Ölpreis - Erdöl - Öl - Rohöl: Infos, Fakten, Analysen, Charts und Ausblick (Seite 958)

eröffnet am 01.01.15 22:56:07 von

neuester Beitrag 16.04.24 09:10:35 von

neuester Beitrag 16.04.24 09:10:35 von

Beiträge: 24.352

ID: 1.205.072

ID: 1.205.072

Aufrufe heute: 14

Gesamt: 3.854.509

Gesamt: 3.854.509

Aktive User: 0

ISIN: XC0009677409 · WKN: 967740

83,61

USD

-0,67 %

-0,57 USD

Letzter Kurs 17:30:35 Lang & Schwarz

Neuigkeiten

15:00 Uhr · wallstreetONLINE Redaktion |

13:03 Uhr · dpa-AFX |

12:51 Uhr · Shareribs Anzeige |

08:30 Uhr · BNP Paribas Anzeige |

08:05 Uhr · dpa-AFX |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 13,300 | +27,27 | |

| 1,0400 | +18,18 | |

| 5,6270 | +15,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8850 | -7,23 | |

| 175,00 | -7,35 | |

| 2,0500 | -9,69 | |

| 11,790 | -12,67 | |

| 1,0340 | -18,97 |

Beitrag zu dieser Diskussion schreiben

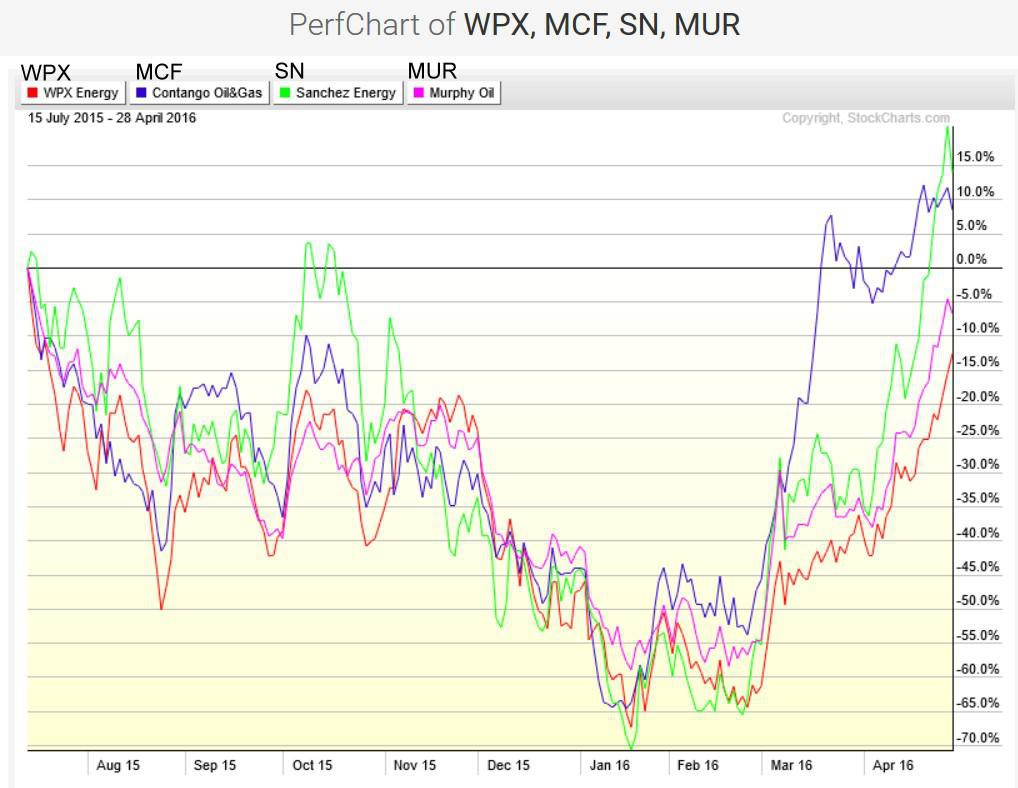

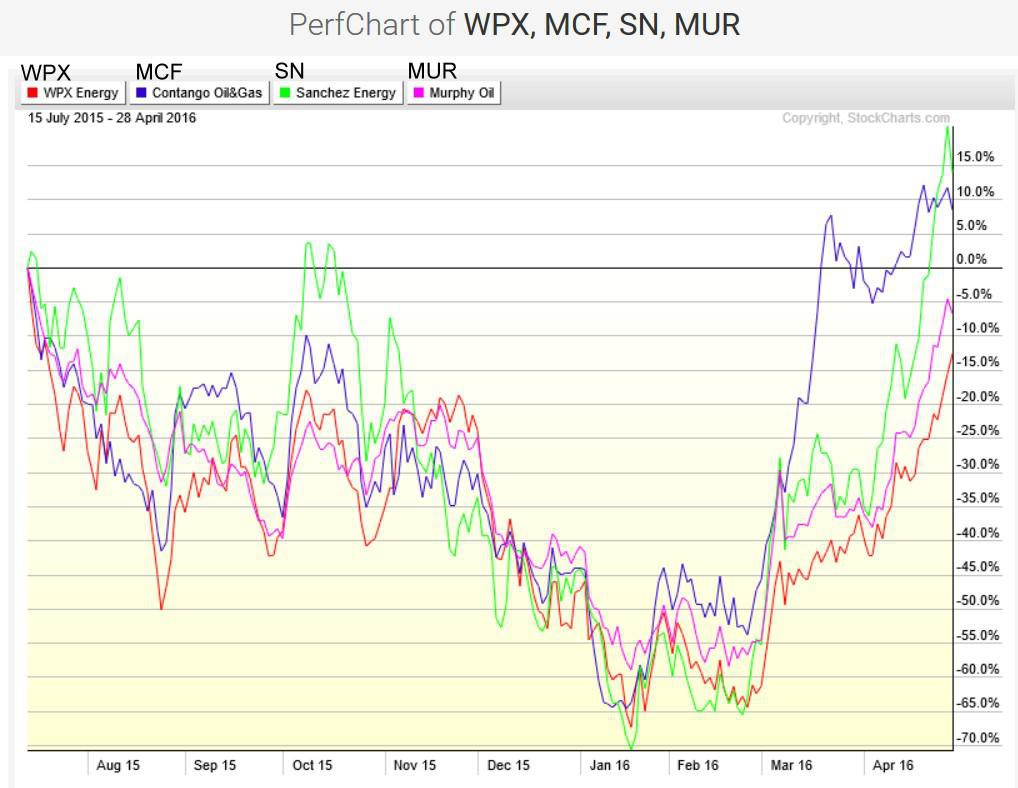

Sanchez Energy - Murphy oil - contango oil and gas

hier das video mit den special oil-stockshttp://stockcharts.com/articles/commodities/2016/04/looking-…

06:33 MUR Murphy oil volume-large http://stockcharts.com/h-sc/ui?s=MUR

10:58 SN Sanchez Energy volume-medium http://stockcharts.com/h-sc/ui?s=SN

--------------------

14:54 MCF contango oil volume- small http://stockcharts.com/h-sc/ui?s=MCF

24:13 WPX Energy volume http://stockcharts.com/h-sc/ui?s=WPX

----------------------

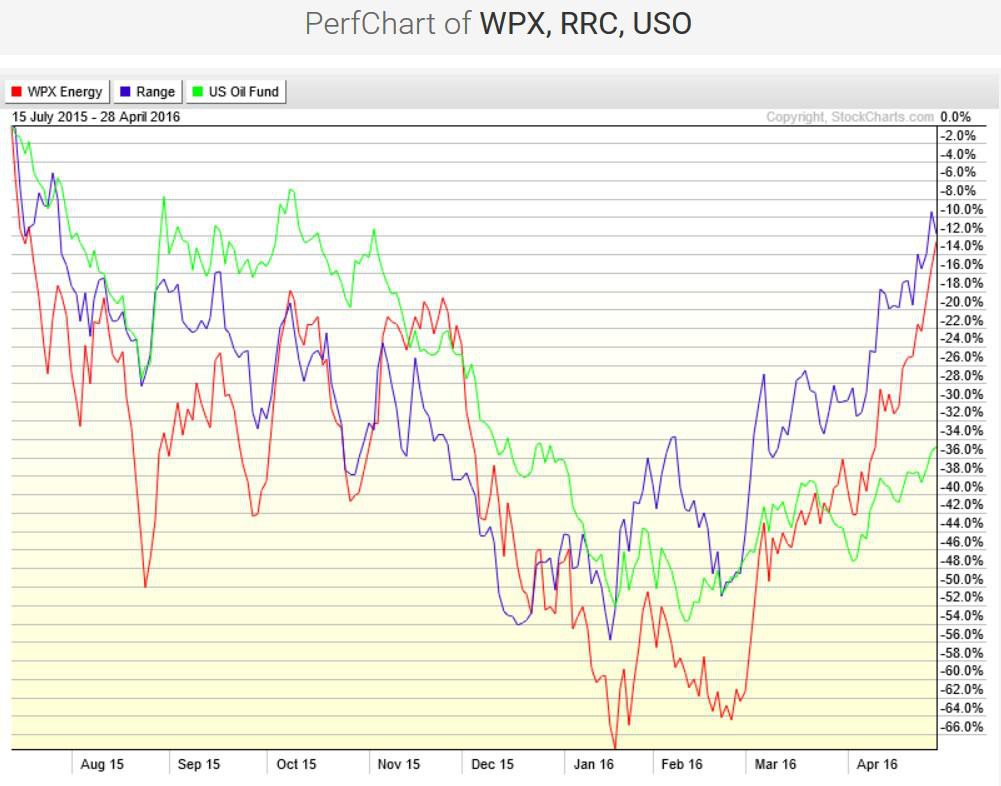

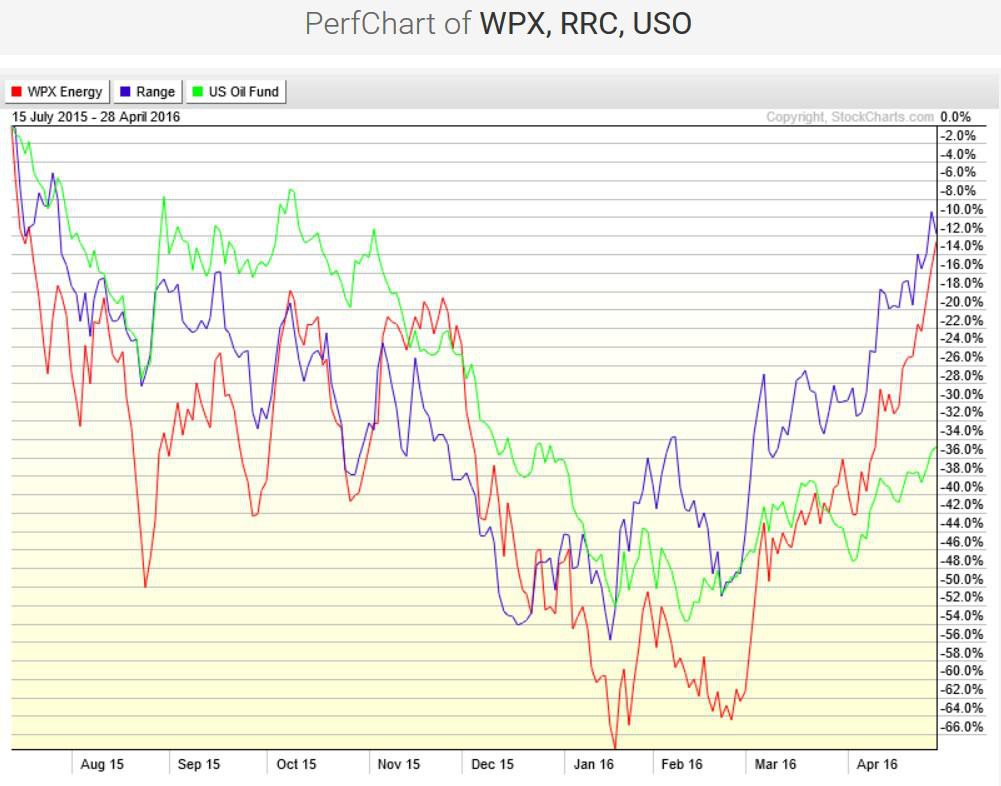

26:52 RRC Range Resources wenn die SCTR-scooter line 90 ist so wirkt die Aktie überproportional gegenüber dem oil-sector

http://stockcharts.com/h-sc/ui?s=RRC

----------------------------

56:48 WLL Whiting Petroleum volume-large http://stockcharts.com/h-sc/ui?s=WLL

DUCS = drilled but uncompleted wells

http://www.oilandgas360.com/ducs-in-a-row-for-2016-its-anybo… DUCS = drilled but uncompleted wells

VORSICHT : ich weiß nicht von wann der Artikel ist / Zahlen können also schon älter sein .....DUC DUC Goose! The Growing Backlog of Uncompleted Shale Wells

Ever hear of a DUC? No, we didn’t forget the “K” on the end of DUC. It stands for Drilled but UnCompleted (DUC) wells. Completing a well means taking the final step of fracking the well and hooking it up to production. Lately there’s been a lot of talk about DUCs–a large inventory of wells drilled (holes in the ground) not yet completed. Completing a well takes a lot of sand, water and money. There’s little incentive to complete wells when commodity prices for oil and gas are so low. In some cases drillers will drill the borehole and not complete a well as a way of holding their acreage before a lease expires. In other cases, they’d love to finish the job–but the price they will get is too darned low, so they put completion on hold. Sometimes a driller has contracted for a rig and crew to operate it–instead of canceling and owing that money anyway, they go ahead and drill. How many DUCs are there in general, and in the Marcellus/Utica specifically? The honest answer is, no one knows for sure. But smart analysts can make some pretty good guesses, based on company reports and their own industry knowledge. Below we bring you the latest we can find on DUCs–specifically how many DUCs there are in the Marcellus/Utica…

Why create a DUC backlog? Here’s what a couple of experts say:

Jeb Armstrong, Vice President of Energy Research for the Marwood Group, doesn’t expect most producers to have a large inventory of DUCs. Instead, he sees the backlog as a matter of circumstance rather than a way of loading up on potential volumes. “The only reason why I can see a company willingly drilling DUCs is because they have a rig contract that’s too expensive to cancel,” he said in an email to Oil & Gas 360®. “Might as well keep the rig operating and plow the capital into the ground than pay a penalty to the rig owner.”

Raymond James analysts shared a similar viewpoint, noting a certain dynamic on the oilservice industry. “Lower returns and crimped cash flow lead operators to slow activity and conserve cash in any way possible,” the note said. “Since many of the land rigs had longer-term contracts and the frac crews didn’t, the quickest way to conserve cash is to drill but not complete.”

Raymond James explains that the “frac crews” are an important factor; most are contracted on a job-by-job basis, while rig contracts can last years and include penalty fees if the operator chooses to break the contract. A further explanation includes: “As operators were faced with cycle-low pricing they were forced to decide between (A) laying down rigs and taking the capital hit as a result or (B) continuing to drill wells until the contracts rolled off. On the whole, we believe many E&Ps chose the latter option; deciding to drill these wells at near-or-below breakeven pricing and deferring the completion (and thus production) for a later date.”(1)

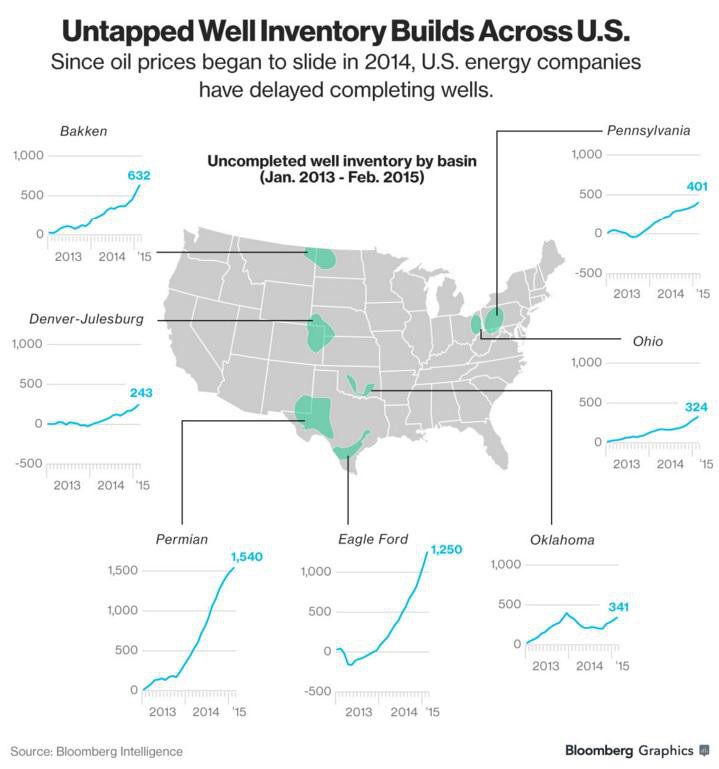

How many DUCs are there? Let’s rewind to the beginning of 2015. We found this excellent analysis from Bloomberg Intelligence:

Bloomberg Intelligence released an estimate for year-end 2014 DUCs in April, revealing a rapid climb of incompletions even before prices began to head south. Estimates showed more than 4,700 DUCs were in inventory in early 2015, with approximately 80% of them being oil wells. The “fracklog” was leaving more than 300 MBOPD off the U.S. production grid. In an email, Bloomberg Intelligence told OAG360 that it plans to update the model again early next year.(1)

The following chart was released by Bloomberg in April:

What about today? How many DUCs are there now and how many are forecast for the beginning of 2016?

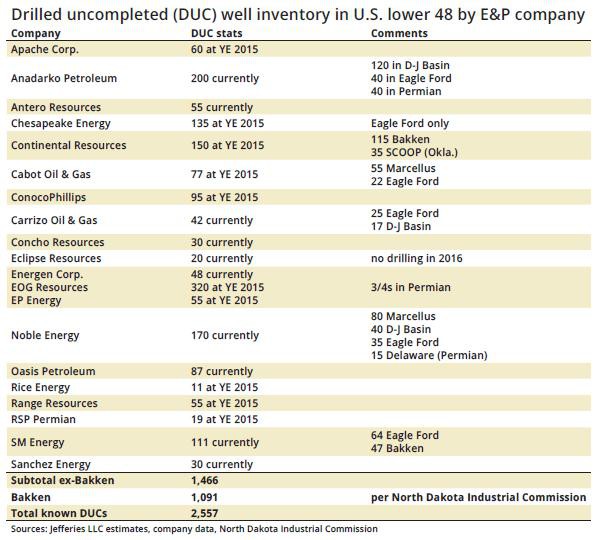

Estimates for a current DUC number can be anybody’s guess, but certain companies did provide their inventory backlog in respective conference calls. EOG Resources (ticker: EOG) holds one of the largest, with about 300 DUCs on the docket. Anadarko Petroleum (ticker: APC) also has a sizable inventory of about 200 DUCs, which management believes provides optionality for its volume output. Continental Resources is also in the 200 DUC camp.

Some gas drillers also have deferred wells, albeit a much lower amount than their oil counterparts. Range Resources (ticker: RRC), Cabot Oil & Gas (ticker: COG) and Antero Resources (ticker: AR), three of the premier producers of the Marcellus/Utica, each have about 50 to 60 regional wells waiting on completion.

The effects of those DUCs coming online were explored in the Raymond James note, but not without extensive caution and consistent reminders that any estimates were made with “very low confidence levels.” Raymond James estimates said the incoming DUC wells could add anywhere from 100 to 300 MBOPD, which, at the high end, would match up with estimates from previous studies.(1)

With respect to the Marcellus/Utica, we picked up on this chatter about Antero Resources, focused totally on our region:

Some E&Ps have bottled up production until prices recuperate.

Antero Resources Corp. (AR) has a $6.5 billion market cap and a $1.6 billion drilling and completion budget. In August, the company decided to tread water in the Marcellus, where it will defer 50 wells into 2016 in order to realize better natural gas prices.

The company expects the halt in well completions to increase its internal rate of returns (IRR) to 57% before taxes in 2016 compared to 39% IRR before taxes in 2015. The deferred production will add more than 350 million cubic feet per day (MMcf/d) in 2016.

“While a DUC backlog of 50 Marcellus wells deferred can lead to capital efficient growth once pricing improves, we view AR’s debt load and some exposure to a weak local price as limiting factors,” said Jonathan D. Wolff, equity analyst at Jefferies LLC.(2)

We finally hit pay dirt with this from SNL Financial:

Exploration and production companies will spend the first half of 2016 working down the number of drilled but uncompleted wells, or DUCs, in their inventory as a way to moderate capital spending while at the same time keeping production numbers up ahead of the spring’s reserve-based lending determinations by their banks, Jefferies LLC’s oilfield services analyst Brad Handler said Nov. 30.

Using company and state data, Jefferies found 2,557 DUCs and theorized that the real number is nearly twice that because of pad drilling.

Several operators told Jefferies that “a large proportion of the DUCs are within ‘normal range’ given increased adoption of multiwall pad drilling and general improvement in drilling efficiencies.”

The surplus of DUCs offers the soundest strategy for weathering currently low prices, Jefferies said. “In what we sense was generally well thought-out commentary on DUC well strategy by E&Ps in recent earnings calls, several E&Ps indicated they would start working off their DUC inventories in early 2016 to ‘manage’ production in the most capital efficient manner,” Jefferies said.

Further, the strategy of completing wells without drilling new ones will help out in talks with lenders this spring. “RBL negotiations are expected to be more onerous this spring; converting DUCs to PDPs can help maintain borrowing base capacity,” Jefferies said. “We expect significant downward pressure on Reserve Based Lending (RBL) borrowing bases in the next round of redeterminations (this coming spring). Completing DUCs is a relatively low capex means of sustaining production through Proved Developed Producing (PDP) wells, which raises the (formula-derived) borrowing base.”

Nearly half the known DUCs are in the Bakken Shale, as indicated by state data, with the other half spread across other shale plays. The Bakken, the Denver-Julesburg Basin and the Marcellus all appear to be seeing growth in DUC wells, while the Eagle Ford is showing a reduction in DUCs, Jefferies said.(3)

Here’s an accompanying graphic with the above:

In reviewing the list above, the following drillers have major operations in the Marcellus/Utica. Unless otherwise indicated under the Comments column, we assume most/all of the DUC wells listed are in the northeast.

Antero Resources

Cabot Oil & Gas

Eclipse Resources

Noble Energy

Rice Energy

das video zu den aufgeführten oil-companies und der video-time

die video-time wurde oben bereits aufgelistet:hier das video

http://stockcharts.com/articles/commodities/2016/04/commodit…

-----------------------------

das ganze dient als postive-feedback

for the good information to DUC (drilled and uncompleted wells)

die Zusammenfassung war sehr gut

denn ich kann eben nicht alles lesen

------------------

29:50 $SSEC http://stockcharts.com/articles/commodities/2016/04/commodit…

09:42 $BPNDX

13:19 $BPTSE vs oil USO

14:01 $BPENER energy-sector

14:30 $BPENER with indicator MACD MACD on the verge of rolling-over from top-position

we have been extrem now, for two or three weeks, when we are at extrem points, the market is planning to roll-over

54:40 Engergy as bullish as I am, so the market should hold-up here

55:51 CNX Consol Energy

--------------

14:54 MCF contango oil volume- small http://stockcharts.com/h-sc/ui?s=MCF

24:13 WPX Energy volume http://stockcharts.com/h-sc/ui?s=WPX

-----------------------

26:52 RRC Range Resources wenn die SCTR-scooter line 90 ist so wirkt die Aktie überproportional gegenüber dem oil-sector

http://stockcharts.com/h-sc/ui?s=RRC

--------------------------

56:48 WLL Whiting Petroleum volume-large http://stockcharts.com/h-sc/ui?s=WLL

------------------------

----------

------------------------

------------------------

29:50 $SSEC http://stockcharts.com/articles/commodities/2016/04/commodit…

09:42 $BPNDX

13:19 $BPTSE vs oil USO

14:01 $BPENER energy-sector

14:30 $BPENER with indicator MACD MACD on the verge of rolling-over from top-position

we have been extrem now, for two or three weeks, when we are at extrem points, the market is planning to roll-over

54:40 Engergy as bullish as I am, so the market should hold-up here

55:51 CNX Consol Energy

--------------

14:54 MCF contango oil volume- small http://stockcharts.com/h-sc/ui?s=MCF

24:13 WPX Energy volume http://stockcharts.com/h-sc/ui?s=WPX

-----------------------

26:52 RRC Range Resources wenn die SCTR-scooter line 90 ist so wirkt die Aktie überproportional gegenüber dem oil-sector

http://stockcharts.com/h-sc/ui?s=RRC

--------------------------

56:48 WLL Whiting Petroleum volume-large http://stockcharts.com/h-sc/ui?s=WLL

------------------------

----------

------------------------

------------------------

Antwort auf Beitrag Nr.: 52.312.783 von tischer88 am 29.04.16 20:04:41

.... so eine richtig tolle DUCs Statistik kenne ich nicht

( die Unternehmen lassen sich da ja auch nicht ganz genau in die Karten hinein sehen )

Grundsätzlich gilt = kein Unternehmen " macht " geplante DUCs

( ist ja blöd zig Millionen USD für ein Loch auszugeben um dann nichts zu machen )

Grund ist meist:

Jeb Armstrong, Vice President of Energy Research for the Marwood Group, doesn’t expect most producers to have a large inventory of DUCs. Instead, he sees the backlog as a matter of circumstance rather than a way of loading up on potential volumes. “The only reason why I can see a company willingly drilling DUCs is because they have a rig contract that’s too expensive to cancel,” he said in an email to Oil & Gas 360®. “Might as well keep the rig operating and plow the capital into the ground than pay a penalty to the rig owner.”

ein schöner Artikel zu den DUCs:

http://marcellusdrilling.com/2015/12/duc-duc-goose-the-growi…

in dem Artikel werden auch einige Zahlen zu DUCs ( richtig oder falsch ?? ) genannt

aber versuchen wir einen größeren Blick darauf zu werfen und das große Ganze zu betrachten :

in Texas waren am 31. März 2016 184.772 oil wels am pumpen

in Texas waren am 31. März 2016 94.205 gas wells am pumpen

in Texas wurden im Kalenderjahr 2012 6.772 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2012 1.780 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2012 13.023 mixed oil+gas wells genehmigt

in Texas wurden im Kalenderjahr 2013 6.717 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2013 1.290 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2013 12.581 mixed oil+gas wells genehmigt

in Texas wurden im Kalenderjahr 2014 7.510 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2014 1.434 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2014 15.748 mixed oil+gas wells genehmigt

wohlgemerkt - diese Zahlen betreffen NUR den Bundesstaat Texas !!!

vereinfacht ausgedrückt - mir san die DUCs wurscht

sie verzögern halt im schlimmsten Fall das was ich glaube das passiert nach hinten ... muß ich halt ein paar Monate länger warten

... muß ich halt ein paar Monate länger warten

Zitat von tischer88: Hallo Luke,

wie sieht es bei den DUCs aus, solange die nicht endgültig verschwinden, sind immer noch große Produktionsreserven vorhanden die rasch wieder die Ölproduktion nach oben treiben. Ich denke das da einige Betreiber eher früher und bei niedrigem Ölpreis ihre DUCs zur Produktion bringen.

Hab leider keine aussagekräftigen Daten gefunden nur Schätzungen , allein im Bakken-Basin soll es bis zu 400 geben. Hast du dazu Informationen ?

.... so eine richtig tolle DUCs Statistik kenne ich nicht

( die Unternehmen lassen sich da ja auch nicht ganz genau in die Karten hinein sehen )

Grundsätzlich gilt = kein Unternehmen " macht " geplante DUCs

( ist ja blöd zig Millionen USD für ein Loch auszugeben um dann nichts zu machen )

Grund ist meist:

Jeb Armstrong, Vice President of Energy Research for the Marwood Group, doesn’t expect most producers to have a large inventory of DUCs. Instead, he sees the backlog as a matter of circumstance rather than a way of loading up on potential volumes. “The only reason why I can see a company willingly drilling DUCs is because they have a rig contract that’s too expensive to cancel,” he said in an email to Oil & Gas 360®. “Might as well keep the rig operating and plow the capital into the ground than pay a penalty to the rig owner.”

ein schöner Artikel zu den DUCs:

http://marcellusdrilling.com/2015/12/duc-duc-goose-the-growi…

in dem Artikel werden auch einige Zahlen zu DUCs ( richtig oder falsch ?? ) genannt

aber versuchen wir einen größeren Blick darauf zu werfen und das große Ganze zu betrachten :

in Texas waren am 31. März 2016 184.772 oil wels am pumpen

in Texas waren am 31. März 2016 94.205 gas wells am pumpen

in Texas wurden im Kalenderjahr 2012 6.772 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2012 1.780 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2012 13.023 mixed oil+gas wells genehmigt

in Texas wurden im Kalenderjahr 2013 6.717 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2013 1.290 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2013 12.581 mixed oil+gas wells genehmigt

in Texas wurden im Kalenderjahr 2014 7.510 oil-wells genehmigt

in Texas wurden im Kalenderjahr 2014 1.434 gas-wells genehmigt

in Texas wurden im Kalenderjahr 2014 15.748 mixed oil+gas wells genehmigt

wohlgemerkt - diese Zahlen betreffen NUR den Bundesstaat Texas !!!

vereinfacht ausgedrückt - mir san die DUCs wurscht

sie verzögern halt im schlimmsten Fall das was ich glaube das passiert nach hinten

... muß ich halt ein paar Monate länger warten

... muß ich halt ein paar Monate länger warten

Hallo Luke,

wie sieht es bei den DUCs aus, solange die nicht endgültig verschwinden, sind immer noch große Produktionsreserven vorhanden die rasch wieder die Ölproduktion nach oben treiben. Ich denke das da einige Betreiber eher früher und bei niedrigem Ölpreis ihre DUCs zur Produktion bringen.

Hab leider keine aussagekräftigen Daten gefunden nur Schätzungen , allein im Bakken-Basin soll es bis zu 400 geben. Hast du dazu Informationen ?

wie sieht es bei den DUCs aus, solange die nicht endgültig verschwinden, sind immer noch große Produktionsreserven vorhanden die rasch wieder die Ölproduktion nach oben treiben. Ich denke das da einige Betreiber eher früher und bei niedrigem Ölpreis ihre DUCs zur Produktion bringen.

Hab leider keine aussagekräftigen Daten gefunden nur Schätzungen , allein im Bakken-Basin soll es bis zu 400 geben. Hast du dazu Informationen ?

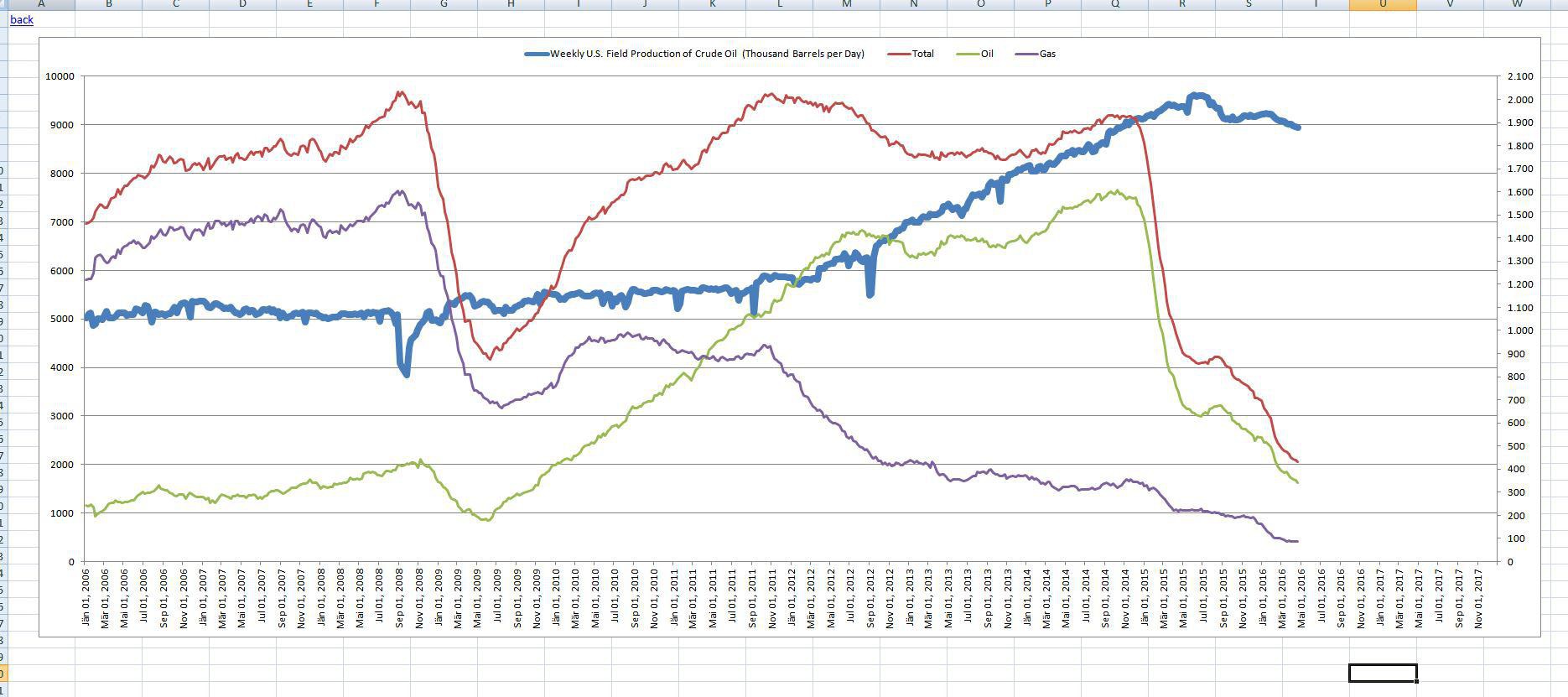

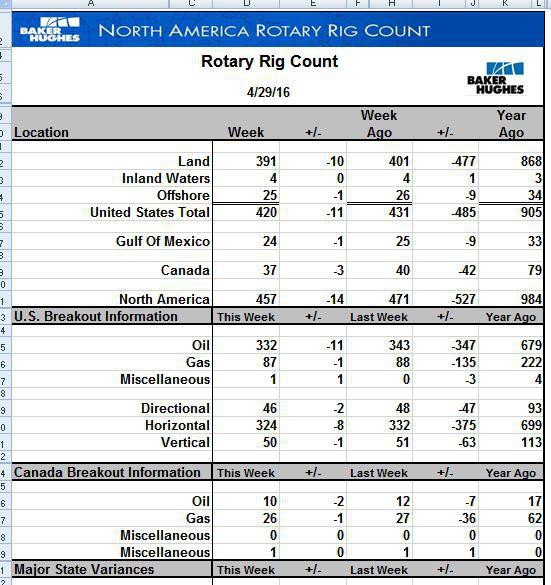

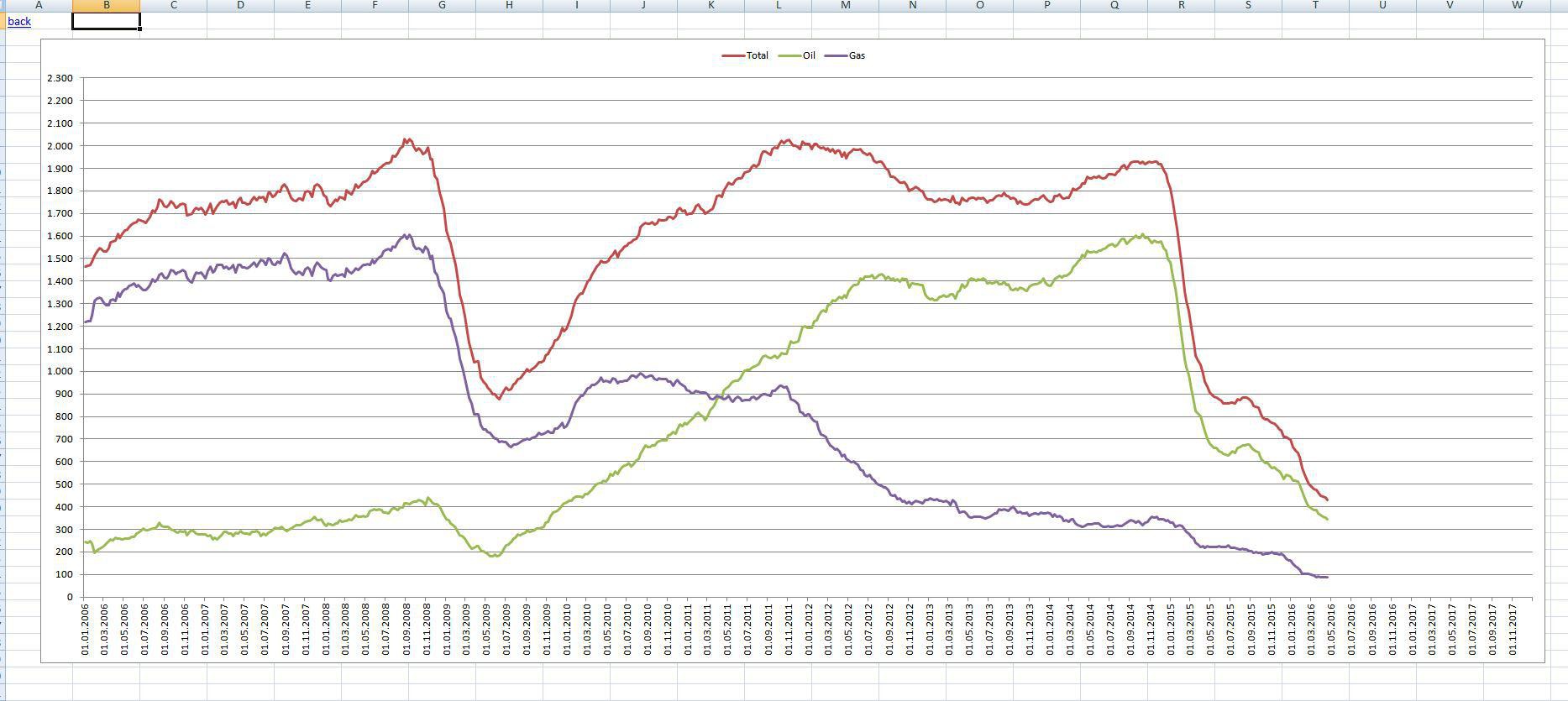

RIGs versus US-öl-production

RIG count - update von heute 29.04.2016

http://phx.corporate-ir.net/phoenix.zhtml?c=79687&p=irol-rep…auch wenn ich mich wiederhole

- RIGs weiter fallend

- RIGs weiter fallend

Antwort auf Beitrag Nr.: 52.312.369 von zoj-82 am 29.04.16 19:08:36Komisch nur, dass die Fuhre nicht wieder richtig in Gang kommt.....

Warten wir mal ab, was heute Abend noch so passiert.

Allen viel Erfolg!

Grüße

Schwoab

Warten wir mal ab, was heute Abend noch so passiert.

Allen viel Erfolg!

Grüße

Schwoab

17:13 Uhr · dpa-AFX · Öl (Brent) |

15:00 Uhr · wallstreetONLINE Redaktion · Öl (Brent) |

13:03 Uhr · dpa-AFX · Öl (Brent) |

12:51 Uhr · Shareribs · Öl (Brent)Anzeige |

08:30 Uhr · BNP Paribas · Öl (Brent)Anzeige |

08:05 Uhr · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

| Zeit | Titel |

|---|---|

| 09.05.24 | |

| 07.04.24 | |

| 08.01.24 | |

| 16.10.23 | |

| 14.10.23 | |

| 23.09.23 | |

| 16.09.23 | |

| 04.09.23 | |

| 04.09.23 | |

| 01.09.23 |