McEwen Mining (Seite 88)

eröffnet am 29.01.12 19:26:51 von

neuester Beitrag 09.05.24 20:20:02 von

neuester Beitrag 09.05.24 20:20:02 von

Beiträge: 1.905

ID: 1.172.023

ID: 1.172.023

Aufrufe heute: 29

Gesamt: 235.992

Gesamt: 235.992

Aktive User: 0

ISIN: US58039P3055 · WKN: A3DMEX · Symbol: MUX

10,320

USD

-15,27 %

-1,860 USD

Letzter Kurs 01:00:00 NYSE

Neuigkeiten

18.03.24 · Stephan Bogner Anzeige |

14.12.23 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,3300 | +21,53 | |

| 0,8488 | +17,61 | |

| 4,6900 | +15,52 | |

| 1,4340 | +14,35 | |

| 65,12 | +14,25 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,3300 | -14,17 | |

| 10,320 | -15,27 | |

| 7,8100 | -15,93 | |

| 0,6601 | -26,22 | |

| 46,34 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Zacks estimated an EPS of $1 for McEwen Mining Inc. (NYSE:MUX)

By Koko Saunders -

February 13, 2017 38

Unten habe ich einen Auszug aus der heutigen News von der Newspaper: topchronicle.com zur Info eingestellt.

Danach hat der Direktor von Lexam, Richard W. Brissenden - Director

Mr. Brissenden is a Chartered Professional Accountant (Ontario) (Diesen Texthabe ich von der Management-Seite bei Lexam genommen und hier eingestellt) bereits im Dezember 2016 Aktien von McEwen Mining gekauft.

https://topchronicle.com/zacks-estimated-an-eps-of-1-for-mce…

The latest Insider trade was made on 14 Dec 2016 where Brissenden (Richard William) Director did a transaction type “Sell” in which 5000 shares were traded at a price of $2.75. Another insider trade includes Director Brissenden (Richard William) who also initiated a transaction in which 25000 shares were traded on 13 Dec 2016 as “Buy”.

By Koko Saunders -

February 13, 2017 38

Unten habe ich einen Auszug aus der heutigen News von der Newspaper: topchronicle.com zur Info eingestellt.

Danach hat der Direktor von Lexam, Richard W. Brissenden - Director

Mr. Brissenden is a Chartered Professional Accountant (Ontario) (Diesen Texthabe ich von der Management-Seite bei Lexam genommen und hier eingestellt) bereits im Dezember 2016 Aktien von McEwen Mining gekauft.

https://topchronicle.com/zacks-estimated-an-eps-of-1-for-mce…

The latest Insider trade was made on 14 Dec 2016 where Brissenden (Richard William) Director did a transaction type “Sell” in which 5000 shares were traded at a price of $2.75. Another insider trade includes Director Brissenden (Richard William) who also initiated a transaction in which 25000 shares were traded on 13 Dec 2016 as “Buy”.

Der Kurs gibt nicht nach. Das ist sehr positiv zu werten. Sonst wurde der Übernehmende erstmal abgestraft.

Antwort auf Beitrag Nr.: 54.306.980 von cervical am 13.02.17 14:20:00Man beachte das Logo von Lexam Gold

http://www.lexamvggold.com/index.php

Chairman von Lexam ist niemand geringerer als Rob McEwen der nicht weniger als 27% des Unternehmens hält... Habe ich da was verpasst???

Auf jedenfall wird so der Deal zu einem für beide Seiten fairen Preis abgewickelt, so hoffe ich. Der Preis kommt rechnerisch auf rund CAD 0.31 was unter dem letzten Hoch von Lexam liegt.

Ohne tiefer zu graben würde ich vom Schiff aus sagen: Daumen hoch (nur meine Meinung).

http://www.lexamvggold.com/index.php

Chairman von Lexam ist niemand geringerer als Rob McEwen der nicht weniger als 27% des Unternehmens hält... Habe ich da was verpasst???

Auf jedenfall wird so der Deal zu einem für beide Seiten fairen Preis abgewickelt, so hoffe ich. Der Preis kommt rechnerisch auf rund CAD 0.31 was unter dem letzten Hoch von Lexam liegt.

Ohne tiefer zu graben würde ich vom Schiff aus sagen: Daumen hoch (nur meine Meinung).

McEwen: Freundliche Übernahme von Lexam VG Gold

McEwen Mining Inc. und Lexam VG Gold Inc. meldeten soeben eine Vereinbarung, wonach McEwen sämtliche ausgegebenen und ausstehenden Wertpapiere von Lexam übernehmen wird. Lexam würde bei Zustandekommen der Transaktion zu einem zu 100% eigenen Tochterunternehmen von McEwen werden. Gemäß Vereinbarung würden die Aktionäre von Lexam, sofern sie der Übernahme zustimmen, pro Lexam-Stammaktie 0,056 einer McEwen-Aktie erhalten.

MinenPortal

Why McEwen Mining Inc. Stock Rallied 21% in January

Why McEwen Mining Inc. Stock Rallied 21% in JanuaryGold and silver miner McEwen Mining benefited from a precious-metals rally and solid production results in January

Reuben Gregg Brewer

(TMFReubenGBrewer)

Feb 7, 2017 at 9:05AM

What happened

Shares of McEwen Mining Inc. (NYSE:MUX) moved 21% higher last month. That follows a gain of nearly 175% in 2016. However, January's gain represents something of a performance reversal. Indeed, investors watched McEwen stock rally more than 325% by mid-2016 only to see those gains fall away through the second half. With one month down in 2017, commodity prices are again pushing the stock higher.

So what

Gold prices rose around 5% last month, with silver advancing a bit more, at nearly 8%. That was a clear positive for McEwen's stock price. Although precious-metals prices are likely to have an outsize impact on the miner's share price, there was more going on than just a silver and gold move last month.

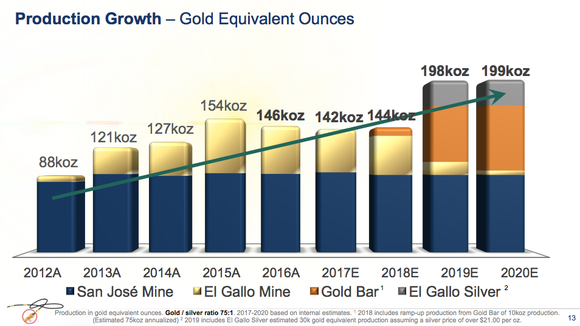

For example, on Jan. 16, McEwen announced that it produced roughly 145,500 gold equivalent ounces in 2016. That metric puts gold and silver production on equal footing, and it also beat the company's internal production forecast of 144,000 ounces. So the company was able to exceed a key guidance target, which is a clear positive.

However, that release also noted that during the year, McEwen doubled its liquid assets -- made up of cash, marketable securities, and precious metals -- to $64 million. And it continues to have no debt on the balance sheet. In other words, it's in pristine financial health, with cash to invest back into two development projects it's working on -- Gold Bar and El Gallo Silver.

[

Now what

McEwen is a small precious-metals miner, but it's financially solid and successfully meeting the public goals it sets for itself. More important, it's benefiting from rising precious-metals prices at a point when it's working on the key growth projects that will underpin its future. There's a lot to like about McEwen from a fundamental point of view. Still, gold and silver prices will continue have an outsize impact on performance. Just don't let that distract you from the work being done to build a foundation for the future.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

----------------

Hier ist ein Überblick über die Investoren die sich in den letzten Monaten 2016 an McEwen Mining . . .

. . . . teilweise richtig "dick" eingekauft haben. Das bedeuted für mich McEwen Mining ist zu diesen Preisen immer noch ein Schnäppchen.

The McEwen Mining Inc. (MUX) Position Boosted by Oppenheimer & Close LLC

February 2, 2017 Jamie Williams

The McEwen Mining Inc. (MUX) Position Boosted by Oppenheimer & Close LLC

Oppenheimer & Close LLC increased its stake in McEwen Mining Inc. (NYSE:MUX) (TSE:MUX) by 0.9% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 533,500 shares of the company’s stock after buying an additional 5,000 shares during the period. McEwen Mining comprises 1.9% of Oppenheimer & Close LLC’s holdings, making the stock its 14th largest position. Oppenheimer & Close LLC’s holdings in McEwen Mining were worth $1,957,000 as of its most recent filing with the SEC.

Other institutional investors also recently added to or reduced their stakes in the company. Bank of Montreal Can raised its position in McEwen Mining by 18.5% in the third quarter. Bank of Montreal Can now owns 1,477,015 shares of the company’s stock valued at $5,421,000 after buying an additional 230,246 shares during the period. Alps Advisors Inc. bought a new position in McEwen Mining during the third quarter valued at approximately $4,629,000. Teacher Retirement System of Texas raised its position in McEwen Mining by 16.4% in the second quarter.

Teacher Retirement System of Texas now owns 31,850 shares of the company’s stock valued at $123,000 after buying an additional 4,483 shares during the period. Sprott Inc. bought a new position in McEwen Mining during the third quarter valued at approximately $2,576,000. Finally, Spot Trading L.L.C raised its position in McEwen Mining by 104.3% in the second quarter. Spot Trading L.L.C now owns 35,552 shares of the company’s stock valued at $137,000 after buying an additional 18,152 shares during the period. 33.68% of the stock is currently owned by hedge funds and other institutional investors.

McEwen Mining Inc. (NYSE:MUX) opened at 3.85 on Tuesday. The firm has a market capitalization of $1.15 billion and a price-to-earnings ratio of 110.00. The firm has a 50 day moving average price of $3.38 and a 200-day moving average price of $3.57. McEwen Mining Inc. has a 12 month low of $1.30 and a 12 month high of $4.92.

McEwen Mining (NYSE:MUX) last announced its quarterly earnings data on Thursday, November 3rd. The company reported $0.01 earnings per share (EPS) for the quarter. McEwen Mining had a return on equity of 3.36% and a net margin of 17.41%. On average, equities analysts forecast that McEwen Mining Inc. will post $0.10 EPS for the current year.

The firm also recently disclosed a semiannual dividend, which will be paid on Tuesday, February 14th. Investors of record on Friday, February 3rd will be paid a $0.005 dividend. This represents a yield of 0.26%. The ex-dividend date of this dividend is Wednesday, February 1st. McEwen Mining’s dividend payout ratio is currently 33.34%.

Separately, Zacks Investment Research lowered McEwen Mining from a “buy” rating to a “hold” rating in a research report on Thursday, October 6th.

http://dailyquint.com/2017-02-02-mcewen-mining-inc-mux-posit…

McEwen Mining Shines Bright

Feb. 1, 2017 8:58 AM ET|

5 comments|

Summary

CEO knows how to make money for shareholders.

Currencies are being devalued across the globe.

San Jose mine spins off $13 million in dividends.

Rob McEwen is not your typical CEO. After a highly successful tenure as founder of Goldcorp (NYSE:GG), he launched McEwen mining (NYSE:MUX) and is banking on a robust stock price move, since he commands a paltry salary of only $1 per year.

Mr. McEwen wants his management decisions to align with his stockholders as he owns a substantial 25% of McEwen stock. With 300 million shares outstanding and the stock trading just shy of $4.00 per share, this is a $1.23 billion company.

Argentina has dramatically improved the financial fortunes of the company's 49% owned San Jose mine, by cutting onerous taxes that had driven miners out of their country. 51% owner Hochschild mining has delivered $13 million in dividends to McEwen Mining- through the first 3 quarters of 2016, with expectations of more to come. Hochschild has been cutting mining costs and the lifting of capital controls by Argentina President Macri has allowed the free market to properly devalue the peso currency. Mining costs have plunged alongside the weaker peso and new investment and exploration should lead to an expansion of gold and silver production.

The great Fidelity Magellan Fund Manager Peter Lynch stated that small company stocks make big price moves and large companies tend to make smaller moves. This fact is very applicable to the mining industry for those small companies that have strong balance sheets. McEwen Mining holds $62 million in cash, precious metals, and liquid securities and 0 debt through September 2016.

The 100% owned El Gallo mine in Mexico is also seeing a sharp decline of all in cash costs to $680 per ounce of gold equivalent (gold and silver converted to gold). The Mexican peso has devalued sharply and mining production costs have fallen accordingly. Gold price is hovering around $1,200 per ounce, but McEwen sees a potential high price of $5,000 in the next few years. Silver price has risen from an average of $14.86 in early 2016 to $17.50 per ounce amid continued reports of strong physical demand from both investors and industry.

McEwen is looking to propel the company into the S&P 500 stock index, through additional acquisitions or mergers. The deal has to be "good" for his stockholders as he is the largest one. One of the requirements of the S&P 500 is that the company must be based in the United States, and McEwen Mining was incorporated in Colorado. There is only one miner currently listed in the index, so the next miner to join-will experience some heavy share purchases and the stock price will jump higher.

Fiat paper money currency continues to be devalued as the central banks seem to believe that printing more paper currency will remedy weak economic conditions. There are huge debt problems in the United States and China, and paper currency inflation is only creating havoc across economic markets everywhere. India has confiscated paper money and China continues to attempt to control capital outflow. Venezuela is experiencing crippling inflation of 122% in 2015 and 546% in 2016 (CIA report) and the United States is vastly understating inflation when it excludes the crushing rise in healthcare costs from the failed Affordable Care Act. As citizens experience loss of paper currency purchasing power, they will continue to purchase hard assets, including silver and gold. China and Russia central banks continue to purchase gold, possibly as a prelude to backing a more stable currency. Noted silver metal analyst Ted Butler reports that JP Morgan has accumulated 80 million ounces of silver in their COMEX warehouse.

The reported manipulation of silver prices by Deutsche Bank among many others has set up a bullish scenario for miners who maintained their fiscal discipline during the period of price suppression. The suppressed price has shut down mining production because its arbitrary price was pushed below the cost of producing the precious metal. The stronger surviving miners such as McEwen, are now in a position to capitalize on these rebounding gold and silver prices. New miners will try to move in to production mode, but it takes time to do so. Rising demand and limited supply creates rising profits.

McEwen mining has not hedged any of its gold, silver, nor copper production and therefore will make large moves in the direction of precious metal prices. The company is funding capital expenditures from cash flow and those huge dividends from San Jose mine do not show in the quarterly earnings figure. This accounting method seems to vastly understate the rising value of this miner. $13 million dividend is a large figure that cannot be ignored. There are more of these dividends that will arrive in 2017 if gold and silver prices continue to move higher.

Disclosure: I am/we are long MUX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://seekingalpha.com/article/4041408-mcewen-mining-shines…

Feb. 1, 2017 8:58 AM ET|

5 comments|

Summary

CEO knows how to make money for shareholders.

Currencies are being devalued across the globe.

San Jose mine spins off $13 million in dividends.

Rob McEwen is not your typical CEO. After a highly successful tenure as founder of Goldcorp (NYSE:GG), he launched McEwen mining (NYSE:MUX) and is banking on a robust stock price move, since he commands a paltry salary of only $1 per year.

Mr. McEwen wants his management decisions to align with his stockholders as he owns a substantial 25% of McEwen stock. With 300 million shares outstanding and the stock trading just shy of $4.00 per share, this is a $1.23 billion company.

Argentina has dramatically improved the financial fortunes of the company's 49% owned San Jose mine, by cutting onerous taxes that had driven miners out of their country. 51% owner Hochschild mining has delivered $13 million in dividends to McEwen Mining- through the first 3 quarters of 2016, with expectations of more to come. Hochschild has been cutting mining costs and the lifting of capital controls by Argentina President Macri has allowed the free market to properly devalue the peso currency. Mining costs have plunged alongside the weaker peso and new investment and exploration should lead to an expansion of gold and silver production.

The great Fidelity Magellan Fund Manager Peter Lynch stated that small company stocks make big price moves and large companies tend to make smaller moves. This fact is very applicable to the mining industry for those small companies that have strong balance sheets. McEwen Mining holds $62 million in cash, precious metals, and liquid securities and 0 debt through September 2016.

The 100% owned El Gallo mine in Mexico is also seeing a sharp decline of all in cash costs to $680 per ounce of gold equivalent (gold and silver converted to gold). The Mexican peso has devalued sharply and mining production costs have fallen accordingly. Gold price is hovering around $1,200 per ounce, but McEwen sees a potential high price of $5,000 in the next few years. Silver price has risen from an average of $14.86 in early 2016 to $17.50 per ounce amid continued reports of strong physical demand from both investors and industry.

McEwen is looking to propel the company into the S&P 500 stock index, through additional acquisitions or mergers. The deal has to be "good" for his stockholders as he is the largest one. One of the requirements of the S&P 500 is that the company must be based in the United States, and McEwen Mining was incorporated in Colorado. There is only one miner currently listed in the index, so the next miner to join-will experience some heavy share purchases and the stock price will jump higher.

Fiat paper money currency continues to be devalued as the central banks seem to believe that printing more paper currency will remedy weak economic conditions. There are huge debt problems in the United States and China, and paper currency inflation is only creating havoc across economic markets everywhere. India has confiscated paper money and China continues to attempt to control capital outflow. Venezuela is experiencing crippling inflation of 122% in 2015 and 546% in 2016 (CIA report) and the United States is vastly understating inflation when it excludes the crushing rise in healthcare costs from the failed Affordable Care Act. As citizens experience loss of paper currency purchasing power, they will continue to purchase hard assets, including silver and gold. China and Russia central banks continue to purchase gold, possibly as a prelude to backing a more stable currency. Noted silver metal analyst Ted Butler reports that JP Morgan has accumulated 80 million ounces of silver in their COMEX warehouse.

The reported manipulation of silver prices by Deutsche Bank among many others has set up a bullish scenario for miners who maintained their fiscal discipline during the period of price suppression. The suppressed price has shut down mining production because its arbitrary price was pushed below the cost of producing the precious metal. The stronger surviving miners such as McEwen, are now in a position to capitalize on these rebounding gold and silver prices. New miners will try to move in to production mode, but it takes time to do so. Rising demand and limited supply creates rising profits.

McEwen mining has not hedged any of its gold, silver, nor copper production and therefore will make large moves in the direction of precious metal prices. The company is funding capital expenditures from cash flow and those huge dividends from San Jose mine do not show in the quarterly earnings figure. This accounting method seems to vastly understate the rising value of this miner. $13 million dividend is a large figure that cannot be ignored. There are more of these dividends that will arrive in 2017 if gold and silver prices continue to move higher.

Disclosure: I am/we are long MUX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

http://seekingalpha.com/article/4041408-mcewen-mining-shines…

Es gibt eine Menge von Leuten die in der letzten Zeit Aktien von McEwen Mining gekauft haben.

Sollen die alle falsch liegen ? McEwen Mining Inc. (MUX) Given Average Rating of “Strong Buy” by Brokerages

Posted by Brent Sawyer on Jan 31st, 2017 // No Comments

McEwen Mining logo Shares of McEwen Mining Inc. (NYSE:MUX) (TSE:MUX) have been assigned an average broker rating score of 1.00 (Strong Buy) from the one brokers that provide coverage for the stock, Zacks Investment Research reports. One equities research analyst has rated the stock with a strong buy recommendation.

Brokers have set a one year consensus price target of $5.00 for the company, according to Zacks. Zacks has also given McEwen Mining an industry rank of 36 out of 265 based on the ratings given to its competitors.

Separately, Zacks Investment Research lowered McEwen Mining from a “buy” rating to a “hold” rating in a report on Thursday, January 5th.

McEwen Mining (NYSE:MUX) opened at 3.85 on Thursday. The firm has a market capitalization of $1.15 billion and a price-to-earnings ratio of 110.00. McEwen Mining has a 1-year low of $1.30 and a 1-year high of $4.92. The firm’s 50-day moving average price is $3.38 and its 200 day moving average price is $3.57.

McEwen Mining (NYSE:MUX) last posted its earnings results on Thursday, November 3rd. The company reported $0.01 earnings per share for the quarter. McEwen Mining had a return on equity of 3.36% and a net margin of 17.41%. On average, analysts predict that McEwen Mining will post $0.10 EPS for the current year.

The firm also recently announced a semiannual dividend, which will be paid on Tuesday, February 14th. Investors of record on Friday, February 3rd will be issued a dividend of $0.005 per share. This represents a dividend yield of 0.26%. The ex-dividend date of this dividend is Wednesday, February 1st. McEwen Mining’s payout ratio is presently 33.34%.

Hedge funds and other institutional investors have recently bought and sold shares of the company. Connor Clark & Lunn Investment Management Ltd. increased its stake in McEwen Mining by 4.9% in the third quarter.

Connor Clark & Lunn Investment Management Ltd. now owns 62,075 shares of the company’s stock valued at $228,000 after buying an additional 2,900 shares during the period.

Jane Street Group LLC increased its stake in McEwen Mining by 34.5% in the third quarter. Jane Street Group LLC now owns 1,184,713 shares of the company’s stock valued at $4,348,000 after buying an additional 303,941 shares during the period.

OLD Mission Capital LLC purchased a new stake in McEwen Mining during the third quarter valued at about $331,000.

Morgan Stanley increased its stake in McEwen Mining by 254.1% in the third quarter. Morgan Stanley now owns 283,217 shares of the company’s stock valued at $1,040,000 after buying an additional 203,244 shares during the period.

Finally, Suntrust Banks Inc. purchased a new stake in McEwen Mining during the third quarter valued at about $124,000. 33.68% of the stock is currently owned by institutional investors and hedge funds.

https://sportsperspectives.com/2017/01/31/mcewen-mining-inc-…

Jetzt hat Rob es geschafft, er wird in Canada unvergesslich sein und werden durch die Aufstellung in die

. . . Canadian Mining Hall of Fame. Rob McEwen ist eine Legende in Canada und ich wünsche ihm, das es ihn nochmal gelingen wird, ein ähnliches Unternehen zu bauen.

Warum sollte es nicht gelingen, ich gehe davon aus, das wir alle gemeinsam auf einen guten Weg sind.

Rob McEwen inducted into Canadian Mining Hall of Fame

Andrew Topf | a day ago | 775 | 0

"“He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents”: Michael Wekerle, chairman and co-founder of Difference Capital, on Rob McEwen"

"“He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents”: Michael Wekerle, chairman and co-founder of Difference Capital, on Rob McEwen"Legendary mine developer Rob McEwen has been recognized for his accomplishments in Canadian mining through an induction into the hallowed corridors of the Canadian Mining Hall of Fame.

The Goldcorp (NYSE:GG, TSX:G) founder was recognized at a gala dinner this past month in Toronto – an annual event that celebrates men and women whose contributions to the country's mining industry have been particularly impactful.

“Rob is a man of rare talents, he is a natural innovator with a keen business mind,” Michael Wekerle, chairman and co-founder of Difference Capital, was quoted saying in TimminsToday – where Goldcorp continues to be one of the mining town's largest employers. “He is a strategic thinker – the consummate chess player – whose every move is calculated and well ahead of his opponents.”

In a video, McEwen said his father Donald was his life's inspiration. Told by doctors that he would never walk again after returning from the Second World War in an iron lung, Donald McEwen refused to accept their diagnosis and regained the use of his legs.

“Today, I look at challenges and obstacles I face and say this seems to pale compared to what my dad faced,” McEwen said in the video honouring his induction into the Hall of Fame. His father also inspired his son to become an avid investor, with Rob buying his first stock at the tender age of 12.

McEwen's story is well known to those who follow mining, but for those wanting a refresher, here it is again, reprised by the Canadian Mining Hall of Fame:

He is best known for transforming Goldcorp Inc. from a holding company into a global gold-mining powerhouse and revitalizing Ontario’s Red Lake gold mine through the discovery of new high-grade resources at depth. His famous “Goldcorp Challenge” in 2000, which provided open access to 50 years of proprietary geological data from Red Lake and offered prizes to anyone who could find the next six million ounces of gold, created an estimated $6 billion of value from subsequent discoveries.

McEwen is also an astute investor and corporate strategist, as demonstrated by Goldcorp’s friendly merger with Wheaton River Minerals in 2005. Goldcorp shares tripled in the next 14 months as it grew through a series of mergers into one of the world’s largest gold producers. He went on to build a new flagship, McEwen Mining, while supporting many worthy causes through donations totalling more than $50 million to date.

Born and raised in Toronto, McEwen worked at his father’s investment firm after earning a B.A. from the University of Western Ontario in 1973, followed by an MBA from York University in 1978. In the 1980s, he took the reins of Goldcorp, then a gold fund, and managed its investment portfolio. In 1989, he led Goldcorp’s acquisition of Dickinson Mines and its aging and capital-starved gold mine in the famous Red Lake camp, and began building an operating company.

His faith in the mine’s untapped potential was rewarded after a $10-million exploration led to a high-grade discovery in the mid-1990s. In a brilliant move, he created the “Goldcorp Challenge” and placed the mine’s geological data since 1948 on the internet and offered $575,000 in prizes for the best exploration concepts. More than 1,000 participants from 80 countries took part, resulting in more than 50 new targets, 80% of which yielded total gold resources valued at $6 billion. The Red Lake mine was transformed from a 50,000-ounce producer in 1997 to a 500,000-ounce producer in 2001, while cash costs fell from $360 per ounce to $60 per ounce over this period.

Goldcorp went on to become a star performer, with its share price appreciating at a compound annual rate of 31% between 1993 and 2004. McEwen stepped down from Goldcorp after its high-profile $2.4-billion merger with Wheaton River to focus on junior mining. After acquiring U.S. Gold and expanding its assets, he merged the junior with Minera Andes to create McEwen Mining, a gold, silver and copper producer with projects in Nevada, Mexico and Argentina.

As a philanthropist, McEwen has donated more than $50 million to encourage excellence, innovation and leadership in healthcare and education. He also contributed to the Red Lake Margaret Cochenour Memorial Hospital, the Red Lake Regional Heritage Centre, St. Andrews College Leadership Program, Rumie Initiative and most recently the McEwen School of Architecture at Laurentian University. In addition to an honorary degree from York University, McEwen has received many accolades for his achievements, including Developer of the Year for 2001, Mining Man of the Year for 2002, Most Innovative CEO in 2006, and the Order of Canada in 2007.

http://www.mining.com/rob-mcewen-inducted-into-canadian-mini…" target="_blank" rel="nofollow ugc noopener">

http://www.mining.com/rob-mcewen-inducted-into-canadian-mini…

Antwort auf Beitrag Nr.: 54.164.285 von orofino1 am 25.01.17 17:13:09

... wer sich etwas eingehender mit dieser Firma befasst stellt bald fest das hier nichts von "fernhalten " zu reden ist, genau das Gegenteil ist doch der Fall. Die Firma steht sehr gut da und wächst, gehört zu den Topinvestments im Gold/Silbersektor. Aber entscheiden soll ja jeder wie er meint...

... wer sich etwas eingehender mit dieser Firma befasst stellt bald fest das hier nichts von "fernhalten " zu reden ist, genau das Gegenteil ist doch der Fall. Die Firma steht sehr gut da und wächst, gehört zu den Topinvestments im Gold/Silbersektor. Aber entscheiden soll ja jeder wie er meint...