HECLA MINING - Entwicklung zum Major Player (Seite 2)

eröffnet am 04.03.08 05:38:51 von

neuester Beitrag 03.05.24 23:13:37 von

neuester Beitrag 03.05.24 23:13:37 von

Beiträge: 24.220

ID: 1.139.154

ID: 1.139.154

Aufrufe heute: 14

Gesamt: 1.066.384

Gesamt: 1.066.384

Aktive User: 0

ISIN: US4227041062 · WKN: 854693 · Symbol: HL

4,7400

USD

-0,63 %

-0,0300 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

25.04.24 · Business Wire (engl.) |

25.04.24 · Dr. Hamed Esnaashari |

25.04.24 · wallstreetONLINE Redaktion |

18.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 185,00 | -9,76 | |

| 0,6700 | -14,92 | |

| 43,97 | -16,90 | |

| 12,000 | -25,00 | |

| 46,27 | -98,01 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.482.571 von waldis2000 am 19.03.24 20:53:18IMO sind wir am Beginn der Wall-Of-Worry-Phase! Keiner traut dem Braten so richtig:

- Neueinsteiger nutzen selbst kleine Gewinne und verkaufen schnell wieder und

- wer schon länger dabei ist und vom langfristigen Kursverlauf enttäuscht ist nutzt einen Spike und denkt sich bloß schnell raus hier bevor es wieder runter geht!

- Neueinsteiger nutzen selbst kleine Gewinne und verkaufen schnell wieder und

- wer schon länger dabei ist und vom langfristigen Kursverlauf enttäuscht ist nutzt einen Spike und denkt sich bloß schnell raus hier bevor es wieder runter geht!

wie ist das eigentlich zu erklären Silber verliert so 0,48 Heute Gestern 1 Prozent und die Minen fallen fast alle wieder in sich zusammen man hört doch von allen Ecken die Minen wären so unterbewertet muss Silber erst auf 30 oder 40 steigen das die Minen ihre Gewinne mal länger als drei Tage halten können.

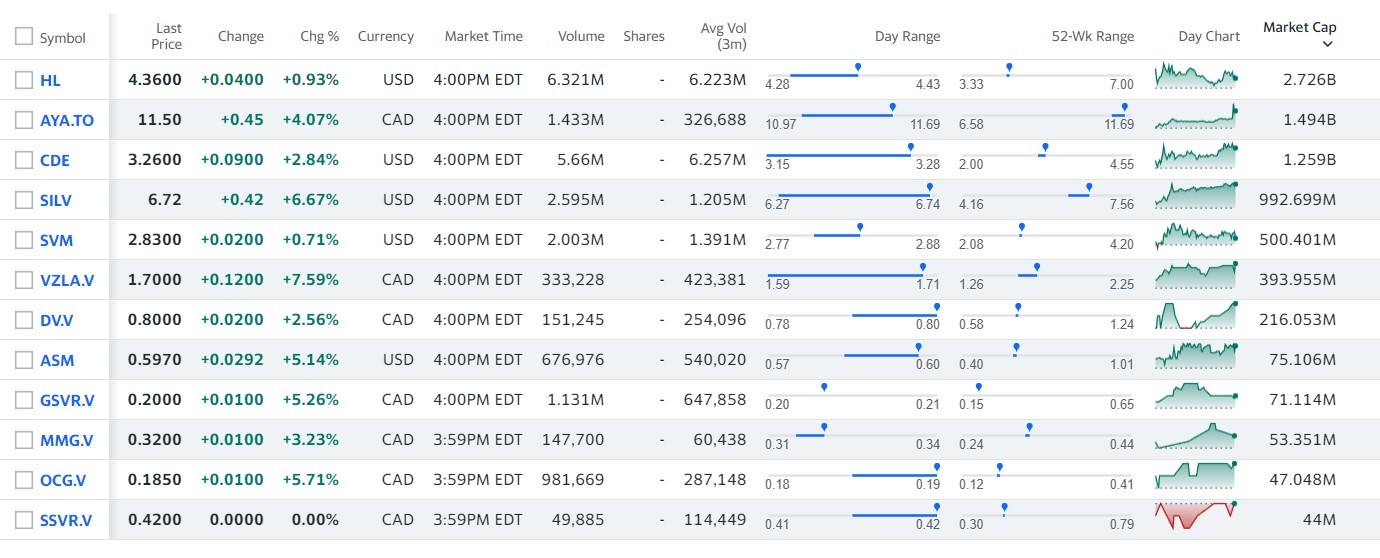

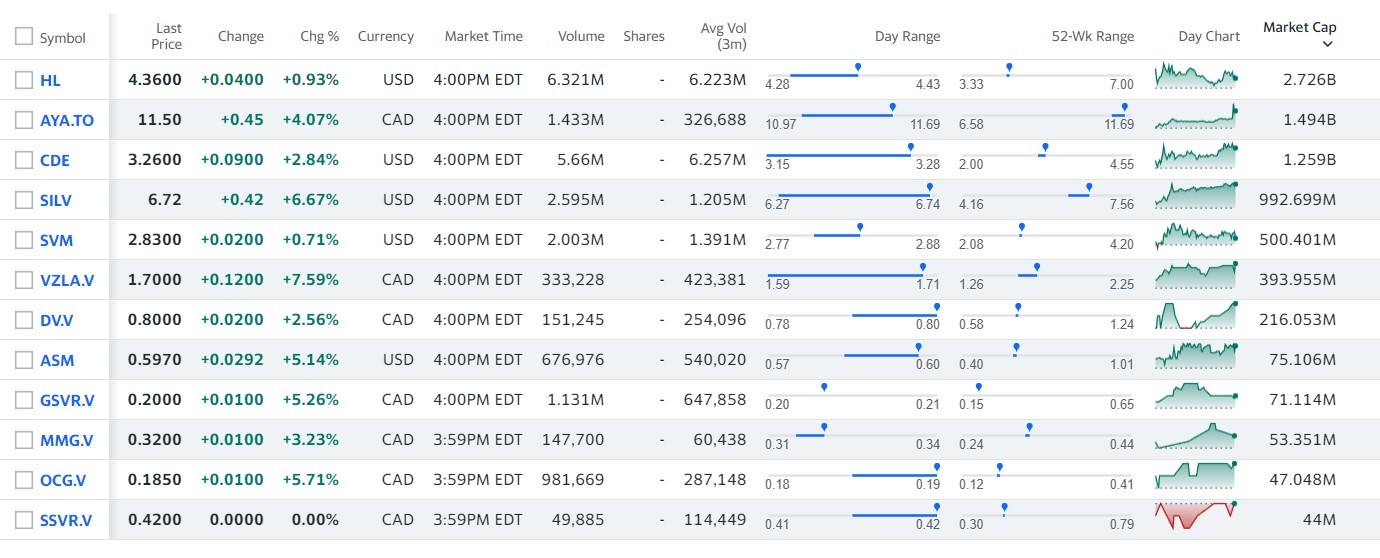

Antwort auf Beitrag Nr.: 75.462.813 von Pebbles am 15.03.24 17:00:21So gaaaanz langsam lösen sich die Minen von ihren 52 Wochen Tiefs, der erste Produzent (Aya) hat bereits ein neuen 52week high gemacht, die meisten anderen Producer (Hecla, Coeur, SilverCorp, SilverCrest) liegen schon im Mittelfeld, und bei den Klitschen (Summa, Avino und Metallic) und Explorern ist noch Katzenjammer angesagt, hier mal sortiert nach MCap:

Bin heute bei Hecla Mining eingestiegen

Dafür bei Newmont Mining ausgestiegen. Trotz gestiegenen Goldpreises lahmte die Aktie schon seit geraumer Zeit und hat sich wohl mit der Übernahme von Newcrest verschluckt.Ich bin heut bei Hecla Mining eingestiegen und hoffe, dass das der richtige Wechsel war. Aber bei Minen geht man immer ein unbekanntes Risiko ein und man ist nie sicher vor Streik, Umweltauflagen und riesigen Erschließungskosten. Aber nach allen was ich so gelesen habe, scheint Hecla zumindest besser zu agieren als Newmont.

Mal schaun, ob das die richtige Entscheidung war!

Der Kurs von Hecla Mining notiert endlich wieder über der 4 Dollar Marke!

Second highest revenues, silver reserves and production; Expecting silver production growth

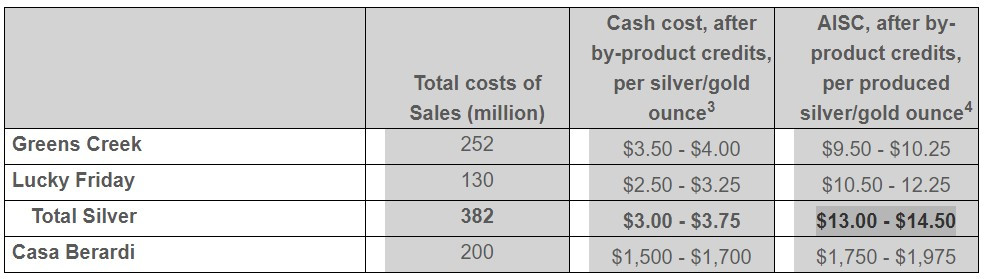

Das wichtigste zuerst: Silver AISC (after by-product credits): 11.76 Dollar/oz SUPER!!!

Gold AISC (after by-product credits): 2,048 Dollar/oz 100 Bucks je oz draufgezahlt!!!!

(Hauptproblem war allerdings Q1-2023 mit 2,392 Dollar!!! )

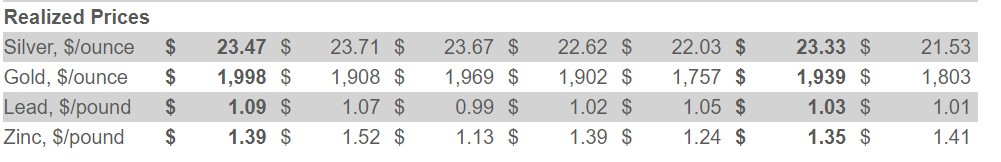

Realized Prices Silver: 23.33 Dollar/oz

Realized Prices Gold: 1,939 Dollar/oz

RESERVES & RESOURCES HIGHLIGHTS

- Silver reserves at 238 million ounces with additions at Keno Hill and Lucky Friday after depletion;

- Silver reserves only 1% less than last year’s all-time highest reserve;

- Keno Hill reserves increased 10% to 55 million ounces, an increase of 45% since acquisition;

- Gold reserves decreased by 16% due to the strategic change to transition to a surface operation only at Casa Berardi.

- Measured and indicated gold reserves increased 21% and inferred gold resources increased 11% following the acquisition of ATAC Resources

- gold resource is the highest in our history

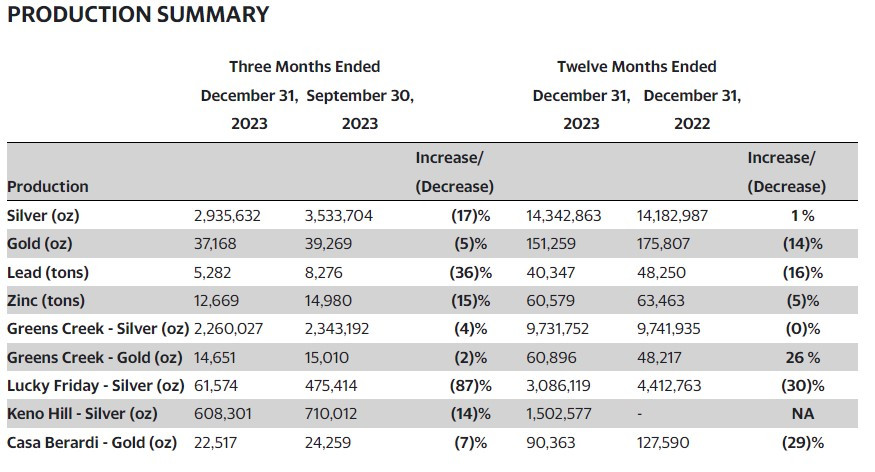

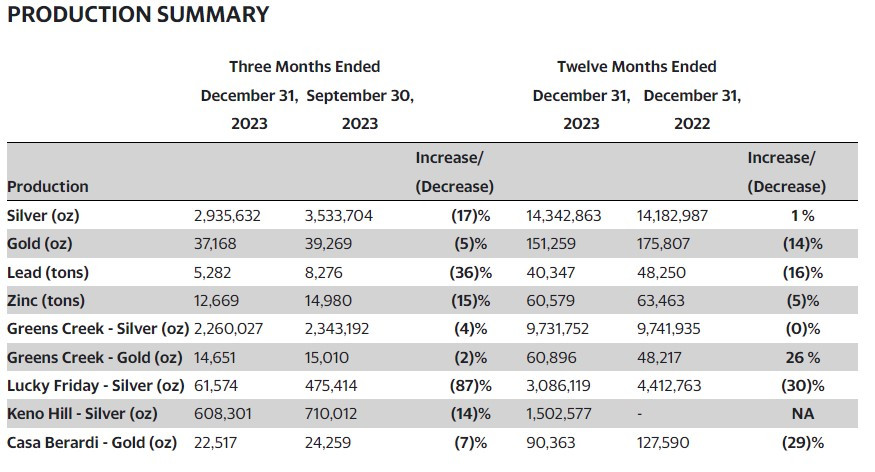

Hecla Reports Fourth Quarter and Full Year 2023 Results

COEUR D'ALENE, Idaho - Hecla Mining Company (NYSE:HL) announced fourth quarter 2023 financial and operating results.

HIGHLIGHTS

- Silver production of 14.3 million ounces,

- total sales of $720.2 million, second highest in Company history.

- Lucky Friday restarted production on January 9th, with first insurance proceeds received in February.

- Hecla received a U.S. patent for the Underhand Closed Bench ("UCB") mining method.

- Greens Creek achieved record throughput and generated $157.3 million in cash flow from operations and free cash flow of $121.6 million.

- Casa Berardi began the transition to surface only mining with results exceeding expectations.

- Keno Hill began silver production in the second half of the year, focusing on improving safety and environmental performance while completing major infrastructure projects.

- Completed Technical Report Summary for Keno Hill and Casa Berardi demonstrating the value of the assets.

Net loss applicable to common stockholders for the year was $84.8 million, an increase over the prior year primarily related to:

- Ramp-up and suspension costs increased by $52.1 million, reflecting the impact of the Lucky Friday suspension, and the ramp-up of production at Keno Hill.

- foreign exchange loss of $3.8 million, compared to a gain of $7.2 million in the prior year, reflecting the impact of the U.S. dollar appreciation on Canadian dollar denominated monetary assets and liabilities.

- income tax provision of $1.2 million, compared to a benefit of $7.6 million due to an increase in the valuation allowance for losses incurred by Keno Hill during the year.

https://ir.hecla.com/News--Media/news-releases/news-details/…

AISC Q12023 bis Q42023 und FY-2023 / FY-2022

Realized Prices

2024 Cost Guidance AISC

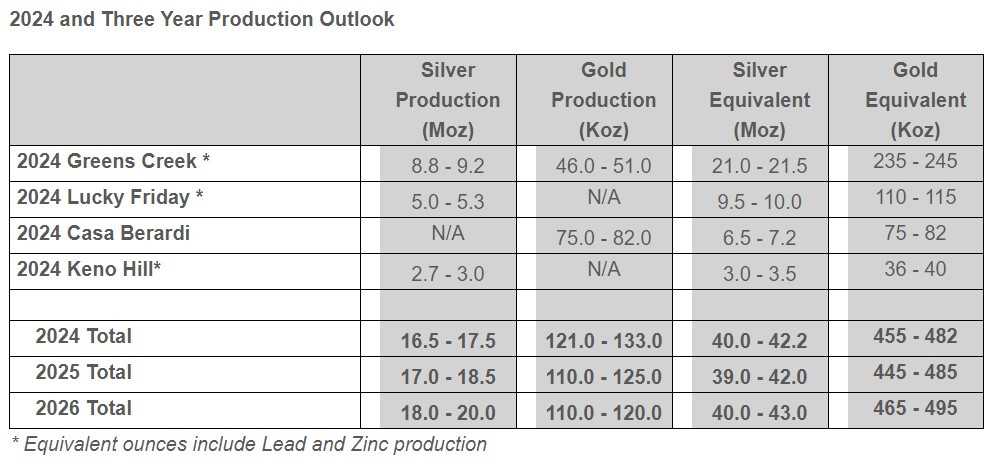

2024 and Three Year Production Outlook

Hecla Mining reports mixed Q4 results; initiates FY24 outlook

https://www.finanznachrichten.de/watchlist/nachrichten.htm

https://www.finanznachrichten.de/watchlist/nachrichten.htm

Empfehlung für Hecla Mining:

Mining-Silver Stocks to Keep an Eye on

Hecla Mining: The company recently reported production numbers for 2023. Silver production inched up 1% year over year to 14.3 million ounces despite the halt in operations at the Lucky Friday mine since August 2023. The upside was driven by strong performance at Greens Creek. Keno Hill produced 1.5 million ounces in 2023, with the Bermingham deposit achieving the highest mined tonnage in December. The Lucky Friday mine restarted production earlier this month and is expected to ramp up to full production in the first quarter. HL maintains its target of reaching the silver production level of 20 million ounces in 2025. The company already produces 45% of the U.S. silver and has the largest and highest-grade silver reserve base in the United States. It is gearing up to be Canada’s largest silver producer by 2024.

The Coeur d'Alene, Idaho-based company has a trailing four-quarter earnings surprise of 25%, on average. The Zacks Consensus Estimate for HL’s fiscal 2024 earnings indicates year-over-year growth of 317%. The estimate has moved up 29% in the past 30 days. HL currently carries a Zacks Rank #2 (Buy).

https://www.zacks.com/commentary/2214114/4-silver-mining-sto…

Hecla Announces 2023 Production

COEUR D'ALENE, Idaho, - Hecla Mining Company (NYSE:HL) today announced its preliminary silver and gold production for the fourth quarter and full year 2023.

HIGHLIGHTS

- Silver production of 14.3 million ounces exceeded 2022 production of 14.2 million ounces, despite the temporary shutdown at the Lucky Friday mine since August 2023

- As expected, annual gold production decreased 14% as Casa Berardi transitions to an open pit mine; Greens Creek gold production increased 26%

- Lucky Friday restarts production - Commenced restart at the Lucky Friday; ramp-up to full production and receipt of insurance payments expected to commence in the first quarter of 2024

- Keno Hill produced 1.5 million ounces, with the Bermingham deposit achieving the highest mined tonnage in December; initiated a safety action plan to build a strong operational foundation at the mine

https://finance.yahoo.com/news/hecla-announces-2023-producti…

Hauptproblem 2023 war natürlich Lucky Friday!

The Lucky Friday mine produced 3.1 million ounces of silver in 2023, 30% lower than in 2022, due to the suspension of production since August due to a fire in the secondary escapeway (#2 shaft). Fourth quarter production was nominal as the mill processed residual material from ore pockets.

The mine restarted production on January 9th and is expected to ramp up to full production in the first quarter. The plans to resume production were completed on schedule and involved developing a new secondary egress consisting of a ramp of 1,600 feet and a 290-foot vertical escapeway. The Company received a favorable coverage determination letter and expects to start receiving insurance proceeds during the first quarter.

Zur besseren Übersicht:

COEUR D'ALENE, Idaho, - Hecla Mining Company (NYSE:HL) today announced its preliminary silver and gold production for the fourth quarter and full year 2023.

HIGHLIGHTS

- Silver production of 14.3 million ounces exceeded 2022 production of 14.2 million ounces, despite the temporary shutdown at the Lucky Friday mine since August 2023

- As expected, annual gold production decreased 14% as Casa Berardi transitions to an open pit mine; Greens Creek gold production increased 26%

- Lucky Friday restarts production - Commenced restart at the Lucky Friday; ramp-up to full production and receipt of insurance payments expected to commence in the first quarter of 2024

- Keno Hill produced 1.5 million ounces, with the Bermingham deposit achieving the highest mined tonnage in December; initiated a safety action plan to build a strong operational foundation at the mine

https://finance.yahoo.com/news/hecla-announces-2023-producti…

Hauptproblem 2023 war natürlich Lucky Friday!

The Lucky Friday mine produced 3.1 million ounces of silver in 2023, 30% lower than in 2022, due to the suspension of production since August due to a fire in the secondary escapeway (#2 shaft). Fourth quarter production was nominal as the mill processed residual material from ore pockets.

The mine restarted production on January 9th and is expected to ramp up to full production in the first quarter. The plans to resume production were completed on schedule and involved developing a new secondary egress consisting of a ramp of 1,600 feet and a 290-foot vertical escapeway. The Company received a favorable coverage determination letter and expects to start receiving insurance proceeds during the first quarter.

Zur besseren Übersicht:

Kaufempfehlung: Hecla Mining Platz 2 der Best Junior Silver Mining Stocks To Buy Now

2. Hecla Mining Company (NYSE:HL)

Number of Hedge Fund Investors In Q3 2023: 17

Hecla Mining Company (NYSE:HL) is an American mining company headquartered in Idaho. The firm’s shares are rated Buy on average and analysts have set an average share price target of $5.83.

After digging through 910 hedge fund portfolios for 2023’s September quarter, Insider Monkey discovered that 17 were the firm’s shareholders. Hecla Mining Company (NYSE:HL)’s biggest hedge find investor is Israel Englander’s Millennium Management due to its $10.5 million stake.

https://finance.yahoo.com/news/12-best-junior-silver-mining-…

2. Hecla Mining Company (NYSE:HL)

Number of Hedge Fund Investors In Q3 2023: 17

Hecla Mining Company (NYSE:HL) is an American mining company headquartered in Idaho. The firm’s shares are rated Buy on average and analysts have set an average share price target of $5.83.

After digging through 910 hedge fund portfolios for 2023’s September quarter, Insider Monkey discovered that 17 were the firm’s shareholders. Hecla Mining Company (NYSE:HL)’s biggest hedge find investor is Israel Englander’s Millennium Management due to its $10.5 million stake.

https://finance.yahoo.com/news/12-best-junior-silver-mining-…

25.04.24 · Dr. Hamed Esnaashari · Hecla Mining |

25.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

18.04.24 · wallstreetONLINE Redaktion · Hecla Mining |