Rohstoff-Explorer: Research oder Neuvorstellung (Seite 1784)

eröffnet am 13.03.08 13:14:32 von

neuester Beitrag 18.04.24 09:34:48 von

neuester Beitrag 18.04.24 09:34:48 von

Beiträge: 29.529

ID: 1.139.490

ID: 1.139.490

Aufrufe heute: 21

Gesamt: 2.701.012

Gesamt: 2.701.012

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 6756 | |

| vor 1 Stunde | 5393 | |

| vor 31 Minuten | 4549 | |

| vor 23 Minuten | 4226 | |

| vor 1 Stunde | 2947 | |

| heute 19:32 | 2179 | |

| heute 14:53 | 1971 | |

| vor 9 Minuten | 1717 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.172,36 | +1,35 | 236 | |||

| 2. | 3. | 0,1855 | -1,85 | 97 | |||

| 3. | 2. | 1,1800 | -14,49 | 96 | |||

| 4. | 5. | 9,3550 | +1,19 | 63 | |||

| 5. | 4. | 167,30 | -1,69 | 57 | |||

| 6. | Neu! | 0,4250 | -1,16 | 40 | |||

| 7. | Neu! | 4,8200 | +7,47 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 32 |

Beitrag zu dieser Diskussion schreiben

Treibstoff für das Militär

US-Marine macht Sprit aus Meerwasser

http://www.n-tv.de/wissen/US-Marine-macht-Sprit-aus-Meerwass…

US-Marine macht Sprit aus Meerwasser

http://www.n-tv.de/wissen/US-Marine-macht-Sprit-aus-Meerwass…

Antwort auf Beitrag Nr.: 46.794.991 von Boersiback am 09.04.14 18:27:28da stehst Du aber sowas von auf verlorenem Posten:

http://www.fool.com/investing/general/2014/04/09/1-company-t…

The future looks bright

Frac sand demand is only expected to grow from here....

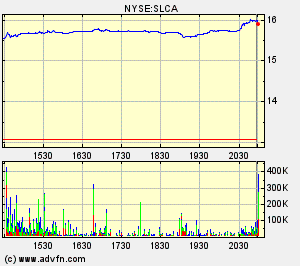

.,..This trend points to a bright future for fellow frac sand producer U.S. Silica (NYSE: SLCA ) , as well as ceramic proppant maker CARBO Ceramics (NYSE: CRR

) . This is

why U.S. Silica is working just as hard as Hi-Crush to position itself to meet growing demand. The company is scheduled to open a new 1.5 million ton frac sand mine in Illinois next quarter and, beyond that, it's seeking permission for a new greenfield site in Wisconsin. Meanwhile, CARBO Ceramics has four lines of capacity expansion at Millen that will be coming online during the next few years to meet demand for ceramic proppants.

Investor takeaway

Oil and gas production in America is booming, which is creating increased demand for proppants. While the industry's supply might be running a bit low, that shortfall shouldn't last too long, as both U.S. Silica and Hi-Crush are investing to ensure the industry doesn't run out of sand. Meanwhile CARBO Ceramics continues to expand ceramic capacity to ensure it can meet surging demand for its high-end proppant. That makes all three a pretty compelling way to invest in the fracking boom....

http://www.fool.com/investing/general/2014/04/09/1-company-t…

The future looks bright

Frac sand demand is only expected to grow from here....

.,..This trend points to a bright future for fellow frac sand producer U.S. Silica (NYSE: SLCA ) , as well as ceramic proppant maker CARBO Ceramics (NYSE: CRR

) . This is

why U.S. Silica is working just as hard as Hi-Crush to position itself to meet growing demand. The company is scheduled to open a new 1.5 million ton frac sand mine in Illinois next quarter and, beyond that, it's seeking permission for a new greenfield site in Wisconsin. Meanwhile, CARBO Ceramics has four lines of capacity expansion at Millen that will be coming online during the next few years to meet demand for ceramic proppants.

Investor takeaway

Oil and gas production in America is booming, which is creating increased demand for proppants. While the industry's supply might be running a bit low, that shortfall shouldn't last too long, as both U.S. Silica and Hi-Crush are investing to ensure the industry doesn't run out of sand. Meanwhile CARBO Ceramics continues to expand ceramic capacity to ensure it can meet surging demand for its high-end proppant. That makes all three a pretty compelling way to invest in the fracking boom....

Antwort auf Beitrag Nr.: 46.794.865 von Popeye82 am 09.04.14 18:07:03Silber – Das bessere Gold besitzt

großes Aufholpotenzial

OMG - hier werden ja wieder mal alle Kampfklischees bedient, in der Kolumne. Könnte mir sogar vorstellen, das der Autor einer der unentwegten Poster im Silber-Thread ist. Der Zungenschlag ist gar zu ähnlich mit manchem, was dort zu lesen ist.

großes Aufholpotenzial

OMG - hier werden ja wieder mal alle Kampfklischees bedient, in der Kolumne. Könnte mir sogar vorstellen, das der Autor einer der unentwegten Poster im Silber-Thread ist. Der Zungenschlag ist gar zu ähnlich mit manchem, was dort zu lesen ist.

Antwort auf Beitrag Nr.: 46.794.991 von Boersiback am 09.04.14 18:27:28http://www.vistavusolutions.com/newsroom/vistavu-clients-amo…

Antwort auf Beitrag Nr.: 46.794.535 von XIO am 09.04.14 17:28:03ob Sand oder Driller... ich seh da einfach das problem, daß sich bei den mengen an öllagerstätten die mühen noch mehr zu finden/zu fördern langsam zurückgefahren werden.

sonst wär ich vielleicht schon in PHX drin. keine ahnung aber wie nachhaltig deren zahlen sind. die letzten jahre waren sie nachhaltig. kgv 5 ist so eben nach meinem geschmack. vor allem wenn dann noch das wachstum auf 4 jahre enorm war, dass sie sogar in berichten auftauchen der am stärksten wachsenden unternehmen.

sonst wär ich vielleicht schon in PHX drin. keine ahnung aber wie nachhaltig deren zahlen sind. die letzten jahre waren sie nachhaltig. kgv 5 ist so eben nach meinem geschmack. vor allem wenn dann noch das wachstum auf 4 jahre enorm war, dass sie sogar in berichten auftauchen der am stärksten wachsenden unternehmen.

Antwort auf Beitrag Nr.: 46.794.865 von Popeye82 am 09.04.14 18:07:03also irgendwie scheinen alle nicht mehr richtig hinzusehen...

EXS hat da 9,9 mios shares outstanding... im anderen bericht über sie sind´s gar 185 mios

und sie haben es doch so schön in ihrer januarpräsi aufgelistet...

Shares Outstanding 43.6 million

Warrants Outstanding 6.8 million

Brokers Warrants .4 million

Options Outstanding 3.7 million

Fully Diluted Shares o/s 54.5 million

geben sich solche mühe und keiner liest es

gruslig teils, was man so an daten sieht. aber spricht ja für den tiefpunkt wenn keiner mehr richtig hinsieht

EXS hat da 9,9 mios shares outstanding... im anderen bericht über sie sind´s gar 185 mios

und sie haben es doch so schön in ihrer januarpräsi aufgelistet...

Shares Outstanding 43.6 million

Warrants Outstanding 6.8 million

Brokers Warrants .4 million

Options Outstanding 3.7 million

Fully Diluted Shares o/s 54.5 million

geben sich solche mühe und keiner liest es

gruslig teils, was man so an daten sieht. aber spricht ja für den tiefpunkt wenn keiner mehr richtig hinsieht

Wer nicht weiss was die besten Gold/Silber/Kupferaktien, dieses Jahr, sind.

http://netzagentur.de/sdr/sdr-goldsilber-2014.pdf

Gruß

P.

http://netzagentur.de/sdr/sdr-goldsilber-2014.pdf

Gruß

P.

US Silica holt Hi-Crush im Shareprice ein:

Hi-Crush Partners acquires Augusta frack sand facility, updates Q1 guidance

04:34 PM ET · HCLP

Hi-Crush Partners (HCLP) agrees to acquire equity interests in Hi-Crush Augusta, the entity that owns the raw frack sand processing facility in Augusta, Wis., for ~$224M; HCLP expects the transaction to contribute more than $30M of incremental annual EBITDA.

HCLP also provides updated Q1 guidance, seeing EBITDA of $18.8M-$19.5M after being negatively impacted by reduced sales volumes, primarily in the month of January.

To pay for the Augusta acquisition, HCLP plans to launch a public offering of 4.25M common units

04:34 PM ET · HCLP

Hi-Crush Partners (HCLP) agrees to acquire equity interests in Hi-Crush Augusta, the entity that owns the raw frack sand processing facility in Augusta, Wis., for ~$224M; HCLP expects the transaction to contribute more than $30M of incremental annual EBITDA.

HCLP also provides updated Q1 guidance, seeing EBITDA of $18.8M-$19.5M after being negatively impacted by reduced sales volumes, primarily in the month of January.

To pay for the Augusta acquisition, HCLP plans to launch a public offering of 4.25M common units

Mechanisierung von Minen ist in Südafrika ein riesen Thema. Und, ich denke, noch stark zunehmend. Möglicherweise in dem Zusammenhang interessant.

Accord with AMCU "sets mechanised gold junior on new growth path" - MW/CMR, NELSPRUIT - Apr 8, 2014

- M. Creamer -

www.miningweekly.com/article/accord-with-amcu-sets-mechanise…

"An accord with the feared Association of Mineworkers and Construction Union (AMCU) has become a tailwind of growth for South African gold junior Vantage Goldfields, which has already invested R710-million in Barberton's Lomshiyo valley and where it plans to spend considerably more.

After suffering a severe setback when AMCU’s illegal strike shut the company down for seven weeks shortly after its listing on the Australian Stock Exchange (ASX), the company is now relishing constructive engagement with the union, which will form a key part of the company’s upcoming expansion programme, in sharp contrast to its aggression in South Africa’s platinum belt, where the devastating AMCU strike is in the eleventh week.

The company, which is now aspiring to be an eventual 100 000 oz/y producer like the London- and Johannesburg-listed Pan African next door, is also mulling a future listing on the JSE once the company derisks into strong cash flow.

Vantage has a net asset value on its balance sheet of $57-million.

The company last month raised A$12.5-million on top of the $30-million raised four years ago when it went on to the ASX, where its share price has plummeted from 40c a share on listing to 2.9c a share.

The three-year loan at 16%, extendable to five years, gives the company the wherewithal to carry out its expansion and keep gearing at just under 25%.

Not yet tax paying but only royalty paying, Vantage is currently on track to hit the 45 000 oz/y mark over the next 18 months.

However, that will be dependent on the gold price, government policy and power supply from Eskom.

“If those three things align, we’ll have a chance of moving forward,” Vantage CEO Michael McChesney told Mining Weekly Online, which formed part of a media group visiting the company’s Lily and Barbrook gold mines in the Barberton goldfields, where additional gold mines are on the drawing board.

McChesney, who has been mining in the Barberton goldfields for the last quarter century, has developed a sound relationship with the Lomshiyo community, from which 90% of the 800-strong workforce is drawn and where its broad-based black economic-empowerment partnership is focused.

Former Anglo American executive chairperson Kuseni Dlamini, a nephew of the chief, is a shareholder, together with the workforce and the community.

“We don’t have migrant labourers. We draw our workforce from our own communities,” said Vantage nonexecutive director Dr Willo Stear.

“And they go home every night to their wives and children,” said operations director Mike Begg, who set up the dialogue with AMCU that is now sustaining the company.

AMCU members are at work despite R12 500 a month - AMCU's tabled demand in the platinum sector - not being paid by the company.

While the nearby Pan African Resources’ deep, high-grade and labour-intensive mines mill 300 000 t/y with 2 500 employees, Vantage’s shallow, low-grade and mechanised mines mill more than 500 000 t/y with 800 employees.

Pan African’s grade is 4 g/t and its costs are R2 400/t whereas Vantage’s grade is 2.5 g/t and its costs are R600/t, rendering the margins the same.

“We are a high volume, low-grade but also low-cost operation,” said McChesney.

Last year’s all-in sustaining costs were $1 200/oz, which are expected to decline to $1 000/oz when the 45 000 oz production level is reached.

Vantage has 4.7-million resource ounces in the ground compared with the three-million of Barberton Mines.

Many of the company’s shareholders are international investment houses headed by South Africans.

Vantage projects manager Dr Tony Parry told Mining Weekly Online that the company was able to get gold recoveries of up to 85% in laboratory testwork using available technology and expected Barbrook to be a higher margin operation than Lily.

“The dog days of Barbrook are over,” Parry said, adding that technology would be installed soon to push up recoveries. "

Accord with AMCU "sets mechanised gold junior on new growth path" - MW/CMR, NELSPRUIT - Apr 8, 2014

- M. Creamer -

www.miningweekly.com/article/accord-with-amcu-sets-mechanise…

"An accord with the feared Association of Mineworkers and Construction Union (AMCU) has become a tailwind of growth for South African gold junior Vantage Goldfields, which has already invested R710-million in Barberton's Lomshiyo valley and where it plans to spend considerably more.

After suffering a severe setback when AMCU’s illegal strike shut the company down for seven weeks shortly after its listing on the Australian Stock Exchange (ASX), the company is now relishing constructive engagement with the union, which will form a key part of the company’s upcoming expansion programme, in sharp contrast to its aggression in South Africa’s platinum belt, where the devastating AMCU strike is in the eleventh week.

The company, which is now aspiring to be an eventual 100 000 oz/y producer like the London- and Johannesburg-listed Pan African next door, is also mulling a future listing on the JSE once the company derisks into strong cash flow.

Vantage has a net asset value on its balance sheet of $57-million.

The company last month raised A$12.5-million on top of the $30-million raised four years ago when it went on to the ASX, where its share price has plummeted from 40c a share on listing to 2.9c a share.

The three-year loan at 16%, extendable to five years, gives the company the wherewithal to carry out its expansion and keep gearing at just under 25%.

Not yet tax paying but only royalty paying, Vantage is currently on track to hit the 45 000 oz/y mark over the next 18 months.

However, that will be dependent on the gold price, government policy and power supply from Eskom.

“If those three things align, we’ll have a chance of moving forward,” Vantage CEO Michael McChesney told Mining Weekly Online, which formed part of a media group visiting the company’s Lily and Barbrook gold mines in the Barberton goldfields, where additional gold mines are on the drawing board.

McChesney, who has been mining in the Barberton goldfields for the last quarter century, has developed a sound relationship with the Lomshiyo community, from which 90% of the 800-strong workforce is drawn and where its broad-based black economic-empowerment partnership is focused.

Former Anglo American executive chairperson Kuseni Dlamini, a nephew of the chief, is a shareholder, together with the workforce and the community.

“We don’t have migrant labourers. We draw our workforce from our own communities,” said Vantage nonexecutive director Dr Willo Stear.

“And they go home every night to their wives and children,” said operations director Mike Begg, who set up the dialogue with AMCU that is now sustaining the company.

AMCU members are at work despite R12 500 a month - AMCU's tabled demand in the platinum sector - not being paid by the company.

While the nearby Pan African Resources’ deep, high-grade and labour-intensive mines mill 300 000 t/y with 2 500 employees, Vantage’s shallow, low-grade and mechanised mines mill more than 500 000 t/y with 800 employees.

Pan African’s grade is 4 g/t and its costs are R2 400/t whereas Vantage’s grade is 2.5 g/t and its costs are R600/t, rendering the margins the same.

“We are a high volume, low-grade but also low-cost operation,” said McChesney.

Last year’s all-in sustaining costs were $1 200/oz, which are expected to decline to $1 000/oz when the 45 000 oz production level is reached.

Vantage has 4.7-million resource ounces in the ground compared with the three-million of Barberton Mines.

Many of the company’s shareholders are international investment houses headed by South Africans.

Vantage projects manager Dr Tony Parry told Mining Weekly Online that the company was able to get gold recoveries of up to 85% in laboratory testwork using available technology and expected Barbrook to be a higher margin operation than Lily.

“The dog days of Barbrook are over,” Parry said, adding that technology would be installed soon to push up recoveries. "