Cordoba Minerals - Die nächste Ivanhoe? - 500 Beiträge pro Seite

eröffnet am 08.03.16 11:17:13 von

neuester Beitrag 27.02.18 14:31:15 von

neuester Beitrag 27.02.18 14:31:15 von

Beiträge: 118

ID: 1.228.068

ID: 1.228.068

Aufrufe heute: 0

Gesamt: 8.048

Gesamt: 8.048

Aktive User: 0

ISIN: CA21852Q4043 · WKN: A114TW

0,0515

EUR

+6,19 %

+0,0030 EUR

Letzter Kurs 08.02.21 Tradegate

Neuigkeiten

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 42,93 | +19,98 | |

| 247,15 | +16,31 | |

| 3.200,00 | +15,90 | |

| 12,040 | +11,38 | |

| 49,73 | +10,51 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 33,00 | -7,30 | |

| 50.000,00 | -8,76 | |

| 2,1200 | -9,40 | |

| 9,0100 | -9,49 | |

| 4,6500 | -10,23 |

Obwohl die Aktie seit letzter Woche um 60% von 0,25 auf 0,40 CA$ gestiegen ist, habe ich bisher noch keine Diskussion darüber gefunden.

Welche Meinungen habt ihr zu Cordoba Minerals?

Die Story habe ich aus dem Goldherz Report, ein neuer Newsletter aus dem Rohstoffbereich. Wird vertrieben von Sharedeals...

Robert Friedland (Gründer von Ivanhoe - verkauft an Rio Tinto) und mit der 2. Ivanhoe vornehmlich in Afrika involviert, sicherte sich in den letzten Monaten rund 45% aller ausstehenden Aktien von Cordoba Minerals.

Der Goldherz Report schreibt dazu:

"Nicht nur die Altinvestoren besitzen einen Durchschnittspreis von 1 US$, Friedland selbst kaufte in den letzten Monaten Aktien am Markt auf, hält für seine letzte Einlage, welche er zu 0,14 CA$ tätigte, Optionen im Wert von 1,5 Mio. CA$, mit Wandlungspreis von 0,20 US$. Vor drei Tagen nahm Friedland das Recht wahr und übte diese Optionen sogleich aus. Er hätte damit auch warten können, bis der Kurs deutlich über dem Wandlungspreis steht. Doch ihm ging es nicht um einen schnellen Profit, sondern um die Kontrolle der Aktien. Friedland besitzt 45% aller Aktien und das Recht, bis zu 65% am Projekt zu erhalten, sofern er bei künftigen Kapitalerhöhungen voll mitzieht." Quelle: http://www.goldherzreport.de

Welche Meinungen habt ihr zu Cordoba Minerals?

Die Story habe ich aus dem Goldherz Report, ein neuer Newsletter aus dem Rohstoffbereich. Wird vertrieben von Sharedeals...

Robert Friedland (Gründer von Ivanhoe - verkauft an Rio Tinto) und mit der 2. Ivanhoe vornehmlich in Afrika involviert, sicherte sich in den letzten Monaten rund 45% aller ausstehenden Aktien von Cordoba Minerals.

Der Goldherz Report schreibt dazu:

"Nicht nur die Altinvestoren besitzen einen Durchschnittspreis von 1 US$, Friedland selbst kaufte in den letzten Monaten Aktien am Markt auf, hält für seine letzte Einlage, welche er zu 0,14 CA$ tätigte, Optionen im Wert von 1,5 Mio. CA$, mit Wandlungspreis von 0,20 US$. Vor drei Tagen nahm Friedland das Recht wahr und übte diese Optionen sogleich aus. Er hätte damit auch warten können, bis der Kurs deutlich über dem Wandlungspreis steht. Doch ihm ging es nicht um einen schnellen Profit, sondern um die Kontrolle der Aktien. Friedland besitzt 45% aller Aktien und das Recht, bis zu 65% am Projekt zu erhalten, sofern er bei künftigen Kapitalerhöhungen voll mitzieht." Quelle: http://www.goldherzreport.de

Antwort auf Beitrag Nr.: 51.928.491 von BigFigure am 08.03.16 11:17:13Cordoba Minerals besitzt ein riesiges 26.000 Ha grosses Explorationsgebiet, welches unmittelbar an die Nickelmine von Cerro Matoso (BHP Billiton) angrenzt... Wobei es um Kupfer/Gold geht (0,6% respektive 1g/t), welches sich hochprofitabel im Tagebau fördern liesse.

Voraussetzung: Explorationsarbeiten werden abgeschlossen und die Genehmigungen erteilt.

Mit einem Robert Friedland an der Seite sehe ich da gute Chancen, dass es klappt. Da der schon viele Regierungen überzeugen konnte und schon in den 90er Jahren allein in der Mongolei sowie Myanmar unterwegs war.

Homepage von Cordoba:

http://www.cordobaminerals.com/s/Home.asp

Investorenpräsentation vom Dezember als Überblick:

http://www.cordobaminerals.com/i/pdf/Presentations/Cordoba-P…

Zum Kurs der Aktie kann ich nicht viel sagen. Unter 0,50 CA$ scheint es mir ein günstiger Einstieg zu sein. Denn warum sollte sich Friedland, der die Aktien kontrolliert, bei der nächsten Finanzierungsmassnahme selbst verwässern?

Dennoch würde ich nur in Tranchen kaufen, um dann bei Kursrückgang nachkaufen zu können.

An Kapitalerhöhungwn würde ich NICHT teilnehmen. Meistens gibt es die Aktien danach wieder günstiger.

Momentan warten alle auf den nächsten Deal / Finanzierung. So lange die Spekulationen anhalten wird der Kurs weiter steigen.

Danach wird er noch weiter angetrieben werden und nach einiger Zeit wieder fallen und dann wäre es eine 2. Möglichkeit, um wieder ein paar Aktien nachzulegen.

Alles nur eine heisse Spekulation... Aber wahnsinnig interessant.

Die Geschichte von Ivanhoe wurde 2003 so richtig angeheizt. Damals stieg die Aktie um 300%. Hier ein alter Forbes Artikel: http://www.forbes.com/forbes/2003/1124/125.html

Erst ein paar erfolgreiche Bohrungen, dann Aktien-Hype und erst danach Finanzierung und Minenaufbau sowie Verkauf an Rio Tinto, das war irgendwann 2006/07...

Wiederholt sich die Geschichte bei Cordoba noch einmal? Möglich wäre es.

Voraussetzung: Explorationsarbeiten werden abgeschlossen und die Genehmigungen erteilt.

Mit einem Robert Friedland an der Seite sehe ich da gute Chancen, dass es klappt. Da der schon viele Regierungen überzeugen konnte und schon in den 90er Jahren allein in der Mongolei sowie Myanmar unterwegs war.

Homepage von Cordoba:

http://www.cordobaminerals.com/s/Home.asp

Investorenpräsentation vom Dezember als Überblick:

http://www.cordobaminerals.com/i/pdf/Presentations/Cordoba-P…

Zum Kurs der Aktie kann ich nicht viel sagen. Unter 0,50 CA$ scheint es mir ein günstiger Einstieg zu sein. Denn warum sollte sich Friedland, der die Aktien kontrolliert, bei der nächsten Finanzierungsmassnahme selbst verwässern?

Dennoch würde ich nur in Tranchen kaufen, um dann bei Kursrückgang nachkaufen zu können.

An Kapitalerhöhungwn würde ich NICHT teilnehmen. Meistens gibt es die Aktien danach wieder günstiger.

Momentan warten alle auf den nächsten Deal / Finanzierung. So lange die Spekulationen anhalten wird der Kurs weiter steigen.

Danach wird er noch weiter angetrieben werden und nach einiger Zeit wieder fallen und dann wäre es eine 2. Möglichkeit, um wieder ein paar Aktien nachzulegen.

Alles nur eine heisse Spekulation... Aber wahnsinnig interessant.

Die Geschichte von Ivanhoe wurde 2003 so richtig angeheizt. Damals stieg die Aktie um 300%. Hier ein alter Forbes Artikel: http://www.forbes.com/forbes/2003/1124/125.html

Erst ein paar erfolgreiche Bohrungen, dann Aktien-Hype und erst danach Finanzierung und Minenaufbau sowie Verkauf an Rio Tinto, das war irgendwann 2006/07...

Wiederholt sich die Geschichte bei Cordoba noch einmal? Möglich wäre es.

Vielleicht kommt der Kurs noch etwas zurück, bei der geringen Liquidität wäre das sicher möglich? Hoffentlich, dann gäbe es noch einmal eine Chance, für einen günstigen Einstieg.

Kursexplosion Teil 2

Es scheint bald weiter zu gehen, mit dem phänomenalen Anstieg. Kai Hoffmann vom Investor-Magazin ist dort auch gut informiert:

http://investor-magazin.de/1854pdac-2016-updates-zu-aurico-m…

Es stehen Bohrergebnisse an, es sollen Informationen zu geophysischen Untersuchungen veröffentlicht werden und in Zusammenarbeit mit Friedlands Gesellschaft HPX wurden weitere Ziele auf dem Projekt in Kolumbien identifiziert. Auf dem Alacran-Projekt soll zudem die historische Ressource von 37 Mio. Tonnen Kupfer mit einem Gehalt von 0,62% und 0,40 g/t Gold aktualisiert werden. Wir gehen davon aus, dass Cordoba hier auf rund 50 Mio. Tonnen zu ähnlichen Gehalten kommen könnte.

50 Millionen Tonnen wären schon eine gewaltige Nummer.

Erstaunlich, dass die Aktie in Deutschland noch immer so wenig Follower hat?!

News 11.4

Cordoba drills 111m of 1.01% Cu, 0.38 g/t Au at Alacran

2016-04-11 07:29 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS CONFIRMS A SIGNIFICANT COPPER-GOLD DISCOVERY AT THE ALACRAN PROJECT WITH 111 METRES OF 1.01% COPPER AND 0.38 G/T GOLD

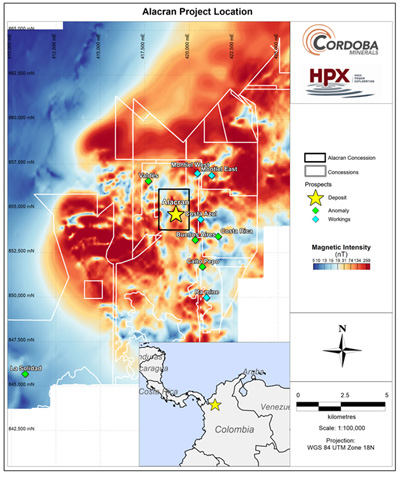

Drilling at the Alacran project within Cordoba Minerals Corp.'s San Matias copper gold project in Colombia has confirmed a high-grade and shallow copper-gold discovery. The initial six drill holes in the preliminary 3,000-metre diamond drilling program all contain significant intercepts of copper and gold mineralization, often from near surface. Drilling also has demonstrated similar visual copper-sulphide mineralization in an additional four holes. Drilling to date at Alacran covers 270 metres of strike length at the northern end of a 1,300-metre defined mineralized trend. The mineralized trend remains open in all directions and at depth.

Alacran drilling highlights

ASA051: 111 metres at 1.01 per cent copper and 0.38 gram per tonne gold (1.32 per cent copper equivalent (CuEq));

ACD006A: 109 metres at 0.95 per cent copper and 0.35 g/t gold (1.24 per cent CuEq);

ACD001: 108 metres at 0.94 per cent copper and 0.37 g/t gold (1.24 per cent CuEq);

ACD005: 29 metres at 2.72 per cent copper and 1.16 g/t gold (3.66 per cent CuEq);

ACD002: 80 metres at 0.75 per cent copper and 0.31 g/t gold (1.0 per cent CuEq).

Mario Stifano, president and chief executive officer of Cordoba, commented: "Our drilling at Alacran has confirmed a significant high-grade copper-gold discovery within what we believe is potentially a large and prolific copper-gold district. The geological importance of the Alacran discovery confirms our belief that the San Matias copper-gold project hosts porphyry copper-gold mineralization and high-grade replacement (or skarn-hosted) copper-gold systems. In addition, preliminary results from the proprietary Typhoon deep induced polarization technology deployed by the company's joint venture partner, High Power Exploration, indicate multiple large and potentially significant sulphide chargeability targets, indicating the potential to make a world-class discovery."

Cordoba and High Power Exploration (HPX) are jointly planning the next phase of the exploration program at the San Matias project. Current plans include an expansion of the Typhoon survey and follow-on drilling at Alacran and additional high-priority targets defined by Typhon IP and detailed airborne magnetic surveys.

Details

Alacran copper-gold system

The Alacran copper-gold system is located within the company's San Matias copper-gold project in the department of Cordoba, Colombia. The Alacran system is located on a topographic high in gently rolling topography, optimal for potential open-pit mining. Access and infrastructure are good. Alacran is approximately two kilometres southwest of the Montiel porphyry copper-gold discovery, where recent drilling interested 101 metres of 1.0 per cent copper and 0.65 g/t gold, and two kilometres northwest of the Costa Azul porphyry copper-gold discovery, where recent drilling interested 87 metres of 0.62 per cent copper and 0.51 g/t gold. The copper-gold mineralization at Alacran is associated with strata-bound replacement of a marine volcanosedimentary sequence in the core of a faulted anti-formal fold structure. The deposit comprises moderately to steeply dipping stratigraphy that is mineralized as a series of subparallel replacement-style or skarn zones and associated disseminations. The copper-gold mineralization is composed of multiple overprinting hydrothermal events with the main ore phase comprising chalcopyrite-pyrrhotite-pyrite that appears to overprint a large-scale early magnetite metasomatic event.

High-temperature potassic feldspar-biotite-amphibole-albite alteration in the host geological sequence indicates that the copper-gold mineralization is proximal to a source intrusion. At least two intrusive phases, locally occurring as sills, confirm an intrusive source for the mineralizing fluids. The overall size and complexity of the hydrothermal system indicate a significant mineralization event. Mineralization occurs within all members of the sedimentary and volcanic sequence, where it can be traced over a strike length of greater than 1,300 metres and local thickness of more than 90 metres true width from the current drilling and surface sampling.

Alacran exploration

In addition to the continuing diamond drilling program, extensive soil sampling and detailed geological mapping programs are under way to further define the extent of copper-gold mineralization at Alacran and to determine if additional mineralized zones exist. The hydrothermal alteration halo associated with the known mineralization is of kilometre-scale dimensions, indicating the potential for a substantial mineralized zone and the high probability of additional mineralized areas. A Typhoon IP and electromagnetic survey also has been completed over the northern parts of the Alacran project and data are currently being interpreted.

Typhoon

Typhoon is a proprietary deep IP technology, developed by HPX, that generates high signal-to-noise ratios enabling accurate inversions to identify prospective targets. The recently completed phase one Typhoon program at San Matias, which covered Montiel and the northern area of Alacran, will be expanded north and south of the currently surveyed areas as the trends and targets remain open. The final 3-D inversion of the Typhoon geophysical survey is being completed and will be released in the coming weeks.

About San Matias project

The newly discovered San Matias copper-gold project comprises a 20,000-hectare land package on the inferred northern extension of the richly endowed Mid Cauca belt in Colombia. The project contains several known areas of porphyry copper-gold mineralization, copper-gold skarn mineralization and vein-hosted, gold-copper mineralization. Porphyry mineralization at the San Matias project incorporates high-grade zones of copper-gold mineralization hosted by diorite porphyries containing secondary biotite alteration and various orientations of sheeted and stockwork quartz-magnetite veins with chalcopyrite and bornite. The copper-gold skarn mineralization at Alacran is associated with strata-bound replacement of a marine volcanosedimentary sequence. District-scale alteration and an abundance of mineralized showings at San Matias show similarities to other world-class Tier 1 copper-gold porphyry deposits.

Cordoba drills 111m of 1.01% Cu, 0.38 g/t Au at Alacran

2016-04-11 07:29 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS CONFIRMS A SIGNIFICANT COPPER-GOLD DISCOVERY AT THE ALACRAN PROJECT WITH 111 METRES OF 1.01% COPPER AND 0.38 G/T GOLD

Drilling at the Alacran project within Cordoba Minerals Corp.'s San Matias copper gold project in Colombia has confirmed a high-grade and shallow copper-gold discovery. The initial six drill holes in the preliminary 3,000-metre diamond drilling program all contain significant intercepts of copper and gold mineralization, often from near surface. Drilling also has demonstrated similar visual copper-sulphide mineralization in an additional four holes. Drilling to date at Alacran covers 270 metres of strike length at the northern end of a 1,300-metre defined mineralized trend. The mineralized trend remains open in all directions and at depth.

Alacran drilling highlights

ASA051: 111 metres at 1.01 per cent copper and 0.38 gram per tonne gold (1.32 per cent copper equivalent (CuEq));

ACD006A: 109 metres at 0.95 per cent copper and 0.35 g/t gold (1.24 per cent CuEq);

ACD001: 108 metres at 0.94 per cent copper and 0.37 g/t gold (1.24 per cent CuEq);

ACD005: 29 metres at 2.72 per cent copper and 1.16 g/t gold (3.66 per cent CuEq);

ACD002: 80 metres at 0.75 per cent copper and 0.31 g/t gold (1.0 per cent CuEq).

Mario Stifano, president and chief executive officer of Cordoba, commented: "Our drilling at Alacran has confirmed a significant high-grade copper-gold discovery within what we believe is potentially a large and prolific copper-gold district. The geological importance of the Alacran discovery confirms our belief that the San Matias copper-gold project hosts porphyry copper-gold mineralization and high-grade replacement (or skarn-hosted) copper-gold systems. In addition, preliminary results from the proprietary Typhoon deep induced polarization technology deployed by the company's joint venture partner, High Power Exploration, indicate multiple large and potentially significant sulphide chargeability targets, indicating the potential to make a world-class discovery."

Cordoba and High Power Exploration (HPX) are jointly planning the next phase of the exploration program at the San Matias project. Current plans include an expansion of the Typhoon survey and follow-on drilling at Alacran and additional high-priority targets defined by Typhon IP and detailed airborne magnetic surveys.

Details

Alacran copper-gold system

The Alacran copper-gold system is located within the company's San Matias copper-gold project in the department of Cordoba, Colombia. The Alacran system is located on a topographic high in gently rolling topography, optimal for potential open-pit mining. Access and infrastructure are good. Alacran is approximately two kilometres southwest of the Montiel porphyry copper-gold discovery, where recent drilling interested 101 metres of 1.0 per cent copper and 0.65 g/t gold, and two kilometres northwest of the Costa Azul porphyry copper-gold discovery, where recent drilling interested 87 metres of 0.62 per cent copper and 0.51 g/t gold. The copper-gold mineralization at Alacran is associated with strata-bound replacement of a marine volcanosedimentary sequence in the core of a faulted anti-formal fold structure. The deposit comprises moderately to steeply dipping stratigraphy that is mineralized as a series of subparallel replacement-style or skarn zones and associated disseminations. The copper-gold mineralization is composed of multiple overprinting hydrothermal events with the main ore phase comprising chalcopyrite-pyrrhotite-pyrite that appears to overprint a large-scale early magnetite metasomatic event.

High-temperature potassic feldspar-biotite-amphibole-albite alteration in the host geological sequence indicates that the copper-gold mineralization is proximal to a source intrusion. At least two intrusive phases, locally occurring as sills, confirm an intrusive source for the mineralizing fluids. The overall size and complexity of the hydrothermal system indicate a significant mineralization event. Mineralization occurs within all members of the sedimentary and volcanic sequence, where it can be traced over a strike length of greater than 1,300 metres and local thickness of more than 90 metres true width from the current drilling and surface sampling.

Alacran exploration

In addition to the continuing diamond drilling program, extensive soil sampling and detailed geological mapping programs are under way to further define the extent of copper-gold mineralization at Alacran and to determine if additional mineralized zones exist. The hydrothermal alteration halo associated with the known mineralization is of kilometre-scale dimensions, indicating the potential for a substantial mineralized zone and the high probability of additional mineralized areas. A Typhoon IP and electromagnetic survey also has been completed over the northern parts of the Alacran project and data are currently being interpreted.

Typhoon

Typhoon is a proprietary deep IP technology, developed by HPX, that generates high signal-to-noise ratios enabling accurate inversions to identify prospective targets. The recently completed phase one Typhoon program at San Matias, which covered Montiel and the northern area of Alacran, will be expanded north and south of the currently surveyed areas as the trends and targets remain open. The final 3-D inversion of the Typhoon geophysical survey is being completed and will be released in the coming weeks.

About San Matias project

The newly discovered San Matias copper-gold project comprises a 20,000-hectare land package on the inferred northern extension of the richly endowed Mid Cauca belt in Colombia. The project contains several known areas of porphyry copper-gold mineralization, copper-gold skarn mineralization and vein-hosted, gold-copper mineralization. Porphyry mineralization at the San Matias project incorporates high-grade zones of copper-gold mineralization hosted by diorite porphyries containing secondary biotite alteration and various orientations of sheeted and stockwork quartz-magnetite veins with chalcopyrite and bornite. The copper-gold skarn mineralization at Alacran is associated with strata-bound replacement of a marine volcanosedimentary sequence. District-scale alteration and an abundance of mineralized showings at San Matias show similarities to other world-class Tier 1 copper-gold porphyry deposits.

Key information from the last news release.

"Drilling also has demonstrated similar visual copper-sulphide mineralization in an additional four holes. Drilling to date at Alacran covers 270 metres of strike length at the northern end of a 1,300-metre defined mineralized trend. The mineralized trend remains open in all directions and at depth."

"Mario Stifano, President and CEO of Cordoba, commented: "Our drilling at Alacran has confirmed a significant high-grade copper-gold discovery within what we believe is potentially a large and prolific copper-gold district."

"In addition, preliminary results from the proprietary Typhoon deep Induced Polarization technology deployed by the Company's joint venture partner, High Power Exploration, indicate multiple large and potentially significant sulphide chargeability targets, indicating the potential to make a world-class discovery."

"Drilling also has demonstrated similar visual copper-sulphide mineralization in an additional four holes. Drilling to date at Alacran covers 270 metres of strike length at the northern end of a 1,300-metre defined mineralized trend. The mineralized trend remains open in all directions and at depth."

"Mario Stifano, President and CEO of Cordoba, commented: "Our drilling at Alacran has confirmed a significant high-grade copper-gold discovery within what we believe is potentially a large and prolific copper-gold district."

"In addition, preliminary results from the proprietary Typhoon deep Induced Polarization technology deployed by the Company's joint venture partner, High Power Exploration, indicate multiple large and potentially significant sulphide chargeability targets, indicating the potential to make a world-class discovery."

Ein sehr guter Artikel zu Cordoba Minerals! Gestern erst veröffentlicht!

Cordoba Minerals and Friedland’s HPX advance San Matias

POSTED BY: TRISH SAYWELL APRIL 12, 2016

When Mario Stifano found himself alone in an elevator with mine finder Robert Friedland at the end of a long day of presentations at the BMO Conference, the stars just seemed to align.

“It was around 4:30 p.m. and usually the elevators at the conference are packed around that time but there he was—it was just him and I,” Stifano, the president and CEO of junior explorer Cordoba Minerals(TSXV: CDB), recalls of the chance encounter in February 2014.

“I introduced myself, told him I loved his speeches, and that I wanted to tell him about our project, where airborne surveys seemed to show some similarities with his Oyu Tolgoi project. I had thirty seconds to pitch him.”

Friedland agreed to meet Stifano at 7:30 p.m. that evening to learn more about the company’s San Matias project in northern Colombia, where drilling the year before at the Montiel prospect had returned high-grade copper-gold porphyry mineralization including a 101.10 metre intercept averaging 1.0% copper and 0.65 gram gold per tonne.

“I explained the project to him and why I thought it was special,” Stifano says. “He told me why it would be extremely difficult for Cordoba to advance it on its own, and relayed his experience at Oyu Tolgoi and how difficult it is to find these porphyries and how you need a lot of experience and lots of geophysics. He reminded me that it took him 134 holes, some of them really deep, to hit the discovery hole at Oyu Tolgoi.”

Nevertheless, Friedland was intrigued enough to dispatch the exploration team at his his privately held High Power Exploration (HPX), to take a look at the project.

“We didn’t need money at the time, but I was thinking ahead and thought it might make sense for him to look at the project because you don’t know what the future is going to hold,” Stifano says, noting that Cordoba had already raised $15 million in early 2014 from a syndicate consisting of the Bank of Montreal, Dundee, GMP Securities and Clarus Securities.

At the same time, he notes, Cordoba was signing a number of confidentiality agreements with large base metal companies. “We had almost every major mining company in the base metal space and some of the world’s largest mining companies come and look at our ground in the district,” Stifano says. “But from day one I always wanted to do a deal with Robert. There’s no better mine finder and explorer than Robert Friedland.”

Over the course of that year, Cordoba continued to find more copper-gold porphyry mineralization at San Matias. At its Costa Azul target, an 800 metre by 800 metre copper-gold soil anomaly about 2 km south of the Montiel target, results of rotary air blast drilling were released in August 2014. Intercepts included 31 metres of 0.25 gram gold and 0.61% copper; 30 metres of 0.22 gram gold and 0.70% copper; and 12 metres of 0.20 gram gold and 0.65% copper.

Stifano’s wish that Cordoba would ultimately do a deal with Friedland, however, came true in May 2015. Under a joint-venture agreement, HPX will spend $6 million for a 25% stake in the project and another $10.5 million for a 51% stake. They then have the right to carry it to feasibility.

Separately, Friedland also owns 37% of Cordoba, a lot of which he bought on the open market, through private placements and through the exercise of warrants, Stifano says.

“I wanted as part of the joint-venture deal that my partner earn into the property but at the same time I wanted them to be a shareholder of Cordoba because I wanted all of our interests aligned,” Stifano says. “That was one of my conditions and Robert agrees with that strategy and that we need to be aligned in all matters.”

Cordoba holds a 35% stake in the project and does not to need to spend additional funds until a feasibility study has been completed.

“We did this deal in the early part of 2015, when no juniors could get anything done,” Stifano continues. “I’ve always felt that great projects always get financed.”

HPX has a robust treasury to take the project forward, Stifano says. “It raised $100 million with Robert’s own personal money and some additional money from a high net worth individual,” he says. “They can spend money where they need to spend money. And Robert can raise money—it’s never been an issue for him.”

Another reason Stifano wanted to partner with HPX was because of its proprietary Typhoon technology, a deep induced polarization technology. “It’s almost like deep IP but it allows you to go 2 km below surface with significant detail and they are fantastic at doing inversions so you can do it in three dimensions,” he explains.

This week, Cordoba released drill results from its Alacran target at San Matias, about 2 km southwest of the Montiel porphyry copper-gold discovery and 2.5 km from Costa Azul. Highlights included 111 metres of 1.01% copper and 038 gram gold; 109 metres of 0.95% copper and 0.35 gram gold; and 108 metres of 0.94% copper and 0.36 gram gold.

Alacran covers 270 metres of strike length at the northern end of a 1,300 metre defined mineralized trend, which remains open in all directions and at depth.

Stifano notes that the Alacran discovery confirms his belief that San Matias hosts porphyry copper-gold mineralization and high-grade skarn-hosted copper-gold systems.

“People always ask me why HPX came into this little company called Cordoba and the answer is quite simple: The HPX team that visited the project saw a lot of similarities with Oyu Tolgoi,” Stifano says. “We think we’re in a porphyry cluster. There’s a lot of faulting that you would have seen at Oyu Tolgoi. What we see in a lot of our geophysics is that some of these intrusions are deep and big.”

“We’re not talking about 0.2% copper or 0.3% copper, we’re talking some pretty high-grade copper and this has potential, with a lot of work obviously, for us to find a world-class Tier 1 discovery,” he adds.

“Robert is probably the most aggressive explorations out there, period. This is what he does, this is what he loves. You can’t fault his track record: Voiseys Bay, Oyu Tolgoi, Kamoa, Platreef, all his projects are world-class. There is nobody better at finding world-class projects than Robert Friesland and his team, nobody.”

San Matias, about 200 km north of Medellin, is 20 km south of BHP Billitonn’s Cerro Matoso nickel mine and within 10 km of two open-pit coal mines operated by a Colombian conglomerate, and has access to road infrastructure and power.

Link: http://www.northernminer.com/news/cordoba-minerals-and-fried…

Cordoba Minerals and Friedland’s HPX advance San Matias

POSTED BY: TRISH SAYWELL APRIL 12, 2016

When Mario Stifano found himself alone in an elevator with mine finder Robert Friedland at the end of a long day of presentations at the BMO Conference, the stars just seemed to align.

“It was around 4:30 p.m. and usually the elevators at the conference are packed around that time but there he was—it was just him and I,” Stifano, the president and CEO of junior explorer Cordoba Minerals(TSXV: CDB), recalls of the chance encounter in February 2014.

“I introduced myself, told him I loved his speeches, and that I wanted to tell him about our project, where airborne surveys seemed to show some similarities with his Oyu Tolgoi project. I had thirty seconds to pitch him.”

Friedland agreed to meet Stifano at 7:30 p.m. that evening to learn more about the company’s San Matias project in northern Colombia, where drilling the year before at the Montiel prospect had returned high-grade copper-gold porphyry mineralization including a 101.10 metre intercept averaging 1.0% copper and 0.65 gram gold per tonne.

“I explained the project to him and why I thought it was special,” Stifano says. “He told me why it would be extremely difficult for Cordoba to advance it on its own, and relayed his experience at Oyu Tolgoi and how difficult it is to find these porphyries and how you need a lot of experience and lots of geophysics. He reminded me that it took him 134 holes, some of them really deep, to hit the discovery hole at Oyu Tolgoi.”

Nevertheless, Friedland was intrigued enough to dispatch the exploration team at his his privately held High Power Exploration (HPX), to take a look at the project.

“We didn’t need money at the time, but I was thinking ahead and thought it might make sense for him to look at the project because you don’t know what the future is going to hold,” Stifano says, noting that Cordoba had already raised $15 million in early 2014 from a syndicate consisting of the Bank of Montreal, Dundee, GMP Securities and Clarus Securities.

At the same time, he notes, Cordoba was signing a number of confidentiality agreements with large base metal companies. “We had almost every major mining company in the base metal space and some of the world’s largest mining companies come and look at our ground in the district,” Stifano says. “But from day one I always wanted to do a deal with Robert. There’s no better mine finder and explorer than Robert Friedland.”

Over the course of that year, Cordoba continued to find more copper-gold porphyry mineralization at San Matias. At its Costa Azul target, an 800 metre by 800 metre copper-gold soil anomaly about 2 km south of the Montiel target, results of rotary air blast drilling were released in August 2014. Intercepts included 31 metres of 0.25 gram gold and 0.61% copper; 30 metres of 0.22 gram gold and 0.70% copper; and 12 metres of 0.20 gram gold and 0.65% copper.

Stifano’s wish that Cordoba would ultimately do a deal with Friedland, however, came true in May 2015. Under a joint-venture agreement, HPX will spend $6 million for a 25% stake in the project and another $10.5 million for a 51% stake. They then have the right to carry it to feasibility.

Separately, Friedland also owns 37% of Cordoba, a lot of which he bought on the open market, through private placements and through the exercise of warrants, Stifano says.

“I wanted as part of the joint-venture deal that my partner earn into the property but at the same time I wanted them to be a shareholder of Cordoba because I wanted all of our interests aligned,” Stifano says. “That was one of my conditions and Robert agrees with that strategy and that we need to be aligned in all matters.”

Cordoba holds a 35% stake in the project and does not to need to spend additional funds until a feasibility study has been completed.

“We did this deal in the early part of 2015, when no juniors could get anything done,” Stifano continues. “I’ve always felt that great projects always get financed.”

HPX has a robust treasury to take the project forward, Stifano says. “It raised $100 million with Robert’s own personal money and some additional money from a high net worth individual,” he says. “They can spend money where they need to spend money. And Robert can raise money—it’s never been an issue for him.”

Another reason Stifano wanted to partner with HPX was because of its proprietary Typhoon technology, a deep induced polarization technology. “It’s almost like deep IP but it allows you to go 2 km below surface with significant detail and they are fantastic at doing inversions so you can do it in three dimensions,” he explains.

This week, Cordoba released drill results from its Alacran target at San Matias, about 2 km southwest of the Montiel porphyry copper-gold discovery and 2.5 km from Costa Azul. Highlights included 111 metres of 1.01% copper and 038 gram gold; 109 metres of 0.95% copper and 0.35 gram gold; and 108 metres of 0.94% copper and 0.36 gram gold.

Alacran covers 270 metres of strike length at the northern end of a 1,300 metre defined mineralized trend, which remains open in all directions and at depth.

Stifano notes that the Alacran discovery confirms his belief that San Matias hosts porphyry copper-gold mineralization and high-grade skarn-hosted copper-gold systems.

“People always ask me why HPX came into this little company called Cordoba and the answer is quite simple: The HPX team that visited the project saw a lot of similarities with Oyu Tolgoi,” Stifano says. “We think we’re in a porphyry cluster. There’s a lot of faulting that you would have seen at Oyu Tolgoi. What we see in a lot of our geophysics is that some of these intrusions are deep and big.”

“We’re not talking about 0.2% copper or 0.3% copper, we’re talking some pretty high-grade copper and this has potential, with a lot of work obviously, for us to find a world-class Tier 1 discovery,” he adds.

“Robert is probably the most aggressive explorations out there, period. This is what he does, this is what he loves. You can’t fault his track record: Voiseys Bay, Oyu Tolgoi, Kamoa, Platreef, all his projects are world-class. There is nobody better at finding world-class projects than Robert Friesland and his team, nobody.”

San Matias, about 200 km north of Medellin, is 20 km south of BHP Billitonn’s Cerro Matoso nickel mine and within 10 km of two open-pit coal mines operated by a Colombian conglomerate, and has access to road infrastructure and power.

Link: http://www.northernminer.com/news/cordoba-minerals-and-fried…

Cordoba Minerals: Rohstoffguru hält jetzt 37%

Das letzte Mal saßen wir mit CEO Mario Stifano im Rahmen des Precious Metals Summit in Beaver Creek im September persönlich zusammen. Es war also höchste Zeit für ein Update. Wir hatten Ihnen den Wert Ende Oktober abermals ans Herz gelegt und sind damit sehr gut gefahren. Aktuell liegen wir bei dem Explorer mit 158% im Plus. Ausschlaggebend für die jüngste Kursrallye war, dass Rohstoffguru und Mininglegende Robert Friedland über den Markt weitere Anteile an Cordoba gekauft hat. Er kommt nun auf einen Anteil von 37% am Unternehmen. Stifano ist sehr zufrieden damit, dass Friedland Wort hält und nicht nur auf Projektebene investiert, sondern auch der Hauptgesellschaft weiterhilft. Operativ sollte es in den nächsten Wochen bei Cordoba Schlag auf Schlag gehen.

Es stehen Bohrergebnisse an, es sollen Informationen zu geophysischen Untersuchungen veröffentlicht werden und in Zusammenarbeit mit Friedlands Gesellschaft HPX wurden weitere Ziele auf dem Projekt in Kolumbien identifiziert. Auf dem Alacran-Projekt soll zudem die historische Ressource von 37 Mio. Tonnen Kupfer mit einem Gehalt von 0,62% und 0,40 g/t Gold aktualisiert werden. Wir gehen davon aus, dass Cordoba hier auf rund 50 Mio. Tonnen zu ähnlichen Gehalten kommen könnte. Eine neue NI 43-101 konforme Ressourcenschätzung erwartet Stifano für Juli. Bei Cordoba geht es jetzt erst richtig los. Der Nachrichtenfluss der nächsten Monate ist verheißungsvoll und wer Robert Friedland kennt, weiß, dass dieser nicht kleckert. Konferenzteilnehmer haben Cordoba bereits mit Oyu Tolgoi verglichen, eine ebenfalls von Friedland entdeckte Gold-Kupfer-Mine in der Mongolei. 2015 wurden dort zwischen 175.000 und 195.000 Tonnen Kupfer und 600.000 bis 700.000 Unzen Gold produziert – eine Mega-Mine.

Quelle:

investor-magazin.de/...rdoba-minerals-und-golden-queen-mining/

Das letzte Mal saßen wir mit CEO Mario Stifano im Rahmen des Precious Metals Summit in Beaver Creek im September persönlich zusammen. Es war also höchste Zeit für ein Update. Wir hatten Ihnen den Wert Ende Oktober abermals ans Herz gelegt und sind damit sehr gut gefahren. Aktuell liegen wir bei dem Explorer mit 158% im Plus. Ausschlaggebend für die jüngste Kursrallye war, dass Rohstoffguru und Mininglegende Robert Friedland über den Markt weitere Anteile an Cordoba gekauft hat. Er kommt nun auf einen Anteil von 37% am Unternehmen. Stifano ist sehr zufrieden damit, dass Friedland Wort hält und nicht nur auf Projektebene investiert, sondern auch der Hauptgesellschaft weiterhilft. Operativ sollte es in den nächsten Wochen bei Cordoba Schlag auf Schlag gehen.

Es stehen Bohrergebnisse an, es sollen Informationen zu geophysischen Untersuchungen veröffentlicht werden und in Zusammenarbeit mit Friedlands Gesellschaft HPX wurden weitere Ziele auf dem Projekt in Kolumbien identifiziert. Auf dem Alacran-Projekt soll zudem die historische Ressource von 37 Mio. Tonnen Kupfer mit einem Gehalt von 0,62% und 0,40 g/t Gold aktualisiert werden. Wir gehen davon aus, dass Cordoba hier auf rund 50 Mio. Tonnen zu ähnlichen Gehalten kommen könnte. Eine neue NI 43-101 konforme Ressourcenschätzung erwartet Stifano für Juli. Bei Cordoba geht es jetzt erst richtig los. Der Nachrichtenfluss der nächsten Monate ist verheißungsvoll und wer Robert Friedland kennt, weiß, dass dieser nicht kleckert. Konferenzteilnehmer haben Cordoba bereits mit Oyu Tolgoi verglichen, eine ebenfalls von Friedland entdeckte Gold-Kupfer-Mine in der Mongolei. 2015 wurden dort zwischen 175.000 und 195.000 Tonnen Kupfer und 600.000 bis 700.000 Unzen Gold produziert – eine Mega-Mine.

Quelle:

investor-magazin.de/...rdoba-minerals-und-golden-queen-mining/

Cordoba Minerals profitiert weiter von der Zusammenarbeit mit Mininglegende Robert Friedland.Die von Friedland kontrollierte Gesellschaft HPX Technologieswird nun im Rahmen der Joint-Venture Vereinbarung mit einem Phase-1 Explorationsprogramm starten. Hierbei kann HPX einen 25%-Anteil durch die Aufwendung von 6 Mio. US-Dollar am San Matias-Projekt in Kolumbien erwerben. HPX kann insgesamt bis zu 65% am Projekt erwerben, sofern man bereit ist die Kosten bis zur Veröffentlichung einer finalen Machbarkeitsstudie zu tragen.

Auch hier ein DANKESCHÖN an Günther Goldherz

Ja aber hallo mein lieber Freund Robert Friedland :-) Wäre ich eine Dame, würde ich mich glatt in Dich verlieben...

Heute toller Cash-Out Day. Mein Verkaufskurs liegt bei 0,85 CA$. Eine kleine "Erinnerungsposition" behalte ich aber noch, wahlweise für die Enkel oder den Totengräber.

Vielleicht geht das Teil wirklich auf 2-3 CA$ aber ich will ja nicht gierig sein.

Danke an Günther Goldherz, dessen Leser selbst aber gar nicht mehr reinkamen, weil sein Kauflimit zu knapp war oder die Käufer sich nicht dran hielten

Dennoch DANKE! So kann es gerne weitergehen.

News! Top-Management

Cordoba appoints Meredith, Friedland, Makuch to board

2016-04-20 09:36 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS ANNOUNCES THREE KEY APPOINTMENTS TO THE BOARD OF DIRECTORS AND SIGNIFICANT ADDITIONS TO THE MANAGEMENT TEAM

Cordoba Minerals Corp. has appointed Peter Meredith, Govind Friedland and Tony Makuch to its board of directors.

Board of director appointments

Mr. Meredith, who will assume the role as chairman of the board of Cordoba, is an experienced and well-respected mining executive. Mr. Meredith has been a director of Ivanhoe Mines Ltd. since 1998. Mr. Meredith is the former deputy chairman and chief financial officer of Ivanhoe Mines Ltd. (now Turquoise Hill Resources Ltd.), where he was involved in overseeing Ivanhoe's business development and government relations. Prior to joining Ivanhoe Mines Ltd., Mr. Meredith spent 31 years with Deloitte LLP and retired as a partner in 1996. Mr. Meredith is a chartered accountant and is a member of the Institute of Chartered Accountants of British Columbia and the Institute of Chartered Accountants of Ontario.

Mr. Makuch was the chief executive officer of Lake Shore Gold prior to the recent acquisition by Tahoe Resources. Since joining Lake Shore Gold in 2008, Mr. Makuch had overseen the company's progression from exploration to annual production of approximately 180,000 ounces of gold. He is a professional engineer (Ontario) with over 25 years of management, operations and technical experience in the mining industry, having managed numerous projects in Canada and the United States from advanced exploration through production. Mr. Makuch holds a bachelor of science degree (honours applied earth sciences) from the University of Waterloo in Ontario, and both a masters of science degree in engineering and a masters of business administration from Queens University in Ontario. Mr. Makuch holds the Institute of Corporate Directors designation, ICDD.

Mr. Friedland is the executive chairman of the board of directors of GoviEx Uranium and a principal and co-founder of Ivanhoe Industries, the parent company of I-Pulse Inc., a high-tech company providing innovative solutions for mining, oil and gas, and advanced manufacturing sectors based in Toulouse, France. He earned his degree in geology and geological engineering from the Colorado School of Mines in 2000 with a focus on exploration geology. Mr. Friedland also was the former business development manager for Ivanhoe Mines Ltd. based in China and has significant experience in emerging markets.

"We are delighted to have Peter, Tony and Govind join our board," commented Mario Stifano, chief executive officer of Cordoba. "They each bring a wealth of experience in exploring, developing and operating mines throughout the world. Their extensive leadership experience and mining knowledge will be an extremely valuable asset as we look to advance our San Matias copper gold project in Colombia."

Mr. Meredith, Mr. Makuch and Mr. Friedland will replace three existing directors: Beatriz Uribe, William Katzin and Tod Turley who have decided to resign from the board.

"The company and the board would like to express its sincere thanks to Mrs. Uribe, Mr. Katzin and Mr. Turley for the valuable contributions that they made during their tenures as directors with the company," said Mr. Stifano.

Management team additions

In addition, Charles Forster and Luis Fernando De Angulo have been appointed special advisers to Cordoba's board of directors and chief executive officer while Sarah Armstrong is joining Cordoba as vice-president and general counsel.

Charles Forster, PGeo, has more than 45 years of diversified mineral exploration experience in Canada, United States, sub-Saharan Africa, Portugal, China and Mongolia. Mr. Forster was formerly the senior vice-president of exploration at Oyu Tolgoi in Mongolia for Ivanhoe Mines (now Turquoise Hill Resources) from early 2001 to June, 2008. During this time, he led a team of multinational and Mongolian geologists in the discovery and delineation of the world-class Oyu Tolgoi copper-gold porphyry deposit. The discovery of the massive, high-grade Hugo Dummett underground deposit at Oyu Tolgoi was subsequently recognized by the Prospectors and Developers Association of Canada, which in 2004 named Mr. Forster a co-recipient of the inaugural Thayer Lindsley medal awarded for the international discovery of the year.

Mr. De Angulo is a sustainability, human rights and social standards professional. Mr. De Angulo started his career with the Cerrejon coal project in Colombia where he was involved with a variety of issues in relation to community development. Most recently Mr. De Angulo was the worldwide corporate social responsibility (CSR) director for Occidental Petroleum, with responsibility for operations in three continents. Currently, he is a founding partner of Gestion Responsible, a sustainability consultancy to the oil and mining industries. Mr. De Angulo is a native of Colombia, educated in Bogota, the U.S. (Harvard) and the Netherlands (Institute of Social Studies).

Ms. Armstrong is also the general counsel at High Power Exploration Inc., Cordoba's joint venture partner at the San Matias project. Ms. Armstrong previously worked at Linklaters and Xstrata and has nine years experience in emerging markets having worked on, and led transactions in, Asian and Latin American countries including Hong Kong, Singapore, Mongolia, China, Philippines, Chile, Peru and Colombia ranging from mining projects, structured capital market transactions, mergers and acquisitions, takeovers, joint ventures, and earn-ins and international arbitration proceedings. Ms. Armstrong is admitted as a legal practitioner in Australia (Supreme Court of New South Wales and Supreme Court of Queensland) and a registered foreign lawyer in Hong Kong.

Mario Stifano, chief executive officer of Cordoba, commented: "I am extremely pleased with the additions to Cordoba's management as we move the San Matias copper-gold project to the next phase. Charles's wealth of experience at Oyu Tolgoi, one of the world's largest copper-gold discoveries, will be a vital contribution to our team as we expand our exploration programs at San Matias. Luis Fernando's CSR expertise will enable Cordoba to continue building upon its strong community relations in the San Matias region where the company has been formally recognized by the Colombian government for its social work in the region. Sarah Armstrong, who will be based in Colombia, was instrumental in negotiating and completing the acquisition of the Alacran project by Cordoba."

Cordoba is also announcing that it has granted 1,925,000 incentive stock options to certain directors, officers and consultants pursuant to the company's stock option plan, at an exercise price of 85 cents per share, expiring on April 19, 2026. This stock option grant is subject to approval by the TSX Venture Exchange.

Cordoba appoints Meredith, Friedland, Makuch to board

2016-04-20 09:36 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS ANNOUNCES THREE KEY APPOINTMENTS TO THE BOARD OF DIRECTORS AND SIGNIFICANT ADDITIONS TO THE MANAGEMENT TEAM

Cordoba Minerals Corp. has appointed Peter Meredith, Govind Friedland and Tony Makuch to its board of directors.

Board of director appointments

Mr. Meredith, who will assume the role as chairman of the board of Cordoba, is an experienced and well-respected mining executive. Mr. Meredith has been a director of Ivanhoe Mines Ltd. since 1998. Mr. Meredith is the former deputy chairman and chief financial officer of Ivanhoe Mines Ltd. (now Turquoise Hill Resources Ltd.), where he was involved in overseeing Ivanhoe's business development and government relations. Prior to joining Ivanhoe Mines Ltd., Mr. Meredith spent 31 years with Deloitte LLP and retired as a partner in 1996. Mr. Meredith is a chartered accountant and is a member of the Institute of Chartered Accountants of British Columbia and the Institute of Chartered Accountants of Ontario.

Mr. Makuch was the chief executive officer of Lake Shore Gold prior to the recent acquisition by Tahoe Resources. Since joining Lake Shore Gold in 2008, Mr. Makuch had overseen the company's progression from exploration to annual production of approximately 180,000 ounces of gold. He is a professional engineer (Ontario) with over 25 years of management, operations and technical experience in the mining industry, having managed numerous projects in Canada and the United States from advanced exploration through production. Mr. Makuch holds a bachelor of science degree (honours applied earth sciences) from the University of Waterloo in Ontario, and both a masters of science degree in engineering and a masters of business administration from Queens University in Ontario. Mr. Makuch holds the Institute of Corporate Directors designation, ICDD.

Mr. Friedland is the executive chairman of the board of directors of GoviEx Uranium and a principal and co-founder of Ivanhoe Industries, the parent company of I-Pulse Inc., a high-tech company providing innovative solutions for mining, oil and gas, and advanced manufacturing sectors based in Toulouse, France. He earned his degree in geology and geological engineering from the Colorado School of Mines in 2000 with a focus on exploration geology. Mr. Friedland also was the former business development manager for Ivanhoe Mines Ltd. based in China and has significant experience in emerging markets.

"We are delighted to have Peter, Tony and Govind join our board," commented Mario Stifano, chief executive officer of Cordoba. "They each bring a wealth of experience in exploring, developing and operating mines throughout the world. Their extensive leadership experience and mining knowledge will be an extremely valuable asset as we look to advance our San Matias copper gold project in Colombia."

Mr. Meredith, Mr. Makuch and Mr. Friedland will replace three existing directors: Beatriz Uribe, William Katzin and Tod Turley who have decided to resign from the board.

"The company and the board would like to express its sincere thanks to Mrs. Uribe, Mr. Katzin and Mr. Turley for the valuable contributions that they made during their tenures as directors with the company," said Mr. Stifano.

Management team additions

In addition, Charles Forster and Luis Fernando De Angulo have been appointed special advisers to Cordoba's board of directors and chief executive officer while Sarah Armstrong is joining Cordoba as vice-president and general counsel.

Charles Forster, PGeo, has more than 45 years of diversified mineral exploration experience in Canada, United States, sub-Saharan Africa, Portugal, China and Mongolia. Mr. Forster was formerly the senior vice-president of exploration at Oyu Tolgoi in Mongolia for Ivanhoe Mines (now Turquoise Hill Resources) from early 2001 to June, 2008. During this time, he led a team of multinational and Mongolian geologists in the discovery and delineation of the world-class Oyu Tolgoi copper-gold porphyry deposit. The discovery of the massive, high-grade Hugo Dummett underground deposit at Oyu Tolgoi was subsequently recognized by the Prospectors and Developers Association of Canada, which in 2004 named Mr. Forster a co-recipient of the inaugural Thayer Lindsley medal awarded for the international discovery of the year.

Mr. De Angulo is a sustainability, human rights and social standards professional. Mr. De Angulo started his career with the Cerrejon coal project in Colombia where he was involved with a variety of issues in relation to community development. Most recently Mr. De Angulo was the worldwide corporate social responsibility (CSR) director for Occidental Petroleum, with responsibility for operations in three continents. Currently, he is a founding partner of Gestion Responsible, a sustainability consultancy to the oil and mining industries. Mr. De Angulo is a native of Colombia, educated in Bogota, the U.S. (Harvard) and the Netherlands (Institute of Social Studies).

Ms. Armstrong is also the general counsel at High Power Exploration Inc., Cordoba's joint venture partner at the San Matias project. Ms. Armstrong previously worked at Linklaters and Xstrata and has nine years experience in emerging markets having worked on, and led transactions in, Asian and Latin American countries including Hong Kong, Singapore, Mongolia, China, Philippines, Chile, Peru and Colombia ranging from mining projects, structured capital market transactions, mergers and acquisitions, takeovers, joint ventures, and earn-ins and international arbitration proceedings. Ms. Armstrong is admitted as a legal practitioner in Australia (Supreme Court of New South Wales and Supreme Court of Queensland) and a registered foreign lawyer in Hong Kong.

Mario Stifano, chief executive officer of Cordoba, commented: "I am extremely pleased with the additions to Cordoba's management as we move the San Matias copper-gold project to the next phase. Charles's wealth of experience at Oyu Tolgoi, one of the world's largest copper-gold discoveries, will be a vital contribution to our team as we expand our exploration programs at San Matias. Luis Fernando's CSR expertise will enable Cordoba to continue building upon its strong community relations in the San Matias region where the company has been formally recognized by the Colombian government for its social work in the region. Sarah Armstrong, who will be based in Colombia, was instrumental in negotiating and completing the acquisition of the Alacran project by Cordoba."

Cordoba is also announcing that it has granted 1,925,000 incentive stock options to certain directors, officers and consultants pursuant to the company's stock option plan, at an exercise price of 85 cents per share, expiring on April 19, 2026. This stock option grant is subject to approval by the TSX Venture Exchange.

Antwort auf Beitrag Nr.: 52.244.740 von socialking am 21.04.16 13:56:08Gestriger Kommentar von Rick Rule (Pres. & CEO Sprott USA) zu Cordoba Minerals:

Very high quality exploration target. Understand that exploration is an extremely dangerous game. There is no one he knows that is as good at exploration finance as Robert Friedland. The stock has had a tremendous move, and is a very, very large target.Thinks this is going higher.

Top-Empfehlung!

Very high quality exploration target. Understand that exploration is an extremely dangerous game. There is no one he knows that is as good at exploration finance as Robert Friedland. The stock has had a tremendous move, and is a very, very large target.Thinks this is going higher.

Top-Empfehlung!

Whansinn, was ist dennin Kanada los? Gestern 26% und nun aktuell wieder ca. 21%....

http://www.stockhouse.com/companies/quote?symbol=v.cdb

http://www.stockhouse.com/companies/quote?symbol=v.cdb

Antwort auf Beitrag Nr.: 52.734.256 von socialking am 30.06.16 17:49:44During the third quarter $CDB Cordoba Minerals targeting issuing an initial NI 43-101 resource to incorporate the drilling success Alacran. A non-compliant historical resource of 37 million tonnes of 0.62% copper and 0.40 g/t gold was completed previously for Alacran.

Die erste Ressourcenkalkulation wird noch im Oktober 2016 erwartet - man rechnet aufgrund den bisherigen Bohrergebnisse mit einem deutlichen Anstieg der Ressourcen!

Die erste Ressourcenkalkulation wird noch im Oktober 2016 erwartet - man rechnet aufgrund den bisherigen Bohrergebnisse mit einem deutlichen Anstieg der Ressourcen!

Die nächsten Bohrergebnisse sollten in Kürze eintreffen. Die Entwicklung des Unternehmens mit Robert Friedland (HPX / Ivanoe) ist echt bemerkenswert. In Deutschland findet es aber wohl unter Ausschluss der Öffentlichkeit statt. Sehr schade! Bei Cordoba geht es jetzt erst richtig los.:-)

Wenn Cordoba selbst nur 35% vom gesamten projekt bleiben, ist das dann so toll ?

Erspart natürlich Verwässerung. Aber Friedland kommt hier schon insgesamt sehr günstig zum zuge.

marktkap 50 Mios CAD ist natürlich nicht unbedingt hoch.

Erspart natürlich Verwässerung. Aber Friedland kommt hier schon insgesamt sehr günstig zum zuge.

marktkap 50 Mios CAD ist natürlich nicht unbedingt hoch.

Antwort auf Beitrag Nr.: 53.731.920 von Boersiback am 19.11.16 20:45:45 Die Aktie geht durch die Decke! :-) Gestern mit plus 16,4%

http://www.stockwatch.com/Quote/Detail.aspx?symbol=CDB®io…

Die Proben der Bohrkerne wurden bereits verschickt und man darf auf die Bohrergebnisse gespannt sein. Ich rechne bald mit News! Aktuell steigt die Nachfrage in Kanada.

http://www.stockwatch.com/Quote/Detail.aspx?symbol=CDB®io…

Die Proben der Bohrkerne wurden bereits verschickt und man darf auf die Bohrergebnisse gespannt sein. Ich rechne bald mit News! Aktuell steigt die Nachfrage in Kanada.

Antwort auf Beitrag Nr.: 54.008.480 von socialking am 04.01.17 15:23:28hatte mich eingelesen und einen vortrag gehört.

ende 2016 dann unter 0,70 cad investiert. bislang perfektes timing gewesen.

großes gebiet zudem highgrade-goldzone denkbar.

da geht einiges und der friedland-deal schützt vor verwässerung

ende 2016 dann unter 0,70 cad investiert. bislang perfektes timing gewesen.

großes gebiet zudem highgrade-goldzone denkbar.

da geht einiges und der friedland-deal schützt vor verwässerung

Antwort auf Beitrag Nr.: 54.012.920 von Boersiback am 04.01.17 23:30:56

2017-01-11 07:16 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS INTERSECTS 108 METRES OF 1.26% COPPER AND 0.87 G/T GOLD AT THE ALACRAN DEPOSIT

Cordoba Minerals Corp. and its joint venture partner, High Power Exploration Inc., a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland's Ivanhoe Industries LLC, have provided an update. Drilling at the San Matias copper-gold project in Colombia has significantly expanded the volume of near-surface copper-gold mineralization at the Alacran deposit. Copper mineralization at Alacran has been intersected over a strike length of 1.3 kilometres, to widths of up to 400 metres, and extends from surface to depths of more than 260 metres below surface.

Recent Alacran drilling highlights (refer to the associated table for complete drilling results):

ACD028:

24 metres (m) at 1.64 per cent copper (Cu) plus 0.62 gram per tonne gold (Au) (from 42 m), including:

Six m at 1.97 per cent Cu plus 0.91 g/t Au (from 50 m);

Four m at 3.69 per cent Cu plus 1.06 g/t Au (from 62 m).

ACD032:

66 m at 1.20 per cent Cu plus 0.23 g/t Au (from 46 m), including:

14 m at 3.31 per cent Cu plus 0.26 g/t Au (from 60 m);

Six m at 1.95 per cent Cu plus 0.72 g/t Au (from 98 m).

ACD033:

108 m at 1.26 per cent Cu plus 0.87 g/t Au (from zero m), including:

26 m at 1.48 per cent Cu plus 1.37 g/t Au (from 20 m);

26 m at 3.18 per cent Cu plus 1.62 g/t Au (from 62 m).

ACD035:

34 m at 0.75 per cent Cu plus 0.47 g/t Au (from six m), including:

18 m at 1.20 per cent Cu plus 0.74 g/t Au (from 22 m);

60 m at 0.40 per cent Cu plus 0.21 g/t Au (from 122 m).

Hole ACD033 (108 m at 1.26 per cent Cu plus 0.87 g/t Au) has returned one of the best intersections to date on the project with mineralization outside the current inferred mineral resource shell. The recent drilling results demonstrate the potential to significantly increase the current inferred mineral resource at Alacran of 53.5 million tonnes of 0.70 per cent copper and 0.37 g/t gold announced in a press release dated Jan. 5, 2017. The area around hole ACD033 is a priority target to follow up with additional drilling to the east, where the mineralization remains open.

Prior to the current drilling program, the mineralization at Alacran was believed to be striking in a north-south direction, with a subvertical westerly dip. This drilling campaign has shown that the mineralization dips more moderately to the west, conformable to the host stratigraphy, adding additional shallow mineralization updip to the east. Moving from north to south, the host stratigraphy appears to steepen while the mineralization changes from pyrrhotite-pyrite-chalcopyrite to magnetite-chalcopyrite. Based on magnetic and induced polarization surveys, attractive exploration targets remain down plunge and along strike.

Mario Stifano, president and chief executive officer of Cordoba, commented: "These drill results highlight the potential for Alacran to host a large high-grade, open-pittable, copper-gold deposit. Current drilling at Alacran will continue to test the eastern extensions of the deposit as well as priority exploration to identify and target the potential source for the mineralization at Alacran."

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aCDB-24356…

Super Bohrloch

Cordoba drills 108 m of 1.26% Cu, 0.87 g/t Au at Matias2017-01-11 07:16 ET - News Release

Mr. Mario Stifano reports

CORDOBA MINERALS INTERSECTS 108 METRES OF 1.26% COPPER AND 0.87 G/T GOLD AT THE ALACRAN DEPOSIT

Cordoba Minerals Corp. and its joint venture partner, High Power Exploration Inc., a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland's Ivanhoe Industries LLC, have provided an update. Drilling at the San Matias copper-gold project in Colombia has significantly expanded the volume of near-surface copper-gold mineralization at the Alacran deposit. Copper mineralization at Alacran has been intersected over a strike length of 1.3 kilometres, to widths of up to 400 metres, and extends from surface to depths of more than 260 metres below surface.

Recent Alacran drilling highlights (refer to the associated table for complete drilling results):

ACD028:

24 metres (m) at 1.64 per cent copper (Cu) plus 0.62 gram per tonne gold (Au) (from 42 m), including:

Six m at 1.97 per cent Cu plus 0.91 g/t Au (from 50 m);

Four m at 3.69 per cent Cu plus 1.06 g/t Au (from 62 m).

ACD032:

66 m at 1.20 per cent Cu plus 0.23 g/t Au (from 46 m), including:

14 m at 3.31 per cent Cu plus 0.26 g/t Au (from 60 m);

Six m at 1.95 per cent Cu plus 0.72 g/t Au (from 98 m).

ACD033:

108 m at 1.26 per cent Cu plus 0.87 g/t Au (from zero m), including:

26 m at 1.48 per cent Cu plus 1.37 g/t Au (from 20 m);

26 m at 3.18 per cent Cu plus 1.62 g/t Au (from 62 m).

ACD035:

34 m at 0.75 per cent Cu plus 0.47 g/t Au (from six m), including:

18 m at 1.20 per cent Cu plus 0.74 g/t Au (from 22 m);

60 m at 0.40 per cent Cu plus 0.21 g/t Au (from 122 m).

Hole ACD033 (108 m at 1.26 per cent Cu plus 0.87 g/t Au) has returned one of the best intersections to date on the project with mineralization outside the current inferred mineral resource shell. The recent drilling results demonstrate the potential to significantly increase the current inferred mineral resource at Alacran of 53.5 million tonnes of 0.70 per cent copper and 0.37 g/t gold announced in a press release dated Jan. 5, 2017. The area around hole ACD033 is a priority target to follow up with additional drilling to the east, where the mineralization remains open.

Prior to the current drilling program, the mineralization at Alacran was believed to be striking in a north-south direction, with a subvertical westerly dip. This drilling campaign has shown that the mineralization dips more moderately to the west, conformable to the host stratigraphy, adding additional shallow mineralization updip to the east. Moving from north to south, the host stratigraphy appears to steepen while the mineralization changes from pyrrhotite-pyrite-chalcopyrite to magnetite-chalcopyrite. Based on magnetic and induced polarization surveys, attractive exploration targets remain down plunge and along strike.

Mario Stifano, president and chief executive officer of Cordoba, commented: "These drill results highlight the potential for Alacran to host a large high-grade, open-pittable, copper-gold deposit. Current drilling at Alacran will continue to test the eastern extensions of the deposit as well as priority exploration to identify and target the potential source for the mineralization at Alacran."

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aCDB-24356…

Antwort auf Beitrag Nr.: 54.012.920 von Boersiback am 04.01.17 23:30:56

Wenn das kein perfektes Timing war!

:-) Wir werden bald Kurse über 1,50 EUR sehen - da bin ich mir ganz sicher! Die Zusammenarbeit mit Robert Friedland ist spitze. Einer meiner Favoriten für 2017!

Antwort auf Beitrag Nr.: 54.067.153 von socialking am 12.01.17 11:29:56danke, hätte heute keine news mehr gecheckt...

sehr schön über diese länge

sehr schön über diese länge

Antwort auf Beitrag Nr.: 54.067.204 von socialking am 12.01.17 11:35:25ja, wo friedland dabei ist in irgendeiner form macht´s immer spaß (bin schon länger in Clean TeQ und ne weile in GoviEx). Der Name bringt einfach sehr (money, vertrauen und connections) viel in dieser schwierigen branche

Antwort auf Beitrag Nr.: 54.072.938 von Boersiback am 12.01.17 22:20:45Da stimme ich dir absolut zu. Der Einstieg von Miningguru und Multimilliardär Robert Friedland in Cordoba - das war definitiv der Grund, warum ich in Cordoba eingestiegen bin. Robert Friedland hat bis heute (innerhalb von einem Jahr!) 20 Mio. CA$ in Cordoba investiert. Dieses Jahr sollen noch weitere 20.000 Meter gebohrt werden. HPX habe bisher alle Zusagen eingehalten und zeigt dabei auch, das Projekt schnellstmöglich voranzubringen. Bei Cordoba geht es erst jetzt richtig los!!!

http://www.mining-journal.com/financeinvestment/exploration/…

Alacran, Colombia: 108m at 1.26% Cu and 0.87% Au from surface (ACD033)

Cordoba Minerals (CN:CDB) has hit more copper-gold mineralisation at the Alacran deposit, part of its San Matias project, a week after announcing Alacran’s maiden resource of 53.52 million tonnes grading 0.70% copper and 0.37g/t gold.

Cordoba’s joint venture partner at San Matias is High Power Exploration Inc (HPX), a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland’s Ivanhoe Industries.

Cordoba president and CEO Mario Stifano said Hole ACD033 returned one of the best intersections to date on the project, with the mineralisation outside the current resource shell.

It also included intersections of 26m at 1.48% copper and 1.37g/t gold from 20m, and 26m at 3.18% copper and 1.62g/t gold from 62m.

Stifano has told Mining Journal Friedland didn’t invest to find 5Moz or 10Moz and Stifano believed Alacran could be part of a tier one district.

HPX has earned a 51% interest in San Matias by spending C$19 (US$14.4) million on exploration and can now earn up to 65% by completing a feasibility study.

Follow-up drilling is planned to extend the known mineralisation area, which already spans 1.3km and widths of up to 400m.

Alacran, Colombia: 108m at 1.26% Cu and 0.87% Au from surface (ACD033)

Cordoba Minerals (CN:CDB) has hit more copper-gold mineralisation at the Alacran deposit, part of its San Matias project, a week after announcing Alacran’s maiden resource of 53.52 million tonnes grading 0.70% copper and 0.37g/t gold.

Cordoba’s joint venture partner at San Matias is High Power Exploration Inc (HPX), a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland’s Ivanhoe Industries.

Cordoba president and CEO Mario Stifano said Hole ACD033 returned one of the best intersections to date on the project, with the mineralisation outside the current resource shell.

It also included intersections of 26m at 1.48% copper and 1.37g/t gold from 20m, and 26m at 3.18% copper and 1.62g/t gold from 62m.

Stifano has told Mining Journal Friedland didn’t invest to find 5Moz or 10Moz and Stifano believed Alacran could be part of a tier one district.

HPX has earned a 51% interest in San Matias by spending C$19 (US$14.4) million on exploration and can now earn up to 65% by completing a feasibility study.

Follow-up drilling is planned to extend the known mineralisation area, which already spans 1.3km and widths of up to 400m.

Cordoba Minerals schießt heute ohne News in Kanada rund 12 % nach oben!!! In Deutschland gibt es kaum Volumen bzw. wird nicht beachtet  Ich hoffe es bleibt so.

Ich hoffe es bleibt so.

Ich hoffe es bleibt so.

Ich hoffe es bleibt so. Interessanter Artikel

Quelle: CEO. Forum The Northern Miner publishes interview with Mario Stifano, CEO of Cordoba Minerals

We invite you to view The Northern Miner's interview with Mr. Stifano here, where he discusses Cordoba's maiden resource at the Alacran copper-gold deposit in Colombia; the company's drilling program with Robert Friedland’s private exploration vehicle, High Power Exploration (HPX); and upcoming plans to further demonstrate Alacran's size potential.

http://cordobaminerals.us14.list-manage1.com/track/click?u=4…

Neuer Artikel

http://www.financialpost.com/m/wp/news/mining/small-cap-news…Cordoba: Copper in Colombia

Resources Wire | Jay Currie

The biggest deposits in the world write their own rules, said Mario Stifano, President and CEO of Cordoba Minerals (V.CDB), Our Alacran Copper-Gold project is potentially a very big and very complex system.

Located in northern Colombia, Cordobas San Matias property covers 200 square kilometers with another 200,000 hectares under application. The Alacran Copper-Gold project is a 390 hectare portion of the overall property.

To figure out a large system Cordoba needed money and world beating technology. Both were supplied by multi-mine mogul, Robert Friedland who, literally, met Stifano on an elevator and has been engaged in the San Matias project ever since.

Getting a handle on such a vast area with so many mineral indications is a huge job. While the test of a discovery is the diamond drill, where to drill is critical to cost-effective success. We have a tremendous number of targets, said Stifano, Which is where the Typhoon technology from joint venture partner, High Power Exploration (HPX), is so useful. It uses terrifically powerful bursts of energy to see deep into the ground. Two kilometers down, which is leaps and bounds ahead of competitive technology. We have access to the technology and, as importantly, the people who can interpret the results through HPX which is indirectly controlled by mining entrepreneur Robert Friedlands Ivanhoe Industries. So we drill according to the information and interpretation Typhoon gives us. Exploration is looking for a needle in a haystack and what Typhoon tells us is where the haystacks are and potentially the needles.

The results to date have obviously impressed Friedland and his team. Hes spent 20 million dollars on the property in a year and a half. Under the terms of our deal he had seven years to make that investment, said Stifano. Robert Friedland is excited by the project.

For Cordoba a significant milestone was passed with the filing of a NI 43-101 in early January 2017. In the press release announcing this initial resource estimate, Stilfano is quoted as saying, We are pleased with the initial mineral resource which demonstrates the potential for the Alacran Project to host a significant tonnage of high-grade, potentially open-pittable copper-gold mineralization. This is just the beginning as our ongoing, aggressive drilling program is aimed at growing the mineral resources in size and confidence levels, extending high-grade copper- and gold-rich mineralized zones and drilling additional exploration targets with potential to add a new and significant exploration front to Alacran.

The initial NI 43-101 inferred resource is an impressive start. We already have 53.5 million tonnes at 0.70% copper and 0.37 g/t gold or 1.1 billion pounds of copper equivalent or 2.4 million ounces of gold equivalent. Most copper mines are 0.5% copper equivalent, and we have signifantly more copper plus the gold putting our grade at almost twice the average and the deposit will get bigger, added Stifano.

In our interview Stifano elaborated, The initial NI 43-101 was based on results from only the first 22 holes weve drilled. There is a lot of unclassified material within the pit shell but we have just not done enough drilling to commit this material to resources. Also the deposit remains open.

Perhaps as important is that the best hole Cordoba has drilled so far, with 108 meters of 1.26% copper and 0.87 g/t gold, is outside the pitshell. Wherever we have drilled or sampled on the property we have found mineralization. said Stifano.

Stifano is confident that Cordoba is looking at a world class district at San Matias. To be world class you need grade and you need quantity. Half a billion tons of high grade material and you hit world class. said Stifano, But that still leaves the question, wheres the heart of it?

Using Typhoon to find the targets, Cordoba is running its drills to try to find the source of the mineralization it is encountering. From the Cordoba shareholder perspective this is costless exploration as HPX is financing the exploration effort as part of their deal to acquire shares. Cordoba does not have to spend a dime, explained Stifano. And given that Friedland owns 36 percent of Cordoba, there is a precise alignment of interests.

At the moment, despite a gratifying rise in the price of Cordoba shares, Stifano is certain that the real value of the property is not yet appreciated by the market. Were identifying porphyries all over the property. To really appreciate the potential value of Cordoba you have to look at the potential of the district as a whole. The blue sky here is in the ongoing exploration of the district. We will turn that blue sky into reality with our aggressive exploration. said Stifano.

At time of writing Cordoba was trading at $0.88 per share with 86.7 million shares outstanding for a market cap of $76.29 million.

Wow, ein schöner Umsatz in can. Und eine sehr schöne Kursentwicklung in den letzten Tagen. Schaut so aus, als wenn die Aktie jetzt ins Laufen käme. Hier gibt es ein gewaltiges Potential. Und Robert Friedland, der Mann mit dem goldenen Händchen!!!

Super News! Frisch reingekommen

Cordoba Minerals Intersects 4,440 g/t Gold, 10.25% Copper, 24.7% Zinc and 347 g/t Silver Over 0.9 Meters in New DiscoveryV.CDB | 57 minutes ago

TORONTO, ONTARIO--(Marketwired - Jan. 23, 2017) - Cordoba Minerals Corp. (TSX VENTURE:CDB)(OTCQX:CDBMF) ("Cordoba" or the "Company") and its joint-venture partner, High Power Exploration Inc. ("HPX"), a private mineral exploration company indirectly controlled by mining entrepreneur Robert Friedland's Ivanhoe Industries, LLC, are pleased to announce that drilling at the San Matias Copper-Gold Project in Colombia has intersected bonanza gold veins at Alacran. The discovery of this new style of high grade gold mineralization represents a separate and significant exploration opportunity at Alacran.

Alacran drilling highlights:

ACD036:

0.90 meters (m) @ 4,440 g/t gold (Au) + 10.25% copper (Cu) + 24.70% zinc (Zn) + 347 g/t silver (Ag)

Part of

5.00 m @ 800.90 g/t Au + 3.70% Cu + 8.60% Zn + 88.63 g/t Ag

136.00 m @ 1.00% Cu + 0.56 g/t Au (cut*)

The 0.90 meter bonanza grade gold intersection in ACD036 is hosted in a late stage, chalcopyrite-sphalerite-carbonate-coarse gold vein that overprints earlier chalcopyrite-pyrrhotite copper-gold mineralization (Figure 1). The high-grade gold vein is similar to Carbonate Base Metal (CBM) vein systems found globally, including Barrick Gold's Porgera gold mine and also Continental Gold's Buritica deposit, located south of Cordoba's licenses along the Mid Cauca belt in Colombia.

The discovery of these structurally controlled high-grade gold rich veins represents an important new target to add extremely high value material within the existing inferred copper-gold mineral resource shell and resource expansion. The CBM Vein in ACD036 was intersected at a depth of approximately 90 meters below surface. Copper-gold mineralization at Alacran has now been intersected over a strike length of 1.3 kilometres, to widths of up to 400 meters, and extends from surface to depths of more than 260 meters below surface.

Mario Stifano, President and CEO of Cordoba, commented: "We are excited by the discovery of bonanza grade gold in CBM veins as this new style of mineralization adds another significant exploration front to potentially increase the size and scope of mineralization at Alacran. We are still in the very early stages of our aggressive exploration program at our district scale San Matias copper-gold project, but our best in class exploration team and HPX's proprietary Typhoon technology, reminds us that anywhere, anytime, there is potential for a significant discovery at San Matias."

Drilling at Alacran will now focus on testing the up-dip eastern extensions of the deposit, the extent of the newly discovered CBM veins including structural controls and the potential source for the mineralization at Alacran.

Alacran Copper-Gold System

The Alacran copper-gold system is located within the San Matias Copper-Gold Project in the Department of Cordoba, Colombia. The San Matias Copper-Gold Project comprises a 20,000-hectare land package on the inferred northern extension of the richly endowed Mid-Cauca Belt in Colombia. The project contains several known areas of porphyry copper-gold mineralization, copper-gold skarn mineralization and vein-hosted, gold-copper mineralization.