Vital Metals der erste REE Produzent in Nord Amerika? (Seite 5)

eröffnet am 13.04.20 21:05:54 von

neuester Beitrag 06.02.24 10:57:44 von

neuester Beitrag 06.02.24 10:57:44 von

Beiträge: 410

ID: 1.323.250

ID: 1.323.250

Aufrufe heute: 1

Gesamt: 25.664

Gesamt: 25.664

Aktive User: 0

ISIN: AU000000VML1 · WKN: A0F5YD

0,0032

EUR

+14,55 %

+0,0004 EUR

Letzter Kurs 29.04.24 Lang & Schwarz

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7100 | -7,79 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

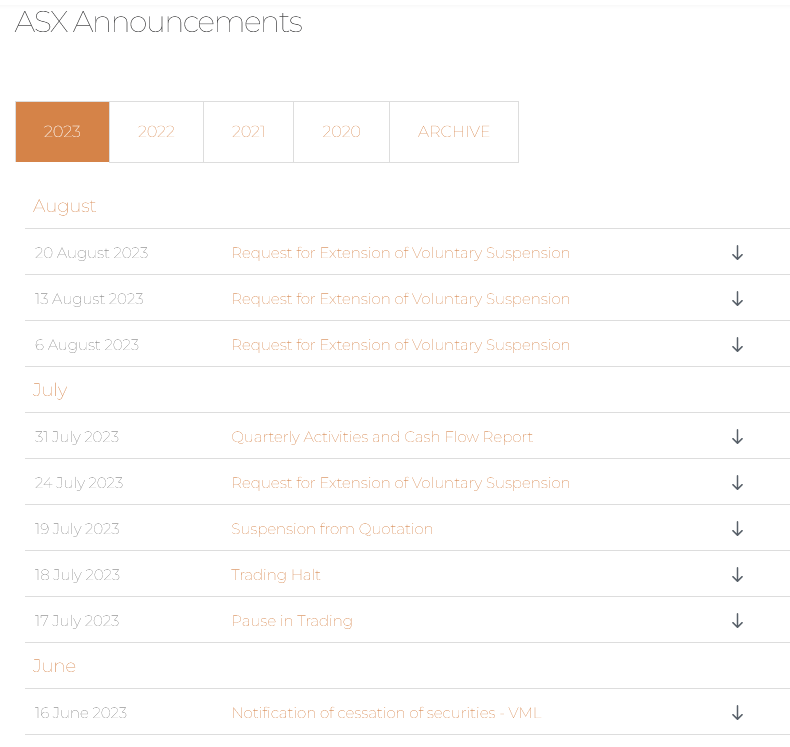

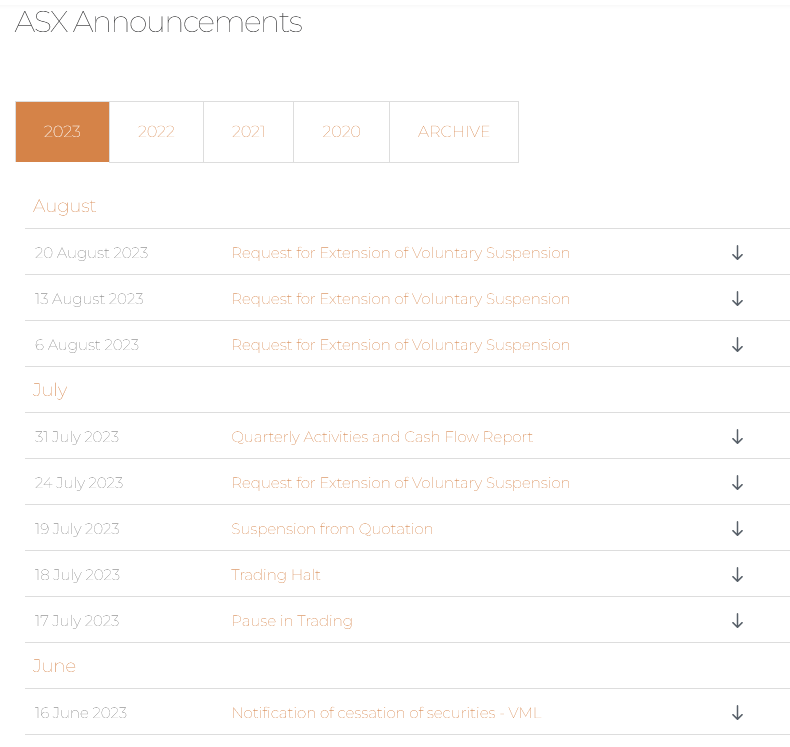

Frage mich, wie oft können Sie verlängern?

https://vitalmetals.com/investor-centre/asx-announcements/

https://vitalmetals.com/investor-centre/asx-announcements/

Wie lange soll der Halt denn noch dauern? Ich rechne so langsam mit einem Totalverlust, leider....

Langsam wird es albern mit dem Trading Halt…..

VITAL METALS’ JUNE 2023 QUARTERLY REPORT

Highlights• Resource definition drilling at Tardiff deposit returns large intersections of total rare earth oxides (TREO) from initial results of 74-hole, 6,664m resource definition drilling program.

• First 17 infill drillholes return 35+ intervals greater than 1% TREO, confirming strong REO mineralisation in the drilling area.

• Initial results include:

- 14.0m at 2.8% TREO from 76m;

- 20.45m at 2.2% from 6.25m; and

- 38.25m at 1.7% TREO from 21.35m.

• Drilling aimed to increase confidence of the Tardiff Zone 1 and 3 resource areas from Inferred to Measured and Indicated Mineral Resources.

• Assay results from the remaining 57 holes are expected in Q3 CY2023.

• Vital is focused on developing the large-scale Tardiff deposit, one of the largest single rare earths deposits in the western World, estimated to contain 416,000 tonnes of permanent magnet minerals neodymium and praseodymium (NdPr)1.

• Strategic Review of Saskatoon Rare Earth Processing Facility commenced and largely completed.

Vital Metals Limited (ASX: VML l OTCQB: VTMXF) (“Vital”, “Vital Metals” or “the Company”) is pleased to report on its activities during the June 2023 quarter, including at its 100%-owned Nechalacho Rare Earth Project in Yellowknife, Northwest Territories, Canada.

>> https://wcsecure.weblink.com.au/pdf/VML/02692552.pdf

Antwort auf Beitrag Nr.: 74.183.741 von stepback am 20.07.23 15:48:00Abwarten, am 25.7. wissen wir mehr....☕☕☕

Für die Zwecke der Listungsregel 17.2 stellt das Unternehmen die folgenden Informationen zur Verfügung:

1 Die freiwillige Aussetzung wird beantragt, bis eine Ankündigung zum Abschluss vorliegt

Überprüfung der Saskatoon-Verarbeitungsanlage

2 Das Unternehmen beantragt, die freiwillige Aussetzung bis zur Veröffentlichung der Ankündigung fortzusetzen

gemäß Punkt 1 oben, voraussichtlich am Dienstag, 25. Juli 2023.

3 Das Unternehmen bestätigt, dass ihm kein Grund bekannt ist, warum seine Wertpapiere nicht ausgesetzt werden sollten.

4 Der Gesellschaft sind keine zusätzlichen Informationen bekannt, die erforderlich sind, um den Markt darüber zu informieren

Für die Zwecke der Listungsregel 17.2 stellt das Unternehmen die folgenden Informationen zur Verfügung:

1 Die freiwillige Aussetzung wird beantragt, bis eine Ankündigung zum Abschluss vorliegt

Überprüfung der Saskatoon-Verarbeitungsanlage

2 Das Unternehmen beantragt, die freiwillige Aussetzung bis zur Veröffentlichung der Ankündigung fortzusetzen

gemäß Punkt 1 oben, voraussichtlich am Dienstag, 25. Juli 2023.

3 Das Unternehmen bestätigt, dass ihm kein Grund bekannt ist, warum seine Wertpapiere nicht ausgesetzt werden sollten.

4 Der Gesellschaft sind keine zusätzlichen Informationen bekannt, die erforderlich sind, um den Markt darüber zu informieren

Vital Metals Limited (ASX: VML) – Suspension from Quotation

Das klingt härter als nur "vorübergehend ausgesetzt". Wie lange diese Finalisierung des Reviews wohl dauern wird - und was sie bedeutet. Ich fürchte, nichts Gutes. https://wcsecure.weblink.com.au/clients/vitalmetals/headline…

Antwort auf Beitrag Nr.: 74.071.234 von Oginvest am 27.06.23 21:04:52Lese soeben: Published November 25, 2022:

https://www.wallstreet-online.de/diskussion/1323250-31-40/vi…

https://www.wallstreet-online.de/diskussion/1323250-31-40/vi…

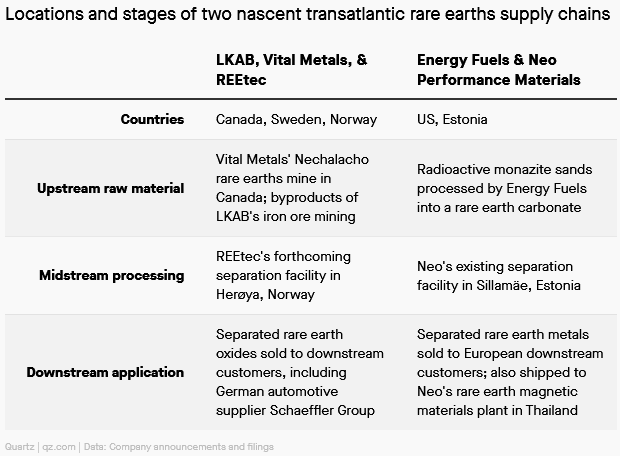

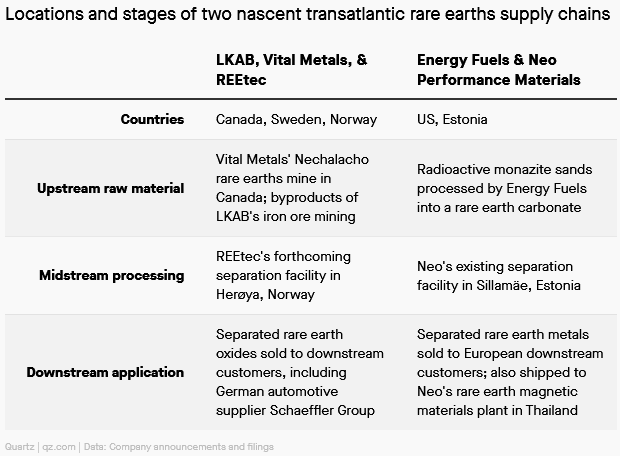

The West is rebuilding its rare earths supply chain—but China still looms large

A new rare earths supply chain spanning Canada, Sweden, and Norway could help reduce the West's reliance on China

Bit by bit, Western companies and governments are reassembling their rare earths supply chain, trying to reverse decades of the hollowing out, outsourcing, and offshoring of the critical industry to China.

No one said this would be easy.

This month brought a promising development: new investment in a Norwegian rare earths processing firm. It’s a vital cog in the eventual establishment of a transatlantic supply chain spanning Canada, Sweden, and Norway.

...

“A...Nordic value chain for rare earth metals”

The Swedish state-owned iron ore mining company LKAB announced this month that it has become the main investor in and owner of REEtec, a Norwegian firm. Since its founding in 2008, REEtec has been developing technology to separate rare earths from impurities and refine them into high-quality, high-purity materials, known as rare earth oxides, for use in products like electric vehicle motors and wind turbines.

LKAB’s 400 million kroner ($40.3 million) investment will help REEtec finance a substantial portion of its rare earths separation factory in the Norwegian industrial peninsula of Herøya, where production is slated to begin in 2024.

“Together with REEtec, we will create the base for a strong and sustainable Nordic value chain for rare earth metals,” Jan Moström, the CEO of LKAB, said in a statement.

This isn’t the first such transatlantic supply chain to take shape. Last year, two North American companies announced a partnership to establish a US-Europe supply chain running from the desert plateaus of Utah, in the US, to the small coastal town of Sillamäe in Estonia.

To run its factory, REEtec will source its raw material, known as rare earth carbonate, from Canada’s Northwest Territories. There, a company called Vital Metals is mining rare earth ores at its Nechalacho project, then performing some preliminary processing at a nearby facility. Under what’s known as an offtake agreement, REEtec will buy the rare earth carbonate from Vital Metals, to then bring to the forthcoming REEtec separation plant for further refining.

LKAB, Europe’s largest iron ore producer, will also supply REEtec with raw material from 2027. That feedstock will be extracted as a byproduct of LKAB’s iron ore mining in Sweden—a business model that China has used to great success. LKAB declined to specify the volume of its expected raw material supplies to REEtec.

“I like this very much, the approach with the byproduct, because you don’t need to establish a new mine,” said Per Kalvig, a senior researcher at the Geological Survey of Denmark and Greenland’s Center for Minerals and Materials. “And second, with reduced capital costs, you’re less vulnerable to the competition from China, because it’s an add-on production.”

Removing China from one segment of the supply chain

The incipient Canada-Sweden-Norway supply chain is also important for another strategic reason: Vital Metals’ Nechalacho mine will not be dependent on Chinese buyers.

That sets it apart from the only other commercially active rare earths mine in North America—MP Materials’ Mountain Pass mine in California—which sells almost all of its mined rare earths to its Chinese minority stakeholder, the partially state-owned company Shenghe Resources. According to MP’s latest filings (pdf), Shenghe accounted for over 94% of MP’s total revenues in the first three quarters of 2022.

“[Nechalacho] is the only rare earths mine in North America that doesn’t supply China,” David Connelly, vice president of strategy and corporate affairs at Vital Metals and its mining subsidiary Cheetah Resources, told the Canadian Press in May.

...

https://qz.com/the-west-is-rebuilding-its-rare-earths-supply…

A new rare earths supply chain spanning Canada, Sweden, and Norway could help reduce the West's reliance on China

Bit by bit, Western companies and governments are reassembling their rare earths supply chain, trying to reverse decades of the hollowing out, outsourcing, and offshoring of the critical industry to China.

No one said this would be easy.

This month brought a promising development: new investment in a Norwegian rare earths processing firm. It’s a vital cog in the eventual establishment of a transatlantic supply chain spanning Canada, Sweden, and Norway.

...

“A...Nordic value chain for rare earth metals”

The Swedish state-owned iron ore mining company LKAB announced this month that it has become the main investor in and owner of REEtec, a Norwegian firm. Since its founding in 2008, REEtec has been developing technology to separate rare earths from impurities and refine them into high-quality, high-purity materials, known as rare earth oxides, for use in products like electric vehicle motors and wind turbines.

LKAB’s 400 million kroner ($40.3 million) investment will help REEtec finance a substantial portion of its rare earths separation factory in the Norwegian industrial peninsula of Herøya, where production is slated to begin in 2024.

“Together with REEtec, we will create the base for a strong and sustainable Nordic value chain for rare earth metals,” Jan Moström, the CEO of LKAB, said in a statement.

This isn’t the first such transatlantic supply chain to take shape. Last year, two North American companies announced a partnership to establish a US-Europe supply chain running from the desert plateaus of Utah, in the US, to the small coastal town of Sillamäe in Estonia.

To run its factory, REEtec will source its raw material, known as rare earth carbonate, from Canada’s Northwest Territories. There, a company called Vital Metals is mining rare earth ores at its Nechalacho project, then performing some preliminary processing at a nearby facility. Under what’s known as an offtake agreement, REEtec will buy the rare earth carbonate from Vital Metals, to then bring to the forthcoming REEtec separation plant for further refining.

LKAB, Europe’s largest iron ore producer, will also supply REEtec with raw material from 2027. That feedstock will be extracted as a byproduct of LKAB’s iron ore mining in Sweden—a business model that China has used to great success. LKAB declined to specify the volume of its expected raw material supplies to REEtec.

“I like this very much, the approach with the byproduct, because you don’t need to establish a new mine,” said Per Kalvig, a senior researcher at the Geological Survey of Denmark and Greenland’s Center for Minerals and Materials. “And second, with reduced capital costs, you’re less vulnerable to the competition from China, because it’s an add-on production.”

Removing China from one segment of the supply chain

The incipient Canada-Sweden-Norway supply chain is also important for another strategic reason: Vital Metals’ Nechalacho mine will not be dependent on Chinese buyers.

That sets it apart from the only other commercially active rare earths mine in North America—MP Materials’ Mountain Pass mine in California—which sells almost all of its mined rare earths to its Chinese minority stakeholder, the partially state-owned company Shenghe Resources. According to MP’s latest filings (pdf), Shenghe accounted for over 94% of MP’s total revenues in the first three quarters of 2022.

“[Nechalacho] is the only rare earths mine in North America that doesn’t supply China,” David Connelly, vice president of strategy and corporate affairs at Vital Metals and its mining subsidiary Cheetah Resources, told the Canadian Press in May.

...

https://qz.com/the-west-is-rebuilding-its-rare-earths-supply…