Baker Hughes (Seite 5)

eröffnet am 27.01.17 18:32:09 von

neuester Beitrag 04.11.23 12:48:23 von

neuester Beitrag 04.11.23 12:48:23 von

Beiträge: 76

ID: 1.245.675

ID: 1.245.675

Aufrufe heute: 1

Gesamt: 4.468

Gesamt: 4.468

Aktive User: 0

ISIN: US05722G1004 · WKN: A2DUAY · Symbol: 68V

30,97

EUR

+0,90 %

+0,28 EUR

Letzter Kurs 29.04.24 Tradegate

Neuigkeiten

| Baker Hughes Company Registered (A) Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

29.04.24 · Accesswire |

18.03.24 · Accesswire |

16.03.24 · wO Chartvergleich |

19.02.24 · Accesswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,046 | +27,24 | |

| 2,049 | +26,56 | |

| 2,030 | +25,77 | |

| 2,040 | +24,54 | |

| 42,40 | +20,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 20,030 | -7,61 | |

| 107,90 | -7,62 | |

| 101,30 | -9,43 | |

| 4,6700 | -10,19 | |

| 0,8220 | -38,66 |

Beitrag zu dieser Diskussion schreiben

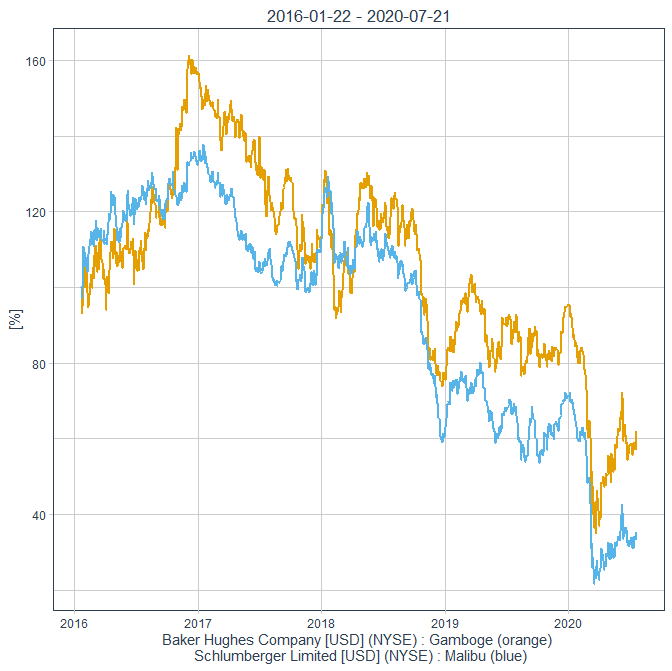

Antwort auf Beitrag Nr.: 64.505.709 von faultcode am 22.07.20 16:01:32Baker Hughes hielt sich bisher besser als Schlumberger:

Total return kann ich nichts sagen, aber z.Z. ist die Forward-Div.-Rendite besser bei Baker Hughes

Total return kann ich nichts sagen, aber z.Z. ist die Forward-Div.-Rendite besser bei Baker Hughes

22.7.

..

Baker Hughes Co <BKR.N> posted its second consecutive quarterly loss on Wednesday and said it would continue to rein in costs in preparation for a longer period of volatility in oil prices.

Oil producers halted the drilling of new wells and drastically cut their budgets following a collapse in crude oil prices in March and April that clipped demand for services offered by Baker Hughes and rivals Schlumberger <SLB.N> and Halliburton <HAL.N>.

Revenue from Baker Hughes' oilfield services business, which accounts for about half of total sales, tumbled 26% to $2.41 billion in the second quarter. Total revenue fell 21% to $4.74 billion.

U.S. crude futures were trading around $41 per barrel on Wednesday, at the lower end of what most producers need to be profitable.

Some smaller oilfield service firms have filed for bankruptcy since the oil price crash, including fracker BJ Services, in which Baker Hughes holds a minority interest.

Baker Hughes has cut its 2020 budget by over 20% year-on-year and disclosed plans to exit or shut down non-core product lines, including North American full-service drilling and completions fluids business.

"We are preparing for potential future volatility, while also focusing on structurally reducing our cost base," Chief Executive Lorenzo Simonelli said, pointing to the risks from a second wave of coronavirus cases and high unemployment that could lead to economic uncertainty.

Net loss attributable to the company widened to $201 million, or 31 cents per share, in the second quarter, from a loss of $9 million, or 2 cents per share, a year earlier.

The quarter included an income-tax gain of $75 million related to the federal pandemic-linked CARES Act for aid and relief.

Excluding charges, Baker Hughes lost 5 cents per share, worse than analysts' average expectation of 1 cent, according to Refinitiv IBES data.

...

Baker Hughes posts second quarterly loss as oil slump slams demand

https://finance.yahoo.com/news/baker-hughes-posts-second-str…

..

Baker Hughes Co <BKR.N> posted its second consecutive quarterly loss on Wednesday and said it would continue to rein in costs in preparation for a longer period of volatility in oil prices.

Oil producers halted the drilling of new wells and drastically cut their budgets following a collapse in crude oil prices in March and April that clipped demand for services offered by Baker Hughes and rivals Schlumberger <SLB.N> and Halliburton <HAL.N>.

Revenue from Baker Hughes' oilfield services business, which accounts for about half of total sales, tumbled 26% to $2.41 billion in the second quarter. Total revenue fell 21% to $4.74 billion.

U.S. crude futures were trading around $41 per barrel on Wednesday, at the lower end of what most producers need to be profitable.

Some smaller oilfield service firms have filed for bankruptcy since the oil price crash, including fracker BJ Services, in which Baker Hughes holds a minority interest.

Baker Hughes has cut its 2020 budget by over 20% year-on-year and disclosed plans to exit or shut down non-core product lines, including North American full-service drilling and completions fluids business.

"We are preparing for potential future volatility, while also focusing on structurally reducing our cost base," Chief Executive Lorenzo Simonelli said, pointing to the risks from a second wave of coronavirus cases and high unemployment that could lead to economic uncertainty.

Net loss attributable to the company widened to $201 million, or 31 cents per share, in the second quarter, from a loss of $9 million, or 2 cents per share, a year earlier.

The quarter included an income-tax gain of $75 million related to the federal pandemic-linked CARES Act for aid and relief.

Excluding charges, Baker Hughes lost 5 cents per share, worse than analysts' average expectation of 1 cent, according to Refinitiv IBES data.

...

Baker Hughes posts second quarterly loss as oil slump slams demand

https://finance.yahoo.com/news/baker-hughes-posts-second-str…

Antwort auf Beitrag Nr.: 63.312.112 von faultcode am 13.04.20 14:45:0022.4.

Baker Hughes Cutting Jobs, Spending After Oil Prices Plunge

https://www.wsj.com/articles/baker-hughes-cutting-jobs-spend…

...

Baker Hughes Co. is cutting jobs and reducing capital spending by 20% as it tries to save cash and ride out one of the worst energy downturns in decades.

Chief Executive Lorenzo Simonelli said Wednesday the company expects oil-field activity in North America to decline about 50% this year, with the industry's outlook hinging on the pace of economic recovery amid the coronavirus pandemic and the speed at which crude supplies decline.

"There are now signs that the dramatic collapse in oil demand and the quickly growing threat to global storage capacity could prompt a quicker supply response with production shut-ins in the United States," Mr. Simonelli said, noting that output in the continental U.S. will likely decline over the next 12 to 18 months.

In the first quarter, the No. 3 oil-field services company said it recorded restructuring, impairment and other charges of about $1.53 billion, mostly related to downsizing of business lines and its head count in certain geographies, but it didn't provide specifics. The company also took a noncash impairment charge of $14.7 billion.

The company on Wednesday reported a first-quarter net loss of $10.2 billion, or $15.64 per share, compared with a net income of $32 million, or 6 cents a share, in the same period last year. Revenue dropped to $5.4 billion from $5.62 billion.

Its earnings per share, adjusted to exclude charges and credits, of 11 cents for the quarter matched analysts' expectations for the quarter, according to FactSet.

Baker Hughes shares have fallen 50% this year as oil prices plunged under the weight of a historic drop in energy demand. Its North American revenue fell to $1 billion from $1.2 billion, while international sales were $2.1 billion, up from $1.8 billion.

It is shutting down its full-service drilling and completions fluids business in North America. Overall, the company expects $700 million in annualized savings from its restructuring plan, which includes head count reductions, manufacturing footprint and overhead costs, Mr. Simonelli said.

...

Oil-field services companies are expected to reduce their global workforce by 1 million this year, cutting 220,000 jobs in the U.S., according to consulting firm Rystad Energy. Drillers have idled 261 rigs operating on U.S. land since mid-March, according to Baker Hughes' rig count.

On Monday, its rival Halliburton Co. said it was cutting jobs, reducing its debt and slashing $1 billion in costs to prepare for a drop in activity for the rest of 2020. Schlumberger Ltd., the world's largest oil-field services company, cut its dividend 75% last week and said it expected North American oil-field activity to decline 40% to 60%.

Baker Hughes had about 68,000 employees at the end of 2019.

...

Baker Hughes Cutting Jobs, Spending After Oil Prices Plunge

https://www.wsj.com/articles/baker-hughes-cutting-jobs-spend…

...

Baker Hughes Co. is cutting jobs and reducing capital spending by 20% as it tries to save cash and ride out one of the worst energy downturns in decades.

Chief Executive Lorenzo Simonelli said Wednesday the company expects oil-field activity in North America to decline about 50% this year, with the industry's outlook hinging on the pace of economic recovery amid the coronavirus pandemic and the speed at which crude supplies decline.

"There are now signs that the dramatic collapse in oil demand and the quickly growing threat to global storage capacity could prompt a quicker supply response with production shut-ins in the United States," Mr. Simonelli said, noting that output in the continental U.S. will likely decline over the next 12 to 18 months.

In the first quarter, the No. 3 oil-field services company said it recorded restructuring, impairment and other charges of about $1.53 billion, mostly related to downsizing of business lines and its head count in certain geographies, but it didn't provide specifics. The company also took a noncash impairment charge of $14.7 billion.

The company on Wednesday reported a first-quarter net loss of $10.2 billion, or $15.64 per share, compared with a net income of $32 million, or 6 cents a share, in the same period last year. Revenue dropped to $5.4 billion from $5.62 billion.

Its earnings per share, adjusted to exclude charges and credits, of 11 cents for the quarter matched analysts' expectations for the quarter, according to FactSet.

Baker Hughes shares have fallen 50% this year as oil prices plunged under the weight of a historic drop in energy demand. Its North American revenue fell to $1 billion from $1.2 billion, while international sales were $2.1 billion, up from $1.8 billion.

It is shutting down its full-service drilling and completions fluids business in North America. Overall, the company expects $700 million in annualized savings from its restructuring plan, which includes head count reductions, manufacturing footprint and overhead costs, Mr. Simonelli said.

...

Oil-field services companies are expected to reduce their global workforce by 1 million this year, cutting 220,000 jobs in the U.S., according to consulting firm Rystad Energy. Drillers have idled 261 rigs operating on U.S. land since mid-March, according to Baker Hughes' rig count.

On Monday, its rival Halliburton Co. said it was cutting jobs, reducing its debt and slashing $1 billion in costs to prepare for a drop in activity for the rest of 2020. Schlumberger Ltd., the world's largest oil-field services company, cut its dividend 75% last week and said it expected North American oil-field activity to decline 40% to 60%.

Baker Hughes had about 68,000 employees at the end of 2019.

...

13.4.

Baker Hughes to book non-cash goodwill impairment charges of about $15 billion after oil price slump, coronavirus

https://www.marketwatch.com/story/baker-hughes-to-book-non-c…

Baker Hughes Co. said Monday it expects to book a $15 billion noncash impairment charge in the first quarter, plus another $1.5 billion of restructuring, impairment and other charges.

The $15 billion charge comes after its market cap declined sharply in the quarter as macro and geopolitical conditions pressured oil prices and as the COVID-19 pandemic hammered demand.

The oil services company said uncertainty regarding oil demand is having a significant impact on the investment and operating plans of its primary customers. "Based on these events, Baker Hughes concluded that a triggering event occurred which required the company to perform an interim quantitative impairment test as of March 31, 2020," the company said in a statement.

"Based upon the results of the impairment test, the company concluded that the carrying value of the Oilfield Services and Oilfield Equipment reporting units exceeded their estimated fair value, resulting in a goodwill impairment charge." The $1.5 billion restructuring charge is part of a total charge of $1.8 billion.

The company is expecting future cash expenditures of about $500 million with an expected payback within one year. The restructuring is designed to right-size the company and its operations to meet expected activity levels, according to Baker Hughes. The company is planning to reduce 2020 capital expenditures by about 20% compared with 2019.

It had $3 billion in cash and cash equivalents as of year-end, excluding assets held on behalf of parent GE. The company is slated to report first-quarter earnings on April 22...

Baker Hughes to book non-cash goodwill impairment charges of about $15 billion after oil price slump, coronavirus

https://www.marketwatch.com/story/baker-hughes-to-book-non-c…

Baker Hughes Co. said Monday it expects to book a $15 billion noncash impairment charge in the first quarter, plus another $1.5 billion of restructuring, impairment and other charges.

The $15 billion charge comes after its market cap declined sharply in the quarter as macro and geopolitical conditions pressured oil prices and as the COVID-19 pandemic hammered demand.

The oil services company said uncertainty regarding oil demand is having a significant impact on the investment and operating plans of its primary customers. "Based on these events, Baker Hughes concluded that a triggering event occurred which required the company to perform an interim quantitative impairment test as of March 31, 2020," the company said in a statement.

"Based upon the results of the impairment test, the company concluded that the carrying value of the Oilfield Services and Oilfield Equipment reporting units exceeded their estimated fair value, resulting in a goodwill impairment charge." The $1.5 billion restructuring charge is part of a total charge of $1.8 billion.

The company is expecting future cash expenditures of about $500 million with an expected payback within one year. The restructuring is designed to right-size the company and its operations to meet expected activity levels, according to Baker Hughes. The company is planning to reduce 2020 capital expenditures by about 20% compared with 2019.

It had $3 billion in cash and cash equivalents as of year-end, excluding assets held on behalf of parent GE. The company is slated to report first-quarter earnings on April 22...

Antwort auf Beitrag Nr.: 61.738.558 von faultcode am 21.10.19 21:15:4911.12.

Oil Company Baker Hughes Commits to 100% Clean Power in Texas

https://business.financialpost.com/pmn/business-pmn/oil-comp…

...Baker Hughes Co., one of the world’s largest oil-services companies, is pledging to power all its Texas operations with wind and solar.

Switching to renewables at more than 170 of the Houston-based company’s facilitates in the state will eliminate 12% of its global greenhouse gas emissions, according to a statement Wednesday.

While Royal Dutch Shell Plc, Total SA and other oil giants have begun taking steps to address climate change, Baker Hughes and its peers — the hired hands of the oil patch — have largely sat on the sidelines. Baker Hughes now aims to eliminate carbon emissions on a net basis by 2050.

The move comes as clean energy has become affordable enough to compete with fossil fuels. That’s especially true in Texas, where oil production is driving up demand for power and wind is the cheapest source available. Exxon Mobil Corp. last year agreed to buy 500 megawatts of wind and solar power in Texas.

Oil Company Baker Hughes Commits to 100% Clean Power in Texas

https://business.financialpost.com/pmn/business-pmn/oil-comp…

...Baker Hughes Co., one of the world’s largest oil-services companies, is pledging to power all its Texas operations with wind and solar.

Switching to renewables at more than 170 of the Houston-based company’s facilitates in the state will eliminate 12% of its global greenhouse gas emissions, according to a statement Wednesday.

While Royal Dutch Shell Plc, Total SA and other oil giants have begun taking steps to address climate change, Baker Hughes and its peers — the hired hands of the oil patch — have largely sat on the sidelines. Baker Hughes now aims to eliminate carbon emissions on a net basis by 2050.

The move comes as clean energy has become affordable enough to compete with fossil fuels. That’s especially true in Texas, where oil production is driving up demand for power and wind is the cheapest source available. Exxon Mobil Corp. last year agreed to buy 500 megawatts of wind and solar power in Texas.

Baker Hughes Co. --> BKR

https://www.wallstreet-online.de/nachricht/11823328-bhge-cha…

Baker Hughes, a GE company (NYSE: BHGE) announced today its successful name change to Baker Hughes Company. The Company will be known as Baker Hughes, and on Oct. 18, 2019, its Class A common stock will begin trading on the New York Stock Exchange under the symbol “BKR”.

https://www.wallstreet-online.de/nachricht/11823328-bhge-cha…

Baker Hughes, a GE company (NYSE: BHGE) announced today its successful name change to Baker Hughes Company. The Company will be known as Baker Hughes, and on Oct. 18, 2019, its Class A common stock will begin trading on the New York Stock Exchange under the symbol “BKR”.

Antwort auf Beitrag Nr.: 61.458.515 von faultcode am 11.09.19 13:19:45premarket NYSE +5.6%

GE --> <50%

https://www.marketwatch.com/story/ge-to-sell-millions-of-bak…https://www.wallstreet-online.de/nachricht/11732831-baker-hu…

=>

...General Electric Co. plans to sell millions of shares in spinoff Baker Hughes, and will no longer control the majority of shares in the company.

Baker Hughes said in an announcement Tuesday afternoon that GE and other affiliates plan to sell 105 million shares in an underwritten secondary offering, and sell $250 million in stock back to Baker Hughes.

Baker Hughes, which saw shares drop about 3% in late trading, intends to finance the share repurchase with cash "and other available sources of liquidity."

The sale means GE's stake in Baker Hughes will drop lower than 50%, which reduces the number of board members that GE gets to designate from five to one. John G. Rice will remain on the Baker Hughes board as GE's official designee, and Lorenzo Simonelli and W. Geoffrey Beattie are expected to remain on the board without affiliation to GE. Jamie Miller and James Mulva, GE's other board designees, will offer their resignations, according to the announcement...

GE Is New Target of Madoff Whistleblower Harry Markopolos

aus: https://www.wallstreet-online.de/diskussion/1124559-3051-306…...

The Markopolos group also alleges that GE’s ownership of oil-and-gas business Baker Hughes isn’t being properly accounted for and that the company should have booked $9.6 billion of losses on the investment. Last year GE recorded a $2.2 billion loss on the sale of part of its Baker Hughes stake, reducing its ownership from 62.5% to 50.2%.

In SEC filings, GE has disclosed that selling below 50% will trigger it to stop reporting Baker Hughes’s financial results as part of its own and record its loss on the rest of its investment. GE said its paper loss on the remaining investment was about $7.4 billion as of July 24, according to the company’s 10-Q report.

Mr. Markopolos said that the Baker Hughes stake is now “strictly an investment” and that GE as of 2018 has been improperly holding back from recording the loss, thus inflating its financial results. GE should be simply recording the value of its investment in the company, Mr. Markopolos said, a change he said could strain GE debt agreements.

GE responds that, as a majority shareholder of Baker Hughes it is required to report consolidated results for Baker Hughes, under generally accepted accounting principles. GE says it is providing more transparent reporting by including Baker Hughes’s revenues and costs and assets and liabilities, rather than just giving a value for the investment....

--> na ja -- Buchhalter unter sich. Aber gut, wenn auch das mal endgültig geklärt werden könnte.

Antwort auf Beitrag Nr.: 61.068.907 von faultcode am 20.07.19 02:59:28

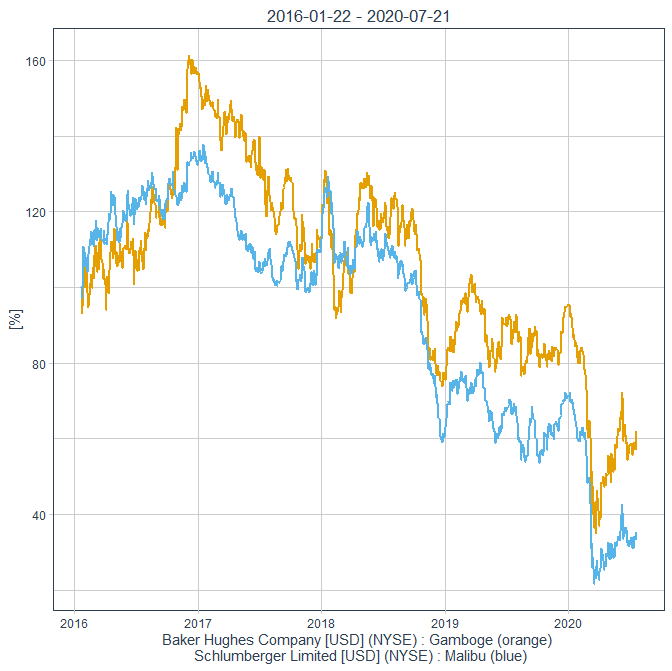

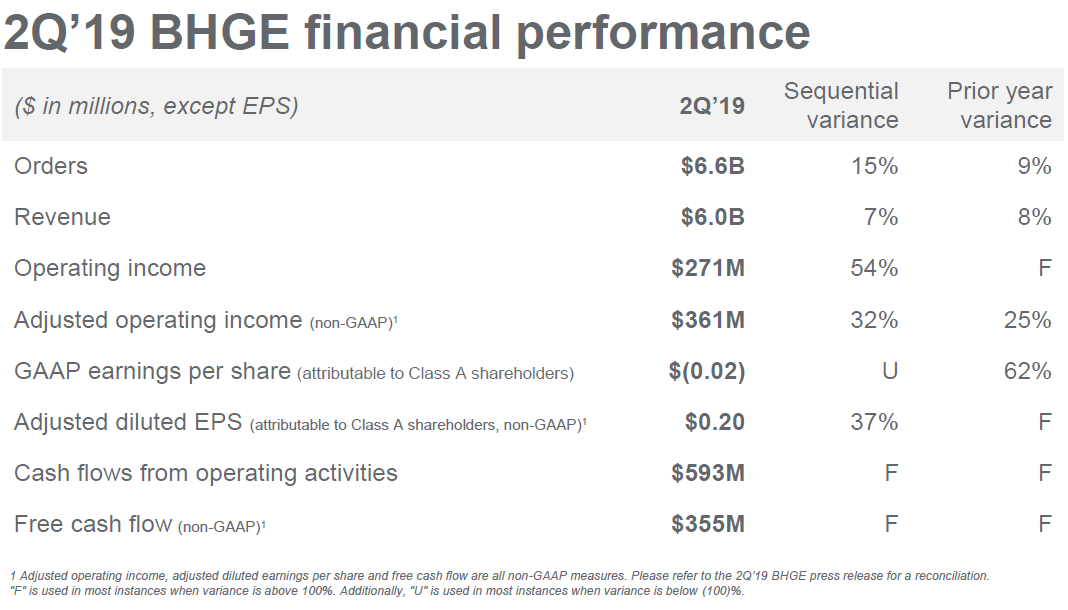

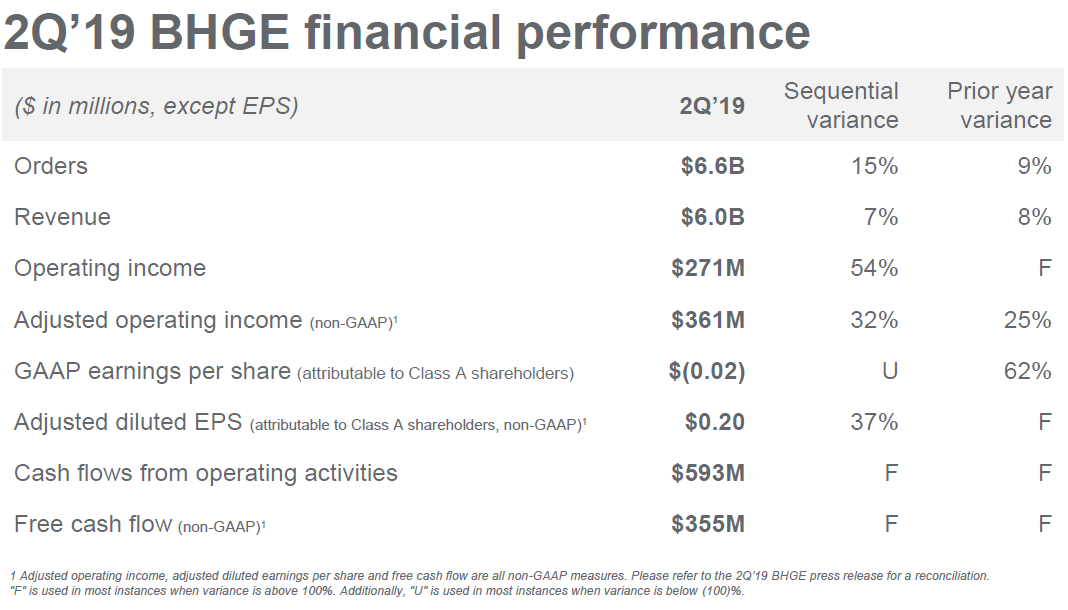

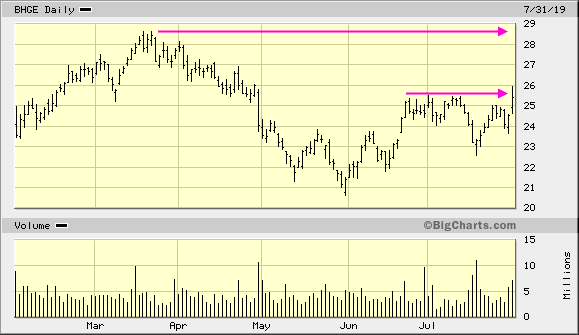

=> Chart:

Digital Solutions sind noch klein, aber es ist schon absehbar, daß sie die Oilfield Equipment umsatzmäßig überholen werden

--> sie sind der profitabelste Bereich von BHGE mit z.Z. (Q2) 13.2% Operating income (#2 ist: Turbomachinery & Process Solutions)

=> klar, die Konkurrenz ist hart (ML, AI, etc.) --> "jeder" will da jetzt (spätestens) rein

--> wie so oft, die Plattform machst

--> insofern ist BHGE auch eine Teil-Wette darauf, daß ihre Plattform(en) oben mitspielen wird:

• Deployed SureCONNECT for BP in the North Sea, enabling real time distributed monitoring of entire well

• Announced joint venture with C3.ai to deliver AI to drive outcomes for customers

Digital Solutions

Q2: gefällige Ergebnisse

=> Chart:

Digital Solutions sind noch klein, aber es ist schon absehbar, daß sie die Oilfield Equipment umsatzmäßig überholen werden

--> sie sind der profitabelste Bereich von BHGE mit z.Z. (Q2) 13.2% Operating income (#2 ist: Turbomachinery & Process Solutions)

=> klar, die Konkurrenz ist hart (ML, AI, etc.) --> "jeder" will da jetzt (spätestens) rein

--> wie so oft, die Plattform machst

--> insofern ist BHGE auch eine Teil-Wette darauf, daß ihre Plattform(en) oben mitspielen wird:

• Deployed SureCONNECT for BP in the North Sea, enabling real time distributed monitoring of entire well

• Announced joint venture with C3.ai to deliver AI to drive outcomes for customers

16.03.24 · wO Chartvergleich · Adobe |

24.01.24 · wO Newsflash · Abbott Laboratories |

18.11.23 · wO Chartvergleich · ABB |