SANDSTORM GOLD -- ehemals --Sandstorm Resources (Seite 29)

eröffnet am 01.01.10 13:25:00 von

neuester Beitrag 09.04.24 07:14:48 von

neuester Beitrag 09.04.24 07:14:48 von

Beiträge: 1.041

ID: 1.155.089

ID: 1.155.089

Aufrufe heute: 5

Gesamt: 67.295

Gesamt: 67.295

Aktive User: 0

ISIN: CA80013R2063 · WKN: A1JX9B · Symbol: AYS1

5,4150

EUR

+3,34 %

+0,1750 EUR

Letzter Kurs 16:32:43 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 725,25 | +18,50 | |

| 0,9700 | +12,79 | |

| 5,5800 | +10,36 | |

| 0,8040 | +10,29 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 27,61 | -6,25 | |

| 3,5600 | -7,53 | |

| 3,1000 | -8,01 | |

| 0,9800 | -10,09 | |

| 0,5550 | -20,71 |

Beitrag zu dieser Diskussion schreiben

dreifachtief könnte sich bestätigen. ausbruch heute über das alte verlaufshoch gelingen.

drücken wir die daumen. danach könnte es schnell auf $4.50 und danach $5 laufen

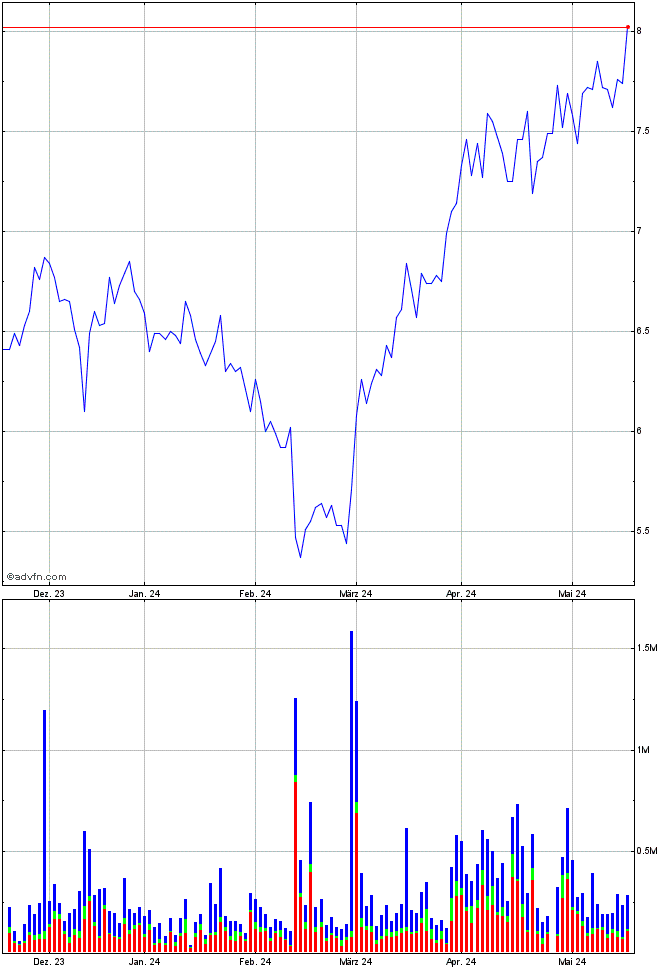

6 monate

1 jahr

drücken wir die daumen. danach könnte es schnell auf $4.50 und danach $5 laufen

6 monate

1 jahr

Sandstorm Gold Announces Amendment with Entrée Gold, Receives US$5.5 Million in Cash

Vancouver, British Columbia | March 1, 2016

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) has amended its metal credit purchase agreement with Entrée Gold Inc. (“Entrée”). In exchange for US$5.5 million in cash and 5.1 million common shares in the capital of Entrée (the “Consideration”), Sandstorm has agreed to reduce, by 17%, the amount of metal credits that the Company is contracted to purchase under the metal credit purchase agreement. The Consideration received by Sandstorm represents 17% of the value of the original metal credit purchase agreement completed with Entrée in 2013.

Under the amended agreement, Sandstorm has the right to purchase metal credits from Entrée equivalent to 5.62% and 4.26% of the gold and silver by-products produced from the Hugo North Extension and Heruga deposits in Mongolia, respectively, and 0.42% of the copper produced from the deposits.

The original metal credit purchase agreement between Sandstorm and Entrée contemplated certain events that would require Entrée to repay a portion of Sandstorm’s upfront deposit. The newly amended agreement maintains these same contractual protections for the benefit of Sandstorm should one of these events occur in the future, but the amendment provides flexibility in terms of how Entrée will refund up to an additional 17% of the refundable deposit if necessary.

The US$5.5 million in proceeds from this amendment will be used to repay amounts owing on the Company’s revolving debt facility.

FROOME ZONE CONTINUES TO GROW AND DEMONSTRATES SIGNIFICANT CONTINUITY OF MINERALIZATION

After receiving positive exploration results in 2015, Primero Mining Corp. (“Primero”) has aggressively targeted the Froome zone, located approximately 800 metres west of the Black Fox mine. This area continues to demonstrate significant gold mineralization over wide widths. Highlights from recent drilling at the Froome zone include 5.0 g/t gold over 42.9 metres true width (15PR-G011), 4.6 g/t gold over 35.3 metres true width (15PR-G031) and 6.0 g/t gold over 25.6 metres true width (15PR-G048). Additionally, Primero recently completed a drill hole to test the down plunge extent and continuity of mineralization, which featured notable intercepts of 6.1 g/t gold over 44.1 metres, 7.2 g/t gold over 14.7 metres, and 7.7 g/t gold over 102.6 metres (15PR-G016).

Recent drilling continues to confirm Primero’s exploration thesis that the long intercepts of significant gold grades found at the Froome zone represent a different style of gold mineralization than seen at the nearby Black Fox deposit. Notably, the Froome zone demonstrates gold mineralization with consistent grades and good continuity which may make the zone amenable to bulk underground mining techniques. The Froome zone has been delineated from the bedrock surface, located 18 metres below the ground surface level, to approximately 260 metres below surface, and continues to remain open to the east, west and at depth.

Froome is a priority for surface exploration at Black Fox in 2016. Primero expects to complete approximately 25,000 metres of drilling by May 2016 in order to define and delineate the Froome deposit, and will evaluate the deposit as a medium term alternative to complement Black Fox ore in order to fill the mill beyond the end of 2017. An initial resource estimate for the Froome zone based on the results of all drilling received to-date is expected to be included with Primero’s year-end reserves and resources update in early March 2016.

For more information and complete drill results, visit the Primero website at http://www.primeromining.com/English/investors/news/default.… and see the press release dated February 29, 2016.

Sandstorm has a gold stream agreement to purchase 8% of the gold produced from the Black Fox mine at $524 per ounce. The gold stream applies to an area of interest that includes the recently discovered Froome zone.

SANDSTORM COUNTERPARTIES BEING ACQUIRED

Recently, a number of mineral properties underlying Sandstorm’s streams and royalties have been acquired by larger, better capitalized organizations. The most recent examples include Lake Shore Gold Corp.’s (“Lake Shore”) announced business combination with Tahoe Resources Inc. (see Lake Shore press release dated February 8, 2016) and the announced acquisition of Magellan Minerals Ltd. (“Magellan”) by Anfield Nickel Corp. (see Magellan press release dated February 16, 2016). Sandstorm holds a 1.0% net smelter returns (“NSR”) royalty on the entirety of Lake Shore’s Thunder Creek and 144 deposits, and has a 2.5% NSR on Magellan’s Coringa property and a 1.0% NSR on the Cuiu Cuiu project. Other projects underlying Sandstorm streams and royalties that were acquired during the last twelve months include:

Project Name Former Owner Present Owner Sandstorm Interest

Santa Elena SilverCrest Mines Inc. First Majestic Silver Corp. 20% of gold @ $357/ounce

Mt. Hamilton Solitario Waterton Global Resources Management 2.4% NSR

East My-Ritt Mega Precious Metals Inc. Yamana Gold Inc. 0.5% NSR

Windfall Lake Eagle Hill Exploration Corp. Oban Mining 0.5%-1.0% NSR

Buffelsfontein Village Main Reef Ltd. Heaven-Sent Capital 1.0% NSR

Vancouver, British Columbia | March 1, 2016

Sandstorm Gold Ltd. (“Sandstorm” or the “Company”) (NYSE MKT: SAND, TSX: SSL) has amended its metal credit purchase agreement with Entrée Gold Inc. (“Entrée”). In exchange for US$5.5 million in cash and 5.1 million common shares in the capital of Entrée (the “Consideration”), Sandstorm has agreed to reduce, by 17%, the amount of metal credits that the Company is contracted to purchase under the metal credit purchase agreement. The Consideration received by Sandstorm represents 17% of the value of the original metal credit purchase agreement completed with Entrée in 2013.

Under the amended agreement, Sandstorm has the right to purchase metal credits from Entrée equivalent to 5.62% and 4.26% of the gold and silver by-products produced from the Hugo North Extension and Heruga deposits in Mongolia, respectively, and 0.42% of the copper produced from the deposits.

The original metal credit purchase agreement between Sandstorm and Entrée contemplated certain events that would require Entrée to repay a portion of Sandstorm’s upfront deposit. The newly amended agreement maintains these same contractual protections for the benefit of Sandstorm should one of these events occur in the future, but the amendment provides flexibility in terms of how Entrée will refund up to an additional 17% of the refundable deposit if necessary.

The US$5.5 million in proceeds from this amendment will be used to repay amounts owing on the Company’s revolving debt facility.

FROOME ZONE CONTINUES TO GROW AND DEMONSTRATES SIGNIFICANT CONTINUITY OF MINERALIZATION

After receiving positive exploration results in 2015, Primero Mining Corp. (“Primero”) has aggressively targeted the Froome zone, located approximately 800 metres west of the Black Fox mine. This area continues to demonstrate significant gold mineralization over wide widths. Highlights from recent drilling at the Froome zone include 5.0 g/t gold over 42.9 metres true width (15PR-G011), 4.6 g/t gold over 35.3 metres true width (15PR-G031) and 6.0 g/t gold over 25.6 metres true width (15PR-G048). Additionally, Primero recently completed a drill hole to test the down plunge extent and continuity of mineralization, which featured notable intercepts of 6.1 g/t gold over 44.1 metres, 7.2 g/t gold over 14.7 metres, and 7.7 g/t gold over 102.6 metres (15PR-G016).

Recent drilling continues to confirm Primero’s exploration thesis that the long intercepts of significant gold grades found at the Froome zone represent a different style of gold mineralization than seen at the nearby Black Fox deposit. Notably, the Froome zone demonstrates gold mineralization with consistent grades and good continuity which may make the zone amenable to bulk underground mining techniques. The Froome zone has been delineated from the bedrock surface, located 18 metres below the ground surface level, to approximately 260 metres below surface, and continues to remain open to the east, west and at depth.

Froome is a priority for surface exploration at Black Fox in 2016. Primero expects to complete approximately 25,000 metres of drilling by May 2016 in order to define and delineate the Froome deposit, and will evaluate the deposit as a medium term alternative to complement Black Fox ore in order to fill the mill beyond the end of 2017. An initial resource estimate for the Froome zone based on the results of all drilling received to-date is expected to be included with Primero’s year-end reserves and resources update in early March 2016.

For more information and complete drill results, visit the Primero website at http://www.primeromining.com/English/investors/news/default.… and see the press release dated February 29, 2016.

Sandstorm has a gold stream agreement to purchase 8% of the gold produced from the Black Fox mine at $524 per ounce. The gold stream applies to an area of interest that includes the recently discovered Froome zone.

SANDSTORM COUNTERPARTIES BEING ACQUIRED

Recently, a number of mineral properties underlying Sandstorm’s streams and royalties have been acquired by larger, better capitalized organizations. The most recent examples include Lake Shore Gold Corp.’s (“Lake Shore”) announced business combination with Tahoe Resources Inc. (see Lake Shore press release dated February 8, 2016) and the announced acquisition of Magellan Minerals Ltd. (“Magellan”) by Anfield Nickel Corp. (see Magellan press release dated February 16, 2016). Sandstorm holds a 1.0% net smelter returns (“NSR”) royalty on the entirety of Lake Shore’s Thunder Creek and 144 deposits, and has a 2.5% NSR on Magellan’s Coringa property and a 1.0% NSR on the Cuiu Cuiu project. Other projects underlying Sandstorm streams and royalties that were acquired during the last twelve months include:

Project Name Former Owner Present Owner Sandstorm Interest

Santa Elena SilverCrest Mines Inc. First Majestic Silver Corp. 20% of gold @ $357/ounce

Mt. Hamilton Solitario Waterton Global Resources Management 2.4% NSR

East My-Ritt Mega Precious Metals Inc. Yamana Gold Inc. 0.5% NSR

Windfall Lake Eagle Hill Exploration Corp. Oban Mining 0.5%-1.0% NSR

Buffelsfontein Village Main Reef Ltd. Heaven-Sent Capital 1.0% NSR

Antwort auf Beitrag Nr.: 51.840.442 von elsolivars am 26.02.16 00:16:36Werde nicht in diese Aktie investieren... Bin nur beim surfen auf den Wert gestoßen und habe mir den mal ganz kurz angesehen. Wollte einfach mal kurz ein paar Infos...

Entscheide auch nicht anhand der Foreneinträge oder Antworten ob ich in einen Wert investiere. Wie gesagt, wollte einfach mehr erfahren...

Euch weiterhin viel Glück

Entscheide auch nicht anhand der Foreneinträge oder Antworten ob ich in einen Wert investiere. Wie gesagt, wollte einfach mehr erfahren...

Euch weiterhin viel Glück

Antwort auf Beitrag Nr.: 51.840.442 von elsolivars am 26.02.16 00:16:36

Klar hat der Fragesteller keine Ahnung, aber die "AISC" von Sandstorm wären in der Tat recht interessant. Folgendermaßen zu berechnen: "Cashcosts" = der Preis, für welchen Sandstorm die Unzen im Schnitt bekommt, AISC= Alle anderen Kosten von Sandstorm draufgerechnet.

Auf so eine Berechnung seitens des Unternehmens dürfte man allerdings lange warten können. Macht sich optisch nicht so klasse.

Zitat von elsolivars: sandstorm ist ein streamer !; sandstorm hat in dem sinne keine asics !, etc.

Klar hat der Fragesteller keine Ahnung, aber die "AISC" von Sandstorm wären in der Tat recht interessant. Folgendermaßen zu berechnen: "Cashcosts" = der Preis, für welchen Sandstorm die Unzen im Schnitt bekommt, AISC= Alle anderen Kosten von Sandstorm draufgerechnet.

Auf so eine Berechnung seitens des Unternehmens dürfte man allerdings lange warten können. Macht sich optisch nicht so klasse.

für die, die es noch nicht wissen sollten :

China plans to launch yuan-denominated gold fix on April 19 – sources

3 340 33 Google+0

Feb 25, 2016 - 12:56 PM GMT

by Meimei Qin

(Updated to include background on banks that may participate in the yuan-denominated fixing)

London 25/02/2016 – China plans to launch its new yuan-denominated gold pricing fix on April 19 this year, sources familiar with the matter said on Thursday.

The launch date has been officially settled and draft trading rules have been sent out to those banks that will be involved in the Shanghai fixing, FastMarkets understands.

The banks that will participate in the planned launch are predominently Chinese but FastMarkets understands that foreign banks could also be involved, according to sources.

It is likely that the 10 banks that are official market makers in the system set up by the SGE in January to facilitate interbank gold trading will participate in the yuan-denominated fixing, one source said.

Most Chinese banks in the list of ‘official’ market makers probably will be involved in the fix, the source noted, alongside one foreign bank.

The 10 ‘official’ market makers are ICBC, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China CITIC Bank, China Merchants Bank, Industrial Bank Co, Bank of Ningbo and ANZ (China).

The SGE is looking to bring more foreign banks on broad, a well-informed source said.

The new benchmark will be run through the state-owned Shanghai Gold Exchange (SGE), the world’s largest physical gold exchange.

The SGE declined to comment.

(Editing by Mark Shaw)

- See more at: http://www.bulliondesk.com/gold-news/update-china-plans-to-l…

elsolivars

China plans to launch yuan-denominated gold fix on April 19 – sources

3 340 33 Google+0

Feb 25, 2016 - 12:56 PM GMT

by Meimei Qin

(Updated to include background on banks that may participate in the yuan-denominated fixing)

London 25/02/2016 – China plans to launch its new yuan-denominated gold pricing fix on April 19 this year, sources familiar with the matter said on Thursday.

The launch date has been officially settled and draft trading rules have been sent out to those banks that will be involved in the Shanghai fixing, FastMarkets understands.

The banks that will participate in the planned launch are predominently Chinese but FastMarkets understands that foreign banks could also be involved, according to sources.

It is likely that the 10 banks that are official market makers in the system set up by the SGE in January to facilitate interbank gold trading will participate in the yuan-denominated fixing, one source said.

Most Chinese banks in the list of ‘official’ market makers probably will be involved in the fix, the source noted, alongside one foreign bank.

The 10 ‘official’ market makers are ICBC, Agricultural Bank of China, Bank of China, China Construction Bank, Bank of Communications, China CITIC Bank, China Merchants Bank, Industrial Bank Co, Bank of Ningbo and ANZ (China).

The SGE is looking to bring more foreign banks on broad, a well-informed source said.

The new benchmark will be run through the state-owned Shanghai Gold Exchange (SGE), the world’s largest physical gold exchange.

The SGE declined to comment.

(Editing by Mark Shaw)

- See more at: http://www.bulliondesk.com/gold-news/update-china-plans-to-l…

elsolivars

Antwort auf Beitrag Nr.: 51.672.565 von Physisch am 05.02.16 22:13:39du bist sicher, dass du das geschäftsmodell von sandstorm verstanden hast ?

(ernst gemeint); warum, glaubst du hast du noch keine antwort erhalten ?

sandstorm ist ein streamer !; sandstorm hat in dem sinne keine asics !, etc.

vielleicht opferst du doch mal ein paar stunden und liest das brett hier einfach mal quer.

vielleicht hilft dir das, zumal wenn du vorhast hier zu investieren, .... oder bist du gar ?

elsolivars

(ernst gemeint); warum, glaubst du hast du noch keine antwort erhalten ?

sandstorm ist ein streamer !; sandstorm hat in dem sinne keine asics !, etc.

vielleicht opferst du doch mal ein paar stunden und liest das brett hier einfach mal quer.

vielleicht hilft dir das, zumal wenn du vorhast hier zu investieren, .... oder bist du gar ?

elsolivars

Mon, 8th Feb 2016 08:31

LONDON (Alliance News) - Mariana Resources Ltd shares rose on Monday after it said it has hit "exceptionally high grade" gold and copper mineralisation near the surface at the Hot Maden project in Turkey and said the latest set of results host the best intersection to date.

Mariana shares were up 8.6% to 1.71 pence per share on Monday morning.

"The exceptional drill hole, HTD-34, represents our best hole to date and, together with HTD-35, the drilling continues to deliver ounces outside of the reported mineral resource estimate," said Chief Executive Glen Parsons.

Hole HTD-34 produced an intercept of 71 metres at 32.7 grammes of gold per tonne of ore and 1.9% copper from a 55 metre downhole, including 22 metres at 83.9 grammes of gold per tonne of ore and 1.8% copper from an 89 metre downhole.

HTD-35 reported an intercept of 63.6 metres at 14.5 grammes of gold per tonne of ore and 3.4% copper from a 46.8 metre downhole, including 21 metres at 38.9 grammes of gold per tonne of ore and 5.1% copper from an 85 metre downhole.

The ongoing drilling at Hot Maden is aimed at extending the existing resource at the project, and Mariana said it will speed up drilling on site after securing a second rig.

Mariana is hoping to complete a maiden preliminary economic assessment for the project, aimed at outlining the commercial viability and financial projections of a producing project, late in the third quarter of this year or early in the fourth.

LONDON (Alliance News) - Mariana Resources Ltd shares rose on Monday after it said it has hit "exceptionally high grade" gold and copper mineralisation near the surface at the Hot Maden project in Turkey and said the latest set of results host the best intersection to date.

Mariana shares were up 8.6% to 1.71 pence per share on Monday morning.

"The exceptional drill hole, HTD-34, represents our best hole to date and, together with HTD-35, the drilling continues to deliver ounces outside of the reported mineral resource estimate," said Chief Executive Glen Parsons.

Hole HTD-34 produced an intercept of 71 metres at 32.7 grammes of gold per tonne of ore and 1.9% copper from a 55 metre downhole, including 22 metres at 83.9 grammes of gold per tonne of ore and 1.8% copper from an 89 metre downhole.

HTD-35 reported an intercept of 63.6 metres at 14.5 grammes of gold per tonne of ore and 3.4% copper from a 46.8 metre downhole, including 21 metres at 38.9 grammes of gold per tonne of ore and 5.1% copper from an 85 metre downhole.

The ongoing drilling at Hot Maden is aimed at extending the existing resource at the project, and Mariana said it will speed up drilling on site after securing a second rig.

Mariana is hoping to complete a maiden preliminary economic assessment for the project, aimed at outlining the commercial viability and financial projections of a producing project, late in the third quarter of this year or early in the fourth.

Zudem würde mich interessieren, was ihr von der Vorgehensweise des MM haltet, das ja immer wieder neue Projekte hinzu kauft. Ich denke damit kann man sich sehr schnell übernehmen.

Danke

Danke

Hallo,

kann mir jemand erklären, warum der Kurs Mitte/Ende Januar so abgeschmiert ist?

Ich finde die Präsentation von Sandstorm nicht so prall. Vielleicht habe ich es überlesen, aber wie hoch sind die Schulden? Und vor allen die AISC?

Hoffe jemand kann mir die Fragen beantworten.

Danke

kann mir jemand erklären, warum der Kurs Mitte/Ende Januar so abgeschmiert ist?

Ich finde die Präsentation von Sandstorm nicht so prall. Vielleicht habe ich es überlesen, aber wie hoch sind die Schulden? Und vor allen die AISC?

Hoffe jemand kann mir die Fragen beantworten.

Danke

VANCOUVER, Jan. 19, 2016 /PRNewswire/ - Sandstorm Gold Ltd. ("Sandstorm" or the "Company") (NYSE MKT: SAND, TSX: SSL) is pleased to announce that it has agreed to acquire 56 royalties (the "Royalty Package") from Teck Resources Limited and its affiliates (collectively, "Teck") for total consideration of US$22 million (C$32 million), payable in US$1.4 million (C$2 million) in cash and US$20.6 million (C$30 million) in common shares of the Company (the "Common Shares") (the "Transaction"). Certain royalties in the Royalty Package are subject to rights of first offer and first refusal as well as the requirement for various transfer consents and as a result, the Transaction will have a number of closing dates, with today being the first such closing date.

As consideration for the royalties, Sandstorm has issued a total of 8,365,863 Common Shares priced at C$3.57 per share, the price of the Common Shares being based on the ten (10) day volume weighted average price of the Company's Common Shares traded on the Toronto Stock Exchange. A portion of the Common Shares will be held in escrow to be released on subsequent closing dates.

— TRANSACTION HIGHLIGHTS

Asset Diversification: Royalty Package consists of assets in North America (33), Asia (11), South America (9) and Europe (3) and includes producing assets (4), development- stage projects (9), advanced exploration-stage projects (8) and exploration-stage properties (35);

Immediate Cash Flow and Significant Cash Flow Growth Potential: Estimated cash flow in 2016 of US$1.5 million to US$2.0 million, growing to US$10 million to US$15 million in cash flow per year;

Strong Counterparties: Royalty counterparties include Barrick Gold Corporation, Glencore plc ("Glencore"), KGHM Polska Miedz SA, Newmont Mining Corporation ("Newmont"), Kinross Gold Corporation ("Kinross"), Centerra Gold Inc. ("Centerra"), New Gold Inc. and Imperial Metals Corporation;

Long-Term Optionality: Over two dozen royalties on exploration-stage properties, several of which are undergoing active exploration programs.

— ROYALTY PORTFOLIO: KEY ASSETS

The Royalty Portfolio includes the following key assets:

a 2.0% net smelter returns ("NSR") royalty on the high-grade, advanced exploration-stage Hot Maden project located in Turkey, owned by Mariana Resources Ltd. ("Mariana"). Lidya Madencilik Sanayi ve Ticaret A.S. has an option to earn-in up to 70% in Hot Maden from Mariana;

a 2.0% NSR royalty on the development-stage Hackett River project in Nunavut, Canada owned by Glencore plc;

a 1.75% NSR royalty, on 60% of production subject to a US$40 million cap, on the development-stage Lobo-Marte project in Chile owned by Kinross Gold Corporation;

a 2.0% NSR royalty on the development-stage Burhaniye project in Turkey owned by Tumad Madencilik Sanayi ve Ticaret A.S. The Burhaniye royalty begins paying after 300,000 ounces have been produced;

a 5.0% NSR royalty on copper, and a 2.5% NSR royalty on all other metals produced, on a portion of the producing Copper Mountain project in British Columbia, Canada owned by Copper Mountain Mining Corporation;

a US$10/ounce production royalty, subject to a maximum ounce cap, on the development-stage Ağı Dağı/Kirazli projects in Turkey owned by Alamos Gold Inc. and payable by Newmont; and

a 0.5%-1.5% NSR royalty, based on cumulative production, on the development stage Öksüt project in Turkey owned by Centerra Gold Inc. ("Centerra"). Centerra holds a right of first offer on the sale of the Öksüt royalty.

"The acquisition of this royalty package from Teck materially enhances Sandstorm's existing portfolio while allowing the Company to maintain a strong balance sheet," said Sandstorm's President & CEO Nolan Watson. "We believe this deal enhances, on a per share basis, the Company's production growth, cash flow growth, NAV, diversification and precious metal optionality. With over 130 streams and royalties now in our portfolio, we believe Sandstorm is well positioned for an exciting future."

Hot Maden – 2.0% NSR

The Hot Maden gold-copper project is located approximately 20 kilometres ("km") southeast of Artvin and 130 km northeast of Erzurum in north-eastern Turkey. A highly successful 2015 drill campaign led to the release, by Mr. Stewart Coasts from RungePincockMinarco, of a maiden mineral resource estimate for the high-grade mineralisation at Hot Maden as follows:

Indicated Resource – 2.0 million gold equivalent ounces; 4.7 million tonnes ("Mt") at 10.0 grams per tonne ("g/t") gold and 2.2% copper, for a gold equivalent grade of 13.4 g/t;

Inferred Resource – 1.0 million gold equivalent ounces; 3.7 Mt at 5.5 g/t gold and 1.8% copper, for a gold equivalent grade of 8.2 g/t.

High grade gold-copper mineralisation was first intersected at Hot Maden in the Phase I diamond drill program, which was completed in January 2015 and included the following key intercepts (not true widths):

DH HTD-04: 103.0 metres @ 9.0 g/t gold and 2.2% copper from 25.0 metres, including a significantly higher grade massive sulphide zone containing 33.4m @ 18.3 g/t gold and 3.3% copper from 79.8m downhole (February 2, 2015 NR, Mariana Resources Ltd., Eric Roth QP);

DH HTD-05: 82.0 metres @ 20.4 g/t gold and 1.9% copper from 147.0 metres downhole, including a bonanza 13.0 meters @ 88.0 g/t gold and 2.5% copper from 150.0 metres (February 12, 2015 NR, Mariana Resources Ltd., Eric Roth QP).

The immediate focus for exploration at Hot Maden is to continue with resource delineation drilling within, and around, the main mineralised zone. Future work will include geophysics and new target generation activities along an extended portion of the Hot Maden Fault Zone.

Hackett River – 2.0% NSR

The Hackett River property is located in Nunavut, Canada, approximately 480 km northeast of Yellowknife. Hackett River is a silver-rich volcanogenic massive sulphide project and is one of the largest undeveloped projects of its kind. The property is made up of four massive sulphide deposits that occur over a 6.6 km strike distance.

A preliminary economic assessment updated in 2010 evaluated a possible large-scale open pit and underground operation, processing up to 17,000 tonnes per day. The most recent Technical Report, completed in 2013, contained a mineral resource estimate prepared by Sabina Gold and Silver Corporation, with technical support from Xstrata Canada Corporation, now Glencore plc. The updated resource reported 25.0 million tonnes of indicated resources containing 4.2% zinc and 130.0 g/t silver plus 57.0 million tonnes of inferred resources with 3.0% zinc and 100.0 g/t silver.

Sandstorm's 2.0% NSR royalty covers 7,141 hectares of the Hackett River property including the licenses where the mineral resources have been defined.

Lobo-Marte – 1.75% NSR (on 60% of production)

The Lobo-Marte project contains two potential open-pit gold resources located in the Maricunga Gold District of Chile. The resources are seven kilometers apart, and are located 60 km south of Kinross's La Coipa mine, and 60 km north of Kinross's Refugio mine, 100 kilometres east of Copiapó.

Kinross completed a prefeasibility study at Lobo-Marte that contemplated a heap-leach operation and submitted an environmental and social impact study to Chilean authorities. Kinross has since withdrawn its permit application due to changes in the plan of operations, project economics, and other factors. As a result of the permit withdrawal, much of the historic 7.0 million ounces of measured and indicated gold resources, contained in 185.4 Mt @ 1.2 g/t gold, were reclassified from historic mineral reserves. Future development and operations at Lobo-Marte will require the re-initiation of the permitting process.

Sandstorm holds a 1.75% net smelter return royalty on 60% of future production at Lobo-Marte, up to a maximum of US$40 million.

Copper Mountain – 5.0% NSR on copper, 2.5% NSR on other metals

The Copper Mountain mine is a large-scale, open pit copper-gold-silver mine, operated by Copper Mountain Mining Corporation. The mine is located 300 km east from the port of Vancouver, in southern British Columbia. Mining began in 2011 and with the recent addition of a secondary crusher to the project, the mine has been able to achieve production rates up to 40,000 tonnes per day from multiple open pits. During the full year 2014, Copper Mountain produced 81 million pounds of copper, 22,600 ounces of gold and 443,800 ounces of silver at an operating cost of $1.49/pound, net of by-products.

Sandstorm holds a 5.0% NSR on copper, and a 2.5% NSR on all other metals produced from the Alabama and Virginia pits, located to the north of the Copper Mountain Superpit. The copper royalty is a sliding scale royalty and is a 5.0% NSR at copper prices above US$1.20 per pound. Mining operations are active at the Virginia pit and Sandstorm expects to receive cash flow from this royalty in 2016.

Ağı Dağı/Kirazli – US$10/ounce

The Ağı Dağı and Kirazlı gold development projects are located in the Çanakkale Province of northwestern Turkey. A positive pre-feasibility study (PFS) was completed by Dr. Dennis Ferrigno, CAF & Associates, LLC et al. on Ağı Dağı and Kirazli in 2012 with both projects evaluated for a potential stand-alone open-pit, heap-leach operation. The PFS evaluated production for an average 99,000 ounces of gold per year over a 5 year mine life at Kirazli. The PFS at Ağı Dağı evaluated production for an average of 143,000 ounces of gold per year over a 7 year mine life. Initial production from Ağı Dağı is projected to commence approximately 18 months after first production at Kirazli.

Sandstorm holds a US$10/ounce production royalty payable by Newmont, subject to a maximum of 600,000 ounces from Ağı Dağı and a maximum of 250,000 from Kirazli.

Öksüt – 0.5%-1.5% NSR

The Öksüt property contains an epithermal precious metals resource, located on the Anatolian Plateau in south-central Turkey, near the city of Develi. The property is owned and operated by Centerra. In July 2015, Centerra completed a feasibility study which evaluated a conventional truck and shovel, open pit, heap leach mining operation. The property contains probable reserves of 26.1 Mt @ 1.4 g/t gold, containing 1.16 million ounces of gold. The Öksüt feasibility study evaluates a mine plan that incorporates two open pits that are operated over an eight year mine life. Centerra has received environmental permits and pending final permits proposes to begin construction in mid-2016 with heap leach processing to begin in the first quarter of 2017.

Sandstorm holds a 0.5% to 1.5% NSR royalty based on cumulative production at the mine. The 0.5% NSR royalty begins after 250,000 ounces have been produced at Öksüt. Centerra has a right of first offer on the sale of the Öksüt royalty.

— OTHER ROYALTIES

Below is a list of the other assets that make up the Royalty Package.

http://www.prnewswire.com/news-releases/sandstorm-gold-annou…

As consideration for the royalties, Sandstorm has issued a total of 8,365,863 Common Shares priced at C$3.57 per share, the price of the Common Shares being based on the ten (10) day volume weighted average price of the Company's Common Shares traded on the Toronto Stock Exchange. A portion of the Common Shares will be held in escrow to be released on subsequent closing dates.

— TRANSACTION HIGHLIGHTS

Asset Diversification: Royalty Package consists of assets in North America (33), Asia (11), South America (9) and Europe (3) and includes producing assets (4), development- stage projects (9), advanced exploration-stage projects (8) and exploration-stage properties (35);

Immediate Cash Flow and Significant Cash Flow Growth Potential: Estimated cash flow in 2016 of US$1.5 million to US$2.0 million, growing to US$10 million to US$15 million in cash flow per year;

Strong Counterparties: Royalty counterparties include Barrick Gold Corporation, Glencore plc ("Glencore"), KGHM Polska Miedz SA, Newmont Mining Corporation ("Newmont"), Kinross Gold Corporation ("Kinross"), Centerra Gold Inc. ("Centerra"), New Gold Inc. and Imperial Metals Corporation;

Long-Term Optionality: Over two dozen royalties on exploration-stage properties, several of which are undergoing active exploration programs.

— ROYALTY PORTFOLIO: KEY ASSETS

The Royalty Portfolio includes the following key assets:

a 2.0% net smelter returns ("NSR") royalty on the high-grade, advanced exploration-stage Hot Maden project located in Turkey, owned by Mariana Resources Ltd. ("Mariana"). Lidya Madencilik Sanayi ve Ticaret A.S. has an option to earn-in up to 70% in Hot Maden from Mariana;

a 2.0% NSR royalty on the development-stage Hackett River project in Nunavut, Canada owned by Glencore plc;

a 1.75% NSR royalty, on 60% of production subject to a US$40 million cap, on the development-stage Lobo-Marte project in Chile owned by Kinross Gold Corporation;

a 2.0% NSR royalty on the development-stage Burhaniye project in Turkey owned by Tumad Madencilik Sanayi ve Ticaret A.S. The Burhaniye royalty begins paying after 300,000 ounces have been produced;

a 5.0% NSR royalty on copper, and a 2.5% NSR royalty on all other metals produced, on a portion of the producing Copper Mountain project in British Columbia, Canada owned by Copper Mountain Mining Corporation;

a US$10/ounce production royalty, subject to a maximum ounce cap, on the development-stage Ağı Dağı/Kirazli projects in Turkey owned by Alamos Gold Inc. and payable by Newmont; and

a 0.5%-1.5% NSR royalty, based on cumulative production, on the development stage Öksüt project in Turkey owned by Centerra Gold Inc. ("Centerra"). Centerra holds a right of first offer on the sale of the Öksüt royalty.

"The acquisition of this royalty package from Teck materially enhances Sandstorm's existing portfolio while allowing the Company to maintain a strong balance sheet," said Sandstorm's President & CEO Nolan Watson. "We believe this deal enhances, on a per share basis, the Company's production growth, cash flow growth, NAV, diversification and precious metal optionality. With over 130 streams and royalties now in our portfolio, we believe Sandstorm is well positioned for an exciting future."

Hot Maden – 2.0% NSR

The Hot Maden gold-copper project is located approximately 20 kilometres ("km") southeast of Artvin and 130 km northeast of Erzurum in north-eastern Turkey. A highly successful 2015 drill campaign led to the release, by Mr. Stewart Coasts from RungePincockMinarco, of a maiden mineral resource estimate for the high-grade mineralisation at Hot Maden as follows:

Indicated Resource – 2.0 million gold equivalent ounces; 4.7 million tonnes ("Mt") at 10.0 grams per tonne ("g/t") gold and 2.2% copper, for a gold equivalent grade of 13.4 g/t;

Inferred Resource – 1.0 million gold equivalent ounces; 3.7 Mt at 5.5 g/t gold and 1.8% copper, for a gold equivalent grade of 8.2 g/t.

High grade gold-copper mineralisation was first intersected at Hot Maden in the Phase I diamond drill program, which was completed in January 2015 and included the following key intercepts (not true widths):

DH HTD-04: 103.0 metres @ 9.0 g/t gold and 2.2% copper from 25.0 metres, including a significantly higher grade massive sulphide zone containing 33.4m @ 18.3 g/t gold and 3.3% copper from 79.8m downhole (February 2, 2015 NR, Mariana Resources Ltd., Eric Roth QP);

DH HTD-05: 82.0 metres @ 20.4 g/t gold and 1.9% copper from 147.0 metres downhole, including a bonanza 13.0 meters @ 88.0 g/t gold and 2.5% copper from 150.0 metres (February 12, 2015 NR, Mariana Resources Ltd., Eric Roth QP).

The immediate focus for exploration at Hot Maden is to continue with resource delineation drilling within, and around, the main mineralised zone. Future work will include geophysics and new target generation activities along an extended portion of the Hot Maden Fault Zone.

Hackett River – 2.0% NSR

The Hackett River property is located in Nunavut, Canada, approximately 480 km northeast of Yellowknife. Hackett River is a silver-rich volcanogenic massive sulphide project and is one of the largest undeveloped projects of its kind. The property is made up of four massive sulphide deposits that occur over a 6.6 km strike distance.

A preliminary economic assessment updated in 2010 evaluated a possible large-scale open pit and underground operation, processing up to 17,000 tonnes per day. The most recent Technical Report, completed in 2013, contained a mineral resource estimate prepared by Sabina Gold and Silver Corporation, with technical support from Xstrata Canada Corporation, now Glencore plc. The updated resource reported 25.0 million tonnes of indicated resources containing 4.2% zinc and 130.0 g/t silver plus 57.0 million tonnes of inferred resources with 3.0% zinc and 100.0 g/t silver.

Sandstorm's 2.0% NSR royalty covers 7,141 hectares of the Hackett River property including the licenses where the mineral resources have been defined.

Lobo-Marte – 1.75% NSR (on 60% of production)

The Lobo-Marte project contains two potential open-pit gold resources located in the Maricunga Gold District of Chile. The resources are seven kilometers apart, and are located 60 km south of Kinross's La Coipa mine, and 60 km north of Kinross's Refugio mine, 100 kilometres east of Copiapó.

Kinross completed a prefeasibility study at Lobo-Marte that contemplated a heap-leach operation and submitted an environmental and social impact study to Chilean authorities. Kinross has since withdrawn its permit application due to changes in the plan of operations, project economics, and other factors. As a result of the permit withdrawal, much of the historic 7.0 million ounces of measured and indicated gold resources, contained in 185.4 Mt @ 1.2 g/t gold, were reclassified from historic mineral reserves. Future development and operations at Lobo-Marte will require the re-initiation of the permitting process.

Sandstorm holds a 1.75% net smelter return royalty on 60% of future production at Lobo-Marte, up to a maximum of US$40 million.

Copper Mountain – 5.0% NSR on copper, 2.5% NSR on other metals

The Copper Mountain mine is a large-scale, open pit copper-gold-silver mine, operated by Copper Mountain Mining Corporation. The mine is located 300 km east from the port of Vancouver, in southern British Columbia. Mining began in 2011 and with the recent addition of a secondary crusher to the project, the mine has been able to achieve production rates up to 40,000 tonnes per day from multiple open pits. During the full year 2014, Copper Mountain produced 81 million pounds of copper, 22,600 ounces of gold and 443,800 ounces of silver at an operating cost of $1.49/pound, net of by-products.

Sandstorm holds a 5.0% NSR on copper, and a 2.5% NSR on all other metals produced from the Alabama and Virginia pits, located to the north of the Copper Mountain Superpit. The copper royalty is a sliding scale royalty and is a 5.0% NSR at copper prices above US$1.20 per pound. Mining operations are active at the Virginia pit and Sandstorm expects to receive cash flow from this royalty in 2016.

Ağı Dağı/Kirazli – US$10/ounce

The Ağı Dağı and Kirazlı gold development projects are located in the Çanakkale Province of northwestern Turkey. A positive pre-feasibility study (PFS) was completed by Dr. Dennis Ferrigno, CAF & Associates, LLC et al. on Ağı Dağı and Kirazli in 2012 with both projects evaluated for a potential stand-alone open-pit, heap-leach operation. The PFS evaluated production for an average 99,000 ounces of gold per year over a 5 year mine life at Kirazli. The PFS at Ağı Dağı evaluated production for an average of 143,000 ounces of gold per year over a 7 year mine life. Initial production from Ağı Dağı is projected to commence approximately 18 months after first production at Kirazli.

Sandstorm holds a US$10/ounce production royalty payable by Newmont, subject to a maximum of 600,000 ounces from Ağı Dağı and a maximum of 250,000 from Kirazli.

Öksüt – 0.5%-1.5% NSR

The Öksüt property contains an epithermal precious metals resource, located on the Anatolian Plateau in south-central Turkey, near the city of Develi. The property is owned and operated by Centerra. In July 2015, Centerra completed a feasibility study which evaluated a conventional truck and shovel, open pit, heap leach mining operation. The property contains probable reserves of 26.1 Mt @ 1.4 g/t gold, containing 1.16 million ounces of gold. The Öksüt feasibility study evaluates a mine plan that incorporates two open pits that are operated over an eight year mine life. Centerra has received environmental permits and pending final permits proposes to begin construction in mid-2016 with heap leach processing to begin in the first quarter of 2017.

Sandstorm holds a 0.5% to 1.5% NSR royalty based on cumulative production at the mine. The 0.5% NSR royalty begins after 250,000 ounces have been produced at Öksüt. Centerra has a right of first offer on the sale of the Öksüt royalty.

— OTHER ROYALTIES

Below is a list of the other assets that make up the Royalty Package.

http://www.prnewswire.com/news-releases/sandstorm-gold-annou…