Cenovus Energy

eröffnet am 15.09.19 01:49:31 von

neuester Beitrag 08.12.23 14:17:09 von

neuester Beitrag 08.12.23 14:17:09 von

Beiträge: 49

ID: 1.311.773

ID: 1.311.773

Aufrufe heute: 0

Gesamt: 3.408

Gesamt: 3.408

Aktive User: 0

ISIN: CA15135U1093 · WKN: A0YD8C · Symbol: CVE

27,70

CAD

-2,05 %

-0,58 CAD

Letzter Kurs 20:09:21 Toronto

Neuigkeiten

12:00 Uhr · globenewswire |

25.04.24 · globenewswire |

03.04.24 · wO Chartvergleich |

27.02.24 · globenewswire |

15.02.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,250 | +13,64 | |

| 19,650 | +11,77 | |

| 1,1600 | +11,54 | |

| 84,63 | +9,99 | |

| 0,9600 | +9,09 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,689 | -7,57 | |

| 6,6800 | -8,99 | |

| 4,6700 | -10,19 | |

| 3,7050 | -13,64 | |

| 0,720 | -40,00 |

Beitrag zu dieser Diskussion schreiben

7.12.

Ottawa orders emissions cuts of up to 38% for oil and gas companies

Caps a historic first for a fossil-fuel producing country, energy minister says

https://financialpost.com/commodities/energy/oil-gas/canada-…

...

Producers will be allowed the flexibility to emit up to a level of about 20 per cent to 23 per cent below 2019 levels through the ability to buy carbon offsets or pay into a fund that promotes decarbonization in the sector if their emissions exceed the cap.

The cap will go down over time until Canada’s economy reaches net zero in 2050. Thursday’s announcement is a framework that lays out the plan, with more details to be released in draft regulations in the middle of next year, Guilbeault said. Those regulations will narrow down an exact emissions target for 2030, he said.

...

Ottawa orders emissions cuts of up to 38% for oil and gas companies

Caps a historic first for a fossil-fuel producing country, energy minister says

https://financialpost.com/commodities/energy/oil-gas/canada-…

...

Producers will be allowed the flexibility to emit up to a level of about 20 per cent to 23 per cent below 2019 levels through the ability to buy carbon offsets or pay into a fund that promotes decarbonization in the sector if their emissions exceed the cap.

The cap will go down over time until Canada’s economy reaches net zero in 2050. Thursday’s announcement is a framework that lays out the plan, with more details to be released in draft regulations in the middle of next year, Guilbeault said. Those regulations will narrow down an exact emissions target for 2030, he said.

...

25.9.

Canadian Oil Exports Surge With World Hunting for OPEC Alternatives

https://www.bnnbloomberg.ca/canadian-oil-exports-surge-with-…

...

Less demand from US refineries coincides with the end of maintenance season at Alberta’s oil fields, bringing back output that was down for part of summer. The extra volume comes amid a supply squeeze around the world after Saudi Arabia and Russia curtailed production, upending flows and boosting Canadian oil prices. Canadian crude earlier this week hit the narrowest discount to Nymex West Texas Intermediate futures in two months, according to Link Data Services.

...

3.8.

Canadian Oil-Sands Output Poised to Jump as Pipeline Project Nears Finish

https://www.bnnbloomberg.ca/canadian-oil-sands-output-poised…

...

Canadian oil-sands producers including Canadian Natural Resources Ltd. and Cenovus Energy Inc. are rushing to expand production to fill the biggest new pipeline project in more than a decade.

Canadian Natural will raise output from its Primrose site by 25,000 barrels a day in the current quarter and boost production at its Kirby oil-sands operation by 15,000 barrels a day in the fourth quarter, the company said Thursday. Cenovus plans to start up its Narrows Lake oil-sands site, an extension of its Christina Lake operation, in early 2025.

Alberta’s oil producers will have the ability to ship an extra 590,000 barrels of crude a day to the Pacific Coast next year — the biggest jump in the province’s oil-export capacity in more than a decade — after an expansion of the the Trans Mountain Pipeline begins service. The increase is a welcome turnabout for companies that have suffered for years from discounted prices because of a lack of pipeline space.

“This industry has a great habit of expanding to fill pipeline capacity,” Cenovus Chief Operating Officer Jonathan McKenzie said of Trans Mountain on a call this week. “That’ll be filled, I think, in relatively short order over the coming years.”

Canadian Oil-Sands Output Poised to Jump as Pipeline Project Nears Finish

https://www.bnnbloomberg.ca/canadian-oil-sands-output-poised…

...

Canadian oil-sands producers including Canadian Natural Resources Ltd. and Cenovus Energy Inc. are rushing to expand production to fill the biggest new pipeline project in more than a decade.

Canadian Natural will raise output from its Primrose site by 25,000 barrels a day in the current quarter and boost production at its Kirby oil-sands operation by 15,000 barrels a day in the fourth quarter, the company said Thursday. Cenovus plans to start up its Narrows Lake oil-sands site, an extension of its Christina Lake operation, in early 2025.

Alberta’s oil producers will have the ability to ship an extra 590,000 barrels of crude a day to the Pacific Coast next year — the biggest jump in the province’s oil-export capacity in more than a decade — after an expansion of the the Trans Mountain Pipeline begins service. The increase is a welcome turnabout for companies that have suffered for years from discounted prices because of a lack of pipeline space.

“This industry has a great habit of expanding to fill pipeline capacity,” Cenovus Chief Operating Officer Jonathan McKenzie said of Trans Mountain on a call this week. “That’ll be filled, I think, in relatively short order over the coming years.”

28.7.

UPDATE 3-Cenovus Energy criticizes Canadian gov't plans to cut emissions as profits surge

https://finance.yahoo.com/news/1-cenovus-energy-profit-jumps…

...

Cenovus Energy reported a near 11-fold surge in second-quarter profit on Thursday and boosted capital spending and production forecasts, but warned Canadian government plans to cap oil and gas emissions could lead to production being shut in.

Oil prices have scaled multi-year highs this year as Western sanctions against major exporter Russia squeeze an already under-supplied market. Brent crude, the global benchmark, was last trading at over $107 a barrel.

Calgary-based Cenovus, Canada's No. 2 oil and gas producer, said it will increase capital investment by C$400 million ($311.58 million) this year to C$3.3 billion to C$3.7 billion, and raise production by 15,000 barrels of oil equivalent per day (boepd) to 780,000 to 810,000 boepd.

Around C$100 million of the increased spending is due to inflation, with the remainder going to oil sands projects and restarting the West White Rose offshore project in Atlantic Canada.

However, Cenovus remains committed to shareholder returns and will focus on incremental production increases rather than large scale projects, Chief Executive Alex Pourbaix said.

He also criticized federal government plans to cap and cut emissions from Canada's oil and gas sector. Last week the government outlined two options to help cut emissions to 42% below 2005 levels by 2030, which Pourbaix said would not be possible.

"I would say either of those options are more ambitious than what can reasonably be achieved," Pourbaix told a conference call. "I am very worried that if we remain on this path, it could lead to shutting in production, and at a time when the world is literally crying out for more oil and gas production."

Cenovus' production fell to 761,500 boepd in the second quarter, from 765,900 boepd a year earlier due to planned turnarounds. However production is expected to rise beyond 800,000 boepd in the second half of 2022.

Net earnings rose to C$2.43 billion ($1.90 billion), or C$1.19 Canadian cents per share, for the three months ended June 30, from C$224 million, or 11 Canadian cents per share, a year earlier. ($1 = 1.2838 Canadian dollars)

...

UPDATE 3-Cenovus Energy criticizes Canadian gov't plans to cut emissions as profits surge

https://finance.yahoo.com/news/1-cenovus-energy-profit-jumps…

...

Cenovus Energy reported a near 11-fold surge in second-quarter profit on Thursday and boosted capital spending and production forecasts, but warned Canadian government plans to cap oil and gas emissions could lead to production being shut in.

Oil prices have scaled multi-year highs this year as Western sanctions against major exporter Russia squeeze an already under-supplied market. Brent crude, the global benchmark, was last trading at over $107 a barrel.

Calgary-based Cenovus, Canada's No. 2 oil and gas producer, said it will increase capital investment by C$400 million ($311.58 million) this year to C$3.3 billion to C$3.7 billion, and raise production by 15,000 barrels of oil equivalent per day (boepd) to 780,000 to 810,000 boepd.

Around C$100 million of the increased spending is due to inflation, with the remainder going to oil sands projects and restarting the West White Rose offshore project in Atlantic Canada.

However, Cenovus remains committed to shareholder returns and will focus on incremental production increases rather than large scale projects, Chief Executive Alex Pourbaix said.

He also criticized federal government plans to cap and cut emissions from Canada's oil and gas sector. Last week the government outlined two options to help cut emissions to 42% below 2005 levels by 2030, which Pourbaix said would not be possible.

"I would say either of those options are more ambitious than what can reasonably be achieved," Pourbaix told a conference call. "I am very worried that if we remain on this path, it could lead to shutting in production, and at a time when the world is literally crying out for more oil and gas production."

Cenovus' production fell to 761,500 boepd in the second quarter, from 765,900 boepd a year earlier due to planned turnarounds. However production is expected to rise beyond 800,000 boepd in the second half of 2022.

Net earnings rose to C$2.43 billion ($1.90 billion), or C$1.19 Canadian cents per share, for the three months ended June 30, from C$224 million, or 11 Canadian cents per share, a year earlier. ($1 = 1.2838 Canadian dollars)

...

Antwort auf Beitrag Nr.: 71.770.937 von faultcode am 13.06.22 17:36:52<hier auch eine Teilgewinn-Mitnahme>

Antwort auf Beitrag Nr.: 71.452.001 von faultcode am 28.04.22 23:45:10Cenovus acquiring outstanding 50% interest in Sunrise oil sands asset

https://www.cenovus.com/news/news-releases/2022/06-13-2022-c…

Calgary, Alberta (June 13, 2022) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has reached an agreement to purchase the remaining 50% of the Sunrise oil sands project in northern Alberta from bp. Total consideration for the transaction includes $600 million in cash, a variable payment with a maximum cumulative value of $600 million expiring after two years, and Cenovus’s 35% position in the undeveloped Bay du Nord project offshore Newfoundland and Labrador.

The transaction has an effective date of May 1, 2022 and is anticipated to close in the third quarter of this year, subject to closing conditions and normal purchase price adjustments.

Full ownership of Sunrise further enhances Cenovus’s core strength in the oil sands. Sunrise has been operated by the company since the beginning of 2021, following the Husky Energy transaction, and Cenovus is now in the early stages of applying its oil sands operating model at this asset.

“Acquiring the remaining working interest in Sunrise enables us to fully benefit from the significant optimization opportunities available,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “By applying Cenovus’s advanced operating techniques, we expect to increase production at Sunrise while driving down sustaining capital, operating costs and emissions intensity.”

Cenovus currently operates Sunrise and owns 50% of the asset through the Sunrise Oil Sands Partnership, with bp. Current production from the asset is approximately 50,000 barrels per day (bbls/d), and the company expects to achieve nameplate capacity of 60,000 bbls/d through a multi-year development program. The acquisition is expected to be immediately accretive to adjusted funds flow and cash from operating activities.

2022 Guidance

Cenovus’s corporate guidance dated April 26, 2022 does not reflect this acquisition. The company plans to update guidance with its second quarter results in July 2022.

...

https://www.cenovus.com/news/news-releases/2022/06-13-2022-c…

Calgary, Alberta (June 13, 2022) – Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) has reached an agreement to purchase the remaining 50% of the Sunrise oil sands project in northern Alberta from bp. Total consideration for the transaction includes $600 million in cash, a variable payment with a maximum cumulative value of $600 million expiring after two years, and Cenovus’s 35% position in the undeveloped Bay du Nord project offshore Newfoundland and Labrador.

The transaction has an effective date of May 1, 2022 and is anticipated to close in the third quarter of this year, subject to closing conditions and normal purchase price adjustments.

Full ownership of Sunrise further enhances Cenovus’s core strength in the oil sands. Sunrise has been operated by the company since the beginning of 2021, following the Husky Energy transaction, and Cenovus is now in the early stages of applying its oil sands operating model at this asset.

“Acquiring the remaining working interest in Sunrise enables us to fully benefit from the significant optimization opportunities available,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “By applying Cenovus’s advanced operating techniques, we expect to increase production at Sunrise while driving down sustaining capital, operating costs and emissions intensity.”

Cenovus currently operates Sunrise and owns 50% of the asset through the Sunrise Oil Sands Partnership, with bp. Current production from the asset is approximately 50,000 barrels per day (bbls/d), and the company expects to achieve nameplate capacity of 60,000 bbls/d through a multi-year development program. The acquisition is expected to be immediately accretive to adjusted funds flow and cash from operating activities.

2022 Guidance

Cenovus’s corporate guidance dated April 26, 2022 does not reflect this acquisition. The company plans to update guidance with its second quarter results in July 2022.

...

Antwort auf Beitrag Nr.: 71.306.097 von faultcode am 07.04.22 14:23:13Elliott will beim Nachbarn "aufräumen":

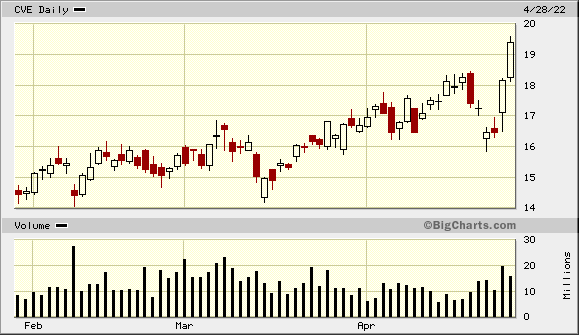

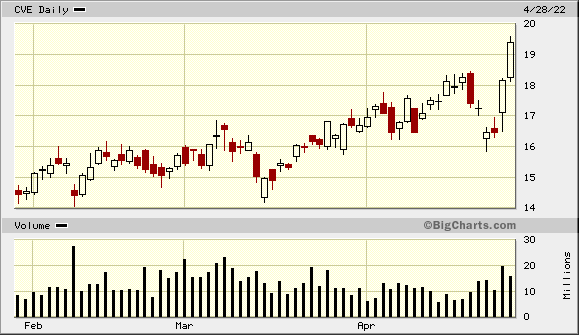

28.4.

Elliott calls for Suncor strategic review, board changes

https://www.msn.com/en-ca/money/topstories/elliott-calls-for…

=>

ein starkes Q1 half gestern auch. Das war aber auch zu erwarten gewesen:

...

The company’s Board of Directors has approved tripling the base dividend starting with the second quarter of 2022, as well as a plan for additional increases to shareholder returns.

Beyond the base dividend increase, Cenovus will target to return 50% of quarterly excess free funds flow to shareholders when reported net debt is less than $9 billion. The company will do this through share buybacks and/or variable dividends while also continuing to pay down the balance sheet. Cenovus has adopted an ultimate net debt target of $4 billion. When reported net debt is at the $4 billion floor, Cenovus will target to return 100% of that quarter’s excess free funds flow to shareholders through share buybacks and/or variable dividends.

...

https://www.cenovus.com/news/news-releases/2022/04-27-2022-C…

28.4.

Elliott calls for Suncor strategic review, board changes

https://www.msn.com/en-ca/money/topstories/elliott-calls-for…

=>

ein starkes Q1 half gestern auch. Das war aber auch zu erwarten gewesen:

...

The company’s Board of Directors has approved tripling the base dividend starting with the second quarter of 2022, as well as a plan for additional increases to shareholder returns.

Beyond the base dividend increase, Cenovus will target to return 50% of quarterly excess free funds flow to shareholders when reported net debt is less than $9 billion. The company will do this through share buybacks and/or variable dividends while also continuing to pay down the balance sheet. Cenovus has adopted an ultimate net debt target of $4 billion. When reported net debt is at the $4 billion floor, Cenovus will target to return 100% of that quarter’s excess free funds flow to shareholders through share buybacks and/or variable dividends.

...

https://www.cenovus.com/news/news-releases/2022/04-27-2022-C…

CVE, das richtige Pferdchen:

...

“Why would I own Suncor when I can own Cenovus?” said Eric Nuttall, a senior portfolio manager at Ninepoint Partners, adding that a string of safety issues need to be addressed before the stock’s performance improves.

...

6.4.

Suncor Shares Go From First to Worst in Canada Oil-Sands Boom

https://finance.yahoo.com/news/suncor-shares-first-worst-can…

...

“Why would I own Suncor when I can own Cenovus?” said Eric Nuttall, a senior portfolio manager at Ninepoint Partners, adding that a string of safety issues need to be addressed before the stock’s performance improves.

...

6.4.

Suncor Shares Go From First to Worst in Canada Oil-Sands Boom

https://finance.yahoo.com/news/suncor-shares-first-worst-can…

24.3.

Canada Will Boost Oil Exports as World Shuns Russian Supply

https://finance.yahoo.com/news/canada-boost-oil-exports-worl…

...

Canada will increase oil and gas exports by the equivalent of 300,000 barrels a day to help nations that are trying to shift away from Russian supplies, the country’s resources minister said.

Energy producers can raise shipments of crude by 200,000 barrels a day and natural gas by the equivalent of 100,000 by year-end by accelerating planned projects to expand output, Jonathan Wilkinson said Thursday at a press conference in Paris.

Canada and the U.S. already have the pipeline capacity to handle the extra volumes, with some of the extra oil expected to be shipped to Europe via the Gulf Coast, he said.

“Canada indicated to our European friends that we will work to help them in the current situation that they find themselves,” he said.

The Canadian government is also in discussions with European countries about eventually supplying them with liquefied natural gas, but any export facility would need to be eventually convertible to exporting hydrogen as part of a planned pivot away from hydrocarbons, Wilkinson said.

Canada has no LNG export terminals yet, but a consortium that includes Shell Plc and Malaysia’s Petroliam Nasional Bhd is building a large one on the Canada’s west coast that is expected to be ready by the middle of the decade.

...

"friends"

Canada Will Boost Oil Exports as World Shuns Russian Supply

https://finance.yahoo.com/news/canada-boost-oil-exports-worl…

...

Canada will increase oil and gas exports by the equivalent of 300,000 barrels a day to help nations that are trying to shift away from Russian supplies, the country’s resources minister said.

Energy producers can raise shipments of crude by 200,000 barrels a day and natural gas by the equivalent of 100,000 by year-end by accelerating planned projects to expand output, Jonathan Wilkinson said Thursday at a press conference in Paris.

Canada and the U.S. already have the pipeline capacity to handle the extra volumes, with some of the extra oil expected to be shipped to Europe via the Gulf Coast, he said.

“Canada indicated to our European friends that we will work to help them in the current situation that they find themselves,” he said.

The Canadian government is also in discussions with European countries about eventually supplying them with liquefied natural gas, but any export facility would need to be eventually convertible to exporting hydrogen as part of a planned pivot away from hydrocarbons, Wilkinson said.

Canada has no LNG export terminals yet, but a consortium that includes Shell Plc and Malaysia’s Petroliam Nasional Bhd is building a large one on the Canada’s west coast that is expected to be ready by the middle of the decade.

...

"friends"

Cenovus Energy