Focus Graphite -- ehem. FOCUS METALS - EINE NEUE GRAPHIT / REE - PERLE !!!! (Seite 155)

eröffnet am 12.01.11 20:26:16 von

neuester Beitrag 18.03.23 10:25:23 von

neuester Beitrag 18.03.23 10:25:23 von

Beiträge: 1.809

ID: 1.162.736

ID: 1.162.736

Aufrufe heute: 0

Gesamt: 281.512

Gesamt: 281.512

Aktive User: 0

ISIN: CA34416E8743 · WKN: A3DM8G · Symbol: FMS

0,1300

CAD

-3,70 %

-0,0050 CAD

Letzter Kurs 14.05.24 TSX Venture

Neuigkeiten

01.08.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 0,6200 | +16,98 | |

| 13,710 | +14,06 | |

| 0,7700 | +13,24 | |

| 0,5400 | +12,50 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,2400 | -13,89 | |

| 0,6166 | -19,12 | |

| 0,5300 | -19,70 | |

| 0,6700 | -21,18 | |

| 46,85 | -98,02 |

Beitrag zu dieser Diskussion schreiben

Hallo anand,

ich besitze leider nicht die notwendige qualifikation, um Dir diese durchaus interessante Frage fundiert beantworten zu können.

Vielleicht findest Du eine antwort in den Technical Reports der Unternehmen?

Focusn Metals

http://www.focusmetals.ca/english/wp-content/uploads/2012/01…

Northern Graphite

http://www.northerngraphite.com/wp-content/uploads/2010/08/B…

Falls Du eine antwort zu der Frage findest, dann lass es mich bitte wissen!

LG, ER

ich besitze leider nicht die notwendige qualifikation, um Dir diese durchaus interessante Frage fundiert beantworten zu können.

Vielleicht findest Du eine antwort in den Technical Reports der Unternehmen?

Focusn Metals

http://www.focusmetals.ca/english/wp-content/uploads/2012/01…

Northern Graphite

http://www.northerngraphite.com/wp-content/uploads/2010/08/B…

Falls Du eine antwort zu der Frage findest, dann lass es mich bitte wissen!

LG, ER

Hallo Extremrelaxer und Raginghammer,

könnt Ihr mir den Unterschied der Graphitqualitäten von Focus und Northern Graphite beschreiben. Bin gut bei Focus investiert und habe nun gelesen, dass NGC mit seinen "+48 mesh and +32 mesh extra large flake graphite" eine Kooperation mit Grafen Chemical Industries eingegangen ist, um Graphene Projekte voranzutreiben.

Ist NGC in Beziehung zu der Flockengröße besser aufgestellt als Focus und müsste man deshalb eigentlich bei beiden investiert sein?

Über eine Antwort wäre ich Euch sehr dankbar.

könnt Ihr mir den Unterschied der Graphitqualitäten von Focus und Northern Graphite beschreiben. Bin gut bei Focus investiert und habe nun gelesen, dass NGC mit seinen "+48 mesh and +32 mesh extra large flake graphite" eine Kooperation mit Grafen Chemical Industries eingegangen ist, um Graphene Projekte voranzutreiben.

Ist NGC in Beziehung zu der Flockengröße besser aufgestellt als Focus und müsste man deshalb eigentlich bei beiden investiert sein?

Über eine Antwort wäre ich Euch sehr dankbar.

Zitat von Raginghammer: Hallo Extremrelaxer,

ich lese deine Einschätzungen immer sehr gerne, aber glaubst du, dass man NGC als Massstab für den Graphitsektor nehmen kann? Ich meine NGC ist kein Blue Chip. NGC ist genauso ein Explorer wie FMS, nur halt auf der Zeitschiene ein bißchen weiter vorne.

SG

Raging

Hallo Raging,

Du scheinst mich da falsch zu verstehen, NGC ist weder der Massstab für Focus, noch für den Graphitsektor.

NGC ist ein Unternehmen, welches m.E. von der Größe des Projekts, von der Entwicklung zur Mine und vom Potential am ehesten mit Focus vergleichbar ist.

Vielleicht kennt da aber jemand einen Graphit-Explorer, der von seiner Art und Entwicklung Focus da noch ähnlicher ist???

Weshalb ich auf NGC schiele: Der NGC-Chart zeigt einen ziemlich engen Aufwärtstrendkanal. solange keine kursrelevanten Unternehmensnews den Kurs beeinflussen dürfte dieser Trendkanal solange intakt bleiben, bis die Stimmung im Graphitsektor kippt -> und dann sollte man sein Investment in Focus ggf. auch überdenken.

Der Chart von Focus ist im Gegensatz zu dem von NGC ein wildes Auf und Nieder ohne Systematik. Charttechnische Interpretationen oder Stop-loss-Limits machen hier im Gegensatz zu NGC keinen Sinn. Solange dies so ist funktioniert nur eine Handlungsdirektive: günstig einsammeln und ggf. teuer abstoßen...

LG, ER

Antwort auf Beitrag Nr.: 42.864.878 von extremrelaxer am 07.03.12 14:34:33Hallo Extremrelaxer,

ich lese deine Einschätzungen immer sehr gerne, aber glaubst du, dass man NGC als Massstab für den Graphitsektor nehmen kann? Ich meine NGC ist kein Blue Chip. NGC ist genauso ein Explorer wie FMS, nur halt auf der Zeitschiene ein bißchen weiter vorne.

SG

Raging

ich lese deine Einschätzungen immer sehr gerne, aber glaubst du, dass man NGC als Massstab für den Graphitsektor nehmen kann? Ich meine NGC ist kein Blue Chip. NGC ist genauso ein Explorer wie FMS, nur halt auf der Zeitschiene ein bißchen weiter vorne.

SG

Raging

Hallo KO,

ich schiele auf NGC, um ein Gefühl für die entwicklung des Sektors zu bekommen. Di MK von NGC ist etwas geringer, als jene von Focus, aber vom Zeitplan ähneln sich beide Unternehmen.

NGC ist für mich deswegen interessant, da die Aktie in einem relativ schmalen Aufwärtstrendkanal nach oben zieht. Sollte dieser Aufwärtstrendkanal verletzt / nach unten durchbrochen werden, dann könnte dies als negatives Omen für den gesammten Sektor zu deuten sein.

Momentan mache ich mir aber noch keine Sorgen. Der große Hype steht hier m.E. erst noch an. Eine deutliche Korrektur erfolgt meist erst im direkten Anschluß an eine Übertreibung, aber solange wir uns innerhalb der BB bewegen und die Handelsumsätze nicht explodieren, sehe ich noch keine Gefahr.

LG, ER

ich schiele auf NGC, um ein Gefühl für die entwicklung des Sektors zu bekommen. Di MK von NGC ist etwas geringer, als jene von Focus, aber vom Zeitplan ähneln sich beide Unternehmen.

NGC ist für mich deswegen interessant, da die Aktie in einem relativ schmalen Aufwärtstrendkanal nach oben zieht. Sollte dieser Aufwärtstrendkanal verletzt / nach unten durchbrochen werden, dann könnte dies als negatives Omen für den gesammten Sektor zu deuten sein.

Momentan mache ich mir aber noch keine Sorgen. Der große Hype steht hier m.E. erst noch an. Eine deutliche Korrektur erfolgt meist erst im direkten Anschluß an eine Übertreibung, aber solange wir uns innerhalb der BB bewegen und die Handelsumsätze nicht explodieren, sehe ich noch keine Gefahr.

LG, ER

Aus "THE INTERNATIONAL RESOURCE JOURNAL":

The globe’s next highest grade, lowest cost, solid supply of graphite

Global graphite consumption has increased from 600,000 tonnes in 2000 to 1.2 million tonnes in 2011 and market watchers forecast demand growth hikes of five to 10 per cent in the years ahead. As anticipation mounts and end-users worldwide from the energy industries to construction and high profile new technologies seek out alternative sources of supply from globally dominant China—which accounts for around 82 per cent of the strategic metal hitting markets today—few emerging producers are more keenly watched than Quebec’s Focus Metals Inc. (TSX-V: FMS) (OTCQX: FCSMF)(FRANKFURT: FKC) (“Focus”).

As the owner of the world’s highest-grade (16 per cent in situ) technology graphite resource at its Lac Knife project near Fermont, northern Quebec—comprising an NI43-101 compliant 8.1 million tons to date (December 2011) and huge potential for adding to the resource inventory along strike and at depth—Focus is taking its flagship project into production. In 24 months, the company will claim pole position as the world’s lowest cost technology grade graphite producer.

“We have a large defined resource and even larger potential for growing it,” says Gary Economo, President and chief executive.

“With the high grade of the graphite content in the ore in the ground we’ll become the lowest cost producer in the world and enable many new high profile applications.”

The coming year consists of completing the scoping study well underway, continuing the search for the right offtake partners, permitting and feasibility works (backed by two historically completed feasibility studies) and swiftly into late-2012/early-2013 construction to complete at the 2013 year-end. Furthermore, armed with the large high grade NI43-101 resource, plans to delineate further tonnage, 10 graphite concentrated showing targets within the Lac Knife claim map, a patented processing technology capable of generating 99.99 per cent purified product and interests in Graphoid Inc., an outfit focused on graphene, Focus will rapidly deliver to the global markets the graphite supply they are hungry for.

Leading with Lac Knife

The past 18 months have seen Focus step up from starting out as a junior explorer-developer with a handful of choice northern Quebec claims, to establishing itself as a leader for technology grade graphite. With its scoping study due to wrap up in a couple of months, the team is looking forward to further drilling out in depth the three zones comprising its current NI43-101 and exploring the stack of graphite shows throughout the wider Lac Knife area. Like any keen mine builder aware that mines are monetised as much as they are built by grade and tons, however high, Focus has readied for 2012 development activity by way of financing, completed in December, 2011. Raising approximately one third of the total funding required to take Lac Knife into commercial output, Economo says, is a critical step in seeing through the upcoming work programmes planned.

“Part of our strategy was always to de-risk the company by having a good cash position and that’s what we’ve done. The financing will make it a lot easier for us to raise the balance required for the mine and the processing plant and allow us to negotiate from a position of strength,” he explains.

The second part of Focus’ sublime production equation stems from the nature of the material itself. While other graphite players strive to put mines into production at grades of two, four and six per cent, Lac Knife’s 16 per cent grade-in-ground is quite something. At two per cent, a company would need to process 48-50 tonnes of ore, making it prohibitively expensive to produce one tonne of 98 per cent material. Comparatively, Focus need process six or seven tonnes of raw ore to obtain that 98 per cent premium product—and with an additional patented processing technology capable of purifying its graphite to an impressive 99.9 and 99.99 per cent product for lithium batteries. At 99.9 per cent concentration, one tonne sells at $4,000 on average while 99.99 per cent purity sells in a range of $10,000-$60,000 per tonne depending on end-user requirements. The company’s operating costs against premium priced production are unmatched.

“The processing plant we will start to build in the town of Fermont by the end of this year will take approximately 150,000 tonnes of ore annually, netting us around 20,000-27,000 tonnes of 98 per cent quality graphite,” Economo explains.

“For our patented proprietary technology, we’ll see a pilot plant by the end of this year and a fully operational plant alongside our processing plant in 2013.”

This Focus-masterminded process is also capable of producing graphene; another favourable potential revenue stream given that it results from the same economical, environmentally friendly process in significant quantities. The implications of this against current processing, which favours vapour chemical deposition-type activity that is both costly and damages the ore through oxidation, remain insurmountable.

“It also ties in well with our 40 per cent interest in Graphoid Inc.,” Economo adds.

“Graphoid is working with Rutgers University in the development of plastics that are extremely strong due to the incorporation of our graphene.”

Combined, the large NI43-101 world-highest-grade resource, unique technology, graphene production and interest in Graphoid will likely prove ever more attractive as 2012 drilling unfolds and delineates more resources.

The offtake, exploration & global demand

Focusing (no pun intended) on the three zones within a 300X600 metre area which make up the current Lac Knife resource, Focus will commence deeper exploration during the spring. Expanding on the current deposit, drilled to 125 metres at a 45 degree angle, effectively 90 metres depth, the team plans to follow the graphite down to around 400 metres and further identify quite how large a resource it has.

“Given that it’s open in all directions that’s the deepest we’ll go for now,” Economo says.

“It’ll definitely be an open pit mine, so going down to 400-500 metres is totally feasible. We expect to come up with much higher resources this summer.”

Drilling for further resource delineation will also take place over the 10 strong showings of graphite concentration within the claim and each may well result in a pit with similar types of volumes as those currently accounted for the December NI43-101.

“We’ll also do surface exploration in the 265 claims we secured this year and last year in Quebec,” Economo says.

“If we want to reach our goal and be the biggest and the best, we need to offer variety to our global customer base. We need diverse products and we need to make sure that we have the resources to fulfil the long-term supply agreements we plan to establish.”

While graphite is Focus’ steadfast main game, staying diverse has remained on the agenda, evidenced by its Kwyjibo rare earth elements-copper project some 10 kilometres north of Lac Manitou where Focus has invested almost $3 million and fast-tracked the project in partnership with Soquem, the Quebec government’s commercial mining corporation, and obtained 50 per cent interest in just one year. Having identified rare earth element neodymium, the company is waiting on assay results from a comprehensive drilling programme undertaken last summer before it makes its next move.

“It’s a little early to say where it will go, until we get our results finalised and reviewed by our geologists over the next month,” Economo affirms.

“We’re at a point in our growth where we have to streamline our interests on Focus Metals and our graphite business. We plan to spin off the other projects in the next few months.”

Prioritising accordingly has also seen the company initiate offtake discussions with some of the world’s largest graphite users. Given that graphite is a requisite element in engineering disciplines from medical applications to construction and semiconductors to solar panels, interest in securing Focus’ high grade, low-cost North American supply has been strong.

“Over the coming year we’ll put offtake agreements in place, in fact it will probably be sooner than later,” Economo says.

“We have a number of people currently testing our graphite and we expect to have some of these offtake agreements signed in the near future.”

There is also room for graphite-knowledgeable parties of a sales, mining or engineering persuasion, he ensures. It’s likely that future offtake partners will be companies capable of placing Focus’ superior graphite products on international markets.

“Graphite, unlike many minerals and metals, is an engineering product and requires a lot of expertise. There are companies that have been doing it for over 100 years, so we see sense in teaming up with those sorts of groups in addition to developing it internally,” Economo explains.

“We’re not looking to option the property in any way. We’ll finance it and maintain control of it, but there are areas we could consider assistance on in terms of sales and technical support.”

At first glance, Focus’ vision to become the world’s largest producer of low-cost, high grade graphite seems a monumental challenge. Closer inspection of quite how impressive the resource, exploration potential, processing technology and funding secured actually are, reveals it to be a fitting one for the company.

Economo says that “the carbon age is just beginning,” and as it unfolds, Focus is braced to hit global graphite markets and deliver precisely the product everyone is looking for.

http://www.internationalresourcejournal.com/north_america/qu…

The globe’s next highest grade, lowest cost, solid supply of graphite

Global graphite consumption has increased from 600,000 tonnes in 2000 to 1.2 million tonnes in 2011 and market watchers forecast demand growth hikes of five to 10 per cent in the years ahead. As anticipation mounts and end-users worldwide from the energy industries to construction and high profile new technologies seek out alternative sources of supply from globally dominant China—which accounts for around 82 per cent of the strategic metal hitting markets today—few emerging producers are more keenly watched than Quebec’s Focus Metals Inc. (TSX-V: FMS) (OTCQX: FCSMF)(FRANKFURT: FKC) (“Focus”).

As the owner of the world’s highest-grade (16 per cent in situ) technology graphite resource at its Lac Knife project near Fermont, northern Quebec—comprising an NI43-101 compliant 8.1 million tons to date (December 2011) and huge potential for adding to the resource inventory along strike and at depth—Focus is taking its flagship project into production. In 24 months, the company will claim pole position as the world’s lowest cost technology grade graphite producer.

“We have a large defined resource and even larger potential for growing it,” says Gary Economo, President and chief executive.

“With the high grade of the graphite content in the ore in the ground we’ll become the lowest cost producer in the world and enable many new high profile applications.”

The coming year consists of completing the scoping study well underway, continuing the search for the right offtake partners, permitting and feasibility works (backed by two historically completed feasibility studies) and swiftly into late-2012/early-2013 construction to complete at the 2013 year-end. Furthermore, armed with the large high grade NI43-101 resource, plans to delineate further tonnage, 10 graphite concentrated showing targets within the Lac Knife claim map, a patented processing technology capable of generating 99.99 per cent purified product and interests in Graphoid Inc., an outfit focused on graphene, Focus will rapidly deliver to the global markets the graphite supply they are hungry for.

Leading with Lac Knife

The past 18 months have seen Focus step up from starting out as a junior explorer-developer with a handful of choice northern Quebec claims, to establishing itself as a leader for technology grade graphite. With its scoping study due to wrap up in a couple of months, the team is looking forward to further drilling out in depth the three zones comprising its current NI43-101 and exploring the stack of graphite shows throughout the wider Lac Knife area. Like any keen mine builder aware that mines are monetised as much as they are built by grade and tons, however high, Focus has readied for 2012 development activity by way of financing, completed in December, 2011. Raising approximately one third of the total funding required to take Lac Knife into commercial output, Economo says, is a critical step in seeing through the upcoming work programmes planned.

“Part of our strategy was always to de-risk the company by having a good cash position and that’s what we’ve done. The financing will make it a lot easier for us to raise the balance required for the mine and the processing plant and allow us to negotiate from a position of strength,” he explains.

The second part of Focus’ sublime production equation stems from the nature of the material itself. While other graphite players strive to put mines into production at grades of two, four and six per cent, Lac Knife’s 16 per cent grade-in-ground is quite something. At two per cent, a company would need to process 48-50 tonnes of ore, making it prohibitively expensive to produce one tonne of 98 per cent material. Comparatively, Focus need process six or seven tonnes of raw ore to obtain that 98 per cent premium product—and with an additional patented processing technology capable of purifying its graphite to an impressive 99.9 and 99.99 per cent product for lithium batteries. At 99.9 per cent concentration, one tonne sells at $4,000 on average while 99.99 per cent purity sells in a range of $10,000-$60,000 per tonne depending on end-user requirements. The company’s operating costs against premium priced production are unmatched.

“The processing plant we will start to build in the town of Fermont by the end of this year will take approximately 150,000 tonnes of ore annually, netting us around 20,000-27,000 tonnes of 98 per cent quality graphite,” Economo explains.

“For our patented proprietary technology, we’ll see a pilot plant by the end of this year and a fully operational plant alongside our processing plant in 2013.”

This Focus-masterminded process is also capable of producing graphene; another favourable potential revenue stream given that it results from the same economical, environmentally friendly process in significant quantities. The implications of this against current processing, which favours vapour chemical deposition-type activity that is both costly and damages the ore through oxidation, remain insurmountable.

“It also ties in well with our 40 per cent interest in Graphoid Inc.,” Economo adds.

“Graphoid is working with Rutgers University in the development of plastics that are extremely strong due to the incorporation of our graphene.”

Combined, the large NI43-101 world-highest-grade resource, unique technology, graphene production and interest in Graphoid will likely prove ever more attractive as 2012 drilling unfolds and delineates more resources.

The offtake, exploration & global demand

Focusing (no pun intended) on the three zones within a 300X600 metre area which make up the current Lac Knife resource, Focus will commence deeper exploration during the spring. Expanding on the current deposit, drilled to 125 metres at a 45 degree angle, effectively 90 metres depth, the team plans to follow the graphite down to around 400 metres and further identify quite how large a resource it has.

“Given that it’s open in all directions that’s the deepest we’ll go for now,” Economo says.

“It’ll definitely be an open pit mine, so going down to 400-500 metres is totally feasible. We expect to come up with much higher resources this summer.”

Drilling for further resource delineation will also take place over the 10 strong showings of graphite concentration within the claim and each may well result in a pit with similar types of volumes as those currently accounted for the December NI43-101.

“We’ll also do surface exploration in the 265 claims we secured this year and last year in Quebec,” Economo says.

“If we want to reach our goal and be the biggest and the best, we need to offer variety to our global customer base. We need diverse products and we need to make sure that we have the resources to fulfil the long-term supply agreements we plan to establish.”

While graphite is Focus’ steadfast main game, staying diverse has remained on the agenda, evidenced by its Kwyjibo rare earth elements-copper project some 10 kilometres north of Lac Manitou where Focus has invested almost $3 million and fast-tracked the project in partnership with Soquem, the Quebec government’s commercial mining corporation, and obtained 50 per cent interest in just one year. Having identified rare earth element neodymium, the company is waiting on assay results from a comprehensive drilling programme undertaken last summer before it makes its next move.

“It’s a little early to say where it will go, until we get our results finalised and reviewed by our geologists over the next month,” Economo affirms.

“We’re at a point in our growth where we have to streamline our interests on Focus Metals and our graphite business. We plan to spin off the other projects in the next few months.”

Prioritising accordingly has also seen the company initiate offtake discussions with some of the world’s largest graphite users. Given that graphite is a requisite element in engineering disciplines from medical applications to construction and semiconductors to solar panels, interest in securing Focus’ high grade, low-cost North American supply has been strong.

“Over the coming year we’ll put offtake agreements in place, in fact it will probably be sooner than later,” Economo says.

“We have a number of people currently testing our graphite and we expect to have some of these offtake agreements signed in the near future.”

There is also room for graphite-knowledgeable parties of a sales, mining or engineering persuasion, he ensures. It’s likely that future offtake partners will be companies capable of placing Focus’ superior graphite products on international markets.

“Graphite, unlike many minerals and metals, is an engineering product and requires a lot of expertise. There are companies that have been doing it for over 100 years, so we see sense in teaming up with those sorts of groups in addition to developing it internally,” Economo explains.

“We’re not looking to option the property in any way. We’ll finance it and maintain control of it, but there are areas we could consider assistance on in terms of sales and technical support.”

At first glance, Focus’ vision to become the world’s largest producer of low-cost, high grade graphite seems a monumental challenge. Closer inspection of quite how impressive the resource, exploration potential, processing technology and funding secured actually are, reveals it to be a fitting one for the company.

Economo says that “the carbon age is just beginning,” and as it unfolds, Focus is braced to hit global graphite markets and deliver precisely the product everyone is looking for.

http://www.internationalresourcejournal.com/north_america/qu…

The Focus Metals Story

Portfolio Updates – Plus, Insight on Junior Resource Investing

Dear Energy & Scarcity Reader:

I hope you saw yesterday's ESI alert. There's a new recommendation there. It's Focus Metals (FMS: TSX-V), an Ottawa-based mineral developer with a world-class graphite deposit in the wilds of Quebec -- but it's near electric power and a railhead.

The Focus Story

Focus is putting together a very doable mine-mill project with a three-year timeline. In addition to graphite, Focus holds rights to a nice rare earths and copper deposit, also up in mining-friendly Quebec. This latter claim is intriguing, but I really like the graphite play.

When I met CEO Gary Economo last week in New York, he told me that his "focus" (so to speak) is on getting the graphite deposit into gear. That's the cash register for this company. And that works for me. Bend some metal. Build that mine!

One great thing about mining graphite is that it's not over-the-top complex. That is it's not like you need rocket science levels of hydro-metallurgy, like you do with rare earths. Graphite is a pretty straightforward mining and milling concept. With Focus, there's an utterly phenomenal ore body that gives this play so much potential value. It's among the best ore bodies of its kind anywhere in the world.

Focus shares took a strong upward pop yesterday. Part of it was the fact of the ESI recommendation hitting the wires. But the shares already had momentum, based on an excellent presentation in New York last week by Mr. Economo at a conference sponsored by Murdock Capital.

At the Murdock Capital presentation, I saw money managers typing on their "CrackBerry" devices, apparently with buy orders. That's not how ESI works, of course. Heck, I don't even have a CrackBerry. I'm just an old-fashioned cell phone kind of guy.

Still our advantage at ESI is that we're among the early investors with Focus. The rest of the investing public is out there, waiting for this idea to filter through into the free blogs, investment-oriented media and such.

Share Price Discussion

Yesterday, we saw what happens when large retail interest hits a small-cap Canadian junior stock. After the ESI write-up, Focus shares traded upward. But past a certain price move and volume, the automatic trading kicked in.

That is, trading went way beyond "just" ESI readers buying shares. There are computers at trading houses in Toronto and New York. They detected action and started trading away -- for 20 times the normal volume of Focus shares.

A lot of yesterday's trading volume for Focus was from brokers who don't know or care if the company makes graphite or baby food. That's why I gave you a "buy" limit of 95 cents for your orders. I don't want you to trade in and wind up paying too much. If you're in Focus now, that's a good thing. If not, look for a price pullback and keep the buy-up-to price at 95 cents. There’s no reason to chase shares higher in the short term. Be patient and I believe you'll be rewarded over time.

Focus has every appearance of becoming a solid, ultra-valuable resource play. In my view, it's like another UNX Energy (UNX: TSX-V). It's like what we're seeing with Reservoir Capital (REO: TSX-V). It's like what we have with IC Potash (ICP: TSX-V). All three of these ideas have a great underlying resource development idea.

So Focus needs to stay on track and develop its mineral assets. Then it could easily turn into a company that large institutions and money managers want to buy. Indeed, if you look at the charts, that kind of buying seems to have started among the New York crowd last week.

Focus is on a medium-term development timeline -- three years. It'll spin off huge cash when it's up and running. So from the current market cap of about $65 million, this company could justify a much higher number. Say, in the $300 million range over the next eight months or so. Even higher in 18 months as management shows more progress on development. I believe we'll see the share price appreciate.

Right now, though, you have to respect the risks. Focus Metals is a Canadian junior. It has over $3 million in the bank, and it's spending it on development. There's no product coming out -- not yet. There's no cash flow. No earnings. No profits. No dividends. Management has to work hard and execute its plan.

I'm very optimistic, or I wouldn't discuss Focus. I'll watch what happens. But you've got to understand that it's not like you're buying shares in an established, technology-leading, cash-rich player like Goldcorp or Schlumberger.

Graphite

While I'm discussing Focus, let me emphasize that its product, graphite, is a critical strategic material. That's among the most important reasons why I like this idea. We're not mining sand and gravel. Heck, we're not mining lead and zinc.

Graphite has all sorts of uses, from insulating rocket engines to draining heat away from the electronics of your iPad. That, and you'll find graphite in things as diverse as carbon rods in electric arc steel making and the ultra-capacitors that the Navy uses in its new system to launch airplanes off aircraft carriers -- the new electromagnetic version of the old steam catapult.

And when you use graphite in, say, high-performance brakes? Oh, man. Those carbon pads grab so hard that you can almost stop time.

That's just a taste of how useful graphite is. And to be sure, there are more and more, better and better uses for graphite rolling out of the research labs and patent mills of the world. But I don't want to turn this update into a long tutorial on graphite. I'll discuss the ideas more in the future. But for now, just say that I'm glad I found Focus.

http://www.murdockcapital.com/pages/load_module.php?pid=115

Portfolio Updates – Plus, Insight on Junior Resource Investing

Dear Energy & Scarcity Reader:

I hope you saw yesterday's ESI alert. There's a new recommendation there. It's Focus Metals (FMS: TSX-V), an Ottawa-based mineral developer with a world-class graphite deposit in the wilds of Quebec -- but it's near electric power and a railhead.

The Focus Story

Focus is putting together a very doable mine-mill project with a three-year timeline. In addition to graphite, Focus holds rights to a nice rare earths and copper deposit, also up in mining-friendly Quebec. This latter claim is intriguing, but I really like the graphite play.

When I met CEO Gary Economo last week in New York, he told me that his "focus" (so to speak) is on getting the graphite deposit into gear. That's the cash register for this company. And that works for me. Bend some metal. Build that mine!

One great thing about mining graphite is that it's not over-the-top complex. That is it's not like you need rocket science levels of hydro-metallurgy, like you do with rare earths. Graphite is a pretty straightforward mining and milling concept. With Focus, there's an utterly phenomenal ore body that gives this play so much potential value. It's among the best ore bodies of its kind anywhere in the world.

Focus shares took a strong upward pop yesterday. Part of it was the fact of the ESI recommendation hitting the wires. But the shares already had momentum, based on an excellent presentation in New York last week by Mr. Economo at a conference sponsored by Murdock Capital.

At the Murdock Capital presentation, I saw money managers typing on their "CrackBerry" devices, apparently with buy orders. That's not how ESI works, of course. Heck, I don't even have a CrackBerry. I'm just an old-fashioned cell phone kind of guy.

Still our advantage at ESI is that we're among the early investors with Focus. The rest of the investing public is out there, waiting for this idea to filter through into the free blogs, investment-oriented media and such.

Share Price Discussion

Yesterday, we saw what happens when large retail interest hits a small-cap Canadian junior stock. After the ESI write-up, Focus shares traded upward. But past a certain price move and volume, the automatic trading kicked in.

That is, trading went way beyond "just" ESI readers buying shares. There are computers at trading houses in Toronto and New York. They detected action and started trading away -- for 20 times the normal volume of Focus shares.

A lot of yesterday's trading volume for Focus was from brokers who don't know or care if the company makes graphite or baby food. That's why I gave you a "buy" limit of 95 cents for your orders. I don't want you to trade in and wind up paying too much. If you're in Focus now, that's a good thing. If not, look for a price pullback and keep the buy-up-to price at 95 cents. There’s no reason to chase shares higher in the short term. Be patient and I believe you'll be rewarded over time.

Focus has every appearance of becoming a solid, ultra-valuable resource play. In my view, it's like another UNX Energy (UNX: TSX-V). It's like what we're seeing with Reservoir Capital (REO: TSX-V). It's like what we have with IC Potash (ICP: TSX-V). All three of these ideas have a great underlying resource development idea.

So Focus needs to stay on track and develop its mineral assets. Then it could easily turn into a company that large institutions and money managers want to buy. Indeed, if you look at the charts, that kind of buying seems to have started among the New York crowd last week.

Focus is on a medium-term development timeline -- three years. It'll spin off huge cash when it's up and running. So from the current market cap of about $65 million, this company could justify a much higher number. Say, in the $300 million range over the next eight months or so. Even higher in 18 months as management shows more progress on development. I believe we'll see the share price appreciate.

Right now, though, you have to respect the risks. Focus Metals is a Canadian junior. It has over $3 million in the bank, and it's spending it on development. There's no product coming out -- not yet. There's no cash flow. No earnings. No profits. No dividends. Management has to work hard and execute its plan.

I'm very optimistic, or I wouldn't discuss Focus. I'll watch what happens. But you've got to understand that it's not like you're buying shares in an established, technology-leading, cash-rich player like Goldcorp or Schlumberger.

Graphite

While I'm discussing Focus, let me emphasize that its product, graphite, is a critical strategic material. That's among the most important reasons why I like this idea. We're not mining sand and gravel. Heck, we're not mining lead and zinc.

Graphite has all sorts of uses, from insulating rocket engines to draining heat away from the electronics of your iPad. That, and you'll find graphite in things as diverse as carbon rods in electric arc steel making and the ultra-capacitors that the Navy uses in its new system to launch airplanes off aircraft carriers -- the new electromagnetic version of the old steam catapult.

And when you use graphite in, say, high-performance brakes? Oh, man. Those carbon pads grab so hard that you can almost stop time.

That's just a taste of how useful graphite is. And to be sure, there are more and more, better and better uses for graphite rolling out of the research labs and patent mills of the world. But I don't want to turn this update into a long tutorial on graphite. I'll discuss the ideas more in the future. But for now, just say that I'm glad I found Focus.

http://www.murdockcapital.com/pages/load_module.php?pid=115

Focus Metals at 2012 Graphite Express Conference (Vancouver, BC)

In wie weit ist denn der Kurs von NGC als Referenz zu sehen? Sprich Ressourcenschätzung, Produktion, laufende Kosten, Verbindlichkeiten etc..

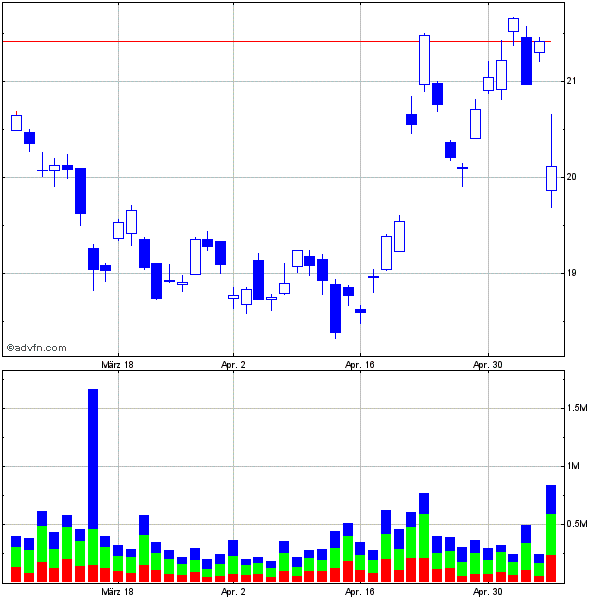

Zum Vergleich, um das Sentiment besser einschätzen zu können:

Northern Graphite vs Focus Metals

NGC

FMS

Wie man schön sieht, läuft NGC ja schon länger, als FMS. Während wir bei FMS gerade die erste Konso durchgemacht haben, hat NGC schon 6 Konsolidierungen im selben 2-Monats-Zeitraum hinter sich gebracht.

Wir haben hier m.E. deutliches Nachholpotential!

LG, ER

Northern Graphite vs Focus Metals

NGC

FMS

Wie man schön sieht, läuft NGC ja schon länger, als FMS. Während wir bei FMS gerade die erste Konso durchgemacht haben, hat NGC schon 6 Konsolidierungen im selben 2-Monats-Zeitraum hinter sich gebracht.

Wir haben hier m.E. deutliches Nachholpotential!

LG, ER

Focus Graphite -- ehem. FOCUS METALS - EINE NEUE GRAPHIT / REE - PERLE !!!!