Softbank & JD.com: Nach 100 % Kursplus noch ein Kauf? | Diskussion im Forum

eröffnet am 07.09.20 13:59:28 von

neuester Beitrag 09.11.23 17:34:50 von

neuester Beitrag 09.11.23 17:34:50 von

Beiträge: 30

ID: 1.330.698

ID: 1.330.698

Aufrufe heute: 0

Gesamt: 3.051

Gesamt: 3.051

Aktive User: 0

ISIN: JP3436100006 · WKN: 891624 · Symbol: SFT

46,86

EUR

-0,30 %

-0,14 EUR

Letzter Kurs 09:35:57 Tradegate

Neuigkeiten

24.02.24 · Markus Weingran |

21.02.24 · BNP Paribas Anzeige |

19.02.24 · Markus Weingran |

19.02.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 108,90 | +40,12 | |

| 40,48 | +21,02 | |

| 0,8680 | +10,57 | |

| 28,40 | +10,51 | |

| 0,9350 | +9,36 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5000 | -11,99 | |

| 56,53 | -12,83 | |

| 9,6000 | -13,51 | |

| 104,72 | -14,16 | |

| 11,450 | -16,42 |

Beitrag zu dieser Diskussion schreiben

9.11.

Softbank schreibt Milliardenverlust wegen Wework-Insolvenz

https://www.wiwo.de/unternehmen/banken/banken-softbank-schre…

...

Der japanische Technologieinvestor Softbank ist wegen der Insolvenz des US-Bürovermieters Wework tiefer in die roten Zahlen gerutscht. Das Ergebnis brach im zweiten Quartal auf minus 789 Milliarden Yen ein (umgerechnet 4,88 Milliarden Euro), wie der Wework-Mehrheitseigner am Donnerstag mitteilte. Das ist der vierte Verlust in Folge. Im Vorjahr stand noch ein Überschuss von rund drei Billionen Yen in den Büchern, als Softbank durch Termingeschäfte mit Aktien des chinesischen Alibaba-Konzerns Riesengewinne einfuhr.

Der Tech-Investor hält 60 Prozent an Wework, das sich vom gehypten Start-up mit einer einstigen Bewertung von 47 Milliarden Dollar binnen fünf Jahren zum Schuldenfass entwickelte. Die Japaner haben bereits Milliarden in die Sanierung des Bürovermieters gesteckt, der sich Anfang November in die Insolvenz flüchtete.

...

Softbank schreibt Milliardenverlust wegen Wework-Insolvenz

https://www.wiwo.de/unternehmen/banken/banken-softbank-schre…

...

Der japanische Technologieinvestor Softbank ist wegen der Insolvenz des US-Bürovermieters Wework tiefer in die roten Zahlen gerutscht. Das Ergebnis brach im zweiten Quartal auf minus 789 Milliarden Yen ein (umgerechnet 4,88 Milliarden Euro), wie der Wework-Mehrheitseigner am Donnerstag mitteilte. Das ist der vierte Verlust in Folge. Im Vorjahr stand noch ein Überschuss von rund drei Billionen Yen in den Büchern, als Softbank durch Termingeschäfte mit Aktien des chinesischen Alibaba-Konzerns Riesengewinne einfuhr.

Der Tech-Investor hält 60 Prozent an Wework, das sich vom gehypten Start-up mit einer einstigen Bewertung von 47 Milliarden Dollar binnen fünf Jahren zum Schuldenfass entwickelte. Die Japaner haben bereits Milliarden in die Sanierung des Bürovermieters gesteckt, der sich Anfang November in die Insolvenz flüchtete.

...

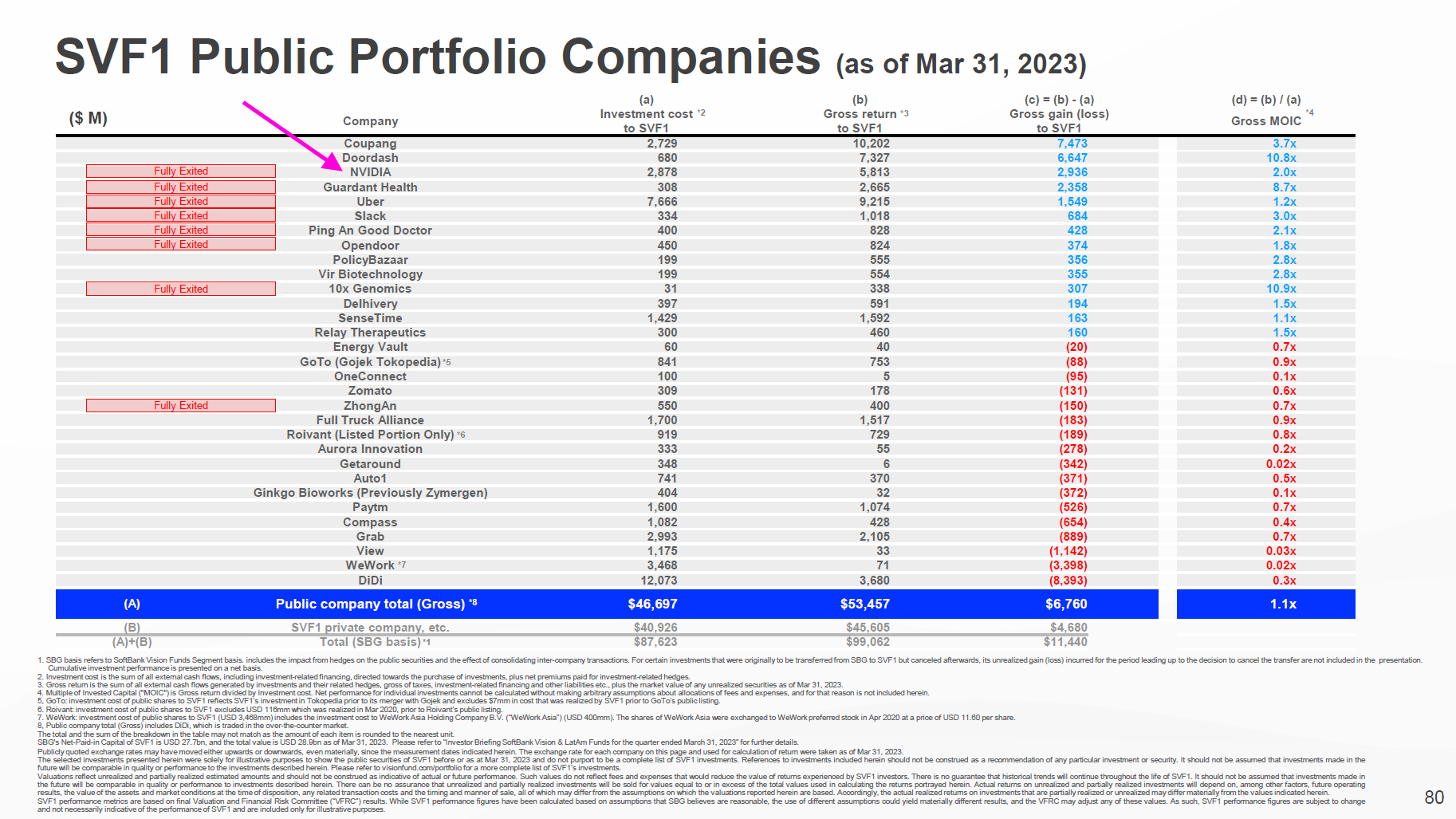

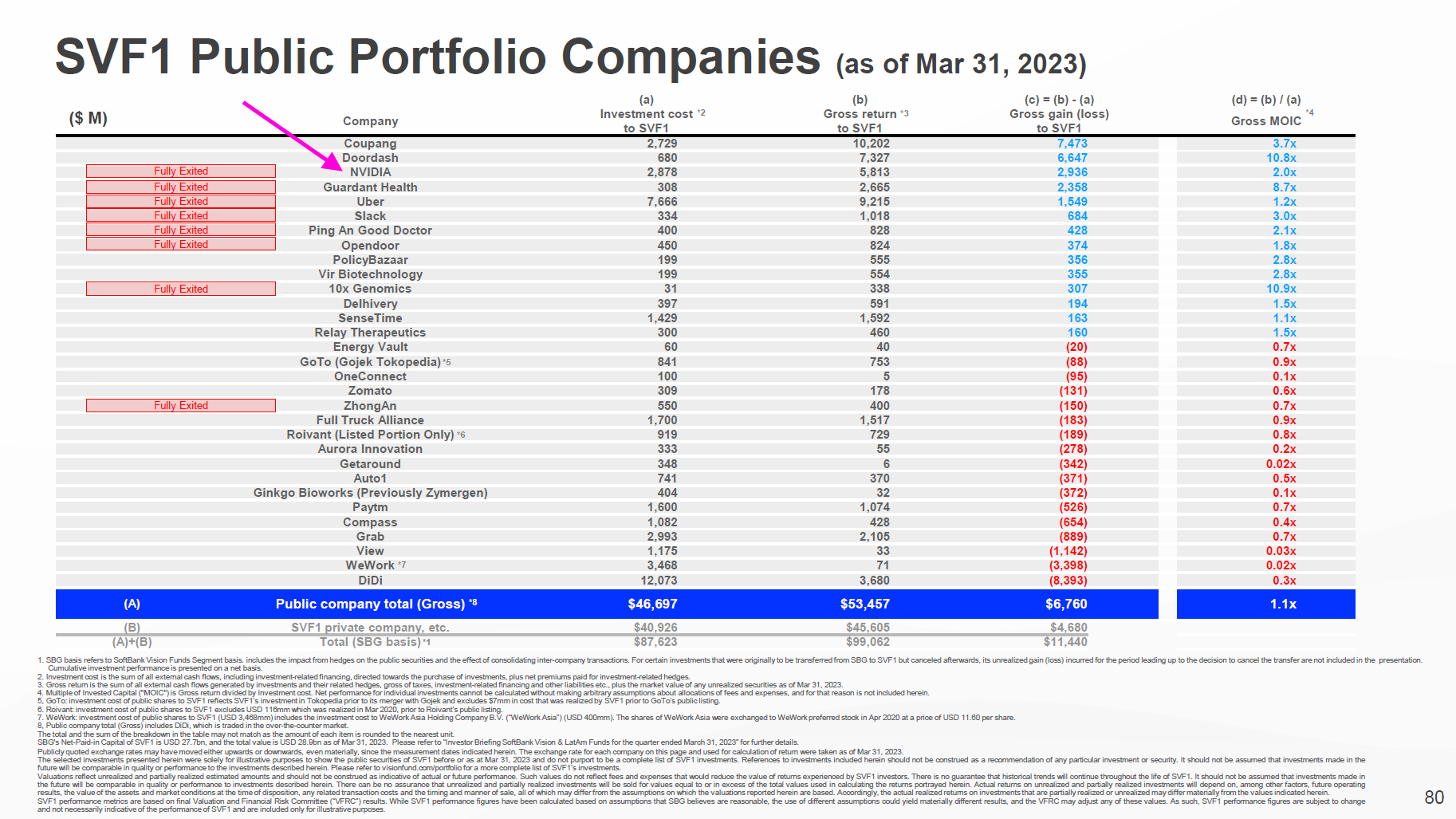

Antwort auf Beitrag Nr.: 73.927.901 von NUGGET am 30.05.23 18:19:27AR2022:

..Includes NVIDIA Corporation shares held by SBG of ¥15.5 billion at the previous fiscal year-end and ¥35.1 billion at the fiscal year-end.

<PDF90/129, ganz unten als Fußnote>

SBG = SoftBank Group Corp.

in 2023Q1 "Fully Exited":

https://group.softbank/en/ir

..Includes NVIDIA Corporation shares held by SBG of ¥15.5 billion at the previous fiscal year-end and ¥35.1 billion at the fiscal year-end.

<PDF90/129, ganz unten als Fußnote>

SBG = SoftBank Group Corp.

in 2023Q1 "Fully Exited":

https://group.softbank/en/ir

besten Dank; der derzeitige ai superstar nvidia ist ja vision fund enthalten; ich konnte die höhe der beteiligung nicht finden- hoffentlich recht ordentlich

Antwort auf Beitrag Nr.: 73.906.592 von NUGGET am 25.05.23 15:27:18Earnings Results for the Fiscal Year Ended March 31, 2023

Investor Briefing

Ver.1.1

https://group.softbank/en/ir

...

...

Investor Briefing

Ver.1.1

https://group.softbank/en/ir

...

...

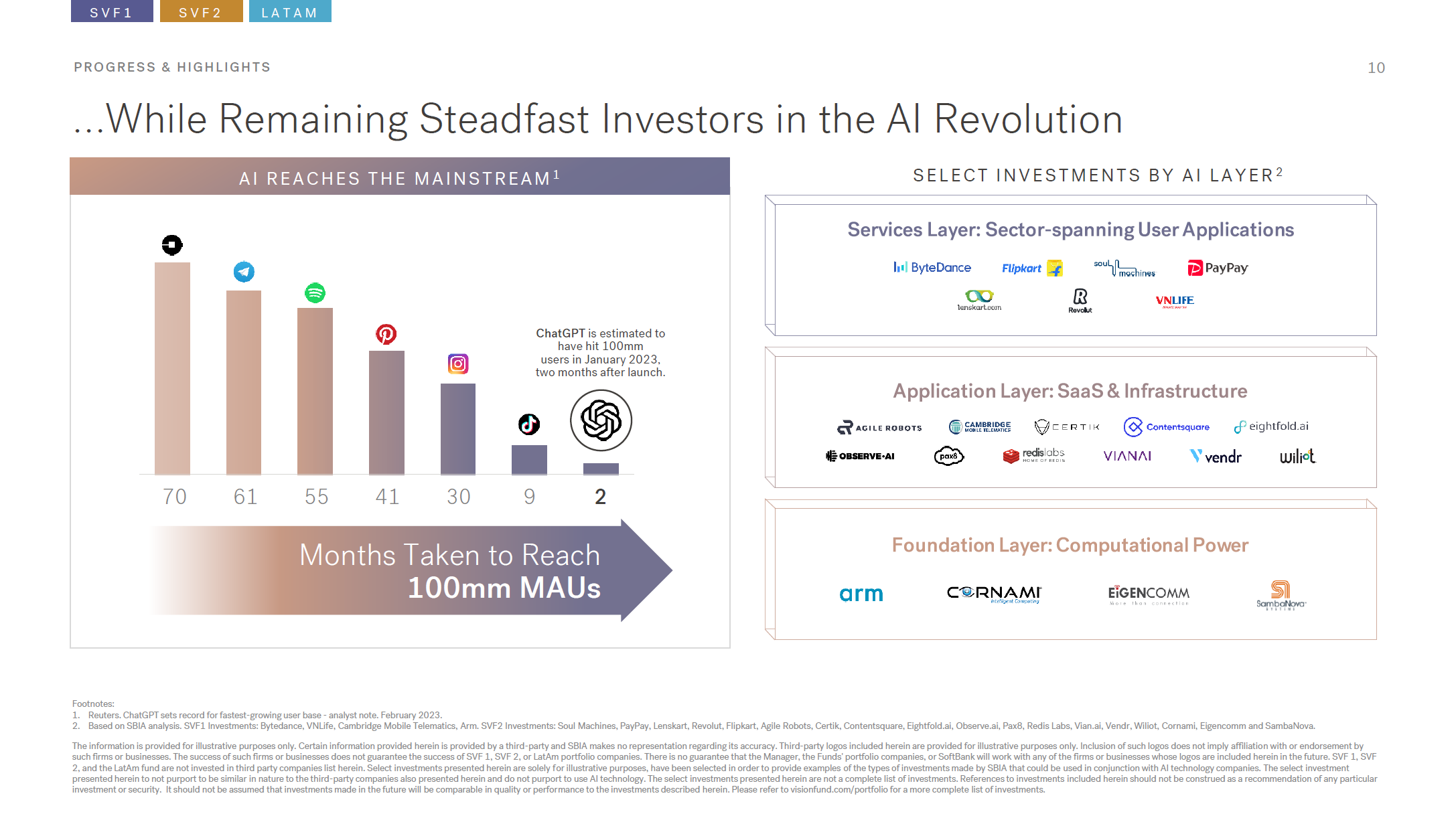

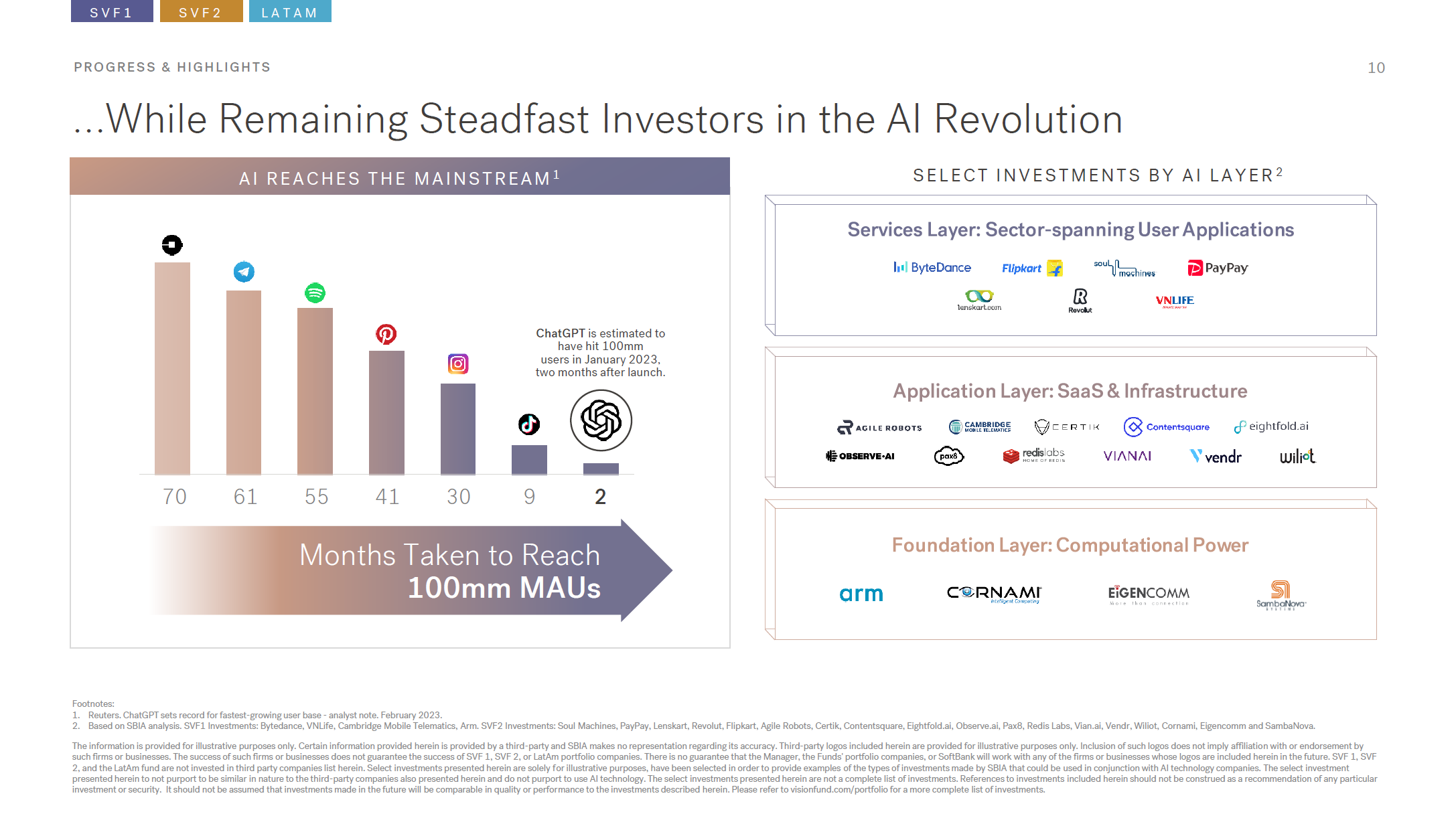

Welche Beteiligungen hat softbank im AI Bereich? Danke für Rückmeldungen

23.5.

SoftBank pushes back after S&P cuts rating deeper into junk

https://www.nasdaq.com/articles/softbank-pushes-back-after-s…

...

S&P Global Ratings cut SoftBank Group Corp's 9984.T long-term rating deeper into junk territory on Tuesday, leading the Japanese tech investment conglomerate to push back against the downgrade.

S&P lowered SoftBank's rating to BB from BB-plus, citing SoftBank's exposure to unlisted companies that are susceptible to changes in the external environment.

SoftBank has sold down assets including its stake in Chinese e-commerce giant Alibaba Group Holding Ltd 9988.HK to stabilise its balance sheet as the value of its portfolio falters.

"(The sale of its shares) have eroded the proportion of listed assets in its portfolio. Furthermore, the technology stocks in which the company has primarily invested have been depressed for a prolonged period," S&P said in a note.

SoftBank CEO Masayoshi Son has pledged to play "defence" with prudent financial management amid weakness in tech valuations.

"It is extremely regrettable that our financial soundness was not properly assessed, and we will continue our dialogue with S&P," SoftBank said in a statement.

S&P said a listing for chip designer Arm, which has become a primary preoccupation for Son, would improve asset liquidity.

SoftBank has sold down assets including its stake in Chinese e-commerce giant Alibaba Group Holding Ltd 9988.HK to stabilise its balance sheet as the value of its portfolio falters.

"(The sale of its shares) have eroded the proportion of listed assets in its portfolio. Furthermore, the technology stocks in which the company has primarily invested have been depressed for a prolonged period," S&P said in a note.

SoftBank CEO Masayoshi Son has pledged to play "defence" with prudent financial management amid weakness in tech valuations.

"It is extremely regrettable that our financial soundness was not properly assessed, and we will continue our dialogue with S&P," SoftBank said in a statement.

S&P said a listing for chip designer Arm, which has become a primary preoccupation for Son, would improve asset liquidity.

SoftBank pushes back after S&P cuts rating deeper into junk

https://www.nasdaq.com/articles/softbank-pushes-back-after-s…

...

S&P Global Ratings cut SoftBank Group Corp's 9984.T long-term rating deeper into junk territory on Tuesday, leading the Japanese tech investment conglomerate to push back against the downgrade.

S&P lowered SoftBank's rating to BB from BB-plus, citing SoftBank's exposure to unlisted companies that are susceptible to changes in the external environment.

SoftBank has sold down assets including its stake in Chinese e-commerce giant Alibaba Group Holding Ltd 9988.HK to stabilise its balance sheet as the value of its portfolio falters.

"(The sale of its shares) have eroded the proportion of listed assets in its portfolio. Furthermore, the technology stocks in which the company has primarily invested have been depressed for a prolonged period," S&P said in a note.

SoftBank CEO Masayoshi Son has pledged to play "defence" with prudent financial management amid weakness in tech valuations.

"It is extremely regrettable that our financial soundness was not properly assessed, and we will continue our dialogue with S&P," SoftBank said in a statement.

S&P said a listing for chip designer Arm, which has become a primary preoccupation for Son, would improve asset liquidity.

SoftBank has sold down assets including its stake in Chinese e-commerce giant Alibaba Group Holding Ltd 9988.HK to stabilise its balance sheet as the value of its portfolio falters.

"(The sale of its shares) have eroded the proportion of listed assets in its portfolio. Furthermore, the technology stocks in which the company has primarily invested have been depressed for a prolonged period," S&P said in a note.

SoftBank CEO Masayoshi Son has pledged to play "defence" with prudent financial management amid weakness in tech valuations.

"It is extremely regrettable that our financial soundness was not properly assessed, and we will continue our dialogue with S&P," SoftBank said in a statement.

S&P said a listing for chip designer Arm, which has become a primary preoccupation for Son, would improve asset liquidity.

1.5.

SoftBank Vision funds post record $39bn annual loss

Tech conglomerate in ‘defence mode’ as it halts new investments and sells down Alibaba stake

https://www.ft.com/content/1dd470c2-be80-4887-83cc-87be93100…

...

SoftBank Vision funds post record $39bn annual loss

Tech conglomerate in ‘defence mode’ as it halts new investments and sells down Alibaba stake

https://www.ft.com/content/1dd470c2-be80-4887-83cc-87be93100…

...

1.5.

Chipdesigner Arm Ltd. stellt Antrag auf Börsengang in den USA

Arm Ltd. will an die US-Börse. Der Antrag wurde bei der U.S. Securities and Exchange Commission (SEC) bereits gestellt, wie das Unternehmen bekannt gab.

https://www.heise.de/news/Chipdesigner-Arm-Ltd-stellt-Antrag…

...

Der Chipentwickler ARM Ltd. hat die zur Registrierung an der US-Börse notwendigen Papiere bei der zuständigen Aufsichtsbehörde eingereicht. Wie das Unternehmen am vergangenen Samstag mitteilte, liegt der U.S. Securities and Exchange Commission (SEC) ein erster Entwurf für den geplanten Börsengang vor. Wie viel durch den Börsengang erlöst werden soll, blieb noch offen: Umfang und die Preisspanne müssten noch festgelegt werden, heißt es in der Mitteilung.

...

Chipdesigner Arm Ltd. stellt Antrag auf Börsengang in den USA

Arm Ltd. will an die US-Börse. Der Antrag wurde bei der U.S. Securities and Exchange Commission (SEC) bereits gestellt, wie das Unternehmen bekannt gab.

https://www.heise.de/news/Chipdesigner-Arm-Ltd-stellt-Antrag…

...

Der Chipentwickler ARM Ltd. hat die zur Registrierung an der US-Börse notwendigen Papiere bei der zuständigen Aufsichtsbehörde eingereicht. Wie das Unternehmen am vergangenen Samstag mitteilte, liegt der U.S. Securities and Exchange Commission (SEC) ein erster Entwurf für den geplanten Börsengang vor. Wie viel durch den Börsengang erlöst werden soll, blieb noch offen: Umfang und die Preisspanne müssten noch festgelegt werden, heißt es in der Mitteilung.

...

11.11.

Son Bids Goodbye to Investor Calls as SoftBank Turns Defensive

https://finance.yahoo.com/news/son-bids-goodbye-investor-cal…

...

SoftBank Group Corp. founder Masayoshi Son bade farewell to the earnings presentations he’s led for decades, as plunging startup valuations force the company into all-out defense.

The 65-year-old said he would no longer speak at the quarterly events after the Tokyo-based company’s Vision Fund investment arm posted a $7.2 billion loss. He’s turning responsibility for the events over to Chief Financial Officer Yoshimitsu Goto, along with several lieutenants.

SoftBank, which for years was the world’s most aggressive tech investor, has virtually halted new investments and focused on its balance sheet. With no clear recovery in sight, Son said he is no longer the right person to lead the calls and that he would focus his time on taking its chip designer Arm Ltd. public. Son declared Goto, a low-profile former banker, the company’s defensive champion.

“Goto is more suitable than me for playing defense,” Son said during what he said would be his last earnings results briefing “Me, I’m an aggressive person, not a defensive person, and I’d like to concentrate on Arm for the time being.”

...

Even on Friday, Son reprised several of his favorite themes. He recalled his earliest days as an entrepreneur in California when he first saw a photo of a microprocessor, claiming it brought him to tears.

“I couldn’t stop crying,” he said.

For his part, Goto said Son would remain firmly in charge of the company, but he said SoftBank had put too much on the shoulders of the founder.

“We at SoftBank have been spoiled by Son,” Goto said. “We need to break the habit of relying on him.”

Overall for the quarter, the Japanese conglomerate logged net income of 3.03 trillion yen in the last quarter, buoyed by the disposal of a chunk of its Alibaba Group Holding Ltd. stake. The company said its total profit on its disposal of Alibaba shares was 5.37 trillion yen.

Son turned his telecom company into the world’s biggest startup investor, intent on repeating his early success in backing the Chinese e-commerce pioneer. But the effort has been plagued by missteps and, more recently, a sharp downturn in technology valuations.

SoftBank has been struggling with declines on public investments, with the Vision Fund recording net valuation losses totaling 1.19 trillion on its public holdings in the quarter just ended. Of those, China’s SenseTime Group Inc. accounted for 364 billion yen, while US food delivery firm Doordash Inc. accounted for 225 billion yen and Indonesian ride-hailing and e-commerce firm GoTo Group 108 billion yen, it said.

“We need to go full-on defense,” Goto said. “SoftBank is pessimistic on the outlook. We do not yet see the light.”

As attention turns to SoftBank’s balance sheet, SoftBank has been hurrying to offload assets to bolster its bottom line and fund a share repurchase spree that has vaulted its share price more than 40% since the start of this quarter. SoftBank’s total interest-bearing debt, excluding telecom arm SoftBank Corp., stood at 13.7 trillion yen, down from more than 17 trillion yen at the end of June.

Other investment losses loom on the horizon. Goto said that SoftBank’s stake in the troubled crypto exchange FTX.com amounted to a little less than $100 million. So even if SoftBank wrote off the entire amount, it would not be a material loss. Crypto occupies only 1.3% of the Vision Fund’s portfolio -- even including indirect stakes -- as it doesn’t fit its investment philosophy, he said.

...

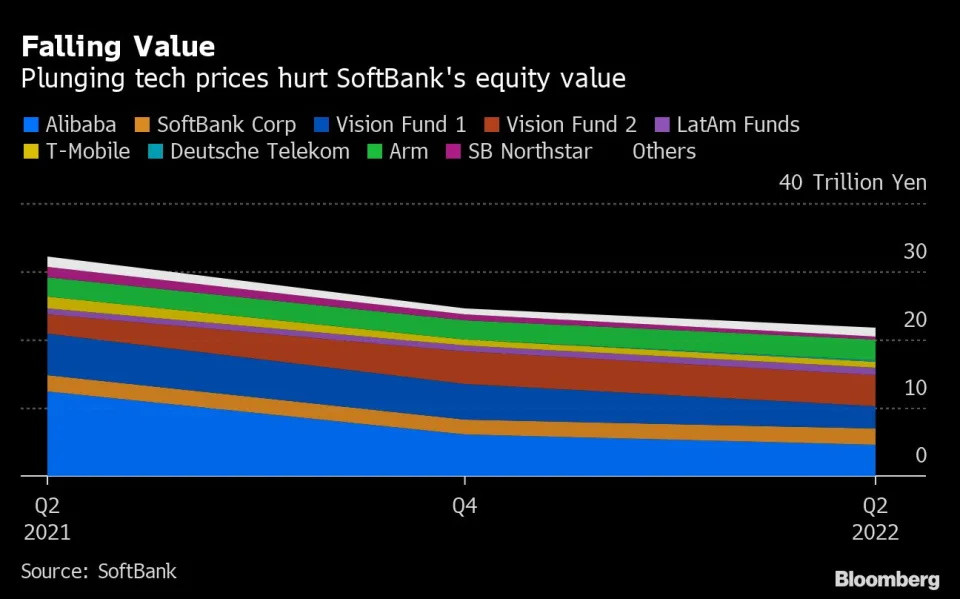

Aufstieg und Fall von Softbank

Das Drama des Tech-Königs Masayoshi Son

Kaum ein anderes Unternehmen verkörpert den Tech-Crash so sehr wie der japanische Investor Softbank. Dessen Chef Masayoshi Son hat auf erfolgreiche Börsengänge seiner jüngsten Tech-Darlings gesetzt - und sieht diese Chancen nun schwinden. Hat Softbank noch eine Zukunft?

https://www.manager-magazin.de/finanzen/immobilien/softbank-…

Das Drama des Tech-Königs Masayoshi Son

Kaum ein anderes Unternehmen verkörpert den Tech-Crash so sehr wie der japanische Investor Softbank. Dessen Chef Masayoshi Son hat auf erfolgreiche Börsengänge seiner jüngsten Tech-Darlings gesetzt - und sieht diese Chancen nun schwinden. Hat Softbank noch eine Zukunft?

https://www.manager-magazin.de/finanzen/immobilien/softbank-…

19.02.24 · wallstreetONLINE Redaktion · NVIDIA |

13.02.24 · dpa-AFX · SoftBank Group |

08.02.24 · dpa-AFX · Netflix |

08.02.24 · dpa-AFX · SoftBank Group |

19.01.24 · Aktienwelt360 · Deutsche Telekom |