Uranproduzent mit perfekten Zukunftsaussichten (Seite 160)

eröffnet am 22.10.06 19:28:14 von

neuester Beitrag 01.03.24 11:11:59 von

neuester Beitrag 01.03.24 11:11:59 von

Beiträge: 1.876

ID: 1.089.272

ID: 1.089.272

Aufrufe heute: 31

Gesamt: 331.381

Gesamt: 331.381

Aktive User: 0

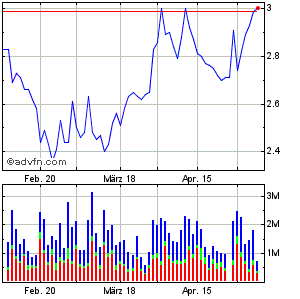

ISIN: CA2483561072 · WKN: A0LFYS · Symbol: DML

2,7100

CAD

+0,37 %

+0,0100 CAD

Letzter Kurs 25.04.24 Toronto

Neuigkeiten

20.03.24 · Mining Investor Anzeige |

11.03.24 · GOLDINVEST.de Anzeige |

06.03.24 · wallstreetONLINE Redaktion |

15.01.24 · wallstreetONLINE NewsUpdate |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 5,1500 | +21,75 | |

| 15,690 | +20,14 | |

| 0,9000 | +16,13 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,8500 | -6,33 | |

| 0,5180 | -7,09 | |

| 10,040 | -7,89 | |

| 0,5400 | -8,47 | |

| 0,5500 | -21,43 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 36.363.263 von buybuy3 am 13.01.09 14:15:09Jupp, es lohnt sich wieder das Depot aufzustocken.

Einkaufen....

....wow, heute gings ganz schön gen süden.....

sollten jedoch in dieser region auf erhebliche

unterstützung stoßen........IMO

sollten jedoch in dieser region auf erhebliche

unterstützung stoßen........IMO

Denison Mines Corp. Satisfies Bank Production Covenant

TORONTO, ONTARIO -- (Marketwire) -- 01/09/09

-- Denison Mines Corp. ("Denison" or the "Company") (TSX: DML)(NYSE Alternext US: DNN) announced today that it has satisfied the covenant outlined in its credit facility with the Bank of Nova Scotia relating to uranium production in 2008. Uranium production for the year totaled 1,635,000 pounds U3O8, with production from the McClean Lake joint venture being approximately 3,250,000 pounds (Denison's share being approximately 731,000 pounds U3O8) and approximately 904,000 pounds U3O8 being produced at the White Mesa mill. The uranium production, combined with the approximately 1,218,000 pounds of vanadium produced at White Mesa, which under the bank covenant is equivalent to 243,700 pounds of uranium, well exceeds the minimum production level specified in the covenant of 1,700,000.

About Denison

Denison Mines Corp. is an intermediate uranium producer in North America, with mining assets in the Athabasca Basin region of Saskatchewan, Canada and the southwest United States including Colorado, Utah, and Arizona. Further, the Company has ownership interests in two of the four conventional uranium mills operating in North America today. The Company also has a strong exploration and development portfolio with large land positions in the United States, Canada, Zambia and Mongolia.

Cautionary Statements

This press release contains statements which are not current statements or historical facts. They are "forward-looking information" as defined under Canadian securities laws and "forward-looking statements", within the meaning of the United States Private Securities Litigation Reform Act of 1995, concerning the business, operations and financial performance and condition of Denison which may be material and that involve risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by them.

The material risk factors that could cause actual results to differ materially from the forward-looking information and statements contained in this press release and the material risk factors or assumptions that were used to develop them include, but are not limited to, statements with respect to estimated production sales volumes, and the expected effects of possible corporate transactions and the development potential of Denison's properties; the future price of uranium, vanadium, nickel and cobalt; the estimation of mineral reserves and resources; the realization of mineral reserve estimates; the timing and amount of estimated future production; costs of production; capital expenditures; success of exploration activities; permitting timelines and permitting, mining or processing issues; currency exchange rate fluctuations; government regulation of mining operations; environmental risks; unanticipated reclamation expenses; title disputes or claims; and limitations on insurance coverage. Generally, these forward-looking-information and statements can be identified by the use of forward-looking terminology such as "plans," "expects" or "does not expect," "is expected," "budget," "scheduled," "estimates," forecasts," "intends," "anticipates" or "does not anticipate," or "believes," or variations of such words and phrases or state that certain actions, events or results "may," "could," "would," "might" or "will be taken," "occur" or "be achieved."

Forward-looking information and statements are based on the opinions and estimates of management as of the date such statements are made. They are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Denison to be materially different from those expressed or implied by such forward-looking-information and statements, including but not limited to risks related to: unexpected events during construction, expansion and start-up; variations in ore grade; amount of material mined or milled; delay or failure to receive board or government approvals; timing and availability of external financing on acceptable terms; risks related to international operations; actual results of current exploration activities; actual results of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; future prices of uranium, vanadium, nickel and cobalt; possible variations in ore reserves, grade or recovery rates; unexpected or challenging geological, hydrogeological or mining conditions which deviate significantly from our assumptions regarding those conditions; political risks arising from operating in certain countries, including the risks of nationalization, terrorism and sabotage; the risk of adverse changes in government legislation, regulations and policies; the risk of natural phenomena including inclement weather conditions, fire, flood, underground floods, earthquakes, pitwall failure and cave-ins; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in the completion of development or construction activities, as well as those factors discussed in or referred to under the heading "Risk Factors" in Denison's Annual Information Form dated March 28, 2008 available at www.sedar.com and its Form 40-F available at www.sec.gov. Although management of Denison has attempted to identify material factors that could cause actual results to differ materially from those contained in forward-looking-information and statements, which only apply as of the date hereof and should not be relied upon as representing Denison's views as of any subsequent date, there may be other factors that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking-information and statements. Denison does not undertake to update any forward-looking-information and statements that are included or incorporated by reference herein, except in accordance with applicable securities laws. Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. Readers should refer to the Annual Information Form and the Form 40-F of the Company for the year ended December 31, 2007 and other continuous disclosure documents filed since December 31, 2007 available at www.sedar.com for further information relating to their mineral resources and mineral reserves.

Contacts:

Denison Mines Corp.

E. Peter Farmer

Chief Executive Officer

(416) 979-1991 Extension 231

Denison Mines Corp.

Ron Hochstein

President and Chief Operating Officer

(604) 689-7842

Denison Mines Corp.

James R. Anderson

Executive Vice President and Chief Financial Officer

(416) 979-1991 Extension 372

(416) 979-5893 (FAX)

Website: www.denisonmines.com

Source: Marketwire (January 9, 2009 - 1:59 PM EST)

News by QuoteMedia

Ich denke mal heute ist ein guter Tag zum kaufen 0,93

Antwort auf Beitrag Nr.: 36.318.871 von fplace am 06.01.09 20:40:07Werde jetzt vorsichtshalber meine Gewinne mitnehmen. Vielen Dank.

Ganz frisch reingekommen:

Denison Mines announces stock purchase deal

HARTFORD, Conn. (AP) - Canadian uranium producer Denison Mines Corp. announced Tuesday an agreement with underwriters that will purchase 25 million shares valued at about $34.8 million with an option to buy up to 3.8 million more shares worth up to $5.2 million.

The offering is scheduled to close on or about Jan. 27 and is subject to regulatory approvals, the Toronto-based company said.

The option to buy additional shares may be exercised within 30 days after the offering closes.

http://news.moneycentral.msn.com/provider/providerarticle.as…

Denison Mines announces stock purchase deal

HARTFORD, Conn. (AP) - Canadian uranium producer Denison Mines Corp. announced Tuesday an agreement with underwriters that will purchase 25 million shares valued at about $34.8 million with an option to buy up to 3.8 million more shares worth up to $5.2 million.

The offering is scheduled to close on or about Jan. 27 and is subject to regulatory approvals, the Toronto-based company said.

The option to buy additional shares may be exercised within 30 days after the offering closes.

http://news.moneycentral.msn.com/provider/providerarticle.as…

Das ist eine Umfinanzierung,mehr nicht.

Die Finazierung in diesem schwierigen Marktumfeld war nötig und gut, daß es geklappt hat!

http://www.theglobeandmail.com/servlet/story/RTGAM.20090106.…

Denison financing placates bankers

Andrew Willis, today at 11:11 AM EST

Post the first comment Back to the blog

Denison Mines kept it bankers happy Monday by selling $41-million of equity, the latest sign that resource plays can raise cash in a tough market.

Uranium miner Denison sold 23 million shares at $1.65 each in a private placement led by investment dealers Cormark Securities and GMP Securities. The underwriters have the option of raising an additional $6.2-million if there is demand for the stock.

This share sale comes on the heels of a low-level rally in uranium prices over the past month. The metal is changing hands for $53 (U.S.) a pound Tuesday, after testing the low $40 levels in November. The summer of 2007 saw uranium prices skyrocket, with brief move above $130 a pound.

When uranium was all the rage in 2007, Denison was $15 (Canadian) stock. Those heady valuations are now a distant memory, as they are for most commodity plays. Denison is the latest in a string of mining and energy companies to face the reality of financing at historically low levels in order to fund growth, and keep lenders happy.

“A successful fundraising should allow Denison to meet all capital commitments at its Canadian operations, continue exploration activities and ensure that should the uranium price increase, it can immediately advance U.S. operations,” said a note Tuesday from BMO Nesbitt Burns analyst Edward Sterck.

But the analyst added that Denison also stays on side with bankers with this financing. The company has a $125-million (U.S.) credit facility outstanding, debt that comes with a number of fairly standard covenants. Mr. Sterck said he “believes that Denison may have breached the first covenant in Q4/08, in which case Denison must reduce the drawn amount of its credit facility from $101-million to $80-million by June 2009.”

LG!

Daytrader12

http://www.theglobeandmail.com/servlet/story/RTGAM.20090106.…

Denison financing placates bankers

Andrew Willis, today at 11:11 AM EST

Post the first comment Back to the blog

Denison Mines kept it bankers happy Monday by selling $41-million of equity, the latest sign that resource plays can raise cash in a tough market.

Uranium miner Denison sold 23 million shares at $1.65 each in a private placement led by investment dealers Cormark Securities and GMP Securities. The underwriters have the option of raising an additional $6.2-million if there is demand for the stock.

This share sale comes on the heels of a low-level rally in uranium prices over the past month. The metal is changing hands for $53 (U.S.) a pound Tuesday, after testing the low $40 levels in November. The summer of 2007 saw uranium prices skyrocket, with brief move above $130 a pound.

When uranium was all the rage in 2007, Denison was $15 (Canadian) stock. Those heady valuations are now a distant memory, as they are for most commodity plays. Denison is the latest in a string of mining and energy companies to face the reality of financing at historically low levels in order to fund growth, and keep lenders happy.

“A successful fundraising should allow Denison to meet all capital commitments at its Canadian operations, continue exploration activities and ensure that should the uranium price increase, it can immediately advance U.S. operations,” said a note Tuesday from BMO Nesbitt Burns analyst Edward Sterck.

But the analyst added that Denison also stays on side with bankers with this financing. The company has a $125-million (U.S.) credit facility outstanding, debt that comes with a number of fairly standard covenants. Mr. Sterck said he “believes that Denison may have breached the first covenant in Q4/08, in which case Denison must reduce the drawn amount of its credit facility from $101-million to $80-million by June 2009.”

LG!

Daytrader12

Uranproduzent mit perfekten Zukunftsaussichten