Drax Group - thermische Energieversorgung in UK (Seite 2)

eröffnet am 16.10.18 19:42:00 von

neuester Beitrag 08.01.24 12:05:26 von

neuester Beitrag 08.01.24 12:05:26 von

Beiträge: 28

ID: 1.290.666

ID: 1.290.666

Aufrufe heute: 0

Gesamt: 3.150

Gesamt: 3.150

Aktive User: 0

ISIN: GB00B1VNSX38 · WKN: A0MK9W · Symbol: D9F2

6,6300

EUR

+2,16 %

+0,1400 EUR

Letzter Kurs 16.05.24 Tradegate

Neuigkeiten

08.01.24 · dpa-AFX |

01.12.23 · dpa-AFX Analysen |

24.11.23 · globenewswire |

22.11.23 · globenewswire |

Werte aus der Branche Versorger

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.197,39 | +16,80 | |

| 16,160 | +11,53 | |

| 4,4000 | +10,00 | |

| 12,01 | +9,08 | |

| 28.400,00 | +8,81 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6800 | -14,10 | |

| 23,72 | -20,16 | |

| 32,63 | -27,52 | |

| 4,0000 | -28,57 | |

| 3,44 | -100,00 |

Beitrag zu dieser Diskussion schreiben

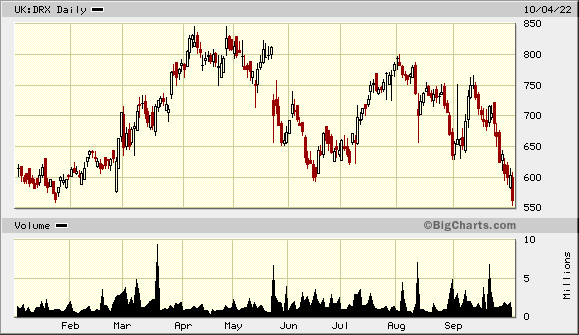

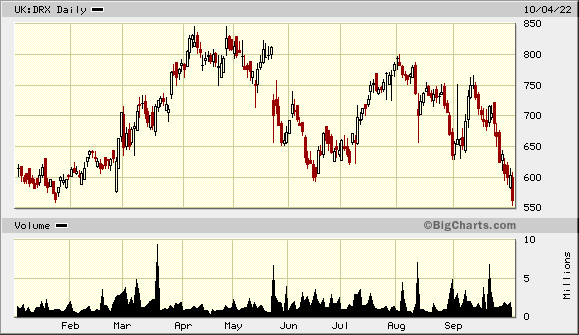

4.10.

UK’s Drax Drops After Panorama Questions Firm’s Forestry Methods

https://financialpost.com/pmn/business-pmn/uks-drax-drops-af…

...

Drax Group Plc shares suffered their biggest intraday drop in nearly two months after BBC Panorama said the UK power firm is cutting down “environmentally important” forests.

The television program aired Monday evening said Drax is chopping down forests in Canada to make wood pellets that are then burned to produce electricity in Britain. That is likely to hurt the investment case for the firm in the near term, said JPMorgan Chase & Co. analyst Pavan Mahbubani.

Drax said ahead of the program that 80% of the material used to make its pellets in Canada is “sawmill residue — sawdust, wood chips and bark left over when the timber is processed.” The rest is waste material collected from forests that would otherwise be burned to reduce the risk of wildfires and disease, it said.

“The forests there are not harvested for biomass, they are harvested for high value timber used in construction,” a spokesperson said in a statement. “People living in and around these forests are best placed to determine how they should be looked after, not the BBC.”

“We believe that the Panorama programme is unhelpful for the Drax story near term, and that the use of wood pellets to generate electricity will continue to be controversial,” JPMorgan’s Mahbubani wrote in a note to clients.

However longer term, the fundamental investment case is unchanged, he said, adding the UK government is likely to remain supportive of biomass and bioenergy with carbon capture and storage. A government biomass strategy that’s due to be published by year-end should be a positive catalyst for the shares, he said, maintaining an overweight rating.

...

=>

UK’s Drax Drops After Panorama Questions Firm’s Forestry Methods

https://financialpost.com/pmn/business-pmn/uks-drax-drops-af…

...

Drax Group Plc shares suffered their biggest intraday drop in nearly two months after BBC Panorama said the UK power firm is cutting down “environmentally important” forests.

The television program aired Monday evening said Drax is chopping down forests in Canada to make wood pellets that are then burned to produce electricity in Britain. That is likely to hurt the investment case for the firm in the near term, said JPMorgan Chase & Co. analyst Pavan Mahbubani.

Drax said ahead of the program that 80% of the material used to make its pellets in Canada is “sawmill residue — sawdust, wood chips and bark left over when the timber is processed.” The rest is waste material collected from forests that would otherwise be burned to reduce the risk of wildfires and disease, it said.

“The forests there are not harvested for biomass, they are harvested for high value timber used in construction,” a spokesperson said in a statement. “People living in and around these forests are best placed to determine how they should be looked after, not the BBC.”

“We believe that the Panorama programme is unhelpful for the Drax story near term, and that the use of wood pellets to generate electricity will continue to be controversial,” JPMorgan’s Mahbubani wrote in a note to clients.

However longer term, the fundamental investment case is unchanged, he said, adding the UK government is likely to remain supportive of biomass and bioenergy with carbon capture and storage. A government biomass strategy that’s due to be published by year-end should be a positive catalyst for the shares, he said, maintaining an overweight rating.

...

=>

11.8.

UK minister questions sustainability of Drax biomass fuel

Kwarteng says shipping wood pellets from Louisiana is costly and ‘doesn’t make any sense’

https://www.ft.com/content/3b18291e-9449-45fd-9517-8edb8433f…

...

The UK’s business secretary has admitted that importing US-made wood pellets to be burnt for energy by power company Drax is not sustainable and “doesn’t make any sense”.

Kwasi Kwarteng also told MPs that the government had not fully investigated the sustainability of burning wood pellets, a type of biomass. He said the Department for Business, Energy and Industrial Strategy had discussed biomass with industry but “we haven’t actually questioned some of the premises” of the sustainability of pellets.

The government has spent millions subsidising the burning of pellets in Drax’s Yorkshire facility over the past decade and the fuel features prominently in the UK’s net zero strategy.

Kwarteng made the comments this week during a meeting with a group of cross-party backbench MPs, who raised concerns about the sustainability of wood pellets, which are described as renewable by Drax.

“There’s no point getting [wood pellets] from Louisiana . . . that isn’t sustainable,” said Kwarteng. Shipping pellets from Louisiana — one of Drax’s sourcing regions in the US — has “a huge cost financially and environmentally . . . [it] doesn’t make any sense to me at all,” he added.

...

UK minister questions sustainability of Drax biomass fuel

Kwarteng says shipping wood pellets from Louisiana is costly and ‘doesn’t make any sense’

https://www.ft.com/content/3b18291e-9449-45fd-9517-8edb8433f…

...

The UK’s business secretary has admitted that importing US-made wood pellets to be burnt for energy by power company Drax is not sustainable and “doesn’t make any sense”.

Kwasi Kwarteng also told MPs that the government had not fully investigated the sustainability of burning wood pellets, a type of biomass. He said the Department for Business, Energy and Industrial Strategy had discussed biomass with industry but “we haven’t actually questioned some of the premises” of the sustainability of pellets.

The government has spent millions subsidising the burning of pellets in Drax’s Yorkshire facility over the past decade and the fuel features prominently in the UK’s net zero strategy.

Kwarteng made the comments this week during a meeting with a group of cross-party backbench MPs, who raised concerns about the sustainability of wood pellets, which are described as renewable by Drax.

“There’s no point getting [wood pellets] from Louisiana . . . that isn’t sustainable,” said Kwarteng. Shipping pellets from Louisiana — one of Drax’s sourcing regions in the US — has “a huge cost financially and environmentally . . . [it] doesn’t make any sense to me at all,” he added.

...

Antwort auf Beitrag Nr.: 71.956.492 von faultcode am 11.07.22 15:08:5326.7.

UK’s Drax Posts Earnings Jump Even as Power Output Declines

https://www.bnnbloomberg.ca/uk-s-drax-posts-earnings-jump-ev…

...

Drax Group Plc posted first-half results that beat expectations by a wide margin as soaring power prices helped lift the UK utility’s income even though it produced less energy.

The generator, which was spared from a UK windfall tax on power generators, saw its biomass generation drop by almost 20% compared with the same period last year, it said in a statement Tuesday. Still, the company reported £225 million ($271 million) in earnings before interest, taxes, depreciation and amortization, which was well above analysts’ consensus.

“It is increasingly obvious with each set of results that Drax is benefiting from the high commodity price environment,” Citigroup Inc. analyst Jenny Ping wrote in a note, adding that she thought that would attract political scrutiny. “We believe the government (whoever in charge) is unlikely to stand by and do nothing to support consumers as energy bills continue to rise into winter.”

...

UK’s Drax Posts Earnings Jump Even as Power Output Declines

https://www.bnnbloomberg.ca/uk-s-drax-posts-earnings-jump-ev…

...

Drax Group Plc posted first-half results that beat expectations by a wide margin as soaring power prices helped lift the UK utility’s income even though it produced less energy.

The generator, which was spared from a UK windfall tax on power generators, saw its biomass generation drop by almost 20% compared with the same period last year, it said in a statement Tuesday. Still, the company reported £225 million ($271 million) in earnings before interest, taxes, depreciation and amortization, which was well above analysts’ consensus.

“It is increasingly obvious with each set of results that Drax is benefiting from the high commodity price environment,” Citigroup Inc. analyst Jenny Ping wrote in a note, adding that she thought that would attract political scrutiny. “We believe the government (whoever in charge) is unlikely to stand by and do nothing to support consumers as energy bills continue to rise into winter.”

...

Antwort auf Beitrag Nr.: 71.927.514 von faultcode am 06.07.22 15:07:37q.e.d.

11.7.

Utility Shares Rise as UK Spares Firms From Windfall Tax

https://finance.yahoo.com/news/utility-shares-rise-uk-spares…

...

A windfall tax on the profits of oil and gas companies, which will be brought before Parliament this week, won’t apply to electricity generators, the prime minister’s spokesman told reporters. Drax Group Plc, SSE Plc and Centrica Plc all rose on the news.

The proposal was seen as jeopardizing billions of pounds of investment in renewable generation, a key part of cutting emissions by 2050. The tax on oil and gas companies was imposed to help pay for support for households struggling with rising energy bills amid the worst cost-of-living crisis for decades.

The move comes as Boris Johnson plans to step down following a revolt by members of his Conservative party. The premier isn’t supposed to make new policy decisions while he’s in a caretaker role.

“There’s no plans to do that in line with convention, so we will continue to evaluate the scale of the profits and take appropriate steps -- but we have no plans to introduce or extend that to that group,” the prime minister’s spokesman Max Blain told reporters.

Drax shares climbed as much as 7.5% to the highest in more than a month, while Centrica advanced as much as 5% and SSE increased 3.9% on the London Stock Exchange.

11.7.

Utility Shares Rise as UK Spares Firms From Windfall Tax

https://finance.yahoo.com/news/utility-shares-rise-uk-spares…

...

A windfall tax on the profits of oil and gas companies, which will be brought before Parliament this week, won’t apply to electricity generators, the prime minister’s spokesman told reporters. Drax Group Plc, SSE Plc and Centrica Plc all rose on the news.

The proposal was seen as jeopardizing billions of pounds of investment in renewable generation, a key part of cutting emissions by 2050. The tax on oil and gas companies was imposed to help pay for support for households struggling with rising energy bills amid the worst cost-of-living crisis for decades.

The move comes as Boris Johnson plans to step down following a revolt by members of his Conservative party. The premier isn’t supposed to make new policy decisions while he’s in a caretaker role.

“There’s no plans to do that in line with convention, so we will continue to evaluate the scale of the profits and take appropriate steps -- but we have no plans to introduce or extend that to that group,” the prime minister’s spokesman Max Blain told reporters.

Drax shares climbed as much as 7.5% to the highest in more than a month, while Centrica advanced as much as 5% and SSE increased 3.9% on the London Stock Exchange.

Antwort auf Beitrag Nr.: 71.666.895 von faultcode am 27.05.22 13:25:196.7.

Resignation of UK’s Sunak Could Sink Power Windfall Tax

https://ampvideo.bnnbloomberg.ca/resignation-of-uk-s-sunak-c…

...

A mooted windfall tax on UK power generators could be delayed or scrapped entirely after Chancellor Rishi Sunak resigned on Tuesday, according to utilities analysts.

“The possibility of a windfall tax on electricity was a Treasury policy, so hopefully Rishi Sunak’s departure will see this misguided policy dropped,” said Investec Plc’s Martin Young in a note Wednesday. The departure could be positive news for shares of Drax Group Plc, Centrica Plc and SSE Plc, he added.

The UK Treasury, which was still considering the policy as recently as mid-June, had been criticized for creating uncertainty in the energy market by dragging its heels on the proposals after reports hit the share prices of generators. Sunak has already set out clear plans for a tax on oil and gas producers, though has since met with industry to discuss their concerns.

Any leadership contest is likely to delay new legislation, “be it windfall taxes or structural reform of the power market,” said Citigroup Inc. analyst Jenny Ping in a note. “It could also change the political narrative all together, for good or bad for the sector.”

...

Resignation of UK’s Sunak Could Sink Power Windfall Tax

https://ampvideo.bnnbloomberg.ca/resignation-of-uk-s-sunak-c…

...

A mooted windfall tax on UK power generators could be delayed or scrapped entirely after Chancellor Rishi Sunak resigned on Tuesday, according to utilities analysts.

“The possibility of a windfall tax on electricity was a Treasury policy, so hopefully Rishi Sunak’s departure will see this misguided policy dropped,” said Investec Plc’s Martin Young in a note Wednesday. The departure could be positive news for shares of Drax Group Plc, Centrica Plc and SSE Plc, he added.

The UK Treasury, which was still considering the policy as recently as mid-June, had been criticized for creating uncertainty in the energy market by dragging its heels on the proposals after reports hit the share prices of generators. Sunak has already set out clear plans for a tax on oil and gas producers, though has since met with industry to discuss their concerns.

Any leadership contest is likely to delay new legislation, “be it windfall taxes or structural reform of the power market,” said Citigroup Inc. analyst Jenny Ping in a note. “It could also change the political narrative all together, for good or bad for the sector.”

...

"Conservatives" in UK:

27.5.

Big Dividend Payers May Be Next After UK Windfall Energy Tax

https://www.bnnbloomberg.ca/big-dividend-payers-may-be-next-…

...

UK Chancellor of the Exchequer Rishi Sunak just slapped a £5 billion ($6.3 billion) levy on energy companies to help fund support for Britons facing a cost-of-living crisis. Other big dividend payers, including miners and consumer-goods firms, could be next.

With the country facing a record squeeze on living standards, public perception of companies that are believed to be over-earning is putting pressure on the government to intervene. Stocks in consumer-sensitive sectors such as food retail and telecoms could also be “vulnerable to increasing political interference,” according to Roger Jones, head of equities at London & Capital.

“It’s possible that other sectors get targeted, given how much pressure the chancellor is under to help out struggling consumers,” said Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. “Last year, the supermarkets were in the frame for a windfall tax because of perceived excess earnings during the pandemic. But the government will be keen to ensure an obvious pattern doesn’t emerge.”

While imposing a windfall tax on the profits of oil and gas producers, Boris Johnson’s government left the door open on applying a similar levy to power generators making “extraordinary profits.” That sent shares of Centrica Plc, SSE Plc and Drax Group Plc slumping on Thursday.

Miners are again expected to make up a large chunk of FTSE 100 dividends this year, with Rio Tinto Plc forecast to be the single biggest paying stock in the index, according to data from AJ Bell. Glencore Plc and Anglo American Plc are also expected to be among the top 10 payers, alongside British American Tobacco Plc, Unilever Plc and AstraZeneca Plc, the data show.

To be sure, other market strategists believe paying high dividends alone won’t be enough to attract levies, with taxes likely to be focused on areas contributing to the surge in inflation to a 40-year high. “I don’t expect a Conservative chancellor to engage in more broad-based windfall taxation,” said James Athey, investment director at abrdn.

Here’s a list of stocks expected to be the 10 biggest contributors to FTSE 100 dividends in 2023, according to Bloomberg data. Figures in parenthesis show the expected contribution as a percentage of the overall amount for the benchmark:

• Shell Plc (8.5%); shares have surged 48% year-to-date

• HSBC Holdings Plc (7.9%); stock +17% YTD

• Rio Tinto (7.8%); shares +16% YTD

• British American Tobacco (7.1%); stock +30% YTD

• Unilever (5.3%); shares -12% YTD

• AstraZeneca (5.0%); stock +22% YTD

• BP Plc (4.8%); shares +32% YTD

• Anglo American (3.4%); stock +26% YTD

• GSK Plc (3.1%); shares +9.2% YTD

• Vodafone Group Plc (2.8%); stock +17% YTD

27.5.

Big Dividend Payers May Be Next After UK Windfall Energy Tax

https://www.bnnbloomberg.ca/big-dividend-payers-may-be-next-…

...

UK Chancellor of the Exchequer Rishi Sunak just slapped a £5 billion ($6.3 billion) levy on energy companies to help fund support for Britons facing a cost-of-living crisis. Other big dividend payers, including miners and consumer-goods firms, could be next.

With the country facing a record squeeze on living standards, public perception of companies that are believed to be over-earning is putting pressure on the government to intervene. Stocks in consumer-sensitive sectors such as food retail and telecoms could also be “vulnerable to increasing political interference,” according to Roger Jones, head of equities at London & Capital.

“It’s possible that other sectors get targeted, given how much pressure the chancellor is under to help out struggling consumers,” said Alexandra Jackson, manager of the Rathbone UK Opportunities Fund. “Last year, the supermarkets were in the frame for a windfall tax because of perceived excess earnings during the pandemic. But the government will be keen to ensure an obvious pattern doesn’t emerge.”

While imposing a windfall tax on the profits of oil and gas producers, Boris Johnson’s government left the door open on applying a similar levy to power generators making “extraordinary profits.” That sent shares of Centrica Plc, SSE Plc and Drax Group Plc slumping on Thursday.

Miners are again expected to make up a large chunk of FTSE 100 dividends this year, with Rio Tinto Plc forecast to be the single biggest paying stock in the index, according to data from AJ Bell. Glencore Plc and Anglo American Plc are also expected to be among the top 10 payers, alongside British American Tobacco Plc, Unilever Plc and AstraZeneca Plc, the data show.

To be sure, other market strategists believe paying high dividends alone won’t be enough to attract levies, with taxes likely to be focused on areas contributing to the surge in inflation to a 40-year high. “I don’t expect a Conservative chancellor to engage in more broad-based windfall taxation,” said James Athey, investment director at abrdn.

Here’s a list of stocks expected to be the 10 biggest contributors to FTSE 100 dividends in 2023, according to Bloomberg data. Figures in parenthesis show the expected contribution as a percentage of the overall amount for the benchmark:

• Shell Plc (8.5%); shares have surged 48% year-to-date

• HSBC Holdings Plc (7.9%); stock +17% YTD

• Rio Tinto (7.8%); shares +16% YTD

• British American Tobacco (7.1%); stock +30% YTD

• Unilever (5.3%); shares -12% YTD

• AstraZeneca (5.0%); stock +22% YTD

• BP Plc (4.8%); shares +32% YTD

• Anglo American (3.4%); stock +26% YTD

• GSK Plc (3.1%); shares +9.2% YTD

• Vodafone Group Plc (2.8%); stock +17% YTD

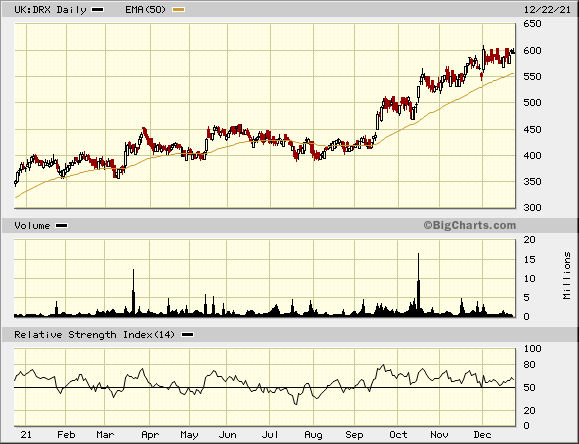

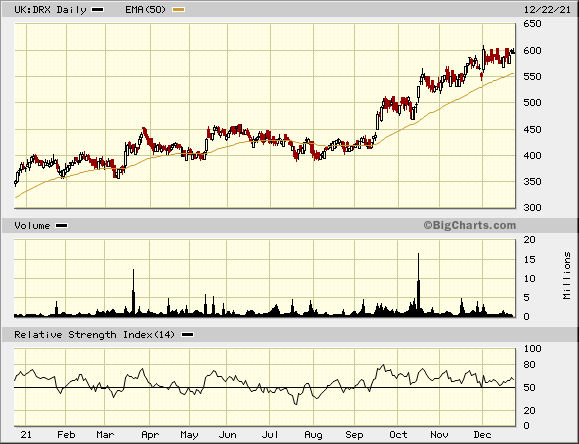

22.12.

U.K. Households Face £18 Billion Increase in Energy Bills

https://finance.yahoo.com/news/u-k-households-face-18-115934…

...

so ist es:

U.K. Households Face £18 Billion Increase in Energy Bills

https://finance.yahoo.com/news/u-k-households-face-18-115934…

...

so ist es:

Antwort auf Beitrag Nr.: 69.552.129 von faultcode am 09.10.21 14:10:5415.11.

U.K. Power Prices Soar Above £2,000 on Low Winds

https://www.bnnbloomberg.ca/u-k-power-prices-soar-above-2-00…

...

Power prices in the U.K. soared to the second highest level on record on Monday as low wind levels exposed the market to a supply crunch.

Prices for between 5 p.m. and 6 p.m. rose to 2,000.01 pounds per megawatt-hour in the N2EX day-ahead auction for Monday, with wind power generation expected to meet less than a 10th of the demand for that hour. U.K. coal plants were operating at 1.5GW of capacity on Monday morning.

It’s Finally Getting Cold and Europe Doesn’t Have Enough Gas

U.K. gas prices are more than three times as high as at the start of the year, as imports from Russia to Europe slowed, and periods with low wind will increase dependence on very expensive fossil fuel power. Hourly power price has only been higher on Sept. 15 when it rose above 2,500 pounds, and average price for Monday was the highest since Sept. 14.

...

U.K. Power Prices Soar Above £2,000 on Low Winds

https://www.bnnbloomberg.ca/u-k-power-prices-soar-above-2-00…

...

Power prices in the U.K. soared to the second highest level on record on Monday as low wind levels exposed the market to a supply crunch.

Prices for between 5 p.m. and 6 p.m. rose to 2,000.01 pounds per megawatt-hour in the N2EX day-ahead auction for Monday, with wind power generation expected to meet less than a 10th of the demand for that hour. U.K. coal plants were operating at 1.5GW of capacity on Monday morning.

It’s Finally Getting Cold and Europe Doesn’t Have Enough Gas

U.K. gas prices are more than three times as high as at the start of the year, as imports from Russia to Europe slowed, and periods with low wind will increase dependence on very expensive fossil fuel power. Hourly power price has only been higher on Sept. 15 when it rose above 2,500 pounds, and average price for Monday was the highest since Sept. 14.

...

tja Leute, erst zwei Atomkraft-Blöcke abschalten und dann vor dem Winter wundern

7.10.

Risk of UK power cuts this winter has increased, says National Grid

https://www.theguardian.com/environment/2021/oct/07/risk-of-…

...

While factories are not expected to face electricity blackouts, they say they need help with costs. Some of the most energy-intensive industries have issued a plea to the government for financial support to help them cope with soaring energy prices.

They say the cost of electricity could force factory shutdowns, production slowdowns, and switches from gas to more polluting energy sources such as fuel oil, potentially causing embarrassment ahead of the upcoming Cop26 climate conference in Glasgow.

...

While coal has been all but phased out of power generation, gas can still account for more than 50% of supply on windless days when the sun isn’t shining.

...

7.10.

Risk of UK power cuts this winter has increased, says National Grid

https://www.theguardian.com/environment/2021/oct/07/risk-of-…

...

While factories are not expected to face electricity blackouts, they say they need help with costs. Some of the most energy-intensive industries have issued a plea to the government for financial support to help them cope with soaring energy prices.

They say the cost of electricity could force factory shutdowns, production slowdowns, and switches from gas to more polluting energy sources such as fuel oil, potentially causing embarrassment ahead of the upcoming Cop26 climate conference in Glasgow.

...

While coal has been all but phased out of power generation, gas can still account for more than 50% of supply on windless days when the sun isn’t shining.

...

23.9.

Energiekrise -- Kohle-Comeback in Großbritannien

Die Gaspreise in Europa sind rasant gestiegen, das setzt die Stromversorgung in Großbritannien unter Druck. Deswegen werden dort wieder Kohlekraftwerke hochgefahren – und gefährden Boris Johnsons Klimaschutzziele.

https://www.spiegel.de/wirtschaft/service/grossbritannien-dr…

...

Die Anlagen hätten in einer Zeit, »in der das Energiesystem unter erheblichem Druck steht«, eine entscheidende Rolle dabei gespielt, die Stromversorgung im Land aufrechtzuerhalten, erklärte der Energiekonzern Drax.

Der Konzern, der das größte britische Kohlekraftwerk in Yorkshire betreibt, wollte dieses Jahr eigentlich von Kohle auf Biomasse umsteigen. Nun könnte die Kohleverstromung aber fortgesetzt werden, falls dies nötig sei, sagte Drax-Chef Will Gardiner der »Financial Times« sagte.

...

Energiekrise -- Kohle-Comeback in Großbritannien

Die Gaspreise in Europa sind rasant gestiegen, das setzt die Stromversorgung in Großbritannien unter Druck. Deswegen werden dort wieder Kohlekraftwerke hochgefahren – und gefährden Boris Johnsons Klimaschutzziele.

https://www.spiegel.de/wirtschaft/service/grossbritannien-dr…

...

Die Anlagen hätten in einer Zeit, »in der das Energiesystem unter erheblichem Druck steht«, eine entscheidende Rolle dabei gespielt, die Stromversorgung im Land aufrechtzuerhalten, erklärte der Energiekonzern Drax.

Der Konzern, der das größte britische Kohlekraftwerk in Yorkshire betreibt, wollte dieses Jahr eigentlich von Kohle auf Biomasse umsteigen. Nun könnte die Kohleverstromung aber fortgesetzt werden, falls dies nötig sei, sagte Drax-Chef Will Gardiner der »Financial Times« sagte.

...

Drax Group - thermische Energieversorgung in UK