ARENA PHARMACEUTICALS + BELVIQ - Wie geht es weiter ??? - 500 Beiträge pro Seite

eröffnet am 12.07.12 11:11:32 von

neuester Beitrag 11.07.17 13:41:55 von

neuester Beitrag 11.07.17 13:41:55 von

Beiträge: 377

ID: 1.175.491

ID: 1.175.491

Aufrufe heute: 0

Gesamt: 35.800

Gesamt: 35.800

Aktive User: 0

ISIN: US0400476075 · WKN: A2DR4A

99,98

USD

+0,06 %

+0,06 USD

Letzter Kurs 11.03.22 NYSE

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,0000 | +25,00 | |

| 56,69 | +20,00 | |

| 0,6400 | +18,52 | |

| 26,46 | +15,70 | |

| 1,1100 | +15,70 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,7200 | -19,60 | |

| 4,0000 | -27,27 | |

| 2,7280 | -29,14 | |

| 14,510 | -32,32 | |

| 0,7000 | -61,96 |

June 27, 2012 - Full FDA Press Release:

FDA approves

to treat some overweight or obese adults

to treat some overweight or obese adults

The U.S. Food and Drug Administration today approved Belviq (lorcaserin hydrochloride), as an addition to a reduced-calorie diet and exercise, for chronic weight management.

The drug is approved for use in adults with a body mass index (BMI) of 30 or greater (obese), or adults with a BMI of 27 or greater (overweight) and who have at least one weight-related condition such as high blood pressure (hypertension), type 2 diabetes, or high cholesterol (dyslipidemia).

BMI, which measures body fat based on an individual’s weight and height, is used to define the obesity and overweight categories. According to the Centers for Disease Control and Prevention, more than one-third of adults in the United States are obese.

“Obesity threatens the overall well being of patients and is a major public health concern,” said Janet Woodcock, M.D., director of the FDA’s Center for Drug Evaluation and Research. “The approval of this drug, used responsibly in combination with a healthy diet and lifestyle, provides a treatment option for Americans who are obese or are overweight and have at least one weight-related comorbid condition.”

Belviq works by activating the serotonin 2C receptor in the brain. Activation of this receptor may help a person eat less and feel full after eating smaller amounts of food.

The safety and efficacy of Belviq were evaluated in three randomized, placebo-controlled trials that included nearly 8,000 obese and overweight patients, with and without type 2 diabetes, treated for 52 to 104 weeks. All participants received lifestyle modification that consisted of a reduced calorie diet and exercise counseling. Compared with placebo, treatment with Belviq for up to one year was associated with average weight loss ranging from 3 percent to 3.7 percent.

About 47 percent of patients without type 2 diabetes lost at least 5 percent of their body weight compared with about 23 percent of patients treated with placebo. In people with type 2 diabetes, about 38 percent of patients treated with Belviq and 16 percent treated with placebo lost at least 5 percent of their body weight. Belviq treatment was associated with favorable changes in glycemic control in those with type 2 diabetes. The approved labeling for Belviq recommends that the drug be discontinued in patients who fail to lose 5 percent of their body weight after 12 weeks of treatment, as these patients are unlikely to achieve clinically meaningful weight loss with continued treatment.

Belviq should not be used during pregnancy. Treatment with Belviq may cause serious side effects, including serotonin syndrome, particularly when taken with certain medicines that increase serotonin levels or activate serotonin receptors. These include, but are not limited to, drugs commonly used to treat depression and migraine. Belviq may also cause disturbances in attention or memory.

In 1997, the weight-loss drugs fenfluramine and dexfenfluramine were withdrawn from the market after evidence emerged that they caused heart valve damage. This effect is assumed to be related to activation of the serotonin 2B receptor on heart tissue. When used at the approved dose of 10 milligrams twice a day, Belviq does not appear to activate the serotonin 2B receptor.

Heart valve function was assessed by echocardiography in nearly 8,000 patients in the Belviq development program. There was no statistically significant difference in the development of FDA-defined valve abnormalities between Belviq and placebo-treated patients. Because preliminary data suggest that the number of serotonin 2B receptors may be increased in patients with congestive heart failure, Belviq should be used with caution in patients with this condition. Belviq has not been studied in patients with serious valvular heart disease.

The drug’s manufacturer will be required to conduct six postmarketing studies, including a long-term cardiovascular outcomes trial to assess the effect of Belviq on the risk for major adverse cardiac events such as heart attack and stroke.

The most common side effects of Belviq in non-diabetic patients are headache, dizziness, fatigue, nausea, dry mouth, and constipation, and in diabetic patients are low blood sugar (hypoglycemia), headache, back pain, cough, and fatigue.

Belviq is manufactured by Arena Pharmaceuticals GmbH of Zofingen, Switzerland, and distributed by Eisai Inc. of Woodcliff Lake, N.J.

http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/uc…

FDA approves

to treat some overweight or obese adults

to treat some overweight or obese adultsThe U.S. Food and Drug Administration today approved Belviq (lorcaserin hydrochloride), as an addition to a reduced-calorie diet and exercise, for chronic weight management.

The drug is approved for use in adults with a body mass index (BMI) of 30 or greater (obese), or adults with a BMI of 27 or greater (overweight) and who have at least one weight-related condition such as high blood pressure (hypertension), type 2 diabetes, or high cholesterol (dyslipidemia).

BMI, which measures body fat based on an individual’s weight and height, is used to define the obesity and overweight categories. According to the Centers for Disease Control and Prevention, more than one-third of adults in the United States are obese.

“Obesity threatens the overall well being of patients and is a major public health concern,” said Janet Woodcock, M.D., director of the FDA’s Center for Drug Evaluation and Research. “The approval of this drug, used responsibly in combination with a healthy diet and lifestyle, provides a treatment option for Americans who are obese or are overweight and have at least one weight-related comorbid condition.”

Belviq works by activating the serotonin 2C receptor in the brain. Activation of this receptor may help a person eat less and feel full after eating smaller amounts of food.

The safety and efficacy of Belviq were evaluated in three randomized, placebo-controlled trials that included nearly 8,000 obese and overweight patients, with and without type 2 diabetes, treated for 52 to 104 weeks. All participants received lifestyle modification that consisted of a reduced calorie diet and exercise counseling. Compared with placebo, treatment with Belviq for up to one year was associated with average weight loss ranging from 3 percent to 3.7 percent.

About 47 percent of patients without type 2 diabetes lost at least 5 percent of their body weight compared with about 23 percent of patients treated with placebo. In people with type 2 diabetes, about 38 percent of patients treated with Belviq and 16 percent treated with placebo lost at least 5 percent of their body weight. Belviq treatment was associated with favorable changes in glycemic control in those with type 2 diabetes. The approved labeling for Belviq recommends that the drug be discontinued in patients who fail to lose 5 percent of their body weight after 12 weeks of treatment, as these patients are unlikely to achieve clinically meaningful weight loss with continued treatment.

Belviq should not be used during pregnancy. Treatment with Belviq may cause serious side effects, including serotonin syndrome, particularly when taken with certain medicines that increase serotonin levels or activate serotonin receptors. These include, but are not limited to, drugs commonly used to treat depression and migraine. Belviq may also cause disturbances in attention or memory.

In 1997, the weight-loss drugs fenfluramine and dexfenfluramine were withdrawn from the market after evidence emerged that they caused heart valve damage. This effect is assumed to be related to activation of the serotonin 2B receptor on heart tissue. When used at the approved dose of 10 milligrams twice a day, Belviq does not appear to activate the serotonin 2B receptor.

Heart valve function was assessed by echocardiography in nearly 8,000 patients in the Belviq development program. There was no statistically significant difference in the development of FDA-defined valve abnormalities between Belviq and placebo-treated patients. Because preliminary data suggest that the number of serotonin 2B receptors may be increased in patients with congestive heart failure, Belviq should be used with caution in patients with this condition. Belviq has not been studied in patients with serious valvular heart disease.

The drug’s manufacturer will be required to conduct six postmarketing studies, including a long-term cardiovascular outcomes trial to assess the effect of Belviq on the risk for major adverse cardiac events such as heart attack and stroke.

The most common side effects of Belviq in non-diabetic patients are headache, dizziness, fatigue, nausea, dry mouth, and constipation, and in diabetic patients are low blood sugar (hypoglycemia), headache, back pain, cough, and fatigue.

Belviq is manufactured by Arena Pharmaceuticals GmbH of Zofingen, Switzerland, and distributed by Eisai Inc. of Woodcliff Lake, N.J.

http://www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/uc…

Hier noch einmal einige Artikel aus der Presse:

FDA approves Arena obesity drug; first in 13 years

FDA approves Arena obesity drug; first in 13 years

http://www.reuters.com/article/2012/06/27/us-arena-obesity-i…

Arena Pharmaceuticals confirms FDA approval of diet drug lorcaserin

Arena Pharmaceuticals confirms FDA approval of diet drug lorcaserin

http://finance.yahoo.com/news/arena-pharmaceuticals-confirms…

Arena’s Weight-Loss Pill Approved by U.S. Regulators

Arena’s Weight-Loss Pill Approved by U.S. Regulators

http://www.bloomberg.com/news/2012-06-27/arena-s-weight-loss…" target="_blank" rel="nofollow ugc noopener">

http://www.bloomberg.com/news/2012-06-27/arena-s-weight-loss…

FDA approves Arena obesity drug; first in 13 years

FDA approves Arena obesity drug; first in 13 years

http://www.reuters.com/article/2012/06/27/us-arena-obesity-i…

Arena Pharmaceuticals confirms FDA approval of diet drug lorcaserin

Arena Pharmaceuticals confirms FDA approval of diet drug lorcaserin

http://finance.yahoo.com/news/arena-pharmaceuticals-confirms…

Arena’s Weight-Loss Pill Approved by U.S. Regulators

Arena’s Weight-Loss Pill Approved by U.S. Regulators

http://www.bloomberg.com/news/2012-06-27/arena-s-weight-loss…" target="_blank" rel="nofollow ugc noopener">

http://www.bloomberg.com/news/2012-06-27/arena-s-weight-loss…

Arena Pharmaceuticals Promotes Craig M. Audet to Executive Officer as Senior Vice President, Operations and Head of Global Regulatory Affairs

http://finance.yahoo.com/news/arena-pharmaceuticals-promotes…

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) has announced Craig M. Audet’s promotion to Senior VP, Operations and Head of Global Regulatory Affairs. This new role means Audet will serve as and executive officer for the company. He has over 25 years experience in the industry. Before joining Arena, he served as VP and Head of the US Regulatory Affairs Marketed Products Group for Sanofi-Aventis from 2003 to 2008.

http://wallstcheatsheet.com/stocks/jp-morgan-sued-by-ferc-an…

So wie ich obenstehenden Artikel verstehe, hat ARENA einen " klugen" Kopf an die Spitze gesetzt , der u.a. sehr viel Erfahrungen bei der Vermarktung von Produkten und damit zusammenhängenden gesetzlichen Regularien in diesem Bereich hat.

Alle Zeichen stehen auf "Expansion"

http://finance.yahoo.com/news/arena-pharmaceuticals-promotes…

Arena Pharmaceuticals, Inc. (NASDAQ:ARNA) has announced Craig M. Audet’s promotion to Senior VP, Operations and Head of Global Regulatory Affairs. This new role means Audet will serve as and executive officer for the company. He has over 25 years experience in the industry. Before joining Arena, he served as VP and Head of the US Regulatory Affairs Marketed Products Group for Sanofi-Aventis from 2003 to 2008.

http://wallstcheatsheet.com/stocks/jp-morgan-sued-by-ferc-an…

So wie ich obenstehenden Artikel verstehe, hat ARENA einen " klugen" Kopf an die Spitze gesetzt , der u.a. sehr viel Erfahrungen bei der Vermarktung von Produkten und damit zusammenhängenden gesetzlichen Regularien in diesem Bereich hat.

Alle Zeichen stehen auf "Expansion"

Hier ein sehr schöner Überblick über das Prozedere und die zeitliche Dimension für die mögliche Zula von Belviq in Europa durch die EMA ( European Medicines Agency)

Mit einem " Approval" seitens der EMA dürfte somit zeitmäßig ab Mitte/Ende Dezember 2012 zu rechnen sein - abhängig davon , in welchem Zeitraum ARENA auf die Fragen der EMA antworten wird.

Ich schätze die Chancen auf ein Approval seitens der FDA als sehr gut ein.

The general process:

A two-phase evaluation:

120 days and 90 days, leading to an opinion (approval or disapproval decision). So the entire process is AT LEAST 210 days.

You can break down the process as follow:

First Phase:

Day 0: EMA accepts ARNA application for (lor). > am 24.03.12 !!!

Day 80: EMA releases Co Rapporteurs Report (from 2 groups) - this is equivalent to FDA's Briefing doc.

Day 100: EMA Peer Review (of the Report).

Day 120: EMA sends ARNA a List of Questions.

Clock now stops.

The 1st phase of the process is finished. Once ARNA submits the responses to the List of Questions, the clocks start again for the 2nd phase. I don't know how long this would take between Day 120 and 121, but ARNA has maximum of 60 days to respond.

Second Phase

Day 121: ARNA responds to List of Questions.

Day 150: Join Report from the 2 groups.

Day 180: EMA sends ARNA a List of Issues.

Clock stops again.

ARNA has maximum of 30 days to respond.

Day 181: ARNA has Oral Explanation to List of Issues.

Day 210: Final Scientific Opinion <-- Approval Decision.

So if you add 210 days (total 2 phases) to the 2 idled periods of 60 and 30 days, it will be grand total of 310 which is about 10 months.

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…" target="_blank" rel="nofollow ugc noopener">

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…

Mit einem " Approval" seitens der EMA dürfte somit zeitmäßig ab Mitte/Ende Dezember 2012 zu rechnen sein - abhängig davon , in welchem Zeitraum ARENA auf die Fragen der EMA antworten wird.

Ich schätze die Chancen auf ein Approval seitens der FDA als sehr gut ein.

The general process:

A two-phase evaluation:

120 days and 90 days, leading to an opinion (approval or disapproval decision). So the entire process is AT LEAST 210 days.

You can break down the process as follow:

First Phase:

Day 0: EMA accepts ARNA application for (lor). > am 24.03.12 !!!

Day 80: EMA releases Co Rapporteurs Report (from 2 groups) - this is equivalent to FDA's Briefing doc.

Day 100: EMA Peer Review (of the Report).

Day 120: EMA sends ARNA a List of Questions.

Clock now stops.

The 1st phase of the process is finished. Once ARNA submits the responses to the List of Questions, the clocks start again for the 2nd phase. I don't know how long this would take between Day 120 and 121, but ARNA has maximum of 60 days to respond.

Second Phase

Day 121: ARNA responds to List of Questions.

Day 150: Join Report from the 2 groups.

Day 180: EMA sends ARNA a List of Issues.

Clock stops again.

ARNA has maximum of 30 days to respond.

Day 181: ARNA has Oral Explanation to List of Issues.

Day 210: Final Scientific Opinion <-- Approval Decision.

So if you add 210 days (total 2 phases) to the 2 idled periods of 60 and 30 days, it will be grand total of 310 which is about 10 months.

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…" target="_blank" rel="nofollow ugc noopener">

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…

Zitat von bernie55: Arena Pharmaceuticals Promotes Craig M. Audet to Executive Officer as Senior Vice President, Operations and Head of Global Regulatory Affairs

So wie ich obenstehenden Artikel verstehe, hat ARENA einen " klugen" Kopf an die Spitze gesetzt , der u.a. sehr viel Erfahrungen bei der Vermarktung von Produkten und damit zusammenhängenden gesetzlichen Regularien in diesem Bereich hat.

Alle Zeichen stehen auf "Expansion"

Soweit ich richtig informiert bin, besitzt ARENA die alleinigen Vertriebsrechte u.a. für Europa und China…

Ausgehend von einem möglichen Approval in Europa wird sich ARENA jetzt schon im Vorfeld positionieren und sich wohl auch nach europäischen Partnern umhören - die Ernennung von Craig M. Audet hat wohl den Zweck, diese Aufgabe für Europa zu übernehmen – zum einen um Partner zu finden, zum anderen Kooperationen abzuschließen, die es ARENA ermöglicht,die „ neuen“ Märkte zu erschließen….

BLOOMBERG > positive Presse über Perspektiven von ARENA und über mögliche Übernahme durch Big Pharmas  ...

...

@ AREANICS....it`s only a beginning ...

First Diet Pill in Decade Turns Arena Into Deal Bait: Real M&A

The first medication in more than a decade to help 78 million obese Americans slim down is turning into takeover bait.

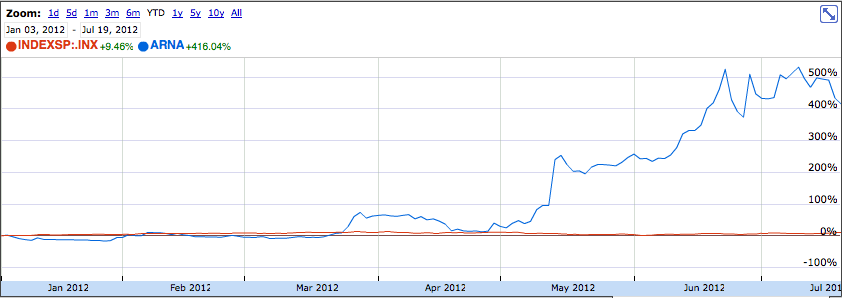

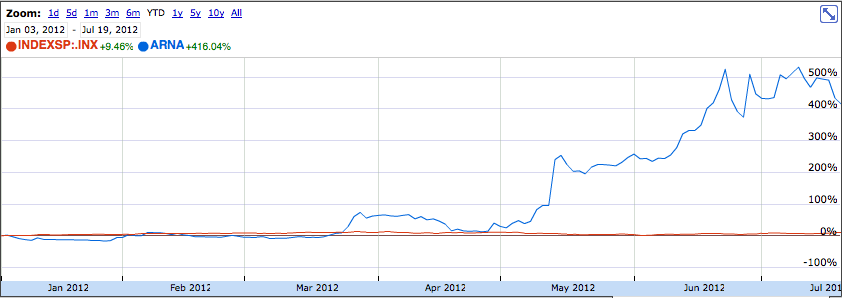

Arena Pharmaceuticals Inc. (ARNA) won Food and Drug Administration approval last month for Belviq, a treatment affecting an area of the brain that helps a person feel full after consuming less food. With the first weight-loss drug to be cleared for sale in the U.S. in 13 years, Arena is projected by analysts to increase revenue 18-fold in the next four years, the fastest growth in the world among specialty pharmaceutical companies greater than $1 billion, according to data compiled by Bloomberg.

Enlarge image First Diet Pill in Decade Turns Arena Into Deal Bait

About 42 percent of the U.S. population may be obese by 2030, up from about a third currently. Photographer: David Paul Morris/Bloomberg

While Arena’s 494 percent stock gain this year makes it the most expensive U.S. specialty drugmaker relative to revenue, the San Diego-based company offers potential buyers a medication that Piper Jaffray Cos. estimates will reach $2 billion in annual sales. Arena, with a $2.2 billion market value, may draw takeover interest from GlaxoSmithKline Plc (GSK), which is divesting its diet pill Alli, said WBB Securities LLC. Tokyo-based Eisai Co. (4523), which has licensed the rights to sell Belviq in the U.S., could also be an acquirer, said Lazard Capital Markets LLC.

“The large pharmaceutical companies are all on the edge of their seats looking at Arena,” Stephen Brozak, president of WBB Securities in Clark, New Jersey, said in a telephone interview. Obesity “is a global pandemic. There are people that absolutely are in need of these types of products. Large pharma are wonderful at marketing drugs and this is a product that lends itself to marketing.”

Appetite Suppression

“Arena is focused on bringing Belviq to the market in the U.S. with Eisai and in obtaining approval of the drug in markets outside of the U.S.,” David Schull, a spokesman for Arena, said in an e-mailed statement when asked whether the company has been approached by potential acquirers about a deal.

The FDA approved Belviq, previously called lorcaserin, on June 27. The pill works in a similar way to fenfluramine, part of the fen-phen appetite-suppression drug combination pulled from pharmacies 15 years ago when it was linked to heart valve abnormalities.

Arena and Eisai agreed to conduct six post-market studies to assess the safety and efficacy of the drug, including determining the potential for major cardiac risks such as heart attack and stroke, the FDA said.

Belviq will be available after the Drug Enforcement Administration completes a review to classify the drug based on its potential for abuse, which Arena has said may take four to six months.

Obesity Rate

“It’s the single most important thing that’s happened to Arena in its entire history,” WBB Securities’ Brozak said. “This is the first approval they’ve ever gotten.”

Analysts project that by 2015 Arena’s sales will have risen faster than every other specialty drugmaker in the world with a market capitalization greater than $1 billion, data compiled by Bloomberg show. The company’s revenue may total $232 million that year, versus $13 million in 2011, according to analysts’ estimates compiled by Bloomberg.

About 42 percent of the U.S. population may be obese by 2030, up from about a third currently, according to a report presented at the Centers for Disease Control and Prevention’s obesity conference in May. Globally, about 500 million people are obese, according to a World Health Organization report. Obesity is defined as having a body mass index of more than 30.

Glaxo, the U.K.’s largest drugmaker, may be interested in purchasing Arena to bolster its presence in the market for weight-loss remedies after sales declined for Alli, its over- the-counter diet pill, according to WBB Securities’ Brozak.

‘Dress Rehearsal’

London-based Glaxo has said it plans to divest Alli, which contains orlistat, a chemical that blocks the intestines from absorbing fat when taken as many as three times a day with meals. Orlistat has been linked to reports of liver injury, prompting consumer advocacy groups to demand its removal from the market. The FDA announced new warnings on the pill’s label in mid-2010, and Glaxo has said that Alli is safe and effective when used as directed.

Glaxo has “done the dress rehearsal,” so it would now know how to best market Arena’s weight-loss drug, Brozak said.

Kevin Colgan, a spokesman for Glaxo, said the company doesn’t comment on speculation, when asked whether it wants to acquire Arena.

Other companies are also seeking approval for weight-loss drugs. Qnexa from Vivus Inc. (VVUS) is slated for an FDA decision by July 17. Orexigen Therapeutics Inc. (OREX), which is developing the pill Contrave with Takeda Pharmaceutical Co., agreed in September to conduct a two-year study of the drug’s heart risks.

Drug Partnership

Belviq is the first prescription obesity medicine to be approved for sale in the U.S. since Roche Holding AG (ROG)’s Xenical in 1999. Glaxo’s Alli is a half-dose version of Xenical’s active ingredient and received FDA clearance in 2007 as the first diet drug available without a prescription.

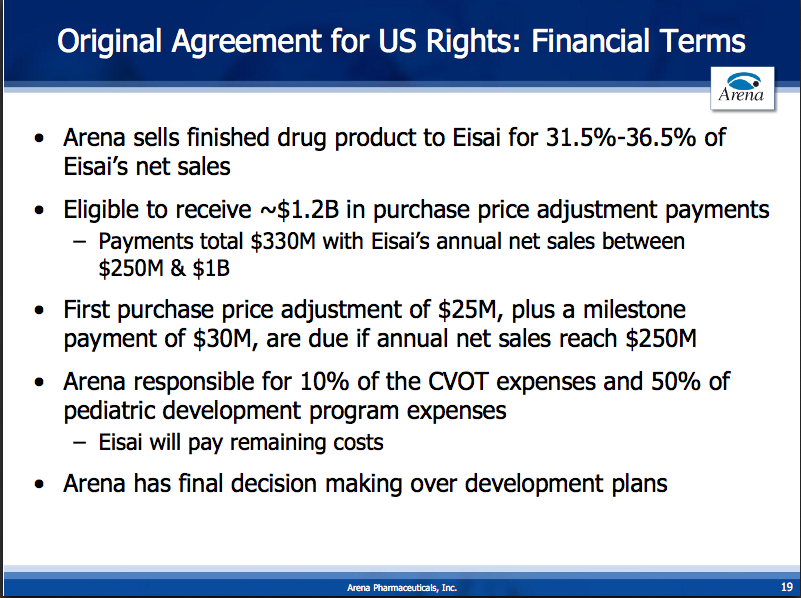

Once available, lorcaserin will be marketed in the U.S. by Eisai under the name Belviq and the company will pay Arena a portion of the drug’s revenue. The partnership may deter potential acquirers that don’t want to share Belviq’s sales, said Alan Carr, a New York-based analyst for Needham & Co.

“Arena is much more attractive from an M&A perspective if you’re getting worldwide rights,” he said in a phone interview.

Eisai may decide to buy Arena so that it collects all of the revenue from Belviq, said Bill Tanner, an analyst for Lazard in New York. The two companies have a so-called standstill agreement that prevents the Japanese drugmaker from purchasing Arena unless someone else tries to first. It’s intended to protect Arena from a hostile takeover and wouldn’t prevent the companies from negotiating a deal, Tanner said.

Eisai’s Interest

“If this is a big drug, it could be a fairly sizeable payment that they have to make to Arena,” he said in a phone interview. “It probably makes sense that they’d want to take a look at acquiring it.”

Marcia Diljak, a spokeswoman for Eisai, declined to comment on whether the company would be interested in buying Arena.

Eisai will probably want to first gauge Belviq’s commercial success so that it doesn’t risk overpaying for Arena in case sales are weaker than analysts expect, Tanner said.

Arena, which has posted an almost six-fold stock price increase this year, is valued at 52 times analysts’ estimates for fiscal 2012 sales. That’s higher than all 14 other specialty pharmaceutical companies in the U.S. that have a market capitalization greater than $1 billion, data compiled by Bloomberg show. Even based on revenue estimates for fiscal 2015, Arena trades at the second-richest multiple in the group.

“If you knew for a fact that there wasn’t a buyer for the company, I don’t think this stock would be where it is,” Lazard’s Tanner said. “It’s not overly expensive if you think it’s going to be a decent drug.”

Edward Tenthoff, a New York-based analyst for Piper Jaffray, estimates Belviq will reach annual sales of $2 billion just in the U.S. by 2020.

“The approval of a drug with the market potential of Belviq certainly makes Arena” an acquisition candidate, Tenthoff said in a phone interview.

“This could be a true blockbuster drug in an age when there are fewer and fewer blockbusters.”

http://www.bloomberg.com/news/2012-07-08/first-diet-pill-in-…" target="_blank" rel="nofollow ugc noopener">

http://www.bloomberg.com/news/2012-07-08/first-diet-pill-in-…

...

...@ AREANICS....it`s only a beginning ...

First Diet Pill in Decade Turns Arena Into Deal Bait: Real M&A

The first medication in more than a decade to help 78 million obese Americans slim down is turning into takeover bait.

Arena Pharmaceuticals Inc. (ARNA) won Food and Drug Administration approval last month for Belviq, a treatment affecting an area of the brain that helps a person feel full after consuming less food. With the first weight-loss drug to be cleared for sale in the U.S. in 13 years, Arena is projected by analysts to increase revenue 18-fold in the next four years, the fastest growth in the world among specialty pharmaceutical companies greater than $1 billion, according to data compiled by Bloomberg.

Enlarge image First Diet Pill in Decade Turns Arena Into Deal Bait

About 42 percent of the U.S. population may be obese by 2030, up from about a third currently. Photographer: David Paul Morris/Bloomberg

While Arena’s 494 percent stock gain this year makes it the most expensive U.S. specialty drugmaker relative to revenue, the San Diego-based company offers potential buyers a medication that Piper Jaffray Cos. estimates will reach $2 billion in annual sales. Arena, with a $2.2 billion market value, may draw takeover interest from GlaxoSmithKline Plc (GSK), which is divesting its diet pill Alli, said WBB Securities LLC. Tokyo-based Eisai Co. (4523), which has licensed the rights to sell Belviq in the U.S., could also be an acquirer, said Lazard Capital Markets LLC.

“The large pharmaceutical companies are all on the edge of their seats looking at Arena,” Stephen Brozak, president of WBB Securities in Clark, New Jersey, said in a telephone interview. Obesity “is a global pandemic. There are people that absolutely are in need of these types of products. Large pharma are wonderful at marketing drugs and this is a product that lends itself to marketing.”

Appetite Suppression

“Arena is focused on bringing Belviq to the market in the U.S. with Eisai and in obtaining approval of the drug in markets outside of the U.S.,” David Schull, a spokesman for Arena, said in an e-mailed statement when asked whether the company has been approached by potential acquirers about a deal.

The FDA approved Belviq, previously called lorcaserin, on June 27. The pill works in a similar way to fenfluramine, part of the fen-phen appetite-suppression drug combination pulled from pharmacies 15 years ago when it was linked to heart valve abnormalities.

Arena and Eisai agreed to conduct six post-market studies to assess the safety and efficacy of the drug, including determining the potential for major cardiac risks such as heart attack and stroke, the FDA said.

Belviq will be available after the Drug Enforcement Administration completes a review to classify the drug based on its potential for abuse, which Arena has said may take four to six months.

Obesity Rate

“It’s the single most important thing that’s happened to Arena in its entire history,” WBB Securities’ Brozak said. “This is the first approval they’ve ever gotten.”

Analysts project that by 2015 Arena’s sales will have risen faster than every other specialty drugmaker in the world with a market capitalization greater than $1 billion, data compiled by Bloomberg show. The company’s revenue may total $232 million that year, versus $13 million in 2011, according to analysts’ estimates compiled by Bloomberg.

About 42 percent of the U.S. population may be obese by 2030, up from about a third currently, according to a report presented at the Centers for Disease Control and Prevention’s obesity conference in May. Globally, about 500 million people are obese, according to a World Health Organization report. Obesity is defined as having a body mass index of more than 30.

Glaxo, the U.K.’s largest drugmaker, may be interested in purchasing Arena to bolster its presence in the market for weight-loss remedies after sales declined for Alli, its over- the-counter diet pill, according to WBB Securities’ Brozak.

‘Dress Rehearsal’

London-based Glaxo has said it plans to divest Alli, which contains orlistat, a chemical that blocks the intestines from absorbing fat when taken as many as three times a day with meals. Orlistat has been linked to reports of liver injury, prompting consumer advocacy groups to demand its removal from the market. The FDA announced new warnings on the pill’s label in mid-2010, and Glaxo has said that Alli is safe and effective when used as directed.

Glaxo has “done the dress rehearsal,” so it would now know how to best market Arena’s weight-loss drug, Brozak said.

Kevin Colgan, a spokesman for Glaxo, said the company doesn’t comment on speculation, when asked whether it wants to acquire Arena.

Other companies are also seeking approval for weight-loss drugs. Qnexa from Vivus Inc. (VVUS) is slated for an FDA decision by July 17. Orexigen Therapeutics Inc. (OREX), which is developing the pill Contrave with Takeda Pharmaceutical Co., agreed in September to conduct a two-year study of the drug’s heart risks.

Drug Partnership

Belviq is the first prescription obesity medicine to be approved for sale in the U.S. since Roche Holding AG (ROG)’s Xenical in 1999. Glaxo’s Alli is a half-dose version of Xenical’s active ingredient and received FDA clearance in 2007 as the first diet drug available without a prescription.

Once available, lorcaserin will be marketed in the U.S. by Eisai under the name Belviq and the company will pay Arena a portion of the drug’s revenue. The partnership may deter potential acquirers that don’t want to share Belviq’s sales, said Alan Carr, a New York-based analyst for Needham & Co.

“Arena is much more attractive from an M&A perspective if you’re getting worldwide rights,” he said in a phone interview.

Eisai may decide to buy Arena so that it collects all of the revenue from Belviq, said Bill Tanner, an analyst for Lazard in New York. The two companies have a so-called standstill agreement that prevents the Japanese drugmaker from purchasing Arena unless someone else tries to first. It’s intended to protect Arena from a hostile takeover and wouldn’t prevent the companies from negotiating a deal, Tanner said.

Eisai’s Interest

“If this is a big drug, it could be a fairly sizeable payment that they have to make to Arena,” he said in a phone interview. “It probably makes sense that they’d want to take a look at acquiring it.”

Marcia Diljak, a spokeswoman for Eisai, declined to comment on whether the company would be interested in buying Arena.

Eisai will probably want to first gauge Belviq’s commercial success so that it doesn’t risk overpaying for Arena in case sales are weaker than analysts expect, Tanner said.

Arena, which has posted an almost six-fold stock price increase this year, is valued at 52 times analysts’ estimates for fiscal 2012 sales. That’s higher than all 14 other specialty pharmaceutical companies in the U.S. that have a market capitalization greater than $1 billion, data compiled by Bloomberg show. Even based on revenue estimates for fiscal 2015, Arena trades at the second-richest multiple in the group.

“If you knew for a fact that there wasn’t a buyer for the company, I don’t think this stock would be where it is,” Lazard’s Tanner said. “It’s not overly expensive if you think it’s going to be a decent drug.”

Edward Tenthoff, a New York-based analyst for Piper Jaffray, estimates Belviq will reach annual sales of $2 billion just in the U.S. by 2020.

“The approval of a drug with the market potential of Belviq certainly makes Arena” an acquisition candidate, Tenthoff said in a phone interview.

“This could be a true blockbuster drug in an age when there are fewer and fewer blockbusters.”

http://www.bloomberg.com/news/2012-07-08/first-diet-pill-in-…" target="_blank" rel="nofollow ugc noopener">

http://www.bloomberg.com/news/2012-07-08/first-diet-pill-in-…

Das Medikament BELVIQ weckt Begehren.....die BIGS haben im Vorfeld der AC Entscheidung und der FDA Entscheidung immer gegen ARENA und ihr Medikament gewettert und immer wieder " bewusst" falsche Information veröffentlicht.

Diese Methode hat Schule !!!

Jim Cramer: "What's important when you're in that hedge-fund mode is to not do anything that's remotely truthful.

Because the truth is so against your view that it's important to create a new truth to develop a fiction."

http://www.youtube.com/watch?v=NSeTKuNyPr4" target="_blank" rel="nofollow ugc noopener">

http://www.youtube.com/watch?v=NSeTKuNyPr4

Erst gestern fing die "Basher- Konsorte" wieder an," kleine" Nebenwirkungen des Medikaments als " hyperproblematisch" darzustellen...

...hier der Stein des Anstosses.....

Arena Pharmaceuticals (ARNA), Vivus Pharmaceuticals (VVUS), Onyx Pharmaceutical (ONXX)

Arena Pharmaceuticals (ARNA) was chosen among followers of Jim Cramer on Twitter as the champion stock for the second half of 2012, but Cramer disagrees with this pick. The stock has rallied $225 on the potential approval of its obesity drug by the FDA; this will be the first major obesity drug for 10 years. The drug could generate $2 billion in revenue, equal to Arena's present market cap of $2 billion. In addition to the fact that Arena has already risen substantially, the story is not perfect. The obesity drug is not as effective as initially thought, and there are substantial cases of side effects, including hallucinations.

Vivus Pharmaceutical (VVUS) also has an obesity drug awaiting approval, and this drug has shown to be more effective than Arena's treatment.

In addition, Vivus owns all of its drug, while Arena just owns 40% of its obesity drug.

Cramer's pick among biotechs is Onyx (ONXX), which has a blood cancer drug which is expected to earn FDA approval, and already has treatments for blood and liver cancer.

http://seekingalpha.com/article/713341-cramer-s-mad-money-fi…

JIM CRAMER versucht mit allen nur erdenklichen Mitteln das Hedgefondsklientel zu bedienen..

...Leute, keep cool....keine SL setzen...

...was sind im übrigen aktuell Minus 5-10 %im Vergleich zu den knapp 500 %, die wir bis jetzt gemacht haben ??

Diese Methode hat Schule !!!

Jim Cramer: "What's important when you're in that hedge-fund mode is to not do anything that's remotely truthful.

Because the truth is so against your view that it's important to create a new truth to develop a fiction."

http://www.youtube.com/watch?v=NSeTKuNyPr4" target="_blank" rel="nofollow ugc noopener">

http://www.youtube.com/watch?v=NSeTKuNyPr4

Erst gestern fing die "Basher- Konsorte" wieder an," kleine" Nebenwirkungen des Medikaments als " hyperproblematisch" darzustellen...

...hier der Stein des Anstosses.....

Arena Pharmaceuticals (ARNA), Vivus Pharmaceuticals (VVUS), Onyx Pharmaceutical (ONXX)

Arena Pharmaceuticals (ARNA) was chosen among followers of Jim Cramer on Twitter as the champion stock for the second half of 2012, but Cramer disagrees with this pick. The stock has rallied $225 on the potential approval of its obesity drug by the FDA; this will be the first major obesity drug for 10 years. The drug could generate $2 billion in revenue, equal to Arena's present market cap of $2 billion. In addition to the fact that Arena has already risen substantially, the story is not perfect. The obesity drug is not as effective as initially thought, and there are substantial cases of side effects, including hallucinations.

Vivus Pharmaceutical (VVUS) also has an obesity drug awaiting approval, and this drug has shown to be more effective than Arena's treatment.

In addition, Vivus owns all of its drug, while Arena just owns 40% of its obesity drug.

Cramer's pick among biotechs is Onyx (ONXX), which has a blood cancer drug which is expected to earn FDA approval, and already has treatments for blood and liver cancer.

http://seekingalpha.com/article/713341-cramer-s-mad-money-fi…

JIM CRAMER versucht mit allen nur erdenklichen Mitteln das Hedgefondsklientel zu bedienen..

...Leute, keep cool....keine SL setzen...

...was sind im übrigen aktuell Minus 5-10 %im Vergleich zu den knapp 500 %, die wir bis jetzt gemacht haben ??

AP News

Arena files for approval of Belviq in Switzerland

Posted on July 11, 2012

SAN DIEGO (AP) — Arena Pharmaceuticals Inc. said Wednesday that it filed for marketing approval for its anti-obesity pill Belviq in Switzerland.

Arena said it expects Swissmedic, the country's health agency, to accept the filing later this month and begin its review process.

The Food and Drug Administration approved Belviq on June 27, making it the first long-term prescription weight loss drug approved in the U.S. in more than a decade. European Union regulators are reviewing the drug.

Shares of Arena Pharmaceuticals lost 68 cents, or 5.8 percent, to $11.13 on Wednesday, after competitor Orexigen Therapeutics Inc. said enrollment in a study of its potentially competing experimental weight-loss drug Contrave was going more quickly than expected. Arena picked up 4 cents to $11.17 in after-hours trading.

http://www.businessweek.com/ap/2012-07-11/arena-files-for-ap…

Arena files for approval of Belviq in Switzerland

Posted on July 11, 2012

SAN DIEGO (AP) — Arena Pharmaceuticals Inc. said Wednesday that it filed for marketing approval for its anti-obesity pill Belviq in Switzerland.

Arena said it expects Swissmedic, the country's health agency, to accept the filing later this month and begin its review process.

The Food and Drug Administration approved Belviq on June 27, making it the first long-term prescription weight loss drug approved in the U.S. in more than a decade. European Union regulators are reviewing the drug.

Shares of Arena Pharmaceuticals lost 68 cents, or 5.8 percent, to $11.13 on Wednesday, after competitor Orexigen Therapeutics Inc. said enrollment in a study of its potentially competing experimental weight-loss drug Contrave was going more quickly than expected. Arena picked up 4 cents to $11.17 in after-hours trading.

http://www.businessweek.com/ap/2012-07-11/arena-files-for-ap…

auch für den INFO-Thread:

hier werden mal ARNA und VVUS nebeneinander betrachtet:

Vivus: Getting Ready For FDA Approval

July 12, 2012 |

Vivus (VVUS) is a biopharmaceutical company, which mainly develops medicines for treatment of sleep apnea, diabetes, obesity and male sexual health. While its portfolio is relatively diversified, there is a great deal of interest in company's obesity treatment products. Vivus is currently awaiting final approval from FDA, for Qnexa, their most recent drug. Qnexa is a drug meant to help reduce weight. A few years ago, Qnexa was initially rejected by FDA at the first attempt. At the second presentation in this year, Qnexa got a vote of confidence by a whopping 20-2 margin by the committee.

Vivus will get a final decision about Qnexa on July, 17, 2012. If approved, Qnexa will be the second drug to be approved by FDA in weight loss category in two months. The company plans on marketing the drug by the end of year 2012. European authorities have delayed a decision on the approval of the drug. Vivus is entirely focusing on getting Qnexa approved by FDA at the moment. Currently, Lorcaserin is the only weight reduction drug approved by FDA. Arena Pharmaceuticals (ARNA) is the developer of Lorcaserin.

Clinical Background

Qnexa has already created a strong buzz in the market. Clinical studies have shown a significant weight loss in the participants. According to the results published by the company, average weight loss for top dose participants was 14.4%. Average weight loss for low dose Qnexa was 6.7% and 2.1% for placebo. Mean weight loss after week 56 was 10.9% for top dose and 5.1% for low dose. Participants who completed the top dose treatment, 83.5% lost ≥5%; 67.7% lost ≥10% and 48.1% lost ≥15% of their baseline weight. There are some adverse effect fears, due to which Vivus has to follow a labeling protocol. Qnexa will not be prescribed to the pregnant woman. Vivus plans on advising the patients to stop taking the medicine, if weight loss is less than 3% after three months.

Stock Performance

VVUS Chart

Both Vivus and Arena stocks are currently trading near its 52 week highs. Vivus stock closed at $28.47 on July, 09, 2010. The 52-week trading range for Vivus is $6.13 - $29.99. Even after the recent retreat, the stock is trading near its 52-week highs. Market cap of Vivus Inc. is $2.83 billion, slightly higher than the $2.15 billion market cap of Arena. Vivus stock has a relatively high Beta of 1.42. Trailing twelve month EPS is -0.63. One year analyst target for Vivus is $31.20.

Ratio Analysis

Estimates for the current year EPS are 40% more than the past 12 months EPS. One year forward estimate for EPS is to grow by 166%. Forward P/E is unusually high at 72.90. Current P/B ratio stands at 8.72. Firm is in an exceptionally strong liquidity position. Quick and current ratios are 25.70 and 25.92 respectively. Unlike Arena Pharmaceuticals, Vivus has no debt in its capital structure.

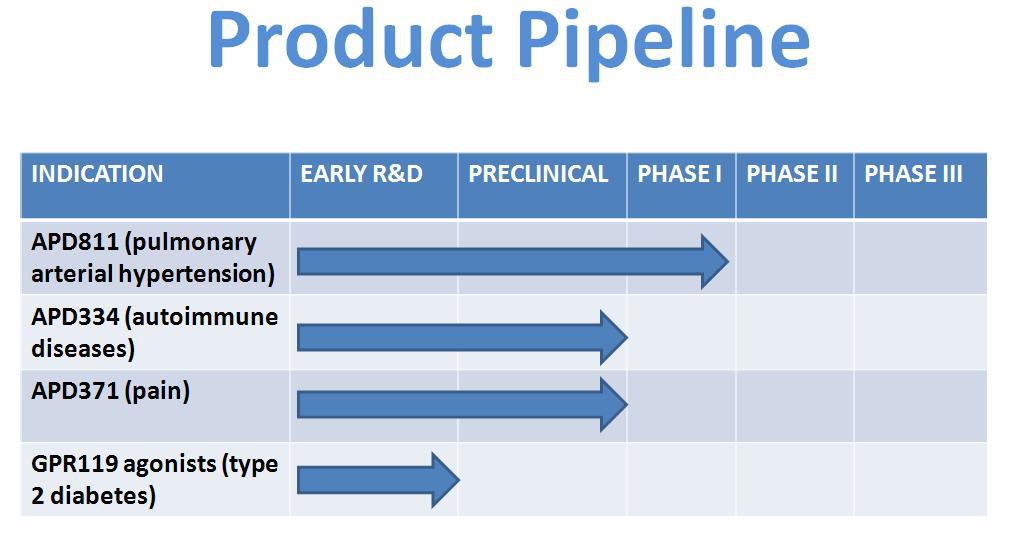

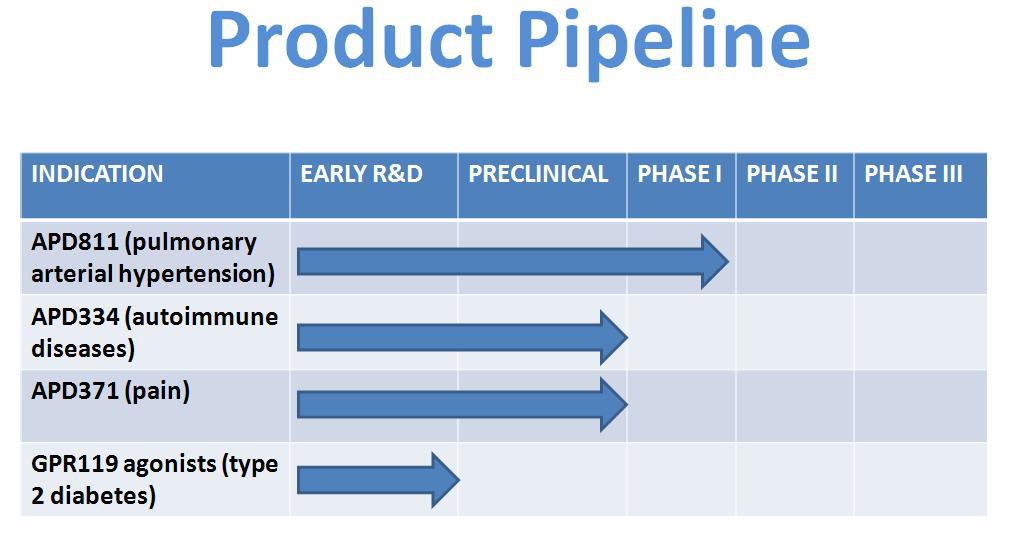

Pipeline Products

Vivus had Avanafil approved by FDA in April, 2012, a drug for men with erectile dysfunction. Vivus plans to sell Avanafil under the brand name Stendra. Stendra promises to work in fifteen minutes, half the time it takes the pills from rivals companies to work. That is a very short period by industry standards.

By getting Stendra approved, Vivus now stand to compete directly with giants of the industry like, Pfizer (PFE), GlaxoSmithKline (GSK) and Bayer. Analysts believe that the sales from Stendra can go up to $68 million in the next year and to $459 million by the year 2017. Erectile dysfunction market itself is currently worth $4.3 billion. Viagra, Pfizer's well-known super-charger, holds almost half of the market share. Vivus is working on getting a partnership to market Stendra as well.

Besides the existing products, Vivus wants to focus on the marketing of Qnexa, if approved. Vivus wants to preserve the entire budget to spend on the marketing of Qnexa. Obesity market is largely unexplored, and it is a large market. There will be less competition in this segment. Vivus has a good marketing network. Vivus has more than one product in the market. As such, the revenues will not be depending on only one drug in a hugely unexplored market.

If approved, Vivus plans to launch Qnexa in the later part of year 2012. On the other hand, Arena Pharmaceutical expects to market the drug in 2013. This will give Vivus Inc a head start on its main competitor, and the firm can capture a large chunk of the market. Vivus is planning to directly market the drug in the U.S. itself and seek partnerships outside the U.S. USA is an immense obesity market. Arena does not have the pure marketing rights for its own obesity drug. Only a certain portion of revenues from sales will go to Arena, whereas the rest will be taken by Aisai Pharmaceuticals, the Japanese partner. This I believe is again an advantage for Vivus over Arena.

Insider Sales

The biggest bearish argument made against Vivus is the sale of shares by three executives in the past two months. Insiders selling stock before the approval are sure to raise concerns among the investors. The main reason, which most people have been ignoring, is something less critical. Vivus executives have been selling stocks under the 10b5-1 trading plan to cover themselves legally against allegations of insider trading. CEO of Vivus recently sold 100,000 shares, but he still owns 4.3 million shares.

Summary

I think the FDA decision is almost certain, and Vivus is extremely hopeful on the approval of Qnexa. This drug will prove to be a catalyst for the success of the company. Analysts believe, after the approval, Vivus stock should be priced at $40. Vivus, currently trading below $30 presents an exciting opportunity to make tidy profits. Insider sales are worrisome, but it is hard to say that insiders are getting rid of their shares, as they hold substantial stake in the company. This still raises a red flag for interested investors. Therefore, as the stock has already made substantial gains, I would suggest a hold and buy at pullback strategy for Vivus.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

http://seekingalpha.com/article/718321-vivus-getting-ready-f…

hier werden mal ARNA und VVUS nebeneinander betrachtet:

Vivus: Getting Ready For FDA Approval

July 12, 2012 |

Vivus (VVUS) is a biopharmaceutical company, which mainly develops medicines for treatment of sleep apnea, diabetes, obesity and male sexual health. While its portfolio is relatively diversified, there is a great deal of interest in company's obesity treatment products. Vivus is currently awaiting final approval from FDA, for Qnexa, their most recent drug. Qnexa is a drug meant to help reduce weight. A few years ago, Qnexa was initially rejected by FDA at the first attempt. At the second presentation in this year, Qnexa got a vote of confidence by a whopping 20-2 margin by the committee.

Vivus will get a final decision about Qnexa on July, 17, 2012. If approved, Qnexa will be the second drug to be approved by FDA in weight loss category in two months. The company plans on marketing the drug by the end of year 2012. European authorities have delayed a decision on the approval of the drug. Vivus is entirely focusing on getting Qnexa approved by FDA at the moment. Currently, Lorcaserin is the only weight reduction drug approved by FDA. Arena Pharmaceuticals (ARNA) is the developer of Lorcaserin.

Clinical Background

Qnexa has already created a strong buzz in the market. Clinical studies have shown a significant weight loss in the participants. According to the results published by the company, average weight loss for top dose participants was 14.4%. Average weight loss for low dose Qnexa was 6.7% and 2.1% for placebo. Mean weight loss after week 56 was 10.9% for top dose and 5.1% for low dose. Participants who completed the top dose treatment, 83.5% lost ≥5%; 67.7% lost ≥10% and 48.1% lost ≥15% of their baseline weight. There are some adverse effect fears, due to which Vivus has to follow a labeling protocol. Qnexa will not be prescribed to the pregnant woman. Vivus plans on advising the patients to stop taking the medicine, if weight loss is less than 3% after three months.

Stock Performance

VVUS Chart

Both Vivus and Arena stocks are currently trading near its 52 week highs. Vivus stock closed at $28.47 on July, 09, 2010. The 52-week trading range for Vivus is $6.13 - $29.99. Even after the recent retreat, the stock is trading near its 52-week highs. Market cap of Vivus Inc. is $2.83 billion, slightly higher than the $2.15 billion market cap of Arena. Vivus stock has a relatively high Beta of 1.42. Trailing twelve month EPS is -0.63. One year analyst target for Vivus is $31.20.

Ratio Analysis

Estimates for the current year EPS are 40% more than the past 12 months EPS. One year forward estimate for EPS is to grow by 166%. Forward P/E is unusually high at 72.90. Current P/B ratio stands at 8.72. Firm is in an exceptionally strong liquidity position. Quick and current ratios are 25.70 and 25.92 respectively. Unlike Arena Pharmaceuticals, Vivus has no debt in its capital structure.

Pipeline Products

Vivus had Avanafil approved by FDA in April, 2012, a drug for men with erectile dysfunction. Vivus plans to sell Avanafil under the brand name Stendra. Stendra promises to work in fifteen minutes, half the time it takes the pills from rivals companies to work. That is a very short period by industry standards.

By getting Stendra approved, Vivus now stand to compete directly with giants of the industry like, Pfizer (PFE), GlaxoSmithKline (GSK) and Bayer. Analysts believe that the sales from Stendra can go up to $68 million in the next year and to $459 million by the year 2017. Erectile dysfunction market itself is currently worth $4.3 billion. Viagra, Pfizer's well-known super-charger, holds almost half of the market share. Vivus is working on getting a partnership to market Stendra as well.

Besides the existing products, Vivus wants to focus on the marketing of Qnexa, if approved. Vivus wants to preserve the entire budget to spend on the marketing of Qnexa. Obesity market is largely unexplored, and it is a large market. There will be less competition in this segment. Vivus has a good marketing network. Vivus has more than one product in the market. As such, the revenues will not be depending on only one drug in a hugely unexplored market.

If approved, Vivus plans to launch Qnexa in the later part of year 2012. On the other hand, Arena Pharmaceutical expects to market the drug in 2013. This will give Vivus Inc a head start on its main competitor, and the firm can capture a large chunk of the market. Vivus is planning to directly market the drug in the U.S. itself and seek partnerships outside the U.S. USA is an immense obesity market. Arena does not have the pure marketing rights for its own obesity drug. Only a certain portion of revenues from sales will go to Arena, whereas the rest will be taken by Aisai Pharmaceuticals, the Japanese partner. This I believe is again an advantage for Vivus over Arena.

Insider Sales

The biggest bearish argument made against Vivus is the sale of shares by three executives in the past two months. Insiders selling stock before the approval are sure to raise concerns among the investors. The main reason, which most people have been ignoring, is something less critical. Vivus executives have been selling stocks under the 10b5-1 trading plan to cover themselves legally against allegations of insider trading. CEO of Vivus recently sold 100,000 shares, but he still owns 4.3 million shares.

Summary

I think the FDA decision is almost certain, and Vivus is extremely hopeful on the approval of Qnexa. This drug will prove to be a catalyst for the success of the company. Analysts believe, after the approval, Vivus stock should be priced at $40. Vivus, currently trading below $30 presents an exciting opportunity to make tidy profits. Insider sales are worrisome, but it is hard to say that insiders are getting rid of their shares, as they hold substantial stake in the company. This still raises a red flag for interested investors. Therefore, as the stock has already made substantial gains, I would suggest a hold and buy at pullback strategy for Vivus.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

http://seekingalpha.com/article/718321-vivus-getting-ready-f…

Ist VVUS für ARNA eine Gefahr?:

Has Arena Pharmaceuticals Inc. (NASDAQ: ARNA) Peaked or will Biopharmaceutical Company See Greater Gains in the Near Future?

Posted on July 13, 2012 by Editor

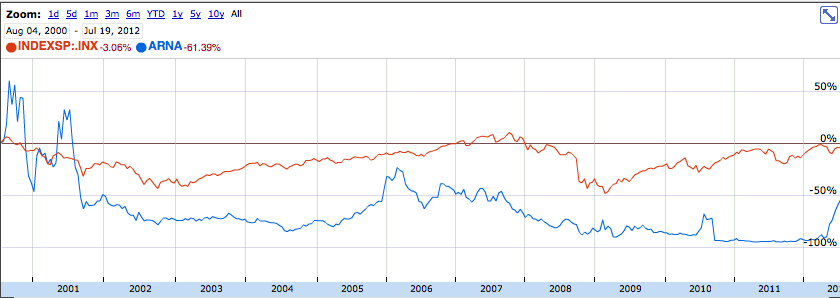

To think that less than three months ago shares of Arena Pharmaceuticals Inc. (NASDAQ: ARNA) were trading as low as 2.00 is mind-numbing but with an FDA approval comes plenty of rewards and shareholders of the biopharmaceutical company experienced that first hand when the agency made lorcaserin, to be marked under the commercial name Belviq, the first obesity medication to win favor in 13 years.

That FDA approval came back in late June and shares climbed as high as 13.50 following the news but since that time ARNA has seen a noticeable pullback with shares falling as low as 10.08 on Thursday. While shares have managed to climb to the 11.20 mark on Friday there are concerns about where the price will go in the near future as the company could be facing some competition.

Just how likely it is that the FDA issues yet another approval for an obesity medication is yet to be seen but Vivus Inc. and their shareholders will find out next week with their Prescription Drug User Fee Act (PDUFA), or FDA `Action` date, for Qnexa, scheduled for July 17th. The overwhelming belief is that Vivus will win approval and that could spell trouble for ARNA and their shareholders.

Of course ARNA’s success isn’t dependent upon what happens on July 17th, the facts seem to support the belief that Belviq has fewer side effects than Qnexa and will be accessible to a larger market. That market is massive considering that the FDA approved lorcaserin for those who are obese or who have a body mass index (BMI) of 27 and have another risk factor like high blood pressure, high cholesterol, or diabetes. What that equates to is nearly two-thirds of the population in the United States.

As it stands there are still some concerns over what risks are presented by lorcaserin, namely how it could play a role in heart disease. While those concerns may have some merit the reality is if you are obese then you are already carrying risks of heart disease. That’s not to say that the risks of lorcaserin should be overlooked but common sense should prevail.

Whether or not Vivus and their Qnexa obesity medication can compete with ARNA’s Belviq remains to be seen but one thing is for certain, Qnexa doesn’t have the same market to work with. Even with an FDA approval Qnexa is facing tighter restrictions as IPQ Analytics, an independent research firm, has warned of “risks that exist which are not currently being factored into expectations.” This could lead to a risk management program that would accompany an approval for Qnexa, something that Belviq was able to avoid.

That could be of substantial benefit to ARNA as the risk management program for Qnexa could place restrictions on prescriptions for women of childbearing age and/or those with cardiovascular risk given the fact that the drug had been sent back for additional studies due to concerns about heart valve damage, a permanent and life-threatening side effect.

Not lost on investors is the fact that a number of insider transactions among executives at Vivus have taken place, giving some skeptics reason to believe that the company has its doubts about Qnexa and its impact on the market. While these transactions are well within the rights of executives and may simply be seen as an opportunity to grab profits the timing does appear odd.

Aside from the potential competition in the way of Qnexa, ARNA is also facing doubt from those who believe the company’s diet drug won’t earn as much as they expect. Jim Cramer has been among the most vocal on this front, predicting Arena will gain just below 40% of its revenue from treatment, substantially lower than what the company has predicted.

Without question there are legitimate concerns investors should be aware of when it comes to ARNA, namely that the company’s shares have already jumped more than 500% for the year. That leaves many to question whether or not ARNA has already peaked. With shares as high as they are right now it may make sense to wait for a pullback and if Vivus gets that approval next week there will almost certainly be a downturn for ARNA shares which could then provide an excellent opportunity for investors to build a position.

http://www.otcequity.com/?p=2331

Has Arena Pharmaceuticals Inc. (NASDAQ: ARNA) Peaked or will Biopharmaceutical Company See Greater Gains in the Near Future?

Posted on July 13, 2012 by Editor

To think that less than three months ago shares of Arena Pharmaceuticals Inc. (NASDAQ: ARNA) were trading as low as 2.00 is mind-numbing but with an FDA approval comes plenty of rewards and shareholders of the biopharmaceutical company experienced that first hand when the agency made lorcaserin, to be marked under the commercial name Belviq, the first obesity medication to win favor in 13 years.

That FDA approval came back in late June and shares climbed as high as 13.50 following the news but since that time ARNA has seen a noticeable pullback with shares falling as low as 10.08 on Thursday. While shares have managed to climb to the 11.20 mark on Friday there are concerns about where the price will go in the near future as the company could be facing some competition.

Just how likely it is that the FDA issues yet another approval for an obesity medication is yet to be seen but Vivus Inc. and their shareholders will find out next week with their Prescription Drug User Fee Act (PDUFA), or FDA `Action` date, for Qnexa, scheduled for July 17th. The overwhelming belief is that Vivus will win approval and that could spell trouble for ARNA and their shareholders.

Of course ARNA’s success isn’t dependent upon what happens on July 17th, the facts seem to support the belief that Belviq has fewer side effects than Qnexa and will be accessible to a larger market. That market is massive considering that the FDA approved lorcaserin for those who are obese or who have a body mass index (BMI) of 27 and have another risk factor like high blood pressure, high cholesterol, or diabetes. What that equates to is nearly two-thirds of the population in the United States.

As it stands there are still some concerns over what risks are presented by lorcaserin, namely how it could play a role in heart disease. While those concerns may have some merit the reality is if you are obese then you are already carrying risks of heart disease. That’s not to say that the risks of lorcaserin should be overlooked but common sense should prevail.

Whether or not Vivus and their Qnexa obesity medication can compete with ARNA’s Belviq remains to be seen but one thing is for certain, Qnexa doesn’t have the same market to work with. Even with an FDA approval Qnexa is facing tighter restrictions as IPQ Analytics, an independent research firm, has warned of “risks that exist which are not currently being factored into expectations.” This could lead to a risk management program that would accompany an approval for Qnexa, something that Belviq was able to avoid.

That could be of substantial benefit to ARNA as the risk management program for Qnexa could place restrictions on prescriptions for women of childbearing age and/or those with cardiovascular risk given the fact that the drug had been sent back for additional studies due to concerns about heart valve damage, a permanent and life-threatening side effect.

Not lost on investors is the fact that a number of insider transactions among executives at Vivus have taken place, giving some skeptics reason to believe that the company has its doubts about Qnexa and its impact on the market. While these transactions are well within the rights of executives and may simply be seen as an opportunity to grab profits the timing does appear odd.

Aside from the potential competition in the way of Qnexa, ARNA is also facing doubt from those who believe the company’s diet drug won’t earn as much as they expect. Jim Cramer has been among the most vocal on this front, predicting Arena will gain just below 40% of its revenue from treatment, substantially lower than what the company has predicted.

Without question there are legitimate concerns investors should be aware of when it comes to ARNA, namely that the company’s shares have already jumped more than 500% for the year. That leaves many to question whether or not ARNA has already peaked. With shares as high as they are right now it may make sense to wait for a pullback and if Vivus gets that approval next week there will almost certainly be a downturn for ARNA shares which could then provide an excellent opportunity for investors to build a position.

http://www.otcequity.com/?p=2331

wie hoch schätzt ihr die chance der zulassung für vvus ? bis jetzt hat man ja von fda bezüglich nachfragen, die zu einer verzögerung der zulassung führen, nichts gehört

sorry falsches thread

In diesem Schreiben wird noch einmal auf die bewusste " Manipulation" von JIM CRAMER eingegangen und seine Aussagen bzgl. Belviq kritisch beleuchtet und widerlegt...

REAL PHYSICIAN: CRAMER REBUTTAL

11-Jul-12 09:14 am

A very important (but never discussed) point about anti-obesity treatment is what real physicians will prescribe for their patients in coming years. I have discussed with many of my fellow M.D.s, and almost all of us are going with BELVIQ instead of QNEXA, regardless of a CRL delay with the latter.

1) We physicians all well remember the recurrent valvulopathies and pulmonary hypertension that occurred with Fen/Fen. QNEXA will contain phentermine (the first FEN). We have a right and sacred responsibility to assess risk vs. potential benefits for every patient for which we write prescriptions. Belviq causes none of these problems (less than placebo controls) in FDA data.

2) The media (and Jim Cramer) have it all wrong as far as Belviq efficacy in weight loss and he misrepresented Belviq last night.

*****The AVERAGE WEIGHT LOSS WITH BELVIQ IS 8% OF BODY WEIGHT AMONG RESPONDERS. About 50% of patients will lose MORE than 5% of BW in 12 weeks. If not, they need to stop it. Among those that do reach this threshold, 35% lost > 10% of BW, and the top 25% of responders lost > 16.7% of BW!

3) Cramer is mistaken regarding his interpretation of FDA data. Regarding weight loss efficacy, he related BELVIQ was not placebo-controlled, and QNEXA’s data was. Wrong! He has it just backwards. BELVIQ’s data was placebo-controlled, and QNEXA was not. This makes a huge difference in accuracy of drug efficacy.

4) Cramer stated that around 60-70% of patients will not respond to BLEVIQ. Wrong again. The real answer is 47.5% will not lose more than 5%, which makes them classified as non-responders. Nevertheless, do not ever underestimate the power of 5%-8% of weight loss. It can have dramatic effects on overall health, with significant reductions in incidence of Type II diabetes mellitus, coronary vascular disease, hyperlipidemias, sleep apnea, stroke , and even malignancy reduction. Our patients will feel much better about their overall health, and can use the psychological improvement to exercise more, with reduction in pain from osteoarthritis in weight bearing joints.

5) Cramer made another blunder in attempting to use scare tactics about “hallucinations” with BELVIQ. The incidence of hallucinations is ridiculously miniscule as to the absurd. We will not go into the significantly elevated risk of cleft lip incidence in babies born of QNEXA mothers, and the mind-numbing “dopey” side effect of topiramate (called “DOPAMAX”). Who needs that? None of this was discussed by Cramer.

6) Cramer misrepresented BELVIQ’s earnings potential because of “limited numbers of Easai drug reps in America”. How hard would it be to train any drug rep about a medication that will change America’s heath?

7) Cramer misrepresented BELVIQ ‘s earnings potential because of its marketing company taking about 40% of its revenues in the United States. He neglected to mention that outside the U.S (Europe, Latin America, and Asia), ARNA will get significantly more, if not all, of the earnings.

8) Cramer said QNEXA will not need to be a scheduled prescription, and BELVIQ will. He got this just backwards as well . It is highly likely QNEXA will be scheduled. BELVIQ has yet to be determined, but far less likely as highly classified as QNEXA, meaning more restrictions on it. QNEXA will have to be mail ordered, whereas most all pharmacies will actually stock BELVIQ.

9) Finally, the ultimate blunder is that Cramer blatantly said that NO INSURANCE COMPANY WILL EVER COVER AND ANTI-OBESITY MED? Why? Because he had asked one! This is preposterous, because as we all know, covered formulary changes take time. When insurance companies can actually SAVE $, by eliminating other costly meds by addressing the root health problem (obesity), instead of its sequellae, we will have stumbled on a major solution to the cost of healthcare in America!

Sentiment : Strong Buy

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…" target="_blank" rel="nofollow ugc noopener">

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…[/quote]

REAL PHYSICIAN: CRAMER REBUTTAL

11-Jul-12 09:14 am

A very important (but never discussed) point about anti-obesity treatment is what real physicians will prescribe for their patients in coming years. I have discussed with many of my fellow M.D.s, and almost all of us are going with BELVIQ instead of QNEXA, regardless of a CRL delay with the latter.

1) We physicians all well remember the recurrent valvulopathies and pulmonary hypertension that occurred with Fen/Fen. QNEXA will contain phentermine (the first FEN). We have a right and sacred responsibility to assess risk vs. potential benefits for every patient for which we write prescriptions. Belviq causes none of these problems (less than placebo controls) in FDA data.

2) The media (and Jim Cramer) have it all wrong as far as Belviq efficacy in weight loss and he misrepresented Belviq last night.

*****The AVERAGE WEIGHT LOSS WITH BELVIQ IS 8% OF BODY WEIGHT AMONG RESPONDERS. About 50% of patients will lose MORE than 5% of BW in 12 weeks. If not, they need to stop it. Among those that do reach this threshold, 35% lost > 10% of BW, and the top 25% of responders lost > 16.7% of BW!

3) Cramer is mistaken regarding his interpretation of FDA data. Regarding weight loss efficacy, he related BELVIQ was not placebo-controlled, and QNEXA’s data was. Wrong! He has it just backwards. BELVIQ’s data was placebo-controlled, and QNEXA was not. This makes a huge difference in accuracy of drug efficacy.

4) Cramer stated that around 60-70% of patients will not respond to BLEVIQ. Wrong again. The real answer is 47.5% will not lose more than 5%, which makes them classified as non-responders. Nevertheless, do not ever underestimate the power of 5%-8% of weight loss. It can have dramatic effects on overall health, with significant reductions in incidence of Type II diabetes mellitus, coronary vascular disease, hyperlipidemias, sleep apnea, stroke , and even malignancy reduction. Our patients will feel much better about their overall health, and can use the psychological improvement to exercise more, with reduction in pain from osteoarthritis in weight bearing joints.

5) Cramer made another blunder in attempting to use scare tactics about “hallucinations” with BELVIQ. The incidence of hallucinations is ridiculously miniscule as to the absurd. We will not go into the significantly elevated risk of cleft lip incidence in babies born of QNEXA mothers, and the mind-numbing “dopey” side effect of topiramate (called “DOPAMAX”). Who needs that? None of this was discussed by Cramer.

6) Cramer misrepresented BELVIQ’s earnings potential because of “limited numbers of Easai drug reps in America”. How hard would it be to train any drug rep about a medication that will change America’s heath?

7) Cramer misrepresented BELVIQ ‘s earnings potential because of its marketing company taking about 40% of its revenues in the United States. He neglected to mention that outside the U.S (Europe, Latin America, and Asia), ARNA will get significantly more, if not all, of the earnings.

8) Cramer said QNEXA will not need to be a scheduled prescription, and BELVIQ will. He got this just backwards as well . It is highly likely QNEXA will be scheduled. BELVIQ has yet to be determined, but far less likely as highly classified as QNEXA, meaning more restrictions on it. QNEXA will have to be mail ordered, whereas most all pharmacies will actually stock BELVIQ.

9) Finally, the ultimate blunder is that Cramer blatantly said that NO INSURANCE COMPANY WILL EVER COVER AND ANTI-OBESITY MED? Why? Because he had asked one! This is preposterous, because as we all know, covered formulary changes take time. When insurance companies can actually SAVE $, by eliminating other costly meds by addressing the root health problem (obesity), instead of its sequellae, we will have stumbled on a major solution to the cost of healthcare in America!

Sentiment : Strong Buy

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…" target="_blank" rel="nofollow ugc noopener">

http://messages.finance.yahoo.com/Stocks_%28A_to_Z%29/Stocks…[/quote]

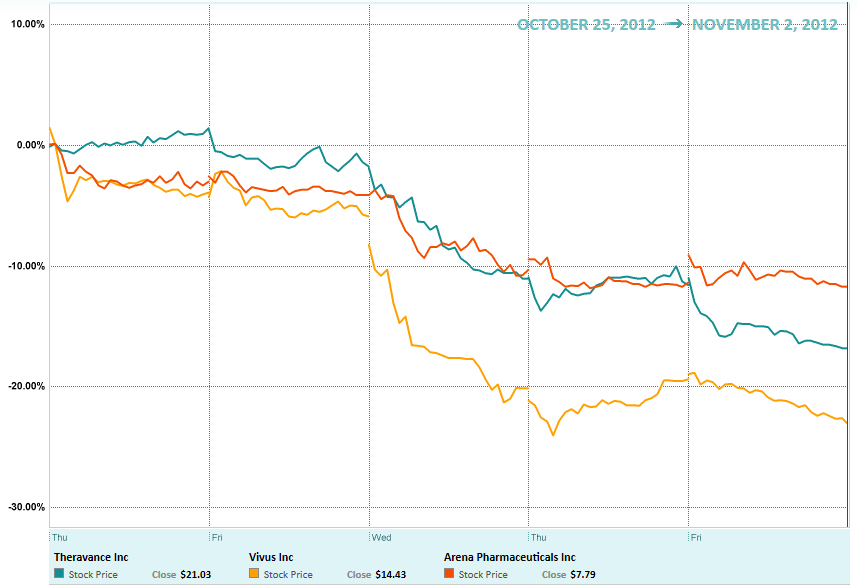

The Time To Buy Arena Pharmaceuticals Is Now

July 16, 2012

One of the benefits for investors who focus in specific sectors is that new opportunities can come from research. While researching Theravance (THRX) and Valeant (VRX) over the last few quarters, Arena Pharmaceuticals (ARNA) came up recently. A number of readers bought Arena when shares traded below $6. This leaves investors noticing shares at the current price paying two-fold or more.

Theravance and its partner GlaxoSmithKline PLC (GSK) reported positive results from four Phase III tests for the treatment of chronic obstructive pulmonary disease ("COPD"). Theravance and GSK are testing LAMA/LABA, which is a mix of two molecules, in four 24-week long studies. LAMA/LABA are two molecules that dilate the bronchial passages.

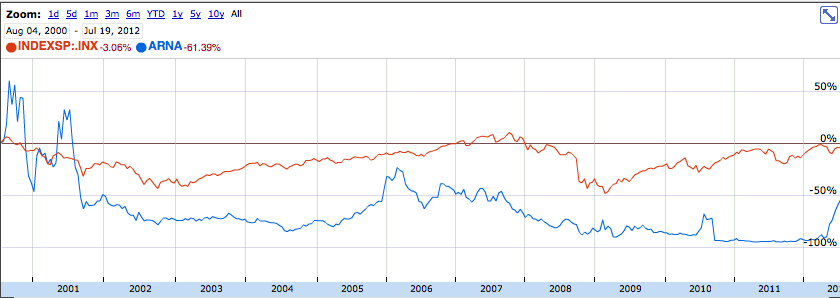

Theravance rose from $18 to $29.49 in recent weeks, up over 60%. Theravance runs the risk of dropping as investors lock gains. The company is worth another look if Theravance files for a regulatory filing for COPD treatment in late-2012. By comparison, Arena is up 8-fold from its 52-week low: should investors new to Arena be initiating a position in the company?

As readers will already be aware, the Food and Drug Administration approved Arena's obesity drug, Belviq, the first weight-loss drug in 13 years. Belviq is known chemically as lorcaserin. Two other firms are trying to gain approval for the same kind of drug: Vivus Inc. (VVUS) and Orexigen Therapeutics (OREX).

There are six reasons why Arena is a company to consider buying:

1) Wall Street Wants Arena to Fall

When Arena gained approval, shares opened at $13.50, but ended the day slightly above $11, a gain of nearly 30%. Shares did not rally because 25% of the shares are institution-owned and 75% retail-owned. By comparison, VVUS is 68% institution-owned, which means Wall Street would favor VVUS over Arena. In addition, short-interest was 46 million shares as of June 29 2012.

A bias for negative news will give new investors an opportunity to start a position in the company at a discount.

2) Takeover Candidate

Arena filed for marketing approval in Switzerland on July 11, which means the company will need an European partner for distribution. A larger pharmaceutical company might want to buy Arena before the company finds a partner to share marketing and distribution costs. As Arena continues to establish global distribution, the value of the company will keep going up.

3) Threat of Qnexa Exaggerated

Qnexa is still awaiting further reviews due to safety concerns.

Qnexa is a combination of phentermine and topiramate. Topiramate, an appetite surpressor, is known to cause birth defects. Phentermine works by increasing metabolism, but is only for short-term use. The onset of tolerance may be followed by a rebound in weight gain.

The results of the FORTRESS (Fetal Outcome Retrospective Topiramte Exposure Study) is still interim, since VVUS did not perform data validation on the results.

4) Arena Insiders Are More Bullish than VVUS Insiders

In 2012, VVUS insiders sold 1.7 million shares for a cumulative market total of $37.4 million as of June 27 2012:

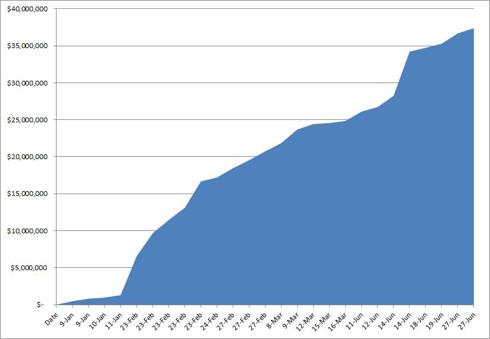

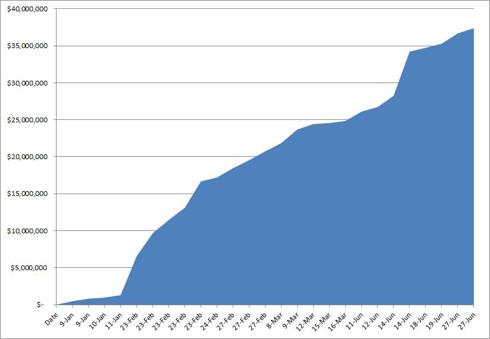

Cumulative Total of VVUS Insider Sales:

By comparison, Arena insiders sold just 177,495 shares valued at just $1.7 million.

5) Skepticism for Belviq Exaggerated

In the BLOSSOM ((Behavioral modification and Lorcaserin Second Study for Obesity Management) study, 63% of the participants who completed the trial lost at least 5% of their body weight. 35% lost at least 10% of their body weight. The long-term benefit was clear: patients lost an average of 17.0 pounds, or 7.9% of their body weight.

6) High Revenue Potential

There are a number of assumptions that need to be made to determine a range of values for Arena. Assuming Belviq will sell for between $2 and $4 per day, and taken twice daily, the revenue per patient per year is:

Revenue Per Patient / Year

Low

$2,920

High

$5,840

There are 78 million Americans who are considered obese, which investors might incorrectly think is be the sales size for the drug. The revenue range for Belviq is enormously wide, at between $228 million and $228 billion:

% Obesity Market (U.S.) # Receiving Treatment Market Size (Low-end)Market Size (High-end)

100% 78,000,000 $227,760,000,000 $455,520,000,000

75% 58,500,000 $170,820,000,000 $341,640,000,000

50% 39,000,000 $113,880,000,000 $227,760,000,000

25% 19,500,000 $56,940,000,000 $113,880,000,000

10% 7,800,000 $22,776,000,000 $45,552,000,000

5% 3,900,000 $11,388,000,000 $22,776,000,000

4% 3,120,000 $9,110,400,000 $18,220,800,000

3% 2,340,000 $6,832,800,000 $13,665,600,000

2% 1,560,000 $4,555,200,000 $9,110,400,000

1% 780,000 $2,277,600,000 $4,555,200,000

0.50% 390,000 $1,138,800,000 $2,277,600,000

0.25% 195,000 $569,400,000 $1,138,800,000

0.10% 78,000 $227,760,000 $455,520,000

Investors should assume worst case scenarios for Arena: no more than 5% (4 million) seek treatment for obesity, with 10% choosing Belviq. After 12-weeks of usage, assume only 33% continue treatment.

The resultant revenue would be between $387 - $774 million:

% Obesity Market (U.S.) # Receiving Treatment Revenue (Low-end) $ Revenue (High-end) $

0.20% 156,000 455,520,000 911,040,000

0.17% 132,600 387,192,000 774,384,000

0.15% 117,000 341,640,000 683,280,000

0.10% 78,000 227,760,000 455,520,000

The resulting earnings and forward P/E at a 25% margin for Arena would be:

% Obesity Market (U.S.)

EPS at 25% Margin (LOW) EPS at 25% Margin (High) P/E (High) P/E

0.25% 0.58 1.16 19.36 9.68

0.25% 0.49 0.98 22.77 11.39

0.25% 0.43 0.87 25.81 12.9

0.10% 0.29 0.58 38.71 19.36

Arena's partner, Eisai, will pay Arena between $40 and $60 million. The conservative payment amount from Eisai should temper investor expectations on the initial sales strength for Belviq and the valuation for Arena.

From its 10k filing on May 2012:

If lorcaserin is approved for US marketing, and upon the delivery of product supply for launch, we will also receive a milestone payment from Eisai of $40.0 million or $60.0 million, depending on the approved drug label.

Conclusion:

There is no doubt that Arena's obesity drug will be successful. The recent surge in shares makes Arena a riskier play than when shares traded below $6. Still, Arena has a product that is safe, and sales will grow as Arena and Eisai market and distribute the product. A share pull-back is likely to be minimal, but the long-term upside is enormous. More importantly, investors who want to start a position in Arena are paying an estimated forward-P/E of between 11.4 and 22.8.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in ARNA over the next 72 hours.

http://seekingalpha.com/article/722811-the-time-to-buy-arena…

July 16, 2012

One of the benefits for investors who focus in specific sectors is that new opportunities can come from research. While researching Theravance (THRX) and Valeant (VRX) over the last few quarters, Arena Pharmaceuticals (ARNA) came up recently. A number of readers bought Arena when shares traded below $6. This leaves investors noticing shares at the current price paying two-fold or more.

Theravance and its partner GlaxoSmithKline PLC (GSK) reported positive results from four Phase III tests for the treatment of chronic obstructive pulmonary disease ("COPD"). Theravance and GSK are testing LAMA/LABA, which is a mix of two molecules, in four 24-week long studies. LAMA/LABA are two molecules that dilate the bronchial passages.

Theravance rose from $18 to $29.49 in recent weeks, up over 60%. Theravance runs the risk of dropping as investors lock gains. The company is worth another look if Theravance files for a regulatory filing for COPD treatment in late-2012. By comparison, Arena is up 8-fold from its 52-week low: should investors new to Arena be initiating a position in the company?

As readers will already be aware, the Food and Drug Administration approved Arena's obesity drug, Belviq, the first weight-loss drug in 13 years. Belviq is known chemically as lorcaserin. Two other firms are trying to gain approval for the same kind of drug: Vivus Inc. (VVUS) and Orexigen Therapeutics (OREX).

There are six reasons why Arena is a company to consider buying: