Platform Specialty Products - 500 Beiträge pro Seite

eröffnet am 25.09.15 11:53:22 von

neuester Beitrag 07.03.19 13:58:40 von

neuester Beitrag 07.03.19 13:58:40 von

Beiträge: 16

ID: 1.219.098

ID: 1.219.098

Aufrufe heute: 0

Gesamt: 1.142

Gesamt: 1.142

Aktive User: 0

ISIN: US28618M1062 · WKN: A2PDWL · Symbol: ESI

23,850

USD

+0,72 %

+0,170 USD

Letzter Kurs 02:04:00 NYSE

Neuigkeiten

15.04.24 · Business Wire (engl.) |

29.03.24 · Business Wire (engl.) |

20.02.24 · Business Wire (engl.) |

15.02.24 · Business Wire (engl.) |

13.02.24 · Business Wire (engl.) |

Werte aus der Branche Chemie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 39,50 | +79,55 | |

| 45,88 | +63,89 | |

| 34,00 | +19,30 | |

| 19,220 | +12,00 | |

| 6,2000 | +10,71 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,2000 | -7,46 | |

| 1,6200 | -8,99 | |

| 28,15 | -9,43 | |

| 35,00 | -18,64 | |

| 22,600 | -27,80 |

...ist eine "Neu"gründung von Ackman-Spezis, die analog Valeant richtig abräumen soll;

ist mir eben zum zweiten Mal über den Weg gelaufen, weil sie Alent (Thread: Alent - neue WKN nach Zusammenlegung)übernehmen wollen

ist mir eben zum zweiten Mal über den Weg gelaufen, weil sie Alent (Thread: Alent - neue WKN nach Zusammenlegung)übernehmen wollen

Platform Specialty Products Corp Bond Prices Fall 4% (PAH)

Posted on September 23, 2015 by Jamal Genner in Investing, Price ArticlesPlatform Specialty Products Corp logoAn issue of Platform Specialty Products Corp (NYSE:PAH) debt fell 4% as a percentage of its face value during trading on Tuesday, ARN reports. The high-yield debt issue has a 6.5% coupon and is set to mature on February 1, 2022. The debt is now trading at $91.00 and was trading at $98.75 last week. Price moves in a company’s debt in credit markets sometimes anticipate parallel moves in its share price.

Several brokerages have recently weighed in on PAH. Zacks raised Platform Specialty Products Corp from a “sell” rating to a “hold” rating in a report on Tuesday, July 14th. Barclays increased their price objective on Platform Specialty Products Corp from $30.00 to $31.00 and gave the stock an “equal weight” rating in a research note on Thursday, June 4th. Nomura upped their target price on Platform Specialty Products Corp from $25.00 to $29.00 and gave the stock a “neutral” rating in a research report on Tuesday, July 14th. Finally, Monness Crespi & Hardt lowered their price objective on Platform Specialty Products Corp from $33.00 to $28.00 and set a “buy” rating on the stock in a report on Monday, August 31st. One investment analyst has rated the stock with a sell rating, two have assigned a hold rating and two have assigned a buy rating to the company. The stock has an average rating of “Hold” and a consensus price target of $28.75.

Shares of Platform Specialty Products Corp (NYSE:PAH) traded down 2.68% on Wednesday, hitting $15.24. The stock had a trading volume of 1,519,682 shares. The firm’s 50 day moving average is $19.33 and its 200-day moving average is $24.49. The stock’s market capitalization is $3.21 billion. Platform Specialty Products Corp has a one year low of $14.98 and a one year high of $28.44.

Platform Specialty Products Corp (NYSE:PAH) last issued its quarterly earnings results on Thursday, August 13th. The company reported $0.25 EPS for the quarter, missing analysts’ consensus estimates of $0.31 by $0.06. The firm earned $675 million during the quarter, compared to the consensus estimate of $735.48 million. Equities research analysts expect that Platform Specialty Products Corp will post $0.95 earnings per share for the current fiscal year.

In other news, Director Martin E. Franklin bought 224,100 shares of the firm’s stock in a transaction dated Tuesday, August 25th. The shares were bought at an average price of $17.81 per share, with a total value of $3,991,221.00. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Benjamin Gliklich bought 4,760 shares of the firm’s stock in a transaction dated Tuesday, August 18th. The stock was purchased at an average cost of $20.80 per share, for a total transaction of $99,008.00. The disclosure for this purchase can be found here.

sie haben sogar eine EURO-Anleihe

http://www.wallstreet-online.de/anleihen/a1zvj3 die derzeit mit 85,40/87,09 notiert;leider 100k Kindersicherung

Platform Specialty Products Corporation Announces Launch of Its Senior Notes Offering

WEST PALM BEACH, Fla., Nov. 2, 2015 (GLOBE NEWSWIRE) -- Platform Specialty Products Corporation (NYSE:PAH) ("Platform") announced today that PSPC Escrow II Corp., a wholly-owned subsidiary of Platform (the "Escrow Issuer"), intends to offer $400 million aggregate principal amount of senior notes due 2021 denominated in U.S. dollars (the "Notes") in a private offering, subject to market and other customary conditions. The Notes are being offered solely to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to non-U.S. persons in accordance with Regulation S under the Securities Act.

If the offering closes prior to the consummation of Platform's previously-announced recommended offer to acquire all the issued and to be issued shares of Alent plc (the "Alent Acquisition"), the net proceeds from the offering (plus an additional amount of funds from Platform necessary to provide for the special mandatory redemption price of the Notes) will be deposited into an escrow account until the date on which certain escrow conditions are satisfied, including the closing of the Alent Acquisition. The Alent Acquisition is expected to be consummated on December 1, 2015, subject to closing conditions customary for a transaction of this type.

Platform intends to use the net proceeds from the offering to finance a portion of the acquisition consideration and related fees and expenses of the Alent Acquisition and pre-pay outstanding debt of Alent plc under its existing credit facility. However, if the closing of the Alent Acquisition does not occur on or before July 13, 2016, the indenture governing the Notes will require that such amounts deposited in the escrow account be used to redeem all of the Notes then outstanding at the special mandatory redemption price. Upon consummation of the Alent Acquisition, Platform will assume the obligations of the Escrow Issuer under the Notes and the related indenture governing the Notes and certain of Platform's existing domestic subsidiaries will guarantee the Notes.

If the closing of the Alent Acquisition has occurred at or prior to the time of the consummation of the offering of the Notes, Platform will issue the Notes directly, Platform will forego the escrow procedures described above and the Notes will not include special mandatory redemption provisions.

No assurance can be given that the offering will be completed, or, if completed, as to the terms on which it is completed. The Notes and related guarantees have not been registered under the Securities Act or any state securities laws and, unless so registered, may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements.

Antwort auf Beitrag Nr.: 50.707.731 von R-BgO am 25.09.15 11:53:22Alent-Deal hat inzwischen geclosed

Antwort auf Beitrag Nr.: 50.708.037 von R-BgO am 25.09.15 12:23:38aktuell 77,26 zu 78,74

Antwort auf Beitrag Nr.: 51.550.221 von R-BgO am 21.01.16 17:28:56

Anleihe wieder über pari,

Kurs vom Tief verdoppelt...

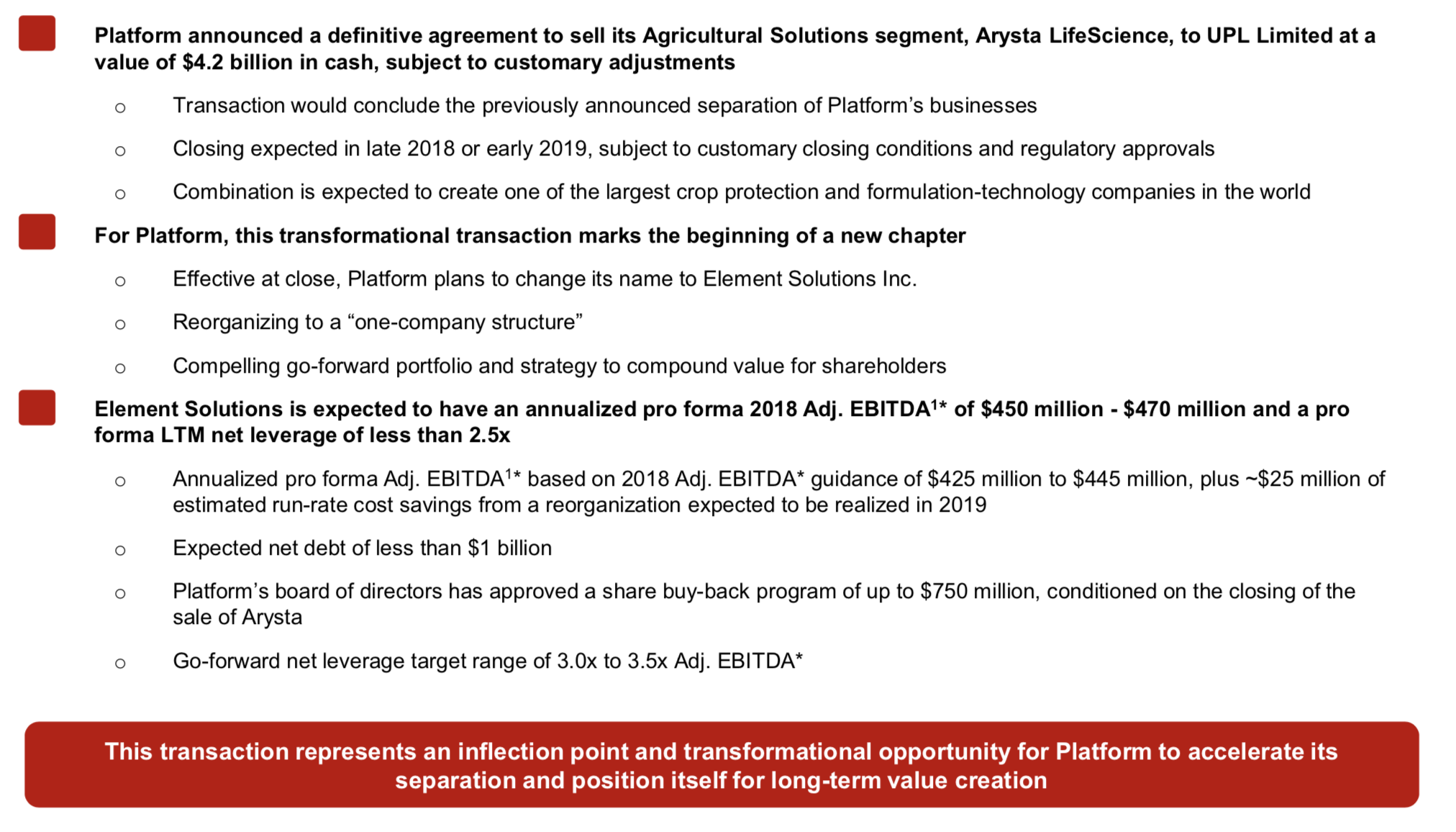

Platform Specialty Products Corporation Announces Intention to Separate into Two Public Companies

WEST PALM BEACH, Fla., Aug. 24, 2017 (GLOBE NEWSWIRE) --

Platform Specialty Products Corporation (NYSE:PAH) ("Platform"), a global, diversified specialty chemicals company, today announced its intention to separate its Agricultural Solutions and Performance Solutions segments.

Executive Commentary

Chairman Martin E. Franklin said, "Following a strategic review and discussions with our management teams, we believe the best way to maximize long-term value for our shareholders is by separating our Agricultural Solutions business as a standalone public company. We are fortunate to have two very high-quality businesses serving two very different market segments in the specialty chemicals industry. We have long felt that this diversification has been an impediment to investors' full appreciation of the value of each asset. We believe that these businesses each have the scale, the management, business quality and growth potential to be great standalone public companies. We intend to structure the separation such that both companies will have appropriate post-separation balance sheets to facilitate independent access to capital for bolt-on acquisitions or strategic combinations within their respective markets. There has been interest from investors to put capital behind our Ag business, and we would expect, as part of this process, equity to be raised by the new Ag entity to support its balance sheet."

CEO Rakesh Sachdev added, "Arysta and MacDermid Performance Solutions are both exceptional businesses serving primarily niche, specialized markets. Arysta is a global, leading agrochemical company with a strong product portfolio, a preferred partnership position with discovery based firms and a robust pipeline focused on fast-growing specialty markets. MacDermid Performance Solutions is a leading global specialty chemicals company that provides differentiated solutions and high-touch service in attractive, niche industrial and electronic end-markets. We believe that as two standalone companies, beyond unlocking shareholder value, these businesses will be further enabled to execute on their respective strategies for growth. Of course, throughout this process we will be focused on avoiding cost dis-synergies from the transaction."

Sachdev continued, "Each business will remain focused first and foremost on meeting customers' needs. These businesses already operate on a largely standalone basis, which should make the process of separating them more straightforward. While this process is subject to a number of variables, including market conditions, we expect the separation to occur in 2018. Over the next few quarters, we will communicate more details about our plans. I am confident that this path will benefit all of our stakeholders. In the meantime, we remain on track to deliver on our 2017 guidance and synergy and cost improvement plans."

WEST PALM BEACH, Fla., Aug. 24, 2017 (GLOBE NEWSWIRE) --

Platform Specialty Products Corporation (NYSE:PAH) ("Platform"), a global, diversified specialty chemicals company, today announced its intention to separate its Agricultural Solutions and Performance Solutions segments.

Executive Commentary

Chairman Martin E. Franklin said, "Following a strategic review and discussions with our management teams, we believe the best way to maximize long-term value for our shareholders is by separating our Agricultural Solutions business as a standalone public company. We are fortunate to have two very high-quality businesses serving two very different market segments in the specialty chemicals industry. We have long felt that this diversification has been an impediment to investors' full appreciation of the value of each asset. We believe that these businesses each have the scale, the management, business quality and growth potential to be great standalone public companies. We intend to structure the separation such that both companies will have appropriate post-separation balance sheets to facilitate independent access to capital for bolt-on acquisitions or strategic combinations within their respective markets. There has been interest from investors to put capital behind our Ag business, and we would expect, as part of this process, equity to be raised by the new Ag entity to support its balance sheet."

CEO Rakesh Sachdev added, "Arysta and MacDermid Performance Solutions are both exceptional businesses serving primarily niche, specialized markets. Arysta is a global, leading agrochemical company with a strong product portfolio, a preferred partnership position with discovery based firms and a robust pipeline focused on fast-growing specialty markets. MacDermid Performance Solutions is a leading global specialty chemicals company that provides differentiated solutions and high-touch service in attractive, niche industrial and electronic end-markets. We believe that as two standalone companies, beyond unlocking shareholder value, these businesses will be further enabled to execute on their respective strategies for growth. Of course, throughout this process we will be focused on avoiding cost dis-synergies from the transaction."

Sachdev continued, "Each business will remain focused first and foremost on meeting customers' needs. These businesses already operate on a largely standalone basis, which should make the process of separating them more straightforward. While this process is subject to a number of variables, including market conditions, we expect the separation to occur in 2018. Over the next few quarters, we will communicate more details about our plans. I am confident that this path will benefit all of our stakeholders. In the meantime, we remain on track to deliver on our 2017 guidance and synergy and cost improvement plans."

spekulativ aufgestockt;

mir gefällt das vormalige Alent-Geschäft, das aber leider unter Bergen von AGCo & Schulden verdeckt ist;

high-risk

mir gefällt das vormalige Alent-Geschäft, das aber leider unter Bergen von AGCo & Schulden verdeckt ist;

high-risk

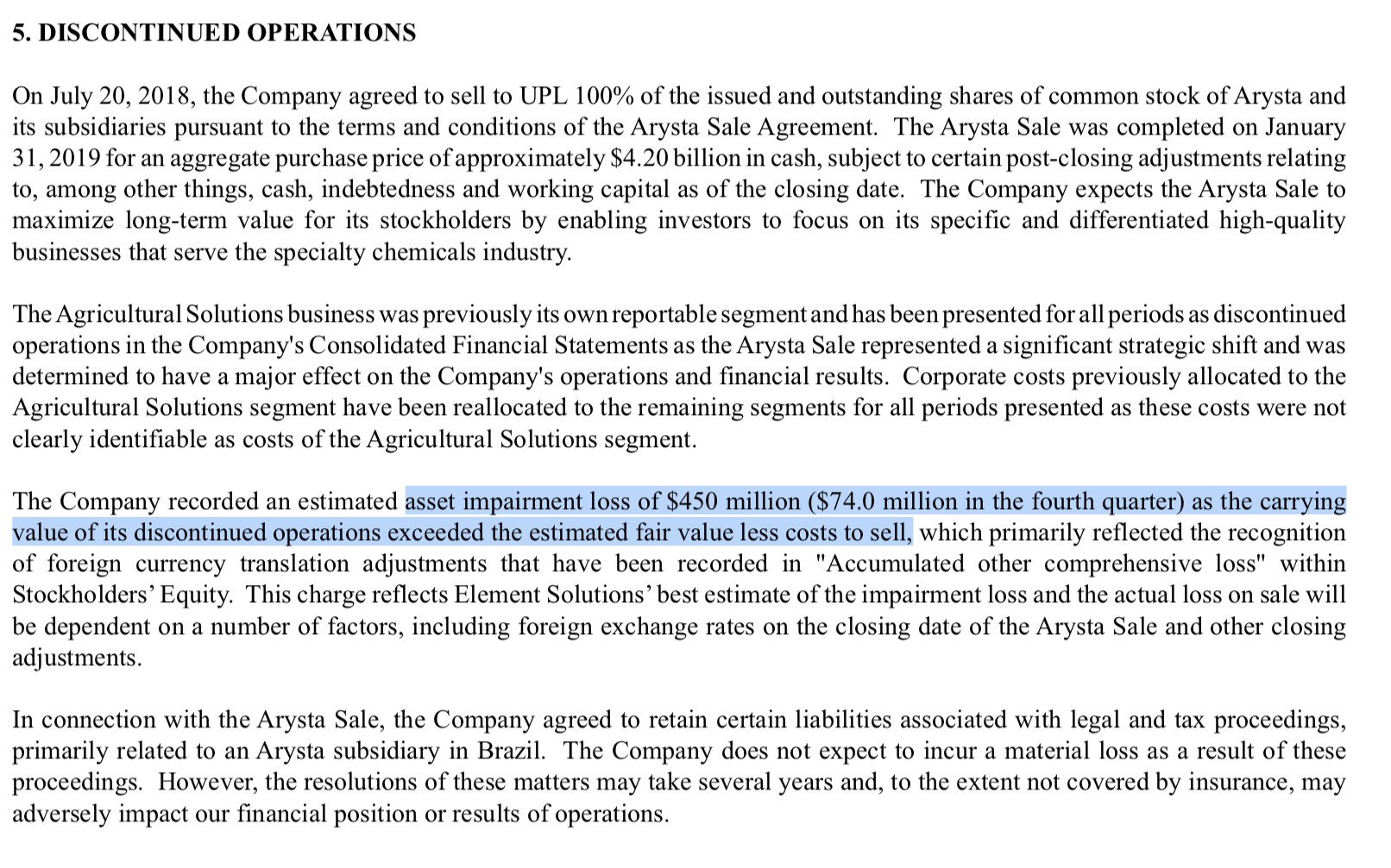

seit heute umbenannt in Element Solutions

Antwort auf Beitrag Nr.: 59.089.208 von R-BgO am 29.10.18 23:01:57

das ist der Käufer:

Thread: UPL Completes the Acquisition of Arysta LifeScience Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| +2,05 | |

| +0,43 | |

| +1,17 | |

| -5,46 | |

| +1,63 | |

| +0,04 | |

| -1,86 | |

| +0,45 | |

| +2,23 | |

| -1,30 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 215 | ||

| 90 | ||

| 78 | ||

| 58 | ||

| 55 | ||

| 35 | ||

| 34 | ||

| 29 | ||

| 26 | ||

| 25 |

Platform Specialty Products