Webjet Ltd - 500 Beiträge pro Seite

eröffnet am 18.07.17 17:46:18 von

neuester Beitrag 03.09.19 18:27:55 von

neuester Beitrag 03.09.19 18:27:55 von

Beiträge: 7

ID: 1.257.455

ID: 1.257.455

Aufrufe heute: 0

Gesamt: 513

Gesamt: 513

Aktive User: 0

ISIN: AU000000WEB7 · WKN: 911549

5,0500

EUR

+0,20 %

+0,0100 EUR

Letzter Kurs 06.05.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 8,8250 | +297,52 | |

| 8,2100 | +33,50 | |

| 0,6370 | +13,95 | |

| 24,240 | +11,45 | |

| 3,8600 | +10,92 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5400 | -4,35 | |

| 351,70 | -5,00 | |

| 2,0400 | -5,99 | |

| 1,8600 | -6,53 | |

| 1,1550 | -9,41 |

adds European rail to its B2B offer for Asia

Jul 13.2017

Australia-listed Webjet continues to grow its global B2B business, with its dedicated brand for Asia – FIT Ruums – signing a deal with Rail Europe.

FIT Ruums was launched in November 2016 and sits alongside European-focused SunHotels and North America and MEA-centric Lots of Hotels within Webjet’s B2B unit, known as WebBeds.

Its deal with Rail Europe effectively allows travel agents in Asia Pacific to sell European rail tickets and passes to clients. Rail Europe works with 35 train companies in Europe, including SNCF in France, Deutsche Bahn in Germany, Trenitalia in Italy, Virgin Trains in the UK and cross-channel operator Eurostar.

FIT Ruums-connected agents in South Korea, Thailand, Hong Kong and Taiwan will be the first to access the inventory, followed by its three key markets – Japan, China and India. Singapore, Malaysia and Indonesia are also part of the second phase.

The demand for European rail travel from Asian tourists is growing, with FIT Ruums saying that more than one million Asian travellers used European rail during the first five months of this year, nearly 10% up on the same period last year.

Switzerland is the most popular destination for Asian rail enthusiasts, followed by the UK, France, Spain, the Netherlands and Germany.

In a presentation to investors around the time that FIT Ruums launched and which summarised its B2B aims and ambitions, Webjet said that in the year to end-June16 its B2B operations generated an EBITDA of A$3.4 million ($2.6 million) from a total transaction volume of A$346 million ($268 million). At the time it expected these figures for the year just ended to come in at more than A$11 million ($8.5 million) and $450 ($348 million) respectively.

And over the next five years it expects B2B to turn in a compound annual growth rate of 30% in terms of its EBITDA.

Jul 13.2017

Australia-listed Webjet continues to grow its global B2B business, with its dedicated brand for Asia – FIT Ruums – signing a deal with Rail Europe.

FIT Ruums was launched in November 2016 and sits alongside European-focused SunHotels and North America and MEA-centric Lots of Hotels within Webjet’s B2B unit, known as WebBeds.

Its deal with Rail Europe effectively allows travel agents in Asia Pacific to sell European rail tickets and passes to clients. Rail Europe works with 35 train companies in Europe, including SNCF in France, Deutsche Bahn in Germany, Trenitalia in Italy, Virgin Trains in the UK and cross-channel operator Eurostar.

FIT Ruums-connected agents in South Korea, Thailand, Hong Kong and Taiwan will be the first to access the inventory, followed by its three key markets – Japan, China and India. Singapore, Malaysia and Indonesia are also part of the second phase.

The demand for European rail travel from Asian tourists is growing, with FIT Ruums saying that more than one million Asian travellers used European rail during the first five months of this year, nearly 10% up on the same period last year.

Switzerland is the most popular destination for Asian rail enthusiasts, followed by the UK, France, Spain, the Netherlands and Germany.

In a presentation to investors around the time that FIT Ruums launched and which summarised its B2B aims and ambitions, Webjet said that in the year to end-June16 its B2B operations generated an EBITDA of A$3.4 million ($2.6 million) from a total transaction volume of A$346 million ($268 million). At the time it expected these figures for the year just ended to come in at more than A$11 million ($8.5 million) and $450 ($348 million) respectively.

And over the next five years it expects B2B to turn in a compound annual growth rate of 30% in terms of its EBITDA.

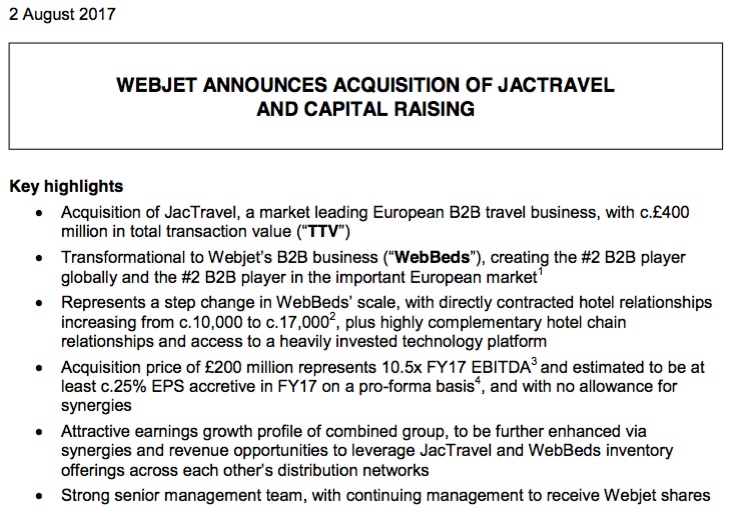

Webjet acquires JacTravel from private equity firm

Aug 2.2017

Online travel firm Webjet is acquiring JacTravel, the UK-based hotel consolidator and specialist in inbound services.

Terms of the deal have not been disclosed but financial press puts it at around £200 million with predications that the Australia-based company may seek to raise capital to help fund the deal.

Webjet is acquiring the business from private equity company Vitruvian Partners, which acquired JacTravel for $135 million three years ago.

Existing brands in the Webjet portfolio include Sunhotels, Lots of Hotels and FIT Ruum on the WebBeds B2B side while Webjet and Zuji make up its B2C offering.

London-based JacTravel operates the JacTravel and totalstay.com brands, with the latter acquired in March 2015.

Both brands now join the WebBeds division and according to a statement “boost its annual total transacted volume to over AUD 1 billion (£600 million).”

In the statement, Webjet managing director John Guscic, says:

“This acquisition is transformational to WebBeds, creating the #2 B2B player globally and the #2 B2B player in the important European market.”

The bedbank space has been hotly contended recently with Hotelbeds acquiring GTA back in March.

Hotelbeds is itself under private equity ownership after it was sold by TUI Group to Cinven and Canada Pension Plan Investment Board last April in a €1.2 billion deal.

Aug 2.2017

Online travel firm Webjet is acquiring JacTravel, the UK-based hotel consolidator and specialist in inbound services.

Terms of the deal have not been disclosed but financial press puts it at around £200 million with predications that the Australia-based company may seek to raise capital to help fund the deal.

Webjet is acquiring the business from private equity company Vitruvian Partners, which acquired JacTravel for $135 million three years ago.

Existing brands in the Webjet portfolio include Sunhotels, Lots of Hotels and FIT Ruum on the WebBeds B2B side while Webjet and Zuji make up its B2C offering.

London-based JacTravel operates the JacTravel and totalstay.com brands, with the latter acquired in March 2015.

Both brands now join the WebBeds division and according to a statement “boost its annual total transacted volume to over AUD 1 billion (£600 million).”

In the statement, Webjet managing director John Guscic, says:

“This acquisition is transformational to WebBeds, creating the #2 B2B player globally and the #2 B2B player in the important European market.”

The bedbank space has been hotly contended recently with Hotelbeds acquiring GTA back in March.

Hotelbeds is itself under private equity ownership after it was sold by TUI Group to Cinven and Canada Pension Plan Investment Board last April in a €1.2 billion deal.

letztes Jahr kamen die Zahlen Anfang September

Antwort auf Beitrag Nr.: 55.461.009 von R-BgO am 04.08.17 17:51:01

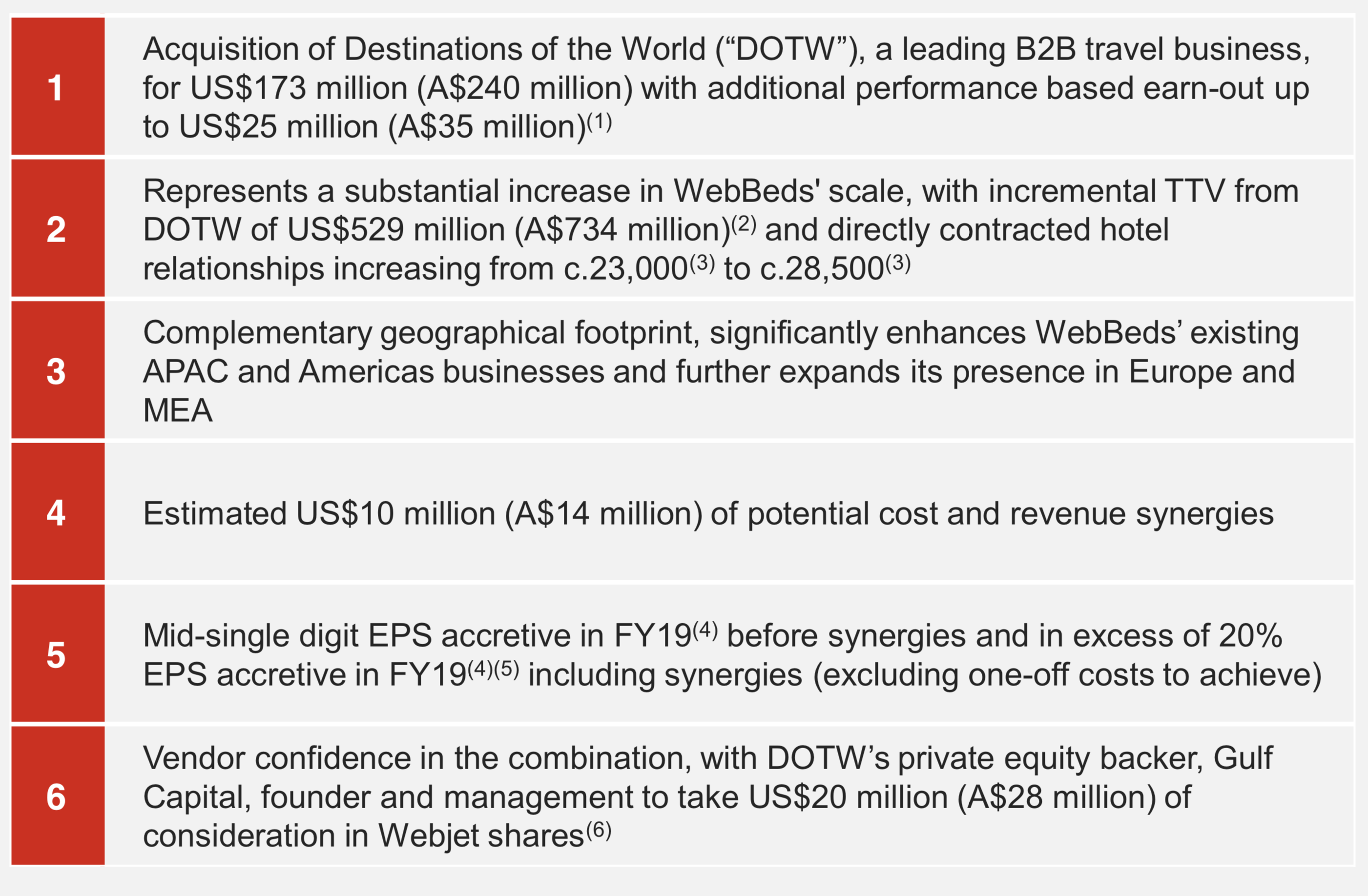

nächster Zukauf:

https://www.dealstreetasia.com/stories/webjet-destinations-o…

Antwort auf Beitrag Nr.: 59.156.661 von R-BgO am 07.11.18 11:19:05

Auszug:

"Hotelbeds remains far bigger than WebBeds, according to Manuel Ferrer, founding partner and chairman of Olea Consultancy and a former Hotelbeds Asia-Pacific executive director.

170,000 hotels" target="_blank" rel="nofollow ugc noopener">Hotelbeds has over 170,000 hotels, the majority if not all are its own direct contracts. By contrast, WebBeds has 28,500 direct contracts. This includes 5,600 it picked up with $173 million acquisition of Destinations of the World from asset management firm Gulf Capital.

Direct contracts are key, for one, because margins are higher compared with bookings drawn from third-party players. What’s more, the majority of the new contracts from Destinations of the World (56 percent) is from Asia-Pacific, which is a key strategic focus of WebBeds.

zur Einordnung:

https://skift.com/2018/11/12/webbeds-on-shopping-spree-for-b…Auszug:

"Hotelbeds remains far bigger than WebBeds, according to Manuel Ferrer, founding partner and chairman of Olea Consultancy and a former Hotelbeds Asia-Pacific executive director.

170,000 hotels" target="_blank" rel="nofollow ugc noopener">Hotelbeds has over 170,000 hotels, the majority if not all are its own direct contracts. By contrast, WebBeds has 28,500 direct contracts. This includes 5,600 it picked up with $173 million acquisition of Destinations of the World from asset management firm Gulf Capital.

Direct contracts are key, for one, because margins are higher compared with bookings drawn from third-party players. What’s more, the majority of the new contracts from Destinations of the World (56 percent) is from Asia-Pacific, which is a key strategic focus of WebBeds.

aktuelles KGV knapp unter 30

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +0,93 | |

| 0,00 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 261 | ||

| 80 | ||

| 70 | ||

| 70 | ||

| 37 | ||

| 34 | ||

| 27 | ||

| 26 | ||

| 23 | ||

| 22 |