II-VI Incorporated (Seite 7)

eröffnet am 08.06.15 13:34:52 von

neuester Beitrag 21.06.23 21:35:26 von

neuester Beitrag 21.06.23 21:35:26 von

Beiträge: 85

ID: 1.213.809

ID: 1.213.809

Aufrufe heute: 0

Gesamt: 9.462

Gesamt: 9.462

Aktive User: 0

ISIN: US19247G1076 · WKN: A3DQXS · Symbol: H7B

51,60

EUR

+4,67 %

+2,30 EUR

Letzter Kurs 26.04.24 Tradegate

Neuigkeiten

25.03.24 · Business Wire (engl.) |

Plug Power, AT&T und Co: Jim Cramer hasst diese 11 Aktien – aber milliardenschwere Investoren lieben sie!(1) 28.01.24 · wallstreetONLINE Redaktion |

16.01.24 · wO Chartvergleich |

17.05.23 · Sharedeals |

Werte aus der Branche Elektrogeräte

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3000 | +71.367,84 | |

| 25,12 | +39,05 | |

| 0,7000 | +32,08 | |

| 0,5900 | +31,11 | |

| 1,0400 | +28,38 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,1100 | -9,75 | |

| 2,0200 | -9,82 | |

| 25,26 | -10,68 | |

| 3,1400 | -11,55 | |

| 4,0000 | -33,33 |

Beitrag zu dieser Diskussion schreiben

Ja, 1,18 pro Aktie. Fett. Und gleich den Bach runter.

vorgestern kamen die Jahreszahlen:

Gewinn 108 MUSD => KGV rund 22

Antwort auf Beitrag Nr.: 58.391.706 von R-BgO am 07.08.18 15:33:25

short-put Jul19@$25 zu 2,59

=> eingesetztes Kapital je Aktie $22,41, gibt 11,6% Seitwärts-Rendite in 7 Monaten

der Kauf war nix vom Timing her,

heute ergänzend:short-put Jul19@$25 zu 2,59

=> eingesetztes Kapital je Aktie $22,41, gibt 11,6% Seitwärts-Rendite in 7 Monaten

II-VI Incorporated to Acquire Finisar, Creating Transformative Strategic Combination with Leading Positions in Photonics and Compound Semiconductors

Fri November 9, 2018 5:07 AM|GlobeNewswire|About: FNSR, IIVI

-Strategic combination expected to drive significant value creation through increased scale, broadened technological base, complementary product roadmaps, and leadership positions in fast-growing markets

-$150 million of expected run-rate cost synergies realized within 36 months of close

-Transaction expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter

-II-VI (IIVI) and Finisar (FNSR) to host conference call today at 8:00 AM ET to discuss transaction

PITTSBURGH and SUNNYVALE, Calif., Nov. 09, 2018 (GLOBE NEWSWIRE) --

II-VI Incorporated, a global leader in engineered materials and optoelectronic components, and Finisar Corporation, a global technology leader in optical communications, today announced that they have entered into a definitive merger agreement under which II-VI will acquire Finisar in a cash and stock transaction with an equity value of approximately $3.2 billion.

Under the terms of the merger agreement, which has been unanimously approved by the Boards of Directors of both companies, Finisar’s stockholders will receive, on a pro-rated basis, $15.60 per share in cash and 0.2218x shares of II-VI common stock, valued at $10.40 per share based on the closing price of II-VI’s common stock of $46.88 on November 8, 2018. The transaction values Finisar at $26.00 per share, or approximately $3.2 billion in equity value and represents a premium of 37.7% to Finisar’s closing price on November 8, 2018. Finisar shareholders would own approximately 31% of the combined company.

The combination of II-VI and Finisar would unite two innovative, industry leaders with complementary capabilities and cultures to form a formidable industry leading photonics and compound semiconductor company capable of serving the broad set of fast growing markets of communications, consumer electronics, military, industrial processing lasers, automotive semiconductor equipment and life sciences. Together, II-VI and Finisar will employ over 24,000 associates in 70 locations worldwide upon closing of the transaction.

“Disruptive megatrends driven by innovative uses of lasers and other engineered materials present huge growth opportunities for both of our companies,” said Dr. Vincent D. Mattera, Jr., President and CEO, II-VI Incorporated. “In communications, materials processing, consumer electronics and automotive, we expect that the combination with Finisar will allow us to leverage our combined technology and intellectual property in InP, GaAs, SiC, GaN, SiP and diamond to achieve faster time to market, cost and scale. Together, we believe that we will be better strategically positioned to play a strong leadership role in the emerging markets of 5G, 3D sensing, cloud computing, electric and autonomous vehicles, and advanced microelectronics manufacturing.”

Dr. Mattera continued, “We have long admired Finisar and have a great deal of regard for its founders and its talented global team. Our companies both have a long history of focusing on innovation, breakthrough solutions and competitive follow-through by manufacturing high quality products for our customers, and we look forward to welcoming Finisar to the II-VI family and further strengthening our competitive position in the industry.”

“The combination of our state-of-the-art technology platforms, deep customer relationships, great assets and amazing talent will enhance our ability to hit market windows that won’t stay open for long,” said Michael Hurlston, Finisar’s CEO. “This combination will accelerate our collective growth and will take advantage of the technology, products and manufacturing expertise that Finisar has uniquely developed over the course of its 30 year history.”

Mr. Hurlston added, “We are extremely excited to combine Finisar with II-VI and together create a leader in photonics and compound semiconductors across all of the markets we serve. We are confident that the growth potential for the combined company is substantial, and we believe that our respective shareholders will be able to enjoy significant potential for value creation when the transaction is completed.”

Compelling Strategic Rationale

As a combined company, II-VI and Finisar will continue to leverage their leading-edge innovation and commercialization of complex technologies to maximize value through vertical integration and manufacturing scale. The core competencies of the two companies in innovation and manufacturing will complement each other at all levels of the value chain, including in the following strategic areas:

* A Stronger Position in Optical Communications: The combined company will provide a full line and scalable supply of high performance Datacom transceivers, products based on coherent transmission technology and ROADM solutions based on more than 30 years of industry leadership. It will market products into next-generation undersea, long-haul and metro networks, hyperscale datacenters and in 5G optical infrastructure.

* Compelling Platform for 3D Sensing & LiDAR: The combined optoelectronics technology leadership based on GaAs and InP compound semiconductor laser design platforms, together with one of the world’s largest 6-inch vertically integrated epitaxial growth and device fabrication manufacturing platforms, will enable faster time to market for a greater number of opportunities in 3D sensing and LiDAR.

* Combined Capabilities Unlock Access to Larger Markets: The broad portfolio of differentiated engineered materials, including GaAs, InP, SiC, GaN and diamond together with a critical mass of optoelectronic, optical and integrated circuit device design expertise and related intellectual property, will unlock access to larger markets in RF devices for next-generation wireless and military applications, as well as power electronics for electric cars and green energy.

* Maximizing Value Creation through Vertical Integration: Deep vertical integration of core technologies ranging from engineered materials to high value-add solutions, enabled by differentiated components, will provide the combined company with a strong foundation to capitalize on a broad range of emerging opportunities while making the overall markets even more competitive.

Driving Enhanced Financial Performance

In addition to the compelling strategic benefits, the combination of II-VI and Finisar will:

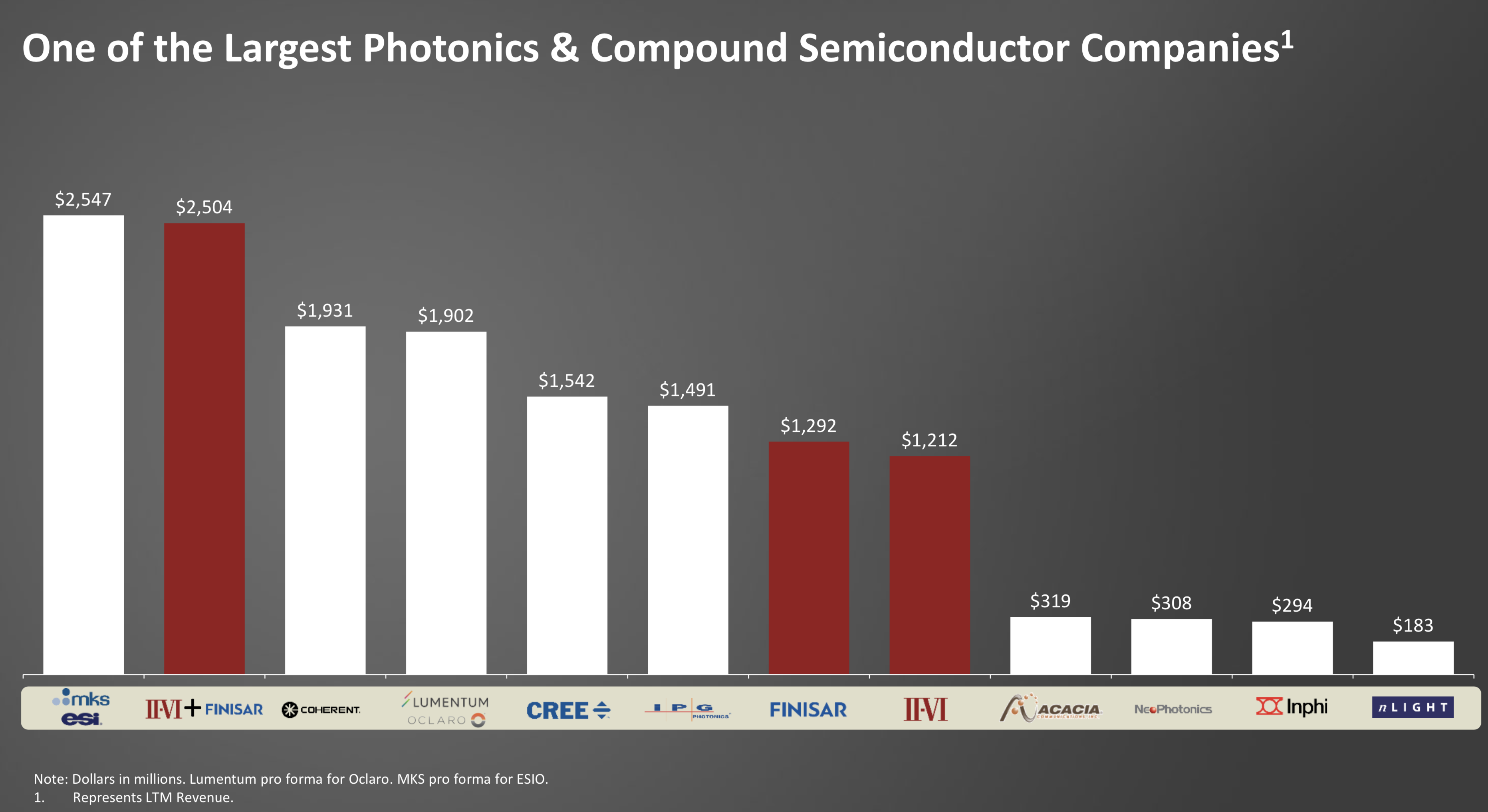

* Accelerate Revenue Growth: On a pro forma basis, the combined company had approximately $2.5 billion of annual revenue. The combined broad base of talent, technology and manufacturing is expected to enhance the ability to better address near-to medium-term opportunities and accelerate revenue growth.

* Provide Significant Synergy Potential: The combined company expects to realize $150 million of run-rate cost synergies within 36 months of closing. Synergies are expected to be achieved from procurement savings, internal supply of materials and components, efficient research and development, consolidation of overlapping costs and sales and marketing efficiencies.

* Strengthen Earnings Accretion: The transaction is expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter.

Transaction Details

II-VI intends to fund the cash consideration with a combination of cash on hand from the combined companies' balance sheets and $2 billion in funded debt financing. The transaction is expected to close in the middle of calendar year 2019, subject to approval by each company’s shareholders, antitrust regulatory approvals and other customary closing conditions.

Fri November 9, 2018 5:07 AM|GlobeNewswire|About: FNSR, IIVI

-Strategic combination expected to drive significant value creation through increased scale, broadened technological base, complementary product roadmaps, and leadership positions in fast-growing markets

-$150 million of expected run-rate cost synergies realized within 36 months of close

-Transaction expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter

-II-VI (IIVI) and Finisar (FNSR) to host conference call today at 8:00 AM ET to discuss transaction

PITTSBURGH and SUNNYVALE, Calif., Nov. 09, 2018 (GLOBE NEWSWIRE) --

II-VI Incorporated, a global leader in engineered materials and optoelectronic components, and Finisar Corporation, a global technology leader in optical communications, today announced that they have entered into a definitive merger agreement under which II-VI will acquire Finisar in a cash and stock transaction with an equity value of approximately $3.2 billion.

Under the terms of the merger agreement, which has been unanimously approved by the Boards of Directors of both companies, Finisar’s stockholders will receive, on a pro-rated basis, $15.60 per share in cash and 0.2218x shares of II-VI common stock, valued at $10.40 per share based on the closing price of II-VI’s common stock of $46.88 on November 8, 2018. The transaction values Finisar at $26.00 per share, or approximately $3.2 billion in equity value and represents a premium of 37.7% to Finisar’s closing price on November 8, 2018. Finisar shareholders would own approximately 31% of the combined company.

The combination of II-VI and Finisar would unite two innovative, industry leaders with complementary capabilities and cultures to form a formidable industry leading photonics and compound semiconductor company capable of serving the broad set of fast growing markets of communications, consumer electronics, military, industrial processing lasers, automotive semiconductor equipment and life sciences. Together, II-VI and Finisar will employ over 24,000 associates in 70 locations worldwide upon closing of the transaction.

“Disruptive megatrends driven by innovative uses of lasers and other engineered materials present huge growth opportunities for both of our companies,” said Dr. Vincent D. Mattera, Jr., President and CEO, II-VI Incorporated. “In communications, materials processing, consumer electronics and automotive, we expect that the combination with Finisar will allow us to leverage our combined technology and intellectual property in InP, GaAs, SiC, GaN, SiP and diamond to achieve faster time to market, cost and scale. Together, we believe that we will be better strategically positioned to play a strong leadership role in the emerging markets of 5G, 3D sensing, cloud computing, electric and autonomous vehicles, and advanced microelectronics manufacturing.”

Dr. Mattera continued, “We have long admired Finisar and have a great deal of regard for its founders and its talented global team. Our companies both have a long history of focusing on innovation, breakthrough solutions and competitive follow-through by manufacturing high quality products for our customers, and we look forward to welcoming Finisar to the II-VI family and further strengthening our competitive position in the industry.”

“The combination of our state-of-the-art technology platforms, deep customer relationships, great assets and amazing talent will enhance our ability to hit market windows that won’t stay open for long,” said Michael Hurlston, Finisar’s CEO. “This combination will accelerate our collective growth and will take advantage of the technology, products and manufacturing expertise that Finisar has uniquely developed over the course of its 30 year history.”

Mr. Hurlston added, “We are extremely excited to combine Finisar with II-VI and together create a leader in photonics and compound semiconductors across all of the markets we serve. We are confident that the growth potential for the combined company is substantial, and we believe that our respective shareholders will be able to enjoy significant potential for value creation when the transaction is completed.”

Compelling Strategic Rationale

As a combined company, II-VI and Finisar will continue to leverage their leading-edge innovation and commercialization of complex technologies to maximize value through vertical integration and manufacturing scale. The core competencies of the two companies in innovation and manufacturing will complement each other at all levels of the value chain, including in the following strategic areas:

* A Stronger Position in Optical Communications: The combined company will provide a full line and scalable supply of high performance Datacom transceivers, products based on coherent transmission technology and ROADM solutions based on more than 30 years of industry leadership. It will market products into next-generation undersea, long-haul and metro networks, hyperscale datacenters and in 5G optical infrastructure.

* Compelling Platform for 3D Sensing & LiDAR: The combined optoelectronics technology leadership based on GaAs and InP compound semiconductor laser design platforms, together with one of the world’s largest 6-inch vertically integrated epitaxial growth and device fabrication manufacturing platforms, will enable faster time to market for a greater number of opportunities in 3D sensing and LiDAR.

* Combined Capabilities Unlock Access to Larger Markets: The broad portfolio of differentiated engineered materials, including GaAs, InP, SiC, GaN and diamond together with a critical mass of optoelectronic, optical and integrated circuit device design expertise and related intellectual property, will unlock access to larger markets in RF devices for next-generation wireless and military applications, as well as power electronics for electric cars and green energy.

* Maximizing Value Creation through Vertical Integration: Deep vertical integration of core technologies ranging from engineered materials to high value-add solutions, enabled by differentiated components, will provide the combined company with a strong foundation to capitalize on a broad range of emerging opportunities while making the overall markets even more competitive.

Driving Enhanced Financial Performance

In addition to the compelling strategic benefits, the combination of II-VI and Finisar will:

* Accelerate Revenue Growth: On a pro forma basis, the combined company had approximately $2.5 billion of annual revenue. The combined broad base of talent, technology and manufacturing is expected to enhance the ability to better address near-to medium-term opportunities and accelerate revenue growth.

* Provide Significant Synergy Potential: The combined company expects to realize $150 million of run-rate cost synergies within 36 months of closing. Synergies are expected to be achieved from procurement savings, internal supply of materials and components, efficient research and development, consolidation of overlapping costs and sales and marketing efficiencies.

* Strengthen Earnings Accretion: The transaction is expected to drive accretion in Non-GAAP earnings per share for the first full year post close of approximately 10% and more than double that thereafter.

Transaction Details

II-VI intends to fund the cash consideration with a combination of cash on hand from the combined companies' balance sheets and $2 billion in funded debt financing. The transaction is expected to close in the middle of calendar year 2019, subject to approval by each company’s shareholders, antitrust regulatory approvals and other customary closing conditions.

Antwort auf Beitrag Nr.: 58.391.676 von R-BgO am 07.08.18 15:30:24

Kauf zu ,40

vorerst ohne Veroptionierung

Antwort auf Beitrag Nr.: 55.488.207 von R-BgO am 09.08.17 13:30:13

bärenstarke Zahlen heute

Kurs rund +8% vorbörslich

Antwort auf Beitrag Nr.: 53.530.431 von R-BgO am 22.10.16 10:29:21wieder mal ein Guter durch die Lappen gegangen...

II-VI posts 4Q profit [Associated Press] Associated PressAugust 8, 2017

SAXONBURG, Pa. (AP) _ II-VI Inc. (IIVI) on Monday reported fiscal fourth-quarter profit of $32.6 million. On a per-share basis, the Saxonburg, Pennsylvania-based company said it had profit of 50 cents. The Laser and optics manufacturer posted revenue of $273.7 million in the period. For the year, the company reported profit of $95.3 million, or $1.48 per share. Revenue was reported as $972 million. For the current quarter ending in October, II-VI said it expects revenue in the range of $250 million to $260 million. II-VI shares have risen 19 percent since the beginning of the year. The stock has climbed 72 percent in the last 12 months.https://finance.yahoo.com/news/ii-vi-posts-4q-profit-1228464…

50 cent .. neues Rekord-Quartalergebnis. Die Vision von 2$ eps/share ist soo weit nicht. Die Aktie ist volatil: Kursgewinne werden schnell abverkauft - das sind Spielchen Der Trend ist glasklar. Wer Zeit und Lust zum Traden hat, kann schön hebeln.

Antwort auf Beitrag Nr.: 54.300.299 von tippse am 12.02.17 10:43:03

Speaking of still further of iPhone, The Benchmark Company’s Mark Miller today defends a Buy rating, and a $40 price target, on shares of laser maker II-VI (IIVI), writing that rumors yesterday about delays in the production of the iPhone 8 are not something to get upset over.

http://blogs.barrons.com/techtraderdaily/2017/04/06/tech-tod…

Der Chart hat sich die Birne zweimal an 40$ blutig geschlagen - die Kurse erreichen aber wieder Kaufniveau und ich sammle mal wieder ein - selbst 40$ target wären 20% von hier aus

iPHONE 8 ...

es wird kolportiert, dass II-VI mit Komponenten in den Zusammenhang mit dem neuen Apple i-Phone gebracht wird ... wie auch immer: buy on rumors ...

Speaking of still further of iPhone, The Benchmark Company’s Mark Miller today defends a Buy rating, and a $40 price target, on shares of laser maker II-VI (IIVI), writing that rumors yesterday about delays in the production of the iPhone 8 are not something to get upset over.

http://blogs.barrons.com/techtraderdaily/2017/04/06/tech-tod…

Der Chart hat sich die Birne zweimal an 40$ blutig geschlagen - die Kurse erreichen aber wieder Kaufniveau und ich sammle mal wieder ein - selbst 40$ target wären 20% von hier aus

Plug Power, AT&T und Co: Jim Cramer hasst diese 11 Aktien – aber milliardenschwere Investoren lieben sie!(1) 28.01.24 · wallstreetONLINE Redaktion · Verizon Communications |

16.01.24 · wO Chartvergleich · Berkshire Hathaway Registered (A) |

17.05.23 · Sharedeals · Coherent |