Hewlett Packard Enterprises (Seite 4)

eröffnet am 11.07.16 13:12:18 von

neuester Beitrag 09.01.24 15:21:44 von

neuester Beitrag 09.01.24 15:21:44 von

Beiträge: 54

ID: 1.234.981

ID: 1.234.981

Aufrufe heute: 0

Gesamt: 5.156

Gesamt: 5.156

Aktive User: 0

ISIN: US42824C1099 · WKN: A140KD · Symbol: HPE

17,170

USD

+1,18 %

+0,200 USD

Letzter Kurs 27.04.24 NYSE

Neuigkeiten

25.04.24 · Business Wire (engl.) |

24.04.24 · Business Wire (engl.) |

23.04.24 · Business Wire (engl.) |

17.04.24 · Business Wire (engl.) |

16.04.24 · Business Wire (engl.) |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5400 | +176,92 | |

| 1,5000 | +20,00 | |

| 122,64 | +20,00 | |

| 174,60 | +20,00 | |

| 220,00 | +18,60 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5500 | -18,17 | |

| 20,06 | -19,76 | |

| 18,96 | -22,61 | |

| 1,1200 | -31,71 | |

| 5,0500 | -43,73 |

Beitrag zu dieser Diskussion schreiben

Hewlett Packard (HPE) Q3 Earnings Surpass Estimates, Up Y/Y

https://finance.yahoo.com/news/hewlett-packard-hpe-q3-earnin…=>

...

HPE reported fiscal third-quarter 2018 non-GAAP net earnings of 44 cents per share, which beat the Zacks Consensus Estimate of 38 cents and increased 42% on a year-over-year basis.

Management noted that the bottom line was driven by the company’s strong operational performance, favorable one-time benefits in OI&E and a lower-than-expected tax rate.

Hewlett Packard Enterprise reported revenues from continuing operations of $7.764 billion, up 3.5% on a year-over-year basis. Further, quarterly revenues outpaced the Zacks Consensus Estimate of $7.678 billion. The upside was driven by Hybrid IT, Intelligent Edge and Financial Services, particularly strong growth in Intelligent Edge segment.

Adjusted for currency-exchange rates, the company’s revenues from continuing operations increased 1% year over year.

...

Guidance

For fourth-quarter fiscal 2018, Hewlett Packard Enterprise projects non-GAAP earnings per share in the range of 39-44 cents.

Increase sales productivity and latest storage offerings are expected to drive organic growth in the fourth quarter. Management is particularly optimistic about HPE InfoSight and next generation HPE Nimble Storage platform to gain customer traction.

However, foreign exchange volatility is a concern. Management predicts less than 1 point of benefit to revenue in fourth quarter at the current rate.

For fiscal 2018, Hewlett Packard Enterprise now expects non-GAAP earnings per share in the range of $1.50-$1.55, up from the previous range of $1.40-$1.50.

The non-GAAP operating margin is anticipated to be a bit more than 9% compared with the company’s prior guidance of 9.5%.

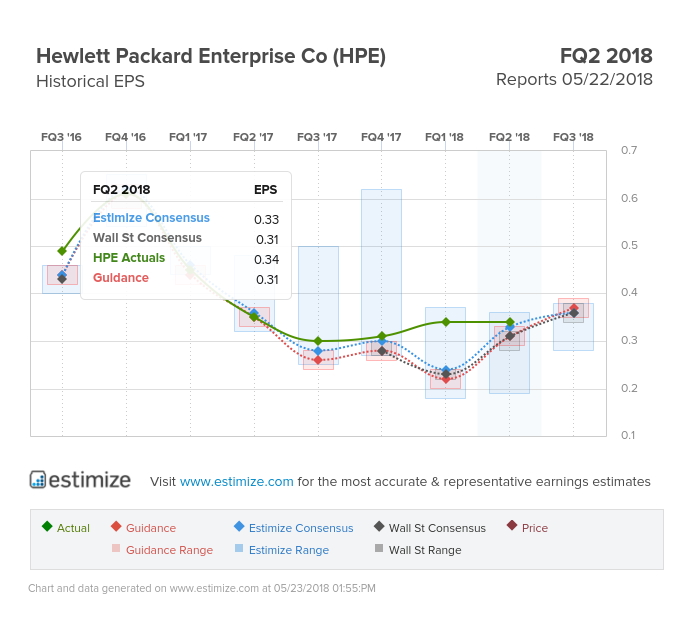

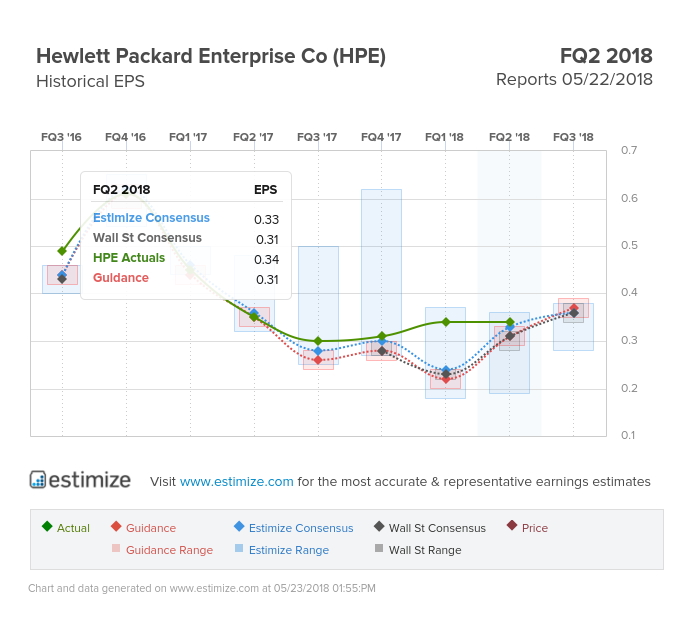

Antwort auf Beitrag Nr.: 57.110.214 von faultcode am 24.02.18 16:06:33

Guidance:

22.5.

https://www.streetinsider.com/Earnings/Hewlett+Packard+Enter…

=>

-- Hewlett Packard Enterprise sees FY2018 EPS of $1.40-$1.50, versus the consensus of $1.41.

-- Hewlett Packard Enterprise sees Q3 2018 EPS of $0.35-$0.39, versus the consensus of $0.36.

2018Q2 --> -9% z.Z.

--> sell the news. Beats slightly on rev and EPS:

Guidance:

22.5.

https://www.streetinsider.com/Earnings/Hewlett+Packard+Enter…

=>

-- Hewlett Packard Enterprise sees FY2018 EPS of $1.40-$1.50, versus the consensus of $1.41.

-- Hewlett Packard Enterprise sees Q3 2018 EPS of $0.35-$0.39, versus the consensus of $0.36.

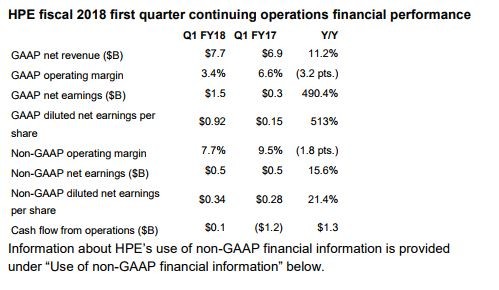

HPEs erste Quartalszahlen ohne Whitman --> ALL TIME HIGH

http://www.zdnet.de/88326753/hpes-erste-quartalszahlen-ohne-…=>

Das Ergebnis fällt besser aus, als von der Börse erwartet und die reagiert mit Kursgewinnen. HPE kündigt zudem einen Aktienrückkauf und für 2019 eine Dividendenausschüttung an.

=>

ABB, HPE team up on industrial IT project

https://finance.yahoo.com/news/abb-hpe-team-industrial-proje…=>

Swiss group ABB and Hewlett Packard Enterprise (HPE) have agreed a strategic partnership that combines their technologies to let customers harness industrial data to increase the efficiency and flexibility of operations.

The partners said on Tuesday the Internet of Things project would yoke ABB's operations technologies (OT) with HPE's information technologies (IT).

"Employing the right mix of IT platforms will accelerate data processing in industrial plants and at the same time enable effective control of industrial processes across locations," they said.

The partnership would include joint research, development, products and service.

Antwort auf Beitrag Nr.: 56.244.179 von faultcode am 22.11.17 11:24:01

=> ja.

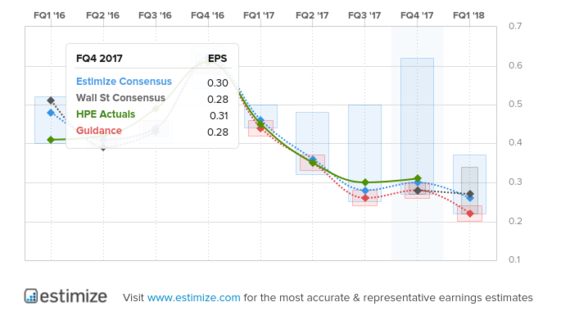

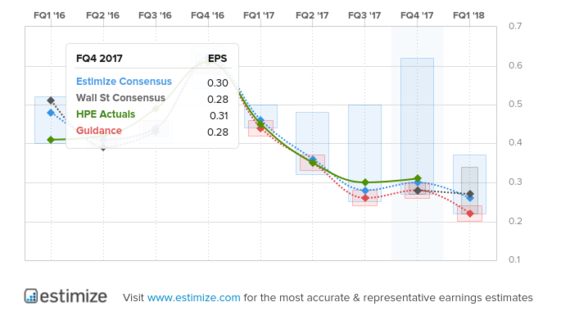

so schauts nun aus:

aus: https://www.estimize.com/hpe/fq1-2018?metric_name=eps&chart=…

Ansonsten:

HPE's Meg Whitman Is Stepping Down on Her Own Terms

https://www.thestreet.com/story/14399979/1/hpe-s-meg-whitman…

=>

...Whitman's departure surprised some analysts but they were largely positive on Neri's appointment...

Zitat von faultcode: ...

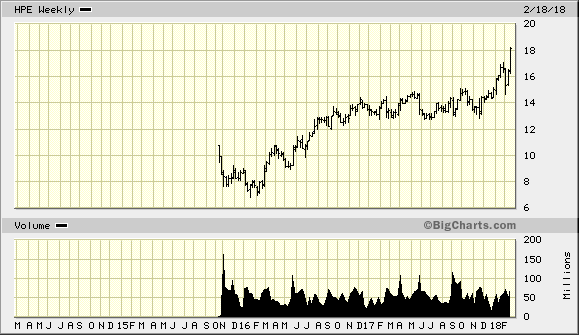

3/ läuft HPE nochmal bis auf den USD13-Widerstand zurück?

=> ja.

so schauts nun aus:

aus: https://www.estimize.com/hpe/fq1-2018?metric_name=eps&chart=…

Ansonsten:

HPE's Meg Whitman Is Stepping Down on Her Own Terms

https://www.thestreet.com/story/14399979/1/hpe-s-meg-whitman…

=>

...Whitman's departure surprised some analysts but they were largely positive on Neri's appointment...

Erste Kommentare zum CEO-Wechsel

z.B.: https://www.marketwatch.com/story/meg-whitman-leaves-behind-…=>

...

Neri is probably going to keep the current strategy, dubbed HPE Next; Whitman said Neri was one of the co-creators of that strategy, which seems to involve more layoffs and a focus on a hybrid-cloud approach. Neri will need to find ways to growth by looking for innovation inside HPE, but at least Whitman leaves him with a smaller, more manageable company.

“I think HPE is out of the woods for the most part,” said Enderle, adding that the last two quarters have shown some improvements. when Neri was in charge of operations in his new role.

Whitman should get very little credit for getting HPE out of those woods, as it doesn’t take an accomplished leader to slash and burn a path out of a thicket of trees, especially if the fire ends up taking out most of the forest. Neri’s task will be to find what remains of those ashes and turn it into growth.

Antwort auf Beitrag Nr.: 56.241.320 von Scheiss_Egal am 22.11.17 02:09:331/ after hours müssen nicht massgeblich sein, erst auf die erste 1/2h reg. US-Handel warten, um zu sehen, wie das grosse Geld die neue Situation sieht

2/ gefällt der Börse der neue Insider-CEO Neri? Besser Aussen-CEO, so wie Whitman? Ich persönlich bevorzuge idR Innen-CEO's

3/ läuft HPE nochmal bis auf den USD13-Widerstand zurück?

2/ gefällt der Börse der neue Insider-CEO Neri? Besser Aussen-CEO, so wie Whitman? Ich persönlich bevorzuge idR Innen-CEO's

3/ läuft HPE nochmal bis auf den USD13-Widerstand zurück?

Antwort auf Beitrag Nr.: 56.241.287 von faultcode am 22.11.17 01:10:53Abwarten aus mehreren Gründen?

Magst Du uns an den Gründen teilhaben lassen?

Magst Du uns an den Gründen teilhaben lassen?

Meg Whitman to step down as chief executive of HPE + Q3 --> -6% after hours

https://www.marketwatch.com/story/meg-whitman-to-step-down-a…=>

Chief Executive Meg Whitman will step down in 2018 and be replaced by Antonio Neri, the company announced Tuesday afternoon.

Whitman has been in charge of the former Hewlett-Packard since 2011, overseeing the company's separation into consumer- and enterprise-facing operations in HP Inc. and HPE, as well as other spin-offs and changes.

...

Neri has been with HPE since 1995, and has been running the Enterprise Group since 2015. He was named president of HPE in June. Whitman will remain on the board of HPE. HPE, which also announced fiscal fourth-quarter earnings Tuesday afternoon, saw shares sink by almost 8% in immediate late trading after the twin announcements.

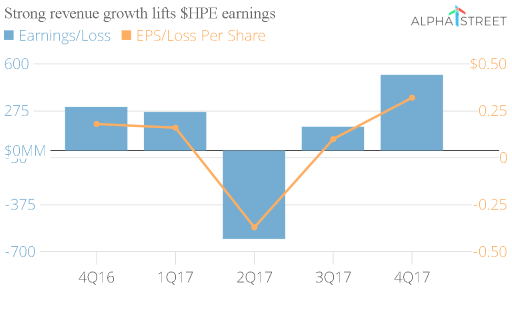

2017Q3:

Q417 combined net revenue of $7.8 billion, including $7.7 billion from continuing operations, which was up 5% from the prior year

Q417 GAAP diluted net earnings per share (EPS) of $0.32, above the previously provided outlook of $0.00 to $0.04 per share

Q417 non-GAAP diluted net EPS of $0.31, above the previously provided outlook of $0.26 to $0.30 per share

FY17 combined net revenue of $37.4 billion includes $28.9 billion from continuing operations and $8.5 billion from Enterprise Services and Software, which is now included in discontinued operations.

FY17 GAAP diluted net EPS of $0.21, above the previously provided outlook of ($0.11) to ($0.07) per share

FY17 non-GAAP diluted net EPS of $1.41, above the previously provided outlook of $1.36 to $1.40 per share

Returned $3.0 billion to shareholders in the form of share repurchases and dividends in FY17

Maintains FY18 full year non-GAAP diluted net EPS outlook of $1.15 to $1.25 and GAAP diluted net EPS outlook of $0.43 to $0.53

=>

=> aber die Q1-Guidance war's:

Co issues downside guidance for Q1, sees EPS of $0.20-0.24, excluding non-recurring items, vs. $0.27 Capital IQ Consensus Estimate.

GF sagt: Forward PE Ratio: 12.05 --> teuer ist die HPE-Aktie nicht. Buy the Dip? --> Abwarten (aus mehreren Gründen)

Antwort auf Beitrag Nr.: 56.066.942 von faultcode am 31.10.17 17:47:11hab hier nochmal meine Position aufgestockt (und beim Spinoff Spin-off MICRO FOCUS INTERN. (ADR), MFGP, verspätet nachgelegt, da jetzt erst "aufgeräumt, da sonst zu klein im Subportfolio; ausserdem glaube ich - auch - an MF.)

--> durch die beiden Spinoffs DXC und MFGP sind die Einkaufskosten bei mir aus 2016-05 substantiell nach unten gegangen.

=> beide Spinoffs sind nicht mehr günstig (wie so oft), aber die Mutter (wie so oft).

--> durch die beiden Spinoffs DXC und MFGP sind die Einkaufskosten bei mir aus 2016-05 substantiell nach unten gegangen.

=> beide Spinoffs sind nicht mehr günstig (wie so oft), aber die Mutter (wie so oft).

Hewlett Packard Enterprises