Die Wasserstoffaktie für den kommenden Sommer (Kaufempfehlung vor den Olympischen Spielen)

eröffnet am 05.01.21 17:03:55 von

neuester Beitrag 17.09.23 20:33:06 von

neuester Beitrag 17.09.23 20:33:06 von

Beiträge: 16

ID: 1.337.642

ID: 1.337.642

Aufrufe heute: 0

Gesamt: 1.273

Gesamt: 1.273

Aktive User: 0

ISIN: JP3386450005 · WKN: A1CS9H · Symbol: JHJ

4,2200

EUR

-2,31 %

-0,1000 EUR

Letzter Kurs 30.04.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7375 | +21,50 | |

| 350,45 | +13,33 | |

| 19,650 | +11,77 | |

| 1,1600 | +11,54 | |

| 84,63 | +9,99 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 48,40 | -8,64 | |

| 6,5700 | -9,63 | |

| 4,6700 | -10,19 | |

| 3,5200 | -15,38 | |

| 0,8300 | -20,95 |

Beitrag zu dieser Diskussion schreiben

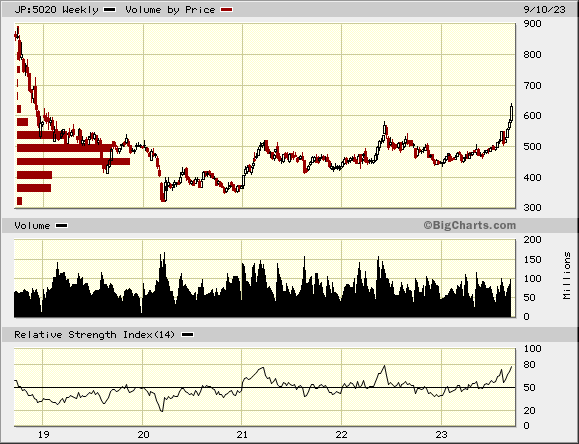

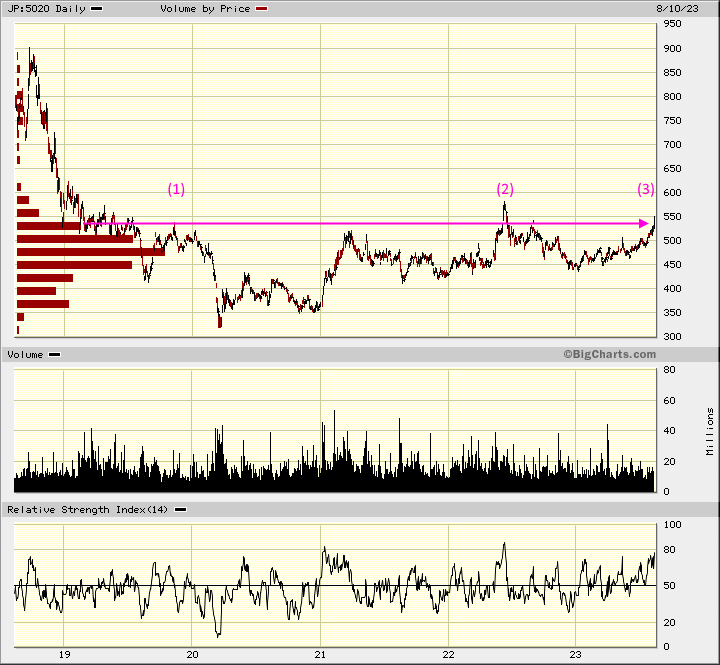

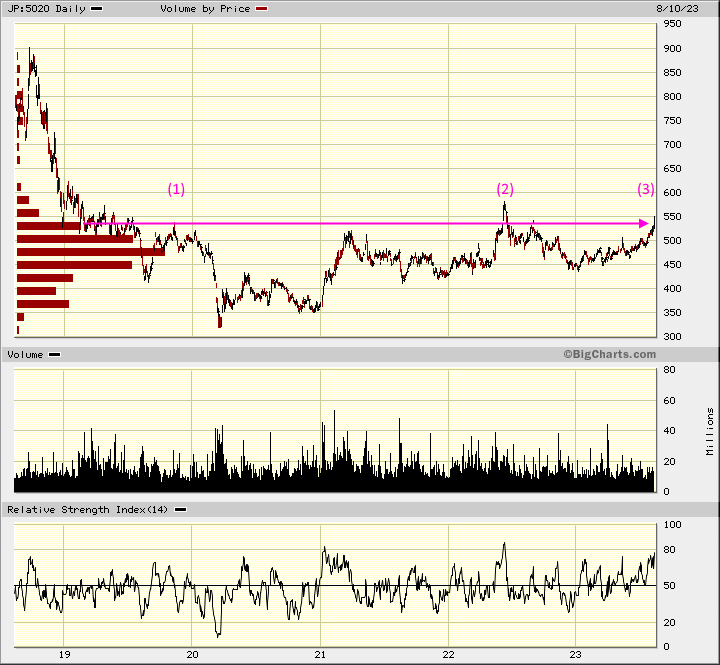

Eneos Holdings vor dem dritten Ausbruchsversuch:

Q2: https://www.hd.eneos.co.jp/english/ir/ -->

...

...

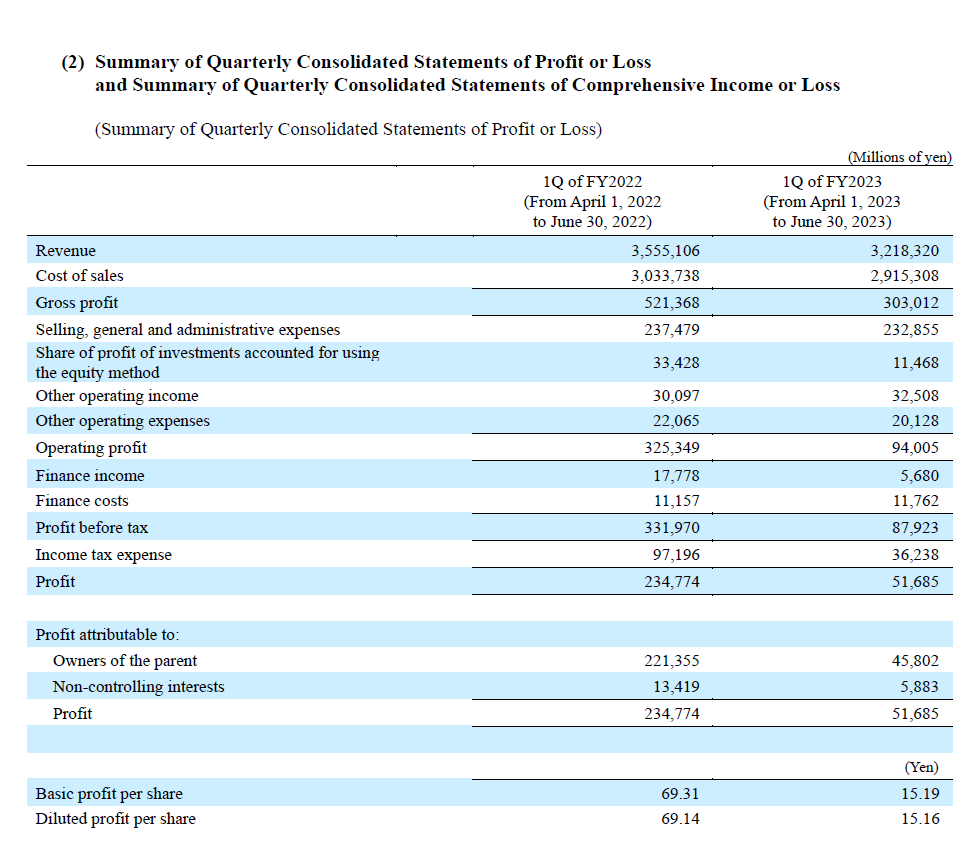

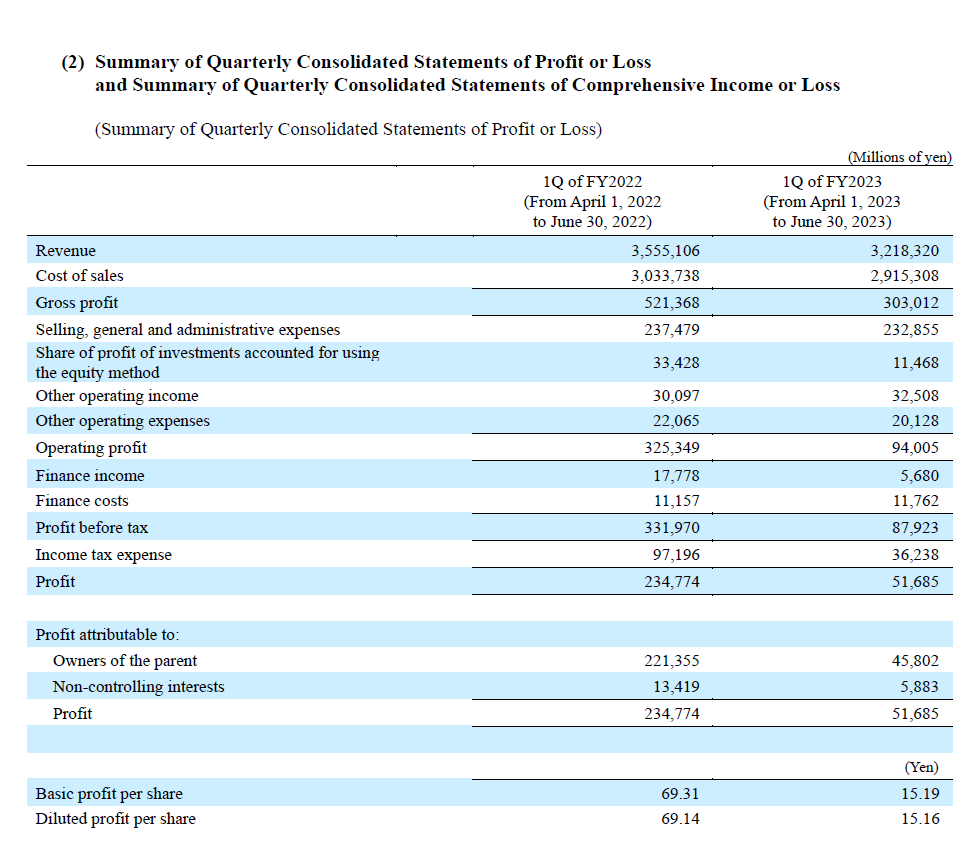

am aktuellen Q-Bericht und dem unveränderten Forecast für's laufende Fiscal Year 2023 (bis März 2024) kann es mMn nicht liegen.

Q2: https://www.hd.eneos.co.jp/english/ir/ -->

...

...

am aktuellen Q-Bericht und dem unveränderten Forecast für's laufende Fiscal Year 2023 (bis März 2024) kann es mMn nicht liegen.

Rock 'n' Roll:

10.5.

Eneos erwägt möglichen Börsengang für JX Nippon Mining & Metals -Nikkei

https://de.marketscreener.com/kurs/aktie/ENEOS-HOLDINGS-INC-…

...

Der japanische Energieriese Eneos Holdings Inc erwägt die Ausgliederung der Tochtergesellschaft JX Nippon Mining & Metals mit einer möglichen Option auf einen Börsengang, berichtete die Zeitung Nikkei am Mittwoch.

Eneos wird den Vorschlag zur Ausgliederung in seinen jüngsten mittelfristigen Geschäftsplan aufnehmen, der am Donnerstag veröffentlicht werden soll, so Nikkei.

Eneos sagte in einer Erklärung, dass der Nikkei-Bericht nicht auf der Ankündigung des Unternehmens basiere und dass es zwar "ständig verschiedene Kapitalstrategien in Betracht ziehe", aber noch keine Entscheidungen getroffen habe.

...

10.5.

Eneos erwägt möglichen Börsengang für JX Nippon Mining & Metals -Nikkei

https://de.marketscreener.com/kurs/aktie/ENEOS-HOLDINGS-INC-…

...

Der japanische Energieriese Eneos Holdings Inc erwägt die Ausgliederung der Tochtergesellschaft JX Nippon Mining & Metals mit einer möglichen Option auf einen Börsengang, berichtete die Zeitung Nikkei am Mittwoch.

Eneos wird den Vorschlag zur Ausgliederung in seinen jüngsten mittelfristigen Geschäftsplan aufnehmen, der am Donnerstag veröffentlicht werden soll, so Nikkei.

Eneos sagte in einer Erklärung, dass der Nikkei-Bericht nicht auf der Ankündigung des Unternehmens basiere und dass es zwar "ständig verschiedene Kapitalstrategien in Betracht ziehe", aber noch keine Entscheidungen getroffen habe.

...

13.9.

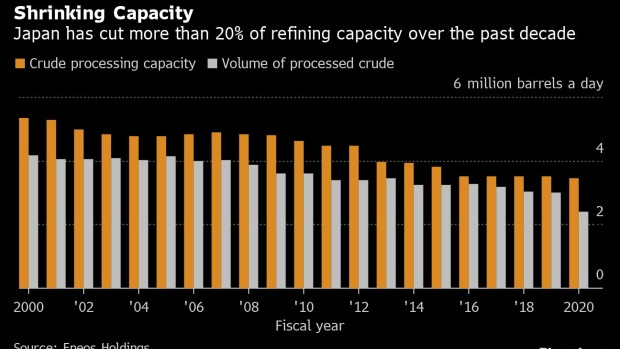

Japan’s Top Refiner Is Gearing Up for the Oil Industry’s Decline

https://www.bnnbloomberg.ca/japan-s-top-refiner-is-gearing-u…

...

Japan’s biggest oil refiner is drawing up plans to consolidate production as domestic demand slumps because of a shrinking population and efforts to cut emissions.

Eneos Holdings Inc. has an outline for fusing operations but is still discussing which of its refineries to shutter when, President Takeshi Saito, who took over the helm of the Tokyo-based company in April, said in an interview. Eneos, which expects domestic fuel demand to slump 50% by 2040, has already announced a plan to close one of its 10 refineries next year.

The 60-year-old faces the same challenges of many of his peers around the world as efforts to reduce carbon-dioxide emissions target diesel and gasoline-powered transportation while electric vehicles become more mainstream. That is compounded in Japan by the effects of a shrinking population that further damps demand for fuels in the world’s third-largest economy.

“We’re keeping close watch on the pace of decline in demand,” said Saito. “We also need to consider the impact to the local municipalities, and decide how to use the refinery site -- whether it’s installing renewable energy, or using it as a logistics facility.”

...

14.6.

Giant Japan Oil Refiner to Shut 53-Year Old Plant on Weak Demand

https://www.bnnbloomberg.ca/giant-japan-oil-refiner-to-shut-…

...

Japan’s Idemitsu Kosan Co. will shut an oil refinery that’s been running for more than half a century in the country’s west, as domestic demand for fuel continues to decline and a global push to decarbonize intensifies.

The company will halt processing at its Yamaguchi plant by the end of March 2024, it said in a statement on Tuesday. Idemitsu will consider new uses for the site, while continuing to store oil as well as generate solar power there.

“There will be surplus refining capacity by 2030 that can be cut down,” Susumu Nibuya, executive vice president for the company, said in a press conference on Tuesday. “We plan to consolidate our capacity beyond 2030 as demand for oil products continue to decline.”

The refinery, first opened in 1969, has the capacity to process 120,000 barrels of crude a day. The Nikkei newspaper reported the announcement earlier.

Idemitsu will make Seibu Oil Co. -- which operates the Yamaguchi refinery -- a wholly owned subsidiary by acquiring stakes held by shareholders UBE Corp., Chugoku Electric Power Co. and others. The refiner plans to increase its stake in Seibu Oil to 66.9% from 38%. The firm plans to keep about 450 jobs at the site.

Japanese oil refiners are consolidating their operations due to falling domestic demand, rising international competition and a shift away from fossil fuels.

Eneos Holdings Inc. announced in January that it would close one of its oil refineries in Wakayama prefecture near Osaka next year.

...

Giant Japan Oil Refiner to Shut 53-Year Old Plant on Weak Demand

https://www.bnnbloomberg.ca/giant-japan-oil-refiner-to-shut-…

...

Japan’s Idemitsu Kosan Co. will shut an oil refinery that’s been running for more than half a century in the country’s west, as domestic demand for fuel continues to decline and a global push to decarbonize intensifies.

The company will halt processing at its Yamaguchi plant by the end of March 2024, it said in a statement on Tuesday. Idemitsu will consider new uses for the site, while continuing to store oil as well as generate solar power there.

“There will be surplus refining capacity by 2030 that can be cut down,” Susumu Nibuya, executive vice president for the company, said in a press conference on Tuesday. “We plan to consolidate our capacity beyond 2030 as demand for oil products continue to decline.”

The refinery, first opened in 1969, has the capacity to process 120,000 barrels of crude a day. The Nikkei newspaper reported the announcement earlier.

Idemitsu will make Seibu Oil Co. -- which operates the Yamaguchi refinery -- a wholly owned subsidiary by acquiring stakes held by shareholders UBE Corp., Chugoku Electric Power Co. and others. The refiner plans to increase its stake in Seibu Oil to 66.9% from 38%. The firm plans to keep about 450 jobs at the site.

Japanese oil refiners are consolidating their operations due to falling domestic demand, rising international competition and a shift away from fossil fuels.

Eneos Holdings Inc. announced in January that it would close one of its oil refineries in Wakayama prefecture near Osaka next year.

...

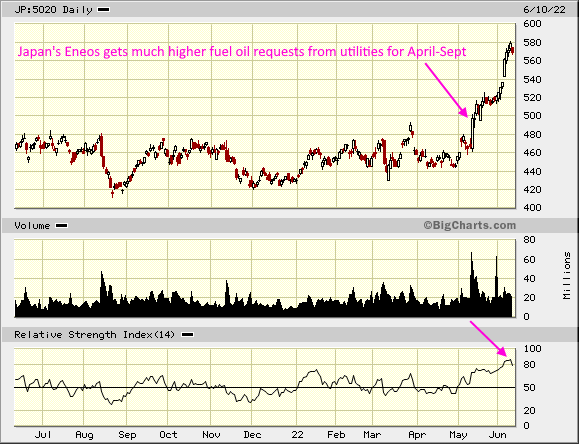

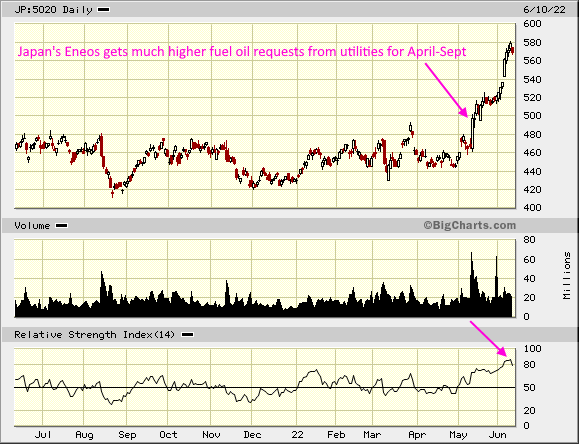

Antwort auf Beitrag Nr.: 71.583.813 von faultcode am 16.05.22 13:33:00dennoch kam ENEOS zuletzt ins Laufen:

=> die Meldung, die denn charttechnischen Ausbruch einleitete, war diese vom 23.5.:

Japan's Eneos gets much higher fuel oil requests from utilities for April-Sept

https://www.reuters.com/article/japan-refiners-eneos-idUSKCN…

...

Japan’s top oil refiner Eneos Holdings Inc has received higher requests from local utilities for fuel oil to be used in oil-fired power plants for April-September, but it will be able to meet only a part of the request, its chairman said.

For the first half of this financial year that started on April 1, Eneos has received strong requests for fuel oil that is 112% higher than a year earlier, but it can only offer limited supply that is 44% higher than a year earlier, Eneos Chairman Tsutomu Sugimori told a news conference.

=> die Meldung, die denn charttechnischen Ausbruch einleitete, war diese vom 23.5.:

Japan's Eneos gets much higher fuel oil requests from utilities for April-Sept

https://www.reuters.com/article/japan-refiners-eneos-idUSKCN…

...

Japan’s top oil refiner Eneos Holdings Inc has received higher requests from local utilities for fuel oil to be used in oil-fired power plants for April-September, but it will be able to meet only a part of the request, its chairman said.

For the first half of this financial year that started on April 1, Eneos has received strong requests for fuel oil that is 112% higher than a year earlier, but it can only offer limited supply that is 44% higher than a year earlier, Eneos Chairman Tsutomu Sugimori told a news conference.

Antwort auf Beitrag Nr.: 71.474.003 von faultcode am 02.05.22 14:40:38...

...

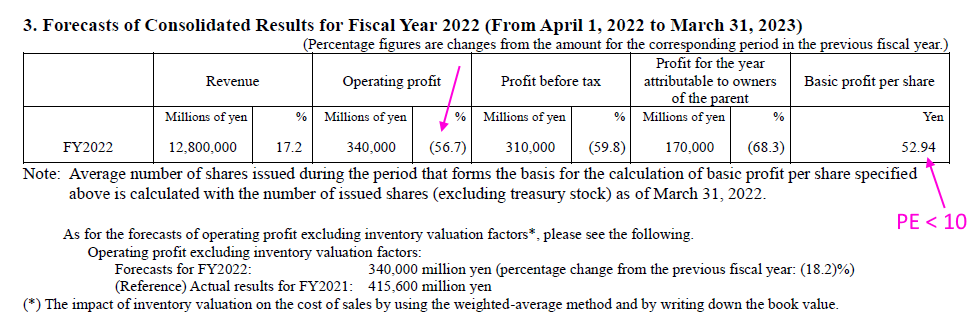

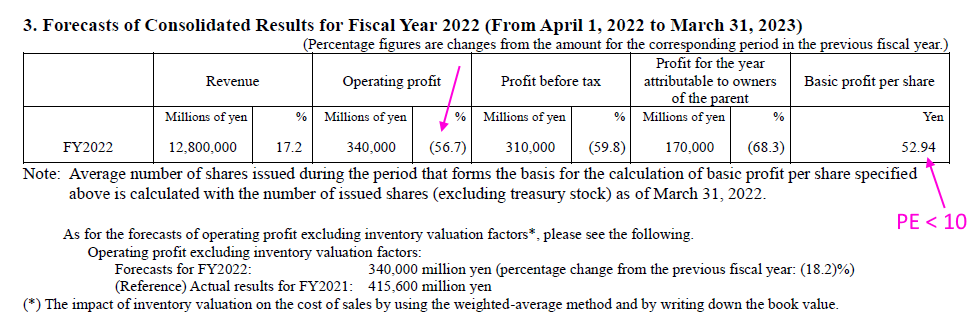

warum Sellside-Analysten, wenn das Unternehmen selber Schätzungen ausgibt?

Ansonsten: die angenommenen Rückgänge in FY2022e störten den Aktienkurs bislang nicht besonders

...

warum Sellside-Analysten, wenn das Unternehmen selber Schätzungen ausgibt?

Ansonsten: die angenommenen Rückgänge in FY2022e störten den Aktienkurs bislang nicht besonders

ansonsten:

2.5.

ENEOS, JERA, and JFE Holdings to Begin Joint Study of a Hydrogen and Ammonia Supply Collaboration

https://solarquarter.com/2022/05/02/eneos-jera-and-jfe-holdi…

...

ENEOS Corporation (“ENEOS”), JERA Co., Inc. (“JERA”), and JFE Holdings, Inc. (“JFE”) have concluded a memorandum of understanding and begun to discuss in detail the possibility of establishing a hydrogen and ammonia receiving and supply base, and developing a supply project at the Keihin Waterfront Area in Kanagawa Prefecture.

Technological development is underway for the practical use of hydrogen and ammonia as next-generation clean fuels that do not emit CO2 during combustion. Given an assumption of large-scale consumption of hydrogen and ammonia at power plants and industrial areas, it is essential to develop large-scale receiving and supply bases near high-demand areas.

At the Keihin Waterfront Area, located in the center of the Kanto region where energy demand is large, ENEOS owns refineries and a plant, JERA owns thermal power plants and an LNG receiving terminal, and the main business area of both companies is an energy supply. In addition, JFE is working with Kawasaki City to devise options for repurposing land at the company’s East Japan Works, where blast furnace and other facility operations will be suspended, and also deep-water wharves capable of docking large ships on Ogishima island and adjacent inland areas.

The three companies have decided to consider utilizing their business foundations in this area to collaborate on the following aspects of the hydrogen and ammonia supply business:

-- Establishment of hydrogen and ammonia receiving and supply base

-- Development of a hydrogen and ammonia supply network

-- Considering hydrogen and ammonia suppliers, transportation carriers, and transportation methods

One of the ENEOS Group’s envisioned goals stated in its Long-Term Vision to 2040 is to contribute to the development of a low-carbon, recycling-oriented society and ENEOS Group are working to achieve this vision. Among hydrogen and ammonia, ENEOS is accelerating our efforts with a particular focus on the mass consumption of hydrogen. In anticipation of a hydrogen-oriented society, ENEOS is striving to develop a CO2-free hydrogen supply chain in Japan and overseas, in addition to operating hydrogen stations for FCVs in Japan.

In this study, ENEOS will consider the establishment of a base for receiving CO2-free hydrogen produced outside Japan and for supplying large-scale hydrogen customers in the vicinity.

...

2.5.

ENEOS, JERA, and JFE Holdings to Begin Joint Study of a Hydrogen and Ammonia Supply Collaboration

https://solarquarter.com/2022/05/02/eneos-jera-and-jfe-holdi…

...

ENEOS Corporation (“ENEOS”), JERA Co., Inc. (“JERA”), and JFE Holdings, Inc. (“JFE”) have concluded a memorandum of understanding and begun to discuss in detail the possibility of establishing a hydrogen and ammonia receiving and supply base, and developing a supply project at the Keihin Waterfront Area in Kanagawa Prefecture.

Technological development is underway for the practical use of hydrogen and ammonia as next-generation clean fuels that do not emit CO2 during combustion. Given an assumption of large-scale consumption of hydrogen and ammonia at power plants and industrial areas, it is essential to develop large-scale receiving and supply bases near high-demand areas.

At the Keihin Waterfront Area, located in the center of the Kanto region where energy demand is large, ENEOS owns refineries and a plant, JERA owns thermal power plants and an LNG receiving terminal, and the main business area of both companies is an energy supply. In addition, JFE is working with Kawasaki City to devise options for repurposing land at the company’s East Japan Works, where blast furnace and other facility operations will be suspended, and also deep-water wharves capable of docking large ships on Ogishima island and adjacent inland areas.

The three companies have decided to consider utilizing their business foundations in this area to collaborate on the following aspects of the hydrogen and ammonia supply business:

-- Establishment of hydrogen and ammonia receiving and supply base

-- Development of a hydrogen and ammonia supply network

-- Considering hydrogen and ammonia suppliers, transportation carriers, and transportation methods

One of the ENEOS Group’s envisioned goals stated in its Long-Term Vision to 2040 is to contribute to the development of a low-carbon, recycling-oriented society and ENEOS Group are working to achieve this vision. Among hydrogen and ammonia, ENEOS is accelerating our efforts with a particular focus on the mass consumption of hydrogen. In anticipation of a hydrogen-oriented society, ENEOS is striving to develop a CO2-free hydrogen supply chain in Japan and overseas, in addition to operating hydrogen stations for FCVs in Japan.

In this study, ENEOS will consider the establishment of a base for receiving CO2-free hydrogen produced outside Japan and for supplying large-scale hydrogen customers in the vicinity.

...

2.5.

Japan’s Eneos announces withdrawal from Myanmar gas project

https://www.arabnews.jp/en/business/article_71234/

...

Japanese oil refiner Eneos Holdings Inc. said Monday that it will withdraw from a natural gas development project in Myanmar.

JX Nippon Oil & Gas Exploration Corp., an Eneos unit, decided the pullout from the project in the Yetagun gas field after examining the business feasibility.

The Eneos group faced strong criticism for remaining involved in the project despite the military coup in Myanmar last year and the suppression of human rights there.

A JX Nippon Oil official said that the group is deeply concerned about Myanmar’s situation since the coup. JX Nippon Oil told its partners in the project of its decision Friday.

The decision will be formalized after necessary procedures, including obtaining approval from the Myanmarese government.

A Japanese joint venture owned by JX Nippon Oil, trading house Mitsubishi Corp. and the Japanese government, holds a 19.3 pct stake in the project, which started gas production in 2000.

...

Japan’s Eneos announces withdrawal from Myanmar gas project

https://www.arabnews.jp/en/business/article_71234/

...

Japanese oil refiner Eneos Holdings Inc. said Monday that it will withdraw from a natural gas development project in Myanmar.

JX Nippon Oil & Gas Exploration Corp., an Eneos unit, decided the pullout from the project in the Yetagun gas field after examining the business feasibility.

The Eneos group faced strong criticism for remaining involved in the project despite the military coup in Myanmar last year and the suppression of human rights there.

A JX Nippon Oil official said that the group is deeply concerned about Myanmar’s situation since the coup. JX Nippon Oil told its partners in the project of its decision Friday.

The decision will be formalized after necessary procedures, including obtaining approval from the Myanmarese government.

A Japanese joint venture owned by JX Nippon Oil, trading house Mitsubishi Corp. and the Japanese government, holds a 19.3 pct stake in the project, which started gas production in 2000.

...

9.11.

Hedge Fund Oasis Calls for Alternative Bidders for Nippo

https://nz.finance.yahoo.com/news/oasis-calls-bidders-counte…

...

Oasis Management Co. called on potential bidders for Nippo Corp. to come forward as the activist shareholder lashed out at Nippo parent Eneos Holdings Inc.’s plan to take the company private with Goldman Sachs Group Inc.

Any potential buyers withholding bids for fear of being perceived as hostile shouldn’t worry, as Eneos and Nippo have clarified that they’re open to alternative bids, Hong Kong-based hedge fund Oasis said in a website it set up Monday.

Oasis, which was founded by Seth Fischer and which holds shares in Nippo, has held talks with several potential acquirers, it said, and added that any bidders would need to provide a detailed proposal to Nippo’s special committee.

“We are aware of other bidders for the company,” Fischer, Oasis’s chief investment officer, said in an interview. “We want an open process for all potential buyers to participate in.”

Fischer’s fund joins Silchester International Investors in taking a swipe at Eneos’s 4,000 yen-a-share bid to privatize Nippo. Oasis last month said last month the bid “significantly” undervalued Nippo, adding that a fairer price would be greater than 5,600 yen per share. Eneos in response rejected calls to raise the price. Nippo shares were unchanged at 4,090 yen on Tuesday at the trading break in Tokyo.

...

Hedge Fund Oasis Calls for Alternative Bidders for Nippo

https://nz.finance.yahoo.com/news/oasis-calls-bidders-counte…

...

Oasis Management Co. called on potential bidders for Nippo Corp. to come forward as the activist shareholder lashed out at Nippo parent Eneos Holdings Inc.’s plan to take the company private with Goldman Sachs Group Inc.

Any potential buyers withholding bids for fear of being perceived as hostile shouldn’t worry, as Eneos and Nippo have clarified that they’re open to alternative bids, Hong Kong-based hedge fund Oasis said in a website it set up Monday.

Oasis, which was founded by Seth Fischer and which holds shares in Nippo, has held talks with several potential acquirers, it said, and added that any bidders would need to provide a detailed proposal to Nippo’s special committee.

“We are aware of other bidders for the company,” Fischer, Oasis’s chief investment officer, said in an interview. “We want an open process for all potential buyers to participate in.”

Fischer’s fund joins Silchester International Investors in taking a swipe at Eneos’s 4,000 yen-a-share bid to privatize Nippo. Oasis last month said last month the bid “significantly” undervalued Nippo, adding that a fairer price would be greater than 5,600 yen per share. Eneos in response rejected calls to raise the price. Nippo shares were unchanged at 4,090 yen on Tuesday at the trading break in Tokyo.

...