Enbridge Inc. - kandischer Energietransporteur (-versorger) (Seite 5)

eröffnet am 22.06.10 00:17:01 von

neuester Beitrag 20.03.24 14:39:05 von

neuester Beitrag 20.03.24 14:39:05 von

Beiträge: 91

ID: 1.158.425

ID: 1.158.425

Aufrufe heute: 1

Gesamt: 13.375

Gesamt: 13.375

Aktive User: 0

ISIN: CA29250N1050 · WKN: 885427 · Symbol: ENB

48,99

CAD

+0,08 %

+0,04 CAD

Letzter Kurs 01.05.24 Toronto

Neuigkeiten

30.04.24 · Accesswire |

23.04.24 · Accesswire |

22.04.24 · Accesswire |

18.04.24 · Accesswire |

16.04.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,250 | +13,64 | |

| 19,650 | +11,77 | |

| 1,1600 | +11,54 | |

| 84,63 | +9,99 | |

| 0,9600 | +9,09 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,689 | -7,57 | |

| 6,6800 | -8,99 | |

| 4,6700 | -10,19 | |

| 3,7000 | -13,75 | |

| 0,720 | -40,00 |

Beitrag zu dieser Diskussion schreiben

14.4.

U.S. oil comprised 77 per cent of Canada's foreign oil imports last year: regulator

https://winnipeg.citynews.ca/2021/04/14/u-s-oil-comprised-77…

...

Canada is growing ever more reliant on imported American oil, a new report from the country’s energy regulator suggests, putting a counter-intuitive spin on the fierce debate about cross-border pipelines and energy independence.

The United States provided nearly four out of every five barrels of imported crude in 2020, a year when global demand for fossil fuels was badly dented by the COVID-19 pandemic, the latest data from the Canada Energy Regulator shows.

Some 77 per cent of Canadian imports came from the U.S., up from 72 per cent in 2019 and a paltry six per cent in 2010, before a dramatic spike in domestic American oil and gas production over the last decade.

“We do often think of the pipeline relationship between the two countries as being one of, ‘Canada produces and exports to the U.S.,'” said Darren Christie, the regulator’s chief economist.

“This is specifically showing that there is another side to that coin, which is that we also import production from the U.S.”

Close observers of Canada-U.S. trade flows, particularly those in the energy sector, might not be overly surprised by how much American crude oil has been travelling north in recent years.

The U.S. absorbed a whopping 96 per cent of Canadian oil exports last year, the bulk of it heavy crude, more than half of it to the U.S. Midwest, which has been ground zero for pipeline disputes for much of the last 15 years.

But a massive surge in U.S. oil and gas production, fuelled in part by new extraction technology like fracking and horizontal drilling, has made it a convenient source of feedstock for refineries in both countries, Christie said.

“Their crude oil production has more than doubled in the last 10 years, which is quite a remarkable increase,” he said.

“That creates a massive supply push out of the U.S. And if we are just north and had previously been importing some crudes from around the world, it’s a natural market for a lot of that increased production out of the U.S.”

While foreign oil has long been a part of the Canadian energy mix, the latest numbers — along with the proportion of imports from the U.S. — casts the ongoing controversy over pipeline links between the two countries in a surprising new light.

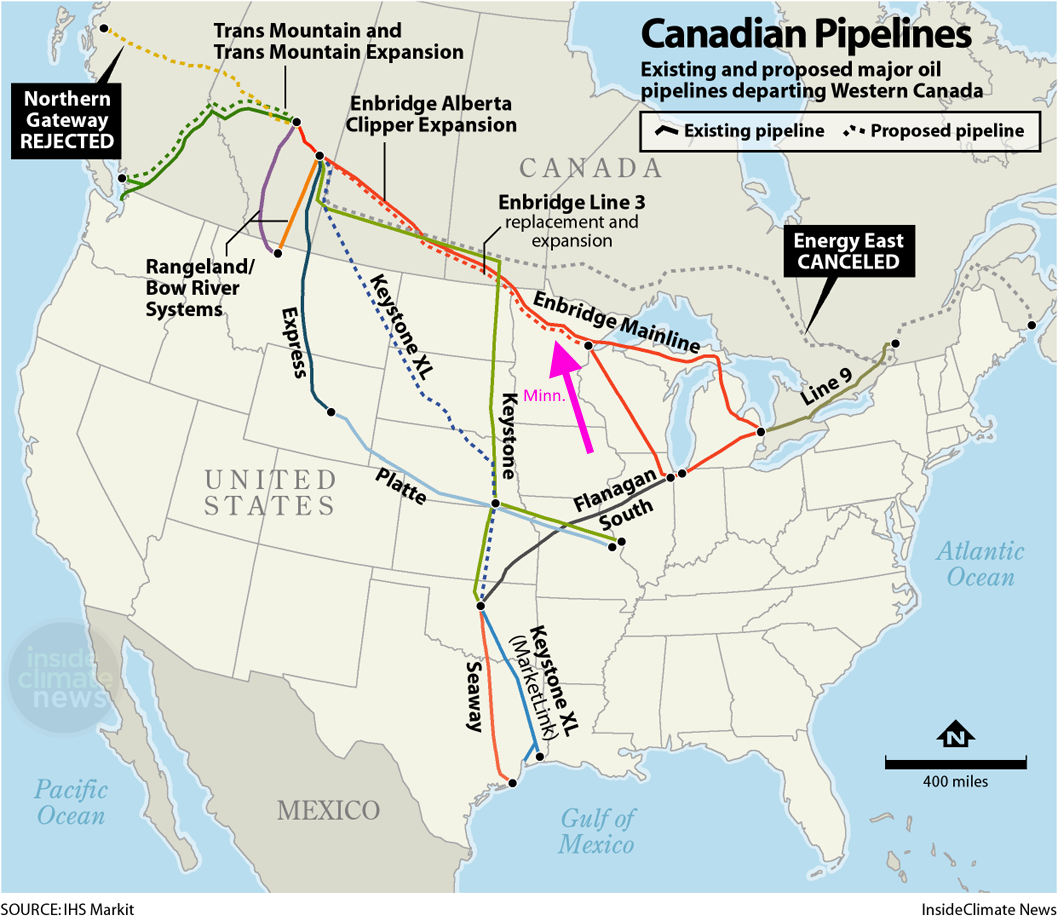

On his first day in the Oval Office, President Joe Biden cancelled the Keystone XL pipeline expansion, which would have ferried an additional 800,000 barrels a day of Alberta oilsands bitumen to refineries on the U.S. Gulf Coast.

Michigan is currently in court with Enbridge Inc. over Gov. Gretchen Whitmer’s efforts to shut down Line 5, a vital cross-border energy link that crosses the Great Lakes beneath the ecologically sensitive Straits of Mackinac.

The pipeline is widely billed by its defenders as a critical piece of infrastructure that feeds key refineries in Sarnia, Ont., and provides more than half of the propane needed to heat homes in Michigan alone, to say nothing of neighbouring states.

Canada has vowed to strenuously defend Line 5, with Natural Resources Minister Seamus O’Regan insisting last month that its operation is “non-negotiable.” Ottawa has yet to say if it will take part in the ongoing court case.

Protesters in Minnesota are also doing their best to disrupt Enbridge’s ongoing $10-billion upgrade of Line 3, another key link in the cross-border chain that connects to Line 5 at a facility in Superior, Wisc.

The dependence on U.S. oil is especially high in Atlantic Canada, a region of the country where pipelines are often not an option. Imports to refineries there have increased tenfold over the last decade.

...

U.S. oil comprised 77 per cent of Canada's foreign oil imports last year: regulator

https://winnipeg.citynews.ca/2021/04/14/u-s-oil-comprised-77…

...

Canada is growing ever more reliant on imported American oil, a new report from the country’s energy regulator suggests, putting a counter-intuitive spin on the fierce debate about cross-border pipelines and energy independence.

The United States provided nearly four out of every five barrels of imported crude in 2020, a year when global demand for fossil fuels was badly dented by the COVID-19 pandemic, the latest data from the Canada Energy Regulator shows.

Some 77 per cent of Canadian imports came from the U.S., up from 72 per cent in 2019 and a paltry six per cent in 2010, before a dramatic spike in domestic American oil and gas production over the last decade.

“We do often think of the pipeline relationship between the two countries as being one of, ‘Canada produces and exports to the U.S.,'” said Darren Christie, the regulator’s chief economist.

“This is specifically showing that there is another side to that coin, which is that we also import production from the U.S.”

Close observers of Canada-U.S. trade flows, particularly those in the energy sector, might not be overly surprised by how much American crude oil has been travelling north in recent years.

The U.S. absorbed a whopping 96 per cent of Canadian oil exports last year, the bulk of it heavy crude, more than half of it to the U.S. Midwest, which has been ground zero for pipeline disputes for much of the last 15 years.

But a massive surge in U.S. oil and gas production, fuelled in part by new extraction technology like fracking and horizontal drilling, has made it a convenient source of feedstock for refineries in both countries, Christie said.

“Their crude oil production has more than doubled in the last 10 years, which is quite a remarkable increase,” he said.

“That creates a massive supply push out of the U.S. And if we are just north and had previously been importing some crudes from around the world, it’s a natural market for a lot of that increased production out of the U.S.”

While foreign oil has long been a part of the Canadian energy mix, the latest numbers — along with the proportion of imports from the U.S. — casts the ongoing controversy over pipeline links between the two countries in a surprising new light.

On his first day in the Oval Office, President Joe Biden cancelled the Keystone XL pipeline expansion, which would have ferried an additional 800,000 barrels a day of Alberta oilsands bitumen to refineries on the U.S. Gulf Coast.

Michigan is currently in court with Enbridge Inc. over Gov. Gretchen Whitmer’s efforts to shut down Line 5, a vital cross-border energy link that crosses the Great Lakes beneath the ecologically sensitive Straits of Mackinac.

The pipeline is widely billed by its defenders as a critical piece of infrastructure that feeds key refineries in Sarnia, Ont., and provides more than half of the propane needed to heat homes in Michigan alone, to say nothing of neighbouring states.

Canada has vowed to strenuously defend Line 5, with Natural Resources Minister Seamus O’Regan insisting last month that its operation is “non-negotiable.” Ottawa has yet to say if it will take part in the ongoing court case.

Protesters in Minnesota are also doing their best to disrupt Enbridge’s ongoing $10-billion upgrade of Line 3, another key link in the cross-border chain that connects to Line 5 at a facility in Superior, Wisc.

The dependence on U.S. oil is especially high in Atlantic Canada, a region of the country where pipelines are often not an option. Imports to refineries there have increased tenfold over the last decade.

...

Antwort auf Beitrag Nr.: 67.718.707 von faultcode am 06.04.21 19:23:27

Das sollte dem Distributable Cash Flow erst einmal zugute kommen und helfen, die Verschuldung besser zu managen. In einem Seeking Alpha Artikel habe ich gelesen, dass Enbridge ein A-Rating anstrebt.

Zitat von faultcode: “We are going to see fewer projects generally in the next two to three years,” he said. “That’s less about opposition in my view and more about the fundamentals of energy. We’ve gone through a massive build in pipelines across North America, and so I think we’ve got enough capacity to keep us going for a while.”

Das sollte dem Distributable Cash Flow erst einmal zugute kommen und helfen, die Verschuldung besser zu managen. In einem Seeking Alpha Artikel habe ich gelesen, dass Enbridge ein A-Rating anstrebt.

6.4.

Enbridge to Biden: Lake Michigan Pipeline Tunnel Fits U.S. Plans

https://finance.yahoo.com/news/enbridge-biden-lake-michigan-…

...

Enbridge Inc. wants to show the Joe Biden administration that the tunnel the Canadian company is building for its oil pipeline under Lake Michigan is exactly what the U.S. president’s plan for better infrastructure is all about.

The tunnel project for the company’s Line 5, opposed by Michigan Governor and Biden ally Gretchen Whitmer, is the kind of upgrade that will make a crucial piece of infrastructure safer, Enbridge Chief Executive Officer Al Monaco said in an interview. The Calgary-based pipeline giant is engaging with the Biden administration to get that message across, he said.

“Under the theme of ‘Build Back Better’ that the president has been talking about, it fits exactly,” Al Monaco said. “That’s what we are doing: We are modernizing an existing piece of infrastructure with a tunnel that reduces the risk to as close to zero as humanly possible, and we are doing it on our dime.”

Enbridge is fighting Whitmer’s move last November to revoke an easement that permitted the pipeline to cross the lake bed, a decision that could force the system to shutdown by May. Meanwhile, Enbridge is pushing ahead with the tunnel project approved by Whitmer’s predecessor.

Line 5 crosses the Straits of Mackinac between Michigan’s upper and lower peninsulas and supplies light oil and fuel to refineries and consumers in the U.S. Midwest and Canada.

...

Al Monaco argues that blocking the existing Line 5 would trigger a crisis given its importance to Midwest refineries. The tunnel addresses concerns about potential oil spills into the water posed by ship anchors, for instance. A court-ordered mediation is scheduled to start on April 16.

“It doesn’t make much sense to create a crisis when we have a solution there in the tunnel,” he said. “Protecting the Great Lakes is exactly what we’re doing.”

Another project that Monaco says fits well with Biden’s goals is its Line 3. Enbridge is currently building a replacement to the aging cross-border pipeline with a new one that can pump increased volumes of Canadian crude into the U.S. Construction of the project in the U.S. only began in December after years of regulatory and legal delays. Protesters, including some indigenous groups, have regularly tried to disrupt construction, but Enbridge plans to finish the line on schedule, by year end. Horizontal directional drilling planned for the summer and eight pump stations are “on track,” he said.

...

“We are going to see fewer projects generally in the next two to three years,” he said. “That’s less about opposition in my view and more about the fundamentals of energy. We’ve gone through a massive build in pipelines across North America, and so I think we’ve got enough capacity to keep us going for a while.”

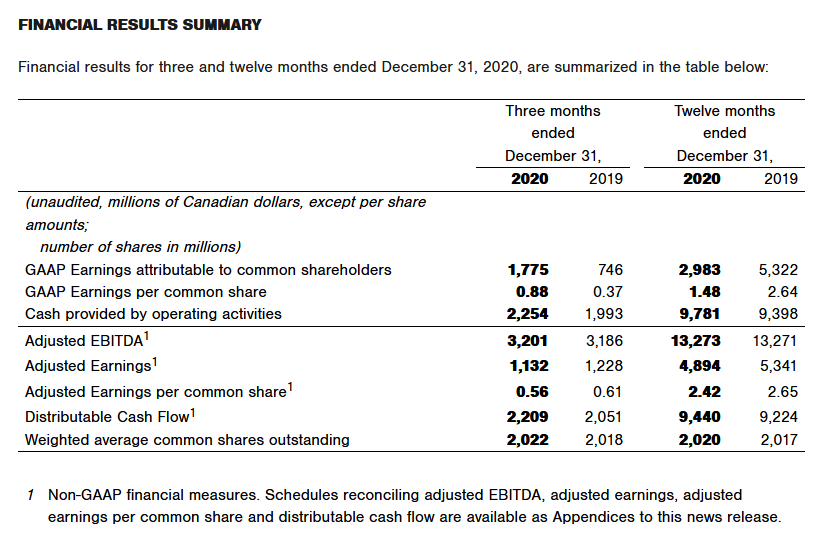

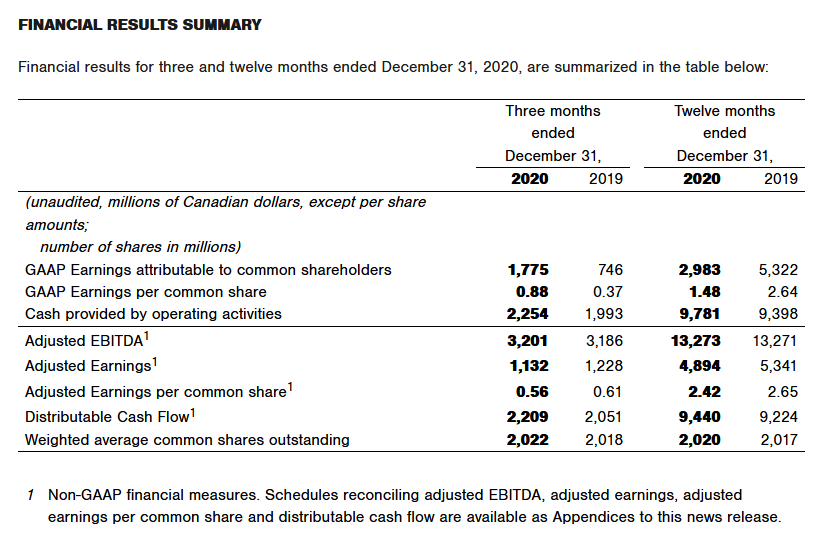

Antwort auf Beitrag Nr.: 66.926.888 von faultcode am 10.02.21 13:03:3012.2. -- 2020Q4

https://www.enbridge.com/media-center/news/details?id=123663

...

...

• Increased the 2021 quarterly dividend by 3% to $0.835 per share reflecting the 26th consecutive annual increase

...

"In Liquids Pipelines, Line 3 construction is underway in Minnesota after a comprehensive and thorough regulatory process over the last 6 years, and we're proud of the broad community support for the project. We're focused on executing world class construction and environmental practices and we've implemented the most up-to-date health and safety protocols to protect communities and our crews. Construction is progressing to our targeted Q4 in-service date.

"We've updated our cost estimate for the full Line 3 project to reflect winter construction, further enhancements to our industry-leading environmental protections and construction techniques, regulatory and permitting delays, higher capitalized interest and COVID-19 protocols. The higher project costs will be managed well within our funding plans and strong financial position. Our updated economics for Line 3 remain attractive.

...

https://www.enbridge.com/media-center/news/details?id=123663

...

...

• Increased the 2021 quarterly dividend by 3% to $0.835 per share reflecting the 26th consecutive annual increase

...

"In Liquids Pipelines, Line 3 construction is underway in Minnesota after a comprehensive and thorough regulatory process over the last 6 years, and we're proud of the broad community support for the project. We're focused on executing world class construction and environmental practices and we've implemented the most up-to-date health and safety protocols to protect communities and our crews. Construction is progressing to our targeted Q4 in-service date.

"We've updated our cost estimate for the full Line 3 project to reflect winter construction, further enhancements to our industry-leading environmental protections and construction techniques, regulatory and permitting delays, higher capitalized interest and COVID-19 protocols. The higher project costs will be managed well within our funding plans and strong financial position. Our updated economics for Line 3 remain attractive.

...

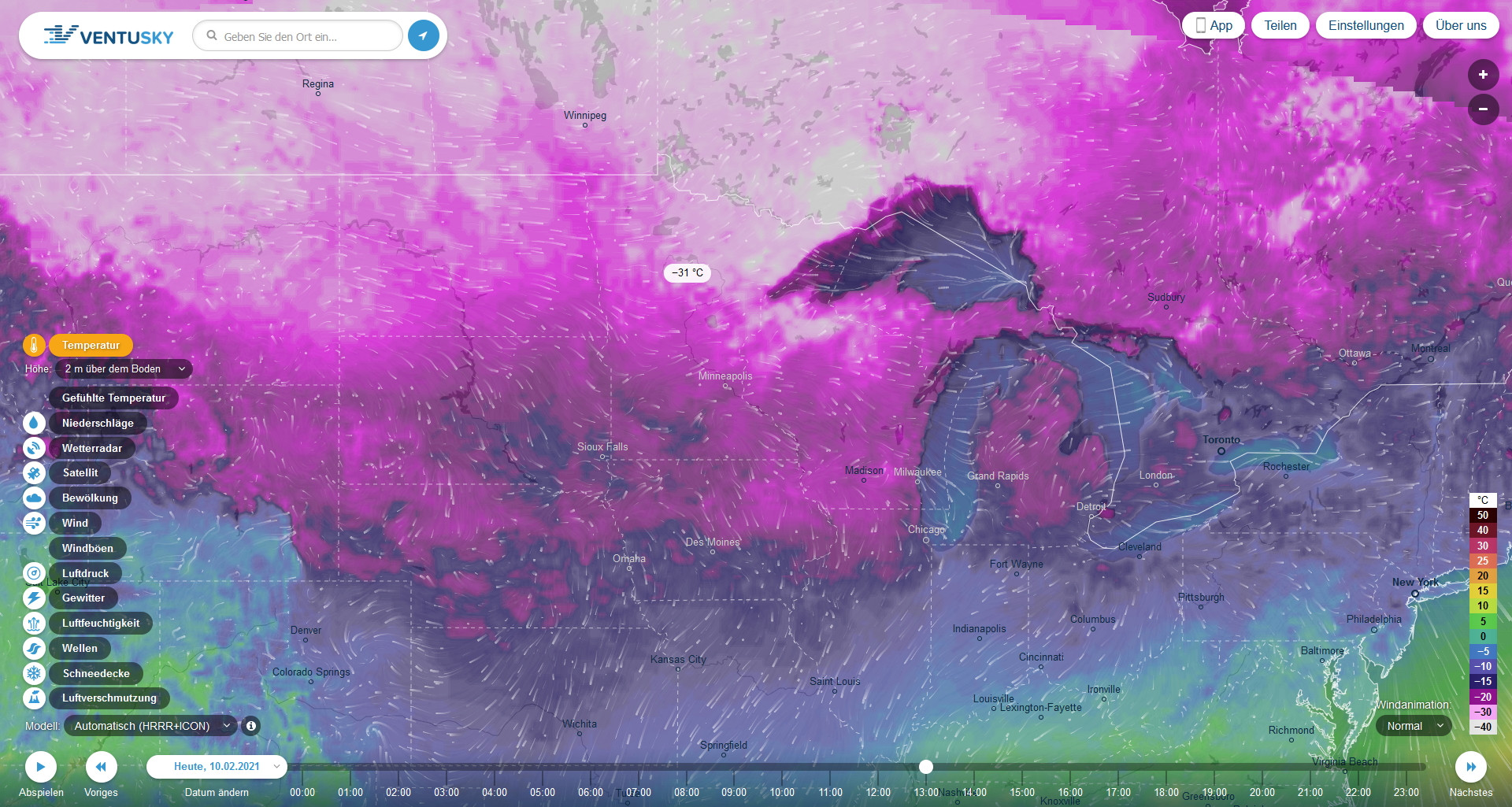

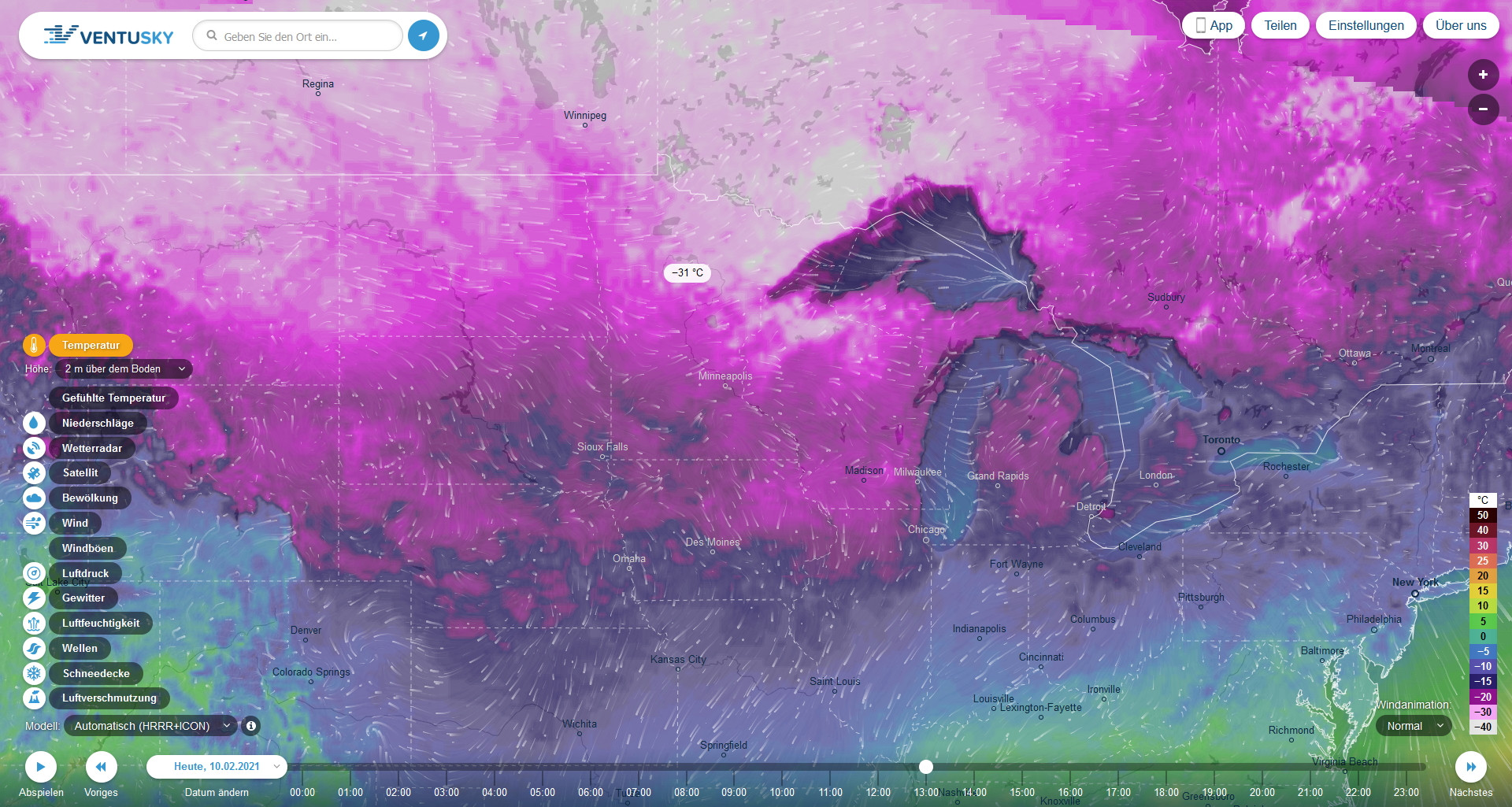

Antwort auf Beitrag Nr.: 65.962.874 von faultcode am 06.12.20 12:08:30

nun ist es an der Baustelle richig kalt - ist aber noch morgens:

https://www.ventusky.com/?p=44.6;-92.4;5&l=temperature-2m

Zitat von faultcode: ...Derzeit um die 0°C. Es wird aber mit Sicherheit noch kälter. Den Eingeborenen nehme ich das sofort ab; aber den weißen Milchgesichtern aus Minneapolis-Saint Paul nicht unbedingt...

nun ist es an der Baustelle richig kalt - ist aber noch morgens:

https://www.ventusky.com/?p=44.6;-92.4;5&l=temperature-2m

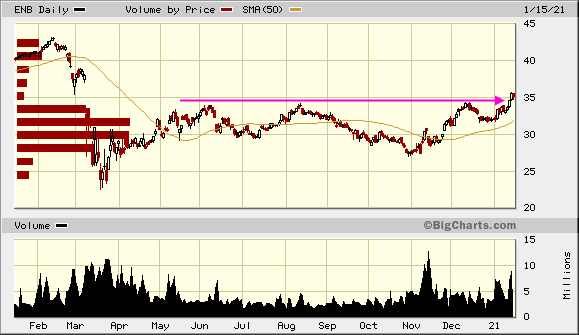

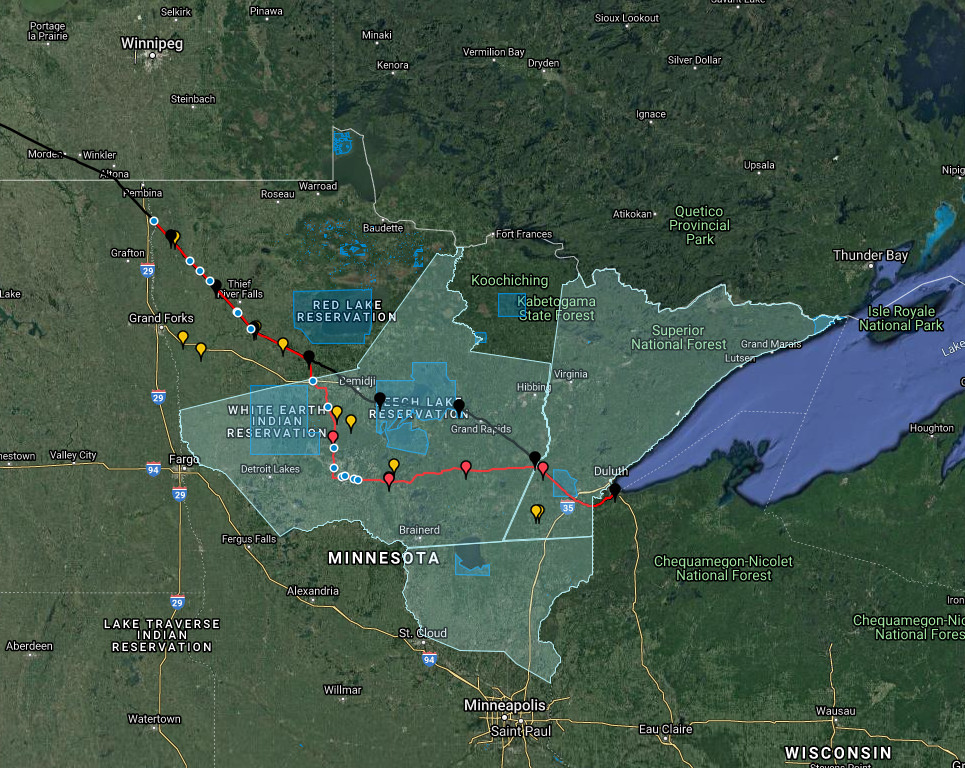

ein Wert will nach oben:

Antwort auf Beitrag Nr.: 65.716.062 von faultcode am 16.11.20 00:47:32

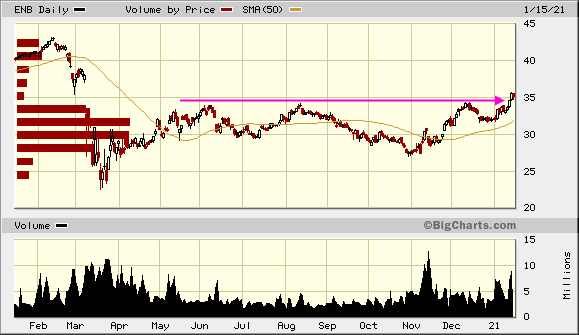

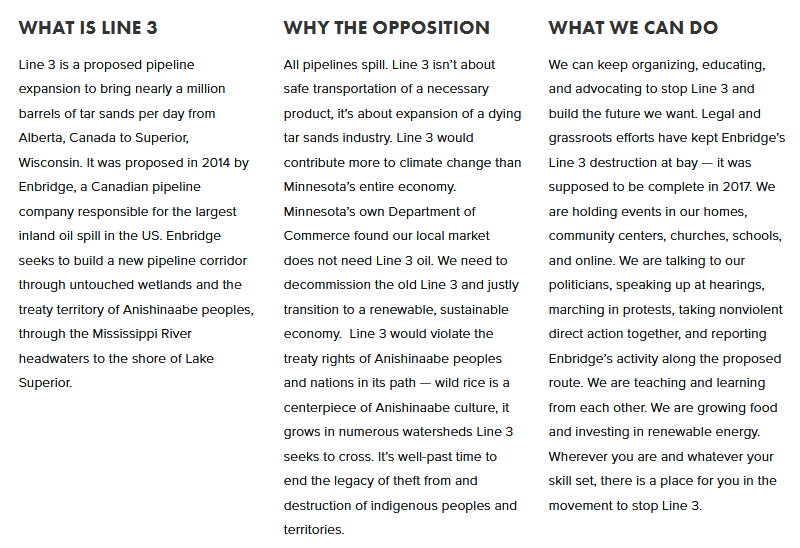

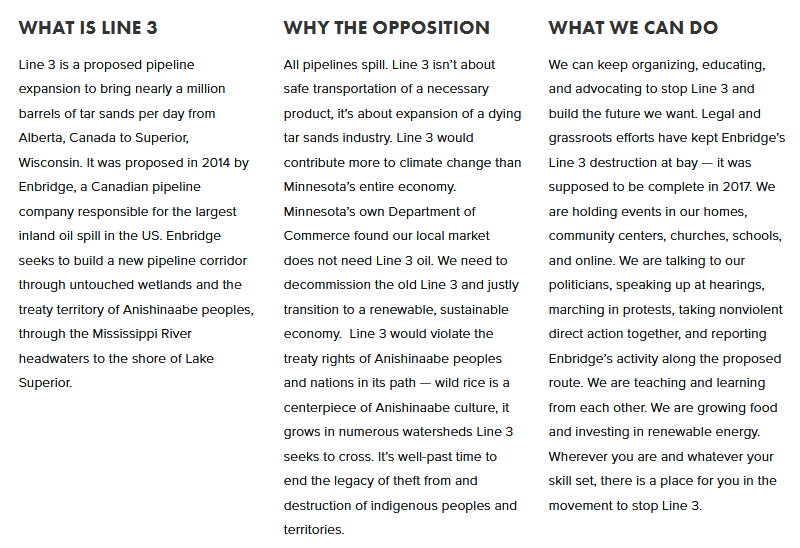

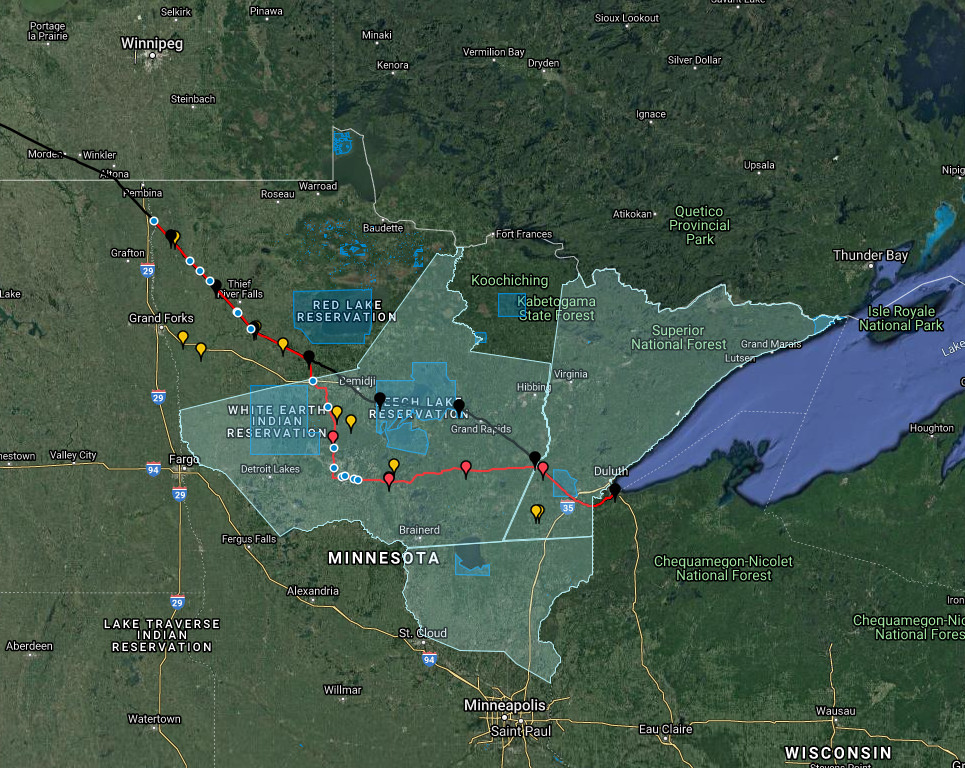

Line 3 durch Minnesota ist derzeit so ein bischen wie die A49 durch den Dannenröder Forst

https://mn.gov/puc/line3/

--> https://www.stopline3.org/#intro

...

...

die 3 hellgrünen Flächen gehören zu den 3 Vertragsflächen aus dem 19. Jahrhundert, sind also auch mit Vorsicht zu genießen.

allerdings ist der Protest - großes Land - im Vergleich zu dem in Hessen als eher gering einzuschätzen:

https://twitter.com/zhaabowekwe

<das ist jemand anders, nicht Tara Houska, Ojibwe native>

Derzeit um die 0°C. Es wird aber mit Sicherheit noch kälter. Den Eingeborenen nehme ich das sofort ab; aber den weißen Milchgesichtern aus Minneapolis-Saint Paul nicht unbedingt

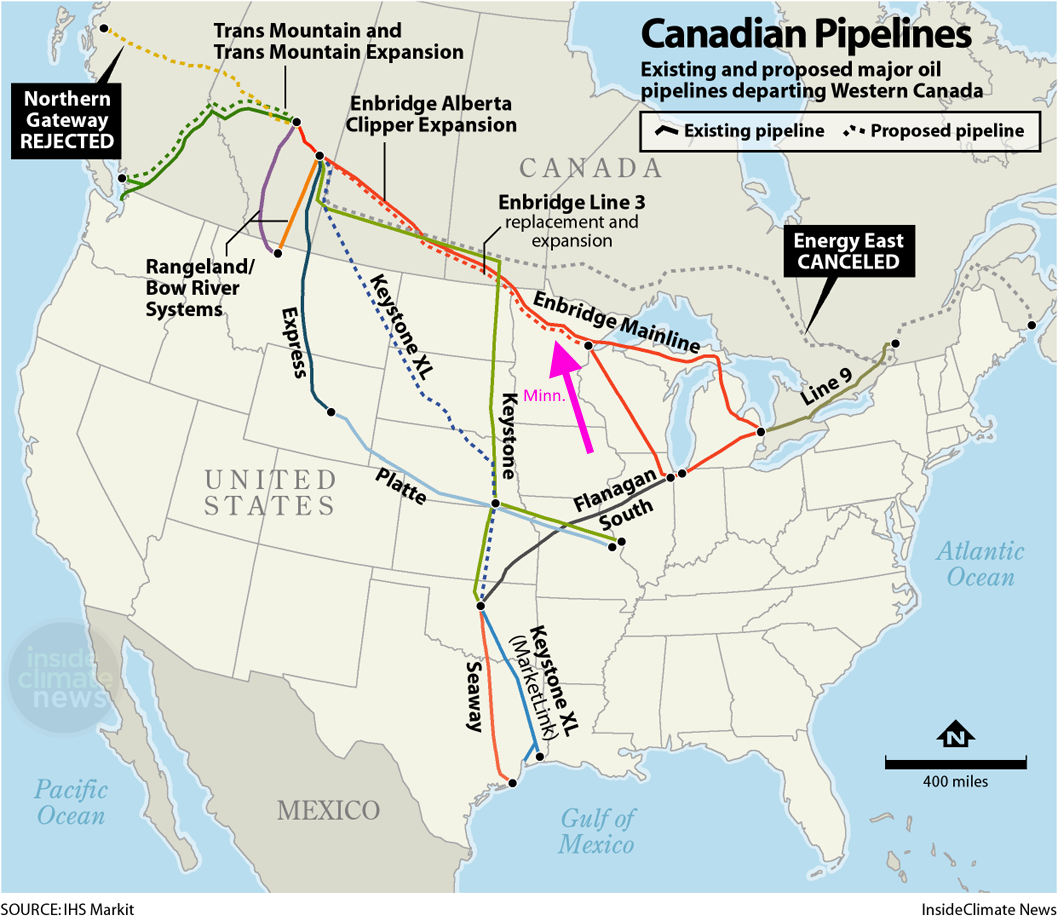

Es ist mMn wichtig zu verstehen, daß dieses Projekt ein (größerer) Ersatz für die Bestandslinie 3 ist (oben rein schwarz).

Die alte Linie, die noch durch das Leech Lake Indian Reservation durchführt, wird anschließend stillgelegt: https://en.wikipedia.org/wiki/Leech_Lake_Indian_Reservation

Und dann kann man davon ausgehen: keine Pipeline mehr, kein/weniger Geld

Man könnte daher auch mal nach Eingeborenen suchen gehen, die auch gegen das Projekt sind, aber eben aus ganz anderen Gründen.

Zitat von faultcode: 12.11.

Minnesota regulators approve permits for Enbridge's Line 3 oil pipeline project

...

Line 3 durch Minnesota ist derzeit so ein bischen wie die A49 durch den Dannenröder Forst

https://mn.gov/puc/line3/

--> https://www.stopline3.org/#intro

...

...

die 3 hellgrünen Flächen gehören zu den 3 Vertragsflächen aus dem 19. Jahrhundert, sind also auch mit Vorsicht zu genießen.

allerdings ist der Protest - großes Land - im Vergleich zu dem in Hessen als eher gering einzuschätzen:

https://twitter.com/zhaabowekwe

<das ist jemand anders, nicht Tara Houska, Ojibwe native>

Derzeit um die 0°C. Es wird aber mit Sicherheit noch kälter. Den Eingeborenen nehme ich das sofort ab; aber den weißen Milchgesichtern aus Minneapolis-Saint Paul nicht unbedingt

Es ist mMn wichtig zu verstehen, daß dieses Projekt ein (größerer) Ersatz für die Bestandslinie 3 ist (oben rein schwarz).

Die alte Linie, die noch durch das Leech Lake Indian Reservation durchführt, wird anschließend stillgelegt: https://en.wikipedia.org/wiki/Leech_Lake_Indian_Reservation

Und dann kann man davon ausgehen: keine Pipeline mehr, kein/weniger Geld

Man könnte daher auch mal nach Eingeborenen suchen gehen, die auch gegen das Projekt sind, aber eben aus ganz anderen Gründen.

Enbridge Gas to blend hydrogen with natural gas for consumers in Markham

https://www.jwnenergy.com/article/2020/11/19/enbridge-gas-to…

https://www.jwnenergy.com/article/2020/11/19/enbridge-gas-to…

12.11.

Minnesota regulators approve permits for Enbridge's Line 3 oil pipeline project

https://www.reuters.com/article/oil-global-enbridge-inc/upda…

...

Minnesota regulators on Thursday approved key permits for Enbridge Inc's ENB.TO Line 3 crude pipeline replacement project, paving the way for federal permits from the U.S. Army Corps of Engineers after years of delays.

The Minnesota Pollution Control Agency (MPCA) announced approvals for the Line 3 project, including the contested 401 Water Quality Certification, and the Minnesota Department of Natural Resources released the final eight permits for the project.

Line 3, built in the 1960s, ships crude from a Canadian oil hub in Edmonton, Alberta, to U.S. Midwest refiners. It currently carries less oil than it was designed for because of age and corrosion. Replacing it would allow Calgary-based Enbridge to roughly double its capacity to 760,000 barrels per day.

The project still needs final permits and authorizations before construction can begin. The Canadian portion is complete, but Enbridge has run into repeated obstacles in Minnesota, where reviews have lasted about five years.

“With the 401 permit in hand, the next major step would be the receipt of the federal 404 permit, which could happen in the next few weeks,” Scotiabank analysts said in a note.

“Absent any successful legal challenges/injunctions, we believe the project is well positioned to start construction in the new year.”

Environmental groups challenged the draft water permits for the pipeline’s construction, which were approved by MPCA in February.

A shortage of pipelines has weighed on Canadian oil prices and pushed it to trade at deep discounts compared with benchmark futures in recent years, but capacity became ample this year after steep oil production cuts during the COVID-19 pandemic.

Canadian oil traders said the news was bullish for crude differentials.

“This is a good thing for sure. Finally ... it’s taken years to get permits and approvals,” one trader said.

___

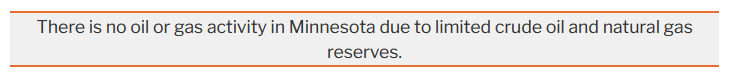

Warum (immer) in Minnesota?

--> ganz einfach:

https://ballotpedia.org/Oil_and_gas_production_in_Minnesota

https://insideclimatenews.org/news/06062019/tar-sands-oil-pi…

Minnesota regulators approve permits for Enbridge's Line 3 oil pipeline project

https://www.reuters.com/article/oil-global-enbridge-inc/upda…

...

Minnesota regulators on Thursday approved key permits for Enbridge Inc's ENB.TO Line 3 crude pipeline replacement project, paving the way for federal permits from the U.S. Army Corps of Engineers after years of delays.

The Minnesota Pollution Control Agency (MPCA) announced approvals for the Line 3 project, including the contested 401 Water Quality Certification, and the Minnesota Department of Natural Resources released the final eight permits for the project.

Line 3, built in the 1960s, ships crude from a Canadian oil hub in Edmonton, Alberta, to U.S. Midwest refiners. It currently carries less oil than it was designed for because of age and corrosion. Replacing it would allow Calgary-based Enbridge to roughly double its capacity to 760,000 barrels per day.

The project still needs final permits and authorizations before construction can begin. The Canadian portion is complete, but Enbridge has run into repeated obstacles in Minnesota, where reviews have lasted about five years.

“With the 401 permit in hand, the next major step would be the receipt of the federal 404 permit, which could happen in the next few weeks,” Scotiabank analysts said in a note.

“Absent any successful legal challenges/injunctions, we believe the project is well positioned to start construction in the new year.”

Environmental groups challenged the draft water permits for the pipeline’s construction, which were approved by MPCA in February.

A shortage of pipelines has weighed on Canadian oil prices and pushed it to trade at deep discounts compared with benchmark futures in recent years, but capacity became ample this year after steep oil production cuts during the COVID-19 pandemic.

Canadian oil traders said the news was bullish for crude differentials.

“This is a good thing for sure. Finally ... it’s taken years to get permits and approvals,” one trader said.

___

Warum (immer) in Minnesota?

--> ganz einfach:

https://ballotpedia.org/Oil_and_gas_production_in_Minnesota

https://insideclimatenews.org/news/06062019/tar-sands-oil-pi…