Invesco Mortgage Capital -- mREIT (nach Reverse Split)

eröffnet am 06.06.22 13:25:41 von

neuester Beitrag 20.12.23 14:28:07 von

neuester Beitrag 20.12.23 14:28:07 von

Beiträge: 14

ID: 1.361.024

ID: 1.361.024

Aufrufe heute: 0

Gesamt: 3.154

Gesamt: 3.154

Aktive User: 0

ISIN: US46131B7047 · WKN: A3DMJV · Symbol: 7M20

8,0820

EUR

+0,97 %

+0,0780 EUR

Letzter Kurs 29.04.24 Tradegate

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5400 | +26,23 | |

| 1,3100 | +24,76 | |

| 0,5300 | +17,78 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 5,1500 | -11,21 | |

| 10,799 | -12,20 | |

| 1,8775 | -14,17 | |

| 3,7500 | -15,73 | |

| 0,5900 | -29,76 |

Beitrag zu dieser Diskussion schreiben

Book value per common share is estimated to be in the range of $9.82 to $10.22(1)

19.12.

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend and Provides Update on Book Value and Portfolio

https://www.invescomortgagecapital.com/news-market-data/pres…

...

19.12.

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend and Provides Update on Book Value and Portfolio

https://www.invescomortgagecapital.com/news-market-data/pres…

...

Q3: https://www.invescomortgagecapital.com/news-market-data/pres…

=>

...

• Net loss per common share of $1.62 compared to $0.03 in Q2 2023

• Earnings available for distribution per common share of $1.51 compared to $1.45 in Q2 2023

• Common stock dividend of $0.40 per common share, unchanged from Q2 2023

• Book value per common share of $9.93 compared to $11.98 as of June 30, 2023

• Economic return of (13.8)% compared to (1.8)% in Q2 2023

...

Update from John Anzalone, Chief Executive Officer

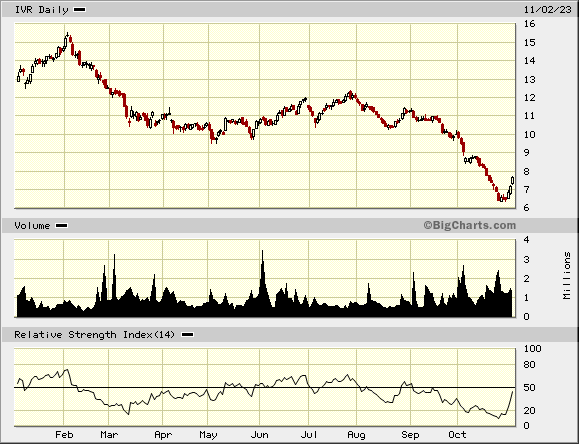

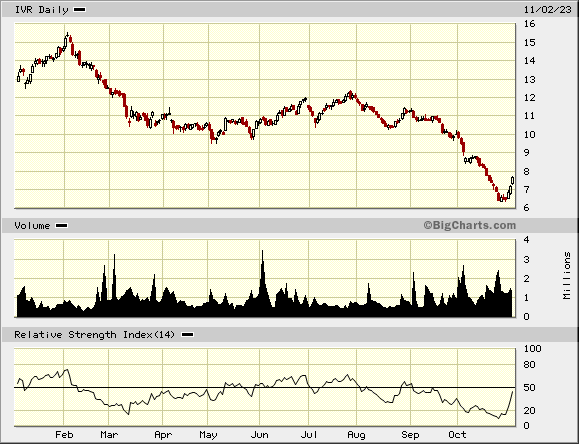

“The third quarter presented another challenging environment for Agency RMBS as financial markets adjusted to shifting expectations for fiscal and monetary policy, leading to sharply higher interest rates and escalating interest rate volatility. Against this backdrop, our Agency RMBS assets underperformed, contributing to a 17.1% decline in our book value per common share for the third quarter. The decline in book value, when combined with our $0.40 common stock dividend, resulted in an economic return of (13.8)% for the quarter.

“Our debt-to-equity ratio ended the third quarter at 6.4x, up from 5.9x as of June 30 . As of the end of the quarter, substantially all of our $5.4 billion investment portfolio was invested in Agency RMBS, and we maintained a sizeable balance of unrestricted cash and unencumbered investments totaling $392 million.

“Earnings available for distribution for the period continued to benefit from attractive interest income on our target assets, favorable funding and low-cost, payfixed

swaps. Subsequent to quarter end, we responded to elevated interest rate volatility and further pressure on Agency RMBS valuations by actively reducing the size of our portfolio, negatively impacting our current earnings power. As of November 3, 2023, our book value per common share is estimated to be between $9.07 and $9.45.

“We remain cautious on the near-term outlook for the sector given the uncertain path of fiscal and monetary policy and heightened geopolitical risks. However, the potential reduction in interest rate volatility associated with the eventual normalization of monetary policy should be supportive of our target assets, and we continue to believe Agency RMBS investors with long term horizons stand to benefit from historically attractive valuations.”

...

=>

...

• Net loss per common share of $1.62 compared to $0.03 in Q2 2023

• Earnings available for distribution per common share of $1.51 compared to $1.45 in Q2 2023

• Common stock dividend of $0.40 per common share, unchanged from Q2 2023

• Book value per common share of $9.93 compared to $11.98 as of June 30, 2023

• Economic return of (13.8)% compared to (1.8)% in Q2 2023

...

Update from John Anzalone, Chief Executive Officer

“The third quarter presented another challenging environment for Agency RMBS as financial markets adjusted to shifting expectations for fiscal and monetary policy, leading to sharply higher interest rates and escalating interest rate volatility. Against this backdrop, our Agency RMBS assets underperformed, contributing to a 17.1% decline in our book value per common share for the third quarter. The decline in book value, when combined with our $0.40 common stock dividend, resulted in an economic return of (13.8)% for the quarter.

“Our debt-to-equity ratio ended the third quarter at 6.4x, up from 5.9x as of June 30 . As of the end of the quarter, substantially all of our $5.4 billion investment portfolio was invested in Agency RMBS, and we maintained a sizeable balance of unrestricted cash and unencumbered investments totaling $392 million.

“Earnings available for distribution for the period continued to benefit from attractive interest income on our target assets, favorable funding and low-cost, payfixed

swaps. Subsequent to quarter end, we responded to elevated interest rate volatility and further pressure on Agency RMBS valuations by actively reducing the size of our portfolio, negatively impacting our current earnings power. As of November 3, 2023, our book value per common share is estimated to be between $9.07 and $9.45.

“We remain cautious on the near-term outlook for the sector given the uncertain path of fiscal and monetary policy and heightened geopolitical risks. However, the potential reduction in interest rate volatility associated with the eventual normalization of monetary policy should be supportive of our target assets, and we continue to believe Agency RMBS investors with long term horizons stand to benefit from historically attractive valuations.”

...

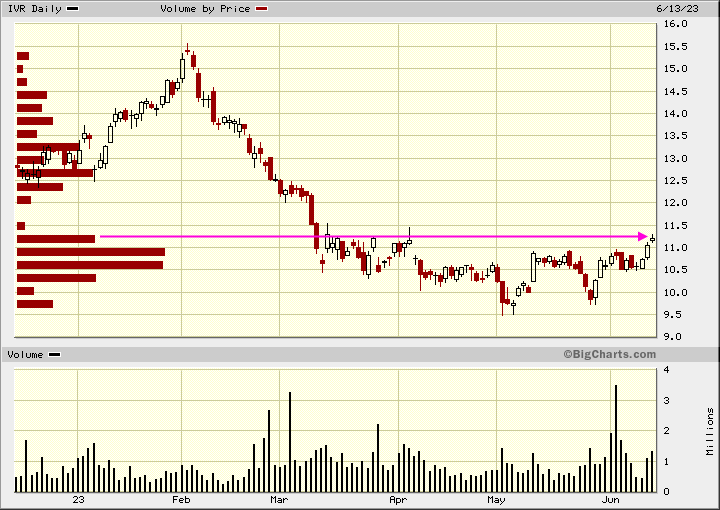

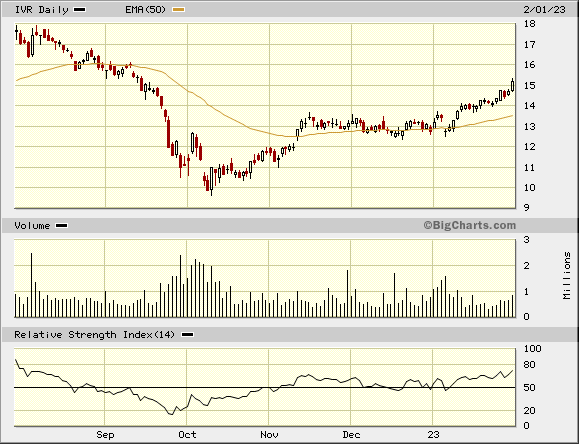

$IVR mit Uuuuuu-Turn:

ansonsten:

Invesco Mortgage Capital Inc. (NYSE: IVR) will announce its third quarter 2023 results Monday, November 6, 2023, after market close

https://www.invescomortgagecapital.com/news-market-data/pres…

ansonsten:

Invesco Mortgage Capital Inc. (NYSE: IVR) will announce its third quarter 2023 results Monday, November 6, 2023, after market close

https://www.invescomortgagecapital.com/news-market-data/pres…

$IVR könnte einer der Gewinner einer FED-Pause und später sogar Zinssenkungen sein, so daß in den nächsten Monaten der Aktienkurs über den (offiz.) Buchwert steigen könnte:

=> nachlegen für mich

=> nachlegen für mich

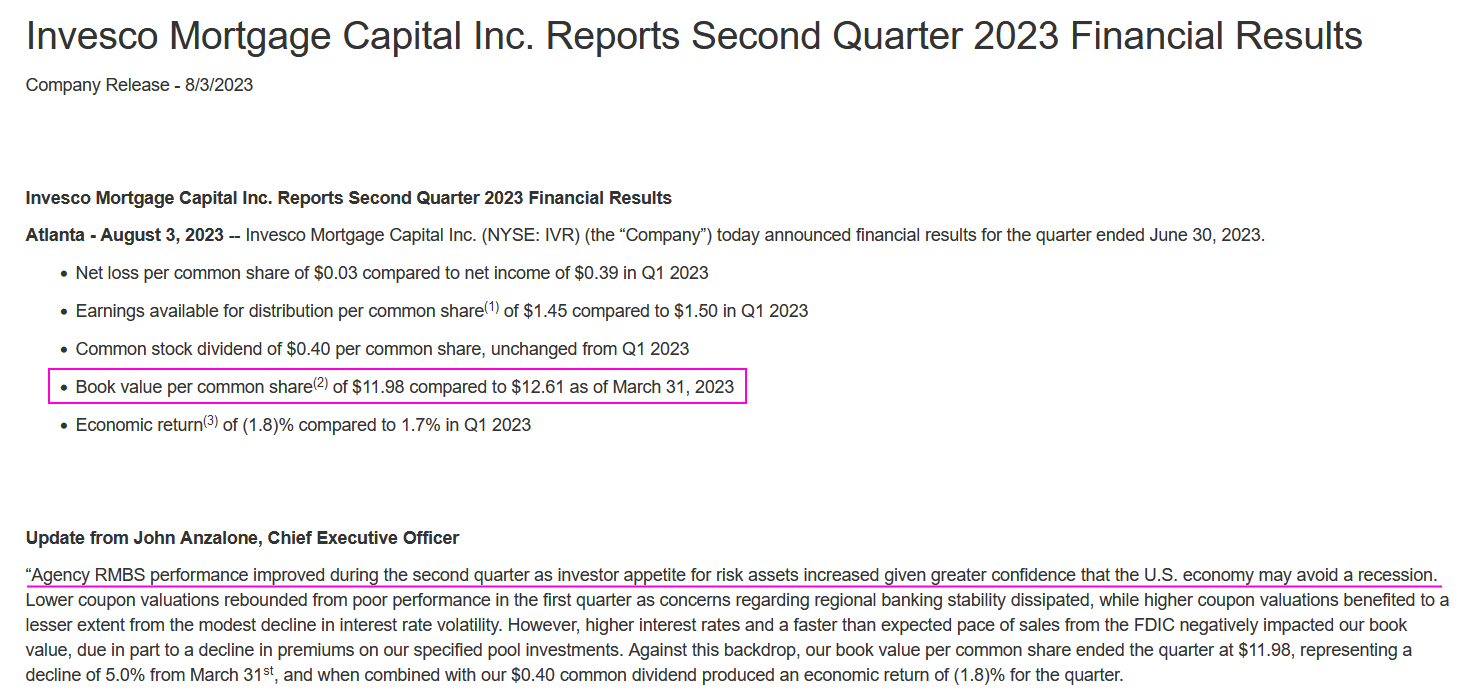

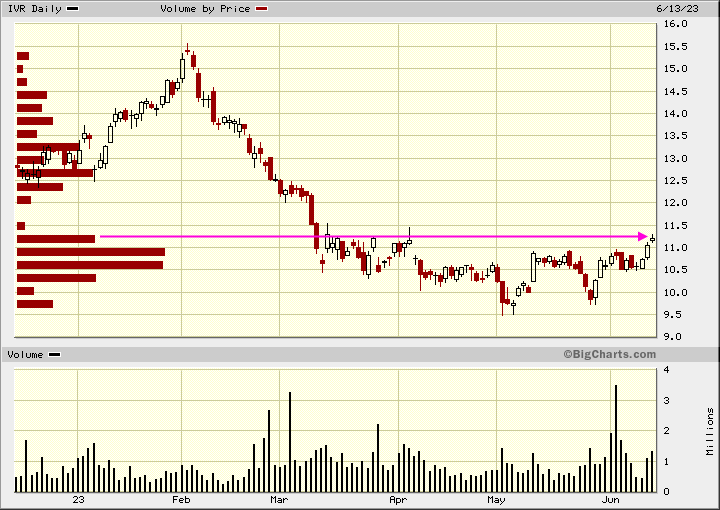

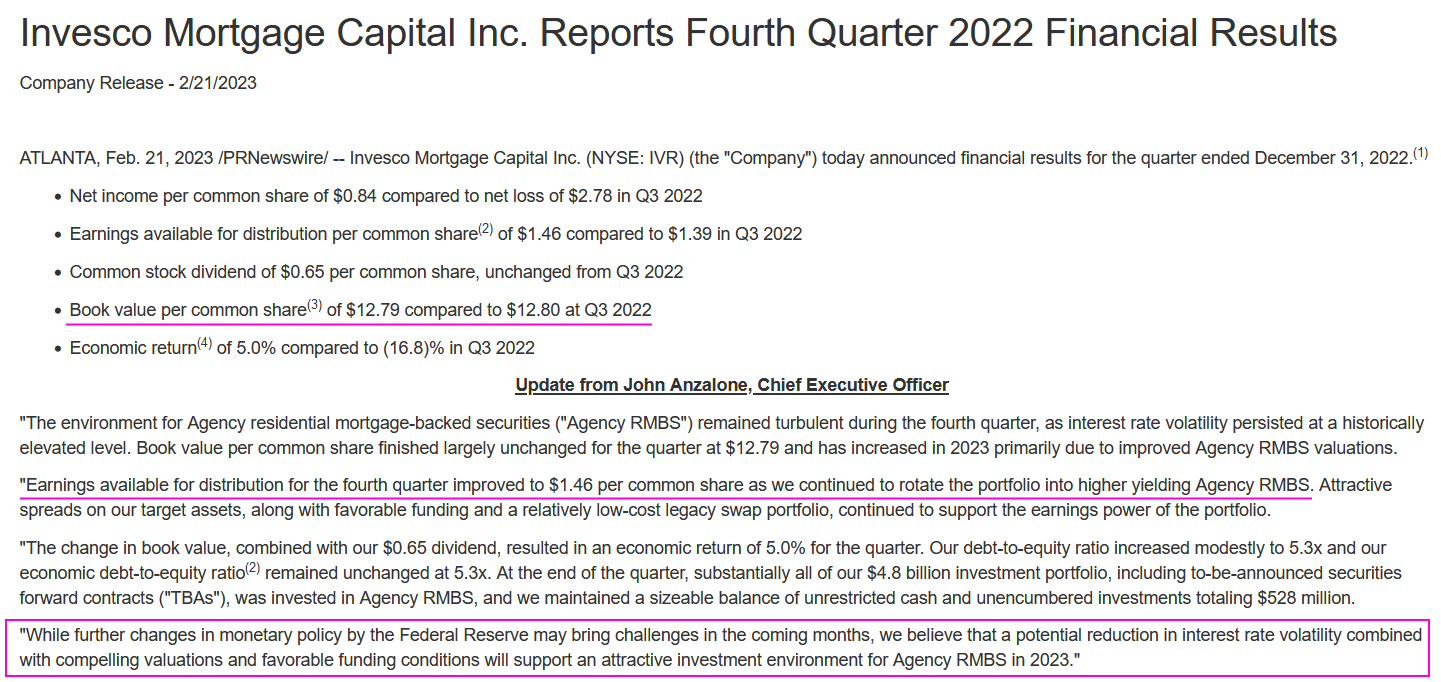

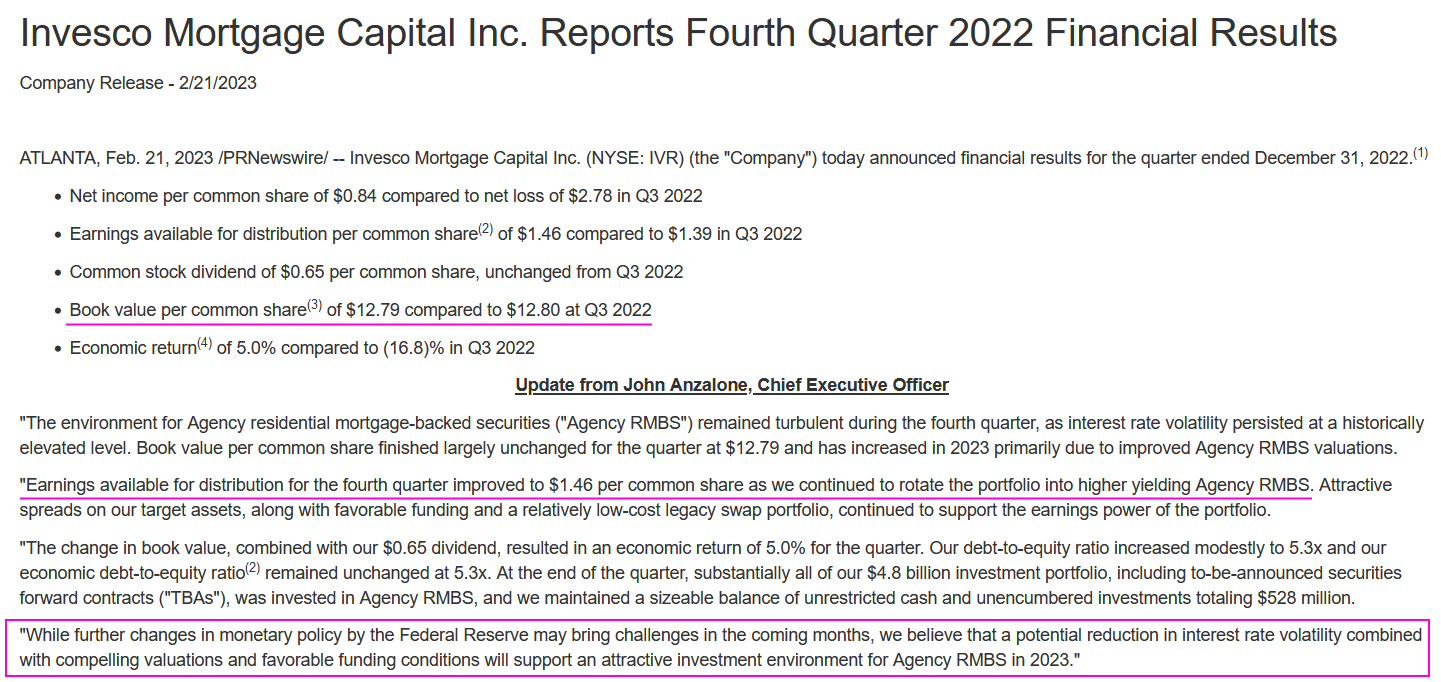

Book value per common share(2) of $12.61 compared to $12.79 at Q4 2022

9.5.

Invesco Mortgage Capital Inc. Reports First Quarter 2023 Financial Results

https://www.invescomortgagecapital.com/news-market-data/pres…

...

Update from John Anzalone, Chief Executive Officer

"The volatile environment for Agency residential mortgage-backed securities ("Agency RMBS") continued during the first quarter of 2023. Strong performance in January was more than offset by sharp underperformance in February and March amidst the slowing disinflationary trend in economic data and turmoil in the regional banking sector.

Against this backdrop, our book value per common share ended the quarter at $12.61, representing a modest decline of 1.4% from year end, and when combined with our $0.40 common dividend produced an economic return of 1.7% for the quarter.

"Earnings available for distribution ("EAD") for the first quarter remained strong at $1.50 per common share. EAD is well supported and is expected to continue to benefit from our hedging strategy, as borrowing costs are hedged by low-cost, pay-fixed swaps with a weighted average maturity of over seven years.

"As noted in our March 27th press release, we reduced our first quarter dividend to $0.40 per share. The reduced dividend remains attractive and allows the Company to retain capital and enhance book value by continuing to invest in Agency RMBS. We believe Agency RMBS are at historically attractive valuations and reduced demand from the Federal Reserve and commercial banks will provide compelling opportunities for new investments. In addition, we expect that the conclusion of the Federal Reserve's tightening cycle will result in a reduction in interest rate volatility, providing a tailwind for our target assets.

"Given our improved outlook for Agency RMBS, we increased our debt-to-equity ratio to 5.8x as of March 31, 2023 from 5.3x at year end. As of the end of the quarter, substantially all of our $5.4 billion investment portfolio was invested in Agency RMBS, and we maintained a sizeable balance of unrestricted cash and unencumbered investments totaling $463.9 million."

...

9.5.

Invesco Mortgage Capital Inc. Reports First Quarter 2023 Financial Results

https://www.invescomortgagecapital.com/news-market-data/pres…

...

Update from John Anzalone, Chief Executive Officer

"The volatile environment for Agency residential mortgage-backed securities ("Agency RMBS") continued during the first quarter of 2023. Strong performance in January was more than offset by sharp underperformance in February and March amidst the slowing disinflationary trend in economic data and turmoil in the regional banking sector.

Against this backdrop, our book value per common share ended the quarter at $12.61, representing a modest decline of 1.4% from year end, and when combined with our $0.40 common dividend produced an economic return of 1.7% for the quarter.

"Earnings available for distribution ("EAD") for the first quarter remained strong at $1.50 per common share. EAD is well supported and is expected to continue to benefit from our hedging strategy, as borrowing costs are hedged by low-cost, pay-fixed swaps with a weighted average maturity of over seven years.

"As noted in our March 27th press release, we reduced our first quarter dividend to $0.40 per share. The reduced dividend remains attractive and allows the Company to retain capital and enhance book value by continuing to invest in Agency RMBS. We believe Agency RMBS are at historically attractive valuations and reduced demand from the Federal Reserve and commercial banks will provide compelling opportunities for new investments. In addition, we expect that the conclusion of the Federal Reserve's tightening cycle will result in a reduction in interest rate volatility, providing a tailwind for our target assets.

"Given our improved outlook for Agency RMBS, we increased our debt-to-equity ratio to 5.8x as of March 31, 2023 from 5.3x at year end. As of the end of the quarter, substantially all of our $5.4 billion investment portfolio was invested in Agency RMBS, and we maintained a sizeable balance of unrestricted cash and unencumbered investments totaling $463.9 million."

...

27.3.

...

Our investment portfolio continues to generate strong earnings available for distribution despite the sharp increase in short-term interest rates given a high percentage of our funding is hedged with a relatively low-cost legacy swap portfolio.

...

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend and Provides Update on Estimated Results of Operations, Portfolio, Liquidity and Book Value

https://www.invescomortgagecapital.com/news-market-data/pres…

...

Estimated book value per common share(1) of $11.96 to $12.44 as of March 17, 2023

...

Aber Dividenden-Reduzierung um 1/3:

The dividend reduction allows us to pay a competitive dividend consistent with Agency RMBS market levered returns and helps increase the ratio of our common stock to total stockholders' equity...

=>

...

Our investment portfolio continues to generate strong earnings available for distribution despite the sharp increase in short-term interest rates given a high percentage of our funding is hedged with a relatively low-cost legacy swap portfolio.

...

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend and Provides Update on Estimated Results of Operations, Portfolio, Liquidity and Book Value

https://www.invescomortgagecapital.com/news-market-data/pres…

...

Estimated book value per common share(1) of $11.96 to $12.44 as of March 17, 2023

...

Aber Dividenden-Reduzierung um 1/3:

The dividend reduction allows us to pay a competitive dividend consistent with Agency RMBS market levered returns and helps increase the ratio of our common stock to total stockholders' equity...

=>

Antwort auf Beitrag Nr.: 73.210.003 von faultcode am 01.02.23 23:54:19https://www.invescomortgagecapital.com/news-market-data/pres…

...

=>

...

=>

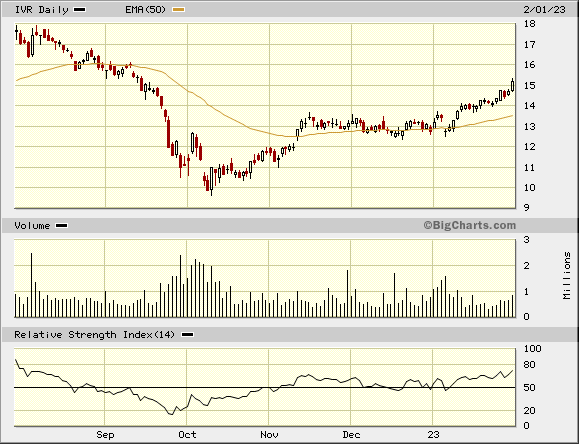

Antwort auf Beitrag Nr.: 72.692.842 von faultcode am 04.11.22 14:38:32die Aktie notiert derzeit deutlich über Buchwert von zuletzt $12.80 (so wie von IVR berichtet):

=> aus meiner Sicht tut der Markt gerade so, als ob die FED im nächsten Monat die Zinsen wieder senken würde und (auch) bei Invesco Mortgage Capital die damit verbundenen Buchgewinne nur so sprudeln würden

Die 2022Q4-Zahlen sollen kommen am ... --> wissen die aktuell noch selber nicht: https://www.invescomortgagecapital.com/news-market-data/even…

=> aus meiner Sicht tut der Markt gerade so, als ob die FED im nächsten Monat die Zinsen wieder senken würde und (auch) bei Invesco Mortgage Capital die damit verbundenen Buchgewinne nur so sprudeln würden

Die 2022Q4-Zahlen sollen kommen am ... --> wissen die aktuell noch selber nicht: https://www.invescomortgagecapital.com/news-market-data/even…

Invesco Mortgage Capital Inc. Reports Third Quarter 2022 Financial Results

ATLANTA, Nov. 2, 2022 /PRNewswire/ -- Invesco Mortgage Capital Inc. (NYSE: IVR) (the "Company") today announced financial results for the quarter ended September 30, 2022.(1)

• Net loss per common share of $2.78 compared to a net loss of $3.52 in Q2 2022

• Earnings available for distribution per common share(2) of $1.39 compared to $1.40 in Q2 2022

• Common stock dividend of $0.65 per common share compared to $0.90 in Q2 2022

• Book value per common share(3) of $12.80 compared to $16.16 at Q2 2022

• Economic return(4) of (16.8%) compared to (17.9%) in Q2 2022

...

https://www.invescomortgagecapital.com/news-market-data/pres…

ATLANTA, Nov. 2, 2022 /PRNewswire/ -- Invesco Mortgage Capital Inc. (NYSE: IVR) (the "Company") today announced financial results for the quarter ended September 30, 2022.(1)

• Net loss per common share of $2.78 compared to a net loss of $3.52 in Q2 2022

• Earnings available for distribution per common share(2) of $1.39 compared to $1.40 in Q2 2022

• Common stock dividend of $0.65 per common share compared to $0.90 in Q2 2022

• Book value per common share(3) of $12.80 compared to $16.16 at Q2 2022

• Economic return(4) of (16.8%) compared to (17.9%) in Q2 2022

...

https://www.invescomortgagecapital.com/news-market-data/pres…