PMDP - Eine Chance für den Golf von Mexiko? - 500 Beiträge pro Seite

eröffnet am 05.05.10 00:08:48 von

neuester Beitrag 02.07.11 15:50:11 von

neuester Beitrag 02.07.11 15:50:11 von

Beiträge: 160

ID: 1.157.593

ID: 1.157.593

Aufrufe heute: 0

Gesamt: 5.040

Gesamt: 5.040

Aktive User: 0

ISIN: US7276341077 · WKN: A0Q9V3 · Symbol: PMDP

0,0000

USD

0,00 %

0,0000 USD

Letzter Kurs 02:10:00 Nasdaq OTC

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 0,5020 | +34,58 | |

| 0,8500 | +26,87 | |

| 0,7100 | +16,39 | |

| 9,0560 | +11,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5001 | -9,07 | |

| 1,5500 | -9,94 | |

| 1,1700 | -12,03 | |

| 0,6100 | -12,86 | |

| 0,5635 | -13,31 |

Plateau Mineral Development, Inc. (PMDP)

Marktkapital: $1,691,946 (Mai 3, 2010)

Aktienanzahl: 3,383,891,002

PMDP ist ein Öl-Recyclingunternehmen, das auf Widerherstellung und Entfernung von Öl spezialisiert ist. Am 3. Mai, 2010 gab man bekannt, dass es über eine Technologie verfügt, um solche Ölteppiche, wie zurzeit im Golf von Mexiko, entfernen zu können. Das Partnerunternehmen Ensol kann seine Technologie verwenden, um das Öl und Teer von den Stränden zurückzunehmen. Es würde aus dem Sand Öl und Teer gewinnen, wodurch sauberer Sand zurückbliebe.

Die Naturkatastrophe im Golf von Mexiko wird dem Ölkonzern BP ca. 7 Mrd. USD kosten. Jetzt spekulieren die Anleger von PMDP, dass diese einen Auftrag bekommen. Allein bei einem Auftragswert von 100 Mio. USD würde die Aktie auf ca. 0,05 USD steigen.

Es wird stark gekauft, die Vermutung liegt nahe, dass PMDP in Verhandlungen mit BP ist.

Hier die Meldung:

Plateau Mineral Development, Inc.'s Technologies Can be Modified to Assist in Cleaning Oil Spills Such as the Current Spill in the Gulf of Mexico

WINSTON-SALEM, N.C., May 3, 2010 (GlobeNewswire via COMTEX) -- Plateau Mineral Development, Inc. (Pink Sheets:PMDP) announced today that its partner company, Environmental Solutions (EnSol), has a technology that can be modified to assist in cleaning up oil spills such as the current one in the Gulf of Mexico. While the EnSol technology would require some modifications to meet the exact needs, those changes would be minor.

EnSol's technology can be used to reclaim the oil and tar, whilst restoring the beaches. It would take in a volume of contaminated sand, dissociate the components, extracting the oil and tar, thereby allowing clean sand to be deposited back onto the beach.

Robert Matthews of Plateau Mineral Development, Inc., states, "The oil spill in the Gulf of Mexico and its negative environmental impact is of significant importance at present. It is our goal to eventually use the green, environmentally-friendly EnSol technologies in an effort to help with the clean-up process of this any future oil spills."

About Plateau Mineral Development, Inc.: Plateau Mineral Development has been in existence for over five years.

Forward-Looking Statements: This press release contains certain forward-looking statements. Investors are cautioned that certain statements in this release are "forward-looking statements" and involve both known and unknown risks, uncertainties and other factors. Such uncertainties include, among others, certain risks associated with the operation of the company described above. The Company's actual results could differ materially from expected results.

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: Plateau Mineral Development Inc.

By Staff

CONTACT: CONTACT: Plateau Mineral Development, Inc.

Investor Relations

410-242-0763

(C) Copyright 2010 GlobeNewswire, Inc. All rights reserved.

Quelle: http://www.otcmarkets.com/pink/quote/quote.jsp?symbol=pmdp" target="_blank" rel="nofollow ugc noopener">http://www.otcmarkets.com/pink/quote/quote.jsp?symbol=pmdp

Marktkapital: $1,691,946 (Mai 3, 2010)

Aktienanzahl: 3,383,891,002

PMDP ist ein Öl-Recyclingunternehmen, das auf Widerherstellung und Entfernung von Öl spezialisiert ist. Am 3. Mai, 2010 gab man bekannt, dass es über eine Technologie verfügt, um solche Ölteppiche, wie zurzeit im Golf von Mexiko, entfernen zu können. Das Partnerunternehmen Ensol kann seine Technologie verwenden, um das Öl und Teer von den Stränden zurückzunehmen. Es würde aus dem Sand Öl und Teer gewinnen, wodurch sauberer Sand zurückbliebe.

Die Naturkatastrophe im Golf von Mexiko wird dem Ölkonzern BP ca. 7 Mrd. USD kosten. Jetzt spekulieren die Anleger von PMDP, dass diese einen Auftrag bekommen. Allein bei einem Auftragswert von 100 Mio. USD würde die Aktie auf ca. 0,05 USD steigen.

Es wird stark gekauft, die Vermutung liegt nahe, dass PMDP in Verhandlungen mit BP ist.

Hier die Meldung:

Plateau Mineral Development, Inc.'s Technologies Can be Modified to Assist in Cleaning Oil Spills Such as the Current Spill in the Gulf of Mexico

WINSTON-SALEM, N.C., May 3, 2010 (GlobeNewswire via COMTEX) -- Plateau Mineral Development, Inc. (Pink Sheets:PMDP) announced today that its partner company, Environmental Solutions (EnSol), has a technology that can be modified to assist in cleaning up oil spills such as the current one in the Gulf of Mexico. While the EnSol technology would require some modifications to meet the exact needs, those changes would be minor.

EnSol's technology can be used to reclaim the oil and tar, whilst restoring the beaches. It would take in a volume of contaminated sand, dissociate the components, extracting the oil and tar, thereby allowing clean sand to be deposited back onto the beach.

Robert Matthews of Plateau Mineral Development, Inc., states, "The oil spill in the Gulf of Mexico and its negative environmental impact is of significant importance at present. It is our goal to eventually use the green, environmentally-friendly EnSol technologies in an effort to help with the clean-up process of this any future oil spills."

About Plateau Mineral Development, Inc.: Plateau Mineral Development has been in existence for over five years.

Forward-Looking Statements: This press release contains certain forward-looking statements. Investors are cautioned that certain statements in this release are "forward-looking statements" and involve both known and unknown risks, uncertainties and other factors. Such uncertainties include, among others, certain risks associated with the operation of the company described above. The Company's actual results could differ materially from expected results.

This news release was distributed by GlobeNewswire, www.globenewswire.com

SOURCE: Plateau Mineral Development Inc.

By Staff

CONTACT: CONTACT: Plateau Mineral Development, Inc.

Investor Relations

410-242-0763

(C) Copyright 2010 GlobeNewswire, Inc. All rights reserved.

Quelle: http://www.otcmarkets.com/pink/quote/quote.jsp?symbol=pmdp" target="_blank" rel="nofollow ugc noopener">http://www.otcmarkets.com/pink/quote/quote.jsp?symbol=pmdp

irgendwie lustig auf was für ideen man kommt,

aber es lohnt sich anscheinend

sowas will ich auch mal machen

aber es lohnt sich anscheinend

sowas will ich auch mal machen

Hier noch die Infos zum Geschehen am Golf von Mexiko:

http://www.reuters.com/article/idUSTRE6412H820100502

Da wird BP sicherlich nach Alternativen suchen.

http://www.reuters.com/article/idUSTRE6412H820100502

Da wird BP sicherlich nach Alternativen suchen.

Guten Morgen ,

PMDP scheint wirklich Interessant zu sein .

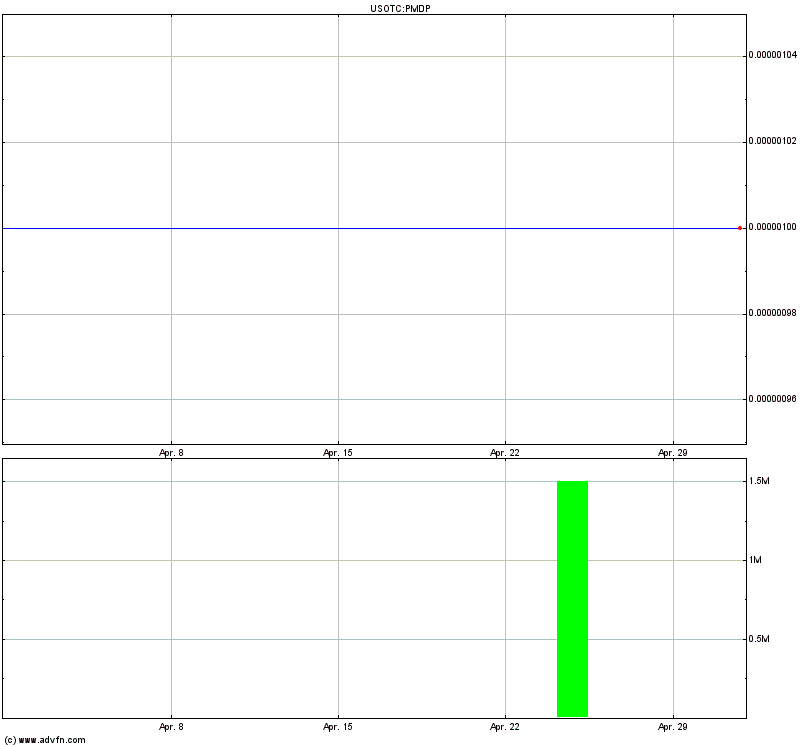

Chart hier sieht sehr gut aus ,Volumen gestern war super .Hier ist was im Busch ...

PMDP scheint wirklich Interessant zu sein .

Chart hier sieht sehr gut aus ,Volumen gestern war super .Hier ist was im Busch ...

PMDP hat gerade erst begonnen und könnte wirklich sehr Interessant werden ,allerdings nur meine ganz persönliche Meinung.

Antwort auf Beitrag Nr.: 39.457.556 von ribey1308 am 05.05.10 08:18:26laut us board hat das Öl die Küste erreicht, man wird schon unruhig

Sherlock, wie kommst du auf die 0,05

gruß

gruß

Morgen,

mal schauen was heute so geht

mal schauen was heute so geht

Antwort auf Beitrag Nr.: 39.476.906 von hapkido10 am 07.05.10 07:34:35Hallo zusammen

Die Konkurrenz schläft nicht

http://finance.yahoo.com/news/Green-Bridge-Industries-Incs-i…

Hoffe das wir auch mal so abgehen .

Gruß Papschy

Die Konkurrenz schläft nicht

http://finance.yahoo.com/news/Green-Bridge-Industries-Incs-i…

Hoffe das wir auch mal so abgehen .

Gruß Papschy

Antwort auf Beitrag Nr.: 39.482.277 von papschy am 07.05.10 17:01:38nur schon zu spät, schade

Antwort auf Beitrag Nr.: 39.482.877 von hapkido10 am 07.05.10 17:53:06Schauen wir mal , bin mal mit nem Tausi rein.

Antwort auf Beitrag Nr.: 39.483.230 von papschy am 07.05.10 18:28:35Na dann viel Glück, wünsche Dir viel Erfolg

Antwort auf Beitrag Nr.: 39.472.791 von hapkido10 am 06.05.10 20:04:02

Grüezi @all! War jetzt paar Tage weg.

Zu deiner Frage: Bei einem Auftragsvolumen von 100 Mio. USD würde die Marktkapitalisierung sicherlich auf etwa den gleichen Wert ansteigen, also pro Aktie auf 0.05 USD.

Grüezi @all! War jetzt paar Tage weg.

Zu deiner Frage: Bei einem Auftragsvolumen von 100 Mio. USD würde die Marktkapitalisierung sicherlich auf etwa den gleichen Wert ansteigen, also pro Aktie auf 0.05 USD.

Antwort auf Beitrag Nr.: 39.485.362 von SherlockHolmes77 am 08.05.10 15:52:27Na dann wollen wir mal hoffen das uns keiner den auftrag

vor der nase weg schnappt

vor der nase weg schnappt

Antwort auf Beitrag Nr.: 39.485.569 von hapkido10 am 08.05.10 17:24:38

Auf saubere Strände im Golf von Mexiko.

Auf saubere Strände im Golf von Mexiko.

Wer den Zuschlag bekommen hat, ist in deinem neuen Thread zu lesen

Hier eine Zusammenfassung es Aufgabengebietes von Ensol:

Ensol Technologie kann verwendet werden, um das Öl und Teer, während die Wiederherstellung der Strände zurückzunehmen. Es würde in einem Volumen von kontaminierten Sand, distanzieren der Komponenten, die Gewinnung von Öl und Teer, wodurch sauberen Sand zu hinterlegen zurück an den Strand.

Robert Matthews von Plateau Mineral Development, Inc., erklärt: "Die Ölverschmutzung im Golf von Mexiko und ihre negativen ökologischen Auswirkungen sind von maßgeblicher Bedeutung heute. Es ist unser Ziel, um schließlich mit dem grünen, umweltfreundlichen Technologien in einem Ensol Bemühungen, mit dem Clean-up-Prozess dieser künftigen Ölunfällen helfen. "

Plateau Mineral Development, Inc. kündigt Positive Ergebnisse der Umweltprüfung

* Pressemitteilung

* Quelle: Plateau Mineral Development Inc.

* Am 09.00 EST, Donnerstag 3. Dezember 2009

* Unternehmen:

o Plateau Mineral Development, Inc.

Winston-Salem, NC, 3. Dezember 2009 (GLOBE NEWSWIRE) - Plateau Mineral Development, Inc. (Pink Sheets: PMDP - News), zusammen mit ihrem Partner, Plateau Mineral Development LLC gab heute bekannt, dass sein Partner in Umweltprogramme , Environmental Solutions, LLC (Ensol) hat erfolgreich seinen Bericht über die Umweltsituation Laboruntersuchungen über die Sommermonate an der Ensol Labor geschieht auf Basis abgeschlossen. Die Ergebnisse zeigen, Kürzungen in gelöster Stickstoff und stark verbesserte Ergebnisse in gelöstem Sauerstoff im Wasser. Die Testergebnisse wurden durch natürliche Prozesse, die keine Gefahr für die Umwelt an und für sich selbst zu vertreten gewonnen.

Der Test wurde von Aubrey C. Williams Jr., PhD erleichtert. Dr. Williams ist derzeit als Assistant Professor an der Southern University in Baton Rouge, Louisiana und ist Mitglied der Akademie der Wissenschaften Louisiana. Er hat eine Reihe von Präsentationen zu verschiedenen umweltrelevanten Themen gegeben, und hat ein Department of Energy Fellowship Award für seinen Herrn Diplom-Forschung.

Dr. Williams erklärt: "Wir sind mit den Ergebnissen der Umweltprüfung zufrieden. Wir haben Kürzungen in Höhe von verschmutztem Wasser mehr als 90% nachgewiesen werden. Das Wasser muss aufgeräumt werden, bevor es wieder in die St. John's River eingeführt wird, und dann in die Seen und Ozeane. Wir sind stolz darauf, Teil bei der Säuberung eines der größten der Erde die natürlichen Ressourcen zu nehmen. "

Quelle: http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Man hat also auch schon Projekte und Erfahrungen in Wiederherstellungs der verschmutzten Umwelt.

Ensol Technologie kann verwendet werden, um das Öl und Teer, während die Wiederherstellung der Strände zurückzunehmen. Es würde in einem Volumen von kontaminierten Sand, distanzieren der Komponenten, die Gewinnung von Öl und Teer, wodurch sauberen Sand zu hinterlegen zurück an den Strand.

Robert Matthews von Plateau Mineral Development, Inc., erklärt: "Die Ölverschmutzung im Golf von Mexiko und ihre negativen ökologischen Auswirkungen sind von maßgeblicher Bedeutung heute. Es ist unser Ziel, um schließlich mit dem grünen, umweltfreundlichen Technologien in einem Ensol Bemühungen, mit dem Clean-up-Prozess dieser künftigen Ölunfällen helfen. "

Plateau Mineral Development, Inc. kündigt Positive Ergebnisse der Umweltprüfung

* Pressemitteilung

* Quelle: Plateau Mineral Development Inc.

* Am 09.00 EST, Donnerstag 3. Dezember 2009

* Unternehmen:

o Plateau Mineral Development, Inc.

Winston-Salem, NC, 3. Dezember 2009 (GLOBE NEWSWIRE) - Plateau Mineral Development, Inc. (Pink Sheets: PMDP - News), zusammen mit ihrem Partner, Plateau Mineral Development LLC gab heute bekannt, dass sein Partner in Umweltprogramme , Environmental Solutions, LLC (Ensol) hat erfolgreich seinen Bericht über die Umweltsituation Laboruntersuchungen über die Sommermonate an der Ensol Labor geschieht auf Basis abgeschlossen. Die Ergebnisse zeigen, Kürzungen in gelöster Stickstoff und stark verbesserte Ergebnisse in gelöstem Sauerstoff im Wasser. Die Testergebnisse wurden durch natürliche Prozesse, die keine Gefahr für die Umwelt an und für sich selbst zu vertreten gewonnen.

Der Test wurde von Aubrey C. Williams Jr., PhD erleichtert. Dr. Williams ist derzeit als Assistant Professor an der Southern University in Baton Rouge, Louisiana und ist Mitglied der Akademie der Wissenschaften Louisiana. Er hat eine Reihe von Präsentationen zu verschiedenen umweltrelevanten Themen gegeben, und hat ein Department of Energy Fellowship Award für seinen Herrn Diplom-Forschung.

Dr. Williams erklärt: "Wir sind mit den Ergebnissen der Umweltprüfung zufrieden. Wir haben Kürzungen in Höhe von verschmutztem Wasser mehr als 90% nachgewiesen werden. Das Wasser muss aufgeräumt werden, bevor es wieder in die St. John's River eingeführt wird, und dann in die Seen und Ozeane. Wir sind stolz darauf, Teil bei der Säuberung eines der größten der Erde die natürlichen Ressourcen zu nehmen. "

Quelle: http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Man hat also auch schon Projekte und Erfahrungen in Wiederherstellungs der verschmutzten Umwelt.

geschrieben am: 2010.05.06

Ölpest, neue toxische COCKTAIL, Geschenk von BP, jubelt AMERICA!

Ben B. Boothe, Sr., von Venedig, Louisianna

Ölpest, TOXIC Cocktail von BP

BP Cocktail, Cheers alles, was Sie

Jungs in Amerika!Bericht aus Venedig, Louisianna

von: Ben Boothe, Global Perspectives

Die 70 Meile Streifen des Mississippi von New Orleans, kann eine der konzentriertesten Strecken der chemischen Industrie in der Welt sein. Es ist nicht nur die auf den gesamten Fluss Trichter, all das Abfließen von Chemikalien, Dünger, Stadt Abfälle Systeme, Tausende von Schiffen, Chemikalien, konzentriert sich hier. Für diejenigen, die ihre Meeresfrüchte mit Öl gekocht, wie haben die Britsh ein Geschenk an den Golf geschickt. 6.000.000 + Liter Öl!

Bundesbehörden haben, geschlossen und verboten kommerzielle Fischerei von Venedig bis nach Florida, weil der Ölpest. Jeder Fischer untätig beschädigt wurde, durch den Verlust des gegenwärtigen Einkommens, und vielleicht langfristig Schäden an der Fischerei auf den Golf. Einige glauben, Hunderte von Millionen von Fischen und anderen Arten sterben wird, oder zumindest, Ingest und tragen Giftstoffe, die Auswirkungen für die Jahre kommen könnte.

Die große chemische flow aus dem Mississippi, schafft ein Gerinne Algen in der Golfregion, dass alle ißt der Sauerstoff, und es gibt jetzt eine tote Zone im Golf von Mexiko so groß wie der Bundesstaat Massachusetts, und es wächst. "Nichts kann in der toten Zone leben. Es gibt keinen Sauerstoff. Es ist wegen der BP Ölpest "Stephen Soloman, Autor des Buches Öl wächst, sagte der epischen Kampf für Reichtum, Macht und Zivilisation, mich.

BP Oil Dome, 4 Stockwerke hochDer Schaden ist bereits geschehen

Mit Schätzungen reichen von 1.000 bis 5.000 Barrel (manche sagen, so hoch wie 20.000) Barrel Öl unter ausgespien pro Tag, bevor der "Containment" Kuppeln, und vor der Ventile wurden repariert, was BP nächsten tut, ändert nichts an der Tatsache, dass der Schaden ist bereits getan worden. Es sind 42 Liter Öl pro Barrel, so dass Sie die Mathematik zu tun. 5000 x 42 x 30 Tage = 6.300.000 Gallonen Öl in den Golf von Mexiko. Das Öl ist da. Es ist nun Teil unserer Nahrungskette und Ökosystem. BP die Nutzung von 45 "tall" Collector Dome "ist zu wenig, zu late.Steve klicken, wird eine Sanierung Experte sagte:

"Menschen rund um den Golf lernen, dass diese winzigen Partikel von Öl, zusammen hängen und wachsen in Büscheln im Laufe der Zeit. Wenn sie nicht sind, oder nicht Mantel den Boden des Golfes, wird auf die Küsten, die mit Teer gespickt werden float und Chemikalien für 50 Jahre, vielleicht länger, um gefressen werden

Venice Marina, La, Fischindustrie BeschädigteLand Vögel und Tiere, auch für uns. "

Der Konsens aus Fischern und der Sachverständigen in den Golfstaaten, einschließlich Larry Swaggart, Präsident der National Wildlife Federation, ist, dass "der BP-Wahl, um noch mehr Chemikalien in den Golf gießen, um das Rohöl auszuzahlen hat einfach viel des Unglücks aus der erzwungenen Blick unter Wasser, oder vermischten sich mit Gewässern des Golfs. Vieles davon ist auf den Boden sinken. Es kann eine gute Politik zu bewegen, weil die Augen der Presse weniger zu sehen. Aber auf lange Sicht, kann es mehr Schaden anrichten, weil es auf der Unterseite des Golfs Jahren sein wird, Auswirkungen der Fischerei auf den Golf. "

Ich besuchte eine vietnamesische Familie. Die Hände des Mannes waren fettig, als er über die Arbeit an seinem Motorboot gebogen, während seine beiden kleinen Mädchen gespielt. Seine Frau lächelte und sagte: "Wir können jetzt nicht arbeiten, so sind wir nur darauf warten." Rund um ihnen den Docks mit inaktiven Fischerbooten gefüllt waren. Die Straße hinunter in Boothville war ein Zeichen von Hand bemalt, lehnte sich gegen die Mail-Box in ihrem Vorgarten, lesen: "Obama, US-HELP". Bei einem großen Marina, östlich von Boothville wurden shrimpers sitzen, trinken Bier und überlegte, wie lange sie ohne Arbeit sein. Einer sagte: "Das könnte unser Geschäft seit Jahren auswirken. Aber jetzt wollen wir nur, um wieder auf das Wasser, so können wir unsere Zahlungen "zu machen. Gulf Coast Unternehmen, von Louisiana bis Florida berichten wirtschaftliche Folgen. Hotels berichten von Stornierungen, erzählte ein Immobilienentwickler mir: "Wir sind wegen der Wirtschaft zu kämpfen, und diese Ölpest ist der Nagel in unserem Sarg. Unsere Eigenschaftswerte sind, fast über Nacht, weil dieser "John Kelly hat mir gesagt. Ein Mitarbeiter eines Sea Food Restaurant, die seinen Namen behalten anonymen bevorzugt, in New Orleans hat mir gesagt: "Wir sind besorgt, dass Fisch-Preise explodieren. Niemand weiß das Gesundheitsrisiko. "

Venedig ist das Ende der Landzunge, die den Mississippi hat 70 Meilen in den Golf gebaut. Es ist ein Dorf durch chemische und Ölfirmen dominiert. Die Straßen sind nach Öl-Unternehmen genannt. Es gibt Berge von alten Schiffen, Stahlschrott, Ölfässer, Junk aus dem Ölgeschäft aufgeschichtet. Hinter hohen Zäunen sind teure Gebäude an der Öl-und Golf-chemischen Vorgänge Haus. Als ich vorbeifuhr, waren die Menschen bis in gefüttert und bekommen Hilfe bereinigen zu verschütten. Arbeitslose Fischer, Soldaten der Nationalgarde, Wildtiere Menschen, alle wollen ihren Teil der Aufräumarbeiten zu tun. Es wurde geschätzt, dass dieser Ölpest, aufräumen, und Schäden werden von $ 10,000,000,000.00 (Mrd.) und die Schätzungen sind steigende Kosten.

Ich saß an der Marina in Venedig, mit Larry Swaggart, Präsident der National Wildlife Federation, wie wir sahen Entwicklungen in Venedig. Er sagte: "Die Wirkung ist so breit und so langfristig, können wir gar nicht quantifizieren. Für ein Chemie-Unternehmen, um zu versuchen, um ein Problem mit mehr Chemikalien Heilung ist typisch. Diese Perlen sind nun von Öl Zusammenarbeit in der Golf-Wasser vermischt, werden einige von Fisch, Austern, Muscheln genommen werden die giftigen Cocktail zu konzentrieren, und es wird die Nahrungskette auswirken und Gesundheit in einer Vielzahl von Möglichkeiten. Alles über die Art und Weise genähert BP Dies hat eine Reihe von Fehlern wurde. Schaden nicht an die Fischer beschränkt, sondern zu jeder isst Fisch. Schaden ist nicht zu Vögeln oder Tieren beschränkt, sondern zu jedem Lebewesen Teil dieses Ökologie. Diese Chemikalien sind giftig. Der Golf ist, wo 50% der USA Garnelen, 40% der Auster, 30% unserer Fischen stammen. Für jeden einen Teil des Wassers, magnify Austern es 1000 Mal, und wie ein Staubsauger zu dienen, erzeugt eine konzentrierte chemische Wirkung, was in den Ozean, aber wir und andere Lebewesen essen Austern. Es ist wie eine riesige Bissen konzentrierten Chemikalien. Alle Arten, die in und um den Golf betroffen sind. Diejenigen, Meeresschildkröten, starb, ohne Zweifel von Chemikalien. Unsere Mitgliedschaft ist sehr aufgeregt, in ein paar Momente, die wir tun, eine Live-Telefon Treffen mit über 10.000 Mitgliedern sind. "

Steve klicken, insgesamt 600 Landwirte in Missouri, zeigte Pellets von "Switch grass", die natürlich absorbieren würde das Öl gemacht, er will www.goshowmeengergy.com 816 365 7952. Steve ist bereit, um ein Produkt zu spenden, um mit dem Aufräumen zu helfen, und zeigen es "natürliche" Effektivität. Es funktioniert wie folgt, mit einem einfachen Besprengung mit dem "alphalfa wie" Pellets auf die Oberfläche des Wassers, und wie es absorbiert Öl, kann es dann leicht gesammelt und entsorgt werden bis. Wir versuchen, mit BP beschäftigen, diese Lösung zu bieten, aber bisher kein Glück mit ihnen.

Advanced Recovery Schadstoff Phillip Ward hat auch eine Lösung erarbeitet. Er zeigte uns ein Glas "Rohöl" aus dem Schlick, dass er gerade aus dem Golf erholt. Er glaubt, BP's Methode des Schlagens des Öls mit ihren Chemikalien (156.000 Gallonen bisher) verursacht das Öl auf den Boden sinken, "Fisch zu essen auf dem Weg nach unten, aber dann ist es für 50 oder mehr Jahren. Die Fischereiindustrie hat schlechte verletzt worden. Putting das Öl auf der Unterseite des Golfs, hält das Öl weg von den Stränden, sondern auf den Ozean, die Millionen von Baby-Fisch, Austern, Garnelen, wirst sterben und nicht überleben. Unsere Lösung ist eine bessere, sagt er. Seine Telefonnummer 251 605 2949, www.recoverUS.com

Ein TV-Team kam auf mich zu und sagte: Was macht Ihr Unternehmen tun? Ich habe ihnen gesagt, "Wir sind ein Beratungsunternehmen Umwelt und kann eine unabhängige 'produzieren Certificate of Damage" oder ein in der Tiefe Dokumentation Bericht zeigt, wie viel sie, ihr Geschäft oder ihr Eigentum, weil dieser Ölpest beschädigt wurde. Ein paar Leute versammelten sich um zuzuhören. "Ich habe beschädigt worden", sagte ein Fischer, "Me too", sagte ein Dockschiff Service Firmeninhaber. Ich sagte: "Wir wollen helfen. Wir hoffen, Sie können alle diese Katastrophe zu überleben. "Ihre dankbaren Augen sagten alles.

Reporting aus dem Golf von Mexico, irgendwo zwischen Venedig und Pensacola am Golf von Mexiko

Ben B. Boothe, Sr.

www.environment-solutions.com

817 738 9595

Ölpest, neue toxische COCKTAIL, Geschenk von BP, jubelt AMERICA!

Ben B. Boothe, Sr., von Venedig, Louisianna

Ölpest, TOXIC Cocktail von BP

BP Cocktail, Cheers alles, was Sie

Jungs in Amerika!Bericht aus Venedig, Louisianna

von: Ben Boothe, Global Perspectives

Die 70 Meile Streifen des Mississippi von New Orleans, kann eine der konzentriertesten Strecken der chemischen Industrie in der Welt sein. Es ist nicht nur die auf den gesamten Fluss Trichter, all das Abfließen von Chemikalien, Dünger, Stadt Abfälle Systeme, Tausende von Schiffen, Chemikalien, konzentriert sich hier. Für diejenigen, die ihre Meeresfrüchte mit Öl gekocht, wie haben die Britsh ein Geschenk an den Golf geschickt. 6.000.000 + Liter Öl!

Bundesbehörden haben, geschlossen und verboten kommerzielle Fischerei von Venedig bis nach Florida, weil der Ölpest. Jeder Fischer untätig beschädigt wurde, durch den Verlust des gegenwärtigen Einkommens, und vielleicht langfristig Schäden an der Fischerei auf den Golf. Einige glauben, Hunderte von Millionen von Fischen und anderen Arten sterben wird, oder zumindest, Ingest und tragen Giftstoffe, die Auswirkungen für die Jahre kommen könnte.

Die große chemische flow aus dem Mississippi, schafft ein Gerinne Algen in der Golfregion, dass alle ißt der Sauerstoff, und es gibt jetzt eine tote Zone im Golf von Mexiko so groß wie der Bundesstaat Massachusetts, und es wächst. "Nichts kann in der toten Zone leben. Es gibt keinen Sauerstoff. Es ist wegen der BP Ölpest "Stephen Soloman, Autor des Buches Öl wächst, sagte der epischen Kampf für Reichtum, Macht und Zivilisation, mich.

BP Oil Dome, 4 Stockwerke hochDer Schaden ist bereits geschehen

Mit Schätzungen reichen von 1.000 bis 5.000 Barrel (manche sagen, so hoch wie 20.000) Barrel Öl unter ausgespien pro Tag, bevor der "Containment" Kuppeln, und vor der Ventile wurden repariert, was BP nächsten tut, ändert nichts an der Tatsache, dass der Schaden ist bereits getan worden. Es sind 42 Liter Öl pro Barrel, so dass Sie die Mathematik zu tun. 5000 x 42 x 30 Tage = 6.300.000 Gallonen Öl in den Golf von Mexiko. Das Öl ist da. Es ist nun Teil unserer Nahrungskette und Ökosystem. BP die Nutzung von 45 "tall" Collector Dome "ist zu wenig, zu late.Steve klicken, wird eine Sanierung Experte sagte:

"Menschen rund um den Golf lernen, dass diese winzigen Partikel von Öl, zusammen hängen und wachsen in Büscheln im Laufe der Zeit. Wenn sie nicht sind, oder nicht Mantel den Boden des Golfes, wird auf die Küsten, die mit Teer gespickt werden float und Chemikalien für 50 Jahre, vielleicht länger, um gefressen werden

Venice Marina, La, Fischindustrie BeschädigteLand Vögel und Tiere, auch für uns. "

Der Konsens aus Fischern und der Sachverständigen in den Golfstaaten, einschließlich Larry Swaggart, Präsident der National Wildlife Federation, ist, dass "der BP-Wahl, um noch mehr Chemikalien in den Golf gießen, um das Rohöl auszuzahlen hat einfach viel des Unglücks aus der erzwungenen Blick unter Wasser, oder vermischten sich mit Gewässern des Golfs. Vieles davon ist auf den Boden sinken. Es kann eine gute Politik zu bewegen, weil die Augen der Presse weniger zu sehen. Aber auf lange Sicht, kann es mehr Schaden anrichten, weil es auf der Unterseite des Golfs Jahren sein wird, Auswirkungen der Fischerei auf den Golf. "

Ich besuchte eine vietnamesische Familie. Die Hände des Mannes waren fettig, als er über die Arbeit an seinem Motorboot gebogen, während seine beiden kleinen Mädchen gespielt. Seine Frau lächelte und sagte: "Wir können jetzt nicht arbeiten, so sind wir nur darauf warten." Rund um ihnen den Docks mit inaktiven Fischerbooten gefüllt waren. Die Straße hinunter in Boothville war ein Zeichen von Hand bemalt, lehnte sich gegen die Mail-Box in ihrem Vorgarten, lesen: "Obama, US-HELP". Bei einem großen Marina, östlich von Boothville wurden shrimpers sitzen, trinken Bier und überlegte, wie lange sie ohne Arbeit sein. Einer sagte: "Das könnte unser Geschäft seit Jahren auswirken. Aber jetzt wollen wir nur, um wieder auf das Wasser, so können wir unsere Zahlungen "zu machen. Gulf Coast Unternehmen, von Louisiana bis Florida berichten wirtschaftliche Folgen. Hotels berichten von Stornierungen, erzählte ein Immobilienentwickler mir: "Wir sind wegen der Wirtschaft zu kämpfen, und diese Ölpest ist der Nagel in unserem Sarg. Unsere Eigenschaftswerte sind, fast über Nacht, weil dieser "John Kelly hat mir gesagt. Ein Mitarbeiter eines Sea Food Restaurant, die seinen Namen behalten anonymen bevorzugt, in New Orleans hat mir gesagt: "Wir sind besorgt, dass Fisch-Preise explodieren. Niemand weiß das Gesundheitsrisiko. "

Venedig ist das Ende der Landzunge, die den Mississippi hat 70 Meilen in den Golf gebaut. Es ist ein Dorf durch chemische und Ölfirmen dominiert. Die Straßen sind nach Öl-Unternehmen genannt. Es gibt Berge von alten Schiffen, Stahlschrott, Ölfässer, Junk aus dem Ölgeschäft aufgeschichtet. Hinter hohen Zäunen sind teure Gebäude an der Öl-und Golf-chemischen Vorgänge Haus. Als ich vorbeifuhr, waren die Menschen bis in gefüttert und bekommen Hilfe bereinigen zu verschütten. Arbeitslose Fischer, Soldaten der Nationalgarde, Wildtiere Menschen, alle wollen ihren Teil der Aufräumarbeiten zu tun. Es wurde geschätzt, dass dieser Ölpest, aufräumen, und Schäden werden von $ 10,000,000,000.00 (Mrd.) und die Schätzungen sind steigende Kosten.

Ich saß an der Marina in Venedig, mit Larry Swaggart, Präsident der National Wildlife Federation, wie wir sahen Entwicklungen in Venedig. Er sagte: "Die Wirkung ist so breit und so langfristig, können wir gar nicht quantifizieren. Für ein Chemie-Unternehmen, um zu versuchen, um ein Problem mit mehr Chemikalien Heilung ist typisch. Diese Perlen sind nun von Öl Zusammenarbeit in der Golf-Wasser vermischt, werden einige von Fisch, Austern, Muscheln genommen werden die giftigen Cocktail zu konzentrieren, und es wird die Nahrungskette auswirken und Gesundheit in einer Vielzahl von Möglichkeiten. Alles über die Art und Weise genähert BP Dies hat eine Reihe von Fehlern wurde. Schaden nicht an die Fischer beschränkt, sondern zu jeder isst Fisch. Schaden ist nicht zu Vögeln oder Tieren beschränkt, sondern zu jedem Lebewesen Teil dieses Ökologie. Diese Chemikalien sind giftig. Der Golf ist, wo 50% der USA Garnelen, 40% der Auster, 30% unserer Fischen stammen. Für jeden einen Teil des Wassers, magnify Austern es 1000 Mal, und wie ein Staubsauger zu dienen, erzeugt eine konzentrierte chemische Wirkung, was in den Ozean, aber wir und andere Lebewesen essen Austern. Es ist wie eine riesige Bissen konzentrierten Chemikalien. Alle Arten, die in und um den Golf betroffen sind. Diejenigen, Meeresschildkröten, starb, ohne Zweifel von Chemikalien. Unsere Mitgliedschaft ist sehr aufgeregt, in ein paar Momente, die wir tun, eine Live-Telefon Treffen mit über 10.000 Mitgliedern sind. "

Steve klicken, insgesamt 600 Landwirte in Missouri, zeigte Pellets von "Switch grass", die natürlich absorbieren würde das Öl gemacht, er will www.goshowmeengergy.com 816 365 7952. Steve ist bereit, um ein Produkt zu spenden, um mit dem Aufräumen zu helfen, und zeigen es "natürliche" Effektivität. Es funktioniert wie folgt, mit einem einfachen Besprengung mit dem "alphalfa wie" Pellets auf die Oberfläche des Wassers, und wie es absorbiert Öl, kann es dann leicht gesammelt und entsorgt werden bis. Wir versuchen, mit BP beschäftigen, diese Lösung zu bieten, aber bisher kein Glück mit ihnen.

Advanced Recovery Schadstoff Phillip Ward hat auch eine Lösung erarbeitet. Er zeigte uns ein Glas "Rohöl" aus dem Schlick, dass er gerade aus dem Golf erholt. Er glaubt, BP's Methode des Schlagens des Öls mit ihren Chemikalien (156.000 Gallonen bisher) verursacht das Öl auf den Boden sinken, "Fisch zu essen auf dem Weg nach unten, aber dann ist es für 50 oder mehr Jahren. Die Fischereiindustrie hat schlechte verletzt worden. Putting das Öl auf der Unterseite des Golfs, hält das Öl weg von den Stränden, sondern auf den Ozean, die Millionen von Baby-Fisch, Austern, Garnelen, wirst sterben und nicht überleben. Unsere Lösung ist eine bessere, sagt er. Seine Telefonnummer 251 605 2949, www.recoverUS.com

Ein TV-Team kam auf mich zu und sagte: Was macht Ihr Unternehmen tun? Ich habe ihnen gesagt, "Wir sind ein Beratungsunternehmen Umwelt und kann eine unabhängige 'produzieren Certificate of Damage" oder ein in der Tiefe Dokumentation Bericht zeigt, wie viel sie, ihr Geschäft oder ihr Eigentum, weil dieser Ölpest beschädigt wurde. Ein paar Leute versammelten sich um zuzuhören. "Ich habe beschädigt worden", sagte ein Fischer, "Me too", sagte ein Dockschiff Service Firmeninhaber. Ich sagte: "Wir wollen helfen. Wir hoffen, Sie können alle diese Katastrophe zu überleben. "Ihre dankbaren Augen sagten alles.

Reporting aus dem Golf von Mexico, irgendwo zwischen Venedig und Pensacola am Golf von Mexiko

Ben B. Boothe, Sr.

www.environment-solutions.com

817 738 9595

Sehr gute Zusammenfassung über PMDP:

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

.

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

.

bei 4 steig ich auch mal mit einer kleinen posi ein.

na ob du da noch welche bekommst

Antwort auf Beitrag Nr.: 39.497.254 von WissenMacht am 11.05.10 09:27:36

Ich bin hier schon bei 8 eingestiegen und nochmals bei 4 und 5.

Mal sehen, was daraus wird.

Ich bin hier schon bei 8 eingestiegen und nochmals bei 4 und 5.

Mal sehen, was daraus wird.

May 14, 2010, 8:05 a.m. EDT

BP oil leak worse than previously thought, reports say

Scientists say broken rig spilling up to 20 times more oil than was estimated

By MarketWatch

NEW YORK

(MarketWatch) -- Scientists and environmentalists believe the U.S. government's estimate of the oil flow from the leaking Deepwater Horizon rig in the Gulf of Mexico is unrealistically low, according to reports.

While the U.S. Coast Guard and the National Oceanic and Atmospheric Administration has said 5,000 barrels a day are pouring out of the pipe from BP PLC's (NYSE:BP) (LSE:UK:BP.) well, separate reports from National Public Radio and The New York Times said the rate is likely many times greater.

Poll shows support for offshore drillingGovernors in California and Florida are backing away from undersea oil exploration. But a new WSJ/NBC News poll indicates some surprising support among Americans for drilling off the U.S. coast.

NPR reported late Thursday that scientific analysis of a video of the leak, released Wednesday by BP, put the rate closer to 70,000 barrels a day, making the resulting spill already far worse than the 1989 Exxon Valdez incident in Alaska. See video of BP's oil leak.

The report cited analysis by Steve Werely of Purdue University, who used a technique he said was accurate to about 20%.

The same report also cited separate calculations by a University of California, Berkeley, astrophysics professor, who said the flow ranged between 20,000 and 100,000 barrels a day.

Separately, a New York Times report Friday cited Florida State University oceanographer Ian MacDonald as saying his own rough calculations put the leak "easily four to five times" beyond the government's estimates.

"The government

has a responsibility to get good numbers," the report quoted MacDonald as saying. "If it's beyond their technical capability, the whole world is ready to help them."

BP spokesman Toby Odone said the oil company

doesn't have a meter on the pipe spewing oil, so it's sticking with the estimates from NOAA, which has used plane flights and other data gathering methods to gauge the spill.

BP and the Coast Guard initially estimated the spill at 1,000 barrels a day immediately after the Deepwater Horizon rig sank in the Gulf of Mexico

on April 22. The official estimate was increased to 5,000 barrels a day shortly thereafter.

BP officials said in a May 4 briefing to members of Congress that the high end of the spill could be as much as 60,000 barrels a day.

Quelle: http://www.marketwatch.com/story/bp-oil-leak-worse-than-prev…

BP oil leak worse than previously thought, reports say

Scientists say broken rig spilling up to 20 times more oil than was estimated

By MarketWatch

NEW YORK

(MarketWatch) -- Scientists and environmentalists believe the U.S. government's estimate of the oil flow from the leaking Deepwater Horizon rig in the Gulf of Mexico is unrealistically low, according to reports.

While the U.S. Coast Guard and the National Oceanic and Atmospheric Administration has said 5,000 barrels a day are pouring out of the pipe from BP PLC's (NYSE:BP) (LSE:UK:BP.) well, separate reports from National Public Radio and The New York Times said the rate is likely many times greater.

Poll shows support for offshore drillingGovernors in California and Florida are backing away from undersea oil exploration. But a new WSJ/NBC News poll indicates some surprising support among Americans for drilling off the U.S. coast.

NPR reported late Thursday that scientific analysis of a video of the leak, released Wednesday by BP, put the rate closer to 70,000 barrels a day, making the resulting spill already far worse than the 1989 Exxon Valdez incident in Alaska. See video of BP's oil leak.

The report cited analysis by Steve Werely of Purdue University, who used a technique he said was accurate to about 20%.

The same report also cited separate calculations by a University of California, Berkeley, astrophysics professor, who said the flow ranged between 20,000 and 100,000 barrels a day.

Separately, a New York Times report Friday cited Florida State University oceanographer Ian MacDonald as saying his own rough calculations put the leak "easily four to five times" beyond the government's estimates.

"The government

has a responsibility to get good numbers," the report quoted MacDonald as saying. "If it's beyond their technical capability, the whole world is ready to help them."

BP spokesman Toby Odone said the oil company

doesn't have a meter on the pipe spewing oil, so it's sticking with the estimates from NOAA, which has used plane flights and other data gathering methods to gauge the spill.

BP and the Coast Guard initially estimated the spill at 1,000 barrels a day immediately after the Deepwater Horizon rig sank in the Gulf of Mexico

on April 22. The official estimate was increased to 5,000 barrels a day shortly thereafter.

BP officials said in a May 4 briefing to members of Congress that the high end of the spill could be as much as 60,000 barrels a day.

Quelle: http://www.marketwatch.com/story/bp-oil-leak-worse-than-prev…

BP sammelt Vorschläge

Die Ratlosigkeit erweckt den Eindruck, dass BP auf einen technischen Geniestreich wartet. Vor ein paar Tagen hat der Ölkonzern eine Webseite eingerichtet und jedermann aufgerufen, Vorschläge einzubringen. Unter den eingebrachten Vorschlägen gibt es auch abenteuerliche Ideen.

Quelle: http://bazonline.ch/panorama/vermischtes/Atombombe-gegen-die…

SOS-Webseite von BP: http://www.deepwaterhorizonresponse.com/go/site/2931/

Die Ratlosigkeit erweckt den Eindruck, dass BP auf einen technischen Geniestreich wartet. Vor ein paar Tagen hat der Ölkonzern eine Webseite eingerichtet und jedermann aufgerufen, Vorschläge einzubringen. Unter den eingebrachten Vorschlägen gibt es auch abenteuerliche Ideen.

Quelle: http://bazonline.ch/panorama/vermischtes/Atombombe-gegen-die…

SOS-Webseite von BP: http://www.deepwaterhorizonresponse.com/go/site/2931/

ich denke im laufe der woche, passiert was bei pmdp

und dann geht´s hoch,

und dann geht´s hoch,

Antwort auf Beitrag Nr.: 39.528.083 von hapkido10 am 16.05.10 13:52:30

Gehe ich davon aus. Wir bauen auch noch charttechnisch ein "W" auf. Sollten News kommen, geht es ganz schnell.

Gehe ich davon aus. Wir bauen auch noch charttechnisch ein "W" auf. Sollten News kommen, geht es ganz schnell.

Die Frage ist, wann wird der Ölteppich die Küste erreichen? Sobald es dazu kommt, werden viele Aufträge erteilt, zur Reinigung der versäuchten Küsten. Da hat PMDP viel Arbeit vor sich.

http://www.youtube.com/watch?v=6w0y18A79s4

http://www.youtube.com/watch?v=6w0y18A79s4

Morgen,

so mal schauen was die neue Woche bringt

so mal schauen was die neue Woche bringt

From researching PMDP’s potential...

I'm really starting to feel the potential here with PMDP more and more. To be able to use their converter system to take old tires and recycle them to where those tires are transformed into oil, gas, and other beneficial products such as fertilizer and carbon black could be huge. Let’s look at some statistics…

http://www.deq.state.va.us/wastetires/

…almost 500 additional new piles (“new finds”) containing approximately 8 million tires have been located and documented. …

According to the EPA

, 290 million scrap tires are generated annually:

http://www.epa.gov/wastes/conserve/materials/tires/faq.htm

http://www.epa.gov/region8/recycling/RCCScrapTireWorkgroup.p…

(On slide 42) …In 2007, more than 303 million scrap tires were generated in the U.S. Nearly 107 million of these tires were recycled into new products and 164 million were reused as tire-derived fuel (TDF) in various industrial facilities. …

From an older article..

http://www.solidwastedistrict.com/stats/tires.html

There are at least 300 million scrap tires in stockpiles in the U.S. …

http://cscanada.net/index.php/ans/article/viewFile/1197/1271

…According to related estimation, automobile possession of China will reach as many as 70 million in 2010 and the tire production will exceed 300 million, which will generate more than 200 million waste tires weighed 5.2 million tons. China will become the biggest tire producing and waste tire generating country in the world. …

Just from researching above, I think it’s easy to see that there is a chance that maybe PMDP could get to where they are recycling well over 100 million tires per year. From the link below, there is a .80 fee charged per tire for buying a tire which leads me to think that there must be an at least standard of .80 chare per tire to have recycled:

http://www.mde.maryland.gov/Programs/LandPrograms/Recycling/…

I think you can see that there is going to be far more than just 100,000,000 tires in need of being recycled throughout the world. However, just by taking the 100,000,000 tires under consideration, that alone is .80 x 100,000,000 = $80,000,000 per year in Revenues.

This number could easily be greater. This website

below has a fee of $1.75 per tire to have recycled:

http://www.boe.ca.gov/pdf/pub91.pdf

Quelle:http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Ein Posting aus dem Amiboard zeigt nochmal, was bei PMDP möglich ist.

I'm really starting to feel the potential here with PMDP more and more. To be able to use their converter system to take old tires and recycle them to where those tires are transformed into oil, gas, and other beneficial products such as fertilizer and carbon black could be huge. Let’s look at some statistics…

http://www.deq.state.va.us/wastetires/

…almost 500 additional new piles (“new finds”) containing approximately 8 million tires have been located and documented. …

According to the EPA

, 290 million scrap tires are generated annually:

http://www.epa.gov/wastes/conserve/materials/tires/faq.htm

http://www.epa.gov/region8/recycling/RCCScrapTireWorkgroup.p…

(On slide 42) …In 2007, more than 303 million scrap tires were generated in the U.S. Nearly 107 million of these tires were recycled into new products and 164 million were reused as tire-derived fuel (TDF) in various industrial facilities. …

From an older article..

http://www.solidwastedistrict.com/stats/tires.html

There are at least 300 million scrap tires in stockpiles in the U.S. …

http://cscanada.net/index.php/ans/article/viewFile/1197/1271

…According to related estimation, automobile possession of China will reach as many as 70 million in 2010 and the tire production will exceed 300 million, which will generate more than 200 million waste tires weighed 5.2 million tons. China will become the biggest tire producing and waste tire generating country in the world. …

Just from researching above, I think it’s easy to see that there is a chance that maybe PMDP could get to where they are recycling well over 100 million tires per year. From the link below, there is a .80 fee charged per tire for buying a tire which leads me to think that there must be an at least standard of .80 chare per tire to have recycled:

http://www.mde.maryland.gov/Programs/LandPrograms/Recycling/…

I think you can see that there is going to be far more than just 100,000,000 tires in need of being recycled throughout the world. However, just by taking the 100,000,000 tires under consideration, that alone is .80 x 100,000,000 = $80,000,000 per year in Revenues.

This number could easily be greater. This website

below has a fee of $1.75 per tire to have recycled:

http://www.boe.ca.gov/pdf/pub91.pdf

Quelle:http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Ein Posting aus dem Amiboard zeigt nochmal, was bei PMDP möglich ist.

Habe ich das auf ihub richtig gelesen, PMDP arbeitet

schon am Strand,

Kann das jemand bestätigen ?

schon am Strand,

Kann das jemand bestätigen ?

Antwort auf Beitrag Nr.: 39.545.431 von hapkido10 am 19.05.10 11:07:11

Nein. Das Öl hat die Küste erreicht. Somit bietet sich für PMDP die Möglichkeit, die Services an BP zur Ölbeseitigung anzubieten. Die Kosten betragen einige Milliarden US-Dollar.

Nein. Das Öl hat die Küste erreicht. Somit bietet sich für PMDP die Möglichkeit, die Services an BP zur Ölbeseitigung anzubieten. Die Kosten betragen einige Milliarden US-Dollar.

Antwort auf Beitrag Nr.: 39.559.844 von SherlockHolmes77 am 20.05.10 21:41:00Morgen Sherlock,

ich verstehe nur nicht, allen anderen bringen ständig

Meldungen heraus, Produkt verbessert, verbilligt usw.

und die Kurse gehen direkt nach oben, nur PMDP bringen

nichts......

Bin gespannt ob da noch was passiert

Gruß

h10

ich verstehe nur nicht, allen anderen bringen ständig

Meldungen heraus, Produkt verbessert, verbilligt usw.

und die Kurse gehen direkt nach oben, nur PMDP bringen

nichts......

Bin gespannt ob da noch was passiert

Gruß

h10

Mojen,

im Amiboard meinen sie bald kommt die News bin gespannt.

im Amiboard meinen sie bald kommt die News bin gespannt.

Antwort auf Beitrag Nr.: 39.674.635 von Riesenwumme am 13.06.10 11:49:48Plateau Mineral Development, Inc. Announces Early Fabrication of Tire Converter

WINSTON-SALEM, N.C., June 22, 2010 (GLOBE NEWSWIRE) -- Plateau Mineral Development, Inc. (Pink Sheets:P MDP) announced today that the firm, in conjunction with Environmental Solutions, has commenced the permitting process for the Tire Converter, and once that's done, early fabrication will begin.

Permitting and early fabrication allow Plateau and EnSol's engineers to resolve any fabrication issues that could make building the Converter take longer than needed. Fabrication issues need to be fixed in order to avoid unforeseen delays that would include follow-on production problems.

The Converter will recover carbon black, oil, gas and petroleum solvents from tires. The market for carbon black includes the manufacturing of batteries and other products, making it an even more important commodity than the company had originally thought. Carbon black sells for approximately $0.46 per pound.

A prototype unit was put to the test, showing that the converter yields more than 95% of usable product after it converts the materials put into it. The fully-operational converter is the size of a truck bed. However, the goal is to fabricate and test a portable unit that can be taken to remote sites for conversion and environmental cleanup jobs.

Robert Matthews of Plateau Mineral Development, Inc. states, "We're thrilled to take the Tire Converter onto the next step in the process. The pre-fabrication brings us one step closer to taking the product to market."

About Plateau Mineral Development, Inc.: Plateau Mineral Development has been in existence for over five years.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

CONTACT: Plateau Mineral Development, Inc.

Investor Relations

410-242-0763

Quelle: http://www.globenewswire.com/news.html?d=194869

WINSTON-SALEM, N.C., June 22, 2010 (GLOBE NEWSWIRE) -- Plateau Mineral Development, Inc. (Pink Sheets:P MDP) announced today that the firm, in conjunction with Environmental Solutions, has commenced the permitting process for the Tire Converter, and once that's done, early fabrication will begin.

Permitting and early fabrication allow Plateau and EnSol's engineers to resolve any fabrication issues that could make building the Converter take longer than needed. Fabrication issues need to be fixed in order to avoid unforeseen delays that would include follow-on production problems.

The Converter will recover carbon black, oil, gas and petroleum solvents from tires. The market for carbon black includes the manufacturing of batteries and other products, making it an even more important commodity than the company had originally thought. Carbon black sells for approximately $0.46 per pound.

A prototype unit was put to the test, showing that the converter yields more than 95% of usable product after it converts the materials put into it. The fully-operational converter is the size of a truck bed. However, the goal is to fabricate and test a portable unit that can be taken to remote sites for conversion and environmental cleanup jobs.

Robert Matthews of Plateau Mineral Development, Inc. states, "We're thrilled to take the Tire Converter onto the next step in the process. The pre-fabrication brings us one step closer to taking the product to market."

About Plateau Mineral Development, Inc.: Plateau Mineral Development has been in existence for over five years.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

CONTACT: Plateau Mineral Development, Inc.

Investor Relations

410-242-0763

Quelle: http://www.globenewswire.com/news.html?d=194869

Plateau Mineral Development , Inc. Reaches Out mit den vorgeschlagenen Lösungen , um die Ölpest im Golf von Mexiko BP Gulf of Mexico

Plateau Mineral Development (OTC ) ( USOTC: PMDP )

Intraday Chart Stock

Heute : Mittwoch, 7. Juli 2010

Plateau Mineral Development , Inc. ( Pink Sheets: PMDP ) heute bekannt, dass Vertreter aus BP haben in dem Bemühen um Ideen, wie die Öl- Leck in den Golf zu stoppen vorschlagen erreicht. Auch PMDP vorgeschlagene Verwendung von Enzymen, die "fressen" Öl- in -situ- Bereinigung zu erleichtern. Dies ist umweltfreundlicher und kostengünstiger als die meisten Alternativen. Keine Antwort hat der Presse rechtzeitig zugegangen . enzymes that "eat" oil to facilitate in situ cleanup. This is more environmentally friendly and less costly than most alternatives. No response has been received as of press time.

Plateau 's Partnerfirma , Environmental Solutions ( Ensol ), hat eine Technologie, die geändert werden, um bei der Säuberung Ölverschmutzungen , wie die aktuelle Deep Horizon Spill in den Golf von Mexiko unterstützen kann. Während die Technologie Ensol einige Änderungen erfordern würde , um den genauen Bedarf zu decken, würden diese Änderungen geringfügig sein werden. Ensol Technologie kann verwendet werden, um das Öl und Teer , während die Wiederherstellung der Strände zurückzunehmen. Es würde in einem Volumen von kontaminierten Sand, distanzieren der Komponenten, die Gewinnung von Öl und Teer, wodurch sauberen Sand zu hinterlegen zurück an den Strand. technology would require some modifications to meet the exact needs, those changes would be minor. EnSol's technology can be used to reclaim the oil and tar, whilst restoring the beaches. It would take in a volume of contaminated sand, dissociate the components, extracting the oil and tar, thereby allowing clean sand to be deposited back onto the beach.

Darüber hinaus können Plateau liefern Enzyme, "essen" Öl , so dass für in situ-Sanierung der Sumpfgebiete und Seegras entlang der Golf- Küste. Dieser Prozess ist umweltverträglicher und billiger als andere Techniken wie Brennen und Baggerarbeiten. environmentally safer, and less costly than other techniques such as burning and dredging.

Plateau Mineral Development veröffentlicht eine Erklärung zum 3. Dezember 2009 angekündigt , dass Environmental Solutions , LLC ( Ensol ) erfolgreich abgeschlossen hatte, seinen Bericht auf der Grundlage der ökologischen Labortests in den Sommermonaten durchgeführt. Die Testergebnisse wurden durch natürliche Prozesse, die keine Gefahr für die Umwelt an und für sich gewonnen vertreten . laboratory testing done over the summer months. The test results were obtained via natural processes that represented no environmental threat in and of themselves.

Robert Matthews von Plateau Mineral Development , Inc., erklärt: " Die Ölverschmutzung im Golf von Mexiko und ihre negativen ökologischen Auswirkungen sind von maßgeblicher Bedeutung . Es ist unser Ziel , den Kontakt mit BP zu machen und unsere Ideen teilen mit ihnen , und hoffentlich Hilfe in der Beendigung des tragischen Ölleck . " oil leak."

Plateau Mineral Development (OTC ) ( USOTC: PMDP )

Intraday Chart Stock

Heute : Mittwoch, 7. Juli 2010

Plateau Mineral Development , Inc. ( Pink Sheets: PMDP ) heute bekannt, dass Vertreter aus BP haben in dem Bemühen um Ideen, wie die Öl- Leck in den Golf zu stoppen vorschlagen erreicht. Auch PMDP vorgeschlagene Verwendung von Enzymen, die "fressen" Öl- in -situ- Bereinigung zu erleichtern. Dies ist umweltfreundlicher und kostengünstiger als die meisten Alternativen. Keine Antwort hat der Presse rechtzeitig zugegangen . enzymes that "eat" oil to facilitate in situ cleanup. This is more environmentally friendly and less costly than most alternatives. No response has been received as of press time.

Plateau 's Partnerfirma , Environmental Solutions ( Ensol ), hat eine Technologie, die geändert werden, um bei der Säuberung Ölverschmutzungen , wie die aktuelle Deep Horizon Spill in den Golf von Mexiko unterstützen kann. Während die Technologie Ensol einige Änderungen erfordern würde , um den genauen Bedarf zu decken, würden diese Änderungen geringfügig sein werden. Ensol Technologie kann verwendet werden, um das Öl und Teer , während die Wiederherstellung der Strände zurückzunehmen. Es würde in einem Volumen von kontaminierten Sand, distanzieren der Komponenten, die Gewinnung von Öl und Teer, wodurch sauberen Sand zu hinterlegen zurück an den Strand. technology would require some modifications to meet the exact needs, those changes would be minor. EnSol's technology can be used to reclaim the oil and tar, whilst restoring the beaches. It would take in a volume of contaminated sand, dissociate the components, extracting the oil and tar, thereby allowing clean sand to be deposited back onto the beach.

Darüber hinaus können Plateau liefern Enzyme, "essen" Öl , so dass für in situ-Sanierung der Sumpfgebiete und Seegras entlang der Golf- Küste. Dieser Prozess ist umweltverträglicher und billiger als andere Techniken wie Brennen und Baggerarbeiten. environmentally safer, and less costly than other techniques such as burning and dredging.

Plateau Mineral Development veröffentlicht eine Erklärung zum 3. Dezember 2009 angekündigt , dass Environmental Solutions , LLC ( Ensol ) erfolgreich abgeschlossen hatte, seinen Bericht auf der Grundlage der ökologischen Labortests in den Sommermonaten durchgeführt. Die Testergebnisse wurden durch natürliche Prozesse, die keine Gefahr für die Umwelt an und für sich gewonnen vertreten . laboratory testing done over the summer months. The test results were obtained via natural processes that represented no environmental threat in and of themselves.

Robert Matthews von Plateau Mineral Development , Inc., erklärt: " Die Ölverschmutzung im Golf von Mexiko und ihre negativen ökologischen Auswirkungen sind von maßgeblicher Bedeutung . Es ist unser Ziel , den Kontakt mit BP zu machen und unsere Ideen teilen mit ihnen , und hoffentlich Hilfe in der Beendigung des tragischen Ölleck . " oil leak."

[urlhttp://www.marketwatch.com/story/plateau-mineral-development-inc-details-use-of-solvent-instead-of-chemical-laced-water-for-fracking-2010-09-30?siteid=nbsh][/url]

Plateau Mineral Development, Inc. Announces Income Projections

Date: 12 November 2010

Source: Plateau Mineral Development Inc. Plateau Mineral Development, Inc. Announces Income Projections

FORT WALTON BEACH, Fla., Nov. 11, 2010 (GLOBE NEWSWIRE) -- Plateau Mineral Development, Inc. (Pink Sheets:PMDP) issued a statement today detailing the income projections on its acquired wells.

Each additional well is expected to produce a minimum of one barrel of oil per day without rework. There are approximately 26 production days per month, and each barrel is currently worth $60. Therefore, each well can produce an income stream of around $1,560 per month. The additional revenue total comes out to approximately $36,000 per month or $900,000 per year. Plateau has a total of 51 producing wells. Most of the properties are located in an area where the basin is thriving and productive. The properties are located in Kentucky, Oklahoma and Michigan. With a minimal rework of some of these wells, the return can dramatically increase.

Robert Matthews of Plateau Mineral Development, Inc., states, "Most of the properties are located in areas where the basin is thriving and productive, so we do not foresee any problems in hitting our goal of one barrel per day. MEI's revenue stream is expected to generate around $1,000,000 per year. In short, the projections are positive and we are striving to reach our productivity goals."

About Plateau Mineral Development, Inc.: Plateau Mineral Development, Inc. specializes in the exploration and development of energy sources. Its partner, Plateau Mineral Development LLC, has been in existence for over five years with successful new wells and rework wells selling both gas and oil.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

CONTACT: Plateau Mineral Development Investor Relations 410-242-0763

Quelle: http://www.stockmarketsreview.com/news/58362/

Date: 12 November 2010

Source: Plateau Mineral Development Inc. Plateau Mineral Development, Inc. Announces Income Projections

FORT WALTON BEACH, Fla., Nov. 11, 2010 (GLOBE NEWSWIRE) -- Plateau Mineral Development, Inc. (Pink Sheets:PMDP) issued a statement today detailing the income projections on its acquired wells.

Each additional well is expected to produce a minimum of one barrel of oil per day without rework. There are approximately 26 production days per month, and each barrel is currently worth $60. Therefore, each well can produce an income stream of around $1,560 per month. The additional revenue total comes out to approximately $36,000 per month or $900,000 per year. Plateau has a total of 51 producing wells. Most of the properties are located in an area where the basin is thriving and productive. The properties are located in Kentucky, Oklahoma and Michigan. With a minimal rework of some of these wells, the return can dramatically increase.

Robert Matthews of Plateau Mineral Development, Inc., states, "Most of the properties are located in areas where the basin is thriving and productive, so we do not foresee any problems in hitting our goal of one barrel per day. MEI's revenue stream is expected to generate around $1,000,000 per year. In short, the projections are positive and we are striving to reach our productivity goals."

About Plateau Mineral Development, Inc.: Plateau Mineral Development, Inc. specializes in the exploration and development of energy sources. Its partner, Plateau Mineral Development LLC, has been in existence for over five years with successful new wells and rework wells selling both gas and oil.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

CONTACT: Plateau Mineral Development Investor Relations 410-242-0763

Quelle: http://www.stockmarketsreview.com/news/58362/

Plateau Mineral Announces New Operations, Business Plan, and Executive Team

FORT WALTON BEACH, FL--(Marketwire - 12/14/10) - Plateau Mineral Development, Inc. (Pinksheets:PMDP - News) announced the adoption of a new business plan and complete replacement of current operations.

In the coming days, a new Board and Executive team will be announced, together with the Plateau Mineral's 2011 Business Plan. All current and unprofitable natural gas operations or opportunities are hereby divested. In their place the company has acquired various precious metal production, shipping, surety, and arbitrage operations. Current consolidated revenues of the combined operations exceed USD$24,000,000, are profitable, and have pro forma 2011 projections based on current executed contracts well in excess of this amount. Formal projections and revenue estimates will be released as part of the Company's regular disclosure.

are profitable, and have pro forma 2011 projections based on current executed contracts well in excess of this amount. Formal projections and revenue estimates will be released as part of the Company's regular disclosure.

The Company's new operations consist of the following key components:

- Precious metal international shipping and arbitrage

- Risk surety services for trans-shipping and precious metals exchange and arbitrage

- Acquisition and development of precious metal production properties

- Online international marketplace operations for direct purchase, sale, ownership and storage of smaller quantity precious metals

Shareholders are advised that changes announced are the result of a private change of control and the Company will not be changing its name and the transaction does not involve a reverse split to achieve its plan. No new shares have, or will be, issued as part of this transaction.

The Company will file complete disclosures and financial statements in order to immediately bring the Company to 'current information' reporting status with the OTC Disclosure service. The Company intends to complete its USA-compliant financial audits and register its securities with the US Securities and Exchange Commission.

The Company will issue a series of disclosure press releases describing each operational category, current revenue, and projections for each.

The Company will soon issue a press release disclosing marketing strategies, web sites, and office and contact information for its various operations worldwide.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

Contact:

CONTACT:

Plateau Mineral Development

Investor Relations

info@plateaumetals.com

Quelle: http://finance.yahoo.com/news/Plateau-Mineral-Announces-New-…

FORT WALTON BEACH, FL--(Marketwire - 12/14/10) - Plateau Mineral Development, Inc. (Pinksheets:PMDP - News) announced the adoption of a new business plan and complete replacement of current operations.

In the coming days, a new Board and Executive team will be announced, together with the Plateau Mineral's 2011 Business Plan. All current and unprofitable natural gas operations or opportunities are hereby divested. In their place the company has acquired various precious metal production, shipping, surety, and arbitrage operations. Current consolidated revenues of the combined operations exceed USD$24,000,000,

are profitable, and have pro forma 2011 projections based on current executed contracts well in excess of this amount. Formal projections and revenue estimates will be released as part of the Company's regular disclosure.

are profitable, and have pro forma 2011 projections based on current executed contracts well in excess of this amount. Formal projections and revenue estimates will be released as part of the Company's regular disclosure.The Company's new operations consist of the following key components:

- Precious metal international shipping and arbitrage

- Risk surety services for trans-shipping and precious metals exchange and arbitrage

- Acquisition and development of precious metal production properties

- Online international marketplace operations for direct purchase, sale, ownership and storage of smaller quantity precious metals

Shareholders are advised that changes announced are the result of a private change of control and the Company will not be changing its name and the transaction does not involve a reverse split to achieve its plan. No new shares have, or will be, issued as part of this transaction.

The Company will file complete disclosures and financial statements in order to immediately bring the Company to 'current information' reporting status with the OTC Disclosure service. The Company intends to complete its USA-compliant financial audits and register its securities with the US Securities and Exchange Commission.

The Company will issue a series of disclosure press releases describing each operational category, current revenue, and projections for each.

The Company will soon issue a press release disclosing marketing strategies, web sites, and office and contact information for its various operations worldwide.

Safe Harbor Statement: This information includes certain "forward-looking statements." The forward-looking statements reflect the beliefs, expectations, objectives and goals of the Company management with respect to future events and financial performance. They are based on assumptions and estimates, which are believed reasonable at the time such statements are made. However, actual results could differ materially from anticipated results. Important factors that may impact actual results include but are not limited to commodity prices, political developments, legal decisions, market and economic conditions, industry competition, the weather, changes in financial markets and changing legislation and regulations. Matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include but are not limited to risks and uncertainties associated with the impact of economic, competitive and other factors affecting the Company and its operations, markets, product, and distributor performance, the impact on the national and local economies resulting from terrorist actions, and U.S. actions subsequently; and other factors detailed in reports filed by the Company. Forward-looking statements are intended to qualify for the safe harbor provisions of Section 21E of the Securities and Exchange Act of 1934, as amended.

Contact:

CONTACT:

Plateau Mineral Development

Investor Relations

info@plateaumetals.com

Quelle: http://finance.yahoo.com/news/Plateau-Mineral-Announces-New-…

Neustrukturierung des Unternehmens mit bombastischen Zielen für 2011 beschert PMDP die letzten Tage gewaltigen Umsatz. Mal sehen, wohin es charttechnisch laufen wird. Sieht sehr ausbruchsverdächtig aus.

Interessant ... 24 Mio. Umsatz mit einem $ 1 Mio. Marktkapital und viel früheren FTD und Kanalisierung 2 / 3. Dies könnte mehr als interessant werden. Sieht aus, als obe es bereit ist für ein Rebound?

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Yeah, das ist sehr interessant, nicht wahr! Ich vergesse, was der A / S und O / S hier mit PMDP, sondern die Tatsache, dass sie nicht R / S (zumindest das ist, was sie uns sagen) noch Thema mehr Aktien und ich würde sagen, dieser hat einige große Möglichkeiten .... Ich freue mich auf die kommenden PR's ....

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

http://investorshub.advfn.com/boards/read_msg.aspx?message_i…

Berücksichtigt man die NEWS und die Aussagen aus dem Amiboard, kann man von einem Jahres-Kursziel von .007 USD ausgehen...

... das sind 2333%

was will man mehr.

... das sind 2333%

was will man mehr.

Antwort auf Beitrag Nr.: 40.734.768 von SherlockHolmes77 am 19.12.10 14:54:42Morgen,

das wäre der Knaller.

0,0007 wäre schon genial

das wäre der Knaller.

0,0007 wäre schon genial

Antwort auf Beitrag Nr.: 40.742.116 von Riesenwumme am 21.12.10 08:03:40

Hey! Endlich mal jemand, der mitdiskutiert.

Auch wenn es bei solchen HOT-Stocks immer drunter und drüber geht,

kann man bei guten News beträchtliche Erfolge feiern.