!!! GOLD - PREIS !!! Informationen und Gerüchte !!! - 500 Beiträge pro Seite (Seite 13)

eröffnet am 04.04.02 08:32:53 von

neuester Beitrag 19.06.06 19:53:59 von

neuester Beitrag 19.06.06 19:53:59 von

Beiträge: 9.079

ID: 573.644

ID: 573.644

Aufrufe heute: 0

Gesamt: 494.065

Gesamt: 494.065

Aktive User: 0

ISIN: XD0002747026 · WKN: CG3AB0 · Symbol: GLDUZ

2.325,66

USD

+0,10 %

+2,38 USD

Letzter Kurs 00:29:43 Forex

Neuigkeiten

06.05.24 · wallstreetONLINE Redaktion |

06.05.24 · Accesswire |

06.05.24 · Redaktion dts |

06.05.24 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7875 | +17,54 | |

| 0,5500 | +17,02 | |

| 2,0500 | +13,89 | |

| 0,5120 | +13,27 | |

| 0,9500 | +13,10 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7200 | -9,43 | |

| 0,9760 | -10,87 | |

| 0,6601 | -26,22 | |

| 1,1600 | -46,79 | |

| 46,24 | -98,00 |

http://www.forbes.com/markets/newswire/2003/06/11/rtr996774.…

Newmont says Aussie gold hedge book getting close to zero

Reuters, 06.11.03, 10:32 AM ET

NEW YORK, June 11 (Reuters) - The chief executive of world No. 1 gold miner Newmont Mining Corp. (nyse: NEM - news - people) said Wednesday the company`s controversial Australian gold hedge book was getting close to zero after its recent buyout from its bankers of most of the unprofitable hedges of its Yandal operations.

"You can`t quite say `zero,` but we`re getting close. It`s zero for all intents and purposes, in my mind," Wayne Murdy, in responses to a question from Reuters after delivering a speech on accounting in the mining industry.

Last week, Newmont Mining announced a $77 million payout to six of seven counterparties to pay 50 cents on the dollar for the money-losing hedge positions of Newmont Yandal Operations Ltd. (Yandal), acquired in Newmont`s 2002 merger with Normandy Mining and Canada`s Franco-Nevada Corp.

Murdy was speaking at a conference hosted by accounting firm PriceWaterhouseCoopers.

Copyright 2003, Reuters News Service

Wusst ich`s doch!

Gestern ist der Kriegstreiber gleich in seiner Zweifaltigkeit nach wochenlanger Versenkung wieder aufgetaucht und hat uns Gold Bugs wieder mal den Zusammenbruch des Goldespreises prophezeit.

Darum steigt wohl heute der Goldpreis wieder!

Gestern ist der Kriegstreiber gleich in seiner Zweifaltigkeit nach wochenlanger Versenkung wieder aufgetaucht und hat uns Gold Bugs wieder mal den Zusammenbruch des Goldespreises prophezeit.

Darum steigt wohl heute der Goldpreis wieder!

Darum hat der Goldpreis gestern eins auf den Deckel gekriegt!

Ohne den gestrigen Abverkauf, würde der Goldpreis vermutlich heute bereits wieder auf weit über 370.- Dollar stehen. Das wurde vom Gold Cabal vorderhand noch erfolgreich verhindert.

" Politik der USA Regierung." target="_blank" rel="nofollow ugc noopener">Der Dollar fällt weiter, und testet neue Tiefs, trotz "starker Dollar " Politik der USA Regierung.

" Politik der USA Regierung.

Ohne den gestrigen Abverkauf, würde der Goldpreis vermutlich heute bereits wieder auf weit über 370.- Dollar stehen. Das wurde vom Gold Cabal vorderhand noch erfolgreich verhindert.

" Politik der USA Regierung." target="_blank" rel="nofollow ugc noopener">Der Dollar fällt weiter, und testet neue Tiefs, trotz "starker Dollar

" Politik der USA Regierung.

" Politik der USA Regierung.

@ThaiGuru

vergiss den Pfinstmontag-Ausflug auf 366 nicht, klassisch nach Gauss, der Goldpreis wurde flugs von Cabal zurückgepfiffen...

es ist einfach zu wenig Nachfrage da... es fehlt einfach an Kraft

erdede

vergiss den Pfinstmontag-Ausflug auf 366 nicht, klassisch nach Gauss, der Goldpreis wurde flugs von Cabal zurückgepfiffen...

es ist einfach zu wenig Nachfrage da... es fehlt einfach an Kraft

erdede

Hallo Thai,

sehe ich auch so, die Unterstützung wird zur Zeit in EUR und nicht in USD definiert.

Die Grenze lieg bei 300 sieht bombenfest aus. Wenn Gold weiter fallen sollte, muss endweder der Dollar stärker werden oder die 300 EUR fallen.

Auch Silber hält sich gut.

Gruß Basic

sehe ich auch so, die Unterstützung wird zur Zeit in EUR und nicht in USD definiert.

Die Grenze lieg bei 300 sieht bombenfest aus. Wenn Gold weiter fallen sollte, muss endweder der Dollar stärker werden oder die 300 EUR fallen.

Auch Silber hält sich gut.

Gruß Basic

@erdede

Nachfrage nach Gold ist schon sehr reichlich verhanden. Darum besteht ja auch seit Jahren ein Produktionsdefizit. Das Problem ist halt noch, dass die Nachfrage nach Papier Gold mit dem fast unbegrenzten Papier Angebot des Gold Cabals nicht Schritt halten kann, und demzufolge die Preise leicht beeinflusst werden können.

Sobald die Hedgefonds und die anderen grossen Käufer an der Comex, anfangen sich ihre gekauften Papier Gold Kontrakte physisch aushändigen zu lassen, dürfte dieses Fiat Money Spiel der Gold Bullion Banken schnell zu ende sein, da mit Sicherheit nicht genügend verfügbares physisches Gold verhanden ist, um diese Kontrakte alle zu bedienen.

Diese Zeit wird vielleicht eher kommen, als manch einem Gold Bug bewusst ist.

Es fehlt nur noch ein Initialzünder, wie ein weiterer Kriegsherd, z.Bsp mit einem Mitglied der Achse des Bösen, crashende Börsen, ein stark fallender Bondmarkt, eine platzende Imobilienblase, z.Bsp. in den USA, ein grösserer Banken-, oder Versicherungskonkurs irgenwo auf dieser Welt, ein crashender Dollar, eine Zahlungsunfähigkeitserklärung eines weiteren Staates, ala Argentinien, ein witerer grösserer Finanzskandal, die wirkliche Einführung der zur Zeit in Japan diskutierten Negativstrafverzinsung von Baranlagen auf Konten, oder die Aufdeckung des Goldpreis Manipulationsskandals einiger weniger Gold Bullion Banken, unter Rückendeckung der FED.

Du darfst dir einen, oder mehrere Initialzünder dazu selber aussuchen.

Darum bleib ich besser immer schön im Gold, und Goldaktien investiert!

Gruss

ThaiGuru

Nachfrage nach Gold ist schon sehr reichlich verhanden. Darum besteht ja auch seit Jahren ein Produktionsdefizit. Das Problem ist halt noch, dass die Nachfrage nach Papier Gold mit dem fast unbegrenzten Papier Angebot des Gold Cabals nicht Schritt halten kann, und demzufolge die Preise leicht beeinflusst werden können.

Sobald die Hedgefonds und die anderen grossen Käufer an der Comex, anfangen sich ihre gekauften Papier Gold Kontrakte physisch aushändigen zu lassen, dürfte dieses Fiat Money Spiel der Gold Bullion Banken schnell zu ende sein, da mit Sicherheit nicht genügend verfügbares physisches Gold verhanden ist, um diese Kontrakte alle zu bedienen.

Diese Zeit wird vielleicht eher kommen, als manch einem Gold Bug bewusst ist.

Es fehlt nur noch ein Initialzünder, wie ein weiterer Kriegsherd, z.Bsp mit einem Mitglied der Achse des Bösen, crashende Börsen, ein stark fallender Bondmarkt, eine platzende Imobilienblase, z.Bsp. in den USA, ein grösserer Banken-, oder Versicherungskonkurs irgenwo auf dieser Welt, ein crashender Dollar, eine Zahlungsunfähigkeitserklärung eines weiteren Staates, ala Argentinien, ein witerer grösserer Finanzskandal, die wirkliche Einführung der zur Zeit in Japan diskutierten Negativstrafverzinsung von Baranlagen auf Konten, oder die Aufdeckung des Goldpreis Manipulationsskandals einiger weniger Gold Bullion Banken, unter Rückendeckung der FED.

Du darfst dir einen, oder mehrere Initialzünder dazu selber aussuchen.

Darum bleib ich besser immer schön im Gold, und Goldaktien investiert!

Gruss

ThaiGuru

@ThaiGuru

Du sagt es!

Sobald die Hedgefonds und die anderen grossen Käufer an der Comex, anfangen sich ihre gekauften Papier Gold Kontrakte physisch aushändigen zu lassen, dürfte dieses Fiat Money Spiel der Gold Bullion Banken schnell zu ende sein, da mit Sicherheit nicht genügend verfügbares physisches Gold verhanden ist, um diese Kontrakte alle zu bedienen.

Initialzünder? Naja... und in New York geht die Rally weiter...wie lange noch? Bewertung spielt ja keine Rolle mehr... alles ist günstig was steigt..

Bis dahin haben die Cabals ein leichtes Spiel...

im Februar hätten wir längst die 400er geknackt und wären gut ein Stück weiter gelaufen. Jetzt ist die Schmerzgrenze bei 375 richtung 357 fallend, den Fibonacci-Retracements entsprechend, wenn immer nur möglich.

Tja, wer warten kann, kann warten

erdede

Du sagt es!

Sobald die Hedgefonds und die anderen grossen Käufer an der Comex, anfangen sich ihre gekauften Papier Gold Kontrakte physisch aushändigen zu lassen, dürfte dieses Fiat Money Spiel der Gold Bullion Banken schnell zu ende sein, da mit Sicherheit nicht genügend verfügbares physisches Gold verhanden ist, um diese Kontrakte alle zu bedienen.

Initialzünder? Naja... und in New York geht die Rally weiter...wie lange noch? Bewertung spielt ja keine Rolle mehr... alles ist günstig was steigt..

Bis dahin haben die Cabals ein leichtes Spiel...

im Februar hätten wir längst die 400er geknackt und wären gut ein Stück weiter gelaufen. Jetzt ist die Schmerzgrenze bei 375 richtung 357 fallend, den Fibonacci-Retracements entsprechend, wenn immer nur möglich.

Tja, wer warten kann, kann warten

erdede

@Basic

Wäre doch schön wenn der Goldpreis zukünftig gleich ganz in Euro gehandelt würde, oder zumindest in englischen Pfund, wie es früher bereits der Fall war. Da hätten wir Gold Bugs sicher unsere Freude daran, vor allem dann, wenn das Goldpreis Fixing von einer etwas neutraleren Institution vorgenommen würde.

Liegt ja eigentlich auf der Hand, da das Goldpreis "Fixing" ja eh 2x täglich in London von der London Bullion Market Association *LBMA* bestimmt wird. Die Eigentumsverhältnisse der privaten LBMA, überschneiden sich ja bekanntlich teilweise mit denen der privaten Federal Reserv Bank *FED* und derjenigen der privaten Bank of England.

Wie dieses "Goldpreis Fixing" von statten geht, wer die bestimmenden Mitglieder sind, etc., davon wissen wohl nur die allerwenigsten wirklich bescheid:

Uebersicht:

http://www.lbma.org.uk/aboutus.html

Die Mitglieder der ehrenswerten Gesellschaft

http://www.lbma.org.uk/members_list.html

" target="_blank" rel="nofollow ugc noopener">"It is also notable how few ounces influence so many, and are probably contributing to a distorted market. The two London Gold Fixes are set on volumes of just 160,000 to 500,000 ounces typically."

Quelle: CPM Group’s Gold Survey 2003

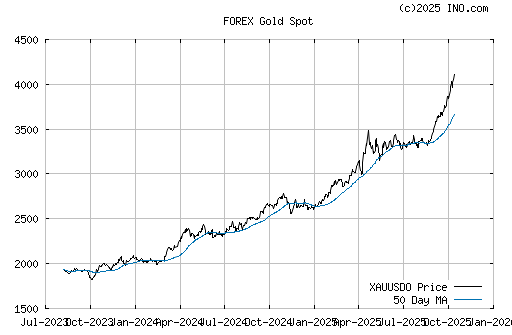

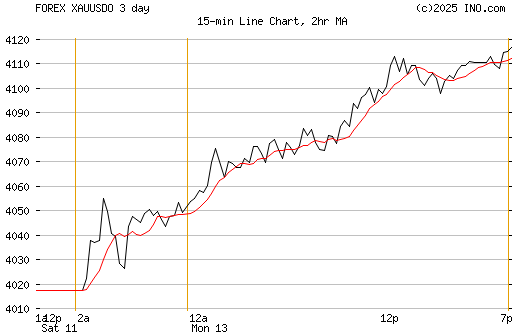

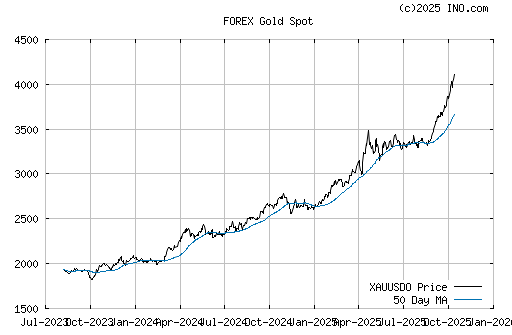

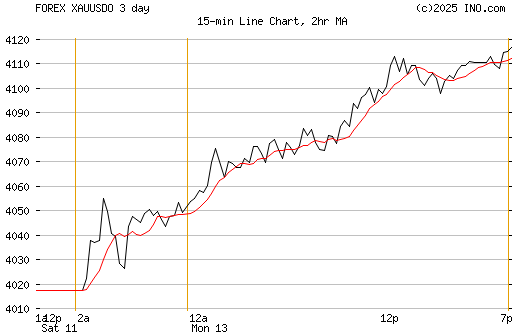

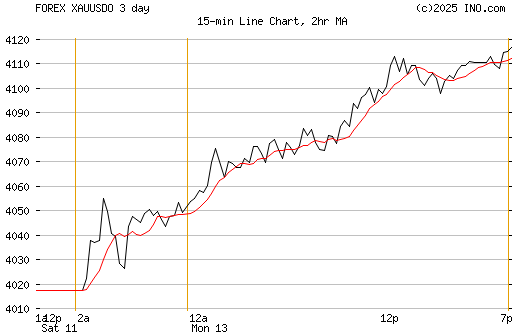

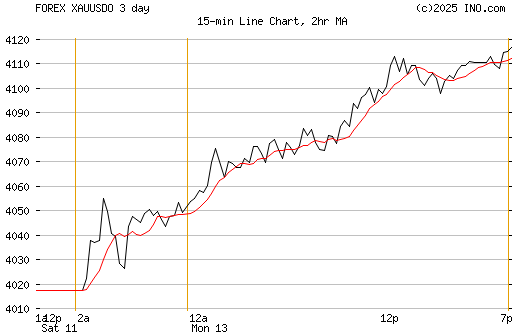

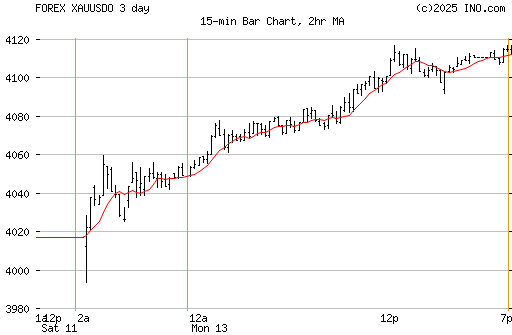

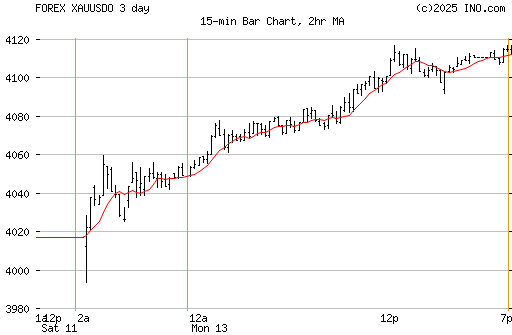

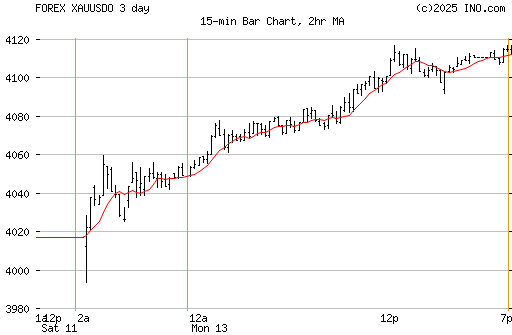

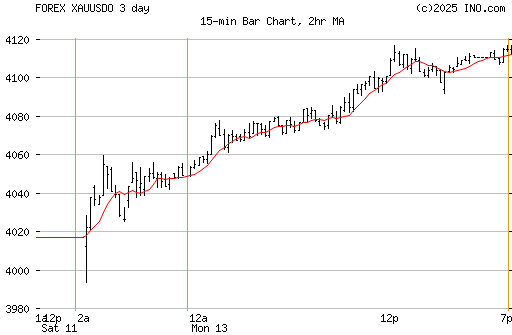

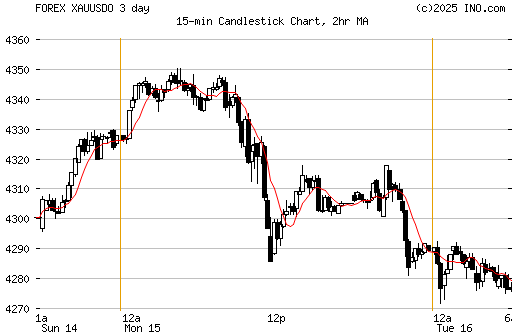

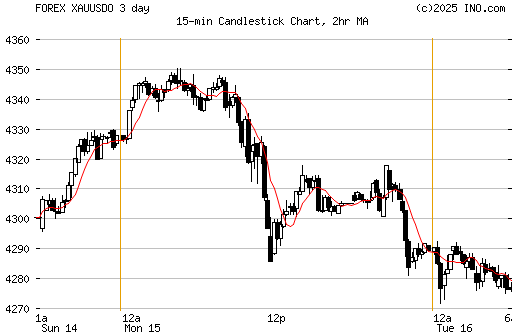

Auch zum Irrglauben der allermeisten Gold Anlegern, dass der Goldpreis Chart, den wir hier im Gold Board aus verschiedensten Quellen, wie KITCO, INO, COMDIRECT, etc., immer wieder sehen können, irgend etwas von Bedeutung mit dem realen physischen Goldhandel zu tun haben könnte, ein absolut zutreffendes Zitat:

“The physical market has been very small compared to the derivatives trading based on it. Yet, it is surprising the extent to which many gold market observers could not see this very fat, very enormous tail that was waging the dog.”

Quelle: CPM Group’s Gold Survey 2003

Gruss

ThaiGuru

Wäre doch schön wenn der Goldpreis zukünftig gleich ganz in Euro gehandelt würde, oder zumindest in englischen Pfund, wie es früher bereits der Fall war. Da hätten wir Gold Bugs sicher unsere Freude daran, vor allem dann, wenn das Goldpreis Fixing von einer etwas neutraleren Institution vorgenommen würde.

Liegt ja eigentlich auf der Hand, da das Goldpreis "Fixing" ja eh 2x täglich in London von der London Bullion Market Association *LBMA* bestimmt wird. Die Eigentumsverhältnisse der privaten LBMA, überschneiden sich ja bekanntlich teilweise mit denen der privaten Federal Reserv Bank *FED* und derjenigen der privaten Bank of England.

Wie dieses "Goldpreis Fixing" von statten geht, wer die bestimmenden Mitglieder sind, etc., davon wissen wohl nur die allerwenigsten wirklich bescheid:

Uebersicht:

http://www.lbma.org.uk/aboutus.html

Die Mitglieder der ehrenswerten Gesellschaft

http://www.lbma.org.uk/members_list.html

" target="_blank" rel="nofollow ugc noopener">"It is also notable how few ounces influence so many, and are probably contributing to a distorted market. The two London Gold Fixes are set on volumes of just 160,000 to 500,000 ounces typically."

Quelle: CPM Group’s Gold Survey 2003

Auch zum Irrglauben der allermeisten Gold Anlegern, dass der Goldpreis Chart, den wir hier im Gold Board aus verschiedensten Quellen, wie KITCO, INO, COMDIRECT, etc., immer wieder sehen können, irgend etwas von Bedeutung mit dem realen physischen Goldhandel zu tun haben könnte, ein absolut zutreffendes Zitat:

“The physical market has been very small compared to the derivatives trading based on it. Yet, it is surprising the extent to which many gold market observers could not see this very fat, very enormous tail that was waging the dog.”

Quelle: CPM Group’s Gold Survey 2003

Gruss

ThaiGuru

http://www.news24.com/News24/Finance/Companies/0,,2-8-24_137…

Gold miners offer NUM 6.5% rise

11/06/2003 21:35 - (SA)

Justin Brown

Johannesburg - Gold miners, affiliated to the Chamber of Mines (CoM), have offered the National Union of Mineworkers (NUM) a 6.5% increase effective from July 1, 2003 while the coal collieries have offered 8%.

The CoM and NUM on Wednesday concluded their second round of negotiations and agreed to meet again on June 17 and 18.

The gold miners also agreed to a minimum wage of R2 000 for all workers, surface and underground, within two years.

For some companies, this implies increases of 12.9% per annum in the minimum wage for both years.

Furthermore, a three-year agreement was proposed, with the increases in the second and third years being equal to inflation (subject to certain escape clauses).

The coal miners agreed to a second year of a two-year deal, proposing a wage increase equal to inflation, subject to a minimum of 5% and a maximum of 7%.

In addition to the wage offers, the gold and coal companies offered bonuses, a 12.5% employer contribution to the retirement fund, free accommodation or a living out allowance, free health care for the employees and a holiday leave allowance equal to a 13th cheque.

"The parties spent a considerable amount of time in the formulation of programmes to further improve the socio-economic conditions of employees. All parties agreed that this was an important priority, which should take place as part of a phased approach spread over a reasonable period of time, so that the long-term sustainability of the mining industry is not threatened," the CoM said in a statement.

In this regard progress was made on the following issues:

An accommodation framework, which outlines a timetable to ensure that employees have a choice in respect of accommodation options, including family accommodation. There remain a few unresolved issues in this regard.

Most aspects relating to the creation of a conducive environment for the employment of women in mining, including paid maternity leave.

Gold mines made progress on health care for employees and dependants.

The demand relating to bonuses and allowances.

Outsourcing and subcontracting.

Care for disabled workers.

http://biz.yahoo.com/bw/030611/115257_1.html

Press Release Source: Sterling Mining Company

Sterling Mining Company Leases the Sunshine Mine

Wednesday June 11, 9:06 am ET

COEUR D`ALENE, Idaho--(BUSINESS WIRE)--June 11, 2003--Sterling Mining Company (OTCBB:SRLM - News), is very pleased to announce that it has signed a lease, with option to purchase, on the world-famous Sunshine Mine, the richest silver mine in American history with more than 350 million ounces of production over the past century.

At the time of its closure in early 2001, the Sunshine was producing at a rate of over three million ounces of silver per year at an average grade of approximately twenty ounces per ton. The prior operator last estimated the mine reserves at 26.75 million ounces of silver, 10.36 million pounds of copper and 7.05 million pounds of lead (or approximately 28.85 million ounces of silver-equivalent), as well as an additional resource of 159.66 million ounces of silver.

The lease term extends for fifteen years with an annual payment of $120,000 and with an option to purchase the mine set between $3 million and $5 million, depending upon the prevailing silver price. Mine production is subject to various royalties related to past arrangements with federal, state and tribal entities.

Sterling President Ray De Motte stated, "Our corporate strategy has been to enhance shareholder value by increasing our silver assets, with our primary focus on the Coeur d`Alene Mining District. The lease-option agreement signed today gives Sterling effective control of the region`s most historically productive silver mine, putting the Sunshine in local hands for the first time in decades. We firmly believe that this transaction, coupled with a plan to evaluate the feasibility of renewed production, serves not merely the interests of our shareholders but also of the entire local community."

Sterling Mining Company is an aggressive silver exploration company, focused upon the Coeur d`Alene Mining District, the richest primary silver-producing region on Earth. Sterling offers superior leverage to silver price increases through control of extensive and strategic "Silver Valley" landholdings, including the legendary Sunshine Mine, as well as through significant projects in other historic mining districts of the Western United States. Sterling was founded in 1903 and proudly celebrates a century of mining exploration this year.

Sterling Mining Company of Idaho is not affiliated with Sterling Mining Company of Montana.

Certain statements contained in this press release are "forward looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based on beliefs of management as well as assumptions made by and information currently available to management. Forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from expected results.

--------------------------------------------------------------------------------

Contact:

Sterling Mining Company

Raymond DeMotte, 208/676-0599

www.sterlingmining.com

--------------------------------------------------------------------------------

Source: Sterling Mining Company

*****

STERLING MINING (Other OTC:SRLM.PK)

Heute von 0.63 auf 0.80 Dollar, um 26.98% gestiegen

2 Jahres Chart. Heutiger Anstieg ist noch nicht im Chart enthalten!

Sterling Mining, schein anscheinend auch von einem stark ansteigenden Silberpreis auszugehen. Falls der von vielen erwartete starke Silberpreisanstieg realität werden sollte, ein kluger Schachzug von SRLM.

Jetzt wird auch klar, wiso die Sunshine Mining Aktie im Vorfeld von 0.20 auf bis max. 0.80 Dollar gestiegen war.

Gruss

ThaiGuru

June 11 - Gold $355.30 up $3.50 - Silver $4.50 up 4 cents

Gold Pops Back As Oil Soars And The Dollar Sinks

In the bivouac of Life,

Be not like dumb, driven cattle!

Be a hero in the strife." target="_blank" rel="nofollow ugc noopener">"In the world`s broad field of battle,

In the bivouac of Life,

Be not like dumb, driven cattle!

Be a hero in the strife.

- Longfellow -

GO GATA!!!

The gold fundamentals continue to improve almost on a daily basis. Two factors that tend to affect the price of gold in a major way are the prices of oil and the dollar. Oil surged to $32.36, up 63 cents, while the dollar sank to 93.02, down .60. It couldn’t even close once above 94. The euro rose .64 to 117.41 and the pound gained .016 to 1.66. Meanwhile, the Freddy Mac scandal has leaped into the criminal arena.

Falling interest rates and increasingly negative REAL interest rates. Then, you have significant producer short-covering, surging physical buying out of India (see JB below), falling interest rates and increasingly negative REAL interest rates. Pile mounting problems in Afghanistan, Iraq and the Middle East on top of that.

All in all, the gold fundamentals don’t get much better. If gold were freely traded, it would easily be $400 bid by now. Instead, it is only $30 higher than it was a year ago.

Contrast the trending bond, dollar and DOW with gold:

Treasury bonds

http://futures.tradingcharts.com/chart/US/63

The dollar

http://futures.tradingcharts.com/chart/TR/63

The DOW

http://futures.tradingcharts.com/chart/DJ/63

Only gold was jolted out of its trend. There is only one explanation. The Gold Cartel was not about to let gold move through $370 to the upside, so they mobilized enough gold to bash it down and turn the funds sellers. That is evidenced by the 7965 lot contraction in open interest yesterday, which now stands a little more than 201,000.

Gold needs to take out $360 and close above that level to put the bullish fire back in the market. Normally, it takes weeks to months for gold to regroup and head back up after breaking down like this. However, the fundamentals are SO bullish, it is hard for me to imagine that being the case. We shall see.

Silver plunged all the way down to $4.40 before reversing. Funds sold and the goon squad, led by JP Morgan Chase and Morgan Stanley, were buyers. Silver seems very much sold out to me and should start a significant move higher. FINALLY!

www.lemetropolecafe.com

The John Brimelow Report

Wednesday, June 11, 2003

Indian ex-duty premiums: AM $7.15, PM $8.25, with world gold at $354 and $353.80. Far above legal import point. Unless some very sustained new factor has entered the market, the world price of gold is too low.

TOCOM had an extraordinary and very interesting day. On enormous volume, equal to 102,949 Comex contracts, up 81% from yesterday, $US gold rose $2.40 from the NY close (which still involved a 24 yen decline from Tuesday’s close) but open interest actually fell the equivalent of 3,614 Comex lots. This effectively reverses the sudden, large, open interest increase of yesterday, and increases the suspicion that the price decline/volume and open interest jump yesterday was short selling by offshore operators.(NY yesterday traded 78,280 lots: open interest fell a huge 7,965 lots.)

Commentaries on yesterday’s action are unusually explicit in asserting that at least some of the action was dealer short selling. Dow Jones refers to

"…heavy dealer short selling…"

UBS attributes the weak close to:

"…futher selling from the same speculative name…".

However, the large open interest fall does suggest that a considerable quantity of spec longs were in fact liquidated. MarketVane’s Bullish Consensus for gold collapsed an unusually large amount, 7 points to 68% (lowest since May 13, at which point gold was $2 lower, but the Dollar Index 3% higher). Considering these factors and the Indian premium, it would be surprising if the Bear raid were not close to exhaustion.

JB

www.lemetropolecafe.com

CARTEL CAPITULATION WATCH

he DOW (9183, + 128) and DOG (1646, + 18) keep going up and up.

GATA’s Mike Bolser last evening:

Hi Bill:

The last ten gold trading sessions have yielded patterns unrelated to the major currencies. Note particularly the lack of similarity between the Euro and the Gold price shown on the attached chart.

In such conditions we can expect arbitrageurs to step in soon and correct the resultant temporary imbalance in the gold price.

Mike

and again this morning:

Hi Bill:

Tomorrow will bring a pretty big repo expiration of $19.50Billion. Today`s add of $7.75 ups the repo total pool to $41.25 Billion and is the reason for the DOW`s rise today.

Unless the Fed adds at least $19.50B the total pool will fall tomorrow. If the Fed adds nothing the pool will stand at $21.75B and that has not been sufficient to keep the DOW up [during the interval of Nov through the present]. So we have an opportunity to see if the Fed wants the DOW even higher that it is today or they want to begin a down cycle.

My guess is they are out of benevolent options [especially with the mess at Freddie Mac] and will continue ramming the DOW higher at all costs. So we can look for a $10B or so add tomorrow. Additional evidence of this potential to keep rocketing the DOW is seen in the anomalous bond market activity. It keeps setting new highs].

This is the Mises "Crack-Up Boom where everybody thinks they are rich from the proliferation of paper financial instruments [Please ignore the falling dollar]. The last missing element is a "New paradigm" media spin campaign to explain higher stock AND bond moves.

I can hardly wait.

Mike

Chuck checked in last evening:

Bill:

Very interesting day in the golds, now that the gap has been filled. On Bloomberg the reason they are giving for gold`s weakness is due to the jewelry trade. At least, they have a grip on it.

One must be impressed with NEM and GSS as they could have been slaughtered, but the volume remains high which I think is very positive.

Maybe once the rates goes under zero, the market will sell off. Amazing! Tomorrow should be interesting in the gold complex…………

I was just reflecting about the action in these incredible markets. I include this chart of the XAU to show that something extremely dynamic is afoot here. We have had three major gaps in this average, gold down $15 in the past three days and yet the XAU has barely budged near its top.

Given the relentless superliberal flow of funds from the "authorities" that is flooding the markets and this action, and the very positive technical signs for gold and now silver and the contrary signs for the stock market, I assume we might be ready for your long anticipated blow out here. If there ever was a day to punish the shares, it was today and yet on very heavy volume they commended themselves most admirably. A new high on NEM might be the signal for the rest of the troops to launch out. It this is to be, it should be soon. Chuck

Then again this afternoon:

How fascinating and rigged!

Bill:

I am totally transfixed by this amazing market. Is there any other word for it? For anyone who loves markets and has time to study them, appreciate this very moment of history. When have we ever had such relentless buying, with no setbacks or testing? And with a bond market that displays the same character. And with no questioning of it as the economic statistics get worse and worse. The Investors Intelligence survey out today now has extended to 58% bulls and 16% bears, the lowest number since…..1987. What will be the trigger of the reversal. It is anybody’s hunch or opinion how this will play out as the world monetary giants pour in as much liquidity as they can to stem and overturn the deflationary forces at work.

What I see now is that there is a white knight coming to the rescue-gold. This monopoly game cannot constrain the metal much longer. And if you are watching closely, the shares are starting to outshine the metal. In the past few days as gold filled its gap in the low $350’s, the shares started to display some relative oomph.

Market moves are highlighted by quality leadership. In the stock market these stocks are IBM, MSFT and WMT. Each of these has been having problems getting out of its own way even during this mindless compulsive buying binge. In spite of the daily move up, you cannot find a quality industrial stock making new highs here. But in the gold complex, we have Newmont, the one the large funds can buy first, and Freeport McMoran, (FCX) a copper and gold company with very large reserves, breaking out. This is how bull markets act. We should soon see others attending the breakout party, especially those companies with fresh stories and legitimate properties or production. There will be new leadership in this very powerful phase, most likely coming from the smaller mining companies not constrained by being too large.

Put all of this in perspective, and I believe we have come to the very threshold of something very special both in the market and in the gold complex. Take it all in. What is about to happen will change the world forever. Chuck Cohen IKIECOHEN@MSN.COM

US stock market bullish sentiment is soaring as Chuck noted:

Advisors’ Sentiment Review

June 11th 2003

Bears run for cover - now at lowest level since April 10th 1987.

Its getting harder and harder to find a bearish advisor as they continue to run for the hills. Don’t fight the Fed and don’t fight the Tape were slogans coined by Marty Zweig, and advisors are currently following that. "Don’t fight the Fed" had not been a good idea from January 2001, when they first started to cut rates, until this March when the market surge started. Only 16.3% of the services continue to be bearish, the lowest since April 10th, 1987, more than 16 years ago.

-END-

Right on the money from Craig Harris:

HARRIS CAPITAL MANAGEMENT, INC.

Today I was thinking about how desensitized the share markets have become to what would have previously been considered significant factors. If you don`t believe the financial engineers are propping it up, it sort of leaves you without an explanation. Some speculate that The DOW keeps walking on air from a steady diet of Fed intervention through its release of repurchase agreements. Their total repo pool level is reportedly $36.5 Billion.

In addition, they have all but flat out said that they are using new money to buy 30 year bonds, forcing interest rates lower and forcing some of the cash used for bond buybacks into stocks. If you read between the lines a little, that`s certainly what I come up with. We are living through what I consider a very dangerous evolution in the financial markets, where the g8 wants to engineer our financial reality rather than letting the free markets< do so. A stock or bond is only worth what it`s worth...not what someone engineers it to be worth....so in that sense the financial engineers are dealing with a spread of engineered value versus free market value. It`s just a very dangerous game but I guess they feel they have no other alternative.

I`ve watched these markets every single day, all day for years and I`m watching this Orwellian evolution that extends from politics to the financial markets. Maybe we will evolve to a point where the markets are happily compliant, engineered by the G8 through massive derivative leverage and that will be that...or maybe there is a limit to how high the house of cards can get....one thing for sure is that it would be the first time in history that the free markets didn`t win in the end. Is it different

this time? Anyway, this is sort of the theme tonight...and I`m not whining, just realizing what is real and trying to determine how to profit and how to avoid joining the pile of cordwood at the bottom of the cliff.

As an example of this desensitization I`m talking about, this latest Freddie Mac scandal was basically greeted with a yawn by the broad market, as was the IBM SEC inquiry. You all know I`ve long suspected IBM book cooking, and if one of the most trusted names in the planet is doing it...well use your common sense. That said, the firing of the FRE Board is a big deal to me. With Freddie, we are talking about numbers so large it`s hard to fathom. To find out they`re cooking the books...well, I can`t say it`s unexpected, but it`s most certainly bad. To me it just indicates a systemic rot of ethics and corporate behavior that is being downplayed by the politicians, not fixed. They`re using the Japanese method...sweep it under the rug, while at the same time criticizing Japan for doing so and blaming Japan`s mess on that sort of behavior. What`s real? they`re crooks...that`s what`s real. Biiiig slice of pie for me...little tiny one for you...while muttering...catch me if you can. Poor Martha gets to be the scapegoat. That`s sort of like arresting a private for the war crimes of a dictator. whatever...the truth doesn`t seem to matter anymore thanks to the Ruperts of the world. FOX news...now that`s an oxymoron.

US home loan chief fired over audit inquiry

http://www.guardian.co.uk/usa/story/0,12271,974367,00.html

An apparent derailing of this much hyped road map wasn`t even noticed by the market. I wasn`t surprised at all by the latest Israel attack that GWB is supposedly so upset about, if you want to know why they attacked, read the old newsletters. If you want to hear the other side, listen to Rupert...he`ll tell you why it was necessary.

-END-

On the Freddy Mac scandal:

Bill-

I believe that this is a highly significant event. Quasi- government agencies simply don`t fire the CEO, COO and CFO for simple bookkeeping problems or "failure to co-operate with the outside auditors. " Something of great magnitude occurred here, probably related to derivatives. Perhaps some of your sources can get to the bottom of it. I suspect that the FED and all of its cohorts will be working overtime behind the scenes to clean up this mess.

As an aside, LTCM was in trouble for several months but it wasn`t until late August/early September,1998 that other people started to get an inkling of how bad things really were. Perhaps we have a far bigger problem about to descend on us in August, 2003.

Best regards,

Bob

Not to be ignored as Bob says:

June 10, 2003 -- The bookkeeping time bomb being probed at Freddie Mac could yank the rug out from under our booming housing market - the last leg holding up the economy.

Economists and analysts fear that the scandal could trigger a domino effect in our banking system that could push historically low mortgage rates - now down to 41/2 percent - soaring in the weeks ahead.

" target="_blank" rel="nofollow ugc noopener">"If rates rise, the housing bubble will pop," said mortgage expert Martha Kaufman, chief operating officer of Prudential`s Preferred Empire, one of New York`s top 10 mortgage brokers.

" target="_blank" rel="nofollow ugc noopener">"It`s all still a very wait-and-see situation."

" target="_blank" rel="nofollow ugc noopener">Wall Street reacted immediately to news of the Freddie Mac shakeup, and sent housing and banking stocks tumbling. "There`s a lot of smoke here, and many are convinced there`s fire. But no one knows exactly what`s involved yet," said portfolio manager Bill King….

-END-

Hi Bill,

I follow this market as closely as anyone and there is a "linkage" missing that would greatly benefit from an explanation from you.

Can you explain for the "common folk" how the futures market can control the price and how it relates to the physical market. What`s the difference if there are annual deficits in silver and gold if the price can be capped with Comex (shorts) contracts?

In order to get some conviction your readers need to know the relationship of these two different markets. The more simple you can make this the better.

Regards,

David Schectman

The futures market can only affect the price for a short period of time. Eventually, gold must be delivered by the gold shorts to the gold longs. The key is the yearly supply/demand deficit. If it is large as we think, say 1400 tonnes, then The Gold Cartel and other big shorts are doomed. They will run out of supply, no matter what games they play in the short-term with derivatives contracts. That is also why GATA’s gold loan/swap number is so important. If they are close to the 5000 minus number put out by the WGC, gold will not seriously advance for almost a decade.

On the COT report and more:

Hi Bill:

Glad to hear the Vancouver conference was a good done. Looking forward to the report on the details.

I am enclosing the gold story from ODJ concerning this afternoon`s debacle for your reading entertainment. I thought I would make some comments regarding the Commitments data that might be of some use to the newer members at the Cafe. As another old trading hand yourself, you know full well that in the `typical` market, whenever the big specs (funds) manage to accrue a significantly large number of net long or net short positions and the commercials are holding significantly large net short or net long postions on the opposite side of the funds , one can look for a reaction or market reversal opposite the direction that the funds are committed to and in favor of the big commercials. The reasons - or so goes conventional wisdom - is that the commercials are the ones whose actual business consists of dealing with the specific commodity that underlies the futures contract and thus are supposedly better informed as to the "real" happenings in the physical market. After all, it only stands to reason, that if one`s business consists of either producing a marketable commodity such as one of the grains or cocoa or sugar , etc., or using that commodity as input to a particular product such a copper wire, orange juice, cotton shirts, etc., that firm ought to be in constant contact with suppliers, producers or end users and as such, be intimately acquainted with what constitutes "value" in the industry. Thus, they understand when a particular commodity is "cheap" or when it is "dear." Since the physical market is what underlies all futures markets, sooner or later, the physical market realities exert their influence on the futures contracts. When prices have been driven to unsustainable lofty levels or depressed to unsustainably low levels by the funds, the savvy commercials will be either selling or buying like crazy knowing full well that the market has reached an extreme level that in the real physical world represents a bargain or a tremendous opportunity.

In an normal market and one that trades free from interference, this can prove to be a most profitable tactic to follow. Once the big funds commit to huge positions, all it takes is a price movement of some sort in the opposite direction to send them heading to the exits in masse resulting in huge price moves. The problem occurs when we come to the gold market. Just who are the "commericals" in the gold market? Are gold mining entities considered entities? So we could assume, all things considered, that among the huge commercial short positions a goodly number would be those of the mining interests. Following `conventional wisdom`, if the mining outfits are piling on short positions, then it is obvious that they consider the current prices to be extreme levels and have moved beyond "value" and thus gold is "too expensive" at these levels and is therefore a screaming sell. In a normal market, that would be a good way of reading this market. However, we know that this is simply not the case when it comes to gold.

The biggest problem facing the mining companies is trying to exit their short hedge positions which are underwater. Simply put, they are trying to buy, not sell. Newmont is reducing its hedges and even Placer Dome and the notorious Barrick are making noises in their reports and to analysts that they are reducing their hedge positions in the face of the rising gold price and bullish long term fundamentals. As a manner of promoting their particular company, many mining CEO`s are making it clear that they are completely unhedged and thus stand to benefit immensely as the price of gold continues its relentless move upward. So again the obvious question that any gold investor ought to be asking - Just who are these "commercials" who are tripping over themselves to add to an already huge net short position. It is certainly not those who need to buy gold for manufacturing purposes such as a jewelry interests. The risk they are exposed to is not falling gold prices but rather rising gold prices. If the gold they need to manufacture their rings and necklaces, etc., is coming down in price they are happy as larks. Their concern is if the price of the raw material they need begins to increase. Their profit margins then are squeezed. Prudence dictates that they would establish what are termed "long hedges." They will buy futures contracts corresponding to the amount of physical gold they intend to purchase to help offset any rise in gold prices. If gold rises and they are then forced to pay up, they can simply sell their future contracts at a higher price than they bought them for using those profits to offset the increasd cost that they must pay for the physical gold they require on the open market. That`s the way a hedge is suppoed to work. So we can rule these interests out.

We have eliminated two commercial interest groups - the mining outfits and jewelry interests. Both of these groups are buying , not selling. Who else is left in the industry that can be considered a commercial? Who is it that is doing the massive selling then that constitutes the bulk of the net short positions on the Comex. The answer - The bullion banks. There`s your culprit. The obvious question then that any astute trader or investor should be asking is, "Why are they selling if everyone in the industry is buying?" Welcome to GATA`s camp!

Dan Norcini

From the Netherlands:

Bill,

congrats on Barrick, you`re right again..

bye the way...almost all goldminingstocks are at the end of a triangle in the

1-year chart I noticed this afternoon...breakout-time on a short notice. –END-

Some insight into the stock trading action and more from a sharp internet poster:

Black Blade (6/10/03; 21:50:00MT - usagold.com msg#: 104441)

Market Wrap Up – Hartman

http://www.financialsense.com/Market/wrapup.htm

Snippit:

For the last three trading days, the Dow has gone up 350 points, all in the first and last thirty minutes of trading. During all three days, the Dow has fallen badly through most of the trading session, but with the intervention at the open and at the close, we stand at breakeven for the three trading days. Please take a look at the chart above, and you can see that this just doesn’t look like a market that is plodding its way higher. You can see it looks like a big lift, then a steady sell-off until the next lift. I believe money is moving from the Federal Reserve Repo pool through the "institutions" to the S&P futures market. Last week I saw a floor trader interviewed on CNBC and he made it clear that the institutions were at it first thing in the morning to buy S&P futures, "IN SIZE." That would explain the abnormal market movement.

Black Blade: I have pointed this pattern out myself on occasion. It is rather thinly veiled isn’t it? Also, notice the large moves in the S&P, DOW, and Nasdaq futures usually right around 5 am (est), especially if they have been in negative territory. Something strange is going on for certain.

Snippit:

Gold was trashed for over nine dollars per ounce today, and according to a Reuters article, was attributed to a stronger dollar. The dollar closed up .23% at 94.02, marginal at best. The dollar strength was not enough to drop gold by that amount. A Bloomberg article stated that the reason gold came down is because, "The recent rally pushed prices so high that jewelry makers will reduce purchases of the metal." WOW, a statement like that really demonstrates a lack of understanding regarding precious metals.

Overall for the day, stocks were up, bonds were up, the dollar was up, and oil was up. The two biggies on the downside were interest rates and gold. Gold should be rising with lower interest rates, so we shall see how long the disconnect persists. There are many financial relationships that are out of whack. Let’s just hope they can engineer an economic recovery with all of the financial tinkering…time will certainly tell!

Black Blade: I noticed the Bloomberg article as well but I thought the explanation to be too absurd to mention. The sell off in gold could be attributable to weak hands getting impatient, however, as Hartman points out and I have pointed this out as well, with negative "real" interest rates the gold currency will ultimately outperform the dollar. The Fed will cut short term rates again by at least 25 basis points and it appears likely it could cut as much as 50 basis points, matching the ECB rate cut. This will send "real" interest rates deeper into negative territory even as the Fed floods the market with infusions of depreciating US dollars.

-END-

Newmont stays in the headlines:

Hi Bill

Know you have written much on the shorting gold shares, but this caught my eye.

Correct my maths, but isn`t that just about half a billion $$ worth of NEM shares that someone has sold but does not own?? In case u missed it:

Tues June 10.

Newmont Mining

Newmont Mining (NYSE: NEM) is currently the world`s top producer of gold, according to Hoover`s Online. Since late March, NEM has been rallying strongly, gaining almost 35 percent. Today, the stock has pulled back to test support at its 10-day trendline, which has worked in tandem with the 20-day moving average to provide support over the past two months. Spurring the stock`s decline today was a downgrade from J.P. Morgan Chase, who

reduced its rating on the shares to a "neutral" from an "overweight." Merrill Lynch followed suit several hours later, lowering its rating to a "neutral" from a "buy." NEM may find strength in a solid "wall of worry" that has been constructed on the equity. Schaeffer`s put/call open interest ratio (SOIR) for NEM currently stands at 0.96, two percent shy of an annual peak. What`s more, the number of shorted NEM shares climbed 22 percent over the past reporting period to 15.79 million, the highest level since February 2002.

Click the following link to see the Daily Chart of NEM Since March 2003

With 10-Day and 20-Day Moving Averages:

http://www.schaeffersresearch.com/wire?ID=7862

For more information on SOIR, short interest, and Expectational Analysis(R), please visit Schaeffer`s Daily Sentiment Complete.

http://www.schaeffersresearch.com/services/sds/index.asp

Should be fun trying to watch someone cover that in a hurry (unless they trash the gold price to do it of course)!

Catchya,

Rob O.

PS: Newmont Jan04 $45 calls were, as at my last email $0.20, now $0.45

Newmont announcement today:

NEW YORK, June 11 (Reuters) - The chief executive of world No. 1 gold miner Newmont Mining Corp. (NEM) said Wednesday the company`s controversial Australian gold hedge book had shrunk close to zero after it assumed of most of the unprofitable hedges of its Yandal operations from its bankers.

"You can`t quite say `zero,` but we`re getting close. It`s zero for all intents and purposes, in my mind," said Newmont CEO Wayne Murdy, in response to a question from Reuters after delivering a speech at a conference.

Newmont Mining last week announced a $77 million payout to six of seven counterparties to pay 50 cents on the dollar for the money-losing hedge positions of Newmont Yandal Operations Ltd. (Yandal), acquired in Newmont`s 2002 merger with Normandy Mining and Canada`s Franco-Nevada Corp.

Newmont has maintained an anti-hedging philosophy and has been unwinding and delivering into the Normandy hedges steadily as market conditions allowed.

Hedging with options and forward sales can protect a company from falling gold prices, but the strategy backfired on some producers during the rally in gold prices since early last year. The strength of gold priced in Australian-dollar terms put the Normandy hedges underwater.

Newmont inherited about 10 million ounces of gold sales and derivatives commitments from Normandy.

At the end of the first quarter, Newmont said the Aussie hedge book stood at about 3.7 million ounces committed through forward sales and 1.4 million ounces of noncommitted ounces related to derivatives positions.

Overhedging was disastrous for some mining companies in 1999, when gold prices began to recover from 20-year lows.

Murdy blamed the bankers for overextending credit to mining companies, many of which did not understand the sophisticated financial products or the risk they were assuming.

It is difficult for companies to know how reserves will pan out overtime and foolhardy to hedge prices on estimated production years in the future.

"I think the bullion banks have just gotten carried away and there were deals done on top of deals, super exotic instruments that frankly very few people understand," Murdy said.

"It`s a tool and it can be used to a degree. But when people start going out so far I think they are kidding themselves. I don`t think anybody has the vision to go out 5 years or 10 years," he said.

-END-

Questions to be answered:

*What happened to the holdout in the Yandal settlement proposal by Newmont, reported to be Goldman Sachs?

*How does this transaction affect the gold price?

*Based on this release, the hedges have been covered. However, did the bullion banks buy gold in the physical market to return it to the central banks?

One comment on the Newmont hedge lifting and a query:

The market shrugged off comments from Newmont Mining (NYSE:NEM - News) CEO Wayne Murdy that Newmont had reduced its Australian gold hedge book close to zero after its recent buyout of unprofitable contracts from hedge counterparties to its Australian mining subsidiary Newmont Yandal Operations Ltd.

"If anything, that`s got to be pretty bearish ... when they say we`re not going to be buying any more," said another chief precious metals dealer."

Why would this be bearish? Seems pretty positive to me. Ray

Most of the bullion dealer crowd put a bearish spin on everything. The dealer says there was huge buying of hedges to unwind the deal and that buying is over. But, was there any physical gold buying as asked above? More importantly, any gold buying associated with the Yandal hedge covering is only one of MANY MANY bullish gold factors.

Besides, all that matters is the demise of The Gold Cartel. Gold producers covered 649 tonnes from March 31, 2002 until March 31, 2003. That was countered by a 30% rise in BIS gold derivatives. The producers cover and the cabal dumps gold via loans and swaps. Do the bullion dealers explain that to anyone? NO! Therefore, I see no reason to pay attention to them. Which ones predicted this gold price rise two years ago? NONE!

Joe Martin’s gold conference in Vancouver on Sunday and Monday was wonderful fun. It was bustling, although not quite up to January’s frenetic event. Went out with my friends Jeff Dahl (CEO of Samex), Nick Ferris (CEO of J-Pacific Gold) and John Anderson, who knows half the gold folk in Vancouver. Of interest to me is the continued lack of new interest in gold as an investment from the general public. Many of the attendees were those already interested in gold and had been to the conference over the years. That’s bullish. They will show up when gold goes $400 bid.

Merrill Lynch and JP Morgan Chase downgraded Newmont just as it was breaking out. That knocked the wind out of its price surge. That’s typical modus operandi behavior by the cabal and friends. One of their mantras is to diminish gold excitement of any sort. A clear break out by Newmont above $33 will set off bells and whistles in the investment world and attract a good deal of attention. The bad guys know that, so they do what they can to bring in selling of the Newmont shares, right as it looked as if it would take out $33. It’s always something with those bums.

The gold shares caught a late bid and moved up nicely. The HUI surged to 145.74, up 2.05 with the XAU climbing .66 to 76.30. The recent share price action is a reason I don’t trade them. Gold was knocked $20 off its highs, yet many of the gold shares are within a stone’s throw of their highs, or are making new highs.

It appears they are going to lead the way up this round. With the gold fundamentals so extremely bullish, that makes perfect sense.

GOT TO BE IN IT TO WIN IT!

www.lemetropolecafe.com

Hoffentlich ersticken sie mal dran!

Eine deftige Kurskorrektur droht!

Noch ist der dritte Aufschwung seit dem Platzen der Blase im Frühjahr 2000 im Gang, und die Aktieneuphorie wächst täglich, wobei das Bemerkenswerteste seit drei Monaten der gleichzeitige Anstieg der Aktien und Anleihenkurse ist. Die Aktienkurse steigen, weil die Anleger glauben, die Unternehmensgewinne sind im Begriff zu steigen, und die Anleihenkurse steigen, das heisst die Renditen fallen, weil die Anleger befürchten, eine Rezession steht vor der Tür, ja sogar eine Deflation wird befürchtet. Beide Lager können nicht recht haben. Entweder kommt der von vielen Optimisten vorhergesagten Wirtschaftsaufschwung, dann steigen die langfristigen Zinsen, auch wenn Alan Greenspan angekündigt hat, er kaufe Staatsanleihen, um die langfristigen Zinsen niedrig zu halten, und es gibt Turbulenzen auf den Anleihemärkten. « Wenn Sie berechnen, dass der faire Wert (fair value) für Anleihen zwischen 5 und 5,5% liegt, dann ist der Bondmarkt reif für Gewinnmitnahmen. », erklärt Mike Lenhoff, Chefstratege bei Brewin Dolphin Securities in der Financial Times. Wenn aber die Wirtschaftserholung nicht kommt, dann ist die Gefahr einer Deflation real, und ein Anstieg der Unternehmensgewinne reines Wunschdenken. Dann kommt es zu einem Mini-Crash am Aktienmarkt. « Die amerikanische Notenbank versucht die Blase wieder aufzupumpen », erklärt James Montier, Chefstratege bei Dresdner Kleinwort Wasserstein. Meine Schlussfolgerung ist klar und eindeutig : In Deutschland und einigen anderen europäischen Ländern (Schweiz, Portugal etc.) sind wir bereits in einer Wirtschaftsrezession, da beisst die Maus keinen Faden ab. Gleichzeitig geht die Rezession in Japan weiter, und die USA riskieren grössere Probleme mit der Finanzierung ihres Leistungsbilanzdefizits (inzwischen 6% des BSP).Das heisst, wegen der Furcht vor einem fallenden Dollar gehen auch die Kapitalströme nach Amerika zurück. Da gleichzeitig der US-Staatshaushalt auf ein Rekorddefizit von 400 Milliarden Dollar (rund 4% des BSP) in diesem Jahr zusteuert (nach Schätzungen des Congressional Budget Office), wird es für die USA langsam gefährlich, da Staat, Unternehmen und Haushalte zusammen eine Rekordverschuldung von über 30 Billionen Dollar aufgetürmt haben. Vergessen wir nicht, noch vor drei Jahren wies der amerikanische Staatsetat einen Überschuss von 236 Milliarden Dollar auf. Die Geschwindigkeit, mit der sich heute solch fundamentale Grössen verändern, ist wirklich atemberaubend, und lässt nichts Gutes ahnen.

Wenn es auch schwer fällt, nehmen Sie Ihre Gewinne mit, die Sie in amerikanischen und europäischen Aktien seit dem März dieses Jahres erzielt haben, und die stattlich sein können. (Die « jungen Aktien » aus der Kapitalerhöhung der Allianz haben sich in weniger als 2 Monaten verdoppelt !). Wir sind noch für einige Jahre in einer Seitwärtsbewegung, und da herrschen andere Spielregeln. Also geben Sie Ihrem Herz einen Stoss und verkaufen zumindest Teilpositionen Ihrer Allianz, Münchener Rück, Siemens etc., die hier an dieser Stelle zu erheblich tieferen Kursen empfohlen wurden. Die amerikanische Aktienbewertung ist nach wie vor schwindelerregend hoch (Standard & Poors 500 P/E = 35), und in Europa kann ich mir keine steigenden Börsen vorstellen, wenn wir in Amerika eine starke Kurskorrektur haben. Der Dax hat seit seinem Tiefstpunkt im März dieses Jahres nun fast 45% zugelegt. Er liegt inzwischen über dem Durchschnitt der 200 Tage (3.000), der noch leicht im Fallen begriffen ist. Optimisten bemerken zu Recht, wenn der Dax noch bis Mitte Juli steigt, dann wird aus der fallenden 200-Tageslinie eine steigende, und dies würde ein Kaufsignal auslösen, da die Trendwende « statistisch gesichert » ist .

Vergessen Sie nicht, dass auch in den letzten 30 bzw. 20 Jahren Rentensparpläne eine höhere Rendite abwarfen als Aktiensparpläne. Wie oft haben wir in Werbespots etc. anhören müssen, dass Aktien langfristig besser seien als Anleihen. Das stimmt aber nur, wenn die Betonung auf langfristig liegt, und das bedeutet, wie ich hier öfters dargelegt habe, rund 100 Jahre. Jetzt haben Sie es amtlich : Nach der vor kurzem veröffentlichten Statistik des Bundesverbandes Asset Management (BVI) wird auch der kühnste Aktienoptimist kleinlaut. Der BVI errechnete, dass ein Sparplan in europäischen Aktien auf 30 Jahre eine jährliche Rendite von 6,3% abwarf, während eine in EU-weiten Rentenfonds gesparte Anlage 6,8% jährlich brachte. Noch dramatischer wird es bei einer Periode von 20 Jahren : Da hätte ein Sparplan in europäischen Aktien 4,2% erbracht, der Anleihe-Sparer hätte aber 6,1% p.a. verdient. « Wer zum Ende seines Berufslebens eine reale Minusrendite erwirtschaftet, den tröstet es wenig, dass die Theorie auf lange Frist Recht behält. », meint die FAZ zu dieser Tatsache. Auf jeden Fall sind wir langfristig alle tot, wie der grösste Ökonom des vergangenen Jahrhunderts, Keynes, dazu trocken bemerkte. (Wohlgemerkt sind alle Angaben nominal und nicht real, das heisst nach Abzug der Inflationsraten.)

Vergessen Sie nicht, einen Teil Ihres Wertpapier-Portefeuilles (je nach Temperament 5 bis 10%) in Gold anzulegen. Wie Sie wissen, hat die chinesische Regierung angekündigt, ihre Goldreserven kräftig aufzustocken, ausserdem darf seit Beginn dieses Jahres der chinesische Staatsbürger zum ersten Male seit der kommunistischen Revolution wieder physisches Gold besitzen. China wird in rund 10 Jahren eine Wirtschaftsgrossmacht und wird mit einer eigenen Währung Machtpolitik treiben wollen…

In ein bis zwei Jahren werden wir uns wieder mit der Inflation beschäftigen, sie allein kann das Problem der insolventen Rentensysteme und der hohen Verschuldung « politisch lösen ».

Roland Leuschel

12.06.2003

http://nachrichten.boerse.de/anzeige.php3?id=62914d64

Noch ist der dritte Aufschwung seit dem Platzen der Blase im Frühjahr 2000 im Gang, und die Aktieneuphorie wächst täglich, wobei das Bemerkenswerteste seit drei Monaten der gleichzeitige Anstieg der Aktien und Anleihenkurse ist. Die Aktienkurse steigen, weil die Anleger glauben, die Unternehmensgewinne sind im Begriff zu steigen, und die Anleihenkurse steigen, das heisst die Renditen fallen, weil die Anleger befürchten, eine Rezession steht vor der Tür, ja sogar eine Deflation wird befürchtet. Beide Lager können nicht recht haben. Entweder kommt der von vielen Optimisten vorhergesagten Wirtschaftsaufschwung, dann steigen die langfristigen Zinsen, auch wenn Alan Greenspan angekündigt hat, er kaufe Staatsanleihen, um die langfristigen Zinsen niedrig zu halten, und es gibt Turbulenzen auf den Anleihemärkten. « Wenn Sie berechnen, dass der faire Wert (fair value) für Anleihen zwischen 5 und 5,5% liegt, dann ist der Bondmarkt reif für Gewinnmitnahmen. », erklärt Mike Lenhoff, Chefstratege bei Brewin Dolphin Securities in der Financial Times. Wenn aber die Wirtschaftserholung nicht kommt, dann ist die Gefahr einer Deflation real, und ein Anstieg der Unternehmensgewinne reines Wunschdenken. Dann kommt es zu einem Mini-Crash am Aktienmarkt. « Die amerikanische Notenbank versucht die Blase wieder aufzupumpen », erklärt James Montier, Chefstratege bei Dresdner Kleinwort Wasserstein. Meine Schlussfolgerung ist klar und eindeutig : In Deutschland und einigen anderen europäischen Ländern (Schweiz, Portugal etc.) sind wir bereits in einer Wirtschaftsrezession, da beisst die Maus keinen Faden ab. Gleichzeitig geht die Rezession in Japan weiter, und die USA riskieren grössere Probleme mit der Finanzierung ihres Leistungsbilanzdefizits (inzwischen 6% des BSP).Das heisst, wegen der Furcht vor einem fallenden Dollar gehen auch die Kapitalströme nach Amerika zurück. Da gleichzeitig der US-Staatshaushalt auf ein Rekorddefizit von 400 Milliarden Dollar (rund 4% des BSP) in diesem Jahr zusteuert (nach Schätzungen des Congressional Budget Office), wird es für die USA langsam gefährlich, da Staat, Unternehmen und Haushalte zusammen eine Rekordverschuldung von über 30 Billionen Dollar aufgetürmt haben. Vergessen wir nicht, noch vor drei Jahren wies der amerikanische Staatsetat einen Überschuss von 236 Milliarden Dollar auf. Die Geschwindigkeit, mit der sich heute solch fundamentale Grössen verändern, ist wirklich atemberaubend, und lässt nichts Gutes ahnen.

Wenn es auch schwer fällt, nehmen Sie Ihre Gewinne mit, die Sie in amerikanischen und europäischen Aktien seit dem März dieses Jahres erzielt haben, und die stattlich sein können. (Die « jungen Aktien » aus der Kapitalerhöhung der Allianz haben sich in weniger als 2 Monaten verdoppelt !). Wir sind noch für einige Jahre in einer Seitwärtsbewegung, und da herrschen andere Spielregeln. Also geben Sie Ihrem Herz einen Stoss und verkaufen zumindest Teilpositionen Ihrer Allianz, Münchener Rück, Siemens etc., die hier an dieser Stelle zu erheblich tieferen Kursen empfohlen wurden. Die amerikanische Aktienbewertung ist nach wie vor schwindelerregend hoch (Standard & Poors 500 P/E = 35), und in Europa kann ich mir keine steigenden Börsen vorstellen, wenn wir in Amerika eine starke Kurskorrektur haben. Der Dax hat seit seinem Tiefstpunkt im März dieses Jahres nun fast 45% zugelegt. Er liegt inzwischen über dem Durchschnitt der 200 Tage (3.000), der noch leicht im Fallen begriffen ist. Optimisten bemerken zu Recht, wenn der Dax noch bis Mitte Juli steigt, dann wird aus der fallenden 200-Tageslinie eine steigende, und dies würde ein Kaufsignal auslösen, da die Trendwende « statistisch gesichert » ist .

Vergessen Sie nicht, dass auch in den letzten 30 bzw. 20 Jahren Rentensparpläne eine höhere Rendite abwarfen als Aktiensparpläne. Wie oft haben wir in Werbespots etc. anhören müssen, dass Aktien langfristig besser seien als Anleihen. Das stimmt aber nur, wenn die Betonung auf langfristig liegt, und das bedeutet, wie ich hier öfters dargelegt habe, rund 100 Jahre. Jetzt haben Sie es amtlich : Nach der vor kurzem veröffentlichten Statistik des Bundesverbandes Asset Management (BVI) wird auch der kühnste Aktienoptimist kleinlaut. Der BVI errechnete, dass ein Sparplan in europäischen Aktien auf 30 Jahre eine jährliche Rendite von 6,3% abwarf, während eine in EU-weiten Rentenfonds gesparte Anlage 6,8% jährlich brachte. Noch dramatischer wird es bei einer Periode von 20 Jahren : Da hätte ein Sparplan in europäischen Aktien 4,2% erbracht, der Anleihe-Sparer hätte aber 6,1% p.a. verdient. « Wer zum Ende seines Berufslebens eine reale Minusrendite erwirtschaftet, den tröstet es wenig, dass die Theorie auf lange Frist Recht behält. », meint die FAZ zu dieser Tatsache. Auf jeden Fall sind wir langfristig alle tot, wie der grösste Ökonom des vergangenen Jahrhunderts, Keynes, dazu trocken bemerkte. (Wohlgemerkt sind alle Angaben nominal und nicht real, das heisst nach Abzug der Inflationsraten.)

Vergessen Sie nicht, einen Teil Ihres Wertpapier-Portefeuilles (je nach Temperament 5 bis 10%) in Gold anzulegen. Wie Sie wissen, hat die chinesische Regierung angekündigt, ihre Goldreserven kräftig aufzustocken, ausserdem darf seit Beginn dieses Jahres der chinesische Staatsbürger zum ersten Male seit der kommunistischen Revolution wieder physisches Gold besitzen. China wird in rund 10 Jahren eine Wirtschaftsgrossmacht und wird mit einer eigenen Währung Machtpolitik treiben wollen…

In ein bis zwei Jahren werden wir uns wieder mit der Inflation beschäftigen, sie allein kann das Problem der insolventen Rentensysteme und der hohen Verschuldung « politisch lösen ».

Roland Leuschel

12.06.2003

http://nachrichten.boerse.de/anzeige.php3?id=62914d64

Wie es aussieht hat sich jetzt der Euro vom Gold abgekoppelt!

Schade!

Das kommt von der verdammten Goldpusherei, wie kann Gold steigen, wenn die Spekulanten für eine Menge Gold long gegangen sind, die am physischen Markt in 10 Jahren vielleicht umgesetzt werden!

Marktumsatz physisch/Jahr: ca. 3000 Tonnen = 3Millionen Kilo = 90 Millionen Unzen = 100 Millionen Unzen

Ein Kontrakt sind meines Wissens 1000 Unzen(Bitte korrigieren, wenn es nicht stimmt!!!)

100.000 Kontrakte (Netto Longposition der Spekulanten) sind also 100 Millionen Unzen, also ein Jahresumsatz.

Da ist es doch ein leichtes ein paar Millionen auf den Markt zu werfen und auf diese Weise ein Vielfaches an den Spekulanten zu verdienen.

Schade!

Das kommt von der verdammten Goldpusherei, wie kann Gold steigen, wenn die Spekulanten für eine Menge Gold long gegangen sind, die am physischen Markt in 10 Jahren vielleicht umgesetzt werden!

Marktumsatz physisch/Jahr: ca. 3000 Tonnen = 3Millionen Kilo = 90 Millionen Unzen = 100 Millionen Unzen

Ein Kontrakt sind meines Wissens 1000 Unzen(Bitte korrigieren, wenn es nicht stimmt!!!)

100.000 Kontrakte (Netto Longposition der Spekulanten) sind also 100 Millionen Unzen, also ein Jahresumsatz.

Da ist es doch ein leichtes ein paar Millionen auf den Markt zu werfen und auf diese Weise ein Vielfaches an den Spekulanten zu verdienen.

@Der_Unglückliche

Du schreibst:

"Ein Kontrakt sind meines Wissens 1000 Unzen(Bitte korrigieren, wenn es nicht stimmt!!!"

Das ist aber noch lange nicht alles, was in Deinem Posting nicht stimmt." target="_blank" rel="nofollow ugc noopener">Das stimmt ganz sicher nicht!!

Ein Kontrakt entsprechen " nur" 100 Unzen Gold, oder ca. 3 Kilo Gold.

Das ist aber noch lange nicht alles, was in Deinem Posting nicht stimmt.

Ich frage mich wirklich, was Du mit Deinem Posting bezweckst. Komplet falsche Angaben, und Berechnungen über Gold Short Positionen zu verbreiten, bevor Du Dich auch nur annähernd mit den grundlegensten Dingen beim Goldgeschehen beschäftigt hast.

Die Gold Bullion Banken sind laut GATA 15000 - 16000 Tonnen Gold short, das entspricht ca. 6 Jahresgoldproduktionen. Dazu kommen noch die ausgewiesenen Vorwärtsverkäufe der Goldproduzenten, und das seit Jahren anhaltende Gold Produktionsdefizit, in der Höhe von mindestens 1000 Tonnen pro Jahr.

Und Du willst uns anhand von netto Specs Long Positionen, im Umfang von 10 Mio. Unzen beim Gold Futures Papier Gold Handel weissmachen, dass desswegen die Gold Preise nicht steigen können, weil diese Specs Deiner Ansicht den Anstieg der Goldpreise verhindern. Das kannst Du doch nicht wirklich glauben?

Gruss

ThaiGuru

Du schreibst:

"Ein Kontrakt sind meines Wissens 1000 Unzen(Bitte korrigieren, wenn es nicht stimmt!!!"

Das ist aber noch lange nicht alles, was in Deinem Posting nicht stimmt." target="_blank" rel="nofollow ugc noopener">Das stimmt ganz sicher nicht!!

Ein Kontrakt entsprechen " nur" 100 Unzen Gold, oder ca. 3 Kilo Gold.

Das ist aber noch lange nicht alles, was in Deinem Posting nicht stimmt.

Ich frage mich wirklich, was Du mit Deinem Posting bezweckst. Komplet falsche Angaben, und Berechnungen über Gold Short Positionen zu verbreiten, bevor Du Dich auch nur annähernd mit den grundlegensten Dingen beim Goldgeschehen beschäftigt hast.

Die Gold Bullion Banken sind laut GATA 15000 - 16000 Tonnen Gold short, das entspricht ca. 6 Jahresgoldproduktionen. Dazu kommen noch die ausgewiesenen Vorwärtsverkäufe der Goldproduzenten, und das seit Jahren anhaltende Gold Produktionsdefizit, in der Höhe von mindestens 1000 Tonnen pro Jahr.

Und Du willst uns anhand von netto Specs Long Positionen, im Umfang von 10 Mio. Unzen beim Gold Futures Papier Gold Handel weissmachen, dass desswegen die Gold Preise nicht steigen können, weil diese Specs Deiner Ansicht den Anstieg der Goldpreise verhindern. Das kannst Du doch nicht wirklich glauben?

Gruss

ThaiGuru

10:14p ET Wednesday, June 11, 2003

Dear Friend of GATA and Gold:

A longtime supporter of GATA wrote today in near-

despair at the pounding gold took Tuesday. The

manipulation of the gold market and other markets

is so brazen now, he said, but what can we ever do

to stop the bad guys?

All I could answer was that GATA would continue

to do what it has been doing for four years now,

would continue to try to expose the bad guys and

the bad things they do, to get the attention of the

news media and the political and legal authorities,

and eventually no one will be taking the other side

of the bad guys` trades and the rig will collapse.

Our side`s best technical analyst, Jim Sinclair,

has put it another way: Beat the bums by running

their own trades ahead of them.

Of course few of us are nimble enough to be traders

like that, so we may just have to wish Sinclair the

best in such undertakings as we muddle on trying to

stay true to our principles and world-view.

But good things ARE happening for our side. As you

may have noted from GATA`s dispatch of Tuesday ...

http://groups.yahoo.com/group/gata/message/1538

... Blanchard & Co.`s federal lawsuit against Barrick

Gold and Morgan Chase, picking up where GATA

consultant Reg Howe`s federal lawsuit left off, is

making good progress and has even elicited Barrick`s

confession that it and Morgan Chase are the agents

of the central banks in controlling the gold price.

And this evening GATA learned that today`s edition of

Richard Russell`s Dow Theory Letters (available

only by subscription at http://www.dowtheoryletters.com

distributed the full text of Tuesday`s GATA dispatch

about Barrick`s confession, which had been provided

to Russell by a subscriber to GATA Chairman Bill

Murphy`s Internet site of financial commentary

http://www.LeMetropoleCafe.com.

While Dow Theory Letters may not have quite the

reach of the Wall Street Journal or New York Times

-- which, financed so heavily by the Wall Street

financial houses, strive mightily to avoid reporting

what is really happening in the world economy -- it

may be the best-regarded financial newsletter in

the United States, as well as the financial newsletter

with the longest single proprietorship, having been

started by Russell in 1958. Few financial observers

are as respected ... and here he is suddenly spreading

the GATA story to highly placed investors and

financial observers all around the world.

GATA and gold are not in Kansas anymore, even if

we hope to be escorting the market riggers to

Leavenworth.

A few months ago the most successful mutual fund

manager in the world in 2002, John Embry of RBC

Global Investments, now president of Sprott Asset

Management in Toronto, told a national television

audience in Canada that GATA was right about the gold

market and that he had been basing investment

decisions on GATA`s research. Russell has been slower

in acknowledging the manipulation of the gold market,

but his commentaries over the last few months have been

raising the question, and his newsletter`s inclusion

today of Tuesday`s GATA dispatch may be taken as a

bit of an endorsement.

Word IS getting out that the emperor is naked, and

more and more people ARE saying so, or at least

hinting at it. GATA will keep helping them along

no matter how dark things seem.

After all, things have been far darker than they

are now.

On a day of terrible battlefront reverses for

Britain in 1941, the Swedish ambassador asked

Prime Minister Winston Churchill just how he

expected his country to win the war, what with

everything going so badly. In reply Churchill told

a little story:

"Once upon a time there were two frogs, Mr. Optimist

Frog and Mr. Pessimist Frog. One evening the two

frogs hippety-hopped across the meadow, enchanted

by the smell of fresh milk from a dairy. They hopped

through the dairy window and plopped right into a

pail of milk.

"The pail`s sides were too steep. Mr. Pessimist

Frog soon gave up and sank to the bottom. But Mr.

Optimist Frog took courage and began thrashing

around, hoping to get out somehow. He didn`t know

exactly how, but he wasn`t going to give up without

a fight. He churned around all night, and by morning

-- oh joy! -- he was floating on a pat of butter."

After taking a puff on his ever-present cigar,

Churchill concluded simply, "I am Mr. Optimist Frog."

Dear Friend of GATA and Gold:

A longtime supporter of GATA wrote today in near-

despair at the pounding gold took Tuesday. The

manipulation of the gold market and other markets

is so brazen now, he said, but what can we ever do

to stop the bad guys?

All I could answer was that GATA would continue

to do what it has been doing for four years now,

would continue to try to expose the bad guys and

the bad things they do, to get the attention of the

news media and the political and legal authorities,

and eventually no one will be taking the other side

of the bad guys` trades and the rig will collapse.

Our side`s best technical analyst, Jim Sinclair,

has put it another way: Beat the bums by running

their own trades ahead of them.

Of course few of us are nimble enough to be traders

like that, so we may just have to wish Sinclair the

best in such undertakings as we muddle on trying to

stay true to our principles and world-view.

But good things ARE happening for our side. As you

may have noted from GATA`s dispatch of Tuesday ...

http://groups.yahoo.com/group/gata/message/1538

... Blanchard & Co.`s federal lawsuit against Barrick

Gold and Morgan Chase, picking up where GATA

consultant Reg Howe`s federal lawsuit left off, is

making good progress and has even elicited Barrick`s

confession that it and Morgan Chase are the agents

of the central banks in controlling the gold price.

And this evening GATA learned that today`s edition of

Richard Russell`s Dow Theory Letters (available

only by subscription at http://www.dowtheoryletters.com

distributed the full text of Tuesday`s GATA dispatch

about Barrick`s confession, which had been provided

to Russell by a subscriber to GATA Chairman Bill

Murphy`s Internet site of financial commentary

http://www.LeMetropoleCafe.com.

While Dow Theory Letters may not have quite the

reach of the Wall Street Journal or New York Times

-- which, financed so heavily by the Wall Street

financial houses, strive mightily to avoid reporting

what is really happening in the world economy -- it

may be the best-regarded financial newsletter in

the United States, as well as the financial newsletter

with the longest single proprietorship, having been

started by Russell in 1958. Few financial observers

are as respected ... and here he is suddenly spreading

the GATA story to highly placed investors and

financial observers all around the world.

GATA and gold are not in Kansas anymore, even if

we hope to be escorting the market riggers to

Leavenworth.

A few months ago the most successful mutual fund

manager in the world in 2002, John Embry of RBC

Global Investments, now president of Sprott Asset

Management in Toronto, told a national television

audience in Canada that GATA was right about the gold

market and that he had been basing investment

decisions on GATA`s research. Russell has been slower

in acknowledging the manipulation of the gold market,

but his commentaries over the last few months have been

raising the question, and his newsletter`s inclusion

today of Tuesday`s GATA dispatch may be taken as a

bit of an endorsement.

Word IS getting out that the emperor is naked, and

more and more people ARE saying so, or at least

hinting at it. GATA will keep helping them along

no matter how dark things seem.

After all, things have been far darker than they

are now.

On a day of terrible battlefront reverses for

Britain in 1941, the Swedish ambassador asked

Prime Minister Winston Churchill just how he

expected his country to win the war, what with

everything going so badly. In reply Churchill told

a little story:

"Once upon a time there were two frogs, Mr. Optimist

Frog and Mr. Pessimist Frog. One evening the two

frogs hippety-hopped across the meadow, enchanted

by the smell of fresh milk from a dairy. They hopped

through the dairy window and plopped right into a

pail of milk.

"The pail`s sides were too steep. Mr. Pessimist

Frog soon gave up and sank to the bottom. But Mr.

Optimist Frog took courage and began thrashing

around, hoping to get out somehow. He didn`t know

exactly how, but he wasn`t going to give up without

a fight. He churned around all night, and by morning

-- oh joy! -- he was floating on a pat of butter."

After taking a puff on his ever-present cigar,

Churchill concluded simply, "I am Mr. Optimist Frog."

June 12 - Gold $352.90 down $2.40 - Silver $4.50 unchanged

Can’t Keep A Good Gold Share Down

" target="_blank" rel="nofollow ugc noopener">"The most important political office is that of private citizen." -Louis Brandeis, lawyer, judge, and writer (1856-1941

A boring day. After selling the close yesterday, The Gold Cartel took gold immediately lower and pressed their case during the Comex session today. Efforts to take out $350 failed, however. When a market is broken down and trashed like gold was on Tuesday, it needs to compose itself before going back up again. Gold and silver usually need more composing time than other commodity markets. This may not be one of those times. The specs are bailing out of gold like crazy. The Comex open interest fell another 6794 contracts to 195,587. Think of gold becoming sick on its way down from $370. It is now healing.

Two gold positives:

*The dollar will not rally more than a blip. It gave up all its early gains and closed lower at

92.89, down .13. The euro closed fractionally higher at 117.64.