Newell Brands Announces Agreement with Carl C. Icahn | Diskussion im Forum

eröffnet am 19.03.18 21:27:49 von

neuester Beitrag 23.04.24 03:15:45 von

neuester Beitrag 23.04.24 03:15:45 von

Beiträge: 64

ID: 1.276.646

ID: 1.276.646

Aufrufe heute: 60

Gesamt: 4.288

Gesamt: 4.288

Aktive User: 0

ISIN: US6512291062 · WKN: 860036 · Symbol: NWL

8,0150

USD

+2,89 %

+0,2250 USD

Letzter Kurs 18:54:40 Nasdaq

Neuigkeiten

26.04.24 · wO Chartvergleich |

26.04.24 · Business Wire (engl.) |

12.04.24 · Business Wire (engl.) |

22.02.24 · Business Wire (engl.) |

Werte aus der Branche Konsum

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 15,530 | +104,07 | |

| 0,6100 | +37,85 | |

| 0,6000 | +19,52 | |

| 1,1630 | +16,30 | |

| 12,500 | +15,96 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6725 | -8,98 | |

| 11,570 | -9,18 | |

| 13,400 | -9,61 | |

| 1,3600 | -10,53 | |

| 7,45 | -12,09 |

Beitrag zu dieser Diskussion schreiben

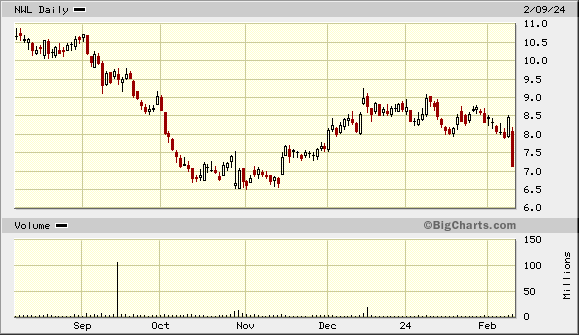

Langsam entwickel sich Newell zu einem Kaufkanidaten. Ich denke es könnte noch ein Stufe tiefer gehen wenn sich

die Wirtschaft in den USA schlechter entwickelt als jetzt.

die Wirtschaft in den USA schlechter entwickelt als jetzt.

9.2.

Newell Brands Announces Fourth Quarter and Full Year 2023 Results

https://www.wallstreet-online.de/nachricht/17779445-newell-b…

...

• Full year operating cash flow increased by $1.2 billion to $930 million compared with outflow of $272 million in the prior year.

...

• The company reduced debt to $4.9 billion at the end of 2023 compared with $5.4 billion at the end of 2022.

...

• The company initiated its full year 2024 outlook for net sales decline of 8 percent to 5 percent and normalized earnings per share of $0.52 to $0.62.

...

=> KGV 2024e = $7.1 / $0.52 = ~13.7

Ansonsten:

Newell Brands Announces Fourth Quarter and Full Year 2023 Results

https://www.wallstreet-online.de/nachricht/17779445-newell-b…

...

• Full year operating cash flow increased by $1.2 billion to $930 million compared with outflow of $272 million in the prior year.

...

• The company reduced debt to $4.9 billion at the end of 2023 compared with $5.4 billion at the end of 2022.

...

• The company initiated its full year 2024 outlook for net sales decline of 8 percent to 5 percent and normalized earnings per share of $0.52 to $0.62.

...

=> KGV 2024e = $7.1 / $0.52 = ~13.7

Ansonsten:

23.1.

Rubbermaid Owner Newell Plans to Use Cash to Pay Off Bond Maturing in 2024

https://www.bloomberg.com/news/articles/2024-01-23/newell-br…

Company has around $200 million coming due this year

Interest rates are expected to come down from highs, CEO Says

...

Rubbermaid Owner Newell Plans to Use Cash to Pay Off Bond Maturing in 2024

https://www.bloomberg.com/news/articles/2024-01-23/newell-br…

Company has around $200 million coming due this year

Interest rates are expected to come down from highs, CEO Says

...

8.1.

Newell Brands Announces Organizational Realignment

https://www.wallstreet-online.de/nachricht/17684175-newell-b…

...

Once organizational design changes are fully executed, the company expects to realize annualized pre-tax savings in the range of $65 million to $90 million, net of reinvestment, with $55 million to $70 million expected in 2024.

Restructuring and related charges associated with these actions are estimated to be in the range of $75 million to $90 million and are expected to be substantially incurred by the end of 2024. The company plans to reduce its office roles by approximately 7%, with most of these actions expected to be complete by the end of 2024, subject to local law and consultation requirements.

...

Newell Brands Announces Organizational Realignment

https://www.wallstreet-online.de/nachricht/17684175-newell-b…

...

Once organizational design changes are fully executed, the company expects to realize annualized pre-tax savings in the range of $65 million to $90 million, net of reinvestment, with $55 million to $70 million expected in 2024.

Restructuring and related charges associated with these actions are estimated to be in the range of $75 million to $90 million and are expected to be substantially incurred by the end of 2024. The company plans to reduce its office roles by approximately 7%, with most of these actions expected to be complete by the end of 2024, subject to local law and consultation requirements.

...

https://ir.newellbrands.com/investor-relations

...

...

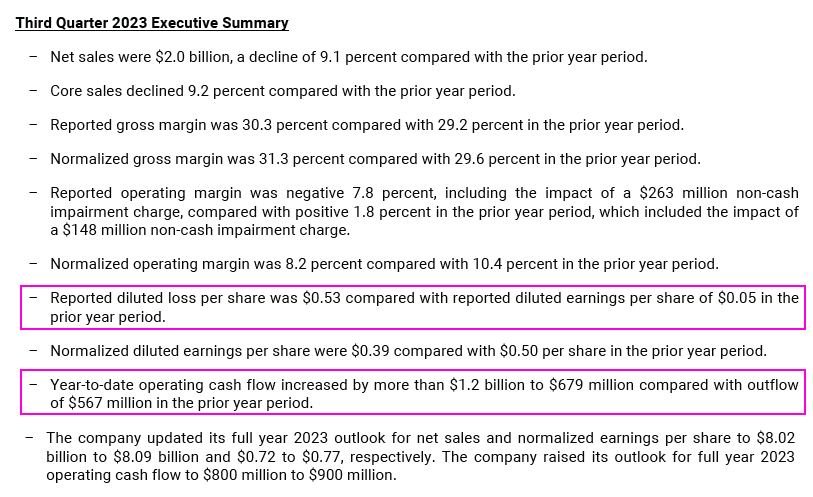

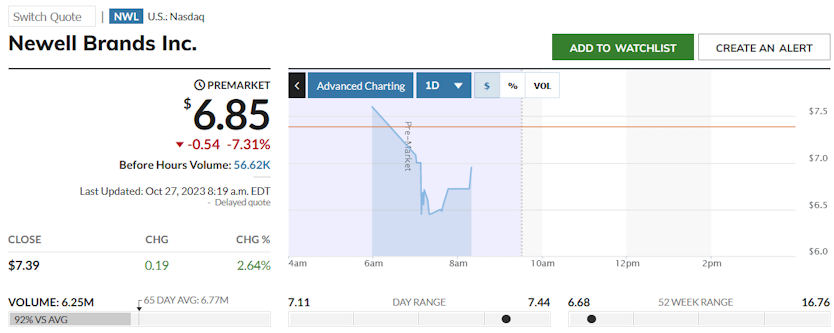

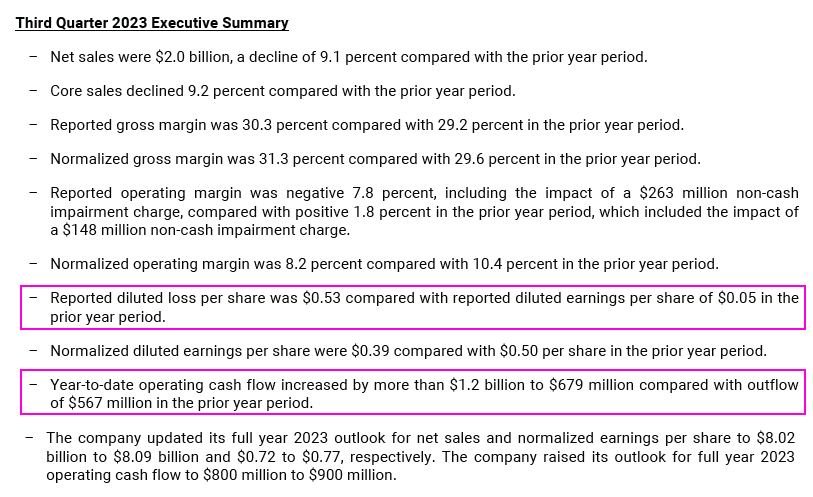

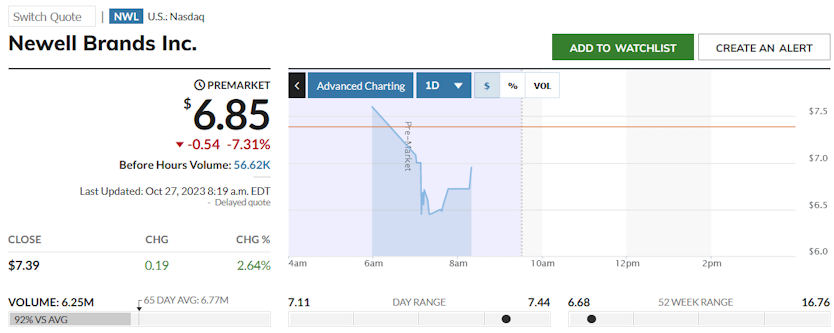

=> die ganz große Katastrophe ist mMn ausgeblieben:

...

...

=> die ganz große Katastrophe ist mMn ausgeblieben:

...

The New York-based Blackstone and Airbnb will replace Lincoln National Corp. and Newell Brands Inc. prior to the start of trading on Sept. 18, S&P Dow Jones Indices said in a press release late Friday.

...

1.9.

Blackstone, Airbnb to Join S&P 500 After Index Rebalancing

https://finance.yahoo.com/news/blackstone-airbnb-join-p-500-…

The New York-based Blackstone and Airbnb will replace Lincoln National Corp. and Newell Brands Inc. prior to the start of trading on Sept. 18, S&P Dow Jones Indices said in a press release late Friday.

...

1.9.

Blackstone, Airbnb to Join S&P 500 After Index Rebalancing

https://finance.yahoo.com/news/blackstone-airbnb-join-p-500-…

28.7.

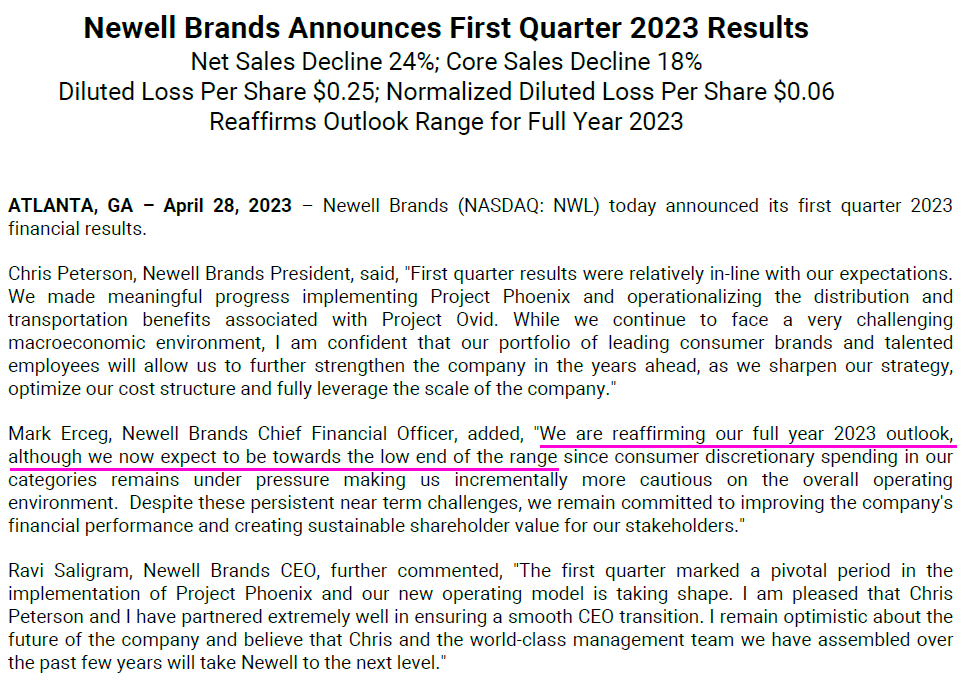

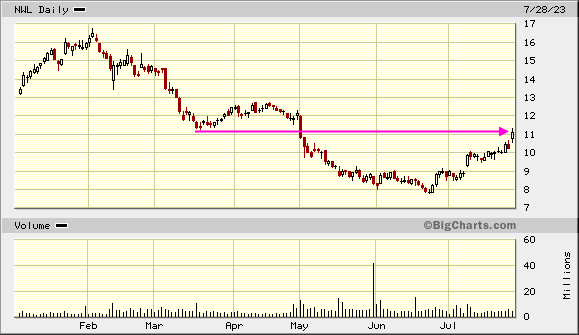

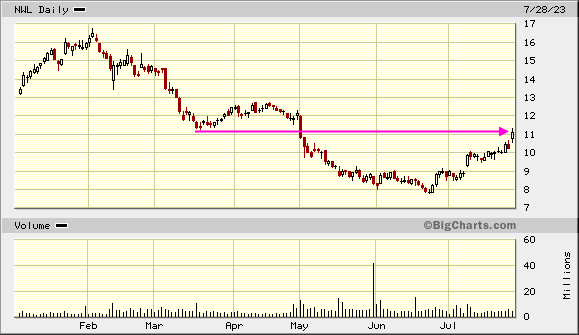

Newell Brands Announces Second Quarter 2023 Results

https://ir.newellbrands.com/news-releases/news-release-detai…

Net Sales Decline 13%; Core Sales Decline 12%

Diluted EPS $0.04; Normalized Diluted EPS $0.24

Operating Cash Flow Improves Significantly Versus Prior Year

Updates Outlook for Full Year 2023

...

=> darauf erstmal +8.3%:

Ansonsten:

Outlook for Third Quarter and Full Year 2023

...

For full year 2023, the company continues to expect to deliver operating cash flow in the range of $700 million to $900 million, including approximately $95 million to $120 million in cash payments associated with Project Phoenix.

...

Project Phoenix ist das Sparprogramm vom Januar 2023.

Newell Brands Announces Second Quarter 2023 Results

https://ir.newellbrands.com/news-releases/news-release-detai…

Net Sales Decline 13%; Core Sales Decline 12%

Diluted EPS $0.04; Normalized Diluted EPS $0.24

Operating Cash Flow Improves Significantly Versus Prior Year

Updates Outlook for Full Year 2023

...

=> darauf erstmal +8.3%:

Ansonsten:

Outlook for Third Quarter and Full Year 2023

...

For full year 2023, the company continues to expect to deliver operating cash flow in the range of $700 million to $900 million, including approximately $95 million to $120 million in cash payments associated with Project Phoenix.

...

Project Phoenix ist das Sparprogramm vom Januar 2023.

Für die Abwendung einer Insolvenz auch nötig. Die Schulden sind viel zu hoch. Der Markt hat es wohl bereits eingepreist, dass >10% nicht gutgehen werden.

radikale Kürzung der Dividende:

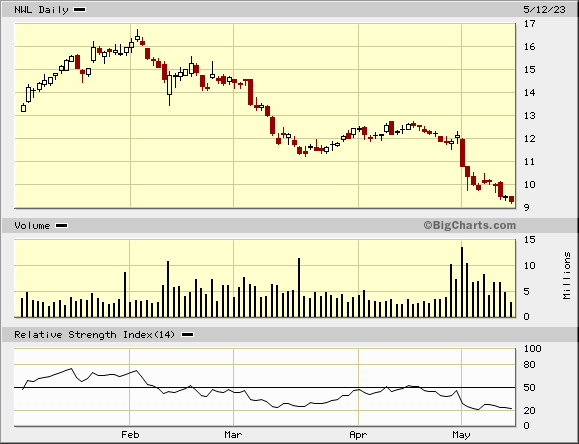

16.5.

Newell Brands Updates Capital Allocation Strategy and Declares Quarterly Dividend of $0.07 per Share

https://www.wallstreet-online.de/nachricht/16941088-newell-b…

...

Newell Brands Inc. (NASDAQ: NWL) announced today that its Board of Directors, together with the management team, updated the company’s dividend policy, reducing the quarterly dividend to $0.07 per share (implies $0.28 per share annually). Accordingly, Newell Brands announced the declaration of a quarterly cash dividend of $0.07 per share. The dividend is payable June 15, 2023 to common stockholders of record at the close of business on May 31, 2023.

Over the past several months, as previously communicated, the management team has undertaken a refresh of the corporate strategy, encompassing: a comprehensive assessment of where Newell Brands stands versus best-in-class competition on the key capabilities required to win in this industry, an updated and integrated set of where to play and how to win choices, an assessment of the talent and culture required to enact the strategy refresh, as well as an evaluation of the capital allocation priorities required to support the new strategy.

Management continues to expect a strong rebound in Newell Brands’ cash flow performance in 2023 and remains confident about the cash flow generation potential of the business. The company is deliberately resetting its capital allocation priorities and right-sizing the dividend to fund high-return internal supply chain consolidation investment opportunities, while enabling faster de-leveraging of the balance sheet and providing additional financial flexibility.

...

=> $0.28 per share annually ~3.2% Dividenden-Rendite p.a.

16.5.

Newell Brands Updates Capital Allocation Strategy and Declares Quarterly Dividend of $0.07 per Share

https://www.wallstreet-online.de/nachricht/16941088-newell-b…

...

Newell Brands Inc. (NASDAQ: NWL) announced today that its Board of Directors, together with the management team, updated the company’s dividend policy, reducing the quarterly dividend to $0.07 per share (implies $0.28 per share annually). Accordingly, Newell Brands announced the declaration of a quarterly cash dividend of $0.07 per share. The dividend is payable June 15, 2023 to common stockholders of record at the close of business on May 31, 2023.

Over the past several months, as previously communicated, the management team has undertaken a refresh of the corporate strategy, encompassing: a comprehensive assessment of where Newell Brands stands versus best-in-class competition on the key capabilities required to win in this industry, an updated and integrated set of where to play and how to win choices, an assessment of the talent and culture required to enact the strategy refresh, as well as an evaluation of the capital allocation priorities required to support the new strategy.

Management continues to expect a strong rebound in Newell Brands’ cash flow performance in 2023 and remains confident about the cash flow generation potential of the business. The company is deliberately resetting its capital allocation priorities and right-sizing the dividend to fund high-return internal supply chain consolidation investment opportunities, while enabling faster de-leveraging of the balance sheet and providing additional financial flexibility.

...

=> $0.28 per share annually ~3.2% Dividenden-Rendite p.a.

Newell Brands Announces Agreement with Carl C. Icahn