`Avino Silver´(ASM.V) besser als `Mines Management´(MGN)? (Seite 2)

eröffnet am 22.12.04 21:46:10 von

neuester Beitrag 18.04.24 11:11:06 von

neuester Beitrag 18.04.24 11:11:06 von

Beiträge: 1.461

ID: 938.312

ID: 938.312

Aufrufe heute: 0

Gesamt: 133.309

Gesamt: 133.309

Aktive User: 0

ISIN: CA0539061030 · WKN: 862191 · Symbol: ASM

0,7703

USD

+0,42 %

+0,0032 USD

Letzter Kurs 02:04:00 NYSE Arca

Neuigkeiten

08.11.23 · Accesswire |

08.11.23 · Christoph Brüning Anzeige |

03.08.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7100 | -7,79 | |

| 15,010 | -8,59 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.559.141 von altenman am 03.04.24 17:08:54Fingerspitzengefühl ...aber nicht zu früh. Könnte diesmal länger dauern, wir sind locker über die 26 gegangen im Silberpreis. Avino hat viel gearbeitet die letzte Zeit.

...aber nicht zu früh. Könnte diesmal länger dauern, wir sind locker über die 26 gegangen im Silberpreis. Avino hat viel gearbeitet die letzte Zeit.

...aber nicht zu früh. Könnte diesmal länger dauern, wir sind locker über die 26 gegangen im Silberpreis. Avino hat viel gearbeitet die letzte Zeit.

...aber nicht zu früh. Könnte diesmal länger dauern, wir sind locker über die 26 gegangen im Silberpreis. Avino hat viel gearbeitet die letzte Zeit.

Antwort auf Beitrag Nr.: 75.548.251 von elsifee am 01.04.24 22:11:21Wird langsam unheimlich. Und ich habe tatsächlich mal etwas Glück mit nachkaufen gehabt. Es gilt wieder, aufpassen, wenn Silber zurückkommt, geht es wieder genauso schnell nach Süden...

Was geht...

Läuft....

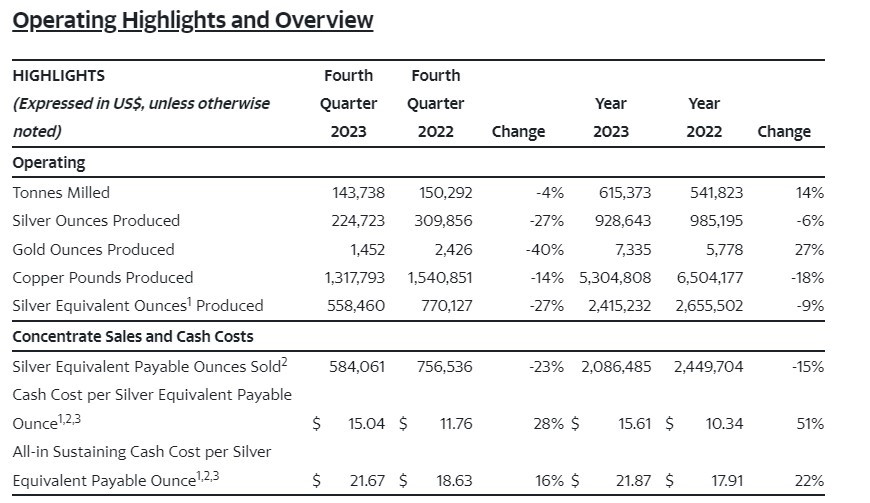

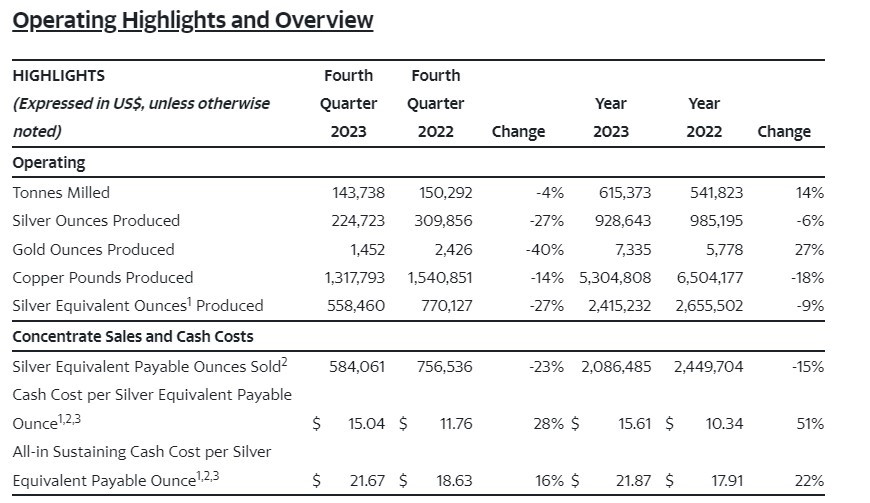

Warten auf deutlich höhere Silberpreise, mit AISC 21.67 Dollar bleibt/blieb bei 25 Dollar Silberpreis zu wenig hängen:

Avino Achieves $43.9 Million in Revenues for 2023; Fourth Quarter Costs Trending Lower

Avino Silver & Gold Mines Ltd. (TSX:ASM) a long-standing silver producer in Mexico, announces its consolidated financial results for the Company's fourth quarter and year ended December 31, 2023.

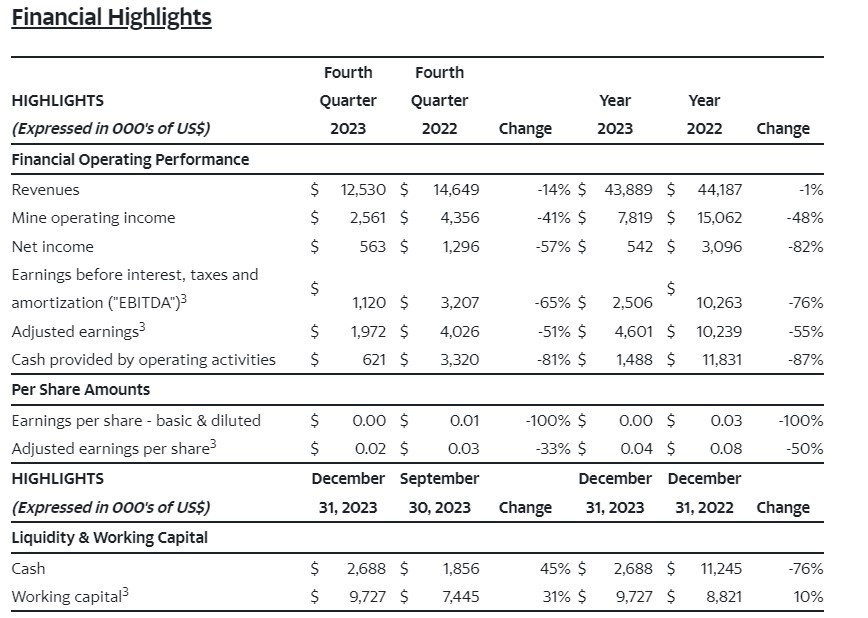

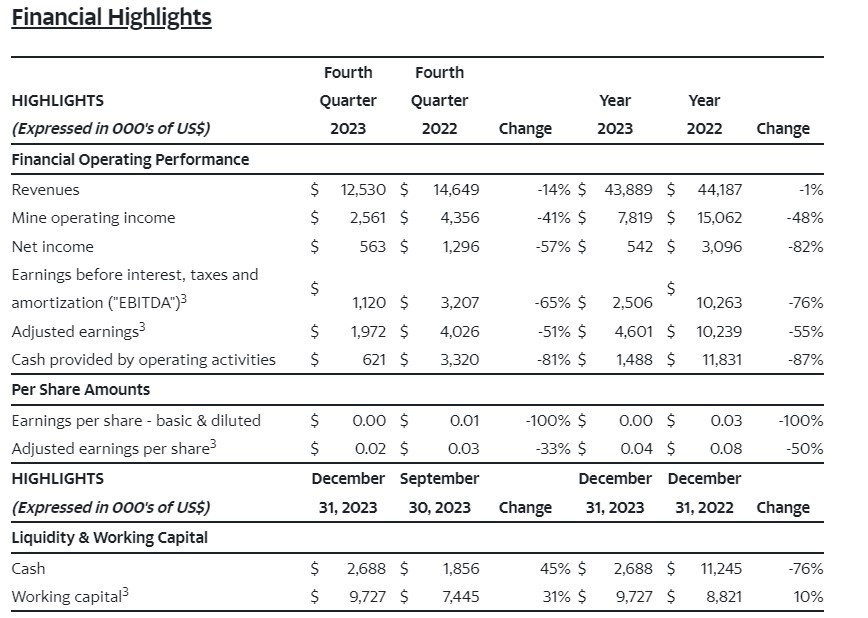

Fourth Quarter 2023 Financial Highlights

- Revenues of $12.5 million

- Mine operating income of $2.6 million, $3.6 million net of non-cash costs of sales

- Net Income of $0.6 million

- Earnings before interest, taxes, depreciation and amortization (EBITDA) of $1.1 million

- Adjusted earnings of $2.0 million

- Cash costs per silver equivalent ounce payable sold of $15.04

- AISC $21.67

Full Year 2023 Financial Highlights

- Revenues of $43.9 million

- Mine operating income of $7.8 million, $11.1 million net of non-cash costs of sales

- Net Income of $0.5 million

- Earnings before interest, taxes, depreciation and amortization (EBITDA) of $2.5 million

- Adjusted earnings of $4.6 million

- Cash costs per silver equivalent payable ounce sold of $15.61

- AISC $21.87

- Cash of $2.7 million at December 31, 2023

- Working capital3 of $9.7 million at December 31, 2023

Avino Achieves $43.9 Million in Revenues for 2023; Fourth Quarter Costs Trending Lower

Avino Silver & Gold Mines Ltd. (TSX:ASM) a long-standing silver producer in Mexico, announces its consolidated financial results for the Company's fourth quarter and year ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights

- Revenues of $12.5 million

- Mine operating income of $2.6 million, $3.6 million net of non-cash costs of sales

- Net Income of $0.6 million

- Earnings before interest, taxes, depreciation and amortization (EBITDA) of $1.1 million

- Adjusted earnings of $2.0 million

- Cash costs per silver equivalent ounce payable sold of $15.04

- AISC $21.67

Full Year 2023 Financial Highlights

- Revenues of $43.9 million

- Mine operating income of $7.8 million, $11.1 million net of non-cash costs of sales

- Net Income of $0.5 million

- Earnings before interest, taxes, depreciation and amortization (EBITDA) of $2.5 million

- Adjusted earnings of $4.6 million

- Cash costs per silver equivalent payable ounce sold of $15.61

- AISC $21.87

- Cash of $2.7 million at December 31, 2023

- Working capital3 of $9.7 million at December 31, 2023

Moin,

So richtig schlecht liest sich das nicht.

Es geht langsam aber stetig weiter.

https://www.finanznachrichten.de/nachrichten-2024-03/6173866…

So richtig schlecht liest sich das nicht.

Es geht langsam aber stetig weiter.

https://www.finanznachrichten.de/nachrichten-2024-03/6173866…

AVINO PROVIDES UPDATE ON ITS 100% OWNED LA PRECIOSA PROPERTY, PREPARING FOR PRODUCTION

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) is pleased to provide an update on recently completed

and ongoing work in connection with La Preciosa, our development stage mineral property which hosts one of the largest

undeveloped primary silver resources in Mexico. La Preciosa is located adjacent to Avino’s existing operations in Durango,

Mexico. The addition of La Preciosa’s mineral resource inventory significantly increased Avino’s consolidated NI 43-101

mineral resources, which is currently 371 million silver equivalent ounces.

At La Preciosa, capital for 2024 is expected to be between US$3.0 – US$4.0 million and will include surface works and

equipment procurement intended for the first phase of mine development for the Gloria and Abundancia Veins. Avino already

has the mining equipment necessary to commence operations at La Preciosa.

The application for the Environmental permit has been submitted by the Company to the relevant authorities. A further

permit will be submitted shortly after receipt of the Environmental permit, which is required to commence the construction

of the portal, haulage ramp, and the mining of the Gloria and Abundancia veins. Avino anticipates receiving these permits

sometime in 2024.

The onsite drill core storage and office buildings are in good condition and are solar powered. Avino is committed to operating

La Preciosa with a small environmental footprint and at a low cost.

ONGOING WORKS AT LA PRECIOSA AND PREP WORK AT THE AVINO MILL INCLUDE:

La Preciosa – Surface & Site Works

• Surface Office building rehabilitation

• Extensive sampling of historic surface mineralized stockpiles

• Haulage of historic stockpiles to the Avino milling complex

• Reinforcing stability of walls at the mine entrance and previously developed areas underground

Avino Mill Processing Works

• Rehabilitation of an unused thickener tank in preparation for processing the previously mentioned stockpiles, in one

of Avino’s 250 TPD circuit’s is currently in progress

• Once the rehabilitation work on the thickener is complete, production of a silver-gold concentrate from this stockpile

material will commence which will be another milestone for the Company

David Wolfin, President and CEO commented “In early January, we announced that a long-term land-use agreement with a

local community for the development of La Preciosa had been signed. This was a pivotal achievement and brought us another

step closer to our goal of bringing La Preciosa into production. Given all the recent activity at site, we are incredibly pleased

to provide this current update on ongoing works at the property.”

https://avino.com/site/assets/files/5522/2024-02-28-nr-asm-r…

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) is pleased to provide an update on recently completed

and ongoing work in connection with La Preciosa, our development stage mineral property which hosts one of the largest

undeveloped primary silver resources in Mexico. La Preciosa is located adjacent to Avino’s existing operations in Durango,

Mexico. The addition of La Preciosa’s mineral resource inventory significantly increased Avino’s consolidated NI 43-101

mineral resources, which is currently 371 million silver equivalent ounces.

At La Preciosa, capital for 2024 is expected to be between US$3.0 – US$4.0 million and will include surface works and

equipment procurement intended for the first phase of mine development for the Gloria and Abundancia Veins. Avino already

has the mining equipment necessary to commence operations at La Preciosa.

The application for the Environmental permit has been submitted by the Company to the relevant authorities. A further

permit will be submitted shortly after receipt of the Environmental permit, which is required to commence the construction

of the portal, haulage ramp, and the mining of the Gloria and Abundancia veins. Avino anticipates receiving these permits

sometime in 2024.

The onsite drill core storage and office buildings are in good condition and are solar powered. Avino is committed to operating

La Preciosa with a small environmental footprint and at a low cost.

ONGOING WORKS AT LA PRECIOSA AND PREP WORK AT THE AVINO MILL INCLUDE:

La Preciosa – Surface & Site Works

• Surface Office building rehabilitation

• Extensive sampling of historic surface mineralized stockpiles

• Haulage of historic stockpiles to the Avino milling complex

• Reinforcing stability of walls at the mine entrance and previously developed areas underground

Avino Mill Processing Works

• Rehabilitation of an unused thickener tank in preparation for processing the previously mentioned stockpiles, in one

of Avino’s 250 TPD circuit’s is currently in progress

• Once the rehabilitation work on the thickener is complete, production of a silver-gold concentrate from this stockpile

material will commence which will be another milestone for the Company

David Wolfin, President and CEO commented “In early January, we announced that a long-term land-use agreement with a

local community for the development of La Preciosa had been signed. This was a pivotal achievement and brought us another

step closer to our goal of bringing La Preciosa into production. Given all the recent activity at site, we are incredibly pleased

to provide this current update on ongoing works at the property.”

https://avino.com/site/assets/files/5522/2024-02-28-nr-asm-r…

2024 OUTLOOK - Production

For 2024, approximately 700,000-750,000 tonnes are planned for mill processing and will be sourced from both the Avino Mine and stockpiles from La Preciosa. Based on current metal prices, the Company expects to produce between 2.5M and 2.8M silver equivalent ounces.

https://avino.com/news/2024/avino-provides-outlook-for-2024-…

Zu Erinnerung:

2023 hatten wir 615.000 dry Tonnen Mill Feed und 2,4moz AgEq - es geht bergauf! Wenn dann noch die Preise mitspielen...!

For 2024, approximately 700,000-750,000 tonnes are planned for mill processing and will be sourced from both the Avino Mine and stockpiles from La Preciosa. Based on current metal prices, the Company expects to produce between 2.5M and 2.8M silver equivalent ounces.

https://avino.com/news/2024/avino-provides-outlook-for-2024-…

Zu Erinnerung:

2023 hatten wir 615.000 dry Tonnen Mill Feed und 2,4moz AgEq - es geht bergauf! Wenn dann noch die Preise mitspielen...!

In einer Zeit wo Minenaktien bei Investoren kaum eine Rolle spielen, ist eine positive Bewertung sehr hoch einzuschätzen. In einer Bullenphase sollte man allerdings langsam an Gewinnmitnahmen denken.

Top 4 :

Hecla Mining Company

Pan American Silver Corp.

Avino Silver

Vizsla Silva

Top 4 :

Hecla Mining Company

Pan American Silver Corp.

Avino Silver

Vizsla Silva

Empfehlung für Avino Silver & Gold Mines:

Mining-Silver Stocks to Keep an Eye on

Avino Silver & Gold Mines: The company recently signed a long-term land-use agreement with a local community for the development of La Preciosa in Durango, Mexico. La Preciosa hosts one of the largest undeveloped primary silver resources in Mexico. Also, La Preciosa’s proximity to the Avino mine and infrastructure could yield numerous financial and operational synergies. The pre-feasibility study for the Oxide Tailings project is expected to be released soon. This project is expected to play a significant role in ASM’s target to become an intermediate silver producer in Mexico. At its flagship Avino mine, the company witnessed a noticeable increase in grade and recovery lately and this trend is expected to continue.

The Zacks Consensus Estimate for this Vancouver, Canada-based player’s 2024 earnings has been unchanged over the past 60 days. The estimate indicates year-over-year growth of 150%. ASM currently carries a Zacks Rank #3.

https://www.zacks.com/commentary/2214114/4-silver-mining-sto…

Wieder mal Licht und Schatten,

Q4-2022 verglichen mit Q4-2023: 143,798 > 150,292 -4%

2023 verglichen mit 2022: 615,373 > 541,823 +14%

2023 Total Silver Produced (oz) 928,643 985,195 -6%

2023 Total Gold Produced (oz) 7,335 5,778 +27%

2023 Total Copper Produced (Lbs) 5,304,808 6,504,177 -18%

2023 Total Silver Equivalent Produced 2,415,232 2,655,502 -9%

Avino’s Q4 and Full Year 2023 Production Results

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) a long-standing and growing silver producer in Mexico, achieved full year 2023 production results of 2.4 million silver equivalent ounces. Fourth quarter production totaled 558,460 silver equivalent ounces.

Production Highlights – Q4 2023

- Silver equivalent production was 558,460 oz1

- Silver production was 224,743 oz

- Copper production was 1.3 million lbs

- Gold production to 1,452 oz

- Mill throughput was 143,798 tonnes

“The Avino Mine continued to provide consistent results in the fourth quarter of 2023; however, overall production was impacted by mining in lower grade areas, and lower recovery rates,” said David Wolfin, President and CEO of Avino. “Although grades were lower than 2022, we did see positive increases as we moved into other blocks of the mine compared to the third quarter. We have made improvements in the mechanical equipment of the mill and expect recovery rates to improve along with grades as we move into higher grade zones inline with the projected mining sequence.

December production saw a noticeable increase in grade and recovery, and we are looking for that trend to continue into Q1. We remain focused on the execution of our 5-year growth plan, with Avino Mine continuing with steady production, and La Preciosa and the Oxide Tailings project both hitting key milestones in Q1 2024.”

https://avino.com/news/2024/avinos-q4-and-full-year-2023-pro…

Q4-2022 verglichen mit Q4-2023: 143,798 > 150,292 -4%

2023 verglichen mit 2022: 615,373 > 541,823 +14%

2023 Total Silver Produced (oz) 928,643 985,195 -6%

2023 Total Gold Produced (oz) 7,335 5,778 +27%

2023 Total Copper Produced (Lbs) 5,304,808 6,504,177 -18%

2023 Total Silver Equivalent Produced 2,415,232 2,655,502 -9%

Avino’s Q4 and Full Year 2023 Production Results

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) a long-standing and growing silver producer in Mexico, achieved full year 2023 production results of 2.4 million silver equivalent ounces. Fourth quarter production totaled 558,460 silver equivalent ounces.

Production Highlights – Q4 2023

- Silver equivalent production was 558,460 oz1

- Silver production was 224,743 oz

- Copper production was 1.3 million lbs

- Gold production to 1,452 oz

- Mill throughput was 143,798 tonnes

“The Avino Mine continued to provide consistent results in the fourth quarter of 2023; however, overall production was impacted by mining in lower grade areas, and lower recovery rates,” said David Wolfin, President and CEO of Avino. “Although grades were lower than 2022, we did see positive increases as we moved into other blocks of the mine compared to the third quarter. We have made improvements in the mechanical equipment of the mill and expect recovery rates to improve along with grades as we move into higher grade zones inline with the projected mining sequence.

December production saw a noticeable increase in grade and recovery, and we are looking for that trend to continue into Q1. We remain focused on the execution of our 5-year growth plan, with Avino Mine continuing with steady production, and La Preciosa and the Oxide Tailings project both hitting key milestones in Q1 2024.”

https://avino.com/news/2024/avinos-q4-and-full-year-2023-pro…