American Express (Seite 2)

eröffnet am 10.02.18 09:47:21 von

neuester Beitrag 09.10.23 07:15:20 von

neuester Beitrag 09.10.23 07:15:20 von

Beiträge: 20

ID: 1.273.757

ID: 1.273.757

Aufrufe heute: 1

Gesamt: 3.666

Gesamt: 3.666

Aktive User: 0

ISIN: US0258161092 · WKN: 850226 · Symbol: AEC1

220,85

EUR

-0,18 %

-0,40 EUR

Letzter Kurs 11:27:24 Tradegate

Neuigkeiten

| American Express Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

11.05.24 · wO Chartvergleich |

10.05.24 · Business Wire (engl.) |

10.05.24 · wO Newsflash |

10.05.24 · Der Aktionär TV |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5080 | +102,39 | |

| 0,9680 | +101,67 | |

| 0,6000 | +50,00 | |

| 5,4850 | +29,06 | |

| 28,57 | +19,24 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 16,100 | -10,56 | |

| 20,400 | -11,27 | |

| 0,7500 | -14,29 | |

| 21,800 | -14,81 | |

| 26,00 | -16,13 |

Beitrag zu dieser Diskussion schreiben

Die Zahlen für das 3.Quartal sind da.

https://ir.americanexpress.com/investor-relations/default.as…

https://ir.americanexpress.com/investor-relations/default.as…

Wer in ein Kreditkarten Unternehmen investieren möchte und trotzdem über 2% Dividendenrendite erzielen möchte, ist bei Amex goldrichtig! Hier gibt es einige aktuelle Kennzahlen zur Aktie: https://www.dividendenaktien.net/finanz-sektor

Konsum-Boom verhilft American Express zu Gewinnsteigerung

NEW YORK (dpa-AFX) - Die Ausgabefreude der Kreditkartenkunden hat American Express im zweiten Quartal zu deutlich mehr Gewinn und Einnahmen verholfen. Verglichen mit dem Vorjahreszeitraum nahm der Überschuss um neun Prozent auf 1,8 Milliarden US-Dollar (1,6 Mrd Euro) zu, wie der Finanzkonzern am Freitag in New York mitteilte. Die Erlöse kletterten um acht Prozent auf 10,8 Milliarden Dollar.usw ......

Quelle: https://www.wallstreet-online.de/nachricht/11615869-konsum-b…

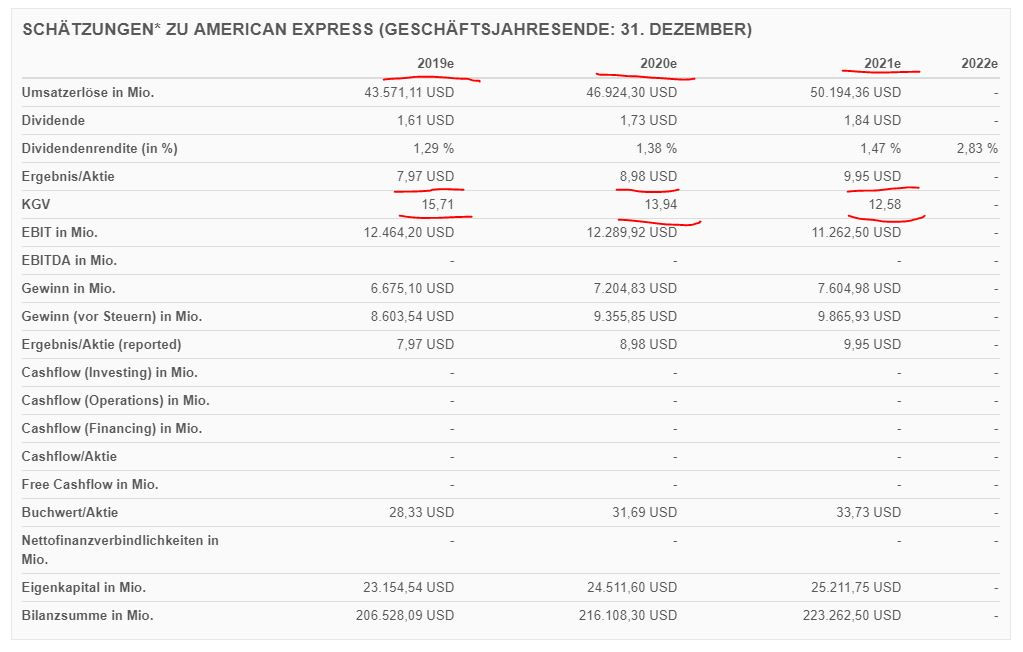

Gewinnschätzungen American Express 2019e bis 2021e

Quelle: www.finanzen.net

# Sehr schwaches Wachstum für diese doch so stark boomende Branche

# Kein Kauf da es chancenreichere Unternehmen in dem Sektor gibt

American Express: Korrektur als Chance?

https://boerse.ard.de/aktien/aktie-des-tages/american-expres…

https://boerse.ard.de/aktien/aktie-des-tages/american-expres…

gut gelaufen bisher

Ansichtsstücke gekauft

..ist mir immer wieder entfallen; vielleicht sollte ich sie jetzt doch mal ins Visier nehmen:

Shake up in business travel as Amex GBT moves to buy HRG

Feb 9.2018

Big consolidation in the travel management space this morning as Amex Global Business Travel has agreed to buy rival Hogg Robinson Group for around £400 million.

The deal, which is subject to antitrust and other regulatory approval, is expected to close in the second quarter of 2018.

Interesting to note that Boron which owns about 24% of Hogg Robinson shares and dnata, which owns almost 22%, have both indicated they will vote in favour of the deal.

Estimates from business travel press put HRG just ahead of Amex GBT in terms of annual sales but the latter has made no secret of its billion in cash on the balance sheet putting it in a “better financial position” than traditional competitors.

Consolidation in travel management companies in recent years has been more around medium players – Portman merging with Clarity in late 2016 and CTM acquiring Chambers in 2014 – as well as big players such as HRG and FCM getting bigger

Just over two years ago, Amex GBT chairman Greg O’Hara spoke of investing in a “flurry of things all over the world” as well as technology to help it recognise and better serve its customers.

That flurry has included the acquisition of expense management specialist KDS in 2016.

HRG has also announced that it is selling its software-as-as-service company Fraedom to Visa for almost £142 million. Back in 2004 the travel management company originally acquired 58 % of payment and expense management company Spendvision, as Fraedom was then called, and then acquired the remaining 42% in 2012.

In what was seen as a slightly left field move, Fraedom was then rebranded and relaunched in 2015 as a standalone SaaS company for the unmanaged business travel market.

Amex GBT provides reasons for the acquisition citing value to shareholders, the strength of the talent of the combined companies and the “complementary geographical footprints.”

It’s hard out there in business travel at the moment with low margins and pressure from all sides. The distribution landscape is rapidly changing with new commercial terms from many large airlines, IATA NDC to contend with and startups nipping at the heels of traditional players.

Technology is therefore a big part of making the process more efficient but getting travellers to use it is a different story especially as the user-experience is so far from what they’re used to in leisure travel.

The Amex GBT statement on the deal talks about technology – the promise of growth via strengthened “capabilities, products and technology.”

It goes on to talk of combining the two “advanced travel technology and development platform” and says:

“Both GBT and Hogg Robinson invest heavily in developing technology-based solutions… The Combined Group will be focused on optimising efforts to innovate and remain on the leading edge of serving customers and travellers through technology.”

It also mentions the combined resources driving “further investment and innovation to enhance the traveller experience”.

None of this is easy as while HRG developed its proprietary technology some years back and launched its data tool Insight back in 2012, it has been quieter on the subject more recently.

Amex GBT, meanwhile had relied on third party technology in the past but more recently has talked of investment in its internal technology infrastructure.

Time will tell what the combined talent can achieve on the tech front.

In the meantime, the deal can be seen as more of a land grab with Amex GBT saying it believes “the value of the acquisition is principally in GBT’s ability to achieve a greater global presence.

Shake up in business travel as Amex GBT moves to buy HRG

Feb 9.2018

Big consolidation in the travel management space this morning as Amex Global Business Travel has agreed to buy rival Hogg Robinson Group for around £400 million.

The deal, which is subject to antitrust and other regulatory approval, is expected to close in the second quarter of 2018.

Interesting to note that Boron which owns about 24% of Hogg Robinson shares and dnata, which owns almost 22%, have both indicated they will vote in favour of the deal.

Estimates from business travel press put HRG just ahead of Amex GBT in terms of annual sales but the latter has made no secret of its billion in cash on the balance sheet putting it in a “better financial position” than traditional competitors.

Consolidation in travel management companies in recent years has been more around medium players – Portman merging with Clarity in late 2016 and CTM acquiring Chambers in 2014 – as well as big players such as HRG and FCM getting bigger

Just over two years ago, Amex GBT chairman Greg O’Hara spoke of investing in a “flurry of things all over the world” as well as technology to help it recognise and better serve its customers.

That flurry has included the acquisition of expense management specialist KDS in 2016.

HRG has also announced that it is selling its software-as-as-service company Fraedom to Visa for almost £142 million. Back in 2004 the travel management company originally acquired 58 % of payment and expense management company Spendvision, as Fraedom was then called, and then acquired the remaining 42% in 2012.

In what was seen as a slightly left field move, Fraedom was then rebranded and relaunched in 2015 as a standalone SaaS company for the unmanaged business travel market.

Amex GBT provides reasons for the acquisition citing value to shareholders, the strength of the talent of the combined companies and the “complementary geographical footprints.”

It’s hard out there in business travel at the moment with low margins and pressure from all sides. The distribution landscape is rapidly changing with new commercial terms from many large airlines, IATA NDC to contend with and startups nipping at the heels of traditional players.

Technology is therefore a big part of making the process more efficient but getting travellers to use it is a different story especially as the user-experience is so far from what they’re used to in leisure travel.

The Amex GBT statement on the deal talks about technology – the promise of growth via strengthened “capabilities, products and technology.”

It goes on to talk of combining the two “advanced travel technology and development platform” and says:

“Both GBT and Hogg Robinson invest heavily in developing technology-based solutions… The Combined Group will be focused on optimising efforts to innovate and remain on the leading edge of serving customers and travellers through technology.”

It also mentions the combined resources driving “further investment and innovation to enhance the traveller experience”.

None of this is easy as while HRG developed its proprietary technology some years back and launched its data tool Insight back in 2012, it has been quieter on the subject more recently.

Amex GBT, meanwhile had relied on third party technology in the past but more recently has talked of investment in its internal technology infrastructure.

Time will tell what the combined talent can achieve on the tech front.

In the meantime, the deal can be seen as more of a land grab with Amex GBT saying it believes “the value of the acquisition is principally in GBT’s ability to achieve a greater global presence.

11.05.24 · wO Chartvergleich · American Express |

10.05.24 · wO Newsflash · American Express |

06.05.24 · wallstreetONLINE Redaktion · American Express |

06.05.24 · wallstreetONLINE Redaktion · American Express |

04.05.24 · wO Chartvergleich · American Express |

03.05.24 · BörsenNEWS.de · American Express |