HUSA - Turnaroundplay noch günstig zu haben! - 500 Beiträge pro Seite

eröffnet am 14.04.12 22:28:26 von

neuester Beitrag 10.05.13 18:53:36 von

neuester Beitrag 10.05.13 18:53:36 von

Beiträge: 34

ID: 1.173.689

ID: 1.173.689

Aufrufe heute: 0

Gesamt: 7.275

Gesamt: 7.275

Aktive User: 0

ISIN: US44183U2096 · WKN: A2QAG9 · Symbol: HUSA

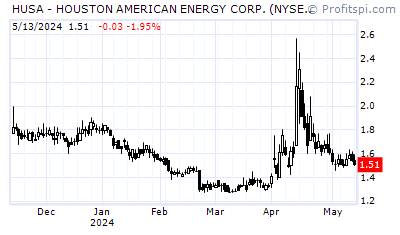

1,5200

USD

-5,59 %

-0,0900 USD

Letzter Kurs 00:40:00 NYSE Arca

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6000 | +18,51 | |

| 350,45 | +13,33 | |

| 19,650 | +11,77 | |

| 1,1600 | +11,54 | |

| 84,63 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,2000 | -7,17 | |

| 1,0500 | -8,70 | |

| 6,6800 | -8,99 | |

| 4,6700 | -10,19 | |

| 3,7000 | -13,75 |

Ticker: HUSA

Preis: $3.72

Webseite: http://www.houstonamericanenergy.com/

http://www.dailyfinance.com/quote/amex/houston-american-ener…

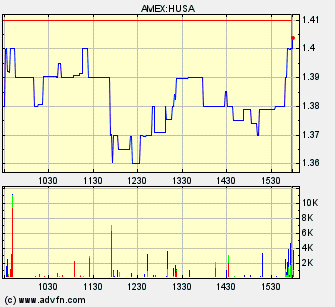

Charts:

Preis: $3.72

Webseite: http://www.houstonamericanenergy.com/

http://www.dailyfinance.com/quote/amex/houston-american-ener…

Charts:

Antwort auf Beitrag Nr.: 43.040.061 von Kursziel1000 am 14.04.12 22:28:26Shares Out (Mil) 31.17

Float (Mil) 13.27

Float (Mil) 13.27

Wo siehst du hier kurzfristig das Potential ?

Wohin könnte der Kurs laufen ?

Wohin könnte der Kurs laufen ?

Zitat von Kursziel1000: Investor Presentations

http://www.houstonamericanenergy.com/presentation/HUSAPresen…

Antwort auf Beitrag Nr.: 43.040.483 von Wohnwunsch am 15.04.12 11:16:181. Kursziel liegt im Bereich von $6.00-$7.00

HUSA - phone call with CEO John Terwilliger - yahoo

yahoo user: smitty789220 - Apr-12 02:50pm

"Just got off the phone with CEO John Terwilliger

Was debating whether to post or not. Figured I would call the office to see if maybe a CC was in the offering and the receptionist asked would like to speak with John. She came back and stated he was in a meeting, would I like his VM. Left # and within about 5 min, he called.

The office # 713-222-6966 is available to anyone.

Summary and I don't want to add anything other than a couple of comments:

The SEC investigation is ongoing and John/HUSA feel they have provided all information to the SEC and just waiting on next step or hopefully a final ruling. This is all based on a 3rd party transaction in 2010. I believe this information is available on the internet. He spoke very frank about it.

The main question I had was the viability of HUSA and the next well. He says they are finalizing some financing and the equipment is moving to next location and will be setup in approx. 30 days.SK will still be the operator and I assume Gulf United. Unless something changes, I assume it will still be SK 50%/ HUSA 37.5% / Gulf United 12.5%.

Last...I did ask if a CC might be on the list of tasks. John states this has been discussed. Obviously, questions concerning ongoing investigations with the SEC would be limited by lawyers but a CC could be a possibility. We do know they typically use the PR route and maybe that's what we get.

Trying to stay positive here...JT was very pleasant in tone and accommodating with questions.

GLTA"

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…

yahoo user: smitty789220 - Apr-12 02:50pm

"Just got off the phone with CEO John Terwilliger

Was debating whether to post or not. Figured I would call the office to see if maybe a CC was in the offering and the receptionist asked would like to speak with John. She came back and stated he was in a meeting, would I like his VM. Left # and within about 5 min, he called.

The office # 713-222-6966 is available to anyone.

Summary and I don't want to add anything other than a couple of comments:

The SEC investigation is ongoing and John/HUSA feel they have provided all information to the SEC and just waiting on next step or hopefully a final ruling. This is all based on a 3rd party transaction in 2010. I believe this information is available on the internet. He spoke very frank about it.

The main question I had was the viability of HUSA and the next well. He says they are finalizing some financing and the equipment is moving to next location and will be setup in approx. 30 days.SK will still be the operator and I assume Gulf United. Unless something changes, I assume it will still be SK 50%/ HUSA 37.5% / Gulf United 12.5%.

Last...I did ask if a CC might be on the list of tasks. John states this has been discussed. Obviously, questions concerning ongoing investigations with the SEC would be limited by lawyers but a CC could be a possibility. We do know they typically use the PR route and maybe that's what we get.

Trying to stay positive here...JT was very pleasant in tone and accommodating with questions.

GLTA"

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…

Habe heute meine Positionen bei $1.85 noch einmal verbilligt!

HUSA $1.63 - CEO received a margin call and he had to sell 985,519 shares.

Price per share is due for a big move up after selling pressure has come to an end.

http://www.insidercow.com/forms/20120324/0001140361-12-02130…

Price per share is due for a big move up after selling pressure has come to an end.

http://www.insidercow.com/forms/20120324/0001140361-12-02130…

Der HUSA Run wäre gestern über $2.00 gegangen , wenn der CEO nicht einen Margin Call seiner Bank vor ein Tagen bekommen hätte mit der Aufforderung Aktien zu verkaufen.

Gestern wurden 1,122,238 Aktien gehandelt ,davon waren 478,983 Aktien die der CEO zu einem Duchschnittskurs von $1.735 pro Aktie verkauft hat.

Somit waren 42,68% des gestrigen Volumens dem CEO zuzurechnen.

Ich rechne mit einem starken Anstieg des Aktienpreises auf mindestens $2.20 bis spätestens Ende der Woche. Kommt ordentlich Volumen in den Wert ist dieses auch schon heute möglich!

Gestriger Schlußkurs $1.63

Gestern wurden 1,122,238 Aktien gehandelt ,davon waren 478,983 Aktien die der CEO zu einem Duchschnittskurs von $1.735 pro Aktie verkauft hat.

Somit waren 42,68% des gestrigen Volumens dem CEO zuzurechnen.

Ich rechne mit einem starken Anstieg des Aktienpreises auf mindestens $2.20 bis spätestens Ende der Woche. Kommt ordentlich Volumen in den Wert ist dieses auch schon heute möglich!

Gestriger Schlußkurs $1.63

Heutiger Schlußkurs $1.80 , Tageshoch $1.82 , Tagestief $1.50

Aktie tendiert stärker auch im After Hours Trading $1.82 x $1.91

Aktie tendiert stärker auch im After Hours Trading $1.82 x $1.91

Akuelles Tageshoch liegt bei $2.32  geht doch

geht doch

geht doch

geht doch

Tageshoch $2.53 , Schlußkurs $2.43

HUSA ist überverkauft und wird das GAP bei $3.47 schließen imo.

Houston American Energy Announces 1st Quarter 2012 Estimated Operating Results

2012-05-01 20:19 ET - News Release

HOUSTON, May 1, 2012 /PRNewswire/ -- Houston American Energy Corp. (NYSE Amex: HUSA) today reported its estimated operating results for the quarter ended March 31, 2012.

The Company is estimating a net loss for the quarter of $987,369, or $0.03 per share, on revenues of $320,510, as compared to a net loss of $1,231,915, or $0.04 per share, on revenues of $124,303 for the quarter ended March 31, 2011, excluding any charges related to impairments or gains on assets.

When including a non-cash impairment charge of $19,995,845 relating to the previously announced decision to cease efforts to test and complete the Tamandua #1 well in Colombia, as well as a gain of $315,119 related to the sale of the Company's indirect interests in the Hupecol Cuerva, LLC, the estimated net loss for the quarter is $20,668,095, or $0.66 per share, as compared to a net loss of $1,231,915, or $0.04 per share for the quarter ended March 31, 2011. The Company is estimated to have positive working capital of $9,284,194 as of March 31, 2012 as compared to $19,636,540 as of December 31, 2011.

http://www.stockwatch.com/News/Item.aspx?bid=U-prDA98997-U%3…

2012-05-01 20:19 ET - News Release

HOUSTON, May 1, 2012 /PRNewswire/ -- Houston American Energy Corp. (NYSE Amex: HUSA) today reported its estimated operating results for the quarter ended March 31, 2012.

The Company is estimating a net loss for the quarter of $987,369, or $0.03 per share, on revenues of $320,510, as compared to a net loss of $1,231,915, or $0.04 per share, on revenues of $124,303 for the quarter ended March 31, 2011, excluding any charges related to impairments or gains on assets.

When including a non-cash impairment charge of $19,995,845 relating to the previously announced decision to cease efforts to test and complete the Tamandua #1 well in Colombia, as well as a gain of $315,119 related to the sale of the Company's indirect interests in the Hupecol Cuerva, LLC, the estimated net loss for the quarter is $20,668,095, or $0.66 per share, as compared to a net loss of $1,231,915, or $0.04 per share for the quarter ended March 31, 2011. The Company is estimated to have positive working capital of $9,284,194 as of March 31, 2012 as compared to $19,636,540 as of December 31, 2011.

http://www.stockwatch.com/News/Item.aspx?bid=U-prDA98997-U%3…

HUSA news - Houston American Energy Corp Announces $13.14 Million Registered Direct Offering

Houston American Energy Corp (NYSE Amex: HUSA, the "Company") announced today that it has entered into definitive agreements with certain institutional investors to sell 6,200,000 units, with each unit consisting of one of the Company's common shares and one warrant to purchase one common share, for gross proceeds of approximately $13.14 million, before deducting placement agent fees and estimated offering expenses, in a "registered direct" offering. The investors have agreed to purchase the units at a purchase price of $2.12 per unit. The warrants, which represent the right to acquire an aggregate of up to 6,200,000 common shares, will be exercisable at any time on or after November 9, 2012 and prior to November 9, 2015 at an exercise price of $2.68 per share, which was 120% of the closing price of the Company's common shares on the NYSE Amex on May 2, 2012. Canaccord Genuity Inc. acted as lead placement agent for the offering, and Pareto Securities AS acted as joint-lead agent for the offering.

The transaction is expected to close on May 8, 2012, subject to customary closing conditions. Houston American Energy Corp intends to use the proceeds from the offering for general working capital purposes, including funding the Company's share of costs of development of properties in which the Company holds interests.

A shelf registration statement relating to these securities previously was filed and declared effective by the Securities and Exchange Commission. A prospectus supplement related to the offering will be filed with the Securities and Exchange Commission. This press release does not constitute an offer to sell or the solicitation of offers to buy any security and shall not constitute an offer, solicitation, or sale of any security in any jurisdiction in which such offer, solicitation, or sale would be unlawful. A copy of the base prospectus and prospectus supplement (once filed) can be obtained at the Securities and Exchange Commission's website http://www.sec.gov or via written request to Houston American Energy Corp. at 801 Travis Street, Suite 1425, Houston, TX, 77002, Attention Investor Relations.

About Houston American Energy Corp

Based in Houston, Texas, Houston American Energy Corp is an independent energy company with interests in oil and natural gas wells and prospects. The Company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-K and other periodic reports filed with the Securities and Exchange Commission.

For additional information, view the company's website at www.houstonamericanenergy.com or contact the Houston American Energy Corp. at (713) 222-6966.

Forward-looking Statements

Disclosures in this press release may contain forward-looking statements relating to anticipated or expected events, activities, trends or results. Forward-looking statements, can be identified by the use of forward looking terminology such as "believes," "suggests," "expects," "may," "goal," "estimates," "should," "likelihood," "plans," "targets," "intends," "could," or "anticipates," or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Such statements are made to provide the public with management's current assessment of the Company's business, and it should not be assumed that actual results will prove these statements to be correct. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this press release speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this release. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

SOURCE Houston American Energy Corp

Houston American Energy Corp (NYSE Amex: HUSA, the "Company") announced today that it has entered into definitive agreements with certain institutional investors to sell 6,200,000 units, with each unit consisting of one of the Company's common shares and one warrant to purchase one common share, for gross proceeds of approximately $13.14 million, before deducting placement agent fees and estimated offering expenses, in a "registered direct" offering. The investors have agreed to purchase the units at a purchase price of $2.12 per unit. The warrants, which represent the right to acquire an aggregate of up to 6,200,000 common shares, will be exercisable at any time on or after November 9, 2012 and prior to November 9, 2015 at an exercise price of $2.68 per share, which was 120% of the closing price of the Company's common shares on the NYSE Amex on May 2, 2012. Canaccord Genuity Inc. acted as lead placement agent for the offering, and Pareto Securities AS acted as joint-lead agent for the offering.

The transaction is expected to close on May 8, 2012, subject to customary closing conditions. Houston American Energy Corp intends to use the proceeds from the offering for general working capital purposes, including funding the Company's share of costs of development of properties in which the Company holds interests.

A shelf registration statement relating to these securities previously was filed and declared effective by the Securities and Exchange Commission. A prospectus supplement related to the offering will be filed with the Securities and Exchange Commission. This press release does not constitute an offer to sell or the solicitation of offers to buy any security and shall not constitute an offer, solicitation, or sale of any security in any jurisdiction in which such offer, solicitation, or sale would be unlawful. A copy of the base prospectus and prospectus supplement (once filed) can be obtained at the Securities and Exchange Commission's website http://www.sec.gov or via written request to Houston American Energy Corp. at 801 Travis Street, Suite 1425, Houston, TX, 77002, Attention Investor Relations.

About Houston American Energy Corp

Based in Houston, Texas, Houston American Energy Corp is an independent energy company with interests in oil and natural gas wells and prospects. The Company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-K and other periodic reports filed with the Securities and Exchange Commission.

For additional information, view the company's website at www.houstonamericanenergy.com or contact the Houston American Energy Corp. at (713) 222-6966.

Forward-looking Statements

Disclosures in this press release may contain forward-looking statements relating to anticipated or expected events, activities, trends or results. Forward-looking statements, can be identified by the use of forward looking terminology such as "believes," "suggests," "expects," "may," "goal," "estimates," "should," "likelihood," "plans," "targets," "intends," "could," or "anticipates," or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Such statements are made to provide the public with management's current assessment of the Company's business, and it should not be assumed that actual results will prove these statements to be correct. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this press release speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this release. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

SOURCE Houston American Energy Corp

Warum ist der Kurs so abgestürzt?

genau das wüßte ich auch ganz gerne

Keine guten Nachrichten

Houston American Energy Announces Operational Update on Cachirre #1 Well

HOUSTON, June 28, 2012 /PRNewswire/ -- Houston American Energy Corp. (NYSE MKT: HUSA) today announced an operational update on the Cachirre #1 well. The Cachirre #1 well was drilled to a total measured depth of 9,486 feet. Upon completion of drilling the well and initial testing, Houston American Energy Corp. has made an election to commence testing the C-9 sand in the well. Houston American Energy Corp. will test the C-9 sand on a "sole risk" basis, bearing the full cost of testing and the potential completion of the well. If the well is successful, Houston American will have the right to all production from the well until it recoups 900% of its testing and completion cost. Test results on the C-9 sand are expected to be available in approximately ten days and will be announced when available.

SK Innovation Co. Ltd. and Gulf United Energy Inc. have elected to cease testing the Cachirre #1 well and therefore would propose to abandon the well at this point in time. Houston American Energy Corp. disagrees with this decision and believes the C-9 sand should be tested. The other objective sands in the well have been deemed to be non productive by Houston American Energy.

About Houston American Energy Corp.

Based in Houston, Texas, Houston American Energy Corp is an independent energy company with interests in oil and natural gas wells and prospects. The Company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-K and other periodic reports filed with the Securities and Exchange Commission.

For additional information, view the company's website at www.houstonamericanenergy.com or contact the Houston American Energy Corp. at (713) 222-6966.

Forward-Looking Statements

Disclosures in this press release may contain forward-looking statements relating to anticipated or expected events, activities, trends or results. Forward-looking statements, can be identified by the use of forward looking terminology such as "believes," "suggests," "expects," "may," "goal," "estimates," "should," "likelihood," "plans," "targets," "intends," "could," or "anticipates," or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Such statements are made to provide the public with management's current assessment of the Company's business, and it should not be assumed that actual results will prove these statements to be correct. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this press release speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this release. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

Houston American Energy Announces Operational Update on Cachirre #1 Well

HOUSTON, June 28, 2012 /PRNewswire/ -- Houston American Energy Corp. (NYSE MKT: HUSA) today announced an operational update on the Cachirre #1 well. The Cachirre #1 well was drilled to a total measured depth of 9,486 feet. Upon completion of drilling the well and initial testing, Houston American Energy Corp. has made an election to commence testing the C-9 sand in the well. Houston American Energy Corp. will test the C-9 sand on a "sole risk" basis, bearing the full cost of testing and the potential completion of the well. If the well is successful, Houston American will have the right to all production from the well until it recoups 900% of its testing and completion cost. Test results on the C-9 sand are expected to be available in approximately ten days and will be announced when available.

SK Innovation Co. Ltd. and Gulf United Energy Inc. have elected to cease testing the Cachirre #1 well and therefore would propose to abandon the well at this point in time. Houston American Energy Corp. disagrees with this decision and believes the C-9 sand should be tested. The other objective sands in the well have been deemed to be non productive by Houston American Energy.

About Houston American Energy Corp.

Based in Houston, Texas, Houston American Energy Corp is an independent energy company with interests in oil and natural gas wells and prospects. The Company's business strategy includes a property mix of producing and non-producing assets with a focus on Colombia, Texas and Louisiana. Additional information can be accessed by reviewing our Form 10-K and other periodic reports filed with the Securities and Exchange Commission.

For additional information, view the company's website at www.houstonamericanenergy.com or contact the Houston American Energy Corp. at (713) 222-6966.

Forward-Looking Statements

Disclosures in this press release may contain forward-looking statements relating to anticipated or expected events, activities, trends or results. Forward-looking statements, can be identified by the use of forward looking terminology such as "believes," "suggests," "expects," "may," "goal," "estimates," "should," "likelihood," "plans," "targets," "intends," "could," or "anticipates," or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Such statements are made to provide the public with management's current assessment of the Company's business, and it should not be assumed that actual results will prove these statements to be correct. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this press release speak only as of the date of this press release, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this release. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan.

am 50er zunächst gescheitert

Nach den News vom 2.11. - guckst Du hier:

http://ih.advfn.com/p.php?pid=nmona&article=54763026

gab es dann auch einen netten Artikel dazu:

Houston American Energy Corp (NYSE MKT: HUSA) today announced that it has completed the drilling

November 2, 2012 Filed under Global News Posted by royaltycruises

inShare

Houston American Energy (HGO 5.88 ↑0.00%) Corp (NYSE MKT: HUSA (0.57 ↓-6.56%)) today announced that it has completed the drilling of the Zorro Gris #1 well to a total depth of 13,160′. Based on the recommendation of the operator, and agreed to by Houston American, tests are expected to be conducted in the Une and Guadalupe formations with potential additional testing in the Barco and Mirador formations. The well has been cased with a 7″ liner from the 9 5/8′s intermediate casing set from approximately 11,898′ to total depth.

Testing is expected to begin in the next several days and results will be announced when available.

Houston American Energy Corp (NYSE MKT: HUSA, the “Company”) announced today that it has closed on its previously announced registered direct equity offering of 14,814,815 units at $0.675 per unit, with each unit consisting of one of the Company’s common shares, one Class A Warrant to purchase one-half share of common stock and one Class B Warrant to purchase one half share of common stock, for gross proceeds of approximately $10.0 million, before deducting placement agent fees and offering expenses. The Class A Warrants, which represent the right to acquire an aggregate of up to 7,407,407 common shares, will be exercisable at any time on or after issuance and ending April 4, 2013 at an exercise price of $0.81 per share.

The Class B Warrants, which represent the right to acquire an aggregate of up to 7,407,407 common shares, will be exercisable at any time on or after issuance and ending October 4, 2015 at an exercise price of $0.90 per share. C. K. Cooper & Company, Inc. acted as placement agent for the offering.

Houston American Energy Corp intends to use the proceeds from the offering for general working capital purposes, including funding the Company’s share of costs of development of properties in which the Company holds interests.

With the recent offering to raise capital at .68 cents a share, and the drilling results now released, we are placing a short term price target on shares of (HUSA) at $2.10 cents a share in 2013. There has been heavy accumulation on the stock recently. The stock is creating higher highs testing .75 cents a share today on heavy accumulation. The stock is trading off the 52 week low of .38 cents a share with good news and a 52 week high of $16.52! With the recent developments and news to be announced this stock will be testing the $1.00 range shortly. Companies like (HUSA) that are trading under $1.00 are gold mines and investors know these are the stocks to buy and hold. Insiders are buying and accumulating shares and increasing their holdings.

It doesn’t get any better than this, a company drilling and testing and entering a bullish trend. Imagine owning a growing oil and gas company at under $1.00 a share! With the recent filings of insiders accumulating shares and the worlds energy demands growing, stocks like this only come along once in a life time. I am long 100,000 shares @ .62 cents a share.

http://hotpennystocksonline.com/houston-american-energy-corp…

Jetzt warten alle auf die Ergebnisse und dann könnte das hier aber mal so richtig up gehen.

Hier könnte sich jetzt eine richtig geile Rebound-Chance auftun

http://ih.advfn.com/p.php?pid=nmona&article=54763026

gab es dann auch einen netten Artikel dazu:

Houston American Energy Corp (NYSE MKT: HUSA) today announced that it has completed the drilling

November 2, 2012 Filed under Global News Posted by royaltycruises

inShare

Houston American Energy (HGO 5.88 ↑0.00%) Corp (NYSE MKT: HUSA (0.57 ↓-6.56%)) today announced that it has completed the drilling of the Zorro Gris #1 well to a total depth of 13,160′. Based on the recommendation of the operator, and agreed to by Houston American, tests are expected to be conducted in the Une and Guadalupe formations with potential additional testing in the Barco and Mirador formations. The well has been cased with a 7″ liner from the 9 5/8′s intermediate casing set from approximately 11,898′ to total depth.

Testing is expected to begin in the next several days and results will be announced when available.

Houston American Energy Corp (NYSE MKT: HUSA, the “Company”) announced today that it has closed on its previously announced registered direct equity offering of 14,814,815 units at $0.675 per unit, with each unit consisting of one of the Company’s common shares, one Class A Warrant to purchase one-half share of common stock and one Class B Warrant to purchase one half share of common stock, for gross proceeds of approximately $10.0 million, before deducting placement agent fees and offering expenses. The Class A Warrants, which represent the right to acquire an aggregate of up to 7,407,407 common shares, will be exercisable at any time on or after issuance and ending April 4, 2013 at an exercise price of $0.81 per share.

The Class B Warrants, which represent the right to acquire an aggregate of up to 7,407,407 common shares, will be exercisable at any time on or after issuance and ending October 4, 2015 at an exercise price of $0.90 per share. C. K. Cooper & Company, Inc. acted as placement agent for the offering.

Houston American Energy Corp intends to use the proceeds from the offering for general working capital purposes, including funding the Company’s share of costs of development of properties in which the Company holds interests.

With the recent offering to raise capital at .68 cents a share, and the drilling results now released, we are placing a short term price target on shares of (HUSA) at $2.10 cents a share in 2013. There has been heavy accumulation on the stock recently. The stock is creating higher highs testing .75 cents a share today on heavy accumulation. The stock is trading off the 52 week low of .38 cents a share with good news and a 52 week high of $16.52! With the recent developments and news to be announced this stock will be testing the $1.00 range shortly. Companies like (HUSA) that are trading under $1.00 are gold mines and investors know these are the stocks to buy and hold. Insiders are buying and accumulating shares and increasing their holdings.

It doesn’t get any better than this, a company drilling and testing and entering a bullish trend. Imagine owning a growing oil and gas company at under $1.00 a share! With the recent filings of insiders accumulating shares and the worlds energy demands growing, stocks like this only come along once in a life time. I am long 100,000 shares @ .62 cents a share.

http://hotpennystocksonline.com/houston-american-energy-corp…

Jetzt warten alle auf die Ergebnisse und dann könnte das hier aber mal so richtig up gehen.

Hier könnte sich jetzt eine richtig geile Rebound-Chance auftun

Ach ja, und wenn man sich mal die Share structure und deren Entwicklung in den vergangenen Monaten anschaut, also das sieht schon richtig klasse aus.

Ich denke, die Großen wissen hier genau, was sie tun.

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Ich denke, die Großen wissen hier genau, was sie tun.

http://apps.cnbc.com/view.asp?country=US&uid=stocks/ownershi…

Freitag gab es nach dem ersten heftigen Anstieg erstmal eine kleinere Konso, aber ich würde mich nicht wundern, wenn wir in dieser Woche noch Kurse jenseits von 1 $ sehen würden.

Schau mal auf die Volumina der letzten Tage...

Schau mal auf die Volumina der letzten Tage...

Sierra kannte ich bislang zwar nur als Tequila-Marke, aber die nette junge Dame scheint bei ihren Vorhersagen doch ziemlich gut zu liegen:

http://sierraworldequityreview.blogspot.de/2012/...usa-targe…

Und auch wenn das Kursziel von 10 $ in 6 Monaten erstmal utopisch erscheint, mag es bei entsprechenden Bohrergebnissen hier ganz schnell Kurse über 1 $ geben

http://sierraworldequityreview.blogspot.de/2012/...usa-targe…

Und auch wenn das Kursziel von 10 $ in 6 Monaten erstmal utopisch erscheint, mag es bei entsprechenden Bohrergebnissen hier ganz schnell Kurse über 1 $ geben

Und DAS habe ich gestern beim Mitlesen auf ihub gefunden:

(HUSA) finds oil!! Everyone read!

Houston American Energy Corp (NYSE MKT: HUSA) today announced that it has completed the drilling of the Zorro Gris #1 well to a total depth of 13,160'. Based on the recommendation of the operator, and agreed to by Houston American, tests are expected to be conducted in the Une and Guadalupe formations with potential additional testing in the Barco and Mirador formations. The well has been cased with a 7" liner from the 9 5/8's intermediate casing set from approximately 11,898' to total depth. Testing is expected to begin in the next several days and results will be announced when available.

what does that mean?

3.1 Well Design and Production Casing Cement The design of an offshore oil and gas well is exclusively the responsibility of the operator. An operator’s geologists and engineers, or their contractors, analyze all available data, including proprietary seismic data, to determine the proper type and strength of the casing, cement, centralizers, reamers, shock absorbers, wellhead, and other equipment and materials that will be used to maintain well integrity and prevent failure throughout the construction and production lifespan of the well. Using this and other information, the operator must develop and submit to the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE), formerly the Minerals Management Service (MMS), a detailed well plan that defines where and how a well is to be drilled, cased, cemented, and completed. Once approved by the agency, the operator’s well plan serves as the basis for all decisions that the operator will make during the construction of the well. Drilling and other contractors are hired by the operator to help execute the operator’s approved well plan.

In english they found oil, I know how this works because i used to work for TJR drilling rigs in NM! Strong buy before market close!

Und auch wenn das mit dem Strong buy nicht mehr so wirklich geklappt hat, kann es hier jederzeit aber so richtig up gehen.

(HUSA) finds oil!! Everyone read!

Houston American Energy Corp (NYSE MKT: HUSA) today announced that it has completed the drilling of the Zorro Gris #1 well to a total depth of 13,160'. Based on the recommendation of the operator, and agreed to by Houston American, tests are expected to be conducted in the Une and Guadalupe formations with potential additional testing in the Barco and Mirador formations. The well has been cased with a 7" liner from the 9 5/8's intermediate casing set from approximately 11,898' to total depth. Testing is expected to begin in the next several days and results will be announced when available.

what does that mean?

3.1 Well Design and Production Casing Cement The design of an offshore oil and gas well is exclusively the responsibility of the operator. An operator’s geologists and engineers, or their contractors, analyze all available data, including proprietary seismic data, to determine the proper type and strength of the casing, cement, centralizers, reamers, shock absorbers, wellhead, and other equipment and materials that will be used to maintain well integrity and prevent failure throughout the construction and production lifespan of the well. Using this and other information, the operator must develop and submit to the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE), formerly the Minerals Management Service (MMS), a detailed well plan that defines where and how a well is to be drilled, cased, cemented, and completed. Once approved by the agency, the operator’s well plan serves as the basis for all decisions that the operator will make during the construction of the well. Drilling and other contractors are hired by the operator to help execute the operator’s approved well plan.

In english they found oil, I know how this works because i used to work for TJR drilling rigs in NM! Strong buy before market close!

Und auch wenn das mit dem Strong buy nicht mehr so wirklich geklappt hat, kann es hier jederzeit aber so richtig up gehen.

Gibts hier irgendwelche Meinungen, wann mit der Veröffentlichung der Bohrergebnisse zu rechnen sein könnte ?

Im Pre-Market schön im Plus - das wäre ja schon geil, wenn heute bei steigendem Öl-Preis und der Präsi-Wahl in den USA hier der nächste Upmove losginge.

Na ja, dann wollen wir uns mal entspannen und schauen, was geht.

Na ja, dann wollen wir uns mal entspannen und schauen, was geht.

Die folgende Berechnung habe ich mir mal aus ihub "geliehen".

Besser gut abgeschrieben als schlecht selber geschrieben...

Alles nur Vermutung im Moment, aber wenn die Bohrergenisse gut ausgefallen sind, dann kann das ganz schnell Realität werden :-))

1546 Bbl/day X $50k/ flowing baffle X .375 = Current Market Cap 29 million.

6000 Bbl/day = current price X 4 In addition the CPO 4 tract could easily contain 100 million barrels of reserves at $10/ barrel equals 1 Billion X .375 = 375 million / 67.3 million shares (fully diluted). = $ 5.57/ share.

Besser gut abgeschrieben als schlecht selber geschrieben...

Alles nur Vermutung im Moment, aber wenn die Bohrergenisse gut ausgefallen sind, dann kann das ganz schnell Realität werden :-))

1546 Bbl/day X $50k/ flowing baffle X .375 = Current Market Cap 29 million.

6000 Bbl/day = current price X 4 In addition the CPO 4 tract could easily contain 100 million barrels of reserves at $10/ barrel equals 1 Billion X .375 = 375 million / 67.3 million shares (fully diluted). = $ 5.57/ share.

Barack Obama bleibt US-Präsident...und das ist auch gut so, denn es erspart den Börsianern das, was sie am meisten hassen: Unsicherheit.

Und nachdem Obama jetzt vier Jahre Präsident "gelernt" hat, wird er sich jetzt hoffentlich schwerpunktmäßig auf die nachhaltige Erholung der US-Wirtschaft konzentrieren.

Und eine brummende Konjunktur in den USA ist ja sehr, sehr gut für hohe Ölpreise...und von denen sollten wir hier zusätzlich profitieren können :-))

Immerhin ist die aktuelle Reaktion des Öl-Preises auf die US-Entscheidung sehr gering...was ich für mich jetzt erstmal positiv bewerte - immerhin galt Romney ja eindeutig als derjenige, der sich - schon traditionell - deutlicher für die (alleinige) Nutzung fossiler Brennstoffe ausgesprochen hatte.

http://newsticker.sueddeutsche.de/list/id/1381320

Und nachdem Obama jetzt vier Jahre Präsident "gelernt" hat, wird er sich jetzt hoffentlich schwerpunktmäßig auf die nachhaltige Erholung der US-Wirtschaft konzentrieren.

Und eine brummende Konjunktur in den USA ist ja sehr, sehr gut für hohe Ölpreise...und von denen sollten wir hier zusätzlich profitieren können :-))

Immerhin ist die aktuelle Reaktion des Öl-Preises auf die US-Entscheidung sehr gering...was ich für mich jetzt erstmal positiv bewerte - immerhin galt Romney ja eindeutig als derjenige, der sich - schon traditionell - deutlicher für die (alleinige) Nutzung fossiler Brennstoffe ausgesprochen hatte.

http://newsticker.sueddeutsche.de/list/id/1381320

Antwort auf Beitrag Nr.: 43.794.382 von Tuedi am 07.11.12 07:53:54Schlechte Ergebnisse, nachboerslich minus 50%!

Meinungen?

Meinungen?

Zitat von Tuedi: Barack Obama bleibt US-Präsident...und das ist auch gut so, denn es erspart den Börsianern das, was sie am meisten hassen: Unsicherheit.

Und nachdem Obama jetzt vier Jahre Präsident "gelernt" hat, wird er sich jetzt hoffentlich schwerpunktmäßig auf die nachhaltige Erholung der US-Wirtschaft konzentrieren.

Und eine brummende Konjunktur in den USA ist ja sehr, sehr gut für hohe Ölpreise...und von denen sollten wir hier zusätzlich profitieren können :-))

Immerhin ist die aktuelle Reaktion des Öl-Preises auf die US-Entscheidung sehr gering...was ich für mich jetzt erstmal positiv bewerte - immerhin galt Romney ja eindeutig als derjenige, der sich - schon traditionell - deutlicher für die (alleinige) Nutzung fossiler Brennstoffe ausgesprochen hatte.

http://newsticker.sueddeutsche.de/list/id/1381320

AUFPASSEN LEUTE, der Kollege Tuedi ist ein bezahlter Pusher....

Bei dem Wert sehr gut erkennbar

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -4,82 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 120 | ||

| 82 | ||

| 60 | ||

| 57 | ||

| 41 | ||

| 30 | ||

| 26 | ||

| 25 | ||

| 24 | ||

| 23 |