.com/finanzen/boerse-maerkte/anleihen…

Antwort auf Beitrag Nr.: 41.096.984 von Market-Insider am 24.02.11 09:05:24Schade das sie, das auch nicht beherzigen.

Deshalb auch hier zur Vollständigkeit.

Das Mezzanine Kapital wurde erst vor zwei Tagen durch S&P hochgestuft

http://www.alacrastore.com/research/s-and-p-credit-research-…

Deshalb auch hier zur Vollständigkeit.

Das Mezzanine Kapital wurde erst vor zwei Tagen durch S&P hochgestuft

http://www.alacrastore.com/research/s-and-p-credit-research-…

Antwort auf Beitrag Nr.: 41.097.039 von stockprofit am 24.02.11 09:12:36Financial sector braces for more testing times Later in the year, we'll know if the 'new Ireland' is going to be served by just three big banks -- AIB, BOI and Ulster

Thursday March 24 2011

AT last, it's showtime. For more than two years, Ireland has watched the banking black hole get bigger and bigger -- this year, it's finally time to sort the whole mess out.

First up are Anglo Irish Bank and Irish Nationwide, who've already handed over their €12.2bn deposit books to AIB and Irish Life & Permanent.

A business plan detailing the wind-down of the two defunct institutions is with Brussels and is expected to get the nod at the end of March.

The odds are that the two institutions will be no more by the end of the summer, unless the fledgling Government has some serious tricks up its sleeve.

The long-awaited sale of building society EBS is finally in the offing as well, with private equity consortium Cardinal on the verge of making the building society its own after a nine-month scrum.

The rest of the sector isn't escaping the whirl of activity either.

Within days, we'll have the results of the much-anticipated stress tests, affectionately dubbed PCAR (the capital one) and PLAR (the liquidity one).

These will show us if the main institutions -- Bank of Ireland (BOI), AIB, Irish Life & Permanent (IL&P) and EBS -- are finally strong enough to withstand future shocks.

The results of the tests will tell us if institutions need even more state cash -- which would be particularly significant for 'non-nationalised' BOI and IL&P.

The stress tests' outcome will also help the authorities form views on the volume of assets Irish banks need to sell in order to be viable without state support.

By the time the first flowers of summer appear, we should know which banks will avoid state ownership (for now at least), and which assets will be sold off, and how quickly.

We should also know whether banks will only have to sell off non-core businesses, or whether they'll have to sell off piles of loans into a new Nama II.

Later in the year, we'll know if the 'new Ireland' is going to be served by just three big banks (AIB, BOI and Ulster) or if Cardinal is going to put its money where its mouth is and complement the acquisition of EBS with a few bigger trophies.

And we'll find out if the Chinese, or some other big international investor group, is going to swoop on Ireland's bargain-basement banking assets like AIB.

Beyond the bigger picture stuff of mergers, takeovers and sell-offs, 2011 will also see banks trying to get to grips with the day-to-day business of operating in post-boom Ireland.

"In the era of the Celtic Tiger, banks became far too focused on property lending, and they lost some skills of lending to other parts of the economy," admits Pat Farrell, who heads up the Irish Bankers Federation (IBF).

The IBF has been "engaged" with Enterprise Ireland to discover the new growth areas in the economy and help upskill banks in how to lend against businesses' cash flow, instead of just lending against property.

"We've even had banks in from other jurisdictions who've got a lot of experience in this kind of lending," says Mr Farrell. "They're sharing their experience here."

Banks will have an uphill battle to win back trust from an SME sector that claims requests are being unreasonably refused on a near-daily basis, but Mr Farrell believes the battle must be fought.

"When the inflection point comes in the economy, and things turn towards growth again, we need to make sure the banking system is fit for purpose and ready to serve the economy," he says.

Later in the year, we'll know if the 'new Ireland' is going to be served by just three big banks -- AIB, BOI and Ulster

http://www.independent.ie/business/financial-sector-braces-f…

Thursday March 24 2011

AT last, it's showtime. For more than two years, Ireland has watched the banking black hole get bigger and bigger -- this year, it's finally time to sort the whole mess out.

First up are Anglo Irish Bank and Irish Nationwide, who've already handed over their €12.2bn deposit books to AIB and Irish Life & Permanent.

A business plan detailing the wind-down of the two defunct institutions is with Brussels and is expected to get the nod at the end of March.

The odds are that the two institutions will be no more by the end of the summer, unless the fledgling Government has some serious tricks up its sleeve.

The long-awaited sale of building society EBS is finally in the offing as well, with private equity consortium Cardinal on the verge of making the building society its own after a nine-month scrum.

The rest of the sector isn't escaping the whirl of activity either.

Within days, we'll have the results of the much-anticipated stress tests, affectionately dubbed PCAR (the capital one) and PLAR (the liquidity one).

These will show us if the main institutions -- Bank of Ireland (BOI), AIB, Irish Life & Permanent (IL&P) and EBS -- are finally strong enough to withstand future shocks.

The results of the tests will tell us if institutions need even more state cash -- which would be particularly significant for 'non-nationalised' BOI and IL&P.

The stress tests' outcome will also help the authorities form views on the volume of assets Irish banks need to sell in order to be viable without state support.

By the time the first flowers of summer appear, we should know which banks will avoid state ownership (for now at least), and which assets will be sold off, and how quickly.

We should also know whether banks will only have to sell off non-core businesses, or whether they'll have to sell off piles of loans into a new Nama II.

Later in the year, we'll know if the 'new Ireland' is going to be served by just three big banks (AIB, BOI and Ulster) or if Cardinal is going to put its money where its mouth is and complement the acquisition of EBS with a few bigger trophies.

And we'll find out if the Chinese, or some other big international investor group, is going to swoop on Ireland's bargain-basement banking assets like AIB.

Beyond the bigger picture stuff of mergers, takeovers and sell-offs, 2011 will also see banks trying to get to grips with the day-to-day business of operating in post-boom Ireland.

"In the era of the Celtic Tiger, banks became far too focused on property lending, and they lost some skills of lending to other parts of the economy," admits Pat Farrell, who heads up the Irish Bankers Federation (IBF).

The IBF has been "engaged" with Enterprise Ireland to discover the new growth areas in the economy and help upskill banks in how to lend against businesses' cash flow, instead of just lending against property.

"We've even had banks in from other jurisdictions who've got a lot of experience in this kind of lending," says Mr Farrell. "They're sharing their experience here."

Banks will have an uphill battle to win back trust from an SME sector that claims requests are being unreasonably refused on a near-daily basis, but Mr Farrell believes the battle must be fought.

"When the inflection point comes in the economy, and things turn towards growth again, we need to make sure the banking system is fit for purpose and ready to serve the economy," he says.

Later in the year, we'll know if the 'new Ireland' is going to be served by just three big banks -- AIB, BOI and Ulster

http://www.independent.ie/business/financial-sector-braces-f…

Antwort auf Beitrag Nr.: 41.259.236 von Aktientitan am 24.03.11 12:10:44Bank shares are volatile as BoI begins disposal of €30bn assets

By Laura Noonan

Tuesday April 05 2011

SHARES in Allied Irish and Bank of Ireland jumped more than 9pc yesterday as the markets continued to cheer the stress tests.

But Irish Life & Permanent had another torrid session, plummeting 25pc to 13c to make one of the country's most widely owned shares almost valueless.

The moves came as BoI kicked off the sale of its €3bn global project finance business with Ireland's only home-grown independent bank battling to offload €30bn of "non-core" assets.

A spokesman for the bank last night confirmed that Deutsche Bank had been appointed to handle the sale of BoI Global Project Finance, which financed a host of high-profile projects, including the development of Arsenal Football Club's Emirates Stadium.

A separate project finance division based in Ireland is unaffected by the move. The bank has also appointed advisers Hawkpoint to sell its UK asset finance business Burdale.

The two assets are first to go on the block because their "niche" nature makes them easier to sell than many of Bank of Ireland's other loan books and assets.

Market sources stressed that any benefit from the sales would help BoI hit the "deleveraging" targets outlined in the latest bailout deal but would not materially impact the bank's €4.2bn capital raising.

Under the "deleveraging" plan, BoI must offload €30bn of loans so that it will only have €122.50 loaned out for every €100 on deposit by the end of 2013.

The capital plan requires the bank to raise €4.2bn from private investors by June or take a fresh injection from the Government and risk majority state ownership.

Since the on-the-market businesses are not expected to sell for more than their book value, analysts are not expected BoI to reap a significant capital gain from the sales.

- Laura Noonan

Irish Independent

By Laura Noonan

Tuesday April 05 2011

SHARES in Allied Irish and Bank of Ireland jumped more than 9pc yesterday as the markets continued to cheer the stress tests.

But Irish Life & Permanent had another torrid session, plummeting 25pc to 13c to make one of the country's most widely owned shares almost valueless.

The moves came as BoI kicked off the sale of its €3bn global project finance business with Ireland's only home-grown independent bank battling to offload €30bn of "non-core" assets.

A spokesman for the bank last night confirmed that Deutsche Bank had been appointed to handle the sale of BoI Global Project Finance, which financed a host of high-profile projects, including the development of Arsenal Football Club's Emirates Stadium.

A separate project finance division based in Ireland is unaffected by the move. The bank has also appointed advisers Hawkpoint to sell its UK asset finance business Burdale.

The two assets are first to go on the block because their "niche" nature makes them easier to sell than many of Bank of Ireland's other loan books and assets.

Market sources stressed that any benefit from the sales would help BoI hit the "deleveraging" targets outlined in the latest bailout deal but would not materially impact the bank's €4.2bn capital raising.

Under the "deleveraging" plan, BoI must offload €30bn of loans so that it will only have €122.50 loaned out for every €100 on deposit by the end of 2013.

The capital plan requires the bank to raise €4.2bn from private investors by June or take a fresh injection from the Government and risk majority state ownership.

Since the on-the-market businesses are not expected to sell for more than their book value, analysts are not expected BoI to reap a significant capital gain from the sales.

- Laura Noonan

Irish Independent

Antwort auf Beitrag Nr.: 41.318.534 von Aktientitan am 05.04.11 09:40:51BoI suing developer's estate for $900,000

Property tycoon took own life in 2009 over financial pressures

By RONALD QUINLAN

Sunday April 10 2011

Bank of Ireland has filed a lawsuit for the recovery of $900,000 (€622,000) plus costs in New York's Supreme Court against the estate of tragic property tycoon John O'Dolan, who took his own life in 2009 due to the pressure of his financial affairs.

Copies of official court documents seen by the Sunday Independent show that lawyers for Bank of Ireland Private Banking Limited have lodged a complaint in which it is alleged that a $954,000 mortgage Mr O'Dolan took with the bank in 2007 for the purchase of an apartment at the exclusive Centria Condominium in midtown Manhattan is now in default.

The bank's complaint states that no payments have been made against the loan since February 18 of last year, despite what it terms its "due demand". The court papers further state that Bank of Ireland is now seeking the repayment of $900,624.19 together with accrued interest, plus the costs of collection.

In seeking to recover the money, the bank's lawyers have asked the court to order the sale of Mr O'Dolan's apartment along with all its "fixtures and articles of personalty [personal effects]".

And in the event that the proceeds of such of a sale fail to cover the debt the bank claims it is owed, lawyers for Bank of Ireland have asked that the court order Mr O'Dolan's estate to make up the difference.

The bank's lawsuit will come as a particularly cruel blow to Mr O'Dolan's widow, Eileen, coming as it does on the back of other proceedings being taken by Anglo Irish Bank, AIB and Bank of Scotland here in Ireland against her personally in her previous capacity as a co-director with her late husband in several of his businesses.

The cases are thought to relate to her husband's interests. Nama has also initiated legal proceedings against Galway City Hostel, of which Mrs O'Dolan is also a director, and which was placed in receivership last year.

Originally from Clontarf in Dublin, Mr O'Dolan moved to Galway to join a local auctioneering firm before striking out on his own as a property developer. At the height of the boom, Mr O'Dolan was arguably the most successful developer in the west of Ireland, with a string of landmark deals to his name.

The most notable of these deals came when his company bought the Island of Ireland in the World development in Dubai for €28m and, the following year, bought the Island of England for a similar sum.

His businesses suffered a dramatic reversal of fortune in the international and domestic property crash, however, and according to the inquest into his death, he had become "depressed" by financial worries.

- RONALD QUINLAN

Sunday Independent

Property tycoon took own life in 2009 over financial pressures

By RONALD QUINLAN

Sunday April 10 2011

Bank of Ireland has filed a lawsuit for the recovery of $900,000 (€622,000) plus costs in New York's Supreme Court against the estate of tragic property tycoon John O'Dolan, who took his own life in 2009 due to the pressure of his financial affairs.

Copies of official court documents seen by the Sunday Independent show that lawyers for Bank of Ireland Private Banking Limited have lodged a complaint in which it is alleged that a $954,000 mortgage Mr O'Dolan took with the bank in 2007 for the purchase of an apartment at the exclusive Centria Condominium in midtown Manhattan is now in default.

The bank's complaint states that no payments have been made against the loan since February 18 of last year, despite what it terms its "due demand". The court papers further state that Bank of Ireland is now seeking the repayment of $900,624.19 together with accrued interest, plus the costs of collection.

In seeking to recover the money, the bank's lawyers have asked the court to order the sale of Mr O'Dolan's apartment along with all its "fixtures and articles of personalty [personal effects]".

And in the event that the proceeds of such of a sale fail to cover the debt the bank claims it is owed, lawyers for Bank of Ireland have asked that the court order Mr O'Dolan's estate to make up the difference.

The bank's lawsuit will come as a particularly cruel blow to Mr O'Dolan's widow, Eileen, coming as it does on the back of other proceedings being taken by Anglo Irish Bank, AIB and Bank of Scotland here in Ireland against her personally in her previous capacity as a co-director with her late husband in several of his businesses.

The cases are thought to relate to her husband's interests. Nama has also initiated legal proceedings against Galway City Hostel, of which Mrs O'Dolan is also a director, and which was placed in receivership last year.

Originally from Clontarf in Dublin, Mr O'Dolan moved to Galway to join a local auctioneering firm before striking out on his own as a property developer. At the height of the boom, Mr O'Dolan was arguably the most successful developer in the west of Ireland, with a string of landmark deals to his name.

The most notable of these deals came when his company bought the Island of Ireland in the World development in Dubai for €28m and, the following year, bought the Island of England for a similar sum.

His businesses suffered a dramatic reversal of fortune in the international and domestic property crash, however, and according to the inquest into his death, he had become "depressed" by financial worries.

- RONALD QUINLAN

Sunday Independent

Antwort auf Beitrag Nr.: 41.259.236 von Aktientitan am 24.03.11 12:10:44RT-Chart:

http://world-of-stocks.com/rt_data/bir

http://world-of-stocks.com/rt_data/bir

Es gibt doch bereits etablierte BOI-Threads...

http://www.wallstreet-online.de/diskussion/1147888-10221-102…

http://www.traderforum.de/showthread.php?3668-Bank-of-Irelan…

http://www.ariva.de/Was_meint_Ihr_lohnt_sich_der_einstig_hie…

Heute ein guter Tag! +9%

http://www.wallstreet-online.de/diskussion/1147888-10221-102…

http://www.traderforum.de/showthread.php?3668-Bank-of-Irelan…

http://www.ariva.de/Was_meint_Ihr_lohnt_sich_der_einstig_hie…

Heute ein guter Tag! +9%

Antwort auf Beitrag Nr.: 41.362.060 von Ro-Bert am 13.04.11 16:18:37Bank of Ireland posts loss of €950m for 2010

Updated: 08:08, Thursday, 14 April 2011

Bank of Ireland has reported a loss before tax of €950m for the the year ending December 2010.

Bank of Ireland has reported a loss before tax of €950m for the the year ending December 2010, with impairment charges on loans and advances for the year amounting to €1.9 billion.

Underlying losses amounted to €3.5 billion, up from €2.96 billion for the nine months to the end of December 2009. Revenues for the year dipped to €1.017 billion from €1.056 billion.

The bank said it lost over €2.2 billion on the sale of its property and land development loans to the National Asset Management Agency. The figure was higher than expected.

The bank said that impairment charges on loans and advances to customers - excluding assets sold to NAMA - were €1.887 billion for the year, 34% lower than the previous year.

It said 4.17% of residential mortgages across the bank were more than 90 days behind with repayments, an increase from 2.76% a year earlier.

The bank said that the ongoing economic slowdown in Ireland including lower levels of employment, reduced disposable income and falling house prices continued to adversely impact the level of mortgage arrears which increased significantly in 2010.

It said that the housing market in Ireland is now not expected to stabilise until at least late 2012 and added that it now expects house prices to slump by 55% from their peak levels in 2006.

Bank of Ireland described 2010 as a challenging and difficult year. It said it was hit by the severe economic downturn in Ireland last year. It added that while progress was made on its main priorities, it was badly hit by sovereign debt concerns about Ireland in the later part of the year.

Since March 2008, its staff numbers have fallen by 2,200, and the bank continues to work on its costs.

The bank said its customer deposits stood at €65 billion by the end of last year, down from €85 billion at the end of 2009.

'Trading conditions in the first months of 2011 remain challenging due to higher funding costs, in particular the cost of customer deposits and the continuing difficult liquidity environment' commented Bank of Ireland's group chief executive Richie Boucher.

He added that operating costs remain under strict control and the bank maintains its expectation that the impairment charges on its non-NAMA designed loans and advances to customers peaked in 2009, reduced in 2010 with anticipated further reductions in subsequent years.

http://www.rte.ie/news/2011/0414/boi-business.html

Updated: 08:08, Thursday, 14 April 2011

Bank of Ireland has reported a loss before tax of €950m for the the year ending December 2010.

Bank of Ireland has reported a loss before tax of €950m for the the year ending December 2010, with impairment charges on loans and advances for the year amounting to €1.9 billion.

Underlying losses amounted to €3.5 billion, up from €2.96 billion for the nine months to the end of December 2009. Revenues for the year dipped to €1.017 billion from €1.056 billion.

The bank said it lost over €2.2 billion on the sale of its property and land development loans to the National Asset Management Agency. The figure was higher than expected.

The bank said that impairment charges on loans and advances to customers - excluding assets sold to NAMA - were €1.887 billion for the year, 34% lower than the previous year.

It said 4.17% of residential mortgages across the bank were more than 90 days behind with repayments, an increase from 2.76% a year earlier.

The bank said that the ongoing economic slowdown in Ireland including lower levels of employment, reduced disposable income and falling house prices continued to adversely impact the level of mortgage arrears which increased significantly in 2010.

It said that the housing market in Ireland is now not expected to stabilise until at least late 2012 and added that it now expects house prices to slump by 55% from their peak levels in 2006.

Bank of Ireland described 2010 as a challenging and difficult year. It said it was hit by the severe economic downturn in Ireland last year. It added that while progress was made on its main priorities, it was badly hit by sovereign debt concerns about Ireland in the later part of the year.

Since March 2008, its staff numbers have fallen by 2,200, and the bank continues to work on its costs.

The bank said its customer deposits stood at €65 billion by the end of last year, down from €85 billion at the end of 2009.

'Trading conditions in the first months of 2011 remain challenging due to higher funding costs, in particular the cost of customer deposits and the continuing difficult liquidity environment' commented Bank of Ireland's group chief executive Richie Boucher.

He added that operating costs remain under strict control and the bank maintains its expectation that the impairment charges on its non-NAMA designed loans and advances to customers peaked in 2009, reduced in 2010 with anticipated further reductions in subsequent years.

http://www.rte.ie/news/2011/0414/boi-business.html

Antwort auf Beitrag Nr.: 41.365.552 von Aktientitan am 14.04.11 09:24:38Annual Report

for the twelve month period ended 31 December 2010

http://www.bankofireland.com/fs/doc/publications/investor-re…

for the twelve month period ended 31 December 2010

http://www.bankofireland.com/fs/doc/publications/investor-re…

Antwort auf Beitrag Nr.: 41.365.648 von Aktientitan am 14.04.11 09:35:48Bank of Ireland verliert Millionen

Schlecht, aber weniger schlecht als befürchtet: Die Bank of Ireland schreibt zwar weiterhin rote Zahlen, vermeidet aber einen weiteren Milliardenverlust. Für 2010 meldet die teilverstaatlichte Bank einen Verlust von 609 Millionen Euro.

Bank of Ireland verliert Millionen

Der Verlust der Bank of Ireland fällt deutlich geringer aus als von Branchenexperten befürchtet. Diese hatten sich im Schnitt auf 1,9 Milliarden Euro Verlust gefasst gemacht. Der Verlust wurde jedoch vor allem durch eine Umschuldung sowie neue Wertberichtigungen begrenzt.

Die Resultate des Bank-Geschäfts beeindruckten die Experten indes nicht - zumal die gesamte irische Bankenbranche weiter auf finanzielle Hilfe durch die Europäische Zentralbank angewiesen ist.

Bankchef Richie Boucher sprach zwar von einer Trendwende. "Wir haben uns von einem Überlebenskampf hin zur Stabilisierung bewegt." Dennoch droht das Traditionshaus bald mehrheitlich in Staatsbesitz zu gelangen, weil die Bank of Ireland nach einem Stresstest der irischen Notenbank weitere 5 Milliarden Euro benötigt, um krisensicher zu werden.

Der Grossteil des durch eine hemmungslose Kreditvergabe ruinierten irischen Bankensektors ist bereits verstaatlicht. Die Rechnung für die Rettung der Branche beläuft sich auf rund 70 Milliarden Euro. Der grösste Rivale der Bank of Ireland, die Allied Irish Banks, hatte erst Anfang der Woche einen Jahresverlust von mehr als 10 Milliarden Euro bekanntgegeben.

(cms/sda)

http://www.stocks.ch/unternehmen/reference-bank-ireland-verl…

Schlecht, aber weniger schlecht als befürchtet: Die Bank of Ireland schreibt zwar weiterhin rote Zahlen, vermeidet aber einen weiteren Milliardenverlust. Für 2010 meldet die teilverstaatlichte Bank einen Verlust von 609 Millionen Euro.

Bank of Ireland verliert Millionen

Der Verlust der Bank of Ireland fällt deutlich geringer aus als von Branchenexperten befürchtet. Diese hatten sich im Schnitt auf 1,9 Milliarden Euro Verlust gefasst gemacht. Der Verlust wurde jedoch vor allem durch eine Umschuldung sowie neue Wertberichtigungen begrenzt.

Die Resultate des Bank-Geschäfts beeindruckten die Experten indes nicht - zumal die gesamte irische Bankenbranche weiter auf finanzielle Hilfe durch die Europäische Zentralbank angewiesen ist.

Bankchef Richie Boucher sprach zwar von einer Trendwende. "Wir haben uns von einem Überlebenskampf hin zur Stabilisierung bewegt." Dennoch droht das Traditionshaus bald mehrheitlich in Staatsbesitz zu gelangen, weil die Bank of Ireland nach einem Stresstest der irischen Notenbank weitere 5 Milliarden Euro benötigt, um krisensicher zu werden.

Der Grossteil des durch eine hemmungslose Kreditvergabe ruinierten irischen Bankensektors ist bereits verstaatlicht. Die Rechnung für die Rettung der Branche beläuft sich auf rund 70 Milliarden Euro. Der grösste Rivale der Bank of Ireland, die Allied Irish Banks, hatte erst Anfang der Woche einen Jahresverlust von mehr als 10 Milliarden Euro bekanntgegeben.

(cms/sda)

http://www.stocks.ch/unternehmen/reference-bank-ireland-verl…

Antwort auf Beitrag Nr.: 41.377.563 von Aktientitan am 16.04.11 06:29:21BoI to launch €4.2bn capital raising plan within weeks

The bank insists falling into state ownership is far from a foregone conclusion as it looks to tap the markets

By Laura Noonan

Friday April 15 2011

BANK of Ireland yesterday vowed to unveil a €4.2bn capital raising plan within weeks and insisted that the bank's descent into majority state ownership was "not a foregone conclusion".

The comments came as BoI revealed losses of €950m last year, marginally ahead of analysts' expectations and significantly better than the €2.2bn loss in 2009.

BoI is hoping to be able to raise €4.2bn in capital to meet the demands set by the latest banking stress tests without having to take another equity injection from the state.

Central Bank governor Patrick Honohan has said all Ireland's major banks were realistically set to fall into majority state ownership as a result of the €24bn industry-wide capital demand that stemmed from the stress tests.

Asked if that held true for BoI, the bank's CEO Richie Boucher said "that is not a forgone conclusion". The bank will unveil detailed capital raising plans "in a couple of weeks", according to its chief executive.

"The most important thing is that the taxpayer sees the investment they didn't want to make in the banks reduced," Mr Boucher said when asked if the bank was determined to stave off state ownership.

Difficult

BoI will be going to the market for new cash against "difficult trading conditions" in its core Irish market, but executives yesterday insisted there was an "investment case" to be made.

BoI's losses are reducing and last year's losses were aggravated by a €2.2bn hit on loans transferred to Nama which will not be repeated, they said.

The 2010 accounts also showed that BoI was dependent on €23bn of funding from the European Central Bank at the end of 2010, plus another €8bn of emergency liquidity channelled through the Central Bank of Ireland.

The last resort cash accounted for about 20pc of Bank of Ireland's total funding at the end of year.

Mr Boucher said the bank would be weaned off all central bank money "well within" the period to the end of 2013.

The bank is also keenly aware of the need to come off the Government guarantee scheme, both to restore "confidence" and to eliminate the €350m annual cost of the guarantee, finance boss John O'Donovan said.

The other key element in yesterday's presentation was BoI's disclosure that its deposits had "stabilised" in November.

Retail deposits were "exceptionally resilient" throughout the crisis, Mr O'Donovan said.

The latest bank restructuring plan will see BoI slim down its asset base by €30bn over the next three years.

The bank yesterday said that some €10bn of the target would be achieved through disposals.

Life insurance division New Ireland is already being prepared for sale, and the bank's approved business plan also includes selling off mortgage lender ICC.

"It [selling ICC in this market] would not see to be sensible, but we'll do what we have to do," Mr Boucher said.

The BoI boss declined to comment on speculation that BoI will ultimately be merged with Permanent TSB.

Despite the higher-than-expected capital demand resulting from the stress tests, Mr O'Donovan said the bank believed they had performed a useful function.

"The stress tests should cauterise any residual doubt that has been on people's mind about the Irish banking system," he said.

- Laura Noonan

http://www.independent.ie/business/irish/boi-to-launch-euro4…

The bank insists falling into state ownership is far from a foregone conclusion as it looks to tap the markets

By Laura Noonan

Friday April 15 2011

BANK of Ireland yesterday vowed to unveil a €4.2bn capital raising plan within weeks and insisted that the bank's descent into majority state ownership was "not a foregone conclusion".

The comments came as BoI revealed losses of €950m last year, marginally ahead of analysts' expectations and significantly better than the €2.2bn loss in 2009.

BoI is hoping to be able to raise €4.2bn in capital to meet the demands set by the latest banking stress tests without having to take another equity injection from the state.

Central Bank governor Patrick Honohan has said all Ireland's major banks were realistically set to fall into majority state ownership as a result of the €24bn industry-wide capital demand that stemmed from the stress tests.

Asked if that held true for BoI, the bank's CEO Richie Boucher said "that is not a forgone conclusion". The bank will unveil detailed capital raising plans "in a couple of weeks", according to its chief executive.

"The most important thing is that the taxpayer sees the investment they didn't want to make in the banks reduced," Mr Boucher said when asked if the bank was determined to stave off state ownership.

Difficult

BoI will be going to the market for new cash against "difficult trading conditions" in its core Irish market, but executives yesterday insisted there was an "investment case" to be made.

BoI's losses are reducing and last year's losses were aggravated by a €2.2bn hit on loans transferred to Nama which will not be repeated, they said.

The 2010 accounts also showed that BoI was dependent on €23bn of funding from the European Central Bank at the end of 2010, plus another €8bn of emergency liquidity channelled through the Central Bank of Ireland.

The last resort cash accounted for about 20pc of Bank of Ireland's total funding at the end of year.

Mr Boucher said the bank would be weaned off all central bank money "well within" the period to the end of 2013.

The bank is also keenly aware of the need to come off the Government guarantee scheme, both to restore "confidence" and to eliminate the €350m annual cost of the guarantee, finance boss John O'Donovan said.

The other key element in yesterday's presentation was BoI's disclosure that its deposits had "stabilised" in November.

Retail deposits were "exceptionally resilient" throughout the crisis, Mr O'Donovan said.

The latest bank restructuring plan will see BoI slim down its asset base by €30bn over the next three years.

The bank yesterday said that some €10bn of the target would be achieved through disposals.

Life insurance division New Ireland is already being prepared for sale, and the bank's approved business plan also includes selling off mortgage lender ICC.

"It [selling ICC in this market] would not see to be sensible, but we'll do what we have to do," Mr Boucher said.

The BoI boss declined to comment on speculation that BoI will ultimately be merged with Permanent TSB.

Despite the higher-than-expected capital demand resulting from the stress tests, Mr O'Donovan said the bank believed they had performed a useful function.

"The stress tests should cauterise any residual doubt that has been on people's mind about the Irish banking system," he said.

- Laura Noonan

http://www.independent.ie/business/irish/boi-to-launch-euro4…

Hallo

Habe hier auch Aktien gekauft. Wo seht ihr den Wert in paar Wochen?

Bitte realistische Werte. Danke

Habe hier auch Aktien gekauft. Wo seht ihr den Wert in paar Wochen?

Bitte realistische Werte. Danke

Antwort auf Beitrag Nr.: 41.377.924 von derfahnder1 am 16.04.11 10:58:50

D. hört sich doch...KLASSE an !!!

The Great Escape

Having emerged relatively unscathed from the banking debacle, Zambia-born Boucher must now nurse BoI back to health

Saturday April 16 2011

This week's better-than-expected results from Bank of Ireland, which showed a halving of losses in 2010, leave chief executive Richie Boucher well-positioned to keep Ireland's oldest bank out of majority state ownership.

As the Irish banking crisis that began with the "St Patrick's Day massacre" of bank shares in March 2008 enters its fourth year, Bank of Ireland is increasingly looking like it will be the only one of the Irish-owned banks to survive in anything resembling its original form.

Bank of Ireland lost €950m in 2010, just over half of the €1.8bn it lost in the nine months to the end of December 2009. In fact, the underlying performance was even better. The 2010 results included almost €2.5bn of losses on loans transferred to NAMA. This is a once-off charge which won't recur in 2011.

There was also a significant decline in Bank of Ireland's non-NAMA loan losses. The bank wrote off €1.88bn of bad loans in 2010, down from €2.27bn in the previous accounting period.

The 2010 Bank of Ireland results stand in stark contrast to those of its major Irish rival, AIB, which also published its 2010 results this week. It wrote off €13bn on bad loans last year, almost three times as much as Bank of Ireland even when losses on loans transferred to NAMA are included.

Loan losses

Last year's loan losses brings Bank of Ireland's total loan losses since mid-2008 to just over €10bn with last month's stress test results from US consultants BlackRock estimating that, in a worst-case scenario, Bank of Ireland might have to write off a further €14.8bn.

While these are huge losses, they pale by comparison with the more than €20bn of loan losses already racked up by AIB, with BlackRock predicting that there could be up to further €16.5bn in a worst-case scenario.

Bank of Ireland's much lower loan losses have meant that it has had to raise much less new capital than AIB. Under the new capital adequacy rules published by the Financial Regulator last month, Bank of Ireland will have to raise €5.2bn of fresh capital. It hopes that it can raise most of this from private sector investors.

This will allow Bank of Ireland to keep the state shareholding in the bank, which currently stands at 36pc, at under 50pc. Bank of Ireland is almost certain to be the only Irish financial institution which stays out of majority stake ownership.

By comparison, the Financial Regulator has told AIB that it needs to raise more than €13bn of extra capital. Given AIB's parlous position, most of this extra capital will have to come from the State, resulting in a further increase in the state shareholding, which already stands at almost 93pc.

So how did Bank of Ireland manage to get things so much less wrong than most of its competitors? It helped that Bank of Ireland never got quite so carried away by the euphoria generated by the property boom. Unlike AIB, which from 2005 onwards tried to compete head-on with Anglo, Bank of Ireland didn't completely abandon the basic banking principles of prudence and caution.

Mistakes

Sure, it made mistakes, but it made fewer of them than most of its competitors. Which, given the crazy state of Irish banking by the middle of the last decade, was about as much as could be hoped for. Bank of Ireland was the least crazy inmate of what had become an asylum.

Almost as important, when the merde did begin to hit the fan, Bank of Ireland quickly owned up to its problems. Unlike AIB, which spent almost two years denying the severity of the problems which it faced, Bank of Ireland came clean almost instantly.

Former chief executive Brian Goggin fell on his sword in January 2009 while chairman Richard Burrows exited in May of that year with an apology to shareholders for having trashed their investment. It mightn't be much consolation to Bank of Ireland shareholders who had seen the value of their shares fall by over 98pc, but it was in stark contrast to the unedifying seven-month stand-off between the AIB board and former Finance Minister Brian Lenihan over who should succeed Eugene Sheehy as chief executive.

However, while Bank of Ireland has in general managed its relationship with Government and regulators much better than AIB, there have been occasional tiffs. The first major spat occurred in January 2009 when Richie Boucher was nominated to succeed Goggin, a move which annoyed Lenihan, who was known to prefer the appointment of an outsider to the position.

Then there was the €66m of bonuses which Bank of Ireland paid to its staff during the period between September 2008, when the Government unconditionally guaranteed the deposits of the Irish-owned banks, and the end of 2010. These bonuses violated the spirit if not the letter of the agreement made when the Government injected €3.5bn of fresh capital into Bank of Ireland in 2009.

When the issue was first raised in the Dail, Bank of Ireland supplied the Department of Finance with apparently misleading information which seemed to indicate that no such bonuses had been paid. When it subsequently emerged that such bonuses had in fact been paid, Bank of Ireland apologised "unreservedly".

A report on the controversy by the Department of Finance found that there had been "a catalogue of errors" and that the information supplied by Bank of Ireland was "presented in a manner which minimised the level of additional payments made". Ouch!

There was also last year's contretemps when it was discovered that Bank of Ireland had topped up Boucher's pension pot by €1.5m, in a move widely seen as an attempt to circumvent the Government's cap of €500,000 a year on the pay of bank bosses. This would have allowed Boucher to retire in 2014 at 55 on an annual pension of €367,000. Once again Bank of Ireland quickly backed down with Boucher agreeing to waive the top-up.