Critical Elements Lithium

eröffnet am 08.10.20 15:04:25 von

neuester Beitrag 03.11.23 20:13:17 von

neuester Beitrag 03.11.23 20:13:17 von

Beiträge: 63

ID: 1.332.032

ID: 1.332.032

Aufrufe heute: 0

Gesamt: 3.530

Gesamt: 3.530

Aktive User: 0

ISIN: CA22675W1077 · WKN: A1H7ZM · Symbol: F12

0,6090

EUR

+15,78 %

+0,0830 EUR

Letzter Kurs 26.04.24 Tradegate

Neuigkeiten

22.04.24 · Accesswire |

15.04.24 · Accesswire |

13.03.24 · Accesswire |

20.02.24 · Accesswire |

20.12.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,900 | +22,13 | |

| 5,1500 | +21,75 | |

| 1,7860 | +20,03 | |

| 0,9000 | +16,13 | |

| 0,5800 | +16,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6050 | -6,20 | |

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 0,5100 | -8,11 | |

| 39,20 | -8,84 |

Beitrag zu dieser Diskussion schreiben

CRITICAL ELEMENTS LITHIUM CORPORATION

TSX.V:CRE

Government of Canada to Enhance Critical Minerals Sector With Launch of $1.5 Billion Infrastructure Fund

https://www.canada.ca/en/natural-resources-canada/news/2023/…

Government of Canada to Enhance Critical Minerals Sector With Launch of $1.5 Billion Infrastructure Fund

Critical minerals are key enablers of clean technologies, like batteries, and clean energy sources, such as wind turbines and solar panels, which are essential to achieving a net-zero-emissions future. Canada’s critical minerals sector has tremendous opportunities that remain underdeveloped. This is largely because critical minerals deposits are often located in remote areas with challenging terrain and limited access to enabling infrastructure, such as roads or grid connectivity. Canada is already a leading supplier of sustainably sourced minerals and materials and is committed to making strategic investments to reinforce our position and drive job creation and economic growth.

That is why today, the Minister of Energy and Natural Resources, the Honourable Jonathan Wilkinson, announced that the Critical Minerals Infrastructure Fund (CMIF) will begin accepting applications when it opens its first call for proposals in late fall 2023.

The CMIF will address key infrastructure gaps to enable sustainable critical minerals production and to connect resources to markets. With up to $1.5 billion available over seven years, the fund will support clean energy and transportation projects that will enable critical mineral development.

Details about the first call for proposals will be available on the Canada.ca website, providing information about how interested applicants can apply.

The CMIF is a key component of the Canadian Critical Minerals Strategy and will complement other clean energy and transportation support that is already benefiting the critical minerals sector. By investing in the foundational and enabling infrastructure needed to develop critical minerals projects, Canada is helping to realize immense economic opportunities all along the value chain, from exploration and sustainable extraction to processing, advanced manufacturing and recycling, while simultaneously supporting the development of clean technologies essential to achieve a global net-zero emissions economy.

TSX.V:CRE

Government of Canada to Enhance Critical Minerals Sector With Launch of $1.5 Billion Infrastructure Fund

https://www.canada.ca/en/natural-resources-canada/news/2023/…

Government of Canada to Enhance Critical Minerals Sector With Launch of $1.5 Billion Infrastructure Fund

Critical minerals are key enablers of clean technologies, like batteries, and clean energy sources, such as wind turbines and solar panels, which are essential to achieving a net-zero-emissions future. Canada’s critical minerals sector has tremendous opportunities that remain underdeveloped. This is largely because critical minerals deposits are often located in remote areas with challenging terrain and limited access to enabling infrastructure, such as roads or grid connectivity. Canada is already a leading supplier of sustainably sourced minerals and materials and is committed to making strategic investments to reinforce our position and drive job creation and economic growth.

That is why today, the Minister of Energy and Natural Resources, the Honourable Jonathan Wilkinson, announced that the Critical Minerals Infrastructure Fund (CMIF) will begin accepting applications when it opens its first call for proposals in late fall 2023.

The CMIF will address key infrastructure gaps to enable sustainable critical minerals production and to connect resources to markets. With up to $1.5 billion available over seven years, the fund will support clean energy and transportation projects that will enable critical mineral development.

Details about the first call for proposals will be available on the Canada.ca website, providing information about how interested applicants can apply.

The CMIF is a key component of the Canadian Critical Minerals Strategy and will complement other clean energy and transportation support that is already benefiting the critical minerals sector. By investing in the foundational and enabling infrastructure needed to develop critical minerals projects, Canada is helping to realize immense economic opportunities all along the value chain, from exploration and sustainable extraction to processing, advanced manufacturing and recycling, while simultaneously supporting the development of clean technologies essential to achieve a global net-zero emissions economy.

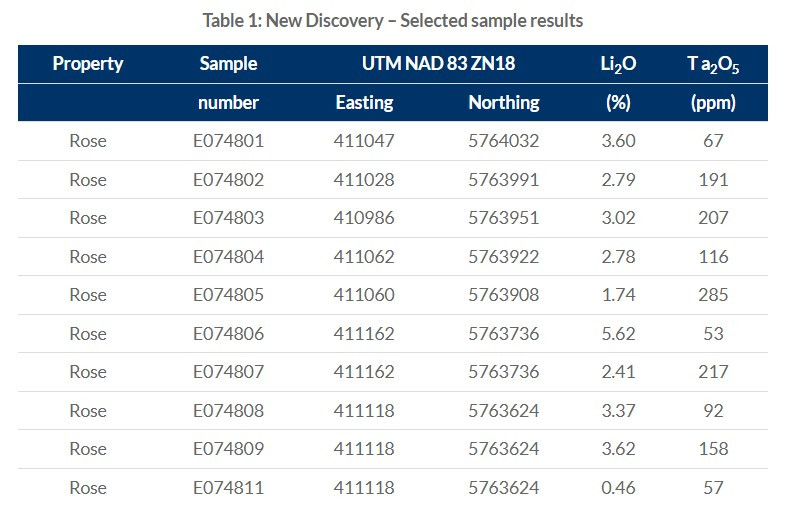

Critical Elements hat von der neuen spodumene bearing pegmatite discovery ca. 8 km westlich vom Rose Deposit Grab Sample Results veröffentlicht. Alle Samples sind Lithium-bearing und 50% davon sogar Werte über 3% Li2O (30.000ppm).

Bester Treffer 5.62% Li2O (56.200ppm)

https://www.cecorp.ca/en/critical-elements-lithium-announces…

Bester Treffer 5.62% Li2O (56.200ppm)

https://www.cecorp.ca/en/critical-elements-lithium-announces…

LOM 17 years

CapEx 471mio

OpEx 587 USD/t

price assumptions 4,699 USD/t technical grade & 2,162 USD/t chemical grade;

+ Tantal 580.000 kg x 150 DOllar (87mio)

Critical Elements files NI-43-101 technical report for the Rose Lithium-Tantalum feasibility study

Montréal, Québec – Critical Elements Lithium Corporation (TSX-V: CRE) is pleased to announce the filing on SEDAR+ of a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant technical report representing the qualifying report for the recently-announced Feasibility Study at the Rose Lithium-Tantalum Project located in James Bay, Québec. For more information, please refer to Critical Elements’ press release dated August 29, 2023. Highlights of the Feasibility Study are as follows:

Highlights

- Expected 17-year LOM

- Average production Year 2-17: 157,706 tonnes of chemical grade 5.56% spodumene concentrate

- Average production Year 2-17: 46,059 tonnes of technical grade 6.16% spodumene concentrate

- Average production Year 2-17: 580 tonnes of tantalum concentrate

- Average operating costs: US$81,30 per tonne milled, US$587 per tonne of concentrate (all concentrate production combined)

- Estimated initial capital cost: US$471 million (before working capital)

- Average gross margin: 78.8%

- After-tax NPV8% of US$2,195 million, after-tax IRR of 65.7%

- Anticipated construction time: 21 months to start of production

- Average price assumptions of

US$4,699 per tonne technical grade lithium concentrate,

US$2,162 per tonne chemical grade lithium concentrate and

US$150 per kg tantalum pentoxide (Ta2O5)

A copy of the technical report, will be available on the Critical Elements’ website at

https://www.cecorp.ca/wp-content/uploads/Rose_Lithium-Tantal…

CapEx 471mio

OpEx 587 USD/t

price assumptions 4,699 USD/t technical grade & 2,162 USD/t chemical grade;

+ Tantal 580.000 kg x 150 DOllar (87mio)

Critical Elements files NI-43-101 technical report for the Rose Lithium-Tantalum feasibility study

Montréal, Québec – Critical Elements Lithium Corporation (TSX-V: CRE) is pleased to announce the filing on SEDAR+ of a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) compliant technical report representing the qualifying report for the recently-announced Feasibility Study at the Rose Lithium-Tantalum Project located in James Bay, Québec. For more information, please refer to Critical Elements’ press release dated August 29, 2023. Highlights of the Feasibility Study are as follows:

Highlights

- Expected 17-year LOM

- Average production Year 2-17: 157,706 tonnes of chemical grade 5.56% spodumene concentrate

- Average production Year 2-17: 46,059 tonnes of technical grade 6.16% spodumene concentrate

- Average production Year 2-17: 580 tonnes of tantalum concentrate

- Average operating costs: US$81,30 per tonne milled, US$587 per tonne of concentrate (all concentrate production combined)

- Estimated initial capital cost: US$471 million (before working capital)

- Average gross margin: 78.8%

- After-tax NPV8% of US$2,195 million, after-tax IRR of 65.7%

- Anticipated construction time: 21 months to start of production

- Average price assumptions of

US$4,699 per tonne technical grade lithium concentrate,

US$2,162 per tonne chemical grade lithium concentrate and

US$150 per kg tantalum pentoxide (Ta2O5)

A copy of the technical report, will be available on the Critical Elements’ website at

https://www.cecorp.ca/wp-content/uploads/Rose_Lithium-Tantal…

Ein Special Report zur Critical Elements Lithium Corporation, alles nochmal schön zusammengefasst, aber nix Neues:

The Corporation’s strengths collectively position it for sustained growth and success and they include:

- Governmental support

- Indigenous collaboration;

- A strategic land package;

- Robust projects;

- Environmental approvals; and

- Seasoned management.

It has projections to produce the following:

- Approximately 157,706 tonnes of chemical-grade 5.6% spodumene concentrate;

- 46,059 tonnes of premium-priced technical-grade 6.2% spodumene concentrate for the glass and ceramics industry; and

- 580 tonnes of tantalum concentrate annually.

https://www.innovationnewsnetwork.com/critical-elements-lith…

The Corporation’s strengths collectively position it for sustained growth and success and they include:

- Governmental support

- Indigenous collaboration;

- A strategic land package;

- Robust projects;

- Environmental approvals; and

- Seasoned management.

It has projections to produce the following:

- Approximately 157,706 tonnes of chemical-grade 5.6% spodumene concentrate;

- 46,059 tonnes of premium-priced technical-grade 6.2% spodumene concentrate for the glass and ceramics industry; and

- 580 tonnes of tantalum concentrate annually.

https://www.innovationnewsnetwork.com/critical-elements-lith…

Antwort auf Beitrag Nr.: 74.458.743 von LithiumLove am 10.09.23 13:56:51Was genau meinst du? Die New Feasibility Study für das Rose Lithium Project kam schon am 29. August.

Capex Funding? Strategic Partner? Offtake Agreement? Joint Venture?

Mal ganz grundsätzlich finde ich falsch, dass sich Critical Elements Lithium jetzt zu sehr auf Technical Grade Spodumene mit 6.0% und Chemical Grade Spodumene mit +5.5% beschränkt!

Wo ist der Plan (oder der Mut) dort oben eine Lithium Hydroxide Conversion Plant für Battery Grade zu bauen???

On August 11th, 2022, the Corporation announced that it had complete an engineering study for a chemical plant to produce high quality lithium hydroxide monohydrate for the electric vehicle and energy storage system battery industries. The study was prepared by Metso Outotec and WSP in Canada (WSP).

Statt dessen wird der bekloppte Plan weiterverfolgt: Transportation of Spodumene by 90 tonnes truck (12 trucks per day) 370Km to Matagami railway

Capex Funding? Strategic Partner? Offtake Agreement? Joint Venture?

Mal ganz grundsätzlich finde ich falsch, dass sich Critical Elements Lithium jetzt zu sehr auf Technical Grade Spodumene mit 6.0% und Chemical Grade Spodumene mit +5.5% beschränkt!

Wo ist der Plan (oder der Mut) dort oben eine Lithium Hydroxide Conversion Plant für Battery Grade zu bauen???

On August 11th, 2022, the Corporation announced that it had complete an engineering study for a chemical plant to produce high quality lithium hydroxide monohydrate for the electric vehicle and energy storage system battery industries. The study was prepared by Metso Outotec and WSP in Canada (WSP).

Statt dessen wird der bekloppte Plan weiterverfolgt: Transportation of Spodumene by 90 tonnes truck (12 trucks per day) 370Km to Matagami railway

Rechne nach dem 26.09 hier mit der news auf die wir alle so lange schon warten!

selective grab samples

Aber immerhin... Critical Elements Lithium samples up to 2.22% Li2O at Duval and 2.44% Li2O in the southwestern extension of Lemare

MONTRÉAL, QUÉBEC – Critical Elements Lithium Corporation (TSX-V: CRE) is pleased to report the results of exploration of multiple lithium-tantalum pegmatite (“LCT pegmatite”) trends with positive prospecting sampling results on the Duval and Lemare sites.

Progression of the wholly owned Rose lithium-tantalum deposit toward a final investment decision is Critical Elements’ primary goal. Rose is one of the most advanced hardrock lithium development projects in North America (see updated feasibility study results in the news release dated August 29, 2023), with key environmental permits and crucial Impact and Benefits Agreement in place. However, the Corporation also owns over 1,050 square kilometres of concessions that are highly prospective in the Eeyou Istchee region of Québec and management intends to catalyze the value inherent in this asset. To this end, Critical Elements launched a surface exploration program as announced in the news release dated May 31, 2023.

During June 2023, Critical Elements conducted a prospecting program over several areas of the Corporation’s Nemaska belt property portfolio using ground-based and helicopter-borne teams of geologists. The program was interrupted for several weeks due to the unprecedented wildfire situation in the region. The Corporation is deeply concerned by the damage caused to the environment, as well as the negative impact on the people of Eeyou Istchee. Our teams have now returned to the field to continue with the planned program. The program’s objective is to identify new pegmatite bodies using systematic rock geochemical sampling of ranked LCT-pegmatite targets as defined by ALS Goldspot “SmartTarget” methodology, which combines both expert-driven and machine-learning data-driven targeting approaches to refine the geological interpretation of the properties for further exploration work.

A total of 108 rock samples were collected during the short exploration campaign of June 2023. Prospecting confirms the discovery of the new two-kilometre-long trend of white pegmatite on the Corporation’s 100% owned Duval property that hosts several lithium, cesium, and tantalum anomalies. Individual results include 2.22% Li2O, 1.54% Li2O and 0.54% Li2O in an angular pegmatite boulder field that may have been transported one kilometre from the main discovery outcrops during glaciation (Table 1 and Figure 1). These mineralized pegmatites are spatially associated with mafic volcanics along an interpreted regional-scale shear zone that borders the Nemiscau Belt, in a similar geological setting that extends to the Whabouchi lithium deposit, three kilometres off the claims to the northeast (Figure 3). These results begin to show the potential of the Corporation’s Nemaska trend properties.

In addition, the Corporation has received sample results confirming the summer 2022 discovery of the extension of the LCT pegmatite trend on the Lemare property marked by a sample grading 0.38% Li2O. Recent high-grade results include up to 2.44% Li2O and 1.60% Li2O (Table 2 and Figure 2) in in situ pegmatite outcrop. This highlights the potential for future drilling to extend the LCT pegmatite trend to over 5 kilometres on the Lemare property.

The reader is cautioned that grab samples are selective by nature and may not represent average grades of the mineralization in the pegmatites.

https://www.cecorp.ca/en/critical-elements-lithium-samples-u…

Antwort auf Beitrag Nr.: 74.178.620 von Dirkix am 19.07.23 17:04:24Kleine Korrektur meinerseits zum LTR Ore Reserve Estimate:

TOTAL 68.5Mt @ 1.34% = 917,243t Lithium

+ 120ppm = 8,247t Tantal

TOTAL 68.5Mt @ 1.34% = 917,243t Lithium

+ 120ppm = 8,247t Tantal

Ich weiss nicht ob das hier schon bekannt ist, aber Critical Elements Lithium hat den dritten Platz bei top-ranked mining projects vom Mining-Journal gemacht, mit 88 Punkten knapp hinter Eskay mit 90 und Liontown mit 89 Punkten. s.u.

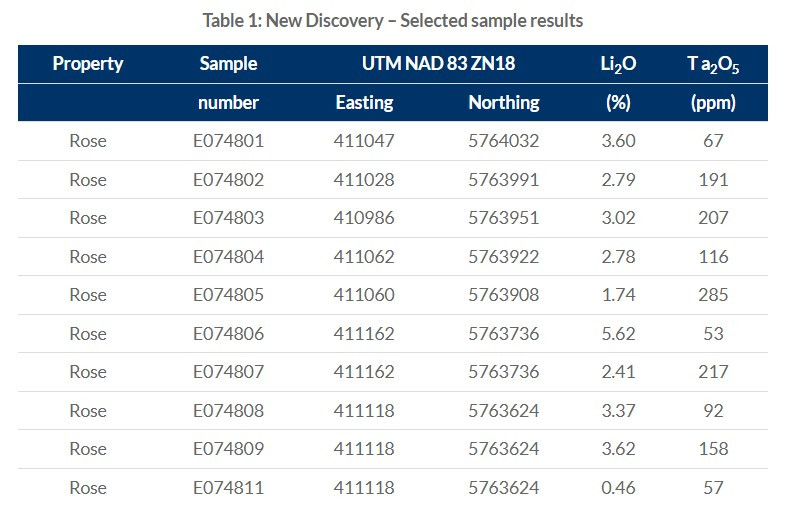

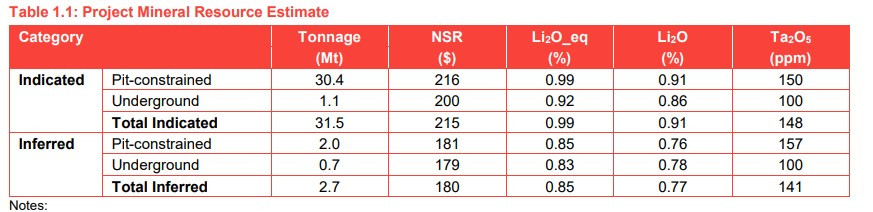

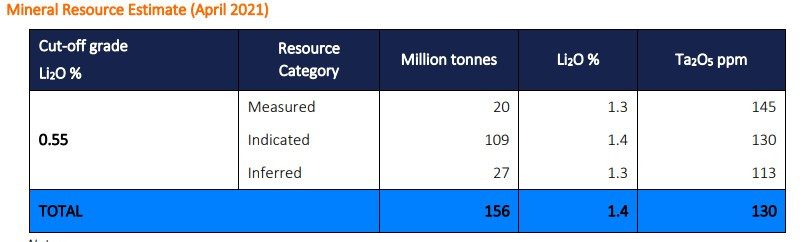

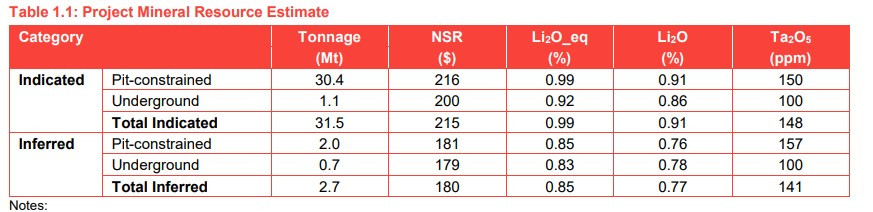

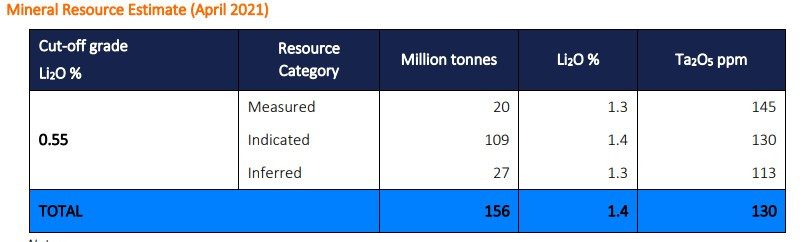

Ich habe das zum Anlass genommen hier mal einen Blick in den NI43-101 zu werfen. IMO ist das Rose Deposit deutlich abgeschlagen. Es ist nur 20 Prozent von LTR und in beiden Kategorien Measured und Indicated sind die Grades (0,8 - 0,9%) deutlich hinter LTR (1,3 - 1,4%), Tantal ist jeweils gleich, hier mal der direkte Mineral Resource Estimate Vergleich zwischen beiden Projekten:

LZR hat auch schon eine Ore Reserve Estimate veröffentlicht: 156Mt at 1.4% Li2O and 130ppm Ta2O

Dazu kommt, dass Critical Elements Lithium IMO deutlich höherer Grades aufweisen müsste, die klimatischen Bedingungen sind viel schwieriger (Kälte, Eis, Niederschlag, ...) und der Transport ist wegen der abgelegenen, schwer erreichbaren Gegend (im Winter bei Eis geht es ja noch, aber im Frühling und Herbst verwandelt sich alles in Matschepampe) ebenfalls aufwendiger.

Oder habe ich hier einen wichtigen Aspekt übersehen, ich lerne gerne dazu?!?

Mining Journal Intelligence top projects

This year's top scorer is Skeena Resources' Eskay Creek, a gold project located in the Canadian province of British Columbia. Eskay Creek's outstanding score of 90 is based on data from a 2022 feasibility study, which outlined a high-grade open pit operation generating a 50.2% post-tax IRR at US$1,700/oz gold prices.

The project scored at least 8.2 out of 10 across all categories, including 9.5 for Financeability and Geology, and 9.3 for Economics.

The asset is expected to produce 431,000ozpa of gold equivalent over the first five years. Skeena is targeting approval of final environmental permits in the first half of 2025.

Eskay Creek was closely followed by Liontown Resources' Kathleen Valley lithium project in Western Australia, which is currently under construction, and scored 89.

Kathleen Valley scored full marks (10 out of 10) in Economics and Financeability, along with 9.3 in the Confidence category, based on an assessment of a 2021 feasibility study.

The project is expected to supply about 500,000tpa of 6% lithium oxide concentrate when it comes on stream in mid-2024. Initial capex estimates were bumped up to A$895 million (US$600 million) earlier in 2023, from A$545 million in the feasibility study.

Despite this, Kathleen Valley's quality has not gone unnoticed in the market, with Liontown rejecting a bid for the company from Albemarle in March.

Four projects in the top 50 scored 88.

Two - Critical Elements Lithium's Rose lithium asset and NexGen Energy's Rook I uranium project - are in Canada.

Taseko Mines' Florence copper project in Arizona - the highest-scoring base metals asset - and Ferro-Alloy Resources' Balasausqandiq vanadium project in Kazakhstan - also scored 88.

https://www.mining-journal.com/research/news/1455799/reveale…

Ich habe das zum Anlass genommen hier mal einen Blick in den NI43-101 zu werfen. IMO ist das Rose Deposit deutlich abgeschlagen. Es ist nur 20 Prozent von LTR und in beiden Kategorien Measured und Indicated sind die Grades (0,8 - 0,9%) deutlich hinter LTR (1,3 - 1,4%), Tantal ist jeweils gleich, hier mal der direkte Mineral Resource Estimate Vergleich zwischen beiden Projekten:

LZR hat auch schon eine Ore Reserve Estimate veröffentlicht: 156Mt at 1.4% Li2O and 130ppm Ta2O

Dazu kommt, dass Critical Elements Lithium IMO deutlich höherer Grades aufweisen müsste, die klimatischen Bedingungen sind viel schwieriger (Kälte, Eis, Niederschlag, ...) und der Transport ist wegen der abgelegenen, schwer erreichbaren Gegend (im Winter bei Eis geht es ja noch, aber im Frühling und Herbst verwandelt sich alles in Matschepampe) ebenfalls aufwendiger.

Oder habe ich hier einen wichtigen Aspekt übersehen, ich lerne gerne dazu?!?

Mining Journal Intelligence top projects

This year's top scorer is Skeena Resources' Eskay Creek, a gold project located in the Canadian province of British Columbia. Eskay Creek's outstanding score of 90 is based on data from a 2022 feasibility study, which outlined a high-grade open pit operation generating a 50.2% post-tax IRR at US$1,700/oz gold prices.

The project scored at least 8.2 out of 10 across all categories, including 9.5 for Financeability and Geology, and 9.3 for Economics.

The asset is expected to produce 431,000ozpa of gold equivalent over the first five years. Skeena is targeting approval of final environmental permits in the first half of 2025.

Eskay Creek was closely followed by Liontown Resources' Kathleen Valley lithium project in Western Australia, which is currently under construction, and scored 89.

Kathleen Valley scored full marks (10 out of 10) in Economics and Financeability, along with 9.3 in the Confidence category, based on an assessment of a 2021 feasibility study.

The project is expected to supply about 500,000tpa of 6% lithium oxide concentrate when it comes on stream in mid-2024. Initial capex estimates were bumped up to A$895 million (US$600 million) earlier in 2023, from A$545 million in the feasibility study.

Despite this, Kathleen Valley's quality has not gone unnoticed in the market, with Liontown rejecting a bid for the company from Albemarle in March.

Four projects in the top 50 scored 88.

Two - Critical Elements Lithium's Rose lithium asset and NexGen Energy's Rook I uranium project - are in Canada.

Taseko Mines' Florence copper project in Arizona - the highest-scoring base metals asset - and Ferro-Alloy Resources' Balasausqandiq vanadium project in Kazakhstan - also scored 88.

https://www.mining-journal.com/research/news/1455799/reveale…

Und wir haben fundamental noch ganz viel Platz noch oben was MC angeht.