LYNAS - Faktenthread, Analysen, Querverweise u. Meldungen zum Unternehmen (Seite 338)

eröffnet am 25.04.07 13:15:18 von

neuester Beitrag 03.05.24 18:38:38 von

neuester Beitrag 03.05.24 18:38:38 von

Beiträge: 3.531

ID: 1.126.458

ID: 1.126.458

Aufrufe heute: 21

Gesamt: 785.147

Gesamt: 785.147

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899 · Symbol: LYI

4,0100

EUR

+1,34 %

+0,0530 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5500 | -8,33 | |

| 1,3160 | -9,12 | |

| 185,00 | -9,76 | |

| 0,7000 | -11,39 | |

| 12,000 | -25,00 |

Beitrag zu dieser Diskussion schreiben

http://seekingalpha.com/symbol/lyscf.pk?source=refreshed

...

http://seekingalpha.com/article/103972-rare-earth-metals-not…

Sehr umfangreich und Informativ!

Auszug:

Rare Earth Metals Not So Rare but Valuable

by: Hard Assets Investor November 04, 2008 | about stocks: ACH / GRA / LYSCF.PK

...

Australia

In Australia, there are currently a number of rare earth mining projects at various stages of development.

According to an ASX announcement at the beginning of July this year, the "Demonstration Pilot Plant" at Alkane Resources' (Bloomberg Ticker - ALK:AU) Dubbo Zirconia project was set to go 24/7 in late July, and it stated that "(l)aboratory scale testing for recovery of the rare earth elements is scheduled to commence in July."

Arafura Resources (Bloomberg Ticker - AFAFF:US) expects the rare earths processing plant at its Nolans Project in the country's Northern Territory to be in production in 2011.

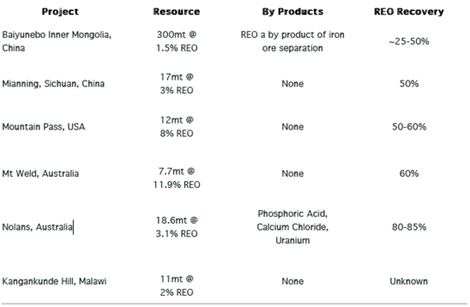

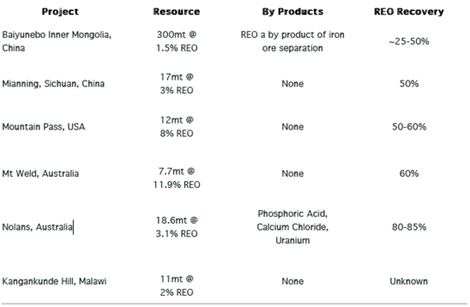

Based on November 2005 figures, the company compared its Nolans resource with some others around the world.

Source: Arafura Resources Limited

At its Mount Weld project in Western Australia, Lynas Corporation (Bloomberg Ticker - LYSCF:US) completed its first mining "campaign" in May. Based on figures updated in March this year, the company believes its resources at the project now amount to some 12.24 million tonnes at 9.7% rare earth oxide, which will produce some 1,124,000 tonnes of REO....

usw.

Gruß JoJo

...

http://seekingalpha.com/article/103972-rare-earth-metals-not…

Sehr umfangreich und Informativ!

Auszug:

Rare Earth Metals Not So Rare but Valuable

by: Hard Assets Investor November 04, 2008 | about stocks: ACH / GRA / LYSCF.PK

...

Australia

In Australia, there are currently a number of rare earth mining projects at various stages of development.

According to an ASX announcement at the beginning of July this year, the "Demonstration Pilot Plant" at Alkane Resources' (Bloomberg Ticker - ALK:AU) Dubbo Zirconia project was set to go 24/7 in late July, and it stated that "(l)aboratory scale testing for recovery of the rare earth elements is scheduled to commence in July."

Arafura Resources (Bloomberg Ticker - AFAFF:US) expects the rare earths processing plant at its Nolans Project in the country's Northern Territory to be in production in 2011.

Based on November 2005 figures, the company compared its Nolans resource with some others around the world.

Source: Arafura Resources Limited

At its Mount Weld project in Western Australia, Lynas Corporation (Bloomberg Ticker - LYSCF:US) completed its first mining "campaign" in May. Based on figures updated in March this year, the company believes its resources at the project now amount to some 12.24 million tonnes at 9.7% rare earth oxide, which will produce some 1,124,000 tonnes of REO....

usw.

Gruß JoJo

0.495A$=0.2637€, aktuell:0.268€

nach Dow: fast minus 4% wird es Lynas morgen mindestens 10% billiger geben, 0.23-0.24€

nach Dow: fast minus 4% wird es Lynas morgen mindestens 10% billiger geben, 0.23-0.24€

Antwort auf Beitrag Nr.: 35.800.355 von technophilosoph am 02.11.08 16:51:01Sei so gut und poste deine pers. Eindrücke in den Thread: LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen "LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen"

http://metalsplace.com/news/articles/23280/global-tantalum-m…

http://translate.google.com/translate?u=http%3A%2F%2Fmetalsp…

29 October 2008

Global tantalum market to exceed 6.95 million pounds lbs. by 2012

Commercialization of new tantalum deposits in recent years has put forth bright prospects for the tantalum industry. The global tantalum market is projected to exceed 6.95 million pounds (lbs.) by the year 2012, registering a CAGR of nearly 3.6%.

Unique properties of tantalum, which are indispensable to a few applications are expected to drive consistent demand for the metal. Increased usage of electronic equipment such as computers, mobile telephones, and video cameras, is expected to boost demand for tantalum capacitors. Consumption of tantalum metal for manufacturing sputtering targets is also projected to go up in the coming years. Furthermore, research activities for developing new applications for tantalum are underway.

Europe is the largest tantalum market in the world and is projected to reach 2.5 million pounds by the year 2010, as stated by Global Industry Analysts, Inc. Asia-Pacific is projected to offer the highest growth opportunity with a CAGR of 6.75% over the period 2001-2010. In North America, tantalum consumption in electronics industry is expected to reach 614.8 thousand pounds by 2010.

Australia accounts for about 60% of global mine production of tantalum, followed by Brazil. The remaining share is occupied by Canada, and African countries such as Ethiopia, Rwanda and Mozambique. Tantalum is also obtained as a major byproduct from tin deposits in Nigeria and Malaysia.

Major market participants profiled include Angus & Ross, AS Silmet, Avalon Ventures, AVX, Cabot Corporation, Cabot Supermetals, H.C. Starck, Kemet Corporation, Lynas Corporation, Mitsui Mining & Smelting, Rusina Mining, Treibacher Industrie, Nichicon, Ulba Metallurgical Plant – Press Release

Grüsse JoJo

http://metalsplace.com/news/articles/23280/global-tantalum-m…

http://translate.google.com/translate?u=http%3A%2F%2Fmetalsp…

29 October 2008

Global tantalum market to exceed 6.95 million pounds lbs. by 2012

Commercialization of new tantalum deposits in recent years has put forth bright prospects for the tantalum industry. The global tantalum market is projected to exceed 6.95 million pounds (lbs.) by the year 2012, registering a CAGR of nearly 3.6%.

Unique properties of tantalum, which are indispensable to a few applications are expected to drive consistent demand for the metal. Increased usage of electronic equipment such as computers, mobile telephones, and video cameras, is expected to boost demand for tantalum capacitors. Consumption of tantalum metal for manufacturing sputtering targets is also projected to go up in the coming years. Furthermore, research activities for developing new applications for tantalum are underway.

Europe is the largest tantalum market in the world and is projected to reach 2.5 million pounds by the year 2010, as stated by Global Industry Analysts, Inc. Asia-Pacific is projected to offer the highest growth opportunity with a CAGR of 6.75% over the period 2001-2010. In North America, tantalum consumption in electronics industry is expected to reach 614.8 thousand pounds by 2010.

Australia accounts for about 60% of global mine production of tantalum, followed by Brazil. The remaining share is occupied by Canada, and African countries such as Ethiopia, Rwanda and Mozambique. Tantalum is also obtained as a major byproduct from tin deposits in Nigeria and Malaysia.

Major market participants profiled include Angus & Ross, AS Silmet, Avalon Ventures, AVX, Cabot Corporation, Cabot Supermetals, H.C. Starck, Kemet Corporation, Lynas Corporation, Mitsui Mining & Smelting, Rusina Mining, Treibacher Industrie, Nichicon, Ulba Metallurgical Plant – Press Release

Grüsse JoJo

Antwort auf Beitrag Nr.: 35.800.320 von technophilosoph am 02.11.08 16:47:27upps der war ja bei 0,12

shit

shit

Schade, ich habe kein Geld, um jetzt Lynas zu kaufen .... bei 0,18 hätte man zuschlagen sollen .... aber der Kurs ist immer noch günstig!!! ich schätze, spätestens in 2 Jahren liegt der Kurs wieder bei 1 Euro

http://www.americanelements.com/AErareearths.html

99% 2N 99.9% 3N 99.99% 4N 99.999% 5N 99.9999% 6N

RARE EARTHSAE Rare Earths™ 32.4 (A)/00.022

--------------------------------------------------------------------------------

(click on an element to view our products)

(Durch klicken Sie auf ein einzelnen Element bekommt man Infos zu den Produkten)

What are the rare earths? The lanthanide or rare earth metals include lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium. scandium and yttrium are also sometimes included in this group in that they share many properties. They appear much like the transition metals, silvery metallic, and find many similar applications. Lanthanum and cerium are used in many solar energy, alloying, electronic, glass, fuel cell, nanotechnology and ceramic applications. Neodymium, praseodymium, erbium and dysprosium ions emit and absorb wave lengths within the visual light range making them useful in applications as varied as welding goggles to fiber optics to medical lasers. Promethium is the one lanthanide that does not naturally occur. Safety Information, properties and technical data for each of the rare earth elements and their many forms are provided.

How are rare earths produced? The 14 elements that make up the rare earth or lanthanide series are produced through the separation of certain rare earth oxide bearing minerals, including Bastnazite, Monazite and Ionic Clays. Mined Bastnazite is processed to a rare earth concentrate which is separated by solvent extraction into individual rare earth chlorides or nitrates depending on the system. These rare earth chloride or nitrate concentrates are subsequently refined to a variety of rare earth compounds, such as oxides, carbonates and fluorides. Rare Earth metal is produced through the thermic reduction of that element's oxide or fluoride powder.

What are the global locations of rare earths deposits? Essentially the entire world's producing reserves of rare earth minerals is located in Northern and Southern China where American Elements operates a rare earth separations plant. In China, an oft quoted statement of Deng Xiao Ping is that "the Middle East has oil and Baotou has rare earths" In fact, 80% of Chinese production is concentrated in Northern China (Baotou, Inner Mongolia). Proven Bastnazite reserves are estimated to be 48 million metric tons with prospective reserves estimated to be another 120 million metric tons.

Annual Chinese rare earth oxide production presently stands at between 70,000-90,000 metric tons, so the availability of rare earth supplies, from the standpoint of rare earth reserves, is not an issue. However recent changes in limitations placed by the Chinese government on rare earth production and export will limit their availability in the future.

Production quality has also benefited from China's proximity to Japan, a major innovator in rare earth applications in the electronics and automotive industries. As stated, China has two production regions. In the north, "ceric" or "light rare earths" are produced from Bastnazite resources from Baotou. In the south, "yttric" or "heavy rare earths" are mined from ion adsorption clays located in the provinces of Jiangxi and Guangdong.

Additionally, globally outside of China there are a few rare earth sources including Bastnazite (USA), monazite (Australia, India and South Africa), ioparite and apatite (Kazakhstan, Uzbekistan and Ukraine) and ion adsorption clays (Southern China). As described below, most of these regions are not exploiting their reserves. For example, we estimate that current world neodymium oxide production as a percentage basis is as follows:

REGION % OF GLOBAL PRODUCTION

China 86%

Russia and Former USSR States 8%

India 4%

Other 2%

Australia has monozite deposits in Western Australia as a bi-product of their zirconium and titanium production from heavy mineral sands. In the early 1990's Australia produced a substantial quantity of monozite for export to rare earth separation plants in Asia and Europe. However, production essentially stopped in 1994 due to the problems associated with the disposal of radioactive thorium (a monozite bi-product). There have been several proposals to develop deposits in Western Australia, such as the Mt. Weld deposit in Pinjarra. There are currently not any large commercial producers in Australia.

Brazil also has large monozite deposits in beach sands on the northeast coast of the country. Brazil has several facilities that produce relatively small quantities of separated rare earths. Since 1997, there has been a plan to separate rare earths from a stockpile of monozite at Industrias Nucleares do Brasil's former mining and milling complex with the intent to store the extracted thorium as fuel for nuclear power plants. There are no current large commercial producers in Brazil.

India is currently the largest monozite producer from beach sands along the coast of Kerala and Tamil Nadu. Producers export monozite concentrate, mixed rare earth chlorides and oxides.

Russia. Several small rare earth processing facilities exist in Russia which process from loparite and apatite deposits in Kazakstan, Uzebekistan and Ukraine. Operations are sporadic and production is usually available only on a spot sale basis.

South Africa has been planning since 1998 to start up production of monozite from the Steenkampskaal mine in the Western Cape province. Estimated reserves are 250,000 metric tons.

United States. Until 1998, the United States was the second largest producer of rare earths from the Molycorp mine in Mountain Pass, California. The facility was closed in December 1998 due to certain environmental concerns. Several monozite deposits were mined in the past in Florida. These operations were forced to close due to the high cost associated with disposing of the radioactive thorium waste products.

American Elements' Rare Earth Production. American Elements maintains the world's largest catalogue of rare earth materials, including metals, compounds, nanoparticles and ultra high purity forms. American Elements' Chinese production facility is one of only a few major rare earth separations plants in Baotou with warehouse and shipping facilities at the port in Tianjin. The facility produces under ISO 9002 certification.

As a major Baotou-based producer, American Elements maintains close working relationships with the key city, state and national Chinese government officials controlling both mineral availability and separated rare earth exportation. Our quota allocation is timely granted and more than sufficient to allow for required sales. We will often have early information on the intentions of government officials and some limited ability to provide input in these areas. By producing close to the mineral source, transportation costs are minimized.

Rare Earth History and Historical Pricing. The history of rare earth use in industry began in the 1950's with the invention of the television which required europium as the phosphor. In the 1960's discoveries were made which created applications for the two rare earth elements that make up over 50% of the Bastnazite ore body; cerium and lanthanum. These elements found uses primarily in glass production and production of various catalysts.

The rare earths began to achieve global commoditized pricing in 1987 when large scale prices were first established as a result of the initial commercialization of the NdFeB magnet. Prices steadily rose until around Q2 1989. Stimulated by these relatively high prices and forecasts of 100%+ annual growth, Chinese rare earth separation plants rapidly expanded output capacity resulting in over capacity and price declines through 1992, which was also influenced by a concurrent recession in the global computer market. By Q4 1992 a combination of (1) plants closing that could not compete in this market environment and (2) exponential growth in NdFeB alloy demand, caused a supply shortage. Prices again recovered, steadily rising from Q1 1993 through Q1 1996. However, as early as the end of 1994, Chinese rare earth producers again rapidly increased capacity with, in our estimate, supply actually exceeding demand as early as Q3 1995.

As prices began to again fall at the beginning of 1996, an effort was initiated by Chinese government agencies to cause producers to voluntarily reduce production to within the projected demand with the stated goal of Chinese officials to establish a continuing "reasonable price" range. This voluntary program was under the threat that China would take a direct hand to control production output and exportation, if voluntary measures were insufficient. However, prices continued to fall through Q3 1999 when Chinese officials announced that export licenses would soon be required for all rare earth product exports. First to respond to this was Japanese buyers who purchased substantial inventories commencing Q4 1999 causing prices to steadily increase.

Prices were additionally impacted by the 1999 closure of the only large scale rare earth mine outside of China; the Mountain Pass mine owned by Molycorp (see above).

In Q2 of 2000, China in fact implemented its export license system granting each producer and certain Chinese import/export companies with quarterly export quota limits based somewhat arbitrarily on a combination of historical volume and a government desire to close many small facilities and reduce the number of ionic clay processors in Southern China in favor of production from Baotou. Additionally, China ordered a production stoppage at many ionic clay mines in Southern China, such that now substantially all rare earth mineral supplies for both exportation and domestic consumption come from Baotou

Current and Projected Rare Earth Trends and Pricing. The forgoing efforts by China to increase and stabilize rare earth prices had only marginal effect. The desire of the central government to continue to collect U.S. currency acted as a countervailing balance. However, in 2005 China first indicated that it was placing a greater emphasize on retaining its raw material resources than continuing to build its cash reserves. This lead to a serious effort to restrict rare earth exports and thereby increase prices.

In 2006, the government issued its first of currently two 10% export tariffs on rare earths. A third 10% tariff is expected before the end of 2007. Additionally, it began to strict the amount of quarterly export quota granted to producers to a very small percentage of the quotas first issued in 2005. In 2008, these factors are expected to force rare earth prices even higher with lower grade forms potentially becoming scarce further in the future.

Forms of Rare Earths. As stated, American Elements is the world's largest catalogue of rare earth materials with forms including metals, oxides, nanoparticles and nanopowders, compound powders and compound solutions and organometallics.

Rare Earth Metal can be purchased in numerous forms for alloying, for use in coating and thin film Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) processes including Thermal and Electron Beam (E-Beam) Evaporation, Low Temperature Organic Evaporation, Atomic Layer Deposition (ALD), Organometallic and Chemical Vapor Deposition (MOCVD) for specific applications such as fuel cells and solar energy.

99% 2N 99.9% 3N 99.99% 4N 99.999% 5N 99.9999% 6N

RARE EARTHSAE Rare Earths™ 32.4 (A)/00.022

--------------------------------------------------------------------------------

(click on an element to view our products)

(Durch klicken Sie auf ein einzelnen Element bekommt man Infos zu den Produkten)

What are the rare earths? The lanthanide or rare earth metals include lanthanum, cerium, praseodymium, neodymium, promethium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium and lutetium. scandium and yttrium are also sometimes included in this group in that they share many properties. They appear much like the transition metals, silvery metallic, and find many similar applications. Lanthanum and cerium are used in many solar energy, alloying, electronic, glass, fuel cell, nanotechnology and ceramic applications. Neodymium, praseodymium, erbium and dysprosium ions emit and absorb wave lengths within the visual light range making them useful in applications as varied as welding goggles to fiber optics to medical lasers. Promethium is the one lanthanide that does not naturally occur. Safety Information, properties and technical data for each of the rare earth elements and their many forms are provided.

How are rare earths produced? The 14 elements that make up the rare earth or lanthanide series are produced through the separation of certain rare earth oxide bearing minerals, including Bastnazite, Monazite and Ionic Clays. Mined Bastnazite is processed to a rare earth concentrate which is separated by solvent extraction into individual rare earth chlorides or nitrates depending on the system. These rare earth chloride or nitrate concentrates are subsequently refined to a variety of rare earth compounds, such as oxides, carbonates and fluorides. Rare Earth metal is produced through the thermic reduction of that element's oxide or fluoride powder.

What are the global locations of rare earths deposits? Essentially the entire world's producing reserves of rare earth minerals is located in Northern and Southern China where American Elements operates a rare earth separations plant. In China, an oft quoted statement of Deng Xiao Ping is that "the Middle East has oil and Baotou has rare earths" In fact, 80% of Chinese production is concentrated in Northern China (Baotou, Inner Mongolia). Proven Bastnazite reserves are estimated to be 48 million metric tons with prospective reserves estimated to be another 120 million metric tons.

Annual Chinese rare earth oxide production presently stands at between 70,000-90,000 metric tons, so the availability of rare earth supplies, from the standpoint of rare earth reserves, is not an issue. However recent changes in limitations placed by the Chinese government on rare earth production and export will limit their availability in the future.

Production quality has also benefited from China's proximity to Japan, a major innovator in rare earth applications in the electronics and automotive industries. As stated, China has two production regions. In the north, "ceric" or "light rare earths" are produced from Bastnazite resources from Baotou. In the south, "yttric" or "heavy rare earths" are mined from ion adsorption clays located in the provinces of Jiangxi and Guangdong.

Additionally, globally outside of China there are a few rare earth sources including Bastnazite (USA), monazite (Australia, India and South Africa), ioparite and apatite (Kazakhstan, Uzbekistan and Ukraine) and ion adsorption clays (Southern China). As described below, most of these regions are not exploiting their reserves. For example, we estimate that current world neodymium oxide production as a percentage basis is as follows:

REGION % OF GLOBAL PRODUCTION

China 86%

Russia and Former USSR States 8%

India 4%

Other 2%

Australia has monozite deposits in Western Australia as a bi-product of their zirconium and titanium production from heavy mineral sands. In the early 1990's Australia produced a substantial quantity of monozite for export to rare earth separation plants in Asia and Europe. However, production essentially stopped in 1994 due to the problems associated with the disposal of radioactive thorium (a monozite bi-product). There have been several proposals to develop deposits in Western Australia, such as the Mt. Weld deposit in Pinjarra. There are currently not any large commercial producers in Australia.

Brazil also has large monozite deposits in beach sands on the northeast coast of the country. Brazil has several facilities that produce relatively small quantities of separated rare earths. Since 1997, there has been a plan to separate rare earths from a stockpile of monozite at Industrias Nucleares do Brasil's former mining and milling complex with the intent to store the extracted thorium as fuel for nuclear power plants. There are no current large commercial producers in Brazil.

India is currently the largest monozite producer from beach sands along the coast of Kerala and Tamil Nadu. Producers export monozite concentrate, mixed rare earth chlorides and oxides.

Russia. Several small rare earth processing facilities exist in Russia which process from loparite and apatite deposits in Kazakstan, Uzebekistan and Ukraine. Operations are sporadic and production is usually available only on a spot sale basis.

South Africa has been planning since 1998 to start up production of monozite from the Steenkampskaal mine in the Western Cape province. Estimated reserves are 250,000 metric tons.

United States. Until 1998, the United States was the second largest producer of rare earths from the Molycorp mine in Mountain Pass, California. The facility was closed in December 1998 due to certain environmental concerns. Several monozite deposits were mined in the past in Florida. These operations were forced to close due to the high cost associated with disposing of the radioactive thorium waste products.

American Elements' Rare Earth Production. American Elements maintains the world's largest catalogue of rare earth materials, including metals, compounds, nanoparticles and ultra high purity forms. American Elements' Chinese production facility is one of only a few major rare earth separations plants in Baotou with warehouse and shipping facilities at the port in Tianjin. The facility produces under ISO 9002 certification.

As a major Baotou-based producer, American Elements maintains close working relationships with the key city, state and national Chinese government officials controlling both mineral availability and separated rare earth exportation. Our quota allocation is timely granted and more than sufficient to allow for required sales. We will often have early information on the intentions of government officials and some limited ability to provide input in these areas. By producing close to the mineral source, transportation costs are minimized.

Rare Earth History and Historical Pricing. The history of rare earth use in industry began in the 1950's with the invention of the television which required europium as the phosphor. In the 1960's discoveries were made which created applications for the two rare earth elements that make up over 50% of the Bastnazite ore body; cerium and lanthanum. These elements found uses primarily in glass production and production of various catalysts.

The rare earths began to achieve global commoditized pricing in 1987 when large scale prices were first established as a result of the initial commercialization of the NdFeB magnet. Prices steadily rose until around Q2 1989. Stimulated by these relatively high prices and forecasts of 100%+ annual growth, Chinese rare earth separation plants rapidly expanded output capacity resulting in over capacity and price declines through 1992, which was also influenced by a concurrent recession in the global computer market. By Q4 1992 a combination of (1) plants closing that could not compete in this market environment and (2) exponential growth in NdFeB alloy demand, caused a supply shortage. Prices again recovered, steadily rising from Q1 1993 through Q1 1996. However, as early as the end of 1994, Chinese rare earth producers again rapidly increased capacity with, in our estimate, supply actually exceeding demand as early as Q3 1995.

As prices began to again fall at the beginning of 1996, an effort was initiated by Chinese government agencies to cause producers to voluntarily reduce production to within the projected demand with the stated goal of Chinese officials to establish a continuing "reasonable price" range. This voluntary program was under the threat that China would take a direct hand to control production output and exportation, if voluntary measures were insufficient. However, prices continued to fall through Q3 1999 when Chinese officials announced that export licenses would soon be required for all rare earth product exports. First to respond to this was Japanese buyers who purchased substantial inventories commencing Q4 1999 causing prices to steadily increase.

Prices were additionally impacted by the 1999 closure of the only large scale rare earth mine outside of China; the Mountain Pass mine owned by Molycorp (see above).

In Q2 of 2000, China in fact implemented its export license system granting each producer and certain Chinese import/export companies with quarterly export quota limits based somewhat arbitrarily on a combination of historical volume and a government desire to close many small facilities and reduce the number of ionic clay processors in Southern China in favor of production from Baotou. Additionally, China ordered a production stoppage at many ionic clay mines in Southern China, such that now substantially all rare earth mineral supplies for both exportation and domestic consumption come from Baotou

Current and Projected Rare Earth Trends and Pricing. The forgoing efforts by China to increase and stabilize rare earth prices had only marginal effect. The desire of the central government to continue to collect U.S. currency acted as a countervailing balance. However, in 2005 China first indicated that it was placing a greater emphasize on retaining its raw material resources than continuing to build its cash reserves. This lead to a serious effort to restrict rare earth exports and thereby increase prices.

In 2006, the government issued its first of currently two 10% export tariffs on rare earths. A third 10% tariff is expected before the end of 2007. Additionally, it began to strict the amount of quarterly export quota granted to producers to a very small percentage of the quotas first issued in 2005. In 2008, these factors are expected to force rare earth prices even higher with lower grade forms potentially becoming scarce further in the future.

Forms of Rare Earths. As stated, American Elements is the world's largest catalogue of rare earth materials with forms including metals, oxides, nanoparticles and nanopowders, compound powders and compound solutions and organometallics.

Rare Earth Metal can be purchased in numerous forms for alloying, for use in coating and thin film Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) processes including Thermal and Electron Beam (E-Beam) Evaporation, Low Temperature Organic Evaporation, Atomic Layer Deposition (ALD), Organometallic and Chemical Vapor Deposition (MOCVD) for specific applications such as fuel cells and solar energy.

Antwort auf Beitrag Nr.: 35.533.177 von JoJo49 am 11.10.08 19:11:13@ noch ein schönes Wochenende, bis in 8-Tagen

dito

dito

Antwort auf Beitrag Nr.: 35.499.877 von technophilosoph am 09.10.08 18:38:29Da hast du natürlich recht!

Zu Thema "Verbindlichkeiten" wie das Abwägen der Vor-Nachteile usw. habe ich im Thread: LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen Stellung genommen.

http://www.mmnews.de/index.php/Seltene-Erden/

u.a.:

Annual Report to Shareholders - Sydney Morning Herald

Trawling the wreckage - The Australian

Austraila A$4 B Bailout; Inpex Picks Darwin - 123Jump.com

Australian Banks Curb Lending - 123Jump.com

PRESS DIGEST - Malaysia - Sept 22 - Hemscott

@ noch ein schönes Wochenende, bis in 8-Tagen

Grüsse JoJo

Zu Thema "Verbindlichkeiten" wie das Abwägen der Vor-Nachteile usw. habe ich im Thread: LYNAS - auf dem Weg zu einem Rohstoffproduzent von Hightech-Rohstoffen Stellung genommen.

http://www.mmnews.de/index.php/Seltene-Erden/

u.a.:

Annual Report to Shareholders - Sydney Morning Herald

Trawling the wreckage - The Australian

Austraila A$4 B Bailout; Inpex Picks Darwin - 123Jump.com

Australian Banks Curb Lending - 123Jump.com

PRESS DIGEST - Malaysia - Sept 22 - Hemscott

@ noch ein schönes Wochenende, bis in 8-Tagen

Grüsse JoJo

Antwort auf Beitrag Nr.: 35.498.832 von JoJo49 am 09.10.08 17:34:20"dann kommen wir auf insgesammt ~ 58.500.000.000 Euo geteilt durch die MK in Höhe von 167.000.000 Euro =~ 350 fache Unterbewertung vo Lynas.

Ich weiss, dass man so nicht rechnen soll, aber es führt uns mal das gewaltige Potential von Lynas vor Auge."

Ich denke, so einfach ist das nicht ... Es gibt Verbindlichkeiten gegenüber Geldgebern, Zinsen, inflationäre Verluste, Abschreibungen und - nicht zu vergessen - eine max. Laufzeit (Abbauzeit), Gebühren, evtl.. Dividenden .... etc. etc..

Wenn das Vorkommen in durchschnittlich 20 Jahren abgebaut wird, muss man den Wert auf diese Laufzeit beziehen, um eine durchschnittliche Rendite pro Jahr zu erhalten ...das gilt natürlich für alle fixen sowie variablen Kosten... Ach ja, die Maschinenkosten und die Infrastrukturkosten sind ja auch noch da, und die Energiekosten und die Löhne und die Steuern ..

Ich weiss, dass man so nicht rechnen soll, aber es führt uns mal das gewaltige Potential von Lynas vor Auge."

Ich denke, so einfach ist das nicht ... Es gibt Verbindlichkeiten gegenüber Geldgebern, Zinsen, inflationäre Verluste, Abschreibungen und - nicht zu vergessen - eine max. Laufzeit (Abbauzeit), Gebühren, evtl.. Dividenden .... etc. etc..

Wenn das Vorkommen in durchschnittlich 20 Jahren abgebaut wird, muss man den Wert auf diese Laufzeit beziehen, um eine durchschnittliche Rendite pro Jahr zu erhalten ...das gilt natürlich für alle fixen sowie variablen Kosten... Ach ja, die Maschinenkosten und die Infrastrukturkosten sind ja auch noch da, und die Energiekosten und die Löhne und die Steuern ..

Antwort auf Beitrag Nr.: 35.497.771 von technophilosoph am 09.10.08 16:36:04aber wenn Lynas ab 2009 produziert und über den Umsatz hinaus Gewinne macht, nehme ich auch das in Kauf

Das kann man doch ganz einfach ausrechnen.

Auf der esten Seite der Investor Presentation vom September 2008 gibt Lynas die "The cash cost per kilo figure on page 32 has been corrected to read USD 6,20 +/- 10% per kilo of final REO product, as was stated in the quarterly report lodged with ASX 31 July 2008."

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=419903

Av. Mt Weld Composition wird zum 06.10.2008 mit 12,84 US$3/kg angegeben.

http://www.lynascorp.com/page.asp?category_id=1&page_id=25

Von den 12,84 ziehen wir die Cash-Kosten pro Kilo von 6,20 ab bleibt nach Adam Riese 6,64% Gewinn +/- 10% wenn ich mich nicht irre.

Aber mal Spass beiseite:

Auf Grund der weltweit weiter steigenden Nachfrage werden sich die Preise für Seltene Erden/Metalle m.e. noch wesendlich erhöhen.

Mit den Gewinnen wir Lynas ein weiteres gleichwertiges Projekt verwirklichen:

Denn zusätzlich zu dem Mt. Weld Seltene Erden Oxide (REO) Vorkommen besitzt Lynas ganz in der Nähe eine umfangreiche polymetallischer Ressource innerhalb der "Crown Deposit" das Niob, Tantal, Zirkonium, Titan, und Seltene Erden einschließt.

Dazu erstellte Dr. Phillip Hellman von Hellman & Schofield Pty Ltd, Sydney, eine Studie, diese JORC-konforme Multi-Metall-geostatistische Ressource Schätzung , indizierte eine Inferred Ressources von 37,7 Millionen Tonnen.

Die Erz Zusammensetzung in Tabelle aufgeführt.(siehe Homepage von Lynas)

Die Mehrheit der Erz liegt zwischen 30m und 60m Tiefe und ist damit für den offenen Tagebau geeignet.

Die Scoping-Studie im Jahr 2005 stellt eine offene Schnitt-Mine und einen Prozess Route auf der Grundlage der bestehenden Technologie zum produzieren vor, eine Suite von Metall-Verbindungen und Produkten. Die starke wirtschaftliche und technische Ergebnisse der Scoping-Studie wurden als „sehr ermutigend“ eingestuft.

Weitere mineralogische Proben für die Beurteilung und die metallurgischen Tests wurden in diesem Jahr durchgeführt.

Eine externes Forschungsinstitut hat weitere Untersuchungen auf die mineralogische vorläufige Bewertung und Entwicklung der Prozess vom polymetallischem Erz durchgeführt um damit dieses Projekt weiterzuführen damit die Mitarbeiter von Lynas sich weiterhin zu 100% auf die Entwicklung vom Seltene Erden-Projekt konzentrieren können.

Der nächste Schritt zur Erschließung vom Polymetallic Projekt wird der Testbeginn der auf der Grundlage der vorläufigen Mineralogie und Prozessentwicklung sein.

Zu Niobium Niob:

Damit ist diese Mt. Weld möglicherweise der weltweit zweitgrößte Nb 2 O 5-Ressource (bezogen auf das Metall Niob) im Vergleich zu den Ressourcen der bestehenden kommerziellen Produzenten, dazu zählen:

· CBMM's Araxa in Brasilien, mit 460 Millionen Tonnen Einstufung von 2,5% Nb 2 O 5 liefert mehr als 80% des weltweiten Marktes Niob,

· Mineracao Catalao de Goias Ltd (Anglo American plc) in Brasilien in Höhe von rund 18 Millionen Tonnen zu einem Durchschnittskurs von 1,34% Nb 2 O 5,

· Niobec Inc's kanadisches Unternehmen mit 24 Millionen Tonnen auf 0,65% Nb 2 O 5

Zu Titanium Titan:

Titan-Metall-und Ti-ferroalloy Produkte werden in der Luft-und Raumfahrtindustrie, für spezielle Apparate und Energietechnik, chemische Verarbeitung und Sportgeräte, vor allem Gold-Clubs.

Zu Rare Earths and Scandium Seltene Erden und Scandium:

Das Mt. Weld Rare Metals Vorkommen enthält auch beträchtliche Anteile in hoher Qualitäten von Seltene Erden die stark angereichert sind mit den wertvollen schweren Lanthaniden, die letztlich dazu beitragen könnten zur erheblichen Wertsteigerung. Ebenfalls vorhanden ist Scandium, wird für die hoher Festigkeit von Aluminiumlegierungen gebraucht.

Wenn wir die Mk von Lynas von z.Z. 167 Mio Euro. den Cashbestend auf der Bank in Höhe von 71 Mio Euro. gegenüberstellen dann das Geld aus den Vorverkaufsverträgen von 490 Mill. USD ~ 360 Mill. Euro dazuaddieren, die Ressourcenschätzung aus der JORC-Studie aus dem Jahr 2005 mit einem Insitu-Wert von über 40 Mrd.USD sowie die 40 Mrd aus Mt. Weld Seltene Erden Vorkommen zusammen rund 58 Mrd.

dann kommen wir auf insgesammt ~ 58.500.000.000 Euo geteilt durch die MK in Höhe von 167.000.000 Euro =~ 350 fache Unterbewertung vo Lynas.

Ich weiss, dass man so nicht rechnen soll, aber es führt uns mal das gewaltige Potential von Lynas vor Auge.

Gruß JoJo

Das kann man doch ganz einfach ausrechnen.

Auf der esten Seite der Investor Presentation vom September 2008 gibt Lynas die "The cash cost per kilo figure on page 32 has been corrected to read USD 6,20 +/- 10% per kilo of final REO product, as was stated in the quarterly report lodged with ASX 31 July 2008."

http://stocknessmonster.com/news-item?S=LYC&E=ASX&N=419903

Av. Mt Weld Composition wird zum 06.10.2008 mit 12,84 US$3/kg angegeben.

http://www.lynascorp.com/page.asp?category_id=1&page_id=25

Von den 12,84 ziehen wir die Cash-Kosten pro Kilo von 6,20 ab bleibt nach Adam Riese 6,64% Gewinn +/- 10% wenn ich mich nicht irre.

Aber mal Spass beiseite:

Auf Grund der weltweit weiter steigenden Nachfrage werden sich die Preise für Seltene Erden/Metalle m.e. noch wesendlich erhöhen.

Mit den Gewinnen wir Lynas ein weiteres gleichwertiges Projekt verwirklichen:

Denn zusätzlich zu dem Mt. Weld Seltene Erden Oxide (REO) Vorkommen besitzt Lynas ganz in der Nähe eine umfangreiche polymetallischer Ressource innerhalb der "Crown Deposit" das Niob, Tantal, Zirkonium, Titan, und Seltene Erden einschließt.

Dazu erstellte Dr. Phillip Hellman von Hellman & Schofield Pty Ltd, Sydney, eine Studie, diese JORC-konforme Multi-Metall-geostatistische Ressource Schätzung , indizierte eine Inferred Ressources von 37,7 Millionen Tonnen.

Die Erz Zusammensetzung in Tabelle aufgeführt.(siehe Homepage von Lynas)

Die Mehrheit der Erz liegt zwischen 30m und 60m Tiefe und ist damit für den offenen Tagebau geeignet.

Die Scoping-Studie im Jahr 2005 stellt eine offene Schnitt-Mine und einen Prozess Route auf der Grundlage der bestehenden Technologie zum produzieren vor, eine Suite von Metall-Verbindungen und Produkten. Die starke wirtschaftliche und technische Ergebnisse der Scoping-Studie wurden als „sehr ermutigend“ eingestuft.

Weitere mineralogische Proben für die Beurteilung und die metallurgischen Tests wurden in diesem Jahr durchgeführt.

Eine externes Forschungsinstitut hat weitere Untersuchungen auf die mineralogische vorläufige Bewertung und Entwicklung der Prozess vom polymetallischem Erz durchgeführt um damit dieses Projekt weiterzuführen damit die Mitarbeiter von Lynas sich weiterhin zu 100% auf die Entwicklung vom Seltene Erden-Projekt konzentrieren können.

Der nächste Schritt zur Erschließung vom Polymetallic Projekt wird der Testbeginn der auf der Grundlage der vorläufigen Mineralogie und Prozessentwicklung sein.

Zu Niobium Niob:

Damit ist diese Mt. Weld möglicherweise der weltweit zweitgrößte Nb 2 O 5-Ressource (bezogen auf das Metall Niob) im Vergleich zu den Ressourcen der bestehenden kommerziellen Produzenten, dazu zählen:

· CBMM's Araxa in Brasilien, mit 460 Millionen Tonnen Einstufung von 2,5% Nb 2 O 5 liefert mehr als 80% des weltweiten Marktes Niob,

· Mineracao Catalao de Goias Ltd (Anglo American plc) in Brasilien in Höhe von rund 18 Millionen Tonnen zu einem Durchschnittskurs von 1,34% Nb 2 O 5,

· Niobec Inc's kanadisches Unternehmen mit 24 Millionen Tonnen auf 0,65% Nb 2 O 5

Zu Titanium Titan:

Titan-Metall-und Ti-ferroalloy Produkte werden in der Luft-und Raumfahrtindustrie, für spezielle Apparate und Energietechnik, chemische Verarbeitung und Sportgeräte, vor allem Gold-Clubs.

Zu Rare Earths and Scandium Seltene Erden und Scandium:

Das Mt. Weld Rare Metals Vorkommen enthält auch beträchtliche Anteile in hoher Qualitäten von Seltene Erden die stark angereichert sind mit den wertvollen schweren Lanthaniden, die letztlich dazu beitragen könnten zur erheblichen Wertsteigerung. Ebenfalls vorhanden ist Scandium, wird für die hoher Festigkeit von Aluminiumlegierungen gebraucht.

Wenn wir die Mk von Lynas von z.Z. 167 Mio Euro. den Cashbestend auf der Bank in Höhe von 71 Mio Euro. gegenüberstellen dann das Geld aus den Vorverkaufsverträgen von 490 Mill. USD ~ 360 Mill. Euro dazuaddieren, die Ressourcenschätzung aus der JORC-Studie aus dem Jahr 2005 mit einem Insitu-Wert von über 40 Mrd.USD sowie die 40 Mrd aus Mt. Weld Seltene Erden Vorkommen zusammen rund 58 Mrd.

dann kommen wir auf insgesammt ~ 58.500.000.000 Euo geteilt durch die MK in Höhe von 167.000.000 Euro =~ 350 fache Unterbewertung vo Lynas.

Ich weiss, dass man so nicht rechnen soll, aber es führt uns mal das gewaltige Potential von Lynas vor Auge.

Gruß JoJo

23.01.24 · kapitalerhoehungen.de · BASF |

22.01.24 · wallstreetONLINE Redaktion · Lynas Rare Earths |

08.08.23 · nebenwerte ONLINE · Lynas Rare Earths |

21.06.23 · Konstantin Oldenburger · Lynas Rare Earths |

09.05.23 · ESG Aktien · Lynas Rare Earths |

| Zeit | Titel |

|---|---|

| 03.05.24 |