Chariot, Namibia und Ene und UNX wohin geht die Reise? - 500 Beiträge pro Seite (Seite 3)

eröffnet am 28.07.09 09:17:16 von

neuester Beitrag 08.05.15 15:24:20 von

neuester Beitrag 08.05.15 15:24:20 von

Beiträge: 1.045

ID: 1.152.005

ID: 1.152.005

Aufrufe heute: 0

Gesamt: 137.850

Gesamt: 137.850

Aktive User: 0

ISIN: GG00B2R9PM06 · WKN: A0Q17M · Symbol: C62

0,0970

EUR

+4,86 %

+0,0045 EUR

Letzter Kurs 25.04.24 Stuttgart

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7000 | +53,15 | |

| 75,38 | +19,99 | |

| 16,530 | +9,98 | |

| 5,2000 | +9,47 | |

| 3,9000 | +8,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 22,795 | -11,82 | |

| 12,080 | -12,27 | |

| 1,2501 | -15,25 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 |

Ab ins Orange Basin, Nimrod hatte Öl aber kein Reservoir

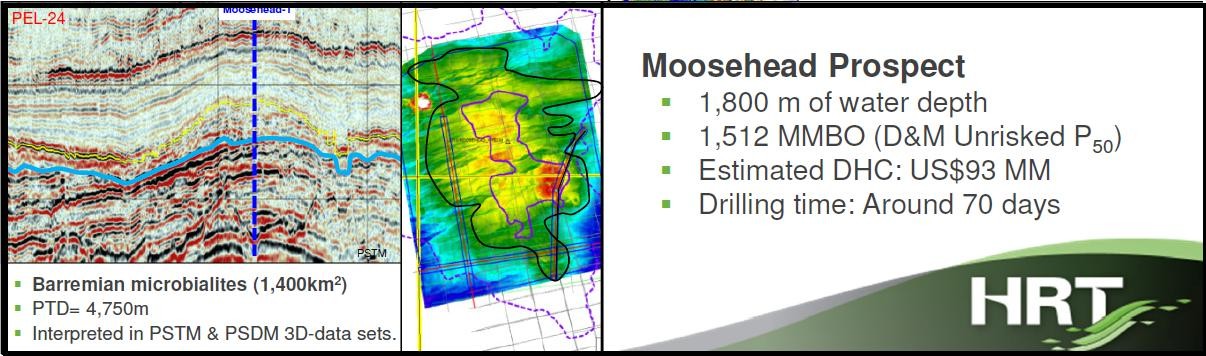

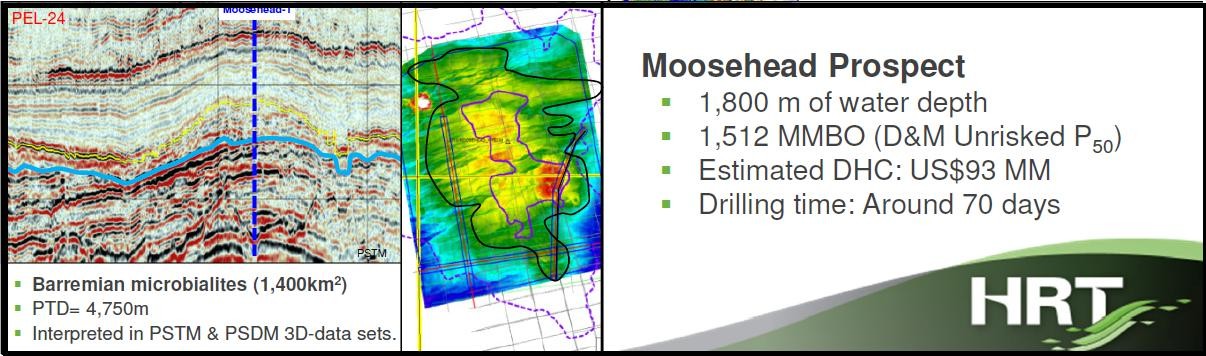

Wird Moosehead Namibia zum Öl führen?

von Jimmy, iii

http://www.iii.co.uk/investment/detail/?display=discussion&c…

I estimate the moose head drill will spud in about a week to ten days.

We now know from chariots website that the adjoining block contained world class source rock, which I believe was not burried deeply enough in block 2714 a, but should be buried deeply at the moose head well location.

There are three stacked reservoir sections in moos head which form part of a huge four way dip anticline. So structure should not be a problem . The nearby kudu gas field has a complex and inconsistent reservoir in it's main sand reservoir, however hrt are targeting a barramian carbonate reservoir, similar to the Brazilian Tupi field I believe, so fingers crossed they get it right this time.

This next well will be important to chariot to proove the presence of mature oil source rocks which can also charge potential reservoirs in chariots block 2714b.

Jimmy

Wird Moosehead Namibia zum Öl führen?

von Jimmy, iii

http://www.iii.co.uk/investment/detail/?display=discussion&c…

I estimate the moose head drill will spud in about a week to ten days.

We now know from chariots website that the adjoining block contained world class source rock, which I believe was not burried deeply enough in block 2714 a, but should be buried deeply at the moose head well location.

There are three stacked reservoir sections in moos head which form part of a huge four way dip anticline. So structure should not be a problem . The nearby kudu gas field has a complex and inconsistent reservoir in it's main sand reservoir, however hrt are targeting a barramian carbonate reservoir, similar to the Brazilian Tupi field I believe, so fingers crossed they get it right this time.

This next well will be important to chariot to proove the presence of mature oil source rocks which can also charge potential reservoirs in chariots block 2714b.

Jimmy

Goood Morning!

http://otp.investis.com/clients/uk/chariot-oil-and-gas/rns1/…

08 August 2013

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

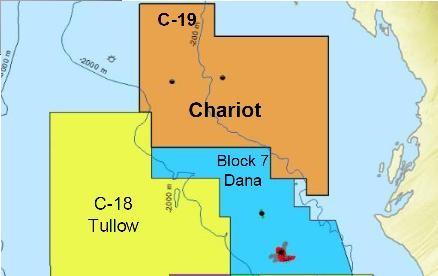

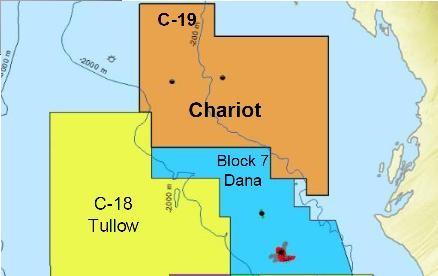

Farm-out agreement signed with Cairn Energy PLC ("Cairn")in Block C19 offshore Mauritania

Highlights:

· Cairn, through its subsidiary Capricorn Mauritania Limited, to acquire 35% interest in Block C19 offshore Mauritania

· Cairn to pay approximately US$26 million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs · Chariot to retain operatorship with 55% equity and SMH with 10%

· Funds to be used to further develop the Chariot portfolio

· Partnering process for drilling based on 3D data interpretation to take place 1Q 2014

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, is pleased to announce that its wholly-owned subsidiary, Chariot Oil & Gas Investments (Mauritania) Ltd., has signed a farm-out agreement with Capricorn Mauritania Limited, a wholly owned subsidiary of Cairn Energy PLC. Following completion of this agreement, Cairn will hold a 35% equity interest in Chariot's C19 licence offshore Mauritania in return for paying approximately US$26million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs. Chariot will have a 55% stake and operatorship of the licence, with the Société Mauritanienne des Hydrocarbures (SMH) holding the remaining 10% as a carried interest. If, before the end of the first phase of the licence (15 June 2015), Cairn were to increase its interest to greater than 50%, Chariot would support its application for operatorship of the block.

This agreement remains subject to the approval of the Ministry of Hydrocarbons in Mauritania and includes standard representations and warranties given by both parties.

Block C19 covers an area of 12,175km2 and is located 30km off the coast of Mauritania with water depths ranging from 5m-2,100m. To date, Chariot has exceeded its work commitments on the licence with the acquisition of a 3,500km2 3D seismic programme. Fast track data was received in mid-March and final Pre-Stack Depth Migration (PSDM) volumes are due to be received in November this year. This data will be fully interpreted and analysed with the objective of identifying a drillable prospect in 1Q 2014 and, subject to the results of this, drilling planning and the evaluation of partnering options will commence thereafter.

Larry Bottomley, CEO commented:

"We are pleased to have agreed a partnership on C19 in Mauritania with Cairn, whose focus on exploration-led growth is aligned with Chariot's objective of creating transformational value for stakeholders through the discovery of material accumulations of hydrocarbons.

"This agreement also demonstrates Chariot's ability to implement our strategy of identifying and accessing large equity positions in underexplored hydrocarbon provinces, adding value in the early stages of exploration and securing farm-out partners to validate our assets, diversify risk and provide funding to further develop our portfolio. Furthermore, this partnership will enable us to continue to expedite our exploration efforts offshore Mauritania, where we see significant prospectivity and we look forward to maturing our prospect selection for drilling."

GLA, onwards & upwards

http://otp.investis.com/clients/uk/chariot-oil-and-gas/rns1/…

08 August 2013

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Farm-out agreement signed with Cairn Energy PLC ("Cairn")in Block C19 offshore Mauritania

Highlights:

· Cairn, through its subsidiary Capricorn Mauritania Limited, to acquire 35% interest in Block C19 offshore Mauritania

· Cairn to pay approximately US$26 million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs · Chariot to retain operatorship with 55% equity and SMH with 10%

· Funds to be used to further develop the Chariot portfolio

· Partnering process for drilling based on 3D data interpretation to take place 1Q 2014

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, is pleased to announce that its wholly-owned subsidiary, Chariot Oil & Gas Investments (Mauritania) Ltd., has signed a farm-out agreement with Capricorn Mauritania Limited, a wholly owned subsidiary of Cairn Energy PLC. Following completion of this agreement, Cairn will hold a 35% equity interest in Chariot's C19 licence offshore Mauritania in return for paying approximately US$26million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs. Chariot will have a 55% stake and operatorship of the licence, with the Société Mauritanienne des Hydrocarbures (SMH) holding the remaining 10% as a carried interest. If, before the end of the first phase of the licence (15 June 2015), Cairn were to increase its interest to greater than 50%, Chariot would support its application for operatorship of the block.

This agreement remains subject to the approval of the Ministry of Hydrocarbons in Mauritania and includes standard representations and warranties given by both parties.

Block C19 covers an area of 12,175km2 and is located 30km off the coast of Mauritania with water depths ranging from 5m-2,100m. To date, Chariot has exceeded its work commitments on the licence with the acquisition of a 3,500km2 3D seismic programme. Fast track data was received in mid-March and final Pre-Stack Depth Migration (PSDM) volumes are due to be received in November this year. This data will be fully interpreted and analysed with the objective of identifying a drillable prospect in 1Q 2014 and, subject to the results of this, drilling planning and the evaluation of partnering options will commence thereafter.

Larry Bottomley, CEO commented:

"We are pleased to have agreed a partnership on C19 in Mauritania with Cairn, whose focus on exploration-led growth is aligned with Chariot's objective of creating transformational value for stakeholders through the discovery of material accumulations of hydrocarbons.

"This agreement also demonstrates Chariot's ability to implement our strategy of identifying and accessing large equity positions in underexplored hydrocarbon provinces, adding value in the early stages of exploration and securing farm-out partners to validate our assets, diversify risk and provide funding to further develop our portfolio. Furthermore, this partnership will enable us to continue to expedite our exploration efforts offshore Mauritania, where we see significant prospectivity and we look forward to maturing our prospect selection for drilling."

GLA, onwards & upwards

Zitat von Drill-a-Hill: Goood Morning!

· Cairn to pay approximately US$26 million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs ·

US$26 million entspricht:

$26mio = £16,77mio

/ 200,64 mio Shares =

£0,084/share in etwa 50% des gestrigen Market Caps (£35,11mio)

der anstieg für solch eine Nachricht ist geradezu lächerlich ...

aber es ist ein anfang für hoffentlich wieder bessere Zeiten für alle chariot aktionäre .

aber es ist ein anfang für hoffentlich wieder bessere Zeiten für alle chariot aktionäre .

And the story continues...

“One of the reasons we chose Cairn is that they have a deep water rig under long term contract,” Bottomley said.

http://www.proactiveinvestors.co.uk/companies/news/59856/cha…

Cairn has hired Transocean’s Cajun Express drill rig and over the course of the next year it will trawl from one prospect to another in the region.Wells are already booked in for prospects in Morocco, where the campaign starts with a well on the FoumDraa permit well in September, and it plans to drill two wells off Senegal.

The rig will, therefore, have to travel through Mauritania, most likely passing through the C19 block itself, at least twice in the next twelve months.

As catalogue of drillable prospects will be ready in early 2014, according to Chariot’s schedule, it is a very real possibility that a well could be drilled in Mauritania at some point within the next year.

“It is an option that we could use that rig to undertake exploration drilling in the licence.”

Bottomley says a second farm out of Chariot’s stake in the Mauritania asset will be pursued to cover its share of drilling costs.

The process will formally begin in the first quarter of 2014, as the findings of the seismic programme are available and a drilling strategy is clearer.

It could equally be another deal with Cairn, or a completely separate arrangement with a third party, Bottomley explained.

“When we go to our farm our process in the first quarter it will be an open and competitive tender process, and we will quite happily release another portion of our [project] equity position to whoever bids with the best commercial terms.”

“One of the reasons we chose Cairn is that they have a deep water rig under long term contract,” Bottomley said.

http://www.proactiveinvestors.co.uk/companies/news/59856/cha…

Cairn has hired Transocean’s Cajun Express drill rig and over the course of the next year it will trawl from one prospect to another in the region.Wells are already booked in for prospects in Morocco, where the campaign starts with a well on the FoumDraa permit well in September, and it plans to drill two wells off Senegal.

The rig will, therefore, have to travel through Mauritania, most likely passing through the C19 block itself, at least twice in the next twelve months.

As catalogue of drillable prospects will be ready in early 2014, according to Chariot’s schedule, it is a very real possibility that a well could be drilled in Mauritania at some point within the next year.

“It is an option that we could use that rig to undertake exploration drilling in the licence.”

Bottomley says a second farm out of Chariot’s stake in the Mauritania asset will be pursued to cover its share of drilling costs.

The process will formally begin in the first quarter of 2014, as the findings of the seismic programme are available and a drilling strategy is clearer.

It could equally be another deal with Cairn, or a completely separate arrangement with a third party, Bottomley explained.

“When we go to our farm our process in the first quarter it will be an open and competitive tender process, and we will quite happily release another portion of our [project] equity position to whoever bids with the best commercial terms.”

Na das sind doch mal gute Nachrichten. Jetzt noch etwas Schützenhilfe von Moosehead und der Kurs könnte richtig anspringen.

Antwort auf Beitrag Nr.: 45.213.171 von DJHLS am 09.08.13 01:04:15& nicht zu vergessen das Bohrprogramm von Tullow sollte diesen Monat beginnen:

Mauritania core campaign drilling this year

Significant play diversity in Mauritania acreage

http://www.tullowoil.com/files/pdf/results/2012_full_year_re… (S.33)

• 80 prospects with risk spread through multiple Central Atlantic plays

•Light oil & gas-condensate already proven in the basin

•Testing new & deeper plays for bigger & better reservoirs

•Four independent exploration wells to commence in H1 2013

−Frégate-1 (Scorpion)

−Tapendar-1

−IDA-1

−Sidewinder-1

GLA

Mauritania core campaign drilling this year

Significant play diversity in Mauritania acreage

http://www.tullowoil.com/files/pdf/results/2012_full_year_re… (S.33)

• 80 prospects with risk spread through multiple Central Atlantic plays

•Light oil & gas-condensate already proven in the basin

•Testing new & deeper plays for bigger & better reservoirs

•Four independent exploration wells to commence in H1 2013

−Frégate-1 (Scorpion)

−Tapendar-1

−IDA-1

−Sidewinder-1

GLA

Guten Morgen,

HRT ist wieder in Geprächen über potentielle Fusionen wie sie es schon mit UNX waren, was zu Kursspüngen von mehreren 1000% führte.

Aus dem Conference Call:

have been approached already by several other companies that want to talk about HRT. There may be synergies that can be explore between ourselves that has for example to very large assets, we are very focused in our portfolio and some other companies are very unfocused in their portfolio. They have a list of assets 10, 15, 20 different assets and the merger of two companies that have a profile like our and some others could be a good decision to jointly operate in more efficient fashion in the future.

Ich denke der Gedankengang war 2011 mit UNX ähnlich, jetzt gilt es herauszufinden, von welchen Unternehmen Milton gesprochen hat wenn er von 10, 15, 20 verschiedenen assets (Blocks?, Basins?) spricht.

Chariot hat schon eine gewisse Geschichte mit HRT, es gab zwar auch Probleme, aber die Zeiten & das Management haben sich geändert.

Jedenfalls hat HRT schon zur UNX Übernahme Interesse an Chariot verlautbart, Ihnen hat gefallen was sie in der Seismic sahen. Also kann ich mir gut vorstellen daß Chariot einer der Firmen ist die HRT über mögliche Kooperationen angesprochen hat.

Chariot hat momentan um die 15 Blocks in 7-8 verschieden Basins unter anderem in Brasilien.

GLA

HRT ist wieder in Geprächen über potentielle Fusionen wie sie es schon mit UNX waren, was zu Kursspüngen von mehreren 1000% führte.

Aus dem Conference Call:

have been approached already by several other companies that want to talk about HRT. There may be synergies that can be explore between ourselves that has for example to very large assets, we are very focused in our portfolio and some other companies are very unfocused in their portfolio. They have a list of assets 10, 15, 20 different assets and the merger of two companies that have a profile like our and some others could be a good decision to jointly operate in more efficient fashion in the future.

Ich denke der Gedankengang war 2011 mit UNX ähnlich, jetzt gilt es herauszufinden, von welchen Unternehmen Milton gesprochen hat wenn er von 10, 15, 20 verschiedenen assets (Blocks?, Basins?) spricht.

Chariot hat schon eine gewisse Geschichte mit HRT, es gab zwar auch Probleme, aber die Zeiten & das Management haben sich geändert.

Jedenfalls hat HRT schon zur UNX Übernahme Interesse an Chariot verlautbart, Ihnen hat gefallen was sie in der Seismic sahen. Also kann ich mir gut vorstellen daß Chariot einer der Firmen ist die HRT über mögliche Kooperationen angesprochen hat.

Chariot hat momentan um die 15 Blocks in 7-8 verschieden Basins unter anderem in Brasilien.

GLA

Northland rates Chariot as a ‘buy’ with a 41p price target, which implies the stock could nearly double in value from the current price of 21p.

http://www.proactiveinvestors.co.uk/companies/news/60197/cha…

He expects that Chariot will continue to press ahead with its aspirations of achieving a ‘zero cost’ exploration strategy – whereby its exploration spend is recouped in subsequent farm-out deals or is ‘carried’ upfront by partners.

“Strong cash backing (with the share price roughly tracking cash) and a growing portfolio of opportunities mean that Chariot is a relatively low-risk exposure to high impact exploration at this level,” he adds.

http://www.proactiveinvestors.co.uk/companies/news/60197/cha…

He expects that Chariot will continue to press ahead with its aspirations of achieving a ‘zero cost’ exploration strategy – whereby its exploration spend is recouped in subsequent farm-out deals or is ‘carried’ upfront by partners.

“Strong cash backing (with the share price roughly tracking cash) and a growing portfolio of opportunities mean that Chariot is a relatively low-risk exposure to high impact exploration at this level,” he adds.

Tullow is in our neighborhood!!

http://www.proactiveinvestors.com.au/companies/news/47670/pa…

The UK major will be assigned a 65% operating interest in EL 0037 while Pancontinental will retain a free-carried 30% interest out of its current 95% interest.

Tullow is expected to spend between US$110 million and US$130 million on an extensive program of 2D and 3D seismic as well as an exploration well – subject to identifying a drillable prospect.

Paragon Oil & Gas (Pty) Ltd’s 5% free-carried interest will be included in the Tullow farmin expenditure.

Der Wert des Farm Outs dürfte um die US$45,5mio sein:

130mio * (0,3 Panon + 0,05 Paragon)

Während ich mir überlege auf Grund von Tullow wieder in Pancontinental einzusteigen, macht es mich auch bezügl. der laufenden FarmDown Gespräche von Chariot in Namibia zuversichtlich.

Chariot hat in Namibia drei mal soviel Lizenzen wie Pancon und hat bereits in 3D Seismic investiert und ist mit zahlreichen prospects Drill-Ready!!

Der Wert der kommenden Farm Outs von Chariots Northern(100%), Central(90%) und Southern (85%) Blocks dürfte Chariots Market Cap von derzeit ca. US$60mio bei WEITEM übersteigen!!!!!

Ich bin mir sicher Tullow wird es nicht dabei belassen und nach weiteren Blocks streben. Die Wingat Bohrung hat bestätigt wonach auch die Majors schauen. Source Rocks & Light Oil im Walvis Basin.

Wer in 2014 in Walvis Basin im Herzen Namibias Offshore bohren möchte,

Chariot Oil & Gas ist Drill-Ready, die DataRooms sind geöffnet...

Ich bin heute mehr als glücklich und zuversichtlich in Chariot zu diesen niedrigen Kursen investiert zu sein,

Achja Tullow ist auch von GB...

GLA

http://www.proactiveinvestors.com.au/companies/news/47670/pa…

The UK major will be assigned a 65% operating interest in EL 0037 while Pancontinental will retain a free-carried 30% interest out of its current 95% interest.

Tullow is expected to spend between US$110 million and US$130 million on an extensive program of 2D and 3D seismic as well as an exploration well – subject to identifying a drillable prospect.

Paragon Oil & Gas (Pty) Ltd’s 5% free-carried interest will be included in the Tullow farmin expenditure.

Der Wert des Farm Outs dürfte um die US$45,5mio sein:

130mio * (0,3 Panon + 0,05 Paragon)

Während ich mir überlege auf Grund von Tullow wieder in Pancontinental einzusteigen, macht es mich auch bezügl. der laufenden FarmDown Gespräche von Chariot in Namibia zuversichtlich.

Chariot hat in Namibia drei mal soviel Lizenzen wie Pancon und hat bereits in 3D Seismic investiert und ist mit zahlreichen prospects Drill-Ready!!

Der Wert der kommenden Farm Outs von Chariots Northern(100%), Central(90%) und Southern (85%) Blocks dürfte Chariots Market Cap von derzeit ca. US$60mio bei WEITEM übersteigen!!!!!

Ich bin mir sicher Tullow wird es nicht dabei belassen und nach weiteren Blocks streben. Die Wingat Bohrung hat bestätigt wonach auch die Majors schauen. Source Rocks & Light Oil im Walvis Basin.

Wer in 2014 in Walvis Basin im Herzen Namibias Offshore bohren möchte,

Chariot Oil & Gas ist Drill-Ready, die DataRooms sind geöffnet...

Ich bin heute mehr als glücklich und zuversichtlich in Chariot zu diesen niedrigen Kursen investiert zu sein,

Achja Tullow ist auch von GB...

GLA

NEWS OUT:

http://otp.investis.com/clients/uk/chariot-oil-and-gas/rns1/…

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Resource Update

Independent CPR of Prospective Resource potential of the Central Area Blocks, Namibia

Highlights:

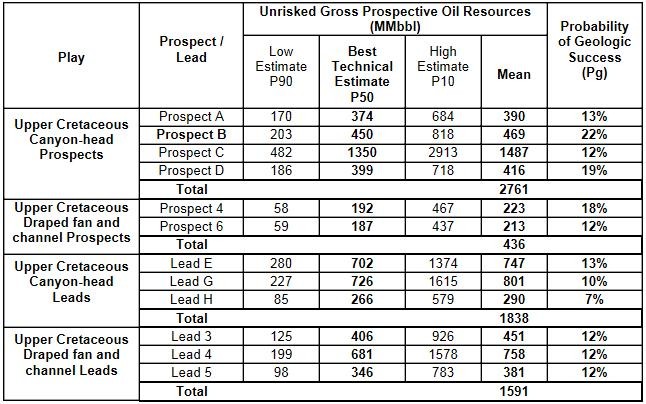

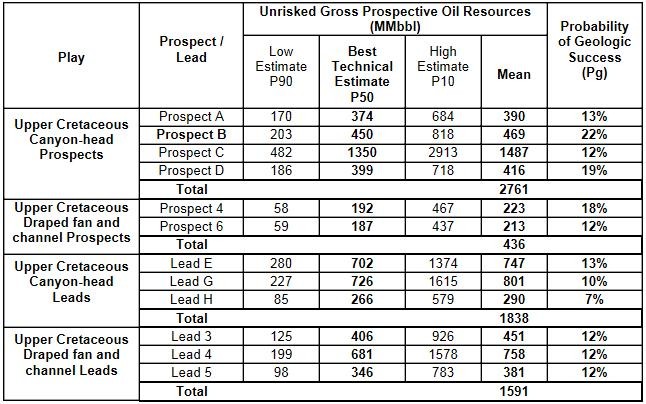

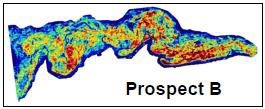

· Principal drilling candidate Prospect B has an independently audited estimated Unrisked Gross Mean Prospective Oil Resource of 469mmbbl and a probability of geologic success (Pg) of 22%

· Additional Upper Cretaceous Prospects and Leads range in estimated Unrisked Gross Mean Prospective Oil Resource from 213mmbbl to 1,487mmbbl

· Partnering process initiated

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, provides an update on selected results from an independent audit by Netherland Sewell and Associates Inc ("NSAI") of the prospective resource potential of the Central Area blocks (2312 A&B and the northern halves of 2412 A&B) in offshore Namibia (90% Chariot (Operator), 10% AziNam Limited).

The technical work and audit is based on the evaluation and integration of the 3,500 km2 of 3D seismic data (acquired by Chariot in 2011/2012 in the north-western quadrant of the Central Area blocks and processed in 2013), the Company's 2D seismic data and information incorporated from nearby drilling activity.

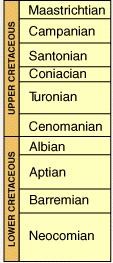

Whilst targets have been identified in both the deeper and shallower petroleum systems in the 3D seismic area, the focus of Chariot's forward exploration programme in the Central Area blocks is on the shallower petroleum system, which the Company believes to have lower associated risk. This is where Upper Cretaceous turbidite clastic reservoirs have been identified in a variety of stratigraphic and structural traps, with the potential for oil charge from locally mature marine source rocks.

Prospect B, Chariot's principal drilling candidate, is an Upper Cretaceous canyon-head trap in the shallower petroleum system and has an audited Unrisked Gross Mean Prospective Oil Resource of 469mmbbl, with an estimated probability of geologic success (Pg) of 22%. For this trap type and age of reservoir there are an additional three prospects (Prospects A, C and D) in the 3D seismic volume and three leads (Leads E, G, and H) in the 2D area. These additional prospects and leads range in Unrisked Gross Mean Prospective Oil Resource from 290mmbbl to 1,487mmbbl and success in Prospect B would offer significant follow-on exploration potential in these targets.

Within and to the west of the 3D seismic area, Chariot has identified a fairway with Upper Cretaceous deep water fan and channel sands draped over an outboard structural high, with the base of those reservoir sequences eroding into the marine source rocks. In this shallower petroleum system there are two further prospects in the 3D area (Prospects 4 and 6) and three leads in the 2D area (Leads 3, 4 and 5) and these targets range in Unrisked Gross Mean Prospective Oil Resource from 213mmbbl to 758mmbbl. Encouragement in Prospect B would offer significant additional follow-on exploration potential in this fairway too.

Chariot has initiated a partnering process to progress the exploration of these prospective licences.

Larry Bottomley, CEO of Chariot commented:

"The independent audit of the Prospective Resource potential of the Central Area blocks demonstrates the giant scale of the opportunity that exists within the Chariot portfolio. Although Namibia remains a frontier and high risk province, all the play elements of source, reservoir and seal have now been demonstrated and success in our exploration campaign would deliver transformational growth. Importantly, such success would also have a significant impact on the rest of the Upper Cretaceous turbidite clastic reservoirs portfolio within these blocks which offers material upside and follow-up potential in what would then be a de-risked play system.

"We have started the farm-out process to identify potential partners to join us in the exploration of this new and emerging province."

Selected prospects and leads from the shallower petroleum system:

"the focus of Chariot's forward exploration programme in the Central Area blocks is on the shallower petroleum system, which the Company believes to have lower associated risk"

Der selbe Grund aus dem Tullow sich 65% von Pancontinentals Block geschnappt hat, HRTs Wingat Bohrung zeigt jetzt wie und wo man bohren muss...

Ein Farm Out von den Central Blocks sollte auch bei Chariot mit Leichtigkeit Ersatz der 3D seismic costs und mindestens eine free carried well von Prospect B bringen, für 30-50% Lizenzanteil IMO! Also einen Wert von US$50-100mio, der sogar den momentanen Market Cap übersteigen könnte.

Ich bin mir sicher die Majors schlagen sich bereits darum..

GLA

http://otp.investis.com/clients/uk/chariot-oil-and-gas/rns1/…

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Resource Update

Independent CPR of Prospective Resource potential of the Central Area Blocks, Namibia

Highlights:

· Principal drilling candidate Prospect B has an independently audited estimated Unrisked Gross Mean Prospective Oil Resource of 469mmbbl and a probability of geologic success (Pg) of 22%

· Additional Upper Cretaceous Prospects and Leads range in estimated Unrisked Gross Mean Prospective Oil Resource from 213mmbbl to 1,487mmbbl

· Partnering process initiated

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, provides an update on selected results from an independent audit by Netherland Sewell and Associates Inc ("NSAI") of the prospective resource potential of the Central Area blocks (2312 A&B and the northern halves of 2412 A&B) in offshore Namibia (90% Chariot (Operator), 10% AziNam Limited).

The technical work and audit is based on the evaluation and integration of the 3,500 km2 of 3D seismic data (acquired by Chariot in 2011/2012 in the north-western quadrant of the Central Area blocks and processed in 2013), the Company's 2D seismic data and information incorporated from nearby drilling activity.

Whilst targets have been identified in both the deeper and shallower petroleum systems in the 3D seismic area, the focus of Chariot's forward exploration programme in the Central Area blocks is on the shallower petroleum system, which the Company believes to have lower associated risk. This is where Upper Cretaceous turbidite clastic reservoirs have been identified in a variety of stratigraphic and structural traps, with the potential for oil charge from locally mature marine source rocks.

Prospect B, Chariot's principal drilling candidate, is an Upper Cretaceous canyon-head trap in the shallower petroleum system and has an audited Unrisked Gross Mean Prospective Oil Resource of 469mmbbl, with an estimated probability of geologic success (Pg) of 22%. For this trap type and age of reservoir there are an additional three prospects (Prospects A, C and D) in the 3D seismic volume and three leads (Leads E, G, and H) in the 2D area. These additional prospects and leads range in Unrisked Gross Mean Prospective Oil Resource from 290mmbbl to 1,487mmbbl and success in Prospect B would offer significant follow-on exploration potential in these targets.

Within and to the west of the 3D seismic area, Chariot has identified a fairway with Upper Cretaceous deep water fan and channel sands draped over an outboard structural high, with the base of those reservoir sequences eroding into the marine source rocks. In this shallower petroleum system there are two further prospects in the 3D area (Prospects 4 and 6) and three leads in the 2D area (Leads 3, 4 and 5) and these targets range in Unrisked Gross Mean Prospective Oil Resource from 213mmbbl to 758mmbbl. Encouragement in Prospect B would offer significant additional follow-on exploration potential in this fairway too.

Chariot has initiated a partnering process to progress the exploration of these prospective licences.

Larry Bottomley, CEO of Chariot commented:

"The independent audit of the Prospective Resource potential of the Central Area blocks demonstrates the giant scale of the opportunity that exists within the Chariot portfolio. Although Namibia remains a frontier and high risk province, all the play elements of source, reservoir and seal have now been demonstrated and success in our exploration campaign would deliver transformational growth. Importantly, such success would also have a significant impact on the rest of the Upper Cretaceous turbidite clastic reservoirs portfolio within these blocks which offers material upside and follow-up potential in what would then be a de-risked play system.

"We have started the farm-out process to identify potential partners to join us in the exploration of this new and emerging province."

Selected prospects and leads from the shallower petroleum system:

"the focus of Chariot's forward exploration programme in the Central Area blocks is on the shallower petroleum system, which the Company believes to have lower associated risk"

Der selbe Grund aus dem Tullow sich 65% von Pancontinentals Block geschnappt hat, HRTs Wingat Bohrung zeigt jetzt wie und wo man bohren muss...

Ein Farm Out von den Central Blocks sollte auch bei Chariot mit Leichtigkeit Ersatz der 3D seismic costs und mindestens eine free carried well von Prospect B bringen, für 30-50% Lizenzanteil IMO! Also einen Wert von US$50-100mio, der sogar den momentanen Market Cap übersteigen könnte.

Ich bin mir sicher die Majors schlagen sich bereits darum..

GLA

MonsterTrades

11:15:57

19p 550,000 £104,500 18.75p 19.25p ?

11:14:42

19.12p 550,000 £105,160 18.75p 19.25p Buy

11:14:29

19.25p 550,000 £105,875 18.75p 19.25p Buy

http://www.iii.co.uk/investment/detail?code=cotn:CHAR.L&disp…

11:15:57

19p 550,000 £104,500 18.75p 19.25p ?

11:14:42

19.12p 550,000 £105,160 18.75p 19.25p Buy

11:14:29

19.25p 550,000 £105,875 18.75p 19.25p Buy

http://www.iii.co.uk/investment/detail?code=cotn:CHAR.L&disp…

Interim Results Webcast September 2013

Conference Call:

http://www.chariotoilandgas.com/media/audio-casts/

& PDF

http://www.chariotoilandgas.com/files/4213/7966/2694/Chariot…

Punkte von Jimmy bei iii:

http://www.iii.co.uk/investment/detail/?display=discussion&c…

Chariot held a conference call to discuss the interim report and presentation. The conference call is on chariots web site and ii recommend all investors to listen to it. It’s 45 minutes long so I set out below the new information I learnt.

Firstly, Larry and mark presented very well and they clearly got the message across that chariots strategy was to achieve zero cost exploration in highly prospective areas where transformational prospects would be drilled by third party major oil companies who would reimburse chariots past costs and drill exploration wells at no cost to chariot.

The following points were worth noting.

1. Chariot have opened a data room in September to farm out its central Namibian blocks. The main prospect is prospect b. the aptian and cenomanian/turonian source rocks which generated oil in HRT Wingat and Murombe wells have been mapped from those locations to prospect b where they are located at a similar depth and in the oil window. The santonian good reservoirs found by HRT in its Baobob prospect are also mapped to be present in prospect b , but are better and more consistent with the high quality sands found by chariot in it’s tapir we’ll and another well in block 1911.

2. Chariot will spend $3m this year ordering long lead time equipment for a well to be drilled in 2014, after farm out. Obviously high expectations of a farm out.

3. The k1 well in block 2714 a failed because of a high temperature gradient in the well which matured the deep source rock before the nimrod prospect was in place. However, world class source rocks were found above the nimrod prospect and the source rocks were not buried deeply enough at that location to be oil generating. These source rocks are mapped as being deeper and oil generating in nearby block 2714 b .

4. Chariot will be shooting a huge 2d seismic survey in block 2714 b in 4q 13 which will target prospects that will be charged by these proven oil source rocks.

5. Chariot expected that the hrt Moosehead well was high risk , due to over mature deep source rocks and reservoirs which they believed to be poor.

6. Northern block farm outs on hold till after Repsol drill their next well nearby, that well depends on long migration pathways for oil to charge the prospects, if it works for Repsol it would high grade chariots Zamba prospect.

7. High quality seismic in Mauritania achieved, seismic time lines received, depth converted lines expected in November. Initial indications show prospects in both shallow and deep water.

8. Morocco 2d mapping underway, a lot of third party activity in the area which will inform prospect selection.

9. Brazil , nothing happening while environmental permits are being obtained. However, even though the blocks are classified as shallow water, the major prospects are in it’s deep water sections . Third party drilling will occur nearby before chariot has to drill in several years time.

10. Chariot have no interest in acquiring HRT.

All good stuff, a great diversified portfolio, strong track record of farming out so it’s just a matter of being patient till lady luck helps out. Incredible value as chariot valued at cash and has a book value of 64 p after writing off past dry well costs..

Jimmy

Conference Call:

http://www.chariotoilandgas.com/media/audio-casts/

http://www.chariotoilandgas.com/files/4213/7966/2694/Chariot…

Punkte von Jimmy bei iii:

http://www.iii.co.uk/investment/detail/?display=discussion&c…

Chariot held a conference call to discuss the interim report and presentation. The conference call is on chariots web site and ii recommend all investors to listen to it. It’s 45 minutes long so I set out below the new information I learnt.

Firstly, Larry and mark presented very well and they clearly got the message across that chariots strategy was to achieve zero cost exploration in highly prospective areas where transformational prospects would be drilled by third party major oil companies who would reimburse chariots past costs and drill exploration wells at no cost to chariot.

The following points were worth noting.

1. Chariot have opened a data room in September to farm out its central Namibian blocks. The main prospect is prospect b. the aptian and cenomanian/turonian source rocks which generated oil in HRT Wingat and Murombe wells have been mapped from those locations to prospect b where they are located at a similar depth and in the oil window. The santonian good reservoirs found by HRT in its Baobob prospect are also mapped to be present in prospect b , but are better and more consistent with the high quality sands found by chariot in it’s tapir we’ll and another well in block 1911.

2. Chariot will spend $3m this year ordering long lead time equipment for a well to be drilled in 2014, after farm out. Obviously high expectations of a farm out.

3. The k1 well in block 2714 a failed because of a high temperature gradient in the well which matured the deep source rock before the nimrod prospect was in place. However, world class source rocks were found above the nimrod prospect and the source rocks were not buried deeply enough at that location to be oil generating. These source rocks are mapped as being deeper and oil generating in nearby block 2714 b .

4. Chariot will be shooting a huge 2d seismic survey in block 2714 b in 4q 13 which will target prospects that will be charged by these proven oil source rocks.

5. Chariot expected that the hrt Moosehead well was high risk , due to over mature deep source rocks and reservoirs which they believed to be poor.

6. Northern block farm outs on hold till after Repsol drill their next well nearby, that well depends on long migration pathways for oil to charge the prospects, if it works for Repsol it would high grade chariots Zamba prospect.

7. High quality seismic in Mauritania achieved, seismic time lines received, depth converted lines expected in November. Initial indications show prospects in both shallow and deep water.

8. Morocco 2d mapping underway, a lot of third party activity in the area which will inform prospect selection.

9. Brazil , nothing happening while environmental permits are being obtained. However, even though the blocks are classified as shallow water, the major prospects are in it’s deep water sections . Third party drilling will occur nearby before chariot has to drill in several years time.

10. Chariot have no interest in acquiring HRT.

All good stuff, a great diversified portfolio, strong track record of farming out so it’s just a matter of being patient till lady luck helps out. Incredible value as chariot valued at cash and has a book value of 64 p after writing off past dry well costs..

Jimmy

14 October 2013

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Farm-out agreement in Block C-19 (Mauritania) with Cairn Energy PLC ("Cairn")approved

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, reports that, as detailed in the announcement of 8 August 2013, the farm-out agreement signed between its wholly-owned subsidiary, Chariot Oil & Gas Investments (Mauritania) Ltd. and Capricorn Mauritania Limited, a wholly owned subsidiary of Cairn, on licence C19 offshore Mauritania has been approved by the Ministry of Hydrocarbons in Mauritania and all other approvals and conditions precedent to the transaction have been granted or fulfilled.

As part of the farm-out agreement, Cairn committed to pay approximately US$26 million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs incurred, which has now been received. Chariot now holds a 55% stake and operatorship in the block, Cairn holds a 35% equity interest and the Société Mauritanienne des Hydrocarbures (SMH) retains 10% as a carried interest.

Following interpretation of the final Pre-Stack Depth Migration (PSDM) volumes, due to be received in November 2013, a resource update will be published in Q1 2014. Drilling planning and the evaluation of partnering options will commence thereafter.

Chariot Oil & Gas Limited

("Chariot", the "Company" or the "Group")

Farm-out agreement in Block C-19 (Mauritania) with Cairn Energy PLC ("Cairn")approved

Chariot Oil & Gas Limited (AIM: CHAR), the Atlantic margins focused oil and gas exploration company, reports that, as detailed in the announcement of 8 August 2013, the farm-out agreement signed between its wholly-owned subsidiary, Chariot Oil & Gas Investments (Mauritania) Ltd. and Capricorn Mauritania Limited, a wholly owned subsidiary of Cairn, on licence C19 offshore Mauritania has been approved by the Ministry of Hydrocarbons in Mauritania and all other approvals and conditions precedent to the transaction have been granted or fulfilled.

As part of the farm-out agreement, Cairn committed to pay approximately US$26 million for the costs of the 3D seismic data acquired by Chariot on the block and other back costs incurred, which has now been received. Chariot now holds a 55% stake and operatorship in the block, Cairn holds a 35% equity interest and the Société Mauritanienne des Hydrocarbures (SMH) retains 10% as a carried interest.

Following interpretation of the final Pre-Stack Depth Migration (PSDM) volumes, due to be received in November 2013, a resource update will be published in Q1 2014. Drilling planning and the evaluation of partnering options will commence thereafter.

Trotz allem geht es trotz haussierender Börsen runter mit dem Kurs. Namibia scheint die Analysten und Fonds total frustriert zu haben.

Die Farm-Downs sind ne tolle Sache, aber CHAR nimmt ja kein Geld ein, sondern das Geld wird zur Exploration verwendet. Letztlich bleibt CHAR damit auf unabsehbare Zeit zwar Cash Flow-negativ. Zwar ist CHAR bilanziell nicht gefährdet, aber sie kommen auch nicht daran, eine Phantasie zu vermitteln, wie und wann da mal Geld an die Aktionäre zurückfließen könnte.

Die Farm-Downs sind ne tolle Sache, aber CHAR nimmt ja kein Geld ein, sondern das Geld wird zur Exploration verwendet. Letztlich bleibt CHAR damit auf unabsehbare Zeit zwar Cash Flow-negativ. Zwar ist CHAR bilanziell nicht gefährdet, aber sie kommen auch nicht daran, eine Phantasie zu vermitteln, wie und wann da mal Geld an die Aktionäre zurückfließen könnte.

Solange Chariot nicht die nächste Bohrung plant oder es in der Nähe zu ihren Blocks zu signifikanten Funden von dritten kommt wird sich der Kurs nicht in dem Ausmaß von mehreren 100% bewegen wie wir es bereits in 2010 gesehen haben.

Am Beispiel von Tower Resources sieht man mal wieder, wie auch schon bei Chariot im Vorfeld Ihres Drilling Programms, daß eine anstehende Bohrung mit prospective resources bis hin zu Milliarden boe zu signifikant steigenden Kursen führen kann. In den letzten Monaten eine Kurssteigerung um 400% nur auf Grund der anstehenden Bohrung in 1H14.

Da sind auch wieder die Analysten zufrieden,

alles was es braucht ist Fantasie & Action.

Auch bei Tower, wie schon bei Chariot und vielen anderen, bin ich mir sicher wird es in den nächsten Wochen zu einer Kapitalerhöhung kommen, im Zuge des hohen Kursanstiegs, welcher möglicherweise auch dafür nach oben getrieben wird, solche Bohrungen kosten schließlich ca. US$100mio per well..

Chariot O&G Kursziel 2014

Bei Chariot braucht es nur "etwas" Geduld bis es zur nächsten Bohrung kommt, möglicherweise schon in 2H14,

spätestens dann, so denke Ich, wird es wie schon 2010 zu einer Vervielfachung des Kurses kommen,

mindestens im Ausmaß von 2-3 Wells zu US$200-300mio.

Also einem Kurs von

₤0,61-₤0,92 (₤122mio-₤183mio)

+200% bis +400%

Beginnen könnte eine Kursexplosion

mit einem FarmIn eines Majors in die Central Blocks von Chariot in Namibia,

welche Drill-Ready sind und/oder

ein weiteres Farmout in Mauritania um die Bohrkosten zu decken, ebenfalls Drill-Ready.

Beides in Verbindung mit einer oder mehreren Bohrungen in 2014 möglich.

In Mauritania erwartet Chariot diesen Monat die Bohrergebnisse von Tullow & Dana, ihren "Liegenschaftnachbarn". Erfolge könnte zu einer gesteigerten Nachfrage im Dataroom von Chariot kommen und die bereits sehr guten Konditionen wesentlich verbessern.

Auch in Namibia hat sich gezeigt dass

Tullow die jüngsten Bohrergebnisse im Walvis Basin gefallen haben,

sie haben einen Deal mit Pancontinental im Ausmaß von bis zu US$200mio geschlossen.

Ich denke 2014 wird 2010 nicht unähnlich für Chariot O & G.

Zeit aus dem Tal herauszusteigen!

GLA

Am Beispiel von Tower Resources sieht man mal wieder, wie auch schon bei Chariot im Vorfeld Ihres Drilling Programms, daß eine anstehende Bohrung mit prospective resources bis hin zu Milliarden boe zu signifikant steigenden Kursen führen kann. In den letzten Monaten eine Kurssteigerung um 400% nur auf Grund der anstehenden Bohrung in 1H14.

Da sind auch wieder die Analysten zufrieden,

alles was es braucht ist Fantasie & Action.

Auch bei Tower, wie schon bei Chariot und vielen anderen, bin ich mir sicher wird es in den nächsten Wochen zu einer Kapitalerhöhung kommen, im Zuge des hohen Kursanstiegs, welcher möglicherweise auch dafür nach oben getrieben wird, solche Bohrungen kosten schließlich ca. US$100mio per well..

Chariot O&G Kursziel 2014

Bei Chariot braucht es nur "etwas" Geduld bis es zur nächsten Bohrung kommt, möglicherweise schon in 2H14,

spätestens dann, so denke Ich, wird es wie schon 2010 zu einer Vervielfachung des Kurses kommen,

mindestens im Ausmaß von 2-3 Wells zu US$200-300mio.

Also einem Kurs von

₤0,61-₤0,92 (₤122mio-₤183mio)

+200% bis +400%

Beginnen könnte eine Kursexplosion

mit einem FarmIn eines Majors in die Central Blocks von Chariot in Namibia,

welche Drill-Ready sind und/oder

ein weiteres Farmout in Mauritania um die Bohrkosten zu decken, ebenfalls Drill-Ready.

Beides in Verbindung mit einer oder mehreren Bohrungen in 2014 möglich.

In Mauritania erwartet Chariot diesen Monat die Bohrergebnisse von Tullow & Dana, ihren "Liegenschaftnachbarn". Erfolge könnte zu einer gesteigerten Nachfrage im Dataroom von Chariot kommen und die bereits sehr guten Konditionen wesentlich verbessern.

Auch in Namibia hat sich gezeigt dass

Tullow die jüngsten Bohrergebnisse im Walvis Basin gefallen haben,

sie haben einen Deal mit Pancontinental im Ausmaß von bis zu US$200mio geschlossen.

Ich denke 2014 wird 2010 nicht unähnlich für Chariot O & G.

Zeit aus dem Tal herauszusteigen!

GLA

Antwort auf Beitrag Nr.: 45.984.496 von Drill-a-Hill am 05.12.13 11:11:48Chariot versus Tower by CURTIS PAUL on iii

http://www.iii.co.uk/investment/detail/?display=discussion&c…

Chariot will have net cash/current assets 2013 YE equating to 17p a share.

Cairn farm in to Mauritania values Chariot's remaining 55% at $40m or 12p per share. The plan is for Chariot to farm down this 55% for free carry on a well.

Attractive acreage in Morocco with third party drilling in both Mauritania and Morocco to validate prospectivity.

Add that lot together (plus early stage Brazil) and Namibia in for free.

Re Namibia, the big interest is in the Central Licence where CHAR have 90% after 3D seismic. With 90% they are in a much better position that say Global who will have to give away large % just to get 3D seismic (as Serica have did, Serica will only have 15% if BP commit to drill).

The Wingat result and the $130m Tullow farm in to Pancontinental's Central Licence has given grounds for optimism that Chariot can achieve a farm out. The data room is open and process going well according to Chariot.

Chariot's Southern and Northern Licences might be of value if third party drilling success (BP/Repsol) generates excitement.

In comparison Tower has bounced to 4.1p, market cap £110m (was $135m earlier today)

Principle asset 30% of Welwitschia-1 which is a Repsol well due to be drilled in Northern part of Namibia April next year.

Tower have c. $18m cash yet Welwitschia-1 will cost $80m - $120m ie TRP's share could be up to $36m.

They have said that 'selling' 10% so that should yield some spare working capital post drill.

However in a bear market where every other small explo company's blue sky upside is ignored, Tower is pretty much ALL blue sky at £110m. Admittedly Welwitschia is a potential humdinger with massive upside but this still leaves the second anomaly.

How can Chariot's Namibian acreage (specifically its drill ready Central Licence) be worth zilch if Tower's is worth £110m?

Meine Antwort darauf ist wie schon gesagt:

Investors want ACTION, sobald die nächsten Bohrtermine in die nähe rücken,

rennen uns die Investoren die Türen ein...

MULTIBAGGER ELEPHANT FIELD POTENTIAL IN 2014

GLA

http://www.iii.co.uk/investment/detail/?display=discussion&c…

Chariot will have net cash/current assets 2013 YE equating to 17p a share.

Cairn farm in to Mauritania values Chariot's remaining 55% at $40m or 12p per share. The plan is for Chariot to farm down this 55% for free carry on a well.

Attractive acreage in Morocco with third party drilling in both Mauritania and Morocco to validate prospectivity.

Add that lot together (plus early stage Brazil) and Namibia in for free.

Re Namibia, the big interest is in the Central Licence where CHAR have 90% after 3D seismic. With 90% they are in a much better position that say Global who will have to give away large % just to get 3D seismic (as Serica have did, Serica will only have 15% if BP commit to drill).

The Wingat result and the $130m Tullow farm in to Pancontinental's Central Licence has given grounds for optimism that Chariot can achieve a farm out. The data room is open and process going well according to Chariot.

Chariot's Southern and Northern Licences might be of value if third party drilling success (BP/Repsol) generates excitement.

In comparison Tower has bounced to 4.1p, market cap £110m (was $135m earlier today)

Principle asset 30% of Welwitschia-1 which is a Repsol well due to be drilled in Northern part of Namibia April next year.

Tower have c. $18m cash yet Welwitschia-1 will cost $80m - $120m ie TRP's share could be up to $36m.

They have said that 'selling' 10% so that should yield some spare working capital post drill.

However in a bear market where every other small explo company's blue sky upside is ignored, Tower is pretty much ALL blue sky at £110m. Admittedly Welwitschia is a potential humdinger with massive upside but this still leaves the second anomaly.

How can Chariot's Namibian acreage (specifically its drill ready Central Licence) be worth zilch if Tower's is worth £110m?

Meine Antwort darauf ist wie schon gesagt:

Investors want ACTION, sobald die nächsten Bohrtermine in die nähe rücken,

rennen uns die Investoren die Türen ein...

MULTIBAGGER ELEPHANT FIELD POTENTIAL IN 2014

GLA

Potential Multibagger News...

...Sollte Chariot O&G in 2014 tatsächlich eine Bohrung

in den Central Blocks im Walvis Basin unternehmen.

Dem voran sollte es ein Farmout geben,

optimal eine free carried well zu XX% der Lizenz.

HRT ist dort bereits auf light oil gestoßen,

allerdings hatte das Reservoir schlechte porosity.

Dritte wie Chariot konnten hier massiv profitieren,

sprich die Drill-Targets entsprechend ausrichten!!

Activity farm-in gains strength in Namibia

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

(mit Google translater aus dem portugiesischen übersetzt)

Barry Morgan 13 December 2013 15:38 GMT

New farm-in agreements will emerge in Namibia during the first quarter of 2014, ensuring that the country maintains its momentum to farm with at least three planned wells and an extensive seismic survey, according to the commissioner oil, Immanuel Mulunga, the Ministry of Mines and Energy.

Repsol and its partner Tower Resources will drill the structure Welwitchia in the first quarter, seeking multiple horizons and potential estimated at 500 million barrels of oil equivalent reserves.

The Chariot Oil & Gas will drill a well in mid-2014 and BP-Serica doing the same in the fourth quarter.

The CSG Energy will acquire 150 km of 2D seismic data and stratigraphic well next year in Caprivi, while ION GX Technology and execute its long-delayed survey along the coast with the ship Seabird Exploration, covering 7905 km for three months in all offshore basins.

The Hydrocarb Energy Corporation will conduct a seismic survey in the Ovambo Basin Chariot and intends to complete the offshore drilling additional wells in Block 2714A in early 2014, while Tullow Oil is committed to 1,200 km of 2D seismic.

"Many think that the discovery of Wingat HRT, earlier this year, was not a success. Yet the well in fact indicated that these shales of the Aptian are within the oil window. It may not have been commercial, but decreased risk of Walvis Basin, "said Mulunga.

Reaktionen des Shareprices auf derlei Ankündigungen

können mitunter beträchtlich sein:

GLA in 2014

...Sollte Chariot O&G in 2014 tatsächlich eine Bohrung

in den Central Blocks im Walvis Basin unternehmen.

Dem voran sollte es ein Farmout geben,

optimal eine free carried well zu XX% der Lizenz.

HRT ist dort bereits auf light oil gestoßen,

allerdings hatte das Reservoir schlechte porosity.

Dritte wie Chariot konnten hier massiv profitieren,

sprich die Drill-Targets entsprechend ausrichten!!

Activity farm-in gains strength in Namibia

http://translate.google.com/translate?sl=pt&tl=en&js=n&prev=…

(mit Google translater aus dem portugiesischen übersetzt)

Barry Morgan 13 December 2013 15:38 GMT

New farm-in agreements will emerge in Namibia during the first quarter of 2014, ensuring that the country maintains its momentum to farm with at least three planned wells and an extensive seismic survey, according to the commissioner oil, Immanuel Mulunga, the Ministry of Mines and Energy.

Repsol and its partner Tower Resources will drill the structure Welwitchia in the first quarter, seeking multiple horizons and potential estimated at 500 million barrels of oil equivalent reserves.

The Chariot Oil & Gas will drill a well in mid-2014 and BP-Serica doing the same in the fourth quarter.

The CSG Energy will acquire 150 km of 2D seismic data and stratigraphic well next year in Caprivi, while ION GX Technology and execute its long-delayed survey along the coast with the ship Seabird Exploration, covering 7905 km for three months in all offshore basins.

The Hydrocarb Energy Corporation will conduct a seismic survey in the Ovambo Basin Chariot and intends to complete the offshore drilling additional wells in Block 2714A in early 2014, while Tullow Oil is committed to 1,200 km of 2D seismic.

"Many think that the discovery of Wingat HRT, earlier this year, was not a success. Yet the well in fact indicated that these shales of the Aptian are within the oil window. It may not have been commercial, but decreased risk of Walvis Basin, "said Mulunga.

Reaktionen des Shareprices auf derlei Ankündigungen

können mitunter beträchtlich sein:

GLA in 2014

Tullow oil & Dana

sollten bald Ihre Bohrung in Mauritania

Fregate well (Scorpion) (Block-7)

beendet haben.

Die Bohrung begann Ende August und man erwartet Ergebnisse im Dezember.

Es geht um gross mean

293 Millionen Barrels of Oil

Chariot O&G als direkter Nachbar wird von den Daten aus den Ergebnissen profitieren, ein Erfolg sollte zum signifikanten De-risking führen.

Das Potential von Chariots C-19 Block wurde bereits kürzlich durch den Farm-in von Cairn Energy durch einen Dritten bestätigt.

US$26 Millionen zahlte Cairn für 35% der Lizenz an Chariot.

Damit wurden die gesamten Kosten der 3,500km2 3D seismic survey abgedeckt.

Chariot O&G hält immernoch 55% und ist damit in der Lage mit einem weiteren geplanten Farmout die Kosten einer ersten Bohrung zu decken.

Ein Erfolg der Fregate Bohrung von Tullow & Dana würde das Interesse im Dataroom Mauritania von Chariot extrem ankurbeln und die Konditionen massiv erhöhen.

Daumen drücken für eine gute Payzone.

GLA

sollten bald Ihre Bohrung in Mauritania

Fregate well (Scorpion) (Block-7)

beendet haben.

Die Bohrung begann Ende August und man erwartet Ergebnisse im Dezember.

Es geht um gross mean

293 Millionen Barrels of Oil

Chariot O&G als direkter Nachbar wird von den Daten aus den Ergebnissen profitieren, ein Erfolg sollte zum signifikanten De-risking führen.

Das Potential von Chariots C-19 Block wurde bereits kürzlich durch den Farm-in von Cairn Energy durch einen Dritten bestätigt.

US$26 Millionen zahlte Cairn für 35% der Lizenz an Chariot.

Damit wurden die gesamten Kosten der 3,500km2 3D seismic survey abgedeckt.

Chariot O&G hält immernoch 55% und ist damit in der Lage mit einem weiteren geplanten Farmout die Kosten einer ersten Bohrung zu decken.

Ein Erfolg der Fregate Bohrung von Tullow & Dana würde das Interesse im Dataroom Mauritania von Chariot extrem ankurbeln und die Konditionen massiv erhöhen.

Daumen drücken für eine gute Payzone.

GLA

Zitat von Drill-a-Hill: Potential Multibagger News...

...Sollte Chariot O&G in 2014 tatsächlich eine Bohrung

in den Central Blocks im Walvis Basin unternehmen.

Dem voran sollte es ein Farmout geben,

optimal eine free carried well zu XX% der Lizenz.

HRT ist dort bereits auf light oil gestoßen,

allerdings hatte das Reservoir schlechte porosity.

Dritte wie Chariot konnten hier massiv profitieren,

sprich die Drill-Targets entsprechend ausrichten!!

(...)

The Chariot Oil & Gas will drill a well in mid-2014 and BP-Serica doing the same in the fourth quarter.

The CSG Energy will acquire 150 km of 2D seismic data and stratigraphic well next year in Caprivi, while ION GX Technology and execute its long-delayed survey along the coast with the ship Seabird Exploration, covering 7905 km for three months in all offshore basins.

(...)

Reaktionen des Shareprices auf derlei Ankündigungen

können mitunter beträchtlich sein:

![]()

GLA in 2014

Mittlerweile hat BP aber verkündet, die Option für den farm-in Anteil an Serica's Lizenzblock nicht zu ziehen und den Anteil an diesem Block verfallen lassen: http://www.OilVoice.com/n/Serica_Energy_provides_an_update_o…

Das betrifft zwar das Luderitz-Basin, aber die Nachricht die wahrgenommen wird, lautet: BP zieht sich aus der Exploration Offshore Namibia zurück.

Zitat von DJHLS: Mittlerweile hat BP aber verkündet, die Option für den farm-in Anteil an Serica's Lizenzblock nicht zu ziehen und den Anteil an diesem Block verfallen lassen: http://www.OilVoice.com/n/Serica_Energy_provides_an_update_o…

Das betrifft zwar das Luderitz-Basin, aber die Nachricht die wahrgenommen wird, lautet: BP zieht sich aus der Exploration Offshore Namibia zurück.

Hi DJHLS,

Der Grund hierfür betrifft allerdings die tiefer liegenden

Barremian Prospects:

Die Bohrungen von HRT haben gezeigt daß diese nicht funktionieren,

wogegen in den

Aptian & Albian und höher liegenden Schichten

hunderte Meter breite Source Rocks gefunden wurden die

Light Oil mit 41° API produzieren.

BP hätte sich eben verpflichtet diese high risk Barramian Prospects zu bohren. Darauf haben sie auf Grund der Daten von HRT verzichtet.

Chariot hat schon längst sein Drill Programm in den Central Blocks im Walvis Basin angepasst und als erstes Drill Target das Prospect B mit Gross Mean 469 Million boe ausgewählt:

In the Namibian Central Blocks, additional information provided by third party drilling was used to develop the Company’s current understanding of the region, which is

now focused on the prospectivity in the shallower petroleum system, as detailed in the recent resource update and independent audit by Netherland Sewell and Associates.

Prospect B, a deep water canyon head, has been identified as the key drilling target with an audited gross mean prospective oil resource of 469mmbbl and a geologic chance of success of 22% with significant follow-on potential identified in additional prospects and leads. A dataroom was opened in September with the aim of securing a partner for drilling. The

Company has received an encouraging response from key industry players and an update on progress will be made as appropriate.

Tullow Oil hatte sich auch auf Grund der von HRT bewiesenen Source Rocks kürzlich Anteile an Pancontinentals Blocks im Walvis Basin gesichert. Bis zu US$130MM übernehmen sie für PC von Seismic bis hin zu einer free carried well. Tower resources & Repsol konnten dank der gewonnenen Daten ihr Drill Target für März 2014 anpassen und die Chance of Success wesentlich erhöhen.

Also wie schon gesagt:

Namibia is now focused on the Shallower Petroleum Systems

mit hunderten Metern breiten Source Rocks aus denen

Light Oil mit 41°API migriert.

Es gilt das Reservoir zu finden groß genug um hunderte Millionen boe zu halten.

Die in Namibia aktiven Unternehmen haben lägst reagiert und in 2014

werden diese Schichten auf geeignete Reservoirs getestet.

GLA

In Marokko geht's demnächst nebenan, aber nicht in unmittelbarer Nachbarschaft, weiter:

DALLAS--(BUSINESS WIRE)-- Kosmos Energy Ltd. announced today that it has entered into a one well rig share agreement with BP plc and Maersk Drilling, a unit of A.P. Moller - Maersk Group, for the rig Maersk Discoverer. The rig is expected to commence drilling operations on the FA-1 (formally Eagle-1) exploration well in the Foum Assaka Offshore block in Morocco during the first half of 2014. Under the terms of the Agadir farm-out agreement with BP announced in October, BP will fund Kosmos share of the well costs, subject to an agreed maximum spend.

Constructed in 2009, the Maersk Discoverer is a sixth generation, ultra-deepwater, dynamically positioned semi-submersible rig capable of drilling to total depths of

http://seekingalpha.com/news-article/8556151-kosmos-energy-a…

DALLAS--(BUSINESS WIRE)-- Kosmos Energy Ltd. announced today that it has entered into a one well rig share agreement with BP plc and Maersk Drilling, a unit of A.P. Moller - Maersk Group, for the rig Maersk Discoverer. The rig is expected to commence drilling operations on the FA-1 (formally Eagle-1) exploration well in the Foum Assaka Offshore block in Morocco during the first half of 2014. Under the terms of the Agadir farm-out agreement with BP announced in October, BP will fund Kosmos share of the well costs, subject to an agreed maximum spend.

Constructed in 2009, the Maersk Discoverer is a sixth generation, ultra-deepwater, dynamically positioned semi-submersible rig capable of drilling to total depths of

http://seekingalpha.com/news-article/8556151-kosmos-energy-a…

Antwort auf Beitrag Nr.: 46.146.711 von DJHLS am 02.01.14 22:28:52Unmittelbar sollten alle Augen jetzt auf Mauritania gerichtet sein.

Der Beginn der Bohrung der Fregate well (Scorpion) ist schon 4 Monate her,

Ergebnisse könnte jeden Tag eintreffen:

http://www.helioschariot.com/2013/07/11/mauritania-tullow-oi…

Tullow plans to drill the Fregate well on the Scorpion prospect in Block C-7 starting in August, targeting the equivalent of about 300 million barrels of oil. It will be followed by the Tapendar, Sidewinder and Ida prospects, reckoned to have 592 million barrels between them, according to Tullow.

“Mauritania is an overlooked petroleum system,” Kosmos Chief Executive Officer Brian Maxted said in a phone interview. “It is one of those basins that’s considered by the industry to be something of an exploration graveyard.” Today, explorers are testing the northernmost limits of Africa’s Atlantic coastline as an oil-producing region after making discoveries in Ghana, Sierra Leone and Ivory Coast. They plan to drill deeper than earlier wells and Tullow Oil said the first discoveries were merely caps for largest fields below. “One of the key things that excites us about Mauritania is that the industry has established there is a petroleum system,” said Tullow Exploration Director Angus McCoss. “What was a reservoir for the previous explorers is our top seal. We want to explore below.”

Die Entscheidung für diese Bohrung kam wohl aus dem Ergebnissen vorangegangener Gas Discoveries (Cormoran & Pelikan),

http://www.tullowoil.com/index.asp?pageid=137&newsid=685

man erwartet darunter auf Öl zu stossen,

"plan to drill deeper than earlier wells and Tullow Oil said the first discoveries were merely caps for largest fields below"

Kürzlich zahlte Cairn US$26 Millionen für 35% von Block 19 an Chariot.

Damit wurden die gesamten Kosten der 3,500km2 3D seismic survey abgedeckt.

Chariot O&G hält immernoch 55%.

Genug um über ein weiteres Farmout auch die Bohrkosten zu decken,

damit hätte Chariot für 0$ Seismic & Bohrung finanziert und würde,

schätze ich, mit 20-30% verbleiben.

In keeping with Chariot’s aim to manage risk through leveraged partnerships, the Company recovered US$26 million for the 3D seismic and other back costs on its Mauritanian licence, Block C-19, through partnering with Cairn Energy Plc. This partnership, in which Chariot has maintained operatorship, has not only reduced the Company’s risk exposure in the licence but has also provided third party validation of the asset whilst ensuring that the Company holds sufficient equity (55%) to retain material upside following a further partnering process for drilling. The partnership received the final PSDM of its 3,500km2 3D seismic programme in December 2013 and will be interpreting the data throughout Q1 2014. A resource update will follow in Q2 2014, concurrent with the opening of a dataroom to secure a further farm-out on this asset.

Daumen drücken für eine gute Payzone.

GLA

Der Beginn der Bohrung der Fregate well (Scorpion) ist schon 4 Monate her,

Ergebnisse könnte jeden Tag eintreffen:

http://www.helioschariot.com/2013/07/11/mauritania-tullow-oi…

Tullow plans to drill the Fregate well on the Scorpion prospect in Block C-7 starting in August, targeting the equivalent of about 300 million barrels of oil. It will be followed by the Tapendar, Sidewinder and Ida prospects, reckoned to have 592 million barrels between them, according to Tullow.

“Mauritania is an overlooked petroleum system,” Kosmos Chief Executive Officer Brian Maxted said in a phone interview. “It is one of those basins that’s considered by the industry to be something of an exploration graveyard.” Today, explorers are testing the northernmost limits of Africa’s Atlantic coastline as an oil-producing region after making discoveries in Ghana, Sierra Leone and Ivory Coast. They plan to drill deeper than earlier wells and Tullow Oil said the first discoveries were merely caps for largest fields below. “One of the key things that excites us about Mauritania is that the industry has established there is a petroleum system,” said Tullow Exploration Director Angus McCoss. “What was a reservoir for the previous explorers is our top seal. We want to explore below.”

Die Entscheidung für diese Bohrung kam wohl aus dem Ergebnissen vorangegangener Gas Discoveries (Cormoran & Pelikan),

http://www.tullowoil.com/index.asp?pageid=137&newsid=685

man erwartet darunter auf Öl zu stossen,

"plan to drill deeper than earlier wells and Tullow Oil said the first discoveries were merely caps for largest fields below"

Kürzlich zahlte Cairn US$26 Millionen für 35% von Block 19 an Chariot.

Damit wurden die gesamten Kosten der 3,500km2 3D seismic survey abgedeckt.

Chariot O&G hält immernoch 55%.

Genug um über ein weiteres Farmout auch die Bohrkosten zu decken,

damit hätte Chariot für 0$ Seismic & Bohrung finanziert und würde,

schätze ich, mit 20-30% verbleiben.

In keeping with Chariot’s aim to manage risk through leveraged partnerships, the Company recovered US$26 million for the 3D seismic and other back costs on its Mauritanian licence, Block C-19, through partnering with Cairn Energy Plc. This partnership, in which Chariot has maintained operatorship, has not only reduced the Company’s risk exposure in the licence but has also provided third party validation of the asset whilst ensuring that the Company holds sufficient equity (55%) to retain material upside following a further partnering process for drilling. The partnership received the final PSDM of its 3,500km2 3D seismic programme in December 2013 and will be interpreting the data throughout Q1 2014. A resource update will follow in Q2 2014, concurrent with the opening of a dataroom to secure a further farm-out on this asset.

Daumen drücken für eine gute Payzone.

GLA

FinnCap’s price target would indicate a potential upside of 40.26% from the stock’s previous close.

http://tickerreport.com/banking-finance/100101/chariot-oil-g…

Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have given a buy rating to the company’s stock. Chariot Oil & Gas presently has an average rating of “Hold” and an

average target price of GBX 29.73 ($0.49).

http://tickerreport.com/banking-finance/100101/chariot-oil-g…

Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have given a buy rating to the company’s stock. Chariot Oil & Gas presently has an average rating of “Hold” and an

average target price of GBX 29.73 ($0.49).

Tullow operational update

http://www.tullowoil.com/index.asp?pageid=137&newsid=877

In Mauritania, the Frégate-1 well is expected to reach total depth of approximately 5,800 metres by the end of January 2014.

teure Bohrung nach 5 Monaten..

2 weeks to go..

GLA

http://www.tullowoil.com/index.asp?pageid=137&newsid=877

In Mauritania, the Frégate-1 well is expected to reach total depth of approximately 5,800 metres by the end of January 2014.

teure Bohrung nach 5 Monaten..

2 weeks to go..

GLA

Hohes Volumen heute in Great Britain,

1.8MM Volumen gab es schon länger nicht mehr,

letztes Mal ca. 1.2MM bei Mauritania farmout News im August letzten Jahres..

Momentan wird gespannt auf baldige Ergebnisse von Tullow Oils Fregate Bohrung direkt neben Chariots C-19 Block in Mauritania geblickt.

Eine Oil discovery würde die Lizenz C-19 extrem aufwerten.

Chariot hält hier noch 55% nochdem sie bereits 35% an Cairn für US$26MM verkauft haben um die Kosten der bereits getanen 3D seismic zu decken.

Chariot hat eine Marktkapitalisierung von US$62MM

Cash Reserven von ca.US$55MM

Lizenzen in Namibia, Mauritania, Morocco und Brazil

davon sind Multi Millairden prospects drill ready in Namibia und Mauritania.

Factsheet, GROWTH THROUGH EXPLORATION 2014

http://www.chariotoilandgas.com/index.php/download_file/view…

GLA

1.8MM Volumen gab es schon länger nicht mehr,

letztes Mal ca. 1.2MM bei Mauritania farmout News im August letzten Jahres..

Momentan wird gespannt auf baldige Ergebnisse von Tullow Oils Fregate Bohrung direkt neben Chariots C-19 Block in Mauritania geblickt.

Eine Oil discovery würde die Lizenz C-19 extrem aufwerten.

Chariot hält hier noch 55% nochdem sie bereits 35% an Cairn für US$26MM verkauft haben um die Kosten der bereits getanen 3D seismic zu decken.

Chariot hat eine Marktkapitalisierung von US$62MM

Cash Reserven von ca.US$55MM

Lizenzen in Namibia, Mauritania, Morocco und Brazil

davon sind Multi Millairden prospects drill ready in Namibia und Mauritania.

Factsheet, GROWTH THROUGH EXPLORATION 2014

http://www.chariotoilandgas.com/index.php/download_file/view…

GLA

Tullow Well Opens ‘New Oil Play’ in Mauritania, Needs More Tests

http://www.bloomberg.com/news/2014-02-12/tullow-well-opens-n…

Tullow Oil Plc (TLW), the U.K. explorer that produces most of its crude in West Africa, said the Fregate well opened “a new oil play” off Mauritania.

The Fregate-1 well found about 30 meters (98.4 feet) of net gas condensate and oil accumulation after drilling to a depth of 5,426 meters, Tullow said today in a statement.

The “well has achieved an important technical breakthrough by establishing a new oil play in deepwater Late Cretaceous turbidites,” London-based Tullow said.

Tullow was targeting the equivalent of about 300 million barrels of oil in Mauritania’s Block C-7, where Fregate was drilled, Exploration Director Angus McCoss said last year.

http://www.bloomberg.com/news/2014-02-12/tullow-well-opens-n…

Tullow Oil Plc (TLW), the U.K. explorer that produces most of its crude in West Africa, said the Fregate well opened “a new oil play” off Mauritania.

The Fregate-1 well found about 30 meters (98.4 feet) of net gas condensate and oil accumulation after drilling to a depth of 5,426 meters, Tullow said today in a statement.

The “well has achieved an important technical breakthrough by establishing a new oil play in deepwater Late Cretaceous turbidites,” London-based Tullow said.

Tullow was targeting the equivalent of about 300 million barrels of oil in Mauritania’s Block C-7, where Fregate was drilled, Exploration Director Angus McCoss said last year.

Antwort auf Beitrag Nr.: 46.430.452 von Drill-a-Hill am 12.02.14 10:03:03Hoffentlich kommt jetzt mal Phantasie in den Kurs .

Jetzt noch Nachrichten zu einem Farm -in und wir sehen hoffentlich mind. die 30 Pence wieder , was ein guter Start für 2014 bedeuten würde .

@Drill

Glaube trotzdem dass HRT dieses Jahr besser laufen wird , auch wenn ich in Chariot wesentlich grösser investiert bin ....

Jetzt noch Nachrichten zu einem Farm -in und wir sehen hoffentlich mind. die 30 Pence wieder , was ein guter Start für 2014 bedeuten würde .

@Drill

Glaube trotzdem dass HRT dieses Jahr besser laufen wird , auch wenn ich in Chariot wesentlich grösser investiert bin ....

Sehr wenige Bohrungen bisher in Namibia mit bereits guten Ergebnissen,

zwar kein commercial oil, aber wichtige Daten über Reservoir Rocks (Tapir South) & Source Rocks (Wingat) könnten den Weg für weitere Bohrungen weisen:

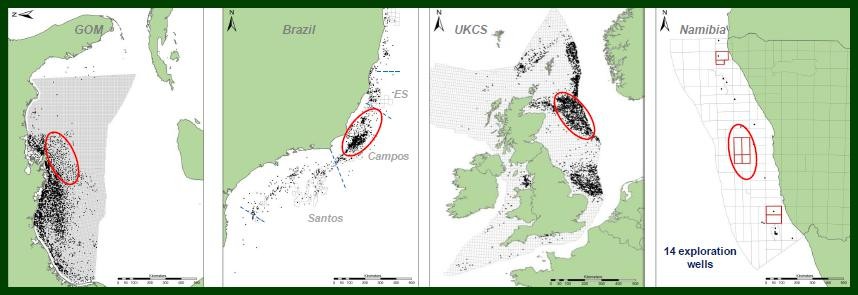

The Namibian Atlantic margin is comparable in area to:

The UKCS North Sea; the Santos,Campos, and Espirito Santo basins of Brazil; and the GoM

The Central blocks region is comparable in area to:

The Central North Sea; the Campos Basin in Brazil; Mississippi Canyon, Green Canyon and Viosko Knoll in the GoM

( Source: Chariot O&G http://www.chariotoilandgas.com/files/2813/9229/4890/Investo…

Investor Presentation February 2014 )

GLA

zwar kein commercial oil, aber wichtige Daten über Reservoir Rocks (Tapir South) & Source Rocks (Wingat) könnten den Weg für weitere Bohrungen weisen:

The Namibian Atlantic margin is comparable in area to:

The UKCS North Sea; the Santos,Campos, and Espirito Santo basins of Brazil; and the GoM

The Central blocks region is comparable in area to:

The Central North Sea; the Campos Basin in Brazil; Mississippi Canyon, Green Canyon and Viosko Knoll in the GoM

( Source: Chariot O&G http://www.chariotoilandgas.com/files/2813/9229/4890/Investo…

Investor Presentation February 2014 )

GLA

!

Dieser Beitrag wurde vom System automatisch gesperrt. Bei Fragen wenden Sie sich bitte an feedback@wallstreet-online.de

http://www.oilvoice.com/n/Chariot_Oil_Gas_announces_appointm…

Nach dieser Nachricht von heute, wird es wohl bald ein Farm-In in Namibia geben.

Nach dieser Nachricht von heute, wird es wohl bald ein Farm-In in Namibia geben.

Da scheint auf jeden Fall etwas im Busch zu sein. Andere Namibia-Explorer wie HRTzeigen aber keinen Auftrieb. Hat also vielleicht eher etwas mit Mauritanien zu tun.

In Namibia & Mauritania kann es jederzeit zu Farmouts kommen,

Dataroom ist offen, es gab bereits reges Interesse

für die Central Blocks, in Mauritania gab es bereits ein farmout an Cairn,

ein zweites ist geplant, ich denke Cairn wird noch einen weiteren Anteil kaufen,

darauf werden Bohrungen mit > 1 BN BOE (prospect.res.)folgen.

Jedenfalls sind farmouts Vorraussetzung für die nächsten Bohrungen.

Ich rechne mit mindestens zwei free carried wells.

Aus den vergangenen Charts von Chariot und Tower kann man sehen,

wie Farmout News und Ankündigungen von Bohrungen den Kurs bewegen können

ich denke die bisherige Entwicklung in 2014 könnte die Grundlage für einen

ähnlichen Trend sein:

Aus den vergangenen farmouts kann man auch auf den

Potentiellen Wert der Lizenzen bezüglich Farmout-Value schließen,

alleine die Lizenzen in Namibia & Mauritania haben ein

"Farmout-Value" von US$248MM

und entsprechen damit 300% der momentanen Marktkapitalisierung von US$83MM:

Chariot O&G Farm Down History

~US$6,000 per 1km² acreage,

~US$7,430 per 1km²3Dseismic (costs)

PetroBras Namibia Southern Block 2714A 50%

(5,480km²)

~US$16MM

US$0.32MM per 1% of one Block, US$5,840 per 1km²

PGS Namibia Central Blocks 2312A&B & 2412A&B 10%

(16,800km²)

~US$10MM

US$0.33MM per 1% of one Block, US$5,952 per 1km²

BP Namibia Southern Block 2714A 25%

(5,480km²)

~US$30MM

US$1.2MM per 1% of one Block, US$21,897 per 1km² (3D Seismic, NimrodBonus)

Cairn Mauritania C-19 35%

(12,175km²)

~US$26MM