Baker Hughes (Seite 3)

eröffnet am 27.01.17 18:32:09 von

neuester Beitrag 04.11.23 12:48:23 von

neuester Beitrag 04.11.23 12:48:23 von

Beiträge: 76

ID: 1.245.675

ID: 1.245.675

Aufrufe heute: 1

Gesamt: 4.468

Gesamt: 4.468

Aktive User: 0

ISIN: US05722G1004 · WKN: A2DUAY · Symbol: BKR

33,22

USD

+1,16 %

+0,38 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

| Baker Hughes Company Registered (A) Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

29.04.24 · Accesswire |

18.03.24 · Accesswire |

16.03.24 · wO Chartvergleich |

19.02.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 17,580 | +20,00 | |

| 1,3450 | +13,26 | |

| 3,4900 | +10,44 | |

| 4,7200 | +10,28 | |

| 1,1000 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,6800 | -8,99 | |

| 4,6700 | -10,19 | |

| 0,6100 | -10,95 | |

| 1,3501 | -20,58 | |

| 0,8220 | -38,66 |

Beitrag zu dieser Diskussion schreiben

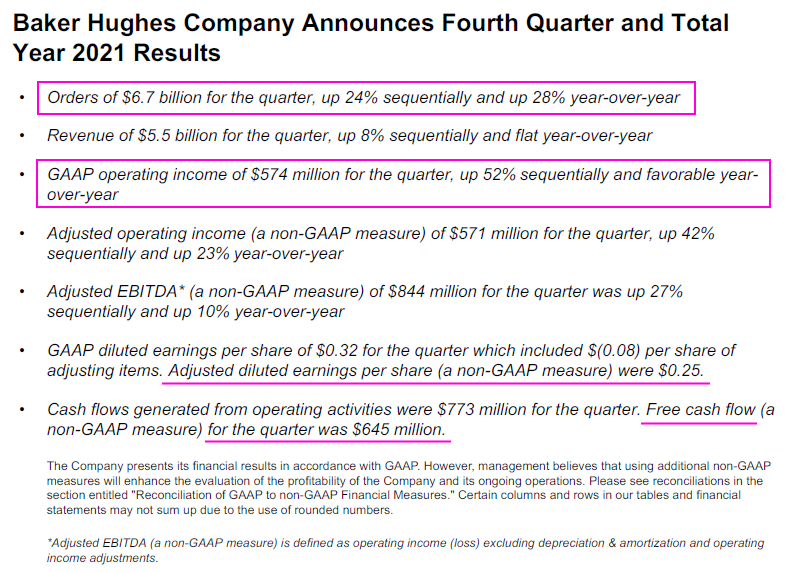

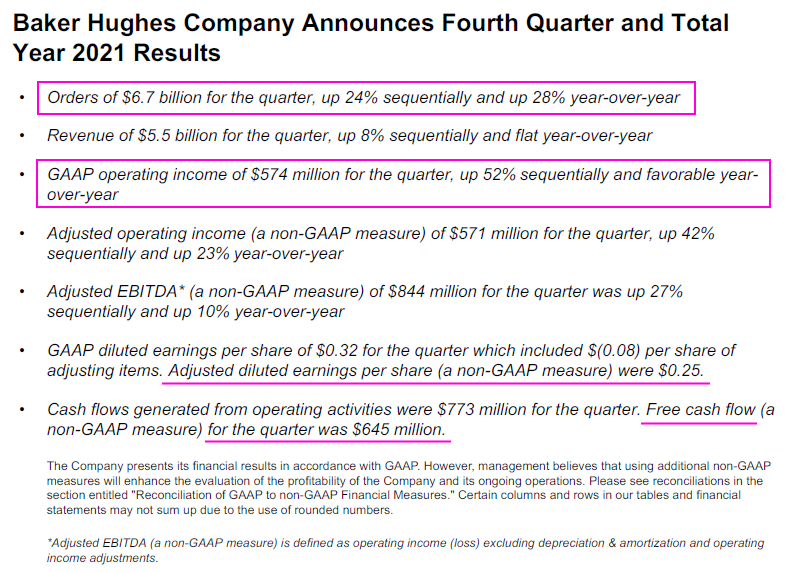

Antwort auf Beitrag Nr.: 70.547.624 von faultcode am 18.01.22 17:14:08https://investors.bakerhughes.com/news-releases/news-release…

...

“We are pleased with our fourth quarter results as we generated another quarter of strong free cash flow, solid margin rate improvement, and strong orders from TPS. For the full year, we were pleased with our performance and took several important steps to accelerate our strategy and help position the Company for the future.

Overall, 2021 proved to be successful on many fronts for Baker Hughes, with key commercial successes and developments in the LNG and new energy markets, as well as record cash flow from operations and free cash flow, and peer-leading capital allocation. I would like to thank our

employees for their hard work and commitment to achieve our goals, deliver for our customers and move the Company forward.” said Lorenzo Simonelli, Baker Hughes chairman and chief executive officer.

“As we look ahead to 2022, we expect the pace of global economic growth to remain strong although slightly moderate compared to 2021. We believe the broader macro recovery should translate into rising energy demand for 2022 and relatively tight supplies for oil and natural gas, providing an attractive investment environment for our customers and a strong tailwind for many of our product companies."

“We are very excited with the strategic direction of Baker Hughes and believe the Company is wellpositioned to capitalize on near-term cyclical recovery and for long-term change in the energy and industrial markets. We look forward to another year of supporting our customers, continuing to advance our strategy, and delivering for shareholders in 2022,” concluded Simonelli.

...

...

“We are pleased with our fourth quarter results as we generated another quarter of strong free cash flow, solid margin rate improvement, and strong orders from TPS. For the full year, we were pleased with our performance and took several important steps to accelerate our strategy and help position the Company for the future.

Overall, 2021 proved to be successful on many fronts for Baker Hughes, with key commercial successes and developments in the LNG and new energy markets, as well as record cash flow from operations and free cash flow, and peer-leading capital allocation. I would like to thank our

employees for their hard work and commitment to achieve our goals, deliver for our customers and move the Company forward.” said Lorenzo Simonelli, Baker Hughes chairman and chief executive officer.

“As we look ahead to 2022, we expect the pace of global economic growth to remain strong although slightly moderate compared to 2021. We believe the broader macro recovery should translate into rising energy demand for 2022 and relatively tight supplies for oil and natural gas, providing an attractive investment environment for our customers and a strong tailwind for many of our product companies."

“We are very excited with the strategic direction of Baker Hughes and believe the Company is wellpositioned to capitalize on near-term cyclical recovery and for long-term change in the energy and industrial markets. We look forward to another year of supporting our customers, continuing to advance our strategy, and delivering for shareholders in 2022,” concluded Simonelli.

...

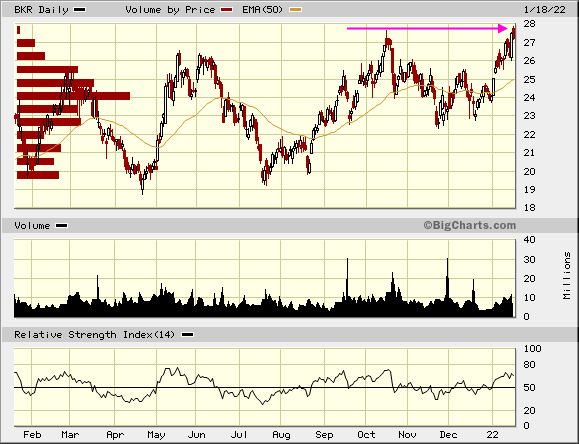

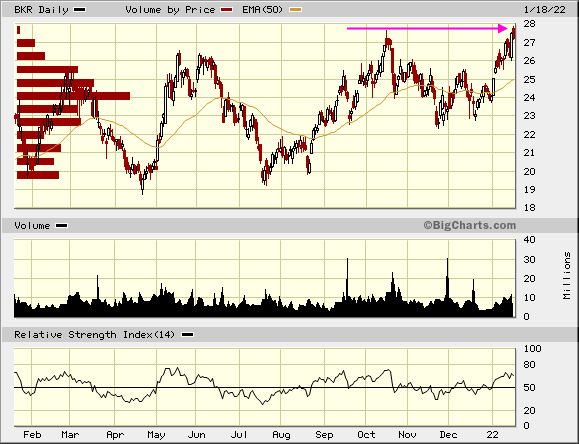

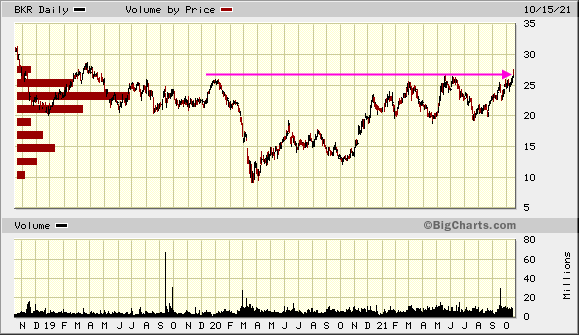

Antwort auf Beitrag Nr.: 69.613.014 von faultcode am 15.10.21 22:48:39$BKR ist dabei die nächste Stufe nach oben zu nehmen:

13.9.

Baker Hughes CEO Says Remaining One Company Still Makes Sense

https://www.bnnbloomberg.ca/baker-hughes-ceo-says-remaining-…

...

Baker Hughes Co. outperformed its biggest oilfield services rivals last week after raising the question of splitting itself up, but its CEO says it still makes sense to keep it as one company.

The world’s no. 2 oilfield contractor by market value is focusing on a second major source of business which it calls industrial energy technology, Chief Executive Officer Lorenzo Simonelli said Sept. 8 on an investor webcast for a Barclays Plc virtual conference. The new business is being driven by liquefied natural gas, energy transition work and industrial asset management.

The company sees its bread and butter oilfield services and equipment businesses likely maturing over the medium to long term, while growth prospects for industrial energy technology look increasingly attractive over the near and long term horizon, Simonelli said.

“With this evolution, you may ask whether it makes sense to keep the company together; we believe the answer today is ‘yes,’” Simonelli said. “However, the energy markets are clearly moving quickly and we will continue to evaluate the best corporate structure for Baker Hughes as we execute on our strategy.”

Potentially splitting up the company was a key driver in the company’s stock performance last week, Paul Sankey, a veteran oil-industry analyst and founder of Sankey Research LLC, said Sunday in a note to investors.

...

Baker Hughes CEO Says Remaining One Company Still Makes Sense

https://www.bnnbloomberg.ca/baker-hughes-ceo-says-remaining-…

...

Baker Hughes Co. outperformed its biggest oilfield services rivals last week after raising the question of splitting itself up, but its CEO says it still makes sense to keep it as one company.

The world’s no. 2 oilfield contractor by market value is focusing on a second major source of business which it calls industrial energy technology, Chief Executive Officer Lorenzo Simonelli said Sept. 8 on an investor webcast for a Barclays Plc virtual conference. The new business is being driven by liquefied natural gas, energy transition work and industrial asset management.

The company sees its bread and butter oilfield services and equipment businesses likely maturing over the medium to long term, while growth prospects for industrial energy technology look increasingly attractive over the near and long term horizon, Simonelli said.

“With this evolution, you may ask whether it makes sense to keep the company together; we believe the answer today is ‘yes,’” Simonelli said. “However, the energy markets are clearly moving quickly and we will continue to evaluate the best corporate structure for Baker Hughes as we execute on our strategy.”

Potentially splitting up the company was a key driver in the company’s stock performance last week, Paul Sankey, a veteran oil-industry analyst and founder of Sankey Research LLC, said Sunday in a note to investors.

...

Antwort auf Beitrag Nr.: 68.372.420 von faultcode am 01.06.21 20:38:2621.7.

Baker Hughes Company Announces Second Quarter 2021 Results

https://finance.yahoo.com/news/baker-hughes-company-announce…

...

• Orders of $5.1 billion for the quarter, up 12% sequentially and up 4% year-over-year.

• Revenue of $5.1 billion for the quarter, up 8% sequentially and up 9% year-over-year.

• GAAP operating income of $194 million for the quarter, up 18% sequentially and favorable year-over-year.

• Adjusted operating income (a non-GAAP measure) of $333 million for the quarter was up 23% sequentially and favorable year-over-year.

• Adjusted EBITDA* (a non-GAAP measure) of $611 million for the quarter was up 9% sequentially and up 38% year-over-year.

• GAAP loss per share of $(0.08) for the quarter which included $0.18 per share of adjusting items. Adjusted earnings per share (a non-GAAP measure) was $0.10.

• Cash flows generated from operating activities were $506 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $385 million.

...

Baker Hughes Company Announces Second Quarter 2021 Results

https://finance.yahoo.com/news/baker-hughes-company-announce…

...

• Orders of $5.1 billion for the quarter, up 12% sequentially and up 4% year-over-year.

• Revenue of $5.1 billion for the quarter, up 8% sequentially and up 9% year-over-year.

• GAAP operating income of $194 million for the quarter, up 18% sequentially and favorable year-over-year.

• Adjusted operating income (a non-GAAP measure) of $333 million for the quarter was up 23% sequentially and favorable year-over-year.

• Adjusted EBITDA* (a non-GAAP measure) of $611 million for the quarter was up 9% sequentially and up 38% year-over-year.

• GAAP loss per share of $(0.08) for the quarter which included $0.18 per share of adjusting items. Adjusted earnings per share (a non-GAAP measure) was $0.10.

• Cash flows generated from operating activities were $506 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $385 million.

...

Antwort auf Beitrag Nr.: 68.221.402 von faultcode am 17.05.21 21:55:00...

...

1.6.

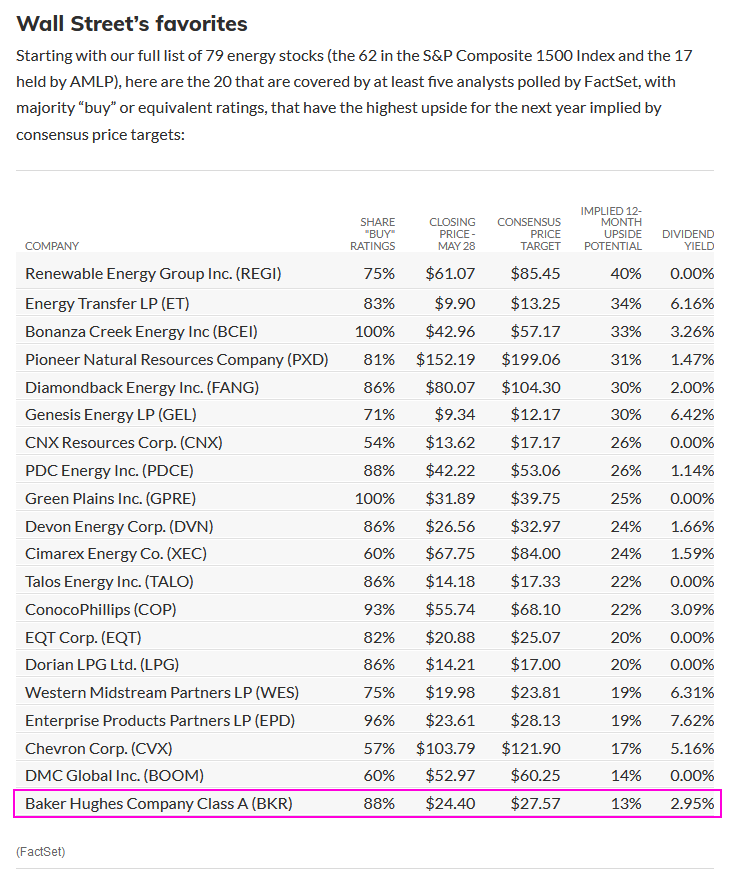

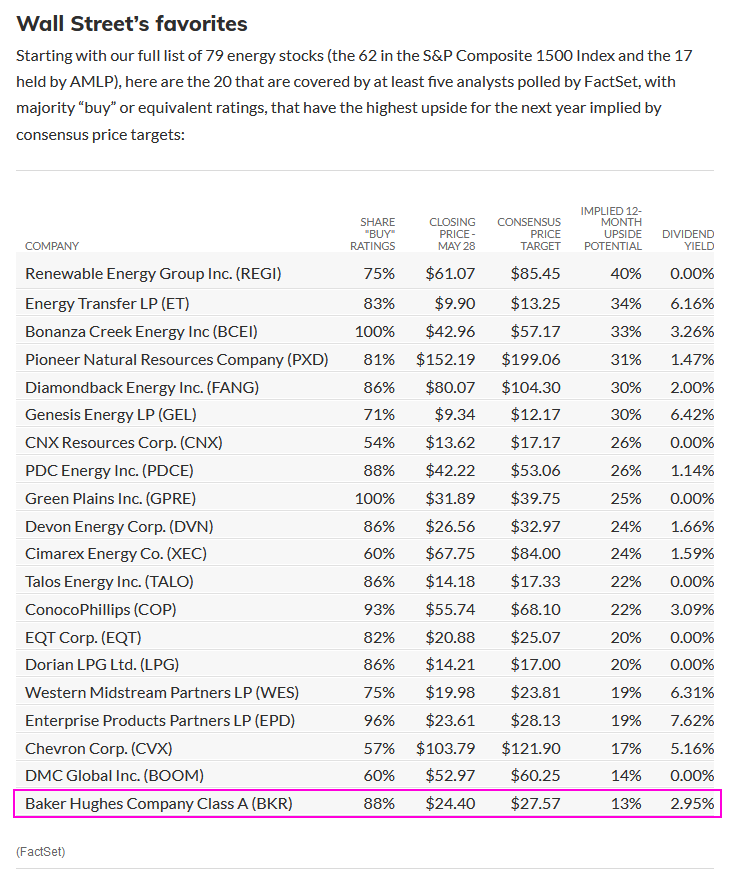

Want to get in on hot energy stocks? Wall Street favors these 20 picks for gains up to 40%

The energy sector is the best performer of 2021, and it still has a long way to go to make up for years of big declines.

https://www.marketwatch.com/story/want-to-get-in-on-hot-ener…

...

1.6.

Want to get in on hot energy stocks? Wall Street favors these 20 picks for gains up to 40%

The energy sector is the best performer of 2021, and it still has a long way to go to make up for years of big declines.

https://www.marketwatch.com/story/want-to-get-in-on-hot-ener…

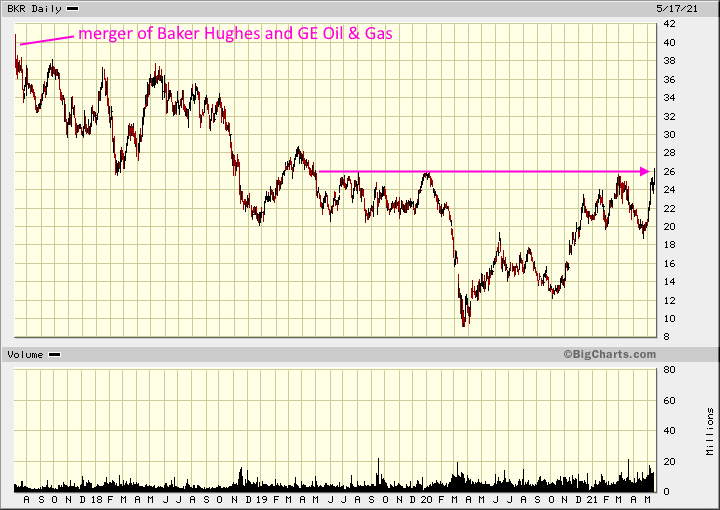

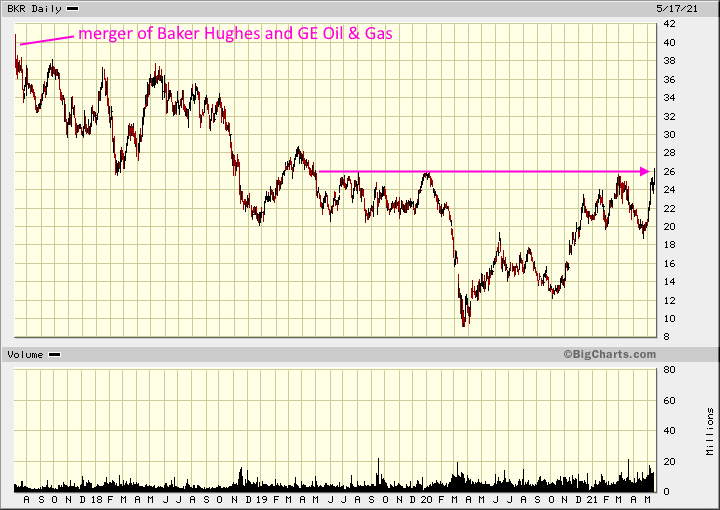

Antwort auf Beitrag Nr.: 68.110.421 von faultcode am 07.05.21 22:23:08Chart seit dem Merger von Baker Hughes und GE Oil & Gas:

S&P 500 Top 5 heute

S&P 500 Top 5 heute

Antwort auf Beitrag Nr.: 68.037.929 von faultcode am 04.05.21 01:18:45BKR mit einem Monster-Tag: Top 5 im SP500: +6.76%

Antwort auf Beitrag Nr.: 67.897.685 von faultcode am 21.04.21 14:43:59

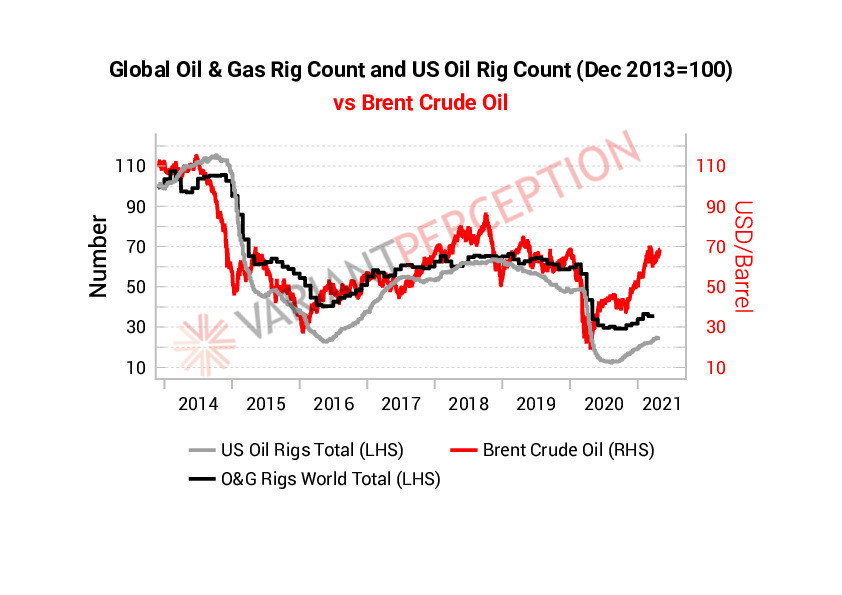

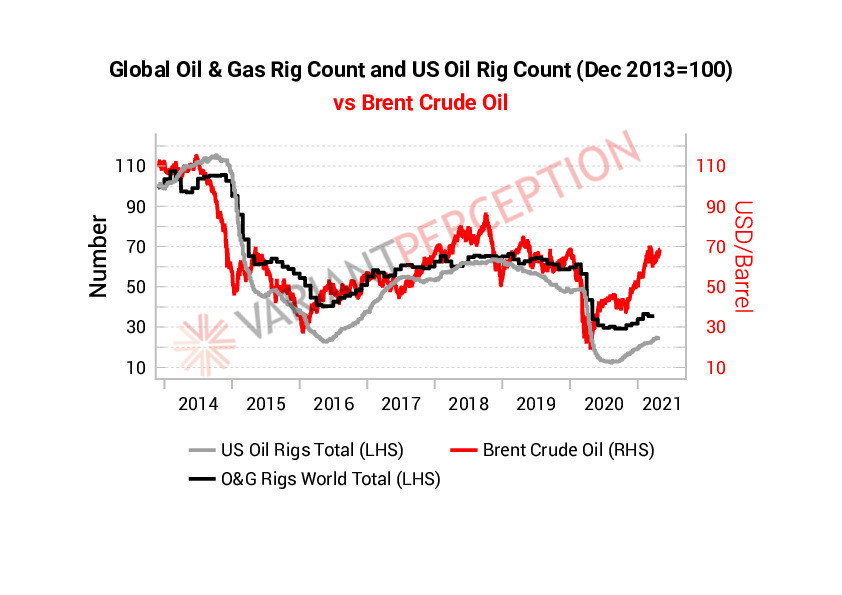

https://twitter.com/VrntPerception/status/138923504549641420…

https://twitter.com/VrntPerception/status/138923504549641420…

21.4.

Baker Hughes tops profit expectations but falls shy on revenue, amid weakness in oilfield services and equipment

https://www.marketwatch.com/story/baker-hughes-tops-profit-e…

Baker Hughes Co. reported Wednesday a first-quarter loss but an adjusted profit that beat expectations, while revenue fell just shy of forecasts as oilfield services and equipment revenue dropped 30%.

The net loss narrowed to $452 million, or 61 cents a share, from $10.23 billion, or $15.66 a share, in the same period a year ago, which included asset impairment and restructuring charges.

Excluding nonrecurring items, adjusted earnings per share rose to 12 cents from 11 cents, topping the FactSet consensus of 11 cents. Revenue fell 12% to $4.78 billion, just below the FactSet consensus of $4.80 billion. Oilfield services revenue dropped 30% to $2.20 billion to miss the FactSet consensus of $2.26 billion, and oilfield equipment revenue surprisingly declined 30% to $345 million compared with expectations for a rise to $658.7 million.

Free cash flow improved to $498 million from $152 million.

""As we look ahead to the rest of 2021, we remain cautiously optimistic that the global economy and oil demand will recover from the impact of the global pandemic," said Chief Executive Lorenzo Simonelli. "We expect spending and activity levels to gain momentum through the year as the macro environment improves, likely setting up the industry for stronger growth in 2022."

...

Baker Hughes tops profit expectations but falls shy on revenue, amid weakness in oilfield services and equipment

https://www.marketwatch.com/story/baker-hughes-tops-profit-e…

Baker Hughes Co. reported Wednesday a first-quarter loss but an adjusted profit that beat expectations, while revenue fell just shy of forecasts as oilfield services and equipment revenue dropped 30%.

The net loss narrowed to $452 million, or 61 cents a share, from $10.23 billion, or $15.66 a share, in the same period a year ago, which included asset impairment and restructuring charges.

Excluding nonrecurring items, adjusted earnings per share rose to 12 cents from 11 cents, topping the FactSet consensus of 11 cents. Revenue fell 12% to $4.78 billion, just below the FactSet consensus of $4.80 billion. Oilfield services revenue dropped 30% to $2.20 billion to miss the FactSet consensus of $2.26 billion, and oilfield equipment revenue surprisingly declined 30% to $345 million compared with expectations for a rise to $658.7 million.

Free cash flow improved to $498 million from $152 million.

""As we look ahead to the rest of 2021, we remain cautiously optimistic that the global economy and oil demand will recover from the impact of the global pandemic," said Chief Executive Lorenzo Simonelli. "We expect spending and activity levels to gain momentum through the year as the macro environment improves, likely setting up the industry for stronger growth in 2022."

...

16.03.24 · wO Chartvergleich · Adobe |

24.01.24 · wO Newsflash · Abbott Laboratories |

18.11.23 · wO Chartvergleich · ABB |