Freeport-McMoRan -- one of the cheapest companies in North America (Seite 83)

eröffnet am 29.05.07 06:45:54 von

neuester Beitrag 30.03.24 14:46:04 von

neuester Beitrag 30.03.24 14:46:04 von

Beiträge: 1.089

ID: 1.127.976

ID: 1.127.976

Aufrufe heute: 0

Gesamt: 112.060

Gesamt: 112.060

Aktive User: 0

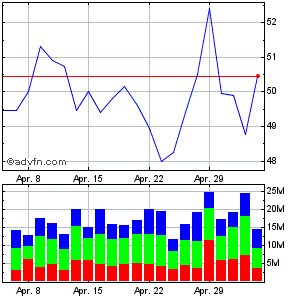

ISIN: US35671D8570 · WKN: 896476 · Symbol: FCX

49,40

USD

+2,40 %

+1,16 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

23.04.24 · wallstreetONLINE Redaktion |

01:47 Uhr · Business Wire (engl.) |

Freeport-McMoRan First-Quarter 2024 Financial and Operating Results Release Available on Its Website 23.04.24 · Business Wire (engl.) |

17.04.24 · wallstreetONLINE Redaktion |

16.04.24 · Sharedeals |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7950 | +30,33 | |

| 227,00 | +21,91 | |

| 5,1500 | +21,75 | |

| 16,050 | +17,41 | |

| 15.699,00 | +15,27 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6850 | -6,80 | |

| 29,70 | -7,19 | |

| 0,8800 | -7,37 | |

| 0,5400 | -8,47 | |

| 46,88 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Bloomberg

China Copper Demand Growth to Slow Further, Antaike Says

November 02, 2011, 7:09 AM EDT

Nov. 2 (Bloomberg) -- Copper consumption growth in China, the largest user, will slow further next year as the economy cools, according to Beijing Antaike Information Development Co.

Refined copper consumption may rise 6.4 percent to 7.85 million metric tons in 2012, said Yang Changhua, an analyst in Antaike who has been studying the market for more than a decade. This compares with 8.5 percent growth this year to 7.38 million tons, and 11.5 percent to 6.8 million tons in 2010, Antaike’s data show.

Slowing growth in China may further damp prices, which have fallen 22 percent from a February record on concern the European debt crisis will derail a global recovery. Economic expansion in China will drop to 8.6 percent in 2012 from 9.3 percent this year, according to provisional projections from the OECD in Paris. The country will account for 37 percent of copper demand this year, according to London-based Barclays Capital.

“I’m pessimistic about the demand outlook,” said Liang Lijuan, an analyst at COFCO Futures Co. “Even home appliance and power sectors, which are considered as pillars of consumption growth, don’t have much faith.”

Tight credit and slower exports are expected to curb demand further, according to slides prepared for presentation by Yang at Antaike’s annual copper conference. Less new-home starts, sluggish auto sales, and shrinking investments in railroads dragged down the consumption increase this year and may continue damp the demand next year, Yang said.

Price Rally

Three-month copper on the London Metal Exchange jumped 14 percent last week, the most since at least 1986, after European governments agreed to expand the region’s bailout fund. It reached a record $10,190 on Feb. 15 and gained 2 percent to $7,881.25 a ton by 2:19 p.m. Shanghai time.

Refined copper production in China fell in September from a record the previous month as smelters reduced capacity and the world’s second-largest economy expanded at a slower rate. Lower copper output may help ease a supply glut after imports climbed to a 16-month high as analysts expect a slowdown in real demand growth for metals.

A Chinese manufacturing index dropped to the lowest level since February 2009, bolstering the case for fiscal or monetary loosening to support the expansion of the economy. The Purchasing Managers’ Index fell to 50.4 in October from 51.2 in September, the China Federation of Logistics and Purchasing said yesterday. A reading above 50 indicates expansion.

China Growth

Premier Wen Jiabao said last week that economic policies will be “fine-tuned” as needed. That fueled speculation the government may ease reserve requirements for smaller banks and add fiscal stimulus, putting growth ahead of inflation risks.

Global copper output this year through August exceeded demand by 312,500 tons, up from 128,000 tons for 2010, according to the World Bureau of Metal Statistics, based in Ware, England.

Still, the longer-term outlook for Chinese demand is good, according to Goldman Sachs Group Inc. Copper prices may be “unimaginably” high in three years, with China growth spurring consumption, Goldman Sachs analyst Julian Zhu said Oct. 28.

Refined copper consumption may reach 12.5 million tons in 2015, said Zhang Ronghui, chief analyst at China Minmetals Corp. This represents a 79 percent jump from 7 million tons of real consumption this year, according to Bloomberg News calculations based on estimates by the China Nonferrous Metals Industry Association.

Prices will stay elevated and volatile in 2012 as the metal continues to be the top pick by funds, according to presentation slides prepared by Zhang for delivery at Antaike’s copper conference in Jinan.

--Helen Sun. Editors: Richard Dobson, Jarrett Banks

http://www.businessweek.com/news/2011-11-02/china-copper-dem…

China Copper Demand Growth to Slow Further, Antaike Says

November 02, 2011, 7:09 AM EDT

Nov. 2 (Bloomberg) -- Copper consumption growth in China, the largest user, will slow further next year as the economy cools, according to Beijing Antaike Information Development Co.

Refined copper consumption may rise 6.4 percent to 7.85 million metric tons in 2012, said Yang Changhua, an analyst in Antaike who has been studying the market for more than a decade. This compares with 8.5 percent growth this year to 7.38 million tons, and 11.5 percent to 6.8 million tons in 2010, Antaike’s data show.

Slowing growth in China may further damp prices, which have fallen 22 percent from a February record on concern the European debt crisis will derail a global recovery. Economic expansion in China will drop to 8.6 percent in 2012 from 9.3 percent this year, according to provisional projections from the OECD in Paris. The country will account for 37 percent of copper demand this year, according to London-based Barclays Capital.

“I’m pessimistic about the demand outlook,” said Liang Lijuan, an analyst at COFCO Futures Co. “Even home appliance and power sectors, which are considered as pillars of consumption growth, don’t have much faith.”

Tight credit and slower exports are expected to curb demand further, according to slides prepared for presentation by Yang at Antaike’s annual copper conference. Less new-home starts, sluggish auto sales, and shrinking investments in railroads dragged down the consumption increase this year and may continue damp the demand next year, Yang said.

Price Rally

Three-month copper on the London Metal Exchange jumped 14 percent last week, the most since at least 1986, after European governments agreed to expand the region’s bailout fund. It reached a record $10,190 on Feb. 15 and gained 2 percent to $7,881.25 a ton by 2:19 p.m. Shanghai time.

Refined copper production in China fell in September from a record the previous month as smelters reduced capacity and the world’s second-largest economy expanded at a slower rate. Lower copper output may help ease a supply glut after imports climbed to a 16-month high as analysts expect a slowdown in real demand growth for metals.

A Chinese manufacturing index dropped to the lowest level since February 2009, bolstering the case for fiscal or monetary loosening to support the expansion of the economy. The Purchasing Managers’ Index fell to 50.4 in October from 51.2 in September, the China Federation of Logistics and Purchasing said yesterday. A reading above 50 indicates expansion.

China Growth

Premier Wen Jiabao said last week that economic policies will be “fine-tuned” as needed. That fueled speculation the government may ease reserve requirements for smaller banks and add fiscal stimulus, putting growth ahead of inflation risks.

Global copper output this year through August exceeded demand by 312,500 tons, up from 128,000 tons for 2010, according to the World Bureau of Metal Statistics, based in Ware, England.

Still, the longer-term outlook for Chinese demand is good, according to Goldman Sachs Group Inc. Copper prices may be “unimaginably” high in three years, with China growth spurring consumption, Goldman Sachs analyst Julian Zhu said Oct. 28.

Refined copper consumption may reach 12.5 million tons in 2015, said Zhang Ronghui, chief analyst at China Minmetals Corp. This represents a 79 percent jump from 7 million tons of real consumption this year, according to Bloomberg News calculations based on estimates by the China Nonferrous Metals Industry Association.

Prices will stay elevated and volatile in 2012 as the metal continues to be the top pick by funds, according to presentation slides prepared by Zhang for delivery at Antaike’s copper conference in Jinan.

--Helen Sun. Editors: Richard Dobson, Jarrett Banks

http://www.businessweek.com/news/2011-11-02/china-copper-dem…

China 2012 Copper Demand Up 6.4% To 7.85 Mln Tons

-Beijing Antaike, Nov 01, 2011 (Dow Jones Commodities News via Comtex)

http://www.menafn.com/qn_news_story.asp?storyid=%7B0ef7e362-…

-Beijing Antaike, Nov 01, 2011 (Dow Jones Commodities News via Comtex)

http://www.menafn.com/qn_news_story.asp?storyid=%7B0ef7e362-…

Production down at Freeport-McMoRan Indonesia mine

Published: Tuesday, 1 Nov 2011 | 12:36 PM ET

PHOENIX - Production has fallen so significantly at a Freeport-McMoRan mine in Indonesia, the company said Tuesday, enough to threaten the company's fourth-quarter sales estimate.

The earlier sales forecast had assumed production at the gold and copper mine would be 75 percent of the normal outflow, or about 175,000 tons a day. However, production has tumbled to 120,000 tons a day.

The strike began Sept. 15 at the Grasberg mining complex in a mountainous region of the eastern province of Papua.

PT Freeport Indonesia has been using non-striking workers and contractors. Milling operations were halted Oct. 22 to repair a pipeline that the company said was damaged during strike-related unrest.

Last month, Indonesian security forces fired on striking workers, killing one and wounding more than a dozen other people. Freeport has blamed strikers for the violence, accusing them of intimidating replacement workers.

The company said Tuesday that it was going through an Indonesian court and seeking a negotiated end to the strike. Miners are demanding higher pay.

Shares of Freeport-McMoRan Copper & Gold Inc., based in Phoenix, fell $1.45, or 3.5 percent, to $38.81 in afternoon trading.

http://www.cnbc.com/id/45120270

Published: Tuesday, 1 Nov 2011 | 12:36 PM ET

PHOENIX - Production has fallen so significantly at a Freeport-McMoRan mine in Indonesia, the company said Tuesday, enough to threaten the company's fourth-quarter sales estimate.

The earlier sales forecast had assumed production at the gold and copper mine would be 75 percent of the normal outflow, or about 175,000 tons a day. However, production has tumbled to 120,000 tons a day.

The strike began Sept. 15 at the Grasberg mining complex in a mountainous region of the eastern province of Papua.

PT Freeport Indonesia has been using non-striking workers and contractors. Milling operations were halted Oct. 22 to repair a pipeline that the company said was damaged during strike-related unrest.

Last month, Indonesian security forces fired on striking workers, killing one and wounding more than a dozen other people. Freeport has blamed strikers for the violence, accusing them of intimidating replacement workers.

The company said Tuesday that it was going through an Indonesian court and seeking a negotiated end to the strike. Miners are demanding higher pay.

Shares of Freeport-McMoRan Copper & Gold Inc., based in Phoenix, fell $1.45, or 3.5 percent, to $38.81 in afternoon trading.

http://www.cnbc.com/id/45120270

Freeport Indonesia mine pay talks deadlocked -union

Fri Oct 28, 2011 9:28am GMT

http://af.reuters.com/article/metalsNews/idAFL4E7LS092201110…

Fri Oct 28, 2011 9:28am GMT

http://af.reuters.com/article/metalsNews/idAFL4E7LS092201110…

Copper ends best weekly rally in decades on muted note

Fri Oct 28, 2011

http://www.reuters.com/article/2011/10/28/markets-metals-idU…

Fri Oct 28, 2011

http://www.reuters.com/article/2011/10/28/markets-metals-idU…

Freeport McMoRan stock looks hot on copper fundamentals

Friday, 28 Oct 2011

Commodity reported that Freeport McMoRan is trading at around USD 35 per share and could be a hot stock considering Copper fundamentals looks reasonably good even in the event of a global slowdown.

Freeport McMoRan is a leading copper producer in the world with massive mines in the Americas and Indonesia. Their total copper reserve as of December 2010 stands at 120 billion pounds.

Considering that Freeport produces almost 4 billion pounds of copper annually copper reserves can be expected to last roughly 30 years. A 120 pound copper mine with a copper price at USD 3.00 per pound puts total value at USD 360 billion. Comex copper is currently trading at USD 3.30 per pound.

Analysts estimate Freeport profit to be around USD 5 billion this year from USD 22 billion earnings. Almost 3/4th of earnings comes from copper which will put earnings from copper at USD 16.5 billion and profits at around USD 3.60 billion.

Now, considering that the copper reserve is expected to last for 30 years Freeport should earn around USD 108 billion in profits over 30 years from copper reserves solely.

(Sourced from Commodity Online)

http://www.steelguru.com/metals_news/Freeport_McMoRan_stock_…

Friday, 28 Oct 2011

Commodity reported that Freeport McMoRan is trading at around USD 35 per share and could be a hot stock considering Copper fundamentals looks reasonably good even in the event of a global slowdown.

Freeport McMoRan is a leading copper producer in the world with massive mines in the Americas and Indonesia. Their total copper reserve as of December 2010 stands at 120 billion pounds.

Considering that Freeport produces almost 4 billion pounds of copper annually copper reserves can be expected to last roughly 30 years. A 120 pound copper mine with a copper price at USD 3.00 per pound puts total value at USD 360 billion. Comex copper is currently trading at USD 3.30 per pound.

Analysts estimate Freeport profit to be around USD 5 billion this year from USD 22 billion earnings. Almost 3/4th of earnings comes from copper which will put earnings from copper at USD 16.5 billion and profits at around USD 3.60 billion.

Now, considering that the copper reserve is expected to last for 30 years Freeport should earn around USD 108 billion in profits over 30 years from copper reserves solely.

(Sourced from Commodity Online)

http://www.steelguru.com/metals_news/Freeport_McMoRan_stock_…

Ungeheures Volumen: 8 Mio Stücke gehandelt in nur 30 Minuten!!

Freeport McMoRan rises on higher copper prices

Thursday, 27 Oct 2011

Business Week reported that shares of Freeport McMoRan Copper & Gold Inc rose boosted by jumps in the prices of copper and other precious metals.

In midday trading, the price of high grade copper rose 18 cents or 5.6% to USD 3.40 per pound on the New York Mercantile Exchange. Gold and silver prices also rose slightly.

Barron's singled out the copper mining giant as a gleaming buying opportunity noting that its shares are down 40% this year making it an attractive investment.

The Phoenix based company mines ores used in construction and manufacturing such as copper for wiring, cables and pipes. Molybdenum is used to strengthen steel and gold largely is sold to investors and jewelry makers.

Last week, Freeport McMoRan said that its Q3 profit fell 10.6% as it sold less copper and gold and a strike continued at its Indonesian mine. The company also noted that copper prices had fallen over the past several weeks and the near-term economic outlook is uncertain. It expects to sell 3.8 billion pounds of copper this year, 1.6 million ounces of gold and 78 million pounds of molybdenum.

Barron's said that Freeport shares could rise as high as USD 75 in several years if copper reaches USD 4 a pound. Barron's pointed to the company's plans to boost supply by adding a billion pounds of copper production by 2016 through the expansion of its mines in the US and Congo. Last week it said it would boost capital spending by USD 1 billion to USD 3.7 billion next year.

In midday trading, Freeport McMoRan shares rose USD 2.55 or 7% to USD 39.13 after peaking at USD 39.20 earlier in the day. Over the past 52 weeks, the company's shares have traded between USD 28.85 and USD 61.35. Since the end of July, its shares have lost 31% of their value.

Meanwhile, the overall stock market rose strongly after a round of corporate takeovers and reports that Europe's bailout fund will be larger than anticipated.

(Sourced from www.businessweek.com)

http://www.steelguru.com/metals_news/Freeport_McMoRan_rises_…

Thursday, 27 Oct 2011

Business Week reported that shares of Freeport McMoRan Copper & Gold Inc rose boosted by jumps in the prices of copper and other precious metals.

In midday trading, the price of high grade copper rose 18 cents or 5.6% to USD 3.40 per pound on the New York Mercantile Exchange. Gold and silver prices also rose slightly.

Barron's singled out the copper mining giant as a gleaming buying opportunity noting that its shares are down 40% this year making it an attractive investment.

The Phoenix based company mines ores used in construction and manufacturing such as copper for wiring, cables and pipes. Molybdenum is used to strengthen steel and gold largely is sold to investors and jewelry makers.

Last week, Freeport McMoRan said that its Q3 profit fell 10.6% as it sold less copper and gold and a strike continued at its Indonesian mine. The company also noted that copper prices had fallen over the past several weeks and the near-term economic outlook is uncertain. It expects to sell 3.8 billion pounds of copper this year, 1.6 million ounces of gold and 78 million pounds of molybdenum.

Barron's said that Freeport shares could rise as high as USD 75 in several years if copper reaches USD 4 a pound. Barron's pointed to the company's plans to boost supply by adding a billion pounds of copper production by 2016 through the expansion of its mines in the US and Congo. Last week it said it would boost capital spending by USD 1 billion to USD 3.7 billion next year.

In midday trading, Freeport McMoRan shares rose USD 2.55 or 7% to USD 39.13 after peaking at USD 39.20 earlier in the day. Over the past 52 weeks, the company's shares have traded between USD 28.85 and USD 61.35. Since the end of July, its shares have lost 31% of their value.

Meanwhile, the overall stock market rose strongly after a round of corporate takeovers and reports that Europe's bailout fund will be larger than anticipated.

(Sourced from www.businessweek.com)

http://www.steelguru.com/metals_news/Freeport_McMoRan_rises_…

Forbes

Freeport McMoran Copper Kicking Up To $41

10/26/2011 @ 10:57AM

http://www.forbes.com/sites/greatspeculations/2011/10/26/fre…

Freeport McMoran Copper Kicking Up To $41

10/26/2011 @ 10:57AM

http://www.forbes.com/sites/greatspeculations/2011/10/26/fre…

Freeport Indonesia declares force majeure at Grasberg

Wed Oct 26, 2011 8:38am GMT

http://af.reuters.com/article/metalsNews/idAFL3E7LQ0PC201110…

Wed Oct 26, 2011 8:38am GMT

http://af.reuters.com/article/metalsNews/idAFL3E7LQ0PC201110…

01:47 Uhr · Business Wire (engl.) · Freeport-McMoRan |

23.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

17.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

16.04.24 · Sharedeals · Freeport-McMoRan |

16.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

04.04.24 · dpa-AFX · Freeport-McMoRan |

29.03.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |