NEUER SOLAR - SILIZIUM - MARKTFÜHRER : REC (Seite 2)

eröffnet am 10.05.06 23:05:55 von

neuester Beitrag 06.02.24 19:18:08 von

neuester Beitrag 06.02.24 19:18:08 von

Beiträge: 734

ID: 1.059.299

ID: 1.059.299

Aufrufe heute: 0

Gesamt: 111.599

Gesamt: 111.599

Aktive User: 0

ISIN: NO0010112675 · WKN: A0BKK5

0,8790

EUR

-3,46 %

-0,0315 EUR

Letzter Kurs 02.05.24 Lang & Schwarz

Werte aus der Branche Halbleiter

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,5000 | +119,30 | |

| 2,0300 | +20,83 | |

| 22,320 | +20,65 | |

| 362,25 | +19,67 | |

| 1,0000 | +19,23 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,140 | -10,00 | |

| 1,3160 | -11,74 | |

| 8,7000 | -12,12 | |

| 95,67 | -14,50 | |

| 3.750,00 | -25,15 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 65.495.761 von Realist2020 am 26.10.20 12:23:50REC Silicon profitiert auch massiv vom Aufschwung des neuen Players Meyer Burger Technologies der immer mehr den Premium Markt der Zukunft einnimmt 🇺🇸😎🇺🇸😎🇨🇭🇨🇭

Gibt es Quellen?

Antwort auf Beitrag Nr.: 66.176.800 von Toto2311 am 23.12.20 13:23:00Heute gab es wieder Neues in den Medien und der Kurs macht..boom..bin gespannt, wie schnell wieder 2stellige Kurse da sind..Grüße an die bestens Investierten..

Antwort auf Beitrag Nr.: 66.176.800 von Toto2311 am 23.12.20 13:23:00..noch nicht, aber bald...viele Grüsse den gut Investierten..

Hallo, gibt es irgendwelche Neuigkeiten?

Die Aktie wird wieder interessant.....

Am 29. Oktober werden Zahlen veröffentlicht. REC Silicon hat sein altes Werk wieder eröffnet und

Was geht bei dieser Aktie ab??

ob es sich lohnt, da nochmal Ansichtsstücke zu ordern?

Antwort auf Beitrag Nr.: 60.317.383 von R-BgO am 09.04.19 23:04:31Fornebu, Norway 3 July 2019:

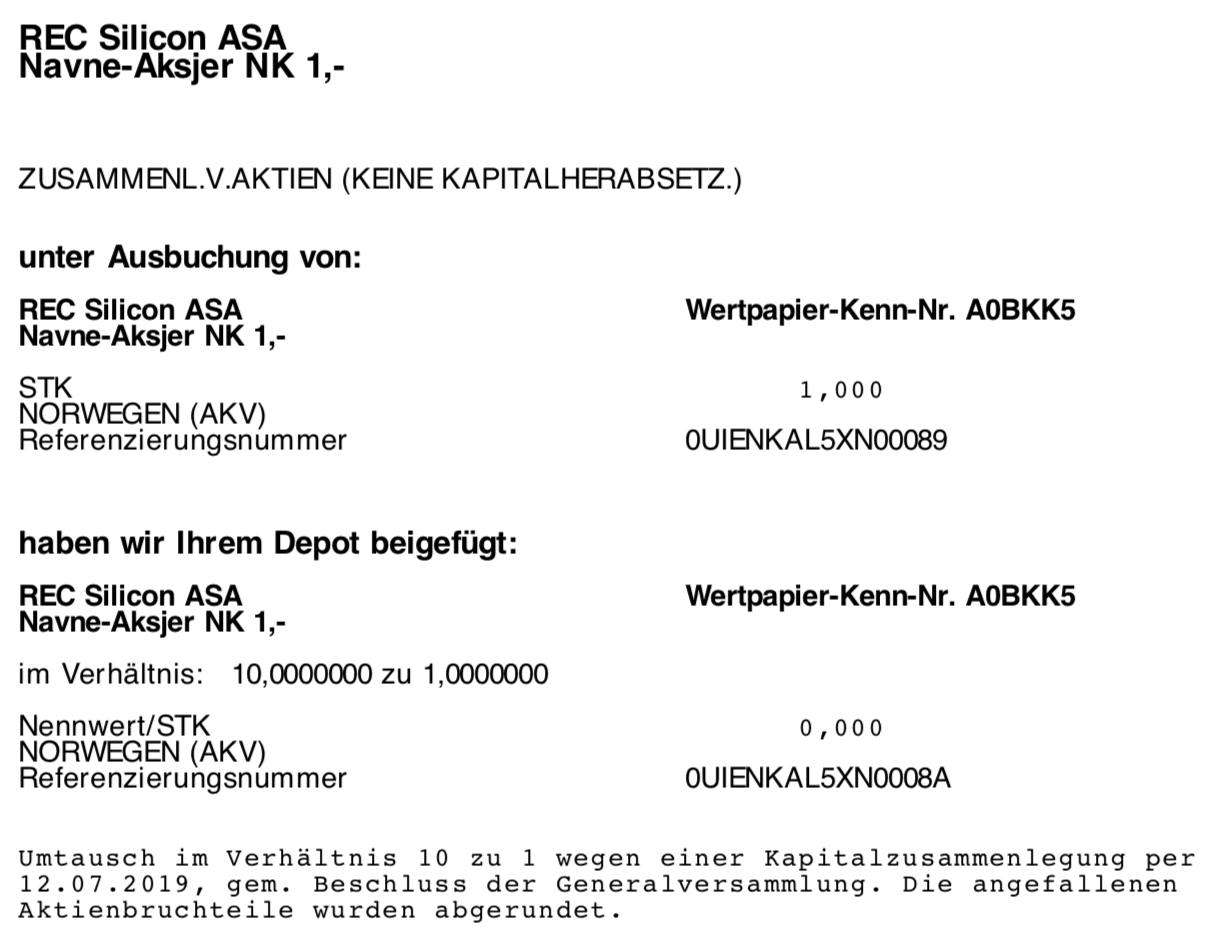

Reference is made to the resolution by the annual general meeting of REC Silicon ASA on 9 May 2019, whereby it was i.a. resolved to reduce the share capital through reduction of par value and to issue 25,438,187 new Class A shares to Umoe AS, the Class A shares being convertible to 254,381,870 ordinary shares upon completion of the share capital reduction.

The share capital reduction and the conversion of the Class A Shares are now completed and registered with the Norwegian Register of Business Enterprises. Consequently, the new share capital of the Company is NOK 279,820,065.50 divided on 2,798,200,655 ordinary shares, each with a par value of NOK 0.10. Umoe AS owns 642,221,509 shares in REC Silicon ASA, approx. 23% of the outstanding shares and votes.

Reference is made to the resolution by the annual general meeting of REC Silicon ASA on 9 May 2019, whereby it was i.a. resolved to reduce the share capital through reduction of par value and to issue 25,438,187 new Class A shares to Umoe AS, the Class A shares being convertible to 254,381,870 ordinary shares upon completion of the share capital reduction.

The share capital reduction and the conversion of the Class A Shares are now completed and registered with the Norwegian Register of Business Enterprises. Consequently, the new share capital of the Company is NOK 279,820,065.50 divided on 2,798,200,655 ordinary shares, each with a par value of NOK 0.10. Umoe AS owns 642,221,509 shares in REC Silicon ASA, approx. 23% of the outstanding shares and votes.

Antwort auf Beitrag Nr.: 60.314.497 von R-BgO am 09.04.19 16:49:52Published: 22:51 CEST 09-04-2019 /GlobeNewswire /Source: REC Silicon ASA / : REC /ISIN: NO0010112675

REC Silicon - Private placement successfully completed

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Fornebu, Norway - April 9, 2019:

Reference is made to the stock exchange release from REC Silicon ASA ("REC" or the "Company") published on April 9, 2019 regarding a contemplated private placement. The Company is pleased to announce that it has raised approximately NOK 170 million in gross proceeds through a private placement (the "Private Placement") of 254,381,870 offer shares (the "Offer Shares"), at a price per share of NOK 0.67 (the "Subscription Price"). The Private Placement took place, and the Subscription Price has been set, through an accelerated bookbuilding process managed by Sparebank 1 Markets as sole manager after close of markets on April 9, 2019. The Private Placement was substantially oversubscribed.

The net proceeds from the Private Placement will be used to strengthen and contain the Company's liquidity situation until access to the Chinese polysilicon market is restored. Specifically, the proceeds will be used for (i) non-recurring restructuring costs of USD 3.7 million to curtail and shut down Moses Lake FBR production, unless access to the Chinese market is restored, (ii) settle the remaining payments to the Yulin JV of USD 3.1 million and USD 5.2 million and (iii) for general corporate purposes.

The Offer Shares will be settled with existing and unencumbered shares in the Company that are already listed on the Oslo Stock Exchange, pursuant to an agreement between SpareBank 1 Markets AS, the Company and Umoe AS. The shares delivered to the subscribers will thus be tradable upon delivery, expected May 10, 2019.

Subject to approval by the Company's AGM, Umoe AS has undertaken to use the full proceeds received from the settlement of the Private Placement to acquire new A-shares in the Company. All of the new A-shares will be converted into ordinary shares as soon as practically possible, expected within eight (8) weeks from the settlement date.

Completion of the Private Placement is subject to approval by the annual general meeting ("AGM") of the Private Placement, the issue of the new A-shares and a share capital reduction.

The board of directors of the Company has resolved to propose that the AGM resolves to authorize the board to carry out a subsequent offering of up to 50,000,000 new shares towards the Company's shareholders as of April 9, 2019 (as documented by the shareholder register in the Norwegian Central Securities Depository (VPS) as of the end of April 11, 2019) who were not allocated shares in the Private Placement or participated in the pre-sounding and who are not resident in a jurisdiction where such offering would be unlawful or, for jurisdictions other than Norway, would require any prospectus, filing, registration or similar action. Such shareholders will be granted non-transferable preferential rights to subscribe for, and, upon subscription, be allocated new shares. The subscription price in such subsequent offering will be the same as the subscription price in the Private Placement.

The waiver of the preferential rights inherent in a private placement is considered necessary in the interest of time and successful completion. Taking into consideration the time, costs and expected terms of alternative methods of the securing the desired funding, as well as the subsequent offering considered, the board has concluded that the conclusion of the Private Placement on acceptable terms at this time is in the common interest of the shareholders of the Company and that the Private Placement complies with the equal treatment obligations under the Norwegian Securities Trading Act and Oslo Børs' Circular no. 2/2014.

The following primary insiders of the Company have been allocated Offer Shares in the Private Placement, each such Offer Share allocated at the Subscription Price:

Umoe AS, was allocated 58,380,639 Offer Shares. After completion of the Private Placement, Umoe AS will own 583,840,870 shares in the Company, corresponding to a shareholding of approximately 23% before the subsequent offering and the issue of new A-shares to Umoe AS, as anticipated above.

REC Silicon - Private placement successfully completed

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, JAPAN OR THE UNITED STATES OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Fornebu, Norway - April 9, 2019:

Reference is made to the stock exchange release from REC Silicon ASA ("REC" or the "Company") published on April 9, 2019 regarding a contemplated private placement. The Company is pleased to announce that it has raised approximately NOK 170 million in gross proceeds through a private placement (the "Private Placement") of 254,381,870 offer shares (the "Offer Shares"), at a price per share of NOK 0.67 (the "Subscription Price"). The Private Placement took place, and the Subscription Price has been set, through an accelerated bookbuilding process managed by Sparebank 1 Markets as sole manager after close of markets on April 9, 2019. The Private Placement was substantially oversubscribed.

The net proceeds from the Private Placement will be used to strengthen and contain the Company's liquidity situation until access to the Chinese polysilicon market is restored. Specifically, the proceeds will be used for (i) non-recurring restructuring costs of USD 3.7 million to curtail and shut down Moses Lake FBR production, unless access to the Chinese market is restored, (ii) settle the remaining payments to the Yulin JV of USD 3.1 million and USD 5.2 million and (iii) for general corporate purposes.

The Offer Shares will be settled with existing and unencumbered shares in the Company that are already listed on the Oslo Stock Exchange, pursuant to an agreement between SpareBank 1 Markets AS, the Company and Umoe AS. The shares delivered to the subscribers will thus be tradable upon delivery, expected May 10, 2019.

Subject to approval by the Company's AGM, Umoe AS has undertaken to use the full proceeds received from the settlement of the Private Placement to acquire new A-shares in the Company. All of the new A-shares will be converted into ordinary shares as soon as practically possible, expected within eight (8) weeks from the settlement date.

Completion of the Private Placement is subject to approval by the annual general meeting ("AGM") of the Private Placement, the issue of the new A-shares and a share capital reduction.

The board of directors of the Company has resolved to propose that the AGM resolves to authorize the board to carry out a subsequent offering of up to 50,000,000 new shares towards the Company's shareholders as of April 9, 2019 (as documented by the shareholder register in the Norwegian Central Securities Depository (VPS) as of the end of April 11, 2019) who were not allocated shares in the Private Placement or participated in the pre-sounding and who are not resident in a jurisdiction where such offering would be unlawful or, for jurisdictions other than Norway, would require any prospectus, filing, registration or similar action. Such shareholders will be granted non-transferable preferential rights to subscribe for, and, upon subscription, be allocated new shares. The subscription price in such subsequent offering will be the same as the subscription price in the Private Placement.

The waiver of the preferential rights inherent in a private placement is considered necessary in the interest of time and successful completion. Taking into consideration the time, costs and expected terms of alternative methods of the securing the desired funding, as well as the subsequent offering considered, the board has concluded that the conclusion of the Private Placement on acceptable terms at this time is in the common interest of the shareholders of the Company and that the Private Placement complies with the equal treatment obligations under the Norwegian Securities Trading Act and Oslo Børs' Circular no. 2/2014.

The following primary insiders of the Company have been allocated Offer Shares in the Private Placement, each such Offer Share allocated at the Subscription Price:

Umoe AS, was allocated 58,380,639 Offer Shares. After completion of the Private Placement, Umoe AS will own 583,840,870 shares in the Company, corresponding to a shareholding of approximately 23% before the subsequent offering and the issue of new A-shares to Umoe AS, as anticipated above.