Nyrstar - größter Feinzinkhersteller der Welt

eröffnet am 04.05.17 11:59:36 von

neuester Beitrag 26.07.22 18:33:32 von

neuester Beitrag 26.07.22 18:33:32 von

Beiträge: 29

ID: 1.252.141

ID: 1.252.141

Aufrufe heute: 0

Gesamt: 4.001

Gesamt: 4.001

Aktive User: 0

ISIN: BE0974294267 · WKN: A2AKN7

0,0699

EUR

-4,12 %

-0,0030 EUR

Letzter Kurs 03.05.24 Lang & Schwarz

Neuigkeiten

02.05.24 · globenewswire |

19.04.24 · globenewswire |

12.03.24 · globenewswire |

19.09.23 · globenewswire |

27.06.23 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 185,00 | -9,76 | |

| 0,7000 | -11,39 | |

| 0,6700 | -14,92 | |

| 43,97 | -16,90 | |

| 12,000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

Gerechtigkeit wird siegen.

https://www.tijd.be/opinie/algemeen/Waar-blijft-de-morele-ve…

https://www.tijd.be/opinie/algemeen/Waar-blijft-de-morele-ve…

Wir erwarten hier mindestens eine Neubewertung.

https://www.vfb.be/artikel/nyrstar-nog-niet-ten-einde

https://www.vfb.be/artikel/nyrstar-nog-niet-ten-einde

Antwort auf Beitrag Nr.: 66.229.206 von 100m_Feldweg am 29.12.20 18:59:31https://twitter.com/Krisvst/status/1341638216512880642?s=20

Nicht nur in Belgien oder Europa --> weltweit '

Nicht nur in Belgien oder Europa --> weltweit '

"wir werden uns stark verteidigen".....besser nach Recht und Gesetz für alle Beteiligten.

Antwort auf Beitrag Nr.: 63.882.368 von faultcode am 03.06.20 12:48:56Das Drama geht weiter!

6.11.

Trafigura Threatened to Deny Nyrstar Key Credit, Adviser Says

https://www.bloomberg.com/news/articles/2020-11-06/trafigura…

...

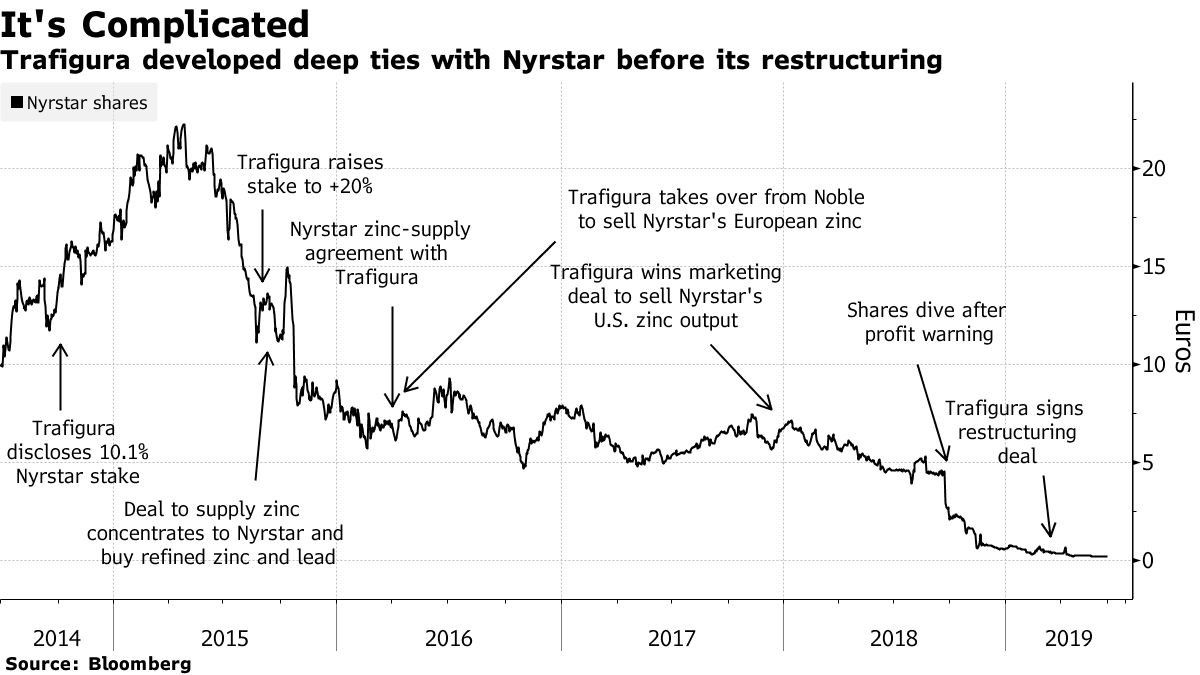

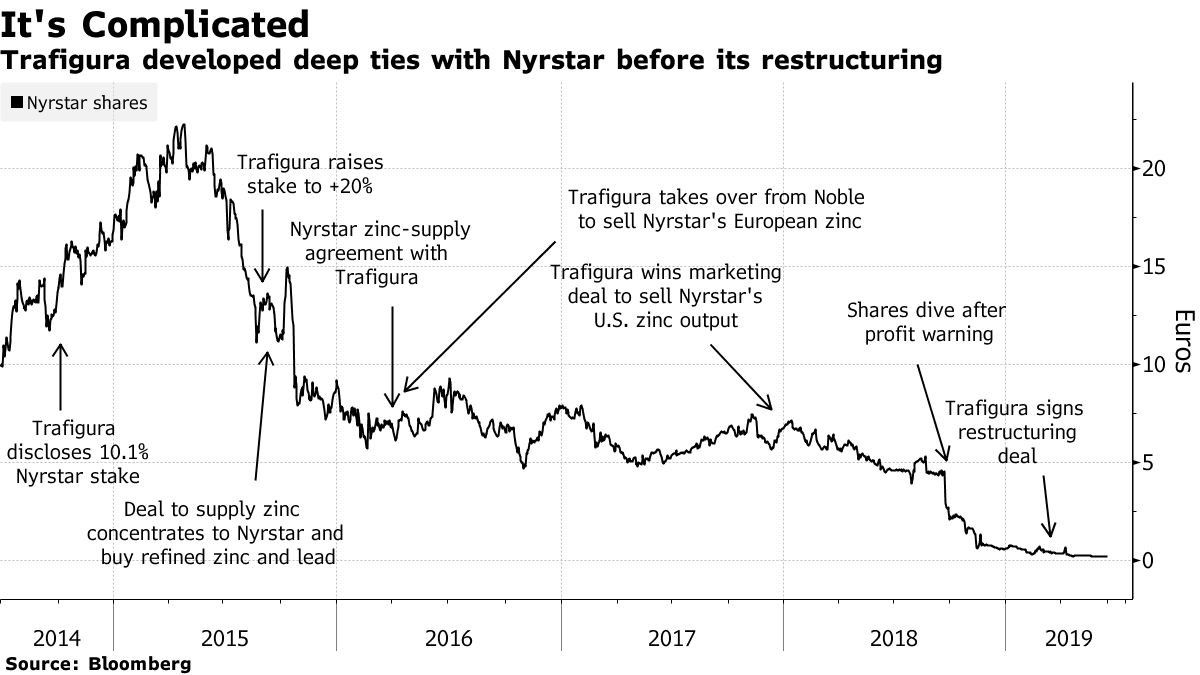

Trafigura Group Ltd. threatened in 2018 to block Nyrstar from drawing on a key loan facility, according to a letter from advisers to Nyrstar’s board, accelerating a cash crunch that ultimately led to the trading giant’s takeover of the company.

The alleged threat by Trafigura -- at the time an important lender to Nyrstar -- to withhold the $250 million credit facility will be examined by a Belgian court-appointed panel of experts as part of a wider investigation into the legality of Trafigura’s acquisition of Nyrstar. Minority investors in Nyrstar, Europe’s largest zinc smelter, allege the takeover infringed governance rules and corporate law.

The accountants’ letter, contained in documents submitted to the Antwerp Commercial Court, was cited by the court in its decision to set up the panel.

It sheds light on how Trafigura may have gained control of Nyrstar. The investigation adds to Trafigura’s legal headaches related to the takeover, with minority investors alleging the company took advantage of its position as Nyrstar’s largest shareholder.

...

The Dec. 5, 2018 letter from Grant Thornton to Nyrstar’s board of directors discusses the credit facility extended by Trafigura, and whether it was still available to Nyrstar.

“A factor in the rapid deterioration of available liquidity came from Trafigura’s assertion that it may have sought to challenge the group’s ability to draw on the original Trafigura facility, which led the group to cease including the original Trafigura facility as part of its available liquidity,” advisers from Grant Thornton wrote.

The Belgian court said Grant Thornton’s letter suggests that Nyrstar’s reluctance to include the $250 million credit facility as part of its available funding resources may have been due to Trafigura’s stance.

“This passage does indeed indicate that the inability to include the TWCF may be due to the attitude of Trafigura itself,” the court said. “This happened at a time when Nyrstar was fighting for its survival.”

Grant Thornton declined to comment.

A spokeswoman for Trafigura said the allegations made by minority shareholders were without merit, but she didn’t comment on the Grant Thornton letter. The debt restructuring, which led to Trafigura taking over Nyrstar, was done in full accordance with the law and approved by U.K. and U.S. courts, the spokeswoman said.

“The restructuring of Nyrstar’s balance sheet was necessitated by the financial stress being experienced by Nyrstar due to its unsustainable levels of debt,” the Trafigura spokeswoman said. “This was brought about by poor mining investments, depressed treatment charges, and losses incurred on the Talvivaara streaming deal, as well as cost over-runs at Port Pirie in Australia.”

The court documents illuminate a critical period in the fall of 2018. When Nyrstar released third-quarter results on Oct. 30, 2018, its management told investors that it had sufficient liquidity to cover its costs and expenses. But over the following weeks, its situation deteriorated rapidly, and on Nov. 21 it agreed to a new $650 million credit line with Trafigura that gave the trading house more security over Nyrstar’s assets and a right of first refusal on any takeover offer.

A lack of clarity on whether Nyrstar still had access to the original facility has long been a central question as to what role Trafigura -- Nyrstar’s biggest supplier of zinc concentrates and No. 1 customer for refined metals -- may have played in the company’s demise. It was also one of the issues Deloitte cited when it said it couldn’t sign off on Nyrstar’s results in a statement included in the annual report.

...

Nyrstar entered talks with Trafigura about additional funding in November 2018 as the company’s liquidity requirements exceeded the existing credit facility, according to a spokesman for Nyrstar.

“The deterioration of the company’s liquidity was a direct consequence of the withdrawal of credit lines at the beginning of November 2018, as well as the fact that its commercial partners no longer provided delayed payment terms or demanded cash as collateral and was not due to Trafigura,” he said. The terms of a new $650 million facility “and the security were not deemed unreasonable given the position Nyrstar was in,” he said.

Trafigura has previously said that banks pulling credit lines caused Nyrstar’s cash crisis, pushing it to the edge of bankruptcy.

Trafigura formally took control of Nyrstar in July 2019, taking on more than $1 billion in company debt and swapping Trafigura-issued debt securities with Nyrstar bondholders. Nyrstar is now consolidated on Trafigura’s books except for the less than 2% equity interest held by minority shareholders in a publicly traded entity called Nyrstar NV.

Belgium’s stock market regulator, the FSMA, has also opened an investigation into whether Brussels-listed Nyrstar made adequate disclosures about its financial situation and its dealings with Trafigura.

6.11.

Trafigura Threatened to Deny Nyrstar Key Credit, Adviser Says

https://www.bloomberg.com/news/articles/2020-11-06/trafigura…

...

Trafigura Group Ltd. threatened in 2018 to block Nyrstar from drawing on a key loan facility, according to a letter from advisers to Nyrstar’s board, accelerating a cash crunch that ultimately led to the trading giant’s takeover of the company.

The alleged threat by Trafigura -- at the time an important lender to Nyrstar -- to withhold the $250 million credit facility will be examined by a Belgian court-appointed panel of experts as part of a wider investigation into the legality of Trafigura’s acquisition of Nyrstar. Minority investors in Nyrstar, Europe’s largest zinc smelter, allege the takeover infringed governance rules and corporate law.

The accountants’ letter, contained in documents submitted to the Antwerp Commercial Court, was cited by the court in its decision to set up the panel.

It sheds light on how Trafigura may have gained control of Nyrstar. The investigation adds to Trafigura’s legal headaches related to the takeover, with minority investors alleging the company took advantage of its position as Nyrstar’s largest shareholder.

...

The Dec. 5, 2018 letter from Grant Thornton to Nyrstar’s board of directors discusses the credit facility extended by Trafigura, and whether it was still available to Nyrstar.

“A factor in the rapid deterioration of available liquidity came from Trafigura’s assertion that it may have sought to challenge the group’s ability to draw on the original Trafigura facility, which led the group to cease including the original Trafigura facility as part of its available liquidity,” advisers from Grant Thornton wrote.

The Belgian court said Grant Thornton’s letter suggests that Nyrstar’s reluctance to include the $250 million credit facility as part of its available funding resources may have been due to Trafigura’s stance.

“This passage does indeed indicate that the inability to include the TWCF may be due to the attitude of Trafigura itself,” the court said. “This happened at a time when Nyrstar was fighting for its survival.”

Grant Thornton declined to comment.

A spokeswoman for Trafigura said the allegations made by minority shareholders were without merit, but she didn’t comment on the Grant Thornton letter. The debt restructuring, which led to Trafigura taking over Nyrstar, was done in full accordance with the law and approved by U.K. and U.S. courts, the spokeswoman said.

“The restructuring of Nyrstar’s balance sheet was necessitated by the financial stress being experienced by Nyrstar due to its unsustainable levels of debt,” the Trafigura spokeswoman said. “This was brought about by poor mining investments, depressed treatment charges, and losses incurred on the Talvivaara streaming deal, as well as cost over-runs at Port Pirie in Australia.”

The court documents illuminate a critical period in the fall of 2018. When Nyrstar released third-quarter results on Oct. 30, 2018, its management told investors that it had sufficient liquidity to cover its costs and expenses. But over the following weeks, its situation deteriorated rapidly, and on Nov. 21 it agreed to a new $650 million credit line with Trafigura that gave the trading house more security over Nyrstar’s assets and a right of first refusal on any takeover offer.

A lack of clarity on whether Nyrstar still had access to the original facility has long been a central question as to what role Trafigura -- Nyrstar’s biggest supplier of zinc concentrates and No. 1 customer for refined metals -- may have played in the company’s demise. It was also one of the issues Deloitte cited when it said it couldn’t sign off on Nyrstar’s results in a statement included in the annual report.

...

Nyrstar entered talks with Trafigura about additional funding in November 2018 as the company’s liquidity requirements exceeded the existing credit facility, according to a spokesman for Nyrstar.

“The deterioration of the company’s liquidity was a direct consequence of the withdrawal of credit lines at the beginning of November 2018, as well as the fact that its commercial partners no longer provided delayed payment terms or demanded cash as collateral and was not due to Trafigura,” he said. The terms of a new $650 million facility “and the security were not deemed unreasonable given the position Nyrstar was in,” he said.

Trafigura has previously said that banks pulling credit lines caused Nyrstar’s cash crisis, pushing it to the edge of bankruptcy.

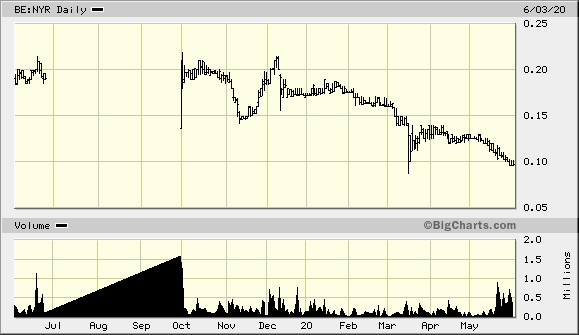

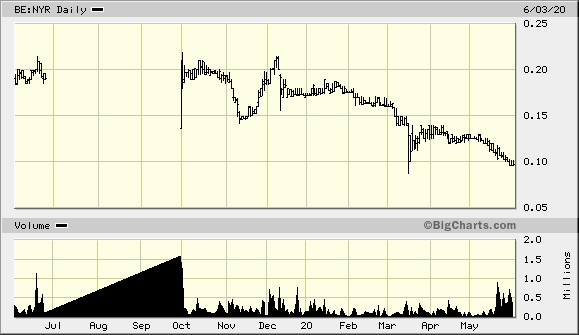

Trafigura formally took control of Nyrstar in July 2019, taking on more than $1 billion in company debt and swapping Trafigura-issued debt securities with Nyrstar bondholders. Nyrstar is now consolidated on Trafigura’s books except for the less than 2% equity interest held by minority shareholders in a publicly traded entity called Nyrstar NV.

Belgium’s stock market regulator, the FSMA, has also opened an investigation into whether Brussels-listed Nyrstar made adequate disclosures about its financial situation and its dealings with Trafigura.

Zinkbedarf weltweit ist höher denn je, der Kurs fällt entsprechend ?

Ein Schelm wer Böses.......

Ein Schelm wer Böses.......

Antwort auf Beitrag Nr.: 63.882.368 von faultcode am 03.06.20 12:48:56Wäre sogar gut vorstellbar, dass Trafigura zusammen mit seinen Lakaien den Zinkpreis gedeckelt hat um die Richard Gere Nummer mit Nyrstar zu vollenden.

Antwort auf Beitrag Nr.: 62.508.842 von faultcode am 28.01.20 14:31:49

01.06.2020

2. FSMA’s continued investigation of the Company The Company notes that a press statement was issued by the FSMA on 29 May 2020 stating that it was to broaden its investigation into the Company.

As stated in the FSMA’s press release, the Management Committee of the FSMA decided in September 2019 to commence an investigation of the provision of information by the Company.

The FSMA has noted that this initial investigation focused on the information provided concerning the commercial relationship with Trafigura. The broadened investigation announced by the FSMA on 29 May 2020 will now include the provision of information about the expected profit contribution from and the total costs for the Port Pirie smelter in Australia, and of information about the Company’s solvency and liquidity position at the end of 2018.

The Company believes that it has at all times properly disclosed the information required by the relevant financial regulations and legislation and will continue to fully cooperate with the investigation.

https://www.wallstreet-online.de/nachricht/12584726-nyrstar-…

FSMA = Financial Services and Markets Authority, Belgium: https://www.fsma.be/language_selection

01.06.2020

2. FSMA’s continued investigation of the Company The Company notes that a press statement was issued by the FSMA on 29 May 2020 stating that it was to broaden its investigation into the Company.

As stated in the FSMA’s press release, the Management Committee of the FSMA decided in September 2019 to commence an investigation of the provision of information by the Company.

The FSMA has noted that this initial investigation focused on the information provided concerning the commercial relationship with Trafigura. The broadened investigation announced by the FSMA on 29 May 2020 will now include the provision of information about the expected profit contribution from and the total costs for the Port Pirie smelter in Australia, and of information about the Company’s solvency and liquidity position at the end of 2018.

The Company believes that it has at all times properly disclosed the information required by the relevant financial regulations and legislation and will continue to fully cooperate with the investigation.

https://www.wallstreet-online.de/nachricht/12584726-nyrstar-…

FSMA = Financial Services and Markets Authority, Belgium: https://www.fsma.be/language_selection