Zalicus - A low-risk development-stage biotech - 500 Beiträge pro Seite

eröffnet am 10.01.11 20:23:37 von

neuester Beitrag 18.06.14 15:40:49 von

neuester Beitrag 18.06.14 15:40:49 von

Beiträge: 443

ID: 1.162.665

ID: 1.162.665

Aufrufe heute: 0

Gesamt: 32.157

Gesamt: 32.157

Aktive User: 0

ISIN: US29428P1075 · WKN: A117U3 · Symbol: EPRSQ

0,0001

USD

+9.900,00 %

+0,0001 USD

Letzter Kurs 22.04.24 Nasdaq OTC

Werte aus der Branche Biotechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,9000 | +59,66 | |

| 0,5922 | +44,44 | |

| 7,3500 | +43,84 | |

| 11,690 | +40,84 | |

| 0,7000 | +36,69 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,110 | -13,44 | |

| 8,2200 | -13,47 | |

| 7,6100 | -17,20 | |

| 1,6100 | -18,27 | |

| 2,1200 | -21,77 |

Unbeobachtet und aus dem Winterschlaf erwacht, klettert ZLCS schrittweise in Richtung Norden.

Die frühere CombinatoRx (CRXX ) hat nach der Vereinigung mit Neuromed neuen Schwung genommen.

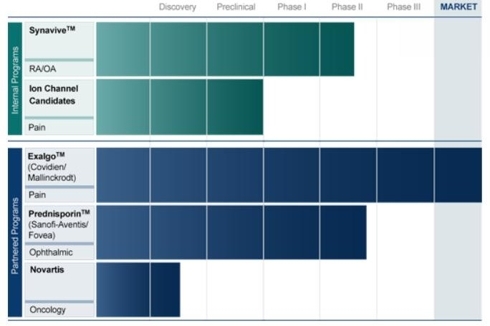

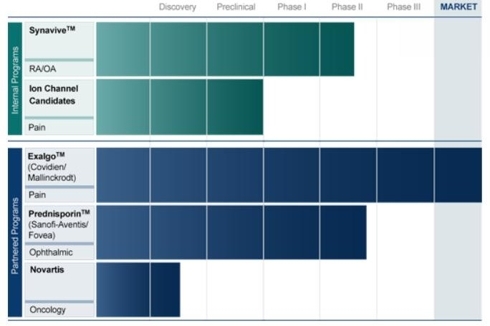

Zalicus (ZLCS) is my pick from New World Investor for this 2011 list. It is a development-stage, yet low-risk, virtually unknown biotech stock. Zalicus was formed by the merger of CombinatoRx (formerly CRXX) and Neuromed, a private company. Most of the current management is from Neuromed, and they have refocused the company on drugs for pain and immuno-inflammatory disease.

But there were many drugs in preclinical and clinical trials at CombinatoRx before the merger, and several of them are showing more potential than Neuromed may have expected when they agreed to the merger. At the least, these drugs provide ongoing partnering opportunities. Some have world-class potential for eventual royalties.

The core development programs include Synavive, developed by CombinatoRx as CRx-102, to treat immuno-inflammatory disorders. It has completed Phase II clinical trials in subjects with knee osteoarthritis. The other core area are calcium channel blockers for chronic pain, developed by Neuromed

Partnered development programs include Prednisporin (FOV1101), which is being developed by Fovea, now owned by Sanofi-Aventis (SNY). Prednisporin is a topical ophthalmic drug combining low doses of prednisolone acetate and cyclosporine A, an immunosuppressant. A second major partnership with Novartis (NVS) is working on cancer drugs. Phase 2 results are imminent from a collaboration agreement with PgxHealth, a subsidiary of Clinical Data, to develop ATL313, an adenosine A2A receptor agonist, as a combination therapy against multiple myeloma and certain other B-cell malignancies.

At the time of the merger, Neuromed had Exalgo, a once-a-day, extended release version of Dilaudid, in the FDA approval process for pain. The company received approval on March 1, 2010, and its U. S. marketing partner Mallinkrodt, owned by Covidien, introduced the drug in April. June quarter inventory stocking resulted in $1.1 million royalties to Zalicus. Covidien expects Exalgo eventually to get $250 million to $300 million of the $6 billion long-acting opioid market.

However, as frequently happens with a new drug that is widely introduced, once the distributors have their initial stock, sales fall off for a quarter or two as the sell-through builds. That is what happened in the September quarter, when Zalicus reported only $0.15 million in Exalgo royalties. It will happen again in the December quarter, when I am expecting only $0.4 million in royalties. Investors who do not understand how stocking and distribution work gave the stock a drubbing, and gave us an amazing opportunity. I expect a steady, rapid increase in quarterly royalties during 2011.

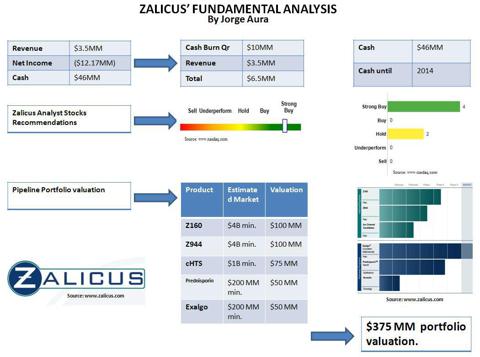

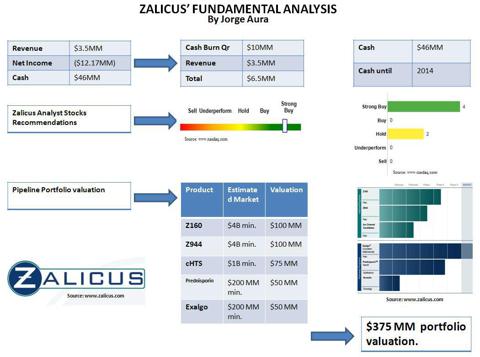

At about $1.32 per share, Zalicus has a total market capitalization of only $117.5 million. But it has $46.8 million in cash, no debt, a $242.7 million net operating loss carryforward, and a drug on the market that will show accelerating royalties in every quarter of 2011. Exalgo alone is worth $1.50 a share.

The company also has numerous press releases coming as its various company and partnered clinical programs progress. Assuming someone doesn’t buy it for its cash, tax loss and pipeline (Covidien (COV)? Novartis?), I think ZLCS will end 2011 between $4 and $7 a share, and be one of the top-performing stocks of the year. You may have to wait for the second half of the year for most of the gains, but this is what some call an oxymoron: A low-risk development-stage biotech.

http://seekingalpha.com/article/244395-5-stocks-for-2011?sou…

Die frühere CombinatoRx (CRXX ) hat nach der Vereinigung mit Neuromed neuen Schwung genommen.

Zalicus (ZLCS) is my pick from New World Investor for this 2011 list. It is a development-stage, yet low-risk, virtually unknown biotech stock. Zalicus was formed by the merger of CombinatoRx (formerly CRXX) and Neuromed, a private company. Most of the current management is from Neuromed, and they have refocused the company on drugs for pain and immuno-inflammatory disease.

But there were many drugs in preclinical and clinical trials at CombinatoRx before the merger, and several of them are showing more potential than Neuromed may have expected when they agreed to the merger. At the least, these drugs provide ongoing partnering opportunities. Some have world-class potential for eventual royalties.

The core development programs include Synavive, developed by CombinatoRx as CRx-102, to treat immuno-inflammatory disorders. It has completed Phase II clinical trials in subjects with knee osteoarthritis. The other core area are calcium channel blockers for chronic pain, developed by Neuromed

Partnered development programs include Prednisporin (FOV1101), which is being developed by Fovea, now owned by Sanofi-Aventis (SNY). Prednisporin is a topical ophthalmic drug combining low doses of prednisolone acetate and cyclosporine A, an immunosuppressant. A second major partnership with Novartis (NVS) is working on cancer drugs. Phase 2 results are imminent from a collaboration agreement with PgxHealth, a subsidiary of Clinical Data, to develop ATL313, an adenosine A2A receptor agonist, as a combination therapy against multiple myeloma and certain other B-cell malignancies.

At the time of the merger, Neuromed had Exalgo, a once-a-day, extended release version of Dilaudid, in the FDA approval process for pain. The company received approval on March 1, 2010, and its U. S. marketing partner Mallinkrodt, owned by Covidien, introduced the drug in April. June quarter inventory stocking resulted in $1.1 million royalties to Zalicus. Covidien expects Exalgo eventually to get $250 million to $300 million of the $6 billion long-acting opioid market.

However, as frequently happens with a new drug that is widely introduced, once the distributors have their initial stock, sales fall off for a quarter or two as the sell-through builds. That is what happened in the September quarter, when Zalicus reported only $0.15 million in Exalgo royalties. It will happen again in the December quarter, when I am expecting only $0.4 million in royalties. Investors who do not understand how stocking and distribution work gave the stock a drubbing, and gave us an amazing opportunity. I expect a steady, rapid increase in quarterly royalties during 2011.

At about $1.32 per share, Zalicus has a total market capitalization of only $117.5 million. But it has $46.8 million in cash, no debt, a $242.7 million net operating loss carryforward, and a drug on the market that will show accelerating royalties in every quarter of 2011. Exalgo alone is worth $1.50 a share.

The company also has numerous press releases coming as its various company and partnered clinical programs progress. Assuming someone doesn’t buy it for its cash, tax loss and pipeline (Covidien (COV)? Novartis?), I think ZLCS will end 2011 between $4 and $7 a share, and be one of the top-performing stocks of the year. You may have to wait for the second half of the year for most of the gains, but this is what some call an oxymoron: A low-risk development-stage biotech.

http://seekingalpha.com/article/244395-5-stocks-for-2011?sou…

Antwort auf Beitrag Nr.: 40.835.248 von HeinzBork am 10.01.11 20:25:11* Contract for development in oncology extended by a year

* Zalicus to start mid-stage study on arthritis drug in Q2 * Zalicus shares rise 11 pct

Jan 10 (Reuters) - Zalicus Inc (ZLCS.O) said its oncology research collaborator, Novartis (NOVN.VX), was extending their contract by a year to May 2012, sending its shares up 11 percent.

The companies had signed an initial two-year agreement in May 2009 to develop novel anti-cancer compounds using Zalicus' proprietary screening technology.

As per the original agreement, Zalicus got a $4 million upfront payment and was eligible to receive up to $58 million in milestones.

Zalicus also said it plans to advance its arthritis drug Synavive into mid-stage trials in the second quarter.

The Cambridge, Massachusetts-based company's shares, which have gained half their value in the past six months, rose 11 percent to $2.39, their highest in nearly 18 months, on Monday on Nasdaq.

http://www.reuters.com/article/idUSSGE7090C020110110?feedTyp…

* Zalicus to start mid-stage study on arthritis drug in Q2 * Zalicus shares rise 11 pct

Jan 10 (Reuters) - Zalicus Inc (ZLCS.O) said its oncology research collaborator, Novartis (NOVN.VX), was extending their contract by a year to May 2012, sending its shares up 11 percent.

The companies had signed an initial two-year agreement in May 2009 to develop novel anti-cancer compounds using Zalicus' proprietary screening technology.

As per the original agreement, Zalicus got a $4 million upfront payment and was eligible to receive up to $58 million in milestones.

Zalicus also said it plans to advance its arthritis drug Synavive into mid-stage trials in the second quarter.

The Cambridge, Massachusetts-based company's shares, which have gained half their value in the past six months, rose 11 percent to $2.39, their highest in nearly 18 months, on Monday on Nasdaq.

http://www.reuters.com/article/idUSSGE7090C020110110?feedTyp…

endlich mal wieder jemand da.

Nach dem fulminanten Kursanstieg ist der Abschlag gestern in USA von 15 % wohl nur eine chartechnische Reaktion. Meldungen habe ich keine gefunden.

Ob das nun auch schon Einkaufkurse sind? Ich befürchte, es geht noch bis unter 1,75 $

Nach dem fulminanten Kursanstieg ist der Abschlag gestern in USA von 15 % wohl nur eine chartechnische Reaktion. Meldungen habe ich keine gefunden.

Ob das nun auch schon Einkaufkurse sind? Ich befürchte, es geht noch bis unter 1,75 $

Antwort auf Beitrag Nr.: 40.844.622 von dottore am 12.01.11 09:08:53jo.

Mir scheint, da hat jemand Kasse gemacht, die Umsätze mit dem Rückgang waren schon erheblich.

Zumindestens hat der Kurs nicht weiter nach gegeben, das stimmt hoffnungsvoll.

Mir scheint, da hat jemand Kasse gemacht, die Umsätze mit dem Rückgang waren schon erheblich.

Zumindestens hat der Kurs nicht weiter nach gegeben, das stimmt hoffnungsvoll.

heute ging der Kurs schon bis 1,82 runter. Unter 1,75, vielleicht auch erst bei 1,60 greif ich noch einmal zu.

Bin auf jeden Fall positiv gestimmt.

Bin auf jeden Fall positiv gestimmt.

http://online.barrons.com/article/SB500014240529702043316045…

Interessant der Kommentar (ist zwar nur eine Privatmeinung, aber wer weiss ..)

..)

Interessant der Kommentar (ist zwar nur eine Privatmeinung, aber wer weiss

..)

..)

hier mal der ganze Artikel

Barron's: The New Doctor in the House: Consolidation

Barron's Cover

| SATURDAY, JANUARY 29, 2011

The New Doctor in the House: Consolidation

By ANDREW BARY | MORE ARTICLES BY AUTHOR

As big drug firms buy up smaller, speciality outfits and their most innovative products, better pipelines and sales-force efficiency will boost profits.

Most major drug makers have enormous cash flows, meager new-medicine pipelines and huge, underutilized sales forces. Lots of small and mid-sized specialty-pharmaceutical and biotech outfits have promising drugs that they find difficult to produce and sell because of strict government manufacturing rules, high marketing costs, and the reluctance of insurers and the government to pay for new and often high-priced treatments.

Could there be a better scenario for more corporate marriages? And for the buyers to pay a nice premium?

Merck & Co. (ticker: MRK) is the most recent casualty of pipeline fatigue: Disappointing trial results for its heralded anticlotting agent, vorapaxar, prompted Wall Street to write off the drug and punish Merck shares.

The big companies are willing to pay up for their smaller brethren because they can use their own sales forces to sell the drugs and slash marketing and overhead at the target company. Pfizer (PFE), may cut about 40% of the overhead at King Pharmaceuticals after its purchase closes in February. Pfizer is paying about 20 times earnings for King, but sees the deal boosting its own profits. Why? The stand-alone profits of a specialty-drug maker understate its earnings potential after it becomes part of a larger company and its costs drop. Ultralow borrowing costs are another plus for buyers.

We've identified 13 promising specialty-drug companies—nearly all of which have at least one product already approved by the Food and Drug Administration—that could prove enticing to the majors.

The 13 each have a stock-market value below $10 billion, making them digestible for buyers. The list includes Alexion Pharmaceuticals (ALXN), Dendreon (DNDN), Human Genome Sciences (HGSI), Cephalon (CEPH) and United Therapeutics (UTHR).

"We foresee the healthy pace of merger activity continuing in 2011, despite the torrid activity of the past five years," wrote Deutsche Bank analyst David Steinberg in a recent research note. He counted 29 deals in 2010 for $75 billion, involving public and private specialty-drug companies. The average premium to the existing stock price paid for public companies last year was about 40%.

"We'll continue to see takeover activity," says Howard Liang, an analyst with Leerink Swann. "Most of these companies have a single drug on the market because it's so hard to develop any product. From an economic perspective, it makes sense to have a sales force sell more than one product."

He sees particular interest among buyers in companies with approved or promising cancer products. In recent years, MGI Pharmaceuticals, OSI Pharmaceuticals and Millennium Pharmaceuticals, all cancer-drug makers, have been snapped up.

Notable specialty-pharma deals last year included Celgene's (CELG) $3.6 billion purchase of Abraxis Bioscience, Astellas Pharmaceuticals' (ALPMF) $3.8 billion deal for OSI, and Pfizer's $3.9 billion purchase of King. Amgen (AMGN) just agreed to pay up to $1 billion for BioVex, a privately held company with a promising cancer product in the final phase of clinical trials.

Some investors take a basket approach to the specialty-pharma group. There are no exchange-traded funds focused on smaller to mid-sized drug companies. The iShares Nasdaq Biotechnology Index Fund (IBB) is dominated by larger companies like Amgen, Teva Pharmaceuticals (TEVA) and Celgene. The $250 million H&Q Life Science Investors Fund (HQL), a closed-end, has some exposure to specialty-drug companies and trades around 11, a 10% discount to its net-asset value.

THE SECTOR IS RISKY for several reasons: Its members' price/earnings ratios generally are high or nonexistent because they're losing money. Takeovers probably will involve only a fraction of sectors. Investor optimism often jumps when a drug gets FDA approval–only to decline if initial sales are disappointing. There also can be controversy about whether an approved drug is particularly effective, or worth its price.

New drugs often target rare conditions and are very expensive, prompting resistance from insurers and other payers. Alexion's Soliris, aimed at a rare blood condition called PNH (paroxysmal nocturnal hemoglobinuria), can cost more than $350,000 a year, making it among the most expensive drugs on the market. Cancer treatments like Dendreon's Provenge can run nearly $100,000 per patient.

Liang says that insurers and the government generally will pay for approved cancer drugs that serve "high unmet needs" in patients with advanced cancer that has spread from the original location, even if treatments extend survival by only months. Large pharmaceutical companies used to be wary of buying companies with super-high-priced drugs because of potentially adverse publicity about gouging the sick. But that reluctance is gone. Sanofi-Aventis (SNY) wants to buy Genzyme (GENZ), whose leading drug, for the rare Gaucher disease, in which a missing enzyme threatens organ function, can cost $500,000 a year.

Another problem: Short sellers can bedevil managements of small-drug producers by trying to publicize or bring to regulatory attention any adverse reactions to new drugs. "With one-product companies, this is a real danger," says a long-time drug investor. "The shorts can destroy these companies. They can't do that to Pfizer, because a single drug doesn't matter much to Pfizer." This can make managements more willing to sell.

Still, it's less dangerous playing smaller outfits with approved drugs than those with treatments still awaiting an okay from an increasingly demanding FDA. That's why investors attracted to the sector probably should own a mix of large and smaller companies. The giants–Pfizer, Merck, Eli Lilly (LLY) Amgen, GlaxoSmithKline (GSK)– are out of favor, and trade cheaply, for an average of just 10 times 2011 profits.

JPMORGAN BIOTECH analysts like companies that haven't partnered with larger drug makers—and thus haven't given away much of the profits of their new products—and those with significant room to boost sales via global distribution or through more effective marketing programs. These include Acorda Therapeutics (ACOR), AMAG Pharmaceuticals (AMAG), Dendreon, Human Genome Sciences and United Therapeutics.

Worldwide annual sales of Dendreon's prostate-cancer drug, Provenge, and Alexion's Soliris could top $1 billion in a few years. Those of Acorda's multiple-sclerosis product, Ampyra, could hit $1 billion.

Analyst Liang says that Provenge amounts to personalized medicine. It's designed to boost a patient's immune system to battle advanced prostate cancer. Immune cells are collected from the blood, treated with Provenge, then put back into the patient. It doesn't have the toxic effects of chemotherapy, but extends the survival of patients by four to 25 months, versus those that get standard treatments. Liang says this "incremental improvement" is the nature of most treatments for advanced cancer.

Dendreon shares, at 35, are down from an May 2010 high of 55–reached around the time the drug was approved. Provenge sales last year were under $50 million, and the Street wonders whether they can ultimately top $1 billion annually. A bullish Liang carries a 55 target for Dendreon, and sees Provenge sales potentially hitting $1.5 billion in 2014.

Acorda also has fallen since its MS drug, Ampyra, was approved last year. It now trades around 23, well below its peak of 40. There's debate about Ampyra's sales potential, with bears pointing to adverse side effects and a potential 2017 patent expiration. JPMorgan analysts are bullish on Ampyra. They have a 48 price target on Acorda, and note that Ampyra sales topped $50 million in the third quarter.

History Lesson

These deals, done at varying multiples of the target's annual revenue, hint at what buyers will now pay for drug outfits.

Alexion has been one of the sector's big winners over the past year, rising 86%, to 85, on hopes for Soliris, whose sales rose 40%, to $384 million, in 2010's first nine months. Soliris has been approved for treatment of PNH, a rare and serious blood disease, and investors are hoping that Alexion gets approval to use the drug for another potentially fatal condition known as aHUS, in which small blood clots form in the body and often destroy kidney function.

The stock is richly priced at 36 times projected 2011 profits, but Liang is still bullish on it, arguing that Alexion has high operating leverage, strong profit growth and acquisition appeal.

Cephalon is a value stock, trading at 61, just seven times projected 2011 earnings. The big concern is the 2012 patent expiration of Provigil, a treatment for narcolepsy, or involuntary sleep during the day, as well as among night-shift workers. Provigil generates $1 billion in annual sales, or a third of its parent's revenue. The bull case on Cephalon is that it will get past the patent problem without a huge hit to profits, and that its valuation anticipates a sharp profit drop.

AMAG IS A VALUE STOCK, too. As of Sept. 30, its cash came to $274 million, or 13 a share. That's just four bucks above the 17 it recently was fetching, down from a peak of 51. The stock has been crushed by disappointing sales of Feraheme, an injectable iron supplement, primarily given to people with chronic kidney disease.

AMAG Pharmaceutical's 2011 sales guidance for Feraheme of $55 million to $60 million was way below the consensus estimate. The company is burning cash because it has a modest revenue base but high expenses. It's expected to lose more than $4 a share in 2011. It aims to broaden the patient population for Feraheme. JPMorgan analyst Geoffrey Meacham is bullish, arguing in a client note that expectations now are very low.

Cadence is a play on Ofirmev, an injectable form of acetaminophen, the active ingredient in Tylenol. It's designed for use by hospitals to supplement or replace morphine for patients in acute pain, often after surgery.

Cadence shares, at around 7, are down 23% in the past year–giving it a stock-market value of just $474 million—as investors wonder about Ofirmev's commercial prospects. The product has advantages over morphine. It isn't addictive, doesn't have narcotics' side-effects and costs only about $10 a dose.

Deutsche Bank's Steinberg is upbeat on Ofirmev, writing in a client note that annual U.S. sales could hit more than $400 million, although it will take time to win over hospitals. He carries a 12 price target, and writes that Cadence could attract a takeover, given the strong interest in companies with pain therapies.

United Therapeutics has two related drugs–Remodulin and Tyvaso—designed to treat pulmonary arterial hypertension, or PAH, a serious condition involving high blood pressure in the pulmonary arteries, which connect the heart to the lungs. Sales and profits of these expensive pharmaceuticals, which can cost more than $100,000 per patient, have risen sharply. The stock, however, is up only a modest 18% in the past year, to 68. Sales of Remodulin and Tyvaso may reach $715 million this year, up from an estimated $575 million in 2010. Profits could hit $3.50 a share, versus 2010's estimated $2.25.

JPMorgan's Meacham carries a 75 price target on United Therapeutics, arguing that it could get a big lift if it can get approval for an oral form of Remodulin—it currently is taken intravenously, via injection or in an inhaled form—because patients prefer pills.

The whole specialty-pharmaceutical area offers plenty of companies like United Therapeutics that boast novel and effective drugs with sharply rising sales. That's just what big drug companies need, and are increasingly willing to buy.

Barron's: The New Doctor in the House: Consolidation

Barron's Cover

| SATURDAY, JANUARY 29, 2011

The New Doctor in the House: Consolidation

By ANDREW BARY | MORE ARTICLES BY AUTHOR

As big drug firms buy up smaller, speciality outfits and their most innovative products, better pipelines and sales-force efficiency will boost profits.

Most major drug makers have enormous cash flows, meager new-medicine pipelines and huge, underutilized sales forces. Lots of small and mid-sized specialty-pharmaceutical and biotech outfits have promising drugs that they find difficult to produce and sell because of strict government manufacturing rules, high marketing costs, and the reluctance of insurers and the government to pay for new and often high-priced treatments.

Could there be a better scenario for more corporate marriages? And for the buyers to pay a nice premium?

Merck & Co. (ticker: MRK) is the most recent casualty of pipeline fatigue: Disappointing trial results for its heralded anticlotting agent, vorapaxar, prompted Wall Street to write off the drug and punish Merck shares.

The big companies are willing to pay up for their smaller brethren because they can use their own sales forces to sell the drugs and slash marketing and overhead at the target company. Pfizer (PFE), may cut about 40% of the overhead at King Pharmaceuticals after its purchase closes in February. Pfizer is paying about 20 times earnings for King, but sees the deal boosting its own profits. Why? The stand-alone profits of a specialty-drug maker understate its earnings potential after it becomes part of a larger company and its costs drop. Ultralow borrowing costs are another plus for buyers.

We've identified 13 promising specialty-drug companies—nearly all of which have at least one product already approved by the Food and Drug Administration—that could prove enticing to the majors.

The 13 each have a stock-market value below $10 billion, making them digestible for buyers. The list includes Alexion Pharmaceuticals (ALXN), Dendreon (DNDN), Human Genome Sciences (HGSI), Cephalon (CEPH) and United Therapeutics (UTHR).

"We foresee the healthy pace of merger activity continuing in 2011, despite the torrid activity of the past five years," wrote Deutsche Bank analyst David Steinberg in a recent research note. He counted 29 deals in 2010 for $75 billion, involving public and private specialty-drug companies. The average premium to the existing stock price paid for public companies last year was about 40%.

"We'll continue to see takeover activity," says Howard Liang, an analyst with Leerink Swann. "Most of these companies have a single drug on the market because it's so hard to develop any product. From an economic perspective, it makes sense to have a sales force sell more than one product."

He sees particular interest among buyers in companies with approved or promising cancer products. In recent years, MGI Pharmaceuticals, OSI Pharmaceuticals and Millennium Pharmaceuticals, all cancer-drug makers, have been snapped up.

Notable specialty-pharma deals last year included Celgene's (CELG) $3.6 billion purchase of Abraxis Bioscience, Astellas Pharmaceuticals' (ALPMF) $3.8 billion deal for OSI, and Pfizer's $3.9 billion purchase of King. Amgen (AMGN) just agreed to pay up to $1 billion for BioVex, a privately held company with a promising cancer product in the final phase of clinical trials.

Some investors take a basket approach to the specialty-pharma group. There are no exchange-traded funds focused on smaller to mid-sized drug companies. The iShares Nasdaq Biotechnology Index Fund (IBB) is dominated by larger companies like Amgen, Teva Pharmaceuticals (TEVA) and Celgene. The $250 million H&Q Life Science Investors Fund (HQL), a closed-end, has some exposure to specialty-drug companies and trades around 11, a 10% discount to its net-asset value.

THE SECTOR IS RISKY for several reasons: Its members' price/earnings ratios generally are high or nonexistent because they're losing money. Takeovers probably will involve only a fraction of sectors. Investor optimism often jumps when a drug gets FDA approval–only to decline if initial sales are disappointing. There also can be controversy about whether an approved drug is particularly effective, or worth its price.

New drugs often target rare conditions and are very expensive, prompting resistance from insurers and other payers. Alexion's Soliris, aimed at a rare blood condition called PNH (paroxysmal nocturnal hemoglobinuria), can cost more than $350,000 a year, making it among the most expensive drugs on the market. Cancer treatments like Dendreon's Provenge can run nearly $100,000 per patient.

Liang says that insurers and the government generally will pay for approved cancer drugs that serve "high unmet needs" in patients with advanced cancer that has spread from the original location, even if treatments extend survival by only months. Large pharmaceutical companies used to be wary of buying companies with super-high-priced drugs because of potentially adverse publicity about gouging the sick. But that reluctance is gone. Sanofi-Aventis (SNY) wants to buy Genzyme (GENZ), whose leading drug, for the rare Gaucher disease, in which a missing enzyme threatens organ function, can cost $500,000 a year.

Another problem: Short sellers can bedevil managements of small-drug producers by trying to publicize or bring to regulatory attention any adverse reactions to new drugs. "With one-product companies, this is a real danger," says a long-time drug investor. "The shorts can destroy these companies. They can't do that to Pfizer, because a single drug doesn't matter much to Pfizer." This can make managements more willing to sell.

Still, it's less dangerous playing smaller outfits with approved drugs than those with treatments still awaiting an okay from an increasingly demanding FDA. That's why investors attracted to the sector probably should own a mix of large and smaller companies. The giants–Pfizer, Merck, Eli Lilly (LLY) Amgen, GlaxoSmithKline (GSK)– are out of favor, and trade cheaply, for an average of just 10 times 2011 profits.

JPMORGAN BIOTECH analysts like companies that haven't partnered with larger drug makers—and thus haven't given away much of the profits of their new products—and those with significant room to boost sales via global distribution or through more effective marketing programs. These include Acorda Therapeutics (ACOR), AMAG Pharmaceuticals (AMAG), Dendreon, Human Genome Sciences and United Therapeutics.

Worldwide annual sales of Dendreon's prostate-cancer drug, Provenge, and Alexion's Soliris could top $1 billion in a few years. Those of Acorda's multiple-sclerosis product, Ampyra, could hit $1 billion.

Analyst Liang says that Provenge amounts to personalized medicine. It's designed to boost a patient's immune system to battle advanced prostate cancer. Immune cells are collected from the blood, treated with Provenge, then put back into the patient. It doesn't have the toxic effects of chemotherapy, but extends the survival of patients by four to 25 months, versus those that get standard treatments. Liang says this "incremental improvement" is the nature of most treatments for advanced cancer.

Dendreon shares, at 35, are down from an May 2010 high of 55–reached around the time the drug was approved. Provenge sales last year were under $50 million, and the Street wonders whether they can ultimately top $1 billion annually. A bullish Liang carries a 55 target for Dendreon, and sees Provenge sales potentially hitting $1.5 billion in 2014.

Acorda also has fallen since its MS drug, Ampyra, was approved last year. It now trades around 23, well below its peak of 40. There's debate about Ampyra's sales potential, with bears pointing to adverse side effects and a potential 2017 patent expiration. JPMorgan analysts are bullish on Ampyra. They have a 48 price target on Acorda, and note that Ampyra sales topped $50 million in the third quarter.

History Lesson

These deals, done at varying multiples of the target's annual revenue, hint at what buyers will now pay for drug outfits.

Alexion has been one of the sector's big winners over the past year, rising 86%, to 85, on hopes for Soliris, whose sales rose 40%, to $384 million, in 2010's first nine months. Soliris has been approved for treatment of PNH, a rare and serious blood disease, and investors are hoping that Alexion gets approval to use the drug for another potentially fatal condition known as aHUS, in which small blood clots form in the body and often destroy kidney function.

The stock is richly priced at 36 times projected 2011 profits, but Liang is still bullish on it, arguing that Alexion has high operating leverage, strong profit growth and acquisition appeal.

Cephalon is a value stock, trading at 61, just seven times projected 2011 earnings. The big concern is the 2012 patent expiration of Provigil, a treatment for narcolepsy, or involuntary sleep during the day, as well as among night-shift workers. Provigil generates $1 billion in annual sales, or a third of its parent's revenue. The bull case on Cephalon is that it will get past the patent problem without a huge hit to profits, and that its valuation anticipates a sharp profit drop.

AMAG IS A VALUE STOCK, too. As of Sept. 30, its cash came to $274 million, or 13 a share. That's just four bucks above the 17 it recently was fetching, down from a peak of 51. The stock has been crushed by disappointing sales of Feraheme, an injectable iron supplement, primarily given to people with chronic kidney disease.

AMAG Pharmaceutical's 2011 sales guidance for Feraheme of $55 million to $60 million was way below the consensus estimate. The company is burning cash because it has a modest revenue base but high expenses. It's expected to lose more than $4 a share in 2011. It aims to broaden the patient population for Feraheme. JPMorgan analyst Geoffrey Meacham is bullish, arguing in a client note that expectations now are very low.

Cadence is a play on Ofirmev, an injectable form of acetaminophen, the active ingredient in Tylenol. It's designed for use by hospitals to supplement or replace morphine for patients in acute pain, often after surgery.

Cadence shares, at around 7, are down 23% in the past year–giving it a stock-market value of just $474 million—as investors wonder about Ofirmev's commercial prospects. The product has advantages over morphine. It isn't addictive, doesn't have narcotics' side-effects and costs only about $10 a dose.

Deutsche Bank's Steinberg is upbeat on Ofirmev, writing in a client note that annual U.S. sales could hit more than $400 million, although it will take time to win over hospitals. He carries a 12 price target, and writes that Cadence could attract a takeover, given the strong interest in companies with pain therapies.

United Therapeutics has two related drugs–Remodulin and Tyvaso—designed to treat pulmonary arterial hypertension, or PAH, a serious condition involving high blood pressure in the pulmonary arteries, which connect the heart to the lungs. Sales and profits of these expensive pharmaceuticals, which can cost more than $100,000 per patient, have risen sharply. The stock, however, is up only a modest 18% in the past year, to 68. Sales of Remodulin and Tyvaso may reach $715 million this year, up from an estimated $575 million in 2010. Profits could hit $3.50 a share, versus 2010's estimated $2.25.

JPMorgan's Meacham carries a 75 price target on United Therapeutics, arguing that it could get a big lift if it can get approval for an oral form of Remodulin—it currently is taken intravenously, via injection or in an inhaled form—because patients prefer pills.

The whole specialty-pharmaceutical area offers plenty of companies like United Therapeutics that boast novel and effective drugs with sharply rising sales. That's just what big drug companies need, and are increasingly willing to buy.

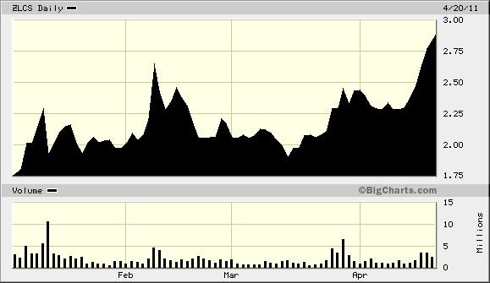

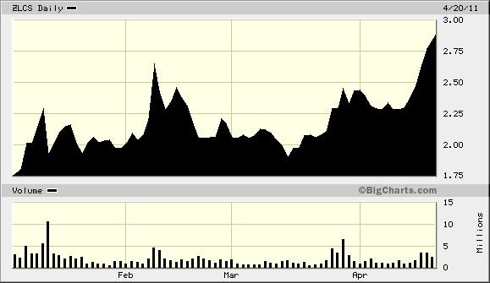

guter tag heute!

erneuter ausbruch, volumen kommt anscheinend wieder, ohne news...

interesse scheint also nach wie vor vorhanden zu sein.

bin gespannt wie weit es diesmal läuft!

ps: danke heinz, freut mich, dass es wieder nen thread gibt!

lg

http://www.nasdaq.com/aspx/chartingbasics.aspx?intraday=off&…

erneuter ausbruch, volumen kommt anscheinend wieder, ohne news...

interesse scheint also nach wie vor vorhanden zu sein.

bin gespannt wie weit es diesmal läuft!

ps: danke heinz, freut mich, dass es wieder nen thread gibt!

lg

http://www.nasdaq.com/aspx/chartingbasics.aspx?intraday=off&…

Wird erneut an Höhe gewinnen.

Erfolgversprechendes Programm und breite Unterstützung durch Big pharma Novartis, die ZLCS einmal übernehmen wird.

Erfolgversprechendes Programm und breite Unterstützung durch Big pharma Novartis, die ZLCS einmal übernehmen wird.

Lesen und staunen...(Heute 1.59€, in 18 Monate auf 10 glatt) http://img.wallstreet-online.de/smilies/eek.gif

Zalicus Climbs on New Price Target, Market Waking Up to Company's Value?

Early Friday morning, JMP Securities issued a "Market Outperform" rating for Zalicus Inc. (ZLCS) and a "target" of $5 per share. Shares jumped 5%-6% on the JMP Securities news following the earlier week's news that Sanofi-Aventis (SNY) featured Zalicus's lead ophthalmology product candidate Prednisporin (FOV1101).

This is a very significant announcement given Zacks' last year target was issued at $3 per share by keen analyst Jason Napodano. In November 2010, Mr. Napodano stated: "Adding in the existing cash on hand totaling $48.6 million as of September 30, 2010, and our sum of parts / NPV analysis for Zalicus yields a total firm value of roughly $260 million, or $3 per share. At the current value of only $105 million we believe the company is far under-valued." It was also observed that in the same quarter of 2010, Jeremy Richards, Manager/Director of Private Wealth Fund, stated: "I believe investors buying the stock under $2 is an exceptional bargain." For those who follow Zalicus, between Q4 2010 and Q1 2011, there was a noticeable jump in daily volume from approximately 500-700,000 traded to 1,879,820 average volume (3M) as of Friday.

It is well-known that Zalicus has been raising an additional $20 million (versus common shares) via Wedbush. The company reported $46 million as of December 2010. On the company's conference call (9 March 2011), Zalicus's CFO Justin Renz reported that the company was over half-way to its goal. I have been told by those close to the firm that the company is aiming to complete all fund raising by the end of this month. If you add together Exalgo's growing royalty figures ($400,000 in Q4 2010) - my projection is $800,000 in Q1 2011, plus the $3,000,000 that Novartis paid to extend its cHTS contract, plus general cHTS contracts (estimate $1,000,000), plus the $20,000,000 fund-raising via Wedbush, Zalicus is going to report a very healthy financial upside (60-70 million dollars) going forward.

Shares traded on the day to a high close of $2.29 per share. Significantly, the company's market cap has exceeded $200 million, and JMP Securities’ new target of $5 per share puts the company in the $450-$500 million corporate value range. However, in my own analysis of Zalicus’ corporate assets, I arrive at a much higher estimate: $1.2 billion, or $13 per share. I base this on two keys points: (1) The internal assets for Zalicus' proprietary cHTS (Cambridge MA location) and electrophysiology screening platform (Vancouver B.C. location) are worth at least $500 million if you study their asset class within other pharmaceutical firms (due diligence I have done). Remember, cHTS is a revenue-generating technology, and (2) the pipeline assets for Zalicus are just beginning to be understood by market analysts. For example, only one ion channel drug candidate (NMED-160) was already worth $450 million to Merck (MRK) just a few years ago. Today, Zalicus has rolled out three ion channel programs with a virtual "army" (a word CEO Corrigan used) of drug candidates in each ion channel program. Furthermore, Zalicus has the Prednisporin license with Sanofi-Aventis, the Exalgo license with Covidien (COV), and Synavive is wholly owned by the company.

Zalicus Climbs on New Price Target, Market Waking Up to Company's Value?

Early Friday morning, JMP Securities issued a "Market Outperform" rating for Zalicus Inc. (ZLCS) and a "target" of $5 per share. Shares jumped 5%-6% on the JMP Securities news following the earlier week's news that Sanofi-Aventis (SNY) featured Zalicus's lead ophthalmology product candidate Prednisporin (FOV1101).

This is a very significant announcement given Zacks' last year target was issued at $3 per share by keen analyst Jason Napodano. In November 2010, Mr. Napodano stated: "Adding in the existing cash on hand totaling $48.6 million as of September 30, 2010, and our sum of parts / NPV analysis for Zalicus yields a total firm value of roughly $260 million, or $3 per share. At the current value of only $105 million we believe the company is far under-valued." It was also observed that in the same quarter of 2010, Jeremy Richards, Manager/Director of Private Wealth Fund, stated: "I believe investors buying the stock under $2 is an exceptional bargain." For those who follow Zalicus, between Q4 2010 and Q1 2011, there was a noticeable jump in daily volume from approximately 500-700,000 traded to 1,879,820 average volume (3M) as of Friday.

It is well-known that Zalicus has been raising an additional $20 million (versus common shares) via Wedbush. The company reported $46 million as of December 2010. On the company's conference call (9 March 2011), Zalicus's CFO Justin Renz reported that the company was over half-way to its goal. I have been told by those close to the firm that the company is aiming to complete all fund raising by the end of this month. If you add together Exalgo's growing royalty figures ($400,000 in Q4 2010) - my projection is $800,000 in Q1 2011, plus the $3,000,000 that Novartis paid to extend its cHTS contract, plus general cHTS contracts (estimate $1,000,000), plus the $20,000,000 fund-raising via Wedbush, Zalicus is going to report a very healthy financial upside (60-70 million dollars) going forward.

Shares traded on the day to a high close of $2.29 per share. Significantly, the company's market cap has exceeded $200 million, and JMP Securities’ new target of $5 per share puts the company in the $450-$500 million corporate value range. However, in my own analysis of Zalicus’ corporate assets, I arrive at a much higher estimate: $1.2 billion, or $13 per share. I base this on two keys points: (1) The internal assets for Zalicus' proprietary cHTS (Cambridge MA location) and electrophysiology screening platform (Vancouver B.C. location) are worth at least $500 million if you study their asset class within other pharmaceutical firms (due diligence I have done). Remember, cHTS is a revenue-generating technology, and (2) the pipeline assets for Zalicus are just beginning to be understood by market analysts. For example, only one ion channel drug candidate (NMED-160) was already worth $450 million to Merck (MRK) just a few years ago. Today, Zalicus has rolled out three ion channel programs with a virtual "army" (a word CEO Corrigan used) of drug candidates in each ion channel program. Furthermore, Zalicus has the Prednisporin license with Sanofi-Aventis, the Exalgo license with Covidien (COV), and Synavive is wholly owned by the company.

Antwort auf Beitrag Nr.: 41.283.740 von Growth2012 am 29.03.11 16:48:18auch sehr gut rechechiert und lesenswert

"Zalicus: Expanding Drug Pipeline Helps Make It a Strong Buy "

http://seekingalpha.com/article/258498-zalicus-expanding-dru…

Beste Smallcap Biotech 2011-2012?

"Zalicus: Expanding Drug Pipeline Helps Make It a Strong Buy "

http://seekingalpha.com/article/258498-zalicus-expanding-dru…

Beste Smallcap Biotech 2011-2012?

Antwort auf Beitrag Nr.: 41.283.866 von Growth2012 am 29.03.11 17:04:38Es wird immer besser

Zalicus Granted Composition-of-Matter Patent for Synavive

http://finance.yahoo.com/news/Zalicus-Granted-bw-2901826003.…

"These two key patents provide the foundation of a solid and enforceable intellectual property estate for Synavive, with issued claims through 2025, and pending applications around our proprietary formulations providing coverage into 2028” commented Mark H.N. Corrigan, MD, President and CEO of Zalicus.

Der Zug rollt nun so gaaaannnzzz langsam aus dem Bahnhof raus, errinert mich sehr an einem frühen DNDN

Zalicus Granted Composition-of-Matter Patent for Synavive

http://finance.yahoo.com/news/Zalicus-Granted-bw-2901826003.…

"These two key patents provide the foundation of a solid and enforceable intellectual property estate for Synavive, with issued claims through 2025, and pending applications around our proprietary formulations providing coverage into 2028” commented Mark H.N. Corrigan, MD, President and CEO of Zalicus.

Der Zug rollt nun so gaaaannnzzz langsam aus dem Bahnhof raus, errinert mich sehr an einem frühen DNDN

Antwort auf Beitrag Nr.: 41.288.780 von Growth2012 am 30.03.11 12:49:16Ein relativ bekannte "Pusherbrief" hat folgendes zu Zalicus geschrieben vor kürzem...

Ein Biotech-Unternehmen ist für uns einer der Gewinner für das Jahr 2011.

Hervorgegangen aus der Verschmelzung von CombuinatoRx, ehemals CRXX, und der Privatfirma Neuromed, hat man sich auf die Forschung von Schmerzmitteln und Medikamenten gegen Autoimmunerkrankungen spezialisiert.

Lesen Sie den Newsletter ganz bis zum Ende, dort haben wir noch eine wichtige Nachricht für Sie!

Bereits vor dem Firmenzusammenschluss gab es eine Reihe von Wirkstoffen, die sich schon in der Phase II oder III befanden. Daneben hat man sich zur Aufgabe gemacht, an Wirkstoffen speziell für Entzündungen der Kniegelenke zu arbeiten, die sogar bis in den Bereich von Knorpelersatzlösungen hineinreichen.

Aufgrund der immer älter werdenden Bevölkerung ist das ein sehr zukunftsträchtiger Geschäftszweig.

Mit dem Pharma-Riesen Sanofi-Aventis ist man diverse Forschungspartnerschaften eingegangen, aus denen zum Beispiel der Wirkstoff Prednisporin hervorgegangen ist. Ein Medikament, welches vornehmlich bei schweren Bindegewebsverletzungen des Auges seine Anwendung findet.

Dieser Wirkstoff bringt Blockbuster-Charakter mit sich.

Eine weitere wichtige Kooperation ist man mit Novartis eingegangen, in der man gemeinsam an Wirkstoffen gegen Krebserkrankungen forscht. Zusätzlich hat man vier andere völlig unterschiedliche Wirkstoffe in der Pipeline, die schon bald anstehen.

Im März letzten Jahres hat man mit Mallinkrodt, das vollständig Covidien gehört, ein erfahrenes Marketing-Unternehmen für sich gewinnen können. Unser Hauptaugenmerk liegt jedoch speziell auf den Wirkstoff Exalgo gerichtet, der bereits während langfristigen Schmerztherapien bei Krebspatienten seine praktische Anwendung findet.

Wenn Sie nun berücksichtigen, dass alleine Exalgo einen Gewinn von rund 1,50 US-Dollar je Aktie ausmacht, wird schnell klar, welches Kurspotenzial in der Aktie unseres Biotech-Favoriten schlummert.

Gänzlich schuldenfrei und Quartal für Quartal mit immer wiederkehrendem Umsatz und Gewinn alleine aus diesem einen Wirkstoff, sehen wir für den Favoriten noch in diesem Jahr Potenzial bis in den Bereich bis zu 7 US-Dollar.

Sie erwartet also, bei einem aktuellen Kurs knapp oberhalb von 2 US-Dollar, ein Kursanstieg von 100 bis 250%.

Übrigens dieses wurde gepostet ohne jegliche weitere Wertung meinerseits

Ein Biotech-Unternehmen ist für uns einer der Gewinner für das Jahr 2011.

Hervorgegangen aus der Verschmelzung von CombuinatoRx, ehemals CRXX, und der Privatfirma Neuromed, hat man sich auf die Forschung von Schmerzmitteln und Medikamenten gegen Autoimmunerkrankungen spezialisiert.

Lesen Sie den Newsletter ganz bis zum Ende, dort haben wir noch eine wichtige Nachricht für Sie!

Bereits vor dem Firmenzusammenschluss gab es eine Reihe von Wirkstoffen, die sich schon in der Phase II oder III befanden. Daneben hat man sich zur Aufgabe gemacht, an Wirkstoffen speziell für Entzündungen der Kniegelenke zu arbeiten, die sogar bis in den Bereich von Knorpelersatzlösungen hineinreichen.

Aufgrund der immer älter werdenden Bevölkerung ist das ein sehr zukunftsträchtiger Geschäftszweig.

Mit dem Pharma-Riesen Sanofi-Aventis ist man diverse Forschungspartnerschaften eingegangen, aus denen zum Beispiel der Wirkstoff Prednisporin hervorgegangen ist. Ein Medikament, welches vornehmlich bei schweren Bindegewebsverletzungen des Auges seine Anwendung findet.

Dieser Wirkstoff bringt Blockbuster-Charakter mit sich.

Eine weitere wichtige Kooperation ist man mit Novartis eingegangen, in der man gemeinsam an Wirkstoffen gegen Krebserkrankungen forscht. Zusätzlich hat man vier andere völlig unterschiedliche Wirkstoffe in der Pipeline, die schon bald anstehen.

Im März letzten Jahres hat man mit Mallinkrodt, das vollständig Covidien gehört, ein erfahrenes Marketing-Unternehmen für sich gewinnen können. Unser Hauptaugenmerk liegt jedoch speziell auf den Wirkstoff Exalgo gerichtet, der bereits während langfristigen Schmerztherapien bei Krebspatienten seine praktische Anwendung findet.

Wenn Sie nun berücksichtigen, dass alleine Exalgo einen Gewinn von rund 1,50 US-Dollar je Aktie ausmacht, wird schnell klar, welches Kurspotenzial in der Aktie unseres Biotech-Favoriten schlummert.

Gänzlich schuldenfrei und Quartal für Quartal mit immer wiederkehrendem Umsatz und Gewinn alleine aus diesem einen Wirkstoff, sehen wir für den Favoriten noch in diesem Jahr Potenzial bis in den Bereich bis zu 7 US-Dollar.

Sie erwartet also, bei einem aktuellen Kurs knapp oberhalb von 2 US-Dollar, ein Kursanstieg von 100 bis 250%.

Übrigens dieses wurde gepostet ohne jegliche weitere Wertung meinerseits

Antwort auf Beitrag Nr.: 41.310.048 von Growth2012 am 03.04.11 15:41:24Michael Murphy spricht für ZLCS (Sein Wort trägt 'Gewicht' Stateside)

#1 Best Stock – Zalicus

Biotech small cap Zalicus (NASDAQ: ZLCS) is our runaway winner, with a whopping 54% return year-to-date. Michael Murphy, an independent technology investment adviser and InvestorPlace.com contributor, initially described this stock as a “low-risk, development-phase biotech,” and the profits have been astounding. The only question is whether the pick can keep this momentum up. According to Murphy, the answer is yes. Read why he thinks Zalicus stock is a buy in his most recent update.

Naja, mal sehen sagt der Blinde

#1 Best Stock – Zalicus

Biotech small cap Zalicus (NASDAQ: ZLCS) is our runaway winner, with a whopping 54% return year-to-date. Michael Murphy, an independent technology investment adviser and InvestorPlace.com contributor, initially described this stock as a “low-risk, development-phase biotech,” and the profits have been astounding. The only question is whether the pick can keep this momentum up. According to Murphy, the answer is yes. Read why he thinks Zalicus stock is a buy in his most recent update.

Naja, mal sehen sagt der Blinde

Antwort auf Beitrag Nr.: 41.314.370 von Growth2012 am 04.04.11 15:22:44>>>Michael Murphy said Synavive was patent protect "until 2028" and Dr. Corrigan is on record stating that Synavive could potentially bring in $300 to $400 million per year once marketed. The indication and market sector bear this estimate out.<<<

Dedicated to pain and immuno-inflammatory drug development, Zalicus' new drugs are identified as Z160, Z212, and Z944. In the world of pain research, Zalicus is arguably among the leaders in what is called ion channel research. In simple terms, Zalicus is seeking to develop oral medications that target pain signaling in the human body. If successful, Zalicus's "Z" drugs would compete in a 20-30 billion dollar market, and particularly, against lucrative opioid drugs that are known to have serious side effects, including addiction.

20-30 billion dollar market, and particularly, against lucrative opioid drugs that are known to have serious side effects, including addiction.

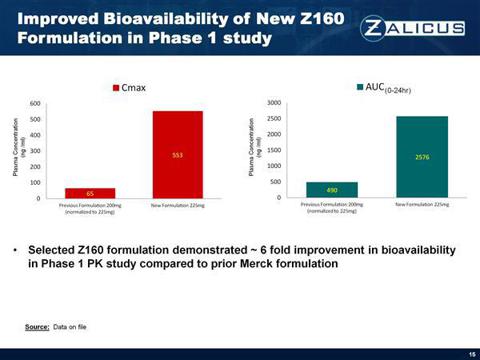

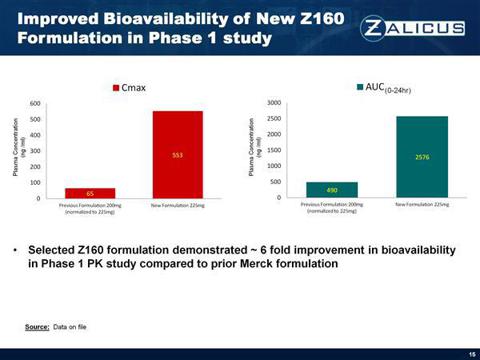

I. Z160

Z160 is identified by Zalicus CEO Mark H. N. Corrigan as a reformulated version of prior failed version NMED-160. Without getting lost in the science, NMED-160 reached phase II clinical studies which led to a highly publicized collaboration with Merck (MRK) in 2006 for approximately 475 million dollars (milestones inclusive). But NMED-160 hit a show-stopper in clinical development because its bioavailability (i.e. the percentage of how much of the drug gets into the body's circulation system) failed to achieve an acceptable target. As a result, in 2009, Merck cancelled its collaboration with then Neuromed Pharmaceuticals (today Zalicus Pharmaceuticals Canada, a subsidiary of Zalicus Inc. USA). However, according to the company's CEO, the bioavailability problem appears resolved, so Z160 is being targeted to start phase I clinical studies assuming it passes all toxicology studies.

II. Z212

Recently, Zalicus announced Z212, including the publication of scholarly research. The Z212 introduction came as a surprise because it is known as a sodium channel modulator while up until recently on the Zalicus website, it was thought that Zalicus was primarily focused on calcium channel modulators. The intrigue here is that Z212 is compared with an already marketed drug called gabapentin. In early preclinical research, the data suggests that Z212 may have similar pain-reducing characteristics as gabapentin. Shareholders also learned from the report that Zalicus scientists have discovered a way to modify their drug compounds to avoid unacceptable cardiac side affects (hERG). Z212 data appears to avoid this challenge that has long plagued ion channel research.

III. Z944

This brings us to Z944, which is known as a calcium T-type ion channel modulator/blocker. According to Zalicus, Z944 should be the first drug candidate entering phase I clinical studies. The value to investors is that Z944 is representative of the company's advance in pain research. In fact, Zalicus claims to have at least 50 other drug candidates in the discovery - preclinical pipeline.

....

Dedicated to pain and immuno-inflammatory drug development, Zalicus' new drugs are identified as Z160, Z212, and Z944. In the world of pain research, Zalicus is arguably among the leaders in what is called ion channel research. In simple terms, Zalicus is seeking to develop oral medications that target pain signaling in the human body. If successful, Zalicus's "Z" drugs would compete in a

20-30 billion dollar market, and particularly, against lucrative opioid drugs that are known to have serious side effects, including addiction.

20-30 billion dollar market, and particularly, against lucrative opioid drugs that are known to have serious side effects, including addiction.I. Z160

Z160 is identified by Zalicus CEO Mark H. N. Corrigan as a reformulated version of prior failed version NMED-160. Without getting lost in the science, NMED-160 reached phase II clinical studies which led to a highly publicized collaboration with Merck (MRK) in 2006 for approximately 475 million dollars (milestones inclusive). But NMED-160 hit a show-stopper in clinical development because its bioavailability (i.e. the percentage of how much of the drug gets into the body's circulation system) failed to achieve an acceptable target. As a result, in 2009, Merck cancelled its collaboration with then Neuromed Pharmaceuticals (today Zalicus Pharmaceuticals Canada, a subsidiary of Zalicus Inc. USA). However, according to the company's CEO, the bioavailability problem appears resolved, so Z160 is being targeted to start phase I clinical studies assuming it passes all toxicology studies.

II. Z212

Recently, Zalicus announced Z212, including the publication of scholarly research. The Z212 introduction came as a surprise because it is known as a sodium channel modulator while up until recently on the Zalicus website, it was thought that Zalicus was primarily focused on calcium channel modulators. The intrigue here is that Z212 is compared with an already marketed drug called gabapentin. In early preclinical research, the data suggests that Z212 may have similar pain-reducing characteristics as gabapentin. Shareholders also learned from the report that Zalicus scientists have discovered a way to modify their drug compounds to avoid unacceptable cardiac side affects (hERG). Z212 data appears to avoid this challenge that has long plagued ion channel research.

III. Z944

This brings us to Z944, which is known as a calcium T-type ion channel modulator/blocker. According to Zalicus, Z944 should be the first drug candidate entering phase I clinical studies. The value to investors is that Z944 is representative of the company's advance in pain research. In fact, Zalicus claims to have at least 50 other drug candidates in the discovery - preclinical pipeline.

....

Antwort auf Beitrag Nr.: 41.345.210 von Growth2012 am 10.04.11 10:12:34Lesenswert von seeking Alpha Stateside...

Major Events for Zalicus Loom Large in Q2

Zalicus in Q1

In Q1 2011, Zalicus (ZLCS) announced a number of remarkable achievements:

* It rolled out its three-prong ion channel program(s) including: a substantial scientific report on sodium channel 1.7 Z212 (click here), a surprise re-introduction of calcium N-type channel revised NMED-160, now Z160, and its lead advancement for IND filing, a calcium T-type channel designated as Z944 (click here).

* The firm also achieved a key patent (United States Patent 7915265) for Synavive (click here).

* JMP Securities announced coverage of Zalicus on 25 March 2011, setting a target of $5/share compared to Zack's studied analyst Jason Napodano's target of $3/share published in 2010.

Now looking deeply into Q2 2011, the following information should be of interest to Zalicus investors.

Q2 Scheduled Events

21 April 2011: Covidien (COV) reports. Zalicus investors will listen for hints of Exalgo sales in Q1. Most likely, Covidien will not release actual figures, but the firm could comment in general terms on the performance of Exalgo sales.

2-9 May 2011: My understanding is Zalicus will report within this date specific window its Q1 results. Investors will be specifically looking for:

* Exalgo royalty figure - Investors are eager to know . has Exalgo gained exponential sales traction? I expect no less than a 100% gain ($800K) over Q4 2010, which Michael Murphy correctly called at $400K.

* Collaboration news - This is a huge issue within the investor community. In Q1, no names were given, but it was clearly indicated by Zalicus CEO Mark Corrigan that progress of some nature has been/is being made. This includes potential ion channel program partnerships and revenue-generating cHTS collaborations - both were mentioned.

* Amgen (AMGN) - Amgen moved into a second phase of its initial pilot program that was set to end in September 2010. So the question is: Has Zalicus signed Amgen to a longer term collaboration?

* Expect Zalicus to report $3M for the Novartis (NVS) contract extension - Expect Zalicus to report $60-70M in cash reserves following the completion of raising $20M facilitated by Wedbush Securities, adding 8,884,800 common shares (click here). Expect Zalicus to report revenue generated from other cHTS contracts (wild card estimate: $1M). And don't forget to add in Exalgo royalties.

24 May 2011: Annual stockholders' meeting.

8-9 June 2011: World Pharma Congress - Dr. Glenn Short is scheduled to present "Using Combination Ultra High-Throughput Screening (cuHTS) to Address Efficacious Drug Combinations to Responsive Tumor Genotypes." This is the first time for Zalicus, I have read "cuHTS" versus "cHTS" in print. Has Zalicus expanded its high-through-put technology? Additionally, Zalicus Chief Scientific Officer Dr. Terrance Snutch is scheduled to present "Design and Pre-Clinical Development of Novel T-Type and N-Type Calcium Channel Blockers for Pain Intervention." Will Dr. Snutch add sodium channels to that discussion?

Imminent Events

Zalicus investors continue to sit tight for:

* Synavive 2B Clinical Trial Launch - As reported by Zalicus, the firm recently received a "Composition-of-Matter" patent for Synavive (click here) and is scheduled to start the SYNERGY trial in Q2 for rheumatoid arthritis. This is one time I hope CEO Corrigan honors his own timeline. I - like other investors - am growing tired of waiting.

* News on Prednisporin - Since 10 November 2010, per the ClinicalTrials.gov website, the phase 2B has been listed as "completed." Meanwhile, Sanofi-Aventis (SNY) which bought Fovea (which originally licensed Prednisporin) from CombinatoRx (now Zalicus Inc.) announced in Q1 the launch of an ophthalmology division with FOV1101 (i.e. Prednisporin) among those drug candidates assets. In addition, Genzyme (Sanofi's recent acquisition) is known to have an ophthalmology focus (click here). Furthermore, Sanofi announced a "privileged partnership" with The Vision Institute in Paris, France, for ophthalmology, announced on 23 March 2011 (click here). While all of this implies good news, it does have investors sitting on pins and needles. However, it would appear that Sanofi is getting close to making some type of announcement. I have read all of the details of Sanofi's upcoming conferences (including those in French), and Prednisporin is not mentioned; another researcher I trust has stated the same thing.

Imminent and Potentially Lucrative: Ion Channel Programs

* Three-Prongs: In bite-size chunks, CEO Corrigan not only rolled out the lead soldiers of his acclaimed "ion channel army" (terminology he and Dr. Snutch coined) of at least 50 composition candidates, Corrigan made a very defined statement. This is not just an ion channel program (i.e. singular); these are ion channel programs (i.e. plural). Terminology like this should not be lost on investors. Why? Because Zalicus has three separate programs that they can partner (if they choose) separately. Corrigan even hinted that one of those programs, even at its early stage, may already have collaborative interest. Keep in mind, one indication from each program could be worth $500M, so multiply that by 3 ... that's a whopping $1.5B.

* Z160 (Former NMED-160): Like Synavive, which was reformulated into a once/day time-released tablet, I know many investors who have been here since pre-merger days of CombinatoRx and Neuromed were taken aback by the announcement that Z160 was back in the game. After all, Merck (MRK) was ready to put down $450M for NMED-160, so when Corrigan stated that they had resolved the bio-availability problem (i.e. drug absorption) at the molecular level, I sat up and quite frankly cheered. An oral N-type calcium channel pain blocker, you have to think that Zalicus is counting on Z160 to score. The question is, Has Merck come back? Or is someone like Novartis or Amgen, or for that matter Sunovion (Dainippon Sumitomo Pharmaceuticals), looking to step in. All I know is NMED-160 made it deep into phase 2 studies before the bio-availability became insurmountable - but now that problem is resolved.

* Scientific Report and Corporate Presentations: Zalicus is submitting that its ion channel candidates are competitive: Z212 versus Gabapentin (Fanatrex, Gabarone, Gralise, Neurontin) and Z944 versus Naproxen for pain, and Z212 versus Lacosamide or Vimpat (an epilepsy drug). Regarding Lacosamide and Z212 we read: "When tested in the spinal cord slice preparation, lacosamide inhibited lamina I/II neuron AP firing approximately 300 times less potently (IC50 = 150 lM) than Z123212 (Fig. 7C)" (Hildebrand ME et al. A novel slow-inaction-specific ion channel modulator attenuates neuropathic pain. PAIN - 2011 - doi: 10.1016/j.pain.2010.12.035). You don't have to be a scientist to understand what this means: at lower dosages, Z212 was 300 times more potent than Lacosamide. That should make big pharmas interested in epilepsy research to sit up and take notice.

* The Range of Ion Channel Applications: While Zalicus claims to be targeting pain and inflammation, a year ago a report came out that ion channel NP078585 (supplied by Neuromed) may be used to treat alcoholism (also click here). This highlights the diverse business opportunities Zalicus is going to have as it moves forward with its three-prong ion channel programs. As an example, Z212 could be developed as private Canadian firm Xenon Pharmaceuticals is pursuing as a topical cream (XEN402) (click here) for post herpetic neuralgia (PHN) or shingles. Or Z212, if it proved to block one's smell sensory, could be developed into a nasal spray for applicable situations in industry or hospital settings or possibly as an appetite suppressant. These examples may seem extreme, but the ion channel world has a literal myriad of potential applications. Is it possible that Zalicus could decide to sell individual licenses for specific medical indications? If so, it would prove to be extremely lucrative.

* The Competition: Bottom line, Zalicus is deep into the game and is definitely a leader in the pack. Months ago I wrote an unpublished article that detailed Zalicus's key competition. I reference it here. The purpose of that report uncovered that Zalicus is definitely among the world leaders of ion channel research. Keep in mind that is among a pack of Glaxo-Smith-Kline (GSK), Vertex (VRTX), Merck, Hydra BioSciences, Pfizer (PFE), Xention, Grunenthal, Scottish Biomedical, Aurora Biomed, Convergence Pharmaceuticals, Chromocell, Selcia, and ICAGen (ICGN). At that time, I particularly noted the work of Convergence. To that report, I now add Afferent Pharmaceuticals, a private firm in Canada brought to my attention by another investor. I will continue to scan for competition. In any case, Zalicus remains a front-runner.

Conclusion

In a previous article, I made the rationalized claim that I thought Zalicus was worth $13/share. In my opinion, the CEO gets high marks for executing on his originally stated strategic plan in March 2010. My valuation-analysis has not changed; if anything, it has been strengthened. Keep in mind, this present article doesn't even begin to touch on the future of cHTS or cuHTS at Zalicus or its present/future collaborations. We are yet to explore the dissociative steroid market and the low-steroid chemistry platform behind Synavive. What I conclude is that Zalicus is definitely well-funded and major Zalicus events loom large in Q2.

I maintain Zalicus is a Strong Buy.

http://seekingalpha.com/article/263309-major-events-for-zali…

Major Events for Zalicus Loom Large in Q2

Zalicus in Q1

In Q1 2011, Zalicus (ZLCS) announced a number of remarkable achievements:

* It rolled out its three-prong ion channel program(s) including: a substantial scientific report on sodium channel 1.7 Z212 (click here), a surprise re-introduction of calcium N-type channel revised NMED-160, now Z160, and its lead advancement for IND filing, a calcium T-type channel designated as Z944 (click here).

* The firm also achieved a key patent (United States Patent 7915265) for Synavive (click here).

* JMP Securities announced coverage of Zalicus on 25 March 2011, setting a target of $5/share compared to Zack's studied analyst Jason Napodano's target of $3/share published in 2010.

Now looking deeply into Q2 2011, the following information should be of interest to Zalicus investors.

Q2 Scheduled Events

21 April 2011: Covidien (COV) reports. Zalicus investors will listen for hints of Exalgo sales in Q1. Most likely, Covidien will not release actual figures, but the firm could comment in general terms on the performance of Exalgo sales.

2-9 May 2011: My understanding is Zalicus will report within this date specific window its Q1 results. Investors will be specifically looking for:

* Exalgo royalty figure - Investors are eager to know . has Exalgo gained exponential sales traction? I expect no less than a 100% gain ($800K) over Q4 2010, which Michael Murphy correctly called at $400K.

* Collaboration news - This is a huge issue within the investor community. In Q1, no names were given, but it was clearly indicated by Zalicus CEO Mark Corrigan that progress of some nature has been/is being made. This includes potential ion channel program partnerships and revenue-generating cHTS collaborations - both were mentioned.

* Amgen (AMGN) - Amgen moved into a second phase of its initial pilot program that was set to end in September 2010. So the question is: Has Zalicus signed Amgen to a longer term collaboration?

* Expect Zalicus to report $3M for the Novartis (NVS) contract extension - Expect Zalicus to report $60-70M in cash reserves following the completion of raising $20M facilitated by Wedbush Securities, adding 8,884,800 common shares (click here). Expect Zalicus to report revenue generated from other cHTS contracts (wild card estimate: $1M). And don't forget to add in Exalgo royalties.

24 May 2011: Annual stockholders' meeting.

8-9 June 2011: World Pharma Congress - Dr. Glenn Short is scheduled to present "Using Combination Ultra High-Throughput Screening (cuHTS) to Address Efficacious Drug Combinations to Responsive Tumor Genotypes." This is the first time for Zalicus, I have read "cuHTS" versus "cHTS" in print. Has Zalicus expanded its high-through-put technology? Additionally, Zalicus Chief Scientific Officer Dr. Terrance Snutch is scheduled to present "Design and Pre-Clinical Development of Novel T-Type and N-Type Calcium Channel Blockers for Pain Intervention." Will Dr. Snutch add sodium channels to that discussion?

Imminent Events

Zalicus investors continue to sit tight for:

* Synavive 2B Clinical Trial Launch - As reported by Zalicus, the firm recently received a "Composition-of-Matter" patent for Synavive (click here) and is scheduled to start the SYNERGY trial in Q2 for rheumatoid arthritis. This is one time I hope CEO Corrigan honors his own timeline. I - like other investors - am growing tired of waiting.

* News on Prednisporin - Since 10 November 2010, per the ClinicalTrials.gov website, the phase 2B has been listed as "completed." Meanwhile, Sanofi-Aventis (SNY) which bought Fovea (which originally licensed Prednisporin) from CombinatoRx (now Zalicus Inc.) announced in Q1 the launch of an ophthalmology division with FOV1101 (i.e. Prednisporin) among those drug candidates assets. In addition, Genzyme (Sanofi's recent acquisition) is known to have an ophthalmology focus (click here). Furthermore, Sanofi announced a "privileged partnership" with The Vision Institute in Paris, France, for ophthalmology, announced on 23 March 2011 (click here). While all of this implies good news, it does have investors sitting on pins and needles. However, it would appear that Sanofi is getting close to making some type of announcement. I have read all of the details of Sanofi's upcoming conferences (including those in French), and Prednisporin is not mentioned; another researcher I trust has stated the same thing.

Imminent and Potentially Lucrative: Ion Channel Programs

* Three-Prongs: In bite-size chunks, CEO Corrigan not only rolled out the lead soldiers of his acclaimed "ion channel army" (terminology he and Dr. Snutch coined) of at least 50 composition candidates, Corrigan made a very defined statement. This is not just an ion channel program (i.e. singular); these are ion channel programs (i.e. plural). Terminology like this should not be lost on investors. Why? Because Zalicus has three separate programs that they can partner (if they choose) separately. Corrigan even hinted that one of those programs, even at its early stage, may already have collaborative interest. Keep in mind, one indication from each program could be worth $500M, so multiply that by 3 ... that's a whopping $1.5B.

* Z160 (Former NMED-160): Like Synavive, which was reformulated into a once/day time-released tablet, I know many investors who have been here since pre-merger days of CombinatoRx and Neuromed were taken aback by the announcement that Z160 was back in the game. After all, Merck (MRK) was ready to put down $450M for NMED-160, so when Corrigan stated that they had resolved the bio-availability problem (i.e. drug absorption) at the molecular level, I sat up and quite frankly cheered. An oral N-type calcium channel pain blocker, you have to think that Zalicus is counting on Z160 to score. The question is, Has Merck come back? Or is someone like Novartis or Amgen, or for that matter Sunovion (Dainippon Sumitomo Pharmaceuticals), looking to step in. All I know is NMED-160 made it deep into phase 2 studies before the bio-availability became insurmountable - but now that problem is resolved.

* Scientific Report and Corporate Presentations: Zalicus is submitting that its ion channel candidates are competitive: Z212 versus Gabapentin (Fanatrex, Gabarone, Gralise, Neurontin) and Z944 versus Naproxen for pain, and Z212 versus Lacosamide or Vimpat (an epilepsy drug). Regarding Lacosamide and Z212 we read: "When tested in the spinal cord slice preparation, lacosamide inhibited lamina I/II neuron AP firing approximately 300 times less potently (IC50 = 150 lM) than Z123212 (Fig. 7C)" (Hildebrand ME et al. A novel slow-inaction-specific ion channel modulator attenuates neuropathic pain. PAIN - 2011 - doi: 10.1016/j.pain.2010.12.035). You don't have to be a scientist to understand what this means: at lower dosages, Z212 was 300 times more potent than Lacosamide. That should make big pharmas interested in epilepsy research to sit up and take notice.

* The Range of Ion Channel Applications: While Zalicus claims to be targeting pain and inflammation, a year ago a report came out that ion channel NP078585 (supplied by Neuromed) may be used to treat alcoholism (also click here). This highlights the diverse business opportunities Zalicus is going to have as it moves forward with its three-prong ion channel programs. As an example, Z212 could be developed as private Canadian firm Xenon Pharmaceuticals is pursuing as a topical cream (XEN402) (click here) for post herpetic neuralgia (PHN) or shingles. Or Z212, if it proved to block one's smell sensory, could be developed into a nasal spray for applicable situations in industry or hospital settings or possibly as an appetite suppressant. These examples may seem extreme, but the ion channel world has a literal myriad of potential applications. Is it possible that Zalicus could decide to sell individual licenses for specific medical indications? If so, it would prove to be extremely lucrative.

* The Competition: Bottom line, Zalicus is deep into the game and is definitely a leader in the pack. Months ago I wrote an unpublished article that detailed Zalicus's key competition. I reference it here. The purpose of that report uncovered that Zalicus is definitely among the world leaders of ion channel research. Keep in mind that is among a pack of Glaxo-Smith-Kline (GSK), Vertex (VRTX), Merck, Hydra BioSciences, Pfizer (PFE), Xention, Grunenthal, Scottish Biomedical, Aurora Biomed, Convergence Pharmaceuticals, Chromocell, Selcia, and ICAGen (ICGN). At that time, I particularly noted the work of Convergence. To that report, I now add Afferent Pharmaceuticals, a private firm in Canada brought to my attention by another investor. I will continue to scan for competition. In any case, Zalicus remains a front-runner.

Conclusion

In a previous article, I made the rationalized claim that I thought Zalicus was worth $13/share. In my opinion, the CEO gets high marks for executing on his originally stated strategic plan in March 2010. My valuation-analysis has not changed; if anything, it has been strengthened. Keep in mind, this present article doesn't even begin to touch on the future of cHTS or cuHTS at Zalicus or its present/future collaborations. We are yet to explore the dissociative steroid market and the low-steroid chemistry platform behind Synavive. What I conclude is that Zalicus is definitely well-funded and major Zalicus events loom large in Q2.

I maintain Zalicus is a Strong Buy.

http://seekingalpha.com/article/263309-major-events-for-zali…

Ein Zusammenschnitt eines Bloggers von seeking alpha. Was ist daran lesenswert?

Antwort auf Beitrag Nr.: 41.364.384 von lunatics am 13.04.11 22:20:46Pipeline, Aussichten, Co-op Partnern, Finanzierung, für mein dafürhalten ein exzellenter Zussamenfassung die vielen ereignisse im Hause ZLCS seit Combimatrix

Antwort auf Beitrag Nr.: 41.364.535 von Growth2012 am 13.04.11 23:05:21Chapeau, feine Arbeit

Schaun wir mal, daß es tatsächlich ein gtes Investment wird.

Schaun wir mal, daß es tatsächlich ein gtes Investment wird.

Antwort auf Beitrag Nr.: 41.364.593 von HeinzBork am 13.04.11 23:21:50Tach' Heinz!

Jetzt wird ZLCS erfasst vom "The Bedford Report" stateside, das Geheimtip Platform für small cap Biotech Niechenanbietern...(Falls man wert darauf legt )

)

XenoPort and Zalicus Poised for Growth as Earnings Trends Improve...

http://finance.yahoo.com/news/XenoPort-and-Zalicus-Poised-iw…

Nun ja, mal sehen sagt der ZLCS Blinde

Ach ja, heute hätte man anteile für schlappe 1,68€ bzw. (2,51$) haben können, nur mal so zum Festhalten

Jetzt wird ZLCS erfasst vom "The Bedford Report" stateside, das Geheimtip Platform für small cap Biotech Niechenanbietern...(Falls man wert darauf legt

)

)XenoPort and Zalicus Poised for Growth as Earnings Trends Improve...

http://finance.yahoo.com/news/XenoPort-and-Zalicus-Poised-iw…

Nun ja, mal sehen sagt der ZLCS Blinde

Ach ja, heute hätte man anteile für schlappe 1,68€ bzw. (2,51$) haben können, nur mal so zum Festhalten

Habe heute meine Anteile bei 2.66 verkauft.

Antwort auf Beitrag Nr.: 41.386.228 von lunatics am 18.04.11 22:23:38...und der Wert ist "trotzdem" nicht sofort eingebrochen-seltsam

Antwort auf Beitrag Nr.: 41.384.805 von Growth2012 am 18.04.11 18:05:47Der Zacks report besagt folgendes:-

Zalicus is in an enviable position within the biotechnology industry. The company has an approved product on the market in Exalgo, and is collecting royalties from a strong partner in Covidien. The company s pipeline contains Synavive, a mid-stage candidate with proof-of-concept data in a significant market opportunity with rheumatoid

arthritis (RA) and osteoarthritis (OA). Zalicus also possess one of the market s leading research and discovery programs in calcium channel programs. Management is focusing the company s early-stage discovery efforts into the development of a new class of analgesics for the treatment of both acute and chronic pain. Finally, the cash