Gulf Keystone Irak-Ölperle Deutschland schläft (Seite 7)

eröffnet am 25.08.09 11:36:58 von

neuester Beitrag 13.05.24 19:01:20 von

neuester Beitrag 13.05.24 19:01:20 von

Beiträge: 1.200

ID: 1.152.605

ID: 1.152.605

Aufrufe heute: 6

Gesamt: 182.702

Gesamt: 182.702

Aktive User: 0

ISIN: BMG4209G2077 · WKN: A2DGZ5

1,4830

EUR

+6,31 %

+0,0880 EUR

Letzter Kurs 13.05.24 Lang & Schwarz

Neuigkeiten

13.05.24 · EQS Group AG |

02.05.24 · EQS Group AG |

25.04.24 · EQS Group AG |

25.04.24 · EQS Group AG |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 15,000 | +15,38 | |

| 1,5300 | +11,68 | |

| 1,8750 | +10,62 | |

| 8,0000 | +10,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 300,01 | -7,69 | |

| 0,9570 | -7,98 | |

| 2,6400 | -8,41 | |

| 2,5850 | -9,17 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

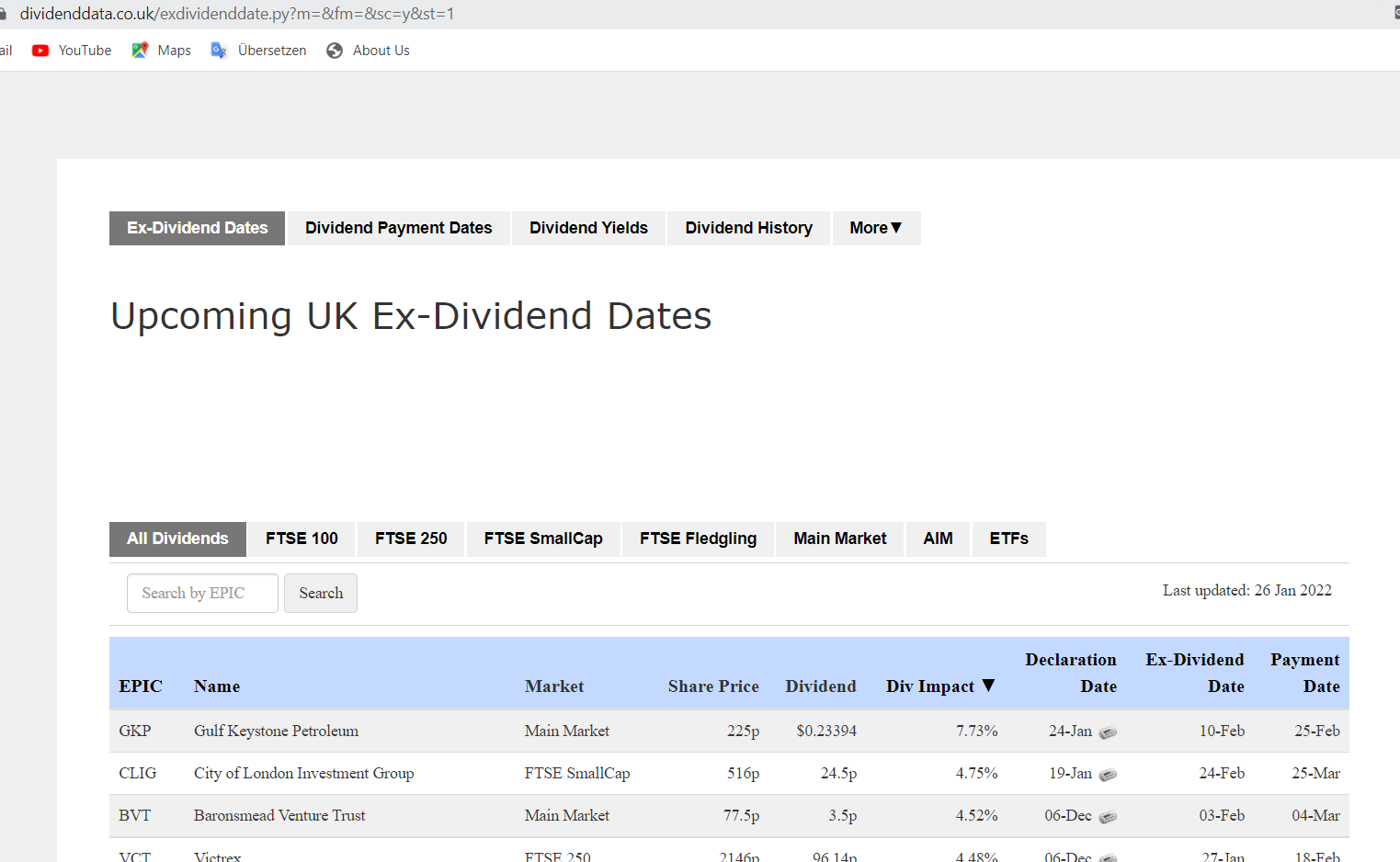

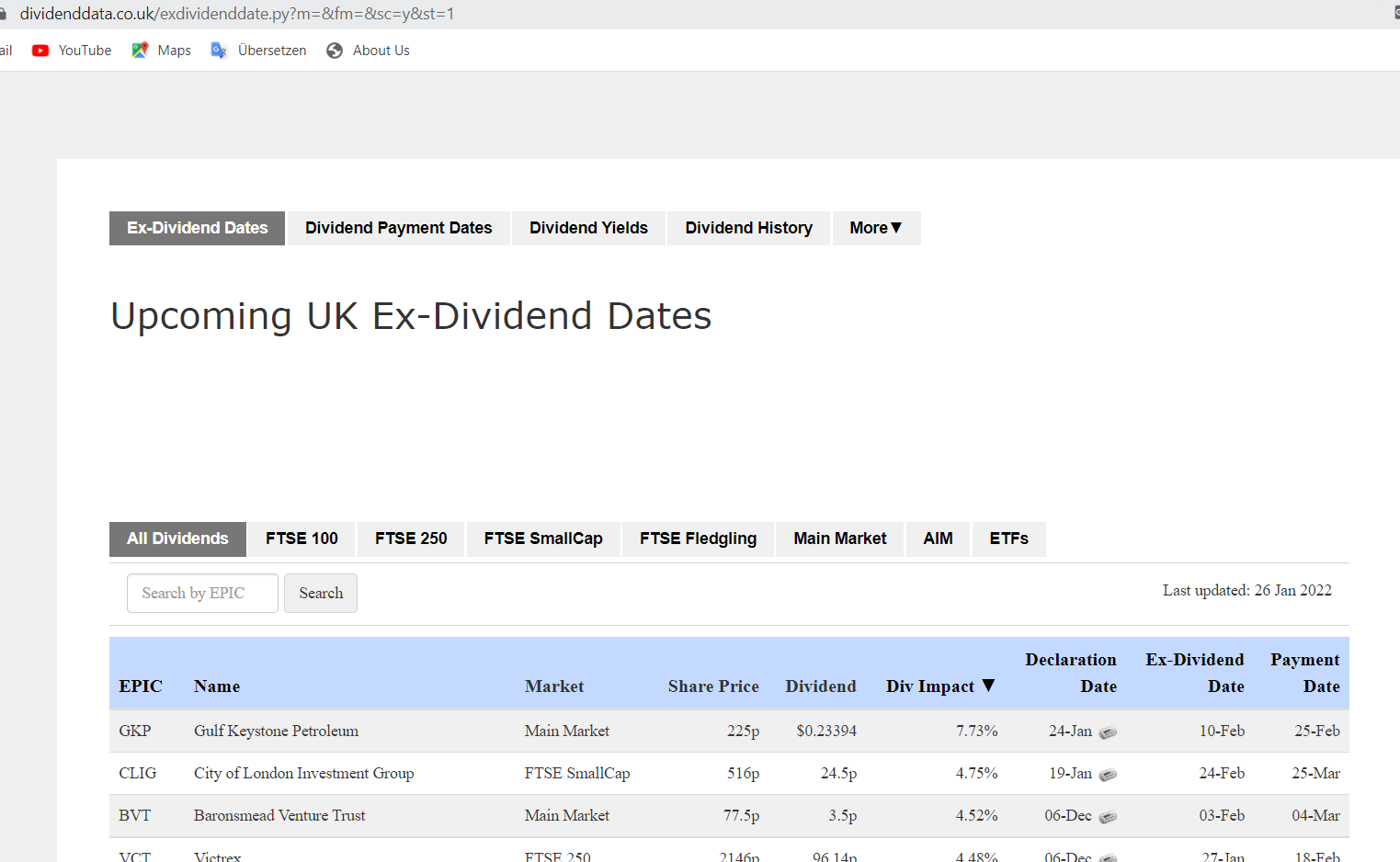

Antwort auf Beitrag Nr.: 70.643.572 von texas2 am 26.01.22 10:01:39und der Gewinner mit der höchsten Dividendenrendite ist:

Antwort auf Beitrag Nr.: 70.386.991 von texas2 am 04.01.22 11:58:47Da kann man jetzt nicht meckern. Am 25 feb zahlt gkp die nächsten 50 mio $ als dividende aus.

Mon, 24th Jan 2022 07:00

RNS Number : 3041Z

Gulf Keystone Petroleum Ltd.

24 January 2022

24 January 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational & Corporate Update

Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, today provides an operational and corporate update.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"We are pleased today to declare an additional interim dividend of $50 million, bringing distributions over the past eight months to $150 million in line with our commitment to balance investment in growth with returns to shareholders.

Since the beginning of 2022, gross production peaked at just over 50,000 bopd and has averaged c.46,800 bopd, versus the 2021 average of 43,440 bopd. However, the lower productivity of recently completed wells, SH-13 and SH-14, and temporarily curtailed production from SH-12, have resulted in a delay in gross production increasing to 55,000 bopd. 2022 gross average production is expected to be 44,000 to 50,000 bopd.

GKP's substantial production base at current oil prices continues to generate significant cash flow and value for Gulf Keystone's stakeholders. On approval of our recently submitted Field Development Plan, we are well positioned to achieve sustainable growth from the Shaikan Field, which has delivered close to 100 MMstb, and has 489 MMstb of estimated 2P gross reserves remaining."

Operational

· Continued strong focus on safety in 2021 despite one previously reported lost time incident ("LTI"); currently no LTIs recorded for over 90 days

· Gross average production for 2021 of 43,440 bopd, at the upper end of guidance range; gross average production in 2022 year to date of c.46,800 bopd

· Drilling of SH-15 progressing well; continue to expect start-up in Q2 2022

· Due to well productivity, the increase in gross production towards 55,000 bopd has been delayed

o SH-13 & SH-14

§ Following completion of the acid stimulation programme on SH-13, and the clean-up of SH-14, both wells were brought on stream in December 2021 and their productivity has been below expectations

§ An acid stimulation programme for SH-14 is currently ongoing

o SH-12

§ Following the early appearance of trace quantities of water, production from the well has been temporarily curtailed, in line with the Company's prudent reservoir management strategy. The Company is investigating options to maximise near-term production from the well

§ Water ingress is common in fractured carbonate reservoirs like the Shaikan Field. Gulf Keystone has historically experienced trace amounts of water in a few other wells and has been successfully optimising their production levels. The Company continues to expedite plans to add water handling to further optimise production

· The Company does not expect any material impact on reserves or medium-term production potential. Considering cumulative gross production of c.99 MMstb, 2P gross reserves are estimated to be 489 MMstb at 31 December 2021, based on the 2020 Competent Person's Report adjusted for 2021 production

Financial

· Following $100m of dividends distributed in 2021, Gulf Keystone is pleased to announce that the Board has approved the declaration of an additional interim dividend of $50 million, equivalent to 23.394 US cents per Common Share of the Company

· The interim dividend is expected to be paid on 25 February 2022, based on a record date of 11 February 2022. The Company will disclose the pounds sterling rate per share prior to the ex-dividend date of 10 February 2022

· $283.2 million ($221.7 million net to GKP) received from the Kurdistan Regional Government in 2021 for payments of crude oil sales and recovery of outstanding arrears, with an additional $89.0 million ($69.7 million net to GKP) received in January 2022 for the combined September 2021 and October 2021 crude oil sales and arrears payments

· The current outstanding arrears balance is $28.6 million net to GKP related to the January and February 2020 invoices

· Robust balance sheet, with a cash balance of $228 million as at 21 January 2022

Outlook

· The Company expects gross average production for 2022 of 44,000 to 50,000 bopd, reflecting the anticipated production contribution from SH-15 and benefits of well workover activities

· Gulf Keystone continues to engage with the Ministry of Natural Resources ("MNR") following the submission of a draft FDP in 2021. The Company will revert to the market at an appropriate time with details on the FDP and updated production guidance

· With continuing strong oil prices and cash flow generation, there may be opportunities to consider further distributions to shareholders and to optimise the capital structure

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone:

+44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations

aclark@gulfkeystone.com

Celicourt Communications:

+ 44(0) 20 8434 2754

Mark Antelme

Jimmy Lea

GKP@Celicourt.uk

Mon, 24th Jan 2022 07:00

RNS Number : 3041Z

Gulf Keystone Petroleum Ltd.

24 January 2022

24 January 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Operational & Corporate Update

Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, today provides an operational and corporate update.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"We are pleased today to declare an additional interim dividend of $50 million, bringing distributions over the past eight months to $150 million in line with our commitment to balance investment in growth with returns to shareholders.

Since the beginning of 2022, gross production peaked at just over 50,000 bopd and has averaged c.46,800 bopd, versus the 2021 average of 43,440 bopd. However, the lower productivity of recently completed wells, SH-13 and SH-14, and temporarily curtailed production from SH-12, have resulted in a delay in gross production increasing to 55,000 bopd. 2022 gross average production is expected to be 44,000 to 50,000 bopd.

GKP's substantial production base at current oil prices continues to generate significant cash flow and value for Gulf Keystone's stakeholders. On approval of our recently submitted Field Development Plan, we are well positioned to achieve sustainable growth from the Shaikan Field, which has delivered close to 100 MMstb, and has 489 MMstb of estimated 2P gross reserves remaining."

Operational

· Continued strong focus on safety in 2021 despite one previously reported lost time incident ("LTI"); currently no LTIs recorded for over 90 days

· Gross average production for 2021 of 43,440 bopd, at the upper end of guidance range; gross average production in 2022 year to date of c.46,800 bopd

· Drilling of SH-15 progressing well; continue to expect start-up in Q2 2022

· Due to well productivity, the increase in gross production towards 55,000 bopd has been delayed

o SH-13 & SH-14

§ Following completion of the acid stimulation programme on SH-13, and the clean-up of SH-14, both wells were brought on stream in December 2021 and their productivity has been below expectations

§ An acid stimulation programme for SH-14 is currently ongoing

o SH-12

§ Following the early appearance of trace quantities of water, production from the well has been temporarily curtailed, in line with the Company's prudent reservoir management strategy. The Company is investigating options to maximise near-term production from the well

§ Water ingress is common in fractured carbonate reservoirs like the Shaikan Field. Gulf Keystone has historically experienced trace amounts of water in a few other wells and has been successfully optimising their production levels. The Company continues to expedite plans to add water handling to further optimise production

· The Company does not expect any material impact on reserves or medium-term production potential. Considering cumulative gross production of c.99 MMstb, 2P gross reserves are estimated to be 489 MMstb at 31 December 2021, based on the 2020 Competent Person's Report adjusted for 2021 production

Financial

· Following $100m of dividends distributed in 2021, Gulf Keystone is pleased to announce that the Board has approved the declaration of an additional interim dividend of $50 million, equivalent to 23.394 US cents per Common Share of the Company

· The interim dividend is expected to be paid on 25 February 2022, based on a record date of 11 February 2022. The Company will disclose the pounds sterling rate per share prior to the ex-dividend date of 10 February 2022

· $283.2 million ($221.7 million net to GKP) received from the Kurdistan Regional Government in 2021 for payments of crude oil sales and recovery of outstanding arrears, with an additional $89.0 million ($69.7 million net to GKP) received in January 2022 for the combined September 2021 and October 2021 crude oil sales and arrears payments

· The current outstanding arrears balance is $28.6 million net to GKP related to the January and February 2020 invoices

· Robust balance sheet, with a cash balance of $228 million as at 21 January 2022

Outlook

· The Company expects gross average production for 2022 of 44,000 to 50,000 bopd, reflecting the anticipated production contribution from SH-15 and benefits of well workover activities

· Gulf Keystone continues to engage with the Ministry of Natural Resources ("MNR") following the submission of a draft FDP in 2021. The Company will revert to the market at an appropriate time with details on the FDP and updated production guidance

· With continuing strong oil prices and cash flow generation, there may be opportunities to consider further distributions to shareholders and to optimise the capital structure

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone:

+44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations

aclark@gulfkeystone.com

Celicourt Communications:

+ 44(0) 20 8434 2754

Mark Antelme

Jimmy Lea

GKP@Celicourt.uk

Passt

Gkp hat 70 mio netto überwiesen bekommen von den kurden

Liqudidät sollte kein Problem mehr seil lol

Tue, 4th Jan 2022 08:01

RNS Number : 3306X

Gulf Keystone Petroleum Ltd.

04 January 2022

4 January 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Shaikan Payments Update

Gulf Keystone confirms that it has received aggregate gross payments for the combined September 2021 and October 2021 crude oil sales and arrears payments of $89.0 million ($69.7 million net to GKP) from the Kurdistan Regional Government ("KRG").

The September gross payment of $37.8 million ($29.6 million net to GKP) is comprised of gross $31.6 million ($24.7 million net) for Shaikan crude oil sales and gross $6.2 million ($4.8 million net) in relation to the arrears from the outstanding December 2019 to February 2020 invoices.

The October gross payment of $51.2 million ($40.1 million net to GKP) is comprised of gross $41.6 million ($32.6 million net) for Shaikan crude oil sales and gross $9.6 million ($7.5 million net) in relation to the arrears from the outstanding December 2019 to February 2020 invoices.

Following receipt of the arrears payments, the current outstanding arrears balance is $28.6 million net to GKP related to the January and February 2020 invoices.

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone:

+44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations

aclark@gulfkeystone.com

Gkp hat 70 mio netto überwiesen bekommen von den kurden

Liqudidät sollte kein Problem mehr seil lol

Tue, 4th Jan 2022 08:01

RNS Number : 3306X

Gulf Keystone Petroleum Ltd.

04 January 2022

4 January 2022

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP" or "the Company")

Shaikan Payments Update

Gulf Keystone confirms that it has received aggregate gross payments for the combined September 2021 and October 2021 crude oil sales and arrears payments of $89.0 million ($69.7 million net to GKP) from the Kurdistan Regional Government ("KRG").

The September gross payment of $37.8 million ($29.6 million net to GKP) is comprised of gross $31.6 million ($24.7 million net) for Shaikan crude oil sales and gross $6.2 million ($4.8 million net) in relation to the arrears from the outstanding December 2019 to February 2020 invoices.

The October gross payment of $51.2 million ($40.1 million net to GKP) is comprised of gross $41.6 million ($32.6 million net) for Shaikan crude oil sales and gross $9.6 million ($7.5 million net) in relation to the arrears from the outstanding December 2019 to February 2020 invoices.

Following receipt of the arrears payments, the current outstanding arrears balance is $28.6 million net to GKP related to the January and February 2020 invoices.

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone:

+44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations

aclark@gulfkeystone.com

2te dividende in diesem jahr

Antwort auf Beitrag Nr.: 69.226.140 von texas2 am 03.09.21 07:14:55Thu, 2nd Sep 2021 07:00

RNS Number : 4691K

Gulf Keystone Petroleum Ltd.

02 September 2021

2 September 2021

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP", "the Group" or "the Company")

2021 Half Year Results Announcement

Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, today announces its results for the half year ended 30 June 2021.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"I am pleased to report strong operational and financial performance in the first half of 2021, despite the continuing challenges of the COVID-19 pandemic. Our leverage to the recovery in oil prices, combined with safe and reliable production towards the top end of our guidance range and a continued sharp focus on costs, has resulted in significant cash flow generation. With continued strong production performance from the Shaikan Field, we are tightening the 2021 production guidance range to 42,000 - 44,000 bopd.

We continue to deliver against our commitment to balance investment in growth and returns to shareholders. Today, we are pleased to declare an interim dividend for 2021 of $50 million, bringing total dividends this year to $100 million.

The early restart of the drilling campaign in June enables us to maintain production growth momentum and to drill an additional well, SH-G, in 2021 after completion of SH-14, the final well in the 55,000 bopd investment programme. SH-14 is expected to come onstream in Q4 2021, while we expect SH-G to come onstream in Q1 2022.

We continue to work closely with the MNR and our partner on the preparation of the Shaikan FDP and expect to submit the FDP to the MNR in Q4 2021 for approval."

Highlights to 30 June 2021 and post reporting period

Operational

· Remain focused on safe and reliable operations with No Lost Time Incident ("LTI") recorded for over 600 days and no recordable incidents for around 550 days

· Continuing to manage the challenges presented by COVID-19 to protect the health of staff and contractors

· Strong average gross 2021 production to 31 August 2021 of c.42,900 bopd, up 18% from the corresponding period in 2020 and towards the top end of 2021 guidance; gross production on 31 August 2021 was 42,842 bopd

· Drilling activities progressing well following early restart in June; SH-13 expected to come onstream imminently; drilling of SH-14 underway with completion and hook-up expected in Q4 2021

· Capitalising on early restart of drilling and opportunity to maintain a continuous drilling programme, planning to spud SH-G in Q4 2021, after completion of SH-14. SH-G is expected to commence production in Q1 2022

· SH-G, the first well after the 55,000 bopd expansion programme, is an opportunity to maintain growth and momentum while we prepare the Shaikan Field Development Plan ("FDP")

· Completed debottlenecking of PF-2, increasing total field processing capacity to c.57,500 bopd

Financial

· H1 2021 revenue up 162% to $130.7 million (H1 2020: $49.9m) contributing to a return to profit after tax of $64.8 million (H1 2020: $33.1 million loss)

· Adjusted H1 2021 EBITDA of $93.8 million, more than triple $27.5 million in H1 2020, driven by the Company's strong leverage to the recovery in oil prices, increase in production and low-cost base:

o Realised price up 129% to $43.7/bbl (H1 2020: $19.1/bbl)

o H1 2021 gross average production up 17% to 43,516 bopd (H1 2020: 37,159 bopd)

o H1 2021 gross Opex per barrel of $2.4/bbl, below 2021 guidance range of $2.5-$2.9/bbl

· Net Capex of $14.1 million (H1 2020: $38.5 million), with the restart of the 55,000 bopd expansion programme

· Total dividends of $50 million paid to date, including an annual dividend of $25 million and a special dividend of $25 million

· Robust cash balance of $177.4 million at 1 September 2021

Outlook

· Tightening 2021 average gross production guidance range from 40,000 - 44,000 bopd to 42,000 - 44,000 bopd

· Maintaining 2021 gross Opex per barrel guidance of $2.5 to $2.9/bbl

· The addition of SH-G increases 2021 net Capex guidance from $55-$65 million to $75-$85 million

· With continued constructive engagement with the Ministry of Natural Resources ("MNR") and the Company's partner Kalegran B.V. (a subsidiary of MOL Hungarian Oil & Gas plc) ("MOL"), Gulf Keystone is expecting to submit an FDP in Q4 2021 to the MNR for approval

o The FDP includes the continued ramp-up of Jurassic oil production, appraisal of the Triassic reservoir and a Gas Management Plan

o We continue to optimise the scope, schedule and cost of the FDP

· Developing Gulf Keystone's sustainability strategy, with the primary environmental focus on more than halving CO2 per barrel by 2025 by eliminating flaring

· In line with the Company's strategy of balancing investment in growth and returns to shareholders, Gulf Keystone is pleased to declare an interim dividend for 2021. The 2021 interim dividend is $50 million to be paid on 8 October 2021 based on a record date of 24 September 2021

· Following payment of the interim dividend, the Company will have distributed $100 million of dividends in 2021

· With continuing strong oil prices and cash flow generation, there may be opportunities to consider further distributions to shareholders and to optimise the capital structure

Investor & analyst presentation

Gulf Keystone's management team will be presenting the Company's 2021 Half Year Results at 10:00am (BST) today via live audio webcast:

https://webcasting.brrmedia.co.uk/broadcast/60e86de51ba1724b…

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

RNS Number : 4691K

Gulf Keystone Petroleum Ltd.

02 September 2021

2 September 2021

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP", "the Group" or "the Company")

2021 Half Year Results Announcement

Gulf Keystone, a leading independent operator and producer in the Kurdistan Region of Iraq, today announces its results for the half year ended 30 June 2021.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"I am pleased to report strong operational and financial performance in the first half of 2021, despite the continuing challenges of the COVID-19 pandemic. Our leverage to the recovery in oil prices, combined with safe and reliable production towards the top end of our guidance range and a continued sharp focus on costs, has resulted in significant cash flow generation. With continued strong production performance from the Shaikan Field, we are tightening the 2021 production guidance range to 42,000 - 44,000 bopd.

We continue to deliver against our commitment to balance investment in growth and returns to shareholders. Today, we are pleased to declare an interim dividend for 2021 of $50 million, bringing total dividends this year to $100 million.

The early restart of the drilling campaign in June enables us to maintain production growth momentum and to drill an additional well, SH-G, in 2021 after completion of SH-14, the final well in the 55,000 bopd investment programme. SH-14 is expected to come onstream in Q4 2021, while we expect SH-G to come onstream in Q1 2022.

We continue to work closely with the MNR and our partner on the preparation of the Shaikan FDP and expect to submit the FDP to the MNR in Q4 2021 for approval."

Highlights to 30 June 2021 and post reporting period

Operational

· Remain focused on safe and reliable operations with No Lost Time Incident ("LTI") recorded for over 600 days and no recordable incidents for around 550 days

· Continuing to manage the challenges presented by COVID-19 to protect the health of staff and contractors

· Strong average gross 2021 production to 31 August 2021 of c.42,900 bopd, up 18% from the corresponding period in 2020 and towards the top end of 2021 guidance; gross production on 31 August 2021 was 42,842 bopd

· Drilling activities progressing well following early restart in June; SH-13 expected to come onstream imminently; drilling of SH-14 underway with completion and hook-up expected in Q4 2021

· Capitalising on early restart of drilling and opportunity to maintain a continuous drilling programme, planning to spud SH-G in Q4 2021, after completion of SH-14. SH-G is expected to commence production in Q1 2022

· SH-G, the first well after the 55,000 bopd expansion programme, is an opportunity to maintain growth and momentum while we prepare the Shaikan Field Development Plan ("FDP")

· Completed debottlenecking of PF-2, increasing total field processing capacity to c.57,500 bopd

Financial

· H1 2021 revenue up 162% to $130.7 million (H1 2020: $49.9m) contributing to a return to profit after tax of $64.8 million (H1 2020: $33.1 million loss)

· Adjusted H1 2021 EBITDA of $93.8 million, more than triple $27.5 million in H1 2020, driven by the Company's strong leverage to the recovery in oil prices, increase in production and low-cost base:

o Realised price up 129% to $43.7/bbl (H1 2020: $19.1/bbl)

o H1 2021 gross average production up 17% to 43,516 bopd (H1 2020: 37,159 bopd)

o H1 2021 gross Opex per barrel of $2.4/bbl, below 2021 guidance range of $2.5-$2.9/bbl

· Net Capex of $14.1 million (H1 2020: $38.5 million), with the restart of the 55,000 bopd expansion programme

· Total dividends of $50 million paid to date, including an annual dividend of $25 million and a special dividend of $25 million

· Robust cash balance of $177.4 million at 1 September 2021

Outlook

· Tightening 2021 average gross production guidance range from 40,000 - 44,000 bopd to 42,000 - 44,000 bopd

· Maintaining 2021 gross Opex per barrel guidance of $2.5 to $2.9/bbl

· The addition of SH-G increases 2021 net Capex guidance from $55-$65 million to $75-$85 million

· With continued constructive engagement with the Ministry of Natural Resources ("MNR") and the Company's partner Kalegran B.V. (a subsidiary of MOL Hungarian Oil & Gas plc) ("MOL"), Gulf Keystone is expecting to submit an FDP in Q4 2021 to the MNR for approval

o The FDP includes the continued ramp-up of Jurassic oil production, appraisal of the Triassic reservoir and a Gas Management Plan

o We continue to optimise the scope, schedule and cost of the FDP

· Developing Gulf Keystone's sustainability strategy, with the primary environmental focus on more than halving CO2 per barrel by 2025 by eliminating flaring

· In line with the Company's strategy of balancing investment in growth and returns to shareholders, Gulf Keystone is pleased to declare an interim dividend for 2021. The 2021 interim dividend is $50 million to be paid on 8 October 2021 based on a record date of 24 September 2021

· Following payment of the interim dividend, the Company will have distributed $100 million of dividends in 2021

· With continuing strong oil prices and cash flow generation, there may be opportunities to consider further distributions to shareholders and to optimise the capital structure

Investor & analyst presentation

Gulf Keystone's management team will be presenting the Company's 2021 Half Year Results at 10:00am (BST) today via live audio webcast:

https://webcasting.brrmedia.co.uk/broadcast/60e86de51ba1724b…

This announcement contains inside information for the purposes of the UK Market Abuse Regime.

Enquiries:

Antwort auf Beitrag Nr.: 69.226.116 von texas2 am 03.09.21 07:10:00100 mio $ dividend insgesamt fuer 2021 ausgezahlt (dh bisher 50 mio und im herbst noch einmal 50 mio geplant)

Das ist schon nicht schlecht

https://www.investorschronicle.co.uk/news/2021/09/02/gulf-ke…

Das ist schon nicht schlecht

https://www.investorschronicle.co.uk/news/2021/09/02/gulf-ke…

Antwort auf Beitrag Nr.: 69.121.661 von texas2 am 23.08.21 08:47:12https://www.standard.co.uk/business/gulf-keystone-hands-out-…

Jetzt wird es konkret, dass das Erdölbegleitgas nicht mehr stumpf abgefackelt werden darf, sondern irgendwie genutzt werden muss, auch wenn es rein wirtschaftlich gesehen nicht besonders attraktiv ist. Hier sind gute Lösungen gefragt, diese Resource Erdölbegleitgas irgendwie besser zu nutzen.

https://www.rudaw.net/english/interview/210820211

https://www.rudaw.net/english/interview/210820211

Danke für die Info.Nicht die schlechtesten Nachrichten...Verbilligen macht bei meinem EK keinen Sinn mehr.Leider.🤧🤧🤧

Antwort auf Beitrag Nr.: 68.892.837 von texas2 am 28.07.21 10:31:10Dh wenn der Ölpreis so bleiben würde und die Zahlungen so weiter laufen würden wie in den letzten Monaten, dann hätten die Kurden vielleicht in einem Jahr ihre Schulden durch das nicht bezahlte geförderte, gelieferte Öl vielleicht in einem Jahr bei GKP abgestottert.