Cenovus Energy (Seite 3)

eröffnet am 15.09.19 01:49:31 von

neuester Beitrag 08.12.23 14:17:09 von

neuester Beitrag 08.12.23 14:17:09 von

Beiträge: 49

ID: 1.311.773

ID: 1.311.773

Aufrufe heute: 0

Gesamt: 3.411

Gesamt: 3.411

Aktive User: 0

ISIN: CA15135U1093 · WKN: A0YD8C

18,551

EUR

-0,58 %

-0,109 EUR

Letzter Kurs 22:42:04 Lang & Schwarz

Neuigkeiten

02.05.24 · globenewswire |

01.05.24 · globenewswire |

25.04.24 · globenewswire |

03.04.24 · wO Chartvergleich |

27.02.24 · globenewswire |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 5,2500 | +20,97 | |

| 15,000 | +15,38 | |

| 8,0000 | +10,34 | |

| 4,5500 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,030 | -9,04 | |

| 43.500,00 | -9,38 | |

| 10,380 | -10,05 | |

| 19,270 | -10,97 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 68.447.225 von faultcode am 08.06.21 23:46:33

https://twitter.com/StitchCapital/status/1414362535826923528

https://twitter.com/StitchCapital/status/1414362535826923528

die Analysten kommen mit Upgrades fast nicht mehr hinterher:

2021-06-08 16:15:00 GMT DJ Cenovus Energy Inc Price Target Raised to C$14.50/Share From C$12.00 by JP Morgan

ansonsten:

...

https://seekingalpha.com/article/4433764-cenovus-energy-big-…

2021-06-08 16:15:00 GMT DJ Cenovus Energy Inc Price Target Raised to C$14.50/Share From C$12.00 by JP Morgan

ansonsten:

...

https://seekingalpha.com/article/4433764-cenovus-energy-big-…

17.5.

Oilsands firms expected to spur $60 billion in cash flow over two years

https://boereport.com/2021/05/17/oilsands-firms-expected-to-…

A group of five large Canadian oilsands companies are expected to generate about $60 billion in net cash flow over the next two years and spend only half of it on dividends and capital expenditures, leaving the rest for debt repayment and sharing with shareholders.

In a report, analyst William Lacey of ATB Capital Markets says the companies are expected to duplicate their sterling financial performance of the first quarter of 2021 for the rest of this year and in 2022, provided that benchmark West Texas Intermediate oil prices remain near US$60 per barrel.

The five companies, Canadian Natural Resources Ltd., Suncor Energy Inc., Imperial Oil Ltd., Cenovus Energy Inc. and MEG Energy Corp., are expected to bring in $59 billion more in cash than they spend on operations, from which about $23.2 billion will go to capital budgets and about $9 billion to dividends.

The report says that will leave about $26.8 billion to pay down debt, buy back shares for cancellation and use to increase dividends.

Lacey says the five companies have been consistent in setting debt and shareholder return targets for all near-term cash flow rather than spending on growing output organically or through buying other companies or assets.

The report says the Canadian firms are attractive for investors in comparison with American rivals because they are more heavily weighted toward oil production.

“Assuming that WTI prices remain in the realm of US$60 per barrel, we believe that the combination of material free cash flow yields and exceptionally low (stock) valuations will be too attractive for generalist investors to look past, especially in light of ongoing inflationary pressures and the resultant rotation towards tangible assets,” the report concludes.

Oilsands firms expected to spur $60 billion in cash flow over two years

https://boereport.com/2021/05/17/oilsands-firms-expected-to-…

A group of five large Canadian oilsands companies are expected to generate about $60 billion in net cash flow over the next two years and spend only half of it on dividends and capital expenditures, leaving the rest for debt repayment and sharing with shareholders.

In a report, analyst William Lacey of ATB Capital Markets says the companies are expected to duplicate their sterling financial performance of the first quarter of 2021 for the rest of this year and in 2022, provided that benchmark West Texas Intermediate oil prices remain near US$60 per barrel.

The five companies, Canadian Natural Resources Ltd., Suncor Energy Inc., Imperial Oil Ltd., Cenovus Energy Inc. and MEG Energy Corp., are expected to bring in $59 billion more in cash than they spend on operations, from which about $23.2 billion will go to capital budgets and about $9 billion to dividends.

The report says that will leave about $26.8 billion to pay down debt, buy back shares for cancellation and use to increase dividends.

Lacey says the five companies have been consistent in setting debt and shareholder return targets for all near-term cash flow rather than spending on growing output organically or through buying other companies or assets.

The report says the Canadian firms are attractive for investors in comparison with American rivals because they are more heavily weighted toward oil production.

“Assuming that WTI prices remain in the realm of US$60 per barrel, we believe that the combination of material free cash flow yields and exceptionally low (stock) valuations will be too attractive for generalist investors to look past, especially in light of ongoing inflationary pressures and the resultant rotation towards tangible assets,” the report concludes.

7.5.

Cenovus makes strong progress on Husky integration and synergies

https://finance.yahoo.com/news/cenovus-makes-strong-progress…

...

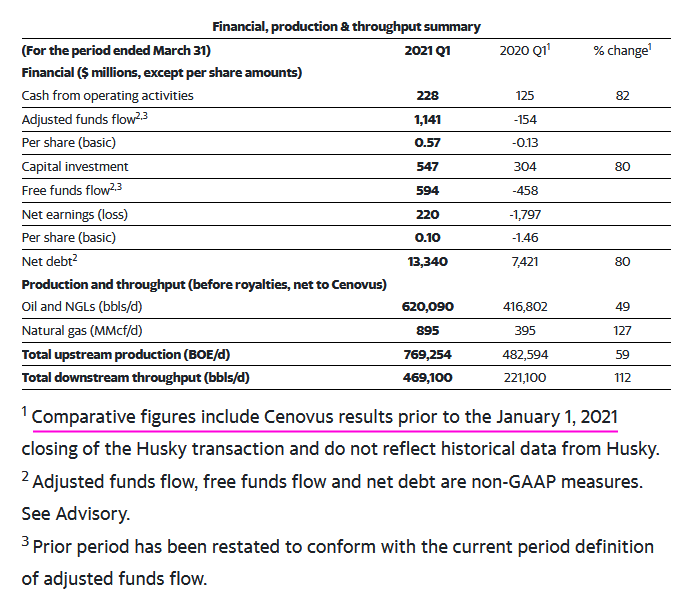

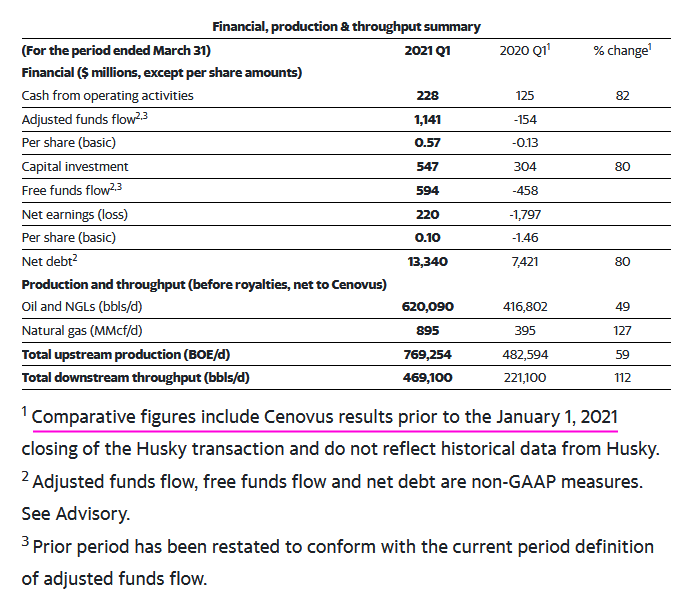

Generates $1.1 billion in adjusted funds flow in first quarter 2021

CALGARY, Alberta, May 07, 2021 (GLOBE NEWSWIRE) -- Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered solid operating and financial performance in the company’s inaugural quarter of operations following the acquisition of Husky Energy Inc. on January 1.

With its disciplined and methodical approach to integrating Husky’s assets, the company has made significant progress in the first three months of the year and is firmly on track to deliver on its targeted acquisition synergies and 2021 budget and production guidance. Cenovus produced nearly 770,000 barrels of oil equivalent per day (BOE/d) in the quarter, and generated adjusted funds flow of more than $1.1 billion, cash from operating activities of $228 million, free funds flow of $594 million and net earnings of $220 million.

“With the extensive due diligence we undertook prior to the acquisition of Husky, and our experience since the close of the acquisition, we’re highly confident we’ll deliver at least $1 billion in synergies this year and reach our planned $1.2 billion in annual run-rate synergies by the end of 2021,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “If the current commodity price environment is sustained, we expect to approach our $10 billion net debt target this year, prior to the benefit of any asset sales.”

...

...

Cenovus makes strong progress on Husky integration and synergies

https://finance.yahoo.com/news/cenovus-makes-strong-progress…

...

Generates $1.1 billion in adjusted funds flow in first quarter 2021

CALGARY, Alberta, May 07, 2021 (GLOBE NEWSWIRE) -- Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered solid operating and financial performance in the company’s inaugural quarter of operations following the acquisition of Husky Energy Inc. on January 1.

With its disciplined and methodical approach to integrating Husky’s assets, the company has made significant progress in the first three months of the year and is firmly on track to deliver on its targeted acquisition synergies and 2021 budget and production guidance. Cenovus produced nearly 770,000 barrels of oil equivalent per day (BOE/d) in the quarter, and generated adjusted funds flow of more than $1.1 billion, cash from operating activities of $228 million, free funds flow of $594 million and net earnings of $220 million.

“With the extensive due diligence we undertook prior to the acquisition of Husky, and our experience since the close of the acquisition, we’re highly confident we’ll deliver at least $1 billion in synergies this year and reach our planned $1.2 billion in annual run-rate synergies by the end of 2021,” said Alex Pourbaix, Cenovus President & Chief Executive Officer. “If the current commodity price environment is sustained, we expect to approach our $10 billion net debt target this year, prior to the benefit of any asset sales.”

...

...

Energy is now the largest sector in the GS Retail Favorites basket after its latest monthly rebalance.

https://twitter.com/GavinSBaker/status/1362007827678699522

https://twitter.com/GavinSBaker/status/1362007827678699522

Antwort auf Beitrag Nr.: 66.594.128 von faultcode am 25.01.21 13:43:1228.1.

Cenovus ups 2021 oil production and spending forecast after Husky deal

https://ca.finance.yahoo.com/news/cenovus-forecasts-higher-2…

...

Canada's Cenovus Energy Inc on Thursday forecast higher production and spending for 2021 after its purchase of rival Husky Energy but stressed its focus on cutting debt as the oil industry rebounds from the depths of the COVID-19 pandemic.

Cenovus agreed to buy rival Husky last year to create Canada's No. 3 oil and gas producer, as historically low oil prices caused by a collapse in fuel demand due to COVID-19 and a price war between Saudi Arabia and Russia forced the industry to consolidate.

The Calgary-based company said it will spend between C$2.3 billion ($1.8 billion) and C$2.7 billion this year, up from a 2020 forecast of C$750 million to C$850 million. The vast majority, C$2.1 billion, of that spending will go toward maintenance capital required to keep existing production flowing.

Forecast production also jumped as a result of the Husky acquisition to between 730,000 and 780,000 barrels of oil equivalent per day (boepd), up from a 2020 production forecast of 432,000-486,000 boepd.

Like many of its competitors in the Canadian oil patch, Cenovus will use free cash flow to pay down debt and repair balance sheets that were battered by the oil price rout last year. The company is aiming to reduce net debt to less than C$10 billion from around C$12 billion right after the Husky deal.

"We have been banging one drum here pretty hard and it is balance sheet, balance sheet, balance sheet. That's where our focus is going to be at least until we get comfortably below that C$10 billion number," Cenovus Chief Executive Alex Pourbaix said on a conference call with analysts.

Pourbaix said one of the best ways for Cenovus to accelerate balance sheet recovery would be by divesting assets and the company was "laser focused" on that opportunity.

...

Cenovus ups 2021 oil production and spending forecast after Husky deal

https://ca.finance.yahoo.com/news/cenovus-forecasts-higher-2…

...

Canada's Cenovus Energy Inc on Thursday forecast higher production and spending for 2021 after its purchase of rival Husky Energy but stressed its focus on cutting debt as the oil industry rebounds from the depths of the COVID-19 pandemic.

Cenovus agreed to buy rival Husky last year to create Canada's No. 3 oil and gas producer, as historically low oil prices caused by a collapse in fuel demand due to COVID-19 and a price war between Saudi Arabia and Russia forced the industry to consolidate.

The Calgary-based company said it will spend between C$2.3 billion ($1.8 billion) and C$2.7 billion this year, up from a 2020 forecast of C$750 million to C$850 million. The vast majority, C$2.1 billion, of that spending will go toward maintenance capital required to keep existing production flowing.

Forecast production also jumped as a result of the Husky acquisition to between 730,000 and 780,000 barrels of oil equivalent per day (boepd), up from a 2020 production forecast of 432,000-486,000 boepd.

Like many of its competitors in the Canadian oil patch, Cenovus will use free cash flow to pay down debt and repair balance sheets that were battered by the oil price rout last year. The company is aiming to reduce net debt to less than C$10 billion from around C$12 billion right after the Husky deal.

"We have been banging one drum here pretty hard and it is balance sheet, balance sheet, balance sheet. That's where our focus is going to be at least until we get comfortably below that C$10 billion number," Cenovus Chief Executive Alex Pourbaix said on a conference call with analysts.

Pourbaix said one of the best ways for Cenovus to accelerate balance sheet recovery would be by divesting assets and the company was "laser focused" on that opportunity.

...

21.1.

Biden administration suspends new oil, gas drilling permits on federal land

Move could be the first step in an eventual goal to ban all leases and permits to drill on federal land

https://www.marketwatch.com/story/biden-administration-suspe…

...

The Biden administration announced Thursday a 60-day suspension of new oil and gas leasing and drilling permits for U.S. lands and waters as officials moved quickly to reverse Trump administration policies on energy and the environment.

The suspension, part of a broad review of programs at the Department of Interior, went into effect immediately under an order signed Wednesday by Acting Interior Secretary Scott de la Vega. It follows Democratic President Joe Biden’s campaign pledge to halt new drilling on federal lands and end the leasing of publicly owned energy reserves as part of his plan to address climate change.

The order did not ban new drilling outright. It includes an exception giving a small number of senior Interior officials — the secretary, deputy secretary, solicitor and several assistant secretaries — authority to approve actions that otherwise would be suspended.

The order also applies to coal leases and permits, and blocks the approval of new mining plans. Land sales or exchanges and the hiring of senior-level staff at the agency also were suspended.

Under former President Donald Trump, federal agencies prioritized energy development and eased environmental rules to speed up drilling permits as part of the Republican’s goal to end reliance on foreign energy supplies and boost domestic production. Trump consistently downplayed the dangers of climate change, which Biden has made a top priority.

On his first day in office, Biden signed a series of executive orders that underscored his different approach — rejoining the Paris Climate Accord, revoking approval of the Keystone XL oil pipeline from Canada and telling agencies to immediately review dozens of Trump-era rules on science, the environment and public health.

The Interior Department order did not limit existing oil and gas operations under valid leases, meaning activity won’t come to a sudden halt on the millions of acres of lands in the West and offshore in the Gulf of Mexico where much drilling is concentrated. Its effect could be further blunted by companies that stockpiled enough drilling permits in Trump’s final months to allow them to keep pumping oil and gas for years.

But Biden’s move could be the first step in an eventual goal to ban all leases and permits to drill on federal land. Mineral leasing laws state that federal lands are for many uses, including extracting oil and gas, but the Democrat could set out to rewrite those laws, said Kevin Book, managing director at Clearview Energy Partners.

The administration’s announcement drew a quick backlash from Republicans and oil industry trade groups. They said limiting access to publicly owned energy resources would mean more foreign oil imports, lost jobs and fewer tax revenues.

...

Biden administration suspends new oil, gas drilling permits on federal land

Move could be the first step in an eventual goal to ban all leases and permits to drill on federal land

https://www.marketwatch.com/story/biden-administration-suspe…

...

The Biden administration announced Thursday a 60-day suspension of new oil and gas leasing and drilling permits for U.S. lands and waters as officials moved quickly to reverse Trump administration policies on energy and the environment.

The suspension, part of a broad review of programs at the Department of Interior, went into effect immediately under an order signed Wednesday by Acting Interior Secretary Scott de la Vega. It follows Democratic President Joe Biden’s campaign pledge to halt new drilling on federal lands and end the leasing of publicly owned energy reserves as part of his plan to address climate change.

The order did not ban new drilling outright. It includes an exception giving a small number of senior Interior officials — the secretary, deputy secretary, solicitor and several assistant secretaries — authority to approve actions that otherwise would be suspended.

The order also applies to coal leases and permits, and blocks the approval of new mining plans. Land sales or exchanges and the hiring of senior-level staff at the agency also were suspended.

Under former President Donald Trump, federal agencies prioritized energy development and eased environmental rules to speed up drilling permits as part of the Republican’s goal to end reliance on foreign energy supplies and boost domestic production. Trump consistently downplayed the dangers of climate change, which Biden has made a top priority.

On his first day in office, Biden signed a series of executive orders that underscored his different approach — rejoining the Paris Climate Accord, revoking approval of the Keystone XL oil pipeline from Canada and telling agencies to immediately review dozens of Trump-era rules on science, the environment and public health.

The Interior Department order did not limit existing oil and gas operations under valid leases, meaning activity won’t come to a sudden halt on the millions of acres of lands in the West and offshore in the Gulf of Mexico where much drilling is concentrated. Its effect could be further blunted by companies that stockpiled enough drilling permits in Trump’s final months to allow them to keep pumping oil and gas for years.

But Biden’s move could be the first step in an eventual goal to ban all leases and permits to drill on federal land. Mineral leasing laws state that federal lands are for many uses, including extracting oil and gas, but the Democrat could set out to rewrite those laws, said Kevin Book, managing director at Clearview Energy Partners.

The administration’s announcement drew a quick backlash from Republicans and oil industry trade groups. They said limiting access to publicly owned energy resources would mean more foreign oil imports, lost jobs and fewer tax revenues.

...

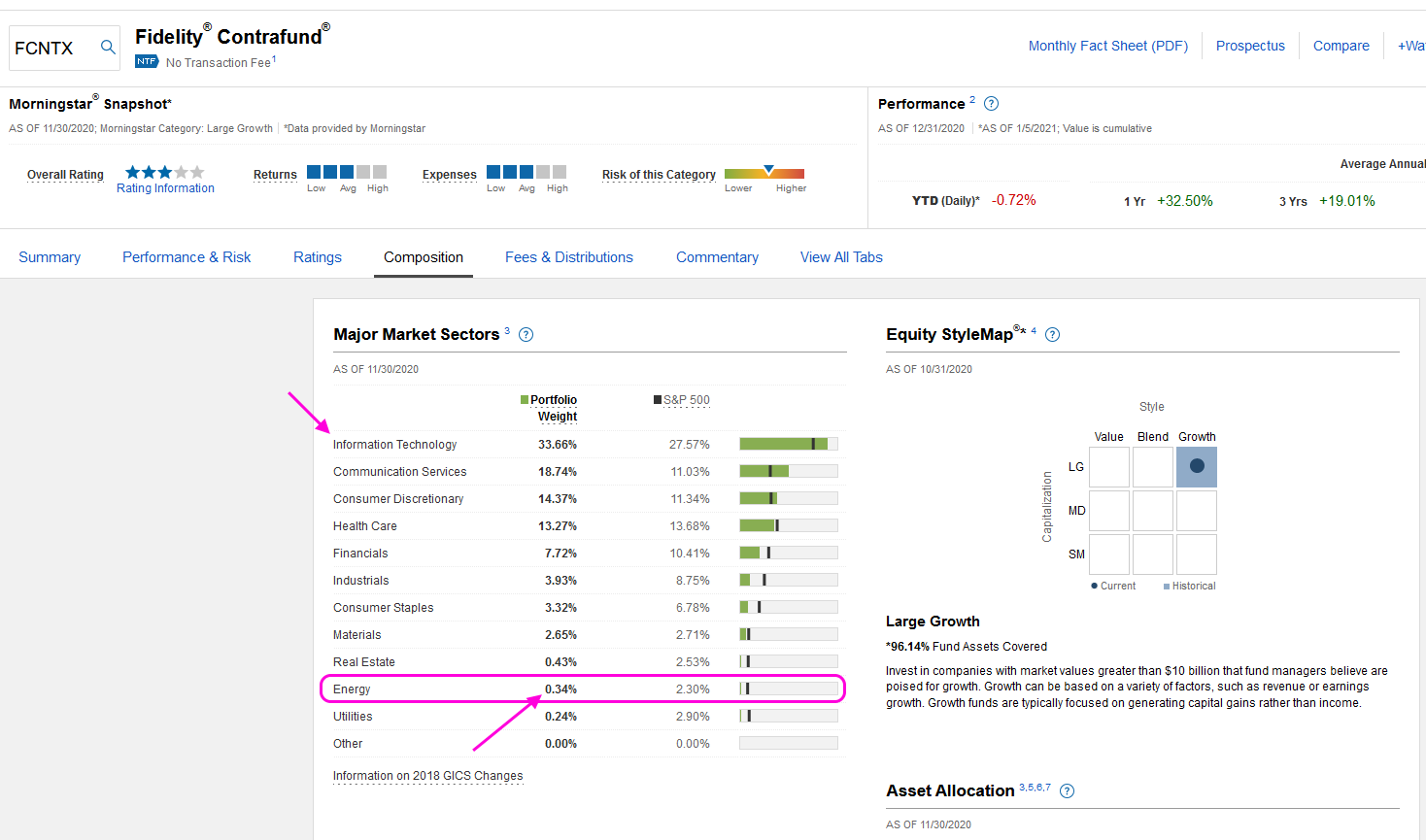

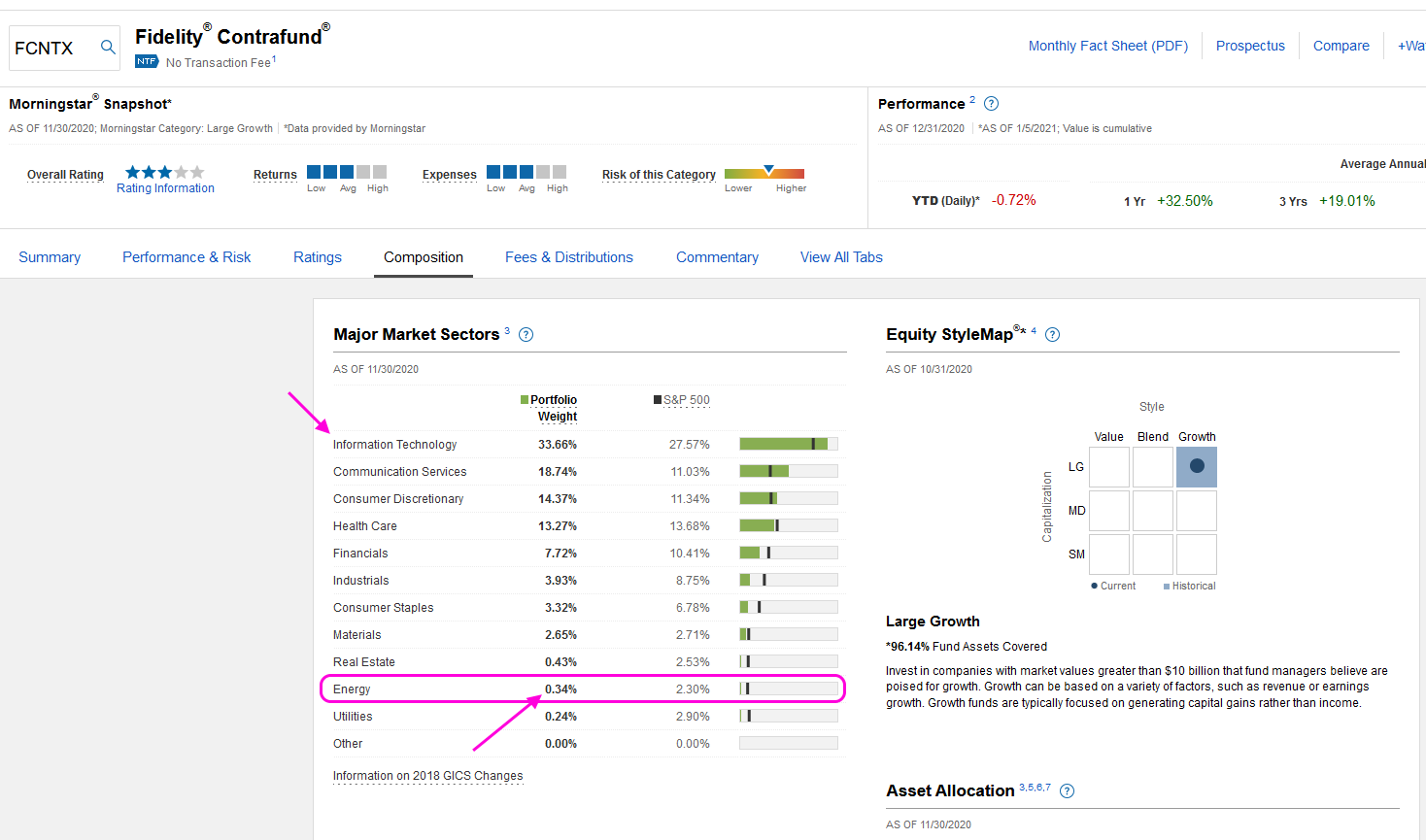

Große Fonds (in den USA) sind teilweise dramatisch unterinvestiert in Energy. Auch eben vermutlich ökobewegt ("ESG").

Z.B. FCNTX -- Fidelity Contrafund: Morningstar Category: Large Growth

Fund Inception: 5/17/1967

Portfolio Net Assets ($M): $136,386.45

Holding #1: Amazon.com mit > 9%

bei den letzten beiden Blasen wurde er für neue Konten geschlossen:

• Fund Closed to New Accounts: This fund is closed to new investors. 4/28/2006 - 12/15/2008

• Fund Closed to New Accounts: This fund is closed to new investors. 4/3/1998 - 12/15/2000

https://fundresearch.fidelity.com/mutual-funds/composition/3…

Z.B. FCNTX -- Fidelity Contrafund: Morningstar Category: Large Growth

Fund Inception: 5/17/1967

Portfolio Net Assets ($M): $136,386.45

Holding #1: Amazon.com mit > 9%

bei den letzten beiden Blasen wurde er für neue Konten geschlossen:

• Fund Closed to New Accounts: This fund is closed to new investors. 4/28/2006 - 12/15/2008

• Fund Closed to New Accounts: This fund is closed to new investors. 4/3/1998 - 12/15/2000

https://fundresearch.fidelity.com/mutual-funds/composition/3…

Cenovus Energy