Alleima -- Sandvik Spinoff für Steel and Materials

eröffnet am 31.08.22 13:20:49 von

neuester Beitrag 16.11.23 11:21:47 von

neuester Beitrag 16.11.23 11:21:47 von

Beiträge: 7

ID: 1.363.132

ID: 1.363.132

Aufrufe heute: 0

Gesamt: 1.060

Gesamt: 1.060

Aktive User: 0

ISIN: SE0017615644 · WKN: A3DSME · Symbol: M46

6,0050

EUR

+2,65 %

+0,1550 EUR

Letzter Kurs 29.04.24 Tradegate

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,1500 | +19,35 | |

| 1.768,45 | +13,98 | |

| 41,23 | +12,65 | |

| 70,06 | +10,07 | |

| 6.700,00 | +8,06 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,9900 | -9,59 | |

| 72.500,00 | -9,94 | |

| 0,5800 | -15,94 | |

| 8,2500 | -21,43 | |

| 1,0000 | -53,27 |

Beitrag zu dieser Diskussion schreiben

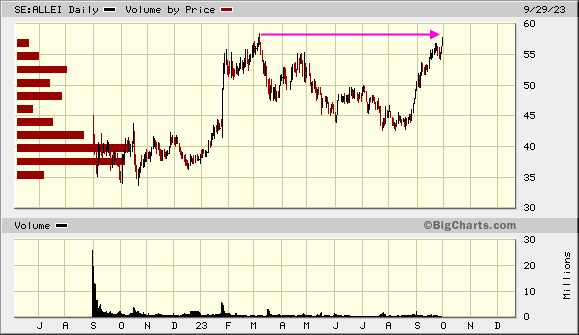

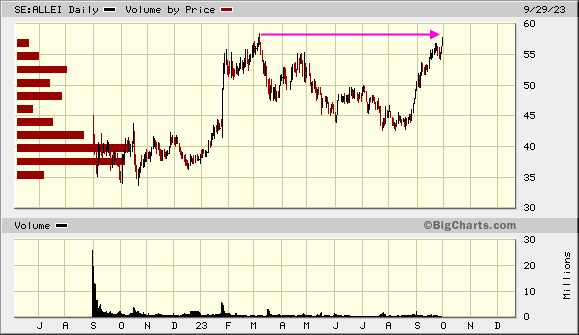

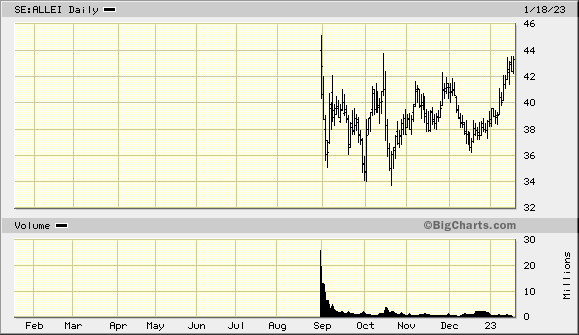

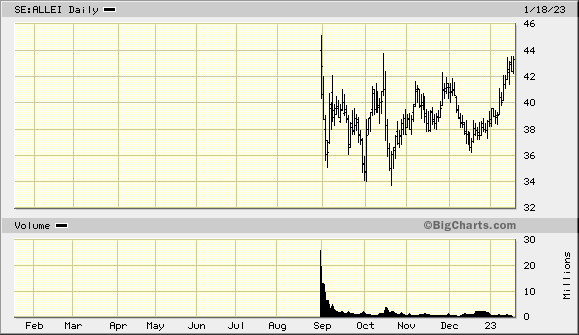

Attacke auf das Post-IPO-Hoch:

Antwort auf Beitrag Nr.: 73.114.494 von faultcode am 18.01.23 13:15:21..und wie:

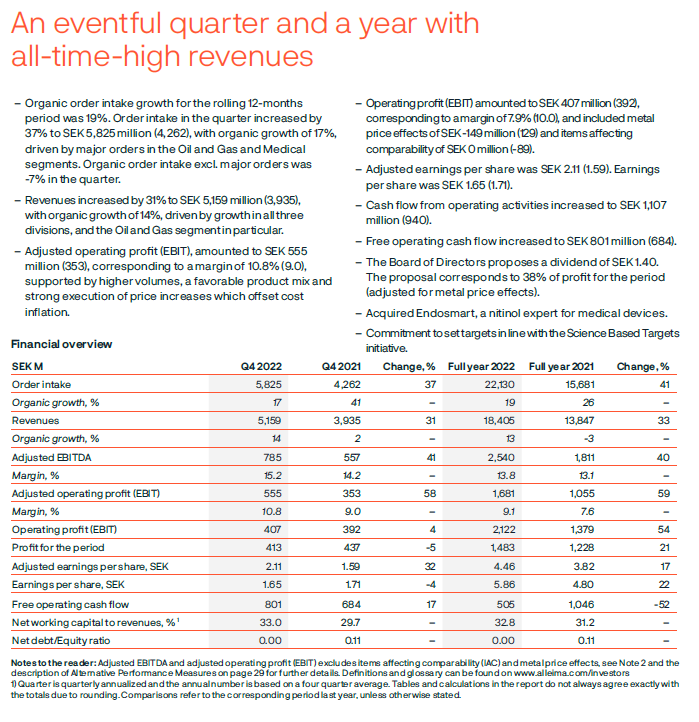

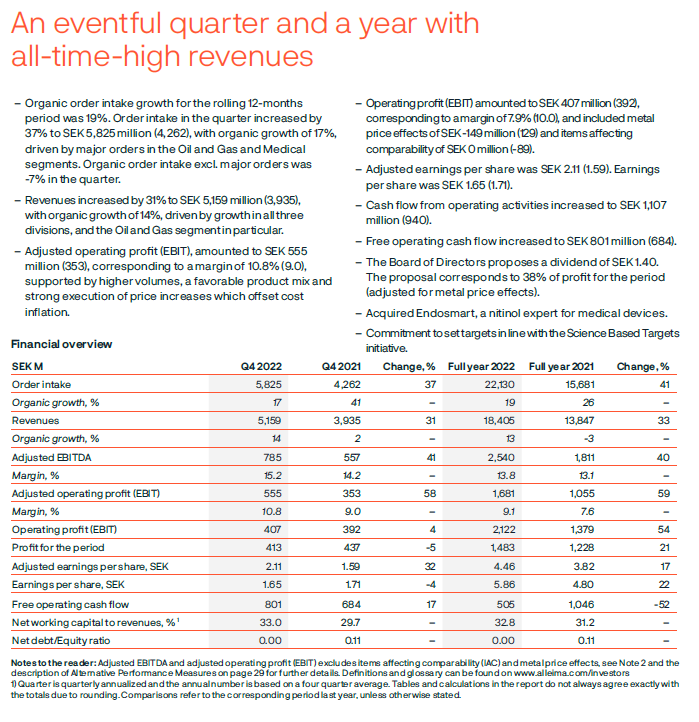

wegen Q4:

...

https://www.alleima.com/en/investors/

=>

...

We have a strong backlog that improved significantly in the quarter and gives us confidence going into 2023.

...

Outlook for the first quarter 2023

Momentum is positive for several of our customer segments, and underlying trends are expected to mitigate the impact of uncertainties in the macroeconomic environment during 2023. Demand is expected to remain subdued for the short-cycle Industrial segment and Consumer segment in the near-term, particularly in Europe and North America.

Going into the first quarter, the product mix is expected to be similar or slightly improved compared with the fourth quarter. Cash flow is normally lower in the first half of the year compared with the second half due to seasonal inventory build-up ahead of summer stoppages.

wegen Q4:

...

https://www.alleima.com/en/investors/

=>

...

We have a strong backlog that improved significantly in the quarter and gives us confidence going into 2023.

...

Outlook for the first quarter 2023

Momentum is positive for several of our customer segments, and underlying trends are expected to mitigate the impact of uncertainties in the macroeconomic environment during 2023. Demand is expected to remain subdued for the short-cycle Industrial segment and Consumer segment in the near-term, particularly in Europe and North America.

Going into the first quarter, the product mix is expected to be similar or slightly improved compared with the fourth quarter. Cash flow is normally lower in the first half of the year compared with the second half due to seasonal inventory build-up ahead of summer stoppages.

so wie andere Stahlwerte, kommt nun auch Alleima etwas ins Rollen:

Antwort auf Beitrag Nr.: 72.310.660 von faultcode am 31.08.22 13:20:49wie unpraktisch, daß es da vorgestern erst gebrannt hat:

30.8.

Comment regarding yesterday's fire in the steel mill at Alleima

https://news.cision.com/alleima/r/comment-regarding-yesterda…

...

On Monday morning, August 29, 2022, a fire broke out in a furnace in the steel mill at Alleima (formerly Sandvik Materials Technology), at the industrial site in Sandviken, Sweden. The fire was extinguished within an hour. Five people sought medical attention but have left the hospital and are under the circumstances well.

An investigation of the damage to the equipment has now been carried out. The assessment is that there will be no impact on customer commitments and deliveries, and that the impact on the financial performance will be limited to an effect on the operating profit by approximately SEK -10 million for the third quarter of 2022.

30.8.

Comment regarding yesterday's fire in the steel mill at Alleima

https://news.cision.com/alleima/r/comment-regarding-yesterda…

...

On Monday morning, August 29, 2022, a fire broke out in a furnace in the steel mill at Alleima (formerly Sandvik Materials Technology), at the industrial site in Sandviken, Sweden. The fire was extinguished within an hour. Five people sought medical attention but have left the hospital and are under the circumstances well.

An investigation of the damage to the equipment has now been carried out. The assessment is that there will be no impact on customer commitments and deliveries, and that the impact on the financial performance will be limited to an effect on the operating profit by approximately SEK -10 million for the third quarter of 2022.

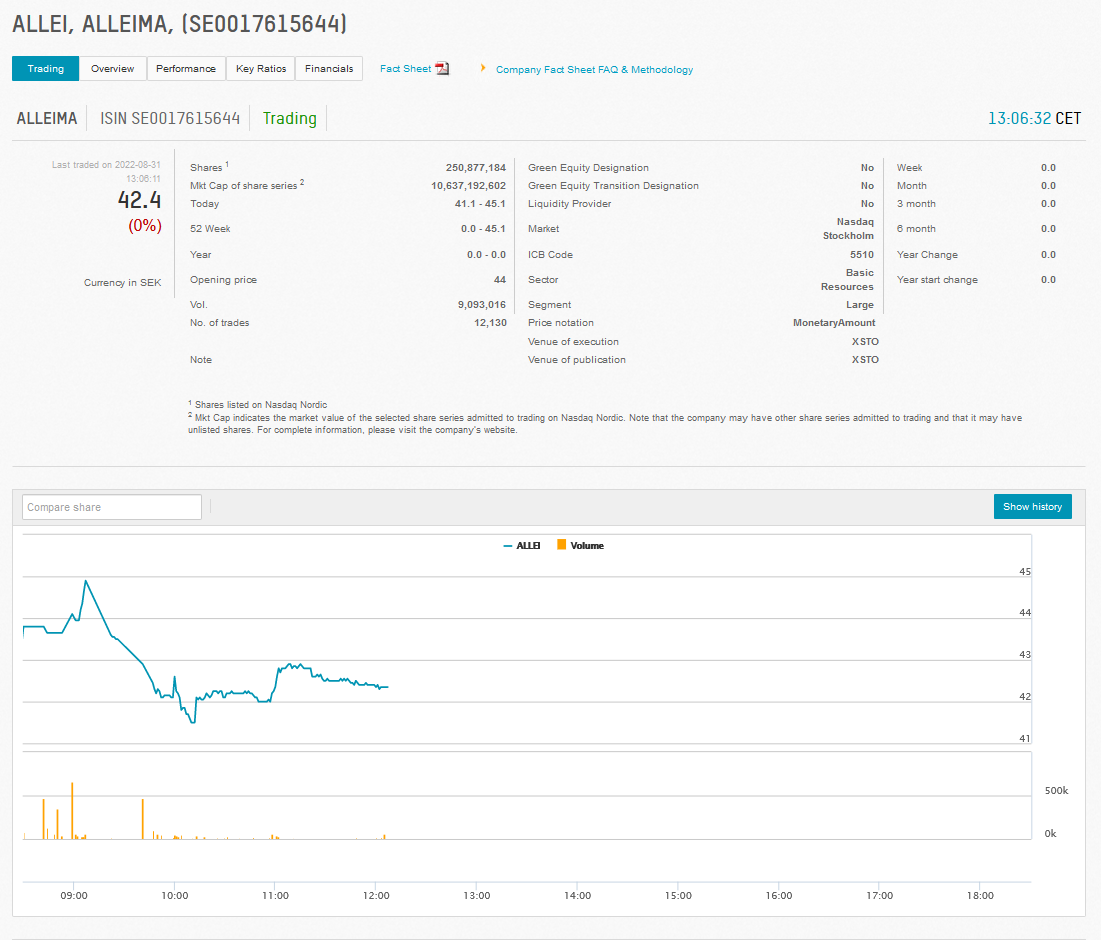

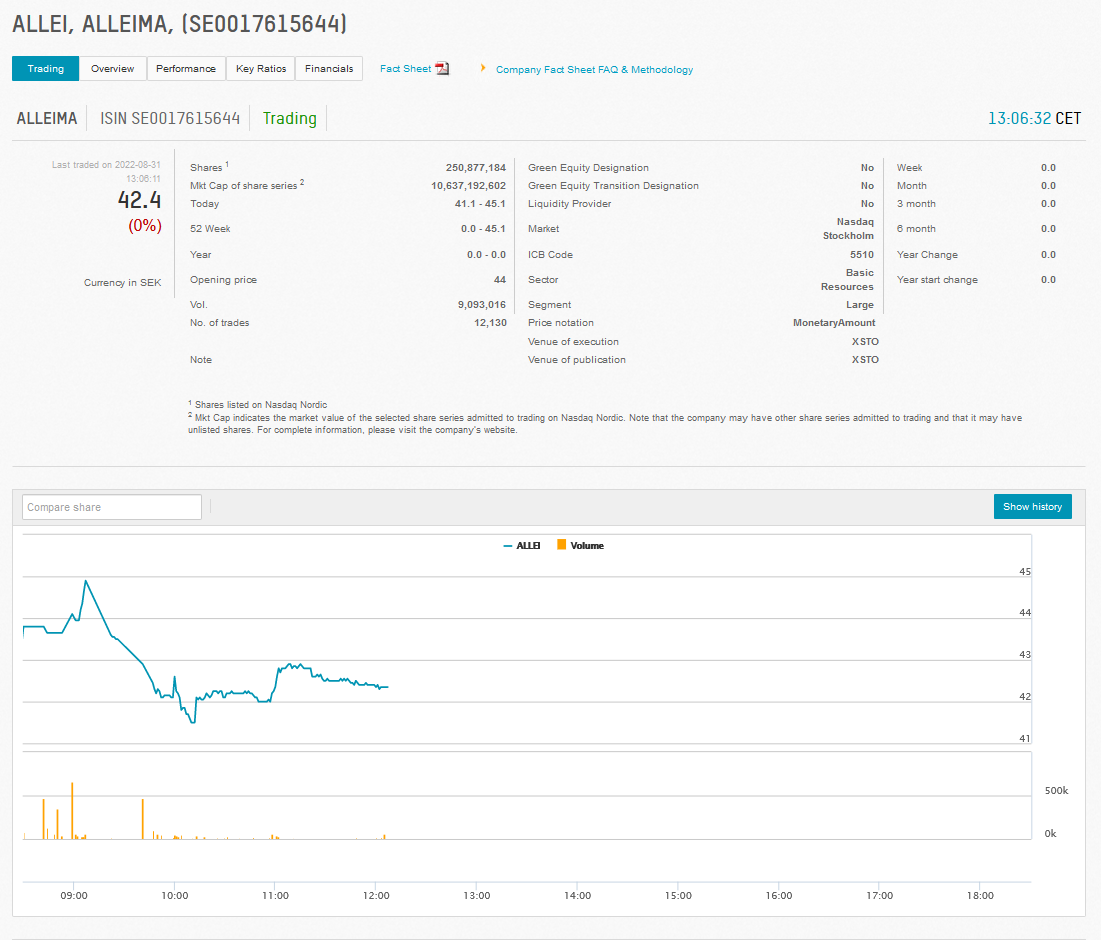

Antwort auf Beitrag Nr.: 72.310.660 von faultcode am 31.08.22 13:20:49ISIN = SE0017615644

http://www.nasdaqomxnordic.com/aktier/microsite?Instrument=S…

=>

http://www.nasdaqomxnordic.com/aktier/microsite?Instrument=S…

=>

31.8.

Sandvik Spinoff Slips in Debut as Market Turmoil Hits Demand

https://finance.yahoo.com/news/sandvik-spinoff-braves-listin…

...

Shares in Alleima AB, one of Sweden’s most keenly anticipated listings this year, slipped in early trading on Wednesday as the company made its debut against a backdrop of plunging stock markets and a deepening energy crisis.

The spinoff of Sandvik AB’s steel and materials unit dropped as much as 6.6% from an opening price of 44 kronor ($4.1) per share, which valued the company at about $1 billion. The listing will nevertheless be a welcome jolt for a market that’s seen volumes dwindle to a paltry $545 million in 2022, in stark contrast to last year’s record haul.

Alleima’s Chief Executive Officer Goran Bjorkman, 56, said in an interview last week that he was not concerned by the market reaction, and that “the spinoff makes strategic sense in the long term.” He also pointed to the share allocation -- Sandvik’s shareholders will receive one share in Alleima for every five held in the Swedish parent -- as a further support.

But the 32-year veteran of Sandvik will also have to convince investors how the standalone company plans to navigate an uncertain outlook for the oil industry. Oil and gas accounts for 20% of sales in Alleima’s Tube business, its largest division, as well as driving demand for more profitable products.

“The structural challenge presented by climate change blurs the oil sector’s investment profile,” Bloomberg Intelligence analyst Omid Vaziri said in a note.

While oil and gas will still play an important role in Alleima’s Tube division in the coming years, Bjorkman says the company is also focusing its efforts on the transition away from fossil fuels. Renewables and hydrogen are “the two segments we see the absolute strongest growth in,” he said.

Its wire business Kanthal is projected to see the highest growth rates because it “can tap into current trends of electrification and medical,” the CEO said. “But I wouldn’t be surprised when the renewables transition picks up speed in Tube it will grow a lot, too.”

Alleima also plans to capitalize on surging interest in nuclear energy amid Europe’s worst energy crisis in decades. The company iproduces steam generator tubing, a vital component in the power plant. “I’m convinced nuclear has a good future,” Bjorkman said.

The company’s momentum is expected to continue in the second half of 2022, “generating a strong backlog and boosting earnings in the coming years,” Handelsbanken analyst Gustaf Schwerin said in a note to clients.

Schwerin did however expect some initial pressure on the shares when they started trading and, in a separate note, Citigroup analyst Klas Bergelind flagged looming recession risks as a downside risk for the company.

“We don’t live in a vacuum, so of course we’ll be affected by a declining world economy,” Alleima’s CEO said. “But I can’t find any indications we are heading in the wrong direction.”

Sandvik Spinoff Slips in Debut as Market Turmoil Hits Demand

https://finance.yahoo.com/news/sandvik-spinoff-braves-listin…

...

Shares in Alleima AB, one of Sweden’s most keenly anticipated listings this year, slipped in early trading on Wednesday as the company made its debut against a backdrop of plunging stock markets and a deepening energy crisis.

The spinoff of Sandvik AB’s steel and materials unit dropped as much as 6.6% from an opening price of 44 kronor ($4.1) per share, which valued the company at about $1 billion. The listing will nevertheless be a welcome jolt for a market that’s seen volumes dwindle to a paltry $545 million in 2022, in stark contrast to last year’s record haul.

Alleima’s Chief Executive Officer Goran Bjorkman, 56, said in an interview last week that he was not concerned by the market reaction, and that “the spinoff makes strategic sense in the long term.” He also pointed to the share allocation -- Sandvik’s shareholders will receive one share in Alleima for every five held in the Swedish parent -- as a further support.

But the 32-year veteran of Sandvik will also have to convince investors how the standalone company plans to navigate an uncertain outlook for the oil industry. Oil and gas accounts for 20% of sales in Alleima’s Tube business, its largest division, as well as driving demand for more profitable products.

“The structural challenge presented by climate change blurs the oil sector’s investment profile,” Bloomberg Intelligence analyst Omid Vaziri said in a note.

While oil and gas will still play an important role in Alleima’s Tube division in the coming years, Bjorkman says the company is also focusing its efforts on the transition away from fossil fuels. Renewables and hydrogen are “the two segments we see the absolute strongest growth in,” he said.

Its wire business Kanthal is projected to see the highest growth rates because it “can tap into current trends of electrification and medical,” the CEO said. “But I wouldn’t be surprised when the renewables transition picks up speed in Tube it will grow a lot, too.”

Alleima also plans to capitalize on surging interest in nuclear energy amid Europe’s worst energy crisis in decades. The company iproduces steam generator tubing, a vital component in the power plant. “I’m convinced nuclear has a good future,” Bjorkman said.

The company’s momentum is expected to continue in the second half of 2022, “generating a strong backlog and boosting earnings in the coming years,” Handelsbanken analyst Gustaf Schwerin said in a note to clients.

Schwerin did however expect some initial pressure on the shares when they started trading and, in a separate note, Citigroup analyst Klas Bergelind flagged looming recession risks as a downside risk for the company.

“We don’t live in a vacuum, so of course we’ll be affected by a declining world economy,” Alleima’s CEO said. “But I can’t find any indications we are heading in the wrong direction.”