SOLARWORLD ++ vorab Q-Zahlen 5/11 + gab es einen Aktienrückkauf im 3-Q ? ++ (Seite 5774)

eröffnet am 02.11.07 13:32:40 von

neuester Beitrag 24.03.23 19:13:18 von

neuester Beitrag 24.03.23 19:13:18 von

Beiträge: 61.296

ID: 1.134.742

ID: 1.134.742

Aufrufe heute: 2

Gesamt: 4.064.627

Gesamt: 4.064.627

Aktive User: 0

ISIN: DE000A1YCMM2 · WKN: A1YCMM · Symbol: SWVK

0,1810

EUR

-2,69 %

-0,0050 EUR

Letzter Kurs 08:37:36 Tradegate

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,0600 | +39,86 | |

| 0,9798 | +30,64 | |

| 1,1026 | +16,06 | |

| 4,6700 | +14,74 | |

| 0,6780 | +10,78 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,9400 | -9,58 | |

| 8,15 | -10,93 | |

| 0,5900 | -11,81 | |

| 4,1800 | -19,62 | |

| 1,3675 | -21,41 |

Beitrag zu dieser Diskussion schreiben

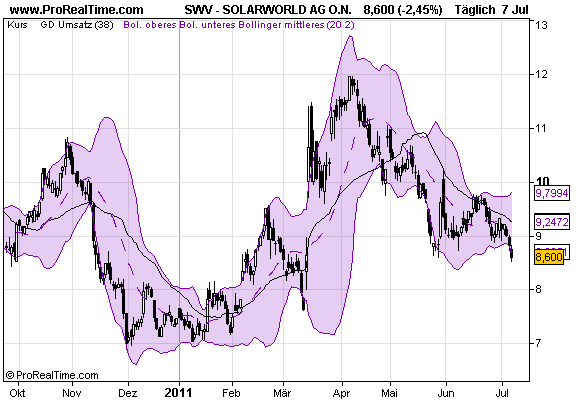

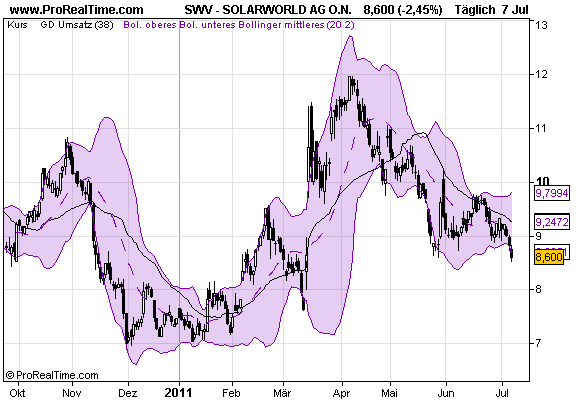

Chartcheck: Solarworld mit Kaufsignal?

22.01.2009 - Nach der Abwärtsbewegung von 17,03 Euro auf 12,58 Euro konnte sich die Aktie in den vergangenen Tagen wieder stabilisieren. Seit Wochenbeginn versucht sich das Papier an einem nachhaltigen Ausbruch über den Widerstand, der im Kern unterhalb von 14,40 Euro angesiedelt ist. Deutlicher gelang der Ausbruch auf Schlusskursbasis aber erst am Mittwoch: Nach einem Tageshoch bei 14,93 Euro wurde die Schlussnotierung bei 14,82 Euro festgestellt – und damit deutlich über der Widerstandsmarke.

Wird dieses Signal am Donnerstag nicht bearish gekontert, so wäre ein Kaufsignal auf Tradingbasis entstanden. Während die übergeordnete Lage noch nicht bullish zu nennen ist, wäre kurzfristig ein Anstieg in Richtung der Zone um 17 Euro möglich. Erst ein nachhaltiger Rebreak hierüber würde auch die übergeorndete Lage zugunsten der Bullen verschieben. Um 20 Euro wäre dann das erste größere Kursziel vorhanden, wobei viele Bullen dann auch in den breiten Bereich um 25 Euro schielen dürften, der im vergangenen Jahr mehrfach Einfluss auf die Solarworld-Aktie ausübte.

Unterstützungen sind neben der Zone unterhalb von 14,40 Euro vor allem oberhalb von 12,58 Euro zu finden.

http://www.4investors.de/php_fe/index.php?sektion=stock&ID=24461

http://www.4investors.de/bilder/solarworld.gif

22.01.2009 - Nach der Abwärtsbewegung von 17,03 Euro auf 12,58 Euro konnte sich die Aktie in den vergangenen Tagen wieder stabilisieren. Seit Wochenbeginn versucht sich das Papier an einem nachhaltigen Ausbruch über den Widerstand, der im Kern unterhalb von 14,40 Euro angesiedelt ist. Deutlicher gelang der Ausbruch auf Schlusskursbasis aber erst am Mittwoch: Nach einem Tageshoch bei 14,93 Euro wurde die Schlussnotierung bei 14,82 Euro festgestellt – und damit deutlich über der Widerstandsmarke.

Wird dieses Signal am Donnerstag nicht bearish gekontert, so wäre ein Kaufsignal auf Tradingbasis entstanden. Während die übergeordnete Lage noch nicht bullish zu nennen ist, wäre kurzfristig ein Anstieg in Richtung der Zone um 17 Euro möglich. Erst ein nachhaltiger Rebreak hierüber würde auch die übergeorndete Lage zugunsten der Bullen verschieben. Um 20 Euro wäre dann das erste größere Kursziel vorhanden, wobei viele Bullen dann auch in den breiten Bereich um 25 Euro schielen dürften, der im vergangenen Jahr mehrfach Einfluss auf die Solarworld-Aktie ausübte.

Unterstützungen sind neben der Zone unterhalb von 14,40 Euro vor allem oberhalb von 12,58 Euro zu finden.

http://www.4investors.de/php_fe/index.php?sektion=stock&ID=24461

http://www.4investors.de/bilder/solarworld.gif

Antwort auf Beitrag Nr.: 36.424.435 von bossi1 am 22.01.09 09:36:50Gleiche Aktie wie vorher ...

Hier wartet man auf einen Trendwechsel

22.01.2009 06:45

Solarworld: Verkaufen - Warten auf den Trendwechsel !

Chartanalyse der Solarworld (News/Aktienkurs) - Aktie

Die Solarworld Aktie befand sich in einem langfristigen Seitwärtstrendkanal. Im Oktober 2008 hat die Aktie diesen Bereich der Seitwärtsbewegung signifikant d.h. mehr als 3% nach unten verlassen, wodurch ein Verkaufssignal ausgelöst wurde. Dieser Ausbruch hat das Chartbild weiter verschlechtert, denn er deutet auf einen möglichen Trendwechsel hin. Ob die Solarworld Aktie somit am Beginn einer Abwärtsbewegung steht oder wieder signifikant in den Bereich des Seitwärtstrendkanals gelangt, werden wir für Sie beobachten. Aufgrund des deutlichen Bruchs der Seitwärtsbewegung und den damit verbundenen ungünstigen Aussichten ist die Solarworld Aktie zur Zeit nur eine Verkaufsposition.

Hier wartet man auf einen Trendwechsel

22.01.2009 06:45

Solarworld: Verkaufen - Warten auf den Trendwechsel !

Chartanalyse der Solarworld (News/Aktienkurs) - Aktie

Die Solarworld Aktie befand sich in einem langfristigen Seitwärtstrendkanal. Im Oktober 2008 hat die Aktie diesen Bereich der Seitwärtsbewegung signifikant d.h. mehr als 3% nach unten verlassen, wodurch ein Verkaufssignal ausgelöst wurde. Dieser Ausbruch hat das Chartbild weiter verschlechtert, denn er deutet auf einen möglichen Trendwechsel hin. Ob die Solarworld Aktie somit am Beginn einer Abwärtsbewegung steht oder wieder signifikant in den Bereich des Seitwärtstrendkanals gelangt, werden wir für Sie beobachten. Aufgrund des deutlichen Bruchs der Seitwärtsbewegung und den damit verbundenen ungünstigen Aussichten ist die Solarworld Aktie zur Zeit nur eine Verkaufsposition.

Chartcheck:

Solarworld mit Kaufsignal?

22.01.2009 - Nach der Abwärtsbewegung von 17,03 Euro auf 12,58 Euro konnte sich die Aktie in den vergangenen Tagen wieder stabilisieren. Seit Wochenbeginn versucht sich das Papier an einem nachhaltigen Ausbruch über den Widerstand, der im Kern unterhalb von 14,40 Euro angesiedelt ist. Deutlicher gelang der Ausbruch auf Schlusskursbasis aber erst am Mittwoch: Nach einem Tageshoch bei 14,93 Euro wurde die Schlussnotierung bei 14,82 Euro festgestellt – und damit deutlich über der Widerstandsmarke.

Wird dieses Signal am Donnerstag nicht bearish gekontert, so wäre ein Kaufsignal auf Tradingbasis entstanden. Während die übergeordnete Lage noch nicht bullish zu nennen ist, wäre kurzfristig ein Anstieg in Richtung der Zone um 17 Euro möglich. Erst ein nachhaltiger Rebreak hierüber würde auch die übergeorndete Lage zugunsten der Bullen verschieben. Um 20 Euro wäre dann das erste größere Kursziel vorhanden, wobei viele Bullen dann auch in den breiten Bereich um 25 Euro schielen dürften, der im vergangenen Jahr mehrfach Einfluss auf die Solarworld-Aktie ausübte.

Unterstützungen sind neben der Zone unterhalb von 14,40 Euro vor allem oberhalb von 12,58 Euro zu finden.

Schlusskurs letzter Handelstag

Solarworld mit Kaufsignal?

22.01.2009 - Nach der Abwärtsbewegung von 17,03 Euro auf 12,58 Euro konnte sich die Aktie in den vergangenen Tagen wieder stabilisieren. Seit Wochenbeginn versucht sich das Papier an einem nachhaltigen Ausbruch über den Widerstand, der im Kern unterhalb von 14,40 Euro angesiedelt ist. Deutlicher gelang der Ausbruch auf Schlusskursbasis aber erst am Mittwoch: Nach einem Tageshoch bei 14,93 Euro wurde die Schlussnotierung bei 14,82 Euro festgestellt – und damit deutlich über der Widerstandsmarke.

Wird dieses Signal am Donnerstag nicht bearish gekontert, so wäre ein Kaufsignal auf Tradingbasis entstanden. Während die übergeordnete Lage noch nicht bullish zu nennen ist, wäre kurzfristig ein Anstieg in Richtung der Zone um 17 Euro möglich. Erst ein nachhaltiger Rebreak hierüber würde auch die übergeorndete Lage zugunsten der Bullen verschieben. Um 20 Euro wäre dann das erste größere Kursziel vorhanden, wobei viele Bullen dann auch in den breiten Bereich um 25 Euro schielen dürften, der im vergangenen Jahr mehrfach Einfluss auf die Solarworld-Aktie ausübte.

Unterstützungen sind neben der Zone unterhalb von 14,40 Euro vor allem oberhalb von 12,58 Euro zu finden.

Schlusskurs letzter Handelstag

Spanish Solar Growth Is Good and Bad News for PV Industry

Spain's photovoltaics market grew by >2.66 GW of new installed power in 2008, helping to boost the global PV market by ~5.6 GW. With a cap this year of 500 MW, the Spanish market will decrease by at least 80%. That is bad news for the global PV industry, but good news for consumers as prices come down.

Edwin Koot, CEO, SolarPlaza -- Semiconductor International, 1/21/2009 9:22:00 AM

The Spanish photovoltaics market grew by >2.66 GW of new installed power in 2008. As a result, the global PV market has grown by ~5.6 GW. This 100% increase over 2007 explains part of the scarcity and high module prices in 2008. But, with a cap of 500 MW in 2009, it also means that the Spanish market will decrease in size by at least 80% (>2.1 GW) this year.

That is bad news for the global PV industry as it faces an oversupply situation and bad economic times, but it’s good news for the customer as prices along the supply chain have decreased by at least 20-40%. Solar modules are now cheaper than ever before. Record growth could be even higher.

The figures for the Spanish PV market were published by the Spanish magazine Energias Renovables, which quoted sources from CNE (Comisión Nacional de la Energía). CNE pays out to the energy utilities that in turn give the feed-in tariff to customers with a PV installation. The >300% increase compared to 2007 could be even higher. CNE estimates that the 2008 market could well be above 3.5 GW. This would mean that the Spanish market in 2008 alone was bigger than the global market figure for 2007. Even the figure of 2.66 GW is astonishing, and comes as a surprise to most people in the solar energy business. It not only made Spain the world’s biggest PV market in 2008, but clearly demonstrates that the new regulation will have a major impact on the global PV market. Although other PV markets in the world will continue to grow, the impact is such that the global PV market in 2009 is likely to decrease by ~10% from 2008, according to calculations by SolarPlaza.

Although Spain's PV market grew by >2.66 GW of new installed power in 2008, new laws will cap that growth at 500 MW this year.

Lessons from Spain

In 2007 and during the first half of 2008, all the signs for PV were positive. There was a very attractive feed-in tariff in Spain, credit lines were easy to get, oil prices were rising, and economies were growing rapidly. Now, the industry faces a strong headwind with oil prices very low, economies in recession, finance hard to obtain, and the world’s largest market regulated by a cap with a 30% lower feed-in tariff.

The consequences will be felt throughout the entire industry. Several major international companies recently announced staff cutbacks. Since many Spanish companies were focused on the domestic market, jobs, and a part of the solar energy business infrastructure, will be lost. What happened in Spain clearly shows that the global PV market is still strongly dependent on government support programs and decisions by politicians. What is needed for continuous market development is not the highest feed-in tariff, but a stable and long-term policy and program. What works is a feed-in tariff that is decreased by clear steps over time. It provides the industry with targets for cost reduction, working toward a situation where incentives are no longer needed. It is no coincidence that Germany — not the country with the best solar resources — is the world’s leading PV market.

Germans set to take the lead again

The German government decreased the feed-in tariff by almost 10% at the start of 2009. Nevertheless, this market is likely to continue to grow steadily. Module prices in the world markets have fallen by >20% over recent months. Germany will therefore resume the lead from Spain to again be the world’s largest PV market in 2009. The stable solar policy pays off.

Strong long-term outlook for USA

Many people expect that President Barack Obama’s renewable energy plans will lead to a further push for solar energy in the United States. The eight-year guaranteed Tax Credit regulation, approved under President Bush, offers an excellent starting point for stable growth. Experts predicted a market growth of ~50% before Obama was elected. Much will now depend on recovery of the economy and details of Obama’s plans. But even if the Californian and whole U.S. market were to grow by 100% in 2009, the U.S. market would be comparable to that of Spain (~500 MWp).

The longer-term prospects are even better. Several energy utilities in the United States have discovered PV as a serious and viable option for power supply. Many large-scale PV projects, like the 800 MWp project by PG&E in California, are being prepared and developed. The push for renewable and solar, and an economic recovery, could make the United States one of the major PV markets from 2010 onwards.

What will happen in China?

The Chinese PV industry grew explosively in 2008 with soaring demand from Spain and Germany in particular. Declining global demand, which started at the end of 2008, means the Chinese PV industry will face hard times in 2009. Sources indicate that many of the hundreds of PV module manufacturers have already gone out of business. Will the Chinese government support its industry with incentives for development of the domestic market in 2009? Rumors indicate that the government is working on this. Reliable figures are hard to obtain, but experts estimate that the market size was <50 MW in 2008. If a feed-in tariff were introduced in 2009, it would be unlikely to have a major impact on demand for 2009.

Italy is the place to be

The most attractive feed-in tariffs can now be found in Italy. The market is growing rapidly as investors have discovered the opportunities, certainly with currently decreasing module prices. In terms of size, Italy will still be smaller than Spain in 2009, but with many projects under development, Italy could become the second largest market in the world in 2010.

Global market consequences

What are the consequences of this all for the global PV market? The promising growth in other markets will not be able to compensate for the 2.1 GWp loss in Spain in 2009. Promising markets are France, Czech Republic, Belgium, Korea, Greece and India. All were still below 50 MW in size in 2008. As in Spain, even under the most attractive circumstances, it takes at least three years to achieve a market size in the hundreds of megawatts. As a result, and based on its global market demand model, SolarPlaza expects the global PV market to decline instead of grow in 2009.

The global PV market is expected to decline in 2009, but still looks promising in the long term.

Long-term perspective still very good

The long-term perspectives for the global solar energy market remain great, however. Module prices are declining and industry members expect prices to fall further during 2009. It will bring solar energy closer to the stage where government support is no longer needed.

And, above all, the long-term market drivers that push solar energy will remain in place:

Oil prices are expected to increase when economic recovery returns due to supply limitation.

An increasing number of countries have started CO2 reduction plans, including renewable energy support programs.

Continuously growing electric power demand is being pushed by economic growth in Western countries and Asian rising stars such as India and China.

Continuously decreasing cost of solar modules makes solar energy attractive as a reliable energy source in a growing number of market segments.

Growing interest for electrified transportation (automotive industry opting for electric cars) will stimulate decentralized electricity production.

The big question for the near term is which of the solar PV manufacturers will be able to survive the global decrease in demand and economic crisis in 2009, and maybe 2010. Those who can will have a bright future and infinite market potential ahead. When the cost of solar energy for customers reaches the cost of energy from the grid, the market potential for a reliable, predictable and 25-year fixed-cost energy source will be infinite. This “grid parity” will be reached in the next three to five years in major markets in the world.

The future for solar energy is still very bright. But, as in Spain, while it’s very sunny most of the time, it still sometimes rains. The current market and industry dynamics and solar future perspectives will be the topic of an international CEO and expert conference called “The Solar Future — Count Down to Grid Parity” in Munich, Germany, on May 26.

http://www.semiconductor.net/article/CA6631126.html

Spain's photovoltaics market grew by >2.66 GW of new installed power in 2008, helping to boost the global PV market by ~5.6 GW. With a cap this year of 500 MW, the Spanish market will decrease by at least 80%. That is bad news for the global PV industry, but good news for consumers as prices come down.

Edwin Koot, CEO, SolarPlaza -- Semiconductor International, 1/21/2009 9:22:00 AM

The Spanish photovoltaics market grew by >2.66 GW of new installed power in 2008. As a result, the global PV market has grown by ~5.6 GW. This 100% increase over 2007 explains part of the scarcity and high module prices in 2008. But, with a cap of 500 MW in 2009, it also means that the Spanish market will decrease in size by at least 80% (>2.1 GW) this year.

That is bad news for the global PV industry as it faces an oversupply situation and bad economic times, but it’s good news for the customer as prices along the supply chain have decreased by at least 20-40%. Solar modules are now cheaper than ever before. Record growth could be even higher.

The figures for the Spanish PV market were published by the Spanish magazine Energias Renovables, which quoted sources from CNE (Comisión Nacional de la Energía). CNE pays out to the energy utilities that in turn give the feed-in tariff to customers with a PV installation. The >300% increase compared to 2007 could be even higher. CNE estimates that the 2008 market could well be above 3.5 GW. This would mean that the Spanish market in 2008 alone was bigger than the global market figure for 2007. Even the figure of 2.66 GW is astonishing, and comes as a surprise to most people in the solar energy business. It not only made Spain the world’s biggest PV market in 2008, but clearly demonstrates that the new regulation will have a major impact on the global PV market. Although other PV markets in the world will continue to grow, the impact is such that the global PV market in 2009 is likely to decrease by ~10% from 2008, according to calculations by SolarPlaza.

Although Spain's PV market grew by >2.66 GW of new installed power in 2008, new laws will cap that growth at 500 MW this year.

Lessons from Spain

In 2007 and during the first half of 2008, all the signs for PV were positive. There was a very attractive feed-in tariff in Spain, credit lines were easy to get, oil prices were rising, and economies were growing rapidly. Now, the industry faces a strong headwind with oil prices very low, economies in recession, finance hard to obtain, and the world’s largest market regulated by a cap with a 30% lower feed-in tariff.

The consequences will be felt throughout the entire industry. Several major international companies recently announced staff cutbacks. Since many Spanish companies were focused on the domestic market, jobs, and a part of the solar energy business infrastructure, will be lost. What happened in Spain clearly shows that the global PV market is still strongly dependent on government support programs and decisions by politicians. What is needed for continuous market development is not the highest feed-in tariff, but a stable and long-term policy and program. What works is a feed-in tariff that is decreased by clear steps over time. It provides the industry with targets for cost reduction, working toward a situation where incentives are no longer needed. It is no coincidence that Germany — not the country with the best solar resources — is the world’s leading PV market.

Germans set to take the lead again

The German government decreased the feed-in tariff by almost 10% at the start of 2009. Nevertheless, this market is likely to continue to grow steadily. Module prices in the world markets have fallen by >20% over recent months. Germany will therefore resume the lead from Spain to again be the world’s largest PV market in 2009. The stable solar policy pays off.

Strong long-term outlook for USA

Many people expect that President Barack Obama’s renewable energy plans will lead to a further push for solar energy in the United States. The eight-year guaranteed Tax Credit regulation, approved under President Bush, offers an excellent starting point for stable growth. Experts predicted a market growth of ~50% before Obama was elected. Much will now depend on recovery of the economy and details of Obama’s plans. But even if the Californian and whole U.S. market were to grow by 100% in 2009, the U.S. market would be comparable to that of Spain (~500 MWp).

The longer-term prospects are even better. Several energy utilities in the United States have discovered PV as a serious and viable option for power supply. Many large-scale PV projects, like the 800 MWp project by PG&E in California, are being prepared and developed. The push for renewable and solar, and an economic recovery, could make the United States one of the major PV markets from 2010 onwards.

What will happen in China?

The Chinese PV industry grew explosively in 2008 with soaring demand from Spain and Germany in particular. Declining global demand, which started at the end of 2008, means the Chinese PV industry will face hard times in 2009. Sources indicate that many of the hundreds of PV module manufacturers have already gone out of business. Will the Chinese government support its industry with incentives for development of the domestic market in 2009? Rumors indicate that the government is working on this. Reliable figures are hard to obtain, but experts estimate that the market size was <50 MW in 2008. If a feed-in tariff were introduced in 2009, it would be unlikely to have a major impact on demand for 2009.

Italy is the place to be

The most attractive feed-in tariffs can now be found in Italy. The market is growing rapidly as investors have discovered the opportunities, certainly with currently decreasing module prices. In terms of size, Italy will still be smaller than Spain in 2009, but with many projects under development, Italy could become the second largest market in the world in 2010.

Global market consequences

What are the consequences of this all for the global PV market? The promising growth in other markets will not be able to compensate for the 2.1 GWp loss in Spain in 2009. Promising markets are France, Czech Republic, Belgium, Korea, Greece and India. All were still below 50 MW in size in 2008. As in Spain, even under the most attractive circumstances, it takes at least three years to achieve a market size in the hundreds of megawatts. As a result, and based on its global market demand model, SolarPlaza expects the global PV market to decline instead of grow in 2009.

The global PV market is expected to decline in 2009, but still looks promising in the long term.

Long-term perspective still very good

The long-term perspectives for the global solar energy market remain great, however. Module prices are declining and industry members expect prices to fall further during 2009. It will bring solar energy closer to the stage where government support is no longer needed.

And, above all, the long-term market drivers that push solar energy will remain in place:

Oil prices are expected to increase when economic recovery returns due to supply limitation.

An increasing number of countries have started CO2 reduction plans, including renewable energy support programs.

Continuously growing electric power demand is being pushed by economic growth in Western countries and Asian rising stars such as India and China.

Continuously decreasing cost of solar modules makes solar energy attractive as a reliable energy source in a growing number of market segments.

Growing interest for electrified transportation (automotive industry opting for electric cars) will stimulate decentralized electricity production.

The big question for the near term is which of the solar PV manufacturers will be able to survive the global decrease in demand and economic crisis in 2009, and maybe 2010. Those who can will have a bright future and infinite market potential ahead. When the cost of solar energy for customers reaches the cost of energy from the grid, the market potential for a reliable, predictable and 25-year fixed-cost energy source will be infinite. This “grid parity” will be reached in the next three to five years in major markets in the world.

The future for solar energy is still very bright. But, as in Spain, while it’s very sunny most of the time, it still sometimes rains. The current market and industry dynamics and solar future perspectives will be the topic of an international CEO and expert conference called “The Solar Future — Count Down to Grid Parity” in Munich, Germany, on May 26.

http://www.semiconductor.net/article/CA6631126.html

Tageshoch 15,49

R4 16,62

R3 16,06

R2 15,49

R1 15,16

Pivot >> 14,59

S1 14,26

S2 13,69

S3 13,36

S4 13,02

R4 16,62

R3 16,06

R2 15,49

R1 15,16

Pivot >> 14,59

S1 14,26

S2 13,69

S3 13,36

S4 13,02

The World’s Most Powerful Solar Panel: RSi Unveils SUPER-PV™ with 350-Watt, 160% Power Output

Rainbow Solar Inc. (RSi) unveils the world’s most powerful commercial solar panel at the GoGreen EXPO (Los Angeles). The DSO SUPER-PV™, a 60-cell, standard-size, mono-crystalline photovoltaic-module with a 350 watt-OUTPUT rating, an incredible 160 to 200% power-output over industry’s top 220 watt-peak modules.

2009 Production capacity of 120 megawatts, at conventional Photovoltaic pricing. RSi believes this will become the standard for all future photovoltaic systems. RSi plans to license the SUPER-PV™ technology to PV and module companies globally.

DSO is working with LEED-AP and AIA professionals to realize ‘self-powered-buildings’ (SPB), by converting the entire building surface into an energy-collector, utilizing advanced technologies such as the PV-Glass-Window and SUPER-PV™.

DSO, the BIPV division of RSi, is dedicated to the realization of a gridless future, where power will be embedded into buildings and freely accessible, like air - wherever there is sunlight, there will be power.

Self-Powered-Buildings

Polycrystalline is the most proven Photovoltaic (PV) technology (16%+/- efficiency) but suffers from low-light and high temperature degradation, resulting in 20%+ lower energy output than the rated level (watt-peak).

ThinFilm PV performs better under low-light conditions but with much lower efficiency (4 to 10%).

The RSi SUPER-PV™ uses a proprietary technology developed for Grid-class applications, to generate more overall total power output, not just pushing marginal watt-peak.

The first production-model documented a whopping 350 watt-output - 160% the power-output of today’s top 220 watt modules.

Benefits:

SPS (solar-power-station) applications - increased FiT (feed-in-tariff) revenues by increasing total power-output.

BIPV - delivers the extra power needed to realize totally power-independent buildings.

Quotes:

”The Self-Powered-Building plan proposed by RSi is a catalyst to self-powered cities of the future, made possible by high power-output PV and via converting entire building into a collector with PV-windows type of new technologies.”

Timothy Boe, NCARB, AIA www.eco-tects.com

”President Obama addressed the importance of clean, renewable energy as the security of a nation. RSi proposed a grid-free self-powered-building plan that provides energy-security with much greater economic gains far beyond any grid-bound solutions.”

Prof. Michael Montoya, PE, LEED AP

”As Film makers, we are always looking for innovative ways to make and deliver our story. I see a parallel in the innovation that RSi has created with its self-powered building concept, powered by revolutionary products such as Photovoltaic Glass window.”

James Dyer, Producer: ”The Italian Job, ”Rome” HBO

About RSi: Rainbow Solar Inc., a privately-held company with worldwide facilities. ‘Rainbow-Solar’ is named after RSi’s proprietary multi-wavelength-light-spectrum photovoltaic technologies.

WWW.SOLAR.TM

Contacts:

Press:

RSi Energy Group

Andrew Bing, 310-601-7588

press@solar.tm

http://www.finanznachrichten.de/nachrichten-2009-01/12899637…

Rainbow Solar Inc. (RSi) unveils the world’s most powerful commercial solar panel at the GoGreen EXPO (Los Angeles). The DSO SUPER-PV™, a 60-cell, standard-size, mono-crystalline photovoltaic-module with a 350 watt-OUTPUT rating, an incredible 160 to 200% power-output over industry’s top 220 watt-peak modules.

2009 Production capacity of 120 megawatts, at conventional Photovoltaic pricing. RSi believes this will become the standard for all future photovoltaic systems. RSi plans to license the SUPER-PV™ technology to PV and module companies globally.

DSO is working with LEED-AP and AIA professionals to realize ‘self-powered-buildings’ (SPB), by converting the entire building surface into an energy-collector, utilizing advanced technologies such as the PV-Glass-Window and SUPER-PV™.

DSO, the BIPV division of RSi, is dedicated to the realization of a gridless future, where power will be embedded into buildings and freely accessible, like air - wherever there is sunlight, there will be power.

Self-Powered-Buildings

Polycrystalline is the most proven Photovoltaic (PV) technology (16%+/- efficiency) but suffers from low-light and high temperature degradation, resulting in 20%+ lower energy output than the rated level (watt-peak).

ThinFilm PV performs better under low-light conditions but with much lower efficiency (4 to 10%).

The RSi SUPER-PV™ uses a proprietary technology developed for Grid-class applications, to generate more overall total power output, not just pushing marginal watt-peak.

The first production-model documented a whopping 350 watt-output - 160% the power-output of today’s top 220 watt modules.

Benefits:

SPS (solar-power-station) applications - increased FiT (feed-in-tariff) revenues by increasing total power-output.

BIPV - delivers the extra power needed to realize totally power-independent buildings.

Quotes:

”The Self-Powered-Building plan proposed by RSi is a catalyst to self-powered cities of the future, made possible by high power-output PV and via converting entire building into a collector with PV-windows type of new technologies.”

Timothy Boe, NCARB, AIA www.eco-tects.com

”President Obama addressed the importance of clean, renewable energy as the security of a nation. RSi proposed a grid-free self-powered-building plan that provides energy-security with much greater economic gains far beyond any grid-bound solutions.”

Prof. Michael Montoya, PE, LEED AP

”As Film makers, we are always looking for innovative ways to make and deliver our story. I see a parallel in the innovation that RSi has created with its self-powered building concept, powered by revolutionary products such as Photovoltaic Glass window.”

James Dyer, Producer: ”The Italian Job, ”Rome” HBO

About RSi: Rainbow Solar Inc., a privately-held company with worldwide facilities. ‘Rainbow-Solar’ is named after RSi’s proprietary multi-wavelength-light-spectrum photovoltaic technologies.

WWW.SOLAR.TM

Contacts:

Press:

RSi Energy Group

Andrew Bing, 310-601-7588

press@solar.tm

http://www.finanznachrichten.de/nachrichten-2009-01/12899637…

Antwort auf Beitrag Nr.: 36.422.968 von bossi1 am 21.01.09 22:20:25Jetzt müssen die Indizes zeigen ob sie was können... Glaube fehlt...

DOW heute schön im Plus, aber ...

Finanzsystem am Abgrund

Dossier Britische Banken vor Verstaatlichung

Den Banken der Insel droht die Verstaatlichung, dem Pfund sogar das Ende, und den Firmen gehen die Kredite aus: Die Finanzkrise erschüttert Regierung, Geschäftswelt und Notenbank in London und darüberhinaus.

http://www.ftd.de/unternehmen/finanzdienstleister/:Finanzsys…

+++++

Euro-Zone vor Zerreissprobe

S&P stuft Portugal herab

Die Spannungen in der Euro-Zone wachsen: Standard & Poor's stufte nach Spanien und Griechenland nun auch Portugal herunter. Marktteilnehmer fragen sich jetzt, welches Land das nächste sein könnte - der Euro fällt. Große Angst herrscht auch in Großbritannien.

http://www.ftd.de/boersen_maerkte/aktien/anleihen_devisen/:E…

+++++

Staatsanleihen

Grenzen der Gemeinsamkeit

Noch vor wenigen Monaten wäre jeder für verrückt erklärt worden, wer vom Bankrott eines großen Euro-Landes geredet hätte.

http://www.ftd.de/meinung/kommentare/:Leitartikel-Staatsanle…

Finanzsystem am Abgrund

Dossier Britische Banken vor Verstaatlichung

Den Banken der Insel droht die Verstaatlichung, dem Pfund sogar das Ende, und den Firmen gehen die Kredite aus: Die Finanzkrise erschüttert Regierung, Geschäftswelt und Notenbank in London und darüberhinaus.

http://www.ftd.de/unternehmen/finanzdienstleister/:Finanzsys…

+++++

Euro-Zone vor Zerreissprobe

S&P stuft Portugal herab

Die Spannungen in der Euro-Zone wachsen: Standard & Poor's stufte nach Spanien und Griechenland nun auch Portugal herunter. Marktteilnehmer fragen sich jetzt, welches Land das nächste sein könnte - der Euro fällt. Große Angst herrscht auch in Großbritannien.

http://www.ftd.de/boersen_maerkte/aktien/anleihen_devisen/:E…

+++++

Staatsanleihen

Grenzen der Gemeinsamkeit

Noch vor wenigen Monaten wäre jeder für verrückt erklärt worden, wer vom Bankrott eines großen Euro-Landes geredet hätte.

http://www.ftd.de/meinung/kommentare/:Leitartikel-Staatsanle…

Antwort auf Beitrag Nr.: 36.422.133 von bossi1 am 21.01.09 20:22:32Upps - das sollte nicht hier hin.

SGV BA 41.758 25.736 16.022

BCY MA 13.862 0 13.862

BTO MA 10.559 800 9.759

BSN BI 10.307 674 9.633

MOR MA 12.135 3.059 9.076

MLC MA 13.569 18.486 -4.917

FBK MA 0 10.329 -10.329

CVX MA 1.655 14.723 -13.068

BYM MA 7.032 27.141 -20.109

BSN BA 69.661 91.855 -22.194

Titulos Acumulados: 262.847

BCY MA 13.862 0 13.862

BTO MA 10.559 800 9.759

BSN BI 10.307 674 9.633

MOR MA 12.135 3.059 9.076

MLC MA 13.569 18.486 -4.917

FBK MA 0 10.329 -10.329

CVX MA 1.655 14.723 -13.068

BYM MA 7.032 27.141 -20.109

BSN BA 69.661 91.855 -22.194

Titulos Acumulados: 262.847