Diskussion nach Re-split -- Hrt Particp Sp GDR - 500 Beiträge pro Seite (Seite 2)

eröffnet am 16.05.11 07:02:15 von

neuester Beitrag 15.07.14 12:18:16 von

neuester Beitrag 15.07.14 12:18:16 von

Beiträge: 1.244

ID: 1.166.203

ID: 1.166.203

Aufrufe heute: 0

Gesamt: 244.789

Gesamt: 244.789

Aktive User: 0

ISIN: US71677D2036 · WKN: A2AKVJ

3,8600

USD

+0,26 %

+0,0100 USD

Letzter Kurs 27.01.17 Nasdaq OTC

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 17,580 | +20,00 | |

| 1,4500 | +15,99 | |

| 7,3400 | +15,77 | |

| 1,3450 | +13,26 | |

| 1,7900 | +11,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,7200 | -8,82 | |

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 1,3501 | -20,58 | |

| 0,8220 | -38,66 |

Markets do not always understand pre-operating companies, says director of HRT

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

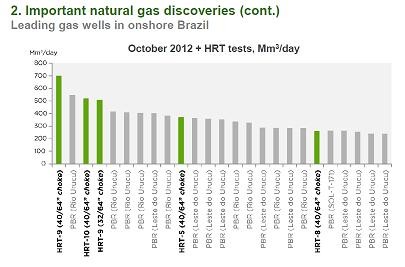

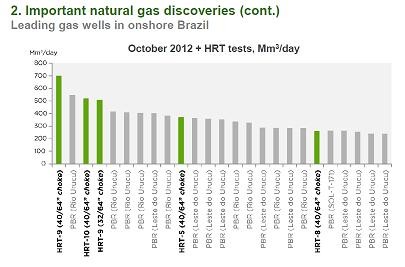

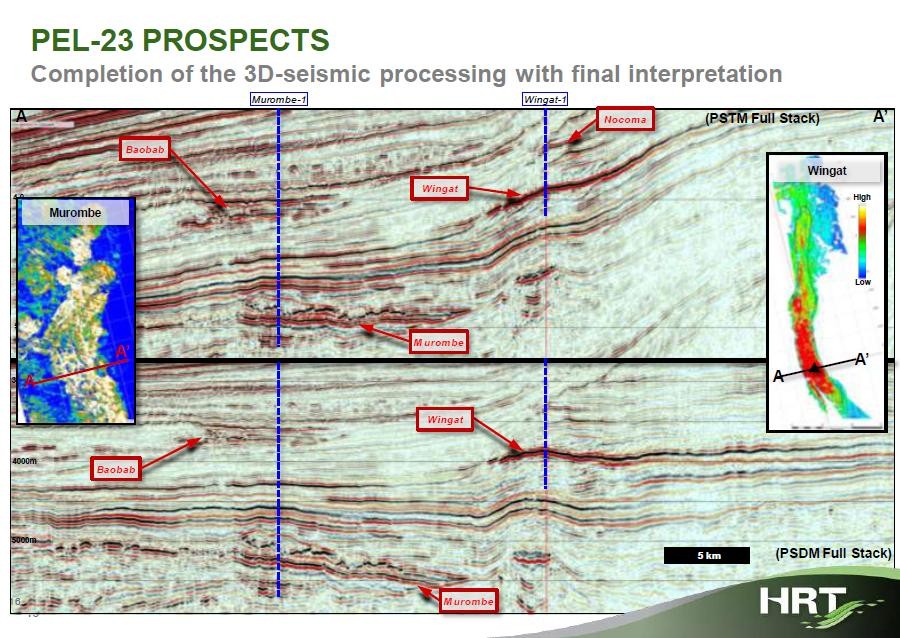

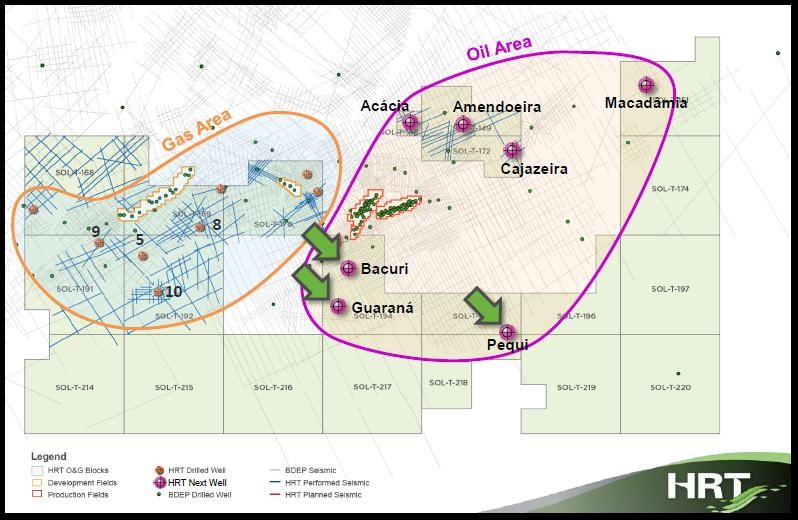

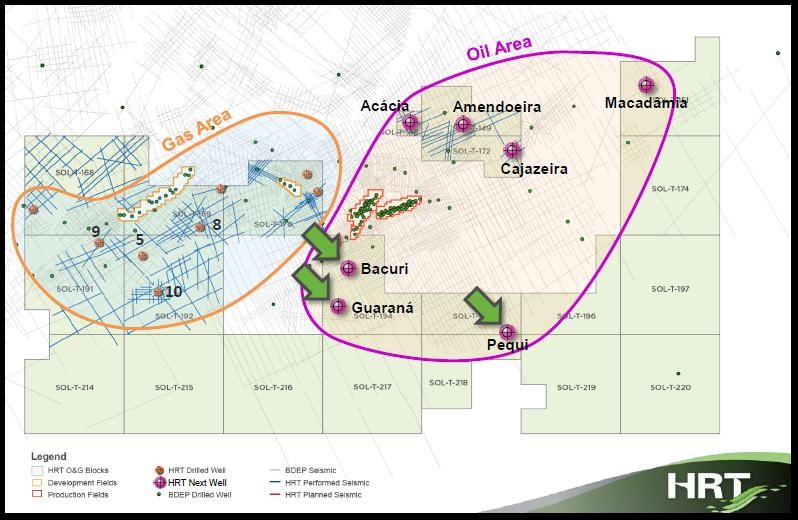

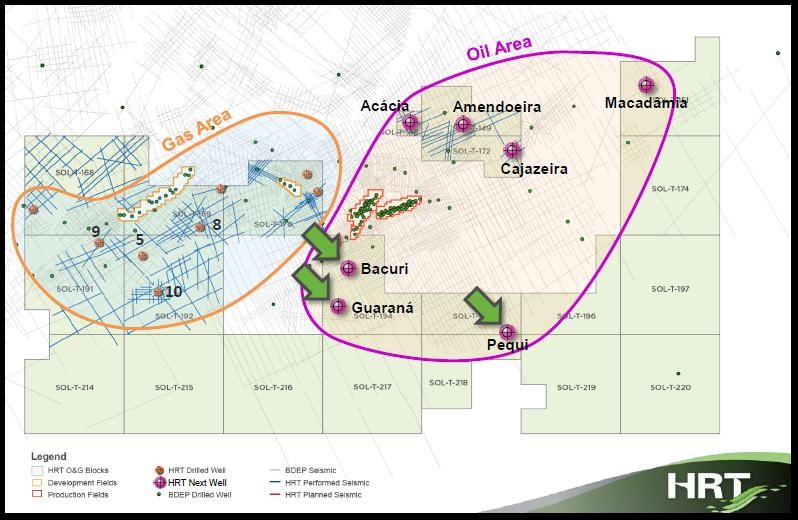

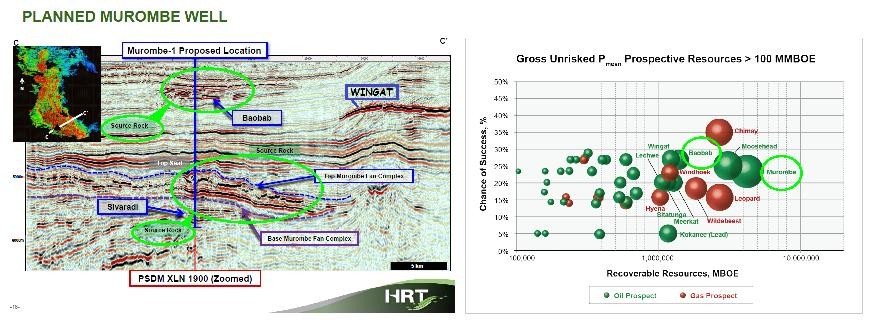

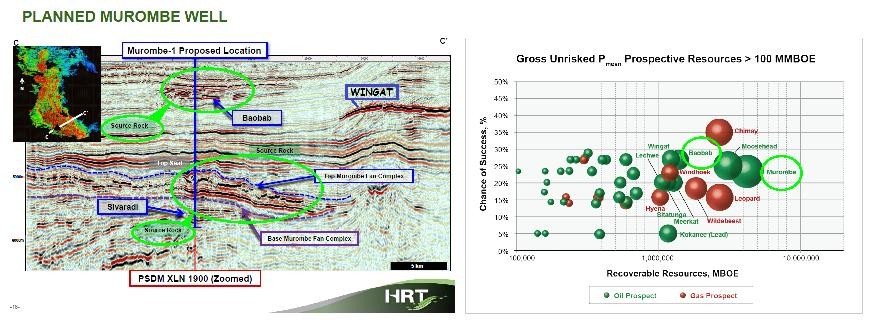

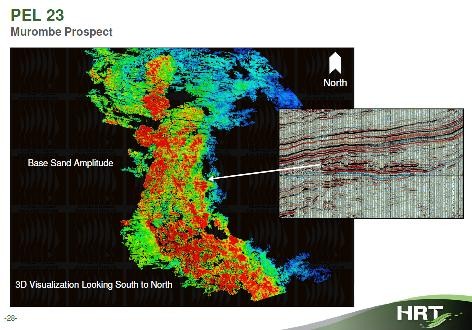

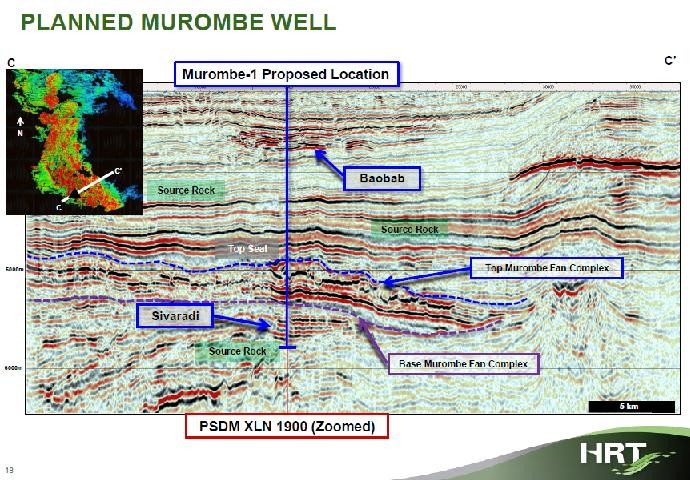

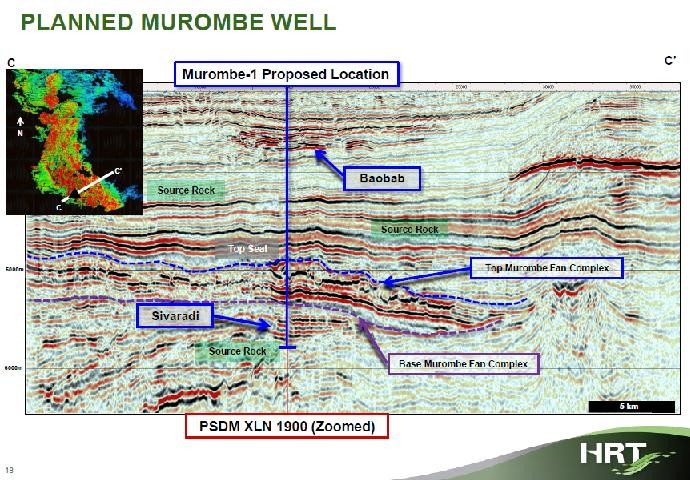

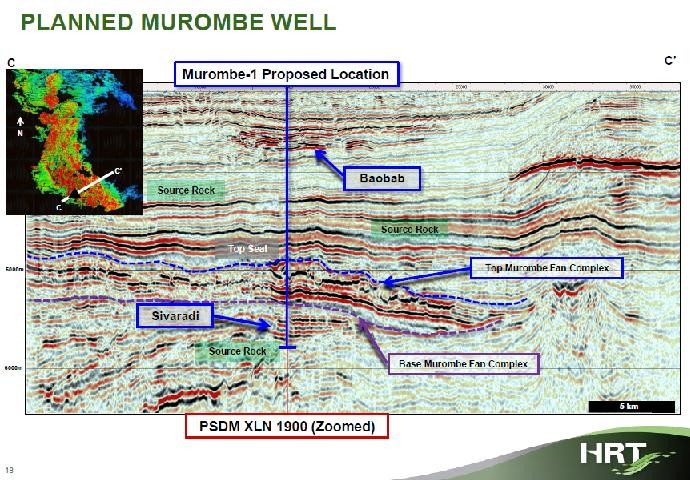

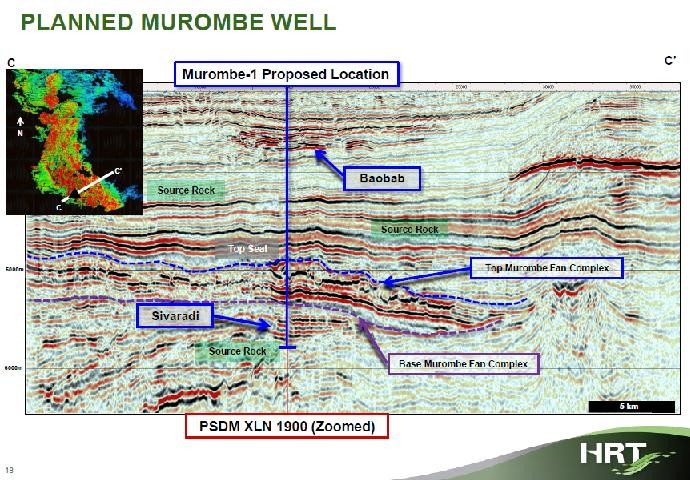

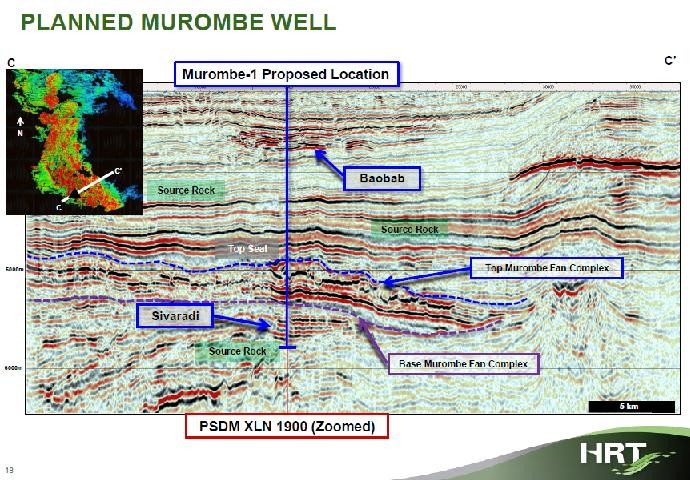

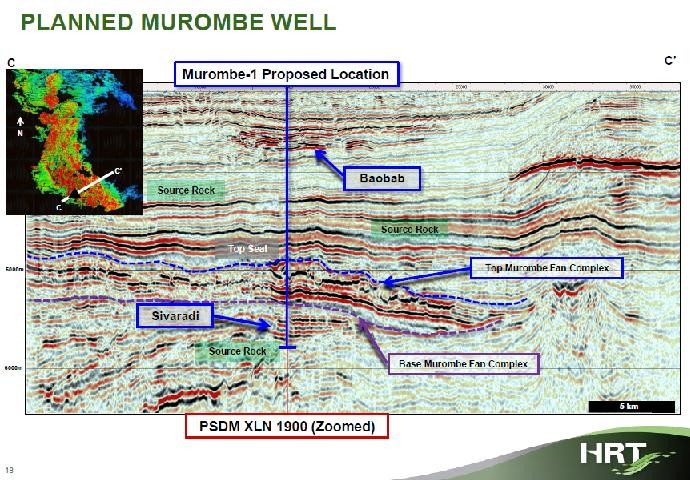

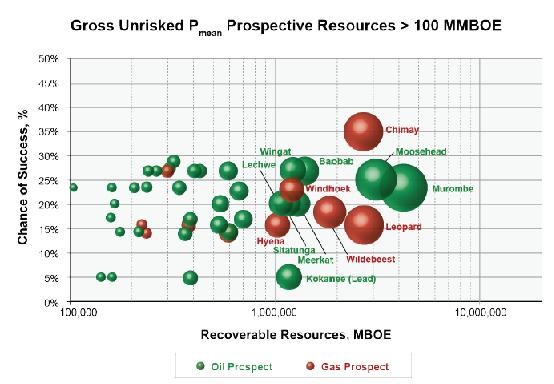

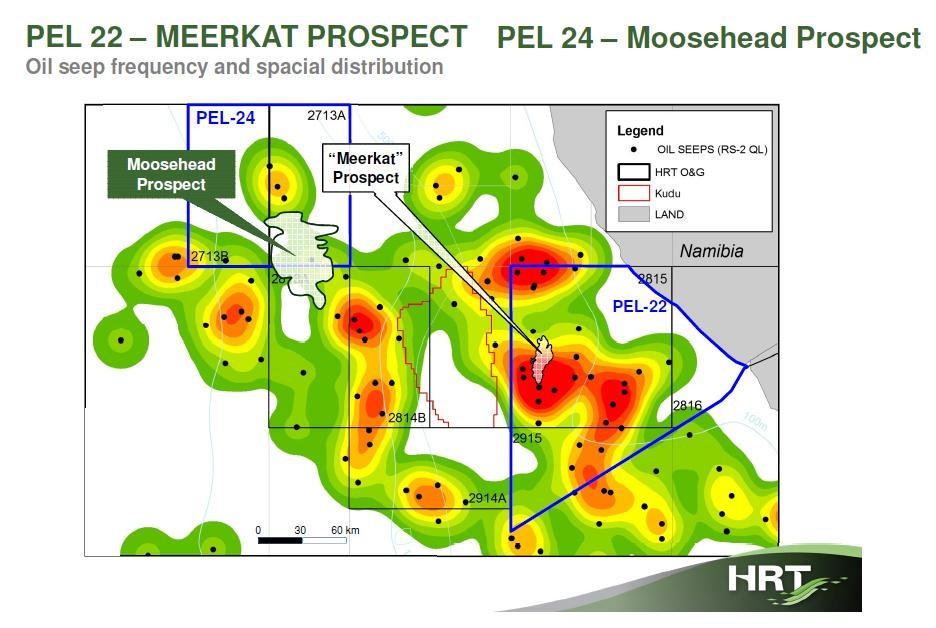

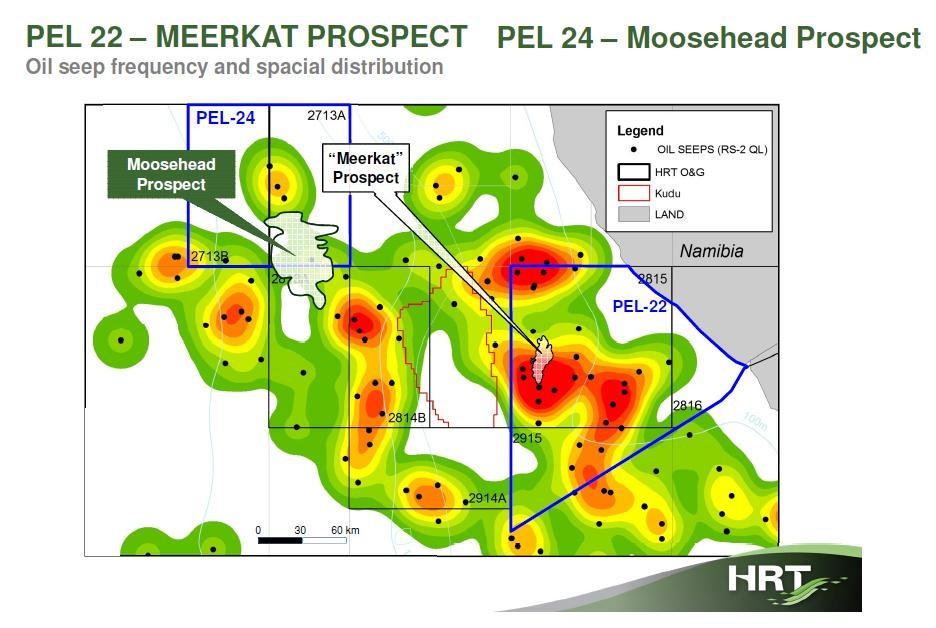

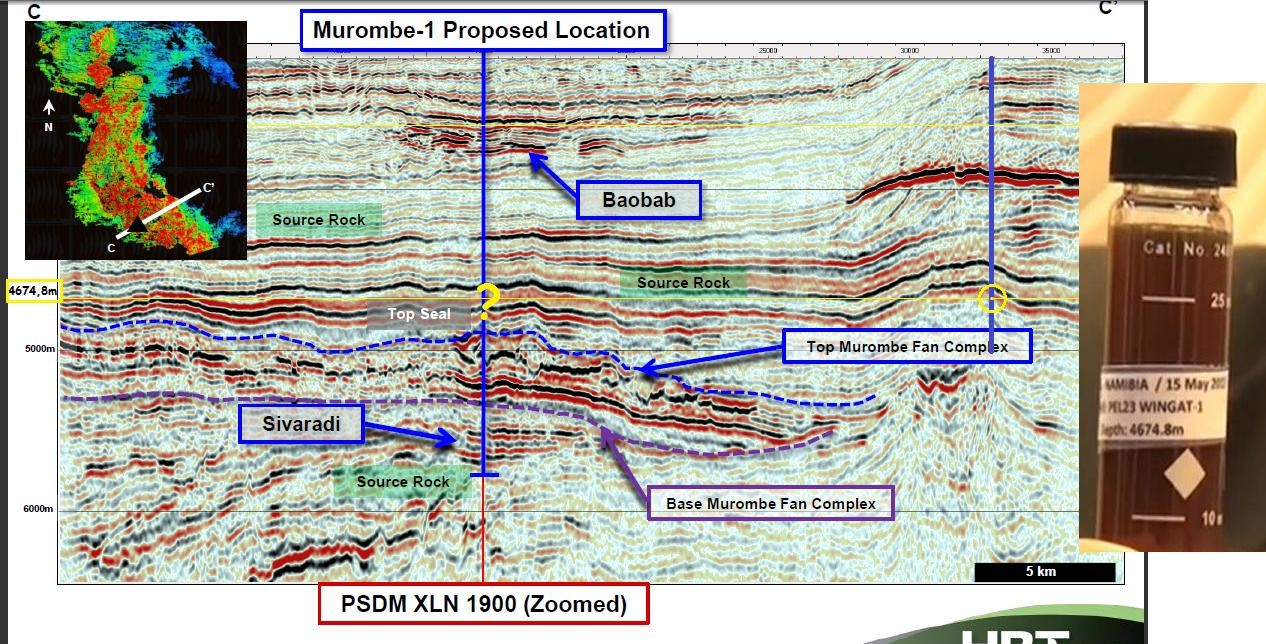

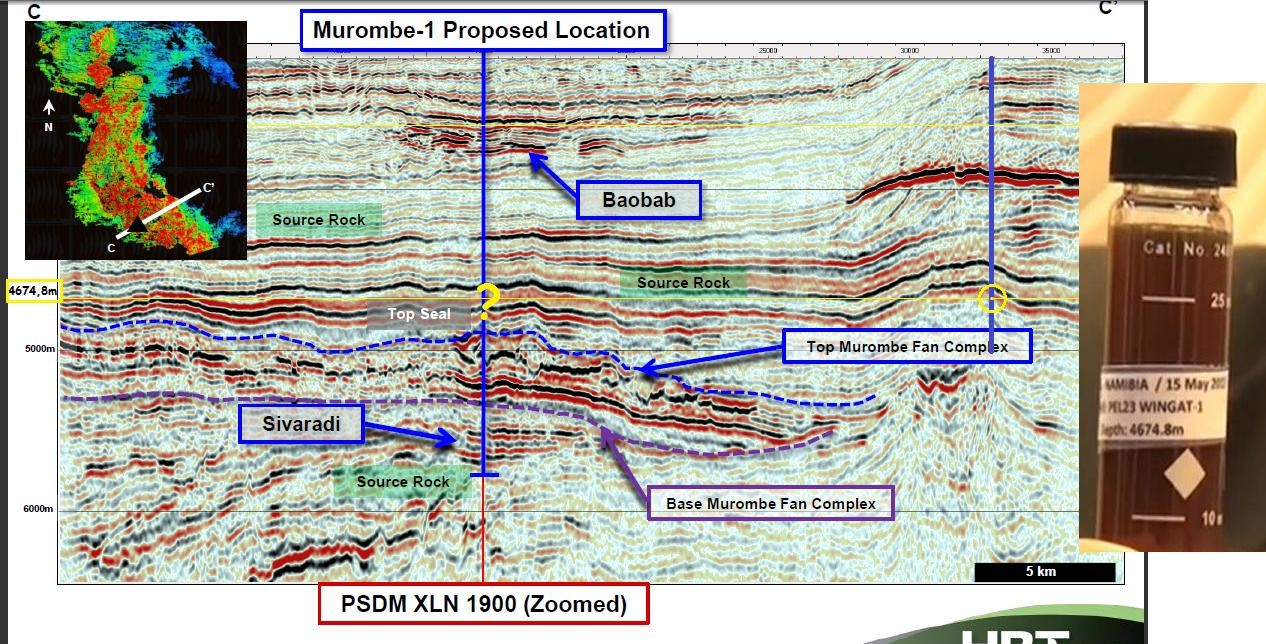

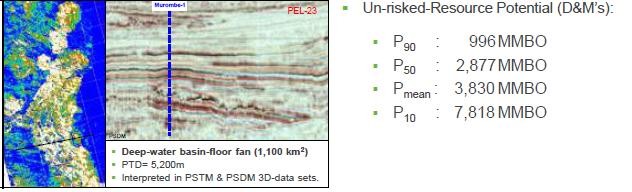

HRT claims to have the largest 3D seismic survey ever done in the region. "The quality of available data bring us safety and comfort to begin a drilling campaign with positive expectations of results."

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

HRT claims to have the largest 3D seismic survey ever done in the region. "The quality of available data bring us safety and comfort to begin a drilling campaign with positive expectations of results."

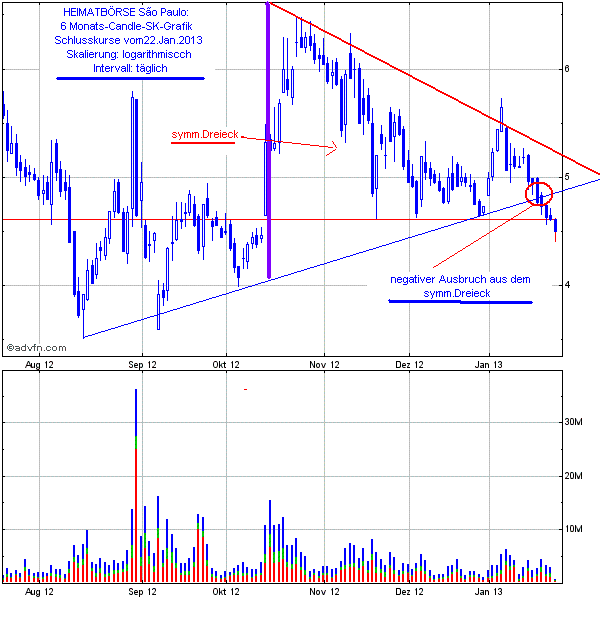

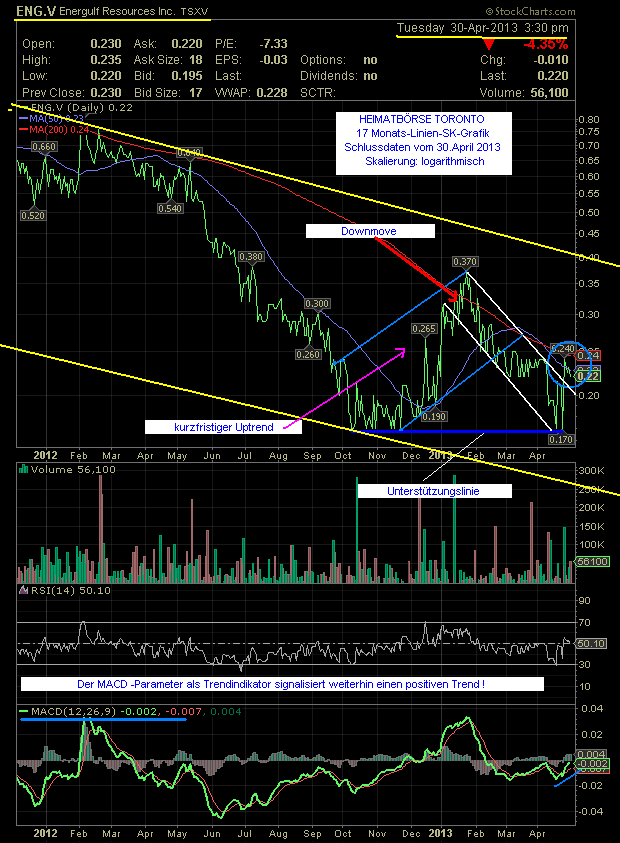

Der nachstehende Kursverlauf zeigt einen interessanten Vergleich von den

Explorern HRT/ENG und Chariot in einem Langfrist-Chart

12 Monats-Linien-Verlaufs-Chart-NASDAQ:

- selbst aktualisierend -

Die heutigen Wochenend-Schlussdaten von der NEBENBÖRSE TORONTO:

1.19 CAD = 0,916 € = k.V.% (zum Handelsvortag)= Volumen 89.711 shares[/quote]

Nachdem zum WE an der NEBENBÖRSE TORONTO der SK mit 1.19 CAD fast an der

brisanten unteren Kante des neuen Uptrend-Kanals aufsetzte, hier noch

einmal im Fokus die charttechnische Grafik in zwei Darstellungen:

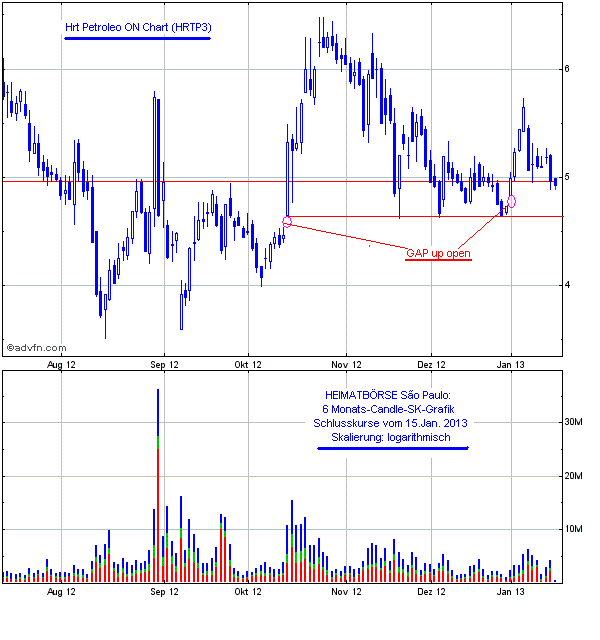

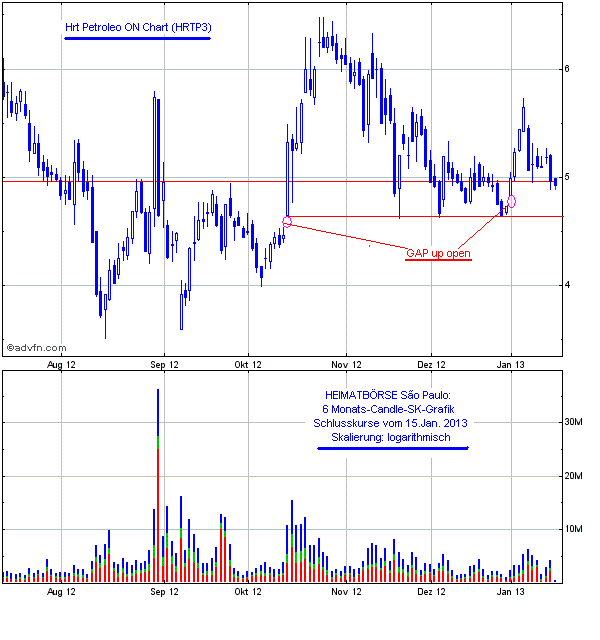

Hier die aktuelle Vorgabe von der HEIMATBÖRSE São Paulo:

http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3

HRT-REALTIME-Chart/Kurse von der HEIMATBÖRSE São Paulo:

- selbst aktualisierend - (REAIS-BR)

Ibovespa (Bras.-INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=IBOV

Und demnach das aktuelle Ergebnis von der NEBENBÖRSE TORONTO.

http://de.advfn.com/p.php?pid=qkquote&btn=s_ok&qkbtn=&qksymb…

HRT-REALTIME-Chart/Kurse von der Nebenbörse TORONTO:

- selbst aktualisierend - (CAD)

http://de.advfn.com/p.php?pid=staticchart&s=TX%5EHRP&p=0&t=2…

S&P TSX Composite (Kanad. INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=T^OSPTX

Die heutigen Wochenanfangs-Schlussdaten von der NEBENBÖRSE TORONTO:

1.19 CAD = 0,919 € = k.V.% (zum Handelsvortag)= Volumen 98.691 shares

NEWS RELEASE

HRT, TNK-Brasil and Petrobras sign an Amendment to the Letter of Intent for the Monetization of the Natural Gas in Solimões

Rio de Janeiro, December 17, 2012 - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that its subsidiary HRT O&G Exploração e Produção de Petróleo Ltda. ("HRT O&G"), Petróleo Brasileiro S.A. ("Petrobras") and TNK-Brasil Exploração e Produção de Óleo e Gás Natural Ltda. ("TNK-Brasil") signed an Amendment to the Work Plan of the Letter of Intent ("LOI") for the gas monetization in the Solimões Basin.

The LOI signed on October 15, 2012 has now been amended to introduce the work plan agreed to amongst the companies, which will be further matured over the next six months, starting January 2013. The signature occurred during the recent visit of President Dilma Rousseff to Moscow, where TNK-BP also has its headquarters.

The activities to be developed include: (1) evaluation of the natural gas resources within the study area, (2) engineering, environmental and logistics studies required to bring the natural gas to market, (3) the technical alternatives to monetize the gas, the markets for such gas and the local logistics of those markets, (4) economic evaluation of the studied alternatives and (5), the administrative aspects of the work plan.

"Our technical team is honored and encouraged to participate along with Petrobras in this project that is deemed so important to Brasil " said Marcio Rocha Mello and Michael Morgan, from HRT and TNK-Brasil.

HRT is exploring the Solimões Basin in partnership with TNK-Brasil, a subsidiary of TNKBP.

For further information, contact HRT`s Investor Relations Department.

HRT, TNK-Brasil and Petrobras sign an Amendment to the Letter of Intent for the Monetization of the Natural Gas in Solimões

Rio de Janeiro, December 17, 2012 - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that its subsidiary HRT O&G Exploração e Produção de Petróleo Ltda. ("HRT O&G"), Petróleo Brasileiro S.A. ("Petrobras") and TNK-Brasil Exploração e Produção de Óleo e Gás Natural Ltda. ("TNK-Brasil") signed an Amendment to the Work Plan of the Letter of Intent ("LOI") for the gas monetization in the Solimões Basin.

The LOI signed on October 15, 2012 has now been amended to introduce the work plan agreed to amongst the companies, which will be further matured over the next six months, starting January 2013. The signature occurred during the recent visit of President Dilma Rousseff to Moscow, where TNK-BP also has its headquarters.

The activities to be developed include: (1) evaluation of the natural gas resources within the study area, (2) engineering, environmental and logistics studies required to bring the natural gas to market, (3) the technical alternatives to monetize the gas, the markets for such gas and the local logistics of those markets, (4) economic evaluation of the studied alternatives and (5), the administrative aspects of the work plan.

"Our technical team is honored and encouraged to participate along with Petrobras in this project that is deemed so important to Brasil " said Marcio Rocha Mello and Michael Morgan, from HRT and TNK-Brasil.

HRT is exploring the Solimões Basin in partnership with TNK-Brasil, a subsidiary of TNKBP.

For further information, contact HRT`s Investor Relations Department.

HRT Participacoes Has An Asymmetric Risk/Reward Profile

http://seekingalpha.com/article/1068871-hrt-participacoes-ha…

http://seekingalpha.com/article/1068871-hrt-participacoes-ha…

Seit Tagen bewegt sich der SK an der Unterstützungslinie im brisanten

Bereich des Uptrend-Kanals. (untere Kante, blaue Linie)

Nachstehend der charttechnische Beweis vom gestrigen Handelstag:

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.20 CAD = 0,920 € = Plus 1,68 % (zum Handelsvortag)= Volumen 91.859 shares

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.26 CAD = 0,963 € = Plus 5,00 % (zum Handelsvortag)= Volumen 241.710 shares

Mit einem ordentlichen Drive und erhöhtem Umsatz-Volumen verabschiedete sich gestern

die NEBENBÖRSE TORONTO mit einem SK von 1.26 CAD. innerhalb des Neuen

Uptrend-Kanals.

Hier noch einmal die Schlussdaten:

1.26 CAD = 0,960 € = Plus 5,00 % (zum Handelsvortag)= Volumen 241.716 shares

Die Schlussdaten von der NEBENBÖRSE TORONTO:

1.25 CAD = 0,955 € = Minus 0,79 % (zum Handelsvortag)= Volumen 338.102 shares

Nachstehend die Grafik und die SK-Daten vom 24.Dez. von der NEBENBÖRSE

TORONTO:

1.27 CAD = 0,966 € = Plus 1,60 % (zum Handelsvortag)= Volumen 28.363 shares

Nachtrag zur Grafik vom 24.12.

Mit der letzten Kerze (gelbe Ellipse) wurde ein DRAGONFLY DOJI

signalisiert, d.h. aus einem Abwärtstrend heraus, innerhalb des neuen

Uptrend-Kanals, ist eine positive Trendumkehr zu erwarten.

Es liegt ein INTRADAY-Reversal vor.

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.23 CAD = 0,933 € = Minus 3,15 % (zum Handelsvortag)= Volumen 242.902 shares

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.19 CAD = 0,903 € = Minus 3,25 % (zum Handelsvortag)= Volumen 147.260 shares

Und hier noch nachträglich die heutige SK-Grafik:

Schönes letztes WE noch vor Jahres-Schluss!

So long butz

Schönes letztes WE noch vor Jahres-Schluss!

So long butz

So schloss gestern die NEBENBÖRSE TORONTO:

Die gestrigen Jahres-Schluss-Daten nachstehend:

1.26 CAD = 0,960 € = Plus 5,88 % (zum Handelsvortag)= Volumen 89.8324 shares

So long butz, der Alleinunterhalter ?

und allen hier ein gesundes und erfolgreiches 2013

Antwort auf Beitrag Nr.: 43.971.610 von butzbutz am 01.01.13 12:13:59Lieber Butz

ein frohes neues Jahr wünsche ich Dir

Allein bestimmt nicht, wir sind dabei

Weterhin danke für die Wertvolle Beiträge und Ausarbeitungen

Gruß

Dadak

ein frohes neues Jahr wünsche ich Dir

Allein bestimmt nicht, wir sind dabei

Weterhin danke für die Wertvolle Beiträge und Ausarbeitungen

Gruß

Dadak

Repost from ihI hub

HRT Petroleo: ¡Esto Es Noticias Fantasticas!

Dear Outstanding Investments Reader:

Are you sitting down? Did you take your heart meds? Are you ready for some good news? Do you speak Portuguese? Because... ¡Esto es noticias fantasticas!

Oh, yes... in English: "This is fantastic news!" Blame it on Rio! It's about HRT Petroleo (HRP: TSX-V). It's what we've been waiting for. It's like Pele taking to the soccer field and scoring another goal. ¡Pele raya otro objetivo!

A Year (and More) of Living Dangerously!

First, let's review -- because frequent OI readers know how much I like to review things. We've had HRT in the OI portfolio for not quite 18 months, since June 2011. After three months, as the leaves turned gold in the fall of 2011, I was wearing a scratchy hair shirt. That is, not long after I recommended HRT, in the summer of 2011, its share price tumbled from the $9 range to... well, low.

The bottom line is that we had a tough year with HRT, from 2011 through 2012 -- up to now. It was tough, that is, unless you're one of those short sellers who made money by betting that HRT wouldn't live up to its potential. Oh, yes, the shorts had a nice walk to the bank.

I'll own up. Full disclosure. You can handle the truth, right? HRT shares drifted down so low that last August, the share price broke a buck one day. Ugh. A "penny stock," so to speak. In OI? I'm sorry. I'm very sorry. It was bad timing for early buyers. And yes, I got your memos and emails. Many of them.

I am, of course, an adaptive newsletter writer. I'm capable of learning. Did I totally blow the call on HRT? Well, I like to think that I follow the facts. So what did I miss?

Early this year, I visited Houston and reviewed HRT at its U.S. office, from top to bottom. I met and shook the hand of every employee on the HRT team -- from the chief geologist to the front desk receptionist. I looked at everything with a critical eye.

Also, as part of my penance, I sentenced myself to read Internet chat boards for HRT. What were investor-commenters saying? Hey, some of that third-party commentary about me was, on occasion, utterly vicious. OK, I get it.

But then again... I told OI readers, from the very first day, that HRT is a pre-production, pre-operational play. That is, HRT is an exploration idea. HRT holds acreage onshore Brazil and offshore Namibia, but it doesn't have vast fields of producing wells -- not yet!

So no, HRT is not the usual OI sort of company that finds its way into the newsletter. There's no established business, ongoing production, sweet cash flow and Big Oil profits.

If, as an investor, you're not tuned into this level of pre-operational risk, then HRT is even a dangerous sort of play. Not to put too fine a point on it, but one can lose a lot of money by moving in and then panicking out. (Of course, I never recommended selling HRT shares, even during the worst of times. If you sold, it was never my idea.)

Look at it another way. With no current sales of oil and gas, the investment nature of HRT was NOT the typical question for investors -- of how badly any company's executives can waste perfectly good cash flow, as is the case with many other firms that inhabit the stock markets of the world. I always told readers that HRT was/is a risky idea, out at the edge of the risk envelope. I never said otherwise.

And what else? I told readers the full HRT story. If you followed what I wrote in this newsletter, I discussed the problems as well as the potential for HRT to find immense new oil and gas discoveries in Brazil and offshore Africa.

Of course, HRT has to drill its wells in the right places, no? Come to think of it, we all have to drill our wells -- of oil, not to mention life -- in the right places.

The Marcio Story

Speaking of telling the full story, along the way, I described the CEO of HRT, Marcio Mello, who is, quite simply, one of the world's great oil finders. That's a fact.

I told OI readers about how Marcio has a Ph.D. in geochemistry, worked for Petrobras (PBR: NYSE) for over 25 years and ran the Petrobras Research Center in Rio de Janeiro. I described how, in 2001, Marcio literally wrote the book on oil exploration in "passive" tectonic settings -- entitled Petroleum Systems of South Atlantic Margins.

I explained how Marcio's "drill deep" theories led Petrobras to spend over $240 million (no typo) on just one well (only one!) targeted at the vast "pre-salt" play offshore Brazil. And I told you how that particular well -- named "Tupi" -- found 8 billion barrels of oil and opened up an entire new energy frontier.

So I've been telling this story, about Marcio and HRT, for a long time -- about four years, actually. I first related the Marcio story in 2009 in my other newsletter, Energy & Scarcity Investor. Many ESI readers made excellent gains (and some made life-changing gains) on another company that Marcio advised, the former UNX Energy, which is now part of HRT.

Really, Marcio is impossible to keep under wraps. For example, I helped arrange getting Marcio to a major international conference on Peak Oil in Denver in 2009. He was... let's say... controversial. Certainly to that audience.

Then I brought Marcio to the Agora Financial Conference in Vancouver in 2010, where he brought down the house with his comments on the BP (BP: NYSE) well blowout in the Gulf of Mexico. And Marcio was in Vancouver in 2011 and 2012 too.

At each Vancouver session, over 1,000 Agora Financial attendees, exhibitors, newsletter writers, media and more heard Marcio give his ebullient pitch. Were you there?

Something Big Is Coming!

And needless to say -- but I'll say it anyhow -- I've written about HRT and Marcio here in OI. I’ve told you what I know. I’ve explained things as best I could.

Then last summer, as the HRT share price hit bottom, I threw my credibility chips onto the table. "What's Going on With Our Brazilian Oil Company?" I asked Aug. 15, 2012. And I answered my own question by explaining how something big was in the works with HRT.

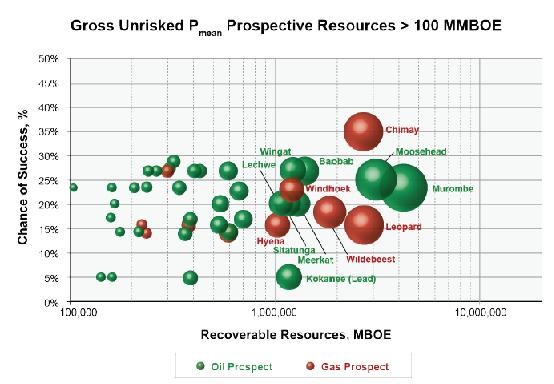

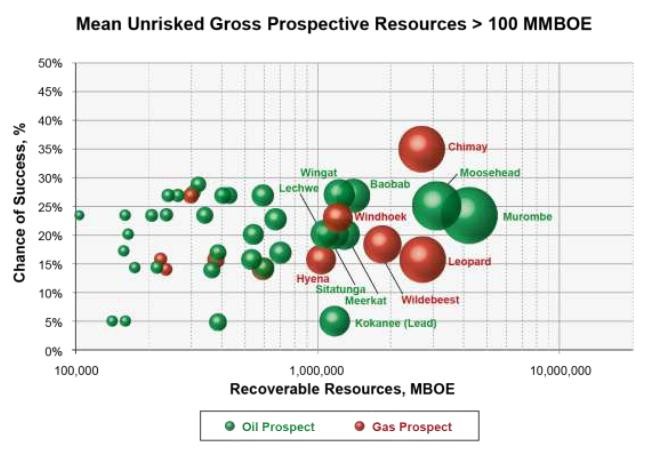

Heck, last August, I was downright optimistic. In my Aug. 15 article, I showed you slides of some of the geophysics from offshore Namibia. I showed you outlines of immense oil-bearing structures. I discussed geology and geochemistry. I mentioned the phenomenal HRT team of geologists, geophysicists and engineers.

Last summer, I explained HRT's lease with Transocean (RIG: NYSE) for a modern, deep-water drilling rig named Transocean Marianas. I wrote about HRT's four-well program to test a group of exceptional prospects offshore Namibia. I described how drilling is scheduled for the first quarter of 2013 -- as in about six weeks hence.

A couple days later, on Aug. 17, I described HRT as "cheap risk, big reward." I explained the HRT story in the context of big-picture resource investing.

Oh, and for the past several months, in the "Five Hot Picks" section of the OI monthly newsletter, I've given honorable mention to HRT. Yes, HRT is risky. And it's risky for me -- as a newsletter writer -- to pound the table so hard over HRT.

But then again, and as I've said on more than a few occasions, I believe that the downside has been slapped out of HRT shares. Thank you, short sellers. So now there's upside. But. It's. Risky. OK?

HRT Has a Partner!

So what's the news? Why did I ask if you're sitting down? Why am I nearly ecstatic? Why am I revisiting the painful moments of the past? Because HRT just announced a deal to partner up with a key player in the international exploration biz -- Galp Energia of Portugal.

Galp will participate in drilling three of the four wells offshore Namibia, essentially covering HRT's costs (up to an as yet undisclosed cap), for a participation share of 14%. I believe that this is a FABULOUS deal, as I'll explain in a moment.

First, let me address something that may be coursing through your brain. Why Galp? Portugal-listed Galp has a market capitalization of about $12.5 billion. Galp isn't a huge oil company as oil companies go. Galp is far from oil giants like Exxon Mobil, Chevron, Shell (RDS-B: NYSE) or Total (TOT: NYSE). But don't be fooled by size.

The big guys ALL had a chance to review the HRT data. Over 30 oil companies -- including virtually all of the household names -- signed confidentiality agreements and reviewed HRT's Namibian play. Many of them offered terms to HRT for a partnership agreement. Galp offered the best deal for HRT and its shareholders. So that's why Galp is the partner.

Let's Look at Galp

Galp works in and around the Iberian peninsula -- Portugal and Spain -- as befits its home base of Lisbon. Galp also operates in what I characterize as the "gold coasts" of Southern Hemisphere energy frontiers.

Start with offshore Brazil -- not too shabby, eh? -- where Galp was a partner with Petrobras in that above-mentioned initial Tupi pre-salt discovery just a few years ago. Impressive, yes? Right place, right time, no? Then again, there are no accidents, comrades. Corporately, Galp understood how to be exactly in the right place at the right time.

Galp also operates offshore Venezuela and Uruguay, in South America. Uruguay? That's mighty intriguing, especially considering the plate tectonics that may have emplaced more of that pre-salt and oil offshore, directly across from... you guessed it... Namibia.

Right now, in Africa, Galp operates offshore Angola, Cape Verde, Guinea-Bissau, Equatorial Guinea, Gambia and -- as of late -- in the stunning new hydrocarbon province that just opened up offshore Mozambique.

Galp seems to have a knack for being where drilling rigs find oil. Funny how that works. And with the HRT tie-up, Galp is now moving into Namibia. It's meaningful.

The Portuguese Connection

What else can we make of Galp? It's fair to say that Galp is a fast-growing company with a keen eye for making success happen. Galp goes where other companies have not accomplished anything or took too long to recognize opportunity. In fact, Galp has strapped into exploration risk in new frontiers unlike just about any other company in its peer group.

In terms of exploration, Galp goes where many larger firms (aka "Big Oil") fear to tread. Actually, the big guys kind of like it when small players like Galp find that first oil with some crazy, super-risky, off-the-wall wildcat well.

The big company guys hate to explain to Wall Street and London analysts why they took a risk in some Godforsaken frontier in lower south Succotash and drilled a few dry holes. The big guys leave such things to the Galps of the world. Then later, they come in and piggyback on someone else's success.

Oh, and Galp is just now starting to see the rewards that come with its astonishing exploration success. So here are a few take-aways respecting HRT's deal with Galp:

Galp is paying a large chunk of the upfront drilling expenses for three (out of four) offshore wells. It's excellent risk sharing by the HRT team. The financial arrangement allows HRT to husband its cash for other things -- like continuing with developments in the Solimoes Basin of Brazil. All for a modest 14% share of the three Namibian concessions to Galp, which leaves 86% for HRT -- a lot still on the table

Galp is "small" enough that there's a low probability of the Portuguese company trying to overwhelm HRT -- as if Marcio & Co. can be overwhelmed. Still, the Galp relationship means that the HRT Namibia wells will receive top-level management attention at every stage. Yet Galp is also large enough to have deep pockets and lots of deep-water experience, so both the money and the bench of manpower are there

Galp has established a remarkable, respectable niche in deep-water exploration for frontier plays in the Southern Hemisphere, certainly with big boy Petrobras and in the Brazilian pre-salt. That is, Galp can work with big-time oil companies, deal with South American and African governments and generally play at the varsity level in the oil biz. So this is a deal that's already turning heads! Indeed, one of my Big Oil contacts emailed me last night, "I never saw this coming" -- which he meant as a high compliment

Galp is well acquainted with the technical challenges of deep-water exploration and development. Indeed, Galp's geological approach to deep-water exploration appears to jive to an astonishing degree with what we've seen from Marcio over the years. Maybe it's something in the Portuguese-speaking mindset?

Fantastic News!

As I said at the beginning of this note, the Galp tie-up is fantastic news! It's a key development for HRT. The Galp partnership -- and the third-party funding it brings to the table -- adds an entire layer of legitimacy (and "other peoples' money") to everything that HRT has accomplished.

Let's do some blue-sky math. Let's say that a three-well commitment obligates Galp for $200 million -- which is my raw speculation, because I do NOT have any information from HRT about exact numbers. Right now, the details of the HRT-Galp deal are proprietary.

In return for teaming with HRT, Galp is getting 14% of the play, or about one-seventh of three concessions.

So hypothetically, the "value" of this Namibian play is seven times $200 million, or $1.4 billion for the three-well program. And that doesn't include the fourth well, yet to come. Plus, it doesn't include any value for the spectacular natural gas finds that HRT has in Solimoes, in Brazil. Oh, by the way, the deal will be worth a LOT more in the event that HRT-Galp finds oil!

Meanwhile, HRT has a market cap of about $600 million, considering the Brazilian and Canadian share structure. So as of the close of business on Monday, HRT is "undervalued" by about half.

These are just speculative, arm-waving numbers, remember! But all of this ought to get you thinking about the size of that risk-reward play for HRT. Right now, the HRT Canadian-traded shares are dramatically undervalued, if you put any faith at all into the Galp deal.

And yes, HRT-Galp still must still drill wells and find oil. That's hard, not easy. So there's plenty of risk in this endeavor. Despite my evident enthusiasm, I must still offer the entire array of cautions. Consider yourself warned!

But if you're game to risk investment cash on an oil play with all the right moving parts and a huge upside? This is your chance to make a play with HRT. Take some money that you can "afford to lose," as the saying goes, and perhaps the return from HRT could change your life.

One of the Great Energy Plays of Our Time

Looking ahead, when those Namibian wells go down, we're about to witness one of the great energy plays of our time. Namibia -- with a coastline longer than that of California -- is about to test key areas of its offshore oil frontier. We're looking for a Brazil-style, pre-salt analogue. Is there oil and gas out there? Hey, we're going to find out in the first half of 2013, and it could be really, really big.

This kind of news makes my day. Heck, it makes my week! Maybe I'll just take the rest of the month off! Voy de vacaciones, eh? Actually, I have other commitments, and I'll fill you in about everything later on. 'Cuz I'm going down to Texas for a spell.

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

HRT Petroleo: ¡Esto Es Noticias Fantasticas!

Dear Outstanding Investments Reader:

Are you sitting down? Did you take your heart meds? Are you ready for some good news? Do you speak Portuguese? Because... ¡Esto es noticias fantasticas!

Oh, yes... in English: "This is fantastic news!" Blame it on Rio! It's about HRT Petroleo (HRP: TSX-V). It's what we've been waiting for. It's like Pele taking to the soccer field and scoring another goal. ¡Pele raya otro objetivo!

A Year (and More) of Living Dangerously!

First, let's review -- because frequent OI readers know how much I like to review things. We've had HRT in the OI portfolio for not quite 18 months, since June 2011. After three months, as the leaves turned gold in the fall of 2011, I was wearing a scratchy hair shirt. That is, not long after I recommended HRT, in the summer of 2011, its share price tumbled from the $9 range to... well, low.

The bottom line is that we had a tough year with HRT, from 2011 through 2012 -- up to now. It was tough, that is, unless you're one of those short sellers who made money by betting that HRT wouldn't live up to its potential. Oh, yes, the shorts had a nice walk to the bank.

I'll own up. Full disclosure. You can handle the truth, right? HRT shares drifted down so low that last August, the share price broke a buck one day. Ugh. A "penny stock," so to speak. In OI? I'm sorry. I'm very sorry. It was bad timing for early buyers. And yes, I got your memos and emails. Many of them.

I am, of course, an adaptive newsletter writer. I'm capable of learning. Did I totally blow the call on HRT? Well, I like to think that I follow the facts. So what did I miss?

Early this year, I visited Houston and reviewed HRT at its U.S. office, from top to bottom. I met and shook the hand of every employee on the HRT team -- from the chief geologist to the front desk receptionist. I looked at everything with a critical eye.

Also, as part of my penance, I sentenced myself to read Internet chat boards for HRT. What were investor-commenters saying? Hey, some of that third-party commentary about me was, on occasion, utterly vicious. OK, I get it.

But then again... I told OI readers, from the very first day, that HRT is a pre-production, pre-operational play. That is, HRT is an exploration idea. HRT holds acreage onshore Brazil and offshore Namibia, but it doesn't have vast fields of producing wells -- not yet!

So no, HRT is not the usual OI sort of company that finds its way into the newsletter. There's no established business, ongoing production, sweet cash flow and Big Oil profits.

If, as an investor, you're not tuned into this level of pre-operational risk, then HRT is even a dangerous sort of play. Not to put too fine a point on it, but one can lose a lot of money by moving in and then panicking out. (Of course, I never recommended selling HRT shares, even during the worst of times. If you sold, it was never my idea.)

Look at it another way. With no current sales of oil and gas, the investment nature of HRT was NOT the typical question for investors -- of how badly any company's executives can waste perfectly good cash flow, as is the case with many other firms that inhabit the stock markets of the world. I always told readers that HRT was/is a risky idea, out at the edge of the risk envelope. I never said otherwise.

And what else? I told readers the full HRT story. If you followed what I wrote in this newsletter, I discussed the problems as well as the potential for HRT to find immense new oil and gas discoveries in Brazil and offshore Africa.

Of course, HRT has to drill its wells in the right places, no? Come to think of it, we all have to drill our wells -- of oil, not to mention life -- in the right places.

The Marcio Story

Speaking of telling the full story, along the way, I described the CEO of HRT, Marcio Mello, who is, quite simply, one of the world's great oil finders. That's a fact.

I told OI readers about how Marcio has a Ph.D. in geochemistry, worked for Petrobras (PBR: NYSE) for over 25 years and ran the Petrobras Research Center in Rio de Janeiro. I described how, in 2001, Marcio literally wrote the book on oil exploration in "passive" tectonic settings -- entitled Petroleum Systems of South Atlantic Margins.

I explained how Marcio's "drill deep" theories led Petrobras to spend over $240 million (no typo) on just one well (only one!) targeted at the vast "pre-salt" play offshore Brazil. And I told you how that particular well -- named "Tupi" -- found 8 billion barrels of oil and opened up an entire new energy frontier.

So I've been telling this story, about Marcio and HRT, for a long time -- about four years, actually. I first related the Marcio story in 2009 in my other newsletter, Energy & Scarcity Investor. Many ESI readers made excellent gains (and some made life-changing gains) on another company that Marcio advised, the former UNX Energy, which is now part of HRT.

Really, Marcio is impossible to keep under wraps. For example, I helped arrange getting Marcio to a major international conference on Peak Oil in Denver in 2009. He was... let's say... controversial. Certainly to that audience.

Then I brought Marcio to the Agora Financial Conference in Vancouver in 2010, where he brought down the house with his comments on the BP (BP: NYSE) well blowout in the Gulf of Mexico. And Marcio was in Vancouver in 2011 and 2012 too.

At each Vancouver session, over 1,000 Agora Financial attendees, exhibitors, newsletter writers, media and more heard Marcio give his ebullient pitch. Were you there?

Something Big Is Coming!

And needless to say -- but I'll say it anyhow -- I've written about HRT and Marcio here in OI. I’ve told you what I know. I’ve explained things as best I could.

Then last summer, as the HRT share price hit bottom, I threw my credibility chips onto the table. "What's Going on With Our Brazilian Oil Company?" I asked Aug. 15, 2012. And I answered my own question by explaining how something big was in the works with HRT.

Heck, last August, I was downright optimistic. In my Aug. 15 article, I showed you slides of some of the geophysics from offshore Namibia. I showed you outlines of immense oil-bearing structures. I discussed geology and geochemistry. I mentioned the phenomenal HRT team of geologists, geophysicists and engineers.

Last summer, I explained HRT's lease with Transocean (RIG: NYSE) for a modern, deep-water drilling rig named Transocean Marianas. I wrote about HRT's four-well program to test a group of exceptional prospects offshore Namibia. I described how drilling is scheduled for the first quarter of 2013 -- as in about six weeks hence.

A couple days later, on Aug. 17, I described HRT as "cheap risk, big reward." I explained the HRT story in the context of big-picture resource investing.

Oh, and for the past several months, in the "Five Hot Picks" section of the OI monthly newsletter, I've given honorable mention to HRT. Yes, HRT is risky. And it's risky for me -- as a newsletter writer -- to pound the table so hard over HRT.

But then again, and as I've said on more than a few occasions, I believe that the downside has been slapped out of HRT shares. Thank you, short sellers. So now there's upside. But. It's. Risky. OK?

HRT Has a Partner!

So what's the news? Why did I ask if you're sitting down? Why am I nearly ecstatic? Why am I revisiting the painful moments of the past? Because HRT just announced a deal to partner up with a key player in the international exploration biz -- Galp Energia of Portugal.

Galp will participate in drilling three of the four wells offshore Namibia, essentially covering HRT's costs (up to an as yet undisclosed cap), for a participation share of 14%. I believe that this is a FABULOUS deal, as I'll explain in a moment.

First, let me address something that may be coursing through your brain. Why Galp? Portugal-listed Galp has a market capitalization of about $12.5 billion. Galp isn't a huge oil company as oil companies go. Galp is far from oil giants like Exxon Mobil, Chevron, Shell (RDS-B: NYSE) or Total (TOT: NYSE). But don't be fooled by size.

The big guys ALL had a chance to review the HRT data. Over 30 oil companies -- including virtually all of the household names -- signed confidentiality agreements and reviewed HRT's Namibian play. Many of them offered terms to HRT for a partnership agreement. Galp offered the best deal for HRT and its shareholders. So that's why Galp is the partner.

Let's Look at Galp

Galp works in and around the Iberian peninsula -- Portugal and Spain -- as befits its home base of Lisbon. Galp also operates in what I characterize as the "gold coasts" of Southern Hemisphere energy frontiers.

Start with offshore Brazil -- not too shabby, eh? -- where Galp was a partner with Petrobras in that above-mentioned initial Tupi pre-salt discovery just a few years ago. Impressive, yes? Right place, right time, no? Then again, there are no accidents, comrades. Corporately, Galp understood how to be exactly in the right place at the right time.

Galp also operates offshore Venezuela and Uruguay, in South America. Uruguay? That's mighty intriguing, especially considering the plate tectonics that may have emplaced more of that pre-salt and oil offshore, directly across from... you guessed it... Namibia.

Right now, in Africa, Galp operates offshore Angola, Cape Verde, Guinea-Bissau, Equatorial Guinea, Gambia and -- as of late -- in the stunning new hydrocarbon province that just opened up offshore Mozambique.

Galp seems to have a knack for being where drilling rigs find oil. Funny how that works. And with the HRT tie-up, Galp is now moving into Namibia. It's meaningful.

The Portuguese Connection

What else can we make of Galp? It's fair to say that Galp is a fast-growing company with a keen eye for making success happen. Galp goes where other companies have not accomplished anything or took too long to recognize opportunity. In fact, Galp has strapped into exploration risk in new frontiers unlike just about any other company in its peer group.

In terms of exploration, Galp goes where many larger firms (aka "Big Oil") fear to tread. Actually, the big guys kind of like it when small players like Galp find that first oil with some crazy, super-risky, off-the-wall wildcat well.

The big company guys hate to explain to Wall Street and London analysts why they took a risk in some Godforsaken frontier in lower south Succotash and drilled a few dry holes. The big guys leave such things to the Galps of the world. Then later, they come in and piggyback on someone else's success.

Oh, and Galp is just now starting to see the rewards that come with its astonishing exploration success. So here are a few take-aways respecting HRT's deal with Galp:

Galp is paying a large chunk of the upfront drilling expenses for three (out of four) offshore wells. It's excellent risk sharing by the HRT team. The financial arrangement allows HRT to husband its cash for other things -- like continuing with developments in the Solimoes Basin of Brazil. All for a modest 14% share of the three Namibian concessions to Galp, which leaves 86% for HRT -- a lot still on the table

Galp is "small" enough that there's a low probability of the Portuguese company trying to overwhelm HRT -- as if Marcio & Co. can be overwhelmed. Still, the Galp relationship means that the HRT Namibia wells will receive top-level management attention at every stage. Yet Galp is also large enough to have deep pockets and lots of deep-water experience, so both the money and the bench of manpower are there

Galp has established a remarkable, respectable niche in deep-water exploration for frontier plays in the Southern Hemisphere, certainly with big boy Petrobras and in the Brazilian pre-salt. That is, Galp can work with big-time oil companies, deal with South American and African governments and generally play at the varsity level in the oil biz. So this is a deal that's already turning heads! Indeed, one of my Big Oil contacts emailed me last night, "I never saw this coming" -- which he meant as a high compliment

Galp is well acquainted with the technical challenges of deep-water exploration and development. Indeed, Galp's geological approach to deep-water exploration appears to jive to an astonishing degree with what we've seen from Marcio over the years. Maybe it's something in the Portuguese-speaking mindset?

Fantastic News!

As I said at the beginning of this note, the Galp tie-up is fantastic news! It's a key development for HRT. The Galp partnership -- and the third-party funding it brings to the table -- adds an entire layer of legitimacy (and "other peoples' money") to everything that HRT has accomplished.

Let's do some blue-sky math. Let's say that a three-well commitment obligates Galp for $200 million -- which is my raw speculation, because I do NOT have any information from HRT about exact numbers. Right now, the details of the HRT-Galp deal are proprietary.

In return for teaming with HRT, Galp is getting 14% of the play, or about one-seventh of three concessions.

So hypothetically, the "value" of this Namibian play is seven times $200 million, or $1.4 billion for the three-well program. And that doesn't include the fourth well, yet to come. Plus, it doesn't include any value for the spectacular natural gas finds that HRT has in Solimoes, in Brazil. Oh, by the way, the deal will be worth a LOT more in the event that HRT-Galp finds oil!

Meanwhile, HRT has a market cap of about $600 million, considering the Brazilian and Canadian share structure. So as of the close of business on Monday, HRT is "undervalued" by about half.

These are just speculative, arm-waving numbers, remember! But all of this ought to get you thinking about the size of that risk-reward play for HRT. Right now, the HRT Canadian-traded shares are dramatically undervalued, if you put any faith at all into the Galp deal.

And yes, HRT-Galp still must still drill wells and find oil. That's hard, not easy. So there's plenty of risk in this endeavor. Despite my evident enthusiasm, I must still offer the entire array of cautions. Consider yourself warned!

But if you're game to risk investment cash on an oil play with all the right moving parts and a huge upside? This is your chance to make a play with HRT. Take some money that you can "afford to lose," as the saying goes, and perhaps the return from HRT could change your life.

One of the Great Energy Plays of Our Time

Looking ahead, when those Namibian wells go down, we're about to witness one of the great energy plays of our time. Namibia -- with a coastline longer than that of California -- is about to test key areas of its offshore oil frontier. We're looking for a Brazil-style, pre-salt analogue. Is there oil and gas out there? Hey, we're going to find out in the first half of 2013, and it could be really, really big.

This kind of news makes my day. Heck, it makes my week! Maybe I'll just take the rest of the month off! Voy de vacaciones, eh? Actually, I have other commitments, and I'll fill you in about everything later on. 'Cuz I'm going down to Texas for a spell.

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Zum Jahresanfang 2013 schloss die NEBENBÖRSE TORONTO mit nachstehenden Daten:

1.28 CAD = 0,985 € = Plus 1,59 % (zum Handelsvortag)= Volumen 123.923 shares

Happy New Year all!!

Ein wichtiges Jahr für HRT, könnte ein gamechanger-Jahr sein, vom Explorer zum Producer in Brazil und "unser" CEO Marcio Mello versucht seine Milliarden-Barrel-Funde mit PB offshore Brazil in offshore Namibia mit HRT zu wiederholen, den RIG ,die Transocean Marianas, haben wir bis NOV/DEZ und sie sollte am 22/01 im Walvis port sein zur Inspektion, das Team folgt eine Woche später

http://ports.co.za/shipmovements/walvisbay/walvis_bay_2012_1…

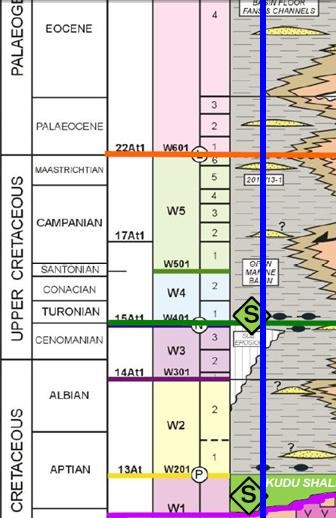

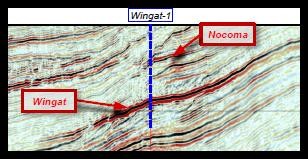

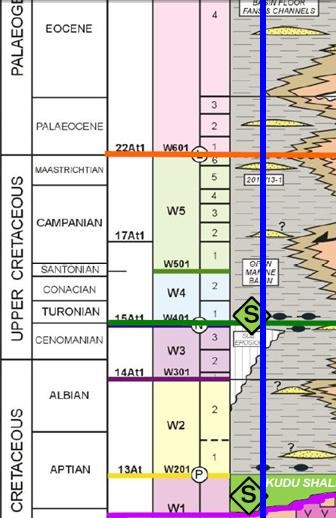

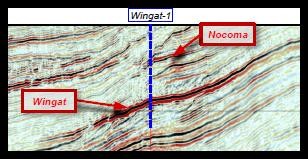

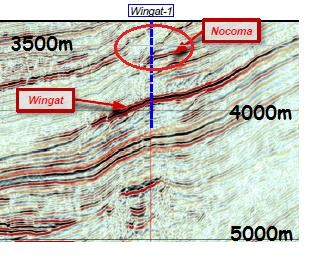

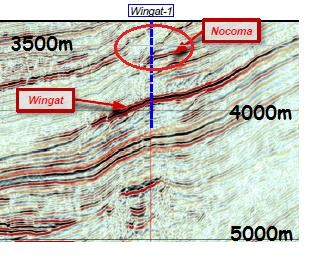

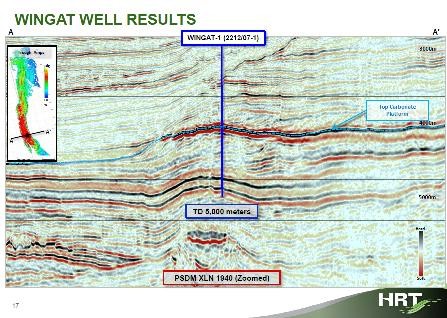

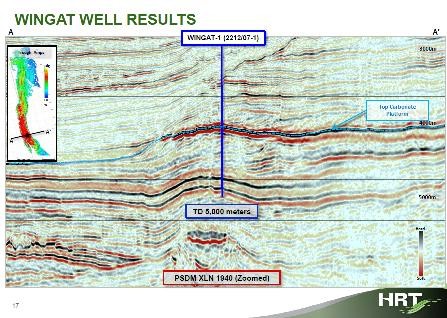

und dann Bohrbeginn vom Wingat-Prospect wahrscheinlich Mitte Februar in den Central Blocks, wird ein spannendes Jahr!!!

, kurzfristig bis Bohrbeginn könnten ein weiteres Farm-out in Namibia bzw. die genauen Konditionen dazu einen Driver für den SharePrice darstellen, die von B.K. erwähnten potentiellen 200mio$ von Galp sind meiner Meinung nach nicht realistisch, eher 80-120mio$ für die 14% der entsprechenden Lizenzen, mit einem oder zwei weiteren Partnern könnte dann das gesamte Drilling Program free carried sein...

DRILL BABY DRILL

GLA

Ein wichtiges Jahr für HRT, könnte ein gamechanger-Jahr sein, vom Explorer zum Producer in Brazil und "unser" CEO Marcio Mello versucht seine Milliarden-Barrel-Funde mit PB offshore Brazil in offshore Namibia mit HRT zu wiederholen, den RIG ,die Transocean Marianas, haben wir bis NOV/DEZ und sie sollte am 22/01 im Walvis port sein zur Inspektion, das Team folgt eine Woche später

http://ports.co.za/shipmovements/walvisbay/walvis_bay_2012_1…

und dann Bohrbeginn vom Wingat-Prospect wahrscheinlich Mitte Februar in den Central Blocks, wird ein spannendes Jahr!!!

, kurzfristig bis Bohrbeginn könnten ein weiteres Farm-out in Namibia bzw. die genauen Konditionen dazu einen Driver für den SharePrice darstellen, die von B.K. erwähnten potentiellen 200mio$ von Galp sind meiner Meinung nach nicht realistisch, eher 80-120mio$ für die 14% der entsprechenden Lizenzen, mit einem oder zwei weiteren Partnern könnte dann das gesamte Drilling Program free carried sein...

DRILL BABY DRILL

GLA

[/url]

[/url]Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO lauten:

1.31 CAD = 1,01 € = Plus 2,34 % (zum Handelsvortag) = Volumen 172.116 shares

Hier die aktuelle Vorgabe von der HEIMATBÖRSE São Paulo:

http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3

HRT-REALTIME-Chart/Kurse von der HEIMATBÖRSE São Paulo:

- selbst aktualisierend - (REAIS-BR)

Ibovespa (Bras.-INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=IBOV

Und demnach das aktuelle Ergebnis von der NEBENBÖRSE TORONTO.

http://de.advfn.com/p.php?pid=qkquote&btn=s_ok&qkbtn=&qksymb…

HRT-REALTIME-Chart/Kurse von der Nebenbörse TORONTO:

- selbst aktualisierend - (CAD)

S&P TSX Composite (Kanad. INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=T^OSPTX

laut google finance haben die HRT-GDRs im moment eine MK von 8.42 Milliarden CAD....

http://www.google.com/finance?q=CVE%3AHRP&ei=6RLnUIihAuaCwAO…

Die zugrundeliegenden "Orginalaktien" haben eine MK von 0,768 Milliarden CAD, für jede 2 GDRs muß eine HRTorginal gekauft bzw verkauft werden

http://www.google.com/finance?q=CVE%3AHRP&ei=6RLnUIihAuaCwAO…

Die zugrundeliegenden "Orginalaktien" haben eine MK von 0,768 Milliarden CAD, für jede 2 GDRs muß eine HRTorginal gekauft bzw verkauft werden

...bei ADVFN liegt man auch falsch,

dort multiplizieren sie die 294.3 mio Orginalaktien aus Brazil mit den Shareprice der GDRs (1,31)in Canada = vollkommener Schwachsinn und bei ihnen dann 400,3 mio CAD

in Wahrheit liegt die MK bei 294.3 mio Shares * 5,4 BRL = 1.589,22 mio BRL

bzw. * 0,484 = 769,18248 mio CAD und für jede GDR besitzen wir 1/2 HRTorg....

dort multiplizieren sie die 294.3 mio Orginalaktien aus Brazil mit den Shareprice der GDRs (1,31)in Canada = vollkommener Schwachsinn und bei ihnen dann 400,3 mio CAD

in Wahrheit liegt die MK bei 294.3 mio Shares * 5,4 BRL = 1.589,22 mio BRL

bzw. * 0,484 = 769,18248 mio CAD und für jede GDR besitzen wir 1/2 HRTorg....

sorry, link vergessen

http://de.advfn.com/p.php?pid=financials&symbol=TSXV%3AHRP

http://de.advfn.com/p.php?pid=financials&symbol=TSXV%3AHRP

Die heutigen-Schluss-Daten von der NEBENBÖRSE TORONTO nachstehend:

1.37 CAD = 1,061 € = Plus 4,68 % (zum Handelsvortag)= Volumen 383.963 shares

Antwort auf Beitrag Nr.: 43.984.373 von butzbutz am 04.01.13 22:32:25Schöner Anstieg bisher im neuen Jahr +15% in Brazil, ich denke im Dezember hat Mr. Tax-Selling ein wenig auf die Bremse gedrückt,...

Bei Stockhouse und Co wird über das kurzfristig anberaumte General Board Meeting am Montag (07/01/13) gemutmaßt,

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

User VanWilder1 sieht mögliche Gründe:

1. HRT10 - Major Oil Find. Duster or Gas would be a "non event"

2. Major Namibia Farmout proposal from a Major Player, ie.... Chevron, Exxon, BP

3. Proposal from a Major to Farmin to monetize the Solimos Gas.

4. Finalize Sale of Air Amazon. Coming to Deal ahead of time.

5. Vote on enacting shareholder Poison Pill - Block surprise Takeover Bid for HRT

6. Problems with Transocean Rig, Delay in Timetable

7. Problems with Namibia GOV'T. All Drilling at Risk.

8. Option to increase acerage in Frontier Regions, add to holdings. Doubtful.

9. Vote "yes" on Takeover Bid. Doubtful

...Meiner Meinung nach

1. hat man bei HRT-10 wie Anfang Dez berichtet eine Gas-Discovery, gäbe es weitere news dazu hätte man sie wie immer in einer NR rausgeschickt

2. Macht Sinn, darüber muß abgestimmt werden

3. Macht Sinn, darüber muß abgestimmt werden

4. Macht Sinn, darüber muß abgestimmt werden

5. Schwachsinn

6. Unwahrscheinlich imo

7. Schwachsinn

8. Macht Sinn, darüber muß abgestimmt werden

9. Never Ever zu diesem Zeitpunkt, Marcio und Co. haben bereits ähnliche Angebote von TNK-BP abgewiesen, "This is our dream"...

am ehesten geht es unter anderem um Punkt 2, ein weiteres Farm-Out in Namibia, auf weches wir alle warten, auch kurz vor dem Farm-In von Galp gab es ein Meeting mit folgenden Punkt:

Then, the Chairman of the Board of Directors, Mr. Marcio Rocha Mello, provided information about the progress of the Company’s activities, such as the activities related to the company’s assets in Namibia and the exploratory campaign in the Solimões Basin, among others; the Board of Directors unanimously decided to authorize the Company to proceed with the farm out negotiations involving certain Namibian assets, as per the proposal received from a new company.

Also drücken wir die Daumen für ein weiteres Farm-Out und damit hoffentlich ein möglichst free carried 3-4 wells drilling programme in Namibia, und das unser CEO Mr. Drill Deep Marcio Rocha Mello seine Erfolge in Offshore Brazil in Namibia wiederholen kann,

have a nice weekend all,

& GLA in 2013 !!!

Bei Stockhouse und Co wird über das kurzfristig anberaumte General Board Meeting am Montag (07/01/13) gemutmaßt,

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

User VanWilder1 sieht mögliche Gründe:

1. HRT10 - Major Oil Find. Duster or Gas would be a "non event"

2. Major Namibia Farmout proposal from a Major Player, ie.... Chevron, Exxon, BP

3. Proposal from a Major to Farmin to monetize the Solimos Gas.

4. Finalize Sale of Air Amazon. Coming to Deal ahead of time.

5. Vote on enacting shareholder Poison Pill - Block surprise Takeover Bid for HRT

6. Problems with Transocean Rig, Delay in Timetable

7. Problems with Namibia GOV'T. All Drilling at Risk.

8. Option to increase acerage in Frontier Regions, add to holdings. Doubtful.

9. Vote "yes" on Takeover Bid. Doubtful

...Meiner Meinung nach

1. hat man bei HRT-10 wie Anfang Dez berichtet eine Gas-Discovery, gäbe es weitere news dazu hätte man sie wie immer in einer NR rausgeschickt

2. Macht Sinn, darüber muß abgestimmt werden

3. Macht Sinn, darüber muß abgestimmt werden

4. Macht Sinn, darüber muß abgestimmt werden

5. Schwachsinn

6. Unwahrscheinlich imo

7. Schwachsinn

8. Macht Sinn, darüber muß abgestimmt werden

9. Never Ever zu diesem Zeitpunkt, Marcio und Co. haben bereits ähnliche Angebote von TNK-BP abgewiesen, "This is our dream"...

am ehesten geht es unter anderem um Punkt 2, ein weiteres Farm-Out in Namibia, auf weches wir alle warten, auch kurz vor dem Farm-In von Galp gab es ein Meeting mit folgenden Punkt:

Then, the Chairman of the Board of Directors, Mr. Marcio Rocha Mello, provided information about the progress of the Company’s activities, such as the activities related to the company’s assets in Namibia and the exploratory campaign in the Solimões Basin, among others; the Board of Directors unanimously decided to authorize the Company to proceed with the farm out negotiations involving certain Namibian assets, as per the proposal received from a new company.

Also drücken wir die Daumen für ein weiteres Farm-Out und damit hoffentlich ein möglichst free carried 3-4 wells drilling programme in Namibia, und das unser CEO Mr. Drill Deep Marcio Rocha Mello seine Erfolge in Offshore Brazil in Namibia wiederholen kann,

have a nice weekend all,

& GLA in 2013 !!!

Antwort auf Beitrag Nr.: 43.985.222 von Drill-a-Hill am 05.01.13 12:08:25

Gemäß unterer Grafik hat sich der gestrige SK mit 1.37 CAD erstmals wieder

nach längerer Zeit oberhalb vom GD 50 Tg. bei 1.34 C$ festgesetzt und damit

auch die Trendwende, nach dem Downtrend (schw.Linie) innerhalb des neuen

Uptrend-Kanals, voll bestätigt.

Diese positive Trendwende wurde durch den Dragonfly Doji mit posting # 517

vom 27.12.12 angekündigt und ist auch dieser charttechnischen Ankündigung zuzuordnen.

Dadurch dürfte der durch den MACD auch bestätigte positive Aufwärtstrend

weiterhin Bestand haben (s.leichte blaue Linien zum Uptrend)

Gemäß unterer Grafik hat sich der gestrige SK mit 1.37 CAD erstmals wieder

nach längerer Zeit oberhalb vom GD 50 Tg. bei 1.34 C$ festgesetzt und damit

auch die Trendwende, nach dem Downtrend (schw.Linie) innerhalb des neuen

Uptrend-Kanals, voll bestätigt.

Diese positive Trendwende wurde durch den Dragonfly Doji mit posting # 517

vom 27.12.12 angekündigt und ist auch dieser charttechnischen Ankündigung zuzuordnen.

Dadurch dürfte der durch den MACD auch bestätigte positive Aufwärtstrend

weiterhin Bestand haben (s.leichte blaue Linien zum Uptrend)

schaut weiterhin gut aus :-)

Alles aktuell digitales von der HEIMATBÖRSE São Paulo:

http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3" target="_blank" rel="nofollow ugc noopener">http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3

Die heutigen-Schluss-Daten von der NEBENBÖRSE TORONTO nachstehend:

1.45 CAD = 1,121 € = Plus 5,84 % (zum Handelsvortag)= Volumen 464.204 shares

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.45 CAD = 1,121 € = Plus 5,84 % (zum Handelsvortag)= Volumen 464.204 shares

MINUTES OF BOARD OF DIRECTORS’ MEETING NO. 01/2013 HELD ON JANUARY 07, 2013

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

(a) Reject the materials received for the acquisition of equity interests;

(b) Approve the granting by the subsidiary HRT África of a bank guarantee in favor of Manica Group Namibia (PTY) Ltd.;

(c) Authorize Board member Wagner Elias Peres to conduct the negotiations with respect to the Farm Down of assets in Namibia; and

(d) Register that the documents based on which the above resolutions were approved have been examined by the Board members, were certified by the Presiding Officers and will be filed at the Company’s headquarters.

Sieht so aus als ginge es mit Peres, CEO HRT America in Houston Texas, in die finale Phase des farm-outs, würde mich nicht wundern wenn wir einen amerikanischen Partner gewinnen...

GLA

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

(a) Reject the materials received for the acquisition of equity interests;

(b) Approve the granting by the subsidiary HRT África of a bank guarantee in favor of Manica Group Namibia (PTY) Ltd.;

(c) Authorize Board member Wagner Elias Peres to conduct the negotiations with respect to the Farm Down of assets in Namibia; and

(d) Register that the documents based on which the above resolutions were approved have been examined by the Board members, were certified by the Presiding Officers and will be filed at the Company’s headquarters.

Sieht so aus als ginge es mit Peres, CEO HRT America in Houston Texas, in die finale Phase des farm-outs, würde mich nicht wundern wenn wir einen amerikanischen Partner gewinnen...

GLA

HRT falls after approval of new farm out in Namibia

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

Already in the oil sector, the shares of HRT ( HRTP3 ) operating in strong decline of 6.55%, to R $ 5.28, giving back some of the gains reported in recent days.

The fall repercurte the minutes of the Board meeting of the company held last Monday (7). In the minutes of the meeting, the main highlight is the confirmation of negotiations farm out - sale of interest - the exploration well in Namibia. "HRT had already signaled a change in the rules for sale of assets of the site as a way to reduce the risks of the operation," said Roberto Altenhofen analyst Empiricus Research.

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

Already in the oil sector, the shares of HRT ( HRTP3 ) operating in strong decline of 6.55%, to R $ 5.28, giving back some of the gains reported in recent days.

The fall repercurte the minutes of the Board meeting of the company held last Monday (7). In the minutes of the meeting, the main highlight is the confirmation of negotiations farm out - sale of interest - the exploration well in Namibia. "HRT had already signaled a change in the rules for sale of assets of the site as a way to reduce the risks of the operation," said Roberto Altenhofen analyst Empiricus Research.

Nach dem Anstieg der letzten Tage von ca. 28 % kam es heute im Handelsverlauf

zu Gewinnmitnahmen und einem gleichzeitigen Eröffnungs-GAP. Der bisherige

Trend ( schw.blaue Linien) innerhalb des neuen Uptrend-Kanals blieben davon

unberührt.

Die heutigen Schlussdaten lauten:

1.27 CAD = 0,984 € = Minus 12,41 % (zum Handelsvortag)= Volumen 785.632 shares

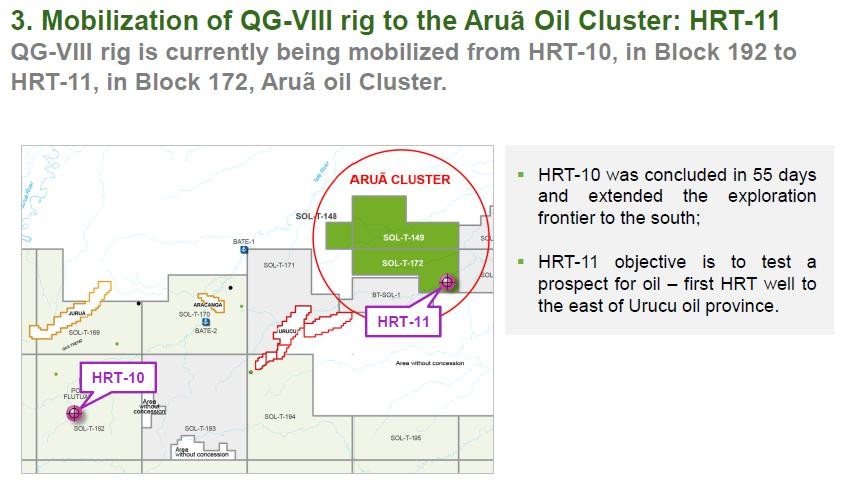

HRT Concludes Drill Stem Test of Well 1-HRT-10-AM, in the Solimões Basin

http://www.newswire.ca/en/story/1096675/hrt-concludes-drill-…

http://www.newswire.ca/en/story/1096675/hrt-concludes-drill-…

[/url]

[/url]Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO lauten:

1.29 CAD = 1,00 € = Plus 1,57% (zum Handelsvortag)= Volumen 312.889 shares

Morning,

2013 - Vom Explorer zum Produzenten??

HRT Jumps on Tests of Solimoes Potential: Sao Paulo Mover

http://www.bloomberg.com/news/2013-01-09/hrt-jumps-on-tests-…

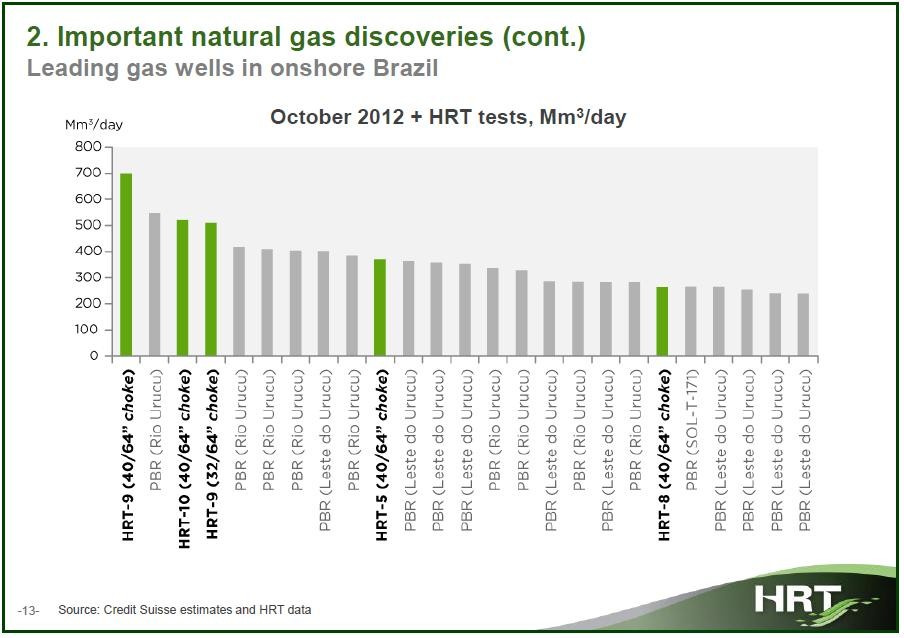

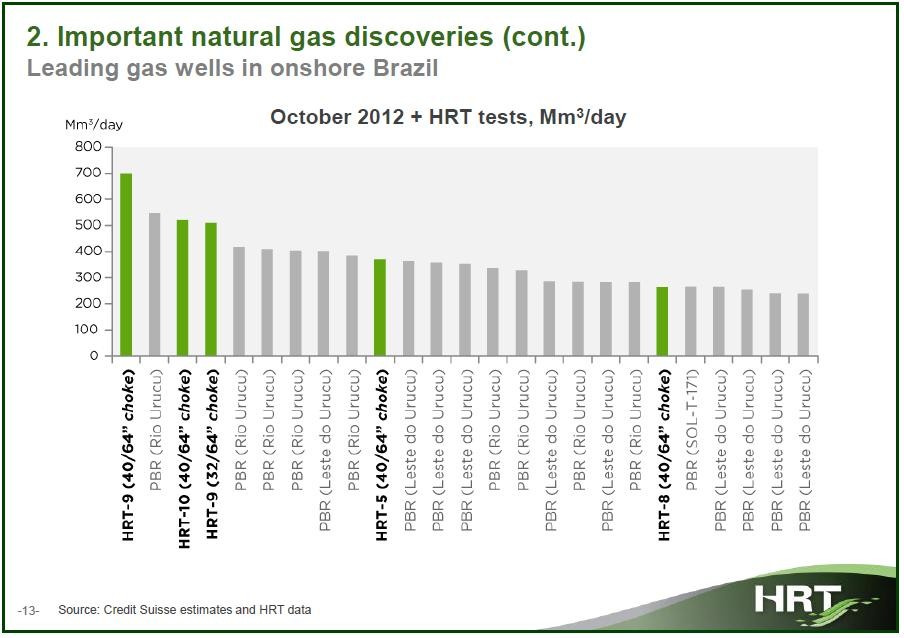

HRT proves Solimoes gas trend south of Jurua

http://www.ogj.com/articles/2013/01/hrt-proves-solimoes-gas-…

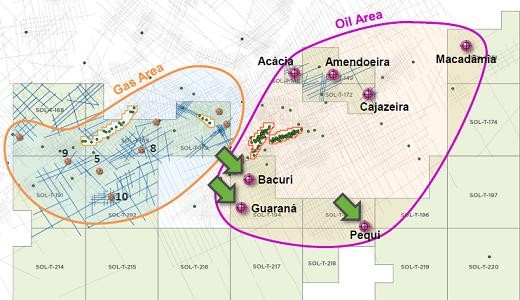

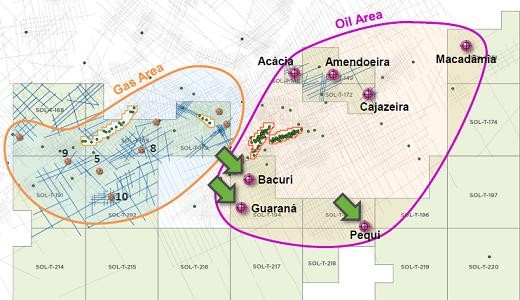

When combined with tests at the 1-HRT-5-AM and 1-HRT-9-AM, the results confirm the gas trend to the south and the potential for gas on SOL-T-191 and the SOL-T-192 block to its west. The results also open an exploratory play fairway for the SOL-T-214, SOL-T-215, and SOL-T-216 blocks, south of SOL-T-191. HRT has identified several exploratory prospects on those three blocks.

“The presence of a richer liquid bearing gas-condensate identified in the DSTs in a relatively underexplored area of the basin, reinforces the geological model interpreted for the area, and consolidates the potential for gas in the region and supports the gas monetization project,” HRT said.

The company set a six-month timeline beginning in January for jointly developing gas fields in the Solimoes Basin along with the state-controlled Brazilian oil company Petroleo Brasileiro SA (PBR) and TNK-BP Ltd. During that period, they will do an evaluation of the resources to be extracted and conduct engineering, environmental and logistics studies on how to bring gas to market.

GLA

2013 - Vom Explorer zum Produzenten??

HRT Jumps on Tests of Solimoes Potential: Sao Paulo Mover

http://www.bloomberg.com/news/2013-01-09/hrt-jumps-on-tests-…

HRT proves Solimoes gas trend south of Jurua

http://www.ogj.com/articles/2013/01/hrt-proves-solimoes-gas-…

When combined with tests at the 1-HRT-5-AM and 1-HRT-9-AM, the results confirm the gas trend to the south and the potential for gas on SOL-T-191 and the SOL-T-192 block to its west. The results also open an exploratory play fairway for the SOL-T-214, SOL-T-215, and SOL-T-216 blocks, south of SOL-T-191. HRT has identified several exploratory prospects on those three blocks.

“The presence of a richer liquid bearing gas-condensate identified in the DSTs in a relatively underexplored area of the basin, reinforces the geological model interpreted for the area, and consolidates the potential for gas in the region and supports the gas monetization project,” HRT said.

The company set a six-month timeline beginning in January for jointly developing gas fields in the Solimoes Basin along with the state-controlled Brazilian oil company Petroleo Brasileiro SA (PBR) and TNK-BP Ltd. During that period, they will do an evaluation of the resources to be extracted and conduct engineering, environmental and logistics studies on how to bring gas to market.

GLA

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO lauten:

1.28 CAD = 0,98 € = Minus 0,78 % (zum Handelsvortag)= Volumen 55.881 shares

Die NEBENBÖRSE TORONTO vermeldet nach Handelsschluss nachstehende Schlussdaten:

1.30 CAD = 1,00 € = Plus 1,56 % (zum Handelsvortag)= Volumen 232.404 shares

Mit dem heutigen SK von 1.30 CAD verblieb zum Wochenende alles im bisherigen

neuen Uptrend !

11 January 2013 23:57 GMT

.

Petrobras said late Friday it had created a programme to scope out the potential of Brazil’s conventional and unconventional onshore gas.

The programme, dubbed Pron-Gas, will look to assess the economic potential of oil and gas in the nation's sedimentary basins, with an eye towards nitrogen fertiliser production and other energy needs for the nation's agribusiness sector, the state-run Brazil company said.

The initiative will work with the company's exploration & production as well as power units, in addition to "third-party technologies currently used in onshore activities."

The comments come as Brazil confronts a hydroelectric power shortage.

Last October Petrobras signed an agreement with independent HRT to evaluate "monetisation" possibilities for natural gas indications discovered in Brazil's remote Solimoes Basin.

http://www.upstreamonline.com/live/article1313813.ece

.

Petrobras said late Friday it had created a programme to scope out the potential of Brazil’s conventional and unconventional onshore gas.

The programme, dubbed Pron-Gas, will look to assess the economic potential of oil and gas in the nation's sedimentary basins, with an eye towards nitrogen fertiliser production and other energy needs for the nation's agribusiness sector, the state-run Brazil company said.

The initiative will work with the company's exploration & production as well as power units, in addition to "third-party technologies currently used in onshore activities."

The comments come as Brazil confronts a hydroelectric power shortage.

Last October Petrobras signed an agreement with independent HRT to evaluate "monetisation" possibilities for natural gas indications discovered in Brazil's remote Solimoes Basin.

http://www.upstreamonline.com/live/article1313813.ece

Antwort auf Beitrag Nr.: 44.021.428 von butzbutz am 14.01.13 23:17:03Update - Walvis Bay Ship Movements

http://ports.co.za/shipmovements/walvisbay/walvis_bay_2013_0…

-Ships due in port on following dates-

31/01/13 Transocean Marianas

little time for 2nd Farmout....

GLA

http://ports.co.za/shipmovements/walvisbay/walvis_bay_2013_0…

-Ships due in port on following dates-

31/01/13 Transocean Marianas

little time for 2nd Farmout....

GLA

Antwort auf Beitrag Nr.: 44.022.393 von Drill-a-Hill am 15.01.13 10:17:44There she is

NEWS RELEASE

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&tipo=3…

HRT ANNOUNCES THE RECEIPT OF TRANSOCEAN MARIANAS SEMI-SUBMERSIBLE RIG

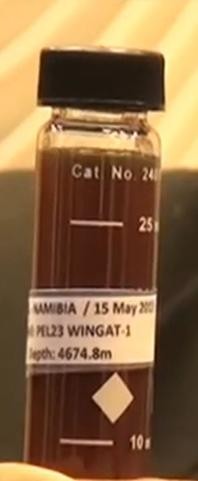

Rio de Janeiro, January 15th, 2013 - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that it has received the semi-submersible drilling-rig Transocean-Marianas from Transocean (NYSE: RIG), offshore Ghana, at zero hour of January 15th, 2013. The rig will be in transit to Namibian waters for the next three weeks and, then, she will undergo mandatory maintenance for the following 21 days, before starting HRT’s drilling campaign in Walvis and Orange sedimentary basins.

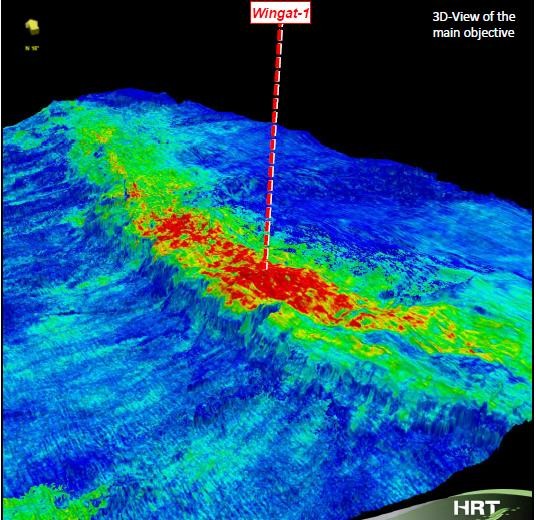

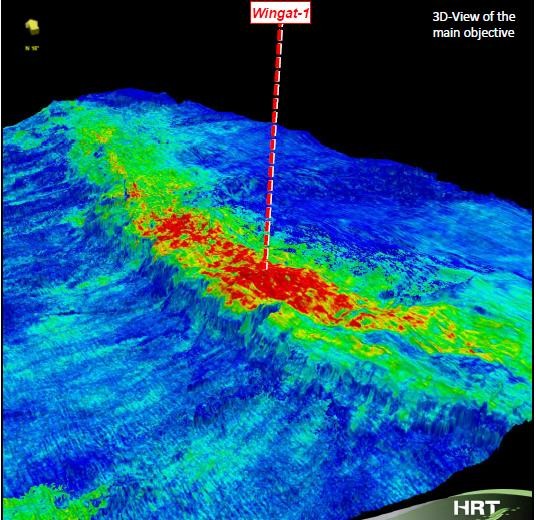

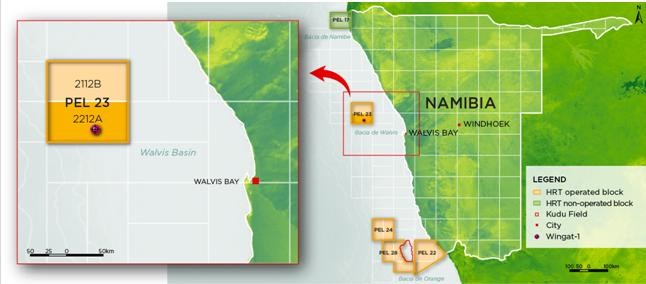

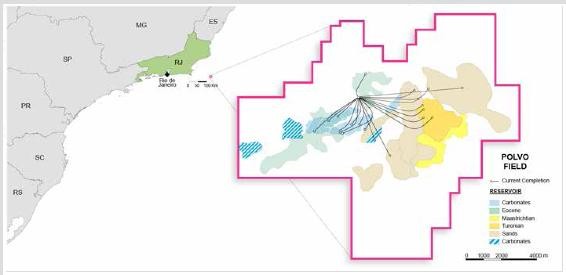

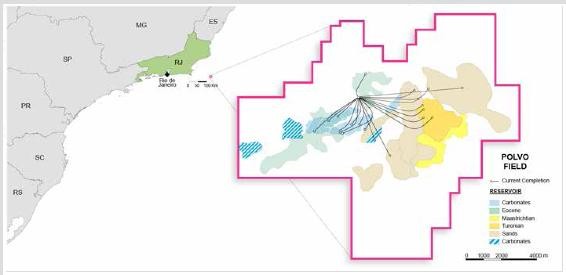

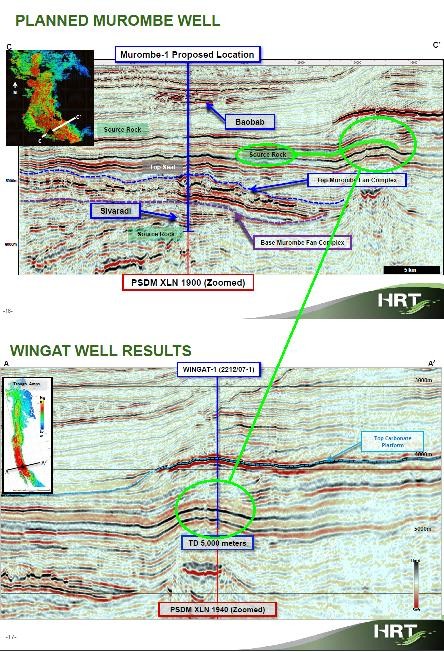

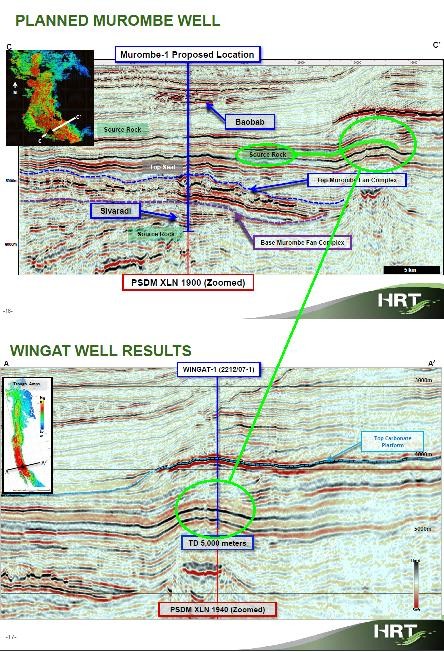

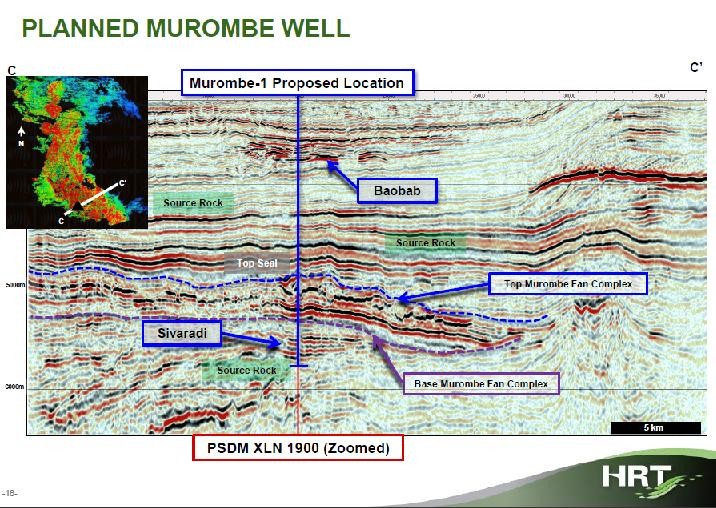

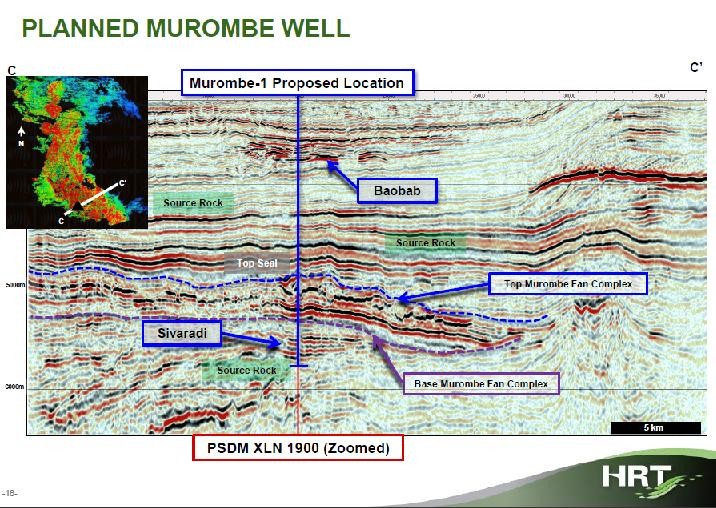

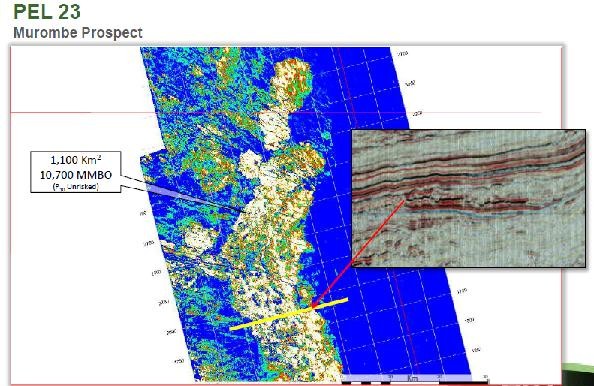

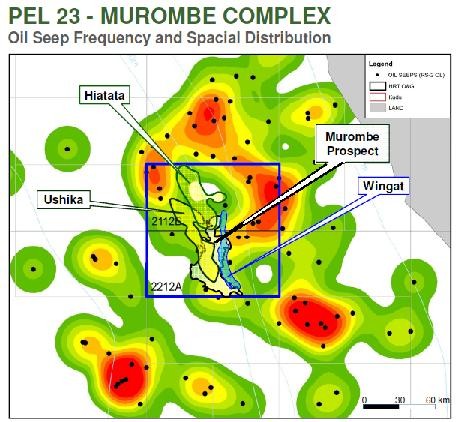

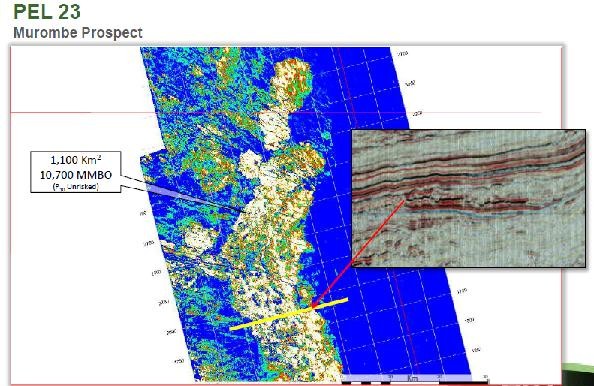

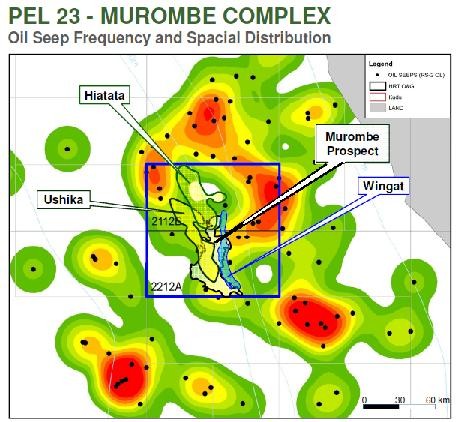

The Marianas is expected to be on location to start drilling the first well in Namibia, in the Wingat Prospect, in Walvis basin at HRT’s Petroleum Exploration License-23 (Pel-23) by the end of 1Q13. Wingat is located in 1,000-meter water depth and its drilling operations are expected to last approximately 60 days.

"The arrival of the Transocean-Marianas is excellent news for HRT and GALP. She is arriving within the planned timeframe to start one of the most expected and exciting drilling campaigns in Southern offshore West Africa", added the CEO, Marcio R. Mello.

NEWS RELEASE

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&tipo=3…

HRT ANNOUNCES THE RECEIPT OF TRANSOCEAN MARIANAS SEMI-SUBMERSIBLE RIG

Rio de Janeiro, January 15th, 2013 - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that it has received the semi-submersible drilling-rig Transocean-Marianas from Transocean (NYSE: RIG), offshore Ghana, at zero hour of January 15th, 2013. The rig will be in transit to Namibian waters for the next three weeks and, then, she will undergo mandatory maintenance for the following 21 days, before starting HRT’s drilling campaign in Walvis and Orange sedimentary basins.

The Marianas is expected to be on location to start drilling the first well in Namibia, in the Wingat Prospect, in Walvis basin at HRT’s Petroleum Exploration License-23 (Pel-23) by the end of 1Q13. Wingat is located in 1,000-meter water depth and its drilling operations are expected to last approximately 60 days.

"The arrival of the Transocean-Marianas is excellent news for HRT and GALP. She is arriving within the planned timeframe to start one of the most expected and exciting drilling campaigns in Southern offshore West Africa", added the CEO, Marcio R. Mello.

Antwort auf Beitrag Nr.: 44.023.858 von Drill-a-Hill am 15.01.13 14:42:20...möglicher Bohrbeginn nicht vor Anfang März, also noch genug Zeit weitere Partner zu finden...

GLA

GLA

mhhh.. ist die nachricht nicht gut? warum gehts dann so extrem runter?!?

Antwort auf Beitrag Nr.: 44.024.926 von Tomu am 15.01.13 18:02:54Die Nachricht ist gut, aber nicht wirklich überraschend, alles nach Plan soweit,...was ich mich schon seit längeren frage, ob sich Anfang des Jahres in Brazil ein GAP ergeben hat welches geschlossen werden will?

@butz, any thoughts?

@butz, any thoughts?

TRANSOCEAN MARIANAS

Position Recorded on:

2013-01-15T23:14:00 (UTC)

http://www.marinetraffic.com/ais/de/default.aspx?oldmmsi=538…

Position Recorded on:

2013-01-15T23:14:00 (UTC)

http://www.marinetraffic.com/ais/de/default.aspx?oldmmsi=538…

Board of Directors Meeting to resolve on: 01/22/2013

(a) Update on Namibia farm down;

(b) Update on Solimões farm down;

(c) Update of Solimoes gas monetization group;

(d) Update PAD Project of Solimoes Basin;

(e) IR Reset 2013;

(f) Approval of regiment and procedures for Technical Committee; e

(g) Matters of the Company’s general interest.

(2013 Corporate Events Calendar)

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

(a) Update on Namibia farm down;

(b) Update on Solimões farm down;

(c) Update of Solimoes gas monetization group;

(d) Update PAD Project of Solimoes Basin;

(e) IR Reset 2013;

(f) Approval of regiment and procedures for Technical Committee; e

(g) Matters of the Company’s general interest.

(2013 Corporate Events Calendar)

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

Antwort auf Beitrag Nr.: 44.025.081 von Drill-a-Hill am 15.01.13 18:32:08

Fortlaufende Kursentwicklung mit entsprechenden Daten und Charts

- digital - von Hrt Petroleo ON Chart (HRTP3)

http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3

Hi D-a-H

bei der Gelegenheit hab`ich gleich ein zweites GAP up open entdeckt,

siehe nachstehend, wobei nicht gesagt ist, dass beide geschlossen

werden. Die TA spricht von 80 - 85 % Rate closed!

So long butz und Grüße

Fortlaufende Kursentwicklung mit entsprechenden Daten und Charts

- digital - von Hrt Petroleo ON Chart (HRTP3)

http://de.advfn.com/p.php?pid=qkchart&symbol=BOV^HRTP3

Hi D-a-H

bei der Gelegenheit hab`ich gleich ein zweites GAP up open entdeckt,

siehe nachstehend, wobei nicht gesagt ist, dass beide geschlossen

werden. Die TA spricht von 80 - 85 % Rate closed!

So long butz und Grüße

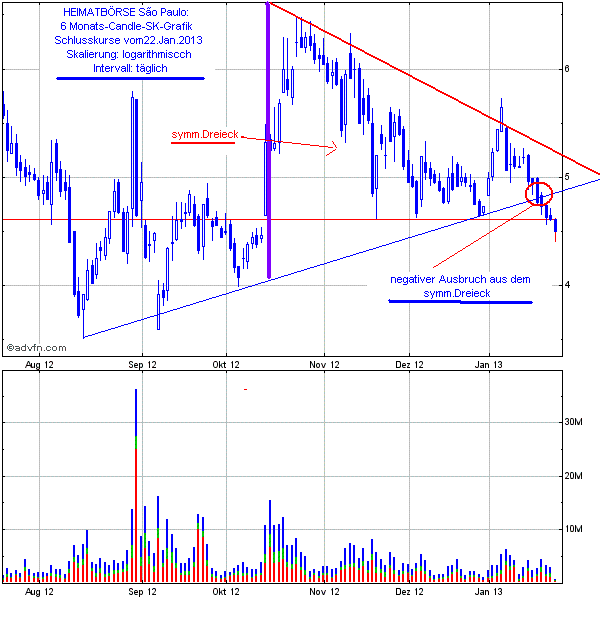

Nachstehend zwei Langfrist-Grafiken von der NEBENBÖRSE TORONTO,

aus denen sich ein gebildetes symm.Dreieck ersichtlich ist.

Der Kurs ist bereits in die äußerste Spitze hinein gelaufen und damit

steht eine Entscheidung kurz bevor!

[/url]

[/url]

Italian oil major Eni has proven the commerciality of an oil discovery off Ghana after an appraisal well hit a large amount of pay.

http://www.upstreamonline.com/live/article1314372.ece

..mit der Transocean Marianas die jetzt am Weg nach Namibia ist

GLA

http://www.upstreamonline.com/live/article1314372.ece

..mit der Transocean Marianas die jetzt am Weg nach Namibia ist

GLA

Die heutigen Schlussdaten von der NEBENBÖRSE TORONTO:

1.20 CAD = 0,910 € = Minus 2,44 % (zum Handelsvortag)= Volumen 241.011 shares

IMO: Solange nicht klar ist wie es um die Farm-outs in Namibia steht, steht der SP unter Druck, das Problem ist das man sich hier bis zum Spud-In von Wingat im März Zeit lassen könnte/(wird?).

Es fehlt auch IMO eine Presentation im Vorfeld des Drillingprogramms um Investoren zu informieren, aber so lange nicht das 2te Farmout erledigt ist wird man sich leider nicht in die Karten schauen lassen.

Und wie schon gesagt ein bekannter Major als Partner könnt das Interesse drastisch erhöhen,...

come on HRT give us something...

Es fehlt auch IMO eine Presentation im Vorfeld des Drillingprogramms um Investoren zu informieren, aber so lange nicht das 2te Farmout erledigt ist wird man sich leider nicht in die Karten schauen lassen.

Und wie schon gesagt ein bekannter Major als Partner könnt das Interesse drastisch erhöhen,...

come on HRT give us something...

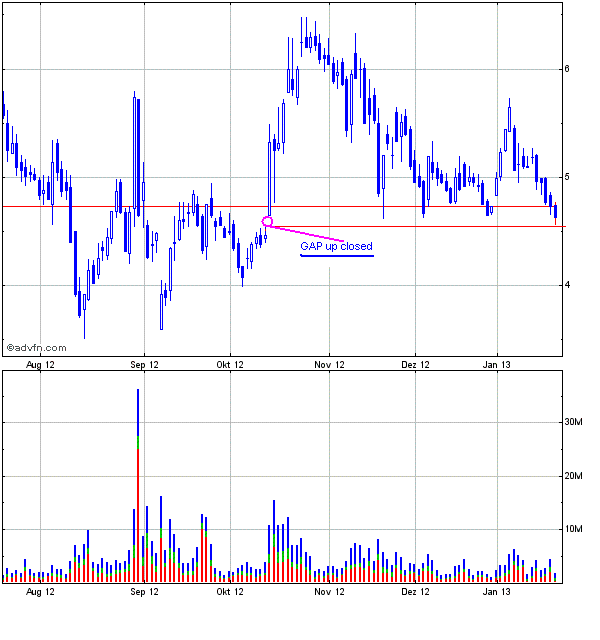

Antwort auf Beitrag Nr.: 44.037.288 von Drill-a-Hill am 18.01.13 13:33:54GAP CLOSED...

6-Monats-Candle-Verlaufs-Chart-HEIMATBÖRSE São Paulo:

- selbst aktualisierend -

Danach ist das GAP up vom Okt.12 noch offen

Antwort auf Beitrag Nr.: 44.037.676 von butzbutz am 18.01.13 14:58:17Hi butzbutz,

der gehört doch zu den 15% die nicht geschlossen werden...

just kidding...

Sieht für mich so aus als hätte sich ein Boden genau über dem gap vom 12.okt gebildet, gibt der vielleicht eine mögliche Unterstützung?

der gehört doch zu den 15% die nicht geschlossen werden...

just kidding...

Sieht für mich so aus als hätte sich ein Boden genau über dem gap vom 12.okt gebildet, gibt der vielleicht eine mögliche Unterstützung?

HRT-REALTIME-Chart/Kurse von der HEIMATBÖRSE São Paulo:

- selbst aktualisierend - (REAIS-BR)

Ibovespa (Bras.-INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=IBOV

HRT-REALTIME-Chart/Kurse von der Nebenbörse TORONTO:

- selbst aktualisierend - (CAD)

S&P TSX Composite (Kanad. INDEX)

http://de.advfn.com/p.php?pid=qkchart&symbol=T^OSPTX

Oil exploration is also big news up the west coast of Africa.

http://www.bdlive.co.za/businesstimes/2013/01/20/oil-rich-co…

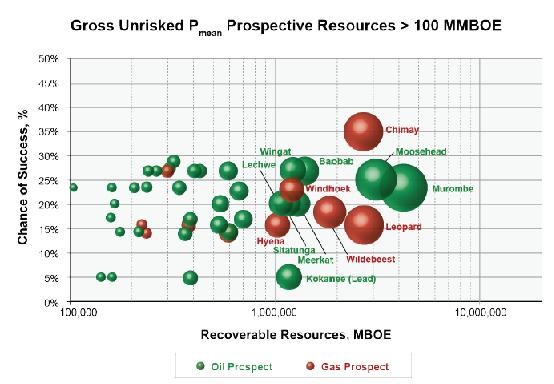

Global experts are betting there are about 75-billion barrels of untapped oil worth about $7.5-trillion in this geological zone, a possibility that would have significant implications for Namibia - and rest of the SADC region - within the next four to five years.

7.000.000.000.000 $.$$$.$$$.$$$.$$$

http://www.bdlive.co.za/businesstimes/2013/01/20/oil-rich-co…

Global experts are betting there are about 75-billion barrels of untapped oil worth about $7.5-trillion in this geological zone, a possibility that would have significant implications for Namibia - and rest of the SADC region - within the next four to five years.

7.000.000.000.000 $.$$$.$$$.$$$.$$$

Das Oktober-GAP up wurde soeben geschlossen.

Noch mal zur Erinnerung für morgen, nachdem der letzte GAP geschlossen wurde, möglicherweise wieder die Trendwende, Good Luck All:

Zitat von Drill-a-Hill: Board of Directors Meeting to resolve on: 01/22/2013

(a) Update on Namibia farm down;

(b) Update on Solimões farm down;

(c) Update of Solimoes gas monetization group;

(d) Update PAD Project of Solimoes Basin;

(e) IR Reset 2013;

(f) Approval of regiment and procedures for Technical Committee; e

(g) Matters of the Company’s general interest.

(2013 Corporate Events Calendar)

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

Antwort auf Beitrag Nr.: 44.046.115 von Drill-a-Hill am 21.01.13 19:20:07I have a feeling...

> 5CAD heute

> 6CAD februar

> 7CAD spud-in wingat

mögliche kurzfristige SharePrice-Driver:

Daten zu farmout in Namibia mit neuem Major als Partner;

Petrobras farm-in Solimoes mit Plan zur Gas Monetization;

Detailierte Presentation zum 280-tägigen Drillingplan in Namibia;

alles nur Vermutungen, time will tell...

GLA

> 5CAD heute

> 6CAD februar

> 7CAD spud-in wingat

mögliche kurzfristige SharePrice-Driver:

Daten zu farmout in Namibia mit neuem Major als Partner;

Petrobras farm-in Solimoes mit Plan zur Gas Monetization;

Detailierte Presentation zum 280-tägigen Drillingplan in Namibia;

alles nur Vermutungen, time will tell...

GLA

Antwort auf Beitrag Nr.: 44.048.575 von Drill-a-Hill am 22.01.13 13:00:28Offshore Brazil???

Private Equity Hunts for Brazil’s Next Big Oil Startup

http://www.bloomberg.com/news/2013-01-22/private-equity-hunt…

...HRT are studying the blocks up for auction and declined to comment on the need for additional financing

Private Equity Hunts for Brazil’s Next Big Oil Startup

http://www.bloomberg.com/news/2013-01-22/private-equity-hunt…

...HRT are studying the blocks up for auction and declined to comment on the need for additional financing

Hi Drill-a-Hil

Ich hoffe, Dein feeling ist stark, ausgeprägt und so zielbewußt und ich habe

`mal zur momentanen Situation, nach meinem posting # 558 vom 17.01. zur

Frage der anstehenden Entscheidung (symm.Dreieck) zwei Grafiken, wie nachstehend, angefertigt:

siehe selbst, der Markt sieht es im Moment charttechnisch nicht so

euphorisch, negativer Ausbruch aus symm.Dreieck, allerdings noch nicht

signifikant. Außerdem handelt es sich hier um einen Explorer und eine

pos. News-Release stellt hier charttechnisch alles auf den Kopf!

Also, time will tell

so long butz und Grüße

Zitat von Drill-a-Hill: I have a feeling...

> 5CAD heute

> 6CAD februar

> 7CAD spud-in wingat

mögliche kurzfristige SharePrice-Driver:

Daten zu farmout in Namibia mit neuem Major als Partner;

Petrobras farm-in Solimoes mit Plan zur Gas Monetization;

Detailierte Presentation zum 280-tägigen Drillingplan in Namibia;

alles nur Vermutungen, time will tell...

GLA

Hi butzbutz,

sorry ich meinte nätürlich BRL nicht CAD

für die GDRs dann

>1.25 CAD

>1.50 CAD

>1.75 CAD

in Brazil, wo ja das größte Volumen gehandelt wird, scheint es charttechnisch anders auszusehen, wenn auch nicht unbedingt besser...

Schönen Tag noch,

DaH

Antwort auf Beitrag Nr.: 44.048.893 von Drill-a-Hill am 22.01.13 14:08:58Bisher wurden die minutes immer noch Tag-gleich rausgeschickt-gestern kam leider nichts mehr,

"Submission of the minutes of the Board of Directors’ Meeting to BM&FBOVESPA 01/22/2013"

, möglicherweise wurden Kurs-sensible Entscheidungen getroffen und wir können bald mit einer BOOOOM-DAY-NEWS-RELEASE rechnen?!

GLA

GLA

"Submission of the minutes of the Board of Directors’ Meeting to BM&FBOVESPA 01/22/2013"

, möglicherweise wurden Kurs-sensible Entscheidungen getroffen und wir können bald mit einer BOOOOM-DAY-NEWS-RELEASE rechnen?!

GLA

GLA

Es lauern aber auch überall Schnäppchen!

L234

L234

oh-ooh...

4,4 BRL not good

4,4 BRL not good

DaH, hier die nachweisliche Vorgabe von der HEIMATBÖRSE São Paulo, der

Markt sieht es wie in TORONTO noch negativ, auch hier der Ausbruch

aus dem symm.Dreieck.

So long butz und Grüße

Markt sieht es wie in TORONTO noch negativ, auch hier der Ausbruch

aus dem symm.Dreieck.

So long butz und Grüße

Antwort auf Beitrag Nr.: 44.053.820 von butzbutz am 23.01.13 14:04:36Minutes of the Board of Directors’ Meeting held on January 22, 2013*

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

nur auf portugiesisch...

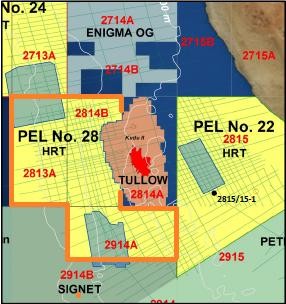

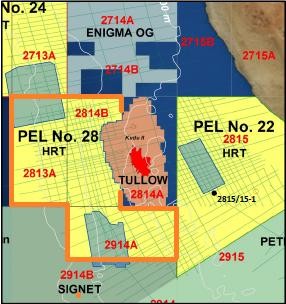

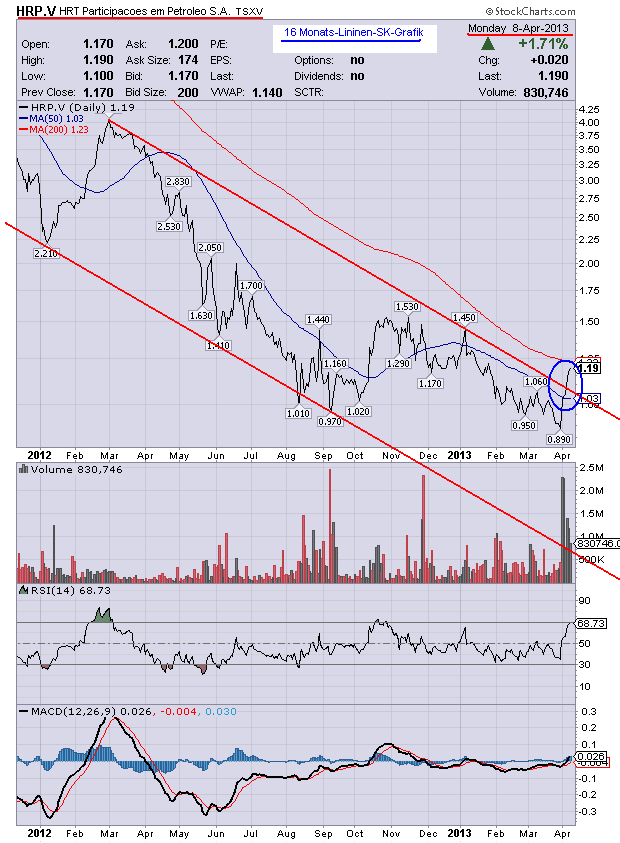

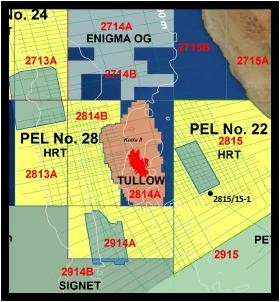

, The counselor Elias Wagner Peres presented to the other directors, to science, the current status of the ongoing negotiations on the farm down of assets in Namibia. Informed the other directors, have received new proposal involving the PEL. 28, which is being analyzed. The Board recommended that the results of this analysis are taken consideration at its next meeting.

Gute Nachricht, man will dieses Farmout, aber man nimmt sich dafür Zeit, weiterhin keine Details hierzu..

http://ir.hrt.com.br/hrt/web/conteudo_en.asp?idioma=1&conta=…

nur auf portugiesisch...

, The counselor Elias Wagner Peres presented to the other directors, to science, the current status of the ongoing negotiations on the farm down of assets in Namibia. Informed the other directors, have received new proposal involving the PEL. 28, which is being analyzed. The Board recommended that the results of this analysis are taken consideration at its next meeting.

Gute Nachricht, man will dieses Farmout, aber man nimmt sich dafür Zeit, weiterhin keine Details hierzu..

Namibian MME Approves the Transfer of Rights and Obligations

RIO DE JANEIRO, Jan. 24, 2013 /CNW/ - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that, the assignment of a 14% participating interest in the exploratory rights over three (3) offshore Petroleum Exploration Licences (PEL) in Namibia to Galp Energia, was approved by the Minister of Mines and Energy ("MME") of the Government of Namibia.

As informed by the Company on November 26, 2012, this assignment is related to PEL 23, located in the Walvis Basin, and PELs 24 and 28, both located in the Orange Basin. HRT will retain operatorship of these PELs.

"With this formal approval by the Government of Namibia, HRT has fulfilled all the requirements of the Farm-Out Agreement and we can confirm we will commence operations in 1Q13 for our exploratory campaign in Namibia. We are confident that HRT is on the right track to accomplish its objectives", said Marcio Rocha Mello, Chief Executive Officer of HRT.

For additional information, please contact HRT`s Investor Relations Department.

Sedar Profile # 00031536

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Quelle: http://www.bloomberg.com/article/2013-01-24/aKnm.qG9c4v8.htm…

L234

RIO DE JANEIRO, Jan. 24, 2013 /CNW/ - HRT Participações em Petróleo S.A. (the "Company" or "HRT") (BM&FBOVESPA: HRTP3, TSX-V: HRP) announces that, the assignment of a 14% participating interest in the exploratory rights over three (3) offshore Petroleum Exploration Licences (PEL) in Namibia to Galp Energia, was approved by the Minister of Mines and Energy ("MME") of the Government of Namibia.

As informed by the Company on November 26, 2012, this assignment is related to PEL 23, located in the Walvis Basin, and PELs 24 and 28, both located in the Orange Basin. HRT will retain operatorship of these PELs.

"With this formal approval by the Government of Namibia, HRT has fulfilled all the requirements of the Farm-Out Agreement and we can confirm we will commence operations in 1Q13 for our exploratory campaign in Namibia. We are confident that HRT is on the right track to accomplish its objectives", said Marcio Rocha Mello, Chief Executive Officer of HRT.

For additional information, please contact HRT`s Investor Relations Department.

Sedar Profile # 00031536

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Quelle: http://www.bloomberg.com/article/2013-01-24/aKnm.qG9c4v8.htm…

L234

Antwort auf Beitrag Nr.: 44.062.196 von links-zwo-drei-vier am 25.01.13 07:47:49Come on Mr. Drill Deep also known as Mr. 10-billion-barrel-man get us some billion boe's in Namibia too, wie schon in Brazil mit Tupi

Hello und schönes Weekend,

Marianas kurz vor Angola...

(2013-01-26 13:01:00)

Drill-a-Hill

Marianas kurz vor Angola...

(2013-01-26 13:01:00)

Zitat von Drill-a-Hill: TRANSOCEAN MARIANAS

![]()

http://www.marinetraffic.com/ais/de/default.aspx?oldmmsi=538…

Drill-a-Hill