McEwen Mining (Seite 62)

eröffnet am 29.01.12 19:26:51 von

neuester Beitrag 11.05.24 12:56:23 von

neuester Beitrag 11.05.24 12:56:23 von

Beiträge: 1.907

ID: 1.172.023

ID: 1.172.023

Aufrufe heute: 1

Gesamt: 236.302

Gesamt: 236.302

Aktive User: 0

ISIN: US58039P3055 · WKN: A3DMEX · Symbol: MUX

10,280

USD

-0,39 %

-0,040 USD

Letzter Kurs 11.05.24 NYSE

Neuigkeiten

18.03.24 · Stephan Bogner Anzeige |

14.12.23 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,2000 | +18,05 | |

| 527,60 | +15,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 324,70 | -10,30 | |

| 9,8500 | -10,54 | |

| 0,6166 | -19,12 | |

| 0,6601 | -26,22 | |

| 47,33 | -97,99 |

Beitrag zu dieser Diskussion schreiben

Sollte das Gold in 2019 wieder steigen, kommt auch McEwen wieder in höhere Gefilden.

Aber es wird nicht nur Gold nach oben gehen sondern auch Silber und andere Edelmetalle die den Weg nach oben, aber nur bei Preiserhöhungen im Edelmetallbereich, suchen und finden werden. Mir kann das allerdings nur recht sein.

Commerzbank Analysen

Warum Gold 2019 steigen wird

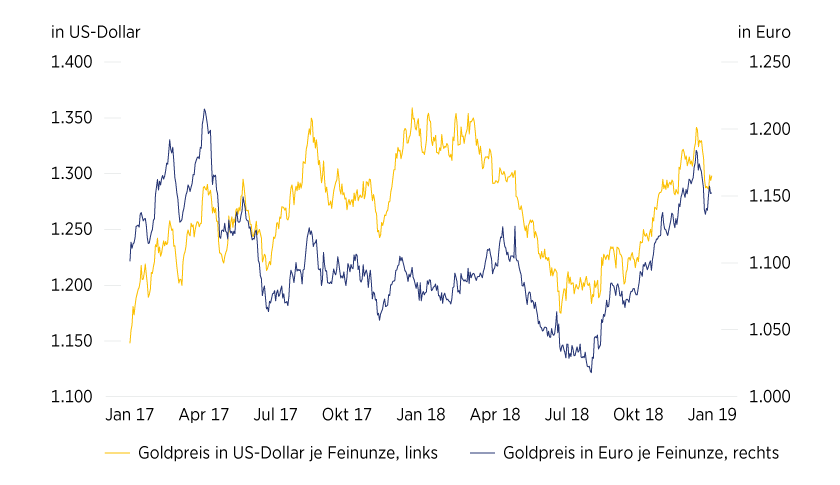

Der Goldpreis rutschte Anfang März wieder unter die Marke von 1.300 US-Dollar je Feinunze. Gold hat damit fast alle Gewinne seit Jahresbeginn wieder abgegeben. Wenige Wochen zuvor verzeichnete es bei knapp 1.350 US-Dollar je Feinunze noch ein 10-Monats-Hoch. Gold in Euro stieg im Februar sogar auf den höchsten Stand seit fast zwei Jahren bei fast 1.190 Euro je Feinunze, verlor dann aber ebenfalls deutlich.

Der Preisanstieg und auch der anschließende Rückgang vollzogen sich in beiden Währungen nahezu parallel (siehe Grafik 1). Gold hatte sich von der Währungsentwicklung in den ersten beiden Monaten 2019 also weitgehend abgekoppelt. Eine wichtigere Rolle bei der Goldpreisentwicklung spielte dagegen der Aktienmarkt. Dieser geriet Ende 2018 stark unter Druck, was Gold die Initialzündung für den Preisanstieg zu Jahresbeginn gab. Die deutliche Erholung der Aktienkurse änderte daran im Januar zwar noch nichts.

Die Gold-ETFs verzeichneten sogar den stärksten Monatszufluss seit fast zwei Jahren. Seit Anfang Februar kommt es aber wieder zu Umschichtungen von Gold zurück in Aktien, was sich in entsprechenden ETF-Abflüssen äußerte und Gold letztlich unter Druck setzte.

Somit scheint sich bei Gold ein mittlerweile bekanntes Muster zu wiederholen, nämlich stark in das Jahr zu starten, um danach wieder den Rückzug anzutreten. 2014, 2015 und 2018 verzeichnete Gold sein Jahreshoch jeweils in den ersten drei Monaten des Jahres. Das jüngste Hoch liegt zudem nicht weit von den Hochs der Jahre 2016, 2017 und 2018 entfernt.

Hat Gold sein Hoch damit schon gesehen? Wir denken nicht. Gold dürfte unseres Erachtens im Laufe des Jahres noch deutlich höhere Preise markieren als im Februar. Dafür sprechen mehrere Gründe:

Die US-Notenbank Fed hat Ende Januar angekündigt, die Leitzinsen nicht weiter anheben zu wollen. Zudem soll der Abbau der Fed-Bilanz voraussichtlich zum Jahresende auslaufen. Es gibt somit keinen Gegenwind für Gold durch weiter steigende Zinsen oder den fortgesetzten Entzug von Liquidität. In der Vergangenheit geriet der US-Dollar nach dem Ende eines Zinserhöhungszyklus zumeist unter Druck. Dass er es diesmal noch nicht tat, hängt vermutlich mit überlagernden Einflussfaktoren wie dem weiterhin schwelenden Handelskonflikt, dem Richtungswechsel auch anderer Zentralbanken weg von geplanten (weiteren) Zinserhöhungen und der schwächelnden Konjunktur in der Eurozone zusammen.

Die EZB hat der stärker ausgeprägten Konjunkturabschwächung in der Eurozone Rechnung getragen und den Zeitpunkt für die erste Zinserhöhung ins nächste Jahr geschoben. Zudem hat sie neue zielgerichtete Langfristtender (TLTROs) angekündigt, um eine unerwünschte monetäre Straffung zu verhindern. Diese würde bei einer Rückzahlung der in einem Jahr auslaufenden TLTROs entstehen. Durch diese Maßnahmen wird zwar eine stärkere Abwertung des US-Dollar gegenüber dem Euro verhindert. Eine längere Beibehaltung der ultralockeren EZB-Geldpolitik – wir rechnen auch 2020 nicht mit einer Zinserhöhung – sollte Gold aber ebenfalls zugutekommen. So liegen die Renditen deutscher Bundesanleihen bis einschließlich neun Jahren Laufzeit unter 0 Prozent.

Die deutsche Zehnjahresrendite kratzt an der Nulllinie. Abzüglich der Inflationsrate sind die Realzinsen somit deutlich negativ. Negative Realzinsen sind ein starkes Kaufargument für Gold.

https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…" target="_blank" rel="nofollow ugc noopener">https://www.ideas-magazin.de/2019/ausgabe-204/maerkte/warum-…

McEwen Mining closes $25-million (U.S.) offering

2019-03-29 09:46 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING ANNOUNCES CLOSING OF US$25 MILLION REGISTERED DIRECT OFFERING

McEwen Mining Inc. has closed the previously announced registered direct offering for aggregate gross proceeds of $25-million (U.S.). Insiders of the Company, including Rob McEwen, subscribed for US$3 million of the offering.

Rob McEwen, Chairman and Chief Owner of McEwen Mining, stated "We are very pleased to have successfully completed this equity raise as it fully funds the Company's current mining projects and exploration prospects.

At Gold Bar in Nevada, our exploration will be testing deep targets for Carlin style high grade sulphide mineralization, such as exists 25 miles to the north at the Cortez Hills Mine. In Argentina, we plan to develop an all-season access route that should enhance the value of our massive Los Azules copper deposit. In Timmins at the Black Fox mine, we plan to modernize the mobile fleet with the objective of driving down operating costs and increasing production.

Accordingly, we are pleased that our production guidance for the year is 205,000 gold equivalent ounces, which is a 16% increase from 2018. In addition, we have a large and exciting exploration program that we expect will generate news throughout the year."

Conference Call

Please join our conference call, where management will discuss why we did this offering and to provide an overview of operations year to date and expectations for the balance of the year. Questions can be asked directly by participants over the telephone or can be emailed in advance to info@mcewenmining.com.

Tuesday, April 2nd, 201911:00 am EDT

Toll Free US & Canada 844) 630-9911

844) 630-9911

Outside US & Canada: (210) 229-8828

Conference ID Number: 5572459

An archived replay of the webcast will be available for one week after it takes place. Access the replay by calling (855) 859-2056 (North America) / (404) 537-3406 (International), Conference ID Number 5572459.

The subscription by insiders is subject to approval by the Company's shareholders at the Company's upcoming 2019 Annual Meeting of Shareholders.

Roth Capital Partners and A.G.P./Alliance Global Partners acted as exclusive lead placement agents for the securities offered in the United States and internationally (except Canada). Maison Placements acted as exclusive placement agent for the securities offered in Canada.

The securities in the offering described above were offered in the United States pursuant to an effective "shelf" registration statement (File No. 333-224476) that was filed with the Securities and Exchange Commission (the "SEC") and was declared effective by the SEC on July 6, 2018. The securities were offered only by means of a prospectus. A prospectus supplement and the accompanying prospectus have been filed with the SEC. The prospectus supplement and accompanying prospectus is available on the SEC's website at http://www.sec.gov .

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-29 09:46 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING ANNOUNCES CLOSING OF US$25 MILLION REGISTERED DIRECT OFFERING

McEwen Mining Inc. has closed the previously announced registered direct offering for aggregate gross proceeds of $25-million (U.S.). Insiders of the Company, including Rob McEwen, subscribed for US$3 million of the offering.

Rob McEwen, Chairman and Chief Owner of McEwen Mining, stated "We are very pleased to have successfully completed this equity raise as it fully funds the Company's current mining projects and exploration prospects.

At Gold Bar in Nevada, our exploration will be testing deep targets for Carlin style high grade sulphide mineralization, such as exists 25 miles to the north at the Cortez Hills Mine. In Argentina, we plan to develop an all-season access route that should enhance the value of our massive Los Azules copper deposit. In Timmins at the Black Fox mine, we plan to modernize the mobile fleet with the objective of driving down operating costs and increasing production.

Accordingly, we are pleased that our production guidance for the year is 205,000 gold equivalent ounces, which is a 16% increase from 2018. In addition, we have a large and exciting exploration program that we expect will generate news throughout the year."

Conference Call

Please join our conference call, where management will discuss why we did this offering and to provide an overview of operations year to date and expectations for the balance of the year. Questions can be asked directly by participants over the telephone or can be emailed in advance to info@mcewenmining.com.

Tuesday, April 2nd, 201911:00 am EDT

Toll Free US & Canada

844) 630-9911

844) 630-9911 Outside US & Canada: (210) 229-8828

Conference ID Number: 5572459

An archived replay of the webcast will be available for one week after it takes place. Access the replay by calling (855) 859-2056 (North America) / (404) 537-3406 (International), Conference ID Number 5572459.

The subscription by insiders is subject to approval by the Company's shareholders at the Company's upcoming 2019 Annual Meeting of Shareholders.

Roth Capital Partners and A.G.P./Alliance Global Partners acted as exclusive lead placement agents for the securities offered in the United States and internationally (except Canada). Maison Placements acted as exclusive placement agent for the securities offered in Canada.

The securities in the offering described above were offered in the United States pursuant to an effective "shelf" registration statement (File No. 333-224476) that was filed with the Securities and Exchange Commission (the "SEC") and was declared effective by the SEC on July 6, 2018. The securities were offered only by means of a prospectus. A prospectus supplement and the accompanying prospectus have been filed with the SEC. The prospectus supplement and accompanying prospectus is available on the SEC's website at http://www.sec.gov .

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

McEwen to hold call re $25M (U.S.) offering on April 2

2019-03-28 08:15 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING CONFERENCE CALL

McEwen Mining Inc. is inviting all shareholders and investors to participate in a conference call to discuss why the company did its recent $25-million (U.S.) offering and to provide an overview of operations year to date and expectations for the balance of the year.

According to securities rules concerning public offerings, the call needs to be hosted two trading days after the close of the offering. The conference call will be held on Tuesday, April 2nd, at 11:00 am EDT.

Questions can be asked directly by participants over the telephone or can be emailed in advance to info@mcewenmining.com . The call will be chaired by Rob McEwen, Chairman and Chief Owner.

Tuesday April 2nd, 2019 at11 am EDT

Toll Free (US & Canada):1 (844) 630-9911

Outside US & Canada: 1 (210) 229-8828

Conference ID Number: 5572459

Webcast Link: https://edge.media-server.com/m6/p/p2hdjhrb

An archived replay of the webcast will be available for one week after it takes place. Access the replay using the link https://edge.media-server.com/m6/p/p2hdjhrb or calling (855)-859-2056 (North America) / (404)-537-3406 (International), Conference ID Number 5572459.

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-28 08:15 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING CONFERENCE CALL

McEwen Mining Inc. is inviting all shareholders and investors to participate in a conference call to discuss why the company did its recent $25-million (U.S.) offering and to provide an overview of operations year to date and expectations for the balance of the year.

According to securities rules concerning public offerings, the call needs to be hosted two trading days after the close of the offering. The conference call will be held on Tuesday, April 2nd, at 11:00 am EDT.

Questions can be asked directly by participants over the telephone or can be emailed in advance to info@mcewenmining.com . The call will be chaired by Rob McEwen, Chairman and Chief Owner.

Tuesday April 2nd, 2019 at11 am EDT

Toll Free (US & Canada):1 (844) 630-9911

Outside US & Canada: 1 (210) 229-8828

Conference ID Number: 5572459

Webcast Link: https://edge.media-server.com/m6/p/p2hdjhrb

An archived replay of the webcast will be available for one week after it takes place. Access the replay using the link https://edge.media-server.com/m6/p/p2hdjhrb or calling (855)-859-2056 (North America) / (404)-537-3406 (International), Conference ID Number 5572459.

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

McEwen Mining to list additional shares March 29

2019-03-27 16:50 ET - Prospectus Approved

The Toronto Stock Exchange reports that McEwen Mining Inc. will list additional shares at the open on March 29, 2019. As stated in the MJDS prospectus supplement dated March 26, 2019, to the MJDS prospectus dated Aug. 8, 2018, the company will issue 14,193,548 units at $1.55 (U.S.) per unit in an offering.

According to the TSX, each unit will consist of one share and one-half of one warrant. Each whole warrant will be exercisable at $2 per share at any time until 5:30 p.m. New York time on March 29, 2022. The units will separate immediately upon the closing of the offering, and the warrants will not be listed and posted for trading on the TSX.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-27 16:50 ET - Prospectus Approved

The Toronto Stock Exchange reports that McEwen Mining Inc. will list additional shares at the open on March 29, 2019. As stated in the MJDS prospectus supplement dated March 26, 2019, to the MJDS prospectus dated Aug. 8, 2018, the company will issue 14,193,548 units at $1.55 (U.S.) per unit in an offering.

According to the TSX, each unit will consist of one share and one-half of one warrant. Each whole warrant will be exercisable at $2 per share at any time until 5:30 p.m. New York time on March 29, 2022. The units will separate immediately upon the closing of the offering, and the warrants will not be listed and posted for trading on the TSX.

© 2019 Canjex Publishing Ltd. All rights reserved.

McEwen arranges $25-million (U.S.) direct offering

2019-03-26 21:38 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING ANNOUNCES US$25 MILLION REGISTERED DIRECT OFFERING

McEwen Mining Inc. has entered into definitive agreements with an institutional investor and certain directors and officers of the company, including Rob McEwen, pursuant to which such investors have agreed to purchase units of the company for aggregate gross proceeds of $25-million (U.S.) in a registered direct offering.

McEwen Mining intends to use the net proceeds from this offering to fully fund its current mining projects and exploration prospects, for additional operating capital and for general working capital purposes.

Rob McEwen, Chairman and Chief Owner of McEwen Mining, stated " I am pleased to say that this financing provides us with the flexibility we need to take advantage of additional opportunities at our operations."

McEwen Mining is a growing gold and silver miner that produced 176,000 ounces gold equivalent in 2018. It owns interests in several mines, two of which are located in the world's top gold mining jurisdictions of Nevada and Timmins. In addition, it owns a large undeveloped copper deposit in Argentina.

Each Unit is priced at $1.55 and consists of a share of common stock and one-half of a warrant to purchase common stock. Each full warrant is exercisable into one share of common stock. The warrants are immediately exercisable and have a term of three years and an exercise price of $2.00.

Roth Capital Partners and A.G.P./Alliance Global Partners are acting as exclusive lead placement agents for the Units offered in the United States and internationally (except Canada). Maison Placements is acting as exclusive placement agent for the Units offered in Canada.

The offering is expected to close on March 29, 2019 and is subject to customary closing conditions, including approvals from the TSX and the NYSE. The subscription by insiders is subject to shareholder approval at the Annual General Meeting of shareholders to be held on May 23, 2019.

The shares of common stock and warrants described above are being offered in the United States pursuant to an effective "shelf" registration statement (File No. 333-224476) that was filed with the Securities and Exchange Commission (the "SEC") and was declared effective by the SEC on July 6, 2018. The securities may be offered only by means of a prospectus. A prospectus supplement and the accompanying prospectus will be filed with the SEC. The prospectus supplement and accompanying prospectus, when filed, will be available on the SEC's website at http://www.sec.gov and may also be obtained from Roth Capital Partners at 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660, (800) 678-9147.

McEwen intends to file a Canadian MJDS prospectus supplement to the Canadian MJDS base shelf prospectus dated August 8, 2018 with respect to the offering in Canada.

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

McEwen has approximately 346 million shares outstanding. Rob McEwen, Chairman and Chief Owner, owns 23% of the shares.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-26 21:38 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING ANNOUNCES US$25 MILLION REGISTERED DIRECT OFFERING

McEwen Mining Inc. has entered into definitive agreements with an institutional investor and certain directors and officers of the company, including Rob McEwen, pursuant to which such investors have agreed to purchase units of the company for aggregate gross proceeds of $25-million (U.S.) in a registered direct offering.

McEwen Mining intends to use the net proceeds from this offering to fully fund its current mining projects and exploration prospects, for additional operating capital and for general working capital purposes.

Rob McEwen, Chairman and Chief Owner of McEwen Mining, stated " I am pleased to say that this financing provides us with the flexibility we need to take advantage of additional opportunities at our operations."

McEwen Mining is a growing gold and silver miner that produced 176,000 ounces gold equivalent in 2018. It owns interests in several mines, two of which are located in the world's top gold mining jurisdictions of Nevada and Timmins. In addition, it owns a large undeveloped copper deposit in Argentina.

Each Unit is priced at $1.55 and consists of a share of common stock and one-half of a warrant to purchase common stock. Each full warrant is exercisable into one share of common stock. The warrants are immediately exercisable and have a term of three years and an exercise price of $2.00.

Roth Capital Partners and A.G.P./Alliance Global Partners are acting as exclusive lead placement agents for the Units offered in the United States and internationally (except Canada). Maison Placements is acting as exclusive placement agent for the Units offered in Canada.

The offering is expected to close on March 29, 2019 and is subject to customary closing conditions, including approvals from the TSX and the NYSE. The subscription by insiders is subject to shareholder approval at the Annual General Meeting of shareholders to be held on May 23, 2019.

The shares of common stock and warrants described above are being offered in the United States pursuant to an effective "shelf" registration statement (File No. 333-224476) that was filed with the Securities and Exchange Commission (the "SEC") and was declared effective by the SEC on July 6, 2018. The securities may be offered only by means of a prospectus. A prospectus supplement and the accompanying prospectus will be filed with the SEC. The prospectus supplement and accompanying prospectus, when filed, will be available on the SEC's website at http://www.sec.gov and may also be obtained from Roth Capital Partners at 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660, (800) 678-9147.

McEwen intends to file a Canadian MJDS prospectus supplement to the Canadian MJDS base shelf prospectus dated August 8, 2018 with respect to the offering in Canada.

ABOUT MCEWEN MINING

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of: the San Jose mine in Santa Cruz, Argentina (49% interest); the Black Fox mine in Timmins, Canada; the Fenix Project in Mexico; the Gold Bar mine in Nevada; and the large Los Azules copper project in Argentina, advancing towards development.

McEwen has approximately 346 million shares outstanding. Rob McEwen, Chairman and Chief Owner, owns 23% of the shares.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

McEwen terminates equity distribution agreement

2019-03-13 16:45 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING TERMINATES EQUITY DISTRIBUTION AGREEMENT

McEwen Mining Inc. has voluntarily terminated the equity distribution agreement entered into on Nov. 8, 2018. Under the equity distribution agreement, McEwen Mining could offer, from time to time, shares of its common stock having an aggregate offering price of up to $90-million. McEwen Mining provided notice to the sales agents of the termination of the equity distribution agreement on March 13, 2019, effective as of the close of business on March 13, 2019.

About McEwen Mining Inc.

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the Black Fox mine in Timmins, Canada, the Fenix project in Mexico, the Gold Bar mine in Nevada and the large Los Azules copper project in Argentina, advancing toward development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-13 16:45 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING TERMINATES EQUITY DISTRIBUTION AGREEMENT

McEwen Mining Inc. has voluntarily terminated the equity distribution agreement entered into on Nov. 8, 2018. Under the equity distribution agreement, McEwen Mining could offer, from time to time, shares of its common stock having an aggregate offering price of up to $90-million. McEwen Mining provided notice to the sales agents of the termination of the equity distribution agreement on March 13, 2019, effective as of the close of business on March 13, 2019.

About McEwen Mining Inc.

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the Black Fox mine in Timmins, Canada, the Fenix project in Mexico, the Gold Bar mine in Nevada and the large Los Azules copper project in Argentina, advancing toward development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

Die news ist hier eher die operating issues at Black fox und Gold bar als der halbe cent per share...

McEwen Mining suspends distribution

2019-03-07 06:20 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING SUSPENDS DISTRIBUTION

McEwen Mining Inc. has decided to suspend the distribution of one-half cent per share, which would have been paid on March 15 to shareholders of record on March 8, 2019.

"We have experienced operating issues at our Black Fox mine and with the start-up of our Gold Bar mine. While viewed as temporary, these issues have resulted in much lower revenue this quarter than planned. As a result, we decided the prudent and responsible course of action was to conserve our cash and suspend the distribution," said Rob McEwen, chairman and chief owner.

About McEwen Mining Inc.

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the Black Fox mine in Timmins, Canada, the Fenix project in Mexico, the Gold Bar mine in Nevada and the large Los Azules copper project in Argentina, advancing toward development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

2019-03-07 06:20 ET - News Release

Mr. Rob McEwen reports

MCEWEN MINING SUSPENDS DISTRIBUTION

McEwen Mining Inc. has decided to suspend the distribution of one-half cent per share, which would have been paid on March 15 to shareholders of record on March 8, 2019.

"We have experienced operating issues at our Black Fox mine and with the start-up of our Gold Bar mine. While viewed as temporary, these issues have resulted in much lower revenue this quarter than planned. As a result, we decided the prudent and responsible course of action was to conserve our cash and suspend the distribution," said Rob McEwen, chairman and chief owner.

About McEwen Mining Inc.

McEwen has the goal to qualify for inclusion in the S&P 500 Index by creating a profitable gold and silver producer focused in the Americas. McEwen's principal assets consist of the San Jose mine in Santa Cruz, Argentina (49-per-cent interest), the Black Fox mine in Timmins, Canada, the Fenix project in Mexico, the Gold Bar mine in Nevada and the large Los Azules copper project in Argentina, advancing toward development.

We seek Safe Harbor.

© 2019 Canjex Publishing Ltd. All rights reserved.

Mir kann das, dass das Gold steigt, nur recht sein.

Gold: Rekord-Ziel bei 3.600 US-Dollar?

Lars Erichsen berichtet heute darüber. Momentan sehen wir eine Rekordnachfrage bei Gold-ETFs. Wieso ich mir vorstellen kann, dass sich Gold im Preis vielleicht verdreifacht, Silber sogar vervielfacht, das möchte ich dir in diesem Video erläutern.

Gold: Rekord-Ziel bei 3.600 US-Dollar?

Lars Erichsen berichtet heute darüber. Momentan sehen wir eine Rekordnachfrage bei Gold-ETFs. Wieso ich mir vorstellen kann, dass sich Gold im Preis vielleicht verdreifacht, Silber sogar vervielfacht, das möchte ich dir in diesem Video erläutern.

Rob gibt hier Auskunft über den weiteren Weg des Unternehmens. Hört es euch an oder liest es wenigstens.

McEwen Mining Inc. (MUX) CEO Robert McEwen on Q4 2018 Results - Earnings Call TranscriptFeb. 21, 2019 6:18 PM ET|

11 comments

|

About: McEwen Mining Inc. (MUX)

FY: 02-21-19 Earnings Summary

Subscribers Only

Earning Call Audio

McEwen Mining Inc. (NYSE:MUX) Q4 2018 Earnings Conference Call February 21, 2019 11:00 AM ET

Company Participants

Robert McEwen - Executive Chairman and Chief Owner

Chris Stewart - President and Chief Operating Officer

Sylvain Guerard - Senior Vice President, Exploration

Andrew Elinesky - Chief Financial Officer

Conference Call Participants

Jake Sekelsky - Roth Capital Partners

Heiko Ihle - H.C. Wainright & Co

Michael Kozak - Cantor Fitzgerald Canada Corporation

Bhakti Pavani - Alliance Global Partners

Bill Powers - Private Investor

Operator

Good morning, ladies and gentlemen, and welcome to the McEwen Mining 2018 Full Year and Q4 Conference Call. I will now hand the call over to Rob McEwen, Chief Owner.

Robert McEwen

Thank you, operator. Good morning, ladies and gentlemen. Welcome fellow shareowners. 2018 was a milestone year for McEwen Mining. And with me today to tell you about last year and provide guidance for this year are: Chris Stewart, President and Chief Operating Officer; Sylvain Guerard, Senior Vice President - Exploration; and Andrew Elinesky, Chief Financial Officer.

The 2018 milestones were numerous. Record production growth, we produced a record 175,640 ounces of gold equivalent, which was a 15% improvement over 2017. In addition, we generated $51 million in earnings from operations. There was an emphasis on exploration. We had our largest exploration budget ever, a total of $35 million that resulted in mine life extension in Nevada at our Gold Bar Mine, and in Timmins it generated much enthusiasm with numerous new targets and increased resources on our Black Fox properties.

We built a new mine. Just before the start of 2018, we received government permits to construct and operate our new Gold Bar Mine and work began immediately. By the end of 2018, we had spent $72 million or 89% of budget. Speaking of budget, we are pleased to say we are on budget. We reported our first gold ingot just last week.

https://seekingalpha.com/article/4243107-mcewen-mining-inc-m…