Sumitomo Heavy Industries Ltd. (SHI) -- (Präzisions-)Maschinen- und Anlagenbau aus Japan

eröffnet am 07.01.18 23:04:40 von

neuester Beitrag 30.05.22 20:22:02 von

neuester Beitrag 30.05.22 20:22:02 von

Beiträge: 14

ID: 1.271.147

ID: 1.271.147

Aufrufe heute: 0

Gesamt: 1.847

Gesamt: 1.847

Aktive User: 0

ISIN: JP3405400007 · WKN: 859555

26,10

EUR

0,00 %

0,00 EUR

Letzter Kurs 02.05.24 Lang & Schwarz

Werte aus der Branche Maschinenbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 24,200 | +16,51 | |

| 3,5000 | +14,01 | |

| 5,8300 | +12,12 | |

| 1.415,15 | +10,53 | |

| 11,180 | +10,04 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 64,57 | -9,98 | |

| 38,68 | -12,05 | |

| 1.619,80 | -16,71 | |

| 9,6700 | -19,42 | |

| 0,9281 | -22,76 |

Beitrag zu dieser Diskussion schreiben

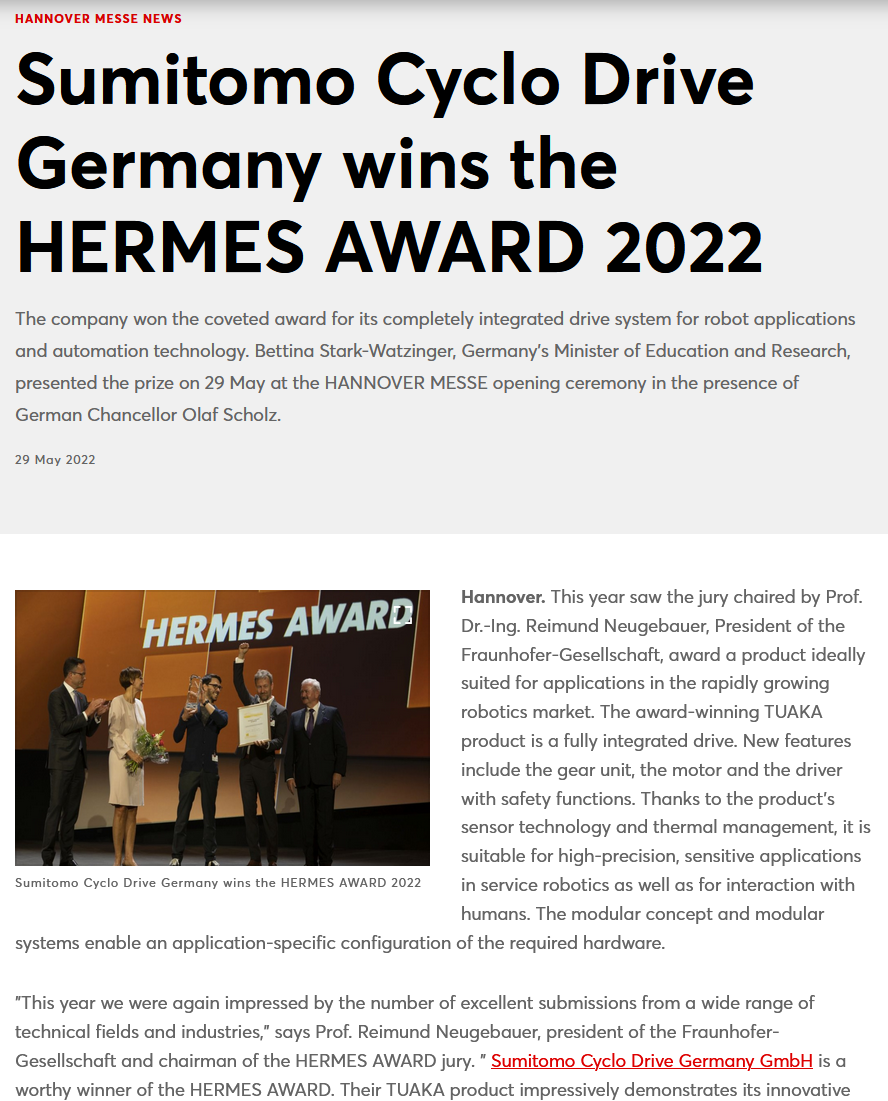

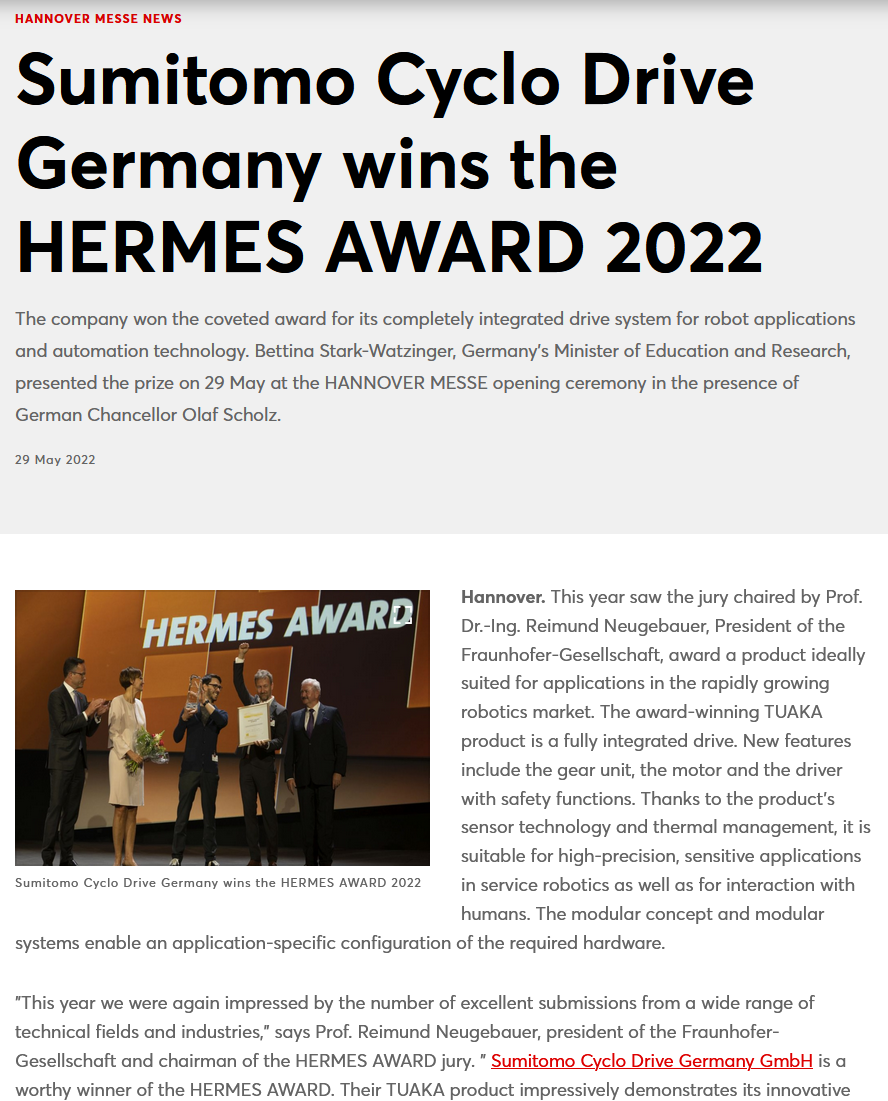

https://www.hannovermesse.de/en/press/press-releases/hannove…

...

die Sumitomo Cyclo Drive Germany GmbH ist eine Tochter der Sumitomo Heavy Industries

...

die Sumitomo Cyclo Drive Germany GmbH ist eine Tochter der Sumitomo Heavy Industries

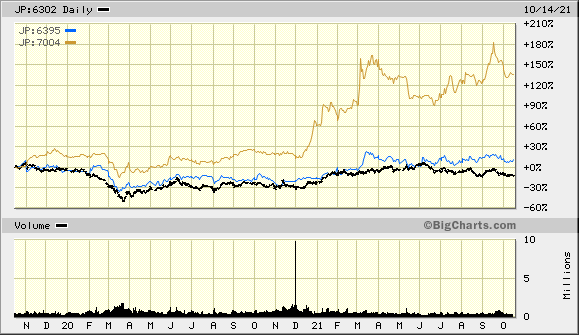

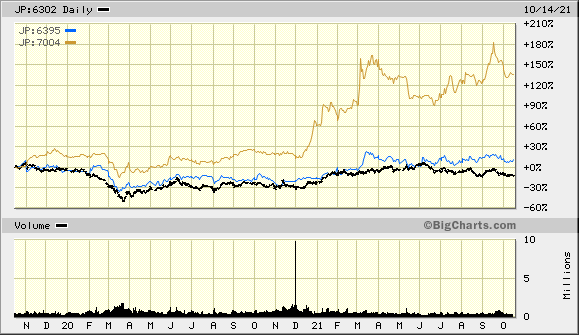

Antwort auf Beitrag Nr.: 64.232.998 von faultcode am 30.06.20 11:10:40ersetze Mitsui Mining durch Tadano (die passen besser als Vergleich; kleine Position):

JP:6302 -- Sumitomo Heavy Industries

JP:6395 -- Tadano

JP:7004 -- Hitachi Zosen

=> nur Hitachi Zosen rocken bislang

JP:6302 -- Sumitomo Heavy Industries

JP:6395 -- Tadano

JP:7004 -- Hitachi Zosen

=> nur Hitachi Zosen rocken bislang

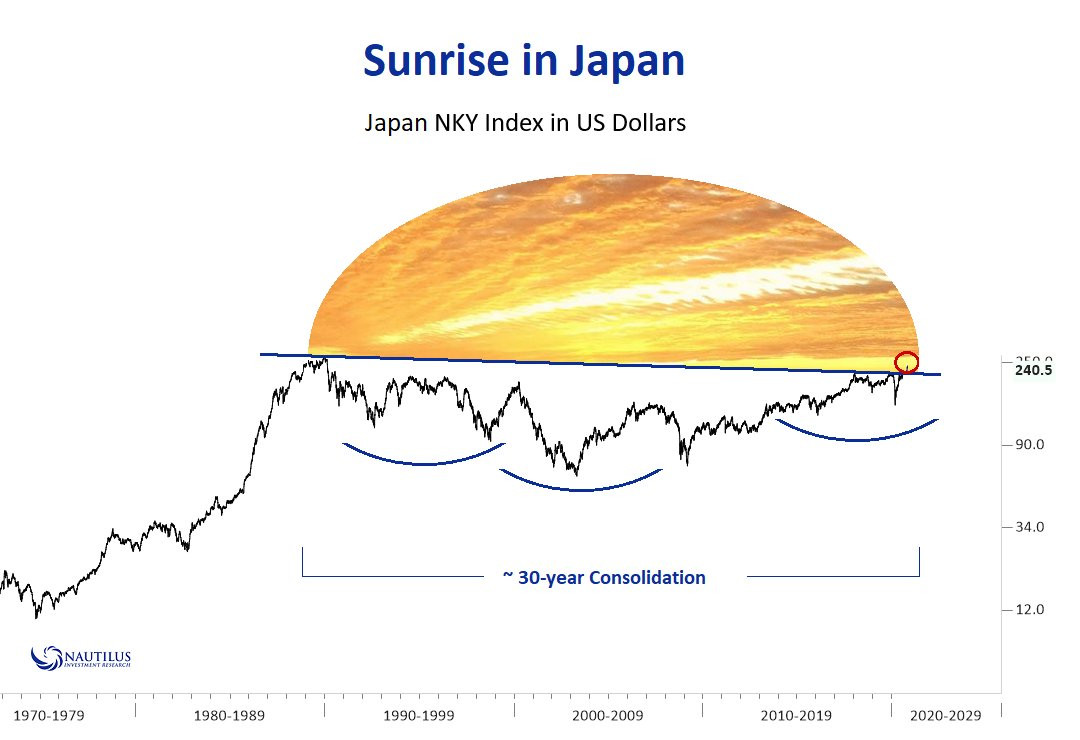

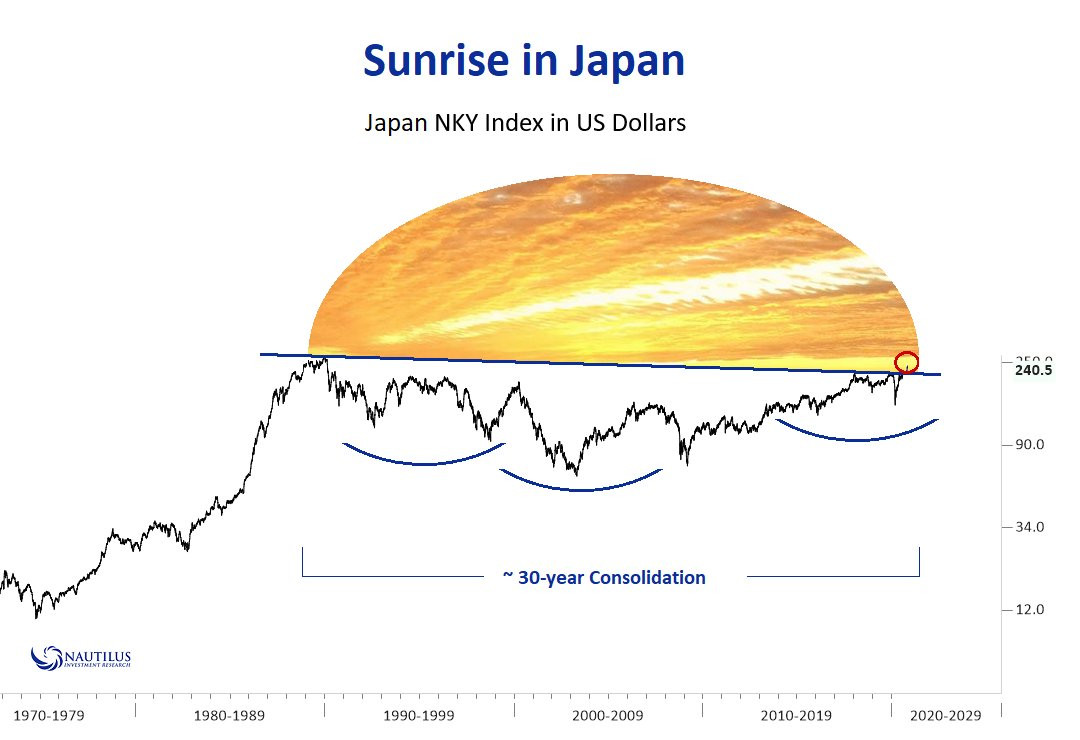

Antwort auf Beitrag Nr.: 64.232.998 von faultcode am 30.06.20 11:10:40Japan, Land der aufgehenden Sonne:

Antwort auf Beitrag Nr.: 59.294.795 von faultcode am 25.11.18 18:36:57..zuletzt war das Gegenteil der Fall:

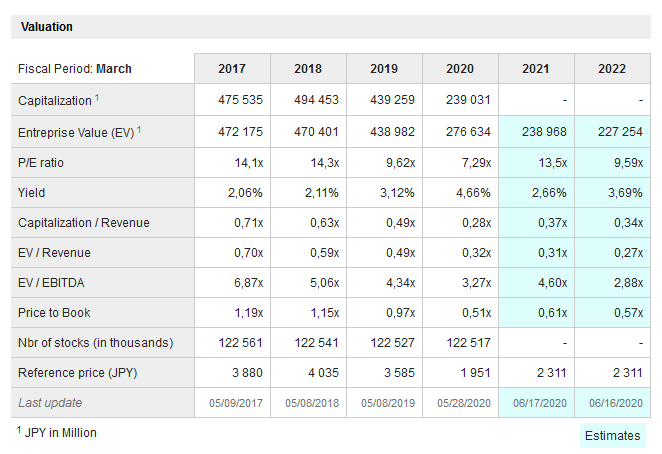

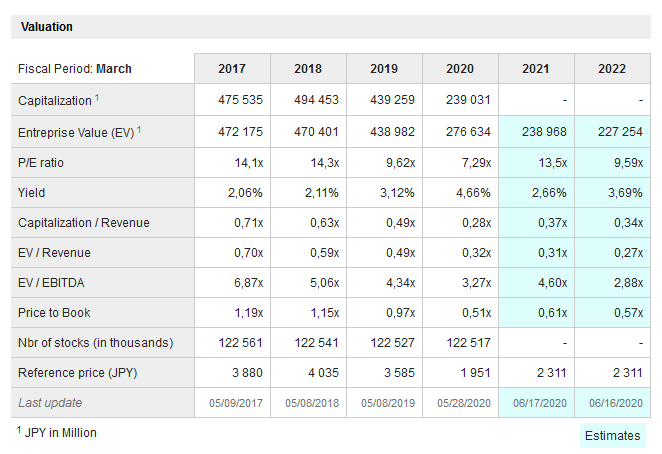

Antwort auf Beitrag Nr.: 62.614.489 von faultcode am 07.02.20 13:52:14spotbillig:

https://www.marketscreener.com/SUMITOMO-HEAVY-INDUSTRIES-649…

https://www.marketscreener.com/SUMITOMO-HEAVY-INDUSTRIES-649…

Antwort auf Beitrag Nr.: 60.266.118 von faultcode am 03.04.19 14:26:047.2.

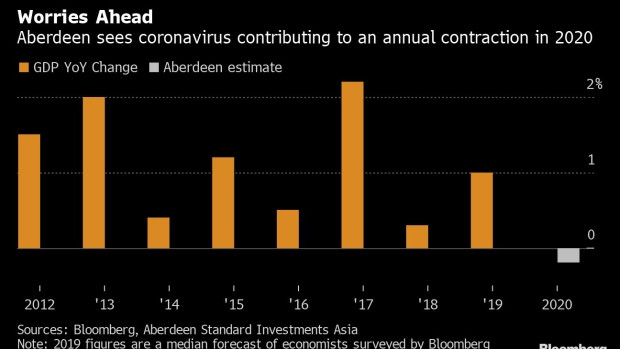

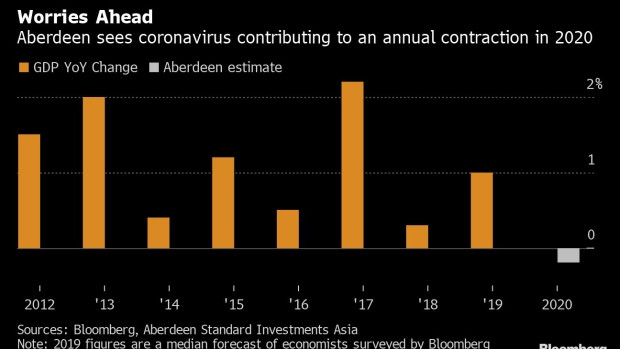

Japan Recession Risks Prompt Forecasts of 2020 Contraction

https://www.bloomberg.com/news/articles/2020-02-07/japan-rec…

Japan is in a recession now, and what’s more its economy is on track to shrink on an annual basis in 2020, according to some analysts factoring in the impact of the coronavirus outbreak and the latest disappointing data.

The effect of the virus is seen as a factor tipping the economy downward for a second quarter at the start of 2020, prompting economists to revise their forecasts this week. Figures out Friday showed household spending deteriorating, suggesting that the economy already contracted more than first thought at the end of last year.

Aberdeen Standard Investments economist Govinda Finn is among those taking a dim view for the whole year, not just in a worst-case scenario but in his baseline view. He now forecasts a contraction of 0.2% in 2020, though he pins more of the blame on policy than the virus. He says the government should have done more to support the economy from the blow of October’s sales tax hike and weak overseas demand.

“If the Ministry of Finance could learn one lesson from the Bank of Japan, it’s that expectations matter,” said Finn, who characterized Prime Minister Shinzo Abe’s stimulus package as more of the same rather than a ramping up of spending. The effectiveness of stimulus is weaker if the government waits until the global economy is in recession before acting, he added.

Abe said earlier Friday he would tap budgeted reserves to put together emergency spending measures next week in response to the coronavirus outbreak.

Economists polled by Bloomberg in a survey released Friday estimate that the economy shrank an annualized 4% in the last quarter. Those forecasting a contraction in the first quarter and a recession are still a small minority, and the median forecast for 2020 is for 0.5% growth.

“The reality is the industrial cycle -- if you look at the production data, it’s still poor. We’re not seeing a turnaround there,” said Finn. “Inventory levels, inventory shipment levels are high. There’s nothing in there that gives me any comfort.”

...

Japan Recession Risks Prompt Forecasts of 2020 Contraction

https://www.bloomberg.com/news/articles/2020-02-07/japan-rec…

Japan is in a recession now, and what’s more its economy is on track to shrink on an annual basis in 2020, according to some analysts factoring in the impact of the coronavirus outbreak and the latest disappointing data.

The effect of the virus is seen as a factor tipping the economy downward for a second quarter at the start of 2020, prompting economists to revise their forecasts this week. Figures out Friday showed household spending deteriorating, suggesting that the economy already contracted more than first thought at the end of last year.

Aberdeen Standard Investments economist Govinda Finn is among those taking a dim view for the whole year, not just in a worst-case scenario but in his baseline view. He now forecasts a contraction of 0.2% in 2020, though he pins more of the blame on policy than the virus. He says the government should have done more to support the economy from the blow of October’s sales tax hike and weak overseas demand.

“If the Ministry of Finance could learn one lesson from the Bank of Japan, it’s that expectations matter,” said Finn, who characterized Prime Minister Shinzo Abe’s stimulus package as more of the same rather than a ramping up of spending. The effectiveness of stimulus is weaker if the government waits until the global economy is in recession before acting, he added.

Abe said earlier Friday he would tap budgeted reserves to put together emergency spending measures next week in response to the coronavirus outbreak.

Economists polled by Bloomberg in a survey released Friday estimate that the economy shrank an annualized 4% in the last quarter. Those forecasting a contraction in the first quarter and a recession are still a small minority, and the median forecast for 2020 is for 0.5% growth.

“The reality is the industrial cycle -- if you look at the production data, it’s still poor. We’re not seeing a turnaround there,” said Finn. “Inventory levels, inventory shipment levels are high. There’s nothing in there that gives me any comfort.”

...

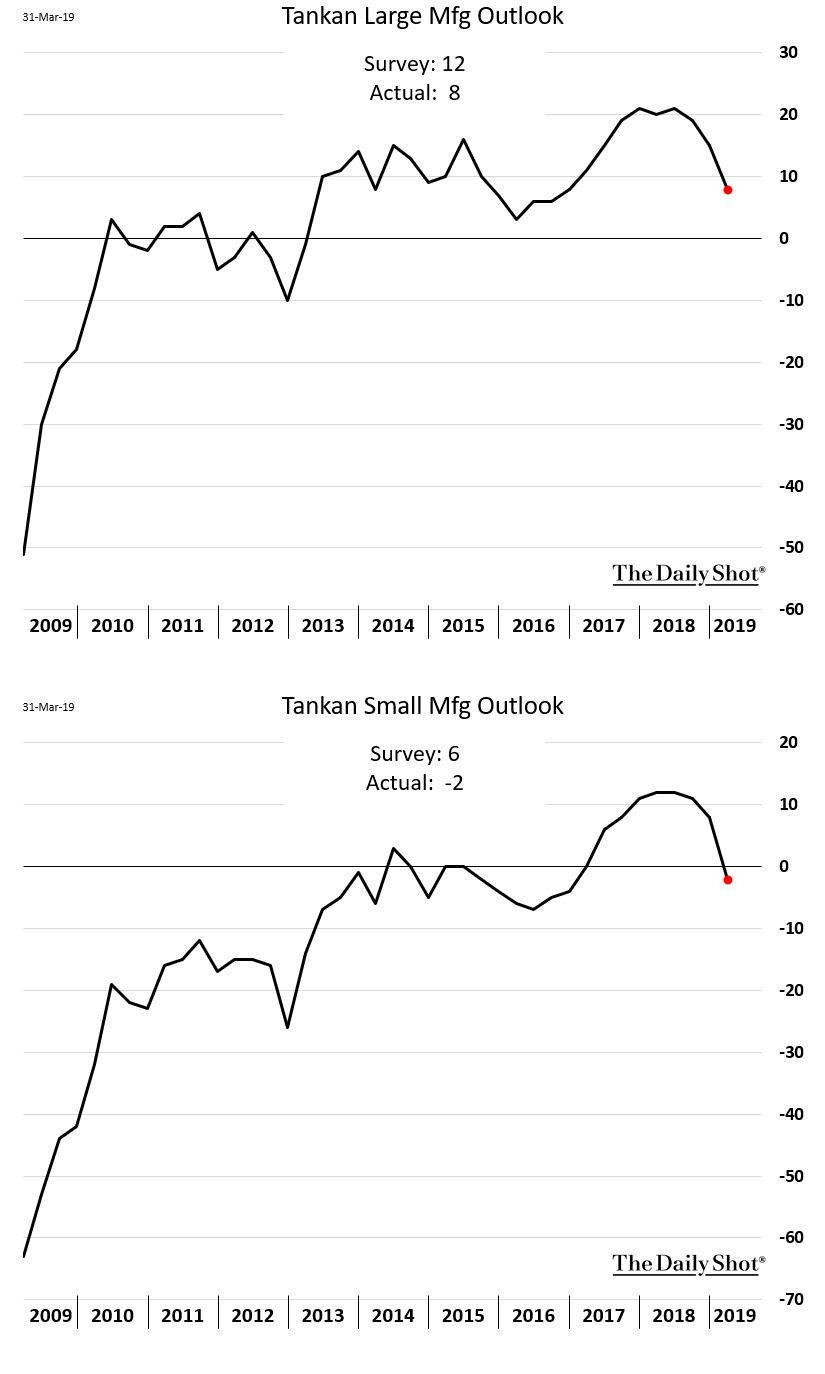

Antwort auf Beitrag Nr.: 59.480.661 von faultcode am 20.12.18 15:56:28

aus: WSJ, The Daily Shot

"Cold winter" in Japan: Tankan Large & Small manufacturing outlook: 2009-2019

.aus: WSJ, The Daily Shot

Antwort auf Beitrag Nr.: 59.294.795 von faultcode am 25.11.18 18:36:57

https://www.bloomberg.com/news/articles/2018-12-20/the-48-bi…

=>

-- Foreigners unload most shares since Black Monday crash of 1987

-- UBS Wealth says it’s going to be a ‘cold winter’ for equities

Japanese stocks tumbled into a bear market, buffeted by the biggest foreign

investor exodus in three decades. UBS Wealth Management says the worst may be

yet to come.

Traders should brace for a “cold winter,” said Toru Ibayashi, head of Japanese

equities at the money manager, after the benchmark Topix index slid 2.5 percent

on Thursday to take its decline from a January high to 21 percent. Overseas

investors have dumped about $48 billion in the country’s stocks so far this

year, the most since 1987, the year of Wall Street’s famous Black Monday market

crash.

The Topix is down 9 percent this month alone, set for its worst December

performance since 1959, as Japanese equities get sucked into a global market

sell-off spurred by concern about the U.S.-China trade war and central banks’

tightening of monetary policy. While that’s sent valuations on the benchmark

gauge to their lowest since 2012, UBS’s Ibayashi says it’s too early to jump

back into the market.

“Japanese equities will suffer from global investors’ selling pressure until

March,” Ibayashi said in a phone interview. He pointed to the need to know the

outcome of trade negotiations between the U.S. and China that are set to run

until the start of that month. “We are near the bottom but we can see some

downside left. Be patient until March.” External Factors

The country’s stock market, so often swayed by external events, is in that

position again. Investors say that because the fall was due to factors such as

the trade uncertainty, not domestic corporate profits, the market is unlikely to

rebound until they’re resolved.

“There isn’t much of a Japan-specific reason to this,” said Naoki Murakami, a

Tokyo-based market strategist at AllianceBernstein Japan Ltd. “It’s not as if

the foreign selling indicates a disappointment towards Japan.”

Murakami says that one of the things that could help Japanese equities is if the

U.S. Federal Reserve moderates its stance on interest-rate increases. A dovish

Fed could bolster U.S. equities and in turn rekindle foreign appetite for

Japanese stocks. Nader Naeimi of AMP Capital Investors Ltd. takes the same

position. He needs to see confidence restored in other markets before he’ll buy

back into Japan.

“Local fundamentals now don’t count for much as the global bear market gains

momentum,” the Sydney-based fund manager Naeimi said by email. “I doubt there

will be a strong interest until fears over global equity bear market and a

possible U.S. recession have given way to global growth optimism.” Foreign

Reversal

This year’s performance and foreign selling is a stark contrast to 2013, when

foreigners piled into the Japanese stock market on enthusiasm about Prime

Minister Shinzo Abe’s plans to stimulate the economy and kickstart inflation.

Ryota Sakagami of JPMorgan Securities estimates that foreign investors have sold

12 trillion yen ($107 billion) of cash equities and futures this year.

“Foreigners are liquidating the positions they’ve built up during the days of

the Abenomics-driven market,” said Hiroshi Matsumoto, head of Japan investment

at Pictet Asset Management Ltd.

Japan has entered a bear market despite record stock-market purchases by the

Bank of Japan. The BOJ has bought 6.2 trillion yen in exchange-traded funds

tracking the nation’s shares this year through Dec. 19, exceeding its annual

target for 6 trillion yen.

The Topix trades at 12 times estimated earnings, the lowest since September

2012. The market is now so cheap that it wouldn’t be strange to see some buyers,

according to Matsumoto. But for foreigners to return en masse like they did in

2013, they’re going to need a more convincing reason, he said.

“They’ll come back when they’re able to picture another growth story for Japan,”

he said.

The Billion Sell-Off That Sent Japan Stocks Into Bear Market

20. Dezember 2018https://www.bloomberg.com/news/articles/2018-12-20/the-48-bi…

=>

-- Foreigners unload most shares since Black Monday crash of 1987

-- UBS Wealth says it’s going to be a ‘cold winter’ for equities

Japanese stocks tumbled into a bear market, buffeted by the biggest foreign

investor exodus in three decades. UBS Wealth Management says the worst may be

yet to come.

Traders should brace for a “cold winter,” said Toru Ibayashi, head of Japanese

equities at the money manager, after the benchmark Topix index slid 2.5 percent

on Thursday to take its decline from a January high to 21 percent. Overseas

investors have dumped about $48 billion in the country’s stocks so far this

year, the most since 1987, the year of Wall Street’s famous Black Monday market

crash.

The Topix is down 9 percent this month alone, set for its worst December

performance since 1959, as Japanese equities get sucked into a global market

sell-off spurred by concern about the U.S.-China trade war and central banks’

tightening of monetary policy. While that’s sent valuations on the benchmark

gauge to their lowest since 2012, UBS’s Ibayashi says it’s too early to jump

back into the market.

“Japanese equities will suffer from global investors’ selling pressure until

March,” Ibayashi said in a phone interview. He pointed to the need to know the

outcome of trade negotiations between the U.S. and China that are set to run

until the start of that month. “We are near the bottom but we can see some

downside left. Be patient until March.” External Factors

The country’s stock market, so often swayed by external events, is in that

position again. Investors say that because the fall was due to factors such as

the trade uncertainty, not domestic corporate profits, the market is unlikely to

rebound until they’re resolved.

“There isn’t much of a Japan-specific reason to this,” said Naoki Murakami, a

Tokyo-based market strategist at AllianceBernstein Japan Ltd. “It’s not as if

the foreign selling indicates a disappointment towards Japan.”

Murakami says that one of the things that could help Japanese equities is if the

U.S. Federal Reserve moderates its stance on interest-rate increases. A dovish

Fed could bolster U.S. equities and in turn rekindle foreign appetite for

Japanese stocks. Nader Naeimi of AMP Capital Investors Ltd. takes the same

position. He needs to see confidence restored in other markets before he’ll buy

back into Japan.

“Local fundamentals now don’t count for much as the global bear market gains

momentum,” the Sydney-based fund manager Naeimi said by email. “I doubt there

will be a strong interest until fears over global equity bear market and a

possible U.S. recession have given way to global growth optimism.” Foreign

Reversal

This year’s performance and foreign selling is a stark contrast to 2013, when

foreigners piled into the Japanese stock market on enthusiasm about Prime

Minister Shinzo Abe’s plans to stimulate the economy and kickstart inflation.

Ryota Sakagami of JPMorgan Securities estimates that foreign investors have sold

12 trillion yen ($107 billion) of cash equities and futures this year.

“Foreigners are liquidating the positions they’ve built up during the days of

the Abenomics-driven market,” said Hiroshi Matsumoto, head of Japan investment

at Pictet Asset Management Ltd.

Japan has entered a bear market despite record stock-market purchases by the

Bank of Japan. The BOJ has bought 6.2 trillion yen in exchange-traded funds

tracking the nation’s shares this year through Dec. 19, exceeding its annual

target for 6 trillion yen.

The Topix trades at 12 times estimated earnings, the lowest since September

2012. The market is now so cheap that it wouldn’t be strange to see some buyers,

according to Matsumoto. But for foreigners to return en masse like they did in

2013, they’re going to need a more convincing reason, he said.

“They’ll come back when they’re able to picture another growth story for Japan,”

he said.

Sumitomo Heavy Industries hält sich von den drei Vergleichswerten noch am besten:

European Union and Japan signed a huge free trade deal that cuts or eliminates tariffs on nearly all goods

July 17, 2018https://money.cnn.com/2018/07/17/news/economy/eu-japan-trade…

=>

...

The agreement covers 600 million people and almost a third of the global economy. It's also a major endorsement of a global trading system that is under increasing threat from protectionism.

It will remove tariffs on European exports such as cheese and wine. Japanese automakers and electronics firms will face fewer barriers in the European Union.

...

Average global tariffs are near record lows. EU products currently face an average tariff of 1.6% when they arrive in Japan, while Japanese products face tariffs of 2.9% in the European Union, according to the World Trade Organization.

Still, the European Union said the tariffs cost its companies up to €1 billion ($1.2 billion) per year.

The trade deal is expected to come into force in 2019 after being approved by lawmakers on both sides.

=> ein möglicher Katalysator für den japanischen Maschinen- und Anlagenbau?