SOLARWORLD ++ vorab Q-Zahlen 5/11 + gab es einen Aktienrückkauf im 3-Q ? ++ (Seite 5744)

eröffnet am 02.11.07 13:32:40 von

neuester Beitrag 24.03.23 19:13:18 von

neuester Beitrag 24.03.23 19:13:18 von

Beiträge: 61.296

ID: 1.134.742

ID: 1.134.742

Aufrufe heute: 1

Gesamt: 4.064.595

Gesamt: 4.064.595

Aktive User: 0

ISIN: DE000A1YCMM2 · WKN: A1YCMM · Symbol: SWVK

0,1850

EUR

-1,07 %

-0,0020 EUR

Letzter Kurs 03.05.24 Tradegate

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9250 | +34,53 | |

| 1,7400 | +33,84 | |

| 0,5770 | +29,66 | |

| 0,5070 | +17,06 | |

| 1,2600 | +11,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,8000 | -5,69 | |

| 0,8000 | -5,88 | |

| 6,1500 | -6,11 | |

| 12,700 | -8,63 | |

| 1,9200 | -13,12 |

Beitrag zu dieser Diskussion schreiben

Solar shakeout less likely to hit wafers, silicons

Tue Feb 10, 2009 9:29am EST

By Christoph Steitz - Analysis

FRANKFURT (Reuters) - Solar energy companies which operate further away from end-customers -- such as wafer and silicon producers -- are likely to fare better during a looming shakeout in the sector than their cell and module-making peers.

In recent years, solar companies have enjoyed significant growth rates and a keen appetite from investors. But the crisis in financial markets has taken its toll on the industry and a falling oil price has curbed demand for renewables, prompting analysts and industry experts to predict a wide-ranging consolidation is around the corner.

This is less likely to hit high-quality producers of wafer and silicon -- both needed to make solar cells -- than cell and module makers suffering from low prices and oversupply, analysts say.

"Producers of wafer and silicon will come out as the likely winners from the shakeout as they are under less pricing pressure than the cell and module producers," said Bjoern Glueck, portfolio manager at Lupus alpha which has 1.3 billion euros ($1.69 billion) under management in European micro-, small- and mid-cap stocks.

Analysts at HSBC forecast average selling prices for solar systems will drop by about a fifth in 2009 given oversupply and a tighter credit environment, but prices for cells and modules have so far fallen much faster than those for silicon and wafer. Several industry bellwethers, such as cell producers Q-Cells and Sharp as well as module maker Solon have had to revise outlooks.

"While we forecast margin erosion through the whole solar value chain, we believe investors should focus on the beginning of the value chain given longer-term contracts, more stable cash flows and the tighter supply/demand balance," HSBC analysts wrote.

They say that in the long term this will favor silicon producers with low-cost operations such as Germany's Wacker Chemie and Hemlock Semiconductor Corp, a joint venture of Dow Corning, Shin-Etsu Handotai and Mitsubishi Materials Corp.

VALUATIONS

Valuations back up this view. Wacker Chemie, a wafer producer, trades at 8.5 times estimated 12-month forward earnings, according to StarMine, a premium to module makers such as Solon at 4.5 times or Aleo Solar at 6.1 times.

At 12.1 times 12-month forward earnings, Norwegian silicon maker Renewable Energy Corporation ASA, too, trades at a large premium to Chinese solar cell maker JA Solar Holdings, which trades at 6.9 times.

But experts also said that all-rounders that operate in several parts of the solar sector are also less likely to fall victim to the crisis, said Arthur Hoffmann, who manages the New Power Fund at Bank Sarasin & Cie AG, with about 200 million euros under management.

"It's those companies that have the highest margins and that are active in more than one sector of the solar value chain, such as SolarWorld, Sunpower, and First Solar," Hoffmann said.

SolarWorld, which manufactures everything from solar-grade silicon to solar cells and solar panels, trades at 11.5 times 12-month forward earnings and Sunpower and First Solar trade at 14 and 20.8 times, respectively.

However, despite the current issues in the sector -- which analysts believe will lead to wide-ranging consolidation -- the industry remains one with "longer term potential," as JP Morgan wrote in a note.

In fact, there are first signs of an overall recovery of the industry with regard to project funding. Executives including Phoenix Solar Chief Executive Andreas Haenel said that financing conditions have improved from the dire fourth quarter of 2008 and that banks' willingness to grant credit lines for solar projects have grown.

U.S. peer GT Solar hit a similar note last week, saying financing conditions in major growth market China had improved over the last two months, comments that led to a positive read-across for German companies.

($1=.7672 Euro)

(Additional reporting by Nichola Groom in Los Angeles; Editing by Jon Loades-Carter)

http://www.reuters.com/article/reutersEdge/idUSTRE5193WG2009…

Tue Feb 10, 2009 9:29am EST

By Christoph Steitz - Analysis

FRANKFURT (Reuters) - Solar energy companies which operate further away from end-customers -- such as wafer and silicon producers -- are likely to fare better during a looming shakeout in the sector than their cell and module-making peers.

In recent years, solar companies have enjoyed significant growth rates and a keen appetite from investors. But the crisis in financial markets has taken its toll on the industry and a falling oil price has curbed demand for renewables, prompting analysts and industry experts to predict a wide-ranging consolidation is around the corner.

This is less likely to hit high-quality producers of wafer and silicon -- both needed to make solar cells -- than cell and module makers suffering from low prices and oversupply, analysts say.

"Producers of wafer and silicon will come out as the likely winners from the shakeout as they are under less pricing pressure than the cell and module producers," said Bjoern Glueck, portfolio manager at Lupus alpha which has 1.3 billion euros ($1.69 billion) under management in European micro-, small- and mid-cap stocks.

Analysts at HSBC forecast average selling prices for solar systems will drop by about a fifth in 2009 given oversupply and a tighter credit environment, but prices for cells and modules have so far fallen much faster than those for silicon and wafer. Several industry bellwethers, such as cell producers Q-Cells and Sharp as well as module maker Solon have had to revise outlooks.

"While we forecast margin erosion through the whole solar value chain, we believe investors should focus on the beginning of the value chain given longer-term contracts, more stable cash flows and the tighter supply/demand balance," HSBC analysts wrote.

They say that in the long term this will favor silicon producers with low-cost operations such as Germany's Wacker Chemie and Hemlock Semiconductor Corp, a joint venture of Dow Corning, Shin-Etsu Handotai and Mitsubishi Materials Corp.

VALUATIONS

Valuations back up this view. Wacker Chemie, a wafer producer, trades at 8.5 times estimated 12-month forward earnings, according to StarMine, a premium to module makers such as Solon at 4.5 times or Aleo Solar at 6.1 times.

At 12.1 times 12-month forward earnings, Norwegian silicon maker Renewable Energy Corporation ASA, too, trades at a large premium to Chinese solar cell maker JA Solar Holdings, which trades at 6.9 times.

But experts also said that all-rounders that operate in several parts of the solar sector are also less likely to fall victim to the crisis, said Arthur Hoffmann, who manages the New Power Fund at Bank Sarasin & Cie AG, with about 200 million euros under management.

"It's those companies that have the highest margins and that are active in more than one sector of the solar value chain, such as SolarWorld, Sunpower, and First Solar," Hoffmann said.

SolarWorld, which manufactures everything from solar-grade silicon to solar cells and solar panels, trades at 11.5 times 12-month forward earnings and Sunpower and First Solar trade at 14 and 20.8 times, respectively.

However, despite the current issues in the sector -- which analysts believe will lead to wide-ranging consolidation -- the industry remains one with "longer term potential," as JP Morgan wrote in a note.

In fact, there are first signs of an overall recovery of the industry with regard to project funding. Executives including Phoenix Solar Chief Executive Andreas Haenel said that financing conditions have improved from the dire fourth quarter of 2008 and that banks' willingness to grant credit lines for solar projects have grown.

U.S. peer GT Solar hit a similar note last week, saying financing conditions in major growth market China had improved over the last two months, comments that led to a positive read-across for German companies.

($1=.7672 Euro)

(Additional reporting by Nichola Groom in Los Angeles; Editing by Jon Loades-Carter)

http://www.reuters.com/article/reutersEdge/idUSTRE5193WG2009…

Used machinery trade now also in the solar industry

/EIN News/ The solar industry continues to grow. New machines allow an even faster production to satisfy the growing demand. However, new machines require also a very high volume of investment. A cost-saving alternative is to buy used machines.

Nowadays in the worldwide financial crisis, even the market leaders try to cut down the costs as much as possible. And they do not only think of buying used equipment, but maybe also of selling some of their own used equipment.

What is usual in many other branches like the textile or metalworking industry, will now also start in the solar industry: the sale of used machinery by live or online auction.

If a company decides to sell its used equipment it can either do this on its own or assign a specialist company to do it. The best way to sell used equipment is assign an auction company as they have a long expertise in selling all kinds of used equipment. They know where to find end-user buyers who are willing to pay the highest price.

Based on the time schedule of the seller the auction company will advice the best selling method for the assets or complete plant. The type of equipment and local circumstances are also important elements for deciding the disposal method. The equipment can either be sold in an online auction, in a live or webcast auction, in a private treaty sale or a tender sale. Each sale method has its own advantages.

- Online Auctions are a perfect sales instrument, especially for assets with a commodity character (such as large quantities of office furniture and equipment) and for very specific and specialized items aimed at a small and specialized market. Slow-selling stocks, phase-out models or surplus goods can also gain from online auctions. Therefore, online auctions have a high potential in both business-to-consumer and business-to-business areas.

Online auctions have several advantages compared to “live” auctions, e.g. bidders are not compelled to make an immediate decision, the auction process can be observed while an item is still active. Online auctions are convenient for bidders as they are able to participate in the auctions from anywhere in the world. Bidders can be sure that others are not being given preferential treatment as all participants have to adhere to the same terms and conditions.

- Live and webcast auctions are an excellent selling method to achieve good prices in a short time from the highest bidder. It's the event character which makes a live auction to a very exciting mode of buying "new" used equipment.

Webcast: the Internet is increasingly being used to support traditional “live” auctions by making the auction available for more potential buyers who do not have time to come to the auction place.

- Tender Sales are suitable for clients either wishing to sell only a few items or an entire plant. The auction company and the client decide on a bid submission deadline. Bidders are then requested to send their written bids within the set bidding period. All bids are submitted in private, i.e. none of the bids are made public to other bidders. After the deadline, the bids are evaluated and the highest bidder wins.

- Private Treaty Sales are recommended when the client is selling goods of a very specific character and for which there is a small market. Private treaty sales are not only suitable for a very small amount of items to be sold but also for assets which together form a complete unit, e.g. a plant or complete production line and where time is not a restricting factor. Private treaty sales are also used when the volume of the sale is relatively small in size.

After the valuation of the machines and the decision about the sales method a catalogue is being made and all lots will be photographed and described. A good preparation of the sale including a very detailed description with good photos of each lot is the most important factor to achieve high prices in a sale.

To get back to the solar industry it's good to come to know that Deutsche Cell GmbH - a subsidiary of SolarWorld AG - has decided to sell some of its used machinery via an auction company.

The European market leader for industrial auctions - the Troostwijk Group - has been assigned to sell machinery for the production of 5" and 6" solar wafers.

As the market is quite small it was decided to sell the machines in a private treaty sale. That means the interested buyers can inspect the machines in operation on site in Freiberg (East Germany) by appointment and decide afterwards which price they want to offer. If the price corresponds with the expectations of Deutsche Cell the bid will be accepted. The buyer has to pay the bidden price + 15% buyer's premium + VAT. Troostwijk is taking care of all interested parties, is coordinating the viewing times and will do the invoicing.

As soon as the money has been paid the client can dismantle his machines and take them to its own factory.

http://www.einnews.com/pr-news/10725-used-machinery-trade-no…

Die Deutsche Cell verkauft Maschinen zur Waferfertigung?!

/EIN News/ The solar industry continues to grow. New machines allow an even faster production to satisfy the growing demand. However, new machines require also a very high volume of investment. A cost-saving alternative is to buy used machines.

Nowadays in the worldwide financial crisis, even the market leaders try to cut down the costs as much as possible. And they do not only think of buying used equipment, but maybe also of selling some of their own used equipment.

What is usual in many other branches like the textile or metalworking industry, will now also start in the solar industry: the sale of used machinery by live or online auction.

If a company decides to sell its used equipment it can either do this on its own or assign a specialist company to do it. The best way to sell used equipment is assign an auction company as they have a long expertise in selling all kinds of used equipment. They know where to find end-user buyers who are willing to pay the highest price.

Based on the time schedule of the seller the auction company will advice the best selling method for the assets or complete plant. The type of equipment and local circumstances are also important elements for deciding the disposal method. The equipment can either be sold in an online auction, in a live or webcast auction, in a private treaty sale or a tender sale. Each sale method has its own advantages.

- Online Auctions are a perfect sales instrument, especially for assets with a commodity character (such as large quantities of office furniture and equipment) and for very specific and specialized items aimed at a small and specialized market. Slow-selling stocks, phase-out models or surplus goods can also gain from online auctions. Therefore, online auctions have a high potential in both business-to-consumer and business-to-business areas.

Online auctions have several advantages compared to “live” auctions, e.g. bidders are not compelled to make an immediate decision, the auction process can be observed while an item is still active. Online auctions are convenient for bidders as they are able to participate in the auctions from anywhere in the world. Bidders can be sure that others are not being given preferential treatment as all participants have to adhere to the same terms and conditions.

- Live and webcast auctions are an excellent selling method to achieve good prices in a short time from the highest bidder. It's the event character which makes a live auction to a very exciting mode of buying "new" used equipment.

Webcast: the Internet is increasingly being used to support traditional “live” auctions by making the auction available for more potential buyers who do not have time to come to the auction place.

- Tender Sales are suitable for clients either wishing to sell only a few items or an entire plant. The auction company and the client decide on a bid submission deadline. Bidders are then requested to send their written bids within the set bidding period. All bids are submitted in private, i.e. none of the bids are made public to other bidders. After the deadline, the bids are evaluated and the highest bidder wins.

- Private Treaty Sales are recommended when the client is selling goods of a very specific character and for which there is a small market. Private treaty sales are not only suitable for a very small amount of items to be sold but also for assets which together form a complete unit, e.g. a plant or complete production line and where time is not a restricting factor. Private treaty sales are also used when the volume of the sale is relatively small in size.

After the valuation of the machines and the decision about the sales method a catalogue is being made and all lots will be photographed and described. A good preparation of the sale including a very detailed description with good photos of each lot is the most important factor to achieve high prices in a sale.

To get back to the solar industry it's good to come to know that Deutsche Cell GmbH - a subsidiary of SolarWorld AG - has decided to sell some of its used machinery via an auction company.

The European market leader for industrial auctions - the Troostwijk Group - has been assigned to sell machinery for the production of 5" and 6" solar wafers.

As the market is quite small it was decided to sell the machines in a private treaty sale. That means the interested buyers can inspect the machines in operation on site in Freiberg (East Germany) by appointment and decide afterwards which price they want to offer. If the price corresponds with the expectations of Deutsche Cell the bid will be accepted. The buyer has to pay the bidden price + 15% buyer's premium + VAT. Troostwijk is taking care of all interested parties, is coordinating the viewing times and will do the invoicing.

As soon as the money has been paid the client can dismantle his machines and take them to its own factory.

http://www.einnews.com/pr-news/10725-used-machinery-trade-no…

Die Deutsche Cell verkauft Maschinen zur Waferfertigung?!

Antwort auf Beitrag Nr.: 36.550.929 von bossi1 am 10.02.09 17:16:0310.02.2009 , 18:17 Uhr

Marktbericht: Börse New York

Geithner-Plan enttäuscht – US-Börsen sacken ab

Nach Bekanntgabe der Rettungspläne für den Bankensektor durch US-Finanzminister Timothy Geithner haben die US-Aktienmärkte am Dienstag ihre Verluste ausgeweitet. Besonders kräftig verlieren die Bankaktien.

http://www.handelsblatt.com/finanzen/marktberichte/geithner-…

Marktbericht: Börse New York

Geithner-Plan enttäuscht – US-Börsen sacken ab

Nach Bekanntgabe der Rettungspläne für den Bankensektor durch US-Finanzminister Timothy Geithner haben die US-Aktienmärkte am Dienstag ihre Verluste ausgeweitet. Besonders kräftig verlieren die Bankaktien.

http://www.handelsblatt.com/finanzen/marktberichte/geithner-…

US-Börsen

Elektrisierte Stimmung vor Geithner-Rede

Die US-Aktienmärkte verzeichnen Abschläge. Berichte, wonach der Rettungsplan des US-Finanzministers keine "Bad Bank" zur Ausgliederung von Risiko-Papieren beinhalten werde, belasten die Kurse.

http://www.ftd.de/boersen_maerkte/aktien/marktberichte/:US-B…

... müßte so gegen 17:00h sein

DOW -2,56%

Q-Cells -7,03%

SWV -2,52%

Elektrisierte Stimmung vor Geithner-Rede

Die US-Aktienmärkte verzeichnen Abschläge. Berichte, wonach der Rettungsplan des US-Finanzministers keine "Bad Bank" zur Ausgliederung von Risiko-Papieren beinhalten werde, belasten die Kurse.

http://www.ftd.de/boersen_maerkte/aktien/marktberichte/:US-B…

... müßte so gegen 17:00h sein

DOW -2,56%

Q-Cells -7,03%

SWV -2,52%

Antwort auf Beitrag Nr.: 36.550.161 von bossi1 am 10.02.09 16:12:29Die haben wohl mit 1,60 gerechnet, die bei Vertragsschluss aktuell waren...

Solarworld ist allerdings auch keine Tochterfirma der Deutschen Solar.

SolarWorld AG, a subsidiary of Deutsche Solar AG

Solarworld ist allerdings auch keine Tochterfirma der Deutschen Solar.

SolarWorld AG, a subsidiary of Deutsche Solar AG

Antwort auf Beitrag Nr.: 36.549.633 von lieberlong am 10.02.09 15:30:41In July 2008, Solar Semiconductor entered into a US$1.2 billion, multi-year contract for the supply of wafers from SolarWorld AG, a subsidiary of Deutsche Solar AG, which operates one of the largest multi-crystalline solar silicon wafer factories.

finanzen.net

SolarWorld schließt Liefervertrag mit Solar Semiconductor ab

Dienstag 24. Juni 2008, 15:26 Uhr

Bonn (aktiencheck.de AG) - Die SolarWorld AG (ISIN DE0005108401/ WKN 510840) und ihr Tochterunternehmen Deutsche Solar AG haben einen Zehn-Jahres-Kontrakt über die Lieferung der hauchdünnen Siliziumscheiben mit einem Gesamtvolumen von über 750 Mio. Euro mit dem indischen Unternehmen Solar Semiconductor Pvt. Ltd. vereinbart. (..)

http://de.biz.yahoo.com/24062008/85/solarworld-schliesst-lie…

1,2 Mrd. USD?

750 Mio.€ = 975 Mio.USD (Euro/USD 1,30)

... Q-Cells hat auch Lieferverträge mit den Indern.

finanzen.net

SolarWorld schließt Liefervertrag mit Solar Semiconductor ab

Dienstag 24. Juni 2008, 15:26 Uhr

Bonn (aktiencheck.de AG) - Die SolarWorld AG (ISIN DE0005108401/ WKN 510840) und ihr Tochterunternehmen Deutsche Solar AG haben einen Zehn-Jahres-Kontrakt über die Lieferung der hauchdünnen Siliziumscheiben mit einem Gesamtvolumen von über 750 Mio. Euro mit dem indischen Unternehmen Solar Semiconductor Pvt. Ltd. vereinbart. (..)

http://de.biz.yahoo.com/24062008/85/solarworld-schliesst-lie…

1,2 Mrd. USD?

750 Mio.€ = 975 Mio.USD (Euro/USD 1,30)

... Q-Cells hat auch Lieferverträge mit den Indern.

India Focus

Solar Semiconductor Adds New PV Cell Line

Solar Semiconductor, a manufacturer of photovoltaic (PV) modules in India, is gearing up to enter the cell manufacturing segment as part of a US$100 million expansion plan.

The plant is based in the southern city of Hyderabad, which is fast becoming India's solar manufacturing hub, where a number of solar energy projects are either coming up or pending approval. About half of the 18 companies setting up plants in India are doing so in Andhra Pradesh, as part of the Fab City project being developed as a public-private partnership initiative of the Andhra Pradesh Government.

"We are coming out with a cell line in addition to the module manufacturing in our new plant being built in the Fab City. Our intention is to make the most efficient and the best PV products in the world," said Ravi Surapaneni, vice president, Solar Semiconductor.

Currently, Solar Semiconductor has an 80MW manufacturing facility in Gundlapochampally, near Hyderabad, which started commercial production in September 2007. The company is now in the first phase of a 50-acre project, and expected an additional 120MW PV module capacity by the end of December 2008, as well as PV cell capacity of 30MW, which will be doubled to 60MW in the first quarter of 2009.

Growing Success

The company generated revenues of US$15 million during the year ending 31 March 2008, and is expecting to earn over US$140 million for the year ending March 2009.

In July 2008, Solar Semiconductor entered into a US$1.2 billion, multi-year contract for the supply of wafers from SolarWorld AG, a subsidiary of Deutsche Solar AG, which operates one of the largest multi-crystalline solar silicon wafer factories. In the same month it also signed a US$695 million agreement with AS Solar GmbH, a large reseller of solar PV products in Europe, to supply its high-quality modules for the European market.

In March 2008, the company secured a US$575 million order from IBC Solar, Germany, a large PV module manufacturer. Through this contract, Solar Semiconductor will supply high quality PV modules over the next three years. IBC Solar will also be using Solar Semiconductor's products to service its Europe and US customers.

Solar Semiconductor's family of multi- and mono-crystalline PV modules includes models ranging from 135W to 270W.

These modules employ 156mm cells and are designed for grid connect applications such as large commercial systems, residential systems, PV power plants, and off-grid applications.

Manufacturing Expertise

"All our expertise in manufacturing comes from our engineers, who come with a great deal of experience from the semiconductor industry," said Surapaneni. "Some of the senior engineers have hands-on experience and have set up semiconductor fabs. Our entire line of machinery is imported, and amongst the best in the world, equipped with the latest robotics at every critical step in the manufacturing process to ensure high quality. Also, we are one of the few manufacturers in the world to manufacture certified modules with power as high as 295W."

The "state-of-the-art" plant is equipped to work with 125mm or 156mm mono and multi-crystalline cells - cells less than 180um or 160um thick and with two or three bus bars.

In October 2008 Solar Semiconductor entered into a reverse merger agreement with US-based Trans-India Acquisition Corp (TIAC). Under this agreement, TIAC would acquire no less than 80% in Solar Semiconductor and its subsidiaries in India and the US. It will pump US$92 million into expansion activities. Solar Semiconductor, meanwhile, will have access to capital markets for raising funds, bypassing the process of going public. After the completion of the process, the entity will be named Solar Semiconductor Corp.

by Sufia Tippu, Bangalore

http://techon.nikkeibp.co.jp/article/HONSHI/20090120/164316/

Solar Semiconductor Adds New PV Cell Line

Solar Semiconductor, a manufacturer of photovoltaic (PV) modules in India, is gearing up to enter the cell manufacturing segment as part of a US$100 million expansion plan.

The plant is based in the southern city of Hyderabad, which is fast becoming India's solar manufacturing hub, where a number of solar energy projects are either coming up or pending approval. About half of the 18 companies setting up plants in India are doing so in Andhra Pradesh, as part of the Fab City project being developed as a public-private partnership initiative of the Andhra Pradesh Government.

"We are coming out with a cell line in addition to the module manufacturing in our new plant being built in the Fab City. Our intention is to make the most efficient and the best PV products in the world," said Ravi Surapaneni, vice president, Solar Semiconductor.

Currently, Solar Semiconductor has an 80MW manufacturing facility in Gundlapochampally, near Hyderabad, which started commercial production in September 2007. The company is now in the first phase of a 50-acre project, and expected an additional 120MW PV module capacity by the end of December 2008, as well as PV cell capacity of 30MW, which will be doubled to 60MW in the first quarter of 2009.

Growing Success

The company generated revenues of US$15 million during the year ending 31 March 2008, and is expecting to earn over US$140 million for the year ending March 2009.

In July 2008, Solar Semiconductor entered into a US$1.2 billion, multi-year contract for the supply of wafers from SolarWorld AG, a subsidiary of Deutsche Solar AG, which operates one of the largest multi-crystalline solar silicon wafer factories. In the same month it also signed a US$695 million agreement with AS Solar GmbH, a large reseller of solar PV products in Europe, to supply its high-quality modules for the European market.

In March 2008, the company secured a US$575 million order from IBC Solar, Germany, a large PV module manufacturer. Through this contract, Solar Semiconductor will supply high quality PV modules over the next three years. IBC Solar will also be using Solar Semiconductor's products to service its Europe and US customers.

Solar Semiconductor's family of multi- and mono-crystalline PV modules includes models ranging from 135W to 270W.

These modules employ 156mm cells and are designed for grid connect applications such as large commercial systems, residential systems, PV power plants, and off-grid applications.

Manufacturing Expertise

"All our expertise in manufacturing comes from our engineers, who come with a great deal of experience from the semiconductor industry," said Surapaneni. "Some of the senior engineers have hands-on experience and have set up semiconductor fabs. Our entire line of machinery is imported, and amongst the best in the world, equipped with the latest robotics at every critical step in the manufacturing process to ensure high quality. Also, we are one of the few manufacturers in the world to manufacture certified modules with power as high as 295W."

The "state-of-the-art" plant is equipped to work with 125mm or 156mm mono and multi-crystalline cells - cells less than 180um or 160um thick and with two or three bus bars.

In October 2008 Solar Semiconductor entered into a reverse merger agreement with US-based Trans-India Acquisition Corp (TIAC). Under this agreement, TIAC would acquire no less than 80% in Solar Semiconductor and its subsidiaries in India and the US. It will pump US$92 million into expansion activities. Solar Semiconductor, meanwhile, will have access to capital markets for raising funds, bypassing the process of going public. After the completion of the process, the entity will be named Solar Semiconductor Corp.

by Sufia Tippu, Bangalore

http://techon.nikkeibp.co.jp/article/HONSHI/20090120/164316/

10.02.2009 14:50

Equinet belässt SolarWorld auf 'Buy' - Ziel 27,50 Euro

Equinet hat die Einstufung für SolarWorld vor Quartalszahlen auf "Buy" mit einem Kursziel von 27,50 Euro belassen. Ingesamt sei mit guten Ergebnissen und einer weiteren Verbesserung des US-Geschäfts zu rechnen, schrieb Analyst Sebastian Growe in einer Studie vom Dienstag. Vermutlich werde sich der Markt nun auf die bereits bestätigte Wachstumsrate von 25 bis 30 Prozent bei Umsatz und Gewinn vor Zinsen und Steuern (EBIT) für 2009 konzentrieren. Angesichts der guten Distributionskanäle, einem langfristigen Auftragsbestand von über sieben Milliarden Euro bei Wafern und einer sehr starken Bilanz bleibe er bei seiner Einstufung.

AFA0037 2009-02-10/14:49

Equinet belässt SolarWorld auf 'Buy' - Ziel 27,50 Euro

Equinet hat die Einstufung für SolarWorld vor Quartalszahlen auf "Buy" mit einem Kursziel von 27,50 Euro belassen. Ingesamt sei mit guten Ergebnissen und einer weiteren Verbesserung des US-Geschäfts zu rechnen, schrieb Analyst Sebastian Growe in einer Studie vom Dienstag. Vermutlich werde sich der Markt nun auf die bereits bestätigte Wachstumsrate von 25 bis 30 Prozent bei Umsatz und Gewinn vor Zinsen und Steuern (EBIT) für 2009 konzentrieren. Angesichts der guten Distributionskanäle, einem langfristigen Auftragsbestand von über sieben Milliarden Euro bei Wafern und einer sehr starken Bilanz bleibe er bei seiner Einstufung.

AFA0037 2009-02-10/14:49

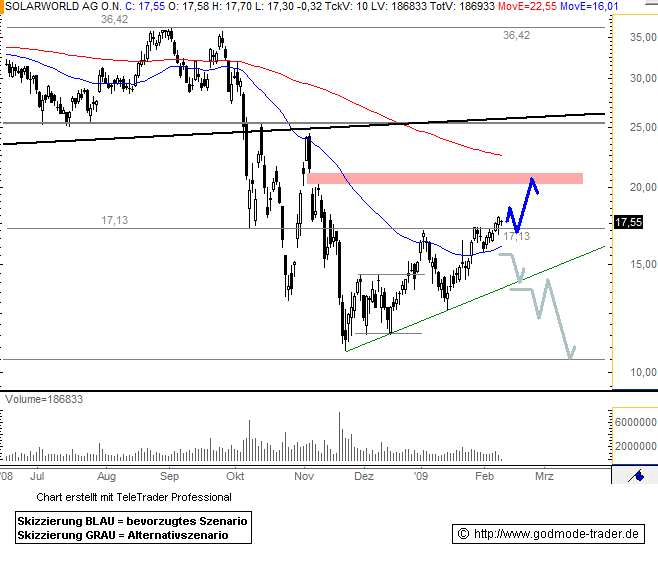

SOLARWORLD - Wie weit kann es jetzt gehen?

Datum 10.02.2009 - Uhrzeit 11:59 (© BörseGo AG 2000-2009, Autor: Berteit Rene, Technischer Analyst, © GodmodeTrader - http://www.godmode-trader.de/)

WKN: 510840 | ISIN: DE0005108401 | Intradaykurs:

Solarworld - WKN: 510840 - ISIN: DE0005108401

Börse: Xetra in Euro / Kursstand: 17,55 Euro

Rückblick: Seit ihrem Tief bei 10,83 Euro befinden sich die Aktien von Solarworld in einer Erholungsphase und konnten sich in dieser bis auf ein aktuelle Hoch bei 17,97 Euro vorarbeiten. Kursgewinne in Höhe von gut 65% stehen damit für die Käufer zu Buche, mit denen sich auch das Chartbild wieder etwas verbessern konnte.

So gelang bereits am Freitag letzter Woche der Ausbruch über den horizontalen Widerstand bei 17,13 Euro, mit dem sich innerhalb der laufenden Aufwärtsbewegung nun ein neues Kaufsignal zeigt. Parallel dazu gelang bereits vor einigen Tagen der Anstieg über die exp. GDL 50, die ihre Drehung bereits vollzogen hat und nun ebenfalls wieder nach oben läuft. Als nächstes wartet nun ein noch offenes Gap zwischen 20,20 Euro und 21,04 Euro auf die Käufer.

Charttechnischer Ausblick: Kurzfristig bestimmen die Käufer das Kursgeschehen in den Aktien von Solarworld und dies sollte auch in den kommenden Tagen weiter anhalten. Kursgewinne bis zunächst 21,04 Euro wären dabei durchaus möglich.

Ein erstes Achtungszeichen zeigt sich im Chart jedoch, wenn die Kurse wieder nachhaltig unter 15,64 Euro zurückfallen. Eine Verkaufswelle bis auf 14,10 Euro wäre dann einzuplanen. Aber erst wenn die dort liegende Unterstützungslinie nach unten durchbrochen wird, muss die Erholung insgesamt in Frage gestellt werden. Verkäufe bis auf 10,47 Euro sind dann nicht unrealistisch.

Kursverlauf vom 17.06.2008 bis 10.02.2009 (log. Kerzendarstellung / 1 Kerze = 1 Tag)

http://www.godmode-trader.de/de/aktie-analyse/SOLARWORLD-Wie…

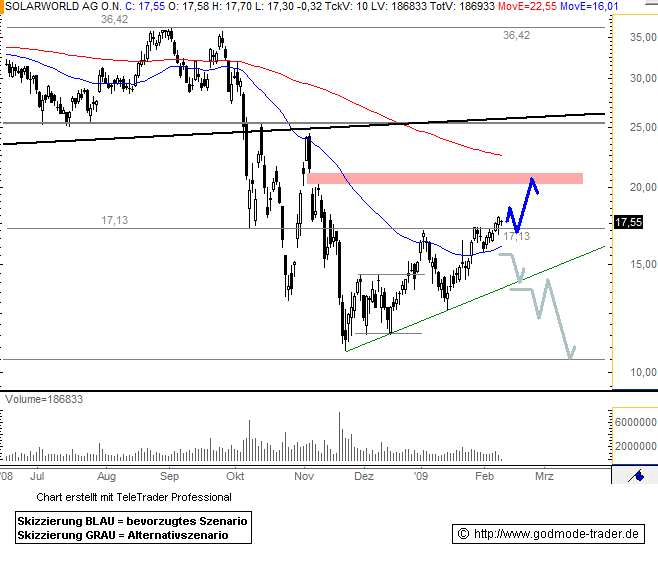

Datum 10.02.2009 - Uhrzeit 11:59 (© BörseGo AG 2000-2009, Autor: Berteit Rene, Technischer Analyst, © GodmodeTrader - http://www.godmode-trader.de/)

WKN: 510840 | ISIN: DE0005108401 | Intradaykurs:

Solarworld - WKN: 510840 - ISIN: DE0005108401

Börse: Xetra in Euro / Kursstand: 17,55 Euro

Rückblick: Seit ihrem Tief bei 10,83 Euro befinden sich die Aktien von Solarworld in einer Erholungsphase und konnten sich in dieser bis auf ein aktuelle Hoch bei 17,97 Euro vorarbeiten. Kursgewinne in Höhe von gut 65% stehen damit für die Käufer zu Buche, mit denen sich auch das Chartbild wieder etwas verbessern konnte.

So gelang bereits am Freitag letzter Woche der Ausbruch über den horizontalen Widerstand bei 17,13 Euro, mit dem sich innerhalb der laufenden Aufwärtsbewegung nun ein neues Kaufsignal zeigt. Parallel dazu gelang bereits vor einigen Tagen der Anstieg über die exp. GDL 50, die ihre Drehung bereits vollzogen hat und nun ebenfalls wieder nach oben läuft. Als nächstes wartet nun ein noch offenes Gap zwischen 20,20 Euro und 21,04 Euro auf die Käufer.

Charttechnischer Ausblick: Kurzfristig bestimmen die Käufer das Kursgeschehen in den Aktien von Solarworld und dies sollte auch in den kommenden Tagen weiter anhalten. Kursgewinne bis zunächst 21,04 Euro wären dabei durchaus möglich.

Ein erstes Achtungszeichen zeigt sich im Chart jedoch, wenn die Kurse wieder nachhaltig unter 15,64 Euro zurückfallen. Eine Verkaufswelle bis auf 14,10 Euro wäre dann einzuplanen. Aber erst wenn die dort liegende Unterstützungslinie nach unten durchbrochen wird, muss die Erholung insgesamt in Frage gestellt werden. Verkäufe bis auf 10,47 Euro sind dann nicht unrealistisch.

Kursverlauf vom 17.06.2008 bis 10.02.2009 (log. Kerzendarstellung / 1 Kerze = 1 Tag)

http://www.godmode-trader.de/de/aktie-analyse/SOLARWORLD-Wie…

Australien baut große Solarzellenfabrik

Die australische Regierung hat 60 Millionen Dollar für den Bau einer Solarzellenfabrik bereitgestellt. Bis Ende 2010 sollen 9.000 Häuser auf Solarenergie umgerüstet werden.

Australien hätte ohne Zweifel das Potential Weltmarktführer im Bereich Solarenergie zu sein. Auf dem Kontinent gibt es so viel Sonnenlicht pro Quadratmeter wie auf keinem anderen. Australien ist auch gleichzeitig am anfälligsten für den Klimawandel, wie man zuletzt an den Rekord-Hitzewellen sehen konnte. Das hat die Regierung dazu gebracht, endlich die Energie-Zukunft des Landes grundlegend zu überdenken. Die Regierung um Premier Kevin Rudd hat deshalb die Pläne für den Bau einer 60 Millionen Dollar teuren Solar-Fabrik abgesegnet.

http://www.dailygreen.de/2009/02/10/australien-baut-grose-so…

Die australische Regierung hat 60 Millionen Dollar für den Bau einer Solarzellenfabrik bereitgestellt. Bis Ende 2010 sollen 9.000 Häuser auf Solarenergie umgerüstet werden.

Australien hätte ohne Zweifel das Potential Weltmarktführer im Bereich Solarenergie zu sein. Auf dem Kontinent gibt es so viel Sonnenlicht pro Quadratmeter wie auf keinem anderen. Australien ist auch gleichzeitig am anfälligsten für den Klimawandel, wie man zuletzt an den Rekord-Hitzewellen sehen konnte. Das hat die Regierung dazu gebracht, endlich die Energie-Zukunft des Landes grundlegend zu überdenken. Die Regierung um Premier Kevin Rudd hat deshalb die Pläne für den Bau einer 60 Millionen Dollar teuren Solar-Fabrik abgesegnet.

http://www.dailygreen.de/2009/02/10/australien-baut-grose-so…