Deutlich unterbewertete kanadische Fintech-Firma? (Seite 25)

eröffnet am 14.10.15 14:49:55 von

neuester Beitrag 21.03.24 10:40:52 von

neuester Beitrag 21.03.24 10:40:52 von

Beiträge: 670

ID: 1.219.959

ID: 1.219.959

Aufrufe heute: 0

Gesamt: 66.582

Gesamt: 66.582

Aktive User: 0

ISIN: CA60800C2085 · WKN: A3ESDA · Symbol: SGC

1,7000

EUR

-2,30 %

-0,0400 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

03.05.24 · Business Wire (engl.) |

01.05.24 · Business Wire (engl.) |

17.04.24 · Business Wire (engl.) |

27.03.24 · Business Wire (engl.) |

21.03.24 · Business Wire (engl.) |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 32,00 | +27,95 | |

| 0,5800 | +23,40 | |

| 6,1100 | +18,64 | |

| 5,9000 | +15,69 | |

| 0,8600 | +14,67 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2200 | -11,59 | |

| 14,750 | -14,14 | |

| 1,8775 | -14,17 | |

| 1,2600 | -16,00 | |

| 1.138,25 | -16,86 |

Beitrag zu dieser Diskussion schreiben

Early Warning Report of Michael Wekerle

GlobeNewswireThis press release is issued pursuant to National Instrument 62-104 - Take-Over Bids and Issuer Bids and National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with the filing of an early warning report dated the date hereof.

Michael Wekerle ("Wekerle") filed an early warning report today in connection with the acquisition by Difference Capital Financial Inc. ("DCF"), which is an associate of Wekerle, of 250,000 common shares (the "Shares") in the capital of Mogo Finance Technology Inc. ("Mogo") through the facilities of the Toronto Stock Exchange at a price of $4.10 per share (the "Transaction"). Wekerle relied upon the private agreement exemption contained in Section 4.2 of National Instrument 62-104 - Take-Over Bids and Issuer Bids to make this purchase.

Prior to the acquisition of the Shares, Wekerle held an aggregate of 2,550,972 Shares directly and DCF held 1,479,463 Shares. Wekerle also held an aggregate $2,000,000 principal amount of 10% senior secured convertible debentures of Mogo (the "Debentures") and DCF held $3,641,000 principal amount of Debentures. Each Debenture is convertible into Shares at a price per Share equal to $5.00. Assuming the conversion of all of the Debentures held by Wekerle and DCF, the two parties collectively had control or direction of an aggregate of 5,158,635 Shares, representing 21.9% of the issued and outstanding Shares. Following the acquisition of the Shares and assuming the conversion of all of the Debentures held by Wekerle and DCF, the two parties collectively have control or direction of an aggregate of 5,408,635 Shares, representing 22.9% of the issued and outstanding Shares.

The Shares were purchased by DCF for investment purposes. Wekerle expects to evaluate on an ongoing basis Mogo's financial condition, results of operations, business and prospects, the market price of the Shares, conditions in securities markets generally and in the market for shares of companies like Mogo, general economic and industry conditions and other factors that Wekerle deems relevant to his investment decisions. Based on such evaluations, Wekerle may at any time or from time to time determine to acquire additional Shares, or securities convertible into or exchangeable for Shares or derivatives relating to Shares, or to dispose of Shares or securities convertible into or exchangeable for Shares or derivatives relating to Shares that Wekerle owns or may hereafter acquire, through open market or privately negotiated transactions or otherwise, at such prices and on such terms as he deems advisable. Wekerle intends to monitor his investment in Shares. Wekerle and his representatives and advisers may communicate with other shareholders, industry participants and other interested parties concerning Mogo. In addition, based on Wekerle's continuing evaluation of the foregoing factors, Wekerle reserves the right to change his plans and intentions at any time or from time to time, as he deems appropriate.

The above-referenced early warning report relating to this press release has been filed on System for Electronic Document Analysis and Review (SEDAR) at www.sedar.com under Mogo's issuer profile. For further information or to obtain a copy of the early warning report please contact Kelly Pullen at 647-985-5798.

Read more at http://www.stockhouse.com/companies/bullboard#WgQtSbUSltTEwx…

Eine interessante Analyse von MOGO:

https://ceo.ca/@currencyfrontier/mogo-a-fast-growing-company…

https://ceo.ca/@currencyfrontier/mogo-a-fast-growing-company…

!

Dieser Beitrag wurde von FairMOD moderiert. Grund: themenfremder Inhalt

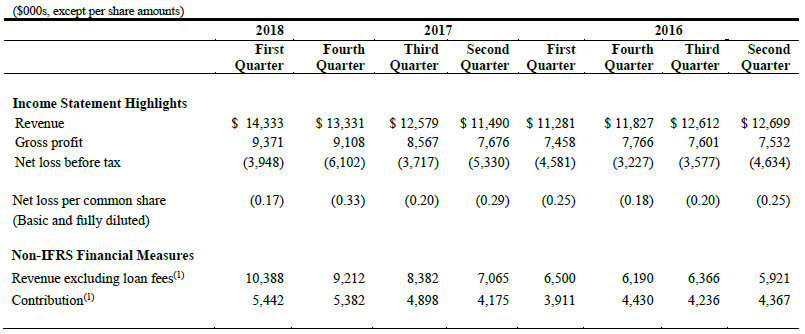

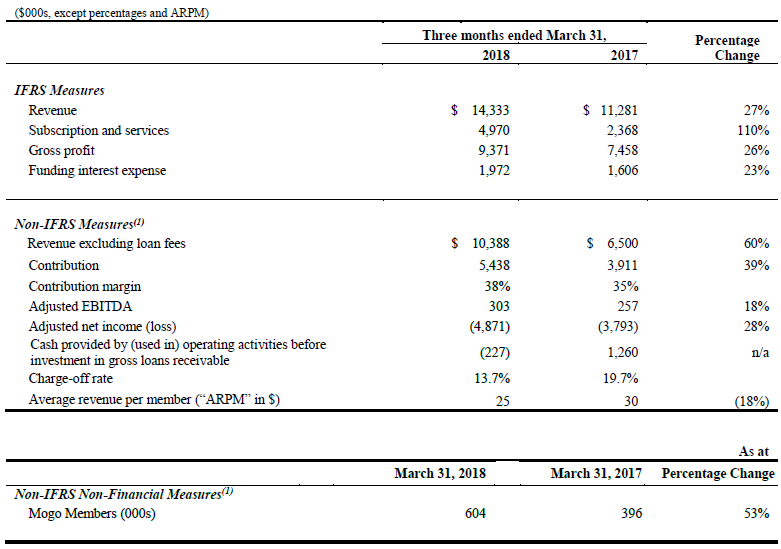

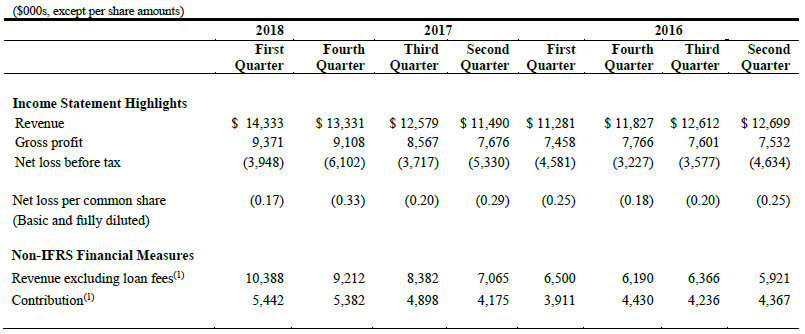

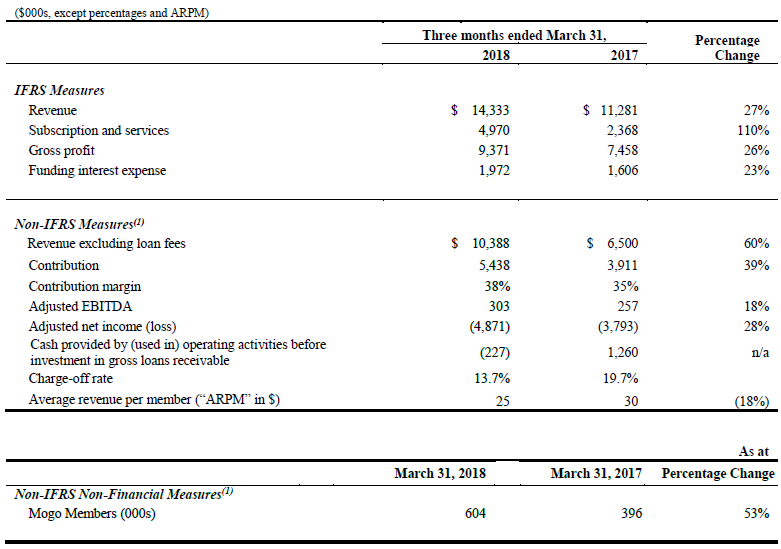

Das Umsatz- und Kunden-Wachstum (604'000 Members) ist grundsätzlich nicht so schlecht, meiner Meinung nach. Wirklich relevant sind die Zahlen bez. "Revenue excluding loan fees". Mogo steigt ja langsam aus dem Geschäft mit den kurzfristigen Darlehen (loan fees) aus, und somit interessiert in erster Linie das Umsatzwachstum ihrer aktuellen Kernprodukte.

Solange sie aber die hohen Quartalsverluste nicht in den Griff kriegen, wird auch der Kurs keine Freudensprünge machen. Geld ist zur Zeit genug vorhanden aber die kommenden Quartalszahlen müssen endlich zeigen, dass auch der Verlust nun stetig in die richtige Richtung läuft.

Den 4.8Mio CAD Quartalsverlust steht immerhin auch dieses Quartal wieder ein leicht positives EBITDA von 0.3Mio gegenüber. Der hohe Quartalsverlust wird begründet mit den Kosten für den Aufbau und die Lancierung der neuen Produkte MogoCrypto und MogoProtect.

Hier noch ein bisschen Originalton dazu:

Revenue excluding loan fees

Revenue excluding loan fees is calculated as total revenue less revenue from loan fees, which are related to the Company's legacy short-term loans. Revenue excluding loan fees increased by 60% for the three months ended March 31, 2018 when compared to the same period last year, driven primarily by subscription and services which increased by 110% during the same period. Interest revenue also contributed to revenue growth, increasing by 31.1% to $5.4 million for the three months ended March 31, 2018, compared to $4.1 million for the comparative period as we grew our gross loans receivable – long-term.

Revenue excluding loan fees is a measure used by our management and Board to understand and evaluate trends within our core products.

Adjusted EBITDA

The Company achieved positive adjusted EBITDA of $0.3 million during the three months ended March 31, 2018, which is consistent with the same period last year. This represents the Company’s seventh consecutive quarter of positive adjusted EBITDA. Growth in Contribution was partially offset by investments in Technology and Development and Marketing to develop and launch our new products including MogoProtect and MogoCrypto.

Solange sie aber die hohen Quartalsverluste nicht in den Griff kriegen, wird auch der Kurs keine Freudensprünge machen. Geld ist zur Zeit genug vorhanden aber die kommenden Quartalszahlen müssen endlich zeigen, dass auch der Verlust nun stetig in die richtige Richtung läuft.

Den 4.8Mio CAD Quartalsverlust steht immerhin auch dieses Quartal wieder ein leicht positives EBITDA von 0.3Mio gegenüber. Der hohe Quartalsverlust wird begründet mit den Kosten für den Aufbau und die Lancierung der neuen Produkte MogoCrypto und MogoProtect.

Hier noch ein bisschen Originalton dazu:

Revenue excluding loan fees

Revenue excluding loan fees is calculated as total revenue less revenue from loan fees, which are related to the Company's legacy short-term loans. Revenue excluding loan fees increased by 60% for the three months ended March 31, 2018 when compared to the same period last year, driven primarily by subscription and services which increased by 110% during the same period. Interest revenue also contributed to revenue growth, increasing by 31.1% to $5.4 million for the three months ended March 31, 2018, compared to $4.1 million for the comparative period as we grew our gross loans receivable – long-term.

Revenue excluding loan fees is a measure used by our management and Board to understand and evaluate trends within our core products.

Adjusted EBITDA

The Company achieved positive adjusted EBITDA of $0.3 million during the three months ended March 31, 2018, which is consistent with the same period last year. This represents the Company’s seventh consecutive quarter of positive adjusted EBITDA. Growth in Contribution was partially offset by investments in Technology and Development and Marketing to develop and launch our new products including MogoProtect and MogoCrypto.

Mogo Announces First Quarter 2018 Financial Results

https://www.prnewswire.com/news-releases/mogo-announces-firs… Mogo Extends Innovative Marketing Agreement with Canada's Largest News Media Company, Postmedia

Marketing collaboration extended until the end of 2020VANCOUVER, May 3, 2018 /CNW/ - Mogo Finance Technology Inc. (TSX:MOGO)(NASDAQ:MOGO)

("Mogo" or the "Company"), one of Canada's leading financial technology companies, today announced that it has extended the term of its marketing collaboration agreement with Postmedia Network Inc. ("Postmedia"), which provided a minimum media value of $50,000,000 over the first 3 years, for an additional 2 years beyond the end of the current agreement, covering calendar 2019 and 2020. The original agreement was executed and announced January 25, 2016.

Postmedia is a Canadian news media company representing more than 160 brands, including the National Post, Toronto Sun and Vancouver Sun, across multiple print, online, and mobile platforms. Postmedia reaches 18.7 million Canadians each month across its platforms, including 10.3 million adults through mobile properties.

"Postmedia has been an excellent partner and this relationship has been highly successful in driving Mogo's brand awareness, but perhaps more importantly, Mogo's credibility and trust with consumers. This is clearly demonstrated by both the growth in our member base, which has more than tripled since the start of the collaboration, as well as the accelerating growth of our subscription and fee based revenue," said Greg Feller, President & CFO of Mogo. "As we build Mogo into the 'go-to' financial app for the next generation of Canadians, the Postmedia relationship is a significant asset and advantage, allowing us to fuel new product launches and invest significantly in our brand in a capitalefficient manner."

"It's been great to be a part of the growth that Mogo has experienced in their business and brand over the last two years," said Andrew MacLeod, President and Chief Operating Officer of Postmedia. "We look forward to continuing our partnership with Mogo as they build one of the leading digital financial services brands in Canada."

The extended agreement provides for: 1) Mogo to receive a similar minimum annual media value from Postmedia to the original agreement and 2) Postmedia to receive a fixed cash quarterly payment equivalent to the Q4 2017 revenue share payment of approximately $525,000, instead of receiving a

percentage of Mogo's revenue.

In connection with the amendment of the agreement, Postmedia and Mogo have also agreed to change the vesting and term of the Performance Warrants previously granted to Postmedia (five year warrants to acquire 598,060 common shares of Mogo at a price of $2.96 per share which vested on achieving specific quarterly revenue targets) so that: 1) they vest equally over the remaining two years of the collaboration (50% in January 2020 and 50% in January 2021); and 2) their term is extended an additional two years (now expiring January 2023).

Extension of the term of the Performance Warrants is subject to TSX approval and receipt of shareholder approval, to be sought at the Company's upcoming annual general meeting.

Quelle: Sedar.com

Investorenkonferenz:

https://www.newswire.ca/news-releases/mogo-to-present-at-cib… Mehr als 600.000 Nutzer:

http://www.stockwatch.com/News/Item.aspx?bid=Z-C:MOGO-259739…

Cool, gute Analysten-Coverage und nun ein NASDAQ Listing. Das dürfte endlich neuen Schwung in die Sache bringen. Müssen dann nur noch gute Zahlen in den folgenden Quartalen folgen, dann wird die Mogo-Welt dieses Jahr irgendwann wieder spürbar freundlicher aussehen.