Dalradian mit Top Management auf die Überholspur - 500 Beiträge pro Seite

eröffnet am 05.03.11 16:16:03 von

neuester Beitrag 27.09.18 13:32:30 von

neuester Beitrag 27.09.18 13:32:30 von

Beiträge: 99

ID: 1.164.345

ID: 1.164.345

Aufrufe heute: 0

Gesamt: 12.709

Gesamt: 12.709

Aktive User: 0

ISIN: CA2354991002 · WKN: A1C72R

0,9550

EUR

-0,10 %

-0,0010 EUR

Letzter Kurs 07.09.18 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 15.699,00 | +15,27 | |

| 0,7999 | +14,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8950 | -7,25 | |

| 0,5100 | -8,11 | |

| 0,5400 | -8,47 | |

| 39,20 | -8,84 | |

| 0,7000 | -12,50 |

Ist einen zweiten Blick wert....

Eine beeindruckendes Team

These are the directors/managment of this beast:

Former President/CEO of Aurelian (Anderson), current President/CEO of Osisko (Roosen), current CEO of Continental Gold & Colossus Minerals (Sussman), former CFO of Aurelian (McKay), former CEO of HudBay Minerals (Gagel).

These are the directors/managment of this beast:

Former President/CEO of Aurelian (Anderson), current President/CEO of Osisko (Roosen), current CEO of Continental Gold & Colossus Minerals (Sussman), former CFO of Aurelian (McKay), former CEO of HudBay Minerals (Gagel).

Unbedingt ansehenswert die Investor Präsentation vom Februar 2011

http://www.dalradian.com/Investors/Presentations

http://www.dalradian.com/Investors/Presentations

guten morgen,

ist hier überhaupt noch jemand?

halte den Wert für sehr interessant

gruß brocki

ist hier überhaupt noch jemand?

halte den Wert für sehr interessant

gruß brocki

seit gestern auch dabei ... die goldgehalte sind einfach bombastisch hier

Antwort auf Beitrag Nr.: 41.682.384 von VodkaLemon am 22.06.11 11:29:41hier die letzten bohrergebnisse mit überragenden werten von 111 g/t :

Drilling at Curraghinalt Intersects 2.06 Metres Grading 111.6 g/t of Gold And 1.11 Metres Grading 26.84 g/t of Gold

Press Release Source: Dalradian Resources Inc. On Wednesday June 8, 2011, 8:52 am EDT

TORONTO, ONTARIO--(Marketwire - 06/08/11) - Dalradian Resources Inc. ("Dalradian" or the "Company") (TSX NA - News)(TSX

NA - News)(TSX NA.WT - News) continues to extend the known mineralization at its Curraghinalt Deposit in County Tyrone, Northern Ireland. Results from 6 step out holes and 1 infill hole are reported for a total of 15 intercepts greater than 5 gram metres.

NA.WT - News) continues to extend the known mineralization at its Curraghinalt Deposit in County Tyrone, Northern Ireland. Results from 6 step out holes and 1 infill hole are reported for a total of 15 intercepts greater than 5 gram metres.

"Our four rig drill program continues to pick up the pace with over 3500 metres of drilling in seven holes reported in this release," says Patrick F. N. Anderson, Company CEO and Chairman, "To put this in perspective, we have completed just over 10,000 metres in 31 drill holes since going public last August. We expect another two drill rigs to arrive on site this summer to further enhance the exploration program."

As part of the company's step out drilling program, the main resource veins continue to be intersected at predicted depths and the Bend and Crow veins (not included in the previously reported 43-101 resource) are providing high grade intersections. An infill drill hole on the T17 vein intercepted 2.06m grading 111.66 g/t gold.

----------------------------------------------------------------------------

Intercept True

From To Width Width

Drill hole (m) (m) (m) (m)

----------------------------------------------------------------------------

11-CT-82a 359.03 360.04 1.01 0.74

----------------------------------------------------------------------------

11-CT-82a 384.46 385.83 1.37 1.07

----------------------------------------------------------------------------

11-CT-83 238.12 238.67 0.55 0.50

----------------------------------------------------------------------------

11-CT-85 126.04 126.49 0.45 0.40

----------------------------------------------------------------------------

11-CT-85 333.60 334.13 0.53 0.51

----------------------------------------------------------------------------

11-CT-85 358.48 358.86 0.38 0.36

----------------------------------------------------------------------------

11-CT-85 504.79 505.90 1.11 1.06

----------------------------------------------------------------------------

11-CT-86a 507.04 507.54 0.50 0.42

----------------------------------------------------------------------------

11-CT-86a 542.64 543.22 0.58 0.44

----------------------------------------------------------------------------

11-CT-86a 562.78 562.97 0.19 0.15

----------------------------------------------------------------------------

11-CT-86a 612.05 612.21 0.16 0.13

----------------------------------------------------------------------------

11-CT-86a 735.09 735.33 0.24 0.21

----------------------------------------------------------------------------

11-CT-87 130.45 131.00 0.55 0.42

----------------------------------------------------------------------------

11-CT-88 30.18 30.43 0.25 0.20

----------------------------------------------------------------------------

11-CT-89 30.59 32.65 2.06 1.95

----------------------------------------------------------------------------

Note: Only drill hole intercepts greater than 5 g/t Au over a 1 metre true

width are reported.

----------------------------------------------------------------------------

Intercept Au

Elevation Grade (Interpreted) Resource Resource

Drill hole (m) (g/t) Vein Name Infill Step-out

----------------------------------------------------------------------------

11-CT-82a -135 7.94 No. 1 Yes

----------------------------------------------------------------------------

11-CT-82a -159 4.68 V75 Yes

----------------------------------------------------------------------------

11-CT-83 65 34.57 Crow Yes

----------------------------------------------------------------------------

11-CT-85 129 28.31 Sheep Dip Yes

----------------------------------------------------------------------------

11-CT-85 -13 57.15 No. 1 Part Part

----------------------------------------------------------------------------

11-CT-85 -30 76.80 106-16 Part Part

----------------------------------------------------------------------------

11-CT-85 -122 26.84 Crow Yes

----------------------------------------------------------------------------

11-CT-86a -277 24.16 No. 1 Yes

----------------------------------------------------------------------------

11-CT-86a -305 14.28 106-16 Yes

----------------------------------------------------------------------------

11-CT-86a -320 70.08 V75 Yes

----------------------------------------------------------------------------

11-CT-86a -358 82.56 Bend Yes

----------------------------------------------------------------------------

11-CT-86a -449 33.08 Crow Yes

----------------------------------------------------------------------------

11-CT-87 101 24.87 V75 Yes

----------------------------------------------------------------------------

11-CT-88 216 26.16 Sheep Dip Yes

----------------------------------------------------------------------------

11-CT-89 195 111.66 T17 Yes

----------------------------------------------------------------------------

Note: Only drill hole intercepts greater than 5 g/t Au over a 1 metre true

width are reported.

Other intersections greater than 5 gram meters

----------------------------------------------------------------------------

Inter-

Inter- cept

cept True Eleva- Au

Drill From To Width Width tion Grade (Interpreted)

hole (m) (m) (m) (m) (m) (g/t) Vein Name

----------------------------------------------------------------------------

11-CT-85 637.61 637.96 0.35 0.25 -206 21.37 New

----------------------------------------------------------------------------

11-CT-85 690.01 690.17 0.16 0.12 -240 114.56 New

----------------------------------------------------------------------------

11-CT-86a 488.52 488.85 0.33 0.27 -263 19.51 T11F?

----------------------------------------------------------------------------

11-CT-86a 556.32 556.53 0.21 0.16 -315 51.84 New

----------------------------------------------------------------------------

T17 vein

Infill drill hole 11-CT-89 intersected 2.06m grading 111.66 g/t gold. This intercept confirms the presence of a very high grade zone of gold mineralization within the T17 vein. The T17 vein has now been traced by drilling over a strike extent of 700m and to a depth of 580m. The T17 vein remains open along strike and to depth.

No. 1 vein

Step out drill holes 11-CT-85, -82a and -86a successfully increased the down dip extent of the No.1 vein on the most easterly drill sections of the present program. Intercepted widths of 0.53m grading 57.15 g/t gold, 1.01m grading 7.94 g/t gold and 0.50m grading 24.16 g/t gold confirm the depth extent and grade in this previously undrilled area. The No. 1 vein has now been traced by drilling over a strike extent of 800m and to a depth of some 700m. The No. 1 vein remains open along strike and to depth.

106-16 Vein

Step out drill holes 11-CT-85 and -86a also successfully increased the down dip extent of the 106-16 vein on the most easterly drill sections of the present program. Intercepted widths of 0.38m grading 76.80 g/t gold and 0.58m grading 14.28 g/t gold confirm vein to a depth of 550m below surface on this drill section. The vein has been traced 1200m along strike and remains open along strike and to depth.

V75 vein

Step out drill holes 11-CT-82a, -86a and -87 successfully increased the strike length and down dip extent of the V75 vein. Intercepted widths of 1.37m grading 4.68 g/t gold and 0.19m grading 70.08 g/t gold have traced to the vein to depths of 550m below surface, while drill hole 11-CT -87(intercepted width 0.55m grading 24.87 g/t gold) has increased the interpreted strike length to 1100m. The V75 vein remains open along strike and to depth.

Sheep Dip vein

Step out drill holes 11-CT-85 and -88 successfully increased the strike extent of the Sheep Dip vein on the most easterly drill sections of the present program. Intercepted widths of 0.45m grading 28.31 g/t gold and 0.25m grading 26.16 g/t gold allow the interpreted strike length of the Sheep Dip vein to be extended to 900m. The Sheep Dip vein remains open along strike and to depth.

Bend Vein

At the time of the May 10, 2010, 43-101 compliant resource estimation, there was insufficient information to include the Bend vein in the estimate. A total of 27 drill holes have now intersected the vein and 16 of these have grades in excess of 5 grams over a 1m true width. Drill hole 11-CT-86a intercepted 0.16m grading 82.56 g/t Au. The Bend vein has been traced for 550m along strike and 600m down dip and remains open.

Crow vein

At the time of the May 10, 2010, 43-101 compliant resource estimation, there was insufficient information to include the Crow vein in the estimate. A total of 30 drill holes have now intersected the vein and 18 of these have grades in excess of 5 grams over a 1m true width. Drill holes 11-CT-83, -85 and -86a intercepted widths of 0.55m grading 34.57 g/t gold, 1.11m grading 26.84 g/t gold and 0.24m grading 33.08 g/t Au. The Crow vein has been traced for 800m along strike and 700m down dip and remains open.

Qualified Person

EurGeol Garth Earls, Managing Director, Dalradian Gold Limited, is the Qualified Person who supervised the preparation of the technical data in this news release.

Omac Laboratories Ltd. (ISO/IEC 17025 accredited) of Loughrea, Republic of Ireland, performed the assays.

Dalradian Resources Inc.: A golden opportunity in Northern Ireland

Dalradian is a Canadian-based exploration company working to increase its gold resources at its approximately 84,000-hectare Tyrone Project, which encompasses its flagship Curraghinalt mesothermal gold deposit, in counties Tyrone and Londonderry in Northern Ireland. Its active exploration program is underway with four drill rigs operating at the site. Curraghinalt hosts an NI 43-101 compliant indicated mineral resource of 0.95 MT grading 13.24 g/t gold for 400,000 contained ounces and inferred mineral resource of 2.46 MT grading 14.64 g/t gold for 1.16 million contained ounces. Dalradian's NI 43-101 report, "A Mineral Resource Estimate for the Curraghinalt Gold Deposit and a Review of a Proposed Exploration Program for the Tyrone Project, County Tyrone and County Londonderry, Northern Ireland" is dated May 10, 2010, and prepared by Micon International Limited. Dalradian's common shares and warrants are listed on the Toronto Stock Exchange under the symbols DNA and DNA.WT respectively. For further information, please see www.dalradian.com.

Forward-looking Information

This news release includes certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements about strategic plans, spending commitments, future operations, results of exploration, future work programs, capital expenditures and objectives. Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results (including mineralization) and future events to differ materially from those expressed or implied by such forward-looking information, including the risks identified in the Company's prospectus under the heading "Risk Factors." There can be no assurance that such information will prove to be accurate, as actual results (including mineralization) and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this news release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

Drilling at Curraghinalt Intersects 2.06 Metres Grading 111.6 g/t of Gold And 1.11 Metres Grading 26.84 g/t of Gold

Press Release Source: Dalradian Resources Inc. On Wednesday June 8, 2011, 8:52 am EDT

TORONTO, ONTARIO--(Marketwire - 06/08/11) - Dalradian Resources Inc. ("Dalradian" or the "Company") (TSX

NA - News)(TSX

NA - News)(TSX NA.WT - News) continues to extend the known mineralization at its Curraghinalt Deposit in County Tyrone, Northern Ireland. Results from 6 step out holes and 1 infill hole are reported for a total of 15 intercepts greater than 5 gram metres.

NA.WT - News) continues to extend the known mineralization at its Curraghinalt Deposit in County Tyrone, Northern Ireland. Results from 6 step out holes and 1 infill hole are reported for a total of 15 intercepts greater than 5 gram metres."Our four rig drill program continues to pick up the pace with over 3500 metres of drilling in seven holes reported in this release," says Patrick F. N. Anderson, Company CEO and Chairman, "To put this in perspective, we have completed just over 10,000 metres in 31 drill holes since going public last August. We expect another two drill rigs to arrive on site this summer to further enhance the exploration program."

As part of the company's step out drilling program, the main resource veins continue to be intersected at predicted depths and the Bend and Crow veins (not included in the previously reported 43-101 resource) are providing high grade intersections. An infill drill hole on the T17 vein intercepted 2.06m grading 111.66 g/t gold.

----------------------------------------------------------------------------

Intercept True

From To Width Width

Drill hole (m) (m) (m) (m)

----------------------------------------------------------------------------

11-CT-82a 359.03 360.04 1.01 0.74

----------------------------------------------------------------------------

11-CT-82a 384.46 385.83 1.37 1.07

----------------------------------------------------------------------------

11-CT-83 238.12 238.67 0.55 0.50

----------------------------------------------------------------------------

11-CT-85 126.04 126.49 0.45 0.40

----------------------------------------------------------------------------

11-CT-85 333.60 334.13 0.53 0.51

----------------------------------------------------------------------------

11-CT-85 358.48 358.86 0.38 0.36

----------------------------------------------------------------------------

11-CT-85 504.79 505.90 1.11 1.06

----------------------------------------------------------------------------

11-CT-86a 507.04 507.54 0.50 0.42

----------------------------------------------------------------------------

11-CT-86a 542.64 543.22 0.58 0.44

----------------------------------------------------------------------------

11-CT-86a 562.78 562.97 0.19 0.15

----------------------------------------------------------------------------

11-CT-86a 612.05 612.21 0.16 0.13

----------------------------------------------------------------------------

11-CT-86a 735.09 735.33 0.24 0.21

----------------------------------------------------------------------------

11-CT-87 130.45 131.00 0.55 0.42

----------------------------------------------------------------------------

11-CT-88 30.18 30.43 0.25 0.20

----------------------------------------------------------------------------

11-CT-89 30.59 32.65 2.06 1.95

----------------------------------------------------------------------------

Note: Only drill hole intercepts greater than 5 g/t Au over a 1 metre true

width are reported.

----------------------------------------------------------------------------

Intercept Au

Elevation Grade (Interpreted) Resource Resource

Drill hole (m) (g/t) Vein Name Infill Step-out

----------------------------------------------------------------------------

11-CT-82a -135 7.94 No. 1 Yes

----------------------------------------------------------------------------

11-CT-82a -159 4.68 V75 Yes

----------------------------------------------------------------------------

11-CT-83 65 34.57 Crow Yes

----------------------------------------------------------------------------

11-CT-85 129 28.31 Sheep Dip Yes

----------------------------------------------------------------------------

11-CT-85 -13 57.15 No. 1 Part Part

----------------------------------------------------------------------------

11-CT-85 -30 76.80 106-16 Part Part

----------------------------------------------------------------------------

11-CT-85 -122 26.84 Crow Yes

----------------------------------------------------------------------------

11-CT-86a -277 24.16 No. 1 Yes

----------------------------------------------------------------------------

11-CT-86a -305 14.28 106-16 Yes

----------------------------------------------------------------------------

11-CT-86a -320 70.08 V75 Yes

----------------------------------------------------------------------------

11-CT-86a -358 82.56 Bend Yes

----------------------------------------------------------------------------

11-CT-86a -449 33.08 Crow Yes

----------------------------------------------------------------------------

11-CT-87 101 24.87 V75 Yes

----------------------------------------------------------------------------

11-CT-88 216 26.16 Sheep Dip Yes

----------------------------------------------------------------------------

11-CT-89 195 111.66 T17 Yes

----------------------------------------------------------------------------

Note: Only drill hole intercepts greater than 5 g/t Au over a 1 metre true

width are reported.

Other intersections greater than 5 gram meters

----------------------------------------------------------------------------

Inter-

Inter- cept

cept True Eleva- Au

Drill From To Width Width tion Grade (Interpreted)

hole (m) (m) (m) (m) (m) (g/t) Vein Name

----------------------------------------------------------------------------

11-CT-85 637.61 637.96 0.35 0.25 -206 21.37 New

----------------------------------------------------------------------------

11-CT-85 690.01 690.17 0.16 0.12 -240 114.56 New

----------------------------------------------------------------------------

11-CT-86a 488.52 488.85 0.33 0.27 -263 19.51 T11F?

----------------------------------------------------------------------------

11-CT-86a 556.32 556.53 0.21 0.16 -315 51.84 New

----------------------------------------------------------------------------

T17 vein

Infill drill hole 11-CT-89 intersected 2.06m grading 111.66 g/t gold. This intercept confirms the presence of a very high grade zone of gold mineralization within the T17 vein. The T17 vein has now been traced by drilling over a strike extent of 700m and to a depth of 580m. The T17 vein remains open along strike and to depth.

No. 1 vein

Step out drill holes 11-CT-85, -82a and -86a successfully increased the down dip extent of the No.1 vein on the most easterly drill sections of the present program. Intercepted widths of 0.53m grading 57.15 g/t gold, 1.01m grading 7.94 g/t gold and 0.50m grading 24.16 g/t gold confirm the depth extent and grade in this previously undrilled area. The No. 1 vein has now been traced by drilling over a strike extent of 800m and to a depth of some 700m. The No. 1 vein remains open along strike and to depth.

106-16 Vein

Step out drill holes 11-CT-85 and -86a also successfully increased the down dip extent of the 106-16 vein on the most easterly drill sections of the present program. Intercepted widths of 0.38m grading 76.80 g/t gold and 0.58m grading 14.28 g/t gold confirm vein to a depth of 550m below surface on this drill section. The vein has been traced 1200m along strike and remains open along strike and to depth.

V75 vein

Step out drill holes 11-CT-82a, -86a and -87 successfully increased the strike length and down dip extent of the V75 vein. Intercepted widths of 1.37m grading 4.68 g/t gold and 0.19m grading 70.08 g/t gold have traced to the vein to depths of 550m below surface, while drill hole 11-CT -87(intercepted width 0.55m grading 24.87 g/t gold) has increased the interpreted strike length to 1100m. The V75 vein remains open along strike and to depth.

Sheep Dip vein

Step out drill holes 11-CT-85 and -88 successfully increased the strike extent of the Sheep Dip vein on the most easterly drill sections of the present program. Intercepted widths of 0.45m grading 28.31 g/t gold and 0.25m grading 26.16 g/t gold allow the interpreted strike length of the Sheep Dip vein to be extended to 900m. The Sheep Dip vein remains open along strike and to depth.

Bend Vein

At the time of the May 10, 2010, 43-101 compliant resource estimation, there was insufficient information to include the Bend vein in the estimate. A total of 27 drill holes have now intersected the vein and 16 of these have grades in excess of 5 grams over a 1m true width. Drill hole 11-CT-86a intercepted 0.16m grading 82.56 g/t Au. The Bend vein has been traced for 550m along strike and 600m down dip and remains open.

Crow vein

At the time of the May 10, 2010, 43-101 compliant resource estimation, there was insufficient information to include the Crow vein in the estimate. A total of 30 drill holes have now intersected the vein and 18 of these have grades in excess of 5 grams over a 1m true width. Drill holes 11-CT-83, -85 and -86a intercepted widths of 0.55m grading 34.57 g/t gold, 1.11m grading 26.84 g/t gold and 0.24m grading 33.08 g/t Au. The Crow vein has been traced for 800m along strike and 700m down dip and remains open.

Qualified Person

EurGeol Garth Earls, Managing Director, Dalradian Gold Limited, is the Qualified Person who supervised the preparation of the technical data in this news release.

Omac Laboratories Ltd. (ISO/IEC 17025 accredited) of Loughrea, Republic of Ireland, performed the assays.

Dalradian Resources Inc.: A golden opportunity in Northern Ireland

Dalradian is a Canadian-based exploration company working to increase its gold resources at its approximately 84,000-hectare Tyrone Project, which encompasses its flagship Curraghinalt mesothermal gold deposit, in counties Tyrone and Londonderry in Northern Ireland. Its active exploration program is underway with four drill rigs operating at the site. Curraghinalt hosts an NI 43-101 compliant indicated mineral resource of 0.95 MT grading 13.24 g/t gold for 400,000 contained ounces and inferred mineral resource of 2.46 MT grading 14.64 g/t gold for 1.16 million contained ounces. Dalradian's NI 43-101 report, "A Mineral Resource Estimate for the Curraghinalt Gold Deposit and a Review of a Proposed Exploration Program for the Tyrone Project, County Tyrone and County Londonderry, Northern Ireland" is dated May 10, 2010, and prepared by Micon International Limited. Dalradian's common shares and warrants are listed on the Toronto Stock Exchange under the symbols DNA and DNA.WT respectively. For further information, please see www.dalradian.com.

Forward-looking Information

This news release includes certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward-looking information includes, but is not limited to, statements about strategic plans, spending commitments, future operations, results of exploration, future work programs, capital expenditures and objectives. Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results (including mineralization) and future events to differ materially from those expressed or implied by such forward-looking information, including the risks identified in the Company's prospectus under the heading "Risk Factors." There can be no assurance that such information will prove to be accurate, as actual results (including mineralization) and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this news release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

Antwort auf Beitrag Nr.: 41.682.420 von VodkaLemon am 22.06.11 11:34:58lebt dieser Thread noch klingt nämlich richtig gut hier

Die Ressourcen wurden von 1,56 Mio. Unzen Gold auf 2,7 Mio. Unzen Gold gesteigert.

Der durchschnittliche Goldgehalt beträgt dabei nach wie vor 13 g/t Gold.

DALRADIAN ANNOUNCES RESOURCE INCREASE AT CURRAGHINALT

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aDNA-19071…

"Our Curraghinalt gold deposit continues to deliver," comments chief executive officer Patrick Anderson. "Our drilling program over the past year has increased the previous resource estimate by 73 per cent and the deposit remains open along strike, across strike and downdip. Currently, all of our rigs are working on an infill drilling program, but we expect to restart drilling along trend and on our regional targets in the next week."

Der durchschnittliche Goldgehalt beträgt dabei nach wie vor 13 g/t Gold.

DALRADIAN ANNOUNCES RESOURCE INCREASE AT CURRAGHINALT

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aDNA-19071…

"Our Curraghinalt gold deposit continues to deliver," comments chief executive officer Patrick Anderson. "Our drilling program over the past year has increased the previous resource estimate by 73 per cent and the deposit remains open along strike, across strike and downdip. Currently, all of our rigs are working on an infill drilling program, but we expect to restart drilling along trend and on our regional targets in the next week."

Na, das war doch gestern ein ordentlich Tag.

+12,5% auf 1,80 CAD (kanadische Dollar)

Die Insiderholdings sprechen für sich:

-------

-------

Chart 12 Monate

Falls der nicht geht, hier klicken: http://www.stockwatch.com/Chart/Hist.aspx?symbol=DNA®ion=…

+12,5% auf 1,80 CAD (kanadische Dollar)

Die Insiderholdings sprechen für sich:

-------

-------

Chart 12 Monate

Falls der nicht geht, hier klicken: http://www.stockwatch.com/Chart/Hist.aspx?symbol=DNA®ion=…

lesezeichen

Dalradian Acquires Additional Concessions Assembling Largest Exploration Holding in Europe

Quelle: http://www.dalradian.com/investor-centre/news-releases/news-…

TORONTO, ONTARIO--(Marketwire - Jan. 26, 2012) - Dalradian Resources Inc. ("Dalradian" or the "Company") (TSX NA) is pleased to announce that it has entered into a definitive agreement (the "Acquisition Agreement") with a group of private vendors (the "Vendors") to indirectly acquire approximately 1.7 million hectares of mineral rights (the "Properties") over four greenstone belts and a historic silver mining camp in Norway (the "Acquisition"). The properties comprise more than five percent of the aggregate landmass of Norway, and include both the historic Kongsberg silver mining district and the Norwegian extension of the greenstone belt which hosts Agnico-Eagle Mines Limited's Kittila producing gold mine and Anglo American's recently announced Sakattilampi nickel-copper discovery, both in in Finland.

NA) is pleased to announce that it has entered into a definitive agreement (the "Acquisition Agreement") with a group of private vendors (the "Vendors") to indirectly acquire approximately 1.7 million hectares of mineral rights (the "Properties") over four greenstone belts and a historic silver mining camp in Norway (the "Acquisition"). The properties comprise more than five percent of the aggregate landmass of Norway, and include both the historic Kongsberg silver mining district and the Norwegian extension of the greenstone belt which hosts Agnico-Eagle Mines Limited's Kittila producing gold mine and Anglo American's recently announced Sakattilampi nickel-copper discovery, both in in Finland.

"It is a rare opportunity today to be able to assemble a dominant land position in a stable first world country, covering geological belts known to host major precious and base metals deposits. As explorers we simply couldn't pass on it. ", Patrick Anderson, Dalradian's President and CEO, commented. Meanwhile, in Northern Ireland, our drills continue to turn and we are testing both regional targets and continuing to advance our knowledge of the Curraghinalt gold deposit. Our engineering team remains on schedule to complete a Preliminary Economic Assessment by mid-year.

Transaction Highlights:

-- Immediately positions Dalradian as the largest explorer in an

underexplored region;

-- Geographical and asset diversification;

-- Adds significant landholding and mineral rights in a historical district

of gold and silver mining to the Dalradian EU portfolio;

-- Acquisition cost of approximately CAD$3.2 million and 4,500,000 common

shares of Dalradian ("Common Shares") with the potential for an issue of

an additional 2,500,000 Common Shares in the event that any time prior

to January 1, 2015, a NI 43-101 technical report discloses a minimum

aggregate resource of 1 million ounces of gold equivalent on the

properties.

About the Norwegian Exploration Concessions:

-- The acquired properties include six areas covering more than 1.7 million

hectares in both southern and northern Norway.

-- The Northern Concessions cover extensive portions of four

paleoproterozoic greenstone belts which host multiple gold showings. The

largest of the belts extends across the border into Finland where it

hosts Agnico Eagle's 6.8 million ounce Kittila gold mine.

-- The Southern Concessions include virtually all of the historic Kongsberg

Silver District which hosts several past-producing silver mines with

historic production of approximately 40 million ounces of silver. These

concessions have seen virtually no modern exploration since the mines

closed in the 1950s.

-- As part of a recent effort to encourage investment in the resource

sector, the Norwegian geological survey has been funded to carry out

extensive regional exploration studies over many of these concessions,

including high-resolution airborne geophysics as well as geological

mapping and sampling programs.

Pursuant to the terms of the Acquisition Agreement, Dalradian will acquire its indirect interest in the Properties by acquiring all of the issued and outstanding shares of Norwegian Minerals Group Inc. ("Ontco"), which will in turn hold all of the issued and outstanding shares of Norwegian Minerals Group AS ("NMG"). NMG holds a 100% interest in the Properties, subject to royalties of up to 0.75% payable to the government. Dalradian shall acquire its 100% interest in Ontco in consideration of the issuance of an aggregate of 4,500,000 Common Shares upon closing; and (ii) the issuance of an additional 2,500,000 Common Shares in the event that any time prior to January 1, 2015, a National Instrument 43-101 compliant technical report discloses a minimum aggregate Mineral Resource of 1 million ounces of gold equivalent on the Properties. All of the Common Shares issuable on closing will be subject to a 12 month escrow, to be released in tranches of 25% every four months with the first release on closing.

Dalradian has also funded an annual tax payment in January 2012 in respect of the Properties with an aggregate amount of approximately CAD$2,450,000 (the "Tax Payment") and also agreed to reimburse certain indebtedness and expenses of NMG and Vendors in the aggregate amount of approximately US$800,000. The Acquisition remains subject to receipt of the applicable approvals of the Toronto Stock Exchange and the Norwegian Directorate of Mining.

In connection with the Acquisition, Dalradian has also made an interim loan of CAD$2,525,000 (the "Loan") in order to fund (i) the Tax Payment; and (ii) certain third party indebtedness of NMG in the aggregate amount of approximately CAD$75,000. The Loan is secured by a pledge of the shares of NMG, and is non-interest bearing and will reduce the cash payments to be made on closing.

About Dalradian Resources Inc.:

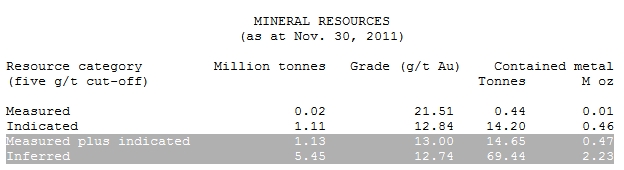

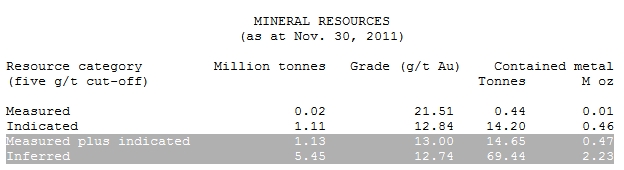

Dalradian is a Canadian-based exploration company engaged in the acquisition, exploration and development of mineral properties. The Company's wholly-owned subsidiary, Dalradian Gold Limited, holds a 100% interest, subject to certain royalties, in mineral prospecting licences in counties Tyrone and Londonderry, Northern Ireland. Dalradian has been working to increase its gold resources at its approximately 84,000-hectare Tyrone Project, which encompasses its flagship Curraghinalt mesothermal gold deposit. Curraghinalt hosts an NI 43-101 compliant measured mineral resource of 0.02 MT grading 21.51 g/t gold for 10,000 contained ounces, indicated mineral resource of 1.11 MT grading 12.84 g/t gold for 460,000 contained ounces and inferred mineral resource of 5.45 MT grading 12.74 g/t for 2,230,000 contained ounces. Dalradian's NI 43-101 report, "An updated Mineral Resource Estimate for the Curraghinalt Gold Deposit, Tyrone Project, County Tyrone and County Londonderry, Northern Ireland" is dated January 10, 2012 and effective November 30, 2011, prepared by Messrs. Hennessey and Mukhopadhyay of Micon International Limited and, and is available on SEDAR at www.sedar.com. Dalradian's Common Shares are listed on the Toronto Stock Exchange under the symbol "DNA". For further information, please see www.dalradian.com.

FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the estimation of mineral resources. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as "plans," "expects," "is expected," "budget," "scheduled," "estimates," "forecasts," "intends," "anticipates," or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and are based on various assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; actual results of reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations of ore grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; political instability; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled "Risk Factors" in the Company's annual information form. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

To view Figure 1: Location Map, please visit the following link: http://media3.marketwire.com/docs/dnamap1.pdf.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dalradian Resources Inc.

Shae-Lynn Mathers

Director, Investor Relations

+1.416.583.5622

investor@dalradian.com

www.dalradian.com

Source: Dalradian Resources Inc.

Quelle: http://www.dalradian.com/investor-centre/news-releases/news-…

TORONTO, ONTARIO--(Marketwire - Jan. 26, 2012) - Dalradian Resources Inc. ("Dalradian" or the "Company") (TSX

NA) is pleased to announce that it has entered into a definitive agreement (the "Acquisition Agreement") with a group of private vendors (the "Vendors") to indirectly acquire approximately 1.7 million hectares of mineral rights (the "Properties") over four greenstone belts and a historic silver mining camp in Norway (the "Acquisition"). The properties comprise more than five percent of the aggregate landmass of Norway, and include both the historic Kongsberg silver mining district and the Norwegian extension of the greenstone belt which hosts Agnico-Eagle Mines Limited's Kittila producing gold mine and Anglo American's recently announced Sakattilampi nickel-copper discovery, both in in Finland.

NA) is pleased to announce that it has entered into a definitive agreement (the "Acquisition Agreement") with a group of private vendors (the "Vendors") to indirectly acquire approximately 1.7 million hectares of mineral rights (the "Properties") over four greenstone belts and a historic silver mining camp in Norway (the "Acquisition"). The properties comprise more than five percent of the aggregate landmass of Norway, and include both the historic Kongsberg silver mining district and the Norwegian extension of the greenstone belt which hosts Agnico-Eagle Mines Limited's Kittila producing gold mine and Anglo American's recently announced Sakattilampi nickel-copper discovery, both in in Finland."It is a rare opportunity today to be able to assemble a dominant land position in a stable first world country, covering geological belts known to host major precious and base metals deposits. As explorers we simply couldn't pass on it. ", Patrick Anderson, Dalradian's President and CEO, commented. Meanwhile, in Northern Ireland, our drills continue to turn and we are testing both regional targets and continuing to advance our knowledge of the Curraghinalt gold deposit. Our engineering team remains on schedule to complete a Preliminary Economic Assessment by mid-year.

Transaction Highlights:

-- Immediately positions Dalradian as the largest explorer in an

underexplored region;

-- Geographical and asset diversification;

-- Adds significant landholding and mineral rights in a historical district

of gold and silver mining to the Dalradian EU portfolio;

-- Acquisition cost of approximately CAD$3.2 million and 4,500,000 common

shares of Dalradian ("Common Shares") with the potential for an issue of

an additional 2,500,000 Common Shares in the event that any time prior

to January 1, 2015, a NI 43-101 technical report discloses a minimum

aggregate resource of 1 million ounces of gold equivalent on the

properties.

About the Norwegian Exploration Concessions:

-- The acquired properties include six areas covering more than 1.7 million

hectares in both southern and northern Norway.

-- The Northern Concessions cover extensive portions of four

paleoproterozoic greenstone belts which host multiple gold showings. The

largest of the belts extends across the border into Finland where it

hosts Agnico Eagle's 6.8 million ounce Kittila gold mine.

-- The Southern Concessions include virtually all of the historic Kongsberg

Silver District which hosts several past-producing silver mines with

historic production of approximately 40 million ounces of silver. These

concessions have seen virtually no modern exploration since the mines

closed in the 1950s.

-- As part of a recent effort to encourage investment in the resource

sector, the Norwegian geological survey has been funded to carry out

extensive regional exploration studies over many of these concessions,

including high-resolution airborne geophysics as well as geological

mapping and sampling programs.

Pursuant to the terms of the Acquisition Agreement, Dalradian will acquire its indirect interest in the Properties by acquiring all of the issued and outstanding shares of Norwegian Minerals Group Inc. ("Ontco"), which will in turn hold all of the issued and outstanding shares of Norwegian Minerals Group AS ("NMG"). NMG holds a 100% interest in the Properties, subject to royalties of up to 0.75% payable to the government. Dalradian shall acquire its 100% interest in Ontco in consideration of the issuance of an aggregate of 4,500,000 Common Shares upon closing; and (ii) the issuance of an additional 2,500,000 Common Shares in the event that any time prior to January 1, 2015, a National Instrument 43-101 compliant technical report discloses a minimum aggregate Mineral Resource of 1 million ounces of gold equivalent on the Properties. All of the Common Shares issuable on closing will be subject to a 12 month escrow, to be released in tranches of 25% every four months with the first release on closing.

Dalradian has also funded an annual tax payment in January 2012 in respect of the Properties with an aggregate amount of approximately CAD$2,450,000 (the "Tax Payment") and also agreed to reimburse certain indebtedness and expenses of NMG and Vendors in the aggregate amount of approximately US$800,000. The Acquisition remains subject to receipt of the applicable approvals of the Toronto Stock Exchange and the Norwegian Directorate of Mining.

In connection with the Acquisition, Dalradian has also made an interim loan of CAD$2,525,000 (the "Loan") in order to fund (i) the Tax Payment; and (ii) certain third party indebtedness of NMG in the aggregate amount of approximately CAD$75,000. The Loan is secured by a pledge of the shares of NMG, and is non-interest bearing and will reduce the cash payments to be made on closing.

About Dalradian Resources Inc.:

Dalradian is a Canadian-based exploration company engaged in the acquisition, exploration and development of mineral properties. The Company's wholly-owned subsidiary, Dalradian Gold Limited, holds a 100% interest, subject to certain royalties, in mineral prospecting licences in counties Tyrone and Londonderry, Northern Ireland. Dalradian has been working to increase its gold resources at its approximately 84,000-hectare Tyrone Project, which encompasses its flagship Curraghinalt mesothermal gold deposit. Curraghinalt hosts an NI 43-101 compliant measured mineral resource of 0.02 MT grading 21.51 g/t gold for 10,000 contained ounces, indicated mineral resource of 1.11 MT grading 12.84 g/t gold for 460,000 contained ounces and inferred mineral resource of 5.45 MT grading 12.74 g/t for 2,230,000 contained ounces. Dalradian's NI 43-101 report, "An updated Mineral Resource Estimate for the Curraghinalt Gold Deposit, Tyrone Project, County Tyrone and County Londonderry, Northern Ireland" is dated January 10, 2012 and effective November 30, 2011, prepared by Messrs. Hennessey and Mukhopadhyay of Micon International Limited and, and is available on SEDAR at www.sedar.com. Dalradian's Common Shares are listed on the Toronto Stock Exchange under the symbol "DNA". For further information, please see www.dalradian.com.

FORWARD-LOOKING INFORMATION

This news release contains "forward-looking information" which may include, but is not limited to, statements with respect to the estimation of mineral resources. Often, but not always, forward-looking statements can be identified by the use of words and phrases such as "plans," "expects," "is expected," "budget," "scheduled," "estimates," "forecasts," "intends," "anticipates," or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved.

Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and are based on various assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, general business, economic, competitive, political and social uncertainties; the actual results of current exploration activities; actual results of reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of metals; possible variations of ore grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; political instability; delays in obtaining governmental approvals or financing or in the completion of development or construction activities, as well as those factors discussed in the section entitled "Risk Factors" in the Company's annual information form. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

To view Figure 1: Location Map, please visit the following link: http://media3.marketwire.com/docs/dnamap1.pdf.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dalradian Resources Inc.

Shae-Lynn Mathers

Director, Investor Relations

+1.416.583.5622

investor@dalradian.com

www.dalradian.com

Source: Dalradian Resources Inc.

Dalradian Resources arranges $25-million financing

2012-01-26 16:57 ET - News Release

Ms. Shae-Lynn Mathers reports

DALRADIAN RESOURCES INC. ANNOUNCES $25 MILLION BOUGHT DEAL FINANCING

Dalradian Resources Inc. has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets and Clarus Securities Inc., and including Stifel Nicolaus Canada Inc., under which the underwriters have agreed to buy on a bought-deal basis, by way of a short-form prospectus, 12.5 million common shares at a price of $2 per common share for gross proceeds of $25-million. The company has granted the underwriters an option, exercisable at the offering price for a period of 30 days following the closing of the offering, to purchase up to an additional 15 per cent of the offering to cover overallotments, if any. The offering is expected to close on or about Feb. 15, 2012, and is subject to Dalradian receiving all necessary regulatory approvals.

The net proceeds of the offering will be used for exploration and development of the company's Tyrone project in Northern Ireland, and for general working capital purposes.

2012-01-26 16:57 ET - News Release

Ms. Shae-Lynn Mathers reports

DALRADIAN RESOURCES INC. ANNOUNCES $25 MILLION BOUGHT DEAL FINANCING

Dalradian Resources Inc. has entered into an agreement with a syndicate of underwriters led by BMO Capital Markets and Clarus Securities Inc., and including Stifel Nicolaus Canada Inc., under which the underwriters have agreed to buy on a bought-deal basis, by way of a short-form prospectus, 12.5 million common shares at a price of $2 per common share for gross proceeds of $25-million. The company has granted the underwriters an option, exercisable at the offering price for a period of 30 days following the closing of the offering, to purchase up to an additional 15 per cent of the offering to cover overallotments, if any. The offering is expected to close on or about Feb. 15, 2012, and is subject to Dalradian receiving all necessary regulatory approvals.

The net proceeds of the offering will be used for exploration and development of the company's Tyrone project in Northern Ireland, and for general working capital purposes.

und 4 Minuten später "halted".

Das heißt, es müssten noch mal News nachkommen. Bohrergebnisse?

Dalradian Resources halted at 1:53 p.m. PT

2012-01-26 17:01 ET - News Release

Dalradian Resources Inc. has been halted at 1:53 p.m. PT on Jan. 26, 2012, following the dissemination of news.

Das heißt, es müssten noch mal News nachkommen. Bohrergebnisse?

Dalradian Resources halted at 1:53 p.m. PT

2012-01-26 17:01 ET - News Release

Dalradian Resources Inc. has been halted at 1:53 p.m. PT on Jan. 26, 2012, following the dissemination of news.

Antwort auf Beitrag Nr.: 42.657.026 von iZock am 27.01.12 11:52:50Leider nein -Verwässerung.Und geschenkt !

Zitat von stefanna: Leider nein -Verwässerung.Und geschenkt !

2 CAD sind doch ein guter Kurs. Keiner hier dürfte teurer eingestiegen sein.

Die 25 Mio. CAD sind nötig um weiter mit voller Power und 6 bis 7 Drillrigs in Nordirland bohren zu können. Das Programm soll ja noch bis November 2012 andauern.

Nun kommen auch noch riesige Gebiete in Norwegen dazu. Da will man natürlich auch bohren, was wiederum Geld kostet.

Ein Explorer hat keine Einnahmen aus der Produktion. Mit was soll man denn die Kosten für die Bohrungen bezahlen wenn nicht durch Einnahmen aus Private Placements?

Antwort auf Beitrag Nr.: 42.659.237 von iZock am 27.01.12 17:11:48Entschuldigung - Du hast völlig Recht ! Ich hatte einen anderen Kurs im Kopf

interessanter titel auf dem niveau...

bin jetzt dabei, kann losgehen

uuppps springt leicht an heute....

Dalradian's Curraghinalt PEA shows 51.7% pretax IRR

2012-07-25 07:38 ET - News Release

Mr. Patrick Anderson reports

DALRADIAN RESOURCES REPORTS POSITIVE PRELIMINARY ECONOMIC ASSESSMENT FOR THE CURRAGHINALT GOLD PROJECT IN NORTHERN IRELAND

Dalradian Resources Inc. has released positive results from the preliminary economic assessment for a proposed underground mine at its wholly owned Curraghinalt gold deposit in County Tyrone, Northern Ireland. The PEA study was led by Micon International Ltd., with contributions from other independent consultants. All figures are quoted in U.S. dollars except where otherwise noted.

Highlights of the PEA:

Pretax internal rate of return of 51.7 per cent (after tax: 41.9 per cent) based on a 36-month trailing average gold price of $1,378 per ounce (after-tax IRR of 31.8 per cent based on $1,200 gold price);

Project payback of two years from first gold production;

After-tax net present value of $467-million based on an 8-per-cent discount rate and a realized gold price of $1,378 per ounce ($655-million using a 5-per-cent discount rate);

Initial capital expenditures of approximately $192-million prior to production start-up (including contingencies of $36.9-million), with sustaining capital of $110-million for a total life of mine capital spend of $302-million;

A 15-year mine life with average LOM cash operating costs of $532 per ounce, or $125 per tonne milled, including royalties, refining costs and byproduct credits of $8.24 per ounce gold;

LOM gold production of 2.223,000 ounces;

Average mined grade of 8.1 grams per tonne gold. Processing at a rate of 1,700 tonnes per day and producing approximately 145,000 ounces gold per year using a conventional flowsheet of crushing, grinding, cyanidation and conventional tailings disposal;

Underground mining using mechanized longhole methods with ramp access and truck haulage;

The mine plan considers 89 per cent of the November, 2011, Micon resource estimate, of which 83 per cent is inferred.

Chairman and chief executive officer, Patrick F.N. Anderson, says: "Our first economic study on this portion of the Curraghinalt deposit has been a resounding success. Our next steps are to better understand the existing resource, prove, through drilling, that the system has a lot of room to grow, and move ahead with planning and permitting for underground development. We have people and drills on the ground right now working towards these goals."

The PEA is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the results of the PEA will be realized.

SUMMARY OF PEA PARAMETERS OR INPUTS

PEA parameters Measurement criteria Input

Average

grade

Metal grade Unit (g/t)

Gold g/t 8.1

Silver g/t 3.3

Metal price per ounce

Gold 3-year trailing average $ 1,378.03

Silver 3-year trailing average $ 26.28

Exchange rates

Canadian dollar to U.S.

dollar 3-year trailing average 1.04

Canadian dollar to British

pound sterling 3-year trailing average 1.62

Taxation Taxable income Income tax rates

0-300,000 pounds 20.00%

United Kingdom 300,000-1.5 million pounds 22.00%

1.5 million pounds and up 24.00%

Royalties NSR 6.00%

SUMMARY OF PEA RESULTS

(U.S.$/oz gold)

Life of mine average

Gross revenue (gold) $ 1,378.03

-----------

Operating costs

Mining costs 324.29

Processing costs 82.28

General and administrative costs 35.20

Royalty 82.20

Refining charges 16.25

Less silver (credit) (8.24)

Cash operating cost 531.98

-----------

Net operating margin 846.05

Capital expenditure

Initial 86.39

Sustaining 49.43

-----------

Capital expenditure 135.82

-----------

Pretax cash flow 710.23

Taxation 174.25

-----------

Net cash flow after tax $ 535.98

-----------

SUMMARY OF PEA SENSITIVITIES

1-yr 2-yr 3-yr 5-yr 10-yr

trailing trailing trailing trailing trailing

Gold $ 1,672 $ 1,521 $ 1,378 $ 1,166 $ 814

IRR Pretax 63.1% 57.1% 51.7% 41.1% 24.9%

IRR After tax 51.0% 46.2% 41.9% 33.4% 20.2%

NPV Pretax $ 840,591 $ 733,348 $ 639,084 $ 460,456 $ 210,330

NPV After tax $ 619,485 $ 538,152 $ 466,664 $ 331,194 $ 141,500

Mineral resources

The basis for the PEA is the mineral resource estimate prepared by Micon in the National Instrument 43-101 report dated Jan. 10, 2011, and effective Nov. 30, 2011, entitled, "An updated Mineral Resource Estimate for the Curraghinalt Gold Deposit, Tyrone Project, County Tyrone and County Londonderry, Northern Ireland," which was filed on SEDAR on Jan. 13, 2012.

SUMMARY OF THE RESOURCE

(reported at a cut-off grade of five grams per tonne gold diluted to a

one-metre minimum horizontal width)

Mineral resources

Resource category (as at Nov. 30, 2011)

Million Grade Contained metal

tonnes (g/t gold) Tonnes Moz

Measured 0.02 21.51 0.44 0.01

Indicated 1.11 12.84 14.20 0.46

---- ----- ----- ----

Measured plus indicated 1.13 13.00 14.65 0.47

---- ----- ----- ----

Inferred 5.45 12.74 69.44 2.23

Note: Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

Mine plan

The mine plan developed by Micon uses mechanized longhole mining with ramp access and truck haulage, at a production rate of 1,700 tonnes per day. Ramp access was chosen over shaft access due to the long lateral extent and relatively shallow depths of the deposit. As the deposit is open at depth a shaft may be required in future to access levels below the current mine plan. The mine plan includes provisions for mining losses and dilution. The mine plan is inclusive of inferred resources. These inferred resources will require further exploration drilling to upgrade them to the higher measured and indicated categories.

Processing and metallurgy

The processing flow sheet selected for the PEA consists of crushing, grinding, cyanidation and conventional tailings disposal. This flow sheet is based on extensive metallurgical testing carried out by previous operators of the project, and by Dalradian. Several other processing flow sheets were examined in the PEA, but were determined to result in less favourable economic outcomes. Total gold recoveries, based on existing metallurgical test work, are expected to be approximately 92 per cent.

OPERATING COSTS

(U.S.$/tonne mined)

Mining costs $ 76.50

Processing costs 19.41

General and administrative costs 8.30

-------

Direct operating costs before royalty $104.21

-------

Capital costs

Initial capital expenditures total approximately $192-million, inclusive of a $37-million contingency. LOM sustaining capital totals approximately $110-million. Sustaining capital consists of capitalized waste development after the initial production start-up, major equipment replacement and tailings expansions. Mining sublevel development cost is included in the operating cost.

CAPITAL COSTS

Start-up Start-up Start-up

minus 2 minus 1 capital

Preproduction $ - $ 15,139 $ 15,139

Mining equipment - 14,202 14,202

Processing capital 14,638 34,154 48,792

Infrastructure 10,029 37,887 47,916

Indirect capital 16,517 49,497 66,014

--------- --------- ---------

Total $ 41,184 $ 150,879 $ 192,063

--------- --------- ---------

A technical report supporting the PEA will be filed on SEDAR within 45 days.

Qualified person

The technical information contained in this news release is based upon information prepared by Messrs. Hennessey, Jacobs, Villeneuve, Damjanovic and Foo of Micon International Ltd., who are each a qualified person as defined by National Instrument 43-101. Messrs. Hennessey, Jacobs, Villeneuve, Damjanovic and Foo are independent of Dalradian as defined by National Instrument 43-101.

John McCombe, PEng, chief operating officer, Dalradian Resources, is the qualified person who supervised the preparation of the technical data in this news release.

We seek Safe Harbor.

Dalradian's Curraghinalt PEA shows 51.7% pretax IRR

2012-07-25 07:38 ET - News Release

Mr. Patrick Anderson reports

DALRADIAN RESOURCES REPORTS POSITIVE PRELIMINARY ECONOMIC ASSESSMENT FOR THE CURRAGHINALT GOLD PROJECT IN NORTHERN IRELAND

Dalradian Resources Inc. has released positive results from the preliminary economic assessment for a proposed underground mine at its wholly owned Curraghinalt gold deposit in County Tyrone, Northern Ireland. The PEA study was led by Micon International Ltd., with contributions from other independent consultants. All figures are quoted in U.S. dollars except where otherwise noted.

Highlights of the PEA:

Pretax internal rate of return of 51.7 per cent (after tax: 41.9 per cent) based on a 36-month trailing average gold price of $1,378 per ounce (after-tax IRR of 31.8 per cent based on $1,200 gold price);

Project payback of two years from first gold production;

After-tax net present value of $467-million based on an 8-per-cent discount rate and a realized gold price of $1,378 per ounce ($655-million using a 5-per-cent discount rate);

Initial capital expenditures of approximately $192-million prior to production start-up (including contingencies of $36.9-million), with sustaining capital of $110-million for a total life of mine capital spend of $302-million;

A 15-year mine life with average LOM cash operating costs of $532 per ounce, or $125 per tonne milled, including royalties, refining costs and byproduct credits of $8.24 per ounce gold;

LOM gold production of 2.223,000 ounces;

Average mined grade of 8.1 grams per tonne gold. Processing at a rate of 1,700 tonnes per day and producing approximately 145,000 ounces gold per year using a conventional flowsheet of crushing, grinding, cyanidation and conventional tailings disposal;

Underground mining using mechanized longhole methods with ramp access and truck haulage;

The mine plan considers 89 per cent of the November, 2011, Micon resource estimate, of which 83 per cent is inferred.

Chairman and chief executive officer, Patrick F.N. Anderson, says: "Our first economic study on this portion of the Curraghinalt deposit has been a resounding success. Our next steps are to better understand the existing resource, prove, through drilling, that the system has a lot of room to grow, and move ahead with planning and permitting for underground development. We have people and drills on the ground right now working towards these goals."

The PEA is preliminary in nature. It includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the results of the PEA will be realized.

SUMMARY OF PEA PARAMETERS OR INPUTS

PEA parameters Measurement criteria Input

Average

grade

Metal grade Unit (g/t)

Gold g/t 8.1

Silver g/t 3.3

Metal price per ounce

Gold 3-year trailing average $ 1,378.03

Silver 3-year trailing average $ 26.28

Exchange rates

Canadian dollar to U.S.

dollar 3-year trailing average 1.04

Canadian dollar to British

pound sterling 3-year trailing average 1.62

Taxation Taxable income Income tax rates

0-300,000 pounds 20.00%

United Kingdom 300,000-1.5 million pounds 22.00%

1.5 million pounds and up 24.00%

Royalties NSR 6.00%

SUMMARY OF PEA RESULTS

(U.S.$/oz gold)

Life of mine average

Gross revenue (gold) $ 1,378.03

-----------

Operating costs

Mining costs 324.29

Processing costs 82.28

General and administrative costs 35.20

Royalty 82.20

Refining charges 16.25

Less silver (credit) (8.24)

Cash operating cost 531.98

-----------

Net operating margin 846.05

Capital expenditure

Initial 86.39

Sustaining 49.43

-----------

Capital expenditure 135.82

-----------

Pretax cash flow 710.23

Taxation 174.25

-----------

Net cash flow after tax $ 535.98

-----------

SUMMARY OF PEA SENSITIVITIES

1-yr 2-yr 3-yr 5-yr 10-yr

trailing trailing trailing trailing trailing

Gold $ 1,672 $ 1,521 $ 1,378 $ 1,166 $ 814

IRR Pretax 63.1% 57.1% 51.7% 41.1% 24.9%

IRR After tax 51.0% 46.2% 41.9% 33.4% 20.2%

NPV Pretax $ 840,591 $ 733,348 $ 639,084 $ 460,456 $ 210,330

NPV After tax $ 619,485 $ 538,152 $ 466,664 $ 331,194 $ 141,500

Mineral resources

The basis for the PEA is the mineral resource estimate prepared by Micon in the National Instrument 43-101 report dated Jan. 10, 2011, and effective Nov. 30, 2011, entitled, "An updated Mineral Resource Estimate for the Curraghinalt Gold Deposit, Tyrone Project, County Tyrone and County Londonderry, Northern Ireland," which was filed on SEDAR on Jan. 13, 2012.

SUMMARY OF THE RESOURCE

(reported at a cut-off grade of five grams per tonne gold diluted to a

one-metre minimum horizontal width)

Mineral resources

Resource category (as at Nov. 30, 2011)

Million Grade Contained metal

tonnes (g/t gold) Tonnes Moz

Measured 0.02 21.51 0.44 0.01

Indicated 1.11 12.84 14.20 0.46

---- ----- ----- ----

Measured plus indicated 1.13 13.00 14.65 0.47

---- ----- ----- ----

Inferred 5.45 12.74 69.44 2.23

Note: Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

Mine plan

The mine plan developed by Micon uses mechanized longhole mining with ramp access and truck haulage, at a production rate of 1,700 tonnes per day. Ramp access was chosen over shaft access due to the long lateral extent and relatively shallow depths of the deposit. As the deposit is open at depth a shaft may be required in future to access levels below the current mine plan. The mine plan includes provisions for mining losses and dilution. The mine plan is inclusive of inferred resources. These inferred resources will require further exploration drilling to upgrade them to the higher measured and indicated categories.

Processing and metallurgy

The processing flow sheet selected for the PEA consists of crushing, grinding, cyanidation and conventional tailings disposal. This flow sheet is based on extensive metallurgical testing carried out by previous operators of the project, and by Dalradian. Several other processing flow sheets were examined in the PEA, but were determined to result in less favourable economic outcomes. Total gold recoveries, based on existing metallurgical test work, are expected to be approximately 92 per cent.

OPERATING COSTS

(U.S.$/tonne mined)

Mining costs $ 76.50

Processing costs 19.41

General and administrative costs 8.30

-------

Direct operating costs before royalty $104.21

-------

Capital costs

Initial capital expenditures total approximately $192-million, inclusive of a $37-million contingency. LOM sustaining capital totals approximately $110-million. Sustaining capital consists of capitalized waste development after the initial production start-up, major equipment replacement and tailings expansions. Mining sublevel development cost is included in the operating cost.

CAPITAL COSTS

Start-up Start-up Start-up

minus 2 minus 1 capital

Preproduction $ - $ 15,139 $ 15,139

Mining equipment - 14,202 14,202

Processing capital 14,638 34,154 48,792

Infrastructure 10,029 37,887 47,916

Indirect capital 16,517 49,497 66,014

--------- --------- ---------

Total $ 41,184 $ 150,879 $ 192,063

--------- --------- ---------

A technical report supporting the PEA will be filed on SEDAR within 45 days.

Qualified person

The technical information contained in this news release is based upon information prepared by Messrs. Hennessey, Jacobs, Villeneuve, Damjanovic and Foo of Micon International Ltd., who are each a qualified person as defined by National Instrument 43-101. Messrs. Hennessey, Jacobs, Villeneuve, Damjanovic and Foo are independent of Dalradian as defined by National Instrument 43-101.

John McCombe, PEng, chief operating officer, Dalradian Resources, is the qualified person who supervised the preparation of the technical data in this news release.

We seek Safe Harbor.

Servus,

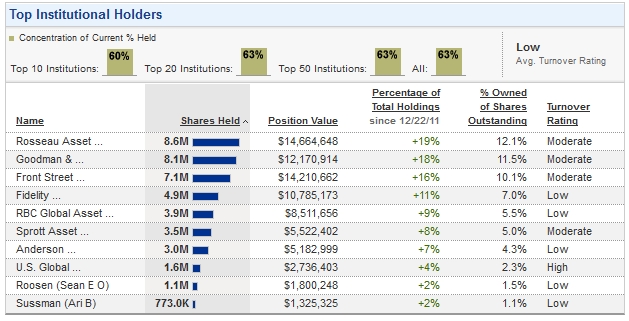

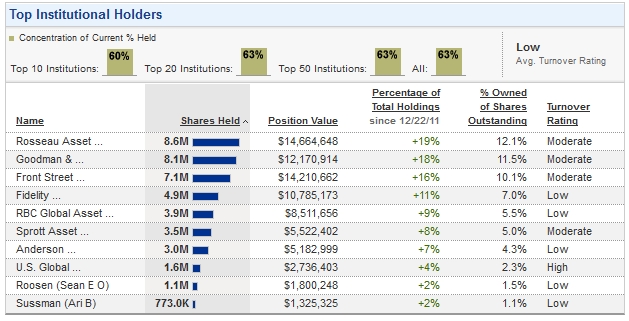

ein interessanter Wert,gutes Projekt(N.Irland)mit sehr gutem Au-gehalt,viel Cash,drilling läuft,top 10 Institutions halten 57%,das zweite projekt in Norwegen hört sich vielversprechend an....

...ab auf die WL !

P&L

S_E

ein interessanter Wert,gutes Projekt(N.Irland)mit sehr gutem Au-gehalt,viel Cash,drilling läuft,top 10 Institutions halten 57%,das zweite projekt in Norwegen hört sich vielversprechend an....

...ab auf die WL !

P&L

S_E

Sehr interessant

http://canadianinsider.com/node/7?ticker=DNA

Jul 26/12 Jul 25/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 10 - Acquisition in the public market 967,000 $0.875

http://canadianinsider.com/node/7?ticker=DNA

Jul 26/12 Jul 25/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 10 - Acquisition in the public market 967,000 $0.875

starke Käufe immer wieder!

gestern gabs noch gute Neuigkeiten, Wasserrechte wurden genehmigt!

Dalradian obtains Curraghinalt water discharge permit

2012-08-01 13:26 ET - News Release

Ms. Shae-Lynn Mathers reports

DALRADIAN RECEIVES WATER DISCHARGE PERMIT FOR THE CURRAGHINALT DEPOSIT IN NORTHERN IRELAND

The Department of Environment has provided Dalradian Resources Inc. with a consent to discharge site drainage arising from mineral exploration drilling in an existing underground adit at its wholly owned Curraghinalt project in County Tyrone, Northern Ireland.

The consent to discharge application was submitted on March 9, 2012, and was received earlier than anticipated in the company's originally stated timeline of end of the third quarter. The issuance of the consent to discharge is a successful first step in testing the permitting process.

The Curraghinalt deposit remains open along strike, and to the north and south as well as at depth. Dalradian's drills continue to explore these limits, and at the same time explore further along the Curraghinalt trend and on regional targets within the company's 84,000-hectare landholding.

We seek Safe Harbor.

gestern gabs noch gute Neuigkeiten, Wasserrechte wurden genehmigt!

Dalradian obtains Curraghinalt water discharge permit

2012-08-01 13:26 ET - News Release

Ms. Shae-Lynn Mathers reports

DALRADIAN RECEIVES WATER DISCHARGE PERMIT FOR THE CURRAGHINALT DEPOSIT IN NORTHERN IRELAND

The Department of Environment has provided Dalradian Resources Inc. with a consent to discharge site drainage arising from mineral exploration drilling in an existing underground adit at its wholly owned Curraghinalt project in County Tyrone, Northern Ireland.

The consent to discharge application was submitted on March 9, 2012, and was received earlier than anticipated in the company's originally stated timeline of end of the third quarter. The issuance of the consent to discharge is a successful first step in testing the permitting process.

The Curraghinalt deposit remains open along strike, and to the north and south as well as at depth. Dalradian's drills continue to explore these limits, and at the same time explore further along the Curraghinalt trend and on regional targets within the company's 84,000-hectare landholding.

We seek Safe Harbor.

Zitat von SEPP_EIXLBERGER: Sehr interessant

http://canadianinsider.com/node/7?ticker=DNA

Jul 26/12 Jul 25/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 10 - Acquisition in the public market 967,000 $0.875

Aug 8/12 Aug 7/12 Sussman, Ari b Direct Ownership Options 50 - Grant of options 150,000 $1.11

Aug 8/12 Aug 7/12 Benner, Colin Keith Direct Ownership Options 50 - Grant of options 150,000 $1.11

Aug 7/12 Aug 7/12 Gagel, Ronald Peter Direct Ownership Options 50 - Grant of options 150,000 $1.11

Aug 7/12 Aug 7/12 Conway, Joseph Francis Direct Ownership Options 50 - Grant of options 150,000 $1.11

Aug 7/12 Aug 7/12 Roosen, Sean Direct Ownership Options 50 - Grant of options 150,000 $1.11

Jul 26/12 Jul 25/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 10 - Acquisition in the public market 967,000 $0.875

May 22/12 May 18/12 Anderson, Patrick Fergus Neill Direct Ownership Common Shares 10 - Acquisition in the public market 11,000 $0.889

May 1/12 Apr 26/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 10 - Acquisition in the public market 380,700 $1.08

Apr 23/12 Apr 20/12 Anderson, Patrick Fergus Neill Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $1.17

Feb 17/12 Feb 15/12 Rosseau Asset Management Ltd. Control or Direction Common Shares 15 - Acquisition under a prospectus 1,500,000 $2.00

Top Institutional Holders

Front Street ... 11.6M $9,349,297 +21% 13.0% Low

Rosseau Asset ... 11.4M $9,164,627 +21% 12.8% Low

GCIC Ltd. 8.1M $12,170,914 +15% 9.1% Moderate

Fidelity ... 5.1M $3,235,120 +9% 5.7% Low

RBC Global Asset ... 4.1M $3,253,799 +7% 4.5% Low

Sprott Asset ... 3.5M $6,566,958 +6% 3.9% Low

Anderson ... 3.1M $2,474,494 +6% 3.5% Low

U.S. Global ... 1.7M $3,116,649 +3% 1.9% Moderate

Tocqueville ... 1.3M $799,311 +2% 1.4% Low

Roosen (Sean E O) 1.1M $843,578 +2% 1.2% Low

Top 10 Institutions held 57%

Top 20 Institutions held 61%

Buy or not to buy that is the Question!

Dies ist ein absoluter Topwert.

Antwort auf Beitrag Nr.: 43.662.092 von NEWpanem am 30.09.12 16:33:32vom Chart her auch schön!

Allerdings gefällt mir nicht, dass man noch 2 offene Gaps hat!

Allerdings gefällt mir nicht, dass man noch 2 offene Gaps hat!

Charttechnik...muss sich an fundamentale Informationen halten!

Zudem ist das Timing möglicherweise im Augenblick tatsächlich eher ungünstig. Dennoch ein klarer Kauf. Spannend auch, dass man in Irland so grandiose Goldgehalte finden kann! In der Produktion wird das eine fantastischer Wert, Man muss nur hoffen, dass sie nicht zu früh übernommen werden.

Zudem ist das Timing möglicherweise im Augenblick tatsächlich eher ungünstig. Dennoch ein klarer Kauf. Spannend auch, dass man in Irland so grandiose Goldgehalte finden kann! In der Produktion wird das eine fantastischer Wert, Man muss nur hoffen, dass sie nicht zu früh übernommen werden.

DNA kan auch bei Bill Matlack mit einer 1.0 glänzen:

http://www.kitco.com/ind/matlack/oct042012_juniors.html

Hatte die Bude bis jetzt übersehen.

http://www.kitco.com/ind/matlack/oct042012_juniors.html

Hatte die Bude bis jetzt übersehen.

läuft sauber nach oben...freu

die Umsätze werden auch stärker das sieht ganz gut aus

Habe auf der EM-Messe kurz am Stand vorbeigeschaut. Bohrergebnisse aus Norwegen stehen an. Und das MGMT kann sich echt sehen lassen. Unternehmenspräsnetation ist auch gut.

Das Management hat sich auch 700k Shares gegönnt.Überleg auch grad noch einzusteigen.Wenn DNA die Inferred Resourcen in Irland in Angezeigte wandeln könnte und in Norwegen gute Funde anstehen,dann geht hier wahrscheinlich die Luzzie ab.

http://canadianinsider.com/node/7?menu_tickersearch=dna

http://canadianinsider.com/node/7?menu_tickersearch=dna

An alle Schreiber im Thread.

vielen Dank für eure bisherige Arbeit beim Zusammentragen von Fakten und Meinungen zu dieser Aktie. Eure Darstellungen haben mir sehr bei der Entscheidung geholfen, seit gestern auch mit dabei zu sein.