Castle Brands, Inc. (ROX) - 500 Beiträge pro Seite

eröffnet am 17.01.07 19:20:54 von

neuester Beitrag 12.12.07 16:07:47 von

neuester Beitrag 12.12.07 16:07:47 von

Beiträge: 7

ID: 1.105.785

ID: 1.105.785

Aufrufe heute: 0

Gesamt: 1.902

Gesamt: 1.902

Aktive User: 0

ISIN: US1484351002 · WKN: A0ESWN

1,1300

EUR

0,00 %

0,0000 EUR

Letzter Kurs 09.10.19 Berlin

Profile:Castle Brands, Inc. engages in the development, manufacture, marketing, and sale of spirit brands of vodka, Irish whiskey, rum, and liqueurs in the United States, Europe, and the Caribbean. Its brands include Boru vodka, Gosling’s rums, Sea Wynde, Knappogue Castle Whiskey, Clontarf Irish whiskeys, Brady’s Irish cream, Celtic Crossing, Pallini Limoncello, Raspicello, and Peachcello. The company was founded in 1998 and is based in New York City.

http://www.castlebrandsinc.com/

http://www.castlebrandsinc.com/

UK: Castle secures UK listing for Boru

25 January 2007| Source: just-drinks.com editorial team

Castle Brands has secured a listing for its Boru Irish vodka brand in a major UK supermarket chain.

25 January 2007| Source: just-drinks.com editorial team

Castle Brands has secured a listing for its Boru Irish vodka brand in a major UK supermarket chain.

Castle Brands Announces Fourth Quarter and Fiscal 2007 Results

Thursday June 28, 4:05 pm ET

U.S. Launch of New Boru Vodka Generates Record Fiscal Fourth Quarter Volume Growth of 120% Over Prior Year

NEW YORK--(BUSINESS WIRE)--Castle Brands Inc. (AMEX:ROX - News), an emerging international premium spirits company today reported financial results for the fourth quarter and fiscal year ended March 31, 2007.

Fiscal Fourth Quarter 2007 Results

U.S. case sales increased 62% year over year to 49,813 nine liter cases in the fourth quarter of fiscal 2007. This increase was largely attributable to Boru Vodka sales which increased 120% over the same quarter in the prior fiscal year due to the March introduction of the redesigned packaging for Boru and its three flavor extensions. Global case sales in the fourth quarter were up 49% to 72,395 nine liter cases.

For the fourth quarter fiscal year 2007, Castle Brands reported net sales of $6.1 million, representing a 64% increase over the prior year quarter.

Highlights for the quarter included:

Total U.S. case sales up 62% year over year;

Total global case sales up 49% year over year;

U.S. Boru Vodka Sales up 120% year over year;

U.S. accounted for 69% of total case sales versus 63% in the prior year; and

Total revenues increase 64% year over year to $6.1 million.

Mark Andrews, the Company's Chairman of the Board and Chief Executive Officer, commented, "Fiscal fourth quarter 2007 was a key period for the company as we launched the new Boru Vodka bottle and its three flavor extensions. This launch was important for the company in positioning our brand in the highly competitive and rapidly growing premium vodka market. We are extremely pleased with the success of the launch of the new Boru packaging and with the acceleration of Boru Vodka sales in the U.S."

In addition to the strength of U.S. case sales of Boru Vodka during the fourth quarter fiscal 2007, Castle Brands also experienced 96% growth in U.S. whiskey case sales (which includes growth resulting from the addition of the McLain & Kyne bourbon brands which were acquired by Castle Brands in October 2006), 56% growth in U.S. rum case sales and 4% increase in U.S. liqueurs case sales. Fourth quarter international case sales were up 26%, led by a 39% growth in international rum case sales and 32% international growth in vodka case sales. International liqueur case sales were down 25% for the quarter but this was offset by 19% growth in international whiskey case sales.

Gross profit for the fourth quarter fiscal year 2007 increased 49% to $2.0 million, up from $1.4 million in the prior year quarter while gross margin decreased to 33.4% compared to 36.7% for the same period. The decrease in gross margin reflected a shift in product and size mix.

As a result of additional expenditure made to support the expansion and growth of its portfolio, Castle Brands' selling expense increased 27.5% to $3.9 million in the quarter ended March 31, 2007 from $3.1 million in the prior year quarter. This support includes increases in costs associated with the Boru relauch, sales support costs and increased expenses in connection with certain elements of the Gosling's rum advertising campaign. However, selling expense as a percentage of net sales decreased to 64.7% from 83.3% in the comparable prior year period.

General and administrative expenses were $2.4 million in the fourth quarter of fiscal 2007 as compared to $1.5 million in the fourth quarter of fiscal 2006. General and administrative expenses as a percentage of net sales were 39.7% in the fourth quarter of fiscal 2007 as compared to 39.5% in the comparable period of fiscal 2006. This increase in general and administrative expense was partly attributable to the incremental increases in costs associated with being a public company. In addition, Castle Brands has hired additional employees over the past year, resulting in an increase in compensation expense. Castle Brands also adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $0.4 million in the quarter ended March 31, 2007, as compared to zero in the comparable period in the prior year.

As a result of the forgoing, the company reported a net loss attributable to common stockholders of $4.5 million, or $(0.38) per share, in the fourth quarter of fiscal 2007 as compared to a net loss attributable to common stockholders of $4.0 million, or $(1.28) per share, in the fourth quarter of fiscal 2006.

Fiscal 2007 Results

For the twelve months ending March 31, 2007, total case sales were 314,644, an 18% increase over the prior year. Volume was driven by strong sales in the United States, with Boru Vodka contributing significantly to this growth. This increase in vodka case sales was approximately 54% in the U.S. and 9% internationally. The rum category was also a driver during the year, with a 21% lift in global case volume for the fiscal year. Case sales of liqueurs were down 5% for the full year, in part due to the discontinuation of certain lower-margin Irish cream products. The decrease in liqueur sales was offset by case sales of Whiskey which grew 26%, benefiting from the contribution of the McLain & Kyne bourbon brands which were acquired by Castle Brands in October 2006.

Castle Brands' international sales, which totaled 40% of total case volume for fiscal 2007, also experienced continued gains, up from 117,154 cases in fiscal 2006 to 125,647 cases in fiscal 2007. Rum was the fastest growing category for the Company's international business, reflecting activity by the Gosling-Castle Partners joint venture, with an increase to 17,992 cases in fiscal 2007 from 13,471 cases in fiscal 2006. This was followed by whiskey case sales up 10% and vodka case sales up 9%. International liqueur case sales declined by 49%. As noted, growth in the Company's flagship brands was partially offset by reduced sales of certain lower-priced Irish cream products which accounted for approximately 17,600 cases in FY 2006 and only approximately 5,100 cases in FY 2007.

For the full year 2007, net sales increased 19% over the same period in the prior year to $25.2 million.

Gross profit increased 12% to $8.4 million during the fiscal year ended March 31, 2007 from $7.5 million in the comparable prior period, while gross margin decreased to 33.3% during the fiscal year ended March 31, 2007 when compared to 35.4% for the prior fiscal year, reflecting shifts in brand and size mix.

Selling expense increased 29% to $16.8 million in the fiscal year ended March 31, 2007 from $13.0 million from the prior fiscal year. This increase in selling expense was attributable to the expansion, growth and continued support of Castle Brands premium portfolio. This support includes increases in costs associated with the Boru relaunch, sales support costs and increased expenses in connection with the Gosling's rum advertising campaign. In order to provide proper support for its portfolio, Castle Brands added new personnel, which resulted in an increase in consultancy and compensation expense. Castle Brands also adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $0.4 million in the fiscal year ended March 31, 2007, as compared to zero in the comparable period in the prior year. As a result of the foregoing, selling expense as a percentage of net sales increased to 66.6% in the fiscal year ended March 31, 2007 as compared to 61.7% for the comparable prior year period.

For the full year, general and administrative expenses were $8.6 million as compared to $5.5 million in fiscal 2006. This increase was largely attributable to the incremental increases in costs incurred by Castle Brands in being a public company. In addition, Castle Brands hired additional employees over the past year, resulting in an increase in compensation expense, and adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $1.0 million in the year ended March 31, 2007, as compared to zero in the comparable period in the prior year. General and administrative expenses as a percentage of net sales were 34.4% for fiscal 2007 as compared to 26.0% for fiscal 2006.

For the twelve months ended March 31, 2007, Castle Brands generated a net loss attributable to common stockholders of $16.6 million, or $(1.40) per share, versus a net loss attributable to common stockholders from the prior year of $14.7 million, or $(4.73) per share.

Reflecting on the year, Mr. Andrews said, "Fiscal 2007 was a pivotal year for Castle Brands and we saw our heavy investments in distribution and brand building begin to yield results. Enhanced distribution, as well as a broader product portfolio, enabled U.S. sales to grow significantly faster than overall company growth. Globally, we were able to deliver record case sales and revenue despite the decision to discontinue sales of some lower margin Irish cream products." Mr. Andrews further commented, "The momentum we have going into fiscal 2008, coupled with other initiatives underway to build brand awareness and drive sales is expected to result in another record year of case sales for Castle Brands."

Balance Sheet

Cash and cash equivalents, together with short-term investments, totaled $6.9 million at March 31, 2007. Subsequent to the end of the quarter, the Company closed a private placement of $21 million of common stock and warrants sold to certain institutional investors. The Company intends to use the proceeds from the offering for further brand development, acquisitions, and other corporate purposes.

Fiscal 2008 Outlook

Castle Brands is entering year three of an ambitious five-year business plan designed to position the Company within the premium segments of the spirits industry. For fiscal 2008, the Company will continue its intense focus on expanding its presence in its core growth markets, while seizing upon opportunities in new international markets. The Company is projecting fiscal 2008 case sales to be in the range of 375,000 - 380,000.

Conference Call

Castle Brands will host a conference call to discuss fourth quarter results on Thursday, June 28, 2007 at 4:30 p.m. ET. All interested parties in the U.S. are invited to join the conference by dialing 1-800-263-8506 and asking for the Castle Brands call. International callers should dial 1-719-457-2681. The access code is 1314710. The company suggests that participants dial in approximately ten minutes in advance of the 4:30 p.m. ET start of the conference call.

The conference call will be webcast and can be accessed from the Investor Relations section of the Company's website at www.castlebrandsinc.com .

For those unable to participate in the live call, a replay will be available by calling 1-888-203-1112 (U.S.) or 1-719-457-0820 (international). The access code is 1314710. The replay will be available from 7:30 p.m. ET on June 28, 2007 through 11:59 p.m. ET on July 12, 2007.

More about Castle Brands Inc.

Castle Brands is an emerging developer and international marketer of premium branded spirits within four growing categories of the spirits industry: vodka, run, whiskey and liqueurs. Castle Brands' portfolio includes Boru ® Vodka, Gosling's Rum ®, Sea Wynde ® Rum, Knappogue Castle Whiskey ®, Clontarf ® Irish Whiskey, Jefferson's (TM) and Jefferson's Reserve ® Bourbon, Sam Houston ® Bourbon, Celtic Crossing ® Liqueur, Pallini ® Limoncello (TM), Raspicello (TM) and Peachcello (TM) and Brady's ® Irish Cream.

Forward Looking Statements

This press release includes statements of our expectations, intentions, plans and beliefs that constitute "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, related to the discussion of our business strategies and our expectations concerning future operations, margins, profitability, liquidity and capital resources and to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. We have used words such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "thinks," "estimates," "seeks," "expects," "predicts," "could," "projects," "potential" and other similar terms and phrases, including references to assumptions, in this press release to identify forward looking statements. These forward looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward looking statements.

When considering these forward looking statements, you should keep in mind the cautionary statements in this press release and the documents incorporated by reference. New risks and uncertainties arise from time to time, and we cannot predict those events or how they may affect us. We assume no obligation to update any forward looking statements after the date of this press release as a result of new information, future events or developments, except as required by the federal securities laws.

CASTLE BRANDS INC. AND SUBSIDIARIES

Condensed Consolidated Statement of Operations

Three Months Ended Twelve Months Ended

March 31, March 31,

-------------------------------------------------------

2007 2006 2007 2006

------------ ------------ ------------- -------------

Sales, net $ 6,070,966 $ 3,698,816 $ 25,164,038 $ 21,149,635

Cost of sales 4,045,947 2,342,646 16,779,694 13,655,772

------------ ------------ ------------- -------------

Gross profit 2,025,019 1,356,170 8,384,344 7,493,863

------------ ------------ ------------- -------------

Selling expense 3,929,690 3,081,650 16,766,119 13,047,580

General and

administrative

expense 2,410,323 1,460,621 8,646,147 5,492,925

Depreciation

and

amortization 257,674 232,661 1,000,888 907,409

------------ ------------ ------------- -------------

Operating loss (4,572,668) (3,418,762) (18,028,810) (11,954,051)

------------ ------------ ------------- -------------

Other income - 771 5,040 4,279

Other expense (9,833) (9,022) (46,831) (37,099)

Foreign

exchange

gain/(loss) 216,912 218,602 1,360,500 (337,990)

Interest

expense, net (378,335) (541,762) (1,085,035) (1,579,283)

Write-off of

DFC - - (295,368) -

Current credit/

(charge) on

Derivative

financial

instrument (3,476) (2,924) 117,921 15,828

Income tax

benefit 37,038 37,038 148,147 148,151

Minority

interests 165,664 227,504 1,267,086 655,946

------------ ------------ ------------- -------------

Net loss $(4,544,698) $(3,488,555) $(16,557,350) $(13,084,219)

Preferred stock

dividends - 482,375 48,238 1,596,027

------------ ------------ ------------- -------------

Net loss

attributable

to common

Stockholders $(4,544,698) $(3,970,930) $(16,605,588) $(14,680,246)

============ ============ ============= =============

Net loss

attributable

to common

stockholders

per common

share

Basic $ (0.38) $ (1.28) $ (1.40) $ (4.73)

============ ============ ============= =============

Diluted $ (0.38) $ (1.28) $ (1.40) $ (4.73)

============ ============ ============= =============

Weighted

average shares

used in

computation

Basic 12,109,741 3,106,666 11,898,313 3,106,666

============ ============ ============= =============

Diluted 12,109,741 3,106,666 11,898,313 3,106,666

============ ============ ============= =============

CASTLE BRANDS INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheet

March 31, March 31,

2007 2006

------------- -------------

ASSETS

-------------------------------------------

CURRENT ASSETS

Cash and cash equivalents $ 1,004,957 $ 1,392,016

Short-term investments 5,912,464 -

Accounts receivable - net of allowance

for doubtful accounts of $395,207 and

$378,146 6,503,449 3,511,215

Due from related parties 10,328 953,616

Inventories 10,716,983 6,673,235

Prepaid expenses and other current

assets 1,585,901 1,021,369

------------- -------------

TOTAL CURRENT ASSETS 25,734,082 13,551,451

------------- -------------

EQUIPMENT - net 643,753 407,983

OTHER ASSETS

Intangible assets - net of accumulated

amortization of $1,379,389 and

$2,233,808 13,213,596 13,936,427

Goodwill 13,636,650 11,649,430

Deferred registration costs - 2,823,594

Restricted cash 502,643 362,293

Other assets 795,237 913,032

------------- -------------

TOTAL ASSETS $ 54,525,961 $ 43,644,210

============= =============

LIABILITIES AND CAPITAL DEFICIENCY

CURRENT LIABILITIES

Current maturities of notes payable

and capital leases $ 419,308 $ 3,678,547

Accounts payable 5,150,535 3,757,515

Accrued expenses and put warrant

payable 1,987,669 2,986,188

Due to related parties 1,092,755 2,121,334

Convertible shareholder loans payable - 1,660,148

Shareholder loans payable - 147,113

------------- -------------

TOTAL CURRENT LIABILITIES 8,650,267 14,350,845

------------- -------------

LONG TERM LIABILITIES

Senior notes payable 9,354,861 4,594,791

Notes payable, less current

maturities and obligations under

capital leases 9,005,207 15,350,640

Shareholder loans payable - -

Convertible shareholder loans payable - -

Preferred stock dividends payable - 1,546,480

Deferred tax liability 2,555,368 2,703,515

------------- -------------

TOTAL LIABILITIES 29,565,703 38,546,271

------------- -------------

REDEEMABLE CONVERTIBLE PREFERRED STOCK

Redeemable convertible preferred stock

Series A, B, C; 4,103,750 shares

designated; 4,089,465 shares issued

and outstanding at March 31, 2006,

liquidation preference of 33,326,484 - 28,447,683

------------- -------------

COMMITMENTS AND CONTINGENCIES

MINORITY INTERESTS 1,407,645 2,674,731

------------- -------------

STOCKHOLDERS' EQUITY/(DEFICIENCY)

Common stock, $.01 par value,

45,000,000 shares authorized,

3,106,666 shares issued and

outstanding at March 31, 2006 and

12,009,741 at December 31, 2006 121,098 31,067

Additional paid in capital 84,086,710 17,182,405

Accumulated deficiency (59,962,237) (43,404,887)

Accumulated other comprehensive

(loss)/income (692,958) 166,940

------------- -------------

TOTAL STOCKHOLDERS'

EQUITY/(DEFICIENCY) 23,552,613 (26,024,475)

------------- -------------

------------- -------------

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY/(DEFICIENCY) $ 54,525,961 $ 43,644,210

============= =============

CASTLE BRANDS INC. AND SUBSIDIARIES

Geographic and Category Case Sales

Three Months Ended Twelve Months Ended

March 31, March 31,

2007 2006 2007 2006

----------- ------------ ---------- -------------

Total

United States 49,813 30,810 188,997 149,898

International 22,582 17,914 125,647 117,154

----------- ------------ ---------- -------------

Total 72,395 48,724 314,644 267,052

=========== ============ ========== =============

Vodka

United States 22,675 10,315 72,284 47,026

International 13,061 9,860 87,787 80,868

----------- ------------ ---------- -------------

Total 35,736 20,175 160,071 127,894

=========== ============ ========== =============

Rum

United States 13,511 8,635 60,560 51,589

International 5,366 3,867 17,992 13,471

----------- ------------ ---------- -------------

Total 18,877 12,502 78,552 65,060

=========== ============ ========== =============

Whiskey

United States 2,700 1,376 7,209 3,889

International 2,733 2,296 15,410 14,053

----------- ------------ ---------- -------------

Total 5,433 3,672 22,618 17,942

=========== ============ ========== =============

Liqueurs

United States 10,927 10,484 48,944 47,394

International 1,422 1,891 4,459 8,762

----------- ------------ ---------- -------------

Total 12,349 12,375 53,403 56,156

=========== ============ ========== =============

ROX- E

Contact:

Investor Relations:

ICR

Kathleen Heaney, 203-803-3585

ir@castlebrandsinc.com

--------------------------------------------------------------------------------

Source: Castle Brands Inc.

Thursday June 28, 4:05 pm ET

U.S. Launch of New Boru Vodka Generates Record Fiscal Fourth Quarter Volume Growth of 120% Over Prior Year

NEW YORK--(BUSINESS WIRE)--Castle Brands Inc. (AMEX:ROX - News), an emerging international premium spirits company today reported financial results for the fourth quarter and fiscal year ended March 31, 2007.

Fiscal Fourth Quarter 2007 Results

U.S. case sales increased 62% year over year to 49,813 nine liter cases in the fourth quarter of fiscal 2007. This increase was largely attributable to Boru Vodka sales which increased 120% over the same quarter in the prior fiscal year due to the March introduction of the redesigned packaging for Boru and its three flavor extensions. Global case sales in the fourth quarter were up 49% to 72,395 nine liter cases.

For the fourth quarter fiscal year 2007, Castle Brands reported net sales of $6.1 million, representing a 64% increase over the prior year quarter.

Highlights for the quarter included:

Total U.S. case sales up 62% year over year;

Total global case sales up 49% year over year;

U.S. Boru Vodka Sales up 120% year over year;

U.S. accounted for 69% of total case sales versus 63% in the prior year; and

Total revenues increase 64% year over year to $6.1 million.

Mark Andrews, the Company's Chairman of the Board and Chief Executive Officer, commented, "Fiscal fourth quarter 2007 was a key period for the company as we launched the new Boru Vodka bottle and its three flavor extensions. This launch was important for the company in positioning our brand in the highly competitive and rapidly growing premium vodka market. We are extremely pleased with the success of the launch of the new Boru packaging and with the acceleration of Boru Vodka sales in the U.S."

In addition to the strength of U.S. case sales of Boru Vodka during the fourth quarter fiscal 2007, Castle Brands also experienced 96% growth in U.S. whiskey case sales (which includes growth resulting from the addition of the McLain & Kyne bourbon brands which were acquired by Castle Brands in October 2006), 56% growth in U.S. rum case sales and 4% increase in U.S. liqueurs case sales. Fourth quarter international case sales were up 26%, led by a 39% growth in international rum case sales and 32% international growth in vodka case sales. International liqueur case sales were down 25% for the quarter but this was offset by 19% growth in international whiskey case sales.

Gross profit for the fourth quarter fiscal year 2007 increased 49% to $2.0 million, up from $1.4 million in the prior year quarter while gross margin decreased to 33.4% compared to 36.7% for the same period. The decrease in gross margin reflected a shift in product and size mix.

As a result of additional expenditure made to support the expansion and growth of its portfolio, Castle Brands' selling expense increased 27.5% to $3.9 million in the quarter ended March 31, 2007 from $3.1 million in the prior year quarter. This support includes increases in costs associated with the Boru relauch, sales support costs and increased expenses in connection with certain elements of the Gosling's rum advertising campaign. However, selling expense as a percentage of net sales decreased to 64.7% from 83.3% in the comparable prior year period.

General and administrative expenses were $2.4 million in the fourth quarter of fiscal 2007 as compared to $1.5 million in the fourth quarter of fiscal 2006. General and administrative expenses as a percentage of net sales were 39.7% in the fourth quarter of fiscal 2007 as compared to 39.5% in the comparable period of fiscal 2006. This increase in general and administrative expense was partly attributable to the incremental increases in costs associated with being a public company. In addition, Castle Brands has hired additional employees over the past year, resulting in an increase in compensation expense. Castle Brands also adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $0.4 million in the quarter ended March 31, 2007, as compared to zero in the comparable period in the prior year.

As a result of the forgoing, the company reported a net loss attributable to common stockholders of $4.5 million, or $(0.38) per share, in the fourth quarter of fiscal 2007 as compared to a net loss attributable to common stockholders of $4.0 million, or $(1.28) per share, in the fourth quarter of fiscal 2006.

Fiscal 2007 Results

For the twelve months ending March 31, 2007, total case sales were 314,644, an 18% increase over the prior year. Volume was driven by strong sales in the United States, with Boru Vodka contributing significantly to this growth. This increase in vodka case sales was approximately 54% in the U.S. and 9% internationally. The rum category was also a driver during the year, with a 21% lift in global case volume for the fiscal year. Case sales of liqueurs were down 5% for the full year, in part due to the discontinuation of certain lower-margin Irish cream products. The decrease in liqueur sales was offset by case sales of Whiskey which grew 26%, benefiting from the contribution of the McLain & Kyne bourbon brands which were acquired by Castle Brands in October 2006.

Castle Brands' international sales, which totaled 40% of total case volume for fiscal 2007, also experienced continued gains, up from 117,154 cases in fiscal 2006 to 125,647 cases in fiscal 2007. Rum was the fastest growing category for the Company's international business, reflecting activity by the Gosling-Castle Partners joint venture, with an increase to 17,992 cases in fiscal 2007 from 13,471 cases in fiscal 2006. This was followed by whiskey case sales up 10% and vodka case sales up 9%. International liqueur case sales declined by 49%. As noted, growth in the Company's flagship brands was partially offset by reduced sales of certain lower-priced Irish cream products which accounted for approximately 17,600 cases in FY 2006 and only approximately 5,100 cases in FY 2007.

For the full year 2007, net sales increased 19% over the same period in the prior year to $25.2 million.

Gross profit increased 12% to $8.4 million during the fiscal year ended March 31, 2007 from $7.5 million in the comparable prior period, while gross margin decreased to 33.3% during the fiscal year ended March 31, 2007 when compared to 35.4% for the prior fiscal year, reflecting shifts in brand and size mix.

Selling expense increased 29% to $16.8 million in the fiscal year ended March 31, 2007 from $13.0 million from the prior fiscal year. This increase in selling expense was attributable to the expansion, growth and continued support of Castle Brands premium portfolio. This support includes increases in costs associated with the Boru relaunch, sales support costs and increased expenses in connection with the Gosling's rum advertising campaign. In order to provide proper support for its portfolio, Castle Brands added new personnel, which resulted in an increase in consultancy and compensation expense. Castle Brands also adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $0.4 million in the fiscal year ended March 31, 2007, as compared to zero in the comparable period in the prior year. As a result of the foregoing, selling expense as a percentage of net sales increased to 66.6% in the fiscal year ended March 31, 2007 as compared to 61.7% for the comparable prior year period.

For the full year, general and administrative expenses were $8.6 million as compared to $5.5 million in fiscal 2006. This increase was largely attributable to the incremental increases in costs incurred by Castle Brands in being a public company. In addition, Castle Brands hired additional employees over the past year, resulting in an increase in compensation expense, and adopted SFAS 123®, Share-Based Payment on April 1, 2006, which resulted in stock-based compensation expense of $1.0 million in the year ended March 31, 2007, as compared to zero in the comparable period in the prior year. General and administrative expenses as a percentage of net sales were 34.4% for fiscal 2007 as compared to 26.0% for fiscal 2006.

For the twelve months ended March 31, 2007, Castle Brands generated a net loss attributable to common stockholders of $16.6 million, or $(1.40) per share, versus a net loss attributable to common stockholders from the prior year of $14.7 million, or $(4.73) per share.

Reflecting on the year, Mr. Andrews said, "Fiscal 2007 was a pivotal year for Castle Brands and we saw our heavy investments in distribution and brand building begin to yield results. Enhanced distribution, as well as a broader product portfolio, enabled U.S. sales to grow significantly faster than overall company growth. Globally, we were able to deliver record case sales and revenue despite the decision to discontinue sales of some lower margin Irish cream products." Mr. Andrews further commented, "The momentum we have going into fiscal 2008, coupled with other initiatives underway to build brand awareness and drive sales is expected to result in another record year of case sales for Castle Brands."

Balance Sheet

Cash and cash equivalents, together with short-term investments, totaled $6.9 million at March 31, 2007. Subsequent to the end of the quarter, the Company closed a private placement of $21 million of common stock and warrants sold to certain institutional investors. The Company intends to use the proceeds from the offering for further brand development, acquisitions, and other corporate purposes.

Fiscal 2008 Outlook

Castle Brands is entering year three of an ambitious five-year business plan designed to position the Company within the premium segments of the spirits industry. For fiscal 2008, the Company will continue its intense focus on expanding its presence in its core growth markets, while seizing upon opportunities in new international markets. The Company is projecting fiscal 2008 case sales to be in the range of 375,000 - 380,000.

Conference Call

Castle Brands will host a conference call to discuss fourth quarter results on Thursday, June 28, 2007 at 4:30 p.m. ET. All interested parties in the U.S. are invited to join the conference by dialing 1-800-263-8506 and asking for the Castle Brands call. International callers should dial 1-719-457-2681. The access code is 1314710. The company suggests that participants dial in approximately ten minutes in advance of the 4:30 p.m. ET start of the conference call.

The conference call will be webcast and can be accessed from the Investor Relations section of the Company's website at www.castlebrandsinc.com .

For those unable to participate in the live call, a replay will be available by calling 1-888-203-1112 (U.S.) or 1-719-457-0820 (international). The access code is 1314710. The replay will be available from 7:30 p.m. ET on June 28, 2007 through 11:59 p.m. ET on July 12, 2007.

More about Castle Brands Inc.

Castle Brands is an emerging developer and international marketer of premium branded spirits within four growing categories of the spirits industry: vodka, run, whiskey and liqueurs. Castle Brands' portfolio includes Boru ® Vodka, Gosling's Rum ®, Sea Wynde ® Rum, Knappogue Castle Whiskey ®, Clontarf ® Irish Whiskey, Jefferson's (TM) and Jefferson's Reserve ® Bourbon, Sam Houston ® Bourbon, Celtic Crossing ® Liqueur, Pallini ® Limoncello (TM), Raspicello (TM) and Peachcello (TM) and Brady's ® Irish Cream.

Forward Looking Statements

This press release includes statements of our expectations, intentions, plans and beliefs that constitute "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are intended to come within the safe harbor protection provided by those sections. These statements, which involve risks and uncertainties, related to the discussion of our business strategies and our expectations concerning future operations, margins, profitability, liquidity and capital resources and to analyses and other information that are based on forecasts of future results and estimates of amounts not yet determinable. We have used words such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "thinks," "estimates," "seeks," "expects," "predicts," "could," "projects," "potential" and other similar terms and phrases, including references to assumptions, in this press release to identify forward looking statements. These forward looking statements are made based on expectations and beliefs concerning future events affecting us and are subject to uncertainties, risks and factors relating to our operations and business environments, all of which are difficult to predict and many of which are beyond our control, that could cause our actual results to differ materially from those matters expressed or implied by these forward looking statements.

When considering these forward looking statements, you should keep in mind the cautionary statements in this press release and the documents incorporated by reference. New risks and uncertainties arise from time to time, and we cannot predict those events or how they may affect us. We assume no obligation to update any forward looking statements after the date of this press release as a result of new information, future events or developments, except as required by the federal securities laws.

CASTLE BRANDS INC. AND SUBSIDIARIES

Condensed Consolidated Statement of Operations

Three Months Ended Twelve Months Ended

March 31, March 31,

-------------------------------------------------------

2007 2006 2007 2006

------------ ------------ ------------- -------------

Sales, net $ 6,070,966 $ 3,698,816 $ 25,164,038 $ 21,149,635

Cost of sales 4,045,947 2,342,646 16,779,694 13,655,772

------------ ------------ ------------- -------------

Gross profit 2,025,019 1,356,170 8,384,344 7,493,863

------------ ------------ ------------- -------------

Selling expense 3,929,690 3,081,650 16,766,119 13,047,580

General and

administrative

expense 2,410,323 1,460,621 8,646,147 5,492,925

Depreciation

and

amortization 257,674 232,661 1,000,888 907,409

------------ ------------ ------------- -------------

Operating loss (4,572,668) (3,418,762) (18,028,810) (11,954,051)

------------ ------------ ------------- -------------

Other income - 771 5,040 4,279

Other expense (9,833) (9,022) (46,831) (37,099)

Foreign

exchange

gain/(loss) 216,912 218,602 1,360,500 (337,990)

Interest

expense, net (378,335) (541,762) (1,085,035) (1,579,283)

Write-off of

DFC - - (295,368) -

Current credit/

(charge) on

Derivative

financial

instrument (3,476) (2,924) 117,921 15,828

Income tax

benefit 37,038 37,038 148,147 148,151

Minority

interests 165,664 227,504 1,267,086 655,946

------------ ------------ ------------- -------------

Net loss $(4,544,698) $(3,488,555) $(16,557,350) $(13,084,219)

Preferred stock

dividends - 482,375 48,238 1,596,027

------------ ------------ ------------- -------------

Net loss

attributable

to common

Stockholders $(4,544,698) $(3,970,930) $(16,605,588) $(14,680,246)

============ ============ ============= =============

Net loss

attributable

to common

stockholders

per common

share

Basic $ (0.38) $ (1.28) $ (1.40) $ (4.73)

============ ============ ============= =============

Diluted $ (0.38) $ (1.28) $ (1.40) $ (4.73)

============ ============ ============= =============

Weighted

average shares

used in

computation

Basic 12,109,741 3,106,666 11,898,313 3,106,666

============ ============ ============= =============

Diluted 12,109,741 3,106,666 11,898,313 3,106,666

============ ============ ============= =============

CASTLE BRANDS INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheet

March 31, March 31,

2007 2006

------------- -------------

ASSETS

-------------------------------------------

CURRENT ASSETS

Cash and cash equivalents $ 1,004,957 $ 1,392,016

Short-term investments 5,912,464 -

Accounts receivable - net of allowance

for doubtful accounts of $395,207 and

$378,146 6,503,449 3,511,215

Due from related parties 10,328 953,616

Inventories 10,716,983 6,673,235

Prepaid expenses and other current

assets 1,585,901 1,021,369

------------- -------------

TOTAL CURRENT ASSETS 25,734,082 13,551,451

------------- -------------

EQUIPMENT - net 643,753 407,983

OTHER ASSETS

Intangible assets - net of accumulated

amortization of $1,379,389 and

$2,233,808 13,213,596 13,936,427

Goodwill 13,636,650 11,649,430

Deferred registration costs - 2,823,594

Restricted cash 502,643 362,293

Other assets 795,237 913,032

------------- -------------

TOTAL ASSETS $ 54,525,961 $ 43,644,210

============= =============

LIABILITIES AND CAPITAL DEFICIENCY

CURRENT LIABILITIES

Current maturities of notes payable

and capital leases $ 419,308 $ 3,678,547

Accounts payable 5,150,535 3,757,515

Accrued expenses and put warrant

payable 1,987,669 2,986,188

Due to related parties 1,092,755 2,121,334

Convertible shareholder loans payable - 1,660,148

Shareholder loans payable - 147,113

------------- -------------

TOTAL CURRENT LIABILITIES 8,650,267 14,350,845

------------- -------------

LONG TERM LIABILITIES

Senior notes payable 9,354,861 4,594,791

Notes payable, less current

maturities and obligations under

capital leases 9,005,207 15,350,640

Shareholder loans payable - -

Convertible shareholder loans payable - -

Preferred stock dividends payable - 1,546,480

Deferred tax liability 2,555,368 2,703,515

------------- -------------

TOTAL LIABILITIES 29,565,703 38,546,271

------------- -------------

REDEEMABLE CONVERTIBLE PREFERRED STOCK

Redeemable convertible preferred stock

Series A, B, C; 4,103,750 shares

designated; 4,089,465 shares issued

and outstanding at March 31, 2006,

liquidation preference of 33,326,484 - 28,447,683

------------- -------------

COMMITMENTS AND CONTINGENCIES

MINORITY INTERESTS 1,407,645 2,674,731

------------- -------------

STOCKHOLDERS' EQUITY/(DEFICIENCY)

Common stock, $.01 par value,

45,000,000 shares authorized,

3,106,666 shares issued and

outstanding at March 31, 2006 and

12,009,741 at December 31, 2006 121,098 31,067

Additional paid in capital 84,086,710 17,182,405

Accumulated deficiency (59,962,237) (43,404,887)

Accumulated other comprehensive

(loss)/income (692,958) 166,940

------------- -------------

TOTAL STOCKHOLDERS'

EQUITY/(DEFICIENCY) 23,552,613 (26,024,475)

------------- -------------

------------- -------------

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY/(DEFICIENCY) $ 54,525,961 $ 43,644,210

============= =============

CASTLE BRANDS INC. AND SUBSIDIARIES

Geographic and Category Case Sales

Three Months Ended Twelve Months Ended

March 31, March 31,

2007 2006 2007 2006

----------- ------------ ---------- -------------

Total

United States 49,813 30,810 188,997 149,898

International 22,582 17,914 125,647 117,154

----------- ------------ ---------- -------------

Total 72,395 48,724 314,644 267,052

=========== ============ ========== =============

Vodka

United States 22,675 10,315 72,284 47,026

International 13,061 9,860 87,787 80,868

----------- ------------ ---------- -------------

Total 35,736 20,175 160,071 127,894

=========== ============ ========== =============

Rum

United States 13,511 8,635 60,560 51,589

International 5,366 3,867 17,992 13,471

----------- ------------ ---------- -------------

Total 18,877 12,502 78,552 65,060

=========== ============ ========== =============

Whiskey

United States 2,700 1,376 7,209 3,889

International 2,733 2,296 15,410 14,053

----------- ------------ ---------- -------------

Total 5,433 3,672 22,618 17,942

=========== ============ ========== =============

Liqueurs

United States 10,927 10,484 48,944 47,394

International 1,422 1,891 4,459 8,762

----------- ------------ ---------- -------------

Total 12,349 12,375 53,403 56,156

=========== ============ ========== =============

ROX- E

Contact:

Investor Relations:

ICR

Kathleen Heaney, 203-803-3585

ir@castlebrandsinc.com

--------------------------------------------------------------------------------

Source: Castle Brands Inc.

kein boden in sicht!

überverkauft ohne ende!

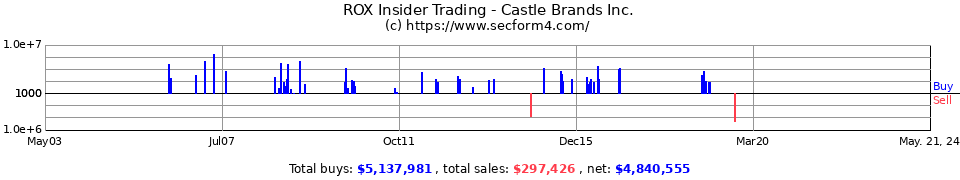

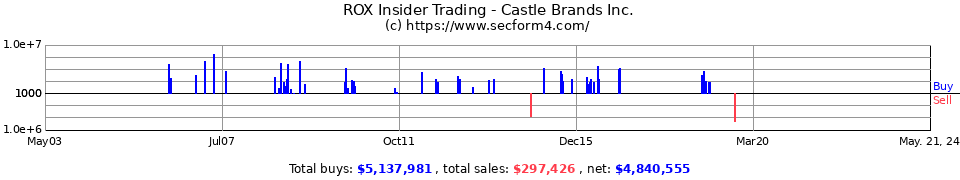

nur insiderkäufe...kein einziger insiderverkauf

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -1,16 | |

| 0,00 | |

| +1,78 | |

| -0,10 | |

| +99.999,00 | |

| -0,07 | |

| +0,42 | |

| -0,45 | |

| +0,40 | |

| +4,04 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 206 | ||

| 119 | ||

| 59 | ||

| 54 | ||

| 48 | ||

| 39 | ||

| 38 | ||

| 30 | ||

| 30 | ||

| 28 |