McEwen Mining (Seite 105)

eröffnet am 29.01.12 19:26:51 von

neuester Beitrag 17.04.24 18:58:02 von

neuester Beitrag 17.04.24 18:58:02 von

Beiträge: 1.903

ID: 1.172.023

ID: 1.172.023

Aufrufe heute: 0

Gesamt: 235.726

Gesamt: 235.726

Aktive User: 0

ISIN: US58039P3055 · WKN: A3DMEX · Symbol: MUX

12,180

USD

+0,74 %

+0,090 USD

Letzter Kurs 08.05.24 NYSE

Neuigkeiten

18.03.24 · Stephan Bogner Anzeige |

14.12.23 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8000 | +11,11 | |

| 0,8100 | +11,11 | |

| 2,0800 | +10,05 | |

| 10,770 | +9,50 | |

| 200,00 | +8,11 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,520 | -12,33 | |

| 0,9860 | -12,74 | |

| 0,6000 | -18,37 | |

| 0,6601 | -26,22 | |

| 46,43 | -98,01 |

Beitrag zu dieser Diskussion schreiben

McEwen Mining wird auch hier bald zur Goldförderung kommen.

McEwen Mining Announces Positive Feasibility Study for Gold Bar Project, NevadaGlobe Newswire

October 21, 2015 6:41am Comments

TORONTO, Oct. 21, 2015 (GLOBE NEWSWIRE) -- McEwen Mining Inc.

MUX 3.1%

(TSX:MUX) ("McEwen Mining" or the "Company") is pleased to announce results of a Feasibility Study (FS) for its 100% owned Gold Bar Project in Nevada. The key outcomes of the study include: Low initial capital of $60 million; Attractive IRR of 20% at current gold price; Average annual gold production of 65,000 oz; and Estimated average cash cost of $728/oz. The FS was prepared by SRK Consulting Inc. (SRK) of Reno, Nevada in accordance with the requirements of Canadian National Instrument 43-101 "Standards of Disclosure for Mineral Projects" ("NI 43-101").

"Completion of this Feasibility Study is an important milestone. I believe Gold Bar will be the next mine we put into production. It includes the fundamental elements we consider important to investors when building a mine: Low capital and operating costs, and a reasonable rate of return in the current price environment. We can now move ahead with a high degree of confidence in the capital estimate and projected operating performance," said Rob McEwen, Chairman and Chief Owner.

Read more: http://www.benzinga.com/pressreleases/15/10/g5930972/mcewen-…

Ist McEwen Mining wieder auf den Weg zu alten Höhen ?

Has McEwen Mining Finally Turned The Corner?Oct. 14, 2015 11:06 PM ET | 2 comments | About: McEwen Mining Inc. (MUX)

Summary

McEwen Mining has underperformed its peers considerably over the past few years.

This could soon change, as McEwen appears to have gotten its cash costs under control and has improved its balance sheet.

The company also announced a share buyback program recently, which is a surprising, yet wise, move.

I feel gold bulls should consider buying McEwen here.

McEwen Mining

(click to enlarge)

Shares of McEwen Mining (NYSE:MUX) have fallen 44.27% year to date, trailing the benchmark gold miners index (NYSEARCA:GDX). However, the stock is up 23% over the past month, and may outperform the index going forward. (Credit: Yahoo Finance)

Recent Stock Price: $.9975

Shares Outstanding: 274.25 million

Market Cap: $300.65 million

52-Week Range: $.65-1.84

McEwen Mining is a junior gold miner that is on the verge of a turnaround.

While it has underperformed the GDX this year and for most of the past few years, the company appears to have turned a corner recently, as it announced solid Q2 financial results and also increased its production guidance for 2015.

First, I'll give a summary of McEwen's assets, an overview of financial and production results, and then why I feel the shares look like a good buy here.

McEwen Mining Overview

McEwen owns and operates two producing mines: the 49%-owned San Jose gold and silver mine in the Santa Cruz province of Argentina and the 100%-owned El Gallo mine in Sinaloa State, Mexico.

San Jose produced 94,161 gold ounces and 6.5 million silver ounces in 2014 (180,000 gold equivalent ounces estimated for 2015), while the El Gallo mine produced 38,212 ounces of gold and 25,912 ounces of silver (62,000 gold ounces estimated for 2015).

However, the company also owns several exciting development projects, including the 100%-owned El Gallo 2 silver project, which would produce 5 million ounces of the metal annually, the 100%-owned gold bar project in Nevada, which would produce 50,000 ounces of gold annually, and the 100%-owned Los Azules copper project in Argentina, which contains 19.7 billion pounds of copper.

Readers should also know that McEwen's CEO owns 25% of the company and takes zero salary or bonuses, which aligns his interests with shareholders.

Why Have Shares Underperformed?

McEwen shares have not outperformed the GDX over the past year, as mentioned above. This can be blamed mostly on falling gold and silver prices, which has hurt nearly every gold and silver miner on the planet.

However, I believe McEwen's losses were larger than other companies due to the company's small size and higher cash costs at its San Jose Mine.

As writer Hebba Investments pointed out in his March 30 article, McEwen was one of the highest-cost producers in 2014, with the company's core non-tax costs (costs excluding taxes) at $1441 per gold-equivalent ounce.

(Credit: McEwen Mining Corporate Presentation)

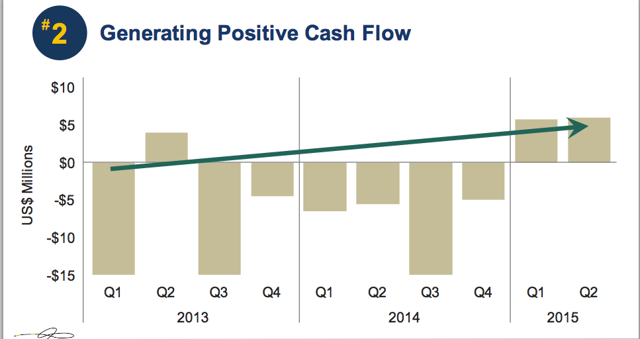

However, the company has staged a major turnaround so far in 2015. In the first two quarters, McEwen generated positive cash flow from operations due to lower cash costs.

In Q1 2015, McEwen reported all-in sustaining costs of $948 per ounce, a major improvement over the $1,100 figure reported a year earlier. That led to operating cash flow of $5.6 million. Consolidated net income was $6 million, or $0.02 per share, for Q1 2015. In Q2 2015, the company reported slightly higher AISC of $1,048, but also reported operating cash flow of $6 million and adjusted net income of $1.8 million.

(Credit: McEwen Mining Corporate Presentation)

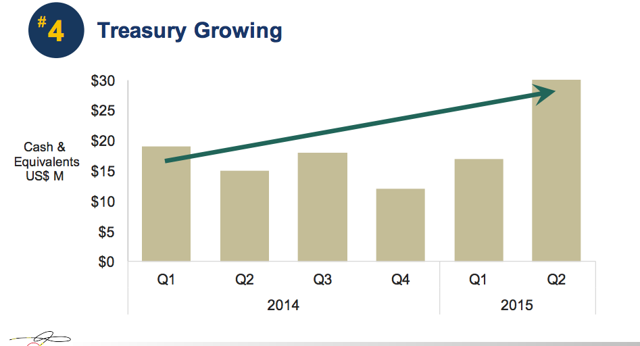

As for the balance sheet, it's definitely improving: McEwen ended Q2 2015 with $28.9 million in cash and equivalents and just $5.8 million debt. This is well above the company's Q4 2014 treasury of $12 million in cash and equivalents, and above its Q1 2014 total of $19 million.

Stock Repurchase Program

McEwen also recently announced a stock repurchase program that allows the company to purchase up to 15 million shares of its common stock over a 12-month period. The only other gold company that I can think of that has implemented a stock repurchase program is Silver Wheaton (NYSE:SLW) and Sandstorm Gold (NYSEMKT:SAND), both streaming companies and not actual gold miners like McEwen.

According to the release:

"Management and the Board of Directors believe that prevailing market conditions have resulted in McEwen Mining's shares being undervalued, and the stock repurchase program is an opportunity to minimize the adverse effects of market volatility and recapture value for shareholders. The repurchase plan is indicative of McEwen Mining's commitment to enhancing shareholder value."

However, the board of directors has also determined that a maximum of $15 million can be spent on the share repurchases, which means that if McEwen's share price continues to rise, the buyback amount could be much lower than 15 million shares.

In my opinion, this is a pretty smart move by the company, as it can only repurchase its own shares when it feels it is the right time. For example, if McEwen's stock were to fall back to $.60-.70, it'd be a much better time to repurchase stock than at the current price of $1 per share.

The Bottom Line

McEwen has gotten its cash costs under control and is generating positive cash flow from operations. The balance sheet has improved, and the share repurchase program is a wise move, as the company can buy its own shares on any dips. Investors who are bullish on gold should consider McEwen here, as the stock has big upside potential, in my opinion.

http://seekingalpha.com/article/3573186-has-mcewen-mining-fi…

Klingt alles ganz interessant. Im Chart kann man auch eine Bodenbildung momentan erkennen. Ich denke hier kann man auf einen ordentlichen Rebound spekulieren bei den Nachrichten (Aktienrückkauf etc.).

http://www.americantradejournal.com/zacks-short-term-rating-…

Zacks Short Term Rating on McEwen Mining Inc. (NYSE:MUX)

Oct 8, 2015

Analysts at Zacks have given a short term rating of hold on McEwen Mining Inc. (NYSE:MUX) with a rank of 3. The company has received an average rating of 1 from 1 brokerage firms. 1 analysts have rated the company as a strong buy.

McEwen Mining Inc. is up 16.79% in the last 3-month period. Year-to-Date the stock performance stands at -13.61%. Shares of McEwen Mining Inc. rose by 8.86% in the last five trading days and 12.72% for the last 4 weeks.

Several financial analysts have commented on the company rating. H.C. Wainwright assumes its view on McEwen Mining Inc. (NYSE:MUX) according to the research report released by the firm to its investors. The shares have now been rated Buy by the stock experts at the ratings house. H.C. Wainwright announces the current price target of $1.3 per share on McEwen Mining Inc.. The rating by the firm was issued on June 29, 2015.

McEwen Mining Inc. (NYSE:MUX) : On Wednesday heightened volatility was witnessed in McEwen Mining Inc. (NYSE:MUX) which led to swings in the share price. The shares opened for trading at $0.9301 and hit $0.9654 on the upside , eventually ending the session at $0.9525, with a gain of 4.66% or 0.0424 points. The heightened volatility saw the trading volume jump to 798,504 shares. The 52-week high of the share price is $1.94 and the company has a market cap of $286 million. The 52-week low of the share price is at $0.65 .

The company shares have dropped -44.38% from its 1 Year high price. On Oct 9, 2014, the shares registered one year high at $1.94 and the one year low was seen on Jul 24, 2015. The 50-Day Moving Average price is $0.87 and the 200 Day Moving Average price is recorded at $0.92.

Zacks Short Term Rating on McEwen Mining Inc. (NYSE:MUX)

Oct 8, 2015

Analysts at Zacks have given a short term rating of hold on McEwen Mining Inc. (NYSE:MUX) with a rank of 3. The company has received an average rating of 1 from 1 brokerage firms. 1 analysts have rated the company as a strong buy.

McEwen Mining Inc. is up 16.79% in the last 3-month period. Year-to-Date the stock performance stands at -13.61%. Shares of McEwen Mining Inc. rose by 8.86% in the last five trading days and 12.72% for the last 4 weeks.

Several financial analysts have commented on the company rating. H.C. Wainwright assumes its view on McEwen Mining Inc. (NYSE:MUX) according to the research report released by the firm to its investors. The shares have now been rated Buy by the stock experts at the ratings house. H.C. Wainwright announces the current price target of $1.3 per share on McEwen Mining Inc.. The rating by the firm was issued on June 29, 2015.

McEwen Mining Inc. (NYSE:MUX) : On Wednesday heightened volatility was witnessed in McEwen Mining Inc. (NYSE:MUX) which led to swings in the share price. The shares opened for trading at $0.9301 and hit $0.9654 on the upside , eventually ending the session at $0.9525, with a gain of 4.66% or 0.0424 points. The heightened volatility saw the trading volume jump to 798,504 shares. The 52-week high of the share price is $1.94 and the company has a market cap of $286 million. The 52-week low of the share price is at $0.65 .

The company shares have dropped -44.38% from its 1 Year high price. On Oct 9, 2014, the shares registered one year high at $1.94 and the one year low was seen on Jul 24, 2015. The 50-Day Moving Average price is $0.87 and the 200 Day Moving Average price is recorded at $0.92.

Am Anfang der abgelaufenen Woche stieg der Kurs in den USA nur um 1,08 % . . .

. . . . aber jetzt zum ochenschluß steht er fast auf 1 US $. Ich gehe davon aus, das es bald wieder über den 1 US $ und auch über den 1 € gehen wird. Company Shares of McEwen Mining Inc. (NYSE:MUX) Rally 1.08%

Shares of McEwen Mining Inc. (NYSE:MUX) rose by 1.08% in the past week and 11.98% for the last 4 weeks. In the past week, the shares have outperformed the S&P 500 by 0.04% and the outperformance increases to 10.25% for the last 4 weeks.

McEwen Mining Inc. (NYSE:MUX) : On Friday heightened volatility was witnessed in McEwen Mining Inc. (NYSE:MUX) which led to swings in the share price. The shares opened for trading at $0.9 and hit $0.9608 on the upside , eventually ending the session at $0.935, with a gain of 8.72% or 0.075 points. The heightened volatility saw the trading volume jump to 869,766 shares. The 52-week high of the share price is $1.94 and the company has a market cap of $281 million. The 52-week low of the share price is at $0.65 .

The company shares have dropped 49.18% in the past 52 Weeks. On October 9, 2014 The shares registered one year high of $1.94 and one year low was seen on July 24, 2015 at $0.65. The 50-day moving average is $0.87 and the 200 day moving average is recorded at $0.92. S&P 500 has rallied 0.84% during the last 52-weeks.

On a different note, The Company has disclosed insider buying and selling activities to the Securities Exchange, Mcewen Robert Ross, CEO of Mcewen Mining Inc., executed a transaction worth $98,407 on September 16, 2015. A total of 108,140 shares were purchased at an average price of $0.91. The Insider information was divulged by the Securities and Exchange Commission in a Form 4 filing. The information is based on open market trades at the market prices.Option exercises are not covered. Currently the company Insiders own 0.6% of McEwen Mining Inc. Company shares. In the past six months, there is a change of 6.79% in the total insider ownership. Institutional Investors own 20.9% of Company shares. During last 3 month period, -1.75% of total institutional ownership has changed in the company shares. McEwen Mining Inc. has dropped 0.08% during the last 3-month period . Year-to-Date the stock performance stands at -15.2%.

McEwen Mining Inc. (McEwen Mining), formerly US Gold Corporation, is engaged in the exploration for and production of precious metals in the United States, Mexico and Argentina. McEwen Minings operating segments include USA and Mexico. The Company holds an interest in numerous exploration and development stage properties and projects in Nevada, Mexico and Argentina, as well as a 49% equity interest in the gold-silver San Jose Mine in Santa Cruz Province, Argentina. The Company holds interests in approximately 1,631 square miles of mineral concessions in west central Mexico. Its primary property in Mexico is the El Gallo Complex, located in Sinaloa state on the Sierra Madre Trend, a geological area of gold and silver mineralization. The Company holds interests in approximately 254 square miles in Nevada, United States. On January 24, 2012, it acquired of Minera Andes Inc. (Minera Andes).

http://www.insidertradingreport.org/company-shares-of-mcewen…

Beide herausgegebenen News werden schon in vielen Medien veröffentlicht.

Wie hier z.B. bei Kitco News. McEwen Mining Undertaking Stock Repurchase Program; CFO To Step Down

Friday October 02, 2015 09:35

McEwen Mining Inc. (NYSE, TSX: MUX) says it intends to begin a share repurchase program that authorizes the company to buy up to 15 million shares of its common stock over a 12-month period. “Management and the board of directors believe that prevailing market conditions have resulted in McEwen Mining's shares being undervalued, and the stock repurchase program is an opportunity to minimize the adverse effects of market volatility and recapture value for shareholders,” the company says in its news release.

“The repurchase plan is indicative of McEwen Mining's commitment to enhancing shareholder value.” The board authorized a maximum of $15 million that can be spent on repurchases.

The company also announces the resignation of Perry Ing, vice president and chief financial officer, effective Oct. 30.

The company is considering candidates to succeed him. "We wish to thank Perry for his significant contribution our growth from an exploration company to a 150,000-ounce gold-equivalent producer, and wish him well in his new endeavor," says Rob McEwen, chairman and chief owner.

By Allen Sykora of Kitco News; asykora@kitco.com

http://www.kitco.com/news/2015-10-02/McEwen-Mining-Undertaki…

Aber auch das ist neu, Pery Ing, Vize Präsident bei McEwen Mining ist bzw. . . .

. . . . . wird das Unternehmen definitiv verlassen. Das ist nach Ian Ball bereits der 2. hochrangige Manager der aus der Firma ausscheidet. Was ist da Lo ?Verfügt das Unternehemen nicht mehr über das Geld um diese Leute zu bezahlen und kauft dafür die Aktien zurück ?

Wenn es dem Kurs helfen sollte ist es schon in Ordnung.

Marketwired·

McEwen Mining Announces Management Change

TORONTO, ONTARIO -- (Marketwired) -- 10/01/15 -- McEwen Mining Inc. (NYSE: MUX)(TSX: MUX) today announces that Perry Ing, VP & CFO, will be resigning on October 30, 2015. Internal and external candidates for this role are currently being considered. "We wish to thank Perry for his significant contribution our growth from an exploration company to a 150,000 ounce gold equivalent producer, and wish him well in his new endeavor," said Rob McEwen, Chairman & Chief Owner.

ABOUT MCEWEN MINING (www.mcewenmining.com)

Trotz der angekündigten Massnahme, dass das Unternehmen innerhalb der . . . .

. . . . nächsten 12 Monate bis zu 15 Mill eigene Aktien zurück kaufen werden, steigt der Kurs nur marginal. Vielleicht ändert sich das ja, wenn der Rückkauf beginnt ?

McEwen Mining announces 15M share repurchase plan

McEwen Mining is pleased to announce its intention to commence a share repurchase program that authorizes the company to purchase up to 15M shares of its common stock over a twelve month period. This news was first reported by TheFlyonTheWall.com, one of the best unbiased market intelligence and live stock news services. The stock decreased 1.68% or $0.015 on October 1, hitting $0.86. MUX has declined 23.89% since February 27, 2015 and is downtrending. It has underperformed by 15.31% the S&P500.

http://www.financialbio.com/stock-news-f/this-coule-be-mcewe…

Diese Leute wissen mehr, ob dass der Grund ist das sie weiter so dick einsteigen ?

Insider Buying: McEwen Mining major shareholder Acquires 91,860 Shares of Stock (MUX)September 17th, 2015 - 0 comments - Filed Under - by Thomas Dobrow

McEwen Mining (NYSE:MUX) major shareholder 2190303 Ontario Inc. acquired 91,860 shares of the business’s stock in a transaction dated Monday, September 14th. The shares were bought at an average price of $0.86 per share, with a total value of $78,999.60. Following the transaction, the insider now directly owns 72,880,494 shares in the company, valued at approximately $62,677,224.84.

The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Large shareholders that own 10% or more of a company’s stock are required to disclose their transactions with the SEC.

Shares of McEwen Mining (NYSE:MUX) opened at 0.91 on Thursday. The company’s market capitalization is $273.48 million. McEwen Mining has a 12-month low of $0.65 and a 12-month high of $2.43. The firm’s 50-day moving average is $0.82 and its 200-day moving average is $0.93.

Separately, HC Wainwright began coverage on shares of McEwen Mining in a report on Monday, June 29th. They set a “buy” rating and a $1.30 price target for the company.

McEwen Mining Inc. is a mining and minerals exploration company. The Company is focused on precious and base metals in Argentina, Mexico and the United States. Its operating segments include Argentina, Mexico and the United States. It has a land position consisting of mining claims, leases of mining claims or concessions of around 814 square miles in Argentina, 697 square miles in Mexico and 241 square miles in Nevada.

http://www.dakotafinancialnews.com/insider-buying-mcewen-min…