Diskussion zum Thema Silber (Seite 50)

eröffnet am 23.04.05 14:56:42 von

neuester Beitrag 26.04.24 17:02:06 von

neuester Beitrag 26.04.24 17:02:06 von

Beiträge: 175.731

ID: 976.618

ID: 976.618

Aufrufe heute: 939

Gesamt: 15.011.990

Gesamt: 15.011.990

Aktive User: 3

ISIN: XD0002746952 · WKN: CG3AB1

18,23

USD

0,00 %

0,00 USD

Letzter Kurs 06.04.17 Eurex

Neuigkeiten

25.04.24 · wallstreetONLINE Redaktion |

17:18 Uhr · onemarkets Blog Anzeige |

14:07 Uhr · GOLDINVEST.de Anzeige |

12:35 Uhr · PR Newswire (dt.) |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 5,1500 | +21,75 | |

| 15,690 | +20,14 | |

| 0,9000 | +16,13 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,8500 | -6,33 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 0,5500 | -21,43 |

Beitrag zu dieser Diskussion schreiben

Silberentwicklung

Ich denke, die Entwicklung von Gold sollte weiter stark bleiben. Es gibt einfach zu viele Risiken, wirtschaftlich und geopolitisch.Silber erleidet immer wieder Rücksetzer, es gelingt nicht, aus dem aktuellen Tradingbereich auszubrechen.

Sollte Gold weiterhin stark bleiben, so könnte ich mir mittlerweile einen sehr starken Ausbruch von Silber vorstellen.

Ich glaube, die Chancen sind groß.

Der Silbermarkt ist momentan psychologisch sehr stark geprägt.

Antwort auf Beitrag Nr.: 75.489.966 von SmallCapTrade am 20.03.24 21:49:48

Im eigenen Land gibt es dafür eine Nachfrage, im Ausland sind sie eher unbekannt und werden schlimmstenfalls nur zum Schmelzwert bzw. Nominale angekauft, wenn man keinen Sammler findet.

Außer es sind Motive, für die es einen Sammlermarkt gibt. Da kann es dann durchaus gewaltige Preissteigerungen geben.

Bei Deutschland ist es etwas anders, da deutsche Münzen auch in vielen Nachbarländern gesammelt werden.

Ich hab auch viele Münzen teurer gekauft, einfach, weil ich sie wollte. Aber auch jede Menge ausländische Münzen und Medaillen aus Silber nahe am Schmelzpreis. Wenn man Zeit hat, findet man dafür durchaus Interessenten, die weit mehr dafür zahlen. Das kann über ebay, sein, aber auch über willhaben, oder einfach am Flohmarkt.

Beispielsweise habe ich die 2 australischen Unzen "Kormoran" und "Sydney" um 150.- Euro gekauft. Ich stelle den Link zu ebay hier jetzt nicht rein, sonst werde ich wieder gelöscht. Kann jeder selbst mit den beiden Stichwörtern nachschauen.

Die Unzen aus San Marino könnten aus mehreren Gründen steigen. Oder auch nicht.

Kommt darauf an, was die aus der Serie machen.

Beispielsweise sind die ersten südafrikanischen Goldunzen Krügerrand aus den 1960er Jahren ziemlich teuer. Weltweit.

Swiss Mint Münzen

Das ist meines Erachtens so ähnlich wie bei den Silbergedenkmünzen der Münze Österreich oder Monnaie Francaise etc.Im eigenen Land gibt es dafür eine Nachfrage, im Ausland sind sie eher unbekannt und werden schlimmstenfalls nur zum Schmelzwert bzw. Nominale angekauft, wenn man keinen Sammler findet.

Außer es sind Motive, für die es einen Sammlermarkt gibt. Da kann es dann durchaus gewaltige Preissteigerungen geben.

Bei Deutschland ist es etwas anders, da deutsche Münzen auch in vielen Nachbarländern gesammelt werden.

Ich hab auch viele Münzen teurer gekauft, einfach, weil ich sie wollte. Aber auch jede Menge ausländische Münzen und Medaillen aus Silber nahe am Schmelzpreis. Wenn man Zeit hat, findet man dafür durchaus Interessenten, die weit mehr dafür zahlen. Das kann über ebay, sein, aber auch über willhaben, oder einfach am Flohmarkt.

Beispielsweise habe ich die 2 australischen Unzen "Kormoran" und "Sydney" um 150.- Euro gekauft. Ich stelle den Link zu ebay hier jetzt nicht rein, sonst werde ich wieder gelöscht. Kann jeder selbst mit den beiden Stichwörtern nachschauen.

Die Unzen aus San Marino könnten aus mehreren Gründen steigen. Oder auch nicht.

Kommt darauf an, was die aus der Serie machen.

Beispielsweise sind die ersten südafrikanischen Goldunzen Krügerrand aus den 1960er Jahren ziemlich teuer. Weltweit.

Antwort auf Beitrag Nr.: 75.501.246 von matze1409 am 22.03.24 13:06:00

hier richtig Kasse machen. Wie heißt es so schön: Was Hänschen nicht lernt, lernt Hans nimmer mehr!

In dem Sinne Hans-Matze: Ein Risiko entsteht nur, wenn man nicht weiß was man tut!

Ich liebe es, so einfach hier mit Silber reich zu werden, man darf nur nicht Hänschen heißen

ALLES NUR NEIDER

Weißt schon, die anderen sind einfach nur neidisch, weil wir immer richtig liegen und mit den Silber-Shorts und Longshier richtig Kasse machen. Wie heißt es so schön: Was Hänschen nicht lernt, lernt Hans nimmer mehr!

In dem Sinne Hans-Matze: Ein Risiko entsteht nur, wenn man nicht weiß was man tut!

Ich liebe es, so einfach hier mit Silber reich zu werden, man darf nur nicht Hänschen heißen

Nein, ich habe keinen an der Klatsche. Ich Shorte den Silberpreis wenn er in relativ kurzer Zeit stark ansteigt. Das wird IMMER abverkauft. 10 Jahre Qual haben sich nun mal in mein Gehirn eingebrannt. Ich spiele das Spiel nur mit, was die großen machen. Nicht mehr und nicht weniger. Ich geh auch wieder Long. Aber nicht bei 24,50!

Antwort auf Beitrag Nr.: 75.498.354 von matze1409 am 22.03.24 03:21:03

Du hast wirklich einen an der Klatsche. Ständig schreibst du den selben Quatsch.

Jeder weiß doch mittlerweile, dass du jeden Spike triffst, IMMER!!!

Zitat von matze1409: Ich hatte zwischenzeitlich gekauft und verkauft. Der Trade jetzt hat aber so richtig gessen. Ihr wisst ja, Spikes muss man Shorten. Funktioniert IMMER !!!

Du hast wirklich einen an der Klatsche. Ständig schreibst du den selben Quatsch.

Jeder weiß doch mittlerweile, dass du jeden Spike triffst, IMMER!!!

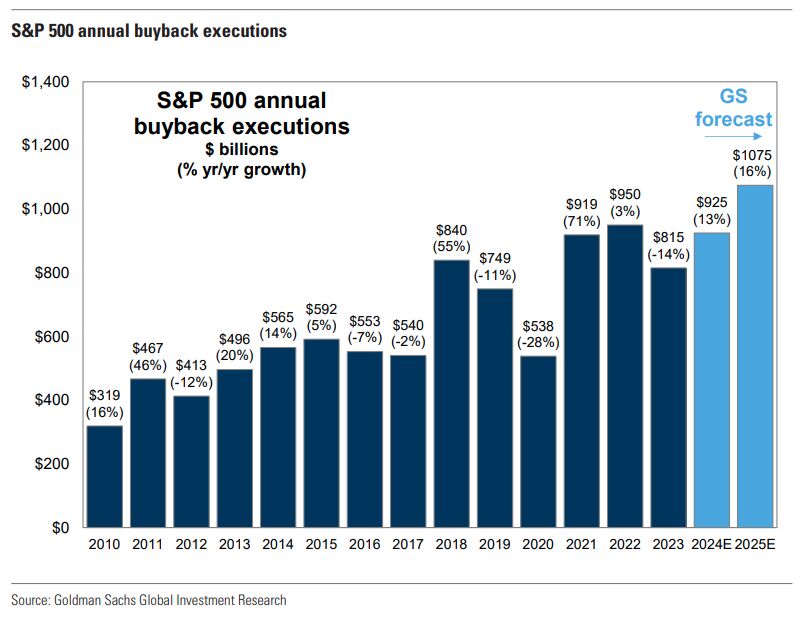

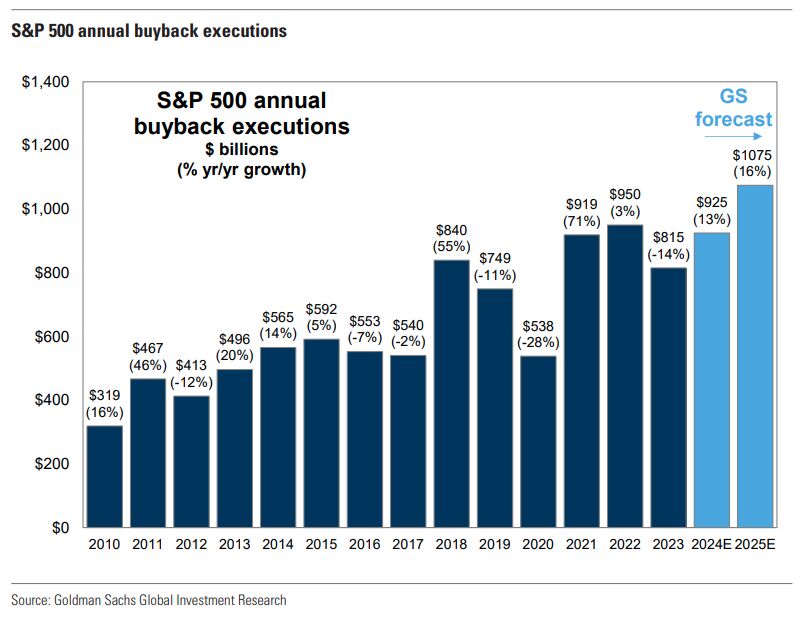

Antwort auf Beitrag Nr.: 75.499.152 von muenchenguru am 22.03.24 08:38:05Ich sehe als einen der Hauptgründe für die ständig steigenden Aktienmärkte die Rückkäufe der Unternehmen an.

Das sind Milliarden um Milliarden die ständig für Nachfrage sorgen.

https://finanzmarktwelt.de/aktienrueckkaeufe-der-sp-500-konz…

Zudem kaufen die Unternehmen auch wenn es eigentlich schon recht teuer ist und die US-Unternehmen schwimmen zur Zeit eher im Geld.

Das ist beim Silber leider nicht so, beim Gold schon, da kaufen ja die Notenbanken ständig zu.

Das sind Milliarden um Milliarden die ständig für Nachfrage sorgen.

https://finanzmarktwelt.de/aktienrueckkaeufe-der-sp-500-konz…

Zudem kaufen die Unternehmen auch wenn es eigentlich schon recht teuer ist und die US-Unternehmen schwimmen zur Zeit eher im Geld.

Das ist beim Silber leider nicht so, beim Gold schon, da kaufen ja die Notenbanken ständig zu.

Antwort auf Beitrag Nr.: 75.498.354 von matze1409 am 22.03.24 03:21:03

Was will man mehr? Merkt Euch: Am Tief long und am Hoch short!

Ganz einfach! Einfach mir nachmachen!

Dankt mir später!

MANN MUSS NUR IMMER AM TIEF LONG GEHEN UND AM HOCH SHORT - GANZ EINFACH!

Ich habe jetzt auch wieder mal ein paar 100 Bagger Trades hinter mir! Was will man mehr? Merkt Euch: Am Tief long und am Hoch short!

Ganz einfach! Einfach mir nachmachen!

Dankt mir später!

Ich finde muss man auch nicht durchblicken. Ich denke ein bisschen genereller Optimismus ist da immer gut. Die Lage war doch noch nie anders und der Lebensstandard ist für alle Menschen trotzdem immer weiter gestiegen. Pessimisten sind noch nie weit gekommen und hängen jetzt schon Ewigkeiten im Gold und sonstigen schlechten Investments rum. Ich denke in 10 Jahren wird es weiter besser gehen und der DAX und Dow werden weit höher als jetzt stehen, Gold und Silber werden eher mittelmässig laufen mit den üblichen kurzen Spikes nach oben.

Antwort auf Beitrag Nr.: 75.498.969 von xolo22 am 22.03.24 08:17:54naja, bei oberflächlicher Betrachtung ja. Aber im Grunde hängt alles an der Liquidität und die an den Banken und die an den Zentralbanken. Wenn der breite Markt abschmiert (Schuldenkrise durch Konsumenten, Studenten, Gewerbeimmos, KMUs....) wie lange können die Mag7 das dann halten ? Was ist mit dem expl.Defizit des US-Staates , kauft die Fed alle Schuldtitel ? Die US Schulden haben hohe kurzfristigen Anteil. Was machen die Brics ? Ich glaube die Stärke der US-Märkte hat auch viel der China-Schwäche zu verdanken, was aber auch ein bedenkliches Zeichen ist.

Das bitte nur als Zwischenfazit zu verstehen, ich versuche ja selbst nur bissl durchzublicken 😉

Das bitte nur als Zwischenfazit zu verstehen, ich versuche ja selbst nur bissl durchzublicken 😉

Antwort auf Beitrag Nr.: 75.498.858 von muenchenguru am 22.03.24 07:56:42Es ist die berühmte Mauer der Angst an den Märkten wie du selbst schreibst. Deswegen werden auch die Märkte DAX und Co. weiter wie selbstverständlich steigen. Die Liquiditätserhöhungen aus den Zinssenkungen werden natürlich in die gut laufenden Branchen fliessen. Dazu gehören nicht Edelmetalle.

Aber so schlecht ist die fundamentale Situation der Gesamtmärkte garnicht. Die Gewinne sind sehr üppig bei den meisten Unternehmen, eigentlich Business as usual.

Aber so schlecht ist die fundamentale Situation der Gesamtmärkte garnicht. Die Gewinne sind sehr üppig bei den meisten Unternehmen, eigentlich Business as usual.

17:18 Uhr · onemarkets Blog · DAXAnzeige |

14:07 Uhr · GOLDINVEST.de · GoldAnzeige |

12:35 Uhr · PR Newswire (dt.) · Gold |

10:05 Uhr · Martin Siegel · Gold |

25.04.24 · Dr. Hamed Esnaashari · Hecla Mining |

25.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

25.04.24 · Smart Investor · Gold |

25.04.24 · news aktuell · Gold |