Baker Hughes (Seite 6)

eröffnet am 27.01.17 18:32:09 von

neuester Beitrag 04.11.23 12:48:23 von

neuester Beitrag 04.11.23 12:48:23 von

Beiträge: 76

ID: 1.245.675

ID: 1.245.675

Aufrufe heute: 1

Gesamt: 4.468

Gesamt: 4.468

Aktive User: 0

ISIN: US05722G1004 · WKN: A2DUAY · Symbol: 68V

30,97

EUR

+0,90 %

+0,28 EUR

Letzter Kurs 29.04.24 Tradegate

Neuigkeiten

| Baker Hughes Company Registered (A) Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

29.04.24 · Accesswire |

18.03.24 · Accesswire |

16.03.24 · wO Chartvergleich |

19.02.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,046 | +27,24 | |

| 2,049 | +26,56 | |

| 2,030 | +25,77 | |

| 2,040 | +24,54 | |

| 42,40 | +20,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,689 | -7,57 | |

| 20,030 | -7,61 | |

| 107,90 | -7,62 | |

| 101,30 | -9,43 | |

| 4,6700 | -10,19 |

Beitrag zu dieser Diskussion schreiben

Buyout firm Arcline Investment to buy Baker Hughes unit --> Kolbenkompressoren im Verkauf

18.7.https://finance.yahoo.com/news/buyout-firm-arcline-investmen…

=>

...Arcline Investment Management, a U.S. private equity firm founded by former Golden Gate dealmaker Rajeev Amara, said on Thursday it would buy a unit of Baker Hughes, General Electric Co's oil-servicing subsidiary.

The deal comes after Arcline said in March it had raised $1.5 billion for a fund targeted at buying small to midsize industrial businesses, which the company defines as companies with less than $1 billion in revenue.

Arcline has agreed to acquire Baker Hughes' reciprocating comprehension division, which makes and services industrial engines and compressors built into natural gas pipelines operated by oil and gas companies.

Arcline said it plans to "aggressively invest" in the unit's "long standing, loyal employee base so that they can support every brand of our equipment operating in the field.

Terms of the deal were not disclosed....

=> also so was: Reciprocating compressor == Kolbenkompressor

https://www.bhge.com/reciprocating-compressors

vom Wettbewerb:

Schlumberger shares rise premarket after revenue tops estimates

https://www.marketwatch.com/story/schlumberger-shares-rise-p…

=>

..."Looking forward to 2019, we expect a more positive supply- and demand-balance sentiment to lead to a gradual recovery in the price of oil over the course of the year, as the OPEC and Russia cuts take full effect; the effect of lower activity in North America land in the second half of 2018 impacts production growth; the dispensations from the Iran export sanctions expire and are not renewed; and as the US and China continue to work toward a solution to their ongoing trade dispute," Chief Executive Paal Kibsgaard said in a statement...

Schlumberger shares rise premarket after revenue tops estimates

https://www.marketwatch.com/story/schlumberger-shares-rise-p…

=>

..."Looking forward to 2019, we expect a more positive supply- and demand-balance sentiment to lead to a gradual recovery in the price of oil over the course of the year, as the OPEC and Russia cuts take full effect; the effect of lower activity in North America land in the second half of 2018 impacts production growth; the dispensations from the Iran export sanctions expire and are not renewed; and as the US and China continue to work toward a solution to their ongoing trade dispute," Chief Executive Paal Kibsgaard said in a statement...

Antwort auf Beitrag Nr.: 59.213.056 von faultcode am 14.11.18 15:48:172.Tranche......

Antwort auf Beitrag Nr.: 59.212.765 von faultcode am 14.11.18 15:20:18kein '$'-Zeichen im Header --> das mag das System nicht

=> nach Open immer noch >USD23.00

=> also mal (gut) abwarten -- nicht teurer kaufen als die Wall Street

=> auch damit bliebe ein P/B von so USD23.00/~USD12.5|30.9. = ~1.84

--> das ist bei einem Debt-to-EBITDA > 3 auch nicht gerade geschenkt

=> mit anderen Worten, das First offering seinerzeit im Juli 2017 war viel zu teuer!

=> das Problem mit dem Zusatz "a GE company" wird auch nicht so schnell verschwinden, da nun ein Makel geworden

=> nach Open immer noch >USD23.00

=> also mal (gut) abwarten -- nicht teurer kaufen als die Wall Street

=> auch damit bliebe ein P/B von so USD23.00/~USD12.5|30.9. = ~1.84

--> das ist bei einem Debt-to-EBITDA > 3 auch nicht gerade geschenkt

=> mit anderen Worten, das First offering seinerzeit im Juli 2017 war viel zu teuer!

=> das Problem mit dem Zusatz "a GE company" wird auch nicht so schnell verschwinden, da nun ein Makel geworden

Antwort auf Beitrag Nr.: 59.205.988 von faultcode am 13.11.18 15:22:27

=>

Baker Hughes, a GE company (BHGE) announced the pricing of a secondary offering of 92M shares of BHGE common stock by General Electric (GE) at a price to the public of $23.00 per share.

The stock closed yesterday at $23.80. The underwriters have a 30 day option to purchase up to an additional 9.2M shares of common stock from the selling stockholder. The offering is expected to close on November 16.

On November 5, Baker Hughes declared a cash dividend of 18c per share of, payable on November 30, to holders of record on November 16. If the offering closes on November 16 as expected, purchasers of shares in this offering will be entitled to receive this dividend, the company said. BHGE is not offering any shares in the offering and will not receive any proceeds from the sale of shares in the offering...

Baker Hughes 92M share secondary offering by GE prices at .00

https://thefly.com/landingPageNews.php?id=2823637=>

Baker Hughes, a GE company (BHGE) announced the pricing of a secondary offering of 92M shares of BHGE common stock by General Electric (GE) at a price to the public of $23.00 per share.

The stock closed yesterday at $23.80. The underwriters have a 30 day option to purchase up to an additional 9.2M shares of common stock from the selling stockholder. The offering is expected to close on November 16.

On November 5, Baker Hughes declared a cash dividend of 18c per share of, payable on November 30, to holders of record on November 16. If the offering closes on November 16 as expected, purchasers of shares in this offering will be entitled to receive this dividend, the company said. BHGE is not offering any shares in the offering and will not receive any proceeds from the sale of shares in the offering...

Antwort auf Beitrag Nr.: 59.205.076 von faultcode am 13.11.18 13:50:16

=>

...Der US-Konzern will aber weiterhin eine Mehrheit an der Tochter halten.

Wie GE mitteilte, sollen bis zu 20 Prozent an Baker Hughes verkauft werden. Demnach plant der Konzern über eine Zweitplatzierung den Verkauf von bis zu 101 Millionen Baker-Hughes-Aktien. Der Ölfeldienstleister wolle davon rund 65 Millionen Anteile selbst übernehmen. Auf Basis des Schlusskurses der Aktie von Baker Hughes am Montag bei 23,64 Dollar ergibt sich ein Gesamtvolumen von rund 4 Milliarden Dollar.

GE darf sich bis Juli 2019 nicht von seinem Anteil an Baker Hughes trennen. Nach dem nun angekündigten Verkauf würde der angeschlagene US-Konzern noch eine Beteiligung von mehr als 50 Prozent halten...

=> pre market freundlich, wie die US Futures, aber nichts Dolles mit ~+0.5%

General Electric reduziert Beteiligung an Baker Hughes

https://www.finanzen.net/nachricht/aktien/mehrheit-halten-ge…=>

...Der US-Konzern will aber weiterhin eine Mehrheit an der Tochter halten.

Wie GE mitteilte, sollen bis zu 20 Prozent an Baker Hughes verkauft werden. Demnach plant der Konzern über eine Zweitplatzierung den Verkauf von bis zu 101 Millionen Baker-Hughes-Aktien. Der Ölfeldienstleister wolle davon rund 65 Millionen Anteile selbst übernehmen. Auf Basis des Schlusskurses der Aktie von Baker Hughes am Montag bei 23,64 Dollar ergibt sich ein Gesamtvolumen von rund 4 Milliarden Dollar.

GE darf sich bis Juli 2019 nicht von seinem Anteil an Baker Hughes trennen. Nach dem nun angekündigten Verkauf würde der angeschlagene US-Konzern noch eine Beteiligung von mehr als 50 Prozent halten...

=> pre market freundlich, wie die US Futures, aber nichts Dolles mit ~+0.5%

GE and Baker Hughes amend agreements, including reduced BHGE payments to GE over time

Published: Nov 13, 2018 7:41 a.m. EThttps://www.marketwatch.com/story/ge-and-baker-hughes-amend-…

=>

...Baker Hughes, a GE company and General Electric Co. announced Tuesday a number of long-term agreements, including a reduction in Baker Hughes payments to GE, a collaboration on critical rotating equipment and creating a joint venture to provide aeroderivative engine services.

GE's stock rallied 1.6% in premarket trade, after tumbling 12% the past two sessions to close Monday at a 9 1/2-year low. Baker Hughes shares dropped 2.7% premarket after falling 12% the previous two sessions.

The rotating equipment deal will include aeroderivative and heavy-duty gas turbine technology, while the JV will serve the oil and gas and industrial markets. GE has recently had issues with an H-frame gas turbine blade, which forced a shutdown of an Exelon Corp. facility.

Separately, Baker Hughes will have access to GE Digital software and technology, the companies have agreed to maintain current operations and pricing levels within Baker Hughes' Control product line, GE will transfer certain U.K. pension liabilities to Baker Hughes, and the intercompany services fee that Baker Hughes pays to GE will be reduced over time beginning next year....

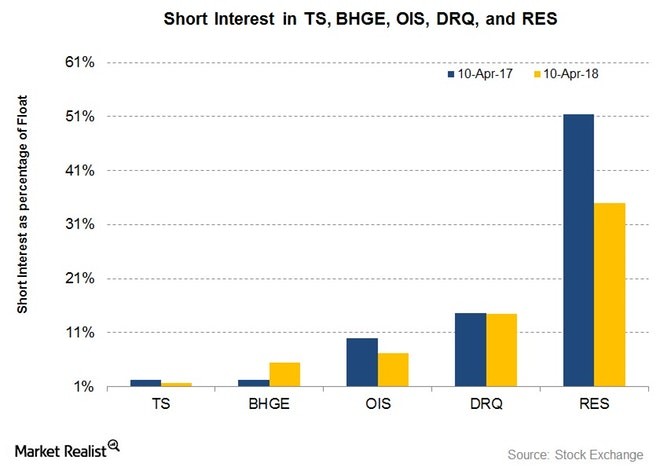

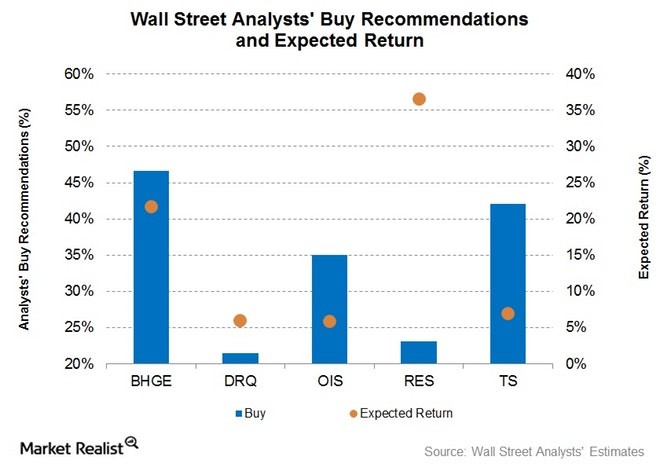

Comparing Oilfield Companies' Short Interest etc.

https://marketrealist.com/2018/04/analysts-views-on-the-lowe…=>

BHGE = Baker Hughes, a GE company

DRQ = Dril-Quip

OIS = Oil States International Inc.

RES = RPC Inc.

TS = Tenaris S.A.

KPMG

zum Annual Meeting habe ich bei Frage:The ratification of KPMG LLP as the Company's independent registered public accounting firm for fiscal year 2018.

mit Nein gestimmt. Siehe hier warum: https://www.wallstreet-online.de/diskussion/1124559-2671-268…

--> was kann der "kleine Mann" sonst auch machen?

Baker Hughes, GE sign contract with Iraq to process natural gas at two fields

https://finance.yahoo.com/news/baker-hughes-ge-sign-contract…BAGHDAD, April 2 (Reuters) - Baker Hughes and General Electric signed a contract with Iraq's government on Monday to process natural gas extracted alongside crude oil at two fields in southern Iraq, the oil ministry said.

The plan was first announced by GE last July and is part of Iraq's efforts to stop flaring gas associated with oil by 2021. Iraq continues to flare some of this gas because it lacks the facilities to process it into fuel for local consumption or exports.

Gas flaring costs nearly $2.5 billion in lost revenue for the government and would be sufficient to meet most of needs for gas‐based power generation, according to the World Bank...

16.03.24 · wO Chartvergleich · Adobe |

24.01.24 · wO Newsflash · Abbott Laboratories |

18.11.23 · wO Chartvergleich · ABB |